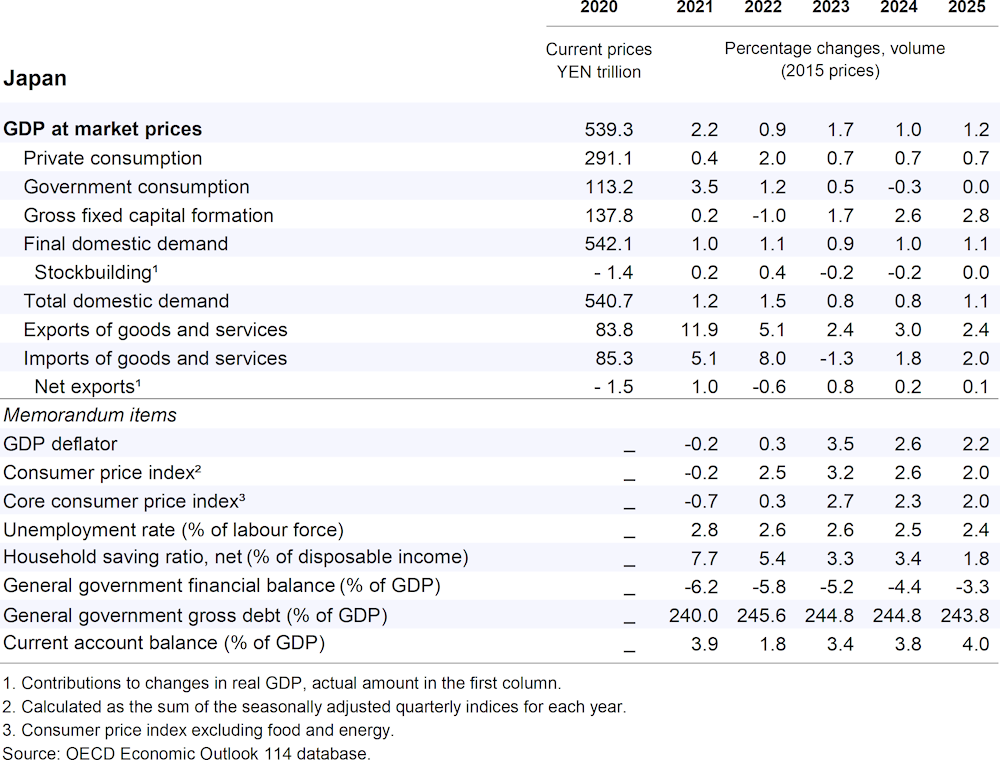

The new economic package announced in November includes measures to moderate the impact of high prices and support medium-term investment in several areas, such as economic security, green and digital transformation, and education. It includes cash handouts to low-income households and temporary cuts to income and residential taxes, which will cost JPY 1.1 trillion (0.2% of GDP) and around JPY 4 trillion, respectively. The current subsidies to cushion the impact of higher fuel oil, electricity and city gas prices are also extended until April 2024, with those for electricity and city gas to continue at reduced rates from May 2024. The related supplementary budget, which also includes expenditures expected to be implemented over multiple years, will be around JPY 13.1 trillion in FY 2023 (2.3% of GDP). The OECD projections assume that the subsidies will remain in place until the end of 2024, albeit gradually declining over time, alongside an annual increase in defence spending of around JPY 1 trillion in 2024-25. Fiscal support is projected to decline with the end of pandemic-related measures and the gradual decline in price subsidies in 2024 and the phase-out of subsidies in 2025. The gross public debt-to-GDP ratio is projected to remain high at 243.8% in 2025.

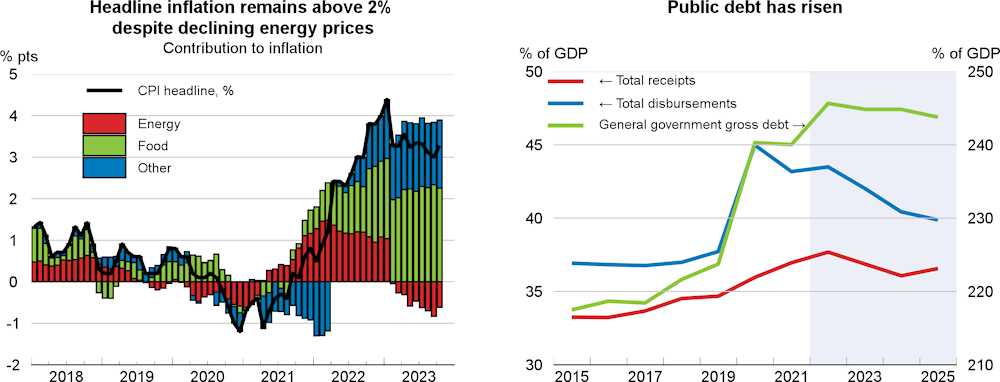

The short-term policy interest rate remains unchanged at -0.1%, but the conduct of yield curve control has been modified twice in 2023. With the second adjustment in late October, the Bank of Japan shifted to an upper bound of 1% for the yield target of 0% for 10-year Japanese government bonds and stated that the upper bound will serve as a reference, with yields controlled mainly through large-scale Japanese government bond purchases and market operations. Such adjustments to further increase flexibility should be continued. OECD projections of sustained inflation around 2%, increasing wage growth and a closing of the output gap imply a gradual increase in the policy rate is warranted, starting from early 2024. However, if the positive wage-inflation cycle gets underway more slowly than projected, the Bank of Japan is likely to wait for longer before raising interest rates.