Akgun, O., B. Cournède and J. Fournier (2017), “The effects of the tax mix on inequality and growth”, OECD Economics Department Working Papers, No. 1447, OECD Publishing, Paris, http://dx.doi.org/10.1787/c57eaa14-en.

Allen and Overy (2017), Indonesia Power Sector: New Regulation on Tariff and Tendering for Renewable Energy Projects, www.jdsupra.com/legalnews/indonesia-power-sector-new-regulation-41003/.

Allen, E. (2016), “Analysis of trends and challenges in the Indonesian labor market”, ADB Papers on Indonesia, No. 16, Asian Development Bank, Manila.

APJII (2017), Penetration and Behavior of Indonesian Internet User 2017, Indonesia Internet Service Provider Association, https://blog.apjii.or.id/index.php/2018/02/19/survei-apjii-penetrasi-internet-indonesia-jangkau-547-persen-populasi-di-2017/.

Arnold, J., B. Brys, C. Heady, Å. Johansson, C. Schwellnus and L. Vartia et al. (2011), “Tax policy for economic recovery and growth”, The Economic Journal, Vol. 121/550, pp. F59-F80.

Austin, K., A. Mosnier, J. Pirker, I. McCallum, S. Fritz and P. Kasibhatla (2017), “Shifting patterns of oil palm driven deforestation in Indonesia and implications for zero-deforestation commitments”, Land Use Policy, Vol. 69, pp. 41-48.

Bali (2015), Sustainable Tourism on Bali?, www.bali.com/news_Sustainable-Tourism-on-Bali-_161.html.

BNM (2018), Financial Stability and Payment Systems Report 2017, Bank Negara Malaysia, Kuala Lumpur, www.bnm.gov.my/index.php?ch=en_publication&pg=en_fspr&ac=23&en.

BPJS Ketenagakerjaan (2018), Hingga Akhir 2017, Sebanyak 33.000 Pekerja Asing Jadi Peserta BPJS Ketenagakerjaan [Until the end of 2017, a total of 33,000 foreign workers became BPJS participants in employment], Press release, 30 April.www.bpjsketenagakerjaan.go.id/berita/19121/Hingga-Akhir-2017,-Sebanyak-33.000-Pekerja-Asing-Jadi-Peserta-BPJS-Ketenagakerjaan

Busch, J. et al. (2015), “Reductions in emissions from deforestation from Indonesia's moratorium on new oil palm, timber, and logging concessions”, Proceedings of the National Academy of Sciences of the United States of America, Vol. 112/5, pp. 1328-33.

Caporale, G., A. Catik, M. Helmi, F. Ali and M. Tajik (2016), “The bank lending channel in a dual banking system: evidence from Malaysia”, DIW Berlin Discussion Papers, No. 1557, German Institute for Economic Research, Berlin.

CBD (2018), Indonesia - Country Profile, www.cbd.int/countries/profile/default.shtml?country=id.

Chalaux, T., A. Kopoin and A. Mourougane (forthcoming), “A formal look at regulations and labour market informality in emerging-market economies”, OECD Economics Department Working Paper, OECD Publishing, Paris.

CNBC Indonesia (2018), Distribusikan BBM Bersubsidi, Pertamina Rugi Rp 5,5 T [Distribution of Subsidised Fuel, Pertamina Loss Rp 5.5 T], www.cnbcindonesia.com/news/20180410154429-4-10431/distribusikan-bbm-bersubsidi-pertamina-rugi-rp-55-t.

Credit Suisse (2017), Credit Suisse Global Wealth Databook 2017, Credit Suisse Research Institute

Dartanto, T. (2017), Universal Health Coverage in Indonesia: Informality, Fiscal Risks and Fiscal Space for Financing UHC, Presentation at IMF-JICA Conference on "Regional Development: Fiscal Risks, Fiscal Space and the Sustainable Development Goals".

Deloitte (2017), Shifting Sands: Risk and Reform in Uncertain Times - 2017 Asia Pacific Tax Complexity Survey.

Demirgüç-Kunt, A., L. Klapper, D. Singer, S. Ansar and J. Hess (2018), The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution, World Bank, Washington DC.

Eagles, P., S. McCool and C. Haynes (2002), Sustainable Tourism in Protected Areas – Guidelines for Planning and Management, World Commission on Protected Areas, United Nations Environment Programme, World Tourism Organisation and IUCN.

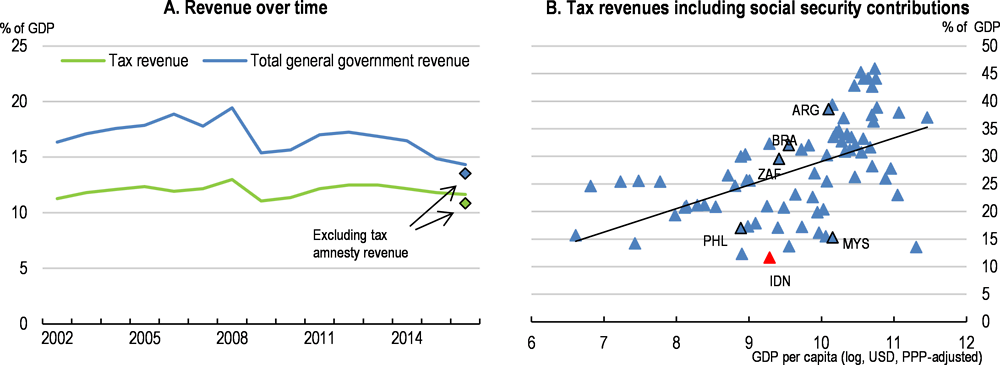

Fenochietto, R. and C. Pessino (2013), “Understanding countries’ tax effort”, IMF Working Papers, No. 13/244, International Monetary Fund, Washington DC.

Flightradar24 (2018), www.flightradar24.com/data/ (accessed on 9 March 2018).

Fountaine, T., J. Lembong, R. Nair and C. Süssmuth Dyckerhoff (2016), Tackling Indonesia’s Diabetes Challenge: Eight Approaches from Around the World, McKinsey & Company and Center for Healthcare Research and Innovation.

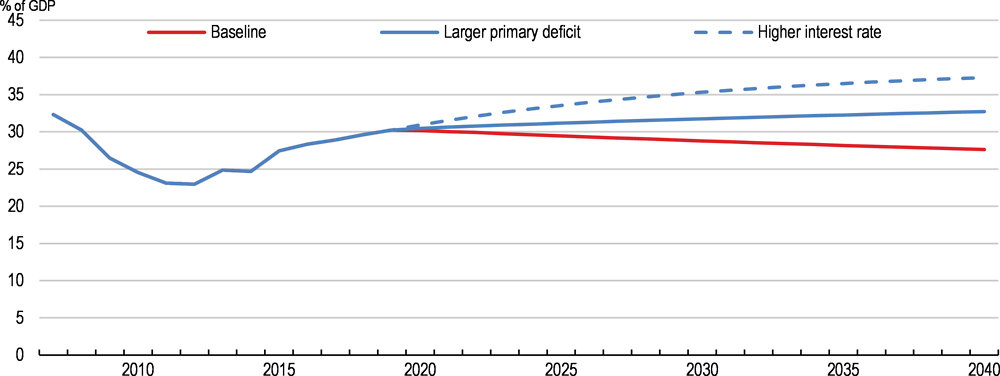

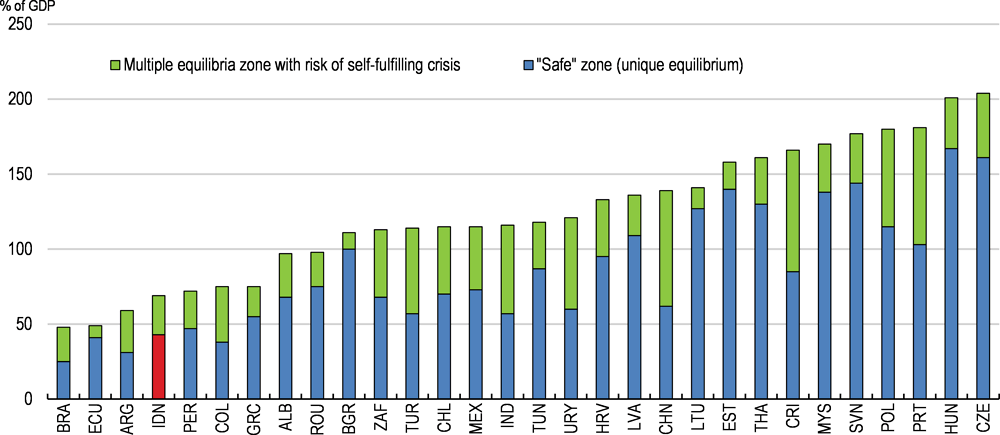

Fournier, J. and M. Bétin (2018), “Limits to debt sustainability in middle-income countries”, OECD Economics Department Working Papers, No. 1493, OECD Publishing, Paris, https://doi.org/10.1787/deed4df6-en.

Gaspar, V., L. Jaramillo and P. Wingender (2016), “Tax capacity and growth: is there a tipping point?”, IMF Working Papers, No. 2016/234, International Monetary Fund, Washington DC.

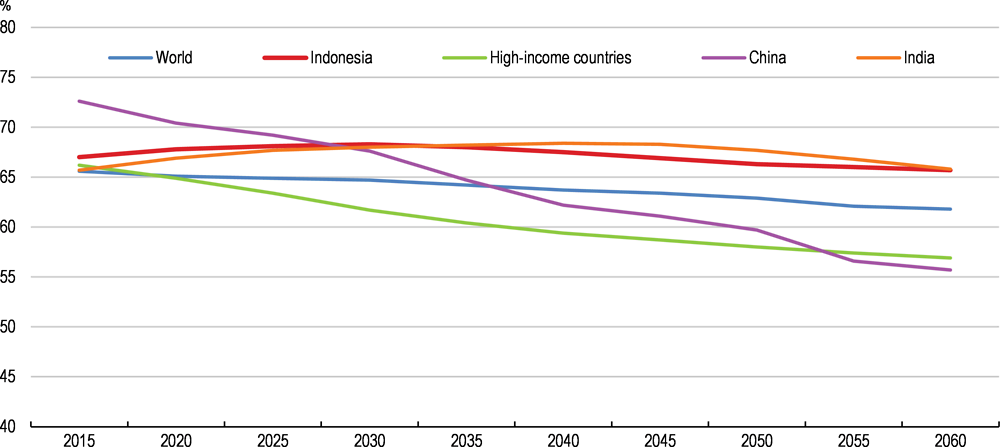

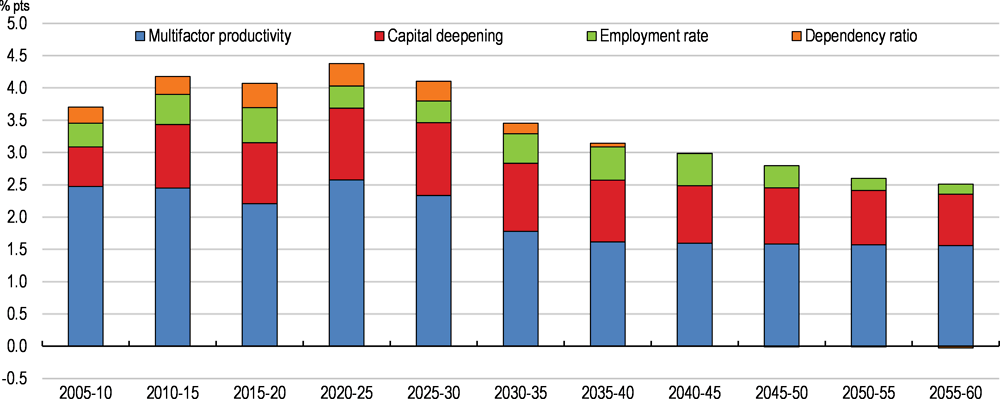

Guillemette, Y. and D. Turner (2018), “The long view: scenarios for the world economy to 2060”, OECD Economic Policy Papers, No. 22, OECD Publishing, Paris, http://dx.doi.org/10.1787/b4f4e03e-en.

IADB (2013), More than Revenue: Taxation as a Development Tool, Palgrave Macmillan US, New York.

IFC (2018), The Indonesia Corporate Governance Manual, 2nd edition, International Finance Corporation, Jakarta.

IFSB (2017), Islamic Financial Services Industry Stability Report 2017, Islamic Financial Services Board, Kuala Lumpur.

IISD (2018), Missing the 23 Per Cent Target: Roadblocks to the Development of Renewable Energy in Indonesia, International Institute for Sustainable Development, Winnipeg.

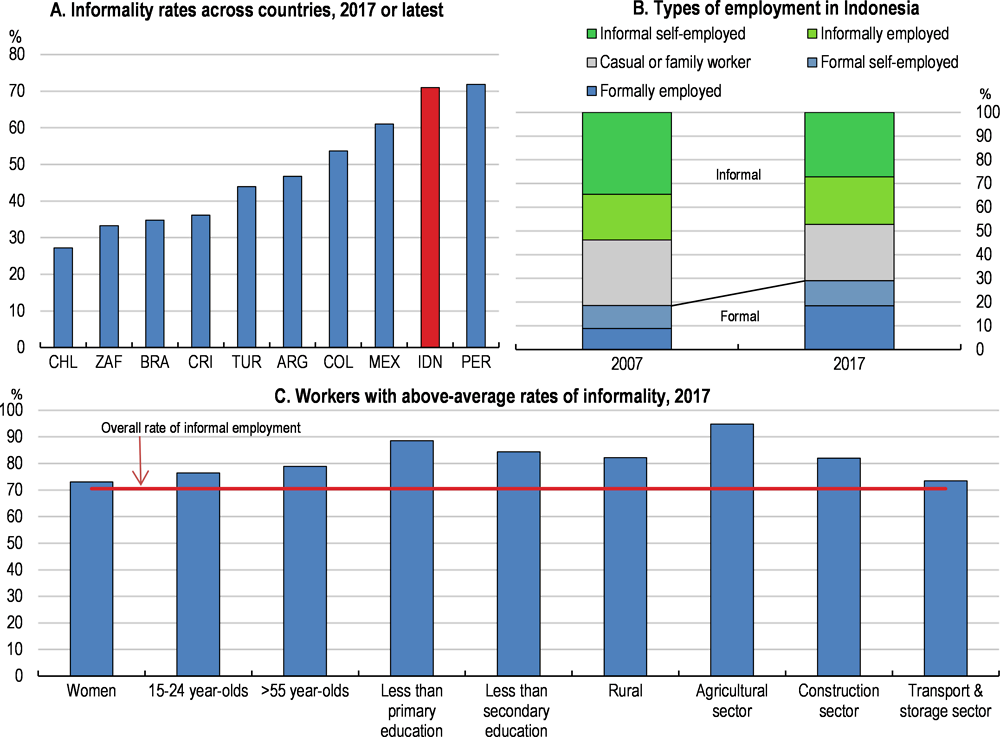

ILO (2014), Trends in informal employment in Colombia: 2009-2013, International Labor Organisation, Geneva.

IMF (2018), “Indonesia: Selected issues”, IMF Country Report, No. 18/33, International Monetary Fund, Washington DC.

IMF (2017a), Indonesia: Financial System Stability Assessment, International Monetary Fund, Washington DC.

IMF (2017b), IMF Investment and Capital Stock Dataset, 2017, International Monetary Fund, Washington DC.

IMF (2017c), “Indonesia: Selected Issues”, IMF Country Report, No. 17/48, International Monetary Fund, Washington DC.

IMF / OECD / UN / World Bank (2015), Options for Low Income Countries' Effective and Efficient Use of Tax Incentives for Investment, A report to the G-20 Development Working Group by the IMF, OECD, UN and World Bank, www.oecd.org/tax/tax-global/options-for-low-income-countries-effective-and-efficient-use-of-tax-incentives-for-investment.pdf.

ITC (2017), Social Progress Index in Tourist Destinations of Costa Rica, http://cf.cdn.unwto.org/sites/all/files/docpdf/presentation-socialprogresindexintouristdestinationsofcostarica-institutocostarricensedeturismo.pdf.

Jahari, A. (2018), Penurunan Masalah Balita Stunting [Decrease in toddler stunting problems], Presentation at the National Health Working Meeting, 6-8 March.

Jambeck, J. et al. (2015), “Plastic waste inputs from land into the ocean”, Science, Vol. 347/6223, pp. 768-71.

Kompas (2016), Empat Strategi Banyuwangi Raih Penghargaan Pariwisata PBB [Four Banyuwangi's Strategies Receive UN Tourism Awards], https://travel.kompas.com/read/2016/01/22/104123127/Empat.Strategi.Banyuwangi.Raih.Penghargaan.Pariwisata.PBB.

KPK (2015), Preventing State Losses in Indonesia’s Forestry Sector: An Analysis of Non-tax Forest Revenue Collection and Timber Production Administration, Corruption Eradication Commission, Jakarta.

La Porta, R. and A. Shleifer (2014), “Informality and development”, Journal of Economic Perspectives, Vol. 28/3, pp. 109-126.

LADA (2018), Langkawi Development Authority, www.lada.gov.my/en/.

Lamb, J. et al. (2018), “Plastic waste associated with disease on coral reefs”, Science, Vol. 359/6374, pp. 460-462.

LPEM (2017), Layanan Keuangan Digital dan Laku Pandai: Inclusivitas, Kendala, dan Potensi [Digital Financial Services and Smart Behaviour: Inclusivity, Constraints, and Potential], Policy Brief, Universitas Indonesia, Jakarta.

Ministry of Manpower (2017), Pentingnya Peran Swasta Dalam Upaya Peningkatan Kompetensi Tenaga Kerja [The Importance of Private Role in Efforts to Increase the Competence of Labor], Press release, http://kemnaker.go.id/berita/berita-kemnaker/pentingnya-peran-swasta-dalam-upaya-peningkatan-kompetensi (accessed on 27 May 2018).

Nurdin, H. (2018), Indonesia Tourism Exchange, http://pemasaranpariwisata.com/2018/02/26/indonesia-tourism-exchange/.

OECD (2018a), SME and Entrepreneurship Policy in Indonesia 2018, OECD Studies on SMEs and Entrepreneurship, OECD Publishing, Paris, https://doi.org/10.1787/9789264306264-en.

OECD (2018b), OECD Economic Surveys: Turkey 2018, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-tur-2018-en.

OECD (2018c), OECD Investment Policy Reviews: Southeast Asia, OECD Publishing, Paris, www.oecd.org/daf/inv/investment-policy/Southeast-Asia-Investment-Policy-Review-2018.pdf.

OECD (2018d), Taxing Energy Use 2018: Companion to the Taxing Energy Use Database, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264289635-en.

OECD (2018e), OECD Tourism Trends and Policies 2018, OECD Publishing, Paris, http://dx.doi.org/10.1787/tour-2018-en.

OECD (2018f), OECD Economic Surveys: Brazil 2018, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-bra-2018-en.

OECD (2017a), Health at a Glance 2017: OECD Indicators, OECD Publishing, Paris, https://doi.org/10.1787/health_glance-2017-en.

OECD (2017b), OECD Economic Surveys: Colombia 2017, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-col-2017-en.

OECD (2017c), Key Issues for Digital Transformation in the G20, OECD Publishing, Paris, http://www.oecd.org/G20/key-issues-for-digital-transformation-in-the-G20.pdf.

OECD (2017d), OECD Economic Surveys: Iceland 2017, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-isl-2017-en.

OECD (2016a), OECD Economic Surveys: Indonesia 2016, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-idn-2016-en.

OECD (2016b), G20/OECD Support Note on Diversification of Financial Instruments for Infrastructure, OECD Publishing, Paris, http://www.oecd.org/daf/fin/private-pensions/G20-OECD-Support-Note-on-Diversification-of-Financial-Instruments-for-Infrastructure.pdf.

OECD (2016c), PISA 2015 Results (Volume I): Excellence and Equity in Education, PISA, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264266490-en.

OECD (2016d), OECD Economic Surveys: Costa Rica 2016: Economic Assessment, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-cri-2016-en.

OECD (2015a), OECD Economic Surveys: Indonesia 2015, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-idn-2015-en.

OECD (2015b), Managing Food Insecurity Risk: Analytical Framework and Application to Indonesia, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264233874-en.

OECD (2015c), OECD Economic Surveys: South Africa 2015, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-zaf-2015-en.

OECD (2015d), “Enhancing job quality in emerging economies”, in OECD Employment Outlook 2015, OECD Publishing, Paris, http://dx.doi.org/10.1787/empl_outlook-2015-9-en.

OECD (2015e), Minimum Wages After the Crisis: Making Them Pay, www.oecd.org/social/Focus-on-Minimum-Wages-after-the-crisis-2015.pdf.

OECD (2014), Tourism and the Creative Economy, OECD Studies on Tourism, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264207875-en.

OECD (2013), Teachers for the 21st Century: Using Evaluation to Improve Teaching, International Summit on the Teaching Profession, OECD Publishing, Paris, http://doi.org/10.1787/9789264193864-en.

OECD (2012a), OECD Economic Surveys: Indonesia 2012, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-idn-2012-en.

OECD (2012b), OECD Reviews of Regulatory Reform: Indonesia 2012: Strengthening Co-ordination and Connecting Markets, OECD Reviews of Regulatory Reform, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264173637-en.

OECD (forthcoming), Social Protection System Review of Indonesia, OECD Publishing, Paris.

OECD/ADB (2015), Education in Indonesia: Rising to the Challenge, Reviews of National Policies for Education, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264230750-en.

OECD/KIPF (2014), “The distributional effects of consumption taxes in OECD countries”, OECD Tax Policy Studies, No. 22, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264224520-en.

OECD, E. Hanushek and L. Woessmann (2015), Universal Basic Skills: What Countries Stand to Gain, OECD Publishing, Paris, https://doi.org/10.1787/9789264234833-en.

OICA (2018), Vehicles in Use 2005-15, International Organisation of Motor Vehicle Manufacturers, www.oica.net/category/vehicles-in-use/ (accessed on 21 December 2017).

Republic of Indonesia (2018), Stability at the Forefront with Unwavering Reforms Commitment - August 2018, Investor Relations Unit - Republic of Indonesia, Jakarta.

Republic of Indonesia (2016), First Nationally Determined Contribution, http://www4.unfccc.int/ndcregistry/PublishedDocuments/Indonesia%20First/First%20NDC%20Indonesia_submitted%20to%20UNFCCC%20Set_November%20%202016.pdf.

Reuters (2018), S&P Cautions on Worsening Balance Sheets at Indonesian State Firms, www.reuters.com/article/us-indonesia-s-p-infrastructure/sp-cautions-on-worsening-balance-sheets-at-indonesian-state-firms-idUSKCN1GP0QW.

Rothenberg, A. et al. (2016), “Rethinking Indonesia's informal sector”, World Development, Vol. 80, pp. 96-113.

Stern, S., A. Wares and T. Epner (2017), Social Progress Index 2017 - Methodology Report, www.socialprogressindex.com/assets/downloads/resources/en/English-2017-Social-Progress-Index-Methodology-Report_embargo-until-June-21-2017.pdf.

Thavorncharoensap, M. (2017), “Effectiveness of obesity prevention and control”, ADBI Working Paper, No. 654, Asian Development Bank Institute, Manila.

Thomas, A., I. Joumard, T. Hanappi and M. Harding (2017), “Taxation and investment in India”, OECD Economics Department Working Papers, No. 1397, OECD Publishing, Paris, http://dx.doi.org/10.1787/4258e11a-en.

TomTom (2018), TomTom Traffic Index, www.tomtom.com/en_gb/trafficindex/list?citySize=LARGE&continent=ALL&country=ALL (accessed on 15 March 2018).

UNEP-WCMC (2014), Review of Corals from Indonesia (coral species subject to EU decisions where identification to genus level is acceptable for trade purposes).

United Nations, Department of Economic and Social Affairs, Population Division (2017), World Population Prospects: The 2017 Revision, DVD Edition.

UNWTO and Griffith University (2017), Managing Growth and Sustainable Tourism Governance in Asia and the Pacific, World Tourism Organisation.

von Haldenwang, C. et al. (2015), “The Devolution of the Land and Building Tax in Indonesia”, Studies Deutsches Institut für Entwicklungspolitik, No. 89, German Development Institute, Bonn.

WEF (2017), The Travel and Tourism Competitiveness Report 2017: Paving the Way for a More Sustainable and Inclusive Future, World Economic Forum, Geneva.

WEF (2016), Accelerating Capital Markets Development in Emerging Economies: Country Case Studies, World Economic Forum, Geneva.

WHO (2017), WHO Report on the Global Tobacco Epidemic 2017, World Health Organization, Geneva.

World Bank (2018a), Indonesia Economic Quarterly: Towards Inclusive Growth, World Bank, Jakarta.

World Bank (2018b), Indonesia Snapshots - Private Participation in Infrastructure (PPI), https://ppi.worldbank.org/snapshots/country/indonesia (accessed on 05 May 2018).

World Bank (2018c), Indonesia – Public Expenditure and Financial Accountability (PEFA): Assessment Report 2017, World Bank.

World Bank (2017), Indonesia Economic Quarterly: Closing the Gap, World Bank, Jakarta.

World Bank / PwC (2018), Paying Taxes 2018, www.pwc.com/payingtaxes.

Yudha, S. (2017), Air Pollution and its Implications for Indonesia: Challenges and Imperatives for Change, http://pubdocs.worldbank.org/en/183201496935944434/200417-AirQualityAsia-Air-Pollution.pdf.