The Assessment and Recommendations present the main findings of the OECD Environmental Performance Review of Israel. They identify 24 recommendations to help the country make further progress towards its environmental objectives and international commitments. The OECD Working Party on Environmental Performance discussed and approved the Assessment and Recommendations at its meeting on 5 December 2022.

OECD Environmental Performance Reviews: Israel 2023

Assessment and recommendations

Abstract

1. Towards sustainable development

Israel’s fast economic and population growth along with a high degree of urbanisation in a land- and water-scarce context continue to exert significant pressure on the environment. Israel’s carbon footprint was increasing steadily over 2014-20 but started to decline in recent years. Both total and per capita greenhouse gas (GHG) emissions and air emissions of key pollutants have decoupled slowly from gross domestic product (GDP), mostly due to the rapid replacement of coal by natural gas in the energy mix. However, the country’s biodiversity continues to suffer from habitat fragmentation, invasive alien species, over-exploitation of water resources and pollution. The average temperature in Israel is projected to rise by 4.4ºC by the end of the century. This will put additional pressure on quality of human life and ecosystems.

The government launched a multi-sectoral process "Israel 2050 – a thriving economy in a sustainable environment" in 2019. The resulting strategy on the "Transition to a Low-Carbon Economy" includes national and sectoral GHG emissions reduction targets and sector-specific implementation plans. The strategy also aims to optimise the way the country uses energy and other resources, shift from fossil fuels to renewables in the power sector, make transport and industry run on electricity and end waste landfilling. The central government dominates most aspects of environmental policy implementation, leaving little space for local initiatives beyond providing waste management services.

Addressing key environmental challenges

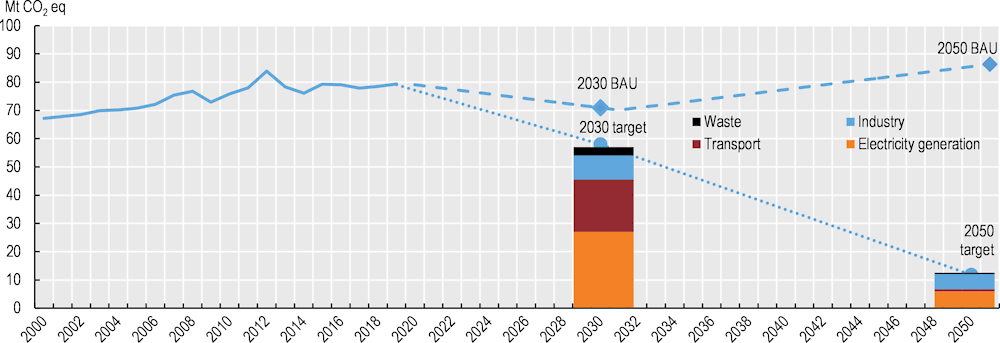

Climate ambition has grown but is not supported enough by sectoral policy measures

Israel has raised its climate ambitions in recent years. In 2021, it updated the national GHG emission reduction target for 2030 from one based on per capita reductions to an absolute target of a 27% reduction compared to 2015. It also set an 85% reduction target for 2050, as well as sectoral targets for GHG emissions from electricity generation, solid waste, transport and industry, before declaring the overall ambition of carbon neutrality by 2050. Israel is not on track to reaching these targets with existing measures (Figure 1) and will need to introduce additional ones across all sectors. The draft Climate Law approved by the government in May 2022 is an important step in this direction.

Figure 1. Meeting the 2030 and 2050 climate targets will require substantial new measures

Note: GHG emissions exclude land use, land-use change and forestry. Dashed lines refer to emission projections according to the business-as-usual (BAU) scenario. Dotted lines refer to trajectories towards 2030 and 2050 GHG reduction targets with abatement measures according to Government Decision 171/2021.

Sources: Country submission; Government of Israel (2021), Updated Nationally Determined Contribution under the Paris Agreement; OECD (2022), "Air and climate: GHG emissions by source", OECD Environment Statistics (database); UNFCCC (2022), Israel National GHG Inventory 2021.

Electricity production is the largest source of GHG emissions in Israel, accounting for 49% in 2019. The share of natural gas in electricity generation rose from 37% in 2010 to 69% in 2021, driven chiefly by the discovery of off-shore natural gas reserves. All coal-fired power plants are scheduled to be shut down by 2026.

Despite a vast climate potential for solar power generation, renewable sources accounted for a meagre 8% in electricity production and 5% in the total energy supply in 2021. The country’s share of renewables in the energy mix is the second smallest in the OECD. The solar generation capacity has been expanding in recent years. However, it is facing barriers of limited land availability, transmission grid constraints and onerous permit procedures. Israel aims at increasing the share of renewable (predominantly solar) energy in electricity generation to 30% by 2030. In May 2022, the Ministry of Energy published a roadmap for achieving this target.

Transport is the second largest contributor to emissions after electricity (24% of Israel’s emissions in 2019). Car dependency is high because of the limited public transport available and the rapidly expanding residential sector. The central government regulates public transport in Israel whereas local governments would be better placed to address their communities’ transport needs (OECD, 2020a). In 2020, electric vehicles in Israel accounted for only 0.1% of the total, partly due to the poor charging infrastructure (Liebes et al., 2018).

GHG emissions from the buildings sector have also been on the rise. While there has been a real energy efficiency improvement in the commercial-public sector, the energy intensity of the residential sector has increased. The Israeli Sustainable Building Standard was mandated for most new buildings in 2022, but there are no energy efficiency targets for existing buildings.

Climate change adaptation efforts are at an early stage

In 2018, the government created a Climate Change Adaptation Administration (CCAA) under the Ministry of Environmental Protection (MoEP) to elaborate strategies and action plans to increase Israel’s resilience to climate change and develop respective adaptation tools. However, the CCAA lacks authority and financial resources to implement adaptation actions (State Comptroller, 2021). Climate change has recently been integrated into the aggregate national threat assessment. However, climate change adaptation measures tend to focus on technological rather than nature-based solutions to prevent flooding, drought or other climate change-induced natural disasters. Few municipalities are proactive in adaptation efforts.

Air pollution remains a problem in several areas

Emissions of all key air pollutants have been steadily declining over the last decade due to reduced combustion of coal and implementation of the 2011 Clean Air Law. However, the exposure to particulate matter pollution – PM2.5 and PM10 – is one of the highest in OECD countries, partly because of Israel’s proximity to the Sahara and the Arabian deserts. In 2021, transport was responsible for 31% of PM10 emissions, while industry and waste burning accounted for 18% and 21%, respectively. Waste burning is particularly problematic in rural areas due to lack of appropriate waste management infrastructure and enforcement. There are also hotspots of nitrogen oxides, ground-level ozone and benzene.

The 2022 national programme for the reduction of air pollution sets new emission reduction targets for 2030. It envisages further conversion of coal-fired power plants to natural gas, prevention of waste burning in open areas and a range of actions in the transport sector. Low-emission zones (LEZs) for some categories of polluting vehicles have already been implemented in Jerusalem and Haifa. However, there are no immediate plans to introduce taxes on air pollutants.

Biodiversity is under pressure from housing and infrastructure development

The increasing demand for new housing and infrastructure is causing more pressure on open natural landscapes and adding to land scarcity and habitat fragmentation. The significant increase in development of settlements and infrastructure is affecting biodiversity more than ever. Outside protected areas, most vulnerable ecosystems are under significant stress. More mammal species are threatened (as a share of total indigenous mammals) in Israel than in any other OECD member country. Invasive alien plant and animal species cause a significant negative impact on biodiversity and ecosystems. It is expected that climate change will put further pressure on biodiversity.

Israel completed its first national ecosystem services assessment in 2021 and published its latest State of Nature Report in 2022. It intends to adopt a new National Biodiversity Strategy and Action Plan by the end of 2022 and set measurable biodiversity targets compatible with the Convention on Biodiversity's Post‑2020 Global Biodiversity Framework. Some ecological corridors have been integrated into spatial plans. Israel has made substantial progress over the last decade, expanding terrestrial protected areas and establishing marine ones. About 25% of Israel’s land area was protected as of mid-2022, but only 4% of its territorial waters. Importantly, the country does not have a whole-of-government approach to mainstreaming biodiversity considerations into sectoral policies. The legislation relevant to biodiversity protection spans different laws and provides partial prevention and protection measures.

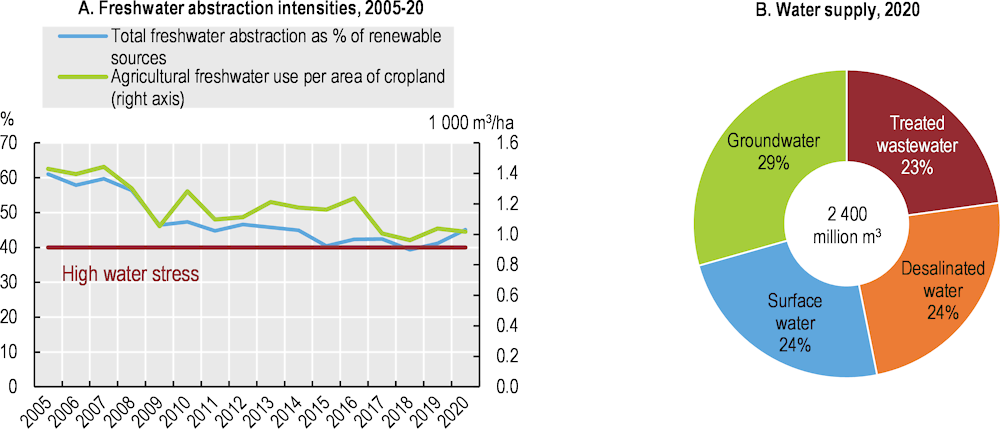

Pressure on freshwater resources is easing, but water quality needs improvement

Israel is one of the most water-stressed countries in the world, with agriculture accounting for over half of water consumption. To address water scarcity, it has invested massively in large-scale reuse of wastewater and desalination of seawater, which together account for almost half of the total water supply (Figure 2). Israel is the largest user of recycled effluent water for agriculture across OECD member countries.

Figure 2. Wastewater reuse and seawater desalination are reducing freshwater scarcity

Note: Panel A – Water stress = total freshwater abstraction as percentage of total renewable water resources. A water stress higher than 40% indicates serious water scarcity and shows unsustainable water use.

Source: CBS (2021), "Water and sewage", Statistical Abstract of Israel 2021 – No 72; OECD (2022), OECD Environment Statistics (database).

Israel has made significant progress in improving water allocation among sectors and to nature by developing and implementing river plans and providing incentives to farmers to minimise upstream water abstraction. Efforts to rehabilitate surface water bodies need to continue. Reduced wastewater discharges have improved water quality in rivers and in Lake Kinneret. However, Israel has not met its target to have tertiary treatment at all its wastewater treatment plants. Nitrate pollution of groundwater caused by extensive fertiliser use in agriculture remains a problem.

Environmental governance and management

Israel’s environmental governance system is centralised: the MoEP employs about 60% of all environmental personnel in the country. The MoEP manages a wide portfolio of environmental issues, but its co-ordination with other ministries with environment-related responsibilities is at times ad hoc and mostly informal. Many local authorities pool resources to deliver waste management services. A quarter of local authorities do not have an environmental unit.

The environmental regulatory framework is fragmented and in part outdated. Political instability in recent years has impeded efforts to upgrade the legislation, creating regulatory uncertainty for businesses. The adoption of good practices for implementing environmental law has been slow, mostly due to a lack of resources.

Coverage of environmental assessment is partial

The field of application of environmental impact assessment remains significantly narrower than in the European Union: it is not required for several categories of installations or for facilities in industrial zones. Spatial plans undergo environmental assessment. However, there is no system of strategic environmental assessment of policies, plans and programmes.

The environmental permitting reform is incomplete

The country’s environmental permitting system is governed by several disparate laws and is not integrated across environmental media. The Environmental Licensing Bill approved by the government in March 2022 would make operators subject to one permitting procedure and consolidate several disparate environmental permits into one that would include most environmental conditions (except for wastewater discharges into water bodies). The law would be an important step towards cross-media substantive integration of environmental permit conditions on the basis of best available techniques. However, the law’s adoption in the Knesset is uncertain. At the same time, Israel is streamlining environmental requirements for lower-risk facilities by adopting general binding rules for a growing range of activity sectors.

Compliance assurance is improving but remains mostly reactive

The MoEP’s compliance monitoring and enforcement capacity has increased over the last decade but remains insufficient. Compliance monitoring is dominated by reactive site visits prompted by incidents or complaints. Many offences are not documented or reported at all. A new electronic system for inspection reporting was piloted in 2022. It is expected to improve inspection co-ordination across the ministry’s district offices and provide access to comparable compliance data.

The duplication and inconsistent entry of compliance data impair the MoEP’s ability to take appropriate enforcement actions. In over half of reported non-compliance cases, no administrative or criminal sanctions are applied (State Comptroller, 2019). The collection of most administrative fines has improved, but monetary penalties are fixed in law and do not allow for recovery of economic benefits of non-compliance. The MoEP is only starting to engage in compliance promotion, mostly by informing the public about enterprises’ environmental performance.

Remediation of contaminated sites is hindered by a regulatory gap

Israel has made progress in creating a methodological and institutional framework for remediation of contaminated sites. The MoEP has determined threshold values for various contaminants and published a national map of contaminated soils throughout the country. However, draft legislation on preventing and remediating land contamination has been stalled for many years due to opposition inside the government. The issue of securing funds for remediation of the contaminated environment remains unresolved. The state pays for clean-up of priority sites contaminated by state-owned entities. However, remediating sites where the responsible party is either unknown or insolvent is a challenge in the absence of appropriate legislation.

Economic instruments and investment for green growth

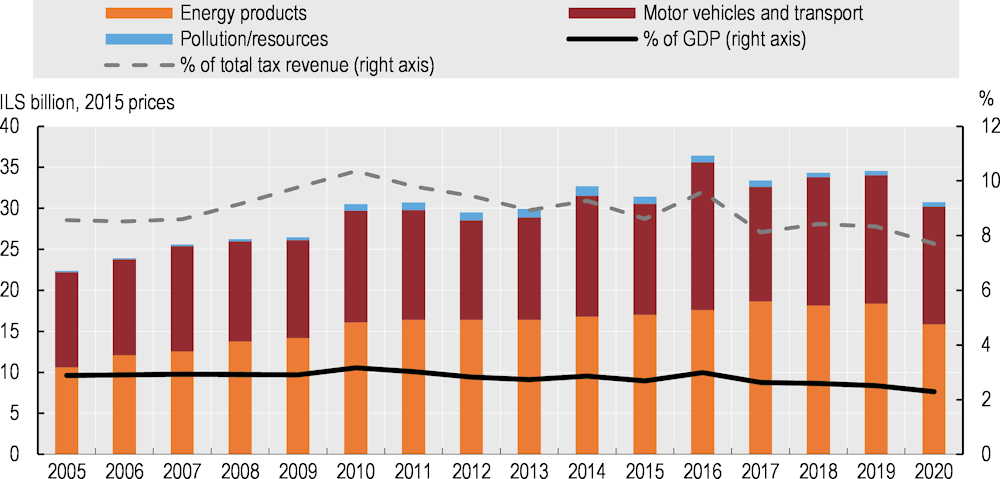

Taxes and charges increasingly account for environmental externalities

Environmentally related tax revenue represented 2.3% of GDP and 7.7% of total government revenue from taxes and social contributions in 2020 (Figure 3). This is relatively high compared to the OECD average. However, Israel has the second lowest share (after New Zealand) of energy taxes in environmentally related taxes among OECD member countries – the OECD average share is 70% – due to both relatively low energy taxes and high vehicle taxes.

Figure 3. Environmentally related tax revenues are growing slower than GDP and total tax revenue

Note: Includes preliminary data and partial data for 2019-20.

Sources: Country submission; OECD (2022), "Environmental policy instruments", OECD Environment Statistics (database).

Excise taxes on motor fuels are among the highest among OECD member countries, for both gasoline and diesel. However, other fossil fuels have so far been taxed at very low rates. In an effort to introduce carbon pricing for all fossil fuels, Israel is planning to create a “carbon tax”. This would take the form of an increase in excise taxes on coal, fuel oil, natural gas, liquefied petroleum gas and petcoke over five years. As a result of this reform, taxes on polluting fossil fuels are expected to cover about 80% of Israel's GHG emissions. However, the tax rates per tonne of carbon dioxide (CO2) emissions would differ greatly between fuel types. The rate for natural gas, for example, would only be USD 20 per tonne, far too low relative to externalities (IMF, 2022). Furthermore, the 2022 energy price increases and general elections have delayed implementation of these measures.

Israel has the second-highest car purchase tax rate in the world. In 2020, the tax rate stood at 10% of the purchase price for full electric cars, 25% for plug-in hybrid cars, 45% for standard hybrid cars and 83% for conventional internal combustion engine vehicles. There is a plan to gradually increase the tax rates for hybrid vehicles so they eventually align with that for conventional vehicles at 83%. At the same time, the rate for full electric vehicles would rise to 35% in 2024. This would reduce the incentives to upgrade the car fleet. Car owners also pay an annual registration fee in conjunction with the vehicle’s inspection. Congestion charges are expected to be introduced in Tel Aviv in 2025.

Israel has also made some progress in applying charges to pollution. In 2011, a charge was imposed on permit holders who discharge wastewater or waste into the sea. Since November 2021, the country has also been applying a charge on single-use plastic utensils that doubles the average consumer price of these items. The charge aims to change behaviour of citizens, and to significantly curb Israel’s high use of these items, with early positive results. However, the landfill levy is not high enough to support the goal of reducing municipal solid waste landfilling as a percentage of total volume from 80% in 2021 to 20% by 2030.

Water tariffs ensure recovery of costs of service provision

The Israeli water sector has almost achieved financial autonomy. The 2017 amendments to the Water Law removed tariff differentiation between sources where the water is abstracted and its uses. They also required tariffs for water production and supply to be based on cost recovery. However, there are still cross-subsidies between users. Water tariffs for the industrial sector were gradually increased over 2010-15, but water prices for agriculture remain subsidised. Treated wastewater for irrigation is significantly subsidised to encourage farmers to use it instead of freshwater, contributing to the decrease in average price of water for agriculture. In 2021, the Water Authority published draft recommendations to gradually raise the price of water for agriculture by 2028 by phasing out the subsidy and implementing the cost recovery approach to pricing.

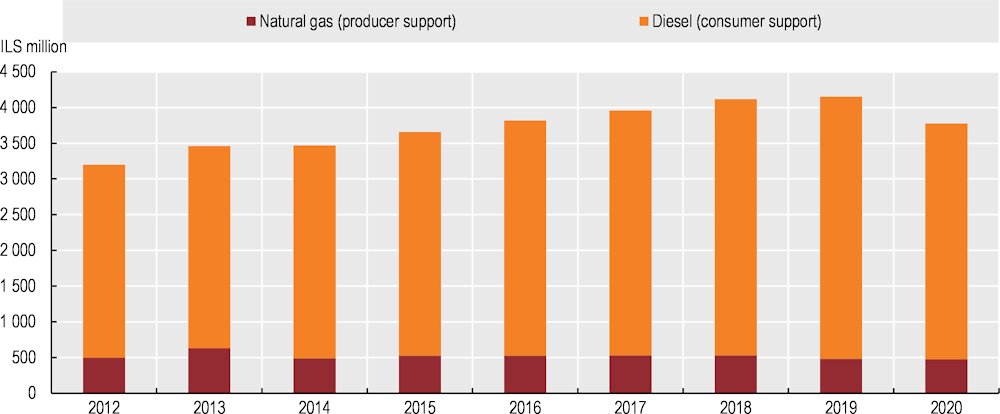

Environmentally harmful subsidies and incentives remain despite the phase-out efforts

Israel’s fossil fuel subsidies increased over the past decade, with a slight decline in 2020. They include consumer subsidies through an excise tax exemption (rebates) on diesel fuel for buses, taxis, fishing boats and specialised vehicles (87% of the total) and support for natural gas producers (Figure 4). In 2018, the government started an eight-year gradual phase-out of diesel rebates. As of 2021, the subsidy reduction has been limited, highlighting the need for further efforts.

Figure 4. Support for diesel fuel consumption increased considerably over the last decade

Note: The OECD estimates government support for fossil fuels as all direct budgetary transfers and tax expenditures (tax reductions, preferential treatment for cost recovery) that provide a benefit or preference for fossil fuel production or consumption. The measures included in the OECD inventory are obtained from official government sources. No attempt is made to assess the justification of these measures, their environmental or economic effect, or need for reform.

Source: OECD (2022), OECD Inventory of Fossil Fuel Support Measures (database).

Environmental investments have been substantial, but gaps remain

Israeli government spending on environmental protection was roughly equal to the OECD average (0.6% of GDP) in 2020. It has been growing in absolute terms over the last decade but slower than GDP. The main domains of Israel’s environmental protection expenditure are waste and wastewater management and biodiversity protection. Most of the government’s environmental expenditure consists of subsidies to local authorities for waste collection, transport and treatment (Section 2).

Massive state investment has driven expanded desalination of seawater and reuse of treated wastewater. The implementation of public-private partnerships has improved the operational performance of water services, raised private funding for investment and ensured the sustainability of water infrastructure. The Water Authority’s subsidies for, and investments in, wastewater treatment and recycling constitute the bulk of public wastewater-related expenditure.

Israel has made significant investments in solar power generation, including in the residential sector, as well as in its transmission and distribution. In 2021, the government set up a task force to remove barriers for infrastructure investments into a low-carbon economy. However, to reach its targets of 30% electricity generation from renewables and 18% energy efficiency improvement by 2030, Israel will need to ramp up these investments. Developing an advanced storage system for solar electricity should be a priority. In 2021, the Israeli Electricity Authority started issuing tenders for solar and storage facilities. Israel is also implementing the 2020 National Plan for Energy Efficiency in the residential, industrial and transportation sectors.

Israel has had some success in increasing the use of public transportation, including railways, light rail and buses. It has built a high-speed rail link between Jerusalem and Tel Aviv and expanded the electrification of the rail network. Light rail is being expanded in Jerusalem and being developed in Tel Aviv. Israel has also begun planning an underground rail system in the Tel Aviv metropolitan area. The government has been promoting public transport through cheaper fares. It also supports a transition from a bus fleet composed almost entirely of diesel-powered vehicles to electric buses, as well as a transition to hybrid, and eventually electric, taxis.

To address the slow and limited uptake of electric vehicles (EVs), Israel is investing in a network of a few thousand public charging stations. However, about 150 000 private chargers and 13 000 public charging stations will be required to support a 5% EV share in the vehicle fleet (Liebes et al., 2018). This highlights the need for further public and private investment.

Environmental risks started to be incorporated into the financial system

The adaptation of Israel’s financial regulations to environmental risks is at an early stage. Companies are now required to include environmental risks in their stock exchange prospectus. Public companies have been rated since 2014 through an Environmental Impact Index based on their impact on the environment, compliance with environmental laws and regulations, and environmental management and reporting. A Fossil Fuel Free Climate Index introduced environmental transparency at the Tel Aviv Stock Exchange in 2020.

In 2021, the country’s financial regulator required institutional investment firms to incorporate environment, social and governance criteria into their investment policies, with a potential positive impact on the entire business sector. Disclosure of non-financial information, including environmental sustainability, has also been promoted. However, Israel has not yet implemented sustainable financing tools, such as green bonds and loans that would facilitate the transition to a low-carbon economy.

Just transition requires continuous measures to mitigate social inequalities

Israel is among the ten OECD member countries with most income inequality (OECD, 2020b). Poverty is widespread especially among Arab-Israeli and Jewish ultra-orthodox communities that are mostly concentrated in separate cities or neighbourhoods, exacerbating inequality across municipalities. Almost all environmental indicators are usually worse in lower-income areas. Social disparities often lead to environmental hazards from waste dumping and burning in open areas, and unequal access to public transportation and green public spaces.

The consequences of carbon pricing are heterogeneous across households that adhere to different lifestyles and consumption patterns. Without further policy measures, carbon pricing in Israel will have regressive distributional outcomes (Stekel and Missbach, 2021). To avoid unintended distributional consequences, the carbon pricing scheme needs to be designed in a transparent and inclusive manner. Revenues generated from carbon pricing can be used to lower existing taxes or provide targeted subsidies, for instance for electricity tariffs.

A 2021-26 whole-of-government Arab Society Programme will invest ILS 30 billion in education, transportation, infrastructure and social welfare in Arab communities. As part of this programme, about ILS 550 million will be allocated to improve waste management and promote climate change adaptation measures and resilience. Other projects have already financed waste management infrastructure in those communities and provided technical assistance to local authorities, including law enforcement and other relevant training. An inter-ministerial government team is set to begin working to design policy and programmes to promote a just transition towards a circular and low-carbon economy.

Recommendations on sustainable development

Climate and air quality policies

Adopt a law on climate with legally binding GHG reduction and renewable energy production targets; promote, and remove administrative barriers for, solar power installations, mindful of the need to preserve open spaces and biodiversity; accelerate integration of renewable sources into the electric grid.

Develop a coherent interagency strategy for a low-carbon transition in the transport sector, enhancing the role of local governments; strengthen links between transport and land-use planning; prioritise investment in public transport, walking and cycling; expand implementation of LEZs in urban areas.

Accelerate implementation of the mandatory Sustainable Building Standard for all new buildings; establish energy efficiency standards for existing buildings.

Conduct a national assessment of medium- and long-term impact of climate change on the economy; promote nature-based solutions in building climate resilience; continue to encourage and support climate change adaptation efforts by local authorities.

Natural resource management

Adopt and implement a national biodiversity strategy and action plan with measurable targets; pursue better mainstreaming of biodiversity protection into sectoral, particularly agricultural, policies, including regulatory measures to stem the introduction and spreading of invasive alien species.

Protect terrestrial ecosystems outside national parks and nature reserves by minimising urban sprawl and integrating ecological corridors into spatial planning; continue rehabilitation of surface water bodies; expand the size of marine protected areas.

Continue to reduce freshwater consumption in agriculture through better water allocation planning and price signals; reduce nutrient loading from agriculture through stricter requirements for fertiliser application, taxes on fertilisers, awareness raising and training for farmers; complete upgrades of the wastewater treatment infrastructure to reduce the impact on water quality.

Regulation and compliance assurance

Establish a comprehensive system of environmental assessment of all projects, policies, plans and programmes with a potentially significant environmental impact, including climate change mitigation and adaptation effects that would provide for consideration of alternatives and broad public participation.

Adopt the Environmental Licensing Law to consolidate environmental permits and pursue further cross-media integration of permit conditions on the basis of best available techniques.

Require local authorities to create environmental units and empower them to engage in compliance assurance activities.

Strengthen risk-based targeting of compliance monitoring and engage in more active compliance promotion with a particular focus on small and medium-sized enterprises; consider introducing variable monetary penalties to increase deterrence and recover economic benefits of non-compliance; improve compliance-related reporting and data management.

Develop and adopt legislation to impose liability for land contamination on operators of activities with high environmental risk and create a mechanism for financing remediation of contaminated sites.

Economic instruments and investment for green growth

Implement the carbon pricing framework, making sure the increased excise tax rates are commensurate with the fuels’ carbon content; phase out excise tax rebates for diesel and eliminate subsidies for natural gas producers.

Increase the landfill levy to provide a greater incentive for waste reduction and recycling; gradually raise water tariffs for agriculture while preserving and strengthening incentives for farmers to use recycled wastewater for irrigation.

Develop and implement a medium-term investment plan for the production, storage and transmission infrastructure for solar-based electricity; accelerate public and private investment in EV-charging infrastructure, in collaboration with local authorities, to support EV uptake targets.

Consider introducing sustainable financing tools such as green bonds and loans; pursue further measures to make conditions of access to financing dependent on firms’ environmental performance.

Ensure that environment-related economic instruments (fuel and vehicle taxation, water tariffs) consider impact on low-income households and ensure targeted measures to address affordability issues where they arise; promote the sustainability of waste management and climate change adaptation measures in Arab and other low‑income communities through empowerment of local authorities and capacity building.

2. Waste management and circular economy

Main trends and policies

Limited progress on waste management as waste generation and landfilling continue to grow

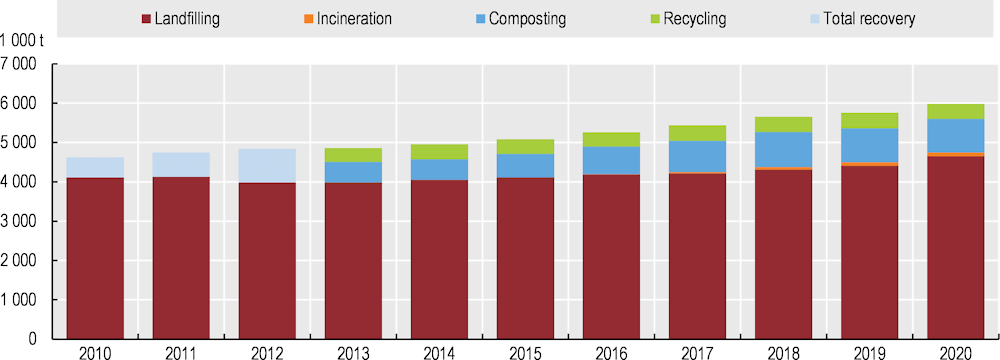

Israel’s sustained economic and population growth over the past decade in the absence of robust waste management policies have contributed to high levels of municipal solid waste (MSW) generation, while the share of both landfilling (80%) and recovery (20%) have remained stable (Figure 5). In 2020, Israel generated 6 million tonnes of MSW for a population of more than 9.2 million, making it one of the countries with the highest level of MSW generation per capita among OECD members (691 kg per capita in 2020, above the OECD average of 534). Households account for 80% of MSW, while the remaining 20% comes from the commercial-institutional sector. Collection of separate waste streams is advanced in the commercial-institutional sector, but is low for household waste. Food waste is a significant issue: food residues constituted 43% of MSW in 2020. In 2020, recycling accounted for 6.4% of total MSW collected. The MoEP is developing standards for composting organic waste for use in agriculture and a ban to landfill untreated organic waste.

Figure 5. Growing municipal solid waste generation and stagnating landfilling rate increase total volume of landfilled waste

Note: Municipal waste includes household waste and similar waste collected by or on behalf of municipalities. It includes bulky waste and excludes construction waste and sewage waste. Breakdown data for recycling and composting are available from 2013.

Sources: CBS (2022), Waste and Recycling (database); OECD (2022), "Waste: Municipal waste", OECD Environment Statistics (database).

Growing waste generation, high landfilling rates and poor separation of bio-waste all contribute to making the waste sector a significant emitter of greenhouse gas (GHG) emissions. MSW in Israel accounts for approximately 8% of GHG emissions, with around 6% of total GHG emissions due to food waste alone (Leket Israel, 2021). In comparison, in OECD member countries, waste contributes on average to about 3% of total GHG emissions. GHG emissions from MSW increased on average by 0.9% per year between 2011 and 2019 (UNFCCC, 2021). Most direct GHG emissions from waste in Israel stem from methane emitted by the decomposition of bio-waste in landfills. Preventing food waste, collecting it separately and reusing it for energy or compost have significant potential to address multiple challenges, namely GHG emissions, waste generation and food security.

Since the 2011 EPR, Israel has made limited progress on waste management laws and regulations. It has adopted a law regulating plastic bags and levying a tax on their use. It has also broadened the extended producer responsibility schemes to packaging and waste electrical and electronic equipment and expanded the deposit-refund mechanism to large plastic bottles. The government has amended the Free Export and Import Ordinances to ensure effective oversight of cross-border movements of waste based on licences granted according to the Basel Convention. Inspection and surveillance against illegal disposal of construction and demolition waste in dumping sites and open spaces have been strengthened, but illegal dumping remains a problem. In addition, standards on the use of recycled aggregates in infrastructure projects have been developed, although the share in use remains very low. More regulations are set to enter into force in the coming years (e.g. banning the landfilling of bio-waste without pre-treatment). Nevertheless, Israel still lacks a comprehensive legislative framework for waste management. The “patchwork” laws and regulations, combined with the absence of harmonised definitions, hinder efficient and effective waste management, policy making and implementation.

A clear vision for a circular economy is lacking

The MoEP decided in 2020 to prioritise waste management and a circular economy. It aimed to engage municipalities, raise awareness across stakeholders to reduce single-use plastics, fight illegal dumping and burning of waste, and set up economic, regulatory and governance tools towards a modern waste management approach. The MoEP set up a Sustainable Waste Economy Strategy (2021-2030) to transform Israel's economy by 2050 from a linear to a circular economy that aspires to zero waste. It aims to reduce the share of waste treatment by landfilling from 80% to 20% in 2030, decrease pressure on natural resources and cut GHG emissions. The strategy foresees consolidation of the main policies and regulations of the waste sector under a single framework law, which would allow more market certainty and potentially unlock investment potential.

The government has launched several circular economy initiatives but there is no consolidated national circular economy plan. The Industries Administration in the Ministry of Economy and Industry (MoEI), along with public and private sector partners, set up a National Programme for a Circular Economy in Industry in 2019. Transition to a circular economy is one of MoEI's priorities. A circular economy is considered a pillar for reducing GHG emissions from industry within Israel’s climate mitigation policy. Other circular economy initiatives (e.g. guidelines for the design of sustainable industrial zones and a centre for resource efficiency) have also been implemented. However, their focus on industry misses opportunities to move towards a producer- and consumer-driven circular economy across sectors.

Israel needs to leverage the full potential of a circular economy across all economic sectors, from preventing waste generation to keeping materials in use for as long as possible, to transforming waste into resources. A roadmap with clear objectives and targets could introduce a life-cycle perspective in policies and projects and stimulate the uptake of eco-design and reuse. Moreover, there is a need to bridge the data gap on material flows, resource efficiency, material exports and imports. This would help identify most resource-intensive sectors and take action to prevent waste and keep resources in use for as long as possible.

Local governments are not sufficiently engaged in the circular transition and waste management

Responsibilities for waste management are shared between the central and local governments. By law, municipalities are obliged to separately collect packaging and electrical waste, while they can decide on sorting other types of waste. Nevertheless, due to a lack of economic incentives and recycling infrastructure, separate waste collection is not widely implemented, leading to inconsistency in collection methods across the country. The national government aims to use socio-economic clusters (eshkolot) as functional areas for locating waste treatment facilities. This can create economies of scale by reducing the number of tenders for municipal waste collection and help manage waste more efficiently.

Strengthening the role of municipalities will be key to achieving recycling targets and applying circular economy principles in areas such as food value chain and the built environment. Beyond bridging the infrastructure gap across municipalities, capacity building programmes will be needed for more sustainable waste management. The government could establish guidelines and offer more flexibility through decentralised decision making. Cities could implement pilots in various sectors to test the impacts of circular-related practices.

Policy tools for transition to a circular economy

The full potential of policy tools to tackle waste has not yet been leveraged

Economic instruments need to be better designed to create incentives for behavioural change. The landfill levy is a key economic instrument for internalising the externalities of landfilling. However, the total cost of landfilling, including the landfill levy, handling fees at the landfill site and transport costs, is one of the lowest among OECD member countries. The cost of landfilling is insufficient to discourage this practice: it is lower than that of incineration with energy recovery and of organic waste treatment, making landfilling the cheapest option.

Property owners in Israel pay for waste collection and treatment, along with other municipal services, as part of the property tax. This gives households limited economic incentive to reduce waste or separate waste streams. Israel has not made progress in separating the revenue raised from waste management activities (e.g. through fees and levies) from the local property tax as recommended in the 2011 EPR, which would make waste management fees more visible for households. Israel has not yet implemented a “pay as you throw” mechanism (foreseen by the Sustainable Waste Economy Strategy), which would increase the costs of waste disposal and make alternatives (recycling) more attractive.

Environment-related criteria have progressively been introduced in government procurement tenders, but there is no obligation to use them. In recent years, the MoEP and the Ministry of Finance set a target of 20% of government spending for green public procurement. These criteria concern energy efficiency, resource efficiency, reduced waste and phase-out of hazardous materials. However, conservative habits, lack of dialogue between suppliers and buyers, and poor knowledge of purchasing practices lead to delays in, and exemptions from, tenders. In addition, although the country is a fertile territory for innovation, start-ups in environmental technology (“cleantech”) face challenges in responding to green tenders. While hundreds of companies operate in this sector in Israel, 75% are specialised in energy and water, while waste and resource management and industrial efficiency are poorly represented.

Stakeholder engagement in the circular economy transition has focused on the private sector

Education and awareness raising will play an important role in making citizens and businesses part of the circular economy transition. However, initiatives to date have largely been voluntary and targeted at the private sector. For example, to foster adoption of circular practices by companies, the Israel-America Chamber of Commerce, in partnership with the MoEP and the MoEI, launched the AMCHAM Circular Economy Forum in 2020. The Forum aims to identify needs and opportunities for member companies to implement circular principles in their activities and to pilot different types of circular solutions. In addition, the Manufacturers’ Association of Israel is involved in capacity building and information sharing: it has set up a database to collect information on wastes that can be reused and/or recycled to promote industrial symbiosis among its members. However, ensuring sustainable waste management and a transition towards a circular economy requires engaging stakeholders beyond the private sector, such as civil society, community-based organisations and knowledge institutions. They need timely information and opportunities to be involved in decision making.

Recommendations on waste management and circular economy

Implement the Sustainable Waste Economy Strategy for 2030; create comprehensive and coherent framework legislation aligned with the strategy's quantitative targets to ensure common statutory definitions and market certainty, set targets and provide regulatory tools.

Establish a roadmap towards a circular economy to define clear objectives and actions across sectors and government departments, anchored in framework legislation; ensure that adequate human and financial resources are in place for implementation of the roadmap, that information is shared across stakeholders in a timely manner and data on waste streams, material flows and resource efficiency are collected and up to date.

Move from waste to resource management by starting to develop higher-value material loops, whereby materials are recovered, reclaimed, recycled or biodegraded through natural or technological processes, and fostering eco-design, repair and reuse; mainstream resource efficiency goals into governmental policy related to climate change, innovation, education, etc.; consider strengthening legislation to promote sustainable production and consumption.

Recognise the role of local authorities as key players in transitioning from a linear to a circular economy; provide regulatory and technical support to strengthen regional waste management schemes; develop agreements across levels of government to build capacity for reducing waste generation and enhancing resource efficiency; develop pilot programmes for circularity in the food system (from production to consumption) and the built environment (e.g. circular neighbourhoods) and foster the exchange of good practices among municipalities.

Set up incentives for separate collection of waste streams and recycling, such as deposit-refund schemes and weight-based disposal fees differentiated by collection bin; gradually introduce pay-as-you-throw schemes for waste handling to separate waste collection fees from municipal taxes as a way to incentivise waste reduction and separation of recyclables at the level of households; introduce a regulatory framework for the management of construction and demolition waste, including taxes on raw materials for construction aggregates to foster sustainability in the construction sector.

Implement circular criteria in green public procurement, incorporate different business models in tenders (e.g. rental, product-as-a-service models) and build capacity in contract management and tender definition.

Engage stakeholders and promote a bottom-up approach to a circular economy by establishing a formal stakeholder engagement mechanism, such as an advisory group, to inform circular economy policies and create incentives to reward cities and businesses that achieve pre‑defined zero waste targets.

References

IMF (2022), “Israel: 2022 Article IV Consultation-Press Release and Staff Report”, Country Report, No. 2022/081, International Monetary Fund, Washington, DC, www.imf.org/en/Publications/CR/Issues/2022/03/21/Israel-2022-Article-IV-Consultation-Press-Release-and-Staff-Report-515406.

Leket Israel (2021), Food Waste and Rescue in Israel: Report 2020, National Food Bank of Israel, website, https://foodwastereport.leket.org/en/ (accessed 30 May 2022).

Liebes I. et al. (2018), Electric Vehicles Charging Infrastructure in Israel: Implementation Policy and Technical Guidelines, Samuel Neaman Institute, Haifa, Israel, www.neaman.org.il/EN/Electric-Vehicles-Charging-Infrastructure-in-Israel-Implementation-Policy-and-Technical-Guidelines.

OECD (2020a), Accelerating Climate Action in Israel: Refocusing Mitigation Policies for the Electricity, Residential and Transport Sectors, OECD Publishing, Paris, https://doi.org/10.1787/fb32aabd-en.

OECD (2020b), OECD Economic Surveys: Israel 2020, OECD Publishing, Paris, https://doi.org/10.1787/d6a7d907-en.

State Comptroller (2021), National Climate Action by the Government of Israel: Special Audit Report, State Comptroller and Ombudsman of Israel, Jerusalem, www.mevaker.gov.il/sites/DigitalLibrary/Documents/2021/Climate/2021-Climate-Abstracts-EN.pdf?AspxAutoDetectCookieSupport=1.

State Comptroller (2019), Enforcement in the areas of environmental protection, State Comptroller and Ombudsman of Israel, Jerusalem, www.mevaker.gov.il/sites/DigitalLibrary/Documents/69b/2019-69b-224-Sviva.pdf.

Stekel, J. and L. Missbach (2021), “Leaving No One Behind – Carbon Pricing in Israel: Distributional Consequences across Households”, Policy Paper Series: Shaping the Transition to a Low-Carbon Economy – Perspectives from Israel and Germany, Israel Public Policy Institute and Heinrich Böll Foundation, Tel Aviv, https://il.boell.org/sites/default/files/2021-03/Steckel%20%26%20Missbach%20-%20Leaving%20No%20One%20Behind%20Carbon%20Pricing%20in%20Israel.pdf.

UNFCCC (2021), “Israel National GHG Inventory 2021”, webpage, https://unfccc.int/documents/370343 (accessed 10 May 2022).

Annex 1. Actions taken to implement selected recommendations from the 2011 OECD Environmental Performance Review of Israel

|

Recommendations |

Actions taken |

|---|---|

|

Chapter 1. Towards sustainable development |

|

|

Addressing key environmental challenges |

|

|

Consider expressing the target for reducing greenhouse gas (GHG) emissions by 2020 in absolute terms and making it legally binding; fully integrate climate, environmental and health considerations into the government’s long-term energy and transport policies. |

The 2030 GHG reduction target was for the first time expressed in absolute terms. In 2021, the government passed a decision on "Transition to a Low-Carbon Economy" and adopted as its part the National Action Plan on Climate Change 2022-2026. The draft Climate Law includes 2030 targets. |

|

Set up a system to monitor the implementation of GHG emissions reduction measures; provide an annual assessment to the Knesset on progress in achieving targets, preferably by an independent body, and periodically propose recommendations to adjust policy measures. |

Israel has established a national system for measurement, reporting and verification. An inter-ministerial committee reports annually to the government on the implementation of GHG reduction measures. |

|

Introduce mandatory minimum energy performance standards for buildings, and ensure that information on building energy performance is available to consumers. |

In 2020, the National Planning and Building Board approved regulations that require most types of new buildings to be constructed according to the Sustainable Building Standard. A new energy efficiency rating system was introduced by the Ministry of Energy in 2020 to inform apartment buyers. Since December 2022, a new regulation approved by the Ministry of Housing requires contractors of new apartment buildings to inform buyers about their apartment's energy rating. |

|

Consider how local ecological conditions and minimum river flows could be better reflected in decisions on water allocation among sectors and to nature. |

A Master Plan for the Supply of Water to Nature was issued jointly by the Nature and Parks Authority, Ministry of Environmental Protection (MoEP) and Water Authority in 2013. An inter-ministerial team has approved river plans for several major rivers. In some places, they set aside a minimum quota of water for ecosystems. |

|

Define water quality objectives for all stretches of rivers, and issue discharge and abstraction permits accordingly. |

The river plans determine the flow regime, water quality and actions necessary to protect the existing ecosystems. The Centre for Aquatic Ecology, established in 2015, determines biological standards used to assess the ecological status of the country’s streams. |

|

Undertake a comprehensive national assessment of Israel’s ecosystems and biodiversity, including their economic value; analyse how the main pressures on biodiversity are likely to evolve and how they could be mitigated by alternative policies. |

An ecosystem assessment was conducted in 2013-21 as part of the National Ecosystem Assessment Programme and included the work of over 200 scientists. The study describes services provided by each of the country’s ecosystems, the biodiversity underpinning these services, the threats to each ecosystem and the drivers of change affecting the services. |

|

Establish measurable biodiversity targets; consolidate the national biodiversity monitoring system to measure progress in achieving these targets and to support future policy development. |

Nineteen national targets were formulated in 2015 in accordance with Aichi Targets but never approved by the government. Israel is developing a National Biodiversity Action Plan which will include biodiversity targets in alignment with the CBD's post-2020 Global Biodiversity Framework. |

|

Strengthen and broaden biodiversity conservation in and around nature reserves, e.g. by establishing buffer zones, ecological corridors and biosphere reserves. |

About 25% of Israel’s land area is protected as part of declared nature reserves and national parks. However, only 4% of the territorial waters are protected. Outside protected areas most vulnerable ecosystems are under significant stress. The National Planning Administration envisages integrating ecological corridors into spatial planning. |

|

Identify specific measures to reduce the introduction of invasive alien species from all sources. |

In 2017, Israel carried out a comprehensive analysis of introduction pathways of invasive alien species. The institutional and regulatory fragmentation on this issue has hampered the adoption of comprehensive biosafety and biosecurity legislation to address invasive species. |

|

Sustainable development and green growth policy framework |

|

|

Develop a whole-of-government approach to sustainable development and green growth; fully integrate environmental and green growth considerations into the government’s development strategies; establish clear performance monitoring and follow-up mechanisms. |

A 2019 government decision required Sustainable Development Goals to be integrated into government programmes. A 2019-21 multi-sectoral process "Israel 2050 – a thriving economy in a sustainable environment" produced a vision and a strategy towards a low-carbon economy. An analysis of progress in achieving SDGs was published in 2022. |

|

Institutional framework for environmental governance |

|

|

Strengthen environmental policy implementation at the local level by making government subsidies to municipalities contingent on the establishment of viable environmental units (including units involving co-operation among local authorities), and by implementing compulsory training for such units. |

Forming an environmental unit is voluntary but subject to tender conditions and funding from the MoEP. The MoEP does not want to run a risk of local governments refusing the much-needed funding if such funding becomes contingent on having a unit. Trainings for local environmental units have been organised. |

|

Introduce a system of performance indicators to monitor the effectiveness and efficiency of environmental policy implementation in the framework of result-oriented planning and budgeting. |

The MoEP has four multi-year targets that serve as a basis for concrete, measurable and realistic goals. Goals are linked to expenditure and have timeframes. |

|

Regulatory framework for environmental management |

|

|

Implement integrated (cross-media) environmental permitting for facilities with high environmental risk; issue such permits based on advanced, process-related technological and management solutions, and using procedures that are open to public participation. |

In March 2022, the government approved a draft Environmental Licensing Law that includes amendments to the Clean Air Law and the Hazardous Materials Law. If the draft law is adopted by the Knesset, the operator will be subject to one permitting procedure and will receive one permit that includes most environmental conditions (wastewater discharges to water bodies would still not be covered). |

|

Building on the voluntary emissions reporting scheme, establish a mandatory Pollutant Release and Transfer Register (PRTR) that includes GHG emissions; strengthen data quality control across the various ambient air quality monitoring networks. |

A 2012 law established a PRTR and required some 500 facilities with significant environmental impact to report on the annual quantity of emissions of pollutants (including GHG emissions) and waste transfers to the environment. The information is accessible on the PRTR webpage. |

|

Compliance assurance |

|

|

Strengthen the system of self-monitoring by requiring all facilities subject to such requirements to report regularly to the environmental authorities; enhance the capacity of environmental inspectors to undertake multi-media compliance monitoring and verification. |

Operators report to the PRTR. The MoEP’s compliance monitoring and enforcement capacity has increased. The ministry has established Drone Squadron 11 as part of its Green Police to enhance its compliance monitoring functions. |

|

Reinforce environmental liability for damage to natural resources by: expanding the use of administrative clean-up orders; strengthening legislative provisions (including those in the Prevention of Land Contamination and the Remediation of Contaminated Lands bill) for the recovery of remediation costs from responsible parties; and applying such provisions more vigorously. |

The Prevention of Land Contamination and Remediation of Contaminated Lands bill has not been adopted due to strong opposition inside the government. A Risk-Based Corrective Action Technical Guidance was published in 2014 to provide a consistent decision-making framework for remediation of contaminated sites. In 2022, the MoEP published a national map of contaminated soils. |

|

Greening the system of taxes and charges |

|

|

Consider introducing an economy-wide carbon tax, or adjusted excise duties on fossil fuels, to reflect an appropriate carbon price. |

In 2021, a government resolution required the Minister of Finance to introduce a carbon tax per tonne on fuel. The “carbon tax” is expected to come in the form of an increase in excise taxes on coal, fuel oil, natural gas, liquefied petroleum gas and petcoke to be introduced in 2023 and rolled out in phases through 2028. |

|

Follow up on plans to introduce environmentally related taxes and economic instruments (notably the proposed air emission levy, coastal and marine protection charges, and the marine pollution levy), and gradually remove tax concessions that are potentially harmful to the environment (including concessions on the water extraction levy for farmers and on the diesel excise duty for commercial use). |

In 2011, Regulations on the Prevention of Sea Pollution from Land-Based Sources imposed a charge on permit holders who discharge wastewater or waste into the sea. In 2021, the Water Authority published draft recommendations to gradually raise the price of water for agriculture by 2028, phasing out the subsidy while implementing the cost recovery approach to pricing. In 2018, the government started an eight-year gradual phase-out of diesel rebates for trucks, taxis and buses. A tax on single-use plastic was introduced in 2021. |

|

Using the legal basis provided by the Clean Air Law, introduce an air emissions levy targeting priority pollutants emitted by large and medium stationary sources. |

Air emission charges have not been introduced because the government is reluctant to impose a charge on only a few polluters permitted under the Clean Air Law and responsible for less than half of air emissions. |

|

Review the tax treatment of company cars, with a view to eliminating the perverse incentives that result in increased car use and environmental impacts; replace the current car allowance for some services and public employees with other forms of compensation that are not linked to car ownership. |

The tax treatment of company cars has not changed over the review period. All the costs of company cars remain fully deductible from corporate taxes, and there is no cap on fuel expenses. |

|

Extend the use of road tolls on congested motorway stretches and consider introducing congestion or pollution charges in major metropolitan areas. |

A first congestion charge will be introduced in the Tel Aviv metropolitan area in 2025. There is a high-occupancy toll lane on the inter-urban freeway connecting Jerusalem to Tel Aviv. |

|

Gradually increase the agricultural and industrial sectors’ share in financing the full costs of water infrastructure, taking account of the positive externalities associated with water supply; establish targets for domestic water consumption in line with best practices in western European countries. |

As of 2017, the Israeli water sector achieved almost full financial autonomy, with the exception of wastewater reuse still relying on investment subsidies. Water tariffs for the industrial sector were gradually increased over 2010-15. However, water prices for agriculture remain heavily subsidised. |

|

Consider broadening the use of economic instruments for water management, including: expanding the scope of the proposed marine pollution tax to effluent discharges in freshwater and aquifers; ensuring that extraction tax rates reflect water scarcity; introducing a pesticide tax with rates reflecting pesticide toxicity; and trading water quotas among different agricultural producers and, in the medium term, with other water users. |

The 2017 amendments to the Water Law removed tariff differentiation between sources where the water is abstracted and its uses. According to this reform, tariffs for water production and supply would be based on cost recovery, thereby creating a water market. |

|

Investing in environmental and low-carbon infrastructure |

|

|

Rationalise the financial incentives for renewable energy projects, taking account of the full range of costs and benefits of renewables; provide consistent guidelines on the types of land used for, and the conditions that apply to, such projects; streamline the associated planning and permitting processes. |

A state-guaranteed loan fund of ILS 500 million offers incentives for local solar energy projects. Other promotional measures include auctions for commercial rooftop projects and improved permitting and tax treatment for residential systems, and the requirement for new buildings to be equipped with solar panels for water heating or photovoltaic panels. |

|

Better integrate transport and land use planning; further develop public transport networks; improve the integration of public transport services and networks. |

Israel has invested significantly in electrifying the rail network and expanding light rail (tramway). A Jerusalem-Tel Aviv high-speed electric rail has been operational since 2019. The first line of the Tel Aviv light rail is expected to be operational by early 2023. |

|

Chapter 2. Waste management and circular economy |

|

|

Review current arrangements for the management of waste, including hazardous waste, and consolidate them in a comprehensive and coherent new policy, possibly a new law, and an action plan. |

The Sustainable Waste Economy Strategy (2021-2030) builds on a long-term vision of transforming Israel's linear economy to a circular one. There is no national legislative framework for waste management. Waste-related requirements are spread across laws/regulations concerning health, hazard prevention, business, cleanliness, recycling and air pollution. The Free Export and Import Ordinances were amended in 2021 to ensure effective oversight of cross-border movements of hazardous waste. |

|

Strengthen national and local efforts to address remaining problems with unregulated waste disposal […]; strengthen responsibilities of the construction sector for treatment and safe disposal of construction and demolition waste. |

Inspection and surveillance against illegal disposal of construction and demolition (C&D) waste in dumping sites and open spaces has been strengthened. Still, about 25% of Israel's C&D waste is illegally discarded. |

|

Increase the level of the waste collection component of the municipal property tax to reflect the real costs of the service; gradually introduce volume- or weight-based waste disposal fees for mixed waste; identify and exchange good practice approaches for waste management among municipalities. |

No progress has been made. Fees for the collection and treatment of municipal solid waste, paid by property owners, cover only 10% of the costs. |

|

Building on pilot projects, roll out the programme for separate collection of dry and organic waste to all municipalities; develop the related treatment infrastructure, including a wider use of waste-to-energy solutions, and engage the private sector in this effort. |

In 2011, the MoEP started a separation of waste at source programme, but the programme ended in 2016. The MoEP has allocated funding for the establishment or upgrading of treatment facilities for biodegradable waste, but they remain to be completed. |

|

Broaden Extended Producer Responsibility systems to other priority waste streams, including batteries, waste electric and electronic equipment, and vehicles; strengthen the collection and safe disposal of used oils and car oil filters; ensure that their design and implementation is effective and efficient. |

Israel has introduced extended producer responsibility schemes for packaging (2011) and waste electrical and electronic equipment (2012), expanded the deposit-refund scheme for beverage containers (2021) and adopted a law on plastic bags (2016). |

Source: OECD Secretariat based on country submission.