Latvia has progressed with recovery and recycling, and the use of economic instruments to divert waste from landfilling. However, waste and materials are not yet managed cost‑effectively and policy implementation is not sufficiently co‑ordinated. Moving towards a circular economy will require further improving basic waste management, strengthening the use of economic instruments and improving performance in extended producer responsibility systems. This chapter gives an overview of trends in material use and waste generation and of related policies. It reviews the effectiveness of the instruments used to encourage waste reduction and recycling and to reduce landfilling. It identifies implementation gaps and opportunities in moving towards a circular economy.

OECD Environmental Performance Reviews: Latvia 2019

Chapter 4. Waste, material management and circular economy

Abstract

“The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

4.1. Introduction and overview

Latvia has one of the lowest population densities in Europe and, since 2010, a declining population. Most people live in urban areas, more than a third of them in Riga. Average household income levels are low, with wide regional disparity. The economy is characterised by strong growth in gross domestic product (GDP). Services account for 70% of GDP, and small and medium-sized enterprises (SMEs) provide almost 80% of employment. Informal economic activity is widespread. With few non-renewable natural assets, Latvia relies heavily on external markets for imports and exports of raw materials and products. These characteristics shape the country’s material consumption patterns and waste management.

In the 2000s, Latvia completely reconstructed its waste management systems. It has fairly complete policy and legal frameworks for waste management, supported by quantitative targets and economic instruments. As in other environmental policy areas, most developments are driven by EU requirements and benefit from EU funding. The country has made progress, including with separate collection and recovery of municipal waste, recycling capacity and the use of economic instruments to encourage recovery and divert waste from landfill.

However, waste and materials are not yet managed cost-effectively, and related policy implementation is not sufficiently co‑ordinated or monitored. The economic instruments used do not yet provide sufficient incentive for moving towards a circular economy; some targets will be difficult to meet. Waste reduction and prevention and the management of specific waste streams, such as construction and demolition waste, have received little attention.

To lay the groundwork for circular economy approaches, essential steps are needed to improve basic waste management, strengthen the use of economic instruments and improve performance and transparency in extended producer responsibility systems. The potential for progress is good, with encouraging recent developments. To be successful, Latvia needs to better use synergies with eco‑innovation and public procurement programmes, increase co‑operation with neighbouring countries to strengthen recycling markets, and efficiently use treatment and recycling capacities in the region. It also needs to plan to progressively reduce its reliance on EU funding, expand co‑operation across ministries and with stakeholders, and strengthen policy integration at all levels.

4.2. Trends in material consumption and waste management

4.2.1. The material basis of the economy

Latvia’s natural asset base mainly consists of domestic forest resources, peat, dolomite, limestone and other construction minerals. Most other resources and materials, mainly metals and fossil fuels, are imported.

The materials mix

Material inputs and consumption are dominated by biomass, with shares much higher than in other countries. Biomass represents 68% of the materials extracted in the country, 61% of direct material input, 58% of domestic material consumption (DMC) and 70% of materials exported. The bulk of it is wood. Domestic demand for wood comes from the wood processing industry, which is Latvia’s main export sector, and the energy production sector. Wood has long been the most important domestic energy source for residential heating, especially in rural areas. Biomass use for energy production is encouraged so as to decrease dependence on imported fossil fuels. Thus, in the past ten years, the use of woodchips as fuel in combined heat and power plants has been growing, as have woodchip exports.

Non-metallic minerals represent about a third of material inputs, largely in construction, including road construction, which peaks periodically depending on EU funding availability. Fossil fuels hold a rather small share (around 7% of inputs), reflecting changes in energy efficiency and the development of renewable energy sources (Chapter 1).

Main trends

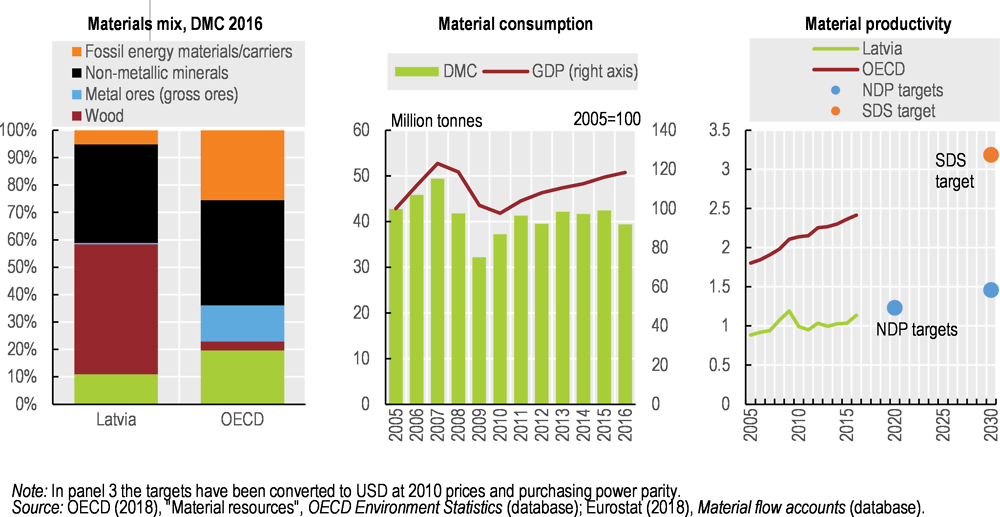

The country was severely affected by the 2008-09 economic crisis, which led to reduced productivity growth and output, especially in construction but also in other sectors. SMEs, which often have limited capacity to absorb new technology and innovate, were particularly affected. Material inputs and consumption thus declined significantly from their pre‑crisis level, dropping by 27% and 35%, respectively, between 2007 and 2009. Over 2005‑16, material inputs rose by a modest 6%, while material consumption fell by 8%, partly due to population decline and reduced purchasing power after the crisis. Material intensity per capita, meanwhile, grew slightly (+5%), with fluctuations. In 2016, every inhabitant consumed, on average, 20 tonnes of materials, much more than the EU average of 13 tonnes and OECD average of 16 tonnes.

The material productivity of the economy (GDP/DMC) improved by 29% over 2005‑16, revealing a decoupling between material consumption (DMC fell by 8%) and economic growth (GDP rose by 18%). But productivity gains were mostly driven by socio‑economic developments; improved resource efficiency seems to have played a minor role. Productivity remains lower than in other OECD and EU countries. Latvia generates less than half the OECD average for economic value per tonne of materials consumed: about USD 1 100 per tonne, compared to USD 2 400 per tonne for the OECD.

Non-binding national targets for improving material productivity by 2020 and 2030 are set in the 2014‑20 national development plan (NDP) and the Sustainable Development Strategy (SDS). The NDP’s 2020 target of EUR 0.6/kg of materials consumed was nearly achieved by 2016 at EUR 0.55/kg (Figure 4.1), and its 2030 target of EUR 0.71/kg is within reach. The SDS target of EUR 1.55/kg (USD 3.18/kg) by 2030 reflects Latvia’s political will but will be difficult to reach.

Figure 4.1. Material use is driven by socio-economic developments and is dominated by biomass

4.2.2. Trends in waste generation and treatment

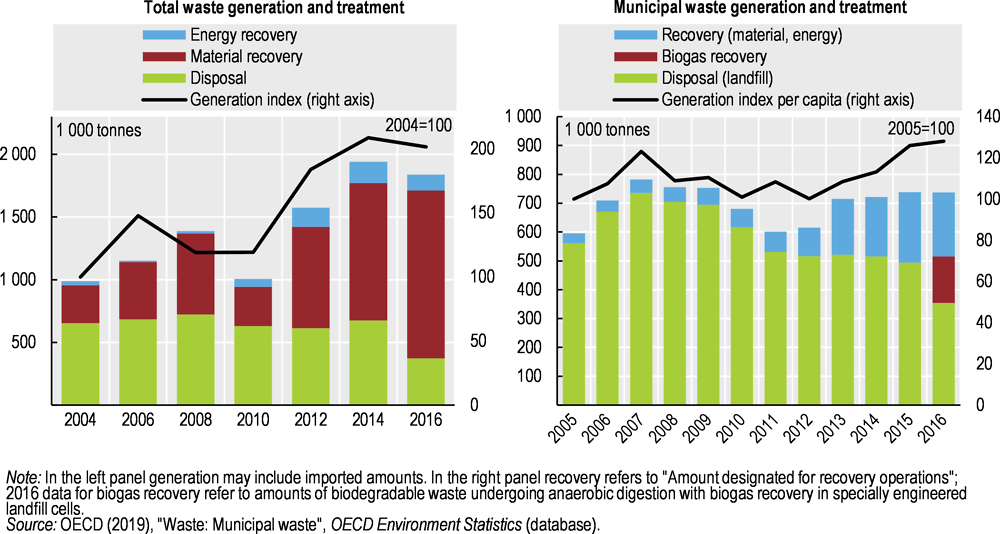

Waste generation has more than doubled since 2004, despite a decrease due to the economic crisis (Figure 4.2). In 2016, Latvia managed about 2.5 million tonnes of municipal and industrial waste, including 300 000 to 400 000 tonnes of inert mineral waste and 65 000 to 80 000 tonnes of hazardous waste. About 70% of the waste was recovered. Landfilling, though decreasing, still represents more than 20% of treatment. Official data show that waste from households and other municipal sources amounts to more than 30% of all waste generated, a much higher share than in most other countries. This could be explained in part by the rather broad national definition of municipal waste.

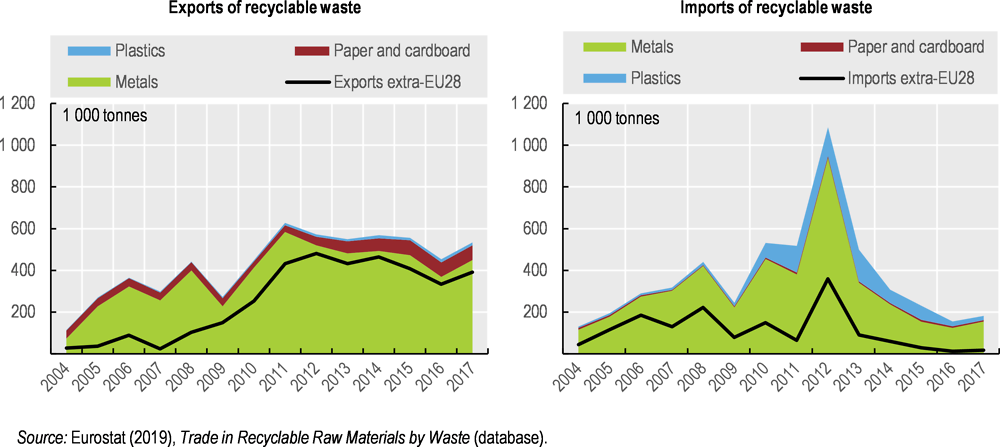

Non-hazardous waste exports rose sevenfold between 2006 and 2013, then decreased till 2016 (Figure 4.3). Most are scrap metal, mainly iron and steel, exports of which spiked between 2009 and 2011 when Latvia’s smelting capacity declined. Exports to non-EU countries have been rising and now represent more than 70%. Imports are also dominated by metal, but include plastic as well, for further recycling in domestic polymer processing.

Municipal waste

Municipal waste generation grew till 2007, then decreased (with some fluctuations) as the crisis reduced household purchasing power. But, contrary to forecasts in the State Waste Management Plan for 2013-20 based on a declining population, the past five years have again seen a rise in amounts generated. In 2017, every Latvian inhabitant generated, on average, 436 kg of household waste, less than the OECD average of 524 kg/capita, but 37% more than the Latvian average in 2005 (318 kg/cap).

Figure 4.2. Progress with waste recovery needs to be consolidated

Figure 4.3. Markets for recyclable waste depend on external demand

The recovery rate grew significantly after 2011 with the gradual introduction of separate collection, development of extended producer responsibility systems and increases in the natural resource tax on landfilling. From basically zero in 2000, the rate had risen to 5% by 2005, 9% by 2010 and 30% by 2016. This is still lower than the EU and OECD averages, and the 2020 target of 50% of municipal waste being prepared for reuse, recycling or recovery, set in line with EU requirements, may be difficult to reach. However, some biodegradable municipal waste, not accounted for in these figures, undergoes anaerobic digestion with biogas recovery in specially engineered cells operating since 2016 at the Riga Getlini landfill site. Accounting for this waste would raise the recovery rate to close to 50% (Figure 4.2).

Landfilling, though decreasing, still accounted for 45% of municipal waste in 2016 after deduction of the amounts used in biogas recovery, and many recoverable and biodegradable materials are sent to landfills. Despite an extension, Latvia missed the 2013 EU target of reducing the amount of biodegradable waste landfilled to 50% of the 1995 level, and the 35% target for 2020 does not seem to be within reach.

Hazardous waste

Latvia manages 65 000 to 80 000 tonnes of hazardous waste from industrial and municipal sources. Domestic capacity for recovering hazardous waste is limited to fluorescent light bulbs, some medical waste, and waste oil used as fuel in cement kilns. Other hazardous waste is exported for processing in other EU countries, in conformity with the Basel Convention and national law. Quantities of exported hazardous waste have been decreasing over the past ten years, and now represent about 13% of the hazardous waste generated (down from 56% in 2006).

Including exports for recycling, the overall recovery rate was 80% in 2016, little changed from 2005. The rest is either permanently stored or landfilled at two sites meeting EU standards.

4.2.3. Waste treatment and disposal infrastructure

Latvia has sufficient capacity for disposal of municipal and other waste. It has long relied mainly on landfilling, and has no waste incineration infrastructure except for hazardous waste, mainly oil, and some plastic residue incinerated as fuel in cement kilns.

Until the 1990s, Latvia had more than 500 unregulated landfills and dumps with little to no monitoring of waste flows; some were close to rivers. Since 2000, they have gradually been closed and recultivated. They were replaced by new regional landfills complying with EU standards. The country now has 1 regulated landfill for hazardous waste, 1 for waste containing asbestos and 11 for non‑hazardous waste of municipal and industrial origin, with total capacity of 16.2 million tonnes. Some landfills for non‑hazardous waste also accept inert construction and demolition waste (CDW). Many landfills have sorting facilities to redirect recoverable materials to other treatment. Biogas recovery is common. Since 2002, Latvia has banned landfilling of liquid waste, wastewater treatment sludge with more than 80% water content, and waste from the food and timber industries that is not used for composting or biogas generation.

Alternative waste treatment options are not yet well developed, but are expanding rapidly. In the past 10 to 15 years, Latvia has invested in the development of its recycling infrastructure, with EU co‑funding. Its recycling facilities specialise in paper and cardboard packaging, with a well-developed infrastructure whose capacity exceeds the available waste paper in Latvia, and polymers, of which Latvia is the Baltic region’s leading recycler. Many materials are prepared for recycling then exported.

Latvia’s total recycling capacity for paper, cardboard, plastics and glass is about 120 000 tonnes per year, including 71 220 tonnes of plastics, 6.2 tonnes of which is composite material. Nine companies generate plastic granulates or flakes that can be used as secondary raw materials in plastic production (Box 4.1).

Box 4.1. Recycling of waste polymers: a success story

Latvia has become a leader in the recycling of plastic polymers in the Baltic Sea Region. Two companies are active in this area: Nordic Plast specialised in recycling high and low density polyethylene (HDPE, LDPE), and PET Baltija specialised in recycling polyethylene terephthalate (PET). The plastic waste for recycling comes from separate collection in Latvia and from other EU countries such as Estonia and Lithuania. It includes light plastic bags and films, hard plastic cans and containers, polypropylene bags, plastic bottles and bottle caps. Most of the recycled feedstock, plastic pellets (natural, grey, black, mixed) and PET flakes (clear, dark mix, light mix), is exported for re-processing.

The 7 000 tonnes of recycled plastic pellets produced annually are sold to producers of plastic products (e.g. plastic films, plastic tableware). The 21 000 tonnes of PET flakes produced annually are sold to food packaging producers (60%) and fibre and plastic strap producers (40%).

Source: Nordic Plast Ltd. (2019), http://www.nordicplast.lv/en/ (website); PET Baltija Jsc. (2019), http://www.petbaltija.lv/en/ (website).

In recent years, the focus has been on production of biogas and compost to divert waste from landfill and contribute to renewable energy targets. Latvia has several plants to treat and recycle biodegradable waste, including 5 large scale composting facilities and 59 small biogas plants with estimated production of 64 MW. Many landfills have their own composting facilities and biogas recovery equipment.

Further expansion of recovery and recycling capacity is planned by 2023. Proposed projects include four plastic recycling plants, a glass recycling plant, a lead battery plant and at least one biodegradable waste plant.

Developing domestic waste-to-energy (WtE) capacity is being considered as a further way to achieve the EU landfill reduction and recovery targets, and reduce Latvia’s energy dependence and consumption of primary fossil fuels. The closest WtE plant is in Estonia, too far from the main waste generating centres in Latvia, according to the government. An installation with a treatment capacity of 11 000 tonnes of refuse-derived fuel (RDF) per year is thus planned. The government is also considering supporting projects that would use RDF to produce heat in some municipalities and thus reduce Latvia’s energy dependence and consumption of primary fossil fuels. Given the size of investment involved in WtE infrastructure and risk of creating a lock-in effect, it is important for the long-term costs and benefits of alternative waste technology and infrastructure to be carefully assessed, along with neighbouring countries’ recycling capacities. Such an assessment also needs to take into account expected developments in the availability of domestic waste as feedstocks for the operation of a WtE plant, and carefully consider the trade-offs between waste management objectives and renewable energy objectives.

4.3. Objectives and policies for waste and materials management

Latvia has fairly complete policy and legal frameworks for waste and materials management, supported with quantitative targets and economic instruments. Strategic objectives are largely determined by the objectives and requirements of EU law and policies, and defined in line with international commitments (e.g. the Basel Convention) and OECD Council Decisions.

4.3.1. Policy framework and objectives

Waste management rests upon on a range of policies addressing issues related to waste, energy supply and bio-resource management. The main objectives are preventing waste generation, minimising negative effects on human health and the environment, maximising recovery and reuse and ensuring supply security, including by replacing primary natural resources with secondary raw materials, and fossil energy sources with renewable biological resources.

The main policy documents are the State Waste Management Plan 2013-20 (SWMP) and associated State Waste Prevention Programme (SWPP), both mandatory under EU law. Resource efficiency and the principles of a sustainable material economy are further enshrined in the 2014 Environmental Policy Guidelines for 2014-20, the 2010 Sustainable Development Strategy of Latvia until 2030 and the 2012 NDP for 2014–20.

The State Waste Management Plan

The SWMP aims at preventing and minimising waste generation and ensuring more efficient resource use. It includes the SWPP, which specifies prevention objectives and measures needed for their achievement. The SWMP includes measures on (i) cleaner technology, product eco‑design, eco‑labelling, green purchasing and environmental management systems; (ii) education and information; and (iii) development of separate collection and recycling capacity. Recent developments in EU policy (amended EU Waste Framework Directive, Packaging and Packaging Waste Directive, Landfill Directive and related targets) are not yet reflected. They will be included in the next version of the SWMP.

Regional waste management plans (WMPs) can be established for the waste management regions (WMRs) in co‑operation with the Ministry of Environmental Protection and Regional Development (MEPRD). In addition, municipalities can develop local WMPs in line with the regional plans. The establishment of regional plans was mandatory until 2013 and has since been voluntary. The three regional plans developed thus far cover 32 of Latvia’s 119 municipalities.1

Other relevant policies and documents

Latvia has no raw material policy, but it is the first Baltic country with a bioeconomy strategy2 to foster knowledge and innovation. The strategy includes incentives for replacing non‑renewable resources with biological resources in public procurement and production. Examples include biomass use in energy production and the use of biological materials in construction. Other relevant documents are:

the 2015 Rural Development Programme 2014‑20, with measures on resource efficiency in agriculture, food production and forestry and on the processing of waste and residues from these sectors

the 2015 Development Guidelines for Forestry and Related Sectors for 2015-20, promoting improved planning and management practices and encouraging sustainable agriculture and forestry

the 2013 Smart Specialisation Strategy, promoting innovation and technological progress, supported by the Industry Policy Guidelines and Science and Technology Guidelines.

4.3.2. Legal framework

Latvia has an extensive regulatory framework, driven by EU legislation. The main laws are:

Waste Management Law (2010), last amended in late 2017, which supports implementation of the SWMP and applies a comprehensive approach to waste management

Pollution Law (2001), which regulates polluting activities, such as waste recovery, disposal and storage facilities, according to their potential environmental risk

Natural Resource Tax Law (2005), which applies the polluters-pays principle to natural resource management (materials, waste) and specifies related exemptions

Environmental Protection Law (2006), which requests waste managers to monitor their environmental performance and inform the public.

Related legislation includes the 2005 Packaging Law and 2004 End-of-life Vehicles Management Law. Implementation is supported by more than 40 Cabinet regulations specifying legal and technical requirements for waste management operations, management and recycling of particular waste streams and reporting on performance.

4.3.3. Institutional framework and governance

The central authority for waste management is the MEPRD, which has a general supervisory and monitoring role. The ministry is responsible for developing and implementing waste management policies and regulations, co‑ordinating the development and implementation of waste policies at the local level, and organising and co‑ordinating hazardous waste management. It is also responsible for green public procurement.

Compliance controls and enforcement are the responsibility of the State Environmental Service (SES) and its eight regional boards. They control compliance with legal requirements, issue technical norms and permits for waste management activities and authorise transboundary movements. Since 2017, the SES has also co‑ordinated and controlled extended producer responsibility systems, a function previously carried out by Latvian Environmental Protection Fund Administration.

Environmental impact assessment of waste management facilities is the responsibility of the Environment State Bureau. It also keeps a register of enterprises dealing with packaging waste and a register of enterprises participating in the EU Eco‑management and Audit Scheme (EMAS).

The Latvian Environment, Geology and Meteorology Centre (LEGMC) handles hazardous waste management, e.g. establishing and managing landfills and incinerators. As the body responsible for environmental monitoring, it also collects, manages and reports waste data.

The Public Utilities Commission approves regulations on authorisation of municipal waste disposal in landfills, registers public service providers and determines how to calculate landfill tariffs. The Health Inspectorate monitors hazardous medical waste management.

Ministries involved in policies supporting resource efficiency, eco-innovation and circular economy objectives include the Ministry of Education and Science, regarding research on environmental innovation; the Ministry of Agriculture, on the bioeconomy strategy; and the Ministry of Economy, in charge of industry and innovation policies.

Practical implementation is the responsibility of the municipalities. Local governments organise the management of municipal waste, including hazardous waste, on their territory according to the SWMP and regional plans (if any). They issue local regulations, finance the necessary infrastructure, select providers for waste services and apply green procurement rules.

Inter‑municipal co‑ordination

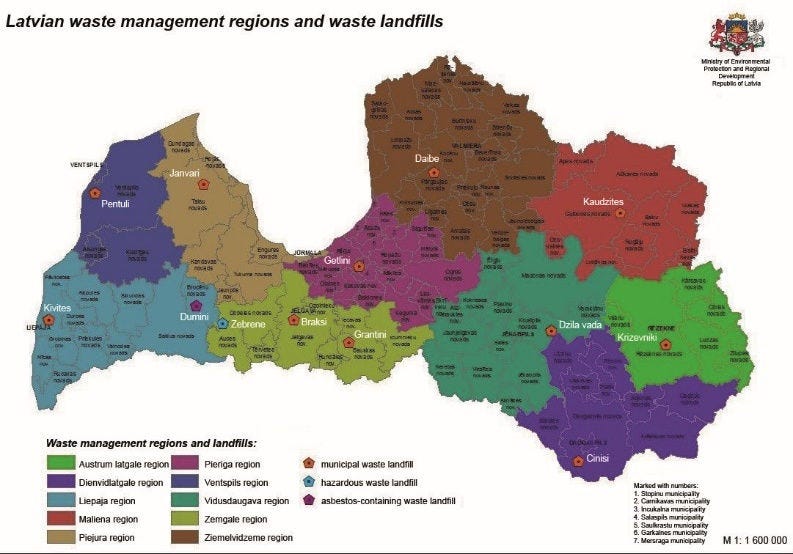

Municipalities co‑operate within the territories of ten WMRs:3 Austrumlatgales, Dienvidlatgales, Liepājas, Malienas, Piejūras, Pierīgas, Ventspils, Vidusdaugavas, Zemgales and Ziemeļvidzemes (Figure 4.4). A further possibility for co‑operation, albeit one rarely used, is that local governments are authorised to set up joint municipal waste management zones within their WMRs, upon mutual agreement, for joint public procurement for waste collection.

Figure 4.4. Municipalities co‑operate within ten waste management regions

Source: Ministry for Environmental Protection and Regional Development (2018).

The organisations that manage regional landfills and waste collection are inter‑municipal limited liability companies. Shares belong to municipalities in proportion to their size. About half of municipalities have established waste management companies that they own wholly or partly. The Latvian Competition Council has criticised this as hindering competition, particular as regards separate collection and sorting markets.

Other co‑ordination mechanisms

The highest national authority for policy co‑ordination is the Cross-Sectoral Coordination Centre, under the Prime Minister’s Office. It is responsible for drafting, supervising and monitoring implementation of the long-term SDS and medium-term NDP.

Horizontal co‑ordination on waste management and related issues is ensured, when needed, through weekly state secretary meetings, a permanent co‑ordination mechanism, and regular meetings of the MEPDR and SES to discuss operational issues, new EU requirements and the results of compliance control. The ministry participates in inter‑ministerial working groups set up to co‑ordinate the development of cross-cutting policy documents (e.g. on the bioeconomy strategy).

Vertical co‑ordination is ensured through annual meetings of the MEPDR and the Latvian Association of Local Governments, and through ministry verification that local regulations on waste management comply with national legislation.

Role of the private sector and stakeholder involvement

The private sector plays an important role in municipal waste management. Privately owned waste management companies serve more than 50% of the population, mainly in the bigger cities where the country’s population is concentrated. Municipally owned waste management companies serve the rest of the population.

Key stakeholders, including business associations and non‑government organisations, are consulted during policy planning and legislative drafting through participation in consultative boards or working groups. The MEPRD has several boards dealing with issues related to material resources, including on packaging management and technology management. Working groups have been set up to discuss issues related to food waste and the development of a deposit-refund system for beverage containers. A permanent working group deals with waste management issues. Recycling and waste management companies4 use lobbying as a participatory mechanism.

4.4. Information and policy instruments for waste and material management

4.4.1. The information base

Monitoring and reporting mechanisms

Monitoring and reporting on waste generation and movements are the responsibility of the LEGMC, which collects data from waste managers,5 reviews and analyses them and reports regularly to the Basel Convention, EU institutions, including Eurostat, and the OECD. Reporting is mandatory for hazardous waste managers, for all enterprises with A and B category polluting permits and for enterprises with permits for waste management operations. Companies under contract to municipalities have to report waste management data to them annually. Companies involved in extended producer responsibility systems have to report to the SES annually on the amounts placed on the market, collected, recycled and recovered. The SES checks the data, verifying them with the provider when needed.

The LEGMC administers the Hazardous Waste Transportation Registration System, which monitors domestic and transboundary movements of municipal and hazardous waste to recycling or recovery facilities. It ensures the operation of the system, registers system users and provides customer support. The main users include waste management companies and control institutions. Use of the system is subject to a contract with the LEGMC.

BRAPUS, an electronic system tracking CDW movements, was established in 2014 to better control CDW management, improve traceability of CDW flows and increase data availability. CDW operators have to report amounts produced to their regional government each year via an online survey. After approval by the region, the data are transferred to the LEGMC for synthesis and submission to EU institutions and the OECD. Over 90 companies use this system. Ongoing work aims at linking BRAPUS to the electronic documentation system for building processes.

Information on material flows and other data

The Central Statistical Bureau (CSB) has compiled economy-wide material flow accounts since 2009 and regularly reports to Eurostat in accordance with EU Regulation 691/2011 on environmental accounting. The accounts are compiled using CSB data on foreign trade, energy and agriculture, state forest data on timber extraction and hunting, and LEGMC data on mineral resource extraction and waste. Covering all years since 1995, they are publicly available on the CSB website and are published annually in Environmental Indicators in Latvia. For mineral resource accounting, the LEGMC prepares an annual balance of mineral reserves and registers the amount of extracted resources for each extracting site each year.

Data quality and gaps

Reporting obligations cover the main aspects of waste management but do not provide all information needed for effective policy planning. Data on food waste and repair and reuse activities, for example, are not covered and have no clear statistical definition. Hence the MEPRD collects additional data from companies when needed. Companies’ willingness to provide these data is low, however, hampering the ministry’s capacity to plan policies and to react to developments in the business sector.

Data quality varies. Data availability and time series length are limited for waste streams that are hard to track or where reporting lacks transparency. For several streams the treatment and disposal routes are not well known. For example, the final destination of waste imported for recycling but of insufficient quality is difficult to know. Little information exists on food waste and other biowaste. Data on CDW are available only from 2013 and on WEEE from 2009.

Little is known, moreover, about local authorities’ management performance and their contribution to the achievement of national recycling targets. The situation could be improved by establishing a regular process for collecting and publishing municipal waste statistics, including on recovery and recycling performance and related costs and revenue.

To support decision making and policy evaluation effectively, additional effort is needed to improve and expand national waste management information and statistics on waste and materials. More complete and coherent data are particularly needed on the collection, treatment and disposal of waste up to final destination. Priority could be given to waste streams that are subject to producer responsibility and for which recycling targets have been set, to streams that raise particular management concerns, such as food waste and biowaste, and to further development of the CDW information system. Consideration should also be given to further development of data on material flows and their integration with waste statistics for better understanding of material pathways in the economy.

Ultimately, waste and material management information could be consolidated in an integrated system that would serve as a central registry and support the development, implementation and monitoring of national policies, as well as international reporting. It could build on the existing information systems for monitoring CDW and transboundary movements, and other databases managed by the LEGMC.

4.4.2. Policy instruments

Latvia employs a range of policy instruments to encourage waste recovery and recycling. They include separate collection requirements and mandatory targets for recoverable materials, in line with EU law; economic instruments, such as taxes on waste disposal and recyclable goods; a deposit-refund system for glass bottles (currently voluntary); and extended producer responsibility and take-back systems for selected products. Most of these instruments apply to the end-of-life stage. They are complemented by demand-based instruments, such as green public procurement (GPP), and information instruments, such as eco-labels, awareness-raising campaigns and training.

Other instruments include information tools, such as communication activities by extended producer responsibility organisations (PROs), eco-labelling, awareness raising and educational activities (e.g. training, experience sharing).

Targets

The main objectives and quantitative targets are set to comply with EU legislation and are mandatory (Table 4.1). The main recovery and recycling targets include those for:

preparation for reuse, recycling or recovery of municipal waste, by 2020;

collection, recovery and recycling of packaging waste, CDW, WEEE and waste from environmentally harmful goods.

A few additional non-binding targets are set as part of the NDP and SDS, including resource productivity targets (Section 4.2.1) and a minimum 80% recycling target for all waste collected by 2030 (SDS). Nationally determined targets have also been set for used tyres.

Economic instruments

The use of economic instruments, in line with the polluter-pays principle, is well established. The main instruments are a differentiated natural resource tax (NRT) that applies to material extraction (mineral resources), landfilling, and products for which special end-of-life management objectives have been set; extended producer responsibility (for packaging, disposable tableware and accessories, WEEE, and other goods harmful to the environment, such as batteries and end-of-life vehicles); landfill tariffs; and municipal waste management fees. There is also a voluntary deposit-refund system for certain types of beverage packaging, whose use will become compulsory under current plans.

Table 4.1. Selected waste-related targets in Latvia

|

Waste type |

Targets |

Status according to official data |

|

|---|---|---|---|

|

All waste |

Achieve a minimum 80% recycling target for all waste collected (SDS target, non-binding). |

By 2030 |

Unclear; the overall recovery rate was 78% in 2016. Amounts actually recycled are not well monitored. |

|

Municipal waste |

Increase to at least 50% the share of waste materials prepared for reuse and recycling. |

By 2020 |

Could be difficult to meet. The recovery rate in 2016 was 30%, not accounting for anaerobic digestion of biodegradable waste with biogas recovery (Riga region) since 2016. |

|

Biodegradable municipal waste |

Reduce the amount of landfilled biodegradable municipal waste:

|

2010 As of 16.07.2013 As of 16.07.2020 |

|

|

Construction and demolition waste |

Increase to at least 70% the share of CDW prepared for reuse, recycling and other material recovery, including backfilling. |

By 2020 |

Met (88% in 2015). |

|

Packaging waste |

Recycling and recovery rates:

|

By end 2015 |

|

|

Recycling rates:

|

|

||

|

End-of-life vehicles (ELVs) |

|

By 2015 |

Met |

|

Waste electrical and electronic equipment |

|

By 13.08.2016 By 14.08.2016 By 14.08.2021 |

Missed (2.5 kg/inh. in 2016) Missed (26% in 2016) |

|

Batteries, accumulators |

Collection rate of 45% of the average amount sold on the Latvian market in the last three years (by average weight). |

By 26.09.2016 |

Met |

* Expressed in terms of weight.

Source: Country submission and calculations based on Eurostat and OECD data.

The NRT6 plays a particularly important role in government policies aiming at improving resource efficiency and is also thought to encourage recycling markets. It is revised every two to three years and has undergone significant changes since 1991, most notably that of 2014:

The rates were increased between 20% and 25% for extraction of mineral resources (peat, quartz sand and sandstone), packaging materials, and goods harmful to the environment.

They were also increased by similar amounts for landfilling of municipal, construction and industrial waste, with continued rises set to 2020, representing a cumulated tenfold increase since the mid-1990s.

Until 2006, the NRT revenue was earmarked for environmental protection activities, including co‑funding of EU environmental infrastructure projects via the Environmental Protection Fund. Revenue from extraction or use of natural resources and from the landfill tax is now allocated to municipalities and earmarked for environmental protection (60%) and the state budget (40%). Revenue from the tax on packaging, disposable tableware and accessories, goods harmful to the environment, and illegal extraction or use of natural resources is allocated to the state budget. The revenue allocated to the state budget is no longer earmarked, but can be used to co‑fund projects receiving EU support.

Waste management companies and extended producer responsibility systems have to provide a financial guarantee, bank guarantee or insurance for the aftercare of disposal sites and management of recyclable waste streams. Part of the landfill tax collected by the State Treasury from landfill managers constitutes a financial guarantee for potential remediation of current landfill sites.

Relief measures are in place to encourage environmentally sound waste management. They include measures to alleviate the administrative burden related to permitting processes, and tax reductions or exemptions for businesses that have an environmental management system (e.g. EMAS). Exemptions from payment of the NRT are granted for products whose producers, retailers or importers have contracted an end-of-life management agreement with an institution or waste manager recognised by the MEPRD, such as a PRO.

The existing instruments, however, do not yet provide sufficient incentive to comply with the waste hierarchy and move towards a more circular economy:

Studies on the NRT’s effectiveness indicate the tax and exemptions from it have encouraged businesses to join extended producer responsibility systems, achieve several related EU targets and stimulate the use of reusable packaging. But the tax has been less effective in stimulating waste prevention, except regarding plastic bags (Jurušs and Brizga, 2017), and has not reduced the cost gap between primary and secondary raw materials.

Despite recent and planned increases, until 2020 landfill tariffs will remain lower than the EU average, too low to incentivise recycling and spur investment in alternative waste technology. Municipal waste fees remain too low to cover the cost of service provision and encourage households to reduce unsorted mixed waste.

Little use is made of pay-as-you-throw (PAYT) systems for collection of mixed household waste, aside from a pilot in the city of Jūrmala. The use of PAYT in major cities, associated with well-functioning free separate collection of recyclable waste, could become an important tool for reducing waste going to final disposal.

Most instruments in place target the extraction and post-consumption phases of the value chain. More attention to instruments that influence consumer behaviour is needed.

4.4.3. Expenditure and financing

EU funding and co-financing

Since 2000, financial support for developing the Latvian waste management system has mainly come from EU funds. They have helped carry out feasibility studies for each WMR and construct landfills in compliance with EU regulations (since 2004). More recently, EU funding has helped upgrade landfill infrastructure and establish separate collection for municipal waste. Since 2005, more than EUR 166 million has been invested. Between 2005 and 2017, 71.3% of waste management investment stemmed from EU funds, 23.4% from private sources and 5.3% from the national budget (Table 4.2).

Table 4.2. Sources of waste management investment, 2005-17, thousand euros

|

Funding sources |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

Total 2005‑17 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

EU sources (co‑financing) |

3 931 |

5 904 |

12 508 |

13 773 |

20 857 |

10 118 |

11 271 |

8 241 |

7 863 |

5 422 |

16 920 |

1 844 |

8 |

118 659 (71.3%) |

|

National sources (state budget) |

63 |

1 244 |

2 818 |

2 873 |

1 734 |

- |

- |

- |

- |

- |

- |

- |

- |

8 732 (5.2%) |

|

Private sources |

435 |

2 193 |

2 443 |

4 680 |

418 |

2 574 |

4 412 |

2 951 |

3 566 |

1 762 |

11 680 |

1 844 |

- |

38 958 (23.4%) |

|

Total |

4 429 |

9 341 |

17 769 |

21 325 |

23 009 |

12 692 |

15 682 |

11 192 |

11 429 |

7 184 |

28 600 |

3 688 |

8 |

166 348 |

Note: The totals cover provision of waste management services and the construction, upgrading and aftercare of EU co-financed waste-related infrastructure projects. State budget: landfilling only. Separate collection is financed from municipal budgets.

Source: Country submission, based on the national EU project database (restricted access).

In the 2014-20 programme period, a further EUR 49.9 million is being invested in separate collection, recycling and energy recovery infrastructure to help the country meet the latest EU requirements and implement circular economy principles.

EU funds also serve as a catalyst for private sector investment. To benefit from EU support, national co‑financing (by state and/or private sources) of 15% to 65% of the total project cost has to be ensured. The co‑financing rates depend on the results of cost-benefit analyses on the project’s financial sustainability (planned revenue and total expenses) and on state aid rules determined by EU regional aid regulations, which specify that:

The share of EU support to private companies cannot exceed 35% and companies have to co‑finance projects exclusively from private sources.

The share of EU support to providers of public services can reach up to 85%.

Funding planning and priorities

National funding is planned according to the priorities and time frames of EU funding programmes and national legislation. The planning process is closely co‑ordinated between the MEPRD and the Ministry of Finance and directly linked to the national budgeting process.

The funding of projects co‑financed by the EU and implemented by public institutions under the MEPRD is integrated into the ministry’s annual and long-term budgets. The MEPRD may request additional funding from the state budget for these projects. Requests for earmarked funding from the state budget for projects implemented by entities not subordinate to the MEPRD, including local governments and businesses, are managed by the Central Financing and Contracting Agency, together with the Ministry of Finance. Payments are made through the State Treasury. EU funding is subject to conditions, including ex ante assessment of the status and investment needs in the waste sector.

EU funds will continue to be needed for further development of Latvia’s waste and material management system, but beyond the next planning period, Latvia will have to plan to reduce its reliance on EU funding and shift to domestic resources.

4.5. Promoting recycling and improving management effectiveness

The SWMP 2013-20 includes economic, regulatory or information instruments for reducing waste throughout the production-consumption-disposal chain and using resources more efficiently. The measures proposed are comprehensive, but their implementation is not sufficiently co‑ordinated with measures by ministries other than the MRDEP, nor with measures by local authorities, and has not yet shown full results.

Recycling and recovery, and the diversion of waste from final disposal, are promoted through separate collection of municipal waste, extended producer responsibility take-back obligations and a voluntary deposit‑refund system for beverage containers. Incentives are provided by taxes on packaging materials, environmentally harmful goods and mineral resource extraction. Binding targets, in line with EU requirements, have been set for collection of municipal waste and its preparation for reuse, recycling and recovery, and for reducing amounts of biodegradable waste going to landfill. Compost production and digestion of biodegradable waste for biogas recovery are encouraged. Public investment and EU co‑financing in waste collection, sorting and recycling infrastructure and technology play an important role. Waste reduction has received less attention, but is anchored in recent plans and programmes (e.g. SWMP, SWPP). It is encouraged through taxes on single-use plastics, eco‑innovation and the use of best available techniques (BAT) in the business sector.

Despite these positive developments, landfilling plays an important role. Recovery and recycling are developing, but not yet well advanced. Most waste is being prepared for reuse, recycling or recovery but little is known about the amounts actually recycled into new products. The lack of a complete information system, tracking waste streams from generation and collection to treatment and final disposal, hampers assessment. Other challenges include the weakness of recycling markets, the rather high domestic recycling costs and insufficient financial incentives for recycling and recovery.

4.5.1. Recovery and disposal of municipal waste

Latvia has long relied on landfilling for waste disposal, including municipal waste. When it joined the EU in 2004, it negotiated a transition period for achievement of EU targets. The targets include an overall recovery rate of 50% by 2020 and reduction of landfilled biodegradable waste (expressed in percent of 1995 levels),7 i.e. 75% by 2010, 50% by 2013 and 35% by 2020. Latvia met the 2010 target for biodegradable waste but missed the 2013 target (EC, 2018a). The 2020 target may be difficult to achieve unless amounts undergoing anaerobic digestion are included.

In 2015, 62% of municipal waste was landfilled; only 29% was sent to recycling and recovery, indicating a risk of missing the 2020 EU target of 50% being prepared for reuse and recycling (EC, 2018). Since then, new equipment at the Getlini landfill near Riga has begun diverting about 160 000 tonnes of biodegradable municipal waste from traditional landfilling for anaerobic digestion in bioenergetic cells to produce biogas, methane and compost (Box 4.2). Whether the amount diverted is eligible to be counted as “recovered” in EU terms remains to be seen, as the installation could be qualified as a specially engineered landfill. This would increase the country’s municipal waste recovery rate by almost 20 percentage points, and increase the chances of the EU 2020 target being met.

Box 4.2. From waste to resources: the Getlini ecological landfill complex

The Greater Riga ecological landfill complex “Getlini” treats 40% of all municipal waste generated in Latvia. It has evolved from a traditional landfill to a modern waste treatment and recovery complex that is open to the public.

After sorting, recyclable materials are sent to further processing. Biodegradable materials are stored, together with separately collected bio-waste, in specially engineered sealed cells where they are digested under anaerobic conditions with accelerated biogas production. The biogas is used in an on-site power plant to produce electricity, delivered to the power network, and heat used on-site for office heating, hot water, wastewater treatment and the production of vegetables (tomatoes, cucumbers), strawberries and flowers in a greenhouse complex. Getlini produces about 20 GWh per year of heat, more than 30 GWh of electricity, and about 500 tonnes of tomatoes sold on-site and in grocery stores. It contributes to the Riga Smart City Sustainable Energy Plan and its carbon reduction targets; the estimated CO2 savings are about 16 000 tonnes per year.

Source: SIA Getliņi EKO (2019), http://www.getlini.lv/en/ (website).

Separate collection

Separate collection of municipal waste became mandatory in 2015 for paper, metal, plastic and glass, and will become mandatory for biodegradable waste in 2021. Between 2007 and 2013, more than EUR 15 million was invested to improve separate waste collection, on top of investment for sorting facilities.

Municipalities ensure separate collection in their jurisdiction in co‑operation with waste management companies under public procurement or public-private partnerships. Collection may be organised as door to door, by deposit at dedicated collection points (the most common) or at civic amenity sites. Latvia has more than 3 200 collection points (about 1 per 620 inhabitants) and 80 civic amenity sites that also accept deposits of hazardous household waste, WEEE and other types of municipal waste. Out of 119 municipalities, 115 carry out separate collection, and 100% of the population is expected to be served by 2020. A 2016 survey carried out for the government found that service was adequate for about half the population (i.e. in 76% of municipalities) and needed improvement for the other half. Collection performance and post-collection sorting quality are key areas where improvement is needed.

As sorted materials are not always of sufficient quality to be recycled, recycling companies must often sort them a second time, with lower-quality materials being directed to landfills or (e.g. for plastics) incinerated in cement kilns.

PROs run their own collection points for packing materials, WEEE and environmentally harmful goods, usually on top of the municipal systems. The existence of two parallel systems leads to duplication of efforts and is not cost-effective. The co‑ordination and possible merger of the two systems should be a matter of priority.

At the same time, greater financial incentives, including volume-based fees, are needed to encourage households to separate recyclable materials and reduce amounts of mixed waste. Progress has so far been hampered by the low population density and related high collection and transport costs, along with households’ low income levels, which make it difficult to raise fees to fully cover the costs (Section 4.5.2).

Vertical co‑ordination

The vertical co‑ordination of the waste management policies that contribute to achievement of recycling and recovery targets is a challenge. The flexibility given to WMRs and municipalities in managing waste leads to gaps in implementation and incomplete monitoring at the local level.

The MRDEP has a co‑ordinating role on SWMP implementation and is consulted to check compliance of local waste management regulations with the national WMP and regulations. But regional and local WMPs are no longer mandatory, and there is no mechanism for cascading national targets down to WMRs and municipalities or for monitoring local performance and related costs and revenue. Many municipalities further lack capacity for implementing new policies and targets. They need more government support and harmonised guidance to carry out their responsibilities.

To strengthen policy implementation and assessment, regular reporting on the results of municipal waste management and municipalities’ performance in contributing to national recycling targets is indispensable, as is a return to systematic regional and local WMPs. These plans should include regional and local targets, in line with national commitments, and related reporting requirements, including on financial aspects.

4.5.2. Economic incentives

Municipal waste fees and charges

Households and other municipal waste generators have to pay fees for unsorted mixed waste. The fees, set by local government, are composed of:

A fee for collection, transport and sorting of municipal waste and other operations, such as preparing waste for reuse, recycling, recovery and disposal. It is calculated on the basis of contracts between local government and waste managers (under public procurement or public-private partnerships). Since 2016, it has also covered the cost of composting biodegradable waste in dedicated facilities. This fee ranged from EUR 4.52/m3 to EUR 20/m3, excluding VAT, in 2016.

A tariff for municipal waste disposal at landfills, set by the Public Utilities Commission. Since 2016, the tariff has also covered the cost of composting biodegradable waste at municipal landfills and a financial guarantee for landfill aftercare.

The NRT on landfilling. Since 2018, it is included in the landfill tariff set by the Public Utilities Commission.

Local authorities submit proposed municipal waste fees to the Public Utilities Commission along with documentation and a justification of the costs to be covered. Though the fees have been increasing over time, this has not been sufficient to induce households to reduce their unsorted mixed waste and participate more actively in separate collection. Additional increases are not planned because of the low average household income levels in Latvia.

Pay-as-you-throw systems

PAYT systems are little used. A notable exception is Jūrmala, the fifth largest city in Latvia, which is pilot-testing a volume-based fee system for mixed municipal waste collection. Jūrmala has low population density, significant natural areas (forests and beaches) and a tourism- and service-based economy. Since January 2018, it has equipped waste bins with electronic chips holding client information and waste collection trucks with weighing equipment and an automatic data storage and client registration system.

Landfill tariffs and taxes

The Public Utilities Commission sets tariffs for landfilling municipal waste, using a methodology8 that ensures full cost recovery and profitability. The calculation takes into account the gate fees proposed by landfill companies to cover their services, which are approved by the commission, and the transport distance to the landfill site. Following an amendment of the Waste Management Law in 2015, landfill tariffs increased in 2016 to take into account costs related to:

Aftercare of landfills and their monitoring for at least 30 years after closure. Related revenue is transferred to the State Treasury as a financial guarantee. After closure of the site, it is transferred back to the landfill owner or the public authority.

Minimisation and recovery of biodegradable waste.

The tariffs vary across the WMRs, ranging from EUR 22.47/tonne to EUR 59.52/tonne, excluding VAT and NRT (Table 4.3).

Table 4.3. Landfill tariffs for municipal waste vary by region

|

Waste management region |

Tariff (EUR/tonne) |

|---|---|

|

Ventspils |

42.85 |

|

Dienvidlatgales |

45.43 |

|

Malienas |

59.52 |

|

Vidusdaugavas |

32.16 |

|

Ziemeļvidzemes |

52.53 |

|

Zemgales (2 landfills) |

53.63 22.47 |

|

Liepājas |

52.29 |

|

Piejūras |

28.44 |

|

Riga un Pierīgas |

58.12 |

|

Austrumlatgales |

54.25 |

Note: Tariffs as of March 2019. Excluding VAT and the natural resource tax on landfilled waste.

Source: Country submission, based on information from the Public Utilities Commission.

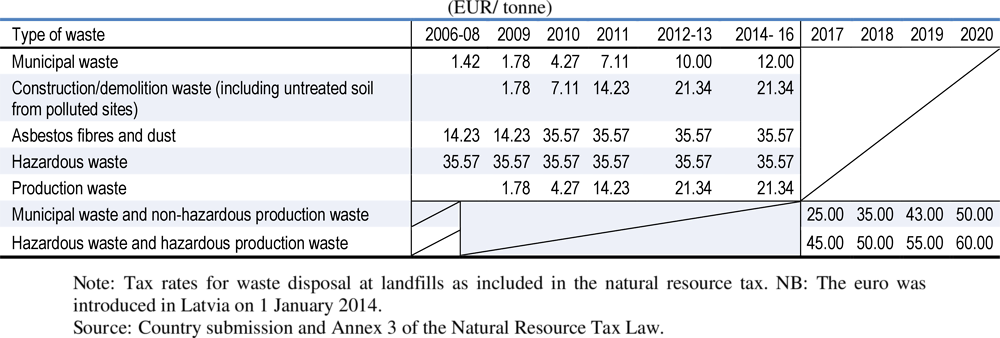

Added to these tariffs is the NRT on landfilling, introduced in 1995. Since 2005, its rates have been differentiated according to type of waste and degree of hazardousness (Table 4.4). They increased significantly between 2014 and 2017, and will continue to increase until 2020. The main increase applies to disposal of mixed municipal waste, whose rate more than doubled between 2014 and 2017 (from EUR 12/tonne to EUR 25/tonne) and will reach EUR 50/tonne in 2020. In 2017 the rate for hazardous waste was increased by 15% to EUR 45/tonne and that for production waste by 21% to EUR 25/tonne. No distinction is made between non‑recoverable waste and recoverable or biodegradable materials.

Table 4.4. Tax rates on landfilling are being increased

The increased NRT and landfill tariff rates are expected to help reduce the amounts of waste being landfilled while incentivising waste management companies to invest in alternative waste treatment options, including recycling.

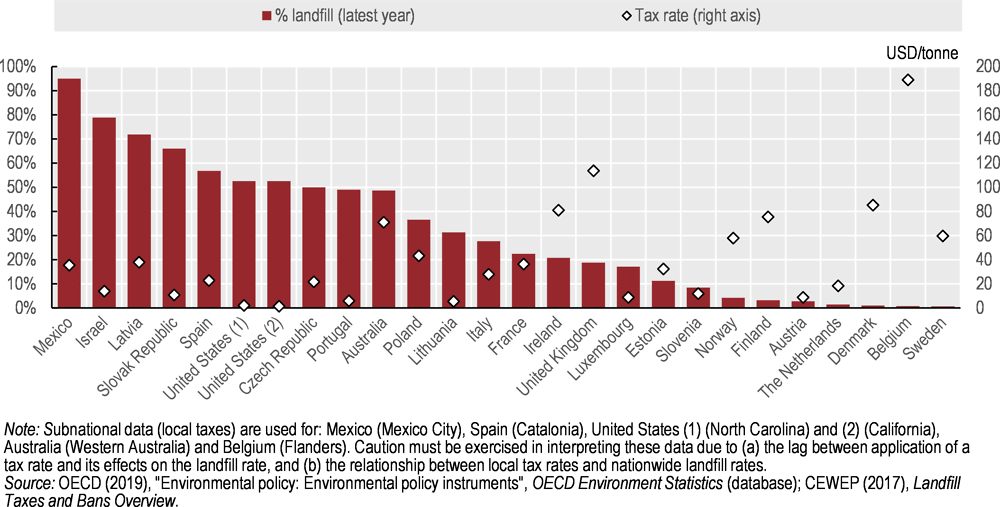

Whether the rates are high enough to create the expected incentives for households and businesses to separate waste and reduce the amount of mixed unsorted waste will need to be reassessed in few years. Despite the increases, overall tariffs will remain low compared to the EU average (about EUR 80/tonne), though comparable to some other EU countries (Figure 4.5). The incentive effect would be much stronger if coupled with implementation of PAYT systems, building on experience in Jūrmala and in other countries. This would be particularly useful in more densely populated areas with apartment buildings, and in future also in less densely populated rural areas.

Figure 4.5. Low landfill taxes encourage landfilling

Extended producer responsibility

Extended producer responsibility, introduced in 2000, applies to packaging, disposable tableware and accessories, passenger cars and environmentally harmful goods, including lubricating oil, batteries and accumulators, ozone-depleting substances, tyres, oil filters and WEEE. The Waste Management Law describes responsibilities of producers, importers and retailers for collection, recycling, recovery and disposal; the Natural Resource Tax Law sets out financial responsibilities; and Cabinet regulations provide detailed specifications.

Businesses that produce, retail or import relevant products can be granted an exemption from the NRT on the products if they fulfil obligations concerning collection and recycling of the waste from their end-of-life products and cover related costs. To do so, they can join one of the PROs, which fulfil the obligations on behalf of their members, or establish their own system. Extended producer responsibility systems can be set up as any type of commercial enterprise. More than 90% of all eligible businesses have joined a PRO. There are 8 such organisations in Latvia and 16 extended producer responsibility systems. In 2018, they covered 7 296 legal entities, up from 4 457 in 2013.

Since 2016, the SES has co‑ordinated and controlled the extended producer responsibility systems. It also administers NRT exemptions and imposes fines when targets are not met. PROs have to sign a contract with the SES and prepare a management plan for achieving recycling and recovery targets in line with their obligations. They have to set up collection networks throughout the country, put information about collection and sorting options on their website, organise public information and communication events, and submit an annual implementation report to the SES. As of 2018, they are also required to provide a financial guarantee (insurance or bank guarantee).

Financing of extended producer responsibility systems

Extended producer responsibility systems are financed by the membership fees paid by participating businesses. The fees must cover collection and recycling costs. PROs have to spend part of their income on information and awareness-raising activities. Waste minimisation and eco-design receive less attention.

PROs set membership fees in agreement with each member company. As they are negotiated case by case, they differ by company. No information on fee levels and calculation methods or on revenue expenditure is shared with the public or the relevant authorities. Some PROs keep fees low to attract companies, even to the point of disregarding the cost-recovery principle. This can encourage companies to switch PROs, thus complicating longer-term planning and investments.

Performance of extended producer responsibility systems

Extended producer responsibility systems have generally reached their recycling and recovery targets. But several systems are insufficiently transparent and their activities are not well co‑ordinated. Strengthened controls by the SES in 2017 revealed deficiencies in the systems’ operation and compliance with recycling targets. The controls, which covered all civic amenity sites, found deficiencies regarding compliance with technical standards and data reporting. The controls also covered one-third of the systems’ recovery facilities and found deficiencies regarding compliance with recycling targets (e.g. for rubber from tyres). As a result, six systems were closed (Table 4.5) and fines equivalent to ten times the relevant NRT were imposed, totalling EUR 35.5 million. The fines were not paid, however: one PRO went bankrupt, and the other organisations’ member companies left and joined other systems before the fines came due.

Table 4.5. Extended producer responsibility systems in Latvia

|

2017(a) |

2018(a) |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Company |

Packaging |

Electrical & electronic equipment |

Environmentally harmful goods |

Packaging |

Electrical & electronic equipment |

Environmentally harmful goods |

|||||||

|

Members (number) |

Market share (%) |

Members (number) |

Market share (%) |

Members (number) |

Market share (%) |

Members (number) |

Market share (%) |

Members (number) |

Market share (%) |

Members (number) |

Market share (%) |

||

|

Green Centre |

144 |

2.8 |

|

|

35 |

3.6 |

166 |

3.3 |

|

|

39 |

4.0 |

|

|

Green Belt |

2116 |

41.7 |

313 |

26.0 |

263 |

27.2 |

2334 |

46.0 |

444 |

36.9 |

335 |

33.9 |

|

|

Latvian Green Dot |

2467 |

48.6 |

541 |

44.9 |

464 |

47.9 |

2539 |

50.0 |

605 |

50.3 |

543 |

55.0 |

|

|

Eko Rija |

4 |

0.1 |

|

|

|

|

35 |

0.7 |

|

|

|

|

|

|

Tyres Blocks |

|

|

|

|

-(b) |

-(b) |

|

|

|

|

— (b,c) |

— (b,c) |

|

|

Latvian Green Electron |

258 |

5.1 |

328 |

27.2 |

126 |

13.0 |

— (b) |

— (b) |

— (b) |

— (b) |

— (b) |

— (b) |

|

|

Nordic Recycling(b) |

88 |

1.7 |

24 |

2.0 |

80 |

8.3 |

— (b) |

— (b) |

— (b) |

— (b) |

3 |

0.3 |

|

|

Latvian Green Fund |

|

|

|

|

|

|

2 |

0.04 |

|

|

64 |

6.5 |

|

|

Eco Point |

|

|

|

|

|

|

2 |

0.04 |

153 |

12.7 |

3 |

0.3 |

|

|

Total |

5077 |

100 |

1206 |

100 |

968 |

100 |

5078 |

100 |

1202 |

100 |

987 |

100 |

|

|

Number of systems |

6 |

|

4 |

|

6 |

|

6 |

|

3 |

|

6 |

|

|

Notes:

(a) An extended producer responsibility system for end-of-life vehicles also exists; it has 29 member companies and covers 100% of the market.

(b) Several systems closed in 2017-18: Tyres Blocks (goods harmful to environment) closed on 1 October 2017, Latvian Green Electron (packaging, electrical and electronic equipment, goods harmful to environment) over the course of 2018; and Nordic Recycling (packaging, electrical and electronic equipment) on 1 January 2018.

(c) The Latvian Tire Management Association, founded in 2018, brings together six companies engaged in tyre distribution, collection and recycling.

Source: Country submission.

This led to the adoption of new standards to better regulate and monitor the market, including the development of end-of-waste criteria for rubber from tyres and the introduction in July 2018 of a mandatory financial guarantee (bank guarantee or insurance) for extended producer responsibility systems. The guarantee applies retroactively and is controlled by the SES. The purpose is to avoid free riders and mobilise resources for managing the waste when a company fails to fulfil its obligations. In addition, the government reconsidered the level of fines applied in case of non-compliance, which used to be equivalent to a tenfold NRT rate for the non-recycled amount. A proposed amendment to the Natural Resource Tax Law would cap the level of fines at double the relevant NRT.

The overall performance of extended producer responsibility systems is not easy to assess. The absence of information on how membership fees are calculated and revenue is spent complicates any review of the costs and benefits of the systems. Whether the fees collected cover the costs incurred is unclear. The data that operators report annually are often incomplete and of insufficient quality. For example, it is often impossible to distinguish among the sources of waste the systems handle or how the recycling performance for the various sources differs among them. Paper packaging waste from households and other waste paper from elsewhere can be mixed and all included in the reported recycling rate for municipal packaging waste.9 This generally masks a weak performance by the system operators. It also hampers quality assurance on the reported data and raises questions as to the reliability of the calculated recovery rates, in addition to impeding comparative assessments and monitoring of compliance with recycling targets.

To improve the cost-effectiveness, co‑ordination and transparency of extended producer responsibility systems, public control over the systems needs to be strengthened. Considerable efficiency gains could be obtained in the separate collection and sorting of end-of-life products to which extended producer responsibility applies. The municipal and private systems need to be fully co‑ordinated, ideally as joint or shared collection programmes, with an obligation for operators of extended producer responsibility systems and municipalities to co‑operate, and with proper arrangements for service provision, cost sharing and reporting. Establishing reference costs for municipal services could facilitate such arrangements (OECD, 2016a).

For oversight to be effective, the resources available for compliance monitoring and quality assurance need to be increased. The SES works with rather limited resources and is obliged to proceed in steps. In 2017, its focus was on control of recycling targets and technical standards; in 2018 on reporting requirements, data quality assurance and methodological guidance.

A clearinghouse mechanism would be useful to establish a level playing field in which all extended producer responsibility operators can work. It would help in specifying the requirements and accountability rules for each system regarding fee calculation, eco‑design, recycling objectives, co‑operation with and reporting to local authorities, and the like. Reporting obligations should include information on the system’s financial status (fees, budgets, expenditure) and should be made public, at least in part. This would also help further streamline and consolidate extended producer responsibility for products for which existing systems are scattered or do not yet reach recycling targets (e.g. WEEE).

4.5.3. Packaging waste

Particular attention is given to the recycling of waste paper and cardboard from packaging, to comply with the EU Packaging and Packaging Waste Directive (94/62/EC). Recycling is encouraged by exempting producers of packaging waste who join an extended producer responsibility system from the packaging part of the NRT. Measures to improve packaging design include awards from the Latvian packaging association for the most ecological packaging. The awards are aimed at use of natural materials (e.g. wood) and avoidance of double packaging (e.g. glass bottle in a paper box).

Latvia was given the longest derogation period among EU countries for meeting the recycling targets for packaging: it had to reach them by 2015.10 The recovery and recycling rate is fairly high. A national target of 78% for 2011 was missed by only a few percentage points (75%). The EU target for 2015 was met (84%).

Tax on packaging materials and producer responsibility

Latvia and Hungary were the first Eastern European countries to introduce a tax to minimise packaging waste and encourage recycling. Latvia’s packaging tax, introduced in 1996 as part of the NRT, applies to paper, glass, plastic and metal packaging.11 It was originally calculated in four ways (per piece, per weight of packaging, per weight of product, according to the customs tax) with no differentiation for the environmental impact of the packaging or the recycling costs. An important driver of the packaging tax design was the government’s will to support the national recycling industry as part of overall industrialisation in the 2000s. In 2002, the tax rate was increased temporarily for PET packaging to support the recycling industry (a PET recycling plant was built in 2003).

Since 2005,12 the tax rates have been based solely on packaging weight (on a per‑kilogram basis) and differentiated by type of material and its recycling costs, the rate being two to three times the recycling cost (Table 4.6). No differentiation is made between recycled and virgin materials. Since 2010, a higher tax rate has been applied to polystyrene, which cannot be recycled in Latvia (EUR 1.56/kg, compared to EUR 1.22/kg for other plastics). In 2014, the rates were increased by 25%.

Table 4.6. Tax rates for packaging materials and disposable tableware and accessories

|

Type of source material |

Rate (EUR/kg) |

|

Glass |

0.44 |

|

Plastics (polymers), excluding bioplastics, oxy-degradable plastics and polystyrene |

1.22 |

|

Metals |

1.10 |

|

Wood, paper and cardboard, other natural fibres, bioplastics |

0.24 |

|

Oxy-degradable plastics |

0.70 |

|

Polystyrene |

2.20 |

Note: The rates are for the packaging part of the natural resource tax.

Source: Country submission.

The tax serves as an incentive to join a PRO. Companies that do so are fully exempted from the tax. Until 2004, they were granted a tax break of up to 80% depending on the recovery rates. Several PROs provide packaging management for producers. The biggest are Latvian Green Dot, Green Belt and Green Centre. Revenue from the packaging tax is rather low; it declined as companies joined PROs. In 2014, it was less than EUR 1 million and represented 5% of the NRT revenue.

The packaging tax has been successful in encouraging companies to adhere to an extended producer responsibility programme. It has also stimulated the use of reusable packaging (e.g. wood pallets, plastic boxes, glass bottles), as users of such packaging have to pay the tax only once. But it does not seem to have influenced producer and consumer choices of packaging materials and design (Juruss and Brizga, 2017).

Tax on single-use plastic bags

A special tax on single-use plastic bags was introduced in 2008 as part of the NRT. Its rates, higher than for other plastic packaging, range from EUR 3.7/kg for lightweight bags (less than 3 g) to EUR 1.14/kg for heavier bags. For bags made of oxy-degradable plastic, the rates are the same as for other plastic packaging. The tax initially led to a significant drop in the use of plastic shopping bags, but it has been stable in recent years. A ban on single‑use plastic bags is operational since January 2019; it applies to all bags except very lightweight bags needed for hygienic purposes or intended to pack non-prepacked food to prevent food waste. A total ban, including on all lightweight bags, is to be implemented in 2025.

Deposit-refund system for reusable packaging

A voluntary deposit-refund system was introduced in 2004 for reusable beverage packaging, i.e. glass bottles and plastic crates for bottles. As the system works well and has been successful, the SWMP has called for making it mandatory, and there are plans to extend it to other types of plastic and metal beverage packaging. A draft law has been prepared, and discussions on a compulsory system are under way. Extended producer responsibility companies opposed it, as they would lose part of their market share. A multidimensional economic assessment of the implementation costs is being carried out. It builds on estimates by the MEPRD, complemented with industry data and economic information provided by other Baltic states that have compulsory deposit systems.

The new system would apply to single- and multiple-use packaging for drinking water, non-alcoholic beverages, beer and beverages with low alcohol content. Covering some 8‑10% of all packaging, it would be managed by an operator from the beverage producers or sellers association. Detailed specifications, to be defined in Cabinet regulations, would take the technical and economic feasibility into account. The new system would also be expected to improve the quality of the packaging waste collected, compared with the quality of waste from separate collection systems and sorting stations. The possibility of a joint system with Estonia, which has had a deposit-refund system for more than ten years, is being investigated.

4.5.4. Waste electrical and electronic equipment

Regulations on WEEE management were implemented in 2004, then revised in line with the related EU directive (2012/19/EU). Tax rates for WEEE are laid down in the Waste Management Law. Three PROs manage end-of-life WEEE, with Latvian Green Dot covering 50% of the market and Green Belt 37%. In 2018, two PROs for WEEE had to be closed following compliance checks by the SES.

Producers of electrical and electronic equipment are required to work with recyclers to facilitate the development and manufacture of equipment that can easily be dismantled or reused, and whose components can easily be recovered and recycled. The producers have to be registered and provide information on the quantity and types of equipment they put on the market, along with the quantity and types of end-of-life equipment collected, reused, recycled or recovered, and exported. PROs such as Green Dot register member producers, importers and traders of such equipment in state registers held by the MEPRD and administered by the Latvian Electrical Engineering and Electronics Industry Association. This facilitates information exchange on the management and control of related goods. Reports on electrical and electronic equipment placed on the market and related waste collected, reused, recycled or recovered are provided twice a year electronically via the related registers, as are data on goods placed on the markets of other EU countries.

Targets for WEEE recovery are in line with EU requirements. With a per capita collection rate of 2.5 kg from households and a three-year average collection rate of 26% of the equipment placed on the market, Latvia missed the 2016 EU targets for WEEE. Reaching the target for 2021 will be a challenge (Table 4.1).

4.5.5. Construction and demolition waste

Latvia produces about 306 kt of CDW a year (including hazardous CDW containing, for example, asbestos from roofs built during the Soviet period). CDW has long been given little attention and was barely monitored. Illegal dumping of hazardous CDW used to be common and can still happen (EC, 2015a). CDW generated by households is managed by the waste manager who provides municipal waste management services on the territory of the relevant municipality.

Today Latvia has specific provisions for CDW, with recovery, reuse and recycling targets specified in the SWMP. Producers of non‑hazardous CDW have to ensure that by 2020, 70% of all CDW generated in a year is reused, recycled, or recovered, including through backfilling. CDW is sorted manually. Bricks, glass and concrete are usually used for backfilling or landfilled; wood is almost exclusively incinerated with energy recovery; wood chips are used for pellets or particle boards; metals are recovered for recycling in the country. According to the LEGMC, Latvia imports CDW from neighbouring Baltic countries, particularly Lithuania; it is mostly metals for recycling and other CDW for road construction.

The market for recycled aggregates is underdeveloped. Natural aggregates are available at lower prices and there is a general mistrust in the quality of recycled construction and demolition material. Financial incentives do not exist, other than the NRT on material extraction.

Despite these constraints, the 70% target does not seem very ambitious, as it includes backfilling operations. It has already been surpassed: in 2015, 88% of CDW was reported as having been recycled or recovered. Latvia could be more ambitious and further encourage high-value recycling of CDW. This would require proper training and information, the development of standards for recycled aggregates and the use of synergies with the 2008 Guidelines on the Promotion of Environmentally Friendly Construction and related public procurement.

4.6. Encouraging waste prevention and moving towards a circular economy

Important drivers for preventing waste generation and keeping materials in the economy are the availability of domestic natural resources – which are limited for non‑renewable resources and mainly consist of biological resources – and related EU requirements and targets, including the energy and resource efficiency targets of the EU’s Europe 2020 strategy and circular economy package. The circular economy is not yet embedded in national policy documents, but a national circular economy strategy is being elaborated. Circular economy principles are implicit in waste policy documents and regulations. They are promoted through recycling and recovery targets, extended producer responsibility systems and the NRT on material extraction, recyclable materials and end‑of‑life disposal.