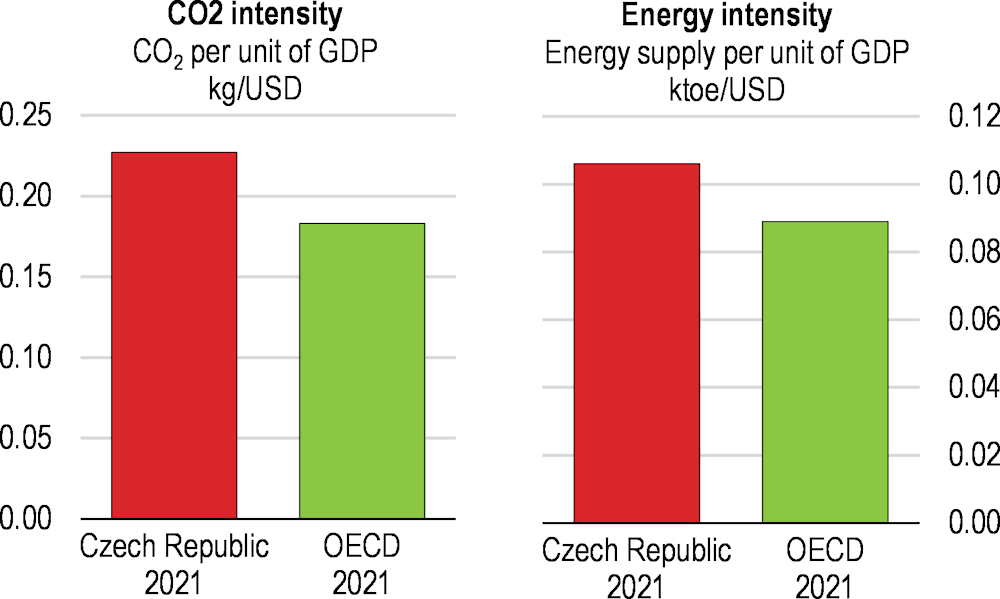

Russia’s war of aggression against Ukraine has derailed the Czech Republic’s post-pandemic recovery and further disrupted the impressive catch-up with OECD average incomes seen in the previous two decades. Steep rises in energy and commodity prices and disruptions in gas and oil imports from Russia triggered a cost-of-living crisis with a risk of broader energy shortages. Lower global growth, constraints in global supply chains and higher uncertainty have dampened activity.

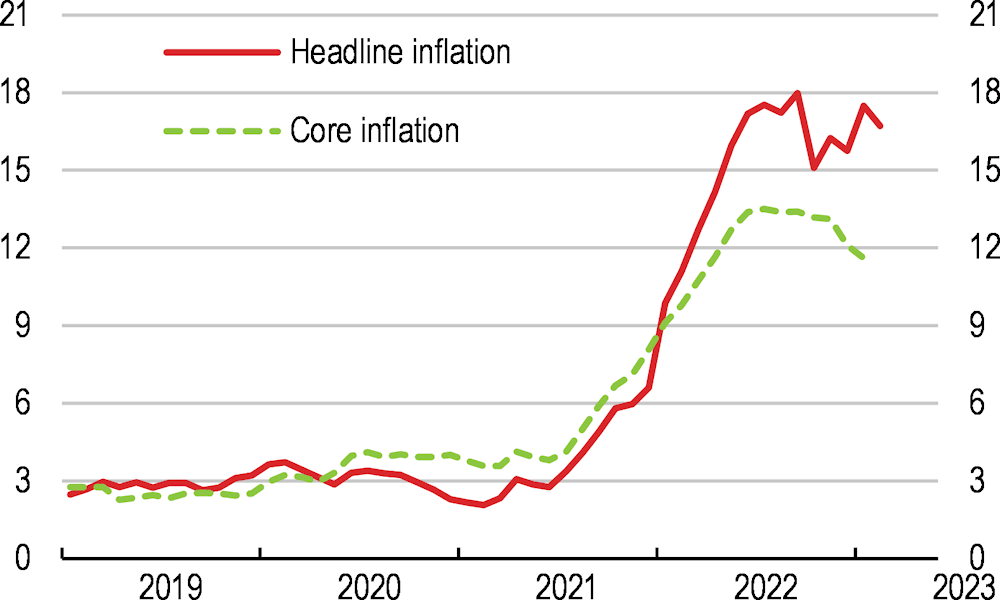

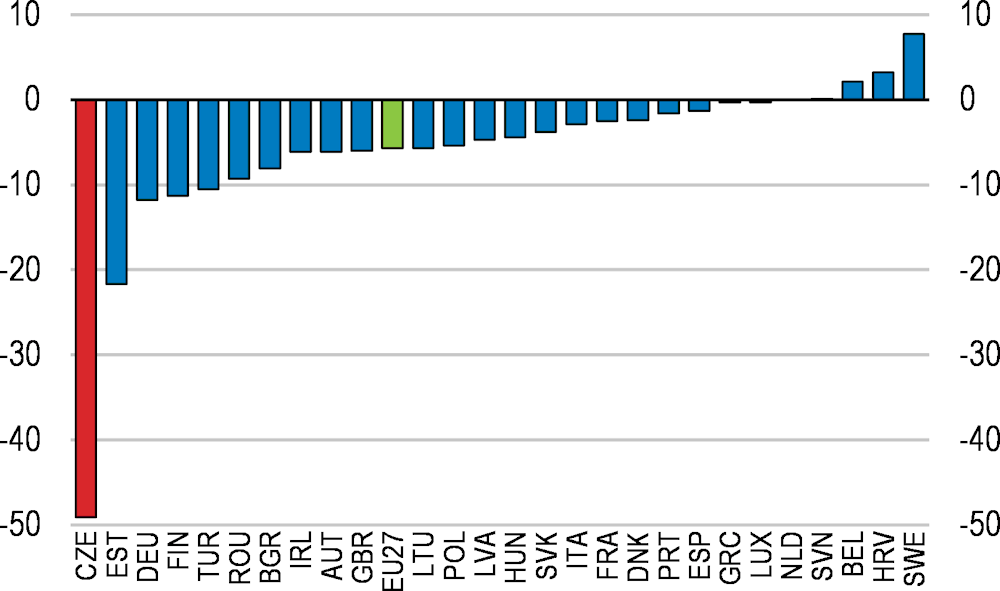

Inflation has risen to high levels and become entrenched. Core inflation was persistently among the highest in the European Union throughout 2022. Inflation expectations have increased markedly, with corporates expecting around 7% inflation at a three-year horizon. The authorities had reacted swiftly and decisively to support the economy during the COVID-19 crisis. However, in hindsight, loose overall macroeconomic policy in 2020-21 contributed to high inflation by boosting demand over supply capacity.

The unemployment rate remains very low but rising prices have eroded domestic demand. High uncertainty and the looming energy crisis have resulted in large falls in consumer and business sentiment, lowering private consumption and investment. Real wages have fallen steeply.

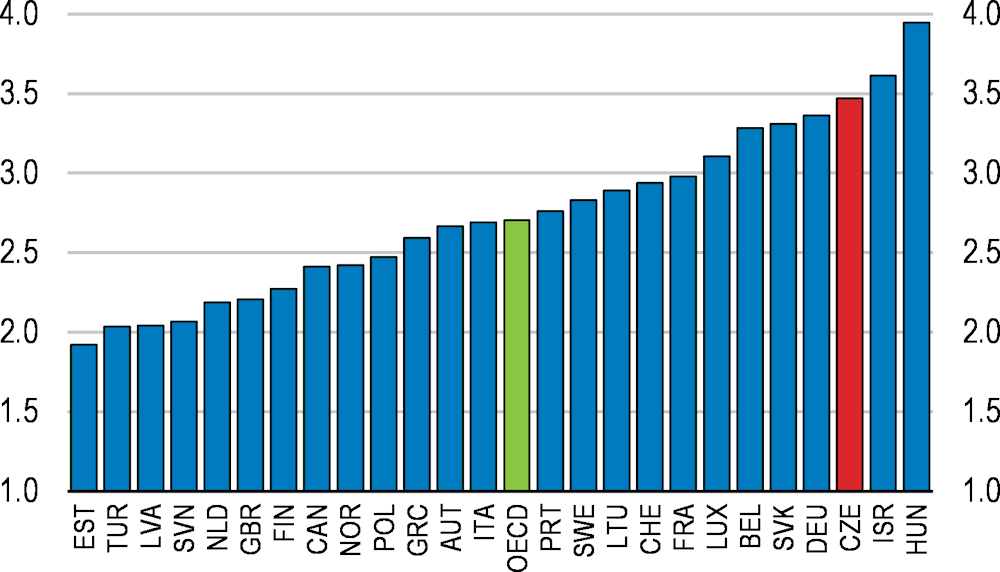

Economic growth will be subdued in 2023 and pick up in 2024 amid reduced supply disruptions and resuming expansion in trading partners. High energy prices, tightened financing conditions and low sentiment will hold back private investment in 2023. Private consumption will be constrained by rising prices. Inflation will start falling from the currently very high levels but will only approach the 2% target towards the end of 2024.

Risks around the projections are considerable. Renewed rises in commodity and energy prices, a strong depreciation of the koruna and de-anchored inflation expectations could further feed inflation pressures and trigger a destabilising wage-price spiral. On the other hand, a deeper recession and lower confidence would lower inflation more quickly.