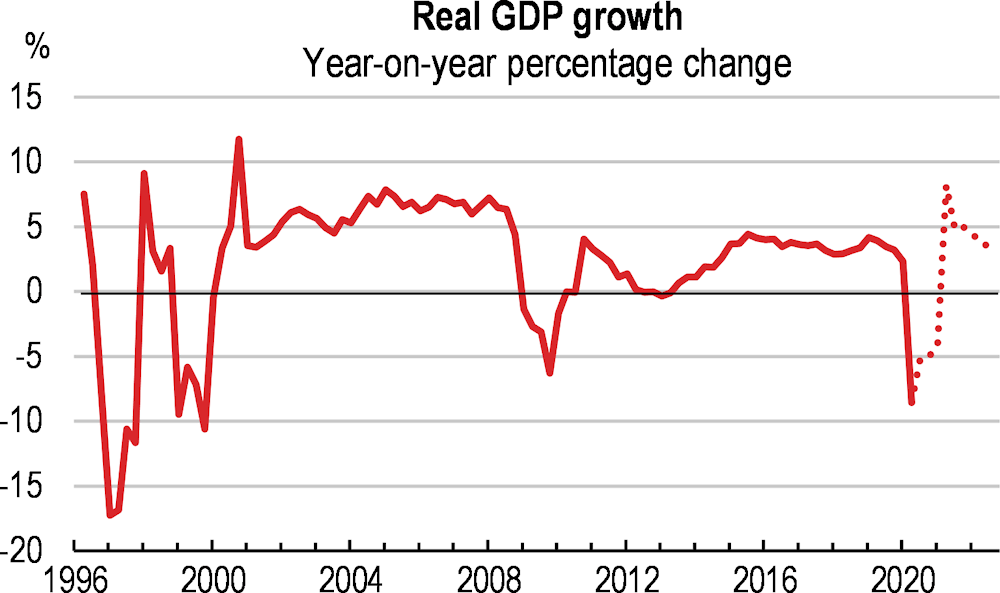

An open economy with a large manufacturing sector integrated in global value chains, Bulgaria has made strong income gains in the past two decades. A sound macroeconomic framework and deepening integration with the European Union have allowed progress towards euro area entry. Prior to the pandemic, unemployment had reached historical lows, and wages had grown substantially. Impressive structural reforms were made to boost productivity, increase income convergence and address social challenges. The COVID-19 pandemic has interrupted this progress, with an output fall not seen since the 1996-97 banking crisis (Figure 1).

OECD Economic Surveys: Bulgaria 2021

Executive summary

The COVID-19 pandemic has interrupted an impressive progress

Figure 1. GDP growth abruptly interrupted

Economic activity contracted sharply when confinement measures were first introduced to contain the pandemic. Travel, accommodation and food services suffered a large contraction. Manufacturing is mostly export-oriented and was hit by initial large volume and price declines. The scarring effects of the COVID-19 shock could be long lived. This makes it essential to press on with reforms facilitating the reallocation of factors of production, which is typical after large shocks.

Employment fell, eroding recent gains. Men and youth were affected the most by job losses. While the government’s wage subsidy scheme protected a high share of jobs, the recovery of employment will require more active labour market policies. The workforce is ageing and the economy can little afford large-scale withdrawals from labour market participation.

A recovery is underway, but uncertainty is high. The re-opening of businesses and relaxation of containment measures over May-June was accompanied by a recovery of activity that gained momentum in July. Business and consumer confidence began to increase. Industrial production has started to recover though it remains below February 2020 levels. However, service and retail sector activity has been held back by consumer income losses, the rise in precautionary savings and continued restrictions on some activity. A continued high COVID-19 caseload could constrain the normalisation of domestic demand.

A sluggish recovery in the global economy is a downside risk. A highly open economy that is dependent on exports, particularly related to the processing and assembly of foreign inputs into manufacturing export goods, Bulgaria’s recovery is vulnerable to further shocks to external demand.

Table 1. The recovery will be gradual

|

2019 |

2020 |

2021 |

2022 |

|

|---|---|---|---|---|

|

Gross domestic product |

3.7 |

-4.1 |

3.3 |

3.7 |

|

Private consumption |

5.5 |

-0.7 |

2.7 |

3.1 |

|

Gross fixed capital formation |

4.5 |

-8.4 |

5.8 |

4.4 |

|

Exports |

3.9 |

-10.7 |

6.0 |

5.7 |

|

Imports |

5.2 |

-9.9 |

6.1 |

5.3 |

|

Unemployment rate |

4.2 |

6.4 |

6.1 |

5.1 |

|

Consumer price index |

3.1 |

1.6 |

1.4 |

1.8 |

|

Current account (% of GDP) |

3.0 |

3.1 |

2.9 |

3.1 |

|

Fiscal balance (% of GDP) |

1.9 |

-4.4 |

-4.5 |

-2.6 |

Note: CPI data are period averages.

Source: OECD, Economic Outlook 108 database.

The government has put in place a fiscal stimulus estimated at 3% of GDP. This has reduced job losses, increased the resources for health care and eased financial pressures for the most impacted firms and households. Prudent budget execution prior to the pandemic has provided Bulgaria with ample fiscal space to respond to the crisis. In 2019, a budget surplus was recorded and public debt was lower than in most OECD economies. Fiscal support measures should not be withdrawn prematurely. Increasing investment related to transport infrastructure, energy efficiency, the digital economy and innovation could make for a more robust economic recovery, and are likely to receive substantial resources from the European Union Recovery and Resilience Facility.

Bulgaria is in a strong position to benefit from joining the euro area. Bulgaria joined the European Exchange Rate Mechanism II in July 2020 and the European Central Bank and the Bulgarian National Bank have established cooperation over banking supervision. For over twenty years, it has maintained a currency board with a fixed exchange rate to the euro. Supervision of the financial sector has improved and the sector is well capitalised. Given that the long-term interest rate differential with the euro has fallen to zero, it seems unlikely that euro entry will attract large inflows of speculative funds. The challenge is that wages, which are currently much lower than elsewhere, will rise as Bulgaria converges towards the euro area. To ensure competitiveness and avoid macroeconomic imbalances, labour productivity will have to keep up with real wage pressures.

The business environment needs improving

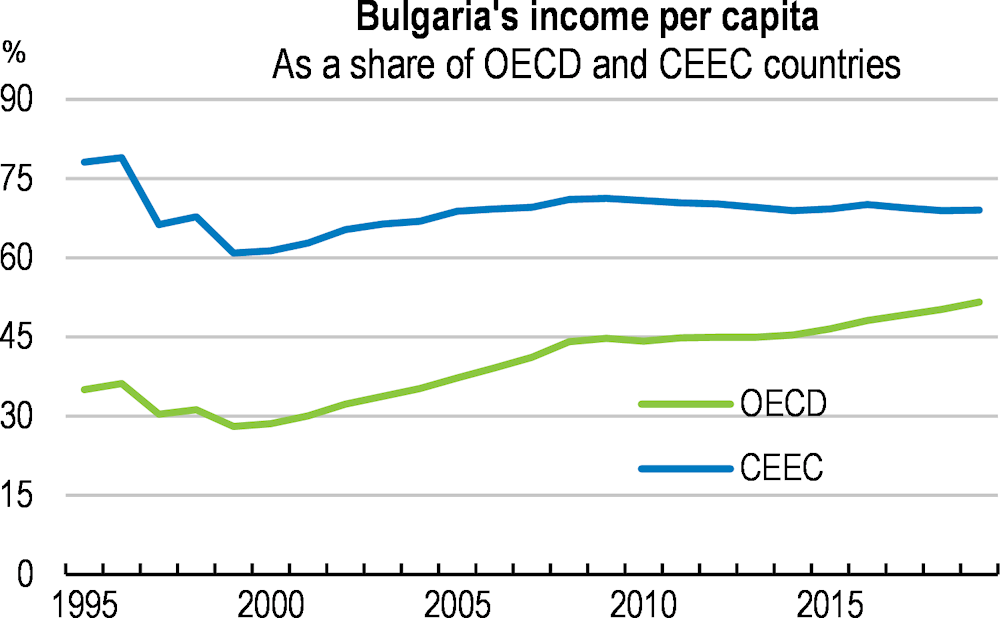

Boosting income convergence will require ambitious reforms. Several years of robust economic growth has lifted income per capita above half of the OECD average (Figure 2), but productivity had trailed that of faster-converging Central and Eastern European peers. Recovery plans from the pandemic should focus on modernizing the business environment.

Figure 2. Convergence had increased

Note: CEEC is the average of the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, the Slovak Republic and Slovenia.

Source: World Bank, World Development Indicators database.

Barriers to competition are high. Reducing regulatory barriers and improving competition policy would stimulate business dynamism and support a more efficient allocation of resources in the economy. Public policies should make sure to level the playing field among different stakeholders, particularly by building on significant action to modernise and improve public procurement in recent years.

Insolvency reform has become all the more pressing. The government has identified gaps in the insolvency framework and has set up a roadmap for reforms. A more rapid and effective bankruptcy framework would help non-viable firms in financial difficulties to shut down and avoid zombie firms from holding back resources and impairing banking system credit. Easing access to firm rehabilitation and debt forgiveness proceedings would allow more businesses that face solvency problems to exercise the option of restructuring their financial obligations with creditors outside of a full formal insolvency process. Like in other countries, measures should be put in place to help firms in financial difficulties due to the pandemic, including out-of-court settlements with creditors.

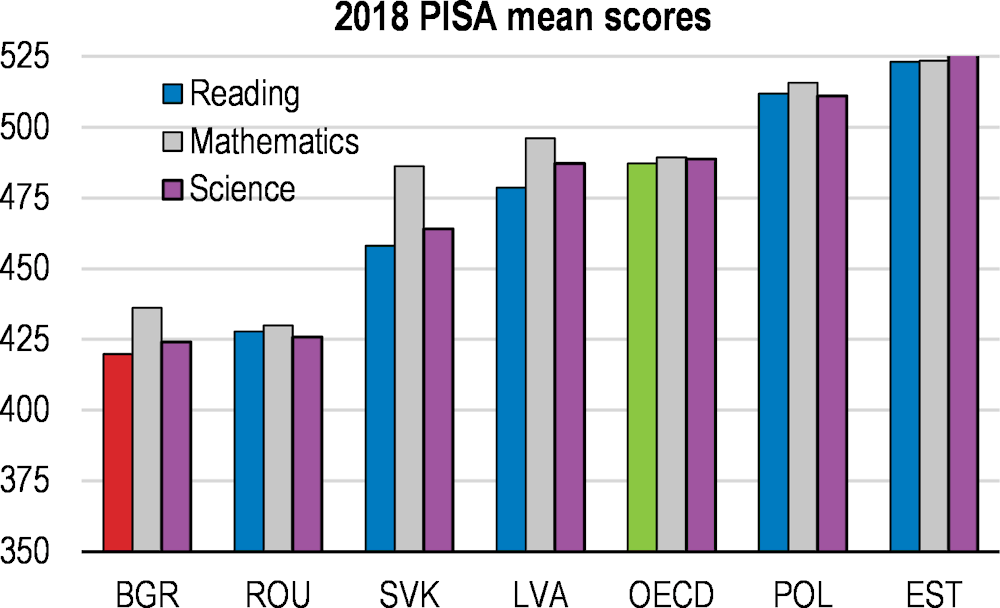

Skills need to be improved. The effectiveness and provision of education and training throughout the lifecycle should be increased. Poor PISA scores (Figure 3), high dropout rates in secondary education, and the large proportion of NEETs (young people neither in employment nor in education or training) are worrying indicators for a country facing ever-shrinking younger cohorts.

Figure 3. PISA education scores are low

The economy is carbon- and energy-intensive. Coal continues to account for almost half of energy production, though the share of renewables has increased above the OECD average. The potential to improve energy efficiency is large. The COVID-19 recovery presents an opportunity to decarbonise the economy, especially the energy mix and housing stock, which could benefit from abundant EU green funds.

Efforts made to fight corruption and organised crime should continue. Important steps have been taken to reform the judiciary, but more is needed to strengthen accountability and safeguard judicial independence, and to establish a coherent public integrity system.

Reducing poverty and raising regional development require more reforms

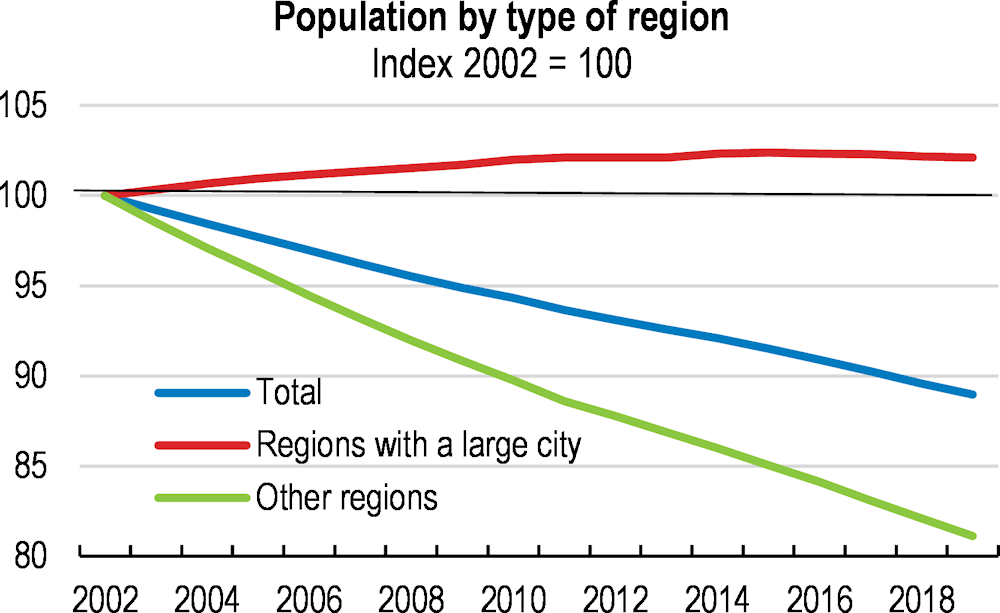

The booming economy translated into robust household disposable income growth. However, income inequality exceeds almost all OECD countries. Regions with large cities are driving growth in Bulgaria, while many rural regions suffer from depopulation and rapid ageing.

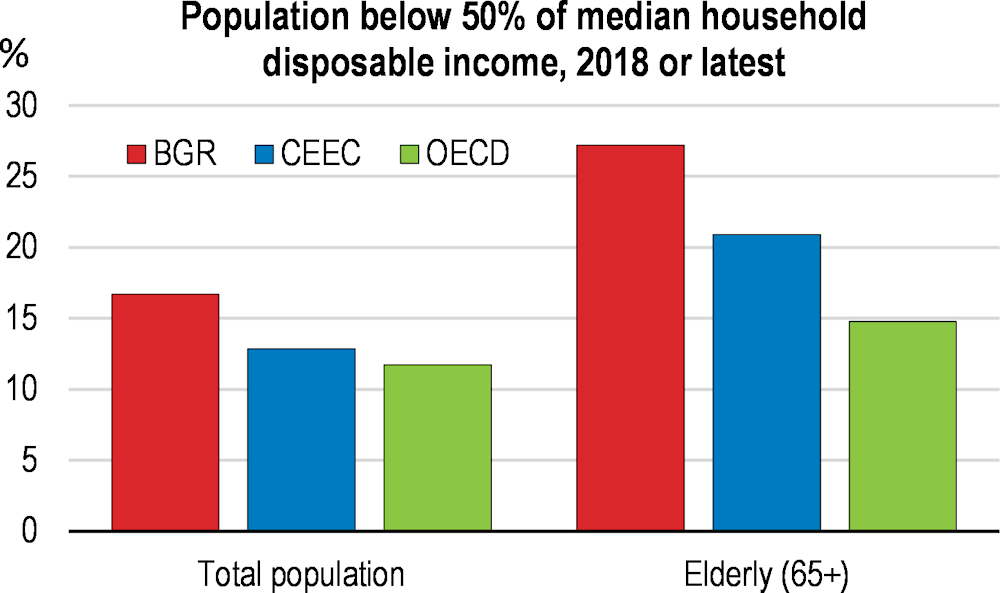

Poverty remains elevated, particularly among ethnic minorities, the elderly and children, and in rural areas. Cash transfers to protect the most vulnerable from income shocks are low and restricted. The combined average income tax and social contribution rate for lower-wage workers is comparatively high and does little to reduce income inequality.

Figure 4. Relative poverty is high

Investments in infrastructure and housing reform would help to boost mobility and strengthen linkages to national and international supply chains. Regional income differences in Bulgaria are larger than in most OECD countries and growth has been lower in regions without larger cities. Increasing the long-term value-added of tourism and agricultural activities can assist in local economic development. Improving living standards for all regions will require better coverage and access to public services, notably in health and long-term care.

Figure 5. Depopulation and urbanisation

Note: A large city has at least 250 000 inhabitants.

Source: Bulgarian National Statistical Institute.

The Roma, making up one-tenth of Bulgarians, live in socially excluded neighbourhoods. Improving their economic integration is important as the Roma are an increasing share of the working-age population. Most Roma lack proper housing and almost 25% of houses in segregated Roma neighbourhoods remain illegal. Roma face difficulties also in accessing healthcare services and social benefits, and are likely to have weaker education outcomes, often dropping out before finishing school. This is a particular concern among young Roma women.

Health care needs to be strengthened. Hospital capacity is high, but primary care is underdeveloped due to significant gaps in health insurance coverage and large out-of-pocket payments. To address the pandemic, the government made treatment of COVID-19 available to all. Yet, access to health care is restricted in many regions, due to low numbers of general practitioners, which results in frequent hospital visits.

Residential mobility is very low in comparison with OECD countries. While Bulgaria has a high number of dwellings per capita, overcrowding is common and a large share of young adults live with their parents. High homeownership and low affordability are the main obstacles to residential mobility and resolving housing market imbalances. Housing allowances and social housing are underdeveloped. The targeted heating allowance increased substantially in 2019, but is the only support programme of significant size and distorts incentives for energy renovation.

|

MAIN FINDINGS |

KEY RECOMMENDATIONS |

|---|---|

|

Fiscal and financial policy to mitigating the impact of COVID-19 |

|

|

Bulgaria entered the pandemic in a strong fiscal position and has put in place a fiscal support package during the pandemic. |

Extend duration of fiscal support measures to families and firms, and expand them in case of a resurgence of the pandemic. Ensure an effective and rapid use of the available European Union funding to support the recovery. Once the recovery is well underway, move back towards a balanced budget by increasing revenues and improving spending efficiency, and longer term continue ensuring fiscal sustainability. |

|

The 60:40 wage subsidy scheme has protected jobs and household incomes from the impact of the COVID-19 shock. |

Establish additional benefit and employment programmes to protect those not covered by the social safety net and help people move to new jobs. |

|

Non-performing loans have been reduced, but remain well above OECD average levels. Deteriorating economic prospects are expected to adversely affect asset quality in view of the potential worsening of the financial situation of firms and households as a result of COVID-19 pandemic. |

Deepen liquidity support to firms and households through the financial sector, if warranted. |

|

Improving the business environment and governance for a stronger post-COVID-19 recovery |

|

|

Competition in product markets is low, with regulatory barriers to competition that are higher than in nearly all OECD countries. |

Put in place the implementing arrangements for the 2019 Law on Public Enterprises for the relevant public agencies, including municipal bodies. Increase the Competition Authority’s detection and enforcement of sanctions on cartels and firms abusing monopoly/market dominant positions. |

|

Increasing the availability of skilled workers is a key priority for enterprises. Basic education is not providing a firm foundation for skills The VET system could better respond to labour demand. |

Provide universal access for four-year olds to early childhood education. Increase secondary school teacher training for teaching special needs students. Deepen the role of workplace training in vocational education and training provision. Invest more in coverage and quality of active labour market policies. |

|

In spite of significant governance reforms, key integrity and anti-corruption institutions are not forming a coherent public integrity system, resulting in fragmented action and limited impact. |

Provide the integrity and anti-corruption institutions with the necessary responsibilities, coordination mechanisms and resources to fulfil their role. |

|

Judicial reform has made substantial progress, but accountability needs further strengthening and judicial independence needs to be safeguarded. |

Implement an effective and transparent accountability mechanism for the Prosecutor General in line with international standards. Enhance judicial independence in relation to the probation period in appointing judges and the composition of the Supreme Judicial Council. |

|

Several cases of vested interests between businesses and political elites have been identified in recent years. There is no regulation of lobbying activities and international rankings suggest challenges in ensuring media freedom. |

Introduce lobbying regulation, including a code of conduct for the engagement of lobbyists with members of Parliament. Protect the independence of media to ensure the integrity of public decision-making processes. |

|

Whistle-blowing mechanisms and protections are comparatively weak. |

Implement the EU whistle-blower Directive and launch a campaign to enhance officials and the public’s acceptance of whistle blowing. |

|

Supporting decarbonisation of the economy |

|

|

Coal accounts for almost half of energy production and is an important source of high air pollution and greenhouse gas emissions. Pricing of the environmental costs of fossil fuels is uneven across sectors. |

Gradually remove support for fossil fuels and align carbon prices for sectors outside of the EU Emissions Trading System (ETS), while protecting poorer households. Support reskilling and relocation of displaced workers in coal regions. |

|

Energy efficiency is lower than in most OECD countries, notably in the residential building sector. |

Continue to support housing renovation and improve targeting to low-income groups. Provide information about the benefits of energy saving investments to households. |

|

Promoting regional development and improving inclusiveness |

|

|

Transport infrastructure is underdeveloped and lacks maintenance. The number of traffic fatalities is high. |

Promote the connection of remote regions to national and international supply chains with investment in transport infrastructure and digital connectivity. |

|

Municipalities have limited opportunities and incentives to collaborate on efficiency-improving service delivery. |

Improve the system for inter-municipal co-operation by reducing regulatory barriers and enhancing fiscal incentives for efficiency improvements. |

|

The flat personal income tax of 10% with no basic tax allowance combined with social security contributions places a high tax burden on lower-income households compared to other countries. Nonetheless, potential gains from a reform need to be weighed against the advantages of the current tax system. |

Consideration should be given to reducing the tax burden for lower-income individuals in the medium or longer term. |

|

Spending on social protection benefits is comparatively low and benefits are poorly targeted to the lowest income households, reflecting high non-take up combined with limited and ineffective means testing. |

Relax entitlement criteria and increase generosity of social benefits. Streamline and simplify multiple and complex means-tested social benefit schemes, notably for families with children. |

|

Up to 14% of the population, and almost half the Roma, lacks health insurance coverage, while out-of-pocket payments, mainly on medicine, are among the highest in the European Union. Hospital capacity is high, while some regions have an acute need for more general practitioners. |

Increase effectiveness of public healthcare spending to improve coverage and reduce out-of-pocket payments for low-income and vulnerable groups. Gradually consolidate the hospital sector and shift focus from inpatient to outpatient care. |

|

Roma face a high risk of poverty and social exclusion. Coordination of Roma policies across line ministries is weak and projects are highly dependent on European Union-funding. Many Roma households live in illegal housing and local authorities often resort to demolitions. |

Enhance the governance and capacities of the National Council in coordinating policies for integration of Roma and involve all relevant stakeholders. Provide technical, legal and financial support to municipalities and Roma households to resolve property rights. |