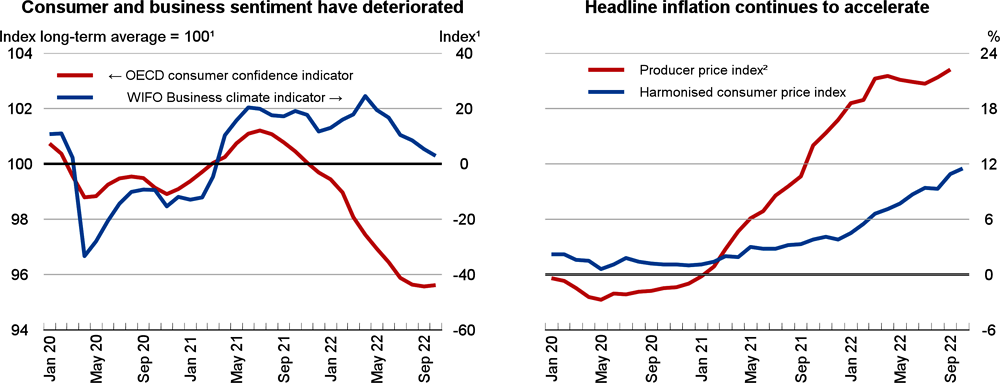

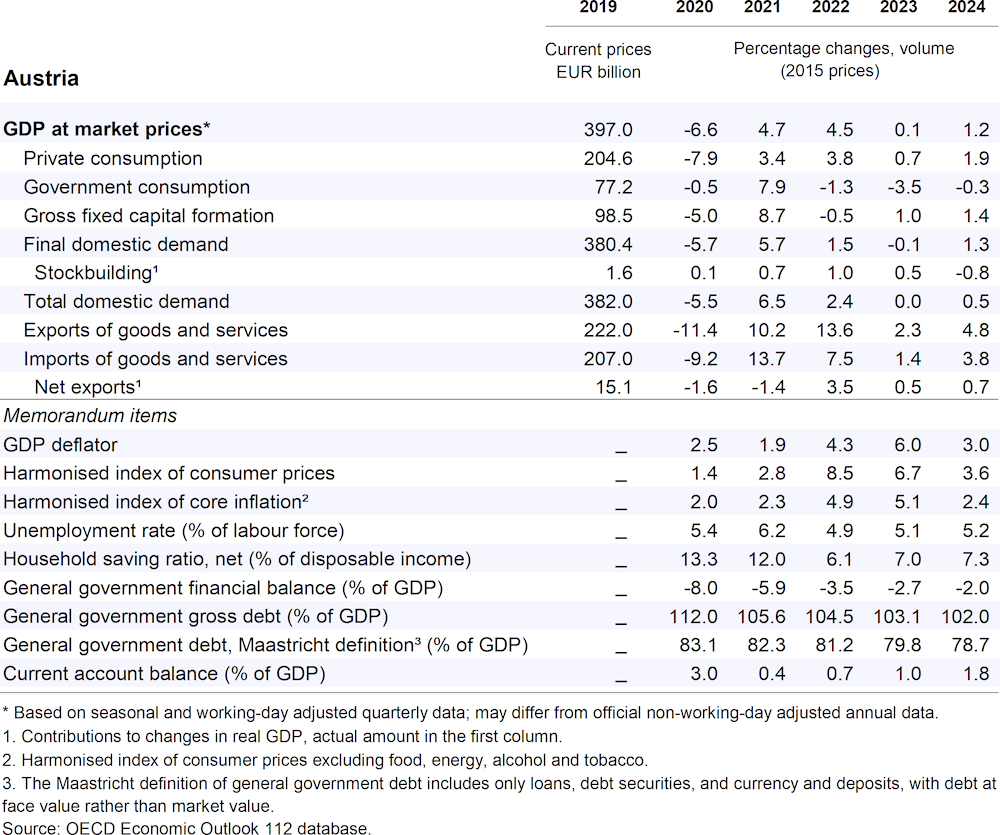

Growth is expected to be 4.5% in 2022, but slow sharply to 0.1% in 2023 and 1.2% in 2024. Headline inflation is broad-based and expected to peak towards the end of 2022, before easing over 2023 and 2024. Real disposable incomes are falling in 2022, depressing private consumption, but should recover as wages catch up with inflation. Low external demand and a deterioration in business confidence will weigh on private investment. Employment growth will weaken, but elevated labour shortages are expected to prevent a significant increase in unemployment.

The fiscal stance will tighten over the projection period. The withdrawal of the pandemic-related support has helped to narrow the primary budget deficit. New support measures to cushion energy price inflation are expected to fade out in 2023-24. Some of these measures aim at lifting growth by reducing labour costs and are welcome. Discretionary measures to compensate for high energy prices need to be better targeted to avoid weakening price signals and to limit fiscal costs. Activating existing labour reserves would help remedy persistent labour shortages.