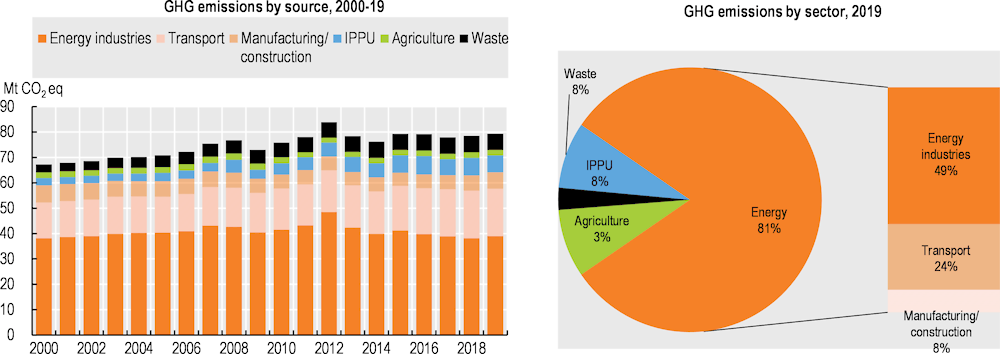

This chapter provides a brief overview of key environmental trends in Israel and progress towards climate change and biodiversity targets. It assesses the environmental effectiveness and economic efficiency of the environmental policy mix, including regulatory and voluntary instruments; fiscal and economic instruments; and public and private investment in environment-related infrastructure. It examines the interaction between the environment and other policy areas with a view to highlighting opportunities and barriers to environmentally friendly and socially inclusive growth.

OECD Environmental Performance Reviews: Israel 2023

Chapter 1. Towards sustainable development

Abstract

1.1. Addressing key environmental challenges

Israel is a small, open economy with the fastest growth among OECD member countries over the last decade. Israel managed the COVID-19 pandemic well. After a relatively mild contraction (-2%) in the economy during 2020, gross domestic product (GDP) expanded rapidly in 2021 (around 8%). The resilience of the Israeli economy is mostly attributable to the strength of its high-tech sector. Exports of high-tech services continued to grow strongly during the pandemic. Meanwhile, employment in the sector well exceeds pre-pandemic levels, performing much better than the country’s labour market overall (OECD, 2020a).

The population is increasing by around 2% each year, which is faster than the OECD average. This poses challenges for the availability and affordability of housing. To alleviate the pressure, the government wants to build 1.5 million homes by 2040. High urbanisation, population density and land scarcity continue to exert significant pressure on the environment.

1.1.1. Progress towards climate targets

In absolute terms, Israel’s greenhouse gas (GHG) emissions have risen by about 5% since 2010, driven primarily by economic and population growth. However, they started to decline in 2020.1 The GHG emission rise has been moderated by the replacement of coal by natural gas in Israel’s energy mix, as well as by less transportation use during the pandemic. Israel’s per capita GHG emissions have declined compared to 2010. However, they remain higher than in countries with comparable climate conditions, such as Greece and Spain. At the same time, both total and per capita GHG emissions have decoupled slowly from GDP.

The country’s carbon dioxide (CO₂) productivity (GDP generated per unit of CO2 emitted) has increased substantially over the years. It surpassed the OECD average from 2013 onwards due to the growing share of low energy-intensity/high-GDP activities (e.g. in the high-tech sector).

Objectives

Over the review period, Israel has set several, increasingly ambitious sets of climate change mitigation objectives. In 2016, the government adopted a national plan that set Israel’s first-ever goals for reducing GHG emissions (general and sectoral) for 2020 and 2030, albeit in per capita terms.2 These goals were less ambitious than the conservative recommendation issued by the interagency steering committee at the time (State Comptroller, 2021). The overall target was a 26% reduction in anticipated GHG emissions in 2030 relative to the 2005 per capita level. The plan also envisaged a 17% reduction of electricity consumption and a 20% reduction of private kilometres travelled by 2030 compared to a business-as-usual (BAU) scenario. Israel was planning to generate at least 13% of electricity from renewable sources in 2025, and at least 17% in 2030.

For many years, poor inter-ministerial collaboration prevented more ambitious climate change targets and hampered implementation efforts. Government ministries (except for the Ministry of Environmental Protection, MoEP) tended to prioritise the goals central to their ministerial responsibility over GHG emission reduction targets. As a result, Israel did not achieve any of the interim sectoral targets for 2020. The private mileage travelled grew by a quarter instead of being reduced by 20%. The target to increase energy efficiency by 20% was met only half-way, with 60% of the funds allocated for energy efficiency investments remaining unused (State Comptroller, 2021).

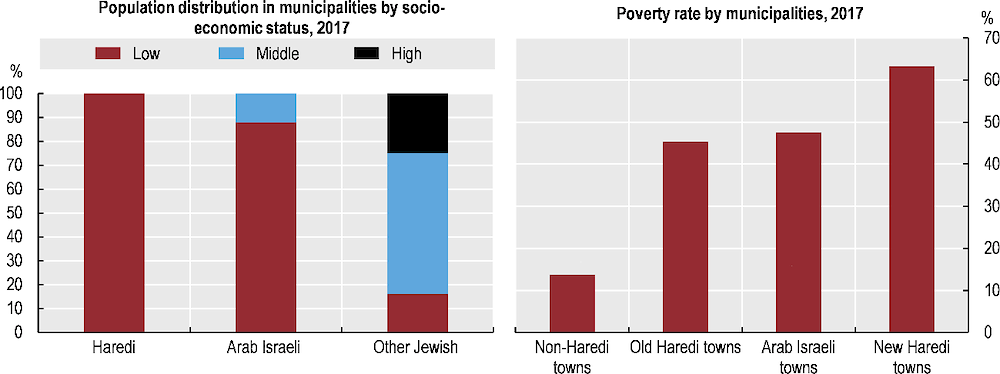

Since 2019, Israel has raised its climate ambitions and developed a low-carbon economy strategy – Israel 2050 – through an inter-ministerial and cross-sectoral process (Section 1.3). In July 2021, the government passed a landmark decision on "Transition to a Low-Carbon Economy" and adopted under its umbrella the National Action Plan on Climate Change 2022-2026. The plan updated the national GHG emission reduction target for 2030 to an absolute target for the first time: a 27% reduction compared to 2015 and an 85% reduction target for 2050. It also set sectoral per capita targets for GHG emissions for 2030 and 2050 compared to 2015: electricity generation (30% and 85%, respectively), transport (3.3% and 96%), waste (47% and 92%) and industry (30% and 56%). The 2020 National Energy Efficiency Plan by the Ministry of Energy called for 1.3% year-over-year reduction in energy intensity of Israel’s economy.

These targets lag in ambition behind most OECD member countries. Moreover, agriculture (responsible for 2.7% of the country’s GHG emissions in 2019) is not featured in Israel’s Nationally Determined Contribution or its national mitigation plan (OECD, 2022a).

Shortly before COP26, Prime Minister Bennett declared that Israel would become climate-neutral by 2050, raising Israel's climate ambition. However, Israel is not on track to reaching these targets with existing measures (Figure 1.1). It will need to introduce additional measures across all sectors.

Figure 1.1. Israel is not on track to reach its climate change targets

Note: GHG emissions exclude land use, land-use change and forestry. Dashed lines refer to emission projections according to the business-as‑usual (BAU) scenario. Dotted lines refer to trajectories towards 2030 and 2050 GHG reduction targets with abatement measures according to Government Decision 171/2021.

Sources: Country submission; Government of Israel (2021), Updated Nationally Determined Contribution (NDC) under the Paris Agreement; OECD (2022), "Air and climate: GHG emissions by source", OECD Environment Statistics (database); UNFCCC (2022), Israel National GHG Inventory 2021.

In May 2022, the government approved a draft Climate Law that enshrines 2030 overall climate change mitigation targets (but not sectoral targets or those for renewable energy use) and formulates a long-term framework for action to reach the 2050 carbon neutrality goal. It would also establish a Ministerial Committee on Climate Affairs headed by the Prime Minister. In addition, an Advisory Committee on Climate Change would bring together representatives of government stakeholders, industry and non-governmental organisations (NGOs). Meanwhile, an independent interdisciplinary committee of academic experts would provide scientific support for government action. However, the prospects for the adoption of the law by the Knesset are uncertain.

Energy mix

The energy intensity of Israel’s economy declined by 38% over 2010-21 and is significantly lower than the OECD average. The overall carbon intensity of the economy (CO2 emissions per unit of GDP) decreased even more over the same period, by almost 40%, and is now slightly below the OECD average. This ratio declined largely due to the fast growth of Israel’s GDP over that period: 51% compared to the average of 21% in the OECD area.

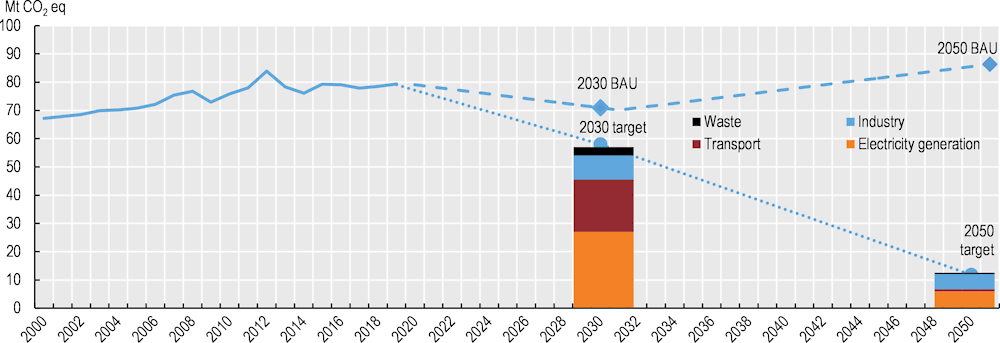

The share of natural gas in electricity generation rose from 37% in 2010 to 69% in 2021 (Figure 1.2), driven chiefly by the discovery of offshore natural gas reserves. This has strengthened the country’s energy security and contributed to most of the reduction of GHG emissions and air pollution over that period (OECD, 2020b). In parallel, the share of coal in electricity generation decreased considerably from 59% in 2010 to 23% in 2021. Several generation units at the Hadera coal power plant are scheduled to be shut down in 2023; plans to construct another coal plant in Ashkelon have been cancelled. All coal plants are scheduled to be closed by June 2026.

Despite a vast potential for solar power, renewable sources accounted for a meagre 8% in electricity generation and 5% in the total energy supply in 2021. The country’s share of renewables in the energy mix is the second smallest in the OECD. It is dominated by solar energy. One of the main objections against developing wind energy in Israel is that the country is on a major migration path of many bird species that would be harmed by wind turbines.

Figure 1.2. Israel’s energy mix relies heavily on fossil fuels

Note: Left panel: Data exclude trade in electricity and heat and small quantities of non-renewable waste. Right panel: Other renewables includes hydro, biofuels and waste.

Source: IEA (2022), IEA World Energy Statistics and Balances (database).

Trends and mitigation policies in key sectors

Power generation

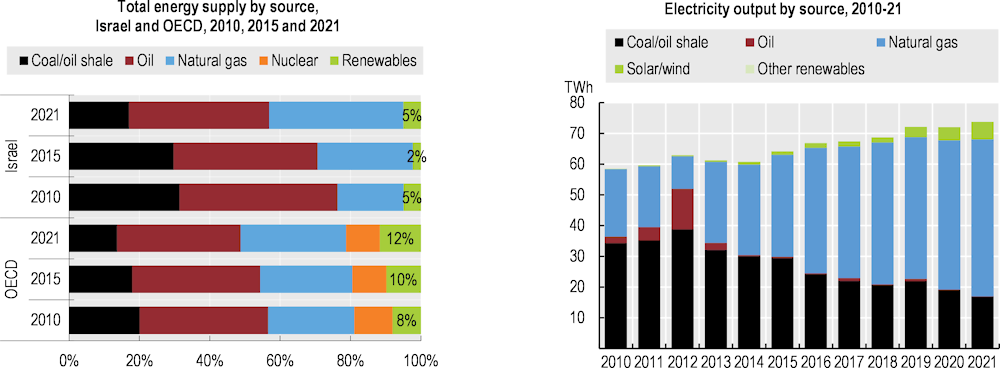

Electricity production is the largest source of GHG emissions in Israel, accounting for 49% of emissions in 2019 (Figure 1.3). Israel’s electricity-related carbon intensity is one of the highest among OECD countries. The massive growth of the share of natural gas (Figure 1.2) has compensated for the impact of increased power generation on GHG emissions. In 2018, the Ministry of Energy set a 2030 goal to use 80% natural gas and 20% renewables in electricity production. In 2020, the government increased the renewables target for 2030 to 30% of electricity production (28% from solar energy, with only a small fraction from wind and biomass). In May 2022, the Ministry of Energy published an operational plan for achieving this goal. The plan listed regulatory measures to accelerate planning and approval of solar and wind projects, actions to improve the electricity grid and ways to optimise spatial planning for renewable energy. Also in 2022, the MoEP called for a 40% target in the same timeframe. However, a longer-term strategy is needed to support planning, development and investment towards a low-carbon economy.

Solar generation capacity has been expanding in recent years, facilitated by policy measures supporting solar energy. These include auctions for commercial rooftop projects and improved permitting and tax treatment for residential systems. New residential buildings must also be equipped with photovoltaic or water heating solar panels. However, these positive drivers have been tempered by several factors. There is limited land availability next to major consumption centres, for example, as well as transmission grid constraints. Concerns about protecting open spaces and natural habitats create a conflict between climate change and biodiversity conservation goals. In addition, complex permit procedures are holding back large‑scale projects. To address the land availability issue, Israel has come up with such innovative solutions as covering water reservoirs with solar panels and installing agrovoltaic panels on agricultural facilities or over fields. In November 2021, Israel signed a declaration of intent with Jordan and United Arab Emirates whereby Israel would provide Jordan with desalinated water in exchange for electricity generated by solar panels to be built in the Jordanian desert. This agreement was reiterated and strengthened in November 2022.

Figure 1.3. Energy industries and transports generate almost three-quarters of total GHG emissions

Note: Energy industries include small quantities of other energy categories (about 1% in 2019). IPPU=Industrial processes and products use.

Source: UNFCCC (2022), Israel National Greenhouse Gas Inventory 2021.

Transport

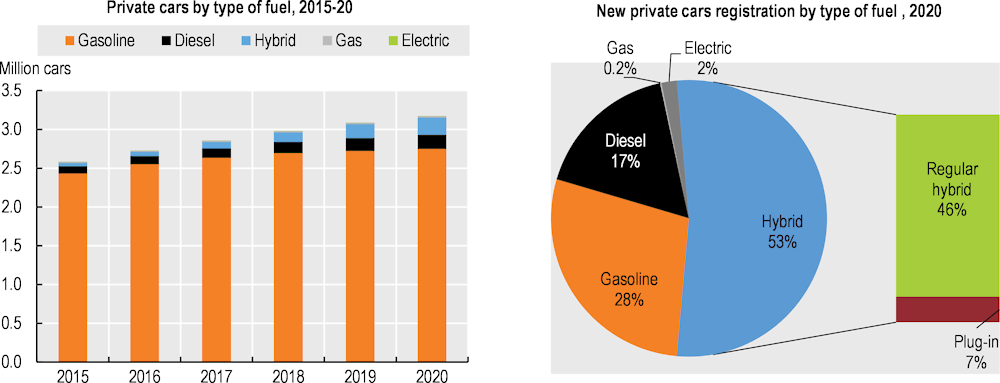

Transport is the second largest contributor to GHG emissions after electricity (24% in 2019); emissions have risen by 15% since 2010 (Figure 1.3). Car dependency is high because of the limited public transport available. Inadequate spatial planning does not provide for sufficient public transport infrastructure investment to match the rapidly expanding residential sector. In 2020, full electric vehicles (EVs) in Israel accounted for less than 1% of the total. EV uptake is impeded by the poor charging infrastructure for EVs and legal issues complicating the installation of charging points in apartment buildings (Section 1.7.3). In 2021, the Ministry of Energy postponed the target set in 2019 – to prohibit import of vehicles with fuel‑burning engines starting from 2030 – by another five years.

The Ministry of Transport has not yet formulated a detailed plan for reducing GHG emissions from this sector. The central government regulates public transport, although local governments are better placed to address their communities’ transport needs (OECD, 2020b). A strategic plan, “Development of Public Transportation”, was published by the Ministry of Transport and the Ministry of Finance in 2012 but has not been fully implemented (State Comptroller, 2021). Since 2020, the MoEP has allocated significant subsidies (ILS 40 million in 2022) to buy electric buses for public and private transportation companies, including inter-city and regular city buses.

Buildings

GHG emissions from the buildings sector have also been on the rise. There has been a real energy efficiency improvement in the commercial-public sector. However, the energy intensity of the residential sector has increased. Residential buildings account for about 30% of total electricity consumption. Part of this trend can be explained by increased energy consumption that accompanies improvement in quality of life. The trend also reflects inadequate regulation of environmental aspects of expansive new construction in response to the housing shortage. This has led to greater sprawl, low-density development and poorly integrated infrastructure across municipalities, all of which increase emissions.

Promoting energy efficiency in buildings is another important policy area. Thousands of housing units, commercial centres and office spaces in Israel have been constructed in accordance with the Israeli Green Building Standard (IS 5281). However, compliance with the standard for energy rating of buildings (IS 5282) had been voluntary. In 2020, the National Planning and Building Board approved regulations that require most types of new construction to meet the Green Building Standard. This would follow the recommendation from the OECD 2011 Environmental Performance Review (EPR) to introduce minimum energy performance standards for buildings. The IS 5281 standard, which has five levels of requirements, covers energy, land, water, building materials, health and welfare of building users, waste, transportation, building site management and innovation.

This regulatory change is expected to lead to a significant reduction of GHG emissions from buildings. However, the Green Building Standard would apply only gradually from 2022 to about 80% of new residential buildings, schools and industrial buildings. To support implementation of the standard, the MoEP has increased the number of verification and labelling authorities for green buildings. The MoEP has also collaborated with the Israeli Green Building Council to offer two training courses for professionals in green building certification. The MoEP recognises the willingness of many local authorities to voluntarily adopt green building policies. Consequently, it will continue to expand their adoption by training local authority staff on green construction standards in 2022. There are no energy efficiency targets for existing buildings. However, a new rating system introduced by the Ministry of Energy in 2020 allows buyers of apartments to verify in advance if their new home is energy efficient. Ministry of Housing regulations require constructors to publish the energy rating of each new apartment starting in 2023.

Industry

The manufacturing sector is the only sector that has reduced its energy consumption in absolute terms over the last decade. The reduction in industrial energy intensity can be explained essentially by industrial plants switching to natural gas (often with improved process efficiency), as well as by technological improvements. An Energy Efficiency Assistance Programme launched in 2013 by the MoEP and the Ministry of Economy and Industry’s Small and Medium Enterprises Agency provides subsidised professional advice to businesses. Since 2016, the MoEP, MoEI and the Ministry of Energy have been jointly managing a subsidy programme for emission reduction, energy efficiency and solar shading projects in businesses and municipalities. In 2022, the subsidy cap was raised from 20% to 25% of capital investment.

Climate change adaptation

Israel is highly vulnerable to the impacts of climate change. In recent years, extreme weather events have been more frequent and lasted longer, including years that were either exceedingly wet or dry. Under a “high emissions scenario”, the mean annual temperature could rise by up to 4.4ºC by the end of the century; 60% of days could be “hot days”. Meanwhile, total annual precipitation is predicted to decrease by 25%, with large year-to-year variability in drought conditions (WHO and UNFCCC, 2022). This, along with other impacts, is expected to reduce recharge of groundwater aquifers and have negative impacts on freshwater ecosystems; reduce water levels and increase salinity of Lake Kinneret; and cause more desertification of the southern part of Israel. Sea level in the Mediterranean is projected to rise by 0.5 metres in 2050 and by 1.0 metres by 2100 (OECD, 2013).

In 2018, the government decided to elaborate a strategy and action plan on Israel’s preparedness to adapt to climate change. Under the MoEP, it created a Climate Change Adaptation Administration (CCAA), which includes representatives of 35 governmental and non-governmental stakeholder organisations. The Climate Change Adaptation Report that the CCAA submitted to the Knesset for approval in 2021 includes recommendations for budgeting some 50 projects. However, the CCAA has not been granted sufficient authority, budget or human resources to implement adaptation actions (State Comptroller, 2021). At the same time, the Ministry of Energy has created a manual to support climate change adaptation efforts by local governments, only a few of which are proactive in this field. Over a dozen local adaptation action plans have been developed, covering about a third of the country’s population.

First steps on adaptation have been taken at the national level. The Ministry of Agriculture and Rural Development and the Water Authority each formulated a risk analysis methodology for climate change adaptation in these sectors, albeit without close co-ordination. Several ministries have adopted adaptation action plans, but these are not sufficiently co-ordinated either. In 2022, the National Emergency Management Authority included climate change in the national threat map, making it part of the aggregate national threat assessment. However, no government economic body or entity responsible for macroeconomic forecasts in Israel has yet assessed the long-term damage and effects of climate change on the Israeli economy. Climate change adaptation measures tend to focus on technological rather than nature-based solutions to prevent flooding, drought or other climate change-induced natural disasters – something the draft Climate Law has the ambition to change.

1.1.2. Atmospheric emissions and air quality

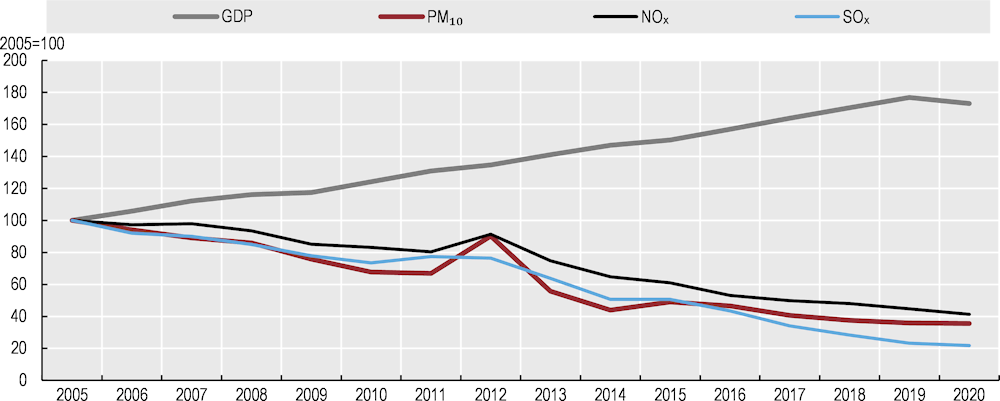

Air emissions of key pollutants have decoupled from Israel’s economic growth (Figure 1.4). This is mostly due to the reduced combustion of coal for electricity generation. However, the country’s population is exposed to levels of air pollution that significantly exceed the target values defined in Israel’s Clean Air Law. The exposure to fine particulate matter pollution (PM2.5) is one of the highest in OECD countries (Figure 1.5), partly because of the country’s proximity to the Sahara and the Arabian deserts. It causes 2 500 premature deaths per year with annual indirect costs of almost USD 7 billion (OECD, 2019a). In its 2021 inventory of external costs of air emissions, the MoEP estimates that burning of fossil fuels accounts for over 70% of the costs inflicted by air pollution.

Figure 1.4. Air emissions have decoupled from economic growth

Note: Data for particulate matter exclude emissions from non-road mobile sources. GDP at constant prices.

Sources: Israel Central Bureau of Statistics (2022), "Air pollution and greenhouse gases", Environment (database); OECD (2022), "Air and climate: Air emissions by source", OECD Environment Statistics (database).

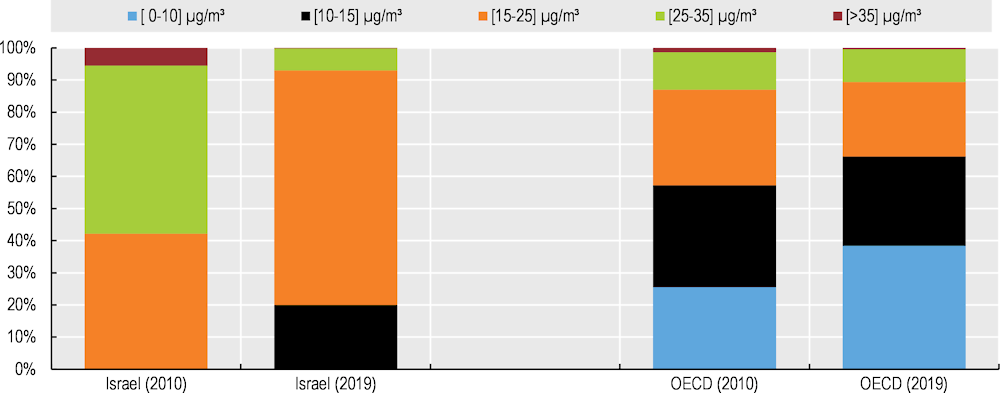

Figure 1.5. Population’s exposure to fine particulate matter is declining but exceeds OECD average

Source: OECD (2022), "Air quality and health: Exposure to PM2.5 fine particles – countries and regions", OECD Environment Statistics (database).

In 2021, transport was responsible for 31% of PM10 emissions, while industry and waste burning accounted for 18% and 21%, respectively (MoEP, 2022). Road transportation is the main source of air pollution in population centres. Waste burning is especially problematic in rural areas due to lack of appropriate waste management infrastructure and enforcement (Chapter 2).

In addition, alarming nitrous oxide levels are found in the centre of the country, particularly in Tel Aviv and Rishon LeZion. The highest levels of ground-level ozone are observed in the Upper Galilee, as well as in the less populated Judean, Arava and Negev deserts. Total national annual emissions of non-methane volatile organic compounds (NMVOCs) dropped in 2021 by 43% compared to their peak in 2016 (MoEP, 2022). The implementation of the 2015 National Plan for Reducing Air Pollution and Environmental Risks in Haifa Bay has led to a 56% reduction in industrial emissions of NMVOCs in that area. This exceeds the programme's target of a 48% reduction by 2018 compared to 2014 levels (MoEP, 2021). Still, Haifa Bay remains a serious air pollution hotspot, especially for NMVOCs such as benzene due to the concentration of the petrochemical industry around the city. In March 2022, the government approved a plan to phase out Haifa Bay’s oil refineries within a decade.

In early 2022, Israel adopted the World Health Organization’s air quality guidelines for key pollutants as the country’s “health standards” (target values). It also approved a new national programme for reduction of air pollution. The programme envisages a 70% reduction of sulphur dioxide (SO2) emissions over 2018‑30, a 38% reduction for nitrogen dioxide, 10% for PM2.5 and PM10, and 3.5% for NMVOCs over the same period. The measures that would lead to such reductions include further conversion of coal-fired power plants to natural gas and prevention of waste burning in open areas. They also include a range of actions in the transport sector: low-emission zones in cities (Box 1.1), promotion of EVs, reduction of commuting through enhanced teleworking, etc. Industrial air emissions have been regulated under the 2011 Clean Air Law through permits based on best available techniques used in the European Union.

Box 1.1. Low-emission zones target air pollution in major Israeli cities

Haifa

The first stage of the low-emission zone (LEZ) initiative in Haifa began in February 2018. It prohibits diesel vehicles weighing more than 3.5 tonnes from entering Haifa's residential areas without an emissions-reducing particulate filter. As of January 2019, polluting light commercial vehicles are also prohibited from entering residential areas of Haifa. The LEZ will ultimately result in a 20% reduction of transport emissions in Haifa.

Jerusalem

In 2020, Jerusalem became the first city in the country to create a LEZ that bans old, polluting vehicles from its entire municipal jurisdiction. During the first phase of the project, which started in February 2020, a regulation prohibited old, heavy (3.5 tonnes or more), polluting diesel vehicles from entering downtown without a particulate filter installed on the vehicle. In September of the same year, the second phase expanded the weight limitation, prohibiting light diesel vehicles from entering Jerusalem's LEZ and implementing the LEZ across the entire municipality. In 2022, the MoEP allocated ILS 10 million for the next phase of the project, which will restrict access to heavy machinery, create bicycle paths and raise people’s awareness.

Tel Aviv

In 2020, the Minister of Environmental Protection and the Mayor of Tel Aviv agreed to turn Tel Aviv into a "Clean Air City" by reducing vehicle-caused pollution. Among other things, the initiative would transform Tel Aviv into a LEZ. However, this initiative has stalled.

Source: MoEP (2021).

However, Israel has not introduced charges on air pollutants recommended by the 2011 EPR. If such taxes were introduced under the Clean Air Law, they would only apply to permitted installations regulated by this law. The difficulty the MoEP is grappling with is that permitted installations are responsible for just half of the country’s air pollution load, making the potential charges inequitable (Section 1.6.3).

1.1.3. Progress towards biodiversity targets

Despite its relatively small size, Israel enjoys extensive biodiversity at a junction of migratory routes between Europe, Asia and Africa. Most of its land is publicly owned, which facilitates the designation of protected areas. However, the country’s biodiversity continues to suffer from habitat fragmentation, invasive alien species, overexploitation of water resources and pollution.

Israel has not yet established official biodiversity targets as recommended by the 2011 EPR. Nineteen national targets were formulated in 2015 in accordance with Aichi Targets under the Convention on Biological Diversity but have not been approved by the government. There is no overarching governmental approach to mainstreaming biodiversity considerations into sectoral policies. The legislation relevant to biodiversity protection spans different laws and provides partial prevention and protection measures. A 2022 State Comptroller report said that Israel had made insufficient progress on 14 of the 19 targets and that biodiversity had declined in 89% of the country’s ecosystems (Surkes, 2022).

The 2010 National Biodiversity Strategy was never implemented. A new biodiversity action plan was intended to be completed in 2017, but this did not happen due to the MoEP’s budget constraints. In January 2020, the MoEP began to develop a new Israeli National Biodiversity Strategy and Action Plan (NBSAP). The plan is expected to be finalised by an inter-ministerial committee and adopted by a government decision by the end of 2022. The NBSAP would include several regulatory and budget recommendations. It will also set measurable biodiversity targets for 2030 in line with the Convention on Biodiversity's Post-2020 Global Biodiversity Framework. These will include, among others, protecting at least 30% of all terrestrial and marine ecosystems, reducing the number of endangered species by at least 10% and restoring at least 20% of degraded ecosystems.

An assessment of Israel’s ecosystems was initiated in 2013 within the framework of the National Ecosystem Assessment Programme, in line with a 2011 EPR recommendation. Its comprehensive report, based on the work of over 200 scientists, was published in 2021. This study, the first of its kind in Israel, details services provided by each of the country’s ecosystems, the biodiversity underpinning these services, the threats to each ecosystem and the drivers of change affecting the services. It attaches monetary value to some of the services, although this valuation is limited by methodological constraints.

Israel published State of Nature reports in 2013, 2016, 2018 and 2022. In addition, Israel’s Central Bureau of Statistics (CBS) published a National Index for Biodiversity in 2019 as part of the Indices of Quality of Life, Sustainability and National Resilience. The biodiversity index is based on the State of Nature report data and is updated every two years. The index is intended to assess the state of the country’s ecosystems. It represents an average of values characterising the remaining natural area and its state for each major ecosystem.

Habitat and species

The increasing demand for new housing and infrastructure is causing more pressure on open natural landscapes and adding to land scarcity. The significant increase in development of settlements and infrastructure causes habitat fragmentation and negative effects on the remaining adjacent natural areas. This is one of the constraints for the development of renewable energy sources in Israel: wind turbines interfere with bird habitats and migration routes, and solar panels should avoid occupying open spaces to prevent further biodiversity loss.

The 2040 Strategic National Housing Plan adopted by the National Planning Administration in 2017 includes some biodiversity considerations such as integrating ecological corridors into spatial planning to address habitat fragmentation. More statutory planning of ecological corridors is underway across the country.

Outside protected areas, most vulnerable ecosystems are under significant stress. In the last decade, the MoEP encouraged local authorities to prepare urban nature surveys. The surveys are intended as a basis for municipal management tools for open landscapes and urban nature sites. To date, 70 local authorities have produced an urban nature survey. As of 2019, four municipalities prepared an urban nature policy document (Jerusalem, Be'er Sheva, Tel Aviv and Kiryat Gat). Jerusalem was the first municipality to incorporate urban nature sites and guidelines into the statutory District Outline Plan.

The Open Spaces Conservation Fund managed by the Israel Land Authority since 2012 serves as an offset fund for land development projects (mainly housing). This government fund is one of Israel's most prominent economic tools to promote biodiversity conservation. It plays an important role in mainstreaming biodiversity at the national and local levels. It aims at the rehabilitation, restoration and conservation of open spaces. This includes development of public recreational parks; removal of invasive species; restoration and rehabilitation of aquatic habitats and their surrounding areas; and collection and processing of spatial planning data, monitoring and research. Over 2012-19, the fund distributed about USD 180 million to more than 500 projects nationwide.

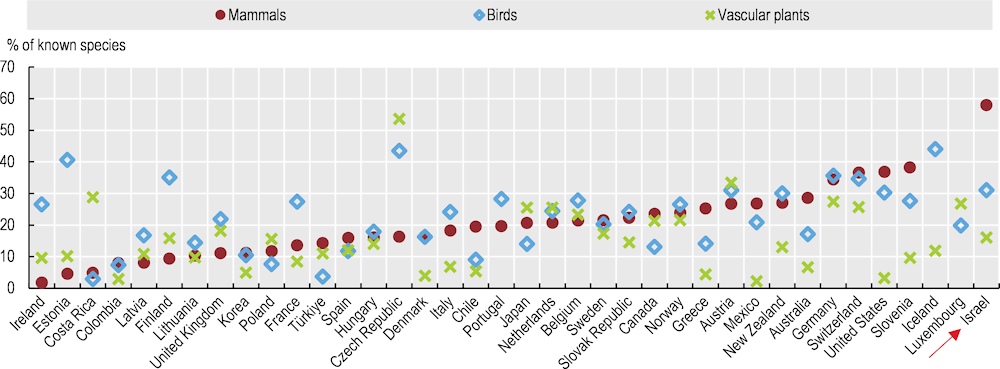

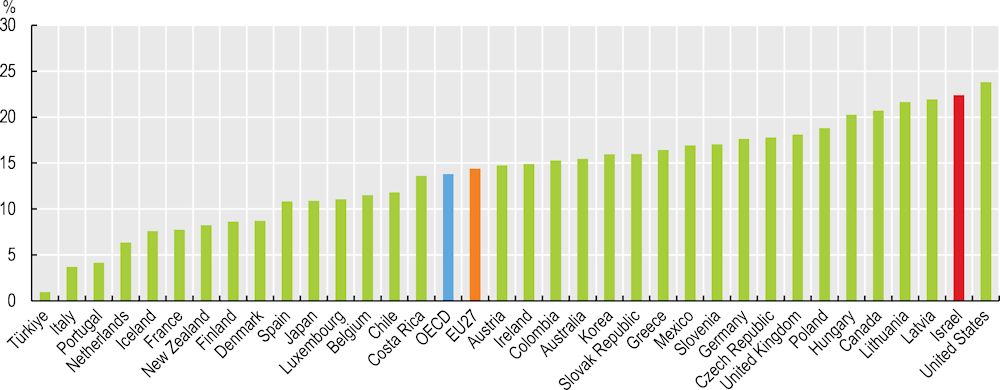

The status of indigenous species is concerning: more mammal species, as a share of total indigenous mammals, are threatened in Israel than in any other OECD member country (Figure 1.6).3 In 2019, the MoEP updated the protected species list for the first time in ten years, aligning it with the list of the Convention on International Trade in Endangered Species. Hundreds of species were added to the list, including 355 endangered plant species and 13 freshwater fish species.

Figure 1.6. Almost 60 percent of indigenous mammal species are threatened in Israel

Note: Data for Israel and New Zealand refer to threatened indigenous species. The reference year varies across OECD member countries as data are collected through sporadic national surveys; Israel data are from 2020.

Source: OECD (2022), “Biodiversity: Threatened species”, OECD Environment Statistics (database).

Over the past decade, Israel has made considerable efforts to prevent invasive alien species from entering the country, as recommended by the 2011 EPR. In 2017, for the first time, introduction pathways of invasive alien species to Israel were comprehensively analysed. This was a joint initiative of the MoEP, the Israel Nature and Parks Authority (INPA) and the Society for the Protection of Nature in Israel. However, invasive alien species (primarily plants, birds, fish and insects) continue to pose a major threat to the country’s biodiversity (Surkes, 2022).

Israeli legislation on invasive alien species is largely focused on the agricultural sector and pest control. A draft law aims to prevent introduction of new invasive alien species that pose a threat to the environment and to control existing ones from a more holistic perspective. However, the institutional and regulatory fragmentation in the country’s approach to this issue has so far hampered adoption of comprehensive biosafety and biosecurity legislation.

Protected areas

Israel has made substantial progress over the last decade, expanding terrestrial protected areas and establishing marine ones. In 2021, Israel joined the High Ambition Coalition and Global Ocean Alliance of over 100 countries committed to protecting at least 30% of global terrestrial land and marine areas. Over 2015-19, 40 terrestrial nature reserves (NRs) and 15 terrestrial national parks (NPs) were declared. This added about 6% to the total area of NRs and 13% to the total area of NPs under INPA management. About 25% of Israel’s land area is protected as part of declared NRs and NPs.

The INPA published a marine spatial and strategic plan for Israel's territorial waters in the Mediterranean Sea in 2018. It included biodiversity guidelines for protected areas. In the Gulf of Eilat in the Red Sea, the Coral Reef Marine Nature Reserve (MNR) protects most of the coral reef ecosystem near the coast, covering 1.3 km of the Israeli territorial Red Sea waters. Israel’s marine conservation strategy is to establish a small number of large marine reserves to enable sound functioning of ecosystems. Only 4% of the Israeli territorial waters were designated as MNRs as of mid-2022. However, a new large MNR was declared in the Palmachim Disturbance of the Mediterranean Sea in September 2022 (a first protected area in Israel’s exclusive economic zone). This has more than doubled the size of Israel’s offshore nature reserves.

1.1.4. Water management

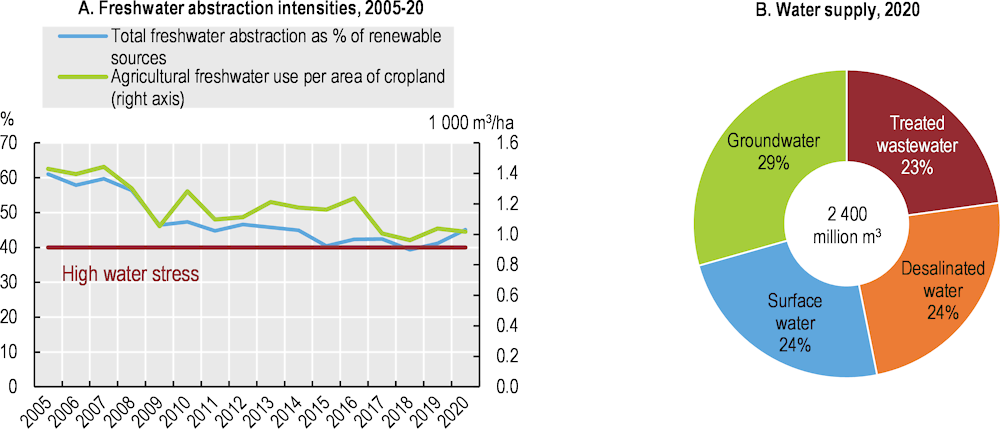

Israel is a country with a high level of water stress (Figure 1.7). To provide its rapidly growing economy with sufficient and reliable water, it has combined institutional and regulatory reforms with massive infrastructure investment. The vast majority of Israeli citizens enjoy water supply through a direct connection to the national water system. However, the projected population growth and the diminishing supply of water from natural sources present a challenge for maintaining this access.

Water supply and consumption

Large-scale reuse of wastewater and desalination of seawater (Figure 1.7) compensates for the lack of freshwater resources. Using advanced reverse osmosis technologies and improved process engineering, Israel’s five desalination plants are among the most efficient in the world, supplying over 80% of the country’s domestic urban water (i.e. water not used for irrigation). However, desalination has adverse environmental impacts. Apart from being highly energy intensive, the process produces brine. Discharges of brine into the sea can lead to increased salinity and temperature and accumulation of several potentially toxic substances in receiving waters. All Israeli desalination companies must monitor the coastal area of the Mediterranean around their plants for effects of brine disposal.

Agriculture accounted for more than half of total water consumption in 2020, while domestic use was responsible for about a third. Israel’s gross freshwater abstraction per capita is among the lowest in OECD member countries. Israel is the largest user of recycled effluent water for agriculture across OECD member countries: more than 87% of wastewater effluent is reused for agriculture, representing approximately half of total water that farmers use nationwide (Marin et al., 2017). A national bulk water conveyance system allows for optimisation of water distribution from various sources depending on demand. Massive public awareness campaigns have emphasised the value of water. Quasi-universal water metering allows for strict enforcement of water abstraction quotas.

Still, freshwater accounts for 36% of water use in agriculture, contributing to high levels of water stress. In 2018, entering the sixth year of the long drought, the Water Authority imposed permanent cuts in agricultural water quotas of up to 41% for irrigators accessing the national water system. Farmers could voluntarily waive part of the quota in exchange for support. Overall, between 2000 and 2018, agriculture’s share of freshwater abstractions decreased by more than half to reach about a third of total water abstractions (OECD, 2019c).

Figure 1.7. Pressure on freshwater resources is easing but high water stress remains

Note: Panel A – Water stress = total freshwater abstraction as percentage of total renewable water resources. Water stress higher than 40% indicates serious water scarcity and unsustainable water use.

Sources: CBS (2021), "Water and sewage", Statistical Abstract of Israel 2021 – No 72; OECD (2022), OECD Environment Statistics (database).

Water resource planning and allocation

In 2012, the Water Authority published a National Long-term Master Plan for the Water Sector through 2050. It covers protection of water resources, water supply and wastewater management. The master plan defines the vision, goals and objectives of the national water sector, as well as policies on major water issues. The plan aimed to integrate engineering considerations (ensuring the quality and quantity of water) with structural, economic, environmental, social and legal ones.

The 2012 master plan provided a medium- and long-term forecast for the balance of water resources in the country. It assumed a drop in the supply of natural water and an increase in non-conventional sources, including wastewater reclamation and desalination. In 2018, the government adopted a strategic plan for coping with periods of drought for 2018-30. Main measures include increasing supply of desalinated water, reducing demand and encouraging water conservation, and reinforcing protection of Lake Kinneret.

Israel has made significant progress in implementing a 2011 EPR recommendation to improve water allocation among sectors and to nature. In 2013, the INPA, MoEP and Water Authority jointly issued a Master Plan for the Supply of Water to Nature. An inter-ministerial team prepares and approves river plans to see how much water is needed for individual ecosystems. The plan determines how much water to discharge, what type and when. Approved plans exist for several major rivers. Water plans relate to ecological, hydrological and regulatory aspects of the overall planning for a river. They determine the flow regime, water quality and actions necessary to protect the ecosystem or rehabilitate it, considering other uses and needs from upstream to downstream. In some places, they set aside a minimum quota of water for ecosystems. Such water plans align with the 2011 EPR recommendation to define water quality objectives for all stretches of rivers. A manual describes the bodies and institutional and regulatory framework involved in preparing water plans.

The Israel Centre for Aquatic Ecology, established in 2015, determines the biological standards used to assess the ecological status of the country’s streams. A database with ecological and hydrological data for each of Israel’s aquatic habitats (about 200 total) has been prepared. However, the methodology for water allocation for nature has been implemented at fewer than half of these sites due to lack of funding.

Water quality and wastewater treatment

Israel has fulfilled its voluntary commitment, made at the 2017 United Nations Oceans Conference, to reduce the direct discharge of wastewater into the sea by the end of 2017 by 80% compared to 2012 (MoEP, 2021). Water quality has improved in Lake Kinneret as a result of a significant reduction in pollutant loads. For example, chloride concentrations are down by 18% in January 2022 from their peak in 2018. About 94% of all wastewater is collected and treated, and 87% is reused, primarily for agriculture. However, nitrogen pollution of groundwater caused by extensive fertiliser use in agriculture remains a problem. Nitrogen balance in the soil was seven times the OECD average level in 2020 (OECD, 2022a). This problem is addressed by treating well water abstracted for human consumption. As drinking water comes increasingly from seawater desalination, the government considers such treatment more cost effective than reducing the nutrient input. High nutrient concentrations are not a problem in irrigation water.

Israel has not met its target for wastewater treatment levels. By 2020, the country planned to have tertiary treatment at all its wastewater treatment plants. Two years later, less than 55% of all wastewater receives tertiary treatment due to delays in upgrading large plants in Jerusalem and Haifa.

1.2. Institutional framework for environmental governance

Israel has a centralised system of governance influenced by the British colonial Municipal Ordinances of 1934 and 1941. There has been no major decentralisation reform: the central government retains most of the powers and strict oversight of local government activities and finances. Bylaws and ordinances adopted by councils, as well as their budgets, are subject to approval by the Ministry of the Interior.

1.2.1. Central government and horizontal co-ordination

The MoEP manages a wide portfolio of environmental issues (climate change, air pollution, waste and chemicals management, biodiversity conservation, environmental planning and education). It has both policy making and enforcement responsibilities and employs about 60% of all environmental personnel in the country. However, the MoEP’s budget has remained one of the smallest in the government and has increased only slightly in absolute terms since 2015.

The Water Authority manages the water sector in accordance with the law and government policy. The Water Authority is governed by the Water Council which comprises representatives from the ministries of energy, environmental protection, finance, interior and agriculture.

The Ministry of Economy and Industry is responsible for resource efficiency as part of industrial policy. The Ministry of Energy is in charge of energy policy. Other important players in the environmental field are the Ministry of Agriculture and Rural Development and the Ministry of Transport. The co-ordination between these ministries on environmental issues is at times ad hoc and mostly informal. Besides the Water Council, several inter-ministerial committees either implement specific legislation (e.g. the Law on Prevention of Sea Pollution from Land-Based Sources) or are formed to design specific draft policies or legislation.

Local government and vertical co‑ordination

Israel’s 257 local governments are divided into three categories: 77 municipalities, 124 local councils and 54 regional councils. There are also two local industrial councils, which only manage industrial zones and do not have residents. The status of municipalities is granted to cities with at least 20 000 inhabitants while that of local councils is reserved for towns between 2 000 and 20 000 inhabitants. Regional councils operate at the local level, bringing together settlements spread across rural areas to unite local communities and provide local services, including waste management. Local authorities, through independent water corporations, own municipal water and wastewater utilities that are regulated under licences issued by the Water Authority. The Ministry of Interior oversees local governments. In co‑ordination with the Ministry of Finance, it approves the budget of local governments and audits their accounts. Government fund transfers account for about 40% of local government revenues, the rest coming mainly from the property tax (OECD, 2020a).

In 2019, 59 local environmental units covered 75% of local authorities and 90% of the population. Forming an environmental unit is voluntary but is subject to tender conditions and funding from the MoEP. The 2011 EPR recommended making government subsidies to municipalities contingent on viable environmental units and compulsory training for such units. This recommendation has not been implemented because the MoEP does not want to risk local governments refusing the much-needed funding for environmental purposes.

In 2014, the MoEP conducted a series of trainings for local environmental units on business licensing, prevention of air pollution and noise nuisances, environmental planning and enforcement. It has also developed a mandatory academic training course for new directors of local environmental units. The MoEP has significant influence over the environmental units’ performance. However, the units’ staff are municipal employees and give precedence to municipal policies. Some municipalities have sustainability units with similar functions, but those have been created outside the MoEP framework. Achieving a degree of uniformity in the powers and structure of environmental units would help strengthen local environmental governance.

Since 2009, the Ministry of Interior has established 11 regional clusters (eshkolot) that are inter-municipal unions that pool resources for delivering common services, primarily waste management. These clusters bring together 147 of the country’s 257 municipalities, covering about 30% of Israel’s population. The MoEP has invested heavily in environmental capacity building in the new clusters. Since 2021, the Ministry of Energy has been funding energy advisers in the clusters who work on energy efficiency and renewable energy projects in municipalities.

There are also other types of inter-municipal associations. For example, ten Municipal Associations for Environmental Quality work on issues ranging from environmental planning to air quality and waste management and environmental education. Forum 15 is an association of Israel’s largest municipalities that advocates decentralisation and runs several programmes on climate and air pollution. In 2011, Forum 15 pioneered the Green Building Standard that was later adopted at the national level (Section 1.1.1). A few local governments have climate change officers. Among them, Tel Aviv has both climate change mitigation targets and an adaptation plan.

1.3. Sustainable development and green growth policy framework

The 2011 EPR recommended that Israel develop a whole-of-government approach to sustainable development and green growth. Although an inter-ministerial committee formulated a national green growth plan in 2012, it was never budgeted or adopted. A 2019 government decision required Sustainable Development Goals (SDGs) to be integrated into strategic government programmes.

The CBS serves as the national focal point for reporting SDG indicators to custodian agencies. It also oversees the reporting process of all relevant data providers within the Israeli national statistical system. Israel submitted its first Voluntary National Report in 2019 reporting on all 17 goals. Currently, statistical data are available for 113 indicators. In March 2022, the CBS published an analysis of the distance from achieving the SDGs in Israel. It concluded that Israel has achieved or is close to achieving the targets of 31 of the 72 indices included in the distance analysis (43%). The best performing indices are health-related ones. The indices below 50% of the target related to poverty eradication, economic inequality, work-related injuries and renewable energy, as well as conservation of marine and terrestrial ecosystems.

In 2019, the MoEP launched a multi-sectoral process, "Israel 2050 – a thriving economy in a sustainable environment". It sought to optimise how the country uses energy and other resources, shift from fossil fuels to renewables in the power sector, make transport and industry run on electricity and end waste landfilling. It focused on transportation, energy, buildings and urban planning, industry and trade. The work, conducted during the COVID-19 pandemic, produced a report in February 2021. The report includes a vision and implementation strategy towards a low-carbon economy with an emphasis on streamlining resource use.

1.4. Regulatory framework for environmental management

Israel’s environmental regulatory framework is fragmented. Some environmental laws (on biodiversity protection, water and waste) have been in place for decades. Regulatory uncertainty is a significant challenge for businesses. The uncertainty is caused by frequent government changes and resulting policy fluctuations, as well as the inability of recent caretaker governments to pass legislation.

1.4.1. Environmental assessment

There have been no substantial changes in the environmental impact assessment (EIA) process since 2010. The field of EIA application remains significantly narrower than in the European Union (EU). Several categories of installations (e.g. certain chemical facilities and large poultry plants), as well as installations located in industrial zones, are not subject to EIA. There is no inherent linkage between the EIA system and permitting processes. However, while issuing permits, the MoEP may use information submitted as part of the EIA process.

Spatial plans under the responsibility of the National Planning Administration undergo an environmental assessment that is similar in scope to the EU definition of strategic environmental assessment (SEA). There is no SEA system in Israel for policies and programmes. The draft Climate Law (Section 1.1.1) includes the concept of climate impact assessment but no implementation mechanism for it. The MoEP is trying to introduce environmental elements into the mandatory regulatory impact assessment of draft laws and regulations.

1.4.2. Permitting

Israel’s environmental permitting system is governed by several disparate laws and is not integrated across media:

Air emission permits are issued by the MoEP under the 2008 Clean Air Law to approximately 140 high-impact facilities.

Hazardous materials (poisons) permits are issued by the MoEP under the 1993 Hazardous Substances Law to approximately 4 600 facilities that handle hazardous substances or wastes.

Business licences are granted by local authorities under the 1968 Business Licensing Law, based on conditions set by several government regulators, including the ministries of agriculture, health, labour and environmental protection. The MoEP sets conditions for about 9 000 business licence holders, with local authorities regulating the environmental impact of smaller facilities.

Marine discharge permits are issued by an inter-ministerial committee headed by the MoEP under the 1988 Prevention of Sea Pollution from Land-Based Sources Law to about 120 entities, more than half of which are industrial facilities.

Wastewater discharges into terrestrial water bodies (very few installations are not connected to public sewerage systems) are regulated by the Water Authority.

Since joining the OECD in 2010, Israel has been trying to introduce integrated environmental permitting in line with the EU Industrial Emissions Directive and the OECD Recommendation on Integrated Pollution Prevention and Control (IPPC). Following a recommendation of the 2011 EPR, the government approved the MoEP’s plan to consolidate environmental permits. The MoEP then prepared a draft law to consolidate separate environmental permits covering air and marine pollution, chemicals and hazardous waste into one integrated permit valid for seven years. This would create one unified and simplified approval procedure. However, the draft law faced opposition from industry fearful of increased regulatory burden. In addition, other government ministries disagreed on substantive issues and required resources to implement the law.

Following a government decision on IPPC in 2021, the MoEP produced a draft Environmental Licensing Law that includes amendments to the Clean Air Law and the Hazardous Materials Law. It would also override certain provisions of the Business Licensing Law, making environmental approval a stand-alone authorisation. As a result, the operator will be subject to one permitting procedure and will receive one permit that includes most environmental conditions (wastewater discharges to water bodies would still not be covered). An agreement was also reached on personnel and budget resources needed to implement the new law. However, this law would only be a first step to achieving cross-media substantive integration of environmental permit conditions on the basis of best available techniques, in line with the practice in many OECD member countries. The draft law was approved by the government and sent to the Knesset in March 2022, but its adoption there remains uncertain.

In 2018, the Business Licensing Law was amended to simplify and accelerate the procedure for low-impact facilities. Uniform specifications (essentially, general binding rules) are expected to be gradually adopted for a range of activity sectors as defined by the respective approving ministries. As of mid-2022, the MoEP had published binding rules for 14 sectors, including gas stations, slaughterhouses, hotels, dry cleaners and non-hazardous waste collection. Businesses that sign an affidavit that they comply with the rules would receive a licence expeditiously. In addition, the amendments reduced the processing time for licence applications and extended licence validity for several activity sectors. The MoEP has also streamlined requirements for lower-risk facilities by developing integrated environmental permitting guidelines and rules for small and medium-sized enterprises and incorporating them in their business licence conditions.

1.5. Compliance assurance

The multitude of environmental enforcement authorities in Israel reflects the fragmented regulatory framework. Routine inspections (for example, of industrial facilities regulated under the Clean Air Law) are carried out by the MoEP’s district offices. However, these offices, particularly for the Southern District, suffer from a chronic shortage of inspection staff (State Comptroller, 2019). The Green Police of the MoEP is responsible for criminal investigations. Local authorities may assume a limited compliance assurance role on issues within their jurisdiction but rarely do: 44% of local authorities did not have any qualified environmental inspectors in 2018 (State Comptroller, 2019).

The Green Police, Marine and Coastal inspectors, Water Authority inspectors, the INPA’s enforcement unit and the Environmental Unit of the Israeli Police have mostly informal co‑ordination. For example, the MoEP and the INPA do not co‑ordinate their inspection activities and reporting. In the last five years, a round table on environmental compliance has been held regularly under the auspices of the Ministry of Justice.

The MoEP is developing a portal to bring together regulatory interactions into a one-stop shop for all inspected entities. It is also planning a unified information-sharing system for all government stakeholders involved in environmental protection to manage permits, licences, monitoring, inspection and emergency events.

1.5.1. Compliance promotion

The MoEP is only starting to engage in compliance promotion activities, mostly by informing the public about companies’ environmental performance. In line with a 2011 EPR recommendation, a 2012 law established a Pollution Release and Transfer Register (PRTR). It required some 500 facilities with significant environmental impact to report on the annual quantity of emissions of pollutants (including GHG emissions) and waste transfers to the environment. The information is publicly accessible on the PRTR webpage, making it possible to compare data across years and to enable international comparisons. The database, in Hebrew, may be searched by factory, sector or area. The online system includes annual reports, a dynamic map of factories, pollutant emissions inventory, a search engine for reports by factory and an advanced data analysis system (added in 2019).

The MoEP publishes an annual Environmental Impact Index of about 40 companies, 100 industrial factories and some 800 gas stations. Released annually since 2014, this index integrates several parameters: pollutant emissions and waste transfers as reflected in the PRTR, risks of using or storing hazardous materials, environmental sensitivity of the site, compliance level with regulatory and permit requirements, and voluntary actions such as environmental management systems and corporate reporting. The index equation is based on the United Kingdom's Operational Risk Appraisal scheme, through which the government assesses environmental risk and determines how to allocate its regulatory resources. As one of its main objectives, the index presents the public, investors and the companies themselves with a reliable measure of the environmental impact of each company.

1.5.2. Compliance monitoring

The MoEP’s compliance monitoring and enforcement capacity has increased over the last decade. The ministry has established Drone Squadron 11 as part of its Green Police to enhance its compliance monitoring functions. Drones are used to gather intelligence and identify illegal operations and other environmental hazards. Enhanced interagency co-ordination has allowed joint enforcement against economic and environmental crimes.

Inspection planning is performed in the MoEP’s six district offices using risk level-based minimum inspection frequencies set in guidelines. However, compliance monitoring is dominated by reactive site visits prompted by incidents or complaints. The district offices do not usually manage to conduct more than 75-80% of planned inspections. About 5 000 citizen volunteers (“cleanliness trustees”) complement compliance monitoring by the MoEP and the Green Police. These volunteers send thousands of non-compliance reports on waste-related offences to a specially designated contractor. The contractor then filters and forwards them to the MoEP for possible enforcement action.

There are considerable gaps between the districts in the number and severity of environmental violations reported. Many offences are not documented or reported at all (State Comptroller, 2019). Compliance data management has been partial and fragmented across MoEP district offices. Different, often incompatible, database formats have been used. The duplication and inconsistent entry of compliance data impair the MoEP’s ability to take appropriate enforcement actions. The Central district office, which has the best reporting and data management arrangements, reported 534 violations detected in 769 inspections in 2021, demonstrating a high level of non-compliance.

A new electronic system for site inspection reporting was piloted in July 2022. It is expected to cover environmental inspections of every type of activity, improve inspection co-ordination across the district offices and allow the ministry’s inspection and enforcement directorate to access comparable compliance data, including compliance monitoring history of individual operators.

1.5.3. Enforcement

Israel has only fixed administrative fines for environmental offences. These fines, with amounts set in respective statutes, can be imposed by MoEP inspectors. The Green Police are authorised to issue fines under the Criminal Procedure Law in a variety of matters (in these cases, the offender can choose to pay the fine or go to court). The government has decided not to develop a system of variable administrative fines for environmental offences because it expects their justification to be difficult to defend in court. Instead, it has raised fixed fines per violation under different laws. For example, the maximum fine under the Hazardous Substances Law is ILS 2.5 million. The introduction of an ILS 6 000 fine for illegal burning of waste is awaiting parliamentary approval.

However, the MoEP’s enforcement procedures do not include criteria for selecting an appropriate non-compliance response. In over half of reported non-compliance cases, no administrative or criminal sanctions are applied. In 2014-18, the Green Police filed criminal indictments in only 1.7% of significant non-compliance cases. About three-quarters of the investigation files in the same period were closed without an indictment (State Comptroller, 2019).

The collection of most administrative fines (with revenue going to the MoEP’s extra-budgetary funds) has improved over the last ten years. The exception is small fines for waste-related offences, where the collection rates are low, at about 20%.

The MoEP has not followed through on its decade-old plans to systematically recover economic benefits of non-compliance. Israeli criminal law allows for this possibility. However, the few attempts to justify a methodology for calculating such benefits have failed in the courts.

1.5.4. Liability for environmental damage

The 2011 EPR noted that state ownership of most industries in the past and the predominant state ownership of land complicated the determination of liability of current land owners and lease holders and remediation of historically contaminated soils. The Prevention of Land Contamination and Remediation of Contaminated Lands bill, first developed in 2008, was endorsed by the 2011 EPR. However, it has still not been adopted due to strong opposition inside the government. The main controversial issues are potential implications for the value of state-owned land and the responsibility of the state as a polluter. The MoEP is revising the bill while also looking to integrate land rehabilitation provisions into conditions of future integrated environmental licences (Section 1.4.2).

A Risk-Based Corrective Action Technical Guidance, published in 2014, provides a consistent decision-making framework for remediation of contaminated sites. The MoEP’s 2015 policy prioritises remediation of sites where environmental and economic benefits clearly outweigh the costs. The state pays for clean‑up of such priority sites if they have been contaminated by state-owned entities. The MoEP has also determined threshold values for various contaminants. When thresholds are exceeded at a contaminated site, remediation must not be postponed beyond seven years. The Environmental Services Company, a government company under the auspices of the MoEP, remediates land left behind by Israel Defence Forces and military industry to make it suitable for construction of some 70 000 housing units. In 2022, the MoEP published a national map of contaminated soils throughout the country, which includes more than 2 200 sites.

A 2019 amendment to the Prevention of Environmental Nuisances Law introduced civil liability for damage to natural resources and biodiversity. The amendment allowed citizens and NGOs to file lawsuits for damages against polluters. However, the issue of securing funds for remediation of the contaminated environment remains unresolved. The MoEP is trying to require remediation of current environmental damage through permit conditions. Remediating the sites where the responsible party is either unknown or insolvent is the biggest challenge in the absence of an appropriate legal framework. Some budget funds have been used for joint remediation projects with the Land Authority, but these efforts have not been systematic.

1.6. Greening the system of taxes and charges

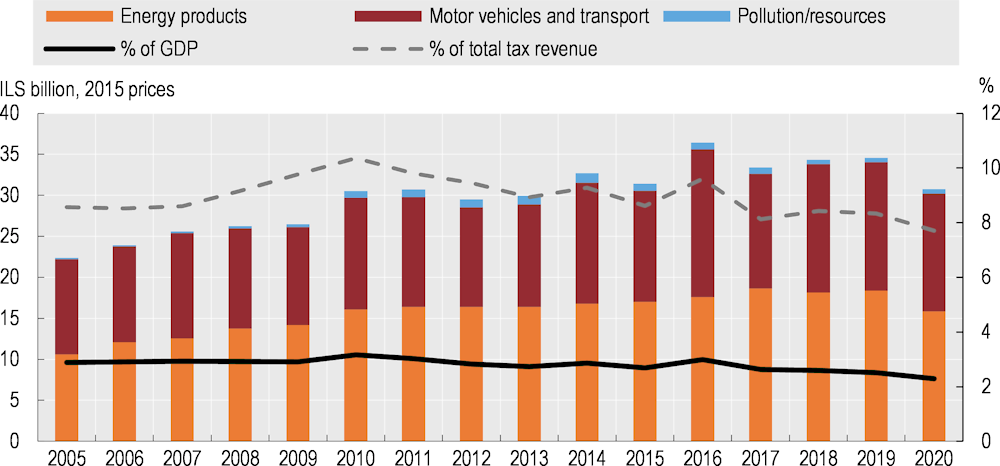

In 2020, the government collected ILS 30.7 billion worth of environmental tax revenue, representing 2.3% of GDP and 7.7% of total government revenue from taxes and social contributions (Figure 1.8).

This is relatively high compared to the OECD average (1.4% of GDP and 4.6% of total tax revenue). However, both shares have been decreasing over the last decade because the rate of increase of environmentally related taxes (1.4% per year on average over 2010-19) has been lower than the growth of GDP and tax revenue. In 2020, this decrease was accentuated by the COVID-19 pandemic that led to a reduction of both the fuel use and vehicle purchases.

As in other OECD member countries, energy-related taxes, including taxes on motor fuels, make up the bulk of environment-related taxes (52%), followed by transport taxes (47%); pollution-related taxes play only a minor role. Israel has the second lowest share (after New Zealand) of energy taxes in environmentally related taxes in the OECD – the OECD average share is 70% – due to both relatively low energy taxes and high vehicle taxes.

Figure 1.8. Environmentally related tax revenues are growing slower than GDP and total tax revenue

Note: Includes preliminary data and partial data for 2019-20.

Sources: Country submission; OECD (2022), "Environmental policy instruments", OECD Environment Statistics (database).

1.6.1. Taxes on energy use and carbon pricing

Over the last decade, Israel has advanced reforms to deregulate its oil sector, particularly the petrol industry. It eliminated some price controls for end users of petroleum products and privatised the country’s two oil refineries. Excise taxes on motor fuels are among the highest among OECD member countries, for both gasoline and diesel.

The 2011 EPR recommended that Israel consider an economy-wide carbon tax to reflect an appropriate carbon price. In 2021, a government resolution required the Minister of Finance to introduce a carbon tax per tonne on fuel. It also proposed amendments to the Excise Tax Directive on Fuel of 2004 and the Directive for Tax Fees and Exemptions and Purchase Tax on Goods of 2017 (State Comptroller, 2021).

The “carbon tax” is expected to take the form of higher excise taxes on coal, fuel oil, diesel, natural gas, liquefied petroleum gas and petcoke phased in over five years. As a result, carbon pricing would cover about 80% of Israel’s GHG emissions. The excise tax on petrol will not increase since it is already among the highest across the OECD. The tax on natural gas would grow almost six-fold from ILS 29 per tonne in 2023 to ILS 170 per tonne. This will happen gradually to limit the increase of electricity prices to 5% per year. However, the resulting implicit carbon tax rate for natural gas would only be about USD 20 per tonne of CO2, much lower than the externalities and rates for other fuels (IMF, 2022). Furthermore, the 2022 energy price increases have delayed implementation of these measures.

The impact of this increased carbon pricing on the industry is expected to be moderate due to the relatively low energy intensity of Israeli industry. Social equity concerns have gained prominence in the public debate. To address them, the Ministry of Energy is considering the mechanism to compensate the economic burden of carbon pricing on low socio-economic segments to avoid unintended distributional consequences (Section 1.8.2).

In 2011, the Petroleum Profits Taxation Law (also known as the Sheshinski Law) imposed a tax on Israel’s natural gas resources. However, its payment was delayed until 2020 (notably for the Tamar gas reserve) to allow faster return on investment (Surkes, 2021a). In 2015, Sheshinski Law 2 extended this tax to all energy resources. Revenues from the Sheshinsky tax are transferred to the Sovereign Wealth Fund (see Section 1.7.4).

1.6.2. Transport-related taxes and charges

Vehicle taxes

Vehicle taxation – including taxes on registration, ownership and usage of company cars – is a key policy instrument for encouraging the purchase of low-emission vehicles. This, in turn, helps reduce GHG emissions in the transport sector.

The car purchase tax in Israel has been historically the highest of any country, except for Denmark. This was one of the reasons for the lowest rate of motorisation among OECD countries, and the higher number of older cars on the roads. This, in turn, meant that vehicles were both less safe and emitted more pollution. The tax was differentiated in 2009 in line with 15 pollution grades, which consider the harmful impact of the vehicle’s emissions. In 2020, the tax rate stood at 10% of the purchase price for full electric cars, 25% for plug-in hybrid cars, 45% for standard hybrid cars and 83% for conventional internal combustion engine vehicles (Ministry of Energy, 2022). There is a plan to gradually increase tax rates for hybrid vehicles to eventually align them with that for conventional vehicles at 83%. At the same time, the rate for full EVs would rise to 35% in 2024 (Table 1.1). This would reduce incentives to upgrade the car fleet, especially since the import ban on combustion engine vehicles has been postponed until 2035 (Section 1.1.1).

Table 1.1. The purchase tax creates an incentive to buy electric vehicles

Purchase tax rate of vehicles by vehicle type

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

|---|---|---|---|---|---|---|

|

Full electric vehicles |

10% |

10% |

10% |

10% |

20% |

35% |

|

Plug-in hybrid electric vehicles |

20% |

25% |

30% |

40% |

55% |

83% |

|

Standard hybrid electric vehicles |

30% |

45% |

50% |

83% |

83% |

83% |

|

Other conventional vehicles |

83% |

83% |

83% |

83% |

83% |

83% |

Source: Ministry of Energy (2022), “Electric vehicle in Israel”.

In Israel, car owners must pay an annual registration fee in conjunction with the vehicle’s inspection. The average registration fee is about ILS 1 500, resulting in a total annual revenue of ILS 4.7 billion.

The tax treatment of company cars has not changed over the review period. All the costs of company cars remain fully deductible from corporate taxes with no cap on fuel expenses. The 2011 EPR recommendation to eliminate the perverse incentives that result in increased car use has not been implemented: company car holders have no financial incentive to drive less.

Congestion charges and differentiated road tolls

About 60% of Israel’s road congestion occurs in the metropolitan area of Tel Aviv, making it the fourth most congested city across OECD member countries (Tom Tom, 2021). A well-designed charging system can relieve congestion by steering users towards more balanced and efficient urban mobility choices. This would also generate revenue to facilitate additional investment. The 2011 EPR recommended that Israel extend the use of road tolls on congested motorway stretches and consider introducing congestion or pollution charges in major metropolitan areas.

Israel has not yet introduced congestion charging, mainly due to the expected public opposition given already high taxes on vehicles and fuels (OECD, 2019b). According to a recently approved law, the first congestion charge will be introduced in the Tel Aviv metropolitan area in 2025. Three virtual rings have been defined, with the innermost ring covering the central business district of Tel Aviv. Vehicles passing through the rings during congestion hours will be charged. The charge amount will vary by ring, direction and time of day. The total daily maximum charge will be ILS 37.5 (USD 10.9). This is lower than the comparable congestion charge in London (USD 18.3) but higher than in Milan (USD 5.2 for non-residents). Israel needs to enhance acceptance of this measure by engaging with the public and the business community on the cost of congestion. To that end, it needs to provide information on the rationale and benefits of the proposed scheme. Congestion tolling is another option that has been tried in Israel (Box 1.2).

A complementary approach to congestion charges is to improve public transportation and parking policies. Parking fees in Israeli cities are low for many car users (OECD, 2020a). International experience shows that free or under-priced parking increases the costs of parking supply and land use. This implies that funds possibly available to improve the public transport system are used for parking (Russo et al., 2019). Therefore, congestion charges need to be combined with increased parking charges in central areas.

Box 1.2. High-occupancy tolls decongest traffic entering Tel Aviv

High-occupancy toll (HOT) lanes are a variant of the more common high-occupancy vehicle (HOV) lanes. HOV lanes allow public transportation vehicles, as well as private vehicles with a sufficient number of persons on board (2+, 3+, 4+, etc.), to use the lane. HOT lanes also allow vehicles that do not meet the relevant HOV threshold to use the lane if they pay a toll.

In theory, HOT lanes are less efficient than pricing congestion on all lanes. However, the choice offered by HOT lanes – between congested general lanes and reserved lanes with tolls – is generally more acceptable to the public. This is due both to the better use of road space and the fee being optional.

Israel is the only country outside the United States operating HOT lanes. The country’s only 13 km-wide HOT lane is located along the inter-urban freeway connecting Jerusalem to Tel Aviv. It has been operating since 2011 in one direction, towards the entrance to Tel Aviv, starting near the Ben-Gurion International Airport.

As a result of the project, overall traffic volume on the freeway did not increase and may have declined slightly. Two mechanisms mitigated congestion in the general purpose lanes. One is a park-and-ride service. It doubles capacity of parking spaces near the interchange and offers a free shuttle service to the central business district. The second is the requirement of a minimum traffic volume and speed to activate the toll. The HOT project’s successful implementation is inspiring other similar projects in Tel Aviv.

Source: Cohen-Blankshtain et al., 2020.

1.6.3. Other environmental charges

Charges on pollution

The landfill levy is the most important pollution-related economic instrument in Israel. The levy, introduced in 2009 by an amendment to the Maintenance of Cleanliness Law, requires landfill site operators to pay a charge for every tonne of waste entering it. The average levy was ILS 114 (EUR 33) per tonne for mixed waste in 2020. This is lower than average across the 23 EU member states with such a tax (it ranges from EUR 10 per tonne in Lithuania to EUR 120 per tonne in Wallonia, Belgium). To reach the policy goal that no more than 20% of municipal solid waste be landfilled by 2030, compared to the current landfilling rate of about 80%, the levy needs to be set higher to enhance its incentive impact (Section 2.5.2). Revenue from the landfill levy goes to the Maintenance of Cleanliness Fund (Section 1.7.4). Israel also applies a charge on single-use plastic utensils, which is expected to lead to a 40% reduction in their consumption (Section 2.5.2).

In 2011, Regulations on the Prevention of Sea Pollution from Land-Based Sources imposed a charge on permit holders who discharge wastewater or waste into the sea. The charge is based on the types and quantities of pollutants discharged, as well as the circumstances and location of discharge. The funds are channelled into the Marine Pollution Prevention Fund (Section 1.7.4).

The 2011 EPR recommended Israel to introduce air emission charges targeting priority pollutants emitted by large and medium-size stationary sources. These charges could use the legal basis provided by the Clear Air Law, but this has not happened. The government is reluctant to impose a charge on only a few polluters permitted under this law who are responsible for less than half of air emissions.

Water tariffs

The Israeli water sector has moved closer to financial autonomy. Water tariffs set by the Water Authority have contributed to cost recovery in the sector without posing significant affordability issues for the population (Avgar, 2018). However, there are cross-subsidies between users. Water tariffs for the industrial sector were gradually increased over 2010-15. This move partly implemented the 2011 EPR’s recommendation to gradually increase the agricultural and industrial sectors’ share in financing the full costs of water infrastructure. Wastewater reuse also still relies on investment subsidies.

The 2017 amendments to the Water Law removed tariff differentiation between sources where the water is abstracted and its uses. According to this reform, tariffs for water production and supply would be based on cost recovery. The production and transmission tariffs would not be derived from water use objectives. Rather, they would be based only on the cost of water production and transmission.

The 2017 reform aims at convergence of freshwater prices for farmers using the national water system and for those accessing water from other sources. In line with this reform, water prices for private producers have been raised. Meanwhile, water prices for consumers of the national water supply company Mekorot have declined (OECD, 2019c).

However, water prices for agriculture remain subsidised. Water tariffs for farmers are below those paid by domestic and industrial consumers and below the opportunity cost of producing freshwater, as is the case in most OECD member countries. Furthermore, they pay a lower freshwater extraction levy than industrial and domestic users, representing an implicit subsidy (OECD, 2019c). The price of treated wastewater for irrigation is significantly subsidised to encourage farmers to use it instead of freshwater, contributing to the decrease in average price of water for agriculture. This lower price for recycled wastewater is possible thanks to large investment subsidies for wastewater treatment and storage.

In February 2021, the Water Authority published draft recommendations to gradually raise the price of water for agriculture by 2028. Draft tariff regulations based on these recommendations were posted for public consultation in November 2022. The measures would phase out the subsidy while implementing the cost recovery approach to pricing. Discussions have begun on compensating farmers for the planned price increase, but no agreement has been reached. In parallel, the Water Authority is exploring ways to reduce cross-subsidies in the agricultural sector between regions and water supply sources.

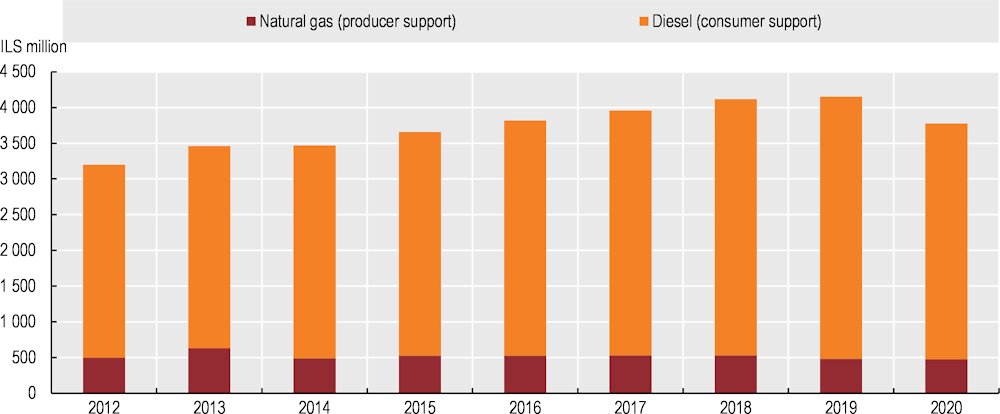

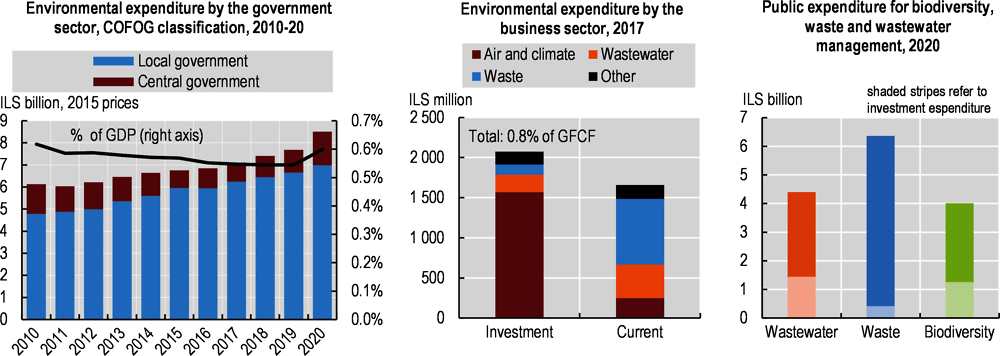

1.6.4. Removing potentially perverse incentives