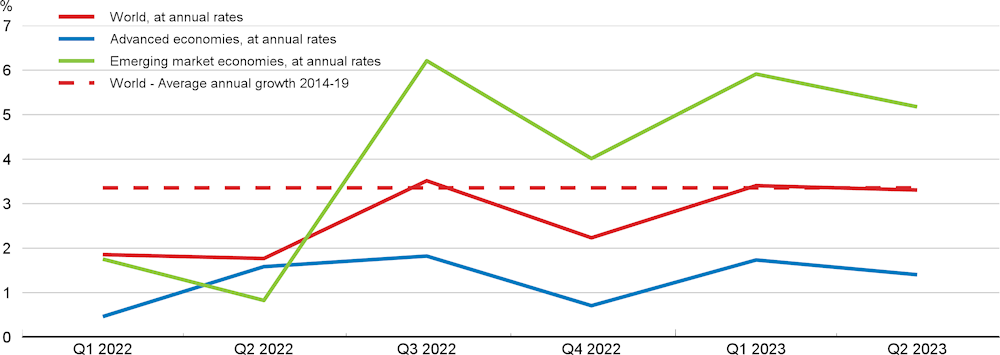

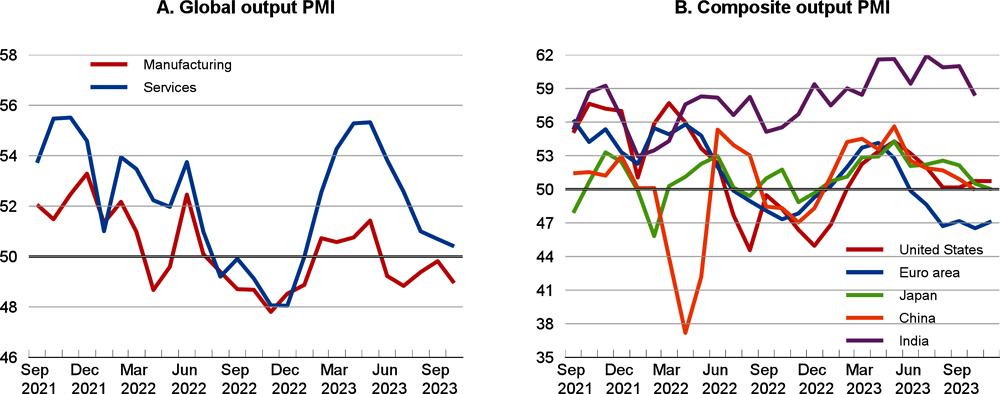

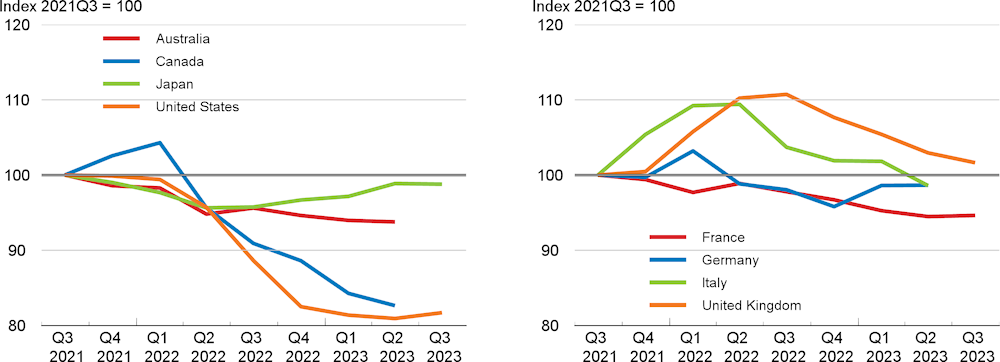

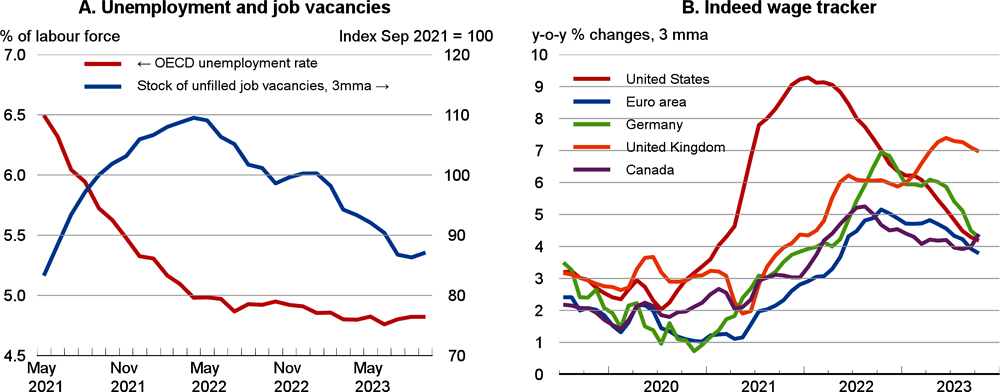

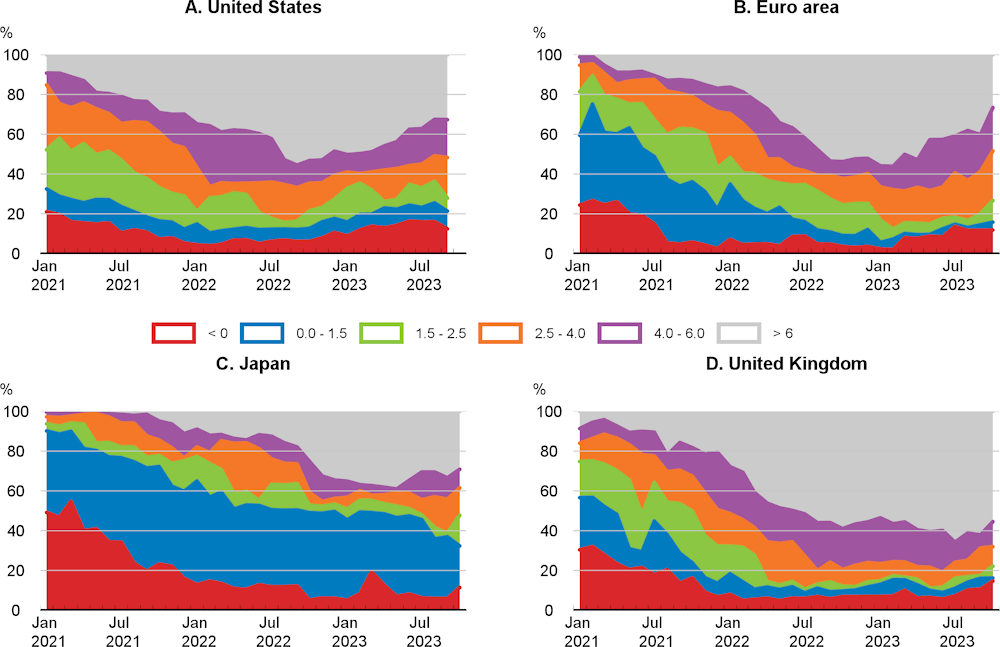

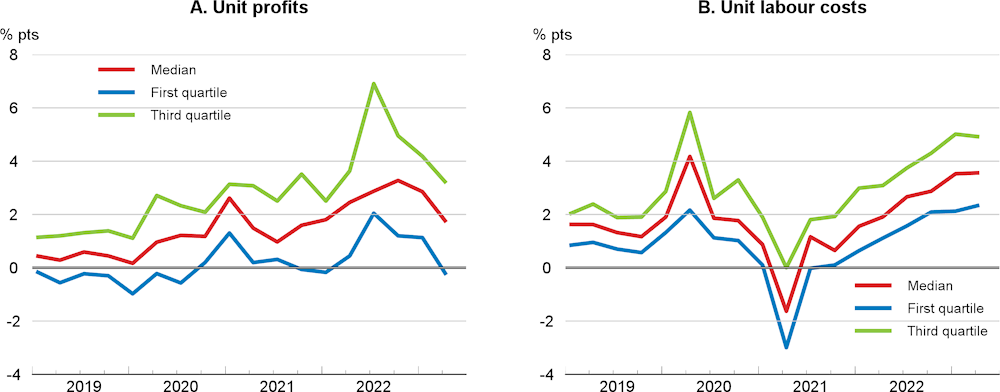

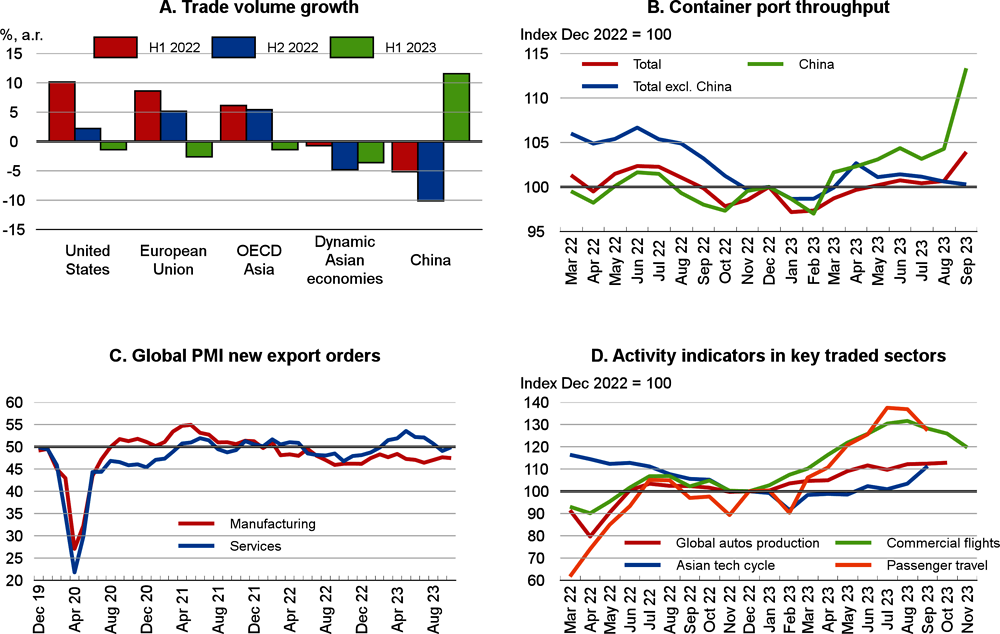

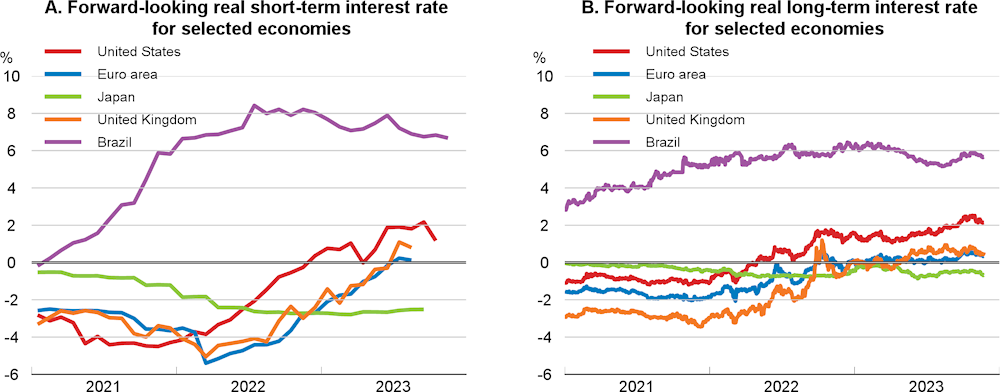

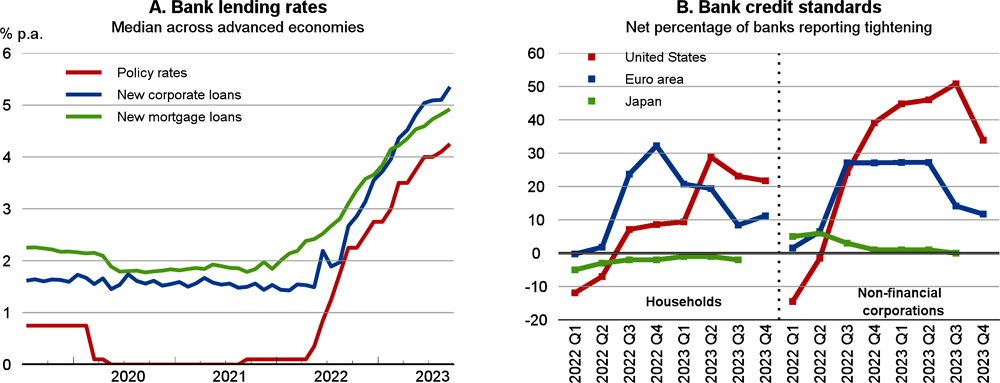

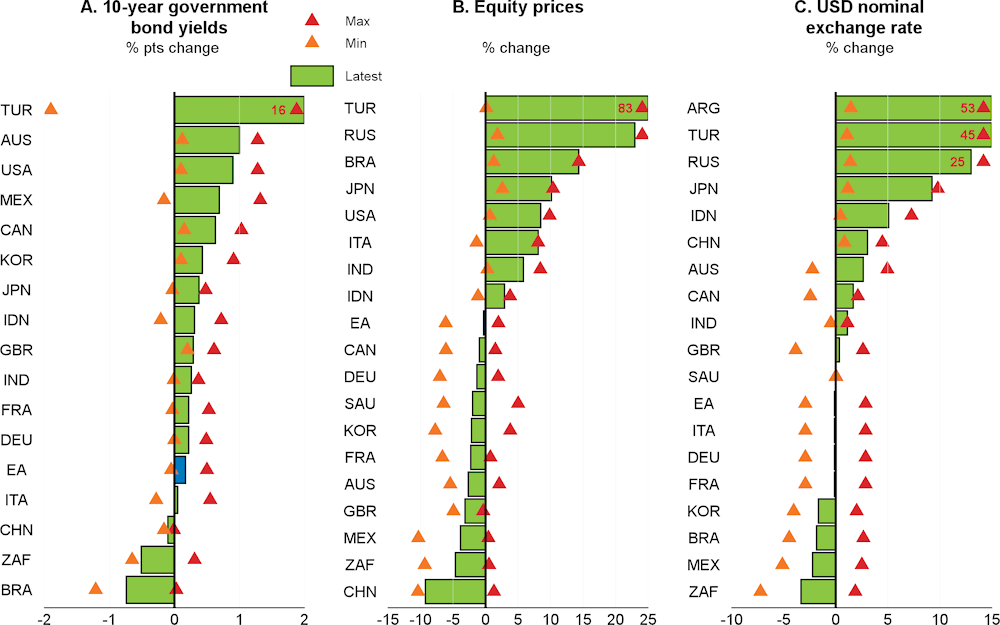

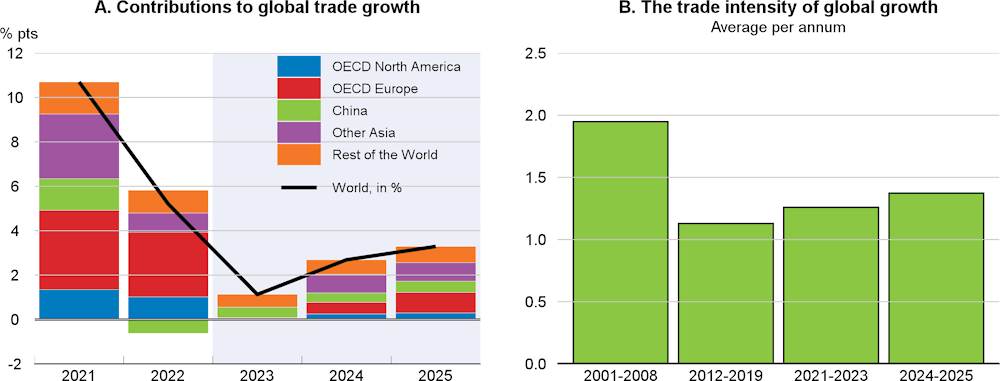

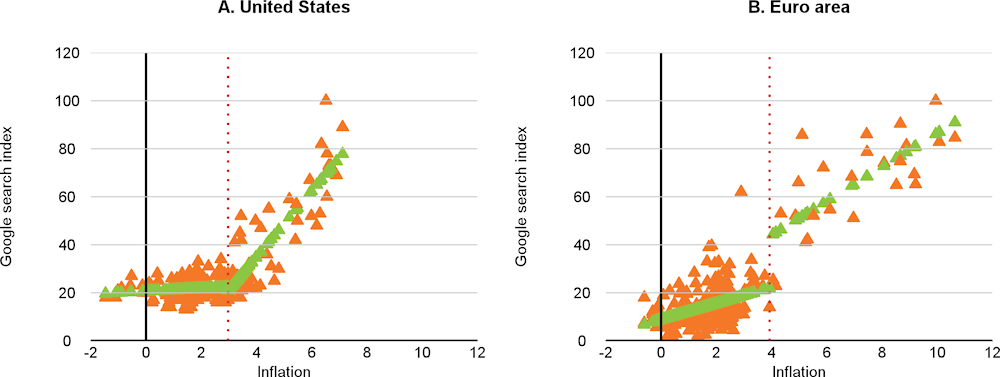

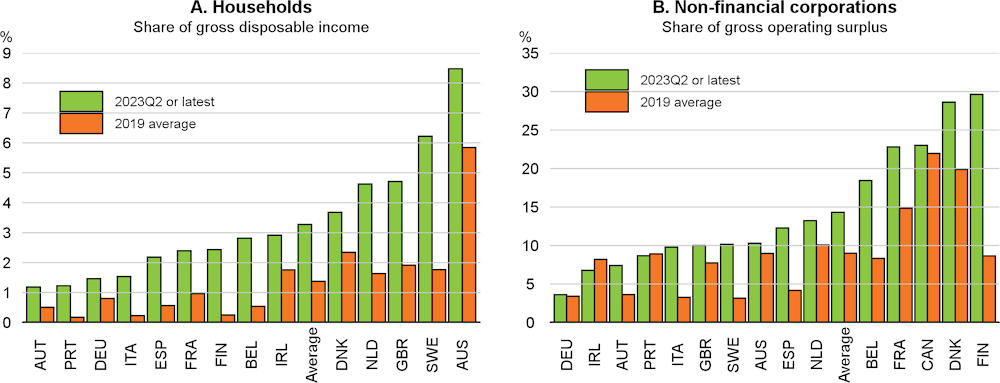

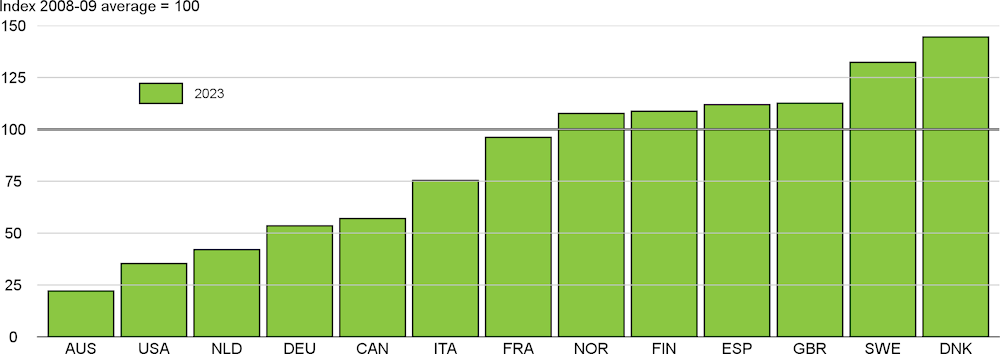

The global economy continues to confront the challenges of persistent inflation and subdued growth prospects. GDP growth has been stronger than expected so far in 2023, but is now moderating as the impact of tighter financial conditions, weak trade growth and lower business and consumer confidence is increasingly felt. Financial conditions are restrictive, with forward-looking real interest rates having generally risen further in recent months. Activity has slowed in interest-sensitive sectors, particularly housing markets, and in economies reliant on bank‑based finance, especially in Europe. Heightened geopolitical tensions are also again adding to uncertainty about the near-term outlook. Headline inflation has fallen in almost all economies, easing pressures on household incomes, but core inflation remains relatively high.

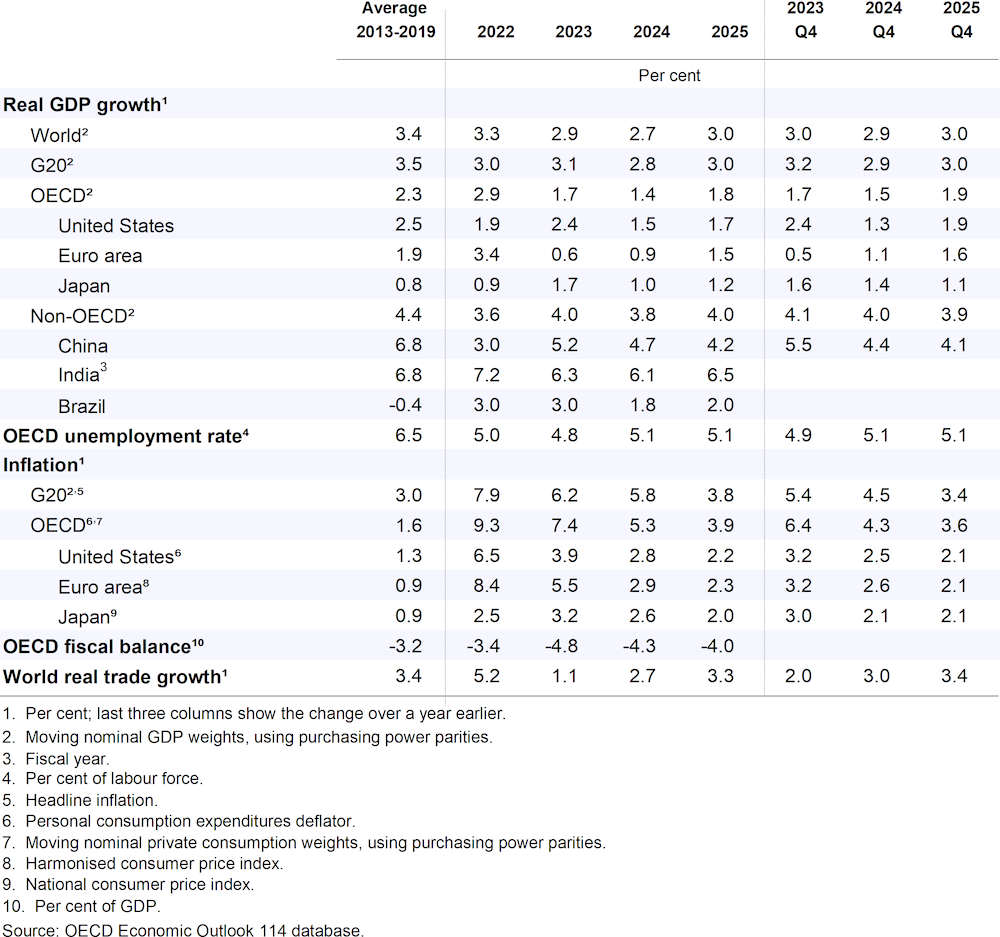

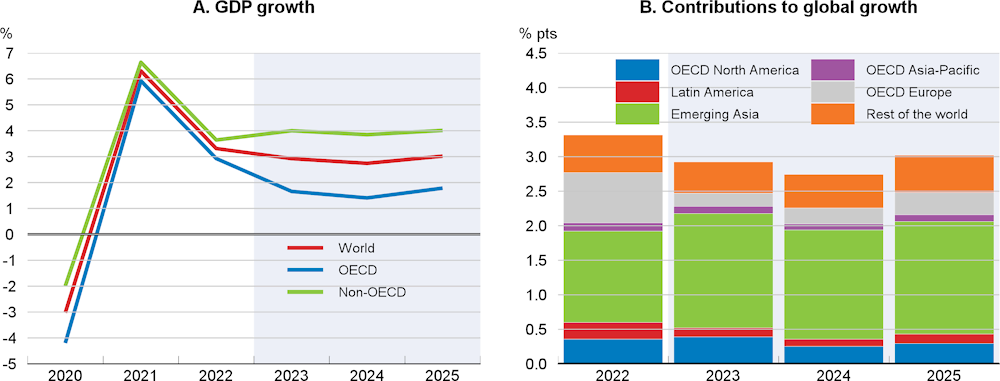

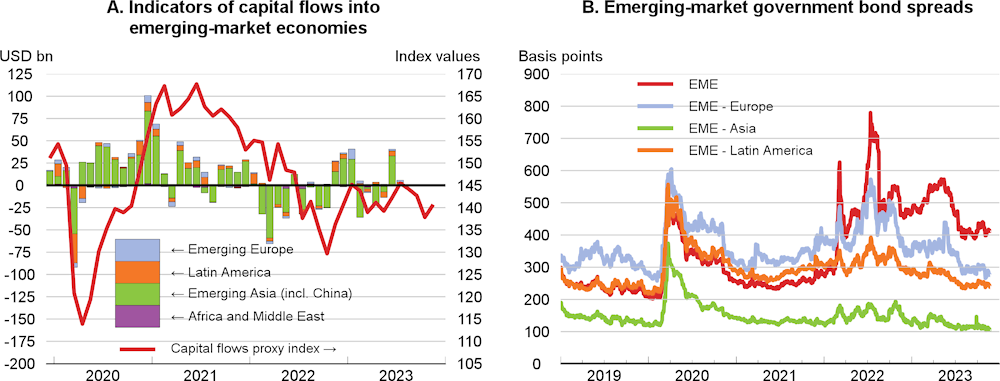

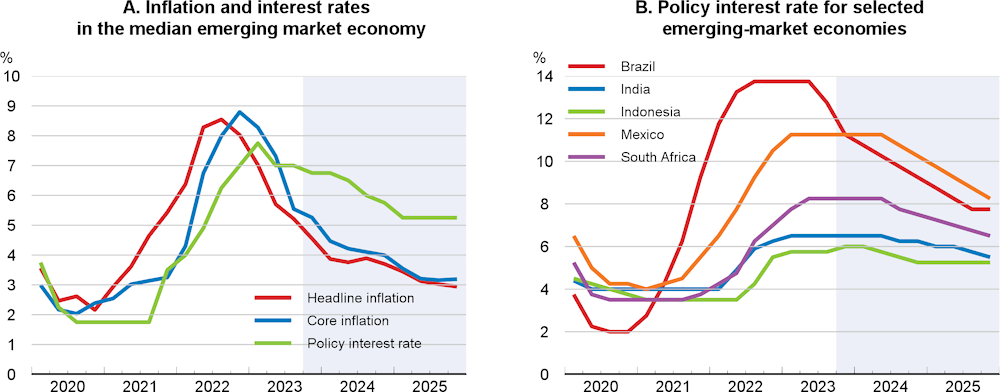

Global GDP growth is projected to ease to 2.7% in 2024, from 2.9% this year, before edging up to 3% in 2025 as real income growth recovers and policy interest rates start to be lowered (Table 1.1). A growing divergence across economies is expected to persist in the near term, with growth in the emerging‑market economies generally holding up better than in the advanced economies, and growth in Europe being relatively subdued compared to that in North America and the major Asian economies. Annual consumer price inflation in the G20 economies is projected to continue easing gradually as cost pressures moderate, declining to 5.8% and 3.8% in 2024 and 2025 respectively, from 6.2% in 2023. By 2025, inflation is projected to be back on target in most major economies.

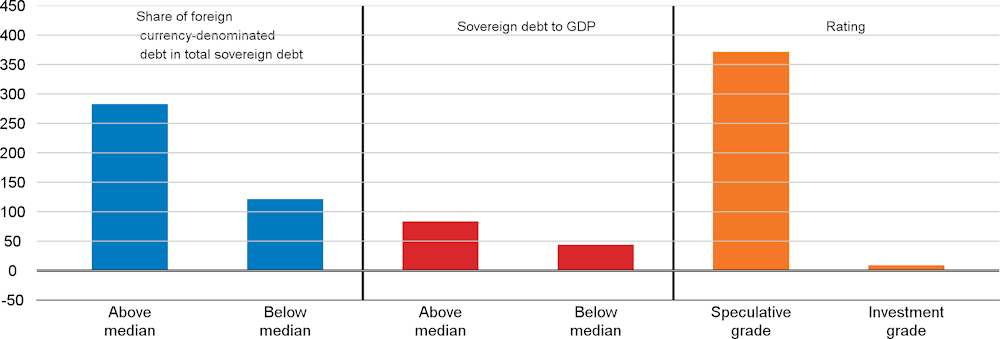

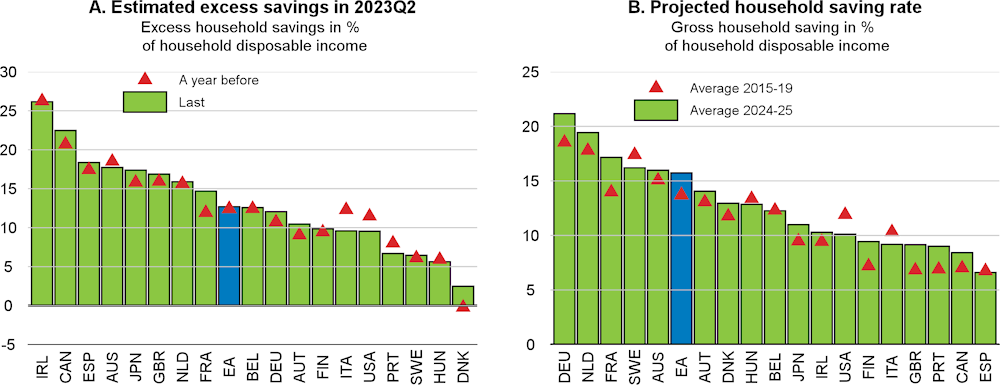

Risks to the near-term global outlook remain tilted to the downside. Heightened geopolitical tensions due to the conflict following the terrorist attacks on Israel by Hamas are a key near-term concern, particularly if the conflict were to broaden. This could result in significant disruptions to energy markets and major trade routes, and additional risk repricing in financial markets, that would slow growth and add to inflation. Headwinds from rising trade restrictions, inward-looking policies and the restructuring of global value chains are also contributing to the uncertain outlook for global trade, which is a key concern given the importance of trade for productivity and development. Continuing cost pressures, renewed rises in energy and food prices, or signs of an upward drift in inflation expectations could compel central banks to keep policy rates higher for longer than expected, potentially generating additional stress in financial markets. Conversely, the impact of higher interest rates and tighter credit standards could prove stronger than anticipated, leading to a more severe slowdown in spending, rising unemployment and higher bankruptcies. Tighter-than-expected global financial conditions would also intensify financial vulnerabilities, including in emerging-market and developing economies, and add to debt‑servicing pressures in lower-income countries. On the upside, the global economy and financial markets have so far proved relatively resilient to the tightening of monetary policy, and inflation could return to target without a marked growth slowdown or a sharp rise in unemployment. A continuation of this pattern would imply better‑than‑expected growth in 2024 while inflation eases. Growth would also be stronger if households were willing to spend excess savings accumulated during the pandemic, but inflation persistence might also be prolonged.

Against this backdrop, the key policy priorities are to ensure that inflation is durably reduced, address mounting fiscal pressures, and improve the prospects for sustainable and inclusive growth in the medium term.

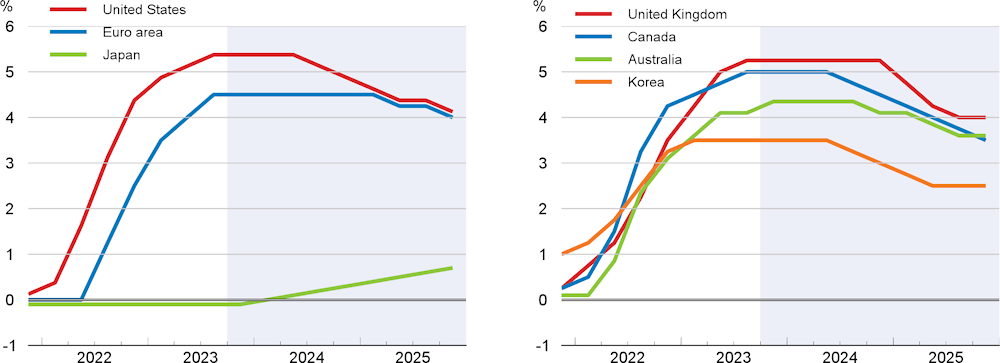

Monetary policy needs to remain restrictive until there are clear signs that underlying inflationary pressures are durably lowered, with inflation expectations moderating further and a rebalancing of supply and demand in labour and product markets. Policy rates appear to be at or close to their peak in most advanced economies, although some additional rate rises could still be needed if underlying inflationary pressures prove persistent. The need to maintain downward pressure on inflation will limit scope for policy rate reductions until well into 2024, with nominal rates then being lowered in parallel with inflation. In Japan, a gradual increase in policy interest rates would be appropriate in 2024-25 provided inflation settles at 2%, as projected. Policy rate reductions have already begun in some emerging-market economies where policy tightening was initiated at a relatively early stage and inflation has eased significantly. There is scope for further rate reductions over 2024‑25, although tight global financial conditions and the need to ensure anchored inflation expectations limit the pace at which these can occur.

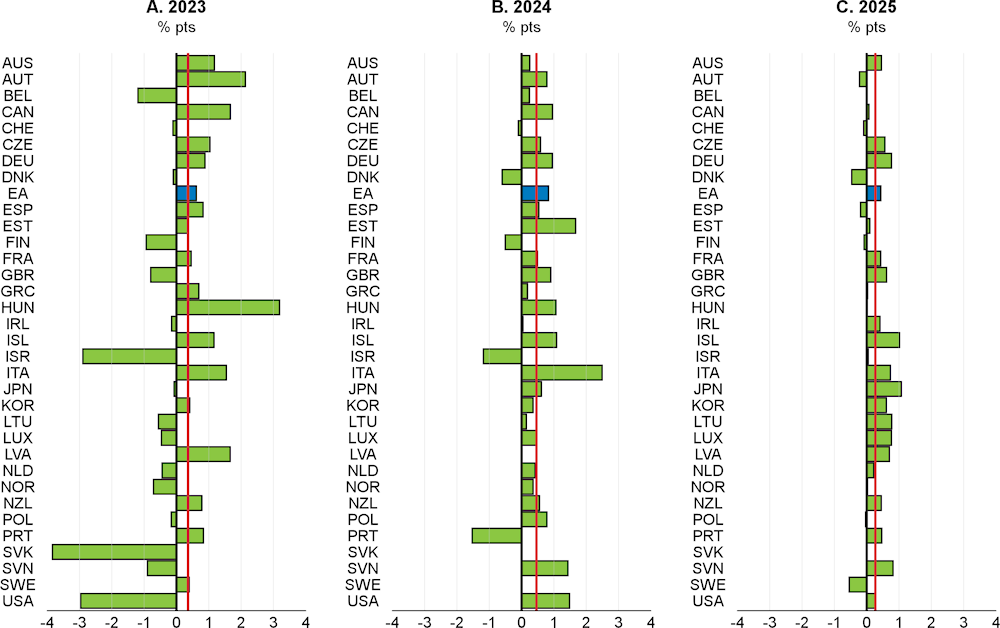

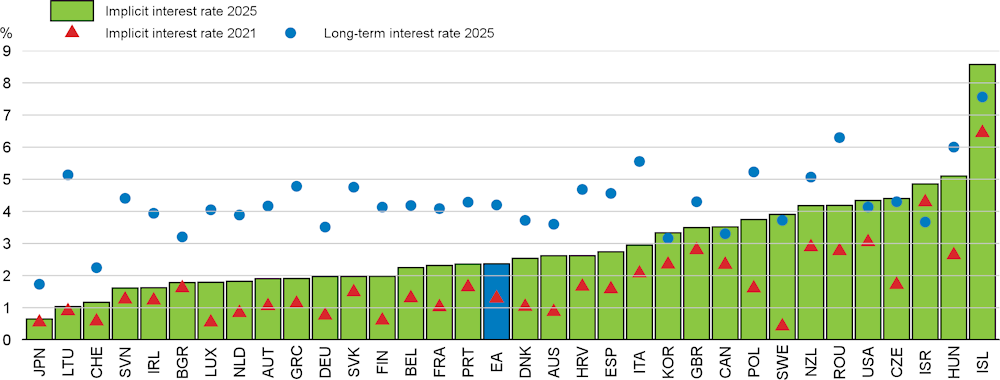

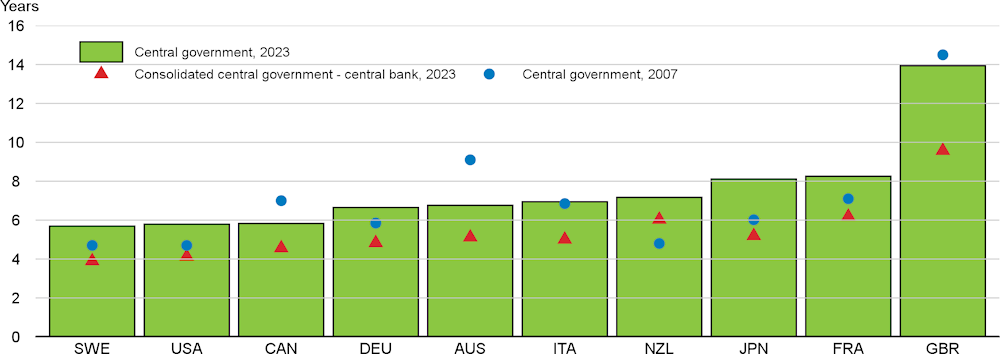

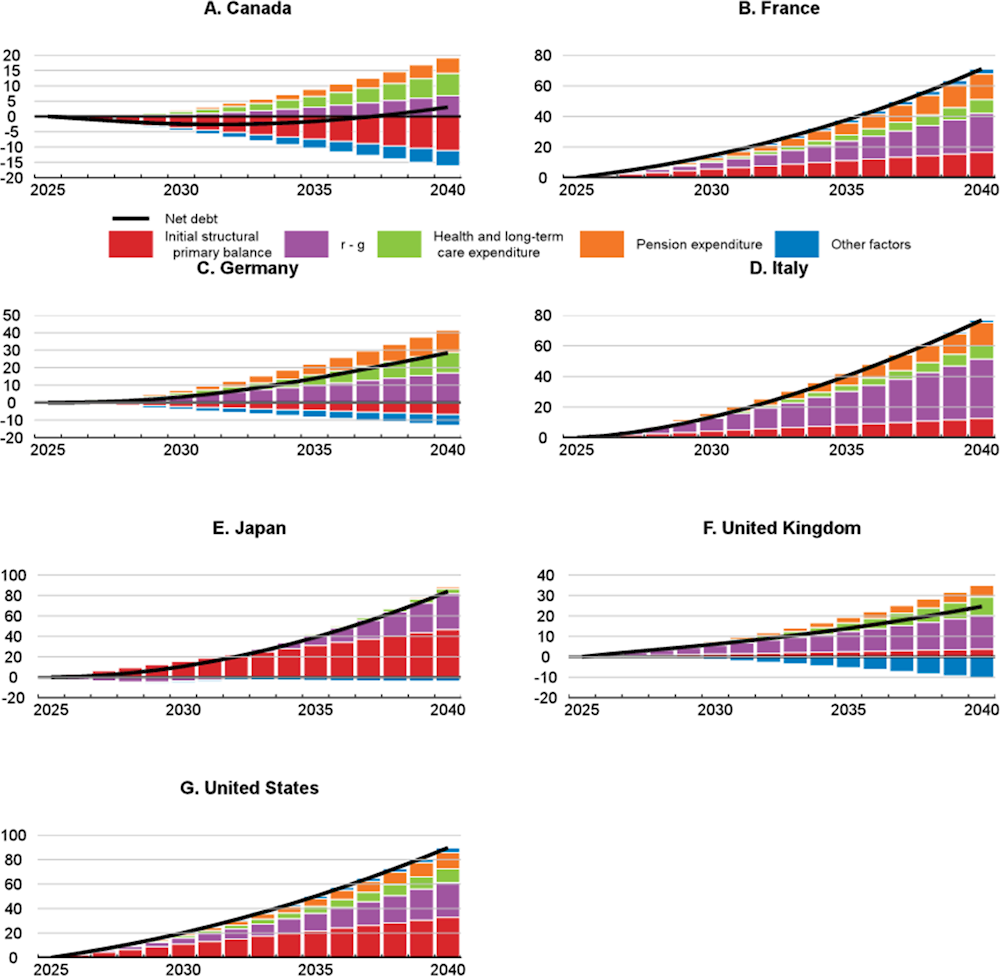

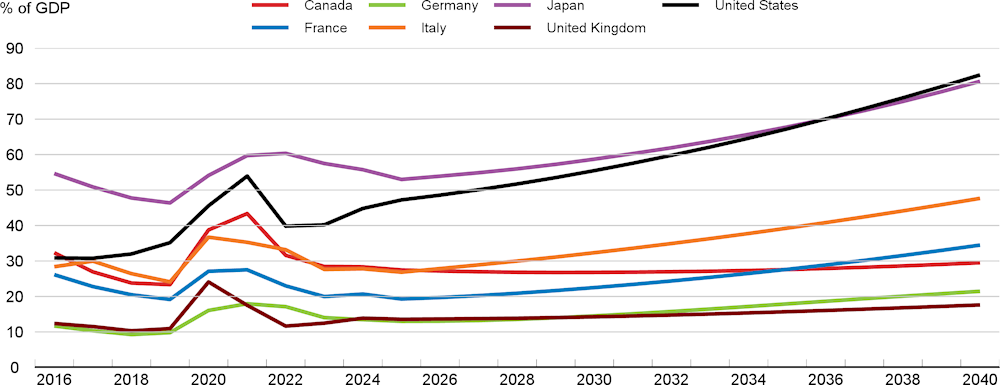

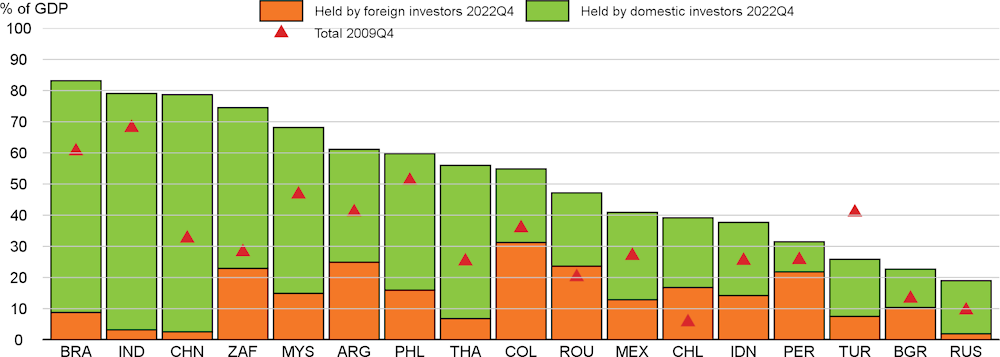

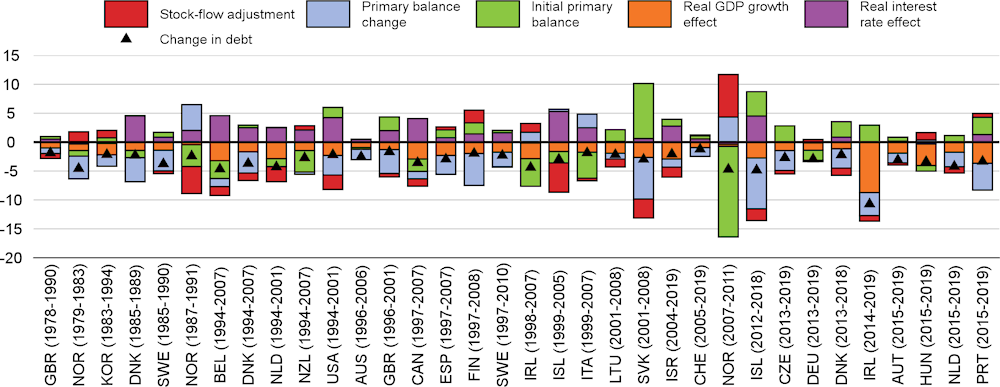

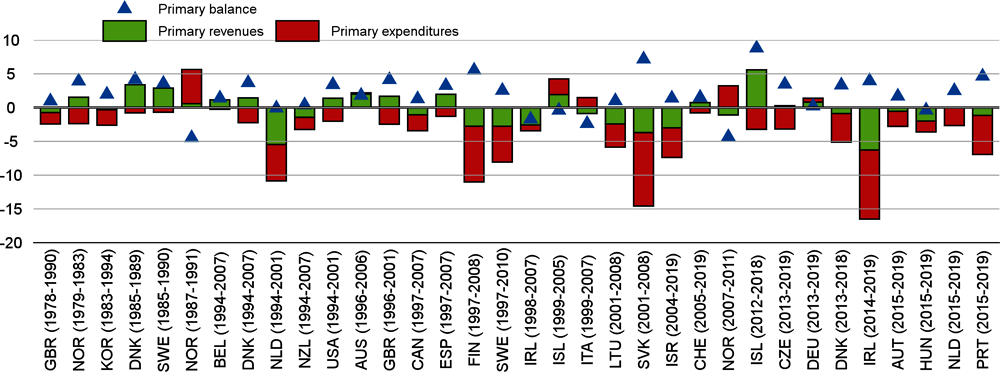

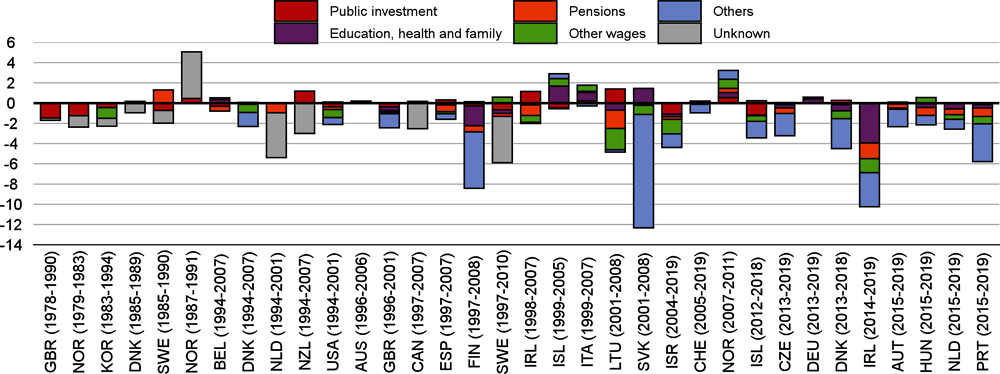

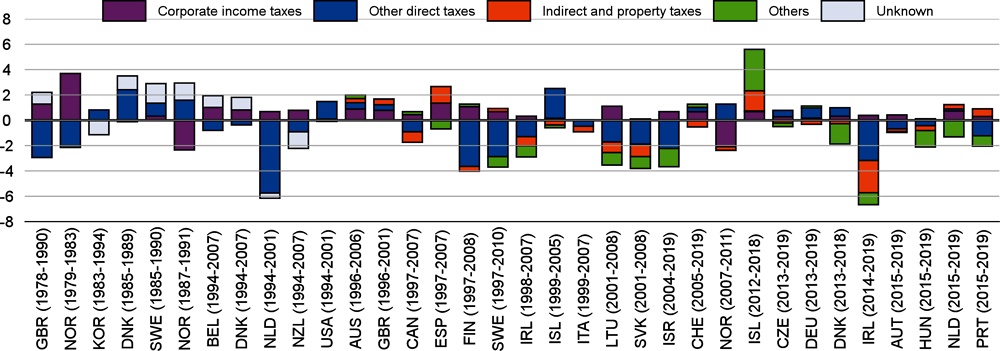

Governments face rising fiscal pressures from high debt burdens and additional spending on ageing populations, the climate transition and defence. Debt-service costs are also increasing as low‑yielding debt matures and is replaced by new issuance. Without action, future debt burdens are likely to rise significantly. Past episodes of sustained debt reductions have generally been achieved with countries maintaining a primary budget surplus. On current plans, few countries are likely to achieve this in 2024-25, suggesting it will be more challenging to reduce high debt now than in the past. Stronger near-term efforts are necessary to create space to meet future spending pressures. A key step is to ensure that fiscal support measures, including remaining energy support schemes, are either withdrawn or become better targeted towards those most in need. Credible medium-term fiscal frameworks, with clear spending and tax plans that address future fiscal pressures and preserve the investment needed to support long-term growth and the climate transition, are also essential to ensure sustainability and provide flexibility to respond to future shocks.

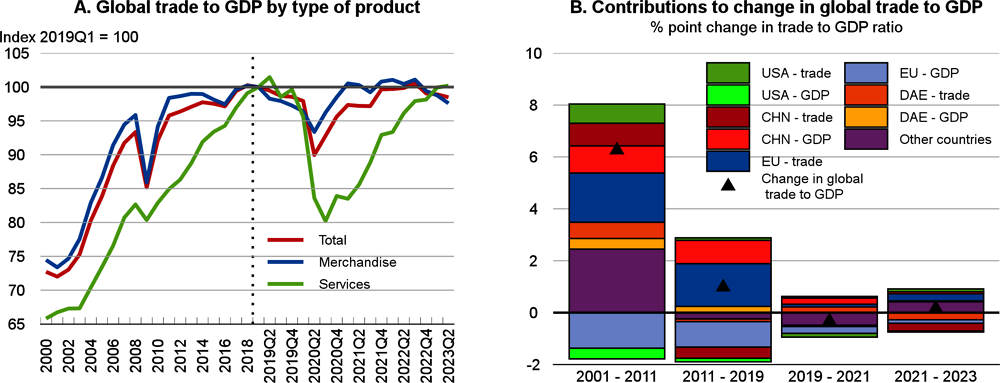

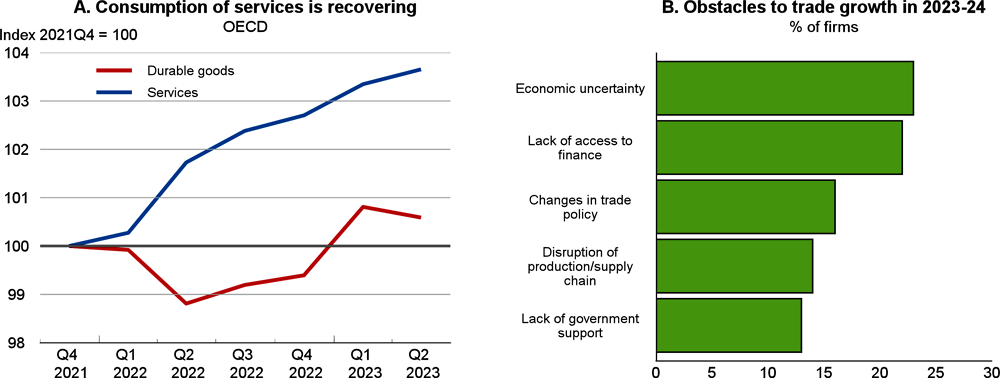

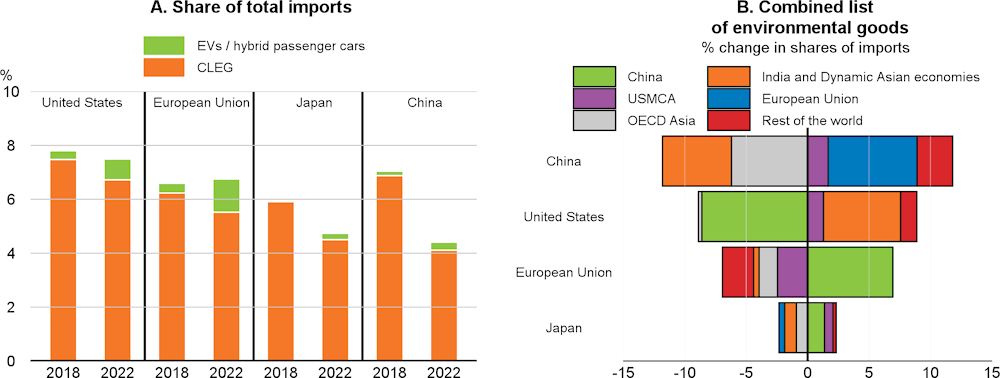

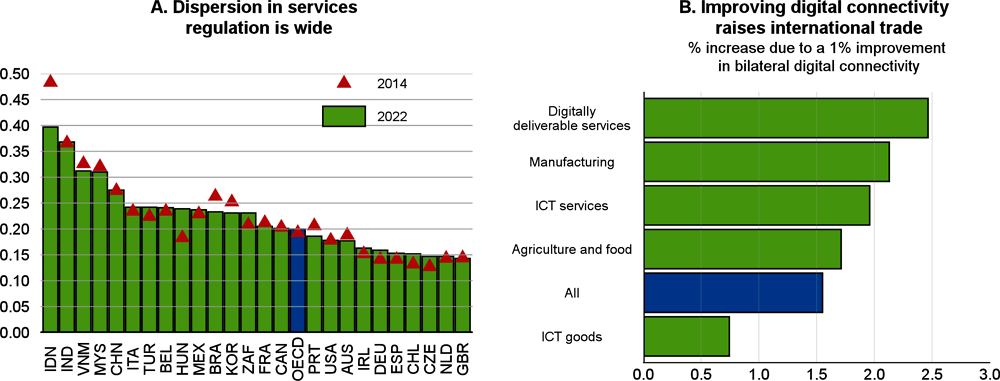

Enhanced multilateral co-operation is required to revive global trade. In an interconnected world, open and well-functioning international markets under a rules-based global trading system are an important source of long-term prosperity for both advanced and emerging‑market economies. A key policy challenge is to balance the need for enhanced resilience of global value chains without eroding their benefits for efficiency or losing sight of the income gains that could accrue from lowering trade barriers, especially in service sectors.

Given the long-term decline in economic growth and the pressing challenges from ageing populations, the climate transition and digitalisation, ambitious structural reforms are needed to reinvigorate growth and improve its quality. As emphasised in the 2023 edition of the OECD Going for Growth report, renewed efforts to reduce constraints in product and labour markets, strengthen investment and labour force participation and enhance skills development would improve productivity prospects and maximise the gains from the digital transformation. Faster progress towards decarbonisation is also essential. Increasing green and digital infrastructure investment and support for innovation, strengthening standards to enable a reduction in emissions, and raising the scope and level of carbon pricing are all key areas for policy action.