The Czech economy is very carbon-intensive and has among the highest greenhouse gas emissions per unit of GDP in the OECD. Getting on the path towards net zero will require rapid emission reductions over the coming decades. Coal still makes up close to one third of the energy supply and the government has pledged to phase it out by 2033, which will require a swift expansion in the use of renewable energy sources as well as increased energy efficiency. This can be achieved by adopting a comprehensive policy package that includes widely applied carbon pricing, incentives to raise energy efficiency, spending on renewable energy and cutting red tape hindering green investments. Compensating policies and adjustment support will be essential to mitigate the socio-economic impacts of climate policies and to increase public support. Active labour market policies including higher spending on re-training for the unemployed is key to facilitate the green transition.

OECD Economic Surveys: Czech Republic 2023

2. Towards net zero

Abstract

Introduction

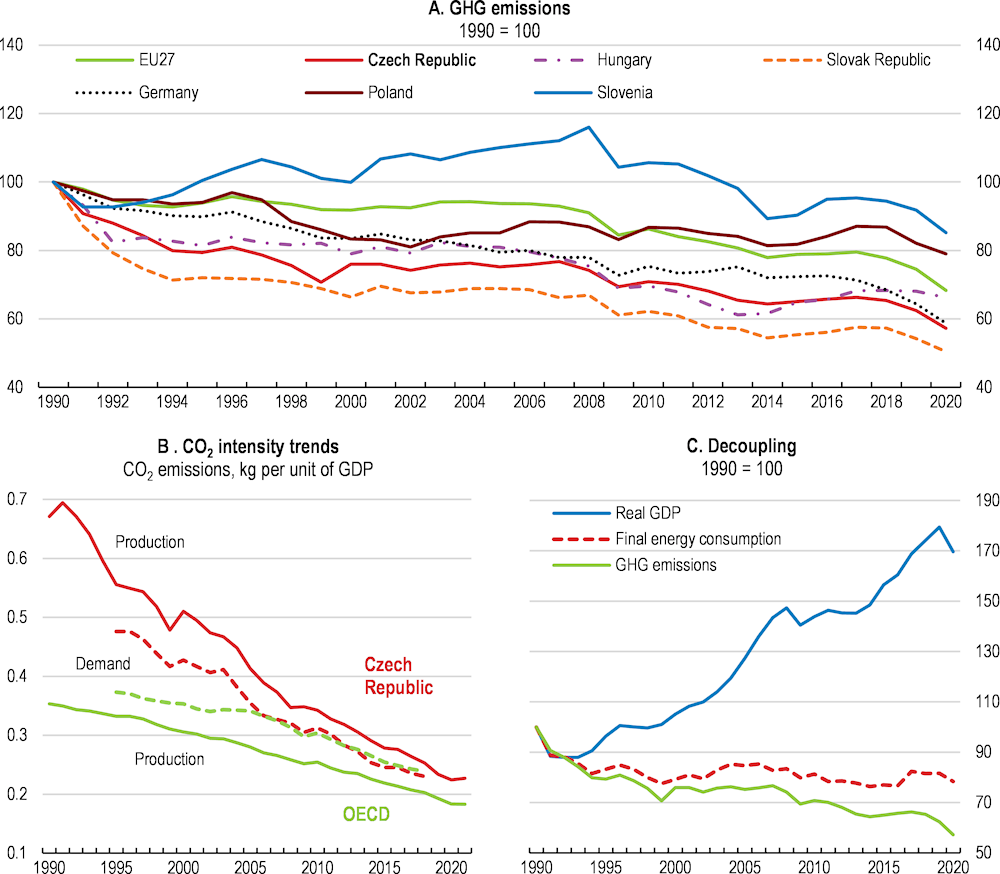

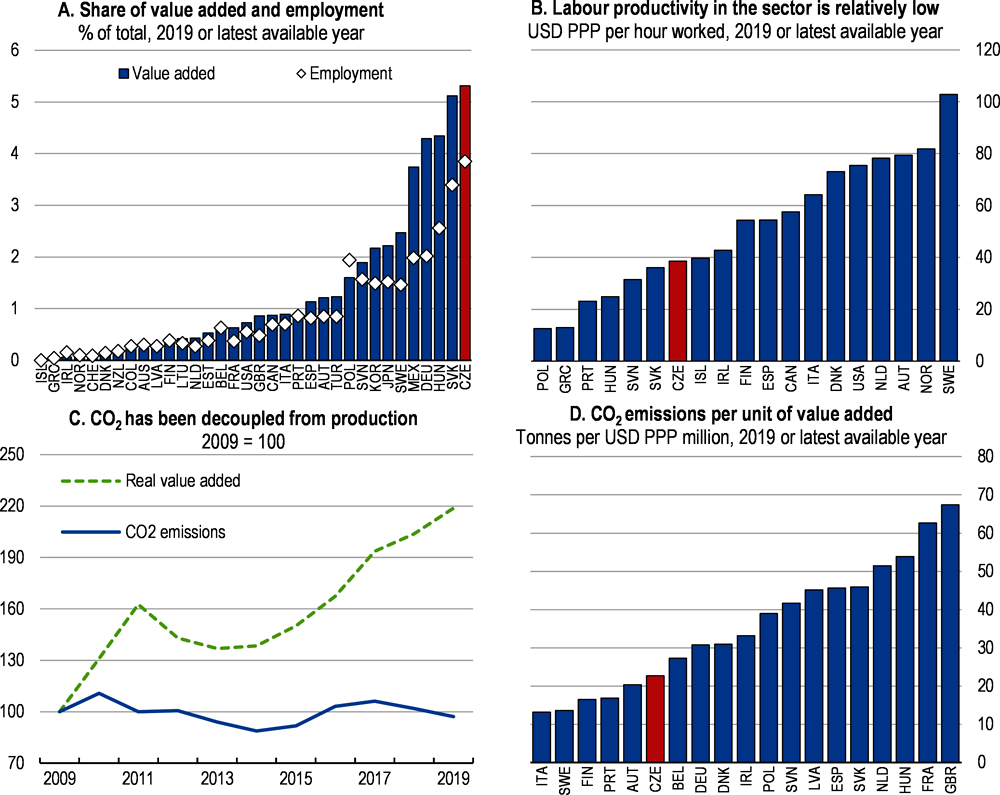

The Czech Republic has made significant headways in reducing its greenhouse gas (GHG) emissions over the past three decades (Figure 2.1A). Progress was achieved at a rapid pace in the 1990s, slowed in the 2000s but gathered pace again in the 2010s. Over the same period, the Czech economy experienced strong economic growth with convergence of living standards towards the European average and was able to decouple energy use and environmental pressures from economic activity (Figure 2.1B and Figure 2.1C). Restructuring and technological progress in the industrial sector and construction have been major drivers behind the emission reductions, alongside a reduced use of coal for power-generation and for heating of residential buildings.

Figure 2.1. Significant GHG reductions, especially over the 1990s

Source: OECD (2022), Green Growth Indicators, OECD Environment Statistics (database); IEA (2021), IEA World Energy Statistics and Balances (database); OECD National Accounts database.

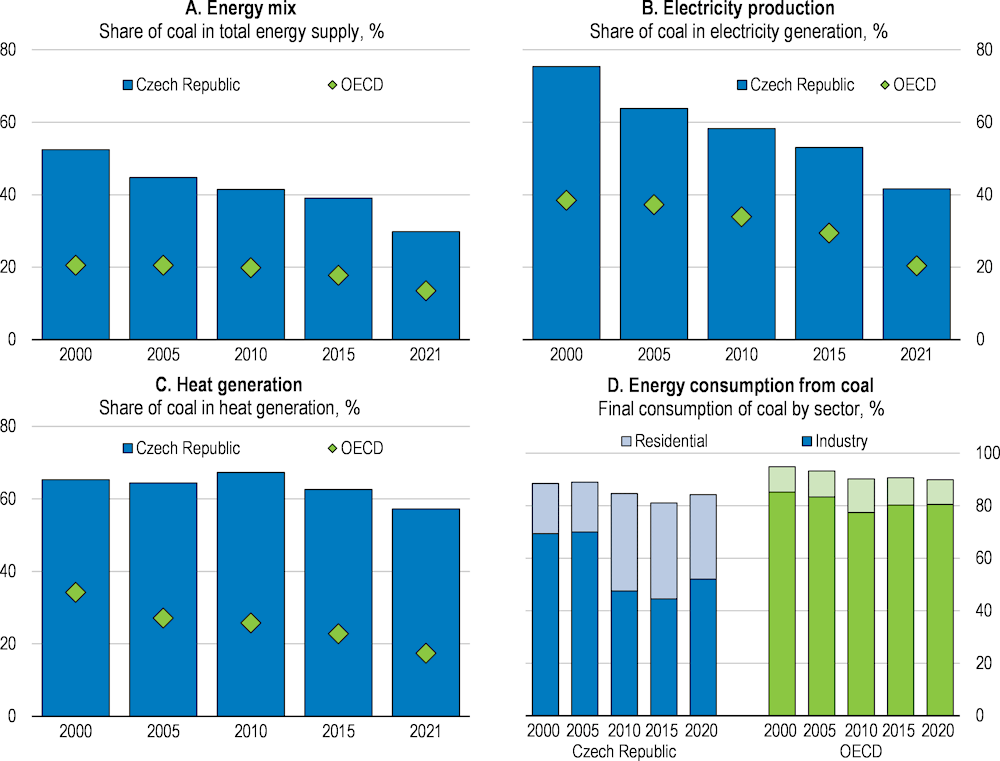

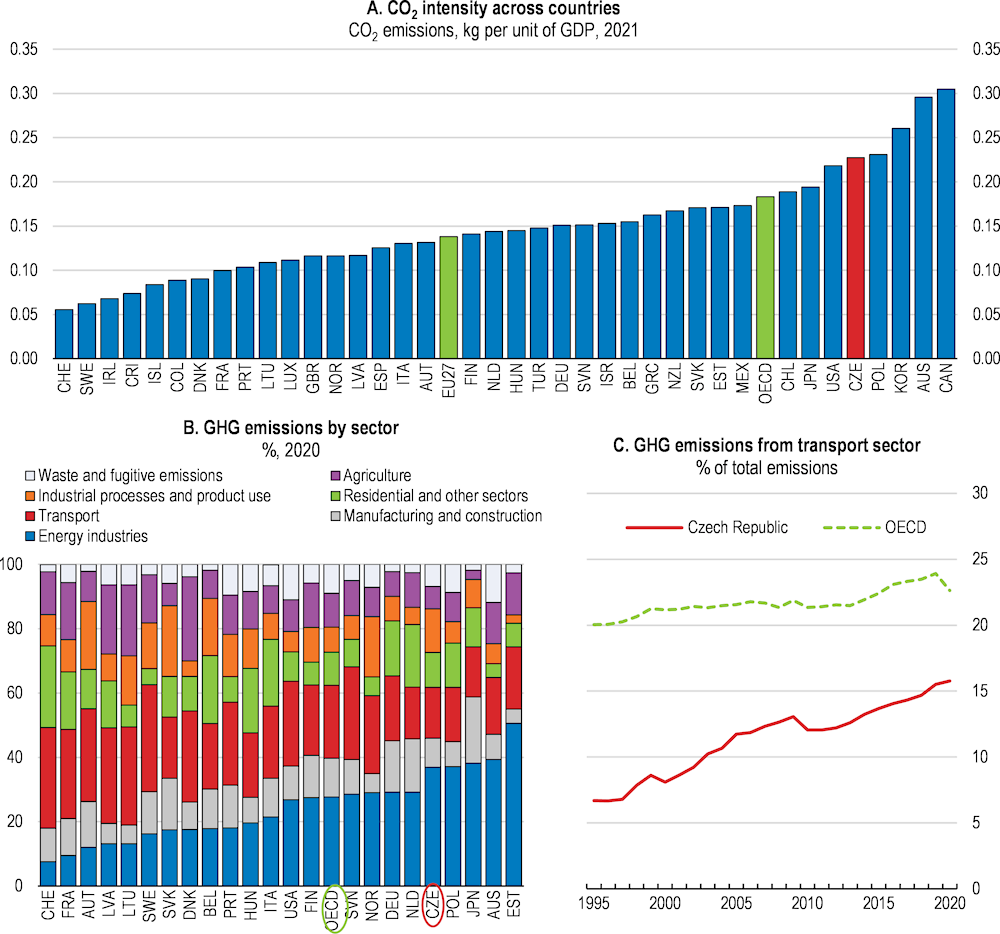

Despite this progress, the Czech Republic remains highly energy dependent and reliant on fossil fuels, with GHG-emission intensities among the highest in the EU (see Figure 2.2A). Per unit of GDP, emissions are higher than the OECD average and in all neighbouring economies, except for Poland. This picture is very similar on a per capita basis. The share of coal in the primary energy supply has declined from more than half in 2000 to 29% in 2021. Yet coal remains one of the main fuels for electricity generation and for residential housing heating and its share in the energy supply remains high, resulting in a very high share (37%) of emissions from the energy sector in the OECD (Figure 2.2B).

Energy intensity per unit of GDP is also considerably higher than in many other OECD countries, driven by the energy-inefficient stock of residential buildings, coal-fuelled heating systems and a large industrial sector. Industrial processes make up 13% of emissions. Rising rates of car ownership and increased reliance on road traffic have had knock-on effects on transport emissions that make up 16% of total GHG-emissions (Figure 2.2C), albeit among the lowest shares in the OECD. Due to higher consumption and inadequate waste management policies, GHG emissions from waste have also increased and make up about 7% of total emissions (OECD, 2018a). The share of renewables in gross final consumption has increased over time, however it remains markedly lower than in many other OECD countries, at 18% in 2021.

Figure 2.2. CO2 intensity remain among the highest in the OECD because of fossil fuel use in energy industries

Note: Energy industries include electricity and heat production, petroleum refining and manufacturing of solid fuels.

Source: OECD (2022), Green Growth Indicators, OECD Environment Statistics (database).

The Czech Republic has experienced rising temperatures at a faster rate than the world average over the past two decades and warming is projected to continue (IEA, 2022a). Climate change will cause substantial economic and social costs, also in the nearer term (International Monetary Fund, 2022). This is especially true for the Czech Republic that has suffered among the highest economic costs per capita in the European Union due to extreme weather and climate-related events since the 1980s (European Environment Agency, 2019).

Adverse effects of climate change include loss of biodiversity, changes in the water regime and risks of more frequent and severe floodings as well as wildfires, and increasing prevalence of vector-borne diseases (parasites, viruses and bacteria) resulting in increased mortality. Flooding can affect water, sanitation and water infrastructure and services, and can contaminate water with bacteria from run-off or sewer overflow. The Czech Republic has already seen a notable increase in the number of days with heavy rainfall, while droughts have become more frequent and longer in duration (Ministry of the Environment, 2019a). In August 2010 flash floods struck Central Europe and caused severe economic and social costs in some Czech regions. Moreover, droughts have several adverse social, economic and environmental consequences, one of which is increasing the prevalence of insects such as bark beetles that attack forests. Particularly large outbreaks since 2015 have caused the Czech Republic land use, land-use change and forest (LULUCF) sector to turn from a carbon sink to a net CO2 emitter (see Box 2.1). To restore the LULUCF-sectors role as a carbon sink and to support forest management and deal with the consequences of the bark beetle outbreak, the government has provided 18.6 billion CZK during 2015-21, alongside legislative amendments to the Forest Law (Law No. 289/1995 Coll.).

The last Czech interim review of climate vulnerabilities was carried out in 2019. The overall assessment demonstrated a high degree of vulnerability of some sectors of the economy to climate change (Ministry of the Environment, 2021). The Strategy on Adaptation to Climate Change (Ministry of the Environment, 2015) was updated in September 2021. Implementation of the measures outlined in the strategy (to prevent long-term droughts, address floods and wildfires) would reduce vulnerabilities and raise the economy’s resilience to climate damages.

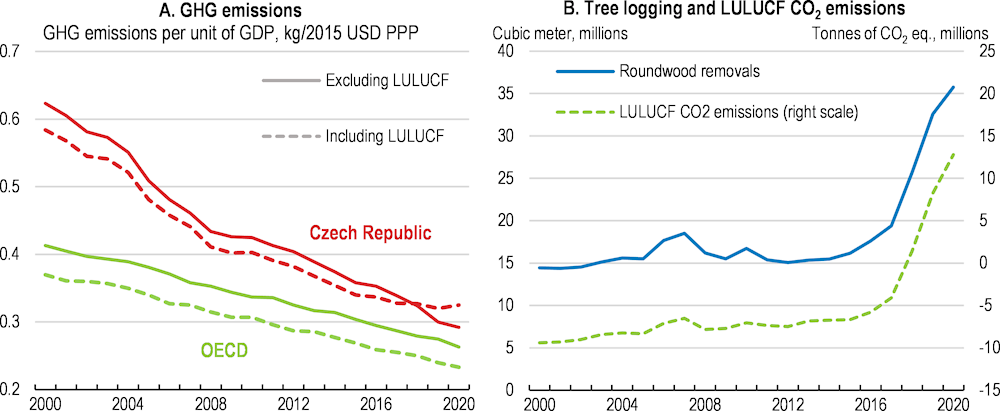

Box 2.1: Forests: from a carbon sink to a source of CO2 emissions

Forests absorb carbon dioxide from the atmosphere and store it in different repositories, which include trees, root systems, undergrowth, the forest floor and soils. Therefore, the LULUCF sector often helps reduce CO2-emissions (Figure 2.3A). In recent years, severe bark beetle outbreaks in the Czech Republic have sparked an increase in salvage felling to slow the infestation and to save timber (Figure 2.3B), which has turned the LULUCF-sector from a carbon sink to a source of CO2-emissions.

The Czech Republic has sizable forest areas, with forests covering 2.67 million hectares (34% of the land area), making large bark beetle outbreaks particularly impactful. The cause of severe outbreaks is multifaceted, including the composition of Czech forests where spruce accounts for 50% of the forest area, and a dryer climate that weaken the trees’ natural defences and help spawn the insects, creating an infestation (Hlásny et al., 2021). As the frequency and severity of droughts may continue to increase with climate change, further outbreaks are likely to occur in the future.

Other European countries have also been affected by bark beetle outbreaks. In Sweden, a collaborative task force was set up in 2018 between the Swedish Forest Agency, businesses, and other organisations to deal with severe outbreaks more effectively and to mitigate their effects. The main priorities of the group have been to pool resources to deal with outbreaks and to do preventive surveillance (Skogsstyrelsen, 2022). Managing the bark beetle outbreaks and increasing the volume of living biomass in forests in the Czech Republic will help reach national climate targets. McKinsey (2020) estimates that if logged areas in the Czech Republic are successfully reforested by 2030, the LULUCF sector could once again act as a net carbon sink up to 2050, at similar levels as during 1990-2015. Reforestation, improved forest management practices and early-detection systems could help to manage future outbreaks and the effects of droughts and other adverse effects of climate change.

Figure 2.3. Sanitary logging to contain insect infestation has increased LULUCF GHG-emissions

Note: LULUCF covers emissions and removals of greenhouse gases resulting from direct human-induced land use, land-use change and forestry activities.

Source: OECD (2022), Green Growth Indicators, OECD Environment Statistics (database); Czech Statistical Office.

Key priorities to move towards net zero are to replace coal in the energy supply with greener energy sources, as well as make the economy more energy efficient. The 2019 Czech Coal Commission recommended that coal use should be phased out by 2038, with natural gas filling its role in the interim period before nuclear power, hydrogen and renewable sources could make up the lion’s share of the energy supply (IEA, 2021a). The ambition was raised further in January 2022 when the government announced its aim to phase out coal by 2033 (Vlada, 2022a). However, setting policies to reach net zero has become significantly more challenging due to Russia’s invasion of Ukraine and the concomitant rise in energy prices (see the ). The Czech Republic does not produce any significant amounts of natural gas and almost all the imports originated in Russia before the war, raising questions about energy security. Nonetheless, the Czech Republic has not announced strategies or targets for phasing out Russian natural gas (IEA, 2022b). This makes it even more urgent to transition towards a net zero economy through the scaling up of reliable, sustainable, and affordable domestic energy production and to improve energy efficiency in the economy.

The increased cost of living brought on by high energy prices has raised demands for cost-reducing measures for consumers and firms. A crucial policy challenge is to ensure that the measures to tackle the energy crisis are temporary, properly designed and targeted, so that they remain consistent with long-term goals of phasing out coal and reducing GHG emissions (Buckle et al., 2020). Reaching internationally agreed climate targets and moving towards net zero will require even greater structural changes to production and consumption patterns than has been the case in the past, with likely significant socio-economic challenges. Adapting to increased demand for low-emission products is particularly important for a small open economy like the Czech Republic, that is highly integrated in global supply chains and reliant on a strong manufacturing base. Moreover, major shifts in employment across regions, sectors and firms can be expected and it is therefore important that the effective emission reduction policies ensure a fair and inclusive transition by supporting workers and regions most exposed to the changes.

Against this backdrop, the rest of this chapter discusses the path towards a comprehensive and inclusive reduction in GHG emissions in the Czech Republic. The outline of the chapter follows the framework discussed in (D’Arcangelo et al., 2022a). It focuses on the policies needed to reach the climate goals, their economic consequences and the associated trade-offs and mitigating policies. First, it briefly reviews the Czech Republic’s strategy to cut emissions. Second, it discusses key emission reduction policies and finally how complementary policies can address distributional and labour transition effects.

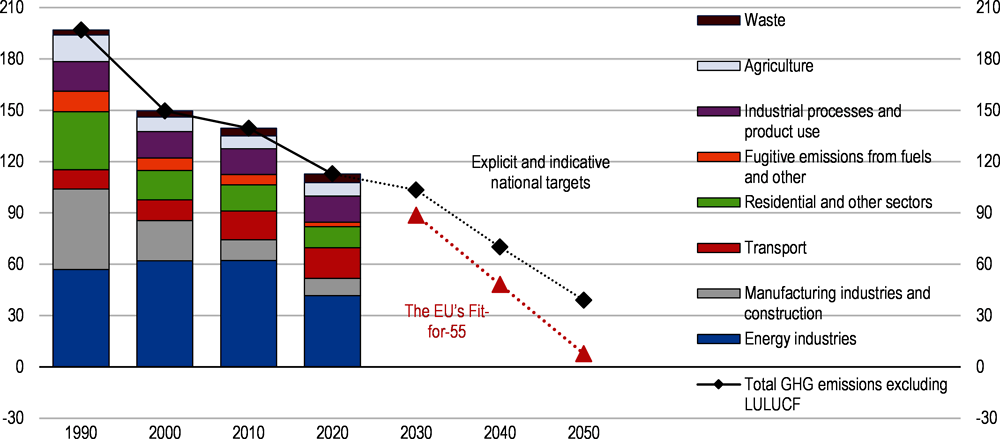

Designing a strategy to effectively manage the transition

The Czech State Environmental Policy (SEP), approved in 2021, outlines overarching environmental priorities, objectives and strategies (Ministry of the Environment, 2021a). EU recommendations and legislation strongly influence the core policies: the Climate Protection Policy (Ministry of the Environment, 2017) and the National Energy and Climate Plan (NECP) (Ministry of Industry and Trade, 2019). The Climate Protection Policy outlines explicit national GHG-reduction targets for 2030 and indicative emission levels for 2040 and 2050: by 2030 GHG emissions are expected to be reduced by 44 million tonnes compared to 2005 and GHG-emission levels are envisaged at 70 Mt CO2 and 39 Mt CO2 in 2040 and 2050 respectively (Figure 2.4). The GHG-emission reduction targets are currently being revised to fully incorporate the more ambitious goals in the EU’s Fit-for-55 agenda (European Commission, 2020a). Matching the EU’s ambition would roughly entail GHG emission levels in the Czech Republic of 89 Mt CO2 by 2030 and a more rapid path towards net zero (Figure 2.4).

Figure 2.4. Achieving long-term climate goals will require accelerating emission reductions

GHG emissions, tonnes of CO2 equivalent, millions

Note: The 2050 target under the Fit-for-55 assumes that the LULUCF sector contributes as a carbon sink of about the same level as its average in 2000-15.

Reaching the emission reduction goals for 2030 outlined in the EU’s Fit-for-55 agenda will require stricter climate policies to achieve the longer-term targets of net zero. Although emissions fell sharply in 2020 because of the COVID19-pandemic that triggered a sharp decrease in mobility, road traffic, and economic activity, this progress is unlikely to persist under current policies. There may be some permanent environmental effects from the pandemic such as new working patterns and increased teleworking (OECD, 2021a). However, the prevalence of telework appears to be more limited in the Czech Republic than among other OECD countries (Ker et al., 2021).

The NECP includes intermediate targets for the desired energy mix, renewables’ share in energy use and energy efficiency targets to achieve the GHG-emission reductions (Ministry of Industry and Trade, 2019). Similarly to the Czech Climate Protection Policy, the targets in the NECP have not yet been updated to reflect the EU Fit-for-55 or the new geopolitical situation following Russia’s war of aggression against Ukraine:

The desired energy mix by 2040 includes a continued shift away from fossil fuels like coal and oil by increasing the use of nuclear energy, hydrogen, renewable sources and gaseous fuels. The NECP foresees that from 2019, coal’s share in the total energy supply would have to fall by an additional 12-18 percentage points and oil and petroleum products’ share by 5-8 percentage points, while nuclear energy, hydrogen, gaseous fuels and renewables would rise to make up the lion’s share (Table 2.1).

Table 2.1. The envisaged energy mix in 2040 foresees a shift towards renewables and nuclear

|

Fuel source |

2021 share |

Required change to reach targets (from 2019, in percentage points) |

2040 target share |

|---|---|---|---|

|

Coal |

29% |

-12 to -18 |

11-17% |

|

Oil and petroleum products |

22% |

-5 to -8 |

14-17% |

|

Gaseous fuels |

18% |

+0 to +7 |

18-25% |

|

Nuclear energy |

19% |

+6 to +14 |

25-33% |

|

Renewable and secondary energy |

13% |

+4 to +9 |

17-22% |

Note: The 2021 shares do not add up to 100% because of rounding.

Source: IEA and Ministry of Industry and Trade (2019).

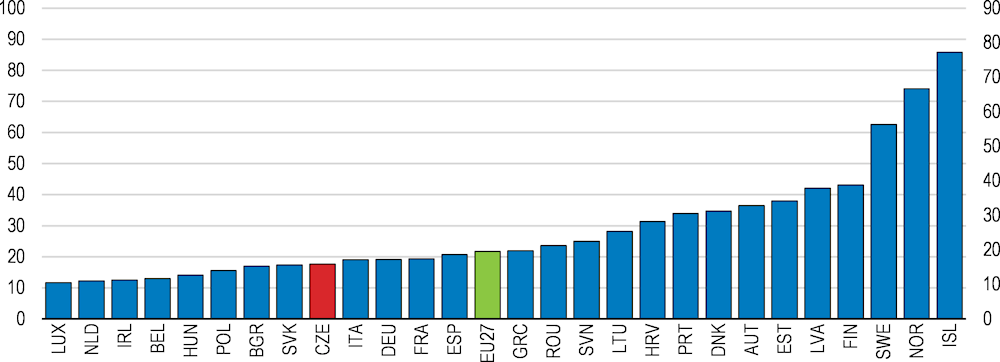

Besides targets for the share of renewables in the energy supply, the NECP also includes a target for their share in total energy consumption. The 2030 target is set at 22%, requiring an increase of four percentage points from 2021, with sub-targets for electricity consumption (16.9%), transport (14.0%) and heating and cooling (30.7%). The European Commission assessed that the minimum share of renewables in total energy consumption in 2030 should be 23% for the Czech Republic (European Commission, 2020b). By comparison, the European Union reached a 22% renewable share in final energy consumption already in 2021 with many countries having achieved significantly greater shares (Figure 2.5). In this context, the Czech Republic is lagging its EU peers, and significantly more progress in renewable energy is needed to move towards net zero (IEA, 2021b). There is untapped potential for raising the share of solar and wind in power generation. The use of these sources, especially solar power, rose rapidly in the late 2000s and early 2010s due to substantial feed-in-tariffs (FITs). However, the FITs were too generous and the government introduced a special tax in 2010 on solar plant owners. The FITs were finally abolished for solar energy at the end of 2013. The retroactive change of compensation resulted in a strong decline in new solar capacity, as investor confidence was severely undermined. Public support waned, and the overall growth of non-combustible renewable electricity generation capacity has stalled since.

Gross final energy consumption by 2030 is targeted as a share of GDP and is set at 0.16 megajoule (MJ) per unit of GDP, compared to a level of 0.22 in 2020. Energy savings have been reached in several areas with financial incentives (investment subsidies and low interest loans) through the New Green Savings Programme, the Operational Programme Environment and the Operational Programme Enterprise and Innovation for Competitiveness (Odyssee-Mure, 2020a). Energy efficiency has increased in industry by 3.1% per year since 2000, 1.4% in the residential building sector and 1.3% in services. The government expects that further energy savings are to be achieved primarily through financial measures and voluntary changes and to a lesser extent through regulation and taxation (Ministry of Industry and Trade, 2019). At the same time, low enthusiasm among households to implement energy-saving measures to increase energy efficiency is a barrier. This stems from a low awareness among the public of the wider benefits of energy-saving measures (Ministry of Industry and Trade, 2019), but can also reflect insufficient incentives and/or problematic administrative processes. Nonetheless, the current crisis with very elevated energy prices and issues regarding energy security has spurred public interest in energy efficiency measures and renewable energy sources.

Figure 2.5. The share of renewables is low

Share of renewable energy in gross final energy consumption, 2021

Raising transparency and public support for climate policies

The success of climate policies hinges on sustained political and public support. Low or fragmented support may lead to resistance towards reforms (Tompson, 2009) and can intensify concerns about job losses and distrust towards climate policies (Morgenstern et al., 2002). The yellow vest movement in France and protests by farmers in the Netherlands against climate action illustrate the significant backlash that can occur when policies are perceived as unjust and do not have enough public support.

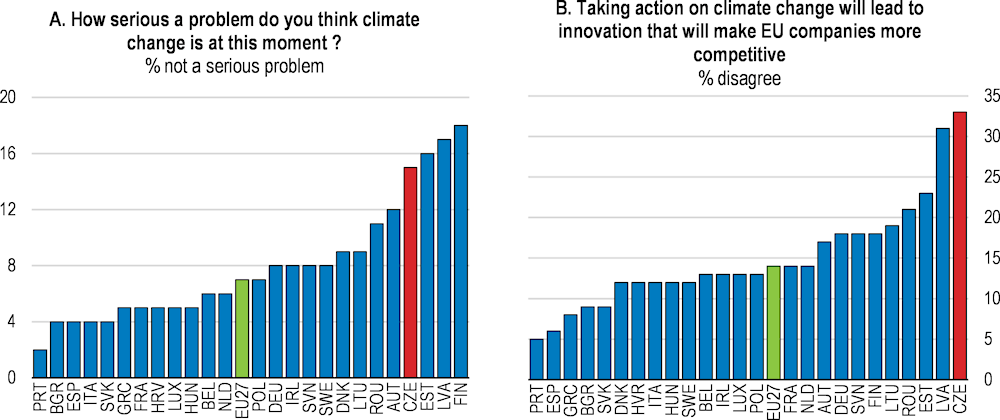

Awareness of the adverse impacts of climate change in the Czech Republic has grown since 2015 according to the Eurobarometer survey (European Commission, 2021a). The share of respondents agreeing that climate change is a very serious problem has risen by 7 percentage points during 2017-21 to 64%. Moreover, roughly three quarters of Czech respondents in the European Investment Bank’s (EIB) climate survey believe that climate change and its consequences are the biggest challenges currently facing humanity (European Investment Bank, 2022a). Yet despite improvements, a large share of Czechs compared to other Europeans still believe that climate change is not a serious problem (Figure 2.6A). Furthermore, Czech respondents in the Eurobarometer survey are generally less enthusiastic than Western Europeans about various climate policies and tend to disagree with statements that the green transition will make companies more competitive, increase energy security and benefit the EU economically (Figure 2.6B). Similarly, Czechs react negatively to environmental policies that raise household’s costs or are expected to decrease living standards (Krajhanzl et al., 2021). For example, Czechs are less in favour of taxes on environmentally damaging products/services, replacing short-distance flights by fast low-polluting trains and strengthening education and awareness of sustainable consumption than many other Europeans (European Investment Bank, 2022b).

Figure 2.6. A relatively large share of Czechs disagree that climate change is a serious problem

Raising awareness and spreading knowledge about climate change can increase public support for more stringent climate policies and aid in their implementation. Although the Czech authorities have carried out several information campaigns and subsidy programmes and launched surveys of perceptions about climate change, there is still room for improvements as seen in Figure 2.6. A combination of communication/education campaigns should be prioritised. Measuring the public’s understanding and receptiveness to messages can indicate the success of campaigns, help further clarify messages, and inform the design of training materials and activities needed (OECD, 2021b). Introducing complementary compensating policies can also increase public support for climate policies (see the next two sections).

Moreover, promoting transparent and accessible information on the design and rationale of climate policies can raise trust and support for government intentions. One example is green budgeting instruments, which can help to increase transparency and accountability of governments’ budgetary policies (OECD, 2020a). They can also help increase transparency towards the public and strengthen political commitment to the amount of green expenditure (D’Arcangelo et al., 2022a). For example, France presented a comprehensive approach to green budget tagging in its 2021 budget, stemming from its participation in the OECD Paris Collaborative on Green Budgeting. The approach has helped to assess potentially negative or positive spill-over effects from one environmental sphere to another and to identify expenditure measures that are harmful to France’s climate goals (‘brown’) and the ones (‘green’) that instead would help to meet them. Expenditures and tax policy that focuses on the long-run benefits in terms of people’s well-being, environmental protection, and resilience to climate change and future problems can also increase public acceptance (OECD, 2021c).

Ensuring energy security while pursuing climate goals

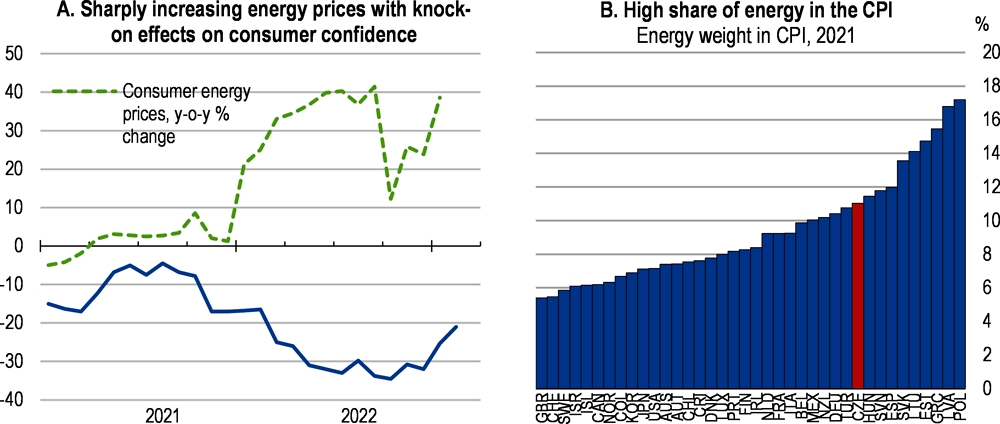

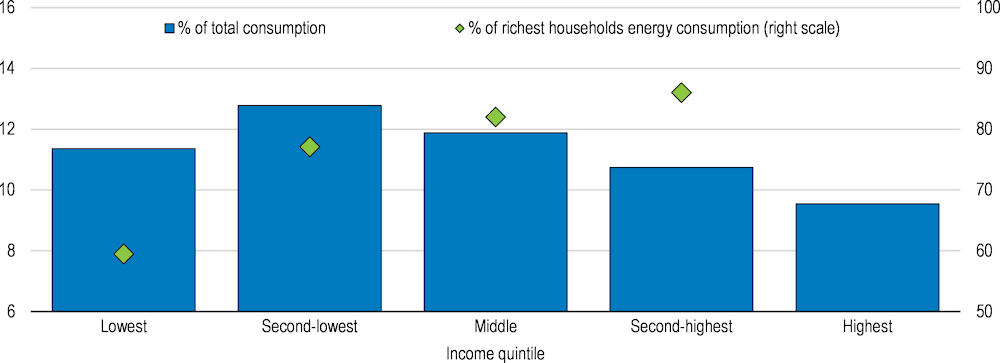

Rapidly rising demand amid the post-pandemic recovery, combined with Russia’s large-scale invasion of Ukraine, sent Czech energy prices soaring in the beginning of 2022. Moreover, some Czech electricity distribution companies went bankrupt (most notably Bohemia Energy, which had around 900,000 customers) at a time when market prices of gas and electricity were already high and rising. Czech households are particularly sensitive to higher energy prices as energy products make up a comparatively high share of consumption and the situation had knock-on effects on consumer confidence (Figure 2.7). To shield consumers from the higher cost of living, the government introduced a variety of fiscal support measures (see Chapter 1), including a temporary reduction in the excise duty on diesel and petrol, state guarantees for loans to firms affected by rising energy costs, a delay of VAT payments for firms in the transport sector, waived fees for renewable energy, an energy price subsidy (“energy savings tariff”) and an energy price cap from 2023.

Figure 2.7. Czech households are very vulnerable to high energy prices

Although the support measures have helped offset some of the rising costs for households and firms, they have been poorly targeted. Support should instead target vulnerable people, and if needed firms, and aim to preserve incentives to save energy (OECD, 2022a). Cash grants that are unrelated to energy consumption but are based on disposable income for households or revenues for firms could help shield the worst off while preserving incentives for energy savings. One example is the “Household Support Fund” enacted by the government in the United Kingdom in the winter of 2021/2022 to disperse funds to vulnerable households (GovUK, 2021). Another option is to compensate households and firms for modest energy consumption, while higher levels of consumption face market prices. This ensures incentives to preserve energy while still providing support. A variant of such a scheme is currently in place in Norway (RME, 2022).

Natural gas plays a significant role in industry, the residential sector and for heat generation. Existing climate plans have counted on natural gas being available before renewable sources and nuclear power make up the bulk of the energy supply, gradually replacing coal. Simultaneously reducing natural gas imports from Russia and phasing out coal will require a significant shift towards gas suppliers within the EU and outside, including a large increase in the imports of LNG (IEA, 2022c). Together with EU member states, the Czech government has taken steps to ensure natural gas purchases with other suppliers in line with the EU’s REPowerEU Plan (European Commission, 2022e). Nevertheless, even with these efforts, coal will likely have to make up a sizable share for heating and electricity production in the shorter run to prevent supply disruptions and to ensure energy security.

To move towards net zero and meet longer-term climate targets, the government should keep its commitments to phase out coal by the 2033 deadline and rapidly scale up investment into renewable and low-emissions energy sources. This includes continued collaboration with other EU member states on energy and energy security, an expansion of solar power and stepping up efforts with respect to wind power, the use of geothermal, green hydrogen and bio-methane.

Key policy instruments to reach net zero – a comprehensive policy mix is needed

A successful decarbonisation strategy for the Czech Republic needs to be comprehensive, cost-effective and inclusive (D’Arcangelo et al., 2022a). Market-based instruments (environmental taxes or cap-and-trade schemes) are the most cost-effective tools to incentivise emission reductions. Such measures should form the basis of any successful decarbonisation strategy. Nonetheless, no single policy instrument dominates the others across all desirable assessment criteria: emission reductions at minimum economic cost, low administrative complexity, strong incentives to spur innovation, predictability and ability to deal with uncertainty, progressive distributional effects or public acceptability (Table 2.2).

Table 2.2. Assessment and implementation of key climate policies in the Czech Republic

|

Policy instruments |

Cost-effectiveness |

Administrative burden |

Distributional consequences |

Public acceptability |

Implementation in the Czech Republic |

|---|---|---|---|---|---|

|

Emissions pricing instruments and other incentive-based instruments |

|||||

|

GHG emissions tax |

High. |

Potentially high as pricing requires monitoring emissions. Revenue raising. |

Moderate concerns of competitiveness, job loss and income distribution. |

Low to moderate. |

No. |

|

Emissions trading scheme |

High. |

High as it requires legal framework and institutions. Revenue raising. |

Moderate concerns of international competitiveness, job loss and income distribution. Free allocation can favour only some firms. |

Low to moderate. |

Yes, ETS through the EU. |

|

Excise taxes on fuels/road taxes |

Low to high. |

Low. Revenue raising. |

Moderate. |

Low. |

Yes. Transport fuel excise duties. Road tax for businesses. |

|

Regulations, standards, subsidies and other instruments |

|||||

|

Environmental regulation |

Low to high. High monitoring costs. Regulations does not encourage to innovation. The design can increase efficiency, for example with tradable performance standards. |

High, as it requires knowledge about the specifics of industries and technologies. |

Concerns of tax- regressively if compliance is costly. Firms and households that have more resources have relatively lower compliance costs. No fiscal revenue raised. |

Moderate. |

Applied at domestic and the EU level (e.g. fuel performance and directives for increasing energy efficiency). |

|

Environmental subsidies |

Low to high. Good design can boost cost-efficiency. Geared towards incumbents and penalise new entrants. Can play a role to support research and development. |

Moderate to high. Requires information on specific technologies and information about firm’s and households receiving the subsidies. |

Concerns of regressivity. Larger firms and emitters are probably able to receive more. |

High. |

Yes. Subsidies for green investments and R&D spending. Available funding both through EU funds and the national budget. |

|

Green financial policy |

Low to high. Can contribute to better-priced assets and to reduce financial risks. Lets investors act on preferences for green investment. |

Potentially high to achieve broad monitoring and reporting of emissions, as well as linking emissions and physical climate exposures of firms back to credit providers. |

Low. |

High. |

The Czech National Bank will undertake stress tests that will incorporate macroeconomic effects from climate change. |

Source: Adapted from D’Arcangelo et al. (2022a).

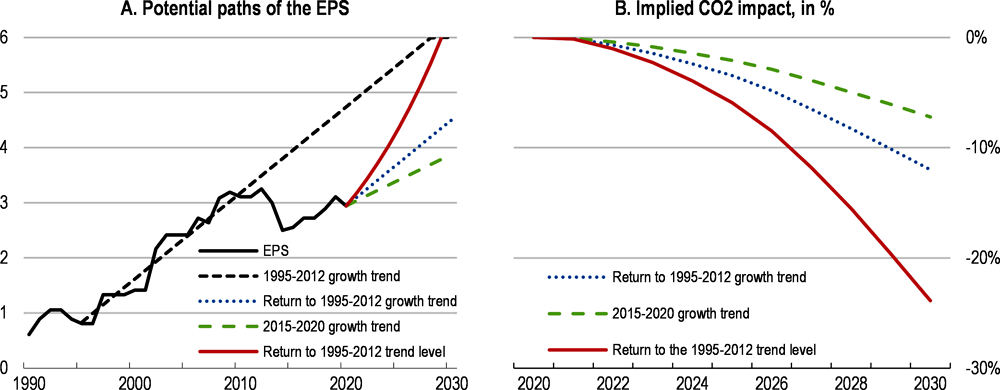

Existing policies and tools result in relatively low environmental stringency

To reach the ambitious emission reductions goals in the EU’s Fit-for-55 agenda, the Czech Republic must step up its efforts to create a comprehensive and cost-effective policy mix that influences all sectors of the economy. The OECD’s Environmental Protection Stringency Index (EPS) (Botta and Koźluk, 2014) is one internationally comparable indicator that captures a broad set of environmental policies related to climate change and air pollution that can be used to track the stringency of environmental policies over time and across countries. This indicator has recently been revised and updated until 2020, covering 40 countries and 13 policy instruments (Kruse et al., 2022).

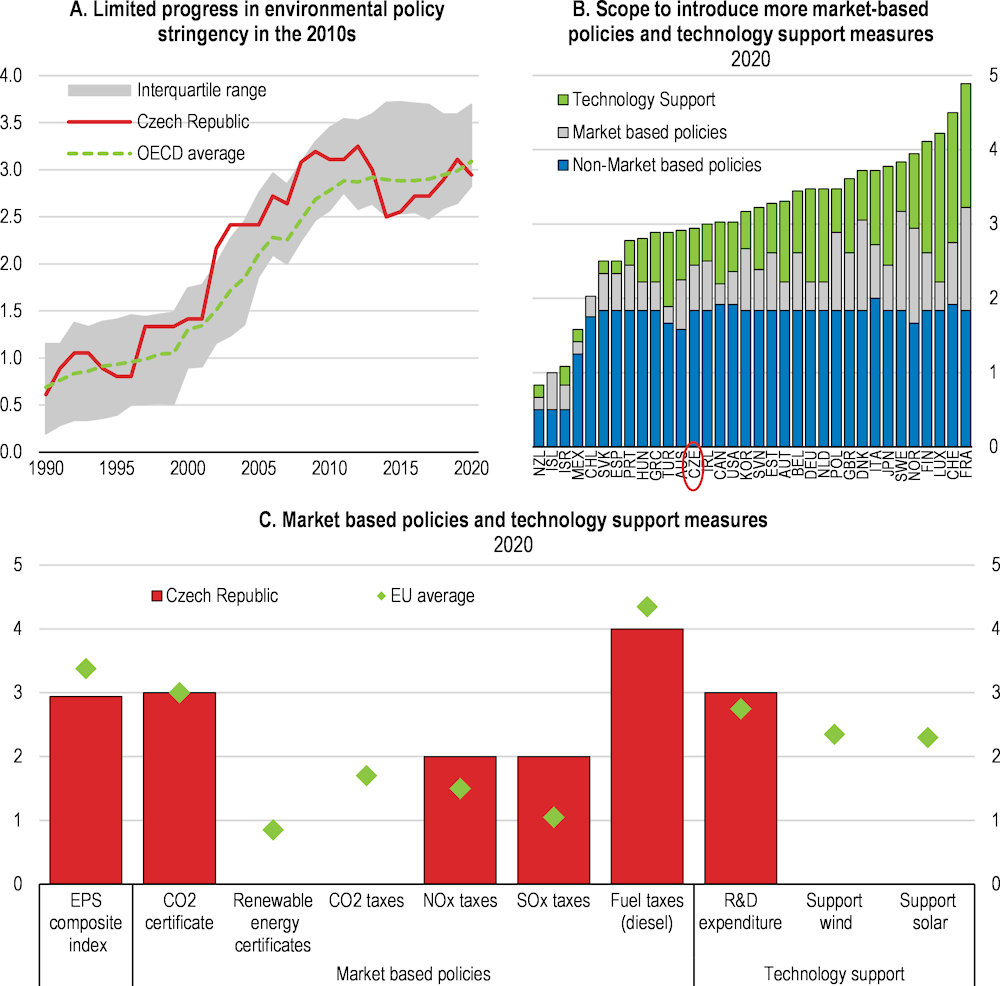

The updated EPS shows that environmental policies in the Czech Republic became increasingly stringent in the 2000s as EU directives were transposed into domestic legislation (Figure 2.8A). Progress was however slow in the 2010s and the country ranked among the bottom half of OECD countries in 2020 (Figure 2.8B). The sluggish progress in environmental policy stringency in the 2010s – also in other OECD countries – owes mostly to reduced technology support measures (R&D spending, feed-in tariffs and adoption support) attributed to fiscal consolidation after the years following the Great Recession (Kruse et al., 2022).

Non-market policies, including standards and regulations that follow EU legislation, are already quite stringent and make-up most of the Czech EPS (Figure 2.8B). Technology support measures, notably adoption support for wind and solar technologies, lag the EU average, primarily due to the abolishing of feed-in tariffs for solar energy in at the end of 2013. Market-based policies in the Czech Republic have progressed, mostly in areas that are covered by EU legislation, including the EU’s Emissions Trading System (ETS) and taxes on NOX, SOX and diesel. At the same time, many other EU countries have expanded their market-based polices and several have introduced a carbon price and renewable certificates to supplement EU legislation (Figure 2.8C).

Empirical estimates suggest that raising the EPS would help reduce CO2-emissions in the Czech Republic. The potential for emissions reduction is largely in the energy-generating sectors and the estimates show that progress can be achieved by phasing out coal as well as reducing natural gas and diesel use (Box 2.2). The empirical estimates also indicate that environmental policy would have to become significantly more stringent over the 2020s to meet the EU’s Fit-for-55 emission reduction targets by 2030.

Figure 2.8. Progress in environmental policy stringency stalled in the 2010s

The OECD Environmental Policy Stringency Index, from 0 (not stringent) to 6 (highest degree of stringency)

Note: OECD and EU are an unweighted average of available countries. The absence of a value in panel C does not necessarily mean the absence of a policy, but rather that the policy only affects smaller installations below a cut-off. See OECD (2022).

Source: OECD (2022), ECO WP 1703.

Box 2.2: Environmental Protection Stringency and CO2-emissions

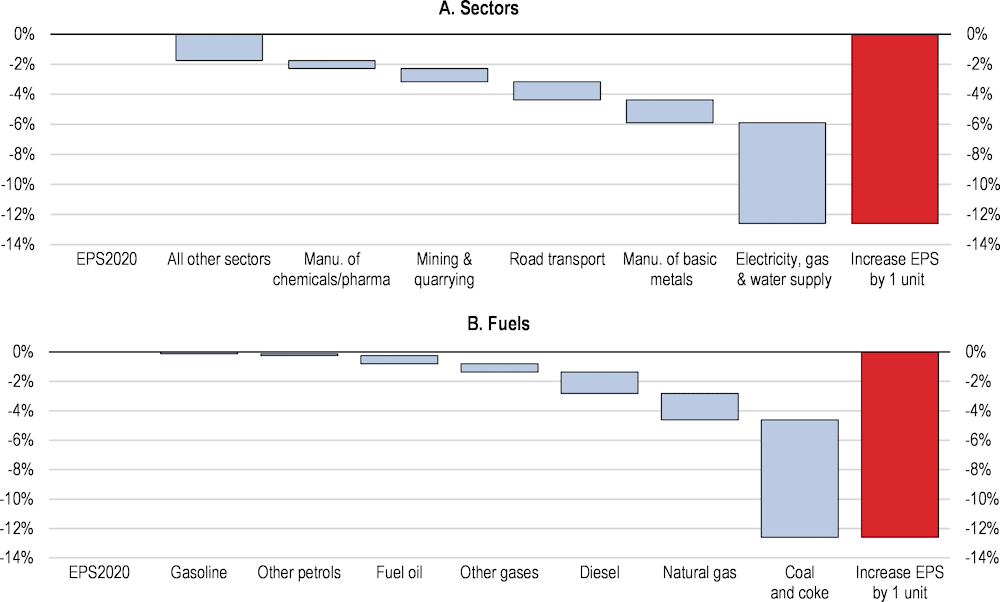

Environmental policies affect the explicit and implicit costs of emissions. Frohm et al. (Forthcoming) estimates that an increase in the EPS is associated with significant reductions in CO2-emissions, both in the shorter and longer-term. The impacts are heterogeneous across sectors and depend on their fossil fuel intensity. This box utilises the results from this study to analyse which sectors and fuels could contribute to emissions reductions in the Czech Republic through two thought-experiments: the first investigates which sectors and fossil fuels could drive the emissions reductions as the EPS increases; the second explores how the Czech EPS would have to evolve over time to achieve the 55% emissions reduction by 2030 compared to 1990, envisaged in the EU’s Fit-for-55.

A one unit increase in the EPS is associated with significant emissions reductions in the longer run (10 years). The emissions reduction potential is 13% and primarily stems from the energy-supply sector (electricity, gas and steam), but also manufacturing of basic metals, road transport and mining and quarrying (Figure 2.9A). In terms of energy sources, the greatest emissions reduction could come from phasing out coal and natural gas use, primarily in electricity and heating, but also diesel in the road transport sector (Figure 2.9B).

Figure 2.9. Raising the EPS can significantly reduce CO2-emissions

Notes: The effects are calculated using the point estimates from a fixed-effects panel regression of the (log of) CO2-emissions on current and up to 10 years lags of the EPS indicator and its interaction with country-sectors shares of fossil fuels in total energy use, as well as additional control variables, including the current and lagged sectoral (log of) real gross output and country (log of) real GDP, linear country and sector time-trends, as well as country-sector and year fixed effects. The aggregate and sectoral effects in the Czech Republic are obtained using each sector’s weight in CO2-emissions in 2016. The sector classification is based on ISIC Rev. 4. Fossil fuels include coal, coke and crude, fuel oil, gasoline, diesel, natural gas, other gases and other types of petrol. For more details, see Frohm et al. (forthcoming).

A significant tightening of environmental policies will be needed to meet the EU’s Fit-for-55 targets. Catching up with the EPS level implied by the 1995-2012 trend in 2030 (Figure 2.10A), would correspond to reductions of CO2-emissions by more than 20% (Figure 2.10B) as compared to 2020. This represents close to a 60% reduction in emissions compared to 1990. Returning to the 1995-2012 growth trend would reduce emissions by 12% compared to 2020 or 53% compared to 1990, close to the 55% envisaged in the EU’s Fit-for-55. The less ambitious policy regime (green line) that would imply policies equivalent to average progress in the EPS over the past six years, is estimated to reduce emissions by less than 10% by 2030, or by 50% as compared to 1990.

The results are only illustrative and subject to several caveats. First, the thought-experiments should not be interpreted as projections but rather an assessment of effects, other factors being held constant. Second, it is assumed that the association between the EPS and CO2-emissions is the same for future EPS changes as it has been in the historical period covered by the estimation. As such, the uncertainty about the estimated effects increases the further into the future they are extrapolated. Third, fossil fuel intensities and the contribution of sectors to national CO2-emissions could change over time which could alter the estimated effects.

Figure 2.10. Reaching the EU’s Fit-for-55 necessitate a rapid tightening of environmental policies

Sufficiently and consistently pricing emissions

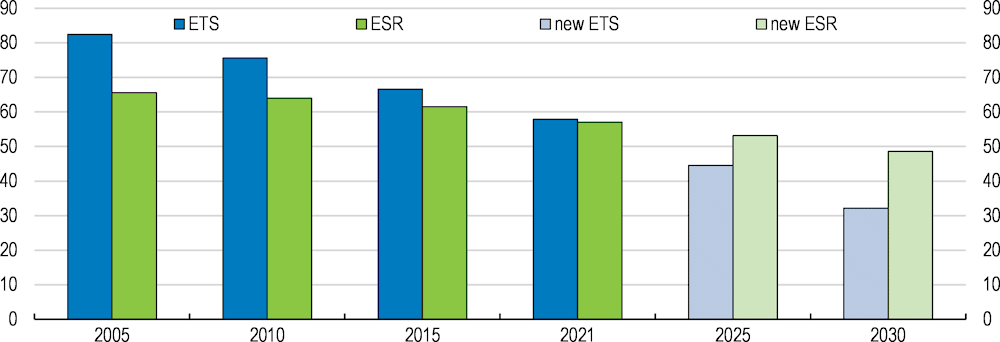

Much of the progress in emissions reductions in the Czech Republic since 2005 has been achieved through the EU’s ETS (Ministry of the Environment, 2021b). The ETS covers emissions from industry, electricity and heat generation as well as intra-EU aviation and covers more than half of the Czech Republic’s total GHG-emissions (Ministry of the Environment, 2019b). In the system, tradable emissions permits are issued and sold, or handed out to participants who can trade them freely. The available permits sum up to the overall quantity of emissions (the “cap”) and this cap is reduced over time to ensure that targets are met (European Commission, 2022a). Czech emissions in the sectors covered by the ETS fell on average by 2.8% per year during 2005-19 while emissions outside the ETS, covered by the Effort Sharing Regulation (ESR), including transport, agriculture, waste, buildings or activities of smaller installations, fell on average by merely 0.5% per year over the same period (Figure 2.11).

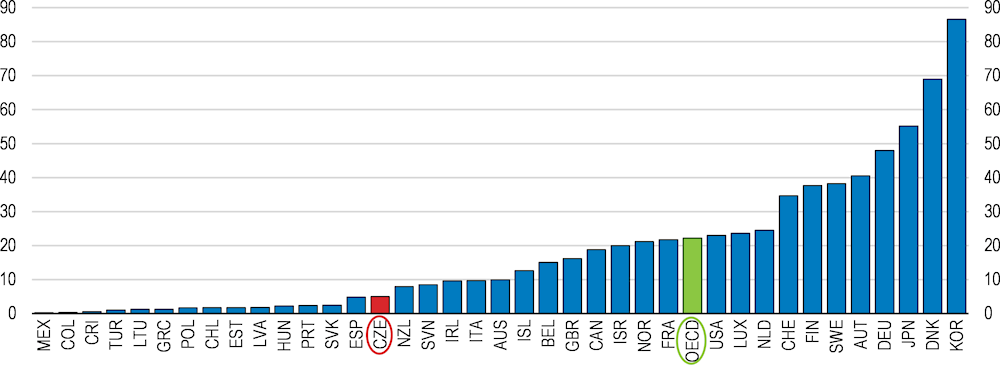

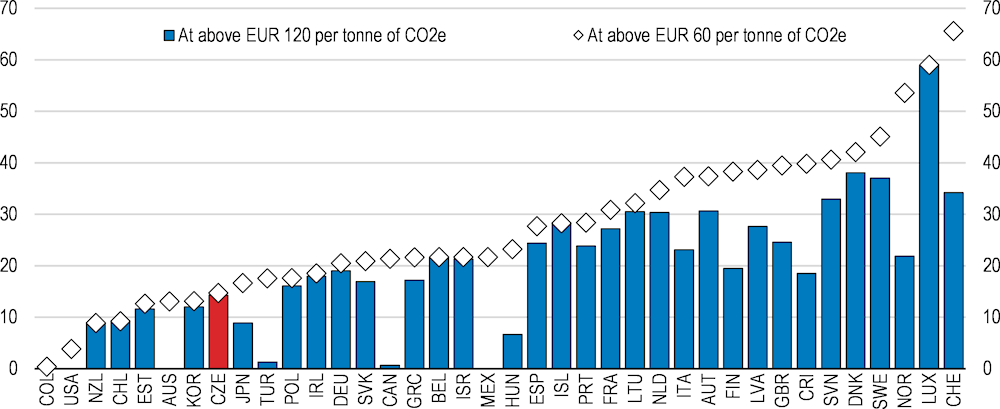

The current policy-mix results in a too low price of carbon to be fully effective. Moreover, carbon is inconsistently priced across sectors of the economy. As a result, a very low share of emissions in the Czech Republic are being priced above 60 EUR per tonne of CO2 (see Figure 2.12). Tax exemptions are also applied to various fuels, for residential heating and in agriculture, which decrease end-use prices and limit incentives to save energy or to switch to cleaner fuels. Moreover, the existing taxes do not generally reflect other environmental costs from energy use, such as noise, congestion and air pollution, which does not encourage polluters to internalise these costs (OECD, 2018a).

Figure 2.11. Czech GHG-emissions outside the ETS have fallen only slightly

Emissions reduction in the ETS (EU Emissions Trading System) and ESR (Effort Sharing Regulation), Mt CO2-eq.

Source: OECD Environmental Statistics and EEA (https://www.eea.europa.eu/data-and-maps/dashboards/emissions-trading-viewer-1/)

Excise taxes on natural gas, solid fuels and electricity were introduced in 2008 following EU directives. However, they were set at a generally low level by European standards (European Commission, 2021b) and have not been adjusted for inflation. As in many other countries, the reason for the relatively low tax rates are affordability concerns. However, environmental taxes should provide sufficient incentives for households to improve their energy efficiency and to switch to cleaner fuels and technologies (see the next section). Meanwhile, the government should provide targeted income support to groups of vulnerable households. Although fuel taxes and tariffs are significant (OECD, 2019a), they remain low compared to the EU (European Commission, 2022b). Taxes on diesel are lower than on gasoline, resulting in a lower price of diesel despite its high carbon content and air pollutant emissions, which has led to an increase in diesel consumption (OECD, 2018a). The Czech Republic does not levy a purchase tax on passenger vehicles and a road tax only applies to vehicles used for business purposes such as heavy goods vehicles, buses and coaches. Other than through toll prices and fuels taxes, vehicle emissions are not taxed in any other way.

Figure 2.12. Effective carbon rates are among the lowest in the OECD

Percentage of GHG emissions subject to a positive Net Effective Carbon Rate (ECR), 2021

Source: OECD (2022), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris.

The absence of a unified carbon price produces uneven conditions for activities within and outside the ETS. This is particularly apparent in the Czech heating sector, where larger district heating systems fall under the ETS whereas smaller heating systems for residential buildings as well as individual systems are not covered, regardless of their energy sources or CO2-emissions. The smaller installations therefore enjoy a competitive edge over the larger district heating systems, even if they are less environmentally friendly. In fact, the share of district heating systems in total heat supply has been shrinking in recent years (IEA, 2021a) although such systems have the possibility to leverage renewable sources, provide heat more efficiently and with lower local air pollution in densely populated areas than individual systems.

Once the currently elevated prices of energy subside, the introduction of an explicit carbon price would send consistent signals across the economy and incentivise households and firms to shift consumption patterns and investment decisions towards products with lower GHG-emissions. Research shows that an increase in the OECD’s Effective Carbon Rates (ECR) of 10 EUR can decrease emissions by 3.7% in the long run (D’Arcangelo et al., 2022b). With the introduction of a carbon price, the current composition of fuel taxes in the Czech Republic should be shifted so that all prices of fuels and the use of energy better reflect their carbon content and impacts (OECD, 2022b).

To avoid inconsistent price signals across sectors and systems of taxation, as well as to ensure competitiveness and harmonisation with EU policies, the introduction of a carbon price in the Czech Republic could aim to trail emissions prices in the current EU ETS within a pre-defined path or corridor. This would align price incentives across the economy and ensure national emissions reductions consistent with EU plans. Price trajectories are key for planning and will help facilitate long-term investment in low-carbon technologies as they reduce uncertainty about future costs. Indeed, higher uncertainty surrounding environmental policies tend to be associated with lower investment, especially among capital-intensive and high-productivity firms (Berestycki et al., 2022). Many countries that have recently introduced a carbon price have implemented transparent price trajectories (Box 2.3).

Box 2.3: Introducing carbon prices with emissions price trajectories

Several OECD countries have implemented carbon prices, following the lead of the Nordic countries that have long used such environmental tools. The introduction of carbon prices has often come with price trajectories that aim to provide households and firms with a planning horizon to adapt to future costs of carbon.

Canada

The Pan-Canadian Pricing on Carbon Pollution guarantees a coherent carbon price ambition across Canadian provinces but leaves the choice to provinces whether to implement a tax or trading system. Provinces implementing a carbon levy should start at a minimum price level of CAD 20 per tonne of CO2-equivalent in 2019 that increases over time by CAD 10 per tonne annually, reaching CAD 50 per tonne in 2022. From 2023-30, the carbon price is set to increase by CAD 15 per tonne annually.

Germany

Germany decided to implement national carbon pricing in sectors that are not covered by the EU ETS, in particular heating and transport. The national trading system entered into force in 2021 with a fixed price of EUR 25 per tonne of CO2-equivalents. Prices will rise subsequently according to a predefined corridor, reaching EUR 55-65 per tonne in 2026.

The Netherlands

The Dutch government proposed the introduction of a national carbon levy in the industry sector, taking the form of a supplement on top of the EU ETS price for emissions that exceed a tax-free base per facility. The total carbon levy (i.e., ETS price and national supplement) includes a price trajectory that was originally set to start at EUR 30 per tonne of CO2-equivalents in 2021 and was proposed to rise in linearly to EUR 125-150 per tonne in 2030.

Source: OECD (2020a).

Carbon prices are cost effective and efficient instruments to reduce emissions. However, public support for carbon prices tends to be much lower when compared to other types of environmental policies. A recent study by Dechezleprêtre et al., (2022) shows that public support for subsidies for low-carbon technologies and public investment into infrastructure are the most popular. Support is also high for the mandatory and subsidised insulation of residential buildings. The study also finds that public opinion for a carbon price may be stronger when it is made clear how the new revenues are to be used: support tends to be greater when the carbon price is combined with the financing of environmental infrastructure, subsidies for low-carbon technologies or reductions of other income taxes.

Revenues from the existing Czech environmental taxes are fully or partially earmarked for specific programmes: ETS revenues are dedicated to spending on programmes for energy savings, including renovation. Roughly 9% of the revenues from excise fuel taxes are for spending on various transport-related investments, such as maintenance (Melanie and van Dender, 2019). Explicit revenue earmarking should generally be discouraged as it creates inflexibility in spending priorities and can lead to inefficient allocation of resources. However, earmarking can also be a useful tool for governments to commit and clearly communicate how additional revenues derived from a carbon price will be used and thereby to gain public acceptability for the tax (Dechezleprêtre et al., 2022).

The additional revenues raised by a carbon price could be used to lower distortionary social security contributions or to fund transfer programmes towards those more affected by the emissions prices, such as lower income households. Revenues can also be put towards public infrastructure or investments into renewable technologies (Melanie and van Dender, 2019). Existing subsidy programmes tend to enjoy strong public support and the Czech economy already has a redistributive system of transfers. Given the strong need to increase energy efficiency and to scale up renewable energy production in the Czech Republic, a share of the new tax revenues could be dedicated to support these goals and used as transfers to households, to maintain public acceptance and political feasibility.

Phasing out coal by investing in alternatives and improving energy efficiency

It is imperative that the Czech Republic phases out coal’s large share in the energy mix (Figure 2.13A) to ensure a credible path towards net zero emissions. Coal is one of the most carbon-intensive fuels. One megawatt hour of electricity produced by lignite coal results in between 800-1300 kilos of CO2-equivalents, whereas natural gas result in 380-1000 kilos, nuclear power 3-35 kilos and hydropower 2-20 kilos (Turconi et al., 2013). The European Union’s revised ETS will reduce the number of emissions allowances at a faster rate compared to the existing system, which will raise the cost of coal in energy production more rapidly. Phasing out coal will require significant – and potentially challenging – structural changes in many domains in the Czech Republic. It will necessitate reshaping power and heat generation and require large investments to modernise technical equipment and to raise the energy efficiency of buildings and industrial processes. Historical reliance on coal also means that jobs in some industries (mining, industry and heat and power generation) concentrated in a few regions will be disproportionally affected (see the next section).

To accommodate a higher share of renewable energy sources, upgrades to the electrical grid will also be required. In December 2022, the European Investment Bank granted a EUR 790 million loan to the Czech utility company ČEZ for the expansion of the national electricity distribution network and to accelerate the modernisation of the grid. The funds will be used to install automation technology and remotely controlled energy supply systems. ČEZ will also make upgrades to increase the reliability of the electricity supply in nine regions of the Czech Republic. With the new infrastructure, ČEZ will be able to integrate up to 2.2 GW of new renewable energy sources.

Most of the coal-based energy in the Czech Republic is used by the industrial sector (Figure 2.13D). The sector has exhibited great improvements in energy efficiency since the 2000s and the energy intensity in Czech industrial production is lower than the EU average (Odyssee-Mure, 2020a). These improvements are due to compositional changes (relatively energy inefficient subsectors now make up a smaller share of industry) and energy efficiency gains (Odyssee-Mure, 2020b). Subsidies for research, development and innovation among small and medium-sized enterprises are available from the Operational Programme for Technologies and Applications for Competitiveness (OPTAK). The programme contains support for activities that raise energy efficiency and can cover 35-65% of the total cost. This includes investments such as replacement of energy-inefficient machines, lighting technologies, insulation of buildings, use of renewable energy sources and modern measurement systems. Progress in improving industrial energy efficiency in the Czech Republic should be maintained and the composition of existing subsidy programmes should be closely monitored to ensure that energy savings continue.

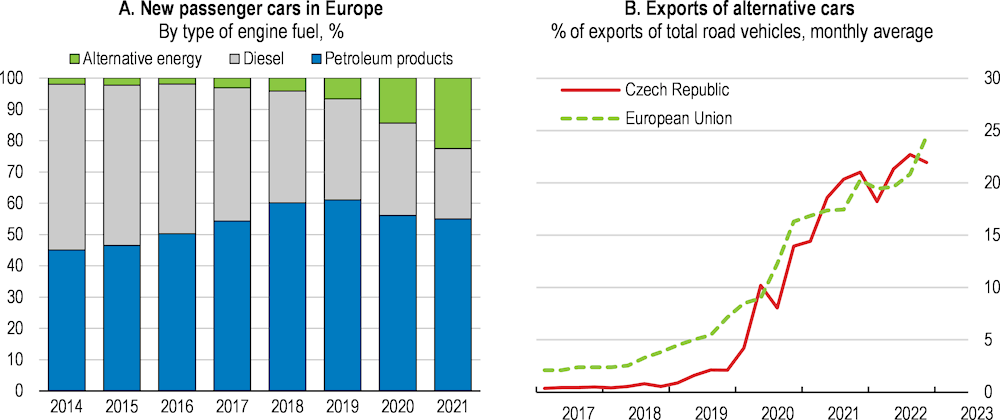

Boosting private investment in renewable energy to lower reliance on coal

Coal currently accounts for 42% of Czech electricity production and 57% of heat generation (Figure 2.13B and Figure 2.13C). Apart from nuclear capacity that will be expanded from the mid-2030s, there is currently no new large generating capacities under construction nor planned for the 2020s (IEA, 2021a). Most of the domestic electricity production potential comes from raising the share of renewables in total generation as solar photovoltaic and wind only generated about 3.2% of electricity in 2021. A key priority to achieve the coal phase-out is thus to raise the share of renewables to allow electricity and heat production to expand with a smaller carbon footprint.

Policy scenarios for the EU’s Fit-for-55 agenda that include the 2033 coal phase-out and with assumptions of a limited supply of natural gas (see Ščasný et al., 2022 and Box 2.4) point to a significant role of renewables in the energy mix by 2035. For electricity and heating, the use of non-combustible renewable sources would rise significantly, from 2% in 2020 to 12% by 2035. However, models that assume more rapid investments into the transmission grid and better construction regulations entail a faster deployment of wind and solar power (Ščasný et al., 2022). Phasing out coal from the energy mix with a limited supply of natural gas will therefore require rapid progress on many fronts. This includes significant improvements in energy efficiency, research into low carbon technologies and carbon storage options, as well as electricity imports. The Czech transmission grid is well connected with neighbouring countries, with a capacity to transport electricity across borders of 30% of its total electricity production. This high cross-border capacity can help the country ensure security of supply in the transition period towards an energy mix without coal (IEA, 2021a).

Figure 2.13. Coal remains core to the energy mix

The Czech State Environmental Fund manages several subsidy programmes to increase investments in green technologies with funds from national and EU sources. The subsidies are designed to support the public sector, businesses and households, and can be used to improve heating systems, energy savings measures as well as funding of green infrastructure of cities and municipalities. In May 2022, the government announced an additional CZK 4.75 billion (194 million EUR) in funds for 2022 for operating support related to the development of new renewable and other supported energy sources (Vlada, 2022b). Importantly, the Act on Promoted Energy Sources (Act No. 165/2012) was amended in 2022 to provide additional support for existing and new power plants with renewable energy sources. A key feature of the legislation was to move away from existing feed-in-tariffs and to introduce competitive bidding and auctions for renewable power generators and to offer green bonuses, also for heat generation. The revised legislation opens the door for support for renewable sources that has largely been lacking since the end of 2013.

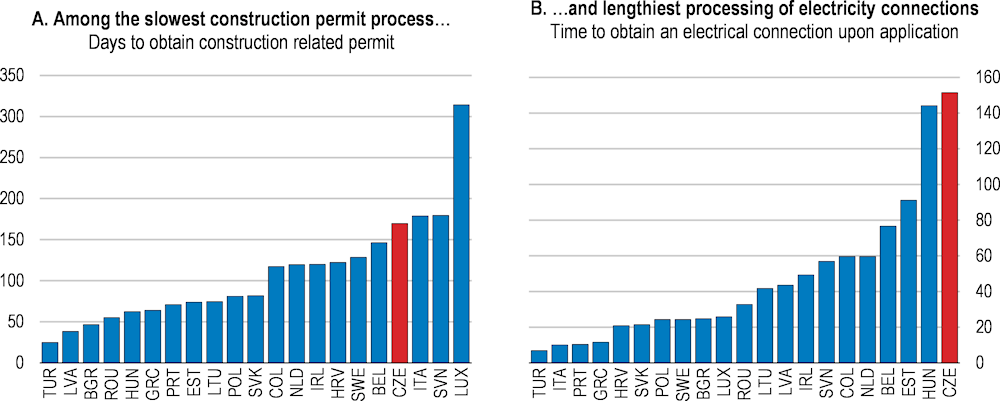

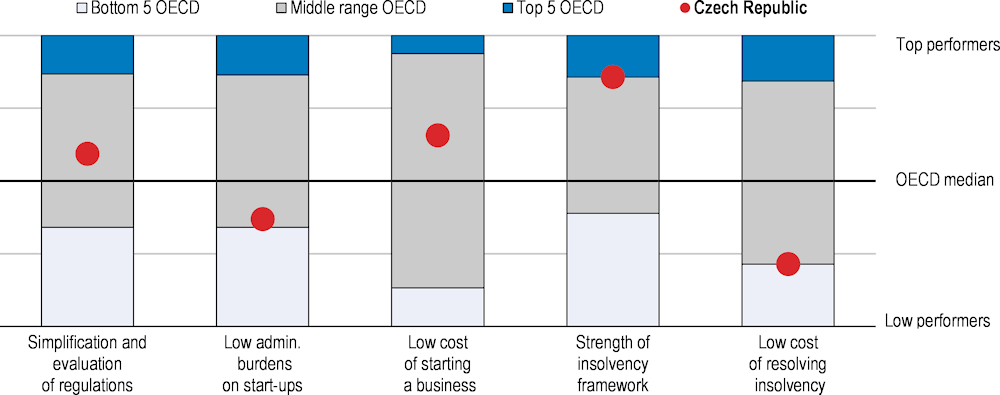

Cumbersome regulations and lengthy construction processes are severe barriers to green investments in the Czech Republic. The process for obtaining building permits is among the slowest in the OECD (Figure 2.14A) (OECD, 2020b), spatial planning is restrictive and the process for obtaining electricity production licenses is complex (Figure 2.14B). Streamlined permitting processes for renewables (such as adopting one-stop-shops), increasing the thresholds for requiring building permits and simplifying access to available grid capacity, and making processes more transparent would be beneficial. Finally, measures to encourage renewable energy self-consumption, private purchasing agreements and energy communities could stimulate private investment and help increase the comparatively low share of renewables in energy consumption.

The new Building Act (No. 283/2021 Coll.) has made important changes by aiming to reduce the red tape and waiting times associated with renovations or new construction projects. The law is currently being amended and is expected to come into force on 1 July 2023 for so-called “reserved buildings”, which are the largest infrastructure projects, and on 1 July 2024 for all other buildings. Moreover, two amendments of the Energy Act No. 458/2000 Coll. aim to reduce the barriers for renewables investment. The first increases the threshold for the obligation to hold a license for electricity generation from 10 kW to 50 kW. The same threshold will also apply for building permits, thus significantly decreasing construction lead times. The second introduces rules and obligations for energy communities to promote decentralised production of energy from renewable energy sources.

Figure 2.14. Cumbersome and lengthy processes hamper green investments

Number of days, 2020 or latest available year

There is scope to increase environmental R&D as a share in total R&D spending in the Czech Republic. Development of environment-related technologies lags other OECD countries (Figure 2.15). The THÉTA programme was launched to raise the green innovative capacity in the Czech economy by supporting applied experimental research and innovation in the area of green technologies, which has helped boost green R&D spending (TACR, 2016). The programme has run tenders from 2018 and will continue up to 2025 with the allocation of CZK 4 billion in public funds, with an average of 70% support per project. A full take-up of the programme would entail private funds of CZK 1.75 billion, yielding 5.75 billion in total. As of 2021, 232 projects have been supported (TACR, 2021). Most of the existing spending involves research related to nuclear power but there are also opportunities to use or expand the THÉTA programme in a range of other energy sources, especially low-carbon technologies, including advances in cleaner fossil fuel applications. The government could consider scaling up support for the building of new facilities for renewable energy production, while still adhering to principles of strict cost-benefit analysis for approving new projects.

Figure 2.15. Environmental R&D spending is relatively low

Development of environment-related technologies, inventions per capita, 2019

Start-ups and young firms often play a leading role in steering the economy towards the technological frontier and can play an important role for raising innovation in green technologies. However, many young and dynamic Czech firms lack sufficient sources of funding suited to their needs. Although bank credit is readily available to SMEs and financing conditions are not significantly worse than for large companies, capital markets are underdeveloped. The unavailability of venture capital creates a financing gap for early-stage innovative companies (OECD, 2020b). To help remedy the lack of venture capital, the Czech government has concluded agreements with various funds (European Investment Fund, Central Europe Fund of Funds), that may invest in innovative start-ups and emerging growth-oriented companies seeking capital for their further development. The National Development Bank also provides guarantees for SMEs and innovative projects. Such efforts and broader efforts to better develop capital markets should be pursued further.

Reducing coal-based energy use in heating

Approximately 300 000 Czech households’ – many of them low income – still use individual coal boilers to heat their homes (IEA, 2021a). Given the limits of relying on natural gas, further use of renewables in the existing district heating systems and the use of sustainable biomass and waste as alternative energy sources will be needed to reduce coal use. Well-designed district heating systems can provide heat efficiently (Cournède et al., Forthcoming). Such systems already cover 40% of Czech households. Modern networks with low operating temperature can run fully on renewable sources to supply energy-efficient buildings. Inefficient solid fuel boilers will be banned in the Czech Republic from 2024, and the government is currently focussing on the replacement of existing non-compliant heaters in roughly 110 000 households (Ministry of the Environment, 2019b). New construction projects should be incentivised to include green heating technologies, like heat pumps.

Several subsidy programmes aim to incentivise private investment into energy-efficient heating systems by offering favourable financing conditions. However, low awareness of the wider benefits of energy-saving measures have hampered the programme’s uptake (Ministry of Industry and Trade, 2019). The government should investigate whether the financing conditions are sufficient to prompt energy-savings investment, assess the difficulty of the administrative processes to receive the subsidies and provide further information about the social and economic benefits of more energy efficient heating systems. Information campaigns about how investments into energy-saving measures lower energy bills and reduce the risk of shortages should also be prioritised as energy prices may remain elevated for some time.

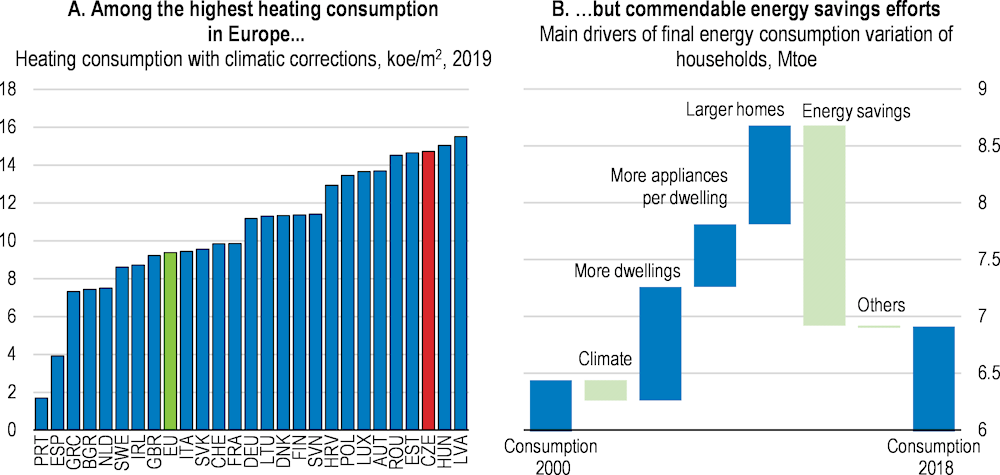

The energy use in Czech dwellings, per square meter, is among the highest in the European Union (Figure 2.16A), in part due to a large share of older dwellings (European Commission, 2022c). Despite some progress since the year 2000 (Figure 2.16B), the country is far from reaching energy savings agreed under the EU Energy Efficiency Directive (European Commission, 2022d). There is vast potential for reducing energy use in residential buildings by stepping up the pace of renovations and scaling up efforts to insulate older buildings, including government buildings. The Czech Long-Term Renovation Strategy includes several instruments to stimulate private investment into energy savings: grants for residential and non-residential buildings financed through structural funds and sales of emission allowances, technical assistance for energy efficiency projects and education measures among others. However, even in an optimal scenario considered in the strategy, energy savings from 2019 onwards are expected to be only 9% by 2030 and 24% by 2050, which is not ambitious enough (European Commission, 2021c). The government should rapidly expand investments into energy efficiency retrofits of the stock of public buildings and further incentivise private investment in energy savings efforts.

Figure 2.16. Heating consumption in residential spaces is high

Improving incentives and regulations to lower road transport emissions

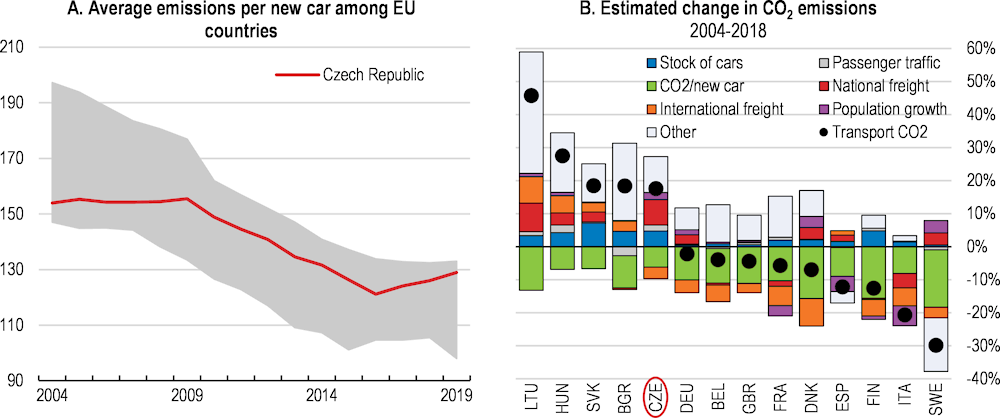

A lack of infrastructure for electric vehicles, ineffectual incentives and comparatively weak public support for hybrid or electric vehicles have contributed to one of the oldest car fleets in the European Union. Cars in circulation are on average 15.3 years old, 3.5 years higher than the EU average (ACEA, 2022). Sales of more fuel-efficient and battery-electric vehicles have increased (Ministry of Transport, 2022), but CO2-emissions of new cars remain among the highest in the EU (Figure 2.17A). Estimates following (broadly) the methodology in the 2021 Economic Survey for Denmark (OECD, 2021d) can gauge how various transport-related factors correlate with emissions. The results show that increasing the CO2-efficiency of new cars is crucial in reducing transport sector emissions, especially when road traffic is rising (Figure 2.17B).

The Transport Policy of the Czech Republic is a key strategic document that aims to raise the CO2-efficiency of the vehicle fleet (Ministry of Transport, 2021). The plan leans on legal requirements, direct incentives for purchasing alternative fuel vehicles, the building of infrastructure and various incentives. To achieve a faster replacement of the vehicle fleet, the government could also consider offering specific incentives to scrap old vehicles and replace them with newer models. A scrapping scheme should ensure that larger and dirtier vehicles that are currently in use are replaced by lighter and cleaner vehicles (International Transport Forum, 2011). Regulations can also help reduce transport emissions by discouraging the use of inefficient vehicles. Setting minimum emission standards could encourage drivers to upgrade to cleaner vehicles. Similarly to carbon-price trajectories, communicating a long-term timetable that sets out how minimum standards will become stricter over time can provide a powerful signal to households and the broader transport sector and facilitate long-term planning.

Promoting the introduction of low- and zero-emission vehicles and shifting individual road transport needs towards lower emissions modes like rail or public transport require large infrastructure investments. Moreover, well-designed regulations and standards can help overcome coordination failure and realise network effects, for example by setting technical standards for electric vehicle charging stations and connectors. The Transport Policy contains several strategies that are expected to change passenger and freight transport volumes. Transport volumes are predicted to shift from road towards rail and road passenger transport allocated towards cycling, bus and public transport modes. The shift will be induced by the continued building of a network of cycle paths and development of standards for cycle parking spaces adjacent to passenger terminals, as well as building of car parks, primarily on the outskirts of large cities, in connection with public transport hubs. The strategy also plans to introduce a uniform tariff for all modes of public transport to stimulate public transport modes further. Connections to all regional cities with a high-quality railway network (in Bohemia to Prague, in Moravia to Prague and to Brno by 2040) are envisaged. In the strategy, electric trains will be favoured, as a penalty surcharge for the operation of a diesel vehicle on an electrified train line (with exceptions) will be implemented from 2025. Moreover, the government will no longer contribute to regional transport services if they operate vehicles with internal combustion engines on electrified lines (Ministry of Transport, 2021). The strategy estimates that a successful implementation would reduce transport CO2-emissions by 32% by from 2019 to 2050. If the plans are not fulfilled, the Transport Policy estimates that CO2-emissions in the transport sector could increase 21% by 2050. A key factor for the strategy to be fulfilled is that red tape related to green infrastructure is cut, especially decreasing the number of days it takes to receive a construction permit.

Figure 2.17. More environmentally friendly vehicles can help reduce transport CO2 emissions

Notes: The shaded area in (a) represents the min-max of average emissions per new car in the EU, except for Croatia and including the United Kingdom. Panel (b) reports the (log) change in transport CO2-emissions between 2004-2018 (starting in 2005 for Slovakia and 2007 for Bulgaria. Ending in 2016 for Belgium and Denmark and 2018 for Lithuania) and the contribution of explanatory variables. The estimates utilises 239 observations for the countries marked on the x-axis and the explanatory variables included are in the chart legend. Country and year fixed effects are included as controls and are part of “Others” in the chart, alongside residuals. The parameter estimates for all explanatory variables are statistically significant at the 5% level, with the exception for stock of cars that has a p-value of 0.073 and road traffic (p-value=0.345). All variables are expressed in logs, except for population growth that is in percentage changes (x100).

Sources: European Environmental Agency, Eurostat and the International Transport Forum.

Addressing the distributional and labour transition effects of climate policies

The Czech Republic maintains comprehensive programmes for redistribution through taxes and cash transfers which, together with high employment rates, have resulted in one of the lowest income inequality rates (after taxes and transfers) in the OECD. The path towards net zero will result in higher prices of consumer products with a high carbon content, such as fuels, electricity and heating and reshape economic activity with distributional consequences (OECD, 2021e). Energy accounts for roughly 10% of private consumption expenditures in the Czech Republic, among the highest shares in the OECD (see Figure 2.7B) due to lower real income per capita and poor energy efficiency (Odyssee-Mure, 2022). Expenditure shares on electricity, gas and heating are particularly high among poorer households (Figure 2.18). As with most structural changes, the people who are already vulnerable are likely to bear the heaviest burden of the transition (D’Arcangelo et al., 2022a). Therefore, the comprehensive policy framework to facilitate green growth needs to be inclusive and ensure that the economic costs and gains are shared.

Figure 2.18. Poorer households spend a larger share on energy

Household consumption expenditure on electricity, gas and other fuels, average 2017-21

Although evidence shows small aggregate effects of climate policies on jobs (Ciccarelli and Marotta, 2021; OECD, 2021f), regional and local labour market effects can be large and distributional consequences sizable (Känzig, 2022). Without a commensurate policy response, the economic burden from the transition would fall disproportionally on certain regions, sectors, firms and households. For example, the planned phase-out of coal in the Czech Republic will directly affect jobs in mining and energy production, primarily in the Northwest regions of the country. Between 20 000 and 30 000 jobs in coal mining and power-generation in these regions could be at stake (Heuer, 2018).

Model-based simulations can help assess the distributional consequences of policies that aim to reduce emissions. Scenarios for the Czech economy suggest that implementing the EU Fit-for-55 targets could lower real GDP and total employment by 2% and 1% respectively during the transition period, compared to a scenario with only existing climate policies (see Box 2.4). However, the economic effects vary across sectors. Industries that supply goods and services that facilitate the transition, like construction and advanced manufacturing, could experience increasing employment whereas sectors such as basic manufacturing, the emissions-intensive energy supply sectors and agriculture, could see large declines. The simulations also show that implementing policies to achieve the emission reduction goals in EU’s Fit-for-55 could reduce real income and consumption across the income distribution compared to the baseline. However, there is significant heterogeneity: lower income households are likely to see the largest reduction in real consumption expenditures, although the distributional consequences hinge on how environmental tax revenues are used to support households.

Box 2.4: Model simulations of the impacts of the EU Fit-for-55 on the Czech Republic

This box summarizes policy scenarios that gauge the climate, macroeconomic and distributional impacts on the Czech economy from implementing major parts of the EU’s Fit-for-55 agenda. The analysis utilises macro-climate models and was prepared for the Czech government by Cambridge Econometrics and Charles University Environment Centre (Ščasný et al., 2022).

The environmental objectives are achievable if addressed with a sense of urgency and sufficiently stringent policies. Regarding the energy sector, two major decarbonisation policy options have been modelled. One where new renewables installations are limited and the decarbonisation would rely heavily on energy savings, carbon capture and storage technology and electricity imports. A second with significantly higher development of photovoltaic and wind energy, but also with extensive transmission network investments. The scenarios include the 2033 coal phase-out, assume a limited availability of natural gas due to Russia’s war against Ukraine and further electrification of the economy.

Table 2.3 shows the energy mix following the first policy option. Nuclear energy has the largest share in the energy mix for electricity and district heating in 2035, supported by non-combustible renewables (solar, wind and hydropower) and biomass and biofuels, which account for 12% and 12-14% in 2035 compared to 2% and 6% in 2020 (Table 2.3). However, models that entail more investments into the transmission grid and better construction regulations see significantly greater shares of non-combustible renewable energy sources in the energy mix by 2035 (Ščasný et al., 2022).

Table 2.3. A significant shift towards renewables in electricity and heat generation by 2035

|

Fuel source |

2020 consumption In PJ (and %) |

2035 consumption In PJ (and %) across scenarios |

|---|---|---|

|

Coal |

393 (47%) |

0 (0%) |

|

Nuclear |

324 (38%) |

319 (60-63%) |

|

Natural gas |

43 (5%) |

32-62 (6 -12%) |

|

Solar, wind and hydro |

21 (2%) |

61-62 (12%) |

|

Biomass and biofuels |

50 (6%) |

63-71 (12-14%) |

|

Other sources |

14 (2%) |

22-24 (4-5%) |

Note: All scenarios include a decrease in primary energy consumption by 2050 ranging from 22 to 28% compared to 2020, reflecting energy efficiency measures. Other sources include other oils, gases, waste and geothermal. The range of values in 2035 is determined by the assumed availability of natural gas.

Source: Ščasný et al. (2022).

Three scenarios for recycling revenues from the European Union’s ETS are considered: 1) a scenario where the revenues are partly used for green projects such as low carbon hydrogen, energy efficiency in industry, electric vehicles or renewable technologies, compensation for low-income households, but also for general government spending. 2) a scenario where all revenues are dedicated to green initiatives and support to low-income households and 3) an environmental tax reform that uses all revenues to lower other taxes (income, labour and sales taxes) proportionally.

Across scenarios, the impact on real GDP varies in the range of -1.8 percentage points to +2.2 percentage points relative to the baseline by 2030 and the impact on employment is roughly half of the GDP impacts. The employment effects differ remarkably across sectors, with rising employment in construction and to a smaller extent in advanced manufacturing. A reason for this increase is that these sectors supply inputs and capital goods that support the transition towards net zero. Employment in basic manufacturing, the energy supply sector and agriculture would at the same time decline.

Impacts at the household-level also differ. Changes in energy prices lead to a demand reduction and/or to a reduction in the consumption of other products, which affects households across consumption deciles differently. All scenarios foresee real consumption decreases relative to the baseline, with regressive impacts: households with lower incomes are more adversely impacted than richer households. Revenue recycling can reduce the overall negative effect on consumption expenditures across the income distribution. Moreover, the environmental tax reform using all revenues to reduce income, labour and sales taxes equally would have the smallest impact on consumption expenditures on average, while being most regressive.

According to the models, the revenue recycling is most progressive when used for climate investments across sectors with a special focus on low-income households (combining social support and energy savings).

Source: Ščasný et al. (2022).

Cushioning the impact of climate policies on vulnerable households

The Czech government should make use of its existing tax and benefit system to offset some of the higher costs of energy associated with climate policies that disproportionally fall on the lowest income households. Other OECD countries have implemented several types of compensating policies, both untargeted and targeted. For example, Switzerland addressed the energy affordability concerns of a carbon price with the introduction of special lump-sum rebates on social security contributions and reimbursements to firms proportional to their wage bill. In Canada’s British Columbia, a carbon price was introduced alongside complementary support to firms, income tax cuts, property tax rebates to rural areas and targeted transfers to low-income households. Several EU countries have shifted taxation away from labour income towards environmentally harmful behaviour since the early 2000s (European Environmental Agency, 2018).

To maintain incentives to improve energy efficiency and the use of low-emission products and fuels, support measures should be geared towards households that are the worst-off. New or expanded climate policies that result in additional tax revenues, such as an explicit carbon price, should be combined with redistribution that support households to mitigate energy affordability concerns and to ensure public acceptance of the policies. As noted in the previous section, some share of the new tax revenue should be used to fund infrastructure benefitting especially the poor. Many of the existing Czech subsidy programmes already focus on such investments, like the New Green Savings Program, and could be scaled up. The government could also consider creating a green social fund that distributes new environmental revenue towards different ends (D’Arcangelo et al., 2022a). This could help signal the country’s commitment to achieve a fair transition toward net zero and increase acceptability of climate policies.

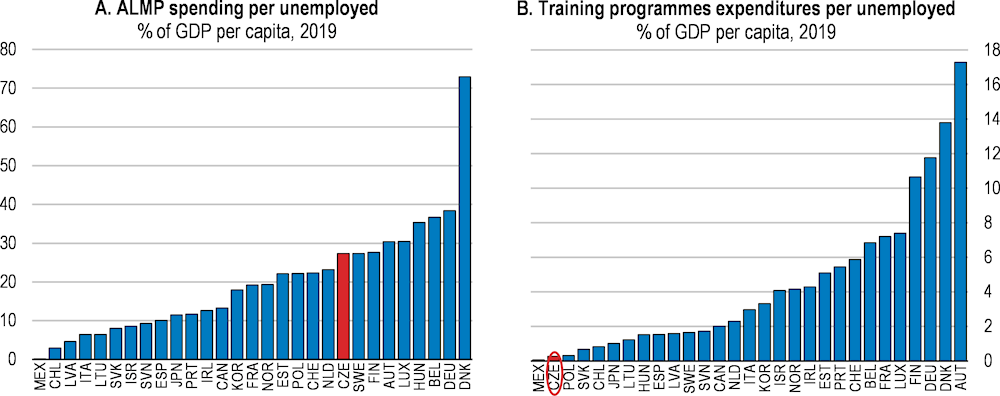

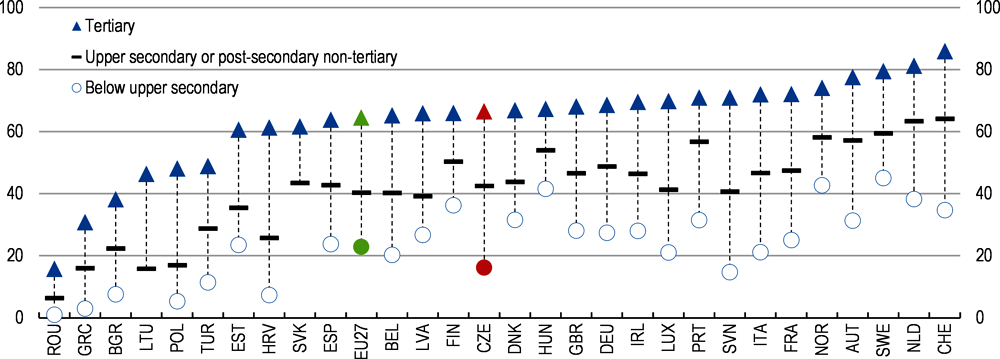

Boost active labour market policies to facilitate labour reallocation

Employment opportunities will shift across regions, sectors and firms as the Czech economy moves towards net zero. Moreover, the skills required in many emissions-intensive jobs are only partially transferable to greener jobs (ILO (International Labour Organisation), 2011). Some “green” jobs require higher level of skills than in comparable occupations in other industries (OECD, 2012). Skills shortages are already very high in the Czech Republic (OECD, 2022c) and improving reskilling and matching in the labour market can help ease labour shortages and at the same time facilitate the green transition.

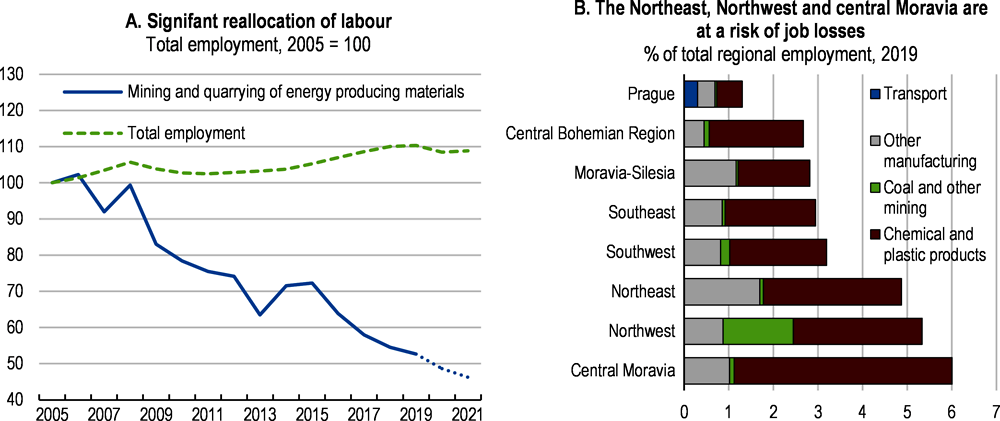

Some of the reallocation has already started in the Czech Republic. Employment in mining and quarrying of energy-related materials (mostly coal) has decreased rapidly – by more than 50% since 2005. In the meantime, total employment increased by almost 10%. The large decline of jobs in the coal sector and simultaneous increase in total employment illustrates that although one sector is exposed to a structural change, developments in other sectors can more than offset the impact.

Structural change that arises from climate mitigation can be very challenging for workers and regions despite small aggregate effects. Three Czech regions - the Northeast, Northwest and central Moravia – have more than 5% of jobs in sectors at risk of job losses related to climate mitigation (OECD, 2021g). The jobs at risk are primarily in the manufacturing of chemical and plastic products and in the mining of coal and lignite (in the Northwest). The economic hardship and risk of poverty in the Northwest are exacerbated by the fact that the region is already lagging the rest of the country with GDP per capita close to 30% below the national average (Czech Statistical Office (CZSO), 2022a), a lower employment rate, higher unemployment rate and higher share of economically inactive people. Moreover, the share of workers in simpler occupations is almost twice that of the national average (Czech Statistical Office (CZSO), 2022b). To ease the adjustment in coal-related industries, Czech governments have since the 1990s implemented an array of policies to support workers (Rečková et al., 2017). Compensation-based support was given as social allowances, early retirement and/or compensation for lost earnings. Adjustment policies focussed on retraining programmes for miners and job search, as well as regional transport allowances.

Figure 2.19. Labour reallocation will continue with some regions and sectors more at risk

Note: In panel A, from 2019, data for employment in mining and quarrying of energy producing materials are estimates based on total employment in mining and quarrying.

Source: STAN structural indicators (iSTAN); Eurostat database; OECD Regional Statistics database.

Tackling the adverse socioeconomic consequences in coal regions