Global growth proved resilient in 2023, with inflation declining more quickly than anticipated. Outcomes diverged across countries, with strong growth in the United States and many emerging‑market economies offset by a slowdown in most European countries.

Recent indicators point to some moderation of growth, with the effects of tighter financial conditions continuing to appear in credit and housing markets, and global trade remaining subdued. Attacks on ships in the Red Sea have raised shipping costs sharply and lengthened delivery times, disrupting production schedules and raising price pressures.

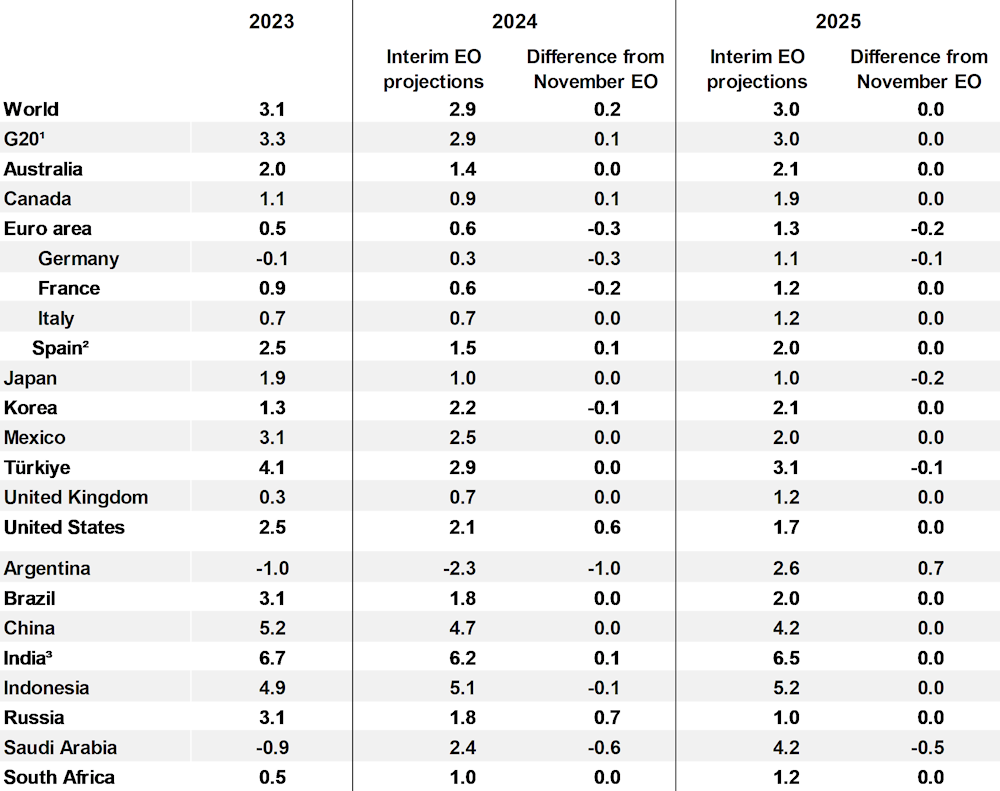

Global GDP growth is projected to ease to 2.9% in 2024, from 3.1% in 2023, before recovering to 3.0% in 2025 as financial conditions ease.

Annual GDP growth in the United States is projected to remain supported by household spending and strong labour market conditions, but moderate to 2.1% in 2024 and 1.7% in 2025. Euro area GDP growth is projected to be 0.6% in 2024 and 1.3% in 2025, with activity held back by tight credit conditions in the near term before picking up as real incomes strengthen. Growth in China is expected to ease to 4.7% in 2024 and 4.2% in 2025, despite additional policy stimulus, reflecting subdued consumer demand, high debt and the weak property market.

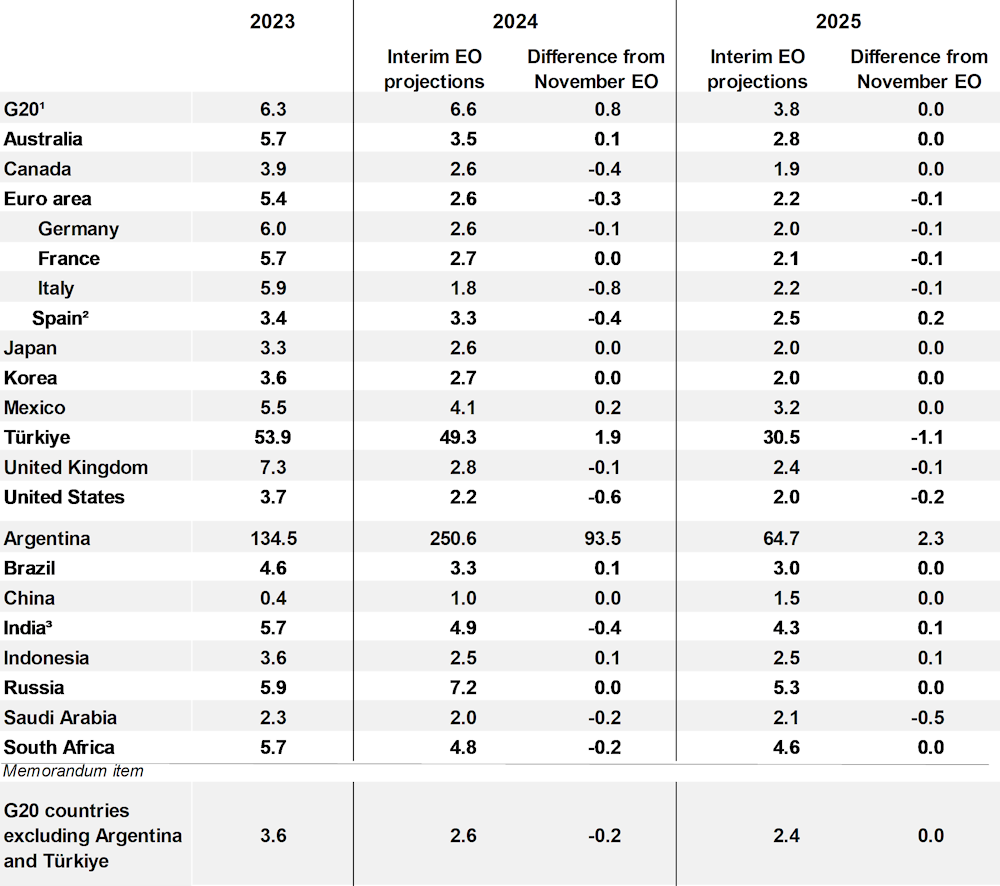

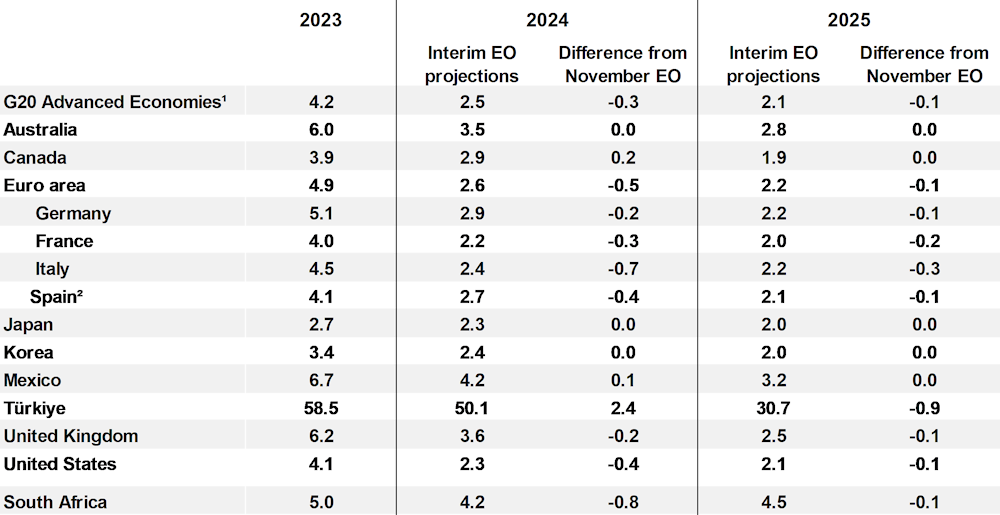

Inflation is projected to be back to target in most G20 countries by the end of 2025. Headline inflation in the G20 economies is projected to drop from 6.6% in 2024 to 3.8% in 2025, with core inflation in the G20 advanced economies easing to 2.5% in 2024 and 2.1% in 2025.

However, it is too soon to be sure that underlying price pressures are fully contained. Labour market conditions have become better balanced, but unit labour cost growth generally remains above rates compatible with medium-term inflation objectives.

High geopolitical tensions are a significant near-term risk to activity and inflation, particularly if the conflict in the Middle East were to disrupt energy markets. Persisting service price pressures could also generate upside inflation surprises and trigger financial market repricing as expectations of monetary policy easing are reassessed. Growth could also be weaker than projected if the lingering effects from past policy rate increases are stronger than expected.

Monetary policy needs to remain prudent to ensure that underlying inflationary pressures are durably contained. Scope exists to lower policy interest rates as inflation declines, but the policy stance should remain restrictive in most major economies for some time to come.

Governments face mounting fiscal challenges from rising debt burdens and sizeable additional future spending pressures. Stronger near-term efforts to contain spending growth and well‑designed medium-term fiscal frameworks are needed to help ensure sustainability and provide flexibility to respond to future shocks.

The foundations for future growth need to be strengthened by policy reforms to improve educational outcomes, enhance skills development, and reduce constraints in labour and product markets that impede investment and labour force participation.

Enhanced international co-operation is needed to revive global trade, ensure faster and better co‑ordinated progress towards decarbonisation, and alleviate debt burdens in lower-income countries.

OECD Economic Outlook, Interim Report February 2024

Strengthening the foundations for growth

Summary

Table 1. Moderate global growth is projected to persist

Note: Difference from November 2023 OECD Economic Outlook in percentage points, based on rounded figures. World and G20 aggregates use moving nominal GDP weights at purchasing power parities (PPPs). Revisions to PPP estimates affect the differences in the aggregates.

1. The European Union is a full member of the G20, but the G20 aggregate only includes countries that are also members in their own right.

2. Spain is a permanent invitee to the G20.

3. Fiscal years, starting in April.

Source: OECD Interim Economic Outlook 115 database; and OECD Economic Outlook 114 database.

Table 2. Headline inflation is projected to return to target in most economies

Note: Difference from November 2023 OECD Economic Outlook in percentage points, based on rounded figures. The G20 aggregate uses moving nominal GDP weights at purchasing power parities (PPPs). Revisions to PPP estimates affect the difference in the aggregate.

1. The European Union is a full member of the G20, but the G20 aggregate only includes countries that are also members in their own right.

2. Spain is a permanent invitee to the G20.

3. Fiscal years, starting in April.

Source: OECD Interim Economic Outlook 115 database; and OECD Economic Outlook 114 database.

Table 3. Core inflation is projected to decline further

Note: Difference from November 2023 OECD Economic Outlook in percentage points, based on rounded figures. The G20 advanced economies aggregate uses moving nominal GDP weights at purchasing power parities (PPPs). Revisions to PPP estimates affect the difference in the aggregate. Core inflation excludes food and energy prices.

1. The European Union is a full member of the G20, but the G20 aggregate only includes EU countries that are also G20 members in their own right.

2. Spain is a permanent invitee to the G20.

Source: OECD Interim Economic Outlook 115 database; and OECD Economic Outlook 114 database.

Recent developments

The global economy proved resilient in 2023 but lost momentum at end-year

1. Global output growth proved unexpectedly resilient last year (Figure 1, Panel A). At the start of 2023, a sharper growth slowdown appeared possible amidst declining real incomes and rapid and widespread monetary policy tightening. Inflation has declined more quickly than initially anticipated and energy support schemes have helped to cushion household incomes and underpin activity in many economies. Growth was particularly buoyant in the United States through the year, including in the fourth quarter, helped by strong consumer spending, with households continuing to run down the excess savings accumulated since the beginning of the pandemic (Figure 2), and higher government spending. Outcomes were weaker in many other advanced economies, particularly in Europe, reflecting the relative importance of bank-based finance and the continued adverse effects of the energy price shock. Growth also moderated in countries in which higher policy rates were quickly reflected in higher borrowing rates. The emerging‑market economies have generally continued to grow at a solid pace, despite tighter financial conditions, reflecting the benefits of improved macroeconomic policy frameworks, strong investment in infrastructure in many countries, including India, and steady employment gains. The reopening of the economy at the start of the year also helped activity to rebound in China, although soft consumer spending and the continued contraction in the property sector are weighing on domestic demand.

Figure 1. Global growth has started to ease with continued divergence across countries

Note: Panel A: GDP growth using moving nominal GDP weights at purchasing power parities. Quarter-on-quarter growth is expressed at an annualised rate.

Source: OECD Interim Economic Outlook 115 database; and S&P Global.

Figure 2. Excess savings have been run down in the United States but not in many other countries

Change in estimated excess savings over the two years to 2023Q3, in percentage points of disposable income

Note: Based on gross household saving as reported in the national accounts. Excess savings are the cumulated sum of the differences between quarterly household savings flows since 2020Q1 and saving that would have occurred if the saving rate had been equal to the average rate over 2015-2019. The data for Japan are estimated from 2021Q1 onwards.

Source: OECD, Quarterly National Accounts database; OECD Interim Economic Outlook 115 database; and OECD calculations.

Recent activity indicators point to continued moderate global growth

2. High-frequency activity indicators generally suggest a continuation of recent moderate growth. Business surveys point to stronger activity developments in services than in manufacturing, with industrial production stagnating outside of China in recent months, and divergent cross-country developments. Across countries, there continues to be clear signs of strong near-term momentum in India, relative weakness in Europe, and mild near‑term growth in most other major economies (Figure 1, Panel B). Consumer confidence also remains subdued relative to longer-term norms in many advanced economies, as well as China, but has held up better in many emerging-market economies where growth has recently been stronger than expected, including Mexico and Brazil.

3. Global trade remains subdued, but has started to show some signs of improvement. A gradual upturn in semiconductor and electronics production in Asia and stronger car sales are helping to underpin merchandise trade, and services trade is being boosted by the return of international air passenger traffic to pre-pandemic levels. However, survey measures of export orders generally remain modest, particularly in manufacturing, and new supply disruptions are appearing.

4. Attacks on shipping in the Red Sea have resulted in trade flows being re-routed (Figure 3, Panel A). Shipping costs have risen sharply (Figure 3, Panel B), and delivery times have lengthened, especially for trade from Asia to Europe. This has already begun to disrupt production schedules in Europe, particularly for car manufacturers. About 15% of global maritime trade volumes passed through the Red Sea in 2022. Use of a longer route around the Cape of Good Hope increases journey times by between 30-50%, depending on the route concerned, and raises global shipping capacity needs. Additional supply capacity this year, reflecting stronger new orders for container ships after the pandemic, should help to meet increased shipping demand and moderate cost pressures. Nonetheless, as seen during the pandemic and its immediate aftermath, higher shipping charges will raise costs, especially for goods. OECD research suggests that the recent 100% increase in shipping costs, if persistent, could raise annual OECD import price inflation by close to 5 percentage points, adding 0.4 percentage points to consumer price inflation after about a year.

Figure 3. Trade disruptions in the Red Sea are increasing shipping costs and delays

Note: Panel A: seven-day moving average, using daily data up to 29 January 2024. Count of all cargo ships transiting the Suez Canal and the Cape of Good Hope, including bulk carriers, container ships and oil and liquid natural gas tankers, but excluding fishing vessels and tugs. Transit is estimated using AIS data transmitted from vessels within OECD-defined geographic boundaries.

Source: Pilgrim, G., E. Guidetti and A. Mourougane (2024) “An Ocean of Data: The Potential of Data on Vessel Traffic”, OECD forthcoming; Bloomberg; and OECD calculations.

Headline and core inflation are declining but disinflation may slow

5. With energy and food price inflation ebbing and monetary policy turning restrictive, both headline and core inflation fell during 2023. Goods price inflation declined to low levels in most countries, helped by lower energy commodity prices and the gradual easing of supply chain bottlenecks from their earlier peak in 2021‑22. Services price inflation has generally proved stickier, drifting down only slowly. An estimated breakdown of consumer price inflation by supply-driven and demand-driven factors in a range of OECD countries suggests that both factors have contributed to the decline in inflation over the past year or so (Figure 4). The generalised easing of inflation pressures has helped to calm fears that inflation expectations would become unanchored, and private sector near-term inflation expectations have continued to moderate. In some countries, annual headline inflation has already fallen back to or below official targets, though core inflation has yet to do so, and in a few others, including the United States, month‑on‑month price changes have recently been at rates consistent with the inflation target.

6. Some of the factors assisting disinflation over the past year, such as past improvements in supply chains and falling commodity prices, are now dissipating or reversing. Others are vulnerable to geopolitical developments, extreme weather events (including the current El Niño event) or other exogenous shocks. With core inflation still above target in most countries and unit labour cost growth generally remaining above levels compatible with medium-term inflation objectives, it is too soon to be sure that the inflationary episode that began in 2021 will end in 2025.

7. Unemployment rates have generally remained low by historical standards in most countries while inflation has declined, raising the chances of a so-called “soft landing”. A range of indicators suggest that supply and demand conditions in labour markets continue to become better balanced. Total hours worked have stabilised in many countries and declined marginally in the euro area and Canada. Job growth has also slowed and the number of vacancies has fallen (Figure 5). Strong population growth and improving labour participation rates have also enhanced labour supply. Survey evidence suggests that firms now have fewer pressing labour shortages, though past difficulties in recruiting workers may limit the extent to which companies are willing to make layoffs. Nominal wage growth appears to have peaked in most economies, helped by a narrowing of the gap between wage gains for job-switchers and job-stayers as demand cools. However, unit labour cost growth remains elevated, at 4% or more, in many economies, in part due to weak productivity growth.

Figure 4. Demand and supply side pressures on inflation have eased in most countries

Decomposition of contributions to year-on-year inflation

Note: Last data point 2023Q4 for the United States and 2023Q3 for all other countries. Based on disaggregated data for prices and expenditure. Shocks to prices and volumes are identified using the residuals from rolling 10-year vector autoregressions for prices and volumes of each item in the price index. Price and volume residuals with the same sign are assumed to reflect demand shocks and residuals with opposite signs to reflect supply shocks. An intermediate range, labelled “ambiguous”, is identified when price and/or volume residuals are too small to be considered significant. The contributions of the three categories sum to the total inflation rate (the year-on-year percentage change in the private consumption deflator). The contributions of each category to year-on-year inflation are calculated as the sum of the latest four quarterly contributions.

Source: Australian Bureau of Statistics; Bank of Korea; INSEE; Statistics Canada; UK Office of National Statistics; U.S. Bureau of Economic Analysis; and OECD calculations.

Figure 5. Job growth is stabilising and the number of vacancies is declining in many countries

Number of people

Note: Scales differ across countries and do not begin at zero. “Last” corresponds to October 2023 for the United Kingdom, November 2023 for Canada, Germany and the United States, 2023Q3 for France, and 2023Q4 for Australia. The coverage for France is limited to firms of 10 or more employees, and excludes agriculture, temporary work, individual employers and public employment.

Source: OECD Interim Economic Outlook 115 database; OECD Registered Unemployment and Job Vacancies Statistics; Labour Ministry of France (DARES); and OECD calculations.

Financial conditions have eased, though credit growth remains weak

8. Global financial conditions have eased recently, with financial market participants now anticipating earlier and faster reductions in policy rates than previously expected. Long-term bond yields have declined, equity prices have strengthened, and volatility has receded. Nonetheless, financial conditions remain relatively restrictive almost everywhere. Long-term real interest rates are at levels last seen prior to the global financial crisis in many economies, and credit growth has turned negative in real terms as the impact of higher lending rates and tighter credit standards is felt.

9. The impact of monetary policy tightening also remains apparent in housing markets. Structural factors, including strong population growth and a limited stock of houses for sale, have resulted in house prices stabilising in a number of countries where price declines initially followed policy and mortgage rate rises. However, the volume of transactions has continued to drop markedly (Figure 6), suggesting that a renewed decline in prices is possible if more owners are forced to sell. Transactions volumes have also declined in commercial real estate markets, where demand has fallen due to higher borrowing costs and changes in working practices since the pandemic.

Figure 6. Housing transactions have declined sharply in most countries

Index 2022Q1 = 100, two-quarter moving average

Note: Estimates for the two-quarter moving average in 2023Q4 are based on incomplete data for France and Spain (2023Q3 only), and Korea (based on monthly data up to November 2023).

Source: The Canadian Real Estate Association; CEIC; Eurostat; Korea Real Estate Board; Turkish Statistical Institute; UK HM Revenue & Customs; US National Association of Realtors; and OECD calculations.

Projections

Growth is expected to remain moderate with inflation converging to target

10. The fading or reversal of previously-supportive cyclical factors, such as the post‑pandemic decline in supply bottlenecks, along with restrictive macroeconomic policies in the major advanced economies and structural strains in China are expected to push global GDP growth down from 3.1% in 2023 to 2.9% in 2024. This would be the third consecutive year of growth moderation. In 2025, global growth is projected to pick up to 3.0%, helped by a widespread easing of monetary policy as inflation converges on central bank targets and a steady recovery in real incomes (Table 1 and Figure 7). In the absence of further adverse supply shocks, cooling demand pressures should allow headline and core inflation to fall further in most economies.

11. In the United States, the rundown of excess household savings and strong government spending are projected to moderate in 2024, but lower inflation will strengthen real wage growth and allow policy interest rates to be eased. Annual GDP growth is projected to ease gently towards trend, at 2.1% in 2024 and 1.7% in 2025. Europe is also feeling the demand‑reducing effects of policy tightening. Growth in the euro area is expected to remain soft through the first half of 2024 before steadily recovering as real incomes strengthen: average annual growth rates are projected to be 0.6% in 2024 and 1.3% in 2025, after 0.5% in 2023. The United Kingdom has a similar profile, with growth picking up from 0.3% in 2023 to 0.7% in 2024 and 1.2% in 2025. In Japan, wage growth is projected to strengthen gradually but GDP growth is projected to ease to 1% in both 2024 and 2025 as macroeconomic policies begin to be tightened.

12. Economic conditions among the emerging-market economies in the G20 are very diverse, with the key factors driving growth varying widely. China continues to struggle with real estate problems, with successive waves of policy stimulus aiming to offset the ongoing contraction of the property sector, while low consumer confidence and inadequate social safety nets hinder the growth of private consumption. GDP growth in China is projected to moderate from 5.2% in 2023 to 4.7% in 2024 and 4.2% in 2025. India and Indonesia are both expected to expand steadily over the next two years, helped by strong investment growth, with GDP rising by more than 6¼ per cent and 5% per annum respectively. Projections for other G20 emerging-market economies mostly portray an improvement in growth during 2024-25, helped by more favourable financial conditions and external demand, although idiosyncratic factors affect the growth profile in individual countries. High inflation and sizeable fiscal tightening are projected to result in an output decline in Argentina in 2024 before growth recovers in 2025 as reforms start to take effect.

13. Aggregate consumer price inflation for the G20 is projected to be higher in 2024 than in 2023, but this is distorted by high inflation in Argentina and Türkiye. In both countries headline inflation accelerated in late 2023, implying a strong carryover effect for average annual inflation in 2024. Excluding these countries, G20 inflation is projected to decline from 3.6% in 2023 to 2.6% in 2024 and 2.4% in 2025. By the end of 2025 inflation is projected to be in line with central bank objectives in most G20 countries (Table 2, Figure 8).

14. Headline inflation fell back in the major advanced economies in 2023, declining to 4.5% from 6.5% in 2022 on an average annual basis, and ran at an annualised rate of just 2% in the last quarter of the year. Disinflation was assisted by the fall in energy prices since mid‑2022 and earlier improvements in supply chain conditions. While base effects from energy and core goods prices are expected to be less favourable in 2024, and supply bottlenecks are beginning to appear again, continued demand restraint via tight monetary policy is projected to deliver a further gradual decline in headline inflation during 2024 and 2025. Core inflation fell only slightly in the G20 advanced economies as a whole in 2023 compared to 2022, but is projected to continue to moderate over the next two years as labour cost pressures ease gradually, helped by some compression of profit margins (Table 3).

15. Inflation in the emerging-market economies is projected to remain generally higher than in the advanced economies while easing gradually through 2024-25. Tighter monetary policy and energy and food price cycles have also been the key drivers of inflation in many of these economies. In Brazil, India, Indonesia, Mexico and South Africa, inflation is projected to continue easing and converge on or towards central bank targets by the end of 2025. The inflation outlook in some other countries is more affected by idiosyncratic factors. Türkiye and Argentina are exceptional cases, with much higher inflation rates stemming from loose macroeconomic policy settings in the past, while China has its own cycle, with subdued consumer demand and lower pork prices keeping inflation at very low levels.

Figure 7. Global growth is projected to remain moderate

Per cent, year-on-year

Note: Aggregates use moving nominal GDP weights at purchasing power parities (PPPs).

Source: OECD Interim Economic Outlook 115 database.

Figure 8. Inflation is projected to decline further over the next two years

Per cent

Note: Personal consumption expenditure price index for the United States, harmonised index of consumer prices for the euro area aggregate, euro area member states and the United Kingdom, and national consumer price indices for all other countries. India projections are based on fiscal years, starting in April. The G20 aggregate uses moving nominal GDP weights at purchasing power parities (PPPs).

Source: OECD Interim Economic Outlook 115 database.

Risks and challenges

16. Upside surprises in inflation could trigger sharp corrections in financial asset prices if markets price in high-for-longer policy rates. There are several reasons why inflation outcomes could disappoint. Geopolitical risks remain high, particularly relating to the ongoing conflict in the Middle East following the terrorist attacks on Israel by Hamas (Figure 9, Panel A). A widening or escalation of the conflict could disrupt shipping more extensively than presently expected, intensify supply bottlenecks, and push up energy prices if traffic is interrupted in the key routes for the transport of oil and gas from the Middle East to Asia, Europe and the Americas (Figure 9, Panel B). This would harm growth and add directly to inflation pressures, and could potentially lead to a flight to safety in global financial markets. The projected easing of service sector inflation could also be checked if cost pressures persist from the combination of strong nominal wage growth and weak productivity, or if profit margins do not narrow as projected. Inflation expectations could also move up again in the event of new adverse shocks, particularly in energy markets, with households’ inflation expectations strongly correlated with petrol prices.

17. Risks also remain that the future drag from past policy rate increases could be stronger than anticipated. There is great uncertainty about how much demand reduction has already been set in train by the increases in policy rates that have been implemented to date. Disinflation has generally proceeded somewhat faster than expected and forward-looking real interest rates have become more restrictive over the past year. Moreover, the tightening of monetary policy over the past two years has been of a scale and speed rarely seen in the past – for the euro area, which came into existence in 1999, it is without precedent – and some effects of policy tightening may be nonlinear. The feedthrough of higher lending rates into household and corporate debt service burdens remains partial, especially in countries where most existing housing loans are at fixed rates or adjustable only after several years, or where companies were able to take advantage of exceptionally low borrowing costs prior to 2022. As this debt matures, or loan conditions are adjusted, the impact of higher interest rates will be felt increasingly. It remains possible that the lagged effects on growth and employment of the policy tightening that has already been undertaken could prove stronger than projected, particularly in credit-dependent economies.

Figure 9. Geopolitical risks remain elevated, with risks of disruptions to global energy trade

Note: Panel A, data downloaded from https://www.matteoiacoviello.com/gpr.htm on January 29, 2024. January 2024 is an average of the available daily data. Panel B data based on total oil flows (million barrels per day) and total LNG flows (billion cubic feet per day).

Source: Caldara, D. and M. Iacoviello (2022), “Measuring Geopolitical Risk”, American Economic Review, Vol. 112; US Energy Information Administration; and OECD calculations.

Policy requirements

Monetary policy

18. Policy interest rates have remained unchanged in the major advanced economies in recent months. Forward‑looking real interest rates are now positive, with the notable exception of Japan where policy remains accommodative, and central bank balance sheet reductions are continuing along well‑communicated paths, adding upward pressure on long-term interest rates. The cumulative effects of past tightening are also continuing to feed through into economic activity, housing and credit markets.

19. Monetary policy needs to remain prudent to ensure that underlying inflationary pressures are durably contained. Scope exists to start lowering nominal policy rates provided inflation continues to ease, with policy rate reductions beginning in the United States and the euro area by the second and third quarters of 2024 respectively, but the policy stance should remain restrictive for some time to come (Figure 10, Panel A). The pace and scale of policy rate reductions will be data dependent, and may vary across countries depending on economic conditions. Stable goods prices, a continued narrowing of supply and demand imbalances in labour markets, and declining cost and price pressures in service sectors will all be key factors helping to determine the timing of policy rate reductions. In Japan, by contrast, a gradual increase in policy interest rates is warranted over the next two years provided inflation settles at 2%, as projected. Nevertheless, the monetary policy stance is expected to remain accommodative for some time, with negative real interest rates persisting until the end of 2025.

Figure 10. Monetary policy needs to remain prudent

Policy interest rates, per cent

Note: For the United States, the policy rate refers to the upper limit of the Federal Funds target range. The main refinancing operations rate is used as the policy rate indicator for the euro area. Shaded areas denote OECD projections.

Source: OECD Interim Economic Outlook 115 database.

20. Easier global financial conditions and the anticipated onset of policy rate reductions in the advanced economies enhance monetary policy space in emerging-market economies by providing more flexibility to implement policy rate reductions. Nonetheless, differences in underlying economic developments are being reflected in an increasingly divergent policy stance in the larger economies. With inflation remaining very low, China has continued to reduce reserve requirement ratios and some lending rates to help boost liquidity within the financial system and support growth. Policy rates are also being lowered in some Latin American countries, including Brazil, that were among the first to tighten policy significantly in 2021 and where inflation has now fallen sharply towards target. In others, including India, Indonesia, Mexico and South Africa, policy easing has yet to get underway, with inflation remaining contained but yet to decline substantially. There is scope for some gradual policy easing over the next two years in most of these economies provided disinflation continues (Figure 10, Panel B). The pace of policy rate reductions should remain cautious to ensure that inflation expectations remain well anchored and avoid a rapid narrowing of interest rate differentials with advanced economies that could increase the risk of capital outflows or currency depreciation. In other economies, including Türkiye, policy rates are likely to have to remain unchanged to curb persistently high inflation.

Fiscal policy

21. Governments face difficult fiscal policy choices. Public debt burdens have risen substantially over the past fifteen years (Figure 11), and debt-service costs are increasing steadily as low‑yielding debt matures and is replaced by new higher-yielding issuance. Ageing populations, the climate transition and plans to raise defence expenditure are among the factors pointing to mounting future spending pressures. In the absence of offsetting spending adjustments or a higher tax burden, such pressures will add significantly to current debt levels in many countries over the coming decades. On current plans, few countries appear likely to achieve a primary budget surplus – one key factor that has previously helped to contain or reduce debt burdens – for some time. Indeed, some countries, including the United States and Japan, still have sizeable budget deficits at present even though there is little or no spare capacity estimated to remain in their economies. This points to significant underlying fiscal pressures that would raise debt further if left unchecked.

22. Tax and spending reforms are needed in many economies if public debt is to remain on a sustainable path, including stronger near-term efforts to contain spending growth, review the composition of spending and create space to meet future budgetary pressures. Ambitious reforms to pension programmes, including linking statutory retirement ages to future changes in life expectancy, alongside labour market reforms to strengthen employment opportunities for older workers, could ease future fiscal pressures substantially. On the revenue side, shifting taxes from labour to property and consumption, and reducing tax exemptions would expand the tax base and revenues, and help to make the tax system more supportive of growth. Credible medium‑term fiscal frameworks, with clear spending and tax plans to contain public debt whilst preserving the spending needed to support long‑term growth and the climate transition, would also help ensure sustainability whilst providing flexibility to respond to future shocks.

Figure 11. Rising public debt heightens the need for tax and spending reforms

General government gross debt, per cent of GDP

Note: General government financial liabilities for Australia, Canada, Japan, Korea and the United States, and general government gross debt on a Maastricht basis for euro area member states. The latest data point is 2023Q2 for Argentina, Brazil, China, India, Indonesia, Mexico, Russia, South Africa and Türkiye, and 2022Q4 for Australia, Japan, Korea and the OECD aggregate. For Korea, the starting data is for 2008Q4. G20 advanced economies in blue and G20 emerging-market economies in green.

Source: Eurostat; UK Office for National Statistics; IMF Sovereign Debt Investor Base dataset; OECD Economic Outlook 114 database; and OECD calculations.

23. Emerging-market economies also face fiscal pressures and refinancing risks from high government debt and rising interest payments. The share of lower-income countries in debt distress also remains high – despite some recent improvements – and many countries have been unable to access international bond markets in the last two years, particularly in sub-Saharan Africa. Governments need to rebuild fiscal space and reduce debt service burdens whilst protecting the spending necessary for development. Efforts to strengthen revenue collection and fight tax evasion, enhance spending efficiency, lower the burden of state-owned enterprises, and reduce informality would provide resources to finance necessary infrastructure spending and help expand the coverage of social protection systems. Transparent and credible fiscal rules and institutions would help to lower financing costs, and limit the pro-cyclicality of fiscal policy in many commodity-rich economies, thereby enhancing macroeconomic stability.

Structural policies should aim to strengthen the foundations for sustainable growth

24. Recent shocks to the global economy, and the long-term challenges that governments already faced from declining future growth prospects, the climate transition and digitalisation underline the urgency of structural reforms to boost productivity, investment and labour market participation, accelerate decarbonisation and make growth more inclusive. A case in point is the crucial area of education. Human capital is a key foundation for growth, affecting productivity, innovation and knowledge diffusion, and ensuring access to employment opportunities for all. The 2023 OECD PISA report is particularly concerning, showing that between 2018 and 2022 – a period spanning the outbreak of COVID‑19 – there was an unprecedented drop in performance in many countries for 15-year-olds tested on reading and mathematics (Figure 12). OECD empirical work suggests that this decline in PISA scores could have a persisting negative impact on the level of productivity over the next 30-40 years.

Figure 12. Improved educational outcomes are needed to boost long-term growth

Note: Charts shows the average PISA score across countries. G20 emerging-market economies aggregate based on data for Argentina, Brazil, Indonesia, Mexico and Türkiye. Data are unavailable for the United Kingdom for maths and reading in 2003, for the United States for reading in 2006, and for Argentina in 2003 and 2015.

Source: PISA 2022 database; and OECD calculations.

25. School closures during the pandemic may have contributed to the recent drop in test scores, particularly for disadvantaged students who were unable to benefit fully from on-line teaching. However, the recent decline in performance continues a downward trend in test scores prior to 2018, pointing to longer-term issues in educational systems in some countries. Countries need to act to improve education and skills outcomes. Key education reforms include measures to improve teaching quality and teachers’ qualifications; enhance the effectiveness of resources targeted to disadvantaged students and schools; expand vocational education and lifelong learning; and strengthen the responsiveness of vocational and university education to labour market needs. Such reforms will involve some additional fiscal costs – reinforcing the challenges governments face – but raising the quality of spending will be as important.

26. Another key priority is to revive global trade growth. Open and well-functioning international markets under a rules-based global trading system are an important source of long-term prosperity for both advanced and emerging‑market economies. Cyclical factors, such as changes in the composition of demand, have affected recent trade developments but there has been a longer-term structural slowdown in global trade openness since the global financial crisis. This has contributed to the recent moderation in productivity growth. Global value chain integration has slowed, restrictive trade policies have increased, and domestic policies are becoming more inward-focused. A key challenge will be to keep sight of the gains that could accrue from expanding trade and the benefits of global value chains for efficiency, whilst enhancing their resilience.

27. Enhanced multilateral co-operation is required to help meet the common challenge of the climate transition. The current mix of national policies may not lower global greenhouse gas emissions before 2030, making the goal of net-zero emissions by mid-century difficult to attain. Reaching that goal requires structural changes in the economy and will entail substantial reallocation of workers and capital from emission‑intensive activities towards greener activities. Accelerating the pace of decarbonisation will require ambitious packages of new policy measures. Increasing green and digital infrastructure investment and support for innovation, strengthening standards to enable a reduction in emissions, and raising the scope and level of carbon pricing are all key areas for policy action.