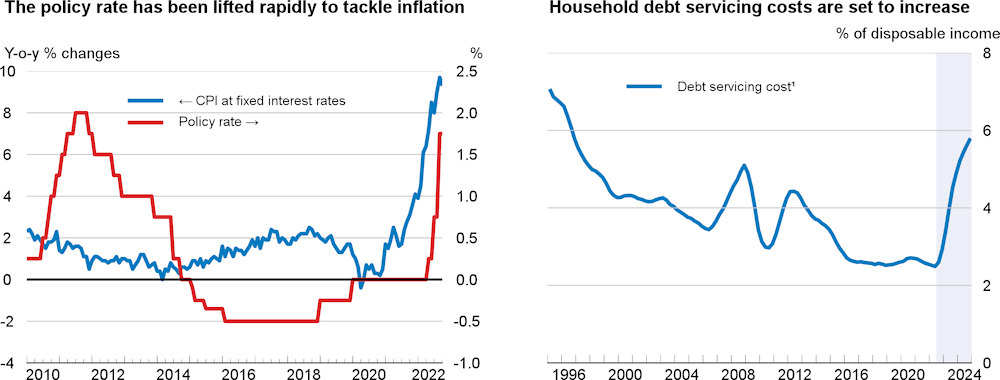

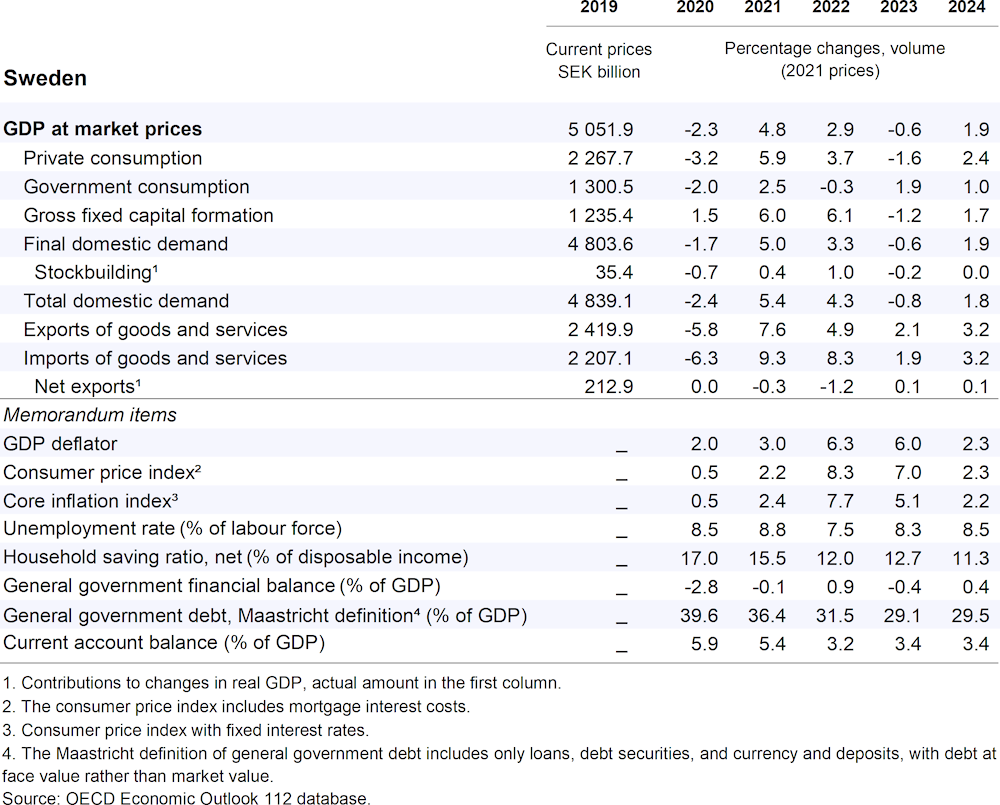

Output is projected to decline in the near term, resulting in annual growth of 2.9% this year, -0.6% in 2023 and 1.9% in 2024. High inflation, rising mortgage interest rates and falling asset prices will erode household purchasing power, holding back private consumption. Unemployment will increase and inflation is expected to recede gradually and close in on the 2% inflation target in the latter half of 2024.

Monetary policy should continue to ensure that inflation expectations are anchored. Fiscal support measures should become more targeted to people vulnerable to rising living costs, while preserving incentives for energy savings. The pandemic has increased long-term unemployment, which has been a persistent policy challenge. Reskilling and upskilling the workforce are key to facilitate a reallocation of labour to expanding sectors. In addition, increasing labour mobility through more affordable housing could also help reallocation. Strengthening electricity transmission capacity is also needed to enhance energy security.