Thailand’s current pledge to achieve carbon neutrality by 2050 and net zero emissions by 2065 will require dramatic policy changes. Given that the economy is in a process of catching up with advanced economies, particular emphasis will need to be placed on making the green transition conducive to economic growth and further improvements in living standards, which requires bold and ‑well-designed reforms. Thailand has already started these efforts. Biofuels are being widely used for road transport, and the role of other renewable energy sources has also been increasing. Investments into greener production technologies and a more responsible use of resources have received strong attention. However, most current initiatives are voluntary, which will not be sufficient to achieve the country’s climate goals. Against this background, this chapter discusses Thailand’s green growth policy framework with a focus on the right policy mix and institutional setup.

OECD Economic Surveys: Thailand 2023

2. Pursuing a strong and inclusive green recovery

Abstract

The green transition combines opportunities and challenges

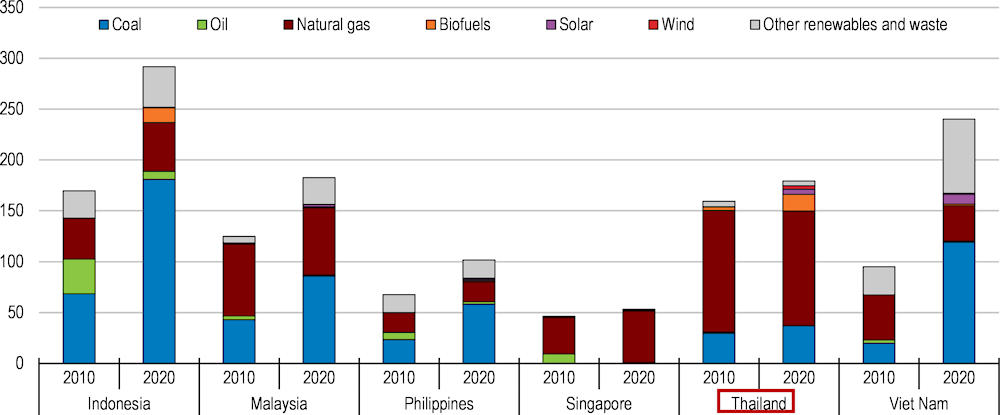

Thailand has made significant pledges for the way towards achieving net zero carbon emissions. These pledges include reaching carbon neutrality by 2050 and net-zero greenhouse gas (GHG) emissions by 2065 (Figure 2.1). The latter concept includes not only the reduction of CO2 emissions, but also methane (CH4), nitrous oxide (N2O) and other hydrofluorocarbons. Moreover, after eliminating the use of chlorofluorocarbon (CFC) gases completely by 2010, Thailand now aims to terminate hydrochlorofluorocarbons (HCFC) before 2030. Implementing these pledges will most likely be the major economic policy challenge for the decades to come.

While mastering the green transition is challenging for all countries across the world, it is even more so for an emerging market economy like Thailand. The green transition will require major investments and policy changes, to induce the required changes in economic structures, scaling down activities that are not compatible with achieving climate goals while fostering those that are.

For an emerging economy like Thailand that is still aspiring to catch up with the income levels of advanced economies, designing a green transition pathway that is supportive of economic growth is particularly important. This need is exacerbated by Thailand’s rapid population ageing, the fastest in the region, which will weigh on economic growth over the next decades. As a result, boosting productivity will become an ever more crucial policy goal.

However, achieving net zero in the coming decades can also provide opportunities to attain both more sustainable and more inclusive growth. Less emission-intensive growth often brings tangible benefits for disadvantaged households, for example when climate mitigation polices improve air quality or reduce urban congestion by making public transport systems more efficient. Greening economic activity can also create new jobs, such as those in sustainable agriculture and tourism.

Figure 2.1. Thailand is committed to significant emission reductions

GHG emissions by source and net CO2 emissions, Mt CO2eq per year

Note: Data for 2000-2019 are from the Fourth National Communication, and those from 2020 are from the Long-term Low Greenhouse Gas Emission Development Strategy.

Source: Ministry of Natural Resources and Environment, Fourth National Communication and Long-term Low Greenhouse Gas Emission Development Strategy.

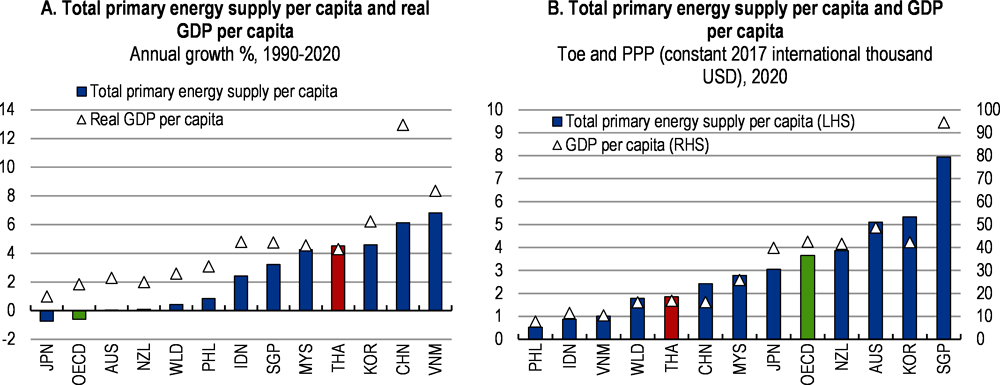

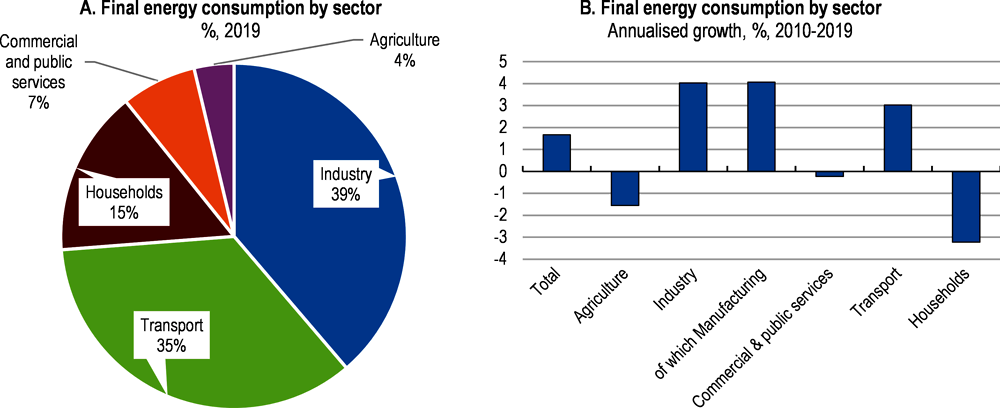

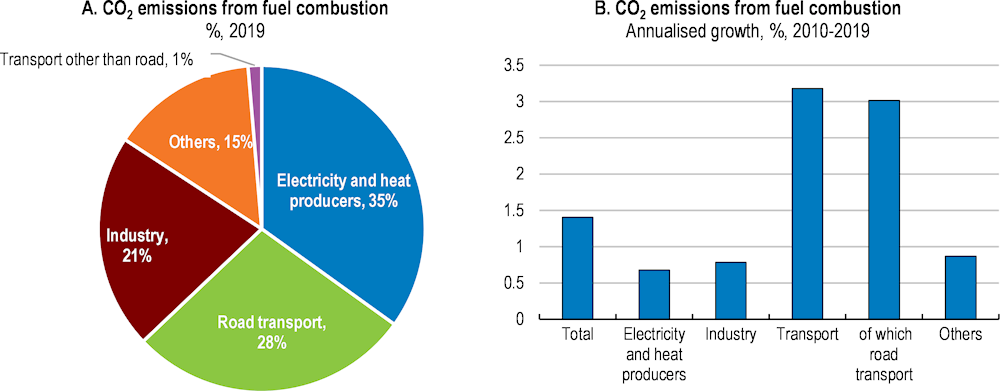

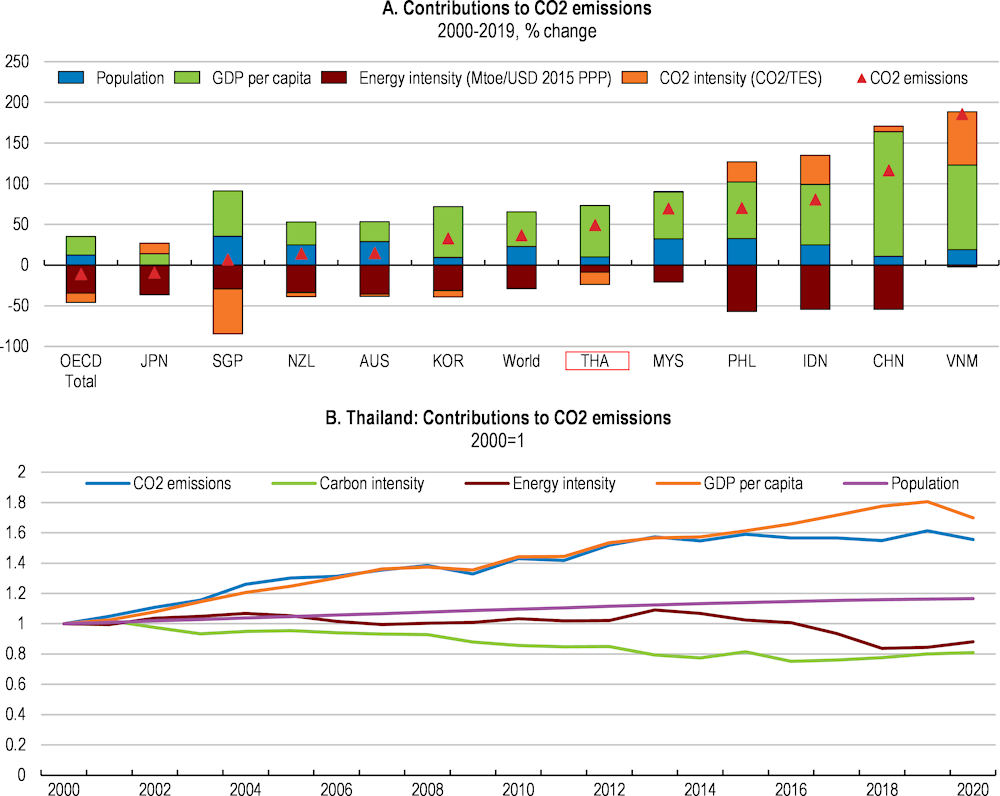

The largest source of GHG emissions is currently the energy sector, which includes energy used by the power sector and transport, among others, followed by agriculture and industrial processes, while land use, land use change and forestry have increasingly subtracted from GHG emissions. In terms of CO2 emissions, transportation is the second largest source in Thailand, after energy suppliers, and its contribution to total emissions has increased rapidly (Figure 2.2, Panels A and B). Like in many other emerging market economies, Thailand’s high economic growth has been underpinned by the increasing use of energy (Figure 2.3, Panel A).

Figure 2.2. CO2 emissions from road transport have increased rapidly

Source: IEA Greenhouse Gas Emissions from Energy.

Energy demand typically increases as activity expands and incomes rise, as evidenced by the strong association between a country’s income level and energy input (Figure 2.3, Panel B). Sustaining Thailand’s high economic growth will require further increases in energy supply, while supply bottlenecks would constrain economic growth (Stern, 2011[1]).

Figure 2.3. Energy is necessary for economic growth

This continuous expansion of energy supply will require massive investments in renewable energy sources as the only way to reconcile future economic development with carbon neutrality. Like in many other countries, the burning of fossil fuels is Thailand’s major CO2 emission source. Reducing CO2 emissions from energy supply and consumption is therefore expected to play the leading role in achieving the country’s net zero pledges (Figure 2.1).

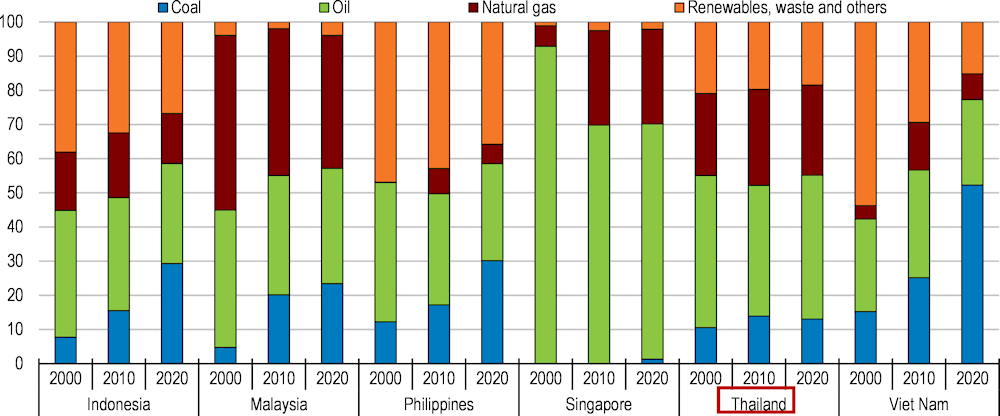

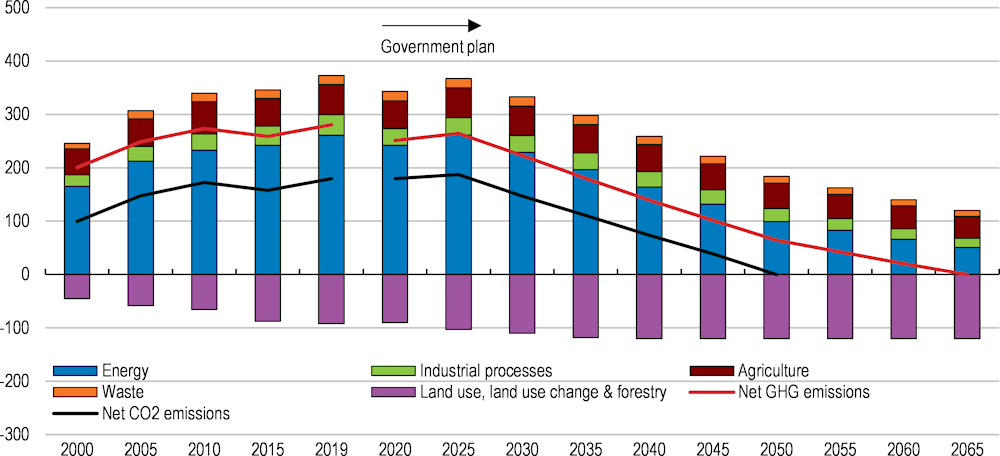

In contrast to other Southeast Asian countries that are heavily reliant on coal, Thailand expanded natural gas use long before others and has tapped into bioenergy sources, such as gasohol and biodiesel for land transport, for years (Figure 2.4). This has helped contain increases of CO2 emissions to some extent over the years. However, reversing the rising trend of its CO2 emissions trajectory within a short period will require significant additional policy efforts. The high share of natural gas means that Thailand should quickly move to further expanding renewables. Some renewable sources, such as solar photovoltaic (PV) electricity generation, are actually more readily available for Thailand than fossil fuels.

Figure 2.4. Thailand’s coal dependence is lower than in peer countries

Total energy supply by source, share %

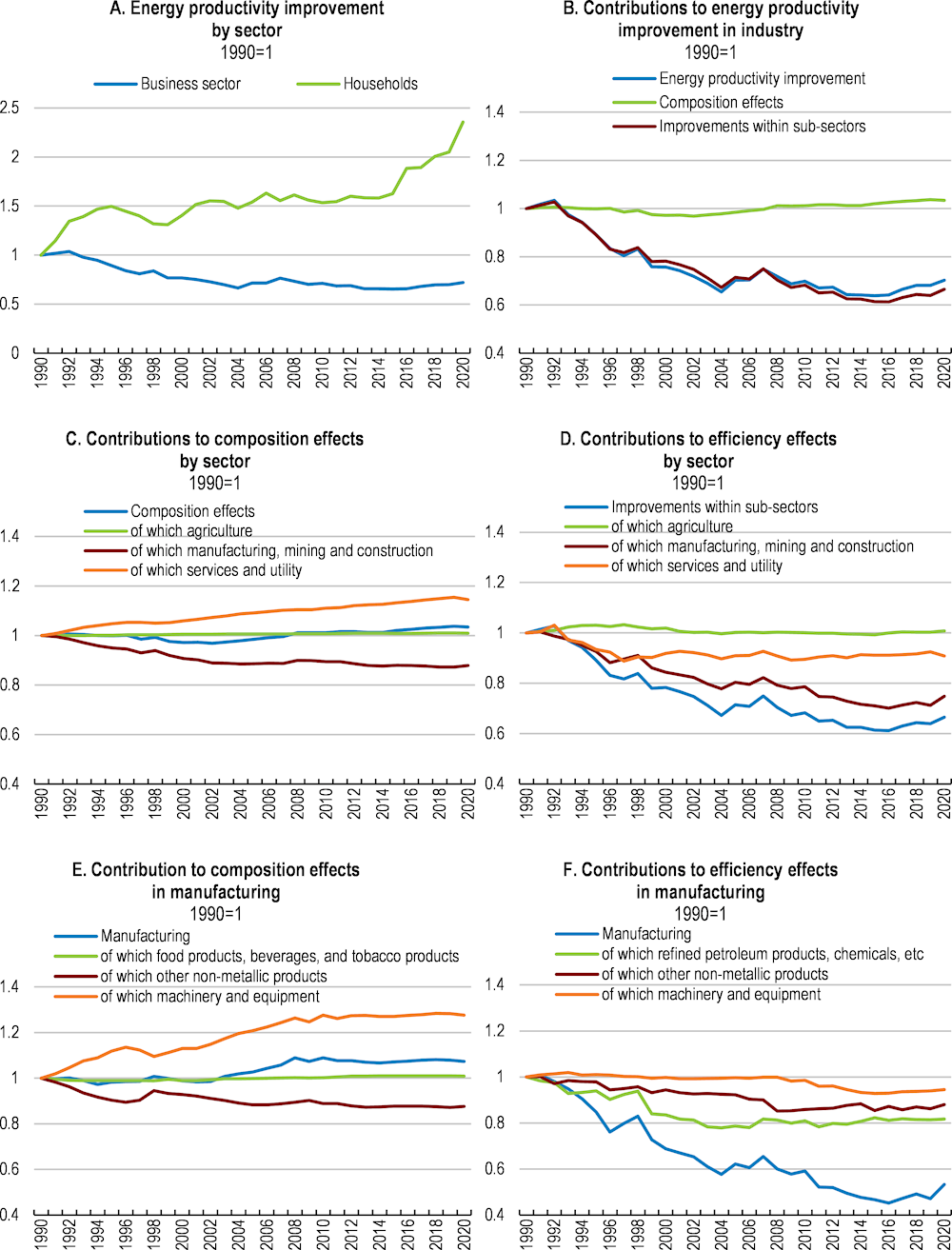

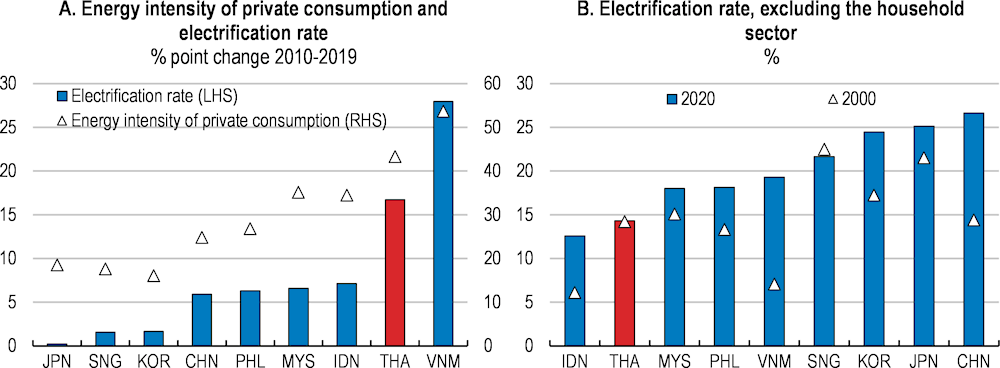

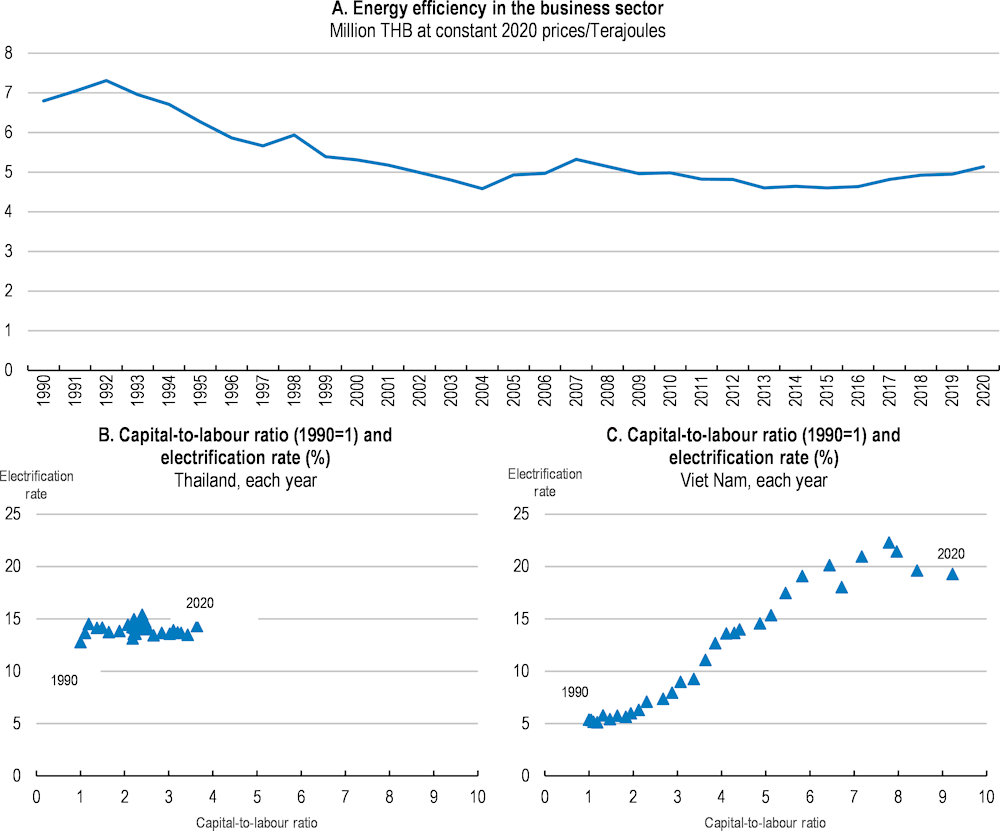

Besides expanding electricity supply, meeting emission pledges will also require limiting electricity demand growth by improving energy efficiency. Indeed, some improvements in efficiency may be easier to achieve in the short run than expansions in renewable energy generation capacity. Over the last two decades, Thailand has become less energy intensive, suggesting that various sectors’ efforts to improve energy efficiency have played a key role to contain increases in CO2 emissions, while the growing share of the services sector could also contribute to low energy intensity (Figure 2.5, Panels A and B). At the same time, other countries in the region have achieved stronger energy efficiency gains, suggesting scope for further efforts in Thailand.

Thailand is one of the most vulnerable countries to climate change in the world and will also need to invest into climate change adaptation. Frequent severe floods and droughts affect its agricultural production, which has become a concern. Therefore, investments in climate change adaptation will have to go hand in hand with mitigation efforts.

A successful green transition will require enhanced policy coordination efforts, in particular flanking policies that can mitigate the impact on low-income households, which could be disproportionally affected by higher fossil fuel prices during the transition. These households are already typically more vulnerable to changes in weather patterns, such as severe droughts and floods.

Figure 2.5. Lowering energy intensity has helped contain CO2 emissions

Note: Decomposition is based on the Kaya identity, CO2 emissions = (Carbon intensity)*(Energy intensity)*(GDP per capita)*(Population). Carbon intensity is calculated as carbon emissions divided by total primary energy supply, and energy intensity is calculated as total primary energy supply divided by real GDP.

Source: World Bank World Development Indicators; OECD Green Growth Indicators.

Comprehensive and well-coordinated reforms will be required to master the planned green transition. This chapter will discuss different climate change mitigation policies and how these policies can be harnessed to boost productivity and economic growth, while also enhancing inclusiveness. Key messages of this chapter are:

A comprehensive strategy for carbon pricing that covers key emission sectors as early as possible is a key pillar of a strong climate change mitigation strategy. Fiscal revenues from carbon pricing should be used for targeted support to vulnerable households to alleviate the economic impacts of climate mitigation efforts and to SMEs to support necessary investments in their transition to cleaner production technologies.

Reducing government interventions in energy markets will lay the grounds for a successful green transition, as regulated prices and subsidies currently weaken the necessary incentives for improvements in energy efficiency.

Aligning environmental regulations with international good practice will play an important role to accompany price-based measures and strengthen the political acceptability of mitigation efforts.

Achieving a coherent policy mix and ensuring strong policy coordination

Getting the policy mix right is crucial for Thailand’s decarbonisation strategy. Achieving carbon neutrality over the coming decades will require significant transformations of economic structures and will require the use of several policy instruments in a coordinated fashion. Key tools that can be deployed include emission pricing, regulatory measures, and subsidies for cleaner alternatives. A broad range of policy tools should consistently be deployed to maximise their complementarities (D’Arcangelo et al., 2022[2]), (Blanchard, Gollier and Tirole, 2022[3]). At the same time, favourable framework conditions will be needed to facilitate the required structural changes and foster business dynamism, for example through the removal of market entry barriers or operational restrictions.

Appropriate carbon prices that internalise some of the climate impacts of carbon emissions are one key instrument for directing resources towards lower-emission uses. From an economic perspective, using price signals to direct resources is highly attractive and efficient because a single carbon price equalises the marginal abatement costs across sectors (D’Arcangelo et al., 2022[4]). The price signals can help attract private investments into low-carbon production technologies. Carbon pricing can be implemented in different ways and can also generate government revenues depending on its design.

However, carbon prices alone are unlikely to be sufficient to drive the changes required to reach net zero emissions, and there may also be other environmental externalities to be taken into account beyond climate change, such as air pollution. High carbon prices alone may also not be enough to stimulate adoption and innovation in low-carbon technologies if uncertainty about policies and technology renders the required investment excessively risky. More stringent environmental regulations, for example, can support price-based measures and reduce the usage of fossil fuels.

Ensuring rapid progress through the deployment of different policy instruments calls for stronger policy coordination. Thailand currently has over 30 national and regional energy and climate policies in effect. These plans have been updated every 3-5 years to reflect the latest developments on various fronts, including technological advances. In addition, several government ministries and agencies have their own policy measures, and taken together, this creates a complex system.

Current policies include policies to promote energy efficiency, sustainable transport and the transition to clean energy sources. A pilot programme for emission trading is currently part of the Climate Change Master Plan. The Long-Term Low Greenhouse Gas Emission Development Strategy serves as an overarching policy strategy. The principal energy policy relevant to reducing GHG emissions is Thailand’s Integrated Energy Blueprint, which encompasses several long-term plans, notably the Alternative Energy Development Plan, Power Development Plan and Energy Efficiency Plan. A new National Energy Plan is expected to replace the current Energy Blueprint as an overarching framework. In addition, the 13th National Economic and Social Development Plan provides guiding principles to connect economic development and climate policies.

These different policy plans also imply that the responsibility for climate and environmental policies is scattered across many different agencies (IEA, 2021[5]). 25 public bodies are responsible for drafting, implementing and enforcing climate policies, which adds to the complexity of steering Thailand towards meeting its climate commitments. Several extra-budgetary funds have been established for similar purposes. In addition to taxes, charges and fees that are imposed by different ministries and agencies, a number of tax incentive programmes exist, potentially leading to policy inconsistencies.

Redesigning and streamlining these complex institutional settings will be a policy priority, with a view towards better coordination within the government. Currently, the National Committee on Climate Change Policy chaired by the prime minister acts as the leading body on climate policies, and a department at the Ministry of Natural Resources and the Environment oversees climate policies. However, policy coordination and consistency concerning climate policies could be strengthened further. To achieve this, the government is planning to introduce the first-ever Climate Change Act and set up a new department, the Department of Climate Change and Environment, which is meant to serve as the secretariat for the National Committee on Climate Change Policy.

The new Department of Climate Change and Environment is currently being established and this process could be accelerated. Its mission will be to define a strategy and measures to deal with climate change and reduce greenhouse gas emissions across the country. As part of the function of the Office of Natural Resources and Environmental Policy and Planning under the same ministry will be transferred to the new department, the division of labour between the two departments should clearly be defined. Overcoming the current coordination challenges will hinge on giving this newly created department a strong mandate, including the necessary leverage to ensure the consistency of policies by other ministries and actors with the overall mitigation strategy.

Better coordination of climate action will also require tying climate objectives more directly to long-term decision processes and budgets, while undertaking regular monitoring and follow-up. Like other Southeast Asian countries, Thailand has a long history of economic development planning. Its 5-year Economic and Social Development Plans serve as a guide to various sectoral plans. Effective monitoring and evaluation is an essential part of any planning system, and a number of countries have made efforts to improve monitoring and evaluation. Setting quantitative targets and providing regular follow-up, including potentially through a direct link with budget management, is equally important as the planning itself (World Bank, 2007[6]). Thailand has an electronic monitoring and auditing system that cover key projects of all ministries and agencies.

Thailand has established a well-organised performance evaluation system for public spending. However, the quality of annual key performance indicators varies among government agencies and a large number of indicators of around 9 000 appears to complicate the evaluation process (OECD, 2020[7]). A number of countries have encountered similar difficulties. France recently reduced the number of indicators used for monitoring and Austria strengthened quality assurance through regular interventions by the Federal Performance Management Office (OECD, 2020[7]).

Another instrument that could be harnessed for this purpose are Strategic Environmental Assessments. These assess the environmental impact of broad policy or individual project plans in the initial phase (OECD, 2012[8]). Thailand plans to formally introduce Strategic Environmental Assessments in several areas of government planning such as energy and transport. The same instrument has been used in the European Union to ensure high levels of environmental consideration in various government plans such as energy and transport (European Commission, 2001[9]).

Knowledge sharing with other countries can also be useful. A case in point is a memorandum of understanding between Thailand and Switzerland of 2022. This collaboration aims at a mutual exchange of experiences and at helping Thailand achieve its net zero emission targets through knowledge transfer and expert advice.

Carbon pricing should be the key element of Thailand’s decarbonisation strategy

Carbon pricing will be an essential building block of reducing carbon emissions. Appropriate carbon prices internalise part of the negative external effect of carbon emissions and induce market participants to favour low-carbon solutions. This will generally reduce emissions in cost-effective ways, taking into account different abatement opportunities, including through creating strong incentives for enhancing energy efficiency and boosting research and innovation into low-carbon technologies. The two main types of explicit carbon pricing are emission trading systems, such as cap-and-trade programmes, and carbon taxes (OECD, 2022[10]). For example, the EU-ETS, the emission trading system of the European Union, has effectively reduced CO2 emissions of regulated firms (Dechezleprêtre, Nachtigall and Venmans, 2018[11]).

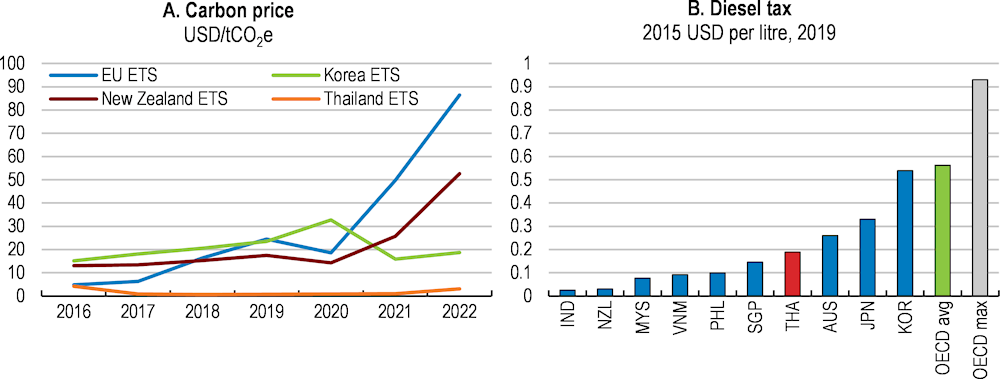

Thailand launched a pilot emissions trading system (ETS) on a voluntary basis in 2015. The first phase between 2015 and 2017 established and tested the market’s design features and the measurement, reporting and verification system. Under the voluntary system, participating businesses can acquire knowledge and experience about emission trading, including estimation of emission numbers stemming from their activities. During the second phase between 2018-20, the government aimed to encourage wider participation and develop participants’ trading capabilities. The pilot trading scheme has helped to gather valuable experience and capacity with carbon markets, and Thailand now has the legal framework to establish an effective emission trading system. The government also plans to include SOEs within the system from 2024. However, the voluntary nature with no stringent emission cap and low carbon prices prevalent under the ETS have implied that the carbon prices generated by the current system are not effective to reduce GHGs (Figure 2.6, Panel A). In addition, Thailand’s excise tax on fossil fuels is low, which results in a low effective tax rate on carbon in international comparison (Figure 2.6, Panel B).

Plans for mandatory carbon pricing are currently underway. A draft law about the framework of a mandatory system is set to be submitted to the cabinet for approval in 2023. When the new law comes into force, the private sector is required to report the data regarding activities involving GHG emissions to the government, with administrative penalties for failures to report. However, a final decision on whether the mandatory system will take the form of an emissions trading system, carbon taxes, or a mix of the two policy tools, is still outstanding, as is the sectoral coverage of the new system.

Irrespective of the carbon pricing policy chosen, the new system should be as comprehensive as possible. Carbon pricing for only a narrow set of sectors would be insufficient to make the necessary progress towards a net zero target. If carbon pricing is applied to limited sectors, activities and resources would move to other sectors not covered by the pricing system, resulting in high emissions and overall low average carbon prices. Stronger emission reduction contributions would then have to come from other policy tools, such as energy saving measures or regulations. To achieve the same emission reduction target through price-based measures, a narrow sectoral coverage would require higher carbon prices compared with a wider coverage.

Building on the experience of the voluntary programme, a cap and trade system with an extensive sectoral coverage could be placed at the centre of Thailand’s carbon pricing strategy (IEA, 2021[5]). In particular, the energy and industry sectors should be among the first to participate in such a scheme. In the early stage, allowances could be allocated for free to some industry sectors in order to prevent carbon leakage to other countries with lower carbon prices. Industrial process could then be included once the new framework is in full operation. In addition to CO2 emissions, a broader set of GHG emissions could be covered.

A cap and trading system has the advantage that it can explicitly set emission caps consistent with a path to the net zero targets, although it may be more challenging to implement from an administrative perspective, including with respect to the allocation of initial allowances, than a fuel-based carbon tax. Emission allowances should eventually be auctioned off among emitters rather than handed out for free, as this will generate fiscal revenues, especially during the transition period. These revenues can then be used to cover additional spending needs related to climate change policies, including those for adaptation or support for those households most affected by carbon pricing.

Recognising that not all emissions can be included in a cap and trade system, complementing such a cap and trade system with a carbon tax for sectors not covered by the scheme would allow to expand the scope of carbon pricing. For example, a carbon tax could be more suitable to reduce emissions from road transport, especially transport emissions originating from households. Allocating allowances to private passenger car users would not be practical, while a carbon tax on fossil fuels could be easily implemented at the pump. As the fossil fuel taxes already exist, reforming the tax rate according to the climate costs of these fuels would be a straightforward option (OECD, 2021[12]).

Figure 2.6. Thailand’s current effective carbon prices are low

Source: OECD Green Growth Indicators; US Department of Energy, Maps and Data - Fuels Taxes by Country; National sources; World Bank Carbon Pricing Dashboard; Thailand Greenhouse Gas Management Organisation, Carbon Market information.

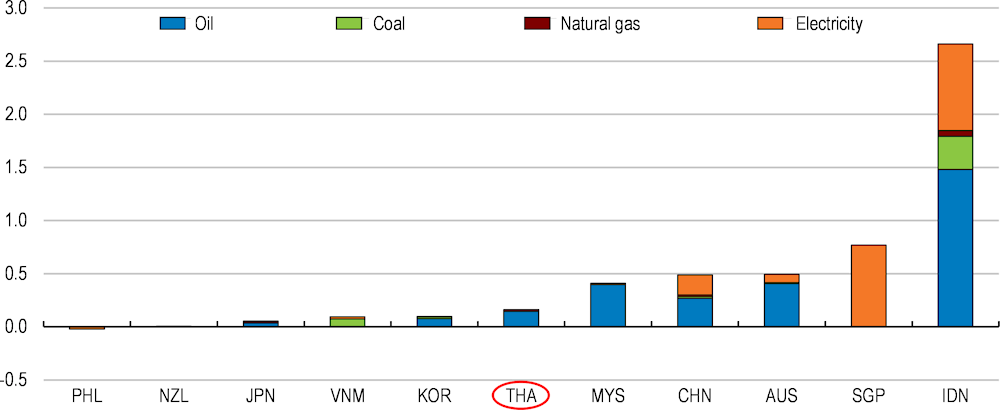

Tax rates should ideally align carbon prices with those envisaged in a cap and trade system to achieve emission cuts consistent with sectoral targets. That, however, would imply phasing out current subsidies, even though these are lower than in some OECD countries and regional peers (Figure 2.7). Total energy subsidies still amount to almost 0.2% of GDP and consist almost entirely of subsidies on oil and petroleum products. The government regularly intervenes to reduce price volatility of petroleum derivatives such as diesel and gasoline through the Oil Fund (Boonpramote, 2017[13]), (Asian Development Bank, 2015[14]). In addition, an explicit cap on retail diesel prices keeps the price at currently THB 34.44 per litre (USD 1.00). These interventions into market prices should be phased out along with the establishment of the emission trading system. Fossil fuel subsidies weaken price signals and are inconsistent with an efficient use of carbon prices to attain emission reduction objectives (D’Arcangelo et al., 2022[2]).

Figure 2.7. Energy subsidies remain in place for oil

Energy subsidies, % of GDP, average 2015-2019

Source: International Institute for Sustainable Development and OECD; FossilFuelSubsidyTracker.org.

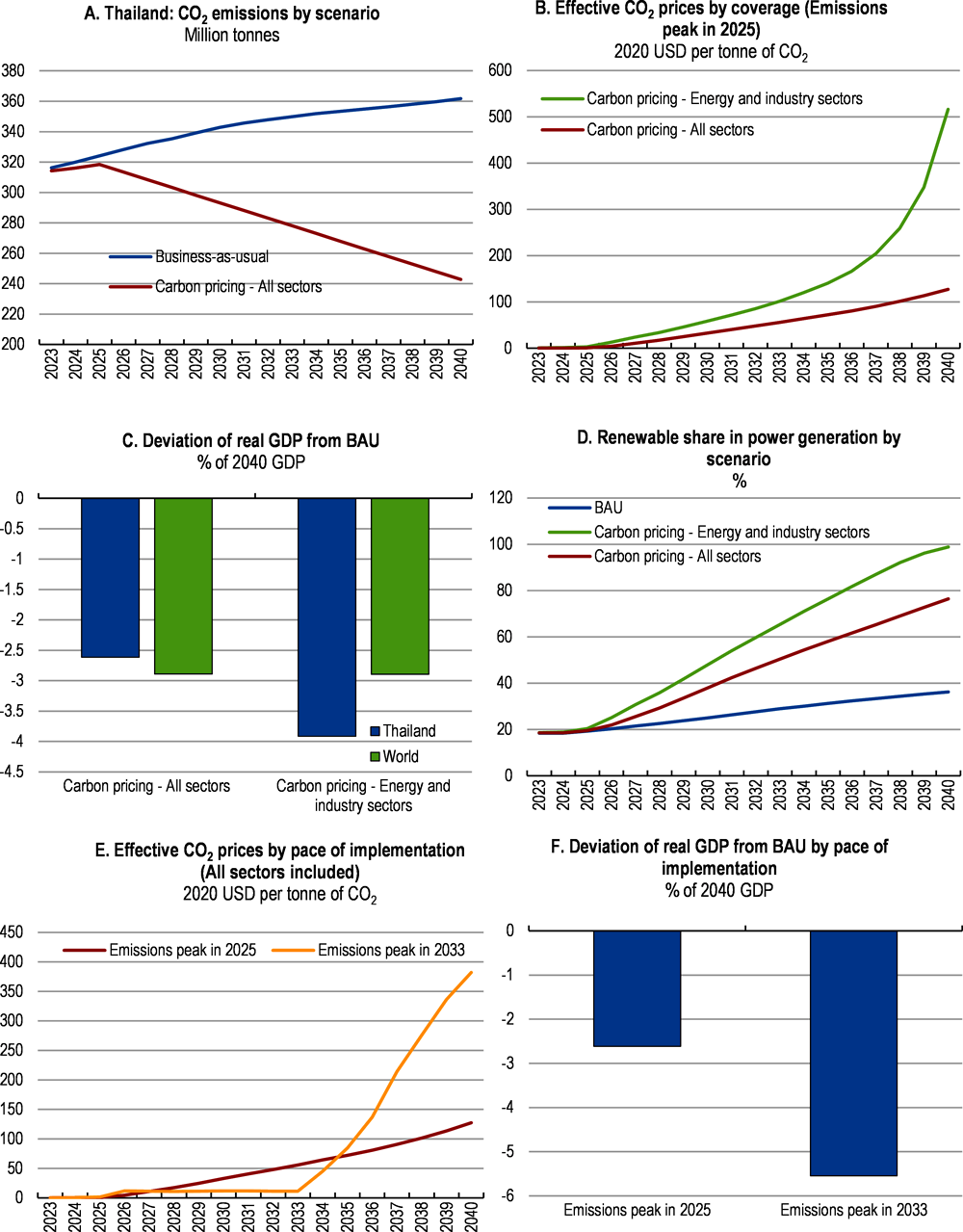

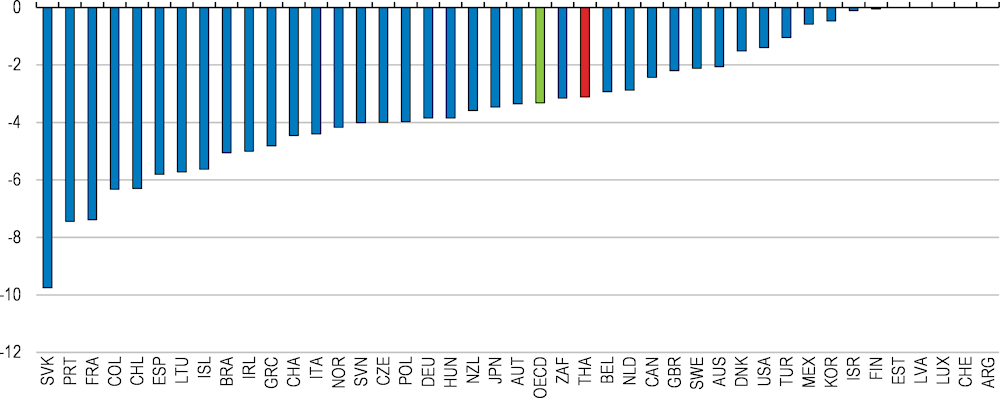

Model simulations prepared for this chapter simulate emission trajectories and the carbon prices required to achieve them, assuming that no other, non-price-based measures are taken. These simulations are based on the OECD-ENV Linkages model, described in Box 2.1. The simulations, shown in Figure 2.8, consider a number of different cases for carbon pricing, all of which achieve the current emission targets, which imply a stark reduction of CO2 emissions relative to a business-as-usual scenario (Panel A, based on (Ministry of Natural Resources and Environment, 2022[15])).

The results of these simulations suggest that carbon price levels would need to rise substantially when relying on carbon pricing alone to achieve emission targets (Panel B). This strengthens the case for deploying a combination of price-based and regulatory measures to reduce carbon emissions. Moreover, the breadth of sectors covered by carbon pricing plays an important role for the level of carbon prices required to reach current net zero targets. A carbon pricing mechanism with only partial coverage comprising the energy and industry sector would require substantially higher carbon prices than if all sectors were included in the carbon pricing mechanism (Panel B). With an even narrower application of carbon pricing to the energy sector alone, achieving emission targets would be out of reach, at least if the other sectors continued to consume fossil fuels without any restrictions. These results underline the importance of aiming for a broad coverage of the carbon pricing mechanism chosen.

Moreover, a partial application of carbon pricing to energy and industry only would entail higher economic costs (Panel C). While the level of GDP is projected to be around 2.5% lower in 2040 on account of the costs of mitigation measures, this loss would amount to almost 4% in the case of only partial coverage. This is due to the fact that the entire mitigation burden would then be put on the energy and industry sector, a scenario that would entail very high economic costs in these sectors (Panel D).

The coverage of carbon pricing could be expanded over time. SMEs with small GHG emissions could be included more gradually into the system, starting with those segments of the SME sector where the complexity of inclusion into the system are lower. The European Union, for example, has progressively expanded the coverage of its emission trading system since 2005. In the first phase until 2007, the system only included CO2 from power generators and energy-intensive industries but now covers more gases, such as N2O, and more sectors, such as aviation, and is to be extended to maritime transport.

Box 2.1. The OECD ENV-Linkages modelling framework

A long-term projection of the interaction between environmental pressures and economic activities is essential to help countries meet their environmental targets. In particular, analysing the long-term impacts of environmental policies on climate challenges and economic growth enables countries to identify more cost-effective policy mixes to effectively achieve green and sustainable growth. The OECD developed the ENV-Linkages model, a recursive dynamic computable general equilibrium (CGE) model, in the early 2000s.

The ENV-Linkages model describes economic activities of different sectors and regions and links them to the drivers of environment pressures. The model fully conforms with the OECD ENV-Growth model, which provides the baseline scenario in the absence of new environmental policies. Therefore, the ENV-Linkages model can assess the impacts of climate change mitigation policies in diverse scenarios. Thanks to its multi-sectoral and multi-regional features, the model enables the analyses of the medium- to long-term effects of policy shifts that require reallocation across sectors and regions, as well as the associated spill-over effects. It also helps countries identify least-cost policies on issues including environmental tax reform and phasing out fossil fuel subsidies.

Figure 2.8. Achieving net zero targets will be challenging

Note: Simulations based on the OECD ENV-Linkages model. In the business as usual (BAU) scenario, Thailand's long-term labour productivity growth is assumed at 2.7%. Consumption shares of necessary goods such as electricity and food are assumed to decline as incomes rise. The all-sectors carbon pricing scenario assumes that non-OECD countries will achieve net zero GHG emissions, including from LULUCF, by 2060, and OECD countries by 2050. For Thailand, carbon neutrality will be achieved by 2050, following the emission trajectory shown in the revised version of Thailand's Long-term Low Greenhouse Gas Emission Development Strategy (Ministry of Natural Resources and Environment, 2022[15]). The partial carbon pricing scenario assumes that Thailand adopts sectoral carbon pricing restricted to energy and industry to achieve the same carbon neutrality target, and the other countries apply full-sector carbon pricing. The end point of the simulation is set in 2040 to obtain robust estimation results. The peak of net CO2 emissions is set to occur in 2025, except in the delayed scenario where this is assumed to happen in 2033.

Source: OECD ENV-Linkages model.

Even with a gradual expansion of coverage, however, it is important to frontload the implementation of carbon prices to ensure compliance with the current government targets of reaching a carbon emission peak in 2025, followed by gradual declines as shown in Panel A. If the turning point were delayed due to a slower implementation of carbon pricing, more efforts than in the frontloading scenario would be required to reach the same amount of cumulative emissions reductions (Panel E). This in turn would imply higher economic losses, both in terms of real GDP and per-capita incomes (Panel F).

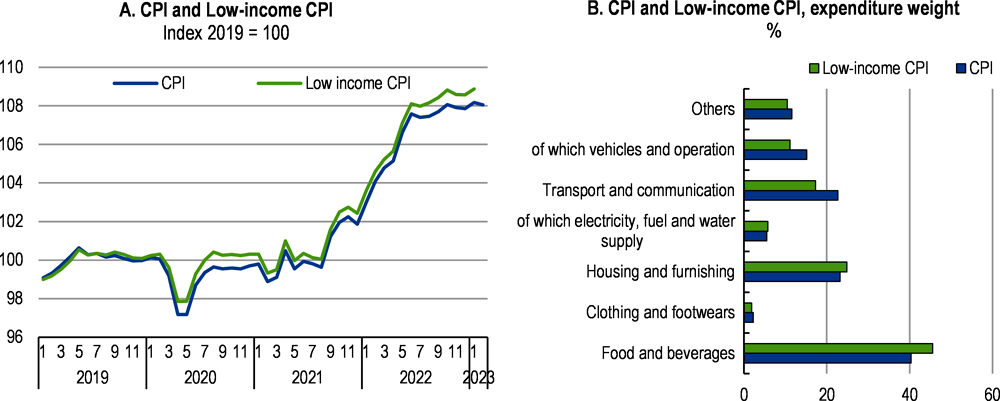

As high prices of fossil fuels and carbon-intensive goods and services entailed by carbon pricing could disproportionally affect low-income households, it is crucial that fiscal revenues from carbon pricing are available to support those who would be affected (D’Arcangelo et al., 2022[2]). Large income inequalities may hinder the green transition through low public support, which could particularly be the case in emerging market economies like Thailand. In emerging market economies, consumption of fossil fuels typically has a larger share in total expenditure for high-income households than for low-income households due to differences in car ownership rates and availability of traditional biomass, such as firewood (Dorband et al., 2019[17]). This would make tend to give carbon pricing a more progressive footprint, although the impacts may differ among countries and fuels (Steckel et al., 2021[18]). The negative effects on low-income households could be exacerbated by associated increases of food prices, which has a large spending share among low-income households (Figure 2.9).

Figure 2.9. Low-income households spend relatively less on transport

Support could go beyond households. Switzerland, for example, recycles most of the revenues of its carbon tax on fossil fuels introduced in 2008. Two thirds of the tax revenue are redistributed to households on per capita basis and to businesses based on payroll and the rest is used to an energy efficiency programme and a technology fund (Hintermann and Zarkovic, 2020[19]). Singapore introduced a CO2 emission tax on the energy and industrial sectors in 2019. Although not directly linked to the carbon tax revenues, the Singaporean government at the same time provides strong support to business investments in energy efficiency, especially to SMEs, recently raising the grant rate from 50% of the investment costs to 70%. Part of the revenues from carbon pricing can also be used for other people, such as to smooth the job transition of those whose jobs are expected to disappear as the economy shifts away from high-emission activities. Recycling revenues from carbon pricing does not necessarily require earmarking these revenues, as long as they are allocated to the above-mentioned purposes.

Thailand has support programmes to low-income groups in place under which low-income electricity consumers who use less than 50kWh per month are exempt from electricity bills, financed through cross-subsidies from other users such as the industrial sector (Asian Development Bank, 2015[14]). Revenues from carbon pricing could ideally be used to support families through a targeted cash transfer, which requires a frequently updated poverty list. Thailand launched a digital welfare card programme for a cash transfer to poor people in 2017. This programme has the potential for achieving strong targeting if its underlying household registry were updated more frequently (Phattarasukkumjorn, 2021[20]). Once its targeting has been improved, the State Welfare Card, which has already included an energy subsidy component, can in principle be a useful tool for delivering targeted of support measures to compensate vulnerable households for the effects of higher energy prices in the medium run.

While market-based carbon pricing introduced by the pilot ETS are likely to be a pillar of Thailand’s decarbonisation policy, pollution taxes are useful policy tools that could complement the ETS in specific cases, as in the case of taxes on air pollutants. The economic rationale for such taxes would be the negative externalities from these pollutants, which often go beyond their climate impact.

A number of OECD countries adopted pollution charges, such as on nitrogen oxides (NOX) and sulphur oxides (SOX), by the late 2000s. In response to accelerating soil acidification and water eutrophication, Sweden started to impose a high tax on nitrogen oxides emissions from industrial combustion plants equivalent to USD 6000/tonne in 1992 (OECD, 2013[21]). As the tax is designed to refund all the revenues to taxpayers in proportion to generated energy, it works as a transfer from plants with high emission intensity to those with low emission intensity. By 1995, average emissions per unit of energy had declined by 40%. Starting from large plants, the coverage of the system has been progressively expanded. Sweden has also seen sulphur dioxide emissions declining since 1991 when it started a tax on sulphur dioxide (SO2) (European Union, 2021[22]). The tax is levied based on sulphur contents in fuels and, if emissions are reduced by cleaning or binding them to ashes, part of the tax is reimbursed to the emitter.

In the case of Thailand, imposing an air pollutant tax on the energy and industrial sectors could be an interesting option, although it may require additional administrative efforts. Sulphur dioxide levels have been lower than the WHO standards (Nikam, Archer and Nopsert, 2021[23]), and its emissions have declined by an annual 1%, but it is still a major source of air pollution (Ministry of Natural Resources and Environment, 2022[24]). Around 80% of sulphur dioxide emissions come from fuel combustion by the manufacturing and construction sector. By contrast, nitrogen oxide emissions continue to increase mostly due to transport activity, which is concentrated in urban areas and discharges half of nitrogen oxides emissions. In addition, the energy sector, emits approximately 20% of nitrogen oxides, mostly from coal power plants.

Aligning environmental regulations with international good practice

Tighter environmental regulations could help Thailand reduce GHG emissions at modest economic costs. One example for this are regulations on air pollutants. While high-pollution sectors will be penalised by more stringent environmental regulations, many highly dynamic sectors and firms would likely fare well despite strict regulations (OECD, 2021[25]). At the macro level, the adverse effects of more stringent environmental regulations on economic activity would likely be modest. Moreover, regulations, such as strict pollution standards, could induce innovation and stimulate demand for innovative products (OECD, 2011[26]). Welfare gains from these policies will be significant as environmental degradation, especially low air quality, imposes high health costs on Thailand (Kummetha, 2022[27]). Previous studies suggest that the social cost stemming from PM2.5 was equivalent to 11% of GDP in 2019 (Attavanich, 2021[28]). Moreover, as energy-related air pollutants and CO2 emissions often stem from the same sources, an integrated approach to tackle both would be highly beneficial (IEA, 2021[29]).

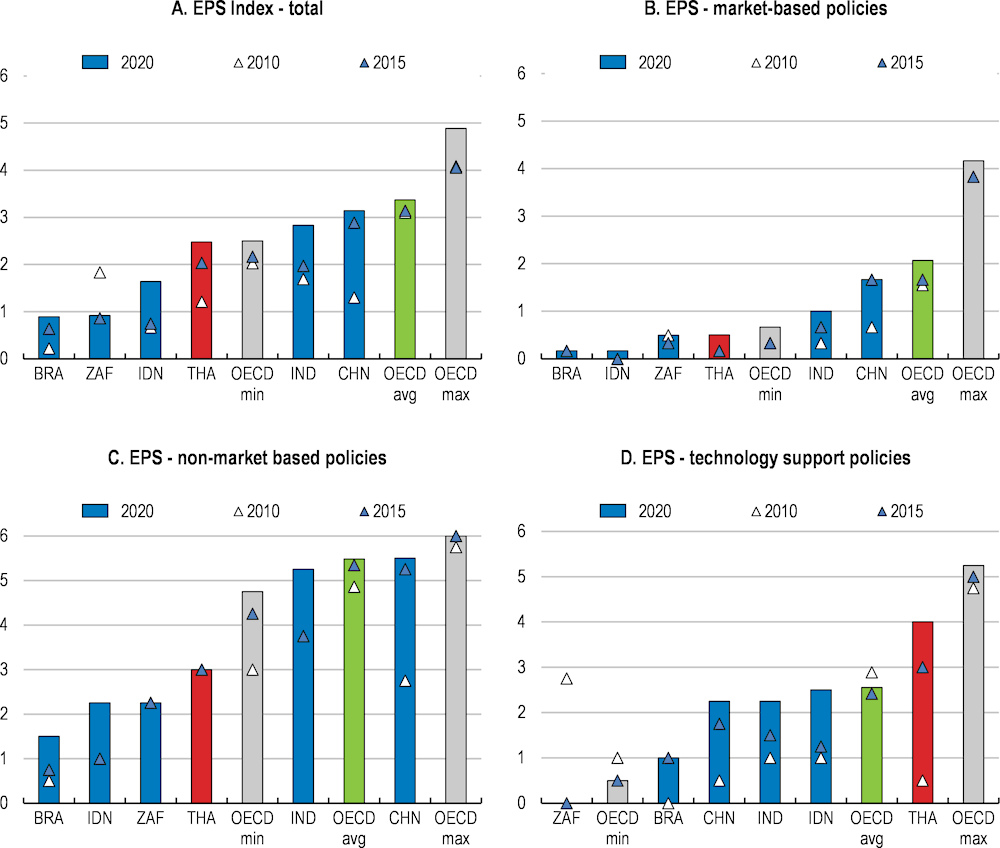

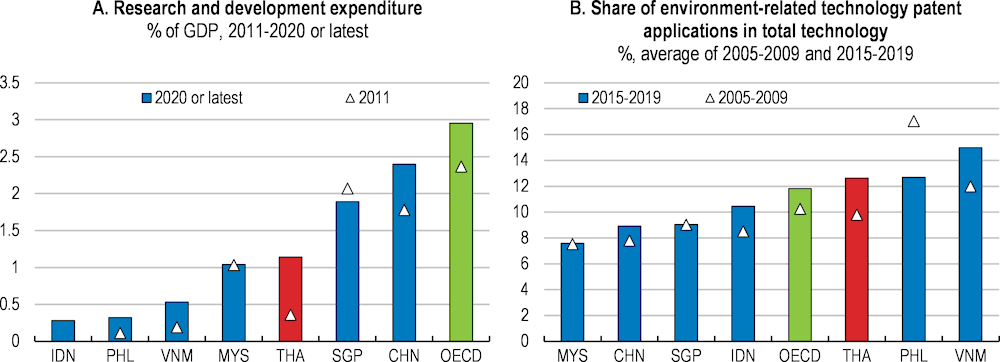

In this context, assessing Thailand’s current environmental regulations can be a useful starting point. The OECD has developed an Environmental Policy Stringency index that aims at capturing rigidity and intensity of a country’s environmental policy from three dimensions: market-based, non-market based and technology support policies (Box 2.2). The indicators compile information on some major policy tools, such as pollution standards and taxes. Calculations prepared for this chapter suggest that overall, Thailand’s environmental policies are less stringent than those of OECD countries, placing Thailand in a middle position vis-à-vis the emerging market economies for which data are available (Figure 2.10).

Like some of these peers, Thailand has increased its overall policy stringency over the past decade. One key example is the introduction of feed-in-tariff programmes for electricity from renewable sources. With respect to market-based instruments, however, Thailand’s policies are weaker than those of other countries. Carbon prices are low due to the voluntary nature of the emissions trading system and environmentally-related taxes are also low, with some at zero rates. With respect to non-market policies, Thailand has seen no change since 2010 when it tightened its air pollution regulations, in contrast to OECD countries where the restrictiveness of non-market policies has increased over the past decade.

Box 2.2. OECD Environmental Policy Stringency Index

There is a growing interest in cross-country comparisons of environmental policy instruments as many countries are setting environmental targets to tackle climate change. The cross-country comparison can help evaluate the impact of environmental policies on pollution as well as their economic and social effects, which is crucial for finding the effective policy tools and identifying relevant sectors. Provided that quantifying diverse environmental policies with a single index is not simple, the OECD developed the Environmental Policy Stringency (EPS) indicators based on selected environmental policy measures with a focus on climate and air pollution. Introduced in 2014 and revised in 2021, the indicators serve as a comprehensive index and enable the comparison of environmental policies across 33 countries in the periods of 1990 and 2020.

The EPS indicators are widely used in empirical studies and policy recommendations as one of the key benchmark indices on the stringency of an environment policy. Stringency is defined as the degree to which environmental policies place explicit or implicit costs on pollution or environmentally harmful behaviour. For example, new taxes on pollutants will directly raise the costs of polluting firms, and would be counted as more stringent environmental policy. New subsidies to R&D or price support to renewable energy can also be interpreted as more stringent environmental policy in a sense that such subsidies will increase the opportunity cost of polluting. The index aggregates market-based policies, non-market-based policies, and technology support with simple weighting of scores from 0 (no policy) to 6 (most stringent).

The index for market-based policies, accounting for one third of the overall index, consists of six sub-indices including, for example, taxation on CO2 emissions. Based on the threshold, each sub-index has a score range from 0 to 6. The non-market-based policies index uses the emission limit value (ELV) of four kinds of pollutants as a benchmark to estimate stringency. The technology support index reflects the R&D expenditure to GDP ratio as well as adoption support proxied by the level of price support for solar and wind energy technologies.

Figure 2.10. Environmental policies are less stringent than in OECD countries, China and India

Environmental Policy Stringency (EPS) Index, scale 0 (least stringent) to 6 (most stringent)

Note: Government R&D investment on low-carbon technologies is calculated based on the assumption that its share in the total government R&D investment is proportional to half of the share of environment-related patents in total patents.

Source: OECD, OECD Environmental Policy Stringency Index; OECD calculations.

Thailand has made progress in some areas that are not captured in the Environmental Policy Stringency index. A case in point is the new building energy code effective from 2018 that requires nine categories of buildings, such as offices and hotels, to ensure high energy efficiency through energy-efficient insulation, lighting, air conditioning, and hot water supply. In 2019, the regulation only covered newly constructed buildings with a total area larger than 10 000 m2 but was rapidly expanded to those with above 2 000 m2 by 2021. The government intends to introduce similar compulsory measures for manufacturing factories.

Introducing more stringent environmental regulations would be one way forward for Thailand, especially concerning air pollution. While there are large differences among OECD countries in terms of policy stringency both for market-based and for technology-support instruments, the stringency of non-market instruments has converged over the past decade. Some non-OECD countries, notably China and India, also introduced strong air pollution controls, including those on coal power plants, reaching levels similar to the OECD average. Against this background, Thailand’s non-market instruments are now less stringent compared not only to OECD countries but also relative to China and India. The convergence of policy stringency among OECD countries as well as some emerging market economies suggests that technologies to meet strict regulatory requirements have now become widely available at affordable costs. In terms of tailpipe emission regulation on newly sold motor vehicles, Thailand plans to move from EURO4 to EURO5 in 2024, which is a step in the right direction. Emission standards for coal power plants will also need to become stricter, potentially including an acceleration of the planned coal phase-out.

Table 2.1. Past OECD recommendation on air pollution

|

Recommendation in the past survey |

Measures taken since October 2020 |

|---|---|

|

Make the national standards for air pollution stricter in line with international standards. |

New ambient air standards have reduced acceptable PM2.5 levels from mid-2023. |

Achieving net zero will require specific strategies for each sector

Decarbonising the power sector by expanding renewable energy sources

The power sector is currently the largest emitter, accounting for around 35% of national CO2 emissions. Reducing emissions from electricity generation presents therefore the largest scope for action and should be the highest policy priority, notably through raising the use of renewable sources. The importance of reducing this kind of emissions is also underlined by the expected rising demand for electricity as electrification advances.

A rapid depletion of domestic natural gas reserves further strengthens this need to move towards renewable sources rapidly. Domestic gas reserves are expected to last only for 4.4 years (BP, 2021[32]). In 2020, 70% of the natural gas used in Thailand was domestically produced, and 80% of the total supply was consumed by the power sector. From the perspective of the sector itself, this implies that 60% of total energy consumption by the power sector came from natural gas.

Against this background, the use of renewable energy sources has been actively promoted for some time. In the Alternative Energy Development Plan 2018-2037, the authorities aim at increasing the share of renewable sources in power generation to 30% by 2037, from the current 17%. Among renewable sources, solar is expected to account for around 40% of total energy production from renewables, followed by biomass at 25% and wind at 10%. The draft Power Development Plan due for publication in 2023, a more ambitious target considers reaching 50% of electricity from renewable sources by 2037. Higher electricity imports, such as from the neighbouring Lao PDR that has abundant hydro-energy sources, are also planned and could complement the wider use of renewables in domestic power generation. Thailand could benefit from enhanced cross-border power trade within ASEAN (IEA, 2019[33]).

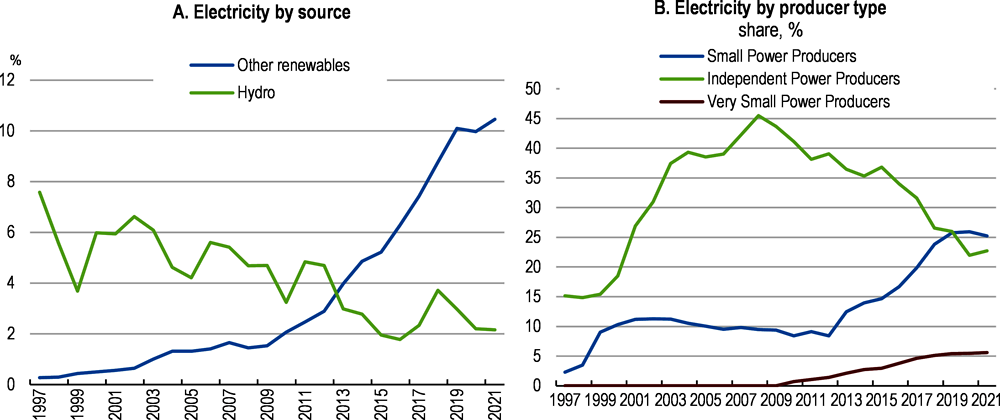

Past increases in the share of renewable sources in Thailand’s electricity generation have been significant, especially starting from the mid-2010s (Figure 2.11). The Electricity Generating Authority (EGAT), a state-owned enterprise, is the dominant power producer, accounting for around 45% of total electricity sales in 2021. Around one third of sold electricity was imported. EGAT also holds majority shares of some private power generators. Nevertheless, the generation market had been open to private actors, both large-scale independent power producers with capacity over 90 MW and small-scale producers with capacity between 10 and 90 MW (ERIA, 2019[34]). Feed-in tariffs were established for the first time in 2006, allowing electricity produced from renewables to be purchased above retail electricity prices. This allowed very small-scale producers with a capacity of less than 10MW to sell electricity directly to two state-owned distributors, the Metropolitan Electricity Authority (MEA) and the Provincial Electricity Authority (PEA). In 2013, the government introduced specific feed-in tariffs for roof-top solar electricity generation. In 2015, this was expanded to electricity generated from other renewable sources. These programmes successfully increased the share of renewables, especially solar.

Despite increases over the past years, the share of renewable energy sources in electricity generation is still low compared with peer countries (Figure 2.12). Further increases are planned in the 2018 Power Development Plan envisages raising the share of very small-scale power producers from currently 6% to 25%. While this will be useful if implemented as planned, it cannot replace a wider use of renewables among large-scale producers, most notably EGAT, whose own energy production is 93% from non-renewable sources, although its imports are mostly from hydro energy. While continuing to stimulate private investment, the government should also use its ownership position to promote renewable investments by EGAT (OECD, 2022[35]).

Figure 2.11. Renewable sources have increased in power generation

The expansion of renewables in large-scale electricity generation will require new instruments beyond feed-in tariffs. For example, renewable energy certificates and public tenders are widely used in a number of countries (IRENA, 2022[36]), (Ang, Röttgers and Burli, 2017[37]). Indonesia recently launched a renewable energy certificate programme and a state-owned power generator and sole distributor, Perusahaan Listrik Negara, participates in the programme (OECD, 2021[38]).

A wider use of renewable sources, which are typically more intermittent, will also require backup energy sources and investments into the power grid to accommodate more volatile electricity supply. These swings in supply which have caused technical difficulties such as over-voltage in the past (Gamonwet, Dhakal and Thammasiri, 2017[39]). Demand response, such as the time shift of peak demand through storage, could be required. The National Smart Grid Development Master Plan adopted in 2015 as a pilot project is meant to address these challenges.

Phasing out coal power would be a first important step and should be accelerated. The share of coal in total power sources is already lower than in other Southeast Asian countries, partly because of Thailand’s strong reliance on natural gas, and has hovered around 20%. Thailand has large domestic coal reserves, likely to last for around 80 years (BP, 2021[40]). However, similar to other countries, growing demand has been met by increases in imports. In 2020, imported coal accounted for around 80% of total supply (in energy terms) and half of that supply was used in the power sector. To achieve the net zero pledges, the authorities plan to phase out coal power by 2050 (Ministry of Natural Resources and Environment, 2022[15]), and announced the closure of a coal plant by state-owned enterprise. However, recent high international natural gas prices prompted the government to postpone the closure of the plant. The draft new Power Development Plan 2023-2037 no longer foresees the construction of any new coal plants. This is an important step but Thailand should prepare a clear phase-out plan for the existing coal power plants.

Thailand has abundant solar energy resources across the country with less seasonal fluctuations. In particular, the northeast and central regions covering 25% of the surface, are endowed with high irradiance sunlight. By 2022, the installed power generation capacity of solar power reached 3 GW, accounting for 25% of the total installed power generation capacity from renewable energy. The government plans to increase it to 12 GW by 2037. Previous studies suggest that a realistic estimate of the technical potential of solar energy would be around 17GW (IRENA, 2017[41]), although roof-top solar generation could be further expanded to 38 GW even if only 10% of the potentially available space is used (OECD/IEA, 2018[42]).

Figure 2.12. Thailand needs to increase the use of renewable energy sources

Electricity generation by source, TWh

In order to expand distributed renewable energy sources, Thailand introduced net-metering for roof-top solar in 2019, under which surplus electricity can be sold to the distributors with an annual accounting period. The uptake was initially low but has gradually been increasing. In 2021, the household sector added 7MW to its capacity, totalling 12MW, although still much lower than the potential.

The potential of roof-top solar could be exploited more than at present. Policies to reduce investment costs, such as tax incentives and subsidies, appear to be effective in a number of countries (IEA, 2019[43]). A higher feed-in tariff could enhance incentives for roof-top solar expansion without overcompensation or economic losses for power utility companies. Currently, the feed-in tariff is set at 2.2 THB/kWh for households and 1.0 THB/kWh for the hospital, academic and agricultural sectors, lower than the average wholesale price of 2.73 THB/kWh (OECD/IEA, 2018[42]). A number of countries have set the remuneration rate above wholesale prices but below retail prices, while shortening accounting periods to less than a year (IEA, 2019[43]). Retail tariffs could also be differentiated according to the time of day and aligned with the cost structures of power utility companies.

In the combination with storage, distributed roof-top solar electricity can provide greater demand-side flexibility. This is important because the high potential of renewable energy sources cannot be fully harnessed without addressing misalignment in peak hours of demand and supply. Previous studies suggest that smart electric vehicle charging for example, which has become widely available at affordable costs, could help shift Thailand’s peak demand from the evening hours to the daytime, when more solar photovoltaic energy is produced (OECD/IEA, 2018[42]). This could also reduce fuel consumption by conventional power producers in the evening hours. Increases in the self-consumption of solar photovoltaic electricity can also accelerate the cost recovery of household investments in storage.

Wind energy potential is also large despite monsoon-related seasonal fluctuations. Although most potential generation locations are far away from high demand areas, the northeast, western and southern regions have strong potential. The Gulf of Thailand also has potential with an average wind speed of 6.4 meters per second at 50-meter height. Previous studies suggest that technical potential across the country could reach 6 GW, but be expanded to 17 GW, if advanced turbine technologies are used (IRENA, 2017[41]). The technical potential is far larger than the current installed capacity of 1.5 GW in 2021 and the planned capacity of 3 GW in 2037.

Expanding renewable energy generation will require further investments, which will require a need to attract increasing amounts of private financing. That in turn will require policy certainty and stable framework conditions. When regulatory frameworks change frequently, or unexpected ad-hoc policy interventions led to less predictable business conditions, investors will demand risk premiums that can raise the economic costs of the green transition unnecessarily. Frontloading the regulatory reforms and defining the broad contours of the business environment early on will help to minimise the costs of reaching net zero.

Enhancing grid connection across areas is also important for an efficient use of solar and wind energy, whose production is unevenly distributed among regions and not necessarily taking place in high-demand areas. This would require additional investment by the network operator EGAT. In Chile, government investment to connect renewable-intensive regions with high demand centres stimulated a significant expansion of renewables in the former areas (Gonzales, Ito and Reguant, 2022[44]). In the case of Thailand, transmission planning and renewable energy promotion are conducted separately by different government departments. Expanding renewable energy would require more coordinated planning between the two to avoid concurrent under-investment in transmission and renewables (OECD/IEA, 2018[42]). In particular, location-specific considerations should be taken into account for transmission planning.

Table 2.2. Past OECD recommendation on green infrastructure

|

Recommendation in the past survey |

Measures taken since October 2020 |

|---|---|

|

To attain a sustainable high growth path, invest in green infrastructure, particularly strengthen the capacity of renewable energy production. |

The Ministry of Energy developed a medium-term plan for smart grid commercialisation. |

Reforming energy markets as a precondition for price signals to work

The electricity sector remains subject to restrictive rules on market entry and prices, which will eventually stand in the way of using price signals to guide the expansion of renewable electricity sources and shifts in consumer behaviour.

While generation is open to independent power producers, the state-owned Electricity Generating Authority of Thailand (EGAT) is the sole transmitter. Distribution is dominated by two state-owned enterprises, both under the egis of the Ministry of Interior. Prices are regulated and government approval is required for price changes by distributors, namely three state-owned enterprises, although electricity prices are updated regularly in line with changing market conditions, such as overall input costs and fuel costs.

The experience of EU countries highlights the potentially positive link between competition and the expansion of renewables. Portugal, for example, opened up its electricity market since the mid-1990s, unbundling transmission, distribution, generation, and end-user supply (OECD, 2019[45]), (OECD, 2012[46]). This helped increase supply form renewable sources, which account for more than 50% of electricity generation today. Enhancing the scope for competition among several actors in Thailand’s electricity sector is likely to create a more fertile ground for the expansion of renewable energy sources. The recent introduction of a pilot programme under which consumers can purchase green electricity at premium rates is one step towards a further market-driven expansion of renewable energy sources.

Creating a transparent wholesale market is an important steppingstone for developing a competitive electricity market. Currently, wholesale prices are flat across the country and throughout the year. Allowing wholesale prices to reflect cost differences across time and location can provide the right signals for investors and generators and guide investment decisions (OECD, 2022[47]). In particular, introducing cost-based location-specific wholesale prices would make fossil fuels more expensive in areas where the actual cost of shipping these fossil fuels such as coal and gas is higher. That could make renewable energy sources more attractive in such areas, even if they are away from demand centres. This systematic price gap in different locations could also incentivise the two state-owned distributors to increase the electricity purchase from more regionally dispersed roof-top solar production (OECD/IEA, 2018[42]).

In addition, reducing price regulation in the electricity market is a precondition for effective carbon pricing. If wholesale and retail electricity prices are heavily regulated, the carbon price signal will have limited impact on investments and consumption. Experience from other countries suggests that a gradual transition is a viable option, introducing more flexible price structures over time (IEA, 2020[48]). In Korea, where retail electricity prices are regulated, the emission trading system includes end-users’ indirect emissions to incentivise them to use electricity more efficiently. In California’s cap-and-trade system, private electricity utilities are required to sell the freely allocated allowances in the trading system and repurchase them, which helps carbon price discovery, while part of the revenues from this trade is used to maintain retail prices stable.

In sharp contrast to electricity markets, the scope for market forces in other parts of the energy sector over the past decade. This includes lower degrees of price intervention as retail price caps and import restrictions on natural gas for vehicles and liquefied petroleum gas have been removed. Private companies are now allowed to import liquefied natural gas, which was previously a public monopoly. The removal of these price caps occurred in tandem with third-party access to natural gas pipelines owned by a government-owned energy company. Price caps have been temporarily re-introduced as an emergency measure for the pandemic since 2020, but as the economy is now recovering strongly, these temporary measures should be removed quickly.

For as long as natural gas is still used for electricity generation, some current regulations could be reviewed to reduce emissions. Under the current long-term power purchase agreements, private power generators with conventional energy sources are required to maintain high minimum generation levels. In addition, EGAT is obliged to use a certain amount of natural gas that is purchased from PTT. While these requirements have contributed to stable electricity supply in the past, they could now become constraints on the expansion of renewable sources, which requires flexible supply adjustments by conventional power generators (IEA, 2021[49]), (OECD/IEA, 2018[42]). Moreover, Thailand maintains high levels of capacity margins of around 30% for security reasons (IEA, 2021[49]), and requires large-scale private power generators from conventional energy sources to secure excess capacity, which may be pushing up wholesale prices unnecessarily.

Reducing transport emissions

The transport sector is the second-largest source of CO2 emissions, and the continuous strong increase in emissions have made transport, and in particular road transport, increasingly central in the quest towards net zero targets. In the short run, improving the energy efficiency of internal combustion engine cars, i.e. through better fuel economy, can reduce fossil fuel consumption and CO2 emissions from transport. In the medium term, policies should strongly promote public transport and zero-emission cars.

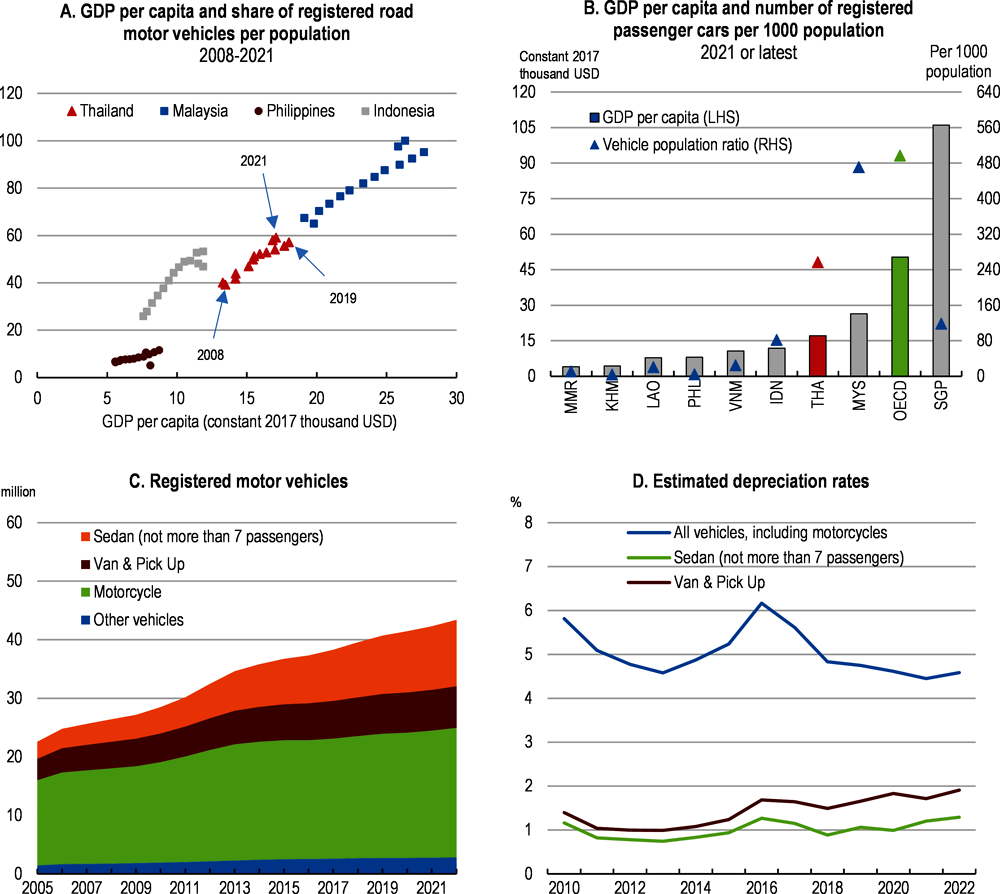

The rapid advancement of motorisation makes transforming road transport into a greener sector a challenge, but it is also an opportunity. Like many other emerging market economies, the number of motor vehicles per population has been steadily increasing over the years (Figure 2.13, Panel A). Thailand has a large automobile production that is strong in exports but also contributes to the evolution of the domestic market. Domestic new motor vehicle sales have been robust with annual sales of new passenger cars hovering around 450 thousand between 2015 and 2019. Given a still rather low level of passenger car ownership (Figure 2.13, Panel B), the rise of the motorisation rate is expected to continue in the coming decades in line with rising incomes (ASEAN Secretariat, 2019[50]). This implies that inflows of new cars in the domestic market will also be increasing.

At the same time, the rapid motorisation is also associated with increases of old car stock. As new cars are still out of reach for many households, the used-car market is evolving especially for passenger cars. While the stock of passenger cars is growing rapidly, the number of transferred registrations has exceeded that of new registrations. As a result, vehicles remain in operation for a long time, reflected in a low estimated depreciation rate (Figure 2.13, Panels C and D). A strong demand for used cars will imply a slow replacement of the existing old stock and vehicles with low fuel efficiency or high emissions will likely remain on the road for many years to come.

The government has stepped up policy measures to improve fuel economy and emissions standards of newly sold cars. Building on a strong automobile manufacturing base, Thailand has one of the most advanced policy settings in the region (ITF, 2022[51]), (ASEAN Secretariat, 2019[50]). Labelling of fuel economy and CO2 intensity has been mandatory for new cars since 2016, and their measurement is based on an advanced international benchmark, the United Nations Regulation No. 101. A one-off registration tax on new cars has been applied at different tax rates based on their CO2 emission intensity per kilometre as of 2016. Importing used cars is banned. From a perspective of reducing the emissions of the vehicle fleet, this ban may be helpful currently as used cars are generally older models with low fuel efficiency and high emission intensity, but this may no longer be the case as the market for used EVs expands in the future.

The next step would now be to introduce minimum regulatory requirements on fuel economy and CO2 emissions of newly sold cars, especially passenger cars. This regulation could also be applied to a car fleet. Given the expanding passenger car fleet, policies that can improve the green footprint of today’s new cars is important as these vehicles could be used as second-hand cars for a long period. Adding minimum regulatory requirements for fuel economy and CO2 emissions of new cars to the existing policy mix can enhance the whole policy framework (ITF, 2022[51]). Previous studies based on data from the United States suggest that such requirements would likely have large effects: the impact of a 10% increase of the US Corporate Average Fuel Economy standards would be 2-3%, while a 100% increase of gasoline prices could increase the average vehicle fuel efficiency by 6-11% (Tikoudis, Mebiame and Oueslati, 2022[52]). By 2015, around 90% of the global market were under some regulatory requirements (ASEAN Secretariat, 2019[50]). China has progressively tightened its minimum fuel economy requirements for newly sold cars since 2005, achieving an annual 1.3% reduction in fuel consumption per kilometre by 2019 (IEA, 2021[53]). For newly sold light-duty vehicles, Thailand has imposed emission standards at the EURO 4 level since 2012. Around 95% of in-road vans and pick-ups are diesel-powered.

Figure 2.13. Motorisation is advancing in Southeast Asian countries

Note: On Panel A, motor vehicles include motorcycles. On Panel B, the OECD average is calculated as an average of 30 members where data are available. On Panel D, the depreciation rate is calculated from the following equation: (Registered vehicles of year t) = (Registered vehicles of year t-1)*(1 - depreciation rate) + (Newly registered vehicles in year t)

Source: ASEAN, ASEANStatDataPortal; World Bank, World Development Indicators; Department of Land Transport, Vehicle Registration Information; OECD, OECD.Stat.; and OECD calculations.

Given the growing stock of used cars, enhancing the annual vehicle tax, a recurrent tax on car ownership and use, could encourage the phase-out of vehicles with low fuel economy or high emissions. A number of OECD countries levy recurrent taxes on car ownership and use based on environmental considerations such as fuel efficiency and emission intensity, with lower rates for hybrid or electric vehicles (OECD, 2022[54]). In Thailand, the annual vehicle tax is based on vehicles’ engine size, age and weight. The tax rate declines with the age of the car. However, aged cars typically entail high environmental costs. Japan imposes an additional 10% on diesel fuel cars aged over 11 years and gasoline cars aged over 13 years. Thailand could raise the annual vehicle tax rate for aged cars, although linking the tax rate more directly to fuel economy and CO2 emissions would be preferable (ASEAN Secretariat, 2019[50]).

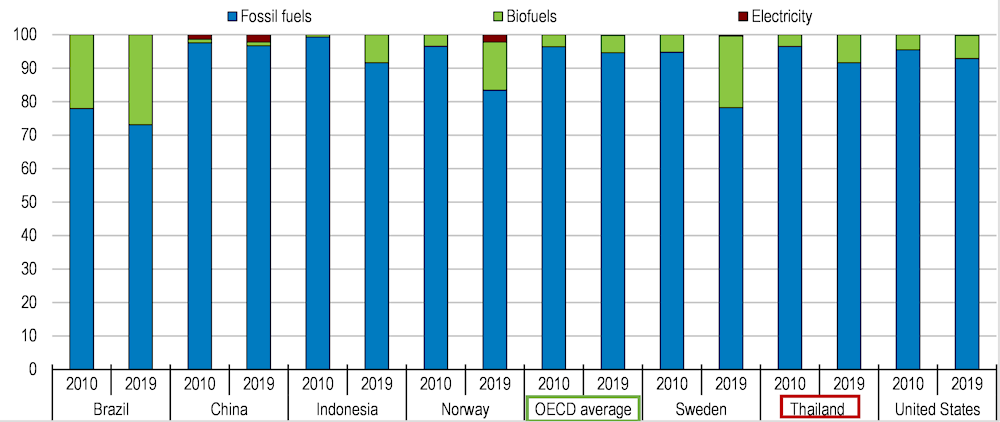

The increasing use of biofuels has contributed to containing the acceleration of CO2 emissions from transport (Pita, Winyuchakrit and Limmeechokchai, 2020[55]). Molasses, sugar cane and cassava are used to produce bioethanol, while biodiesel is mostly made from palm oil. Thailand has promoted biofuel blending in transport fuels. Biofuel consumption in road transport almost tripled between 2010 and 2019, accounting for around 75% of total biofuel consumption in 2019. Gasoline with 10% of ethanol (E10) was first introduced in 2003 and highly blended gasoline at 20% (E20) and 85% (E85) became available as of 2010. The biodiesel blending rate in diesel has been raised gradually from 5% (B5) since 2005 to 10% and 20% (B10 and B20), although B20 is only for heavy-duty vehicles. Biofuel blending is being promoted through differentiated excise tax rates according to blending rates, while the new vehicle registration rate has a discount for biofuel compatibility. Biofuel blending in diesel became mandatory in 2011, raised from 7% to 10% in 2020. However, older vehicles can still use B7 diesel, and the mandatory 10% rate was temporarily reduced in 2021 in an attempt to stabilise retail diesel prices.

The usage of biofuels could be further promoted, to the extent that this can reduce emissions. The government plans to gradually phase out low-blending-rate fuels such as E10 and B7, intending to make E20 gasoline the main product by the mid-2030s. Phasing in higher mandatory blending rates more rapidly could be considered, especially as all vehicles produced in Thailand as of 2008 need to be compatible with E20 gasoline. Some countries have increased the usage of biofuels in road transport with remarkable success (Figure 2.14). Indonesia raised its mandatory blending rate of ethanol in gasoline from 5% to 10%, although these new rules are not yet enforced, and biodiesel from 20% to 30% in 2020, while planning to increase the mandatory rate of ethanol further to 20% by 2025 (United States Department of Agriculture, 2022[56]). The Indonesian government also aims for a high 40% biodiesel blending, although such high rates require technology advancement to avoid engine deterioration (IEA, 2022[57]). Sweden reduced the energy and carbon tax for biofuels as early as 2007, later modified to apply only to high-blending-rate fuels such as 85% or 100% as of 2018. Since then fuel suppliers are required to reduce CO2 emissions from fuels by a certain rate every year though blending biofuels (IEA, 2021[58]), (The Ministry of Infastructre, 2020[59]).

The sustainability of biofuels is an important element to consider in each specific case. The life cycle GHG emissions of biofuels typically range from around 30% to nearly 100% of those of fossil fuels (IEA Bioenergy, 2023[60]). In addition, a rapid expansion of biomass feedstock production could result in inefficient land use and degrade biodiversity. This latter argument does not apply to producing biofuels from agricultural residues and waste, which can also help ease domestic supply constraints. Nascent technologies are available for this but need to be improved through research and development.

Current restrictions on imports of biofuels could be eased, especially as domestic biofuel supply has been volatile due to weather and other conditions that cause supply fluctuations of feedstock (OECD/FAO, 2022[61]), (United States Department of Agriculture, 2022[62]). Despite a progressive expansion of biofuel production, the government has struggled to secure sufficient feedstock crops to meet biofuel blending targets (Koizumi, 2014[63]). Higher mandatory blending requirements would only make sense if sufficient supply of sustainable biofuels can be ensured.

A strong shift to electric vehicles will be necessary to achieve the net zero targets. Even if transport is placed outside of an emissions trading system (ETS), electrification of the transport sector can accelerate decarbonisation of the whole economy through higher demand for electricity generated from renewable sources, on the condition that the power sector is included in the ETS. In addition, using electric vehicles is more energy-efficient than conventional vehicles, as they consume one third of energy per kilometre compared with internal combustion vehicles (Lindberg and Fridstrøm, 2015[64]).

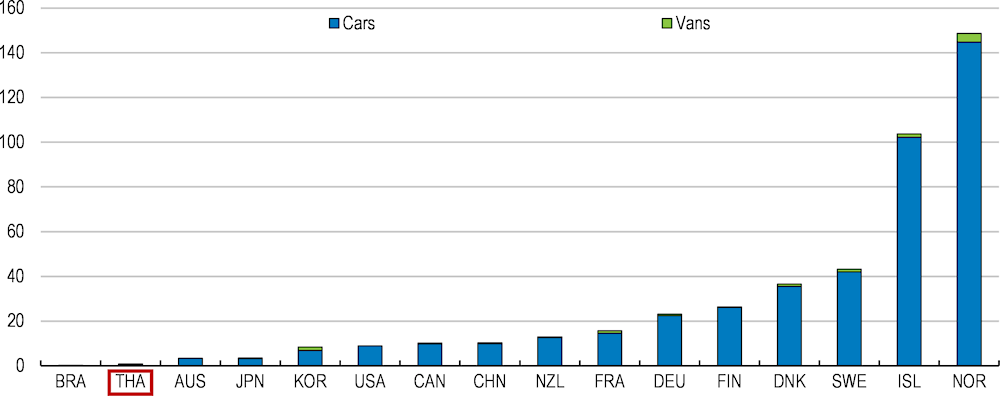

Lowering both upfront capital and running costs can stimulate demand for electric vehicles. Despite the recent decline, sales prices of electric vehicles are higher than those of internal combustion, with a typical price differential in the range of 40-50% in the case of Europe and the United States in 2021 (IEA, 2022[65]). Some countries have dramatically boosted the penetration of electric vehicles over the past years (Figure 2.15).

Figure 2.14. Energy consumption by product type

Road transport, %

Note: Energy consumption is measured in the tonne of oil equivalent (ktoe).

Source: IEA World Energy Balances.

Thailand aims for boosting new registrations of zero emission vehicles. Policy levers used include rebates in excise and annual vehicle taxes as well as import duties for electric vehicles. Subsidies for electric car purchase amounting to USD 2000 or 4300 per car were also introduced in 2022. Simple calculations suggest that to increase the share of zero emission passenger cars in new registrations from the current 2% to 100% by 2035, the new registrations need to grow by 37% each year. Some mature markets have seen such strong growth of electric vehicle sales. In Germany, the share of electric vehicles in new car sales increased from 1% in 2016 to 26% in 2021, while, in Norway, it continued to grow from 29% to 86% during the same period (IEA, 2022[66]).

Figure 2.15. The electric vehicle market is still nascent in Thailand

Electric vehicles stock per thousand of population, 2022

Note: Electric vehicles include battery electric vehicles and plug-in hybrid electric vehicles. For Thailand, vans are defined as microbuses, passenger vans, other vans and pick up cars. Cars are defied as vehicles under the Motor Vehicle Act, excluding vans and motorcycles. As of end 2022, there were 56 636 cars and 78 vans in Thailand. For the other countries, vans are defined as light commercial vehicles with gross vehicle weight below 3.5t.

Source: IEA, Global EV Outlook 2023; World Bank, World Development Indicators; Department of Land Transport, Vehicle Registration Information.

In Thailand, although the registrations of zero emission passenger cars increased by 130% in 2022, this was mostly related to the low starting point and keeping up high sales growth will likely require strong policy support and a rapid price decline. Without accelerating the replacement of older internal-combustion cars, only around one fifth of registered vehicles would be zero emission cars by 2035. Building on the strong international manufacturing hub of conventional vehicles, the government intends to raise the domestic production capacity for electric vehicles, aiming for a share of 30% by 2030. This could reduce production costs of electric vehicles and improve domestic EV sales.

Increasing the number of charging stations across the whole country is crucial to address users’ range anxiety associated with electric vehicles. Thailand had around 1500 public charging stations as of 2021 (IEA, 2022[65]) and aims at increasing the number almost tenfold by 2030. Norway’s experience suggests that, while the government has provided financial support since 2010, private operators have been active in building fast-charging stations (D’Arcangelo et al., 2022[2]). Korea is another example highlighting the role of public financial support to increase the number of charging stations (IEA, 2022[65]). One private Thai operator already runs more than 400 stations and the state-owned electricity company EGAT also plans to install charging stations across the country (Khan et al., 2022[67]). In Thailand, there may be a case for focusing government support on remote areas, given the limited government financial resources. In addition, regulations could complement government support. In Canada, for example, local governments require that operators should install charging stations at petrol stations and in commercial carparks (OECD, 2023[68]).

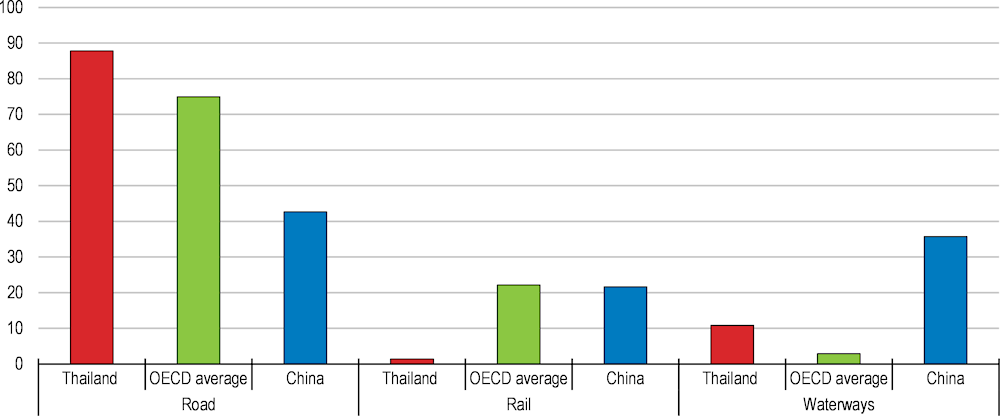

Public transport, especially rail transport, will also need to play an increasing role in reducing transport emissions. This can also contribute to greening the logistics sector and could raise Thailand’s industrial competitiveness. Improving public transport can also be an essential tool to facilitate a just transition, as low- or zero-emission vehicles would not be affordable for the poorest households. Similar to other emerging market economies, roads are the main mode of transport for people and goods, while the public transportation system is rather weak (Figure 2.16). Less than 20% of intercity rail networks are double- or triple-track, which limits transportation capacity. Underinvestment in infrastructure, including operation systems such as signals, undermines transport efficiency. Most intercity railways are not electrified and the scope for greening rail transport is large.

Although most railways are owned by the state-owned enterprise, improving public transport will require more investment from both the private and public sectors, including through public-private partnerships and foreign investments. The Transport Infrastructure Development Strategy 2015–2022 intended to allocate THB 1.9 trillion (11% of GDP) to a number of projects, including expanding double-track intercity rail networks and connecting key production areas to neighbouring countries. More recent plans envisage developing 177 railway stations throughout the country. However, around 80% of the government budget is allocated to road network development. In this context, putting more emphasis on inter-mode operability, i.e. the connection between rail and other transport systems, such as public bus or private cars, which is currently weak, could increase the investment impacts.

Urban public transport in the Bangkok Metropolitan Region has progressively developed. However, compared to the growing population in the region, the number of people who use public transport remains limited, resulting in persistent traffic jams. The Mass Rapid Transit Master Plan intends to build 12 additional lines (509 km) of new urban railways. In order to reduce urban road transport congestion, congestion charges could be an effective tool to be considered (van Dender, 2019[69]). In Singapore, a road charge is automatically levied on car users through an electronic system when they use expressways and main urban roads (Theseira, 2020[70]). The time-varying charge rates are reviewed every quarter to keep traffic speeds within certain ranges.

Figure 2.16. Rail freight transport accounts for a small share in in Thailand

Inland freight transport, share, %, 2019

Note: Calculations are based on tonne-kilometre data. The OECD average is calculated as an average of 26 members where data are available. Air and pipeline transport is not included.

Source: ASEAN Railways, Data & Statistics; ITF Transport Statistics.

Reducing emissions from agriculture

GHG emissions from agriculture constitute 15% of the country’s total GHG emissions. Half of agriculture GHG emissions stems from rice farming, and livestock accounts for around one fourth. Like in many countries the agricultural sector lags behind other sectors in terms of GHG emission reduction. Setting out a long-term strategy for the sector's transformation is thus increasingly important.

Low-emission technologies and practices for rice farming exist, but their uptake could be accelerated. Thailand has promoted rice cultivation techniques that generate less methane emissions, such as an “alternative wetting and drying” method that intermittently wets rice fields rather than keeping them wet, to reduce methane emissions by 30%-70%. This technique could be applied more widely, possibly with public support during a transition phase.

Improving access to irrigation water may also help. Currently, less than 30% of farmers have access to irrigation system, limiting their production period in the year (World Bank Group, 2022[71]). Better access to water can improve the crop yields of small-scale farmers who depend on dryland agriculture, potentially helping them to diversify crops. Improved irrigation systems can also strengthen the sector's climate resilience, especially among small-scale farmers.

Boosting agricultural productivity through greater scale of production can also contribute to reducing emissions. Most farmers are small-scale producers, and their income levels are low (World Bank Group, 2022[71]). Evidence from a government extension programme suggests that large-scale collective rice farming is more productive and emits less GHG emissions than small-scale individual farmers (Arunrat et al., 2021[72]). Diversification of production into higher-value crops may also offer opportunities to reduce emissions (World Bank Group, 2022[71]).