Living standards are rising steadily

Government debt is low and sustainable

Raising revenues is the key fiscal challenge

The youthful population is an opportunity

Tourism can boost regional development

OECD Economic Surveys: Indonesia 2018

Executive summary

Abstract

Living standards are rising steadily

Thanks to a steady economic expansion and helpful government policies, poverty rates and inequality are falling, and access to public services is broadening. Income per capita growth is strong. Yet, the infrastructure gap remains large, and more spending on health and social assistance is needed to enhance inclusiveness. Well-being would also benefit from greater attention to environmental outcomes.

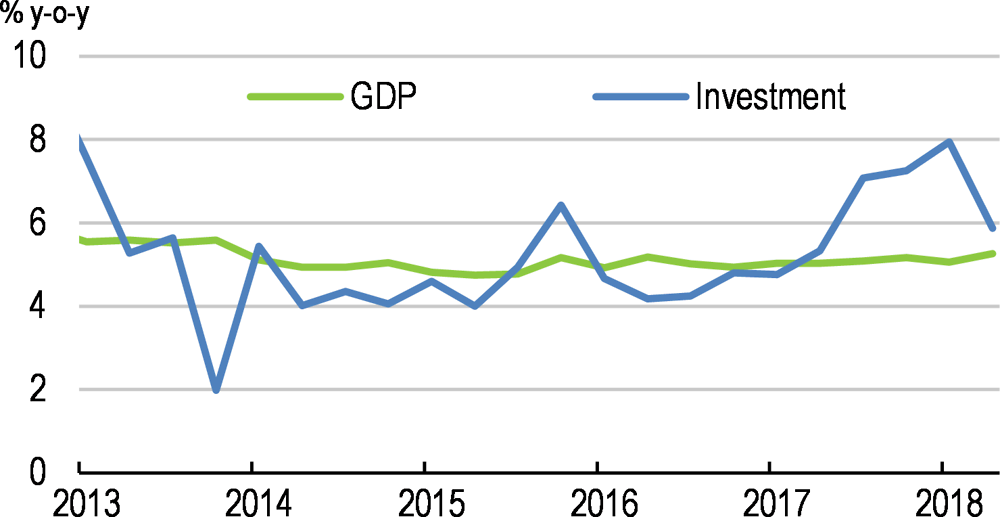

Economic growth has been solid at around 5% per year since 2013, driven by consumption but also, more recently, by much-needed infrastructure investment (Figure A). The recovery in global trade has boosted exports. The import bill has also risen due to higher oil prices and capital goods purchases, contributing to the current account deficit. Annual inflation is well within the target band of 3.5% +/-1%.

Figure A. Economic growth is solid

Macroeconomic policies are finely balancing growth and stability. After lowering policy interest rates during 2016-17 to support economic growth, Bank Indonesia has started to raise them to temper capital outflows. The budget deficit is expected to narrow in 2018 and 2019, expanding the buffer vis-à-vis the legislated cap of 3% of GDP.

GDP growth is projected to remain healthy (Table A). Rising incomes and consumer confidence will support a pick-up in private consumption. Investment is projected to remain robust. Improvements in logistics and price competitiveness will support export growth even as trading partner growth slows.

Table A. Growth is projected to remain healthy

Percentage change unless indicated

|

2017 |

2018 |

2019 |

|

|---|---|---|---|

|

Gross domestic product |

5.1 |

5.2 |

5.3 |

|

Private consumption |

5.0 |

5.2 |

5.4 |

|

Government consumption |

2.1 |

4.7 |

3.6 |

|

Gross fixed capital formation |

6.2 |

6.5 |

5.9 |

|

Exports |

9.1 |

5.5 |

5.6 |

|

Imports |

8.1 |

10.3 |

5.7 |

|

Consumer price index |

3.8 |

3.5 |

3.9 |

|

Fiscal balance (% of GDP) |

-2.5 |

-2.2 |

-2.0 |

|

Current account balance (% of GDP) |

-1.7 |

-2.5 |

-2.5 |

Source: OECD Interim Economic Outlook, September 2018.

A key downside risk to the outlook stems from capital outflows related to US monetary tightening. Large outflows would require a steeper path for interest rates, slowing growth. On the upside, past regulatory reforms and the expansion of infrastructure could boost investment and exports faster than expected.

Government debt is low and sustainable

The deficit rule is containing the growth of debt. But additional spending on infrastructure, health and social assistance is limited by low revenues. Accordingly, resources must be found through greater efficiency and higher revenues. Growth in the public wage bill was curbed in 2017, and targeting of sub-national transfers is improving. However, spending on energy subsidies has risen anew after falling over 2014-17. Shifting social assistance more towards conditional cash and non-cash transfers would improve targeting.

State-owned enterprises are contributing to the development agenda through infrastructure investment, loans to small businesses and price restraint. Yet, growing financial vulnerabilities might in time require public capital injections. SOEs’ dominance in some sectors crowds out private capital. Governance would benefit from increased disclosure, strengthened procedures for board appointments and more explicit mandates with adequate independence to pursue them. Implicit fiscal risks from SOE losses and rising debt at some require more attention.

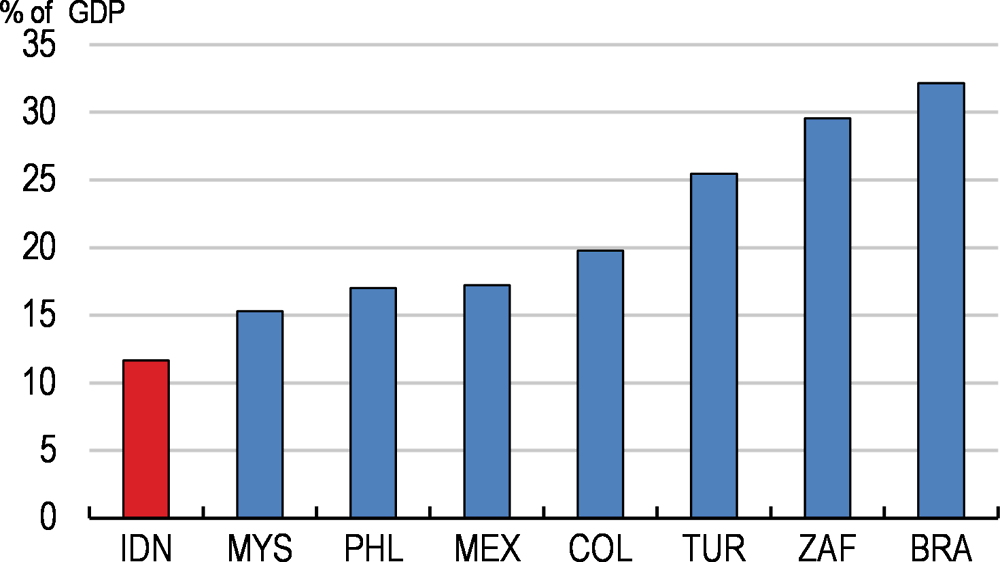

Raising revenues is the key fiscal challenge

Tax revenues are low relative to other emerging economies (Figure B). Registration has expanded but compliance remains a major challenge.

Figure B. Tax revenues are low

Strengthening the tax administration is a government priority and is crucial for improving compliance. Modernising IT systems and processes can promote compliance and improve enforcement. But it will increase demands for highly skilled staff who are in short supply. Effectively using the swathes of new data is crucial to deter future evasion and could help boost revenues. Complexity and frequent policy changes make compliance more difficult. Wider public consultation ahead of proposed changes to tax legislation would enhance the quality of legislation over time.

Low incomes and widespread informality imply that the personal income tax net currently includes few individuals and raises scant revenue. The initial income threshold for paying income tax is relatively high. At medium-to-high incomes, marginal tax rates are well below those in other emerging economies. Gradually lowering the top income tax thresholds would make the system more progressive and raise additional revenue. High-income earners disproportionately benefit from the tax-free treatment of fringe benefits within personal income tax.

The corporate income tax base is also reduced by informality and the prevalence of small firms. Tax holidays and other incentives target specific sectors and locations and have been expanded recently to attract new investment. However, these risk eroding the tax base, creating distortions and spurring further regional tax competition. The recent publication of revenue forgone due to tax incentives improves transparency. These estimates should be published annually, as planned. Shifting to cost-based tax incentives would sharpen investment incentives. Competitiveness concerns could be addressed through greater regional co-operation.

Value-added tax generates sizeable revenue but its revenue-raising potential is undermined by exemptions, including for hotels and restaurants, which are subject to local sales tax, and some intermediate inputs. A high threshold for compulsory registration for firms weakens the self-enforcement mechanism embodied in the tax. A reform package removing most exemptions, replacing local sales tax by VAT, compensating local governments for lost sales tax revenue, and lowering the registration threshold would raise compliance. An accommodation tax for local governments would incentivise them to develop tourism.

There is scope to better use taxes for health and environmental aims. Smoking rates are high and tobacco taxes are lower than elsewhere. Motor vehicle taxes can be better linked to environmental effects. Phasing out fuel subsidies would be a first step towards more cost-reflective energy pricing.

Recurrent taxes on land and structures raise relatively little revenue. The first step is to ensure local governments are able to maintain and update their property tax databases. Then the cap on rates should be raised.

The youthful population is an opportunity

Half of Indonesia’s population is under 30 years old. This favourable age structure will contribute to future prosperity, if policies are put in place to take advantage of it. Reaping the benefits of this opportunity requires shifting the jobs mix to high-quality, high-productivity formal-sector jobs. Improving the health of students and workers will raise learning and productivity.

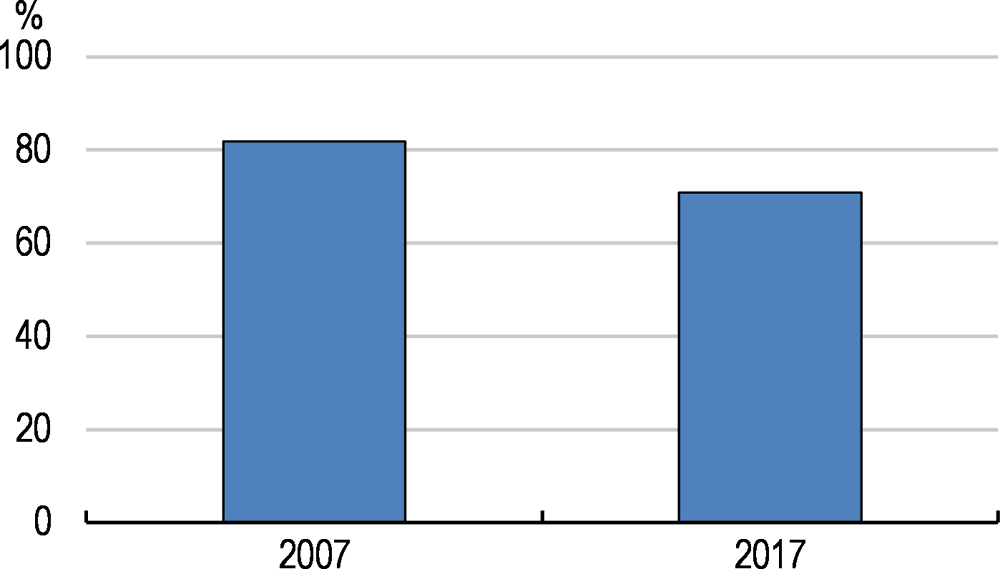

Around half of all dependent employees and 70% of all workers are estimated to still be informal (Figure C). These jobs tend to be associated with lower wages, poorer working conditions and fewer training opportunities. Disadvantaged groups are more likely to be affected, particularly those with less education.

Figure C. Informality has fallen but is still high

Stringent employment regulations, including high dismissal costs and minimum wages, curtail formal-sector employment. Easier employment regulations and a discounted minimum wage for youth could be trialled in special economic zones and, if successful, extended across the country. Improving business regulation at all levels of government would lower the barriers to formalisation. Linking the turnover tax to additional benefits such as access to business development services and book-keeping applications could encourage formalisation and increase revenue. To contain costs, eligibility for the tax should be restricted to very small firms.

Educational attainment has increased, but a scarcity of skills is holding back growth and incomes. The quality of education is still a concern. Teachers should be evaluated regularly and encouraged to undertake professional development by linking remuneration to performance. The government is focusing on developing skills by improving vocational schools. Strong employer engagement and national co-ordination are crucial for success.

Relatively little use is currently made of foreign workers to fill skill shortages. These workers could help to quickly fill acute skills shortages in high-skill jobs, boosting growth, supporting foreign investment and facilitating knowledge transfer. A list of highly skilled occupations with severe shortages could be created, for which processes could be simplified and expedited.

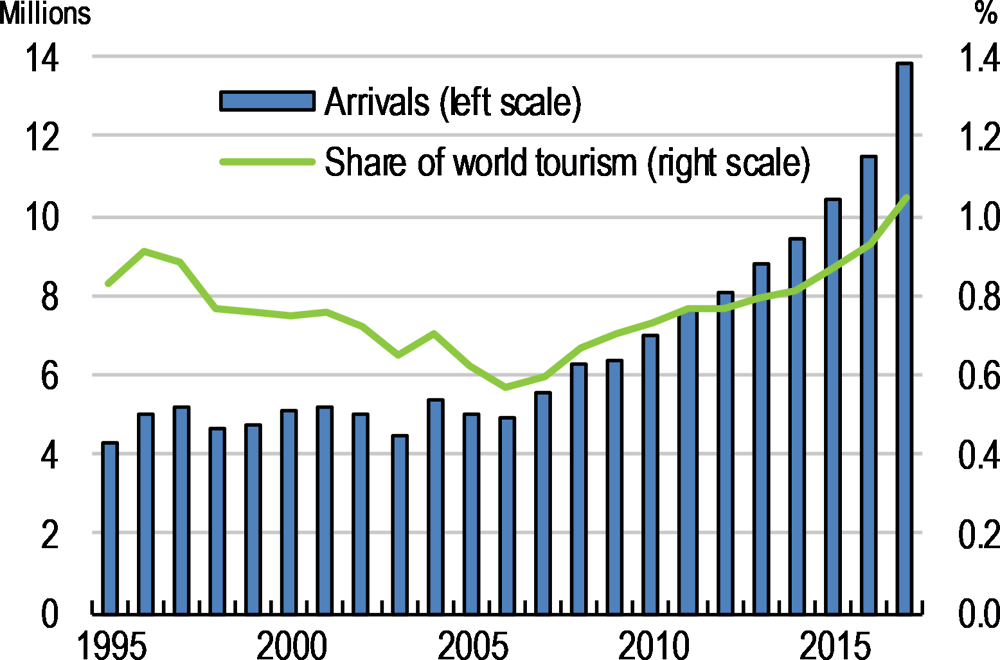

Tourism can boost regional development

Growth in tourism has been remarkable. Annual visits have almost tripled over the past decade, with China becoming the largest source (Figure D). The government aims to reach 20 million foreign tourists by 2019. To unleash the full benefits for regional populations, vocational and on-the-job training should be expanded, driven by local needs. Infrastructure rollout is encouraging tourism, but gaps remain including in tourism-specific infrastructure and environmentally related infrastructure.

Figure D. Tourist arrivals have surged

The central government is driving the tourism strategy, which helps prioritisation. However, local governments are not sufficiently involved. Greater co-ordination would ensure that tourism serves regional development needs. Targets should focus less on tourist numbers and more on revenue generated.

Tourism can create economic incentives to protect natural resources. Protected areas should be expanded and more open to visitors. User fees, along with quantitative restrictions as necessary, could control visitor numbers and help fund the maintenance of these sites.

Land clearing and peatland fires continue to generate environmental, health and economic costs. Moreover, air pollution from transportation is rising. Clearer land rights and better law enforcement would help control deforestation. Taxes, together with road pricing, could help curtail vehicle use.

|

MAIN FINDINGS |

KEY RECOMMENDATIONS |

|---|---|

|

Making the economy more resilient and inclusive |

|

|

Growth is projected to remain healthy but there is a risk of continued capital outflows. Monetary policy and fiscal policy are successfully balancing growth and stability, and the fiscal stance is broadly neutral. Reform of energy subsidies has stalled. |

Deepen domestic financial markets to mitigate risks of capital outflows. Continue to act pre-emptively, including by raising interest rates as needed, to maintain price and financial stability. Improve targeting of social assistance, including by shifting towards more conditional transfers. |

|

State-owned enterprises contribute to development but rising leverage, increasing cost pressures and losses at some firms represent fiscal risks. In some sectors they crowd out private investors. |

Improve the transparency and governance of state-owned enterprises, including by strengthening their supervision and selection of board members. Give public enterprises clearer mandates with greater independence to achieve these. |

|

Low-quality, informal jobs remain prevalent and there are many informal micro enterprises. Stringent employment regulation, high severance costs and high minimum wages discourage formal employment of low-skilled workers. Business regulations have been streamlined but are still burdensome at all levels of government. |

Pilot lower levels of employment protection and discounted minimum wages for youth in special economic zones. If successful, extend them. Further simplify business regulations to encourage formalisation and collect user feedback to improve the online single submission system. Tighten eligibility for the turnover tax to very small firms and link registration to access to additional non-financial benefits. |

|

Educational attainment is rising but still low. The quality of education remains a concern. Skills shortages are constraining growth. Better targeted government social assistance is expected to reduce student drop-out rates. |

Introduce regular teacher evaluations and link teacher remuneration more closely to performance and ongoing training. Encourage greater employer engagement in vocational education and training. Create a list of highly skilled occupations with acute skills shortages, and ease restrictions on hiring foreign workers in these areas. |

|

Raising more revenues to meet spending needs |

|

|

Tax revenues remain low, constraining public spending on infrastructure, education, health and social protection. Registration has increased, but improving compliance remains a challenge. Planned technology upgrades at the tax administration will raise demand for highly skilled civil servants. Complex regulations and frequent policy changes add to compliance costs. |

Increase investment in tax administration, particularly staff, electronic services and databases. Make greater use of information technology to strengthen monitoring and facilitate tax compliance. Continue to expand and improve tax expenditure estimates and publish them annually, as planned. |

|

A high basic tax allowance for personal income tax reduces the number of taxpayers. Higher rates are not applied until high levels of income. Different types of income are treated differently. |

Freeze the basic tax allowance for individuals to broaden the tax base. Gradually lower thresholds for paying the top two rates of personal income tax. Include fringe benefits and employer allowances in taxable income. |

|

Numerous exemptions and a high threshold for compulsory registration reduce the efficiency and effectiveness of the VAT. Sectors such as hotels, restaurants and entertainment are instead subject to sales tax at the sub-national level. |

Broaden value-added tax by removing most exemptions, especially for intermediate goods, replacing local sales tax with VAT, and lowering the threshold for compulsory registration. Compensate sub-national governments for lost sales tax revenue and allow them to charge a tax on accommodation nights. |

|

Taxes are used less than in other countries to target health and environmental outcomes. Smoking rates for men are amongst the highest in the world. |

Increase and harmonise tobacco excise across products. |

|

Recurrent taxation of immovable property raises relatively little revenue partly because of a cap set by the national government. Some district registers are out of date and many districts lack capacity to administer property taxes. |

Increase training and assistance for sub-national governments to improve the quality of property tax databases, valuation methods and tax administration. Raise the cap on property tax rates. |

|

Developing a stronger and sustainable tourism sector |

|

|

The central government is driving the tourism strategy. This helps prioritise planning and co-ordination, but local governments are not sufficiently involved. Local infrastructure is still lacking, including environmental infrastructure and tourism-specific services such as information centres. |

Incorporate needed infrastructure in forthcoming destination management plans to ensure sustainable development of tourism. |

|

Tourism is labour intensive and growing rapidly and skills shortages are increasing. |

Expand vocational and on-the-job training to build tourism-related skills in the workforce, especially in areas with skills shortages. |

|

Government medium-term objectives are mostly based on the number of tourists, which risks generating unsustainable inflows. |

Give more prominence to revenue-based targets for tourism in future plans. |

|

Natural assets are plentiful. The share of protected areas is low by international standards, and they are generally closed to the public to preserve highly sensitive zones. |

Increase the coverage of protected areas, and consider opening more for tourism use, but with visitor controls including regulations, and appropriate user and concession fees. |