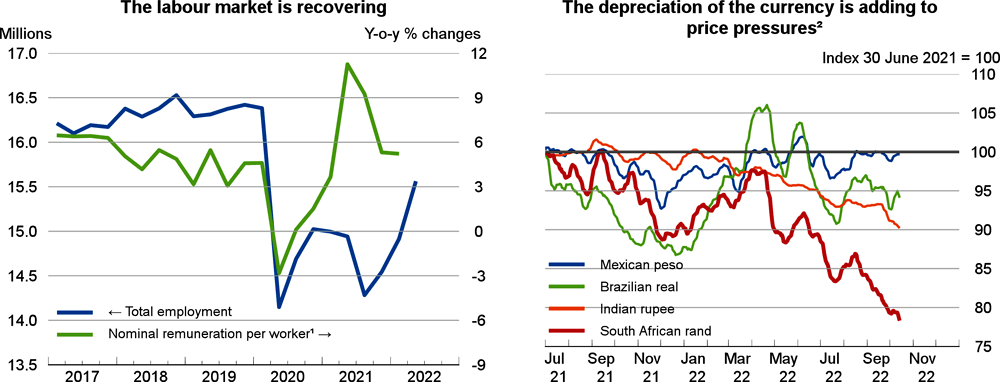

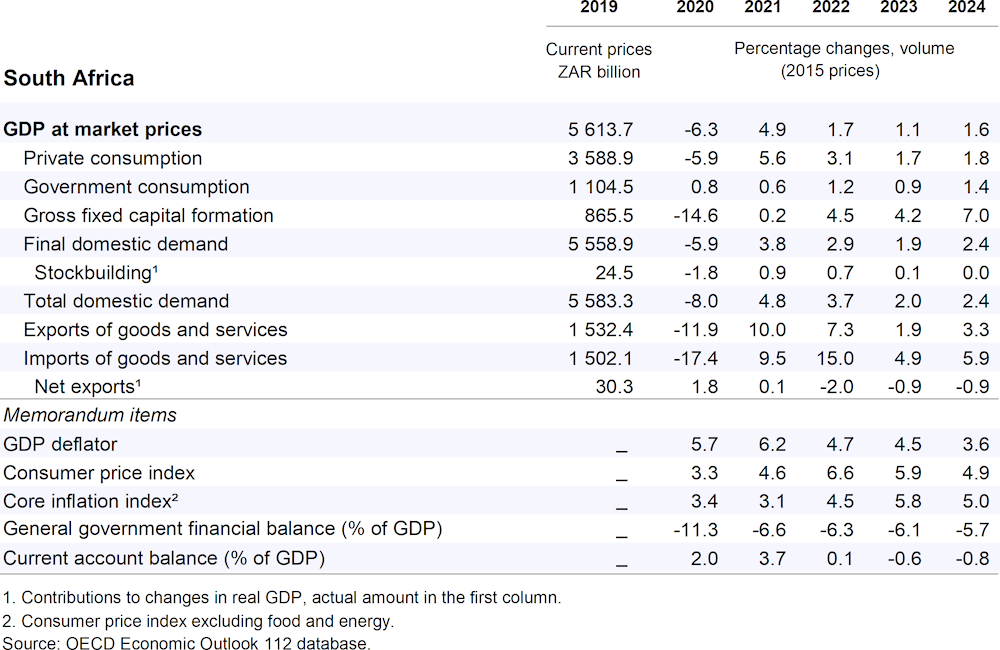

GDP is projected to grow by 1.7% in 2022, 1.1% in 2023, and 1.6% in 2024. Private consumption and investment will remain the main drivers of growth. Household spending remains supported by social transfers and an improving labour market. Private investment will rise as companies replace an increasingly obsolete capital stock. Inflation is projected to slowly fall in response to tighter monetary policy. Risks to growth include prolonged electricity shortages and more persistent inflationary pressures than expected, potentially delaying the reduction of policy rates.

Fiscal risk has eased thanks to a favourable commodity cycle, but debt-servicing costs are rising. Efforts to rein in the public sector wage bill and to address weaknesses in the management of public procurement and state-owned enterprises should continue. Redesigning tax exemptions would lower distortions, increase revenues, and improve equity. Monetary policy should continue to tighten until inflation comes close to the South African Reserve Bank mid-point target. The planned split of the national power company should proceed to allow other producers to compete and complement capacity, while also bringing prices down.