This chapter provides a brief overview of key environmental trends in the United Kingdom and progress towards climate change and biodiversity targets. It assesses the environmental effectiveness and economic efficiency of the environmental policy mix, including regulatory and voluntary instruments, fiscal and economic instruments and public and private investment in environment-related infrastructure. It examines the interaction between the environment and other policy areas with a view to highlighting the opportunities and barriers to environmentally friendly and socially inclusive growth.

OECD Environmental Performance Reviews: United Kingdom 2022

Chapter 1. Towards green growth

Abstract

1.1. Addressing environmental challenges at the time of EU exit and COVID-191

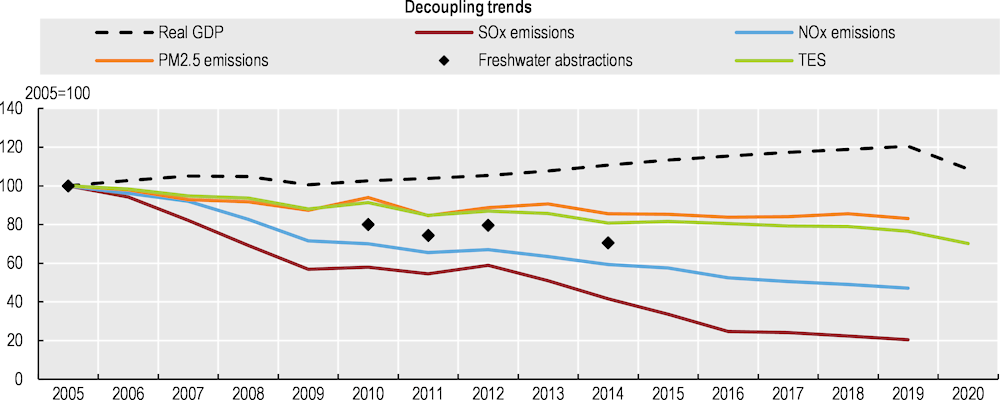

Over the past decade, progress has been made across the United Kingdom in decoupling several environmental pressures from economic growth (e.g. greenhouse gas [GHG] and air pollutant emissions; municipal waste generation; energy and material consumption; water abstractions) (Figure 1.1); in improving wastewater treatment; and in expanding the network of protected areas. However, air pollution, including from domestic heating and road traffic, remains a health concern. Agricultural management, climate change and infrastructure development continue to put pressure on the natural environment, causing habitat loss, fragmentation and degradation (Hayhow et al., 2019). Further efforts are needed to achieve net zero GHG emissions by 2050, address the growing risks of climate change, reverse the loss of biodiversity and ensure a more resource-efficient circular economy.

The UK government has devoted a great deal of time and effort to ensuring EU environmental law was adequately retained in the national legislation after exit from the European Union (EU exit) on 31 January 2020. The Environment Act 2021 lays out a domestic framework for environmental governance post-EU exit (most provisions apply to England only). It puts environmental principles2 into law; introduces legally binding long-term targets on air quality, water, biodiversity, resource efficiency and waste reduction; and establishes a new Office for Environmental Protection (OEP). The implementation of the Act, the setting of targets and the operation of the OEP will tell whether the UK government's ambition is commensurate with the challenge of protecting and enhancing the environment for future generations.

The United Kingdom has been hard hit by the coronavirus pandemic, with the largest gross domestic product (GDP) contraction (-9.7%) in the G7 in 2020 (OECD, 2021a). A fast initial roll-out of COVID-19 vaccines has weakened the link between new COVID-19 cases, hospitalisations and deaths, allowing a broad reopening of the economy. Activity rebounded quickly driven by consumption growth, and GDP is expected to reach its pre-pandemic level at the beginning of 2022. It is estimated that the long-run GDP will be reduced by 4% by the EU exit and a further 2% by the pandemic (OBR, 2021a).

Figure 1.1. The United Kingdom has made progress in decoupling several environmental pressures from economic growth

Note: GDP at 2015 prices. TES: Total energy supply.

Source: OECD (2021), Environment Statistics (database).

1.1.1. Progress towards climate targets

Objectives

The United Kingdom is at the forefront of global climate action. Ahead of its presidency of the 2021 UN Climate Change Conference of the Parties (COP26) in Glasgow, it has led the way by raising its national ambition. In 2019, it was the first G7 country to legislate for net zero GHG emissions by 20503 to deliver on the Paris Agreement, a step up from its previous 80% reduction target. In 2020, it submitted a new Nationally Determined Contribution committing to reduce GHG emissions4 by at least 68% by 2030 from 1990 levels. This is a clear progress from the previous commitment of 57%5 and the highest reduction target set by a major economy (Cuming, 2021). The 2008 Climate Change Act has been the key driver of the UK’s climate policy (Box 1.1).

Box 1.1. The 2008 Climate Change Act: A gold standard for climate action

The 2008 Climate Change Act was adopted on the basis of cross-party consensus. It provided for the establishment of a long-term emissions goal and interim targets expressed in five-year carbon budgets (CB), which the government is legally obliged to achieve. The Act directed that these targets should be established on the basis of advice from an independent expert body – the Climate Change Committee (CCC), which reports on progress to Parliament rather than to the government. The CCC’s mandate extends beyond parliamentary elections, which has helped ensure the UK’s direction on climate change remains focused on the long-term target.

Originally, the Act committed the United Kingdom to reduce its GHG emissions by 80% by 2050, compared to 1990 levels. The first five CBs were set to achieve this goal. CB1, 2, 3 (2008-12, 2013-17 and 2018-22) were set in 2009. CB4 (2023-27) and CB5 (2028-32) were set in 2011 and 2016.

In 2019, to reflect the government’s net zero ambition, the headline target of the Act was amended. In 2021, following the CCC’s recommendations, the government set CB6 (2033-37), which would cut emissions (including international aviation and shipping emissions) by approximately 78% by 2035. This is the first CB setting the path to the UK’s net zero target.

The Act also requires the government to publish a UK-wide climate change risk assessment (CCRA) every five years and to develop a National Adaptation Programme to respond to climate risks across England. CCRA also informs the corresponding programmes of the devolved governments.

The Act has served as a model for the development of climate laws in a number of countries (e.g. Denmark, France, Germany, Mexico, New Zealand, Sweden).

Source: CCC (2020), CCC Insights Briefing 1: The UK Climate Change Act.

Mitigation

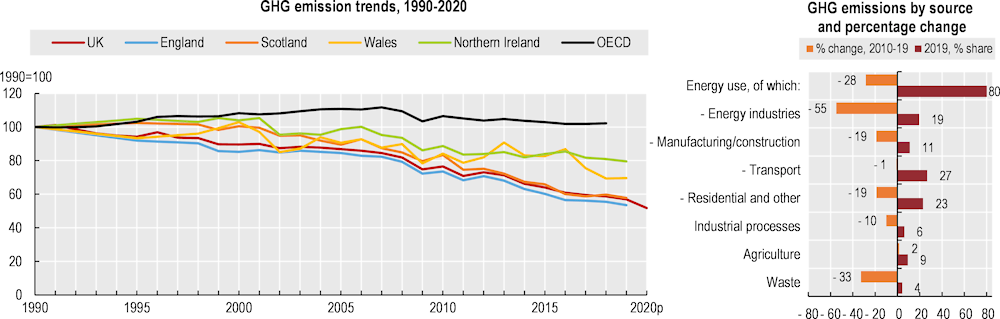

The UK’s GHG emission intensities per capita and per GDP (excluding emissions from land use, land-use change and forestry) are low compared to other OECD countries. However intensity per capita is above the OECD Europe average when emissions embedded in imported goods and services are included (OECD, 2021b). The country has one of the strongest records of emission reductions in the OECD over 1990-2019 (‑44%) (Figure 1.2). Energy industries have been the largest source of emission reductions, with the shift in electricity generation from coal to gas and, in the past decade, to renewable energy. With the COVID-19 crisis, GHG emissions are estimated to have decreased by 9% in 2020, primarily due to the decline of road transport during the lockdowns and the reduction in business activity. Compared to the OECD average, the UK's emissions structure has a higher share of transport (2019: 27% vs 24%), residential and commercial sectors (21% vs. 11%) and a lower share of energy industries (19% vs. 29%) (OECD, 2021b).

Figure 1.2. GHG emissions have fallen significantly, especially in the power sector

Note: Excluding emissions from land use, land-use change and forestry. 2020 data are preliminary. Right panel: “other” includes emissions from fuel combustion in the commercial/institutional and agricultural sectors and fugitive emissions from fuels.

Source: BEIS (2021), 2020 UK greenhouse gas emissions, provisional figures; BEIS (2021), National Inventory Report 2021; NAEI (2021), Greenhouse Gas Inventories for England, Scotland, Wales & Northern Ireland: 1990-2019; OECD (2021), Environment at a Glance Indicators, Climate change.

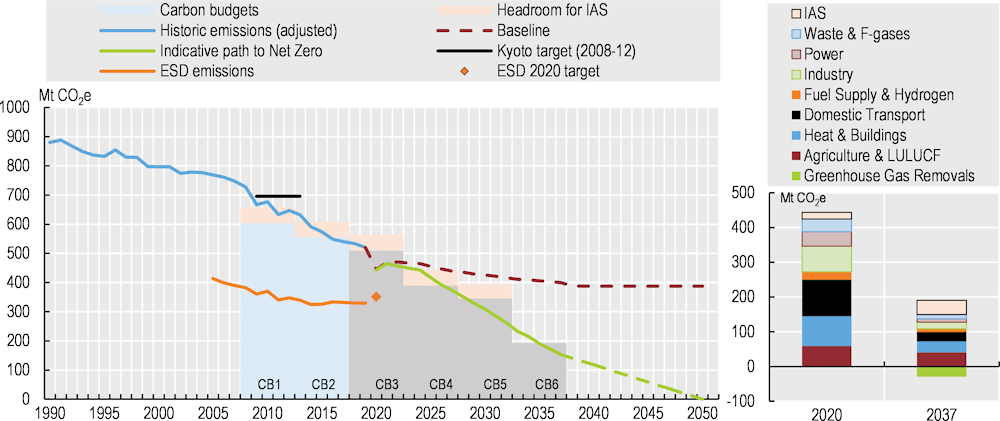

The United Kingdom met its emissions reductions target for the first commitment period of the Kyoto Protocol (2008-12) (Figure 1.3). Under the terms of the Withdrawal Agreement, it remains committed to its shared target with the European Union under the Kyoto Protocol as part of the Joint Fulfilment Agreement (BEIS, 2021a). The United Kingdom had to reduce emissions not covered by the EU Emissions Trading System (ETS) by 16% over 2005-20. It surpassed this target. It met its first and second CB and is on track to meet its third budget (2018-22). The 2007-08 financial crisis and the COVID-19 crisis have played a significant role in meeting these budgets (CCC, 2020a).

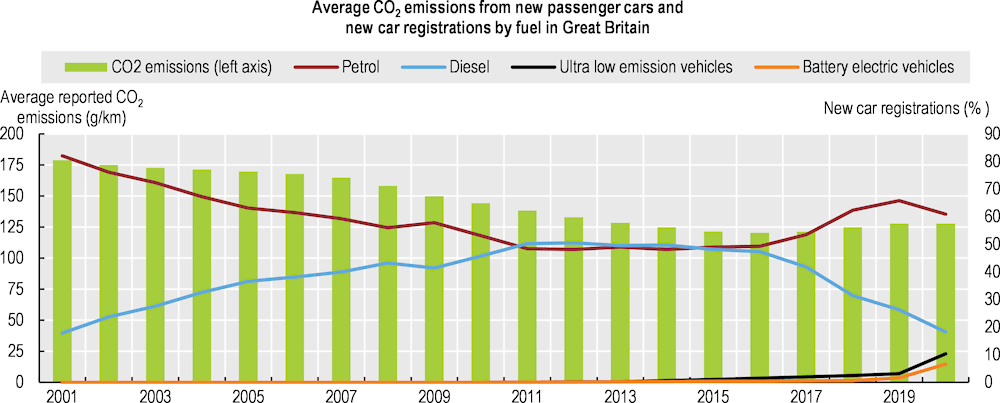

As provided by the 2008 Climate Change Act, the government outlined its plan for reducing emissions in the 2021 Net Zero Strategy (NZS) (HM Government, 2021). It builds on the 2020 Ten Point Plan for a Green Industrial Revolution and sectoral plans including the 2020 Energy White Paper, the 2021 Industrial Decarbonisation Strategy, Transport Decarbonisation Plan and Hydrogen Strategy, as well as the Heat and Buildings Strategy. The NZS outlines indicative emission reductions by sector, to meet the sixth carbon budget (2033-37) and ultimately net zero by 2050 (Figure 1.3). It calls for fully decarbonising electricity by 2035, subject to security of supply, and rapidly electrifying transport, heating and industry. These actions would be supplemented by low-carbon hydrogen, carbon capture and land-use change (CCC, 2021a). The vision is backed by key milestones sending strong signals to investors and consumers, including 40 gigawatts (GW) of offshore wind capacity by 2030; 5 GW of hydrogen production capacity by 2030; 600 000 heat pump installations a year by 2028; ending the sale of new petrol and diesel cars and vans by 2030 and hybrid vehicles by 2035; ending the sale of new gas boilers by 2035; planting 30 000 hectares (ha) of trees per year by 2024; and deploying carbon capture, utilisation and storage in four industrial clusters by 2030.

Baseline projections show the United Kingdom would not have reached the fourth and fifth budgets (2023‑27; 2028-32) set to achieve the 80% reduction target with the policies in place until mid-2019 (Figure 1.3). As of mid-2021, before the NZS was adopted, only 20% of the emission savings for the sixth budget (2033-37), which sets the path to net zero, had policies “potentially on track” for full delivery (CCC, 2021b). The NZS put forward credible policy proposals to put the United Kingdom on track to net zero (CCC, 2021a). However, it is not yet clear how it will deliver on this ambition. The impact of individual measures is not quantified and some, notably in the agriculture and building sectors, remain to be developed. The government will report on its progress annually.

Figure 1.3. Policies must be implemented quickly to put the United Kingdom on a net zero path

Note: The sixth carbon budget (CB6) includes international aviation and shipping (IAS) emissions, but the previous ones do not. Historic emissions are adjusted for accounting changes, including wetlands brought in under the 2019 inventory and IAS emissions; and converting the projections into Global Warming Potential values with climate-carbon feedbacks of the IPCC Fifth Assessment Report. The Kyoto target should be compared to lower emissions. Baseline: based on policies implemented, adopted or planned as of August 2019. ESD: GHG emissions in Effort Sharing Decision sectors (not covered by the ETS). LULUCF: land use, land-use change and forestry.

Source: BEIS (2021), Net Zero Strategy-charts and tables; Eurostat (2021), Greenhouse gas emissions in ESD sectors.

Adaptation

The United Kingdom is experiencing widespread changes in the climate (CCC, 2021c). Average temperature is around 1.2°C warmer than the pre-industrial period, UK sea levels have risen by 16 cm and episodes of extreme heat are becoming more frequent. By 2050 (relative to a 1981-2000 baseline), average winter temperatures are projected to increase by around 1ºC and rainfall by 5% (central estimates) with increasing risk of flash floods. Average summer temperatures are projected to increase by 1.5ºC and rainfall to decrease by 10% with increasing risks of flooding and excess deaths from heat. Continuing sea level rise of around 10-30 cm with possible rises extending up to 30-40 cm across the United Kingdom will increase the risks of flooding and affect the functioning of coastal infrastructure.

The United Kingdom has undertaken three comprehensive assessments of its climate risks, and the government published adaptation plans in 2013 and 2018 (CCC, 2021c). There have been some actions in response, notably in tackling flooding and water scarcity, but overall progress in planning and delivering adaptation is not keeping up with increasing risk. The CCC identified eight priority risk groups in the following areas: i) viability and diversity of terrestrial and freshwater habitats and species from multiple hazards; ii) soil health from increased flooding and drought; iii) natural carbon stores and sequestration from multiple hazards, leading to increased emissions; iv) crops, livestock and commercial trees from multiple climate hazards; v) supply of food, goods and vital services due to climate-related collapse of supply chains and distribution networks; vi) people and the economy from climate-related failure of the power system; vii) human health, wellbeing and productivity from increased exposure to heat in homes and other buildings; viii) the United Kingdom itself from climate change impacts overseas. The third National Adaptation programme due in 2023 is an opportunity to set an ambitious vision with measurable targets to assess progress. Policies are being developed without sufficient recognition of the need to adapt to the changing climate. This undermines their goals, locks in climate risks, and stores up costs for the future.

Climate finance

In 2019, United Kingdom committed GBP 11.6 billion in dedicated climate finance over the 2021/22–2025/26 period split equally between mitigation and adaptation (CCC, 2021b). This figure is double the level of support over the previous five-year period. The commitment is protected at this level against the announced temporary cuts in UK official development assistance (ODA) from 0.7% to 0.5% of gross national income. The GBP 11.6 billion funding is additional to the contribution to large multilateral development banks, some of which will be used to support climate-related projects. The United Kingdom has also committed to align the full extent of its ODA spending with the Paris Agreement and to end export finance for overseas fossil fuel investments.

1.1.2. Atmospheric emissions and air quality

Emissions of most major air pollutants have declined significantly over recent decades with the shift from coal for domestic heating and power generation and stricter emission standards (Figure 1.1); (Defra, 2021a). In 2019, sulphur oxide (SOx), nitrogen oxides (NOx) and fine particulate matter (PM2.5) emission intensities per capita and per GDP were among the lowest in OECD countries. However, the rate of reduction has slowed down for some pollutants in recent years. Industrial and domestic combustion (heating) are major sources of SOx, CO and PM2.5, while road transport is the main emitter of NOx, and non-methane volatile organic compound (NMVOC) emissions mainly come from solvent use. Emissions of ammonia (NH3) are largely driven by agricultural activity, primarily linked to herd sizes and farming practices. They decreased between 2005 and 2013, then rose until 2017 and have stabilised since 2018. The United Kingdom had legally binding targets to reduce air pollutant emissions through the National Emission Ceilings Regulations 2018 and 2012 amended Gothenburg Protocol to the Convention on Long‑range Transboundary Air Pollution. In 2019, it published a Clean Air Strategyand a National Air Pollution Control Programme to limit emissions in accordance with national emission reduction commitments. This plan will be revised in 2022. In 2019, the United Kingdom had already met its 2020 reduction targets for SOx, NOx and NMVOC. However, further efforts were needed to meet 2020 targets for NH3 (from agriculture) and PM2.5, as well as to meet 2030 targets for all pollutants except NMVOCs (Defra, 2021a).

Population exposure to PM2.5 has steadily decreased since 2005 but remained in 2019 above the new World Health Organization guideline value6 of 5 microgrammes per cubic metre (µ/m3) (OECD, 2021b). People in Scotland are least exposed to air pollution (6.7 µ/m3), while people living in Greater London are exposed to levels twice as high. In 2020, concentrations of NO2 decreased with the reduction in road traffic due to COVID-19 lockdown restrictions. Five zones (out of 43) exceeded the annual mean limit value for NO2, down from 33 in 2019 (Defra, 2021b). Urban background ozone pollution has an overall long-term increasing trend. Air pollution continues to be the largest environmental risk to the public’s health in the United Kingdom. Each year, between 28 000 and 36 000 deaths are attributed to human-made air pollution (PHE, 2019).

1.1.3. Progress towards biodiversity targets

The metropolitan United Kingdom (England, Scotland, Wales and Northern Ireland) has a diverse mix of habitats and species for its small size (approximately 240 000 km2) with a marine area approximately 3.5 times the size of the land area. The diversity of geology, landforms and sea floors, the long history of land management, the warming effect of the Gulf Stream, and a large tidal range result in a wide biodiversity range.

The key drivers of change across terrestrial biodiversity, as identified in the 2011 National Ecosystem Assessment, are habitat change (land use/condition) and pollution. Other threats are over-exploitation, invasive species and climate change. The main threats to the marine environment are fishing pressure, climate change, acidification, hazardous substances and eutrophication (JNCC, 2019).

The development and implementation of biodiversity policy in the United Kingdom is largely devolved and delivered through country plans and strategies. Over 2010-20, action was co‑ordinated through the UK post-2010 Biodiversity Framework. This framework set out how the countries worked together to contribute to the Strategic Plan for Biodiversity 2011-20 and meet the Aichi targets of the United Nations Convention on Biological Diversity. The countries have also jointly developed the UK Marine Strategy to achieve good environmental status in their marine waters by 2020.

Biodiversity indicators show progress in several assessed measures, including agri-environment schemes, reducing air and marine pollution, extending marine protected areas and improving knowledge, but many present mixed or negative trends (Table 1.1). In particular, the abundance of UK priority species, and common farmland and woodland birds is in long-term decline while pressure from invasive species is increasing. Most UK habitats and species of European importance are in unfavourable condition.

Table 1.1. Biodiversity loss continues

UK Biodiversity Indicators 2021

|

Indicator / measure(s) |

Long-term change |

Short-term change |

|

|---|---|---|---|

|

A1. Awareness, understanding and support for conservation |

.. |

.. |

|

|

A2. Taking action for nature: volunteer time spent in conservation |

☺ 2000-19 |

☺ 2014-19 |

|

|

A3. Value of biodiversity integrated into decision making |

Under development |

Under development |

|

|

A4. Global biodiversity impacts of UK economic activity/sustainable consumption |

Experimental – under review |

Experimental – under review |

|

|

A5. Integration of biodiversity considerations into business activity |

.. |

.. |

|

|

B1. Agricultural and forest area under environmental management schemes |

B1a. Area of land in agri-environment schemes |

☺ 1992-2020 |

☺ 2015-20 |

|

B1b. Area of forestry land certified as sustainably managed |

☺ 2001-21 |

≈ 2016-21 |

|

|

B2. Sustainable fisheries |

B2a. Percentage of marine fish stocks harvested sustainably |

☺ 1990-2019 |

☺ 2014-19 |

|

B2b. Biomass of marine fish stocks at full reproductive capacity |

☺ 1990-2019 |

☹ 2014-19 |

|

|

B3. Climate change adaptation |

|

Under development |

Under development |

|

B4. Pressure from climate change (Spring Index) |

Not assessed |

Not assessed |

|

|

B5. Pressure from pollution |

|||

|

B5a. Air pollution |

B5a (i). Area affected by acidity |

☺ 1996-2018 |

☺ 2013-18 |

|

B5a (ii). Area affected by nitrogen |

☺ 1996-2018 |

☺ 2013-18 |

|

|

B5b. Marine pollution |

|

☺ 1990-2019 |

☺ 2014-19 |

|

B6. Pressure from invasive species |

B6a. Freshwater invasive species |

☹ 1960-2020 |

Not assessed |

|

B6b. Marine (coastal) invasive species |

☹ 1960-2020 |

Not assessed |

|

|

B6c. Terrestrial invasive species |

☹ 1960-2020 |

Not assessed |

|

|

B7. Surface water status |

|

≈ 2009-20 |

≈ 2015-20 |

|

C1. Protected areas |

C1a. Total extent of protected areas: on land |

☺ 1950-2021 |

≈ 2016-21 |

|

C1b. Total extent of protected areas: at sea |

☺ 1950-2021 |

☺ 2016-21 |

|

|

C1c. Condition of Areas/Sites of Special Scientific Interest |

☺ 2005-21 |

☹ 2016-21 |

|

|

C2. Habitat connectivity |

|

Experimental – under review |

Experimental – under review |

|

C3. Status of European habitats and species |

C3a. Status of UK habitats of European importance |

☹ 2007-19 |

☹ 2013-19 |

|

C3b. Status of UK species of European importance |

☹ 2007-19 |

☹ 2013-19 |

|

|

C4. Status of UK priority species |

C4a. Relative abundance |

☹ 1970-2019 |

≈ 2014-19 |

|

C4b. Distribution |

≈ 1970-18 |

≈ 2013-18 |

|

|

C5. Birds of the wider countryside and at sea |

C5a. Farmland birds |

☹ 1970-18 |

☹ 2013-18 |

|

C5b. Woodland birds |

☹ 1970-18 |

☹ 2013-18 |

|

|

C5c. Wetland birds |

☹ 1975-2018 |

≈ 2013-18 |

|

|

C5d. Seabirds |

Not assessed |

Not assessed |

|

|

C5e. Wintering waterbirds |

☺ 1975/76-2017/18 |

≈ 2012/13-2017/18 |

|

|

C6. Insects of the wider countryside (butterflies) |

C6a. Habitat specialists |

☹ 1976-2020 |

≈ 2015-20 |

|

C6b. Species of the wider countryside |

≈ 1976-2020 |

≈ 2015-20 |

|

|

C7. Plants of the wider countryside |

|

Experimental – under review |

Experimental – under review |

|

C8. Mammals of the wider countryside (bats) |

☺ 1999-2019 |

☺ 2014-19 |

|

|

C9. Genetic resources for food and agriculture |

|||

|

C9a. Animal genetic resources – effective population size of Native Breeds at Risk |

C9a(i). Goat breeds |

☺ 2004-20 |

≈ 2015-20 |

|

C9a(ii). Pig breeds |

☹ 2000-20 |

☹ 2015-20 |

|

|

C9a(iii). Horse breeds |

☹ 2000-20 |

☹ 2015-20 |

|

|

C9a(iv). Sheep breeds |

☺ 2000-20 |

☺ 2015-20 |

|

|

C9a(v). Cattle breeds |

☺ 2000-20 |

☺ 2015-20 |

|

|

C9b. Plant genetic resources – Enrichment Index |

☺ 1960-2018 |

☺ 2013-18 |

|

|

D1. Biodiversity and ecosystem services |

D1a. Fish size classes in the North Sea |

☹ 1983-2019 |

☹ 2014-19 |

|

D1b. Removal of GHGs by UK forests |

☺ 1990-2019 |

☺ 2014-19 |

|

|

D1c. Status of pollinating insects |

☹ 1980-2017 |

≈ 2012-17 |

|

|

E1. Biodiversity data for decision making |

E1a. Cumulative number of records |

☺ 2004-21 |

☺ 2016-21 |

|

E1b. Number of publicly accessible records at 1 km2 resolution or better |

☺ 2008-21 |

☺ 2016-21 |

|

|

E2. Expenditure on UK and international biodiversity |

E2a. Public sector expenditure on UK biodiversity |

☺ 2000/01-2019/20 |

☹ 2014/15-2019/20 |

|

E2b. Non-governmental organisation expenditure on UK biodiversity |

.. |

☺ 2014/15-2019/20 |

|

|

E2c. UK public sector expenditure on international biodiversity |

☺ 2001/02-2019/20 |

≈ 2014/15-2019/20 |

|

Note: ☺: improving, ☹: deteriorating, ≈ little or no overall change, “..”: insufficient or no comparable data. Long-term – an assessment of change since the earliest date for which data are available, although if the data run is for less than ten years a long-term assessment is not made; Short-term – an assessment of change over the latest five years, six years for C3a and C3b.

Source: Defra (2021), UK Biodiversity Indicators 2021 Revised.

In 2019 the United Kingdom reported it was on track to meet 5 of the 20 Aichi Biodiversity Targets:7 mainstreaming, protected areas, implementation of the Nagoya Protocol, National Biodiversity Strategy, and mobilisation of information and research (JNCC, 2019). However, according to the Royal Society for the Protection of Birds (RSPB), most assessments point towards ongoing loss of UK biodiversity or no recovery from depletion (HoCs, 2021a). The United Kingdom is one of the most nature-depleted countries in the world (NHM, 2020). According to the Natural Capital Committee, an independent advisory committee which ran from 2012 to 2020, most natural assets are deteriorating (NCC, 2020a).

Habitat and species

The UK Species Inventory contains 59 210 species of animals, plants and fungi known to occur in the United Kingdom (including native, naturalised and non-native species). Knowledge gaps remain in the number and trends of threatened species, but progress has been made in assessing the threat of extinction and with monitoring indicator species. Overall, only 14% of UK species have had their conservation status assessed; 21% of these are threatened (JNCC, 2019).

Only 8 041 species have been assessed against International Union for Conservation of Nature (IUCN) Red List criteria. The taxa with the highest proportion of species assessed nationally above Least Concern include birds (49%) and terrestrial mammals (55%). Insects, and in particular beetles and moths, have experienced the highest proportion of national extinctions in Great Britain across taxa, with 5% of insect species assessed being classified as extinct. In all, 207 species have been assessed as nationally extinct in Great Britain in recent history. However, no species is known to have gone nationally extinct since 2010. A significant proportion of the UK’s fish (27%), reptiles (46%), birds (22%) and marine mammals (19%) that have been assessed globally are threatened (JNCC, 2019) (OECD, 2021b).

There has been progress in improving the status of some nationally and internationally threatened species. These include successful re-introductions of the white-tailed eagle, short-haired bumblebee and beaver in Scotland, and the chequered skipper in England, as well as recovery programmes for red kite and natterjack toad. However, overall progress is insufficient to halt widespread and significant ongoing declines across many species (e.g. for priority species as a group and for groups such as farmland birds, specialist butterflies and other pollinating insects) (JNCC, 2019). In 2019, only 39% of UK species of European importance were in favourable conservation status (Defra, 2021c).

Protected areas

Within the United Kingdom, the law protects sites that are nationally important for plants, animals or geological or physiographical features as Sites of Special Scientific Interest – or in Northern Ireland as Areas of Special Scientific Interest. In the marine environment, a number of regional marine protected areas are designated, including Marine Conservation Zones in England, Wales and Northern Ireland, and Nature Conservation Marine Protected Areas in Scotland. The United Kingdom also contributes to international networks of protected sites created under the Ramsar, World Heritage and OSPAR Conventions. Special Protection Areas (SPAs) and Special Areas of Conservation protect habitats and species of European importance.

The total extent of protected areas has increased significantly since 2015 to cover 29% of land area and 42% of the economic exclusive zone (EEZ) in 2020 (OECD, 2021b). This is well above the Aichi 2020 targets of protecting at least 17% of land and 10% of marine and coastal areas. It is also close to the G7 targets of protecting at least 30% of land and sea by 2030. However, only 0.5% of land area has strict management objectives (IUCN management categories8 I and II), compared to 7.4% on average in OECD countries. About 9% of land area and 1% of the UK’s EEZ are designated under IUCN categories III and IV, compared to 1.5% and 4% respectively on average in OECD countries. The RSPB estimates that only around 5% of the UK’s land is both protected and managed effectively for nature (HoCs, 2021a).

The recent increase is almost entirely down to the designation of inshore and offshore marine sites under the EU Habitats Directive; the designation of Marine Conservation Zones in English, Welsh and Northern Irish waters; and designation of Nature Conservation Marine Protected Areas in Scottish waters. The extent of protected areas on land has increased by 14 462 ha since 2015. Protected area designation has continued, notably for marine birds. This has resulted in the designation of new marine SPAs in 2020, with more expected shortly in Northern Ireland and Scotland. These efforts have not yet translated into results. In 2019, only 5% of UK habitats of European importance were in favourable conservation status (Defra, 2021c). Bogs, mires and fens, and grasslands show the worst conservation status, while rocky habitats and dune habitats are in most favourable status (EEA, 2019).

Water management

The United Kingdom abstracts less than 5% of its internal and renewable resources. It is therefore under low water stress (OECD, 2021b), although risks of water shortages are projected due to climate change (CCC, 2021c). In 2019-20, England had a low intensity of freshwater abstraction for public water supply per capita compared to other OECD countries (CCC, 2021c). In 2019, only 16% of surface waters in England met the “good ecological status” standard under the EU Water Framework Directive. However, a higher percentage met this standard in the devolved nations, especially in Scotland where 63% of surface waters achieved a “good ecological status” in 2020 (Defra, 2021c). The most common pressures impacting water bodies are physical modification (affecting 41% of water bodies in England), diffuse pollution from rural areas (affecting 40%), waste water (affecting 36%), and related to cities and transport (affecting 18%). The number of designated bathing waters in England meeting at least the minimum standard increased considerably from 46% in 1995 to 98% in 2019. The number of bathing waters achieving “excellent” status has also increased in the past decades, with 71% meeting this standard in 2019. That same year, 85% of surface bodies supported required flow standards and 73% of groundwater bodies were sustainable compared to objectives of achieving sustainable levels for 90% of surface water bodies and 77% for groundwater bodies by 2021. In 2016, the United Kingdom complied with the collection and secondary treatment targets (Articles 3 and 4) of the EU Urban Waste Water Treatment Directive, and was close to achieving the more stringent target (Article 5) (EC, 2020a). However, pollution from sewer overflows is of particular concern (Environment Agency, 2021a).

1.2. Improving environmental governance and management

1.2.1. Institutional framework for environmental governance

The responsibility for environmental policy and regulation is devolved in Scotland, Wales and Northern Ireland to the Scottish government, the Welsh government and the Northern Ireland Executive. There is no devolved government for England; the UK government makes decisions and proposes legislation that concerns England. Indeed, many UK government policies, such as its 25 Year Environment Plan (25 YEP), published in 2018, are intended to apply to England only. Scotland, Wales and Northern Ireland enjoy varying degrees of autonomy, but each has responsibilities for the environment, agriculture, fisheries and energy. The legal frameworks are similar in all the administrations, but the powers are different in each jurisdiction’s acts, regulations and orders.

Devolved administration and horizontal co-ordination

In England and Northern Ireland, dedicated government departments define overall environmental policy and establish the legal framework: the Department of Environment, Food and Rural Affairs (Defra) in England and the Department of Agriculture, Environment and Rural Affairs in Northern Ireland. Defra has lead responsibility for all environmental policy areas apart from climate change mitigation, for which the Department for Business, Energy and Industrial Strategy has the policy lead. In addition, the Department for Transport promotes sustainable mobility.

The Environment Agency in England and the Northern Ireland Environment Agency (NIEA) are executive bodies with regulatory and advisory functions.9 The Scottish Environment Protection Agency (SEPA) and Natural Resources Wales10 are regulatory authorities that report directly to the Scottish and Welsh governments, respectively. In England, Scotland and Wales, flood prevention and management are part of the agencies’ remit along with environmental regulation.

Natural England is responsible for land management and wildlife and habitat conservation, while Forestry England oversees forest management. In Scotland, all these functions fall under the remit of NatureScot. Natural Resources Wales takes care of these issues along with the rest of environmental management in the country. In Northern Ireland, the NIEA is in charge of nature protection, but the Forest Service manages forests.

The devolution agreements were created when the United Kingdom was an EU member state. The intersection of the devolution settlements with EU membership has allowed for “upward divergence” in environmental policy across the four UK nations. In particular, the Scottish and Welsh governments have aspired to pursue environmental policies that would go beyond the European Union’s minimum requirements. However, Northern Ireland has historically been lagging in terms of environmental governance (Burns et al., 2018).

Environmental agencies across the United Kingdom have mechanisms for institutional co‑operation with the other UK nations, but stakeholders perceive that they do not function well (Burns et al., 2018). The Joint Nature Conservation Committee brings together representatives from conservation bodies of the UK’s four nations. This body establishes common standards across the United Kingdom for monitoring and researching nature conservation and analyses the resulting information. Its recommendations are then left to be implemented by the competent legislative authorities in each country. The UK-wide CCC operates on a similar basis. It is the statutory advisory body on climate change to both the Scottish and Welsh governments.

These policy co‑ordination mechanisms were until recently operating within the EU framework. In the absence of this unifying platform, reinforced co-operation mechanisms are necessary to prevent the divergence between the environmental policy approaches of the four nations from compromising the level playing field for UK businesses.

The new arrangements for policy cohesion and managing divergence are covered by a programme of common policy frameworks that is led jointly by the UK and devolved governments. For example, a new UK Biodiversity Framework is being elaborated. The Inter-Ministerial Group for Environment, Food and Rural Affairs is a forum for environment ministers from across the UK nations to regularly discuss current issues in these areas. A review of intergovernmental relations in 2021 has made changes to the structures and ways of working that will strengthen engagement across the four UK nations. However, the focus so far has been primarily on matters crucial to facilitating trade (Chloe, 2021).

Government effectiveness and regulatory quality in the United Kingdom decreased slightly (from a very high level) over 2014-19 (World Bank, 2020). This decline could be attributed to a long period of uncertainty over EU exit. EU exit has affected the capacity of the country’s environmental institutions in particular. The National Audit Office ranked Defra second among UK government departments most affected by EU exit. Defra recruited over 1 300 new staff members to work on EU exit issues (Burns et al., 2018).

EU exit followed a long period of austerity and significant staffing cuts for the environment in all four nations. For example, government funding for the Environment Agency’s functions other than flood defence was nearly halved between fiscal years 2009/10 and 2018/19 (NAO, 2020). The budget cuts were partly offset by the increased subsistence charges for permitted installations (Section 1.2.3) and improved efficiency of administrative procedures. Still, the persistent lack of resources has weakened policy implementation, including environmental quality and compliance monitoring and reporting. Compliance assurance activities with regard to installations not covered by a permitting regime (and hence not paying subsistence fees) have been particularly affected.

SEPA’s capacity has also been undermined by a significant cyber-attack on 24 December 2020, carried out by organised crime to extort money. Most of SEPA’s information technology systems, including backups, were encrypted or content was deleted. As a result, staff had no access to e-mail, data or systems. Since then, SEPA has focused on renewing and upgrading its systems and infrastructure. Full recovery is expected to take around 18-24 months.

Local government and vertical co‑ordination

Local authorities (which usually have an Environmental Health Department) are responsible for spatial planning and waste management. In addition, in England and Wales local authorities perform a number of environmental regulatory functions, including permitting, inspecting and enforcing against some medium- and low-risk installations, in most cases with respect to air emissions only. They also manage local air quality, including emissions from mobile sources. They have administrative enforcement and prosecutorial powers with respect to “statutory nuisance” – noise, odour, dust and smoke. Local authorities also have permitting responsibilities in Northern Ireland.

Vertical co-ordination usually consists of guidance from the national environmental regulator to local governments. For example, Defra produces guidance notes for each of the 80 sectors regulated by local authorities. Developed in collaboration with business organisations by technical working groups, these guidance notes contain the descriptions of relevant best available techniques and emission limit values. They are generally quite prescriptive so as to maintain a level playing field between local authorities across England.

1.2.2. Regulatory and policy evaluation

The United Kingdom continues to emphasise evidence-based policy making. Regulatory and policy evaluation, ex ante and ex post, plays an important role in environmental governance. The country has long been a frontrunner in performance measurement with regard to both policy implementation and corporate results of environmental authorities.

Regulatory impact assessment

Regulatory impact assessment (RIA) is carried out for all regulations except for deregulatory and low-cost measures, which are eligible for a fast-track procedure. The Regulatory Policy Committee, a non-departmental advisory body, provides the government with external, independent scrutiny of evidence and analysis supporting new regulatory proposals in RIAs. It also scrutinises the quality of ex post evaluations of legislation. The Better Regulation Executive within the Department for Business, Energy and Industrial Strategy is responsible for better regulation policy. It is also the lead unit in the UK government for promoting and delivering changes to the regulatory policy framework (OECD, 2018).

RIAs have been required for significant policy changes and new policies for at least the last two decades, although requirements have changed progressively. The latest standard format for RIAs in England is significantly slimmed down, allowing under 50 lines to summarise the problem under consideration and the need for intervention; the policy objectives and intended effects; alternative options considered; and a description of the monetised and non-monetised costs and benefits identified, by main target groups. Further information can be provided in a separate “Evidence base” document. However, the current RIA template focuses primarily on the regulatory burden on businesses. It does not appear to allow sufficient space to identify potential environmental risks or tackle environmental impacts if these are not a primary concern of the draft regulation. Guidance on environmental aspects of RIA is also cursory in the other three nations (Nesbit, 2019).

Strategic environmental assessment

Strategic environmental assessment (SEA) is widely used, particularly in land-use planning. For example, SEA is integrated into the broader sustainability assessment, which is a legal prerequisite for adoption of local spatial plans in England and Wales. Beyond the land-use planning sphere, SEA has been used for local air quality action plans, local transport plans, municipal waste management strategies, water resources (river basin) management plans, waste management plans, etc. The UK government Green Book provides guidance on how to appraise and evaluate policies, projects and programmes. However, SEA is rarely used for non-environmental plans and programmes such as regional economic strategies.

SEA legislation in Scotland (Environmental Assessment [Scotland] Act 2005 and its implementing regulations) is more robust than that in the other jurisdictions of the United Kingdom. Scottish SEA covers some of the highest-level strategies, plans, programmes and policies, including legislation. These include, for example, the Climate Change Act, energy policy, national transport infrastructure strategies and the national planning framework. A database provides a record of all public plans, programmes and strategies that have been subjected to SEA.

Ex post policy evaluation

The Environment Act 2021 lays out a domestic framework for post-EU exit environmental governance (primarily for England) and introduces regulatory changes in the areas of air, water, waste, biodiversity and chemicals. It sets legally binding long-term targets on air quality, water, biodiversity and resource efficiency and waste reduction, as well as statutory Environmental Improvement Plans (EIPs). EIPs set interim targets for each five-year period and lay out steps to improve the natural environment. Both medium- and long-term targets are supported by a new statutory cycle of monitoring, planning and reporting.

The law establishes the OEP to hold the government accountable on progress towards achieving targets. The OEP can make annual recommendations to which the government must respond. However, the OEP will only operate in England and likely in Northern Ireland. In addition, it will be required to consider guidance from the government, raising concerns about its independence.

Environmental Standards Scotland (ESS) is a similar independent watchdog body set up in Scotland in 2021. It aims to ensure the effectiveness of environmental law and prevent enforcement gaps arising from the United Kingdom leaving the European Union. The ESS can examine the implementation and effectiveness of environmental laws, including international obligations. It can prepare improvement reports to which the ministers must respond with an improvement plan, subject to parliamentary approval. It can also serve compliance notices on public authorities, which can be enforced through the courts. Wales has only appointed an interim Environmental Protection Assessor until it completes a review of its environmental governance framework.

Policy evaluation is also done through performance indicators. The 25 YEP outcome indicator framework in England is made up of 66 indicators. These indicators are arranged into ten broad themes related to the goals of the 25 YEP and commitments to protect and improve the global environment. The themes are environmental topics that people will generally recognise (e.g. air, freshwater, seas and estuaries, wildlife). Indicator frameworks are also used in other jurisdictions to evaluate corporate performance of environmental authorities. For example, SEPA uses 17 corporate performance measures. In addition, the National Audit Office reports on the effectiveness of the regulatory policy framework as a whole through value-for-money studies. Welsh ministers publish a State of Natural Resources Report every five years to evaluate the performance of government policy.

1.2.3. Environmental regulation and compliance assurance

During the 47 years of the United Kingdom’s membership in the European Union, the gradual penetration of environment-related EU directives into national policy and legal systems was profound. Consequently, a rapid and sudden disentanglement risks legal uncertainty and policy gaps. The UK government has devoted a great deal of time and effort to ensuring adequate retention of EU environmental law. However, this process is taking longer than expected: specific changes are still being made through a multitude of statutory instruments, particularly on air quality, chemicals and nature protection. In January 2022, the UK government announced its intention to bring forward a Brexit Freedoms Bill to end the special status of EU law and ensure it can be more easily amended or removed to reduce regulatory burden on businesses.

The COVID-19 pandemic has created additional challenges for environmental regulation. SEPA, for example, issued Principles for Regulatory Approach to EU exit and COVID-19 in 2020 to provide clarity on temporary regulatory positions (e.g. on waste management) in relation to these unusual circumstances. Temporary positions enabled regulated businesses to continue operating within the COVID-19 restrictions, while also protecting the environment.

Environmental impact assessment and permitting

Environmental impact assessment (EIA) conclusions must be considered in issuing a development consent (in England, by a local authority) or a planning permission (in Scotland, by a local planning authority or the Scottish government). The environmental regulator is a statutory stakeholder in the development/planning consent process. It must consider any relevant information or conclusions from the EIA when making the subsequent permitting decision.

Operators applying for a bespoke environmental permit in England must conduct a site-specific risk assessment if their activity exceeds certain thresholds of environmental impact. This risk assessment is different from an EIA and includes identification of risk sources, pathways and receptors, as well as actions to control these risks. For example, operators of industrial installations and waste management facilities must assess risks related to their air emissions (including those of GHGs) and discharges into surface water and groundwater.

UK environmental regulators diversify permitting regimes based on the regulated activity’s level of environmental impact. This approach makes the procedural burden proportionate to the risk. The Environmental Authorisations (Scotland) Regulations 2018 establish four types of authorisations:

permits for higher risk and/or non-standard activities that require rigorous assessment (permits may contain a mixture of standard and bespoke conditions)

general binding rules (GBRs) – a set of mandatory rules that cover specific low-risk activities

registrations for activities where a simple assessment or screening can determine whether to allow the proposed activity

notifications of low-risk activities (which may be associated with GBRs) to let the regulator know the activity is carried out.

In England, the Environment Agency issues “standard rules permits” for installations in 21 sectors where activities are sufficiently uniform to make this approach suitable. General legal requirements cover all businesses that do not require a permit. For example, they are required to fulfil their “duty of care” with respect to waste management, to prevent water pollution and to use best practicable means to prevent statutory nuisances.

Cost recovery is a key principle of environmental regulation in the United Kingdom, one of the few OECD member countries to impose service-based environmental fees. The Environment Agency must recover all costs (but without additional revenue) associated with its permitting, compliance assessment and enforcement activities – from staff employment to support services. The Environment Agency’s charging scheme was integrated across different regulatory regimes in 2019. It covers a permit application charge and an annual subsistence charge to cover the costs of compliance monitoring. Local authorities also charge fees, albeit at much lower rates, for their permitting and compliance and enforcement activities. Under similar arrangements in Scotland, SEPA recovered 98% of its costs through charging schemes in 2019-20 (SEPA, 2021).

Sectoral approach and promotion of green practices

SEPA’s 2016 One Planet Prosperity Regulatory Strategy declared a new approach to regulation: working with businesses to go beyond compliance is the best way to deliver the ambitious goals. It recognises multiple influences on environmental performance of a business: consumer demand for environmental credentials; investor and supply-chain requirements for environmental performance; assessment by external ratings bodies; trade association membership standards; expectations of employees about environmental performance; and social scrutiny by residents, non-governmental organisations (NGOs) and via social media. Businesses more often view environmental and social issues as a market driver of business success than as a compliance issue involving concerns about cost and business disruption. The strategy built on the agency’s prior efforts to target promotion of compliance and green business practices at key economic sectors.

SEPA develops a plan for its interactions with each sector it regulates. The sector plans are developed via engagement with the sectors, internal experts, relevant regulators and other key stakeholders. Sector plans focus on practical ways of delivering environmental, social and economic outcomes. They specify levels of compliance, the market context and key social issues. The latter include recognising the importance of creating local jobs in rural communities and any issues that non-compliance is creating in the communities the sector is operating in. This approach seeks to ensure systemic tackling of remaining compliance issues for the sector, mapping out most promising “beyond compliance” opportunities, and identifying and harnessing the key levers that influence that particular sector. As of June 2021, SEPA had published 15 sector plans.

The Environment Agency uses a similar sectoral approach. It systematically produces five-year strategies and annual intervention plans for a range of regulated sectors in England. The 2016-20 strategies covered 14 sectors, including food and drink, cement, chemicals, paper, pulp and textiles, oil and gas, metals, landfills and hazardous waste.

UK environmental regulators use a variety of tools to help businesses to reach and go beyond compliance. The Environment Agency provides “retailer” compliance assistance through direct contacts with businesses; inspectors advise operators as part of their regular activities. In addition, the agency gives limited free assistance as part of the permit application process. This advice allowance is included in the basic application charge. Additional pre-application advice is chargeable at a moderate fee of GBP 100 per hour.

NetRegs – one of the first web-based environmental compliance promotion tools in Europe – was created in partnership between the UK environmental regulators in 2002. In 2011, the Environment Agency (then also covering Wales) withdrew from NetRegs to integrate environmental guidance to businesses into one multi-theme hyper-portal. NetRegs was then revived as a partnership between SEPA and the NIEA. It provides free environmental guidance on a wide variety of environmental topics for businesses in dozens of sectors throughout Scotland and Northern Ireland. The tools include online guidance, an e-mail newsletter, e-learning courses, an environmental self-assessment tool and a mobile app that delivers checklists specific to each sector.

Farmers are a key segment of the regulated community in need of compliance assistance. They are given high-quality, easy to use information on best practices in fertiliser use to comply with requirements in nitrate-vulnerable zones (EC, 2019). In 2018, for example, the NIEA signed a Memorandum of Understanding with the Ulster Farmers Union to build a stronger and more effective working relationship between the NIEA and the farming community, support sustainable farming and deliver improved legislative compliance.

Much of the assistance focuses on good practices that offer win-win environmental and business solutions. Zero Waste Scotland – a not-for-profit environmental organisation fully funded by the Scottish government – uses a variety of tools to help small businesses to achieve cost savings, new sales, reduced risk and competitive advantage through improvements in resource efficiency. SEPA’s nine Sustainable Growth Agreements with individual companies or groups of businesses also target win-win solutions. Examples of sectors covered are construction (a 2017-18 agreement with Superglass) and wastewater management (with Scotland Water, 2018-20). These agreements seek to achieve specific environmental outcomes, and results are monitored annually.

Environmental regulators encourage companies to use effective environmental management systems (EMSs), e.g. through a 5-10% reduction in administrative fees. The British national environmental management standard, BS8555, that governs EMS for small and medium-sized enterprises (SMEs), allows them to implement the system in individual modules rather than as a whole. This makes an EMS more attractive to small businesses by reducing its implementation costs.

UK governments also use public relations incentives to promote environmentally friendly business behaviour. Scotland’s VIBES initiative (Vision in Business for the Environment of Scotland) has been recognising businesses of all sizes and sectors employing environmental best practices in their daily activities since 2010. The award programme is a partnership between SEPA, several other government institutions and business groups. There are many award categories, including energy, climate change adaptation and circular economy. A case study is produced for each winning business and published on the VIBES website.

Environmental inspections

The United Kingdom has historically championed risk-based management of environmental compliance monitoring, the approach taken up by many OECD member countries. For many years, the Environment Agency used the Operational Risk Appraisal (Opra) system as a key tool for risk assessment of sites, inspection planning and charge setting. However, Opra was withdrawn in favour of a simpler performance‑based approach as part of the Environment Agency’s strategic review of charges in 2019. Compliance assessment plans still prioritise permitted installations based on several criteria such as their sector, compliance scores, enforcement activity, incidents, complexity and location. Under a performance-based system, lower-risk, well-managed activities are charged less than higher-risk or poorly managed activities.

In Scotland, the Dynamic Regulatory Effort Assessment Model (DREAM) used by SEPA for the last decade distinguishes three ranges of low-risk installations. It draws on 35 risk factors, with corresponding frequencies of walk-through inspections of every two, three or five years. SEPA is revising the DREAM model as it does not contain the levels of data needed to enable the shift to sector-based regulation. A new mechanism will set priorities within and across sectors while still maintaining a focus on high hazard activities, sites of community concern and those with a history of non-compliance.

In addition to regular site inspections, the Environment Agency carries out audits (in-depth evaluations) to identify root causes of non-compliance. Audits usually review the effectiveness of an operator’s management system. In addition, an audit could be used to assess whether the permit still provides an appropriate level of environmental protection, i.e. by benchmarking it against up-to-date best practices. Audits are always planned, and the operator is notified to provide information or attendance of certain personnel. Regular site inspections can be unannounced so that normal operations can be observed. Inspection and audit reports are available to the public upon request.

The Environment Agency has adopted a standard approach to classify permit breaches and score environmental permit compliance known as the Compliance Classification Scheme (CCS). CCS is organised around performance bands, providing a reactive way of tracking operators’ conduct. The compliance rating is based on CCS events over the previous calendar year. It allocates points for each permit breach recorded in the CCS under one of the four categories based on potential environmental impact (from Category 1 corresponding to most serious offences). The points from each event are added to produce an annual total non-compliance score,11 which is then converted into a compliance rating.

In an excellent practice, UK environmental regulators make compliance indicators a key part of their performance management. For example, the Environment Agency sets targets for the number and percentage of sites to be compliant across a range of activities and industry sectors. These are aggregated for corporate reporting as well as reported and analysed separately by industry sector. The number of serious and significant pollution incidents (Categories 1 and 2 according to the agency’s classification) is used in England as a surrogate measure of environmental impact. An interesting supplementary measure is the number of serious pollution incidents per 100 permits in a sector, which shows the proportion of incidents in each sector and highlights sectors that cause a disproportionate number of incidents.

The risk-based approach, together with the emphasis on compliance promotion, has helped UK environmental regulators to improve permit compliance levels over the years. As of 2019, 90.5% of Scottish regulated businesses were in compliance. Over 2015-20, SEPA was reducing the number of operators found in non-compliance for two years or more by about 40% annually (SEPA, 2021). However, the percentage of permits in the worst-performing bands in England has remained largely unchanged (around 3%) since 2010, as has the number of serious pollution incidents (Environment Agency, 2021b).

Enforcement

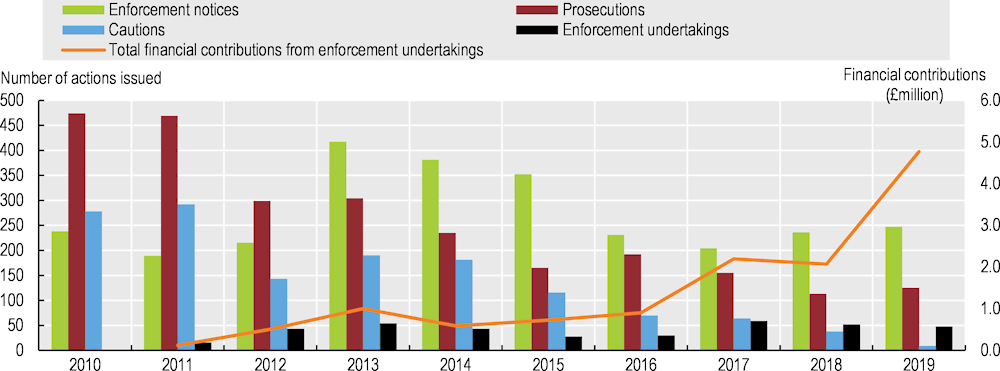

Over the last decade, the United Kingdom has put increasing emphasis on administrative rather than criminal response to non-compliance. Figure 1.4 illustrates this trend for England, where administrative sanctions range from cautions (warnings) to compliance/enforcement notices to fixed or variable monetary penalties (VMPs). The Environment Agency decides on the basis of investigation and according to criteria laid out in its guidance on offence response options whether to use an administrative penalty or resort to criminal prosecution. The decriminalisation of less severe violations has made enforcement more proportionate to non-compliance, more expedient and more efficient. Distancing administrative penalties from criminal justice also increases the impact of the system of sanctions overall.

Fixed monetary penalties (in England, GBP 300 for businesses) may be applied to minor offences. The Regulatory Enforcement and Sanctions Act (2008) introduced VMPs in England and Wales. They became operational in 2010.12 The amount of a VMP may not exceed the maximum amount of the fine that can be imposed by a criminal court or in any event GBP 250 000 per offence. According to the Environment Agency’s latest (2019) Enforcement and Sanctions Policy and the 2018 calculation methodology, the penalty can cover any obvious financial benefit unlawfully gained by the offender as long as the total VMP does not exceed the statutory maximum. This represents progress in the possibility to recover economic benefits of non-compliance – the deterrence approach practised by the United States Environmental Protection Agency since the 1980s. However, the Environment Agency imposed VMPs only three times in 2020‑21, with an average penalty of less than GBP 4 200 per case. VMPs are not yet available under the Environmental Permitting Regulations that cover most permit breaches.

In Scotland, fixed fines of GBP 600 (in most cases) are imposed for first-time offences without significant environmental harm. SEPA plans to introduce VMPs in 2021, based on a 2015 regulation, after an implementation delay caused in part by the 2020 cyberattack on the agency. VMPs will not be available for all offences, but removal of financial gain from the offence is envisaged. The maximum penalty is set out in the legislation defining that offence, whereas the minimum VMP in Scotland will be GBP 1 000. According to SEPA’s Guidance on the use of enforcement action (2016), once an administrative fine has been imposed, the offence can no longer be prosecuted.

Another possible non-compliance response is an enforcement undertaking. In this case, the offender makes a voluntary offer, accepted by the regulator, to restore and remediate the local environment and prevent repeated non-compliance. The agency then decides whether financial resources towards remediation or upgrading of equipment would be more appropriate than monetary penalties. Enforcement undertakings, first introduced in England and Wales, were more recently introduced in Scotland. Since put into practice in England in 2011, their total monetary value has increased sharply (Figure 1.4). Indeed, the Environment Agency views enforcement undertakings as the main enforcement alternative to prosecution.

Figure 1.4. Enforcement in England shifts from prosecution to administrative sanctions

Note: Environmental offences for the purpose of this analysis are waste, water quality and emissions offences.

Source: Environment Agency (2020).

For more serious offences, as defined in the regulatory agency’s enforcement and prosecution policy, agencies consider prosecution. In England and Wales, the Environment Agency, Natural Resources Wales or a local authority can prosecute directly. In Scotland, SEPA must make recommendations to the public prosecutor – the Procurator Fiscal – who decides and then conducts any prosecution proceedings. In Northern Ireland, the NIEA refers prosecution cases to the Public Prosecution Service. In setting penalties for environmental crimes, courts consider guidance developed by the UK Sentencing Council.

In an interesting practice, the Environment Agency often uses a formal administrative “caution” as an alternative to prosecution. This caution is a written acceptance by the violator that it has committed the offence. The agency only uses a formal caution where it considers it could bring a prosecution and the offender consents to be cautioned. The Environment Agency keeps a record of the formal caution. It is produced in court only if the offender is later prosecuted for a different offence. If the offender does not accept the formal caution, the agency then prosecutes for the original offence.

Fighting environmental crime beyond significant permit breaches requires broad interagency efforts across the United Kingdom. For example, the National Wildlife Crime Unit supports police forces across the country in dealing with wildlife crime. The UK Partnership for Action against Wildlife Crime brings together a number of statutory and voluntary bodies to improve co‑operation. These bodies include the police, UK Border Agency, Defra, Home Office, Natural Resources Wales, Scottish Natural Heritage, the Joint Nature Conservation Committee, Royal Botanic Gardens Kew, the NIEA, and environmental and animal welfare NGOs.

Public transparency of enforcement is another good practice demonstrated by UK environmental regulators. The Environment Agency maintains a public register of enforcement actions, searchable by offender’s name, action or offence type, and date. SEPA publishes a list of penalties imposed and undertakings accepted. Making enforcement actions public increases pressure on violators to improve their performance.

1.3. Promoting investment and economic instruments for green growth

In March 2020, the United Kingdom swiftly introduced a massive package of measures to respond to the COVID‑19 emergency and support businesses, households and public services (OECD, 2020a). From the summer onwards, in addition to extending support measures, the government introduced new ones to support demand and jobs. Successive packages totalled GBP 315 billion by October 2021 or 15% of 2020 GDP, one of the largest fiscal responses to the COVID-19 crisis globally (OBR, 2021) (IMF, 2021).The March 2021 budget added virus-related support in 2021-22, designed measures to stimulate economic recovery over 2021-23, and planned fiscal consolidation from 2023. Alongside the budget, the government wants to level up investment across the United Kingdom, to create an outward-looking, net zero, high-tech economy through the 2021 plan to Build Back Better (Plan for Growth) (HM Treasury, 2021a). It introduced a temporary 130% capital allowances super deduction for investment in 2021-23 and launched the UK Infrastructure Bank to increase investment, notably in green infrastructure. As fiscal policy moves from rescue to recovery, the general government deficit is projected to decline from 12.9% of GDP in 2020 to 5.4% in 2022 and 4.0% in 2023. (OECD, 2021a).

1.3.1. Green elements in the UK’s 2020 recovery package

In the summer of 2020, as part of its COVID-response package, the UK government announced investment in cycling and public transport and energy efficiency in buildings to support jobs and reduce GHG emissions (HM Treasury, 2020a). In November 2020, the Prime Minister outlined the Ten Point Plan for a Green Industrial Revolution to build back better (Table 1.2). The plan seeks to mobilise GBP 12 billion of government investment to create and support up to 250 000 green jobs by 2030 and reduce UK emissions by 180 Mt CO2e between 2023 and 2032 (40% of 2019 emissions) (HM Government, 2020). It was followed by the 2020 Spending Review and National Infrastructure Strategy setting out how the UK government intends to fund the Ten Point Plan. The plan was generally welcomed by stakeholders but was criticised for bringing forward previously announced spending commitments and for being insufficient for the net zero target (IISD, 2020); (CCC, 2021b).

Table 1.2. The 2020 Ten Point Plan for a Green Industrial Revolution

|

Targets |

Expected impacts |

|---|---|

|

Offshore wind Quadruple offshore wind capacity to 40 GW by 2030 |

Support for up to 60 000 jobs in 2030 Savings of 21 Mt CO2e between 2023 and 2032 (5% 2018 UK emissions) |

|

Hydrogen 5 GW of low-carbon hydrogen production capacity by 2030 |

Support for up to 8 000 jobs by 2030 Savings of 41 Mt CO2e between 2023 and 2032 (9% 2018 UK emissions) |

|

Nuclear Pursuing large-scale nuclear and developing small and advanced reactors |

A large-scale nuclear power plant will support a peak of around 10 000 jobs during construction |

|

Electric vehicles End the sale of new petrol and diesel cars and vans by 2030 and hybrid cars and vans by 2035 |

Support for around 40 000 new jobs in 2030 GBP 2.8 bn package (incl. GBP 0.5 bn for purchasing grants and GBP 1.3 bn for charging infrastructure) Savings of around 5 Mt CO2e to 2032 |

|

Public transport, cycling and walking Accelerate the transition to more active and sustainable transport with at least 4 000 more British-built zero-emission buses |

Up to 3 000 jobs by 2025 Government investment of GBP 5 bn in buses, cycling and walking over this parliament Savings of around 2 Mt CO2e from green buses, cycling and walking between 2023 and 2032 |

|

Jet zero and green ships Make the United Kingdom the home of green ships and planes |

Up to 5 200 jobs supported by a domestic sustainable aviation fuels industry Savings of up to 1 Mt CO2e by 2032 from clean maritime |

|

Greener buildings 600 000 heat pump installations per year by 2028 and moving away from fossil fuel boilers |

Up to 82 500 jobs GBP 1.5 bn for the Green Homes Grant Voucher Scheme Savings of 71 Mt CO2e between 2023 and 2032 (16% 2018 UK emissions) |

|

Carbon capture, utilisation and storage (CCUS) Capture 10 Mt of carbon dioxide a year by 2030 and establish CCUS in four clusters |

Support for around 50 000 jobs by 2030 Up to GBP 1 bn of public investment by 2025 Savings of around 40 Mt CO2e between 2023 and 2032 (9% 2018 UK emissions) |

|

Protecting our natural environment Planting 30 000 ha of trees every year by 2024 |

Up to 20 000 jobs from improving flood defences by 2027 Up to GBP 5.2 bn of investment for flood defences |

|

Green finance and innovation Raise total R&D investment to 2.4% of GDP by 2027 |

Unlock the potential for 300 000 jobs in exports and domestic industry by 2030 GBP 1 bn of government funding in net zero innovation |

Note: Greener buildings: the Green Homes Grant Voucher Scheme was ended in March 2021 with GBP 314 million spent and 47 500 homes upgraded. CCUS: the 2021 NZS aims to store 20-30 Mt CO2 per year by 2030.

Source: HM Government (2020), The Ten Point Plan for a Green Industrial Revolution; NAO (2021), Green Homes Grant Voucher Scheme.

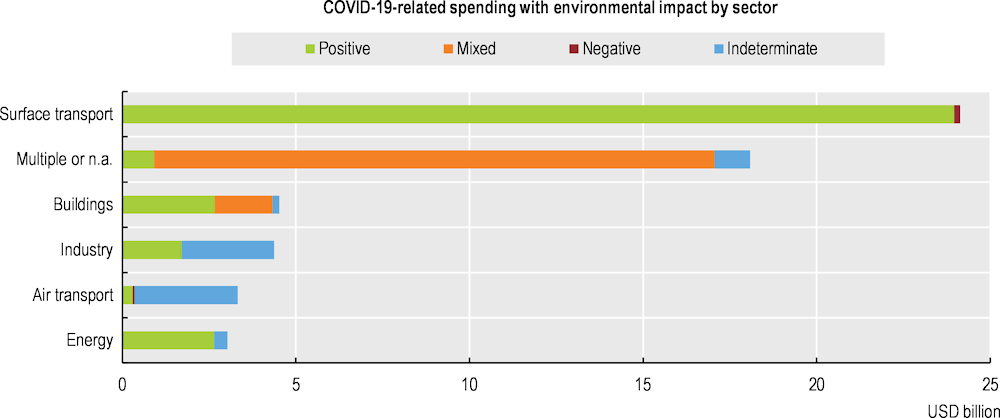

It is difficult to determine whether a measure is exclusively related to COVID-19 and to distinguish between rescue and recovery measures. However, the United Kingdom is reported to have allocated USD 57 billion (2.1% of 2020 GDP) to measures with environmental implications as part of its recovery efforts (Figure 1.5). More than half of this total (1.2% of GDP) was allocated to measures with a likely positive environmental impact. These were mostly grants or loans tagged for their climate mitigation effect, supporting in particular public transport services (rail, transport services in London, bus and light rail services across the rest of England) whose use declined during the pandemic. Environment-related measures represent a small share of the COVID‑19 response package due to the importance of rescue measures. The 2020 Ten Point Plan for a Green Industrial Revolution, the 2021 plan to Build Back Better, the NZS and the Fairer, Greener Scotland Programme for Government 2021-22 aim to mobilise green private investment and to promote green finance through the new UK Infrastructure Bank and the Scottish National Investment Bank.

Figure 1.5. Most green spending related to COVID-19 is on public transport

Note: Airline and car manufacturer bailouts with no green conditions are reported as indeterminate in the figure.

Source: OECD (2021), OECD Green Recovery Database (database).

Among the 50 largest economies covered by the Global Recovery Observatory, the United Kingdom invested the most on green transport (O’Callaghan and Murdock, 2021). This reflects efforts to align the climate and the wider well-being agendas through street redesign and management (Box 1.2) (OECD, 2021c). Budgets were also announced for promoting electric vehicles (EVs) (Section 1.3.3), renewables (Section 1.3.2), woodland creation and peat restoration (Section 1.3.3). However, the hasty implementation of the Green Homes Grant Voucher Scheme has been detrimental to results. It was ended after reaching fewer than 10% of the homes it was set out to upgrade, and had limited impact on job creation (NAO, 2021a). Other measures ran counter to the climate objectives. For example, the Bank of England has granted COVID Corporate Financing Facility loans to UK-based car manufacturers and airlines with no environmental conditions. There are also concerns the super deduction announced in the March 2021 budget could encourage high-carbon investment.

The United Kingdom has made progress in integrating environmental objectives into departmental plans. The 2021 Autumn Budget and Spending Review outlines the public spending contribution to net zero (GBP 26 billion) and other green objectives13 (GBP 4 billion) over 2021-25 (HM Treasury, 2021b). However, it has not published the potential negative contribution of programmes. Despite progress in updating the Green Book (Box 1.3), government departments do not always consider it on a consistent basis when appraising programmes (HoCs, 2021a). Some countries, such as France, have classified budget lines according to their impact (positive or negative) on environmental objectives. The United Kingdom could follow the same approach to ensure public spending is consistent with environmental objectives. The Environment Act exempts HM Treasury from being bound by environmental principles14 by exempting taxation, central spending and resource decisions from their application. This is intended to ensure the Treasury Minister’s ability to alter the UK’s fiscal position but goes against the recommendation of the House of Commons Environmental Audit Committee (HoCs, 2021a).

Box 1.2. Recovery measures to accelerate active travel

In 2019, journeys below 2 miles (3.2 km) represented 43% of all urban and town journeys; 58% of car trips were shorter than 5 miles and 25% were shorter than 2 miles. Switching short car journeys to cycling and walking can contribute to achieve net zero, improve air quality, health and well-being, and address inequalities, congestion and noise pollution. The UK government aims for half of journeys in towns and cities to be cycled or walked by 2030.

In 2020, the Department for Transport has fast-tracked a pre-existing national agenda to overhaul bus, cycle and walking links, as well as to promote electrification. The GBP 2 billion package is focused on stimulating the shift to active modes through providing additional incentives to individuals (e.g. GBP 50 bike-repair voucher estimated at EUR 28 million) and support for local authorities to make temporary pop-up infrastructure permanent (e.g. 240 km of protected bicycle tracks estimated at EUR 300 million). Well-being aspects are mainstreamed as general practitioners are enabled to prescribe cycling as a health-improving measure, a new national rental e-cycle scheme will enable access to e-cycle for those with pre-existing conditions, and employers are encouraged to take on the cycle-to-work scheme (Section 1.3.3).

The Fairer, Greener Scotland Programme for Government 2021-22 commits that 10% of all transport spending will be devoted to active travel by 2024-25.

Source: Buckle et al. (2020), Addressing the COVID-19 and climate crises: Potential economic recovery pathways and their implications for climate change mitigation, NDCs and broader socio-economic goals; Dft (2021), Decarbonising Transport: A Better, Greener Britain.

1.3.2. Investing in environmental and low-carbon infrastructure

Low investment and innovation rates have been key factors behind the weak productivity performance of the United Kingdom in recent years (OECD, 2020a). The government aims to increase public investment from 1.9% of GDP in 2019-20 to 2.7% by 2025-26. The 2020 National Infrastructure Strategy seeks to boost growth and productivity across the whole of the United Kingdom, levelling up and strengthening the Union; put the United Kingdom on the path to net zero; and support private investment (HM Treasury, 2020b). It provides for GBP 27 billion investment (equivalent to 1.2% of GDP) in economic infrastructure (transport, energy and digital communications) in 2021/22. The 2020 and 2021 Spending Reviews also include multi-year capital funding commitments for infrastructure projects such as high speed rail, strategic roads, flood defences and broadband. However, there are questions about whether infrastructure programmes sufficiently consider regional disparities and environmental objectives (Box 1.3).

Box 1.3. Assessing environmental impacts of public investment

The United Kingdom has a robust framework for monitoring and evaluating public spending programmes, including a Green Book to appraise the costs and benefits of policies, projects and programmes. However, an HM Treasury review (2020) concluded that appraisal practice was likely to undermine the government’s objectives in areas such as “levelling up” the regions and reaching net zero. Selection of projects is heavily reliant on benefit-cost ratio. Too much weight is placed on benefits that can easily be assigned a monetary value and insufficient weight on addressing strategic policy priorities.