Thailand has achieved remarkable economic and social progress over the past decades, followed by several years of more moderate growth prior to the pandemic. After a severe downturn, the recovery picked up rapidly, buoyed by a strong rebound of inbound tourism. Nonetheless, making the on-going recovery more solid and inclusive will require bold reforms. Strong fiscal support helped to avoid a sharp economic contraction, but public debt has increased rapidly over the past years, calling for a credible fiscal consolidation plan. The recovery of foreign investment is falling behind regional peers, but improvements in structural policies have the potential to reinvigorate strong investment. The labour market is recovering well, but young people have not fully benefited from this recovery. Reducing labour informality is the longstanding challenge. Against this background, this chapter discusses how macroeconomic and structural policies can help Thailand to return to a robust recovery path and how social policies can make the recovery more inclusive.

OECD Economic Surveys: Thailand 2023

1. Key policy insights

Abstract

Structural reforms are needed to achieve robust and sustainable growth

Thailand has achieved remarkable economic and social development since the 1960s. Among countries in Southeast Asia, Thailand was one of the first to open its economy by pursuing an active integration into global value chains (GVCs) and attracting foreign direct investment (FDI), which enabled the country to undertake significant investment in infrastructure. Thailand’s manufacturing sector was able to gain a competitive edge, while the tourism industry also flourished with increasing facilities for large-scale tourism. In the context of this continuous growth, Thailand became an upper-middle income country in 2011, following the classification used by the World Bank.

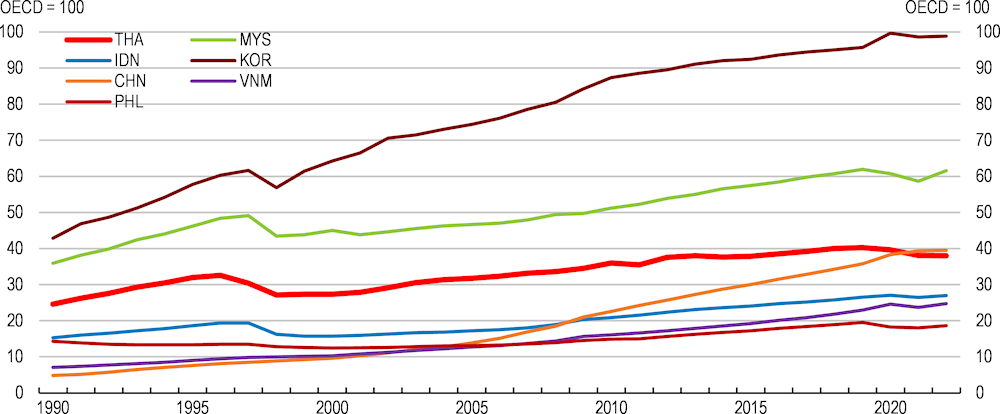

However, Thailand’s growth has been losing momentum over the last decade. GDP per capita has stagnated at the same time as other countries in the region experienced more vigorous growth (Figure 1.1). In response, several policy initiatives have been launched to boost productivity, including by focusing on high value-added industries.

Figure 1.1. After a rapid catch up with the OECD average, incomes stagnated recently

GDP per capita relative to the OECD average, computed at 2017 USD PPP

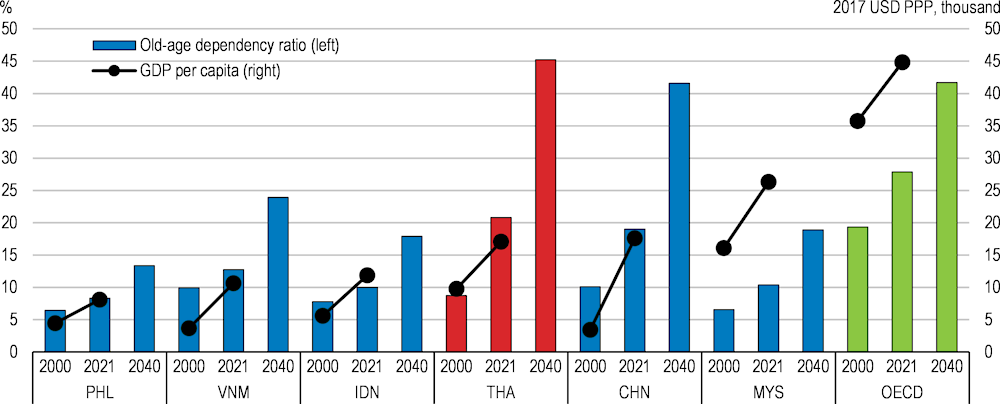

The already softer growth momentum was further weakened by the economic fallout from the pandemic. More recently, Thailand’s economy was also heavily affected by rising energy and food prices in the context of Russia’s war of aggression against Ukraine, which triggered a cost-of-living crisis and caused a delay in structural reforms. As the effects of both the pandemic and high energy prices are gradually receding, Thailand will now need to address a number of key structural challenges, including population ageing, the digital transition, possible reconfigurations of global value chains and the green transition. In fact, Thailand is faced with one of the most rapid processes of population aging in Southeast Asia, with the old-age dependency ratio more than doubling over the past two decades (Figure 1.2).

Further policy efforts to raise productivity will be key to rekindle and eventually accelerate the convergence process towards higher income levels. This will include continuing to attract foreign investment, which has been an engine of growth in the past. Stronger efforts to improve the business climate and foster competition will be key for this, including by relaxing remaining restrictions to foreign direct investment, especially in the particularly restrictive services sector, and expanding trade agreements.

Figure 1.2. Thailand's old-age dependency ratio is rising faster than those of peer countries

Against this background, the 13th National Economic and Social Development Plan for 2023-2027 aims to boost the transition towards a higher value-added and more sustainable economy. The 13th plan is embedded in the 20-Year National Strategic Plan 2018-2037, which is the first long-term strategy at the national level, guided by the objective to obtain high-income status by 2037.

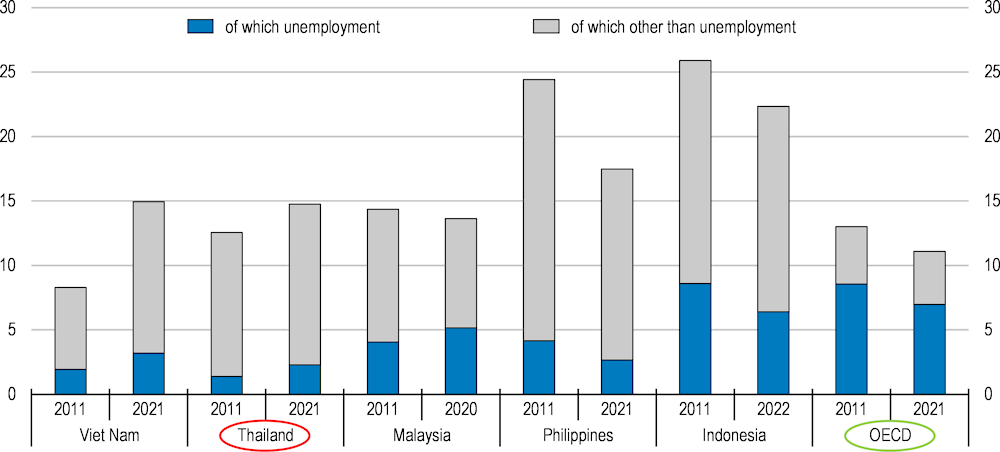

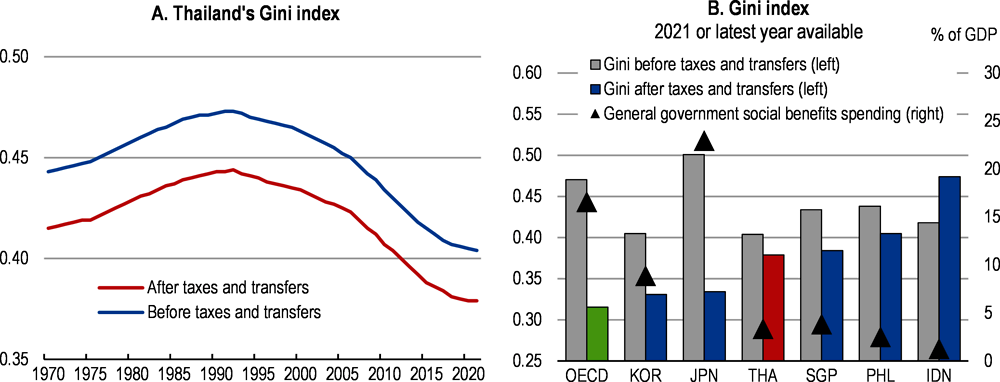

Recent developments have also pointed to the need for Thailand to construct a more comprehensive social safety net to support the most vulnerable parts of the population. Income inequality has significantly improved since the 1990s, as evidenced by a substantial decline in the Gini coefficient from 0.44 in 1990 to 0.38 in 2021. Nonetheless, further efforts will be required to achieve more inclusive growth, as more than 50% of workers in Thailand are in the informal sector and remain outside the reach of the formal social security system.

Against this backdrop, the main messages of this Economic Survey are:

Macroeconomic policies will need to strike a careful balance between supporting the still on-going recovery and containing inflation pressures. Monetary policy should maintain its current stance and remain vigilant to inflation pressures. Fiscal policy should support these efforts and revert to a firm consolidation path. Emergency support to households should be phased out, while protecting those most in need with regular social protection instruments.

Structural reforms will need to continue. Regulatory reform will be key to reduce market entry barriers and boost competition. Efforts to prevent and fight corruption should be continued. Labour market and social policies will have to be stepped up to enhance social inclusion, while bringing down high labour informality and strengthening social safety nets for the unemployed and the elderly.

Achieving current net zero emission pledges will require bold policy action. A comprehensive strategy for carbon pricing in combination with tighter regulations will need to be applied swiftly to frontload the green transition, while phasing out other government interventions in energy prices. Stronger incentives will be needed for both domestic and foreign investment in higher energy efficiency, renewables and green innovation.

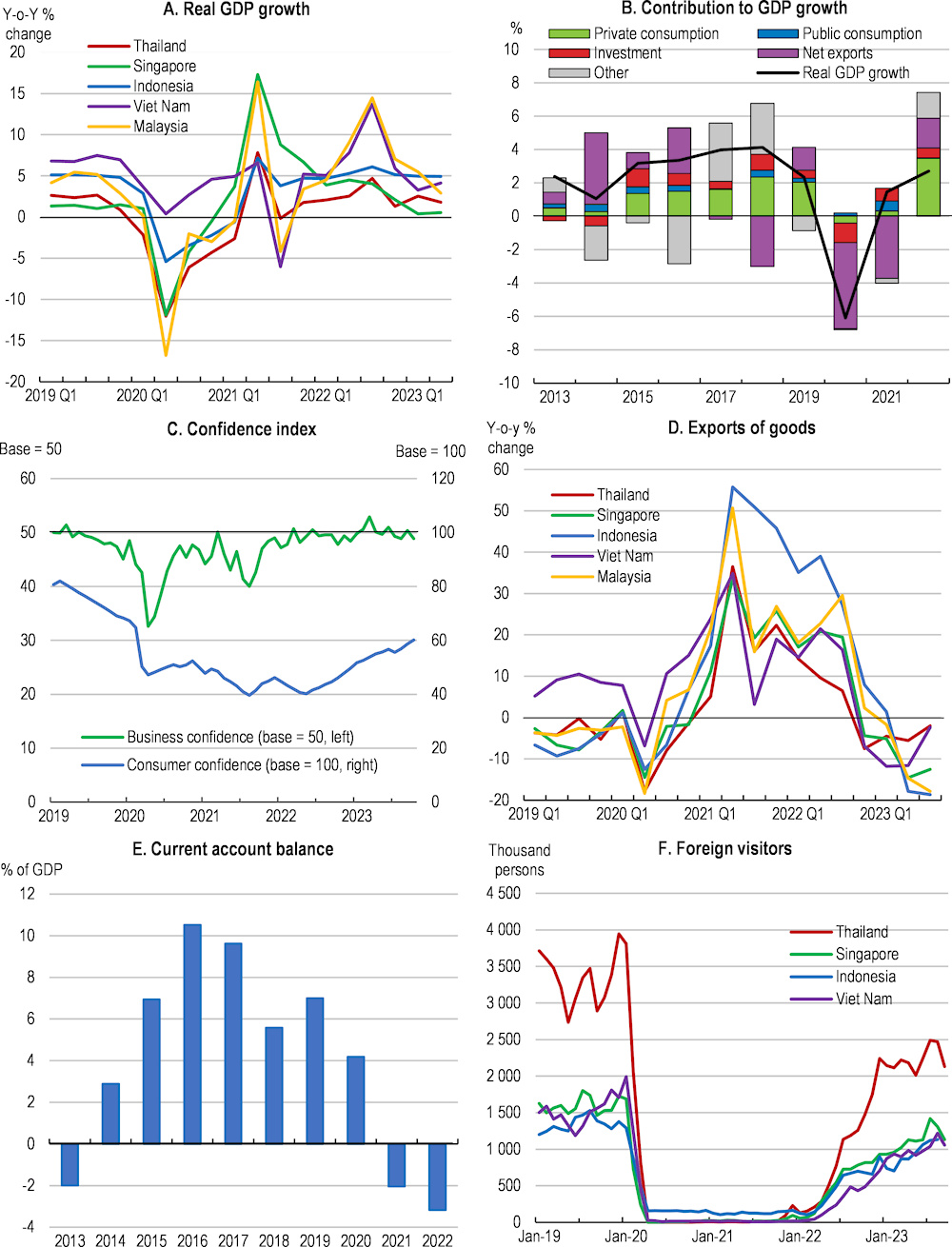

The recovery from recent shocks has been protracted and gradual

The Thai economy has seen a substantially later and weaker recovery from the pandemic than other Southeast Asian countries, amid a protracted rebound in tourism and continuously high uncertainties around the global economic outlook, on which the economy is highly dependent. Annual growth returned to 2.6% in 2022, up from 1.5% in 2021, but this remains moderate in a regional comparison (Figure 1.3, Panels A and B).

Along with a steady rebound of private consumption and investment, exports increased rapidly in 2022, largely owing to the return of foreign visitors as Thailand lifted pandemic-related travel restrictions in September 2022. The number of foreign tourists rebounded to 11 million in 2022, up from only 0.4 million in 2021 (Figure 1.3, Panel F). Merchandise exports continued to decline in early 2023, but at a slower pace than before. The current account deficit has widened amid higher energy prices.

After having surged to 7.9% in August 2022, inflation has come down to -0.3%, below the target range. Domestic financial conditions have tightened as the Bank of Thailand raised its policy rate to 2.5% in September 2023, marking the eighth consecutive increase since August 2022 when the rate was at 0.5%. The monetary tightening successfully brought down inflation, albeit in combination with a temporary tax reduction on diesel fuel. The progressive pass-through of tighter financial conditions to households and corporates continues to weigh on domestic demand, compounding an already-high debt service burden of households and corporates.

In late 2022, the economy experienced a soft patch due to weaker external demand. Quarterly real GDP contracted by 1.1% in the last quarter 2022 in seasonally-adjusted terms relative to the previous quarter, as export of goods declined (Figure 1.3, Panel D), reflecting subdued global demand amid tighter global financial conditions. This soft patch reversed in the first quarter of 2023 with positive GDP growth of 1.7% relative to the previous quarter, after accounting for seasonal influences, followed by weaker growth of 0.2% and 0.8% in the second and third quarters of 2023, respectively. In year-on-year terms, the economy has now been growing at a pace of 2.7%.

Manufacturing activity suffered from renewed declines in new orders in early 2023. Retail sales, by contrast, rebounded visibly in early 2023, as steady declines in inflation support household spending. Recovering domestic demand is also visible in rising merchandise imports in early 2023, and both business and consumer confidence indices have improved recently (Figure 1.3, Panel C).

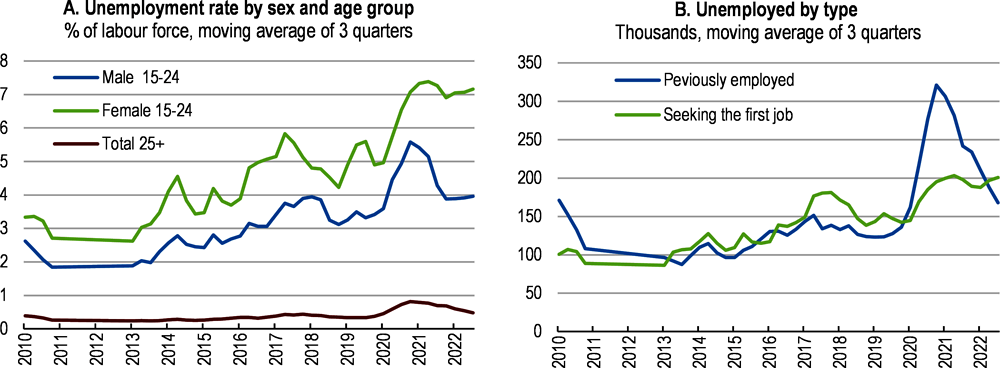

The recovery has also been visible in the labour market, especially since the resumption of economic reopening in early 2021. In early 2023, the unemployment rate returned to 1.1%, the same rate as in 2019. At the same time, around 8% of the labour force work less than 24 hours a week (less than 20 hours per week for agricultural workers).

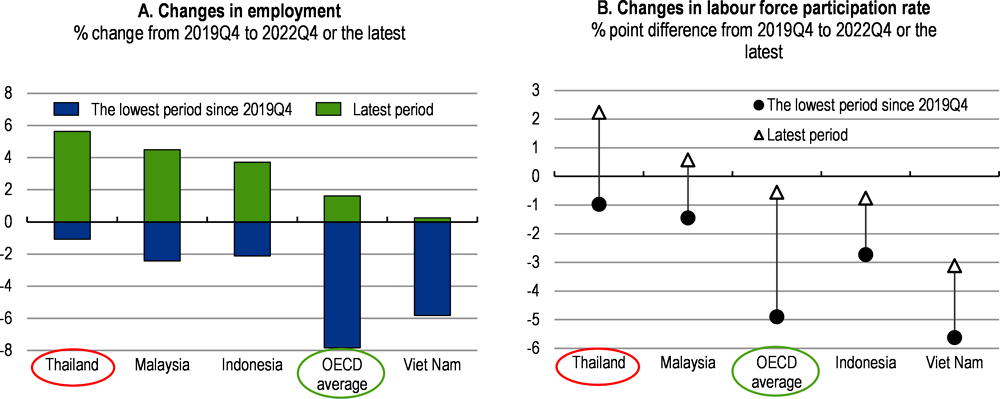

The labour market has shown remarkable resilience over the past few years, especially when compared with regional peers and the OECD average. Even at the peak of the pandemic, employment declined only modestly, and the recovery has been strong (Figure 1.4, Panel A). During the COVID-19 crisis and subsequent recovery, women fared better than men in terms of employment. Among women, employment has risen by 8% since 2019Q4, compared with 4% for men. The overall robust employment was associated with a stable labour force participation, unlike in other countries where many people left the labour force during the pandemic (Figure 1.4, Panel B). The unemployment rate remained low and stable throughout the pandemic period, with a small increase of 0.7 percentage points from late 2019 to early 2021, from 0.7% to 1.4%.

Figure 1.3. Recent macroeconomic developments

Note: In panel B, Other covers the change in stocks and the statistical discrepancy. In Panel C, the Business (Consumer) Confidence Index above 50 (100) means that business (consumer) sentiment has improved and an index below 50 (100) means a deterioration.

Source: CEIC; Bank of Thailand; Office of the National Economic and Social Development Council; University of the Thai Chamber of Commerce.

Figure 1.4. Thailand’s labour market showed strong resilience during the pandemic

Note: Indonesia's data are semi-annual. Quarterly data for the Philippines end in January, April, July and October, and they are considered to correspond to Q1, Q2, Q3 and Q4 respectively. The labour force participation rate of Malaysia does not include aged over 65.

CEIC; and OECD, Labour Force Statistics (database).

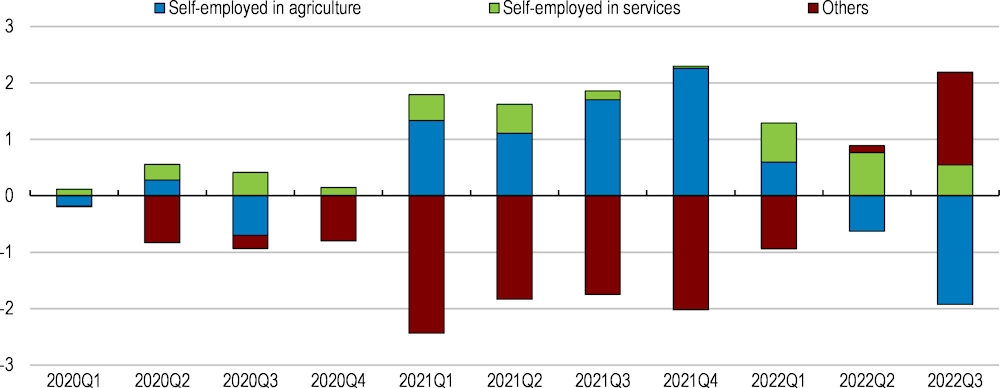

This labour market stability has partly been attributed to Thailand’s diverse industrial structure (OECD, 2020[1]), a feature that often goes along with less volatility (WTO, 2021[2]), (Brown and Greenbaum, 2017[3]), (Carvalho, 2014[4]). In 2020 and 2021, the export-oriented electronics sector benefited from the pandemic-induced upsurge of external demand, followed by a gradual rebound in inbound tourism that started in 2022. In addition, there are also structural factors that can explain Thailand’s persistently low levels of unemployment (Box 1.1). During 2021, for example, increases in the number of self-employed workers, especially those who worked in agriculture, offset decreases in other forms of employment, notably dependent workers, with some reversal in 2022 (Figure 1.5).

Figure 1.5. Self-employed workers in agriculture have smoothed aggregate employment

Employment, difference from the previous year, % of labour force

Source: ILO, ILOSTAT; World Bank, WDI; Department of Statistics Malaysia, Labour Force Survey Report, Annual Economic Statistics - Agriculture Sector.

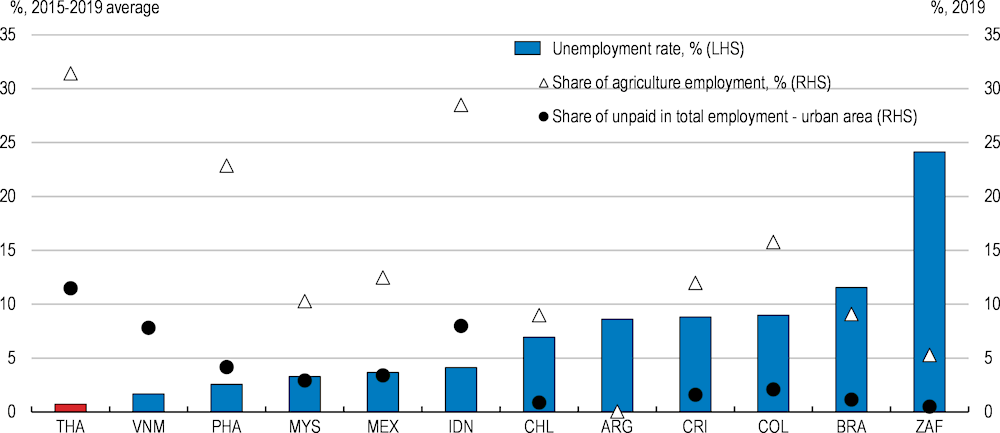

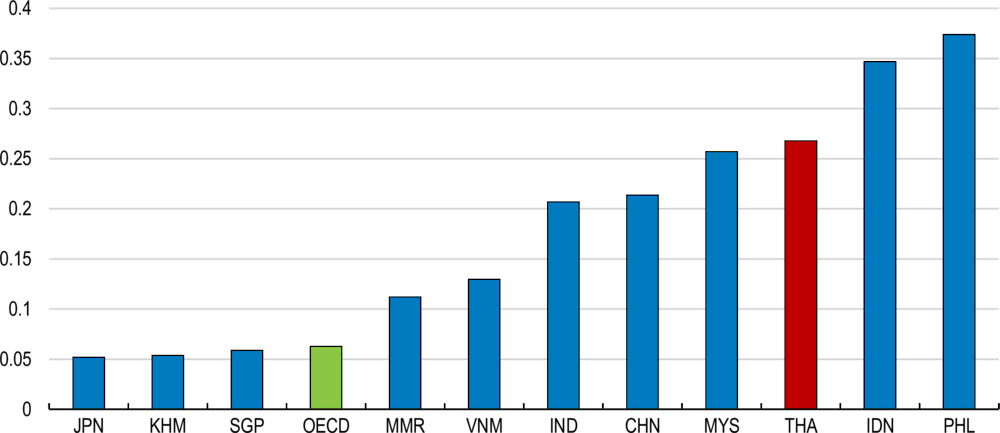

Box 1.1. Thailand’s unemployment rate is one of the lowest in the world

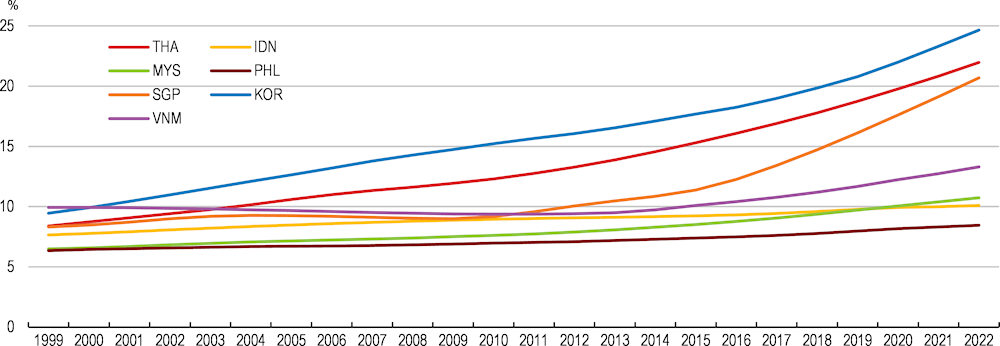

Thailand’s unemployment rate has been much lower than those of many other countries, mostly moving around 1-2% over recent years (Figure 1.6). Even at the height of the Asian Financial Crisis in 1998, it stood at 3.4%, lower than in other crisis-hit countries, notably Indonesia’s 5.5% and Korea’s 7%.

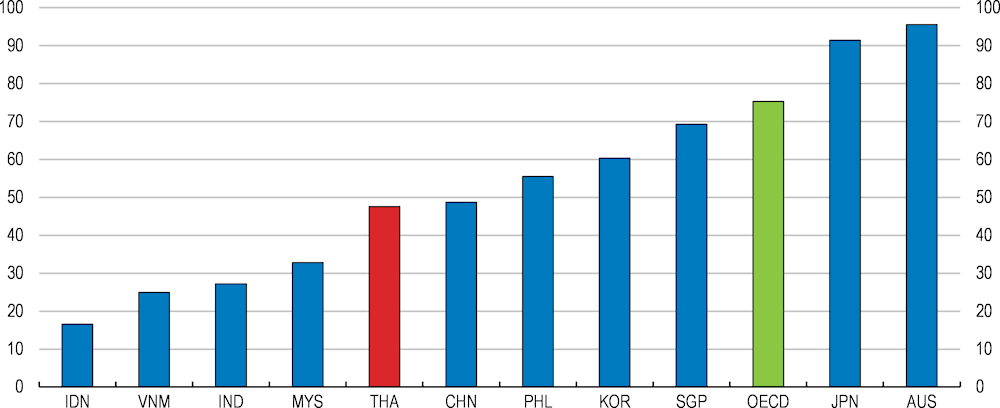

Figure 1.6. Thailand’s unemployment rate is lower than that of other emerging market economies

Note: On the share of unpaid family workers, Malaysia's reference year is 2021 and data are not available for Argentina.

Source: World Bank, WDI; ILO, ILOSTAT; Department of Statistics Malaysia, Labour Force Survey Report.

Previous studies have attributed this low unemployment to the large agriculture sector (Moroz et al., 2021[5]), an explanation that would be in line with pattern observed in other emerging market economies (Bein and Ciftcioglu, 2017[6]). Agriculture requires large amounts of labour with strong seasonal swings, and acts as spare labour capacity for the rest of the year, a pattern that may disguise higher unemployment than actually observed. Hours worked in agriculture are low, with an average 34 working hours a week per person in 2021, compared to 44 hours in other sectors. The ILO calculates underemployment by considering gaps between actual and desired working hours, suggesting that the sum of underemployment and unemployment in rural areas was 1.6% in 2019, or 1.4% country-wide, which was twice the nationwide unemployment rate of 0.7%.

Informal labour in urban areas may be another explanation for low unemployment. Unpaid family workers can adjust their working hours more easily and they account for over 10% of total employment in urban areas, which is high in international comparison (Figure 1.6). There are also seasonal movements between agriculture in rural areas and the informal sector in urban areas. During the dry off-season from February to May, workers in rural areas take up temporary jobs in urban areas (Asami, 2010[7]). These flows lend further flexibility to absorb labour market fluctuations, although these jobs are generally unstable and not well-paid.

Going forward, the Thai economy is projected to continue its gradual recovery. Real GDP is expected to grow by 2.7% in 2023 and to strengthen to 3.6% in 2024 and 3.2% in 2025 (Table 1.1). Private consumption is projected to remain strong, although the gradual phase-out of government relief measures and high levels of household debt will weigh on the purchasing power of households. Business investment will be vigorous as the economy rebounds and firms resume delayed projects after the pandemic, including in tourism-related activities and manufacturing. Exports are projected to be robust, thanks to stronger services exports amid rising tourist arrivals. As China fully reopened in March 2023, further increases in tourist inflows are expected. There is still some way to go before reaching pre-pandemic levels of tourist arrivals, as these were almost 4 times higher in 2019 than in 2022.

Table 1.1. Macroeconomic indicators and projections

Percent changes from previous year unless specified

|

|

2021 |

2022 |

2023 |

2024 |

2025 |

|---|---|---|---|---|---|

|

Output and demand |

|||||

|

Real GDP |

1.5 |

2.6 |

2.7 |

3.6 |

3.2 |

|

Consumption |

1.3 |

4.9 |

3.2 |

3.8 |

3.3 |

|

Private |

0.6 |

6.3 |

5.3 |

4.2 |

3.7 |

|

Government |

3.7 |

0.2 |

-4.1 |

2.0 |

1.8 |

|

Gross fixed investment |

3.1 |

2.3 |

1.1 |

2.5 |

2.9 |

|

Private |

3.0 |

5.1 |

1.8 |

3.7 |

3.8 |

|

Government |

3.4 |

-4.9 |

-1.0 |

-1.1 |

0.3 |

|

Exports of goods and services |

11.1 |

6.8 |

2.5 |

6.6 |

4.3 |

|

Imports of goods and services |

17.8 |

4.1 |

0.7 |

6.3 |

4.2 |

|

Inflation and unemployment |

|||||

|

Consumer price inflation |

1.2 |

6.1 |

1.6 |

2.2 |

2.0 |

|

Unemployment (% of labour force) |

1.9 |

1.3 |

1.1 |

1.0 |

1.0 |

|

Public finances (% of GDP) |

|||||

|

Government budget balance |

-4.6 |

-3.9 |

-3.9 |

-3.1 |

-2.9 |

|

Expenditures |

19.8 |

18.1 |

17.7 |

17.6 |

17.2 |

|

Revenues |

15.1 |

14.7 |

13.9 |

14.5 |

14.3 |

|

Public debt |

58.4 |

60.5 |

62.1 |

62.5 |

62.6 |

|

Memorandum item |

|||||

|

Nominal GDP (THB trillion) |

16 167 |

17 367 |

17 957 |

19 000 |

20 090 |

Note: Data for 2023, 2024 and 2025 are OECD projections.

Source: CEIC; OECD Economic Outlook database and OECD projections.

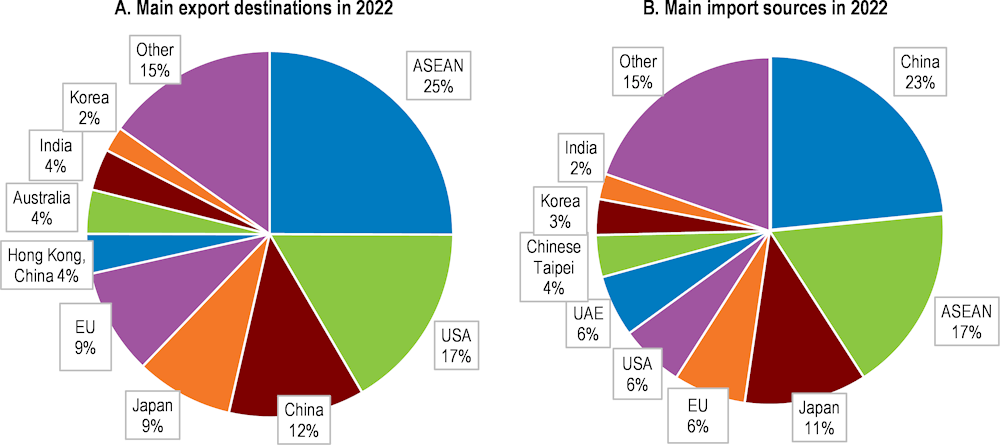

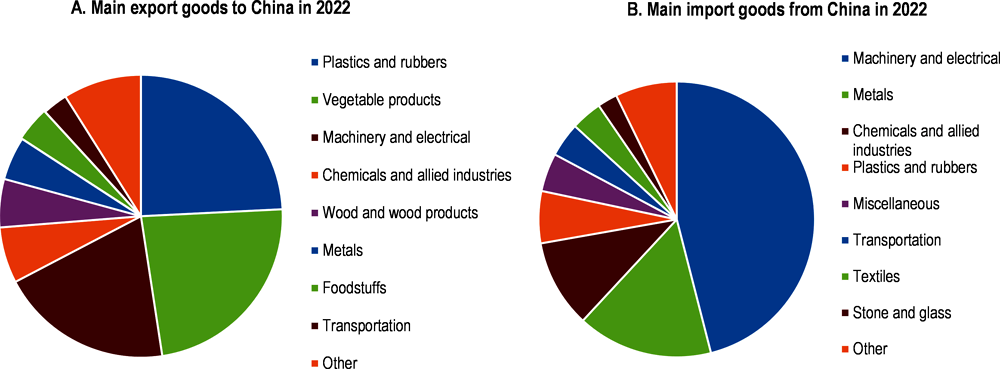

Both services and merchandise exports will continue to be buoyed by growth in China, which is Thailand’s third biggest export destination, after ASEAN and the United States (Figure 1.7). Commodities such as plastic and rubber and agricultural products are the main merchandise export items to China (Figure 1.8). On the other hand, moderate demand from advanced economies, including the United States, EU, and Japan, which account for around 34% of exports, is expected to limit export growth.

The weakening global economy implies significant downside risks

Downside risks persist given the persistent uncertainties surrounding the global economic outlook. Central banks in major advanced economies have been raising policy rates to fight inflationary pressures. This could lead to weaker-than-expected external demand. If global trade continues to be subdued, Thai exporters, which are actively participating in global value chains, will be no exception to these weaker prospects.

As a large importer of oil, Thailand remains vulnerable to swings in global energy prices. Moreover, Russia’s prolonged war against Ukraine could lead to a resurgence in supply chain disruptions and cause energy prices to rise again. Although Russia and Ukraine accounted for a small share in Thailand’s total merchandise trade before the war, Thailand’s high merchandise trade-to-GDP ratio (113% in 2022) renders the economy highly vulnerable to the uncertain external conditions caused by Russia’s aggression against Ukraine.

Figure 1.7. Major exports and imports partners

Figure 1.8. Composition of goods trade with China

Source: ASEANStatsDataPortal, International Merchandise Trade Statistics (IMTS); OECD Calculations.

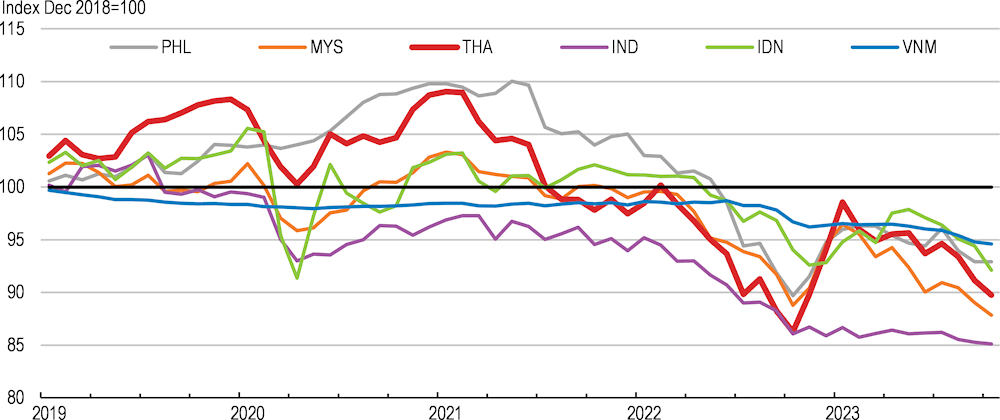

Thailand’s economy has in the past proven vulnerable to sudden changes in market sentiment, which could exacerbate volatility in highly interdependent financial markets. Foreign exchange markets experienced an increase in volatility amid heightened uncertainties in global financial markets in 2022. After a sustained period of depreciation between 2021 and late 2022, the Thai baht started to appreciate against the US dollar in late 2022, along with other Asian currencies (Figure 1.9). The strength partly reflects a strong rebound of the Thai tourism sector. While this may partially help alleviate inflationary pressures, it may also weigh on the price competitiveness of Thai exporting companies. In late 2023, the Thai baht experienced a depreciation.

Amid tighter global financial market conditions, authorities will need to stand ready to respond swiftly if major downside risks were to materialise. The differential between the US policy rates and the Bank of Thailand’s policy rate has reversed and widened from 0.3 percentage points in March 2022, when the policy rate was first raised in the United States, to -2.9 percentage points in October 2023. This differential implies risks related to sudden changes in market sentiment that could trigger sudden portfolio capital outflows, which call for close monitoring.

Figure 1.9. The currency recovered in early 2023 after weakening against the US dollar

Nominal exchange rates, USD per local currency

Thailand’s official foreign reserves remained ample at 226% of short-term external debt with less than one year maturity in late 2022, although down from 275% a year earlier. Reserves are now recovering with the rebound of tourism and re-evaluation effects. As of October 2023, foreign reserves reached 211 billion USD or 44% of 2022 GDP, close to the pre-pandemic level of 217 billion USD in 2019.

The capital account recorded a surplus in 2022, as residents’ capital outflows and non‑residents’ capital inflows offset each other in most periods. Since the onset of the pandemic, authorities have granted greater flexibility to non-residents to support capital inflows. Under the newly introduced non-resident qualified company scheme in July 2021, some non-resident companies can now manage currency risks more freely without providing transaction proofs and without being subject to the account limit of THB 200 million (approximately USD 6 million). In April 2022, authorities also relaxed foreign exchange regulations on residents. For example, the previous limit of USD 50 million per year for lending to foreign companies and the purchase of foreign property has been removed. These relaxed regulations aim at allowing investors more flexibility as well as reducing transaction costs, which is expected to strengthen market resilience. Some studies suggest that in times of financial distress, past outflows of capital by residents could return, potentially injecting valuable liquidity into domestic markets and alleviating financial instability (Cavallo, Izquierdo and León-Díaz, 2020[8]), (Caballero and Simsek, 2020[9]). In the long term, upgrading the framework to international standards would help to facilitate a gradual liberalisation of capital flows while managing short-term disruptions.

Financial markets have been sound, but private debt is high

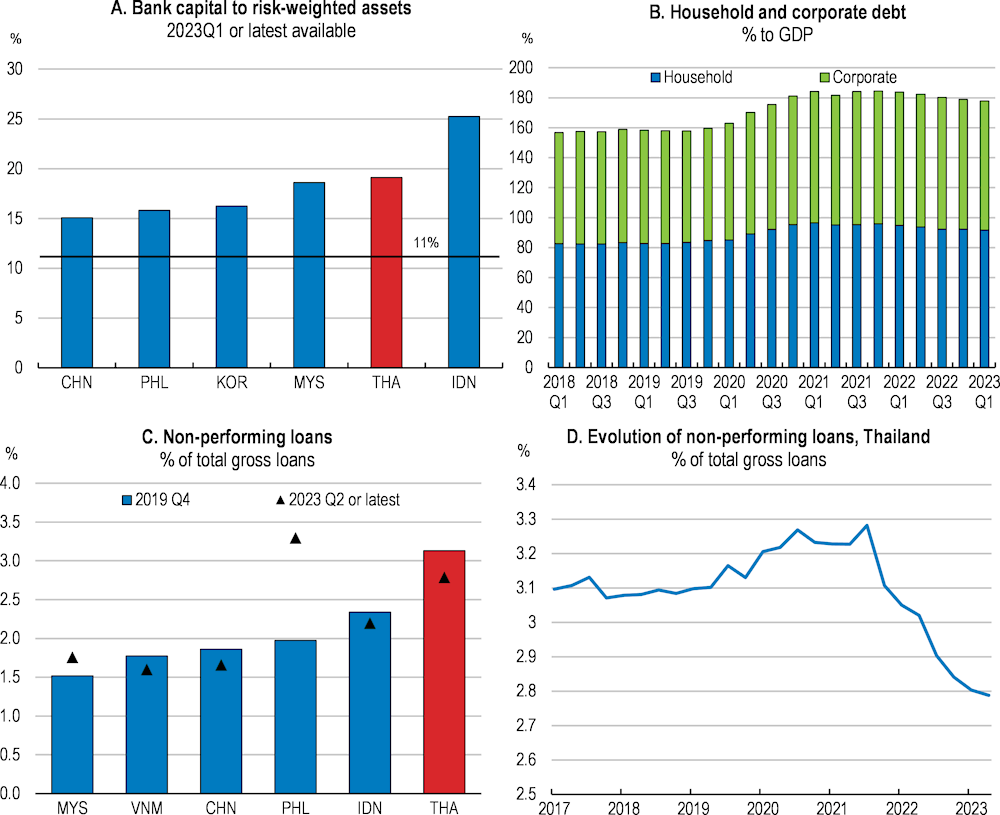

The financial sector appears sound overall, according to analysis by the Bank of Thailand (BOT, 2023[10]). Nevertheless, some segments warrant close monitoring over the near future. Commercial banks are well capitalised, with a capital adequacy ratio of 19.7% in April 2023, well above the minimum regulatory requirement of 11%. In 2023Q1, Thailand’s capital adequacy ratio of 19.1% was higher than in peer economies such as the Philippines (15.8%) and Malaysia (18.6%) (Figure 1.10, Panel A). Banks also recorded a high liquidity coverage ratio at 196% in September 2023, almost twice the minimum requirement ratio of 100%.

High private sector debt remains a key risk, with household and corporate debt summing up to 178% of GDP in 2023Q1, up from 160% at the end of 2019 (Figure 1.10, Panel B). In a regional comparison based on 2021 data, Thailand’s private debt to GDP ratio of then 180% was sizeable compared to regional peers such as Malaysia (143%) and Indonesia (42%), although smaller than in Singapore (221%). This reflects Thailand’s progress in financial development, but high level of private debt will need to be carefully monitored in a context of rising interest rates.

At present, the quality of banks’ loan portfolios does not seem to be much affected. The share of non-performing loans (NPLs), at 2.8% of total gross loans in 2023Q2, is slightly lower than pre-pandemic levels, but higher than in peers like Malaysia (1.8%) and Indonesia (2.1%) (Figure 1.10, Panels C and D). Household mortgages accounted for 46% of total household loans in 2023Q1 and are mostly based on fixed interest rates.

Loans to small and medium enterprises (SMEs) have a higher non-performing loan (NPL) ratio than the remaining loan portfolio and have seen an increase in delinquency from 6.4% in 2020Q3 to 7.4% in 2023Q3. The authorities provided additional liquidity with a higher credit limit and longer maturities and provided access to loan guarantees targeted to vulnerable SMEs and households in 2021 to cushion the prolonged impact of the pandemic and introduced a new debt restructuring programme. These measures have been helpful to reduce the debt service burden of constrained SMEs and households and to support viable SMEs, but the additional liquidity measures should be phased out progressively to avoid contributing to a build-up of private sector debt.

The Bank of Thailand is undertaking regular stress tests of commercial banks and non-bank financial institutions, but the results of these tests are not generally disclosed. Regular disclosures of stress tests can help to monitor the build-up of systemic risks and allow proactive evaluations of financial vulnerabilities ahead of time (Marques et al., 2022[11]) (Puah, Kuek and Arip, 2017[12]). The disclosure of stress test results can also serve as an effective communication tool, providing the market with information on the risks of banks’ balance sheets. Major central banks are also increasingly including climate risk assessments in their stress tests. Considering Thailand’s susceptibility to climate risks in the region, implementing such assessments would be particularly relevant.

Current license requirements can act as an impediment for business to access financing. Hotels, for example, are required to comply with several laws and regulations, but a sizeable number of hotels and accommodations across the country fail to do so, effectively operating without a license. Enforcement of license requirements was halted during the pandemic. Reviewing those license requirements and assisting existing businesses on their way towards becoming compliant would allow these businesses to access loans.

Figure 1.10. Financial institutions appear solid, but private debt has increased

Table 1.2. Low-probability events that could lead to major changes to the outlook

|

External shocks |

Potential impacts |

|---|---|

|

Climate-related disasters |

Extreme floods or abnormally high temperatures due to El Niño could overwhelm the existing coping capacity and bring about wide-ranging dislocation of economic activity, including cuts in electricity supply and shortage of food. |

|

Political instability |

Political instability could affect policy stability and consistency and weaken consumption and private investment further, in particular foreign direct investment. |

|

Geopolitical tensions |

The escalation of tensions or other serious social unrest in the region would entail long-lasting supply chain disruptions and deteriorate sentiment of foreign investors. |

|

Pandemic |

The emergence of new deadly diseases or fatal variants of COVID-19 would dent the overall economy, especially in the tourism sector, and cause large-scale social distress. |

Macroeconomic policies will need to work in tandem towards a smooth recovery

The most immediate short-term challenge for Thailand will be to move from the broad policy support measures designed in the context of Covid-19 and high inflation towards well-targeted permanent social protection instruments to support those most in need, while consolidating fiscal accounts. Fiscal and monetary policies should work hand in hand, avoiding conflicting impulses on the economy between the two. This implies phasing out the emergency support measures put in place over the last years, including fuel tax reductions.

Table 1.3. Past OECD recommendations on macroeconomic policy

|

Recommendations in the past survey |

Measures taken since October 2020 |

|---|---|

|

Extend the emergency support measures to vulnerable households and SMEs. Strengthen the capacity of public health system. |

Vulnerable groups were supported with cash transfers and utility bill discounts, loans to SMEs and free medical treatment. |

|

In the short run, maintain employment and stimulate demand. As the recovery becomes steady, boost the productive capacity of the economy by gradually shifting from income and employment supports to structural measures including the up- and re-skilling of workers. |

Workers in heavily affected sectors benefited from targeted compensation schemes, while all sectors saw increased unemployment compensation, wage subsidies for newly graduated individuals and reduced social contributions. Domestic travel subsidies and VAT exemptions for medical products supported consumption. |

|

In case further spending is required, use the available fiscal space within the fiscal constraints, and ensure cost-effectiveness and transparency. |

The fiscal rule was eased to allow public debt to rise to 70% of GDP in 2022, up from 60% in 2021. Stimulus and pandemic relief measures amounted to THB 1.5 trillion during 2020 and 2021. |

Maintaining the current monetary policy stance will help to anchor inflation expectations

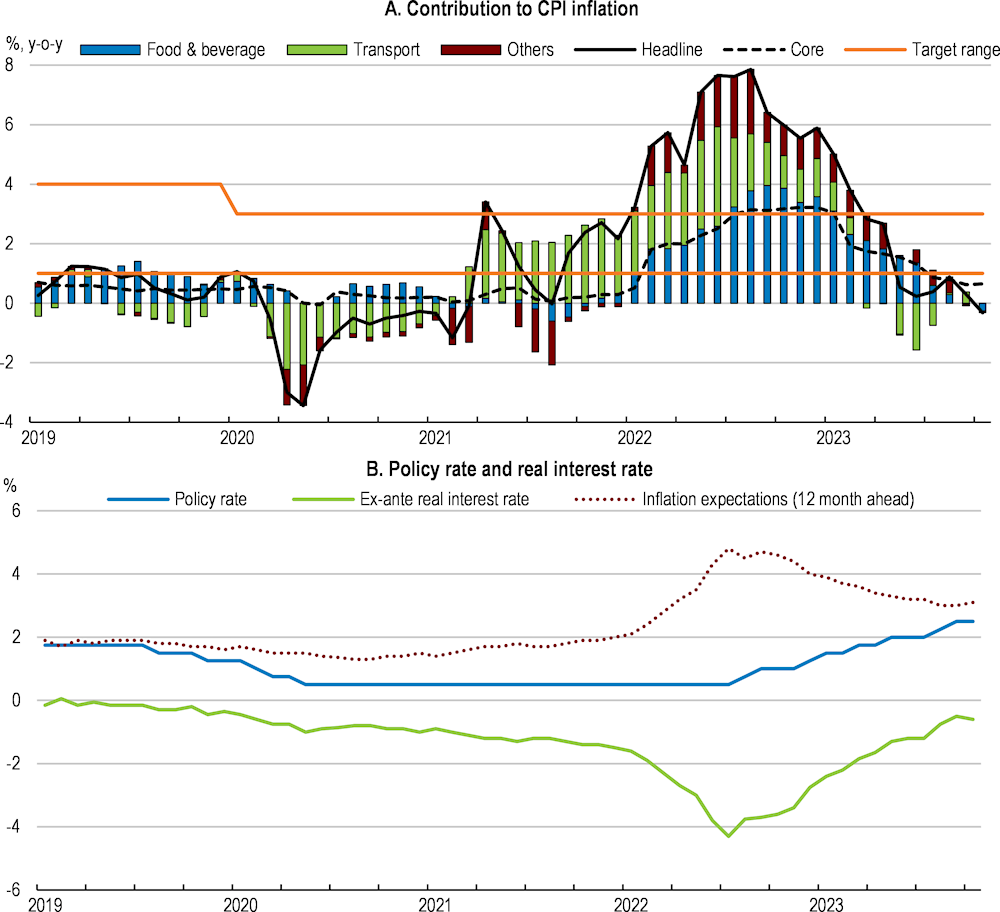

High energy and commodity prices have dramatically changed Thailand’s inflation environment. Global energy and commodity prices soared in 2021, pushing up energy prices and creating a gap between headline and core CPI inflation (Figure 1.11, Panel A). Inflation overshot the target range of 1%–3% in 2022, and inflationary expectations spiked to 4.8% in July 2022. Currency depreciation against a strong US dollar in late 2022 exacerbated the impact of high energy prices via imported fuel prices, although partly mitigated by fuel subsidies. The energy component of the CPI, about one eighth of the CPI basket, increased by 25.0% in 2022, accelerating from 11.9% in 2021. In addition, an outbreak of the African swine fever in January 2022 contributed temporarily to high inflation, raising meat prices by 21.1% in annual terms. Overall, headline inflation increased to 6.1% on average in 2022, up from 1.2% in 2021, recording the highest rate in the last two decades. The last time that inflation had been so high was in 1998, when it reached 8.0%. Core CPI inflation increased from 0.2% in 2021 to 2.5% in 2022.

In response, the Bank of Thailand started to raise its policy rate in August 2022 (Figure 1.11, Panel B). The policy tightening was slower and more moderate than in other countries, including regional peers. With the tourism sector almost shut down, the economic recovery was still significantly weaker than in regional peers until mid-2022. On the other hand, energy imports implied high inflationary pressures, which were partly mitigated by price controls. Prices for 56 goods and 5 services including basic staples such as eggs, rice or medicines are controlled by the Central Committee on the Price of Goods and Services (CCP). As a result, inflation expectations remained rather stable throughout 2022, despite the large overshoot of actual CPI inflation, prompting the BOT to maintain an accommodative policy stance until mid-2022. As global energy prices receded and the temporary impact of the African swine fever dissipated, inflation started to decline gradually in the second half of 2022. Year-on-year headline inflation decreased to 2.7% in April 2023, falling back into the target range of 1%–3%, after having peaked at 7.9% in August 2022. Subsequently, headline inflation rate declined further to –0.3% in October 2023, below the target range, mainly due to further declines in oil prices, energy subsidies and base effects.

Looking ahead, pressures on core inflation are expected to remain in the short term due to the continued recovery of domestic demand and a continued rebound of international tourism. Rising input prices have compressed profit margins, but firms are expected to pass on some of these cost increases to consumers as domestic demand gains momentum. The recovery of the Chinese economy, including tourist inflows, is supporting growth but may add to inflationary pressures by boosting demand for energy and commodities. Moreover, labour shortages in several sectors including tourism are likely to exacerbate wage pressures. The minimum wage was raised in October 2022 and further increases are under consideration. In the second half of 2022, nominal unit labour costs rose rapidly as wage growth outpaced labour productivity growth, with a year-on-year increase of 9.7% in the third quarter of 2022. This represents the most rapid increase of unit labour costs in a decade.

Against this background, the current monetary policy stance should be maintained. Inflation expectations for one year ahead remain at 3.1% as of October 2023, above current inflation and slightly above the 3% upper bound of the inflation target range. This implies a negative ex-ante real interest rate of –0.6%, which is close to the December 2019 level of –0.4%. Inflation is projected to reach 1.6% in 2023, rebound to 2.2% in 2024, before declining to 2.0% in 2025.

Figure 1.11. After peaking in mid-2022, inflation has decreased as interest rates rose

Note: The BOT has been targeting a headline inflation since 2015, changing from the previous core inflation targeting. On panel B, the ex-ante real interest rate is calculated by subtracting inflation expectation (12-month ahead) from the policy interest rate.

Source: CEIC; Bureau of Trade and Economic Indices; Bank of Thailand.

Table 1.4. Past OECD recommendations on monetary policy

|

Recommendations in the past survey |

Measures taken since October 2020 |

|---|---|

|

Keep monetary policy very accommodative, and if downside risks materialise, reduce the policy rate further. |

The key policy rate was lowered from 1.75% in July 2019 to 0.5% in May 2020, where it remained until July 2022. |

Fiscal consolidation should continue at a gradual pace

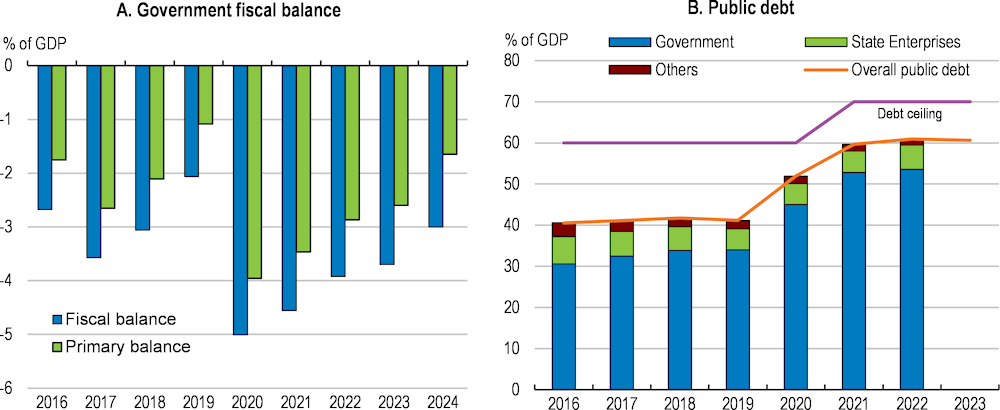

Thailand’s fiscal deficit widened in the fiscal year that began on October 1, 2020 (FY2021) as the government took a series of additional support measures against the economic fallout from the pandemic and later high energy prices (Figure 1.12). The general government headline fiscal balance reached a low of -5.0% of GDP in FY2020 and -4.6% in FY2021, before improving to a deficit of -3.9% in FY2022 as some of the pandemic relief measures were withdrawn and public expenditures declined. Two major pandemic relief packages announced in April 2020 and May 2021, amounting to 9.4% of GDP, have been almost fully disbursed at 96%, including cash transfers, and to a lesser extent health spending and measures to support economic growth. Further support measures in the second half of 2022 included a subsidy programme and cash transfers to mitigate the impact of rising energy prices. A cap on diesel prices is estimated to have caused a fiscal cost of 1.1% of GDP, although part of the cost was born by the State Oil Fund whose aim is to cushion the economy against oil price fluctuations (World Bank, 2022[13]).

Figure 1.12. The fiscal deficit is narrowing but public debt has risen

Note: On Panel A, data since 2023 are targets set under the Medium-Term Fiscal Framework.

Source: Ministry of Finance; NESDC; and OECD calculations.

In the current fiscal year FY2023, existing relief measures will be gradually phased out, as global commodity and oil prices have receded. In particular, energy-related support will expire during 2023, with the excise tax cut on diesel by THB 5 per litre extended to July 2023, although the authorities are considering an additional two-month extension until September 2023. Spending will be lower overall, with a smaller budget for current expenses and more room for investment. In addition to lower spending, the robust rebound of economic activity is expected to push up tax revenues in 2023. This will help to achieve the current budget projections of a -3.7% of GDP general government fiscal balance in FY2023. Medium-term projections foresee further consolidation to -2.8% of GDP by FY2026.

In the short run, Thailand should continue to pursue the current gradual fiscal consolidation plans as domestic demand firms, including by withdrawing extraordinary policy support. This will also support monetary policy in its efforts to tame remaining inflationary pressures and help to rebuild a fiscal buffer to prepare the future shocks. A stronger fiscal position will also help Thailand meet the growing spending needs to address structural challenges, such as the transition to a green economy and population ageing.

Thailand’s public debt stood at 62.1% of GDP in September 2023. This is similar to the average for emerging market economies, but should be evaluated in light of Thailand’s low tax intake of 16% of GDP. The government raised the public debt ceiling to 70% in October 2021, departing from its self-imposed fiscal rule to keep the public debt-to-GDP ratio below 60%, after the Public Debt Management Office (PDMO) announced two Emergency Decrees in 2020 and 2021 that allowed additional borrowing. The new fiscal rule was administered in line with the Fiscal Responsibility Act, which mandates revising the limit every three years. Although such flexibility helped Thailand implement relief measures in a timely manner, it also caused an inevitable delay in fiscal consolidation. (OECD, 2022[14])

Medium-term fiscal planning is achieved through the Medium-Term Fiscal Framework (MTFF), which defines guidelines for next three to five years and is revised annually. Its long-term anchor is the public debt ceiling rule. Setting a clear timeline to lower the public debt limit back to the previous 60% of GDP in the medium term will strengthen the medium to long-term sustainability of fiscal accounts. Tighter fiscal rules can be one way to address growing fiscal pressures from rapid population ageing, an avenue recently chosen by Korea (OECD, 2022[14]).

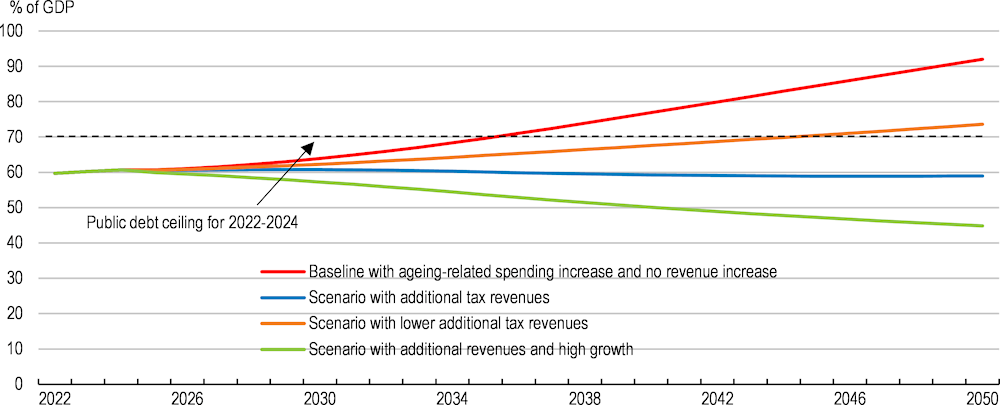

According to the MTFF for FY2024-2027 released in December 2022, public debt is expected to stay below 62% of GDP, peaking at 61.8% in FY2025 and then falling to 61.3% in FY2027. Looking further ahead, population ageing will call for additional expenses, reaching up to an additional 1.4 percentage point of GDP by 2050, even under the conservative assumption of constant per-person spending for the elderly. This will push up social spending from the current 5% of GDP to 6.5%. To maintain the primary fiscal balance at -1% of GDP in the medium term, this additional spending will need to be financed through compensatory measures in the form of additional tax revenues. OECD simulations suggest that with these compensatory fiscal measures amounting to 1.7% of GDP fully implemented by 2035, gross public debt is expected to converge to around 60% of GDP by the mid-2040 (Figure 1.13). Even if only half of these compensation measures were implemented by 2035, public debt would not exceed the current 70% ceiling until 2045. However, if rising spending pressures are not met with additional fiscal measures, gross public debt would continue growing and rise as high as 90% by 2050. By contrast, higher real GDP growth, for example through productivity-enhancing reforms, would allow gross public debt to decline to below 50% of GDP.

Fiscal reforms will be inevitable to face future spending needs while ensuring debt sustainability. There is scope to create this additional fiscal space on the revenue side, but also by eliminating some unnecessary current expenditures, including fuel subsidies. Potential reforms to improve the structure of both public spending and revenues will be discussed in the subsequent sections, with a summary of their potential medium-term fiscal impact presented in Table 1.6.

Figure 1.13. Revenue enhancement is crucial to ensure fiscal sustainability

Public sector debt scenarios

Note: The baseline with ageing-related spending increase and no revenue increase scenario assumes long-term labour productivity of 2.7%, nominal interest rates at 2%, and inflation at 2%. Under this assumption, real GDP growth will decline gradually from 2.9% to 1.9% between 2025 and 2050, given demographic developments. The baseline scenario includes an ageing-related spending increase in social and health spending of 1 and 1.4 percentage points of GDP by 2035 and 2050, respectively, under the assumption of constant government spending per elderly person throughout the estimation periods. The baseline assumes that no additional revenue measures will be taken. The scenario with additional tax revenues assumes that primary balance will be maintained at -1% of GDP from 2035, financed through higher tax revenues. The additional tax revenues and high growth scenario assumes real GDP growth of 4% on top of the scenario with additional tax revenues. The scenario with lower additional tax revenues assumes that only half of these additional revenue measures will be implemented by 2035, implying a primary balance of -1.9% from 2035. All the scenarios assume a constant share of GDP for public sector debt that is not general government debt, most notably debt by state-owned enterprises.

Source: OECD calculations.

Improving the spending mix can help boost long-term productivity

Public investment is key for enhancing productivity and the economy’s long-term growth potential. A current fiscal rule earmarks at least the amount of new government borrowing and at least 20% of the annual budget for capital outlays. In FY2022, capital expenditure was far less than net borrowing and amounted to only 19.7% of the annual budget, although this was later addressed in a remedial plan that included additional investment.

Maintaining strong investment will be key for future growth, and urgently needed in the context of the green transition, but it will also become politically more challenging to sustain investment in the context of rising spending pressures, such as those resulting from population ageing. Over the last years, public investment has been financing mostly infrastructure projects including railways, roads, irrigation system and energy sector. Ensuring sufficient public investment is even more important as actual investment disbursements tend to fall short of the budget. While current expenditures in the budget were fully disbursed, only 68% of capital spending foreseen in the budget was actually disbursed. Actual capital expenditure thus accounted for 14% of total government expenditure, well below the budgetary minimum target of 20%. Disbursement procedures could be accelerated by giving a stronger role to the Committee on Government Budget Disbursement Monitoring and Acceleration chaired by the Minister of Finance, and ensuring frequent meetings of this Committee.

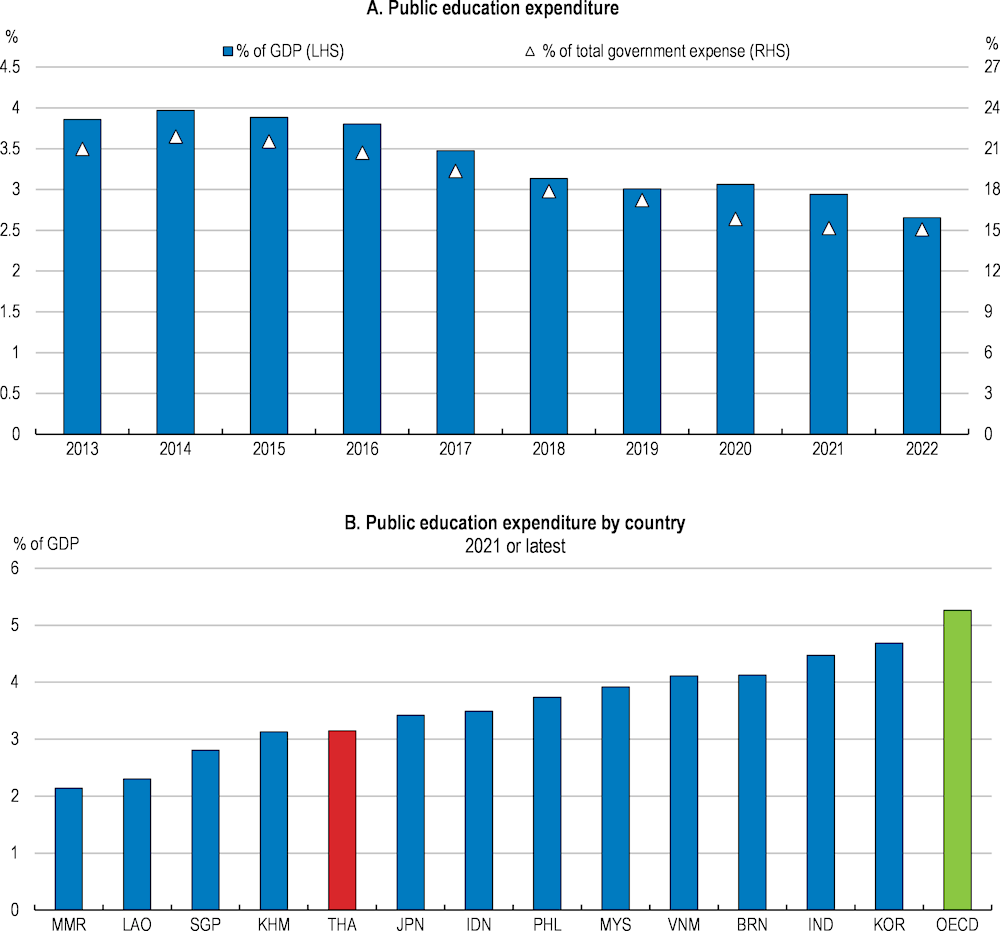

Beyond investing in physical capital, there is also a strong case to boost investment in human capital, which is one of the pillars of sustained productivity growth. In the aftermath of the pandemic, public education spending has become a priority for Thailand. The pandemic caused learning losses in most countries and particularly in developing countries, as education spending was often neglected (World Bank and UNESCO, 2022[15]). Even before the pandemic, however, education spending was on a downward trend in Thailand, and this trend accelerated during the pandemic (Figure 1.14). Thailand’s education spending accounted for 14.6% of total government expenses in FY2022, a significant decline from 21.9% in FY2014. Thailand’s educational outcomes measured by PISA scores in reading, mathematics, and science are relatively low compared to regional peers such as Malaysia. The PISA score in reading fell to 393 in 2018, recording the lowest level since the introduction of PISA in 2000, and may have declined further during the pandemic. Higher spending efficiency in education, including through school funding linked to performance improvements would allow achieving better education outcomes in the future.

Figure 1.14. Education spending has declined and remains low

Source: Government Fiscal Management Information System; World Bank World Development Indicators; and OECD calculations.

Higher and more progressive tax revenues will need to finance additional spending

Against the background of rapid population ageing, future spending pressures are likely to require higher tax revenues. Already, Thailand’s old-age dependency ratio is not only higher than in other countries in the region, but it is also rising faster (Figure 1.15). The working-age population aged 15-64 is anticipated to decline from 70% of the population in 2021 to 60% in 2040, while the proportion of those aged 65 and above will rapidly increase from 15% to 27% during the same period.

Figure 1.15. The population is ageing rapidly

Note: The old-age dependency ratio is defined as the number of persons aged 65 and over relative to the 15-64 years old population.

Source: United Nations, Department of Economic and Social Affairs, Population Division (2022). World Population Prospects 2022, Online Edition; World Bank, World Development Indicators database.

At the same time, tax revenue collection in Thailand has declined due to emergency tax relief measures and lower economic activity during the pandemic. As relief measures are lifted and economic activity rebounds, tax revenues are expected to see a cyclical rebound, but that may not be sufficient to address the structural spending pressures stemming from an ageing population, the need for stronger social protection and the costs of addressing climate change.

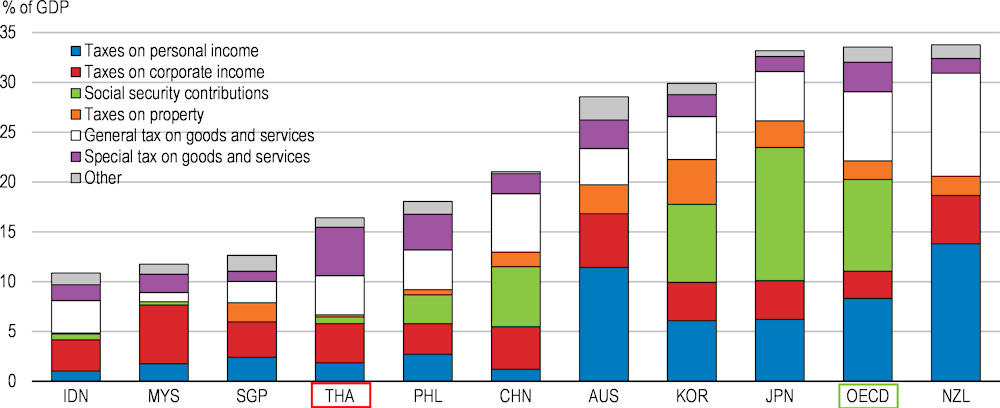

Thailand’s tax revenues are low in international comparison and could be raised by broadening tax bases and improving tax compliance (Figure 1.16). The low tax revenues reflect Thailand’s narrow tax bases and a high degree of informality among firms and workers (OECD, 2020[1]). Informal workers currently account for more than 50% of the workforce. Even if the prospective short-term gains in tax revenues associated with bringing more workers into the tax system may in most cases be limited given the lower incomes of informal workers, this should be seen as a useful long-term investment into ensuring sustainable future tax revenues and could also help to improve workers’ access to public social protection schemes and strengthen the delivery of targeted social benefits.

Making the tax system more progressive could help reduce income inequalities. These have improved over the past decades, but the tax and transfer system has played a relatively limited role in this process (Figure 1.17). More than 50% of total tax revenue comes from indirect taxes such as value-added taxes (VAT), which typically offer little scope for progressive taxation. Excise tax and import duties, which fall into the category of special taxes on goods and services, also have a stronger weight than in other countries. This contrasts with the personal income tax, which is used much less in Thailand than in the average OECD country. Less than 15% of the Thai population is subject to personal income taxes, partly related to the large informal sector.

One way to collect more revenues from the personal income tax would be to reconsider some of its current tax expenditures. Many of the current tax expenditures benefit households with higher incomes, such as the current tax allowances for life insurance premiums, mortgage interest payments and investments in long-term equity funds. Although these allowances are capped, the current cap of THB 100,000 for life insurance premiums or home mortgage interest amounts to more than half an average annual wage income, and the allowance for long-term equity funds is even greater with a maximum of THB 500,000. Phasing out these allowances would clearly strengthen the progressivity of the personal income tax.

Figure 1.16. Thailand’s tax revenue is small

Tax revenue, 2021 or closest year available

Note: Value-added tax and sales tax are classified in general taxes on goods and services.

Source: OECD, Tax Revenue database; OECD calculations.

The current basic allowance exempts net annual income below THB 312,000 (USD 4,420) from personal income taxes, which is about 170% of the average wage income. As a result of this high threshold, even many university graduates are not subject to paying any personal income taxes on their salaries. Above this threshold, a first bracket starts with a 5% rate, and 19% of taxpayers currently fall into this range.

Figure 1.17. The tax-and-transfer system could do more to reduce income inequality

Source: OECD, Income Distribution Database; F. Solt (2020), "Measuring Income Inequality Across Countries and Over Time: The Standardized World Income Inequality Database", Social Science Quarterly 101(3):1183-1199, SWIID Version 9.4, November 2022; IMF, Government Finance Statistics database.

A lower entry rate in personal income taxes will be helpful for bringing more individuals into the personal income tax system, which would be a first step towards a gradual expansion of the tax base. Above the entry rate, a progressive rate schedule would allow more redistribution through the tax system, while a flatter schedule would imply lower disincentives to entrepreneurship and investment. In light of strong income inequalities and a current rate schedule with 6 additional income brackets and a top marginal tax rate of 35% that applies only to very high income levels, there appears to be scope for raising personal income tax revenues from the upper parts of the income distribution, without raising the top marginal rax rate and without increasing the tax burden on lower-income households.

Corporate income taxes also present scope for reviewing the effectiveness of tax expenditures, which are often generous and aimed at attracting investments. The introduction of the global minimum effective tax rate of 15% will make some of the generous tax incentives obsolete for firms within the scope of this tax, which include multinational enterprises with annual revenues above EUR 750 million (OECD, 2021[16]). Thailand approved in principle the introduction of the global minimum tax in March 2023, and the implementation into domestic legislation is now underway.

A new recurrent tax on immovable property, was introduced in 2019, which can also contribute to a more progressive tax system in Thailand. Local governments collect the land and building tax based on the value of property, which is measured by the Treasury Department of the Ministry of Finance. The tax only applies to immovable properties above THB 50 million (approximately USD 1.5 million) in property value, with varying rates based on their usage. Agricultural properties have a comparatively low maximum rate of 0.15%, while residential properties are taxed at up to 0.3%. Vacant or properties used for other purposes such as business activities can face rates of up to 1.2%. Another positive feature of this property tax is that it does not require individual filing. Instead, the Department of Land under the Ministry of Agriculture and Cooperatives directly collects information on the land use and imposes the tax, which improves administrative efficiency.

A full implementation of the recurrent tax on immovable property, however, is still outstanding. Due to the pandemic, the effective date of the tax was postponed until August 2020 and the tax rate was temporarily reduced by 90% in 2020 and 2021 to mitigate the burden on households. The rate then returned to what was planned initially, before being reduced again by 15% in 2023. The tax should now be fully implemented at its originally planned rates, including with enhanced monitoring to avoid possible tax evasion. Reports of idle urban properties being declared as agricultural land to avoid the higher tax rate on undeveloped land suggest that better monitoring of the actual land use, in line with zoning regulations, would be one way to get more revenues from the new property tax. Another way would be through more frequent re-evaluations of property values, which currently take place every 4 years. Singapore updates property values every year, while the Philippines do so every three years (OECD, 2023[17]). Information-sharing among related government agencies and local authorities could support the re-evaluation process and strengthen tax compliance.

Thailand’s statutory VAT rate was originally set at 10% in 1997 but the effective rate was later reduced to 7% in the aftermath of the 1997 Asian Financial Crisis. The application of this lower rate has been extended numerous times since then, but it is relatively low compared to regional peers including Indonesia (11%), the Philippines (12%), Viet Nam (10%) and Malaysia (10%) and other emerging economies such as Mexico (16%), Colombia (19%) and South Africa (15%). The rate should now return to the original 10% and could even be raised further in light of rising future expenditure pressures. Apart from its low rate, Thailand’s VAT appears to be relatively effective on the basis of available data, delivering 81% of potential revenues obtained by subjecting all domestic private consumption by the standard rate in 2022. This exceeds the OECD average of 56% in 2020 (OECD, 2022[18]).

Taxes on the transfer of wealth like inheritance and gift taxes can also be an effective way to reduce inequalities, including inequalities of opportunities. Compared to other taxes on wealth, inheritance and gift taxes can effectively reduce inequality with little harm to economic efficiency (OECD, 2021[19]). After decades-long debate, Thailand introduced inheritance and gift taxes in 2015, with a 10% rate on inheritances and 5% on gifts, which may provide room for arbitrage (Siriprapanukul, 2014[20]). Aligning the rates of inheritance and gift taxes can help obtain neutrality between wealth transfers during lifetime and at death (OECD, 2021). The current inheritance and gift tax rates are also relatively low compared to other countries, and raising it further, including with progressive tax brackets, could be an option for the future. In addition, the automatic exchange of information (AEOI) can help ensure that tax residents declare and pay tax on capital income earned abroad, which could potentially raise tax revenue as well as progressivity and fairness of tax system. Thailand has committed to voluntarily undertake the first automatic information exchanges by 2023, which is a welcome step.

Besides potential changes in the tax code, a stronger enforcement of existing rules through better tax administration could also lead to further revenue improvements. One way to strengthen tax compliance would be to harness digital technologies, which could reduce the cost of enforcement for the authorities and lower the reporting burden for taxpayers. With its unique personal identifier assigned to each citizen on their national identity card, Thailand is well-prepared to make further inroads on tax enforcement through digital means. For example, a new electronic tax filing system enhanced service efficiency with enabling quick access to its online tax services in 2021.

E-commerce is an area that readily benefits from the application of digital technology. A 2021 law imposed VAT on cross-border digital services to non-VAT registrants resident in Thailand. Foreign platform operators with income from services provided in Thailand of over THB 1.8 million (around USD 51,800) are now required to register and pay VAT. The new tax rules on e-commerce aim to increase tax revenue and foster a level playing field between Thai and foreign companies in e-service markets.

Greater adoption of digital technologies in the government sector would allow strong synergies across different areas, notably, tax collection and social protection (OECD, 2022[21]). Digital tools and digitally integrated administrative data including tax registries can improve the targeting of various benefits and facilitate formalisation. Digitalisation of government services would also be useful for regulatory reforms, such as streamlining administrative procedures.

Table 1.5. Past OECD recommendations on revenue enhancement

|

Recommendations in the past survey |

Measures taken since October 2020 |

|---|---|

|

Improve tax compliance, particularly in the personal income tax. Once the solid economic recovery is restored, broaden the tax base, with a full implementation of the new property tax. |

E-registration, e-filing, e-payment, and a digital tax refund system (PromptPay) have been progressively implemented since 2016 and the tax verification system was linked to a major mobile payment application in 2023. Tax audits of high-potential businesses and multinational enterprises has increased. The implementation of the new 2020 recurrent tax on immovable property was delayed during 2020-2023 and the tax rate was reduced. |

Table 1.6. Estimated medium-term fiscal impacts of policy recommendations

|

Policy measures |

Fiscal impact, % of GDP |

|---|---|

|

Revenue measures |

3.9 |

|

Raise the VAT rate from the current 7% to 10%, while considering further increases in the future |

1.5 |

|

Reduce tax expenditures in personal and corporate income taxes and bring more people into the personal income tax system |

0.6 |

|

Fully implement the new recurrent tax on immovable property |

0.1 |

|

Improve tax administration and tax compliance |

0.5 |

|

Phase out subsidies on oil products |

0.2 |

|

Introduce carbon pricing |

1.0 |

|

Spending measures |

-3.5 |

|

Raise spending on public investment and education |

-1.3 |

|

Strengthen social protection by increasing benefit levels of non-contributory pensions and transfers to low-income households, while improving the targeting of the latter. The long-term fiscal burden of social protection reform is likely higher as the population ages. |

-1.1 |

|

Strengthen training programmes, job-search assistance and career guidance services, especially for young people |

-0.1 |

|

Recycle carbon pricing revenues as subsidies for low-income households and SME investment in energy efficiency |

1.0 |

|

Net effect on fiscal balance |

0.4 |

Note: Carbon pricing revenues are based on OECD simulation results (see Chapter 2).

Source: OECD calculations.

Boosting productivity growth through structural reforms

Stronger competition and better regulations could boost productivity

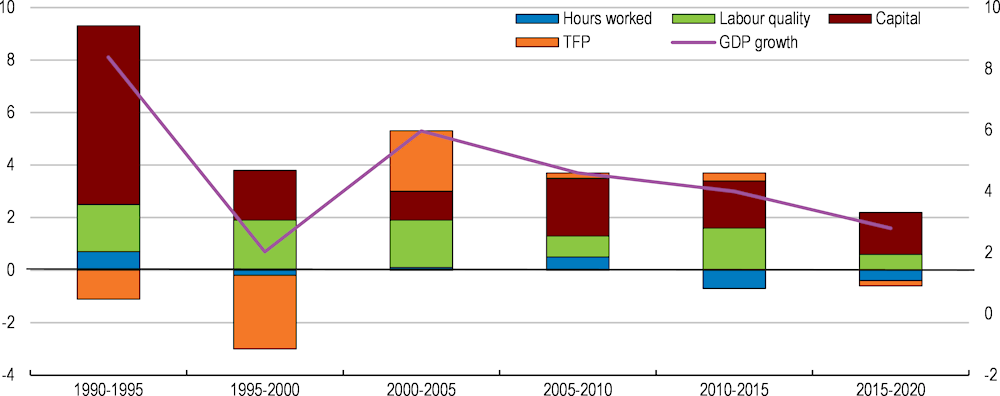

Strong competition is crucial for boosting productivity growth, which has been subdued over the last 20 years (Figure 1.18). Competition is the necessary force to allow the most productive and innovative firms to grow, including at the expense of less efficient incumbents. Only this creative destruction process provides the right incentives for firms to invest in constant improvements of products and processes. Where it is hampered, this can trap resources in low-productivity firms with fewer investment opportunities and curtail incentives for innovation and technological upgrading.

Figure 1.18. Boosting productivity is crucial to sustain high economic growth

Factors contributing to the Thai GDP growth, annual average, %

A large body of empirical evidence suggests a link between stronger competition and productivity gains. Regulations that hamper competition have been found to slow down the process by which countries with lower levels of productivity can catch up with high-productivity economies (Nicoletti and Scarpetta, 2003[22]; Arnold, Nicoletti and Scarpetta, 2011[23]). These effects can work through imposing greater discipline for eliminating inefficiencies and adopting the best technologies within the same sector (Syverson, 2004[24]), but they can also work across sectors through sourcing relationships, as competition in intermediate goods markets can improve productivity downstream (Bourlès et al., 2013[25]; Arnold et al., 2016[26]; Arnold, Javorcik and Mattoo, 2011[27]). In India, for example, stronger competition in services sectors has brought significant productivity benefits for downstream manufacturing sectors using these services as inputs (Arnold et al., 2016[26]).

Finally, stronger competition can also foster reallocations of resources towards more productive firms, either through the entry and rapid growth of more productive start-ups, or through accelerating the exit of low-productivity firms and freeing up resources for more productive competitors (Olley and Pakes, 1996[28]). Open markets with low entry barriers would allow high-performing small and medium enterprises to compete and prosper on a level playing field, which is currently not always guaranteed in the face of dominant market positions prevalent in some sectors. Reducing entry barriers may even provide more effective support to high-potential start-ups than specific support policies to SMEs, which often have much higher budgetary costs.

Moreover, economic rents can arise when policies shield parts of the economy from competition. These policies can then end up redistributing resources towards the affluent and even make the political decision-making process less transparent. At the same time, such policy settings reward firms for seeking political connections rather than performing better. Against this background, ensuring an equal playing field and low entry barriers in all sectors will be a key priority, both to reduce inequalities in incomes and opportunities and to boost productivity. Strengthening competition is also conducive to stimulating both foreign and domestic investments, including by SMEs.

Evidence suggests that a range of Thai industries are characterised by high concentration and low levels of competition, which tends to foster rigid industry structures in which strong performers find it more difficult to grow at the expense of low-productivity firms. Thailand ranked 85th out of 141 countries in an indicator about the extent of market dominance elaborated by the World Economic Forum, suggesting that many markets for products and services are dominated by a few players. Thailand’s performance on this indicator is significantly behind that of regional peers such as Malaysia and Singapore. Analysis based on administrative data of Thai registered firms suggests an increase in market power among Thai firms, which coincided with lower business dynamism (Apaitan et al., 2020[29]).

Structural impediments to competition have been identified across a wide range of sectors, perhaps most notably in services where regulatory constraints inhibit effective competition (ADB, 2015[30]). This has coincided with weak services productivity growth, in stark contrast to other Asian economies (ADB, 2015[30]). In October 2022, a merger of two big telecommunication companies was approved, creating a market leader with a total of 55 million subscribers in a country of 71 million inhabitants, surpassing the previous market leader, which had 44 million subscribers. This duopoly may have a risk of weakening the competitive climate of the mobile network operator market. Also, an acquisition of a big retail supermarket by its competitor in 2020 has led to a strong and potentially dominant market position in the retail sector. Beyond services, restrictive alcohol laws hamper market entry into several alcoholic beverage markets including beer brewing, which is highly concentrated.

Market dominance is a notable feature of the energy sector, particularly in the natural gas and electricity industries. Since its inception in 1981, the gas industry has been dominated by a state-owned enterprise with substantial investments and long-term contractual agreements. For instance, power plants typically sign contracts that span up to 25 years, and individual contracts do not expire simultaneously, making it challenging for new entrants to compete. Furthermore, the structure of the electricity industry, with its dominance of the Enhanced Single Buyer Model purchasing electricity from Independent Power Producer and Small Power Producer to distribute to consumers under the retail tariff, hampers the efficient and effective transmission of electric energy to end-users.

The dominance of conglomerates in Thailand has been steadily growing over the past few decades. The top 5 percent of companies now control over 85 percent of the total revenue, and this trend is expected to continue. This concentration of business ownership is not limited to a few select industries; it is prevalent across various sectors, including liquor production, beer production, beverage and tobacco retail, and plastic production (Apaitan et al., 2019[31]). High concentration often affords greater market power, as reflected in higher markups, and it also has a negative impact on productivity and investment in the domestic market (Apaitan et al., 2020[29]). Firms that do not face strong competitive pressures at home will also face challenges in competing abroad and expanding their presence in foreign markets, which ultimately affects the country's competitive position on the international stage.

State-owned enterprises (SOEs) remain present in a number of sectors, at times competing with private enterprises. This may give rise to an uneven playing field between private companies and SOEs, which is likely to hamper competition. The 2017 competition law, repealing and replacing the previous law in 1999, eliminated an exemption for state-owned enterprises in a broad range of business sectors. Nonetheless, some sectors, such as telecommunications and energy, are not covered by this law, and SOE activities that concern national security and public interest are exempted. Cooperation between the competition authority and regulatory authorities of these sectors can be strengthened to ensure coherent competition policies across the economy. Clarifying the scope of SOE activities concerning and the public interest exemption is also important (OECD, 2020[1]). One step forward would be to require state-owned enterprises to keep separate accounts for those activities where they fulfil a public-interest mandate and those activities where they do not, to avoid cross-subsidies towards the competitive segments.

Given the size of Thailand’s SOEs, their performance has significant implications for public finances. Some SOEs in the public transportation sector have been making losses, and the government has developed a rehabilitation plan for these SOEs. Further losses could potentially present financial risks for public accounts. Aligning SOE governance frameworks with the OECD Guidelines on Corporate Governance of State-Owned Enterprises would reduce the likelihood of such losses in the future, and level the playing field for competition with private enterprises (OECD, 2015[32]).

Although strengthening competition should become a priority focus for a wide range of policies, the institutional framework for competition policy is the 2017 competition law, which was widely perceived as a step towards international standards. This law established the Trade Competition Commission (TCC) as Thailand’s competition authority, as well as addressing some concerns regarding market dominance and anticompetitive agreements. The law applies to a broad range of business sectors; nonetheless, some key services sectors such as telecommunications and energy have been excluded from this law. Looking ahead, there is scope for mainstreaming competition principles across the whole of government. Clearer guidance in the National Development Plan could lay the institutional basis for this, as it would encourage agencies and ministries to give more priority to promoting competition.

Providing more resources to the competition authority would allow it to spend more efforts on monitoring both concentration and conduct, including through market studies. Most investigators are currently working on merger cases, with little resources left for structural reviews and stocktaking exercises in specific sectors.

A comprehensive competition review in key sectors could help to identify regulations that stand in the way of stronger competition. This may include scope to reduce administrative burdens and streamline licensing procedures for new businesses, or to review sector-specific regulations that were originally designed for another purpose but end up creating barriers to competition. Widespread price controls could also be reviewed more systematically to see if they are still needed, and new price controls could include built-in sunset clauses. The OECD’s Competition Assessment Toolkit (OECD, 2019) can provide guidance not only for identifying but also for revising policies that unduly restrict competition. Although Thailand conducted a regulatory reform with the “Regulatory Guillotine” and “Simple and Smart Licence” programme in 2017 to repeal or revise outdated regulations (OECD, 2020[1]), the reform lost steam over the past few years. There has nonetheless been some progress during the pandemic, when a number of laws and regulations were amended to adapt to emergency situations, such as legalising telemedicine and relaxing work permits for foreign workers.

Table 1.7. Past OECD recommendations to boost productivity

|

Recommendations in the past survey |

Measures taken since October 2020 |

|---|---|

|

Gradually extend regulatory and administrative reforms in special economic corridors to the rest of the economy. |

Four additional special economic corridors were set up in 2022. |

|

Continue the on-going review of the existing laws and regulations with an effective implementation scheme. |

A comprehensive review of existing laws and regulation has been conducted, leading to lower regulatory burdens for hospital business operations and working permits for foreign workers. |

|

Review size-dependent policy measures, including taxes. |

No action taken. |

|

Shift to more market-oriented policies and encourage farmers to cultivate higher value-added products, such as organic farming. |

A new Organic Agriculture Action Plan will promote organic farming over the period 2023-2027. |

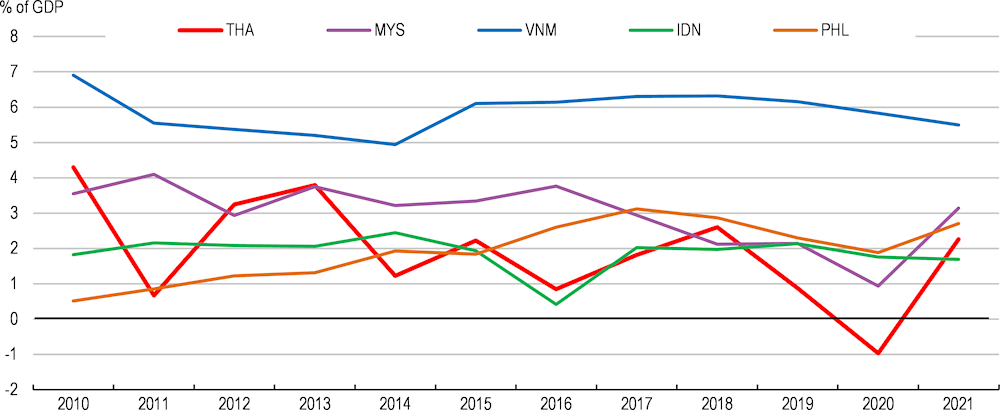

Improving the conditions for foreign trade and investment

Thailand has reaped significant productivity benefits from foreign direct investment (FDI), which has fostered its integration into international production networks. Compared to other Southeast Asian countries (Figure 1.19), however, inward FDI stocks still have scope for further increases. While countries like Indonesia and Malaysia experienced a substantial increase in foreign investment in 2021 and 2022, Thailand saw only a minor improvement. The current geopolitical context may provide opportunities for Thailand to attract further investment as multinational companies revisit their investment portfolios with a view towards diversifying their exposure across countries in Asia.

Thailand’s new FDI strategy adopted in October 2022, the 5-Year Investment Promotion Strategy for the New Economy for 2023-2027, focuses on promoting high-technology, innovation, and green industries such as electric vehicles. A planned extension of the special economic corridors (SECs) into four new geographic areas will complement current policy initiatives focused on the existing Eastern Economic Corridor (EEC). Each new SEC will target specific industries based on close cooperation with regional universities to promote innovation. These plans can build on previous experiences learned in the current special economic corridor and should put more emphasis on cooperation among these corridors.

The new strategy has been complemented by efforts to attract high-skilled foreign workers. A special visa programme of 2018, called the SMART Visa programme, expedites immigration procedures for skilled workers. For 13 targeted industries such as automobiles and digital technology, the programme provides a four-year visa instead of the standard one-year visa. In September 2022, the authorities expanded the programme by adding five additional targeted industries such as national defence and aviation and aerospace industry. In September 2022, a new Long-Term Resident (LTR) Visa programme was established to attract high-skilled foreign workers and wealthy pensioners with diverse tax and non-tax benefits, including a reduced PIT rate of 17% and full tax exemption for overseas income. The programme offers a 10-year renewable visa as well as an exemption from the requirement to employ 4 Thai workers for every foreign worker.

Figure 1.19. FDI to Thailand remained relatively low compared to peers in the region

Inward foreign direct investment, flows, % to GDP

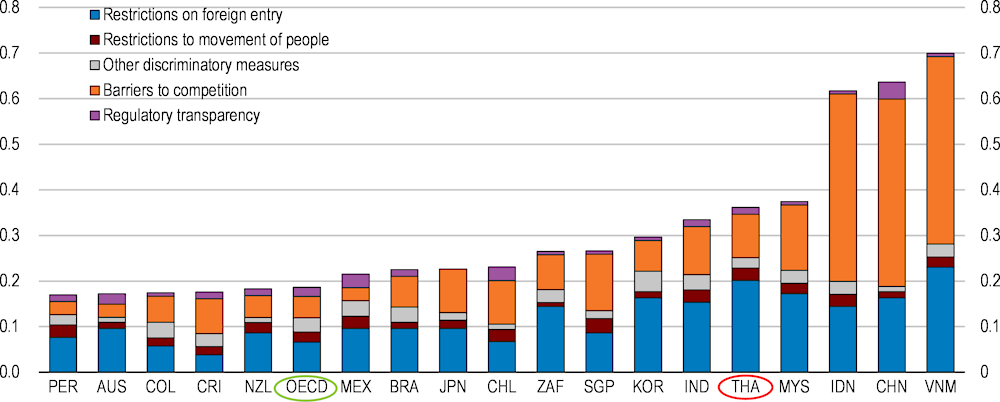

Further policy efforts to stimulate FDI inflows could include easing existing restrictions. Based on the OECD FDI Restrictiveness Index, Thailand’s policies are more restrictive than in regional peers, and this holds particularly true for many services sectors (Figure 1.20). Specifically, foreign equity restrictions and the FDI screening and approval process are more stringent than in OECD and ASEAN countries (OECD, 2021[33]). Regulatory reforms such as those required to strengthen competition and enhance the business climate will also be instrumental to attract more FDI. Indonesia, for example, has taken this road by enacting the Omnibus Law on Job Creation in October 2020, revising 79 laws and eliminating thousands of regulations across 10 broad areas, including a labour reform and improvements in the ease of doing business (OECD, 2022[34])

Figure 1.20. Thailand has more stringent FDI restrictions than other countries

OECD FDI regulatory restrictiveness index, scaled from 0 (open) to 1 (closed), 2022

Note: The OECD FDI Regulatory Restrictiveness Index covers only statutory measures discriminating against foreign investors (e.g. foreign equity limits, screening & approval procedures, restriction on key foreign personnel, and other operational measures). Other important aspects of an investment climate (e.g. the implementation of regulations and state monopolies, preferential treatment for export-oriented investors and special economic zones regimes among other) are not considered. See Kalinova et al. (2010) for further information on the methodology.

Source: OECD FDI Regulatory Restrictiveness Index database, http://www.oecd.org/investment/fdiindex.htm.

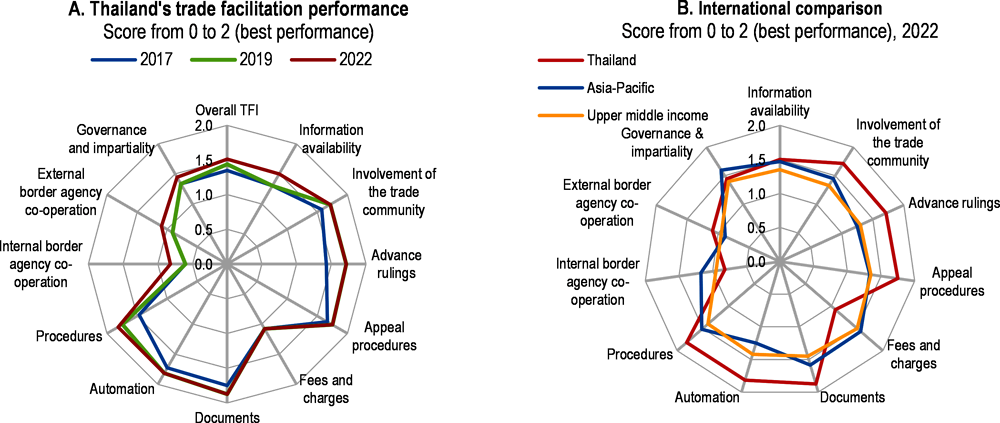

In light of the recent disruptions in global supply chains, trade facilitation has attracted increasing attention. Thailand has made good progress since the ratification of the Trade Facilitation Agreement of the World Trade Organisation in October 2015. The rate of implementation commitments is 98.7%, surpassing the Southeast Asian average rate of 82.9%. Judging by its score on the OECD Trade Facilitation Indicators, Thailand made significant progress in trade facilitation between 2017 and 2022, with a higher score than the average upper-middle income country and the average Asia-Pacific country, especially in the areas of appeal procedure and automation (Figure 1.21). Room for further improvement exists with respect to fees and charges, suggesting that Thailand could further facilitate trade by reducing services fees as well as by improving online access to information on applicable fees and charges.

Additional export opportunities could arise from stronger trade integration, by expanding the current network of preferential trade agreements (PTAs). In November 2021, Thailand ratified the Regional Comprehensive Economic Partnership (RCEP), which took effect in January 2022. With 15 members countries, accounting for around 30% of global GDP, the RCEP will enable Thai exporters to gain better market access in the Asia Pacific region with reduced tariffs. In March 2023, Thailand and the EU announced to resume negotiations on the Thailand-EU Free Trade Agreement (FTA), which had stalled in 2014. This bilateral FTA is expected to boost trade and investment flows with the EU, strengthening the two countries’ well-established trade relationship. The first negotiations took place in September 2023, and the second round is scheduled for January 2024. Thailand has yet to decide on its participation in the Comprehensive and Progressive Agreement for Trans-‑Pacific Partnership, another major free trade agreement.

Opening up services markets to competition and foreign direct investment will be key for moving into higher-value ladders of global value chains. Evidence suggests that access to more competitive services inputs, including as a result of foreign direct investment in services, can have significant productivity benefits for downstream manufacturing companies (Arnold et al., 2016[26]; Arnold, Javorcik and Mattoo, 2011[27]). While Thailand has made progress towards stronger foreign competition in services, the pace of reforms has slowed in recent years. Thailand’s score of the OECD Services Trade Restrictiveness Index is rather high compared to other countries, indicating a relatively stringent regulatory environment (Figure 1.22). Accounting and rail freight services are the most restrictive sectors. In particular, restrictions to foreign entry including screening of foreign investments, residency requirements for management staff and restrictions related to cross-border transfer of personal data contribute to this relatively unfavourable score, in addition to restrictions related to the movement of people such as duration of stay for service suppliers and labour market test for foreign workforce. Thailand’s Foreign Business Act (1999) restricts market access for certain services, for instance in construction services, distribution services and computer services.

Figure 1.21. Thailand's trade facilitation performance has improved

Source: OECD, Trade Facilitation Indicators, https://www.oecd.org/trade/topics/trade-facilitation/

Figure 1.22. Services trade faces tighter restrictions than in other countries

Services Trade Restrictiveness Index in telecommunications, ranging from 0 (open) to 1 (closed), 2022

Table 1.8. Past OECD recommendations on trade integration and services trade

|

Recommendations in the past survey |

Measures taken since October 2020 |

|---|---|

|

Remove barriers in restricted sectors, particularly regarding the international mobility of skilled workers by expanding the coverage of Smart Visa. |

A special long-term visa programme was launched in 2021 to attract skilled foreign workers. The targeted skills categories of Smart Visa were expanded in 2022. |

|

Remove obstacles to FDI by relaxing the rules of capital thresholds and narrowing listed sectors. |

No action taken. |

|

Pursue Preferential Trade Agreements that contain ambitious regulatory reforms. |

Thailand ratified the Regional Comprehensive Economic Partnership (RCEP) and is now negotiating a large FTA with the European Union. |

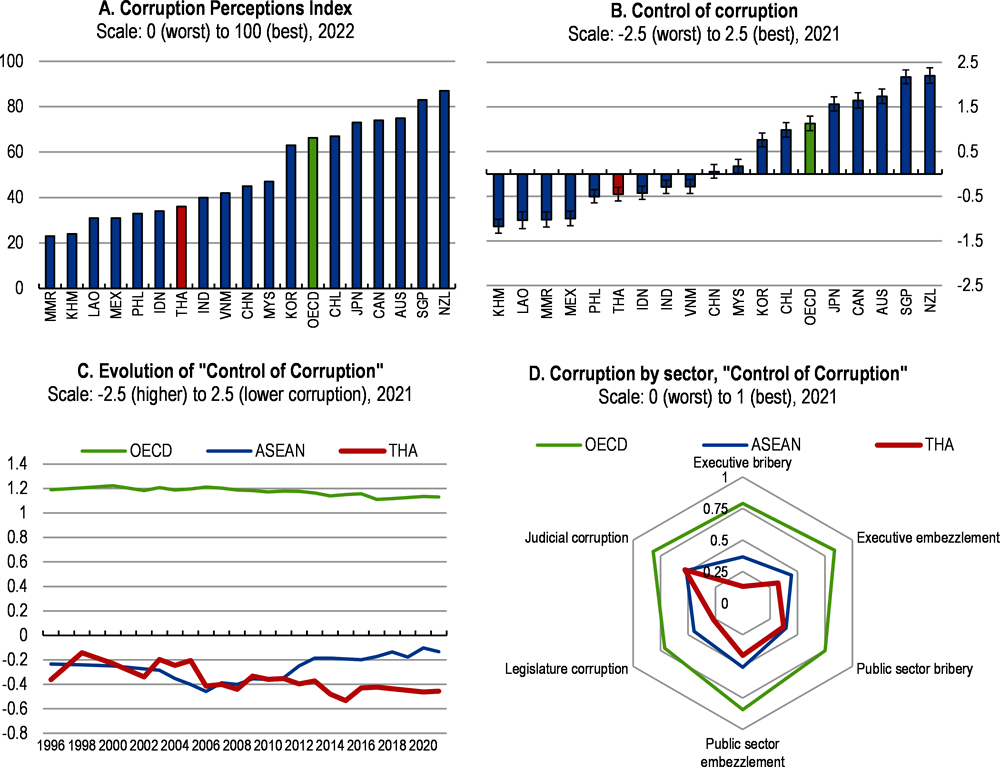

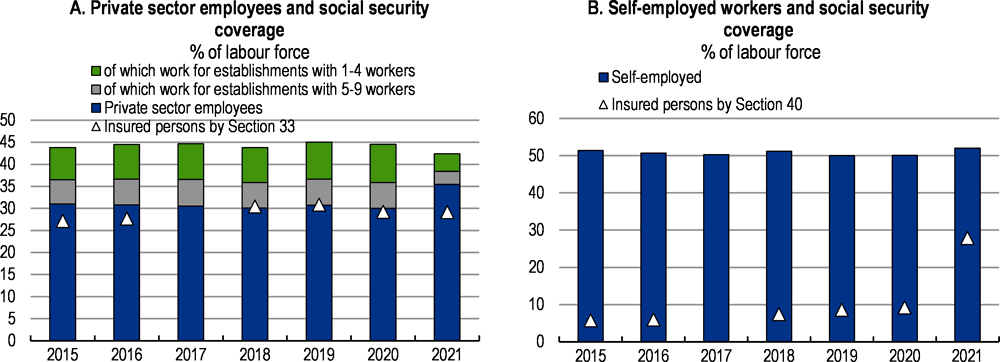

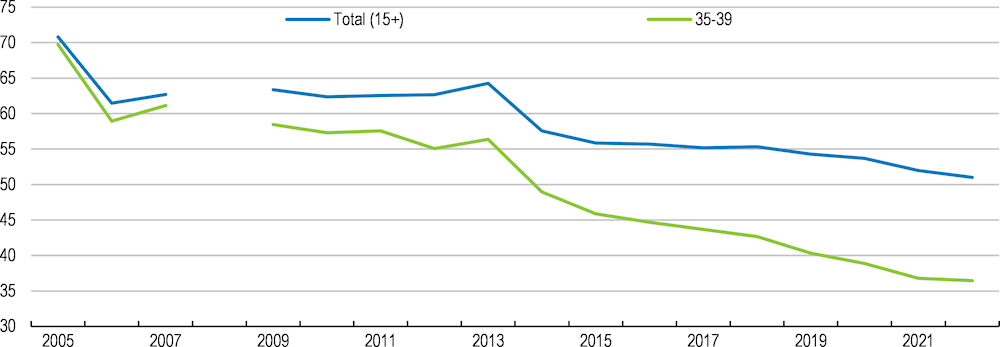

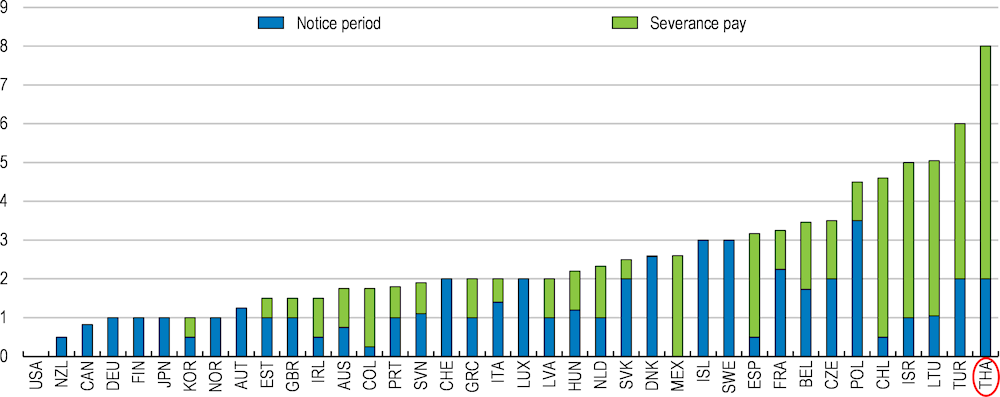

|