This chapter presents the key findings for the consumption, production, trade, and prices of major agricultural and fish commodities covered in the OECD-FAO Agricultural Outlook for the period 2024 to 2033. It summarises a plausible baseline scenario of the next ten years, based on assumptions regarding macroeconomic conditions, productivity trends, weather conditions, consumer preferences, and agriculture and trade policy settings. Global agricultural demand is projected to grow more slowly over the coming decade due to the foreseen slowdown in population and per capita income growth. This 20th joint edition features a review the evolution of agricultural markets over the last twenty years, highlighting the increasing importance of emerging economies. While the influence of The People’s Republic of China in global food and agricultural consumption is projected to diminish over the next decade, India and Southeast Asia are expected to gain significance. Agriculture’s global greenhouse gas emissions intensity is projected to decline, as the projected production growth will be based on productivity improvements rather than cultivated land and livestock herd expansions. However, direct emissions are still projected to rise. The chapter also presents a scenario focussing on the impact of food loss and waste reduction on GHG emissions, food security and nutrition.The Outlook emphasises the continued importance of well-functioning international agricultural commodity markets for global food security and rural livelihoods. The expected developments in global demand and supply are projected to keep real international reference prices on a slightly declining trend over the next ten years, yet potential deviations from the underlying environmental, social, geopolitical and economic assumptions would alter the baseline projections.

OECD-FAO Agricultural Outlook 2024-2033

1. Agricultural and food markets: Trends and prospects

Copy link to 1. Agricultural and food markets: Trends and prospectsAbstract

The OECD-FAO Agricultural Outlook is a collaborative effort of the Organisation for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization of the United Nations (FAO). This year’s report presents a consistent baseline scenario for the evolution of agricultural commodity and fish markets at national, regional, and global levels for the period 2024 to 2033.

The baseline projections are based on structured expert inputs. These projections are influenced by current market conditions (Section 1.2), as well as assumptions about macroeconomic, demographic, and policy developments Section 1.3). The OECD-FAO Aglink-Cosimo model, which links sectors and countries covered in the Outlook, ensures consistency and global equilibrium across all markets.

In Section 1.6, this Outlook highlights the importance of food loss and waste for food security, resource use and the sustainability of food systems. It also presents a scenario analysis that explores the potential implications for global supply and demand of reducing food waste by 50% at the retail and consumer levels between now and 2030, in line with the SDG 12.3. target, along with halving food losses at the production level and through the supply chains over the same period.

1.1. OECD-FAO: 20 years of collaboration and 20 years of evolution in agri-food markets

Copy link to 1.1. OECD-FAO: 20 years of collaboration and 20 years of evolution in agri-food marketsThis 20th joint edition presents an opportunity to reflect on the evolution of global agricultural markets over the past two decades. While consumption and production of agricultural commodities have in general grown steadily there have been noteworthy structural, behavioural and policy shifts within the overall global picture. Imports and exports have surged by 105% globally, from the reference period of 2001-2003 to the base period of 2021-2023. Consumption and production have increased by 58% over the same timeframe. One has been the rising prominence of emerging economies as both consumers and producers, fueled by rapid population growth, increasing disposable incomes and technological progress, and leading to a revised order in international markets. This new order and the evolution towards it, is the background for the Outlook’s projections to 2033. Many of the same shifts will continue to shape agricultural markets in the medium term.

1.1.1. Consumption trends have seen China and India grow in stature

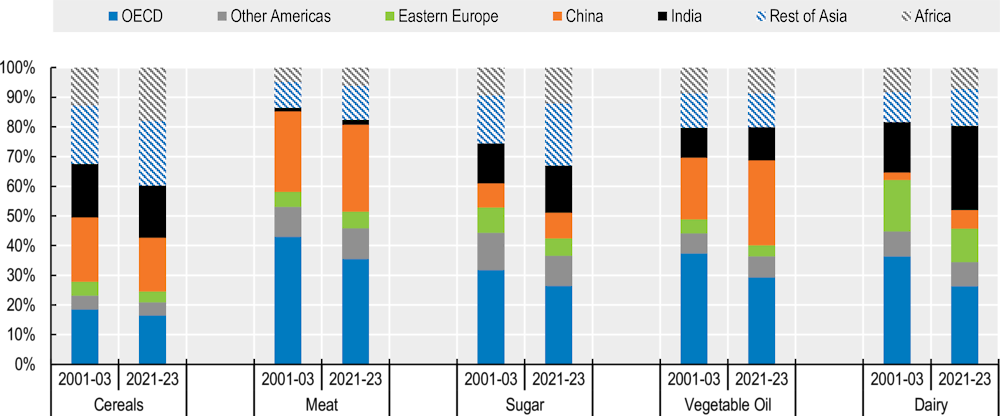

OECD countries have witnessed the most drastic decreases in world market consumption shares for dairy, vegetable oil and meat, with People’s Republic of China (hereafter “China”), India, and the rest of Asia contributing most to these shifts (Figure 1.1). OECD countries’ share of world dairy consumption dropped from 36% to 26%. India largely accounted for this shift, increasing its market share by 11 percentage points. For vegetable oil, the market shares largely shifted towards China, which increased its share by 8 percentage points. In meat, all regions aside from the OECD group showed moderate increases in market shares, with the rest of Asia region showing the largest increase (approximately 3 percentage points).

In non-food consumption, OECD countries’ share in terms of feed use of cereals and protein meals dropped dramatically over the past 20-year period – by 17 and 20 percentage points respectively. In both cases, China contributed most significantly to this shift, increasing its shares in cereal and protein meal consumption by 9 and 11 percentage points respectively.

Figure 1.1. Shares of global food consumption

Copy link to Figure 1.1. Shares of global food consumption

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

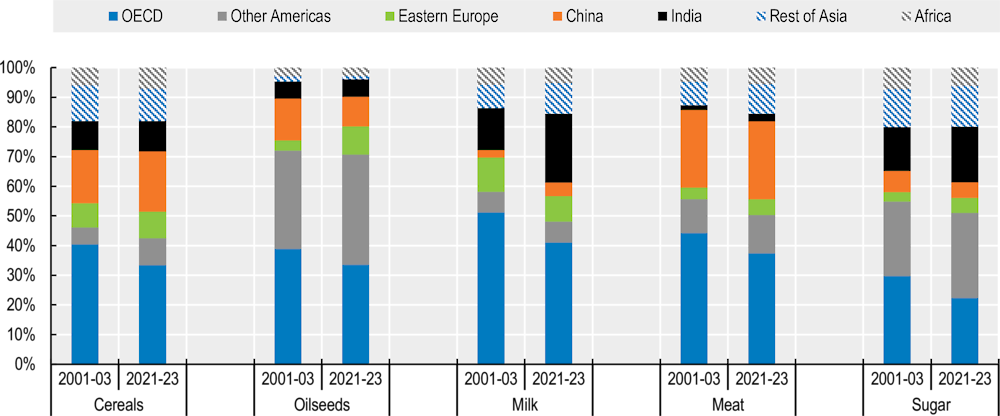

1.1.2. OECD production shares are declining relative to other regions, especially India

OECD countries’ global share of production of cereals, oilseeds, milk, meat and sugar decreased on average by about 7 percentage points in the last 20 years. The most notable change occurred in global milk markets, with the OECD share dropping from 51% to 41% (Figure 1.2). India accounted for nearly all of this shift, increasing its share from 14% to 23%. Interestingly, in oilseeds production markets, China’s share decreased nearly the same amount as OECD countries’ shares, a drop of 4 and 5 percentage points, respectively, with Eastern Europe and the Other Americas regions filling the gap.

Figure 1.2. Shares of global production

Copy link to Figure 1.2. Shares of global production

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

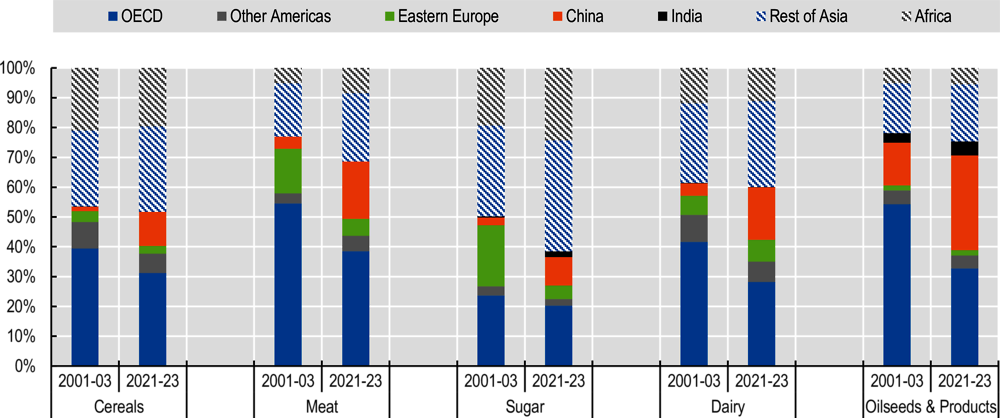

1.1.3. The trade landscape has shifted significantly

The OECD countries’ global share of imports of the five commodities shown in Figure 1.3 decreased across the board, most notably in oilseeds and products (a 21 percentage point decrease), meat (16 percentage point decrease), and dairy (13 percentage point decrease). China filled the gap with markedly increased shares in all three markets. For all five commodities shown in Figure 1.3, China showed the largest increases in import shares out of all the regions, followed by the rest of Asia.

While OECD shares decreased modestly in sugar import markets, the most significant drop occurred in Eastern Europe, plummeting from 20% to just 5%. China, the rest of Asia, and Africa collectively filled this gap, with the most notable increases in sugar import shares. Eastern Europe experienced a notable decline in meat import shares, dropping from 15% to 6%.

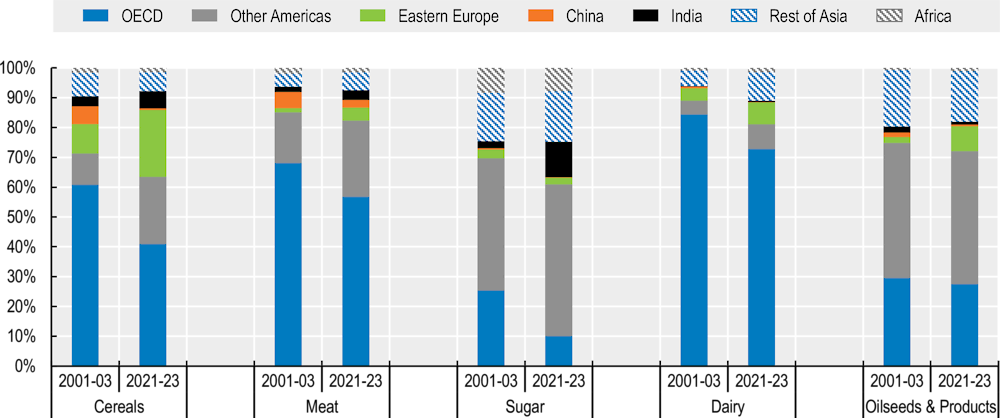

OECD countries’ global share of exports of the five commodities shown in Figure 1.4 all decreased drastically, except for oilseeds and products, which decreased modestly from 30% to 27%. China’s export shares decreased or remained the same for all five commodities. In cereals, the Eastern Europe and Other Americas regions accounted for the largest share increases at 13 and 12 percentage points respectively. India – which exhibited modest changes for all other commodities in both import and export markets – and the Other Americas shared responsibility for sugar import market shifts, with 9 and 7 percentage point increases respectively.

Figure 1.3. Shares of global imports

Copy link to Figure 1.3. Shares of global imports

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 1.4. Shares of global exports

Copy link to Figure 1.4. Shares of global exports

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.2. Recent developments in agricultural markets

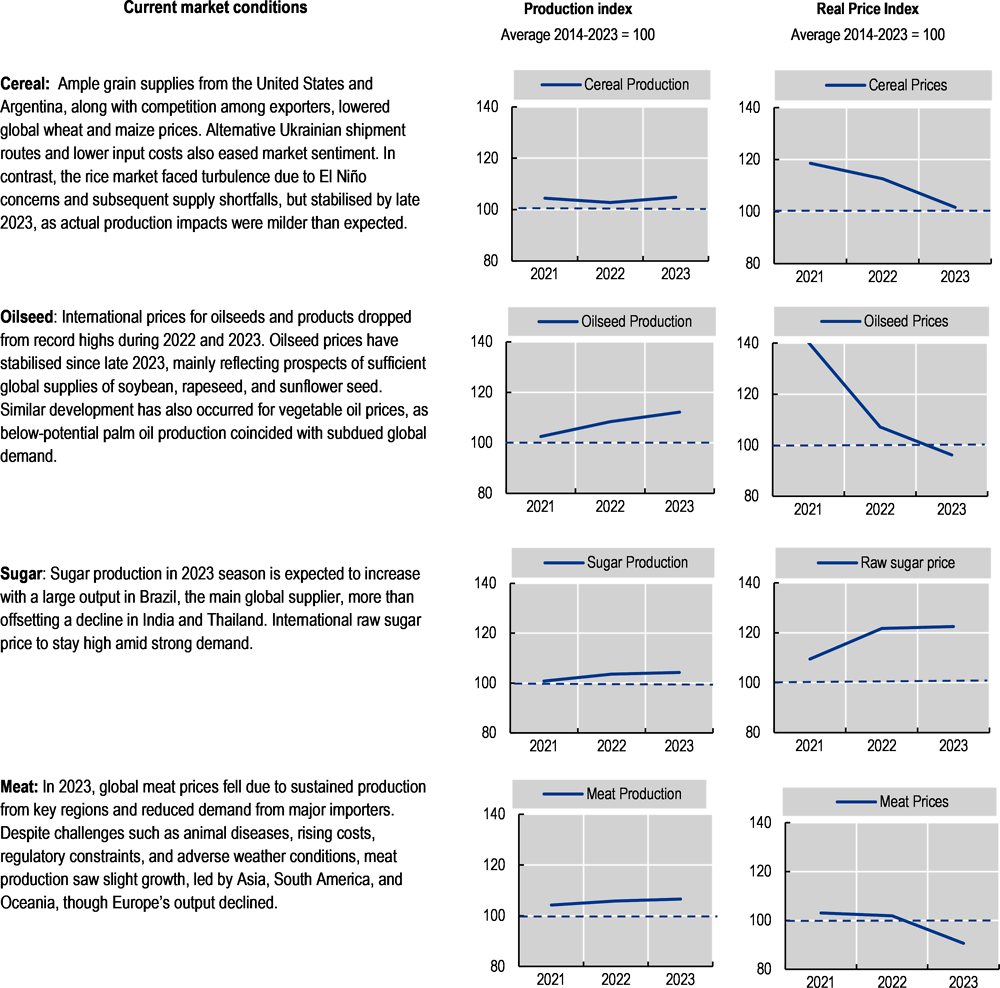

Copy link to 1.2. Recent developments in agricultural marketsInternational agricultural commodity supplies continued to increase in 2023 and matched demand. This resulted in a decline of international reference prices. Those prices are now close or slightly below the last ten-year average. A notable exception are sugar prices which are considerably higher, as increasing global demand outpaced stable production in 2023. Figure 1.5 provides more information on the current commodity situation which is the starting point of the projections.

Figure 1.5. Market conditions for key commodities

Copy link to Figure 1.5. Market conditions for key commodities

Note: All graphs expressed as an index where the average of the past decade (2014-2023) is set to 100. Production refers to global production volumes. Price indices are weighted by the average global production value of the past decade as measured at real international prices. More information on market conditions and evolutions by commodity can be found in the commodity snapshot in the Annex and the online commodity chapters.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.3. Expected macroeconomic and policy changes affecting agriculture markets

Copy link to 1.3. Expected macroeconomic and policy changes affecting agriculture marketsThis baseline scenario generating 2024-2033 projections incorporates the commodity, policy, and country expertise of the OECD and the FAO, as well as input from collaborating member countries and international commodity bodies. The following changes are expected to influence the evolution of agricultural markets in the coming ten years.

1.3.1. A slowing pace of global population growth

World population1 is projected to increase by over 700 million, reaching 8.7 billion by 2033. This reflects an average growth rate of 0.8% p.a., signaling a deceleration compared to the 1.0% p.a. growth observed in the past decade (Figure 1.6). Sub-Saharan Africa is anticipated to witness the most rapid population growth at 2.4% p.a. whereas the population of China is expected to decline gradually. India is projected to cement its position as the most populous country, surpassing China in 2023, with an average growth rate of 0.8% p.a. over the next decade. The overall slowdown in global population growth is anticipated to lead to a slower growth in global food demand compared to the previous ten years.

1.3.2. A sluggish global economic recovery

Global economic recovery from the disruptions of the COVID-19 pandemic and the Russian Federation’s (hereafter “Russia”) war against Ukraine is anticipated to be slow, more so in the advanced economies than in developing markets. Globally, GDP growth is projected to stabilise at an average rate of 3.0% p.a. over the next decade, after declining from an estimated 3.5% in 2022 to 3.0% in 2023. Emerging and developing Asian economies are expected to continue experiencing the fastest growth at 4.5% p.a., followed by Sub-Saharan Africa at 4.3%. In contrast, GDP growth in advanced economies is expected to remain below 2.0% p.a. This divergent recovery will reinforce the role of low- and middle-income countries as primary drivers of global agricultural demand growth.

Global per capita income, expressed in constant 2010 United States Dollars, is expected to grow at 1.4% p.a. in 2024, further weakening from the 2.2% and 1.6% observed in 2022 and 2023 respectively. This indicator is used to represent household disposable income, one of the main determinants of demand for agricultural commodities. Over the next decade, an average annual growth rate of 1.6% p.a. is foreseen globally (Figure 1.6). Strong per capita income growth is expected in Asia, especially in India (5.4% p.a.), Viet Nam (5.1% p.a.), the Philippines (4.2% p.a.) and Indonesia (4.0% p.a.). Per capita income growth in China is expected to weaken to 3.7% p.a. compared to the 5.4% observed in the previous decade. In Sub-Saharan Africa and Latin America and the Caribbean, average per capita incomes are projected to grow at 0.9% and 1.6% p.a. respectively, which are still substantial improvements from the falls seen in the last decade. However, in Sub-Saharan Africa, despite relatively strong overall GDP growth, rising populations will continue to limit gains in real per capita incomes.

1.3.3. Improved affordability of energy and fertiliser inputs as fossil fuel demand weakens

The Outlook uses a composite cost index for agricultural production which covers seeds and energy, as well as various other tradable and non-tradable inputs. In addition, fertiliser costs are explicitly accounted for in the yield and land allocation equations of the Aglink-Cosimo model. Energy costs are represented by the international crude oil price expressed in domestic currency while fertiliser prices are linked to crop and crude oil prices.

According to the International Energy Agency, global demand for oil, coal and gas is set to have peaked in 2023 given the rise of clean energy technologies, potentially putting pressure on international energy prices. Global fertiliser prices have also eased from their 2022 peaks, thanks to lower energy prices and improved market access. Projections in this report are therefore based on the assumption that oil prices will remain flat in real terms.

1.3.4. Existing policies remain unchanged

Policies play an important role in agricultural, biofuel, and fisheries markets, and policy reforms usually trigger changes in market structures. The Outlook assumes current policies will remain in place and that no new policies are enacted. Only free trade agreements that have been ratified up to the end of December 2023 are considered in the Outlook. This specification provides a useful benchmark and allows for the evaluation and analysis of future policy changes.

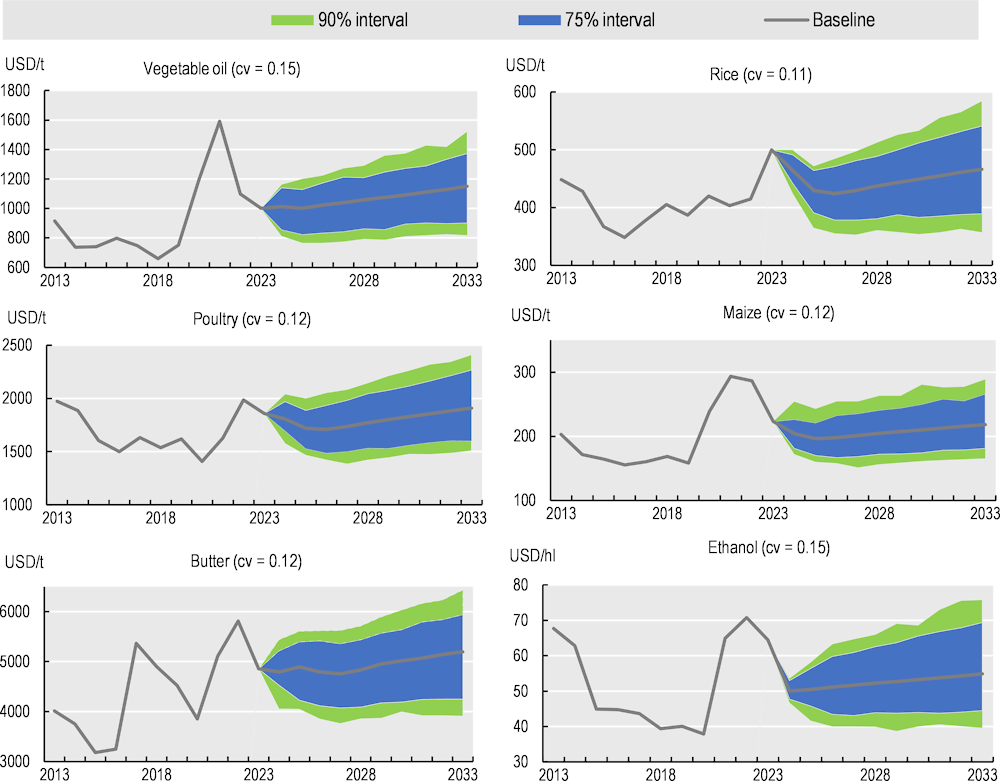

1.3.5. Many uncertainties are likely to affect the projections

The projections of agricultural commodity markets in this report are subject to environmental, social, geopolitical and economic uncertainties that might lead macroeconomic variables to diverge from the assumptions outlined above. A key source of uncertainty is the possible occurrence of abnormal weather events during the ten years ahead, pushing yields outside of the assumed trends influenced by both the effects of climate change and concurrent adaptation measures. In 2023, the Earth recorded its hottest land and sea surface temperatures. Climate change continues to exacerbate the intensity of global temperatures along with the likelihood of other extreme events such as droughts, hurricanes, and floods, impacting global agricultural production and trade patterns. Box 1.3 in Section 1.7 summarises a recently published scenario analysis exploring the role of trade in mitigating the impacts of such extreme weather events. The introduction of more stringent environmental policies by countries to address the sector’s environmental footprint and foster greater sustainability may also limit the production prospects expected over the next decade.

On the demand side, unexpected changes in consumer preferences and behaviour may alter the projections as the Outlook assumes a continuation of current consumer preference developments over the coming decade. Mounting environmental, health and animal welfare concerns may influence consumer behaviour beyond the trends assumed in the Outlook, further increasing the popularity of foods viewed favourably from a health or environmental perspective such as poultry, fish, fruits and vegetables, nuts and seeds, as well as dairy and meat alternatives. In contrast, consumer preferences may increasingly diverge away from commodities with large environmental footprints or potentially adverse health effects such as sugar, palm oil and beef, especially among consumers in upper middle- and high-income economies.

On the trade side, current and potential disruptions to key maritime passages especially the Suez Canal, Panama Canal and the Black Sea may present complex challenges for the seamless movement of agricultural commodities across borders. Disruptions at these critical chokepoints, be it due to geopolitical tensions, changing climate, natural weather phenomenon or other logistical hurdles, can have severe consequences for global supply chains, leading to delays and increased freight costs and thereby affecting the cost and availability of agricultural commodities. For instance, while it may still be too early to make a complete assessment of the impacts of the current Middle East crisis on agricultural markets, prolonged rerouting of oil tankers away from the Suez Canal could lead to spikes in energy prices and transportation costs, reminiscent of the challenges faced during the recovery phase of the COVID-19 pandemic.

Finally, animal and plant disease outbreaks remain a significant source of uncertainty for the global agricultural sector going forward. The economic and social consequences of disease outbreaks for producers and consumers are substantial and often require several years to resolve. This underscores the importance of collaborative biosecurity efforts to ensure disease outbreaks are managed, particularly in the face of risks to exports and imports.

1.4. Consumption: Projected evolution for 2024-2033

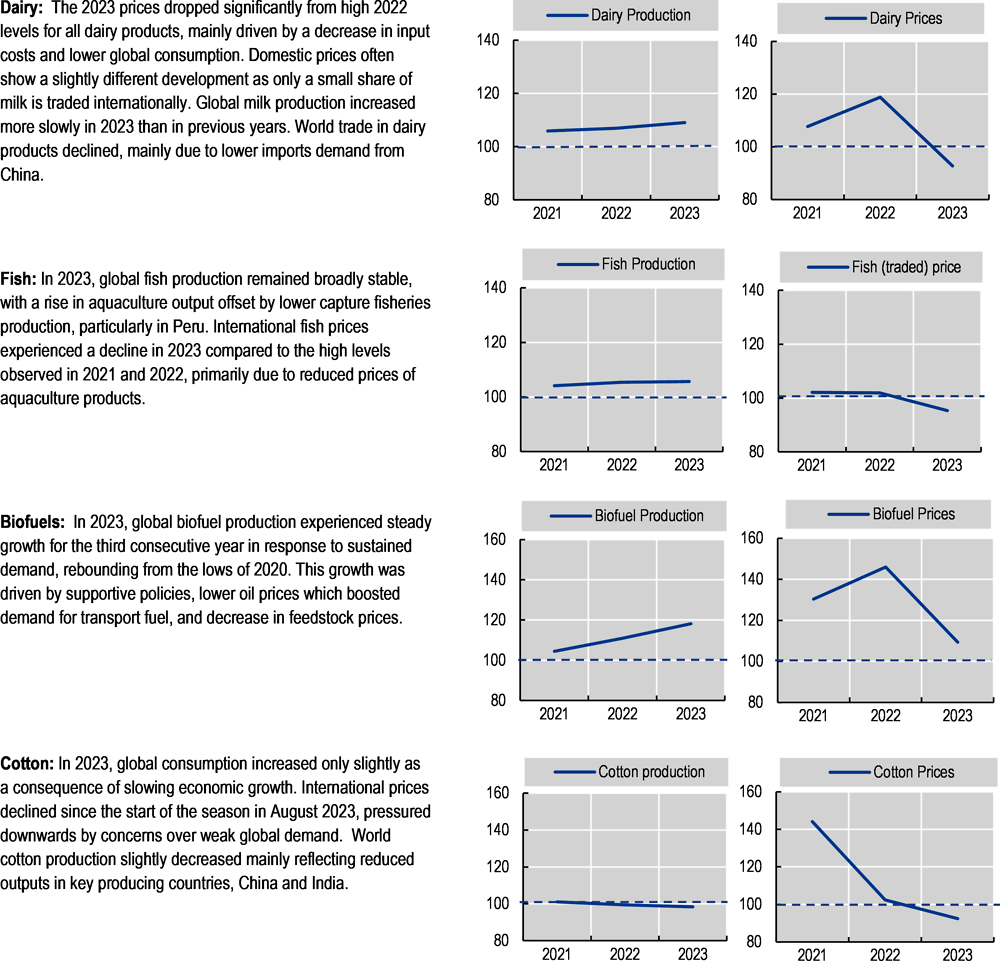

Copy link to 1.4. Consumption: Projected evolution for 2024-20331.4.1. Low- and middle-income economies underpin consumption growth for agricultural commodities

Demand for agricultural commodities is underpinned by a set of factors including real disposable incomes, population, expected prices, consumer preferences and policies, which determine the amount of agricultural output that is consumed as food, feed and fuel, as well as raw materials for other industrial applications. Over the coming decade, total consumption is projected to grow by 1.1% annually, reaching 20.6 million terra calories in 2033. Nearly 94% of the additional consumption is projected to occur in middle- and low-income countries, due to their specific economic, demographic and preference patterns (Figure 1.7). South and Southeast Asia are projected to account for about 40% of additional global consumption, with half this share attributed to India. Growing and increasingly affluent populations are shaping demand for agricultural commodities in these regions, where nutrition patterns are evolving.

A notable shift in the current Outlook is the declining role played by China and the increasing role of India and Southeast Asian countries. While it contributed 28% of global consumption growth in the previous decade, its share of additional demand over the coming decade is expected to fall to 12%, attributed not only to a declining population and slower income growth but also to a stabilisation of nutrition patterns. This contrasts with the rapid nutrition transition observed in the previous decade as the country experienced significant economic growth. India and Southeast Asian countries are expected to account for 31% of global consumption growth by 2033, driven by their growing urban population and increasing affluence. Among predominantly low-income regions, Sub-Saharan Africa is projected to contribute a sizeable share of additional global consumption (18%), primarily due to population-driven demand for food. The Latin America and Caribbean region, an important producer of meat and biofuels, is also expected to contribute a significant share of additional demand, mostly as raw materials for non-food uses.

Globally, food use remains the primary outlet, currently accounting for 42% of total consumption. Feed use, which has expanded strongly over the past decades due to income-driven diversification of diets towards animal sources and subsequent expansion and intensification of livestock production, takes up a third. The largely policy-driven biofuel use is responsible for another 7% of total consumption. The remaining 17% is either lost along the supply chain or used as feedstock for other industrial applications.

Figure 1.7. Use of agricultural commodities by type and region

Copy link to Figure 1.7. Use of agricultural commodities by type and region

Note: the shares are calculated from the data in calories equivalent. The 38 individual countries and 11 regional aggregates in the baseline are classified into the four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000.

Source: FAO (2024). FAOSTAT Food Balances Database, http://www.fao.org/faostat/en/#data/FBS; OECD/FAO (2024), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Over the Outlook period, food use is projected to account for 46% of additional global demand for agricultural commodities, largely due to growing populations in Sub-Saharan Africa, Southeast Asia and India, where urbanisation is also increasing rapidly. Feed use will represent roughly one-third of additional consumption, thanks to the anticipated development of the livestock sector. While food use of crops is anticipated to grow faster than feed use at the global level, this aggregation masks marked differences across countries. In middle- and upper-income economies, feed use of crop commodities is projected to grow faster than food use as higher demand for animal protein is expected to fuel greater demand for feed to sustain production. This trend is especially pronounced in upper middle-income countries where more than half of additional feed demand will originate. On the other hand, low-income countries are projected to see growth in food use exceed growth in feed use as rising populations drive higher demand for staples. Globally, biofuel use is also set to grow, increasing its share of total use by 0.5% by 2033.

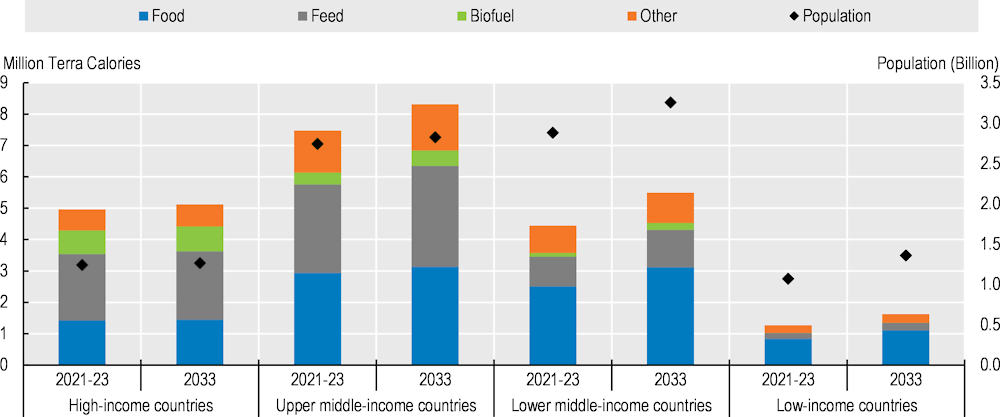

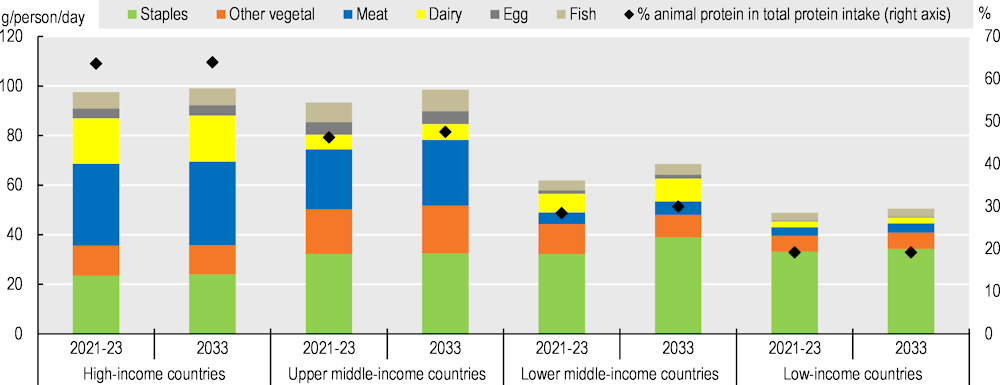

1.4.2. Calorie intake is rising but dietary diversification remains slow

Daily per capita calorie intake (consumption net of household waste) is projected to increase in developing and emerging economies, with lower middle-income countries adding the most calories followed by upper middle-income countries (Figure 1.8). In particular, gains in per capita incomes in India and other parts of emerging Asia are expected to contribute to growth in intake of all food commodities. In low-income countries, despite relatively high rates of GDP growth, increasing populations will mean only modest gains in per capita terms and therefore only moderate increases in food intake compared to middle-income countries. Consumers in high-income economies will increase their calorie intake only marginally as diets have stabilised.

Figure 1.8. Contribution of food groups to total daily per capita calorie intake

Copy link to Figure 1.8. Contribution of food groups to total daily per capita calorie intake

Note: Estimates are based on historical time series from the FAOSTAT Food Balance Sheets database which are extended with the Outlook database. Products not covered in the Outlook are extended by trends. The 38 individual countries and 11 regional aggregates in the baseline are classified into the four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000. Staples include cereals, roots and tubers and pulses. Animal products include meat, dairy products (excluding butter), eggs and fish. Fats include butter and vegetable oil. Sweeteners include sugar and HFCS. The category other includes other crop and animal products. MDER stands for minimum dietary energy requirement.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Per capita intake of staple commodities, the main source of calories, is projected to increase by 5.3% globally, with growth concentrated in low- and middle-income countries as intake in high-income countries has levelled off. While a shift in dietary structure from staples to more high-value items is expected, this transition remains slow as food baskets around the world evolve only gradually, constrained by incomes and cultural preferences. By 2033, the share of dietary energy from nutrient-rich animal products, fruits and vegetables in middle-income countries is projected to increase by just over 1%. Dietary patterns are even more rigid in low-income countries where the share of dietary energy from animal sources remains unchanged and the bulk of calories (71%) continues to come from staples. This slow transition towards animal-source and other nutritious foods in low- and middle-income economies illustrates the challenges in achieving the SDG objective of improved nutrition for global populations by 2030. Nevertheless, despite the limited change in diets, the Outlook projects additional consumption of high-value food items for both low- and middle-income countries, in line with economic growth.

At a global level, per capita intake of fats and sweeteners is projected to increase by 7.2 kcal/day and 6.6 kcal/day, respectively. A strong growth in intake is projected for fats in India, Southeast Asia and Latin America and for sugar in Southeast Asia, driven by rising per capita incomes. In high-income economies, per capita intake of fats and sweeteners is expected to decline further over the coming decade due to growing health concerns and policy measures that discourage their excessive consumption. Reductions in consumption of these foods are offset by increases in poultry, fish, fruits and vegetables, which are viewed as more desirable from a health point of view.

FAO’s State of Food Security and Nutrition in the World (SOFI) report compiles statistics on the prevalence of undernourishment around the world. The report defines hunger as the proportion of the population whose daily food intake falls below the minimum dietary energy requirement (MDER). According to (FAO, 2023[1]), an estimated 735 million people – or 9.2% of the global population – faced hunger in 2022. However, as Figure 1.8 shows, average daily per capita calorie intake in the base period (2021-23) exceeds the 2022 MDER for all country groupings. This implies that although there is enough food to meet the required energy needs, unequal distribution of calories within and between countries is the main reason for the prevalence of hunger. This highlights the importance of socio-economic policies such as effective social safety nets and food distribution programmes in addressing undernourishment.

1.4.3. Protein consumption is projected to increase globally from a variety of sources

In response to increasing affluence among consumers in emerging economies, global per capita intake of protein is projected to rise to 79.8g per day by 2033, from 76.6g in the base period. While upper middle-income countries are projected to close the consumption gap with high-income countries by the end of the decade, the gap for poorer countries will remain between 50%-70% of the intake in high-income countries, a slight improvement from the base period.

Differences in the composition of protein sources will also persist, with countries in Sub-Saharan Africa and Near East and North Africa regions expected to consume mostly proteins from vegetal sources, given their substantially lower average household incomes (Figure 1.9). In South Asia, fresh dairy products remain a critical source of protein. India and Pakistan are each projected to add more than 2g of dairy protein to their average daily per capita intake, bringing the share of dairy in total protein intake to 17.6% and 28.3% respectively.

In the high-income countries of North America, Europe and Central Asia, nutrition patterns have stabilised, and animal sources supply the bulk of their protein needs. However, despite the broad stability of dietary patterns in these regions, mounting environmental and health concerns are expected to shift consumer preferences away from red and processed meat, notably beef, towards leaner and allegedly more environmentally friendly alternatives such as poultry, fish and plant-based protein. This trend towards substitution between meat types is already visible in many industrialised countries, where a noticeable increase in per capita consumption of poultry has occurred at the expense of beef. Growing health awareness in industrialised economies is also expected to raise demand for some other high-value items such as fruits, vegetables, nuts and seeds.

Figure 1.9. Contribution of protein sources to total daily per capita food intake

Copy link to Figure 1.9. Contribution of protein sources to total daily per capita food intake

Note: Staples include cereals, pulses, and roots and tubers. The 38 individual countries and 11 regional aggregates in the baseline are classified into the four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.4.4. The share of food in total household expenditure continues to decline but remains high in the poorest countries

The share of disposable household income spent on food is expected to continue to fall in all regions (Figure 1.10). Although the largest decline is foreseen in low-income countries, their food expenditure share will remain high, indicating a greater vulnerability to food commodity price shocks in the most food insecure countries. A high share of food in total expenditure also has adverse effects on the macroeconomic performance of low-income countries. For those countries that are net importers of agricultural commodities, such as those in Sub-Saharan Africa, high and fluctuating international prices impact food import bills, exacerbating balance of payments problems and adding to inflationary pressures.

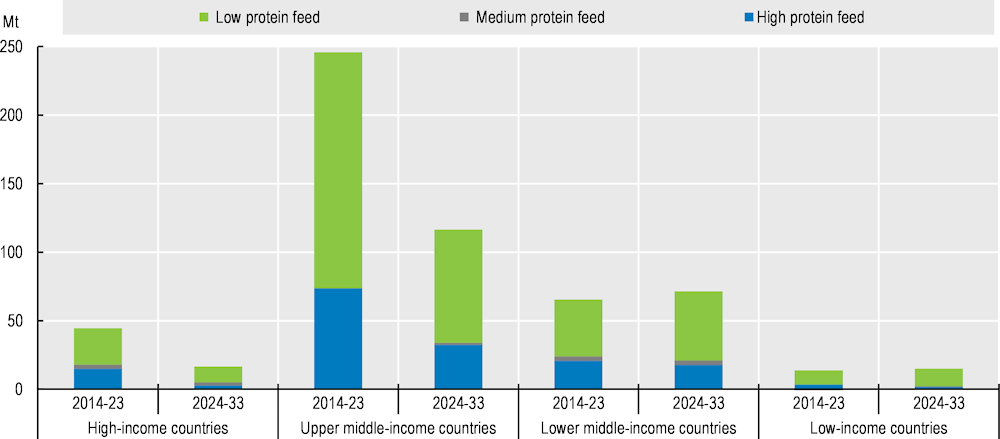

1.4.5. Growing feed use is driven by expansion of herds and increasing intensification of livestock and aquaculture production systems

Over the projection period, global animal inventories are projected to expand by 10%, whereas output on a protein basis increases by 14%, indicating further intensification of livestock and aquaculture production systems. Expanding animal herds and the continuing intensification of production systems, fuelled by income-driven demand for animal protein and rising populations, are projected to lead to a 13% increase in protein-equivalent feed demand globally, indicating overall improvements in animal genetics, feed technology and herd management. The bulk of the expected increase in feed consumption will come from middle-income countries where the share of production from commercialised and feed-intensive farms is increasing and animal numbers are growing (Figure 1.11). In these countries, growth in feed consumption is similar to or exceeds growth in animal production, even without accounting for the share of production from non-concentrate feeds such as pasture, hay, straw and scraps that are not included in the projected feed demand. Feed intensification is expected especially in Southeast Asia, where expanding pig and poultry production will raise demand for mostly imported protein meal and cereals.

Figure 1.11. Change in demand for main feed categories

Copy link to Figure 1.11. Change in demand for main feed categories

Note: Low protein feed includes maize, wheat, other coarse grains, rice, cereal brans, beet pulp, molasses, roots and tubers. Medium protein feed includes dried distilled grains, pulses, whey powder. High protein feed includes protein meal, fish meal, and skim milk powder. The 38 individual countries and 11 regional aggregates in the baseline are classified into the four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

However, despite the projected increase in feed consumption to 2033, the pace of growth is set to slow down substantially compared to the previous decade. Among the upper middle-income economies, feed demand growth in China in particular is expected to slow considerably due to improved feed efficiency and efforts to achieve lower protein meal shares in livestock feed rations, a sluggish economic recovery, and a declining population consuming a relatively stable diet. In high-income economies, greater production efficiency will result in herd reductions, and thus only a slow growth in the use of protein meals and feed cereals is expected.

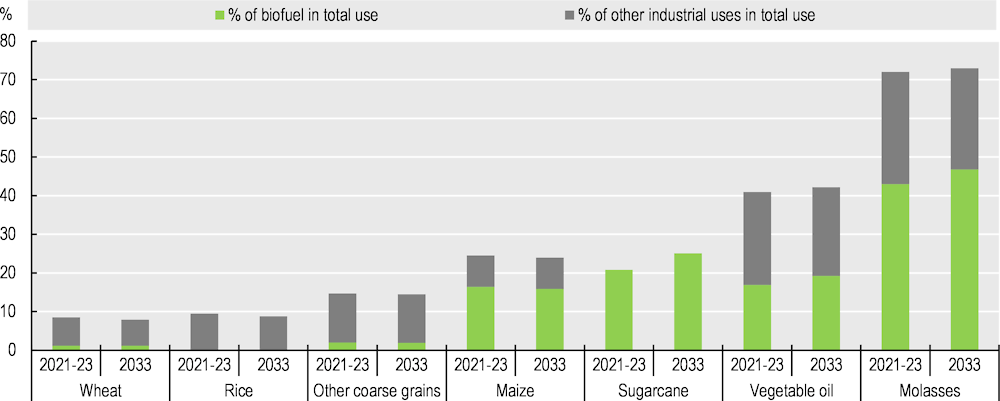

1.4.6. Emerging economies lead the expansion in the use of primary agricultural commodities as feedstocks in biofuels production

Biofuels are liquid transport fuels derived from biomass and are used mostly in blends with fossil fuels to reduce GHG emissions and increase energy security. The production of biofuels creates additional demand for agricultural commodities. Maize and sugar products make up the majority of the feedstock for ethanol, while biodiesel production relies mainly on vegetable oils and used cooking oils. Globally, 6.9% of annual total energy consumed is from biofuels, a share that is projected to increase to 7.3% by the end of the decade.

Global biofuel use is projected to grow, driven by transport fuel demand and public policies. Over the coming decade a significant share of new biofuel production will be accounted for by emerging economies, especially Brazil, Indonesia, and India, where transport fuel demand is rising and supportive policies for biofuel consumption and production are being implemented. Sugarcane-based ethanol is projected to contribute significantly to the increase in these countries (Figure 1.12).

In the United States and European Union, where biofuel consumption is high, new biofuel use by land transport will be constrained by factors such as increasing adoption of electric vehicles, vehicle efficiency improvements, and policies promoting sustainable feedstocks that do not compete directly with food and feed crops.

Figure 1.12. Share of biofuel and other industrial uses in total use of agricultural commodities

Copy link to Figure 1.12. Share of biofuel and other industrial uses in total use of agricultural commodities

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

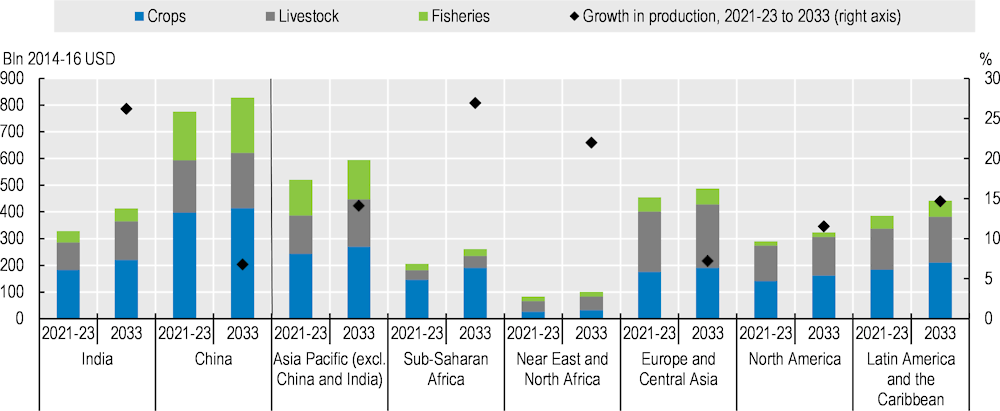

1.5. Production: Projected evolution for 2024-2033

Copy link to 1.5. Production: Projected evolution for 2024-20331.5.1. Growth in production continues to be supported mainly by yield gains in low- and middle-income countries

Over the next ten years, the value of global agricultural production is projected to increase by 1.1% annually (measured at constant prices). Livestock production is anticipated to lead this growth, at 1.3% p.a., driven by expected increase in the proceeds of production sales. Fish production is expected to increase by 1.1% annually, while crop production is projected to grow at an annual rate of 1.0%.

Middle- and low-income countries are expected to remain the main locations of global agricultural expansion (Figure 1.13), contributing nearly 80% of global agricultural output by the end of the projection period. China is projected to have a lower share in both crop and livestock production, but to increase its production share in fisheries. Conversely, India is expected to have a greater share in both livestock and crop production.

Sub-Saharan Africa and the Near East and North Africa regions are anticipated to achieve significant production growth, albeit from a low base. Although crops currently dominate agricultural output in these regions, faster growth is projected in higher-value livestock production sectors. Specifically, dairy will account for much of the livestock production expansion in Sub-Saharan Africa, while poultry is expected to be the primary growth leader in the Near East and North Africa.

In other regions, production growth is expected to be more moderate. Europe and Central Asia will grow the slowest. Limited growth is also anticipated in North America and Latin America and the Caribbean, with growth in crop production surpassing that of livestock. Growth will mainly be derived from productivity gains as the long-term decline in agricultural land-use is expected to persist, but tighter regulations related to environmental sustainability and animal welfare will place downward pressure on yield improvements.

Assuming the continued transition to more intensive production systems, particularly in middle- and low-income countries, projections suggest that 80% of the global crop production growth will come from improvements in yields. Similarly, a significant proportion of the growth in livestock and fish production is also expected to result from yield improvements, although herd expansion will also contribute to livestock production growth. However, it is anticipated that the rate of output growth will not match the levels seen in the previous decade. This slowdown can be attributed to reduced growth incentives with weaker demand growth and more limited progress in improving production efficiency.

In the resource-constrained Asia Pacific region, the Outlook projects that production growth will be predominantly driven by improved land productivity gains. Sub-Saharan Africa's crop production expansion will be supported by both expanded acreage and land productivity increases, mostly coming from the availability of improved crop varieties and better farm management. In Latin America and the Caribbean, robust crop production growth, stemming from both expansion and intensification, will be augmented by yield gains resulting from anticipated rapid increases in fertiliser application. Developed economies are expected to derive growth primarily from productivity gains, given the long-term decline in agricultural land use. However, stricter regulations related to environmental sustainability and animal welfare may temper yield improvements if they are tightened later.

Figure 1.13. Trends in global agricultural production

Copy link to Figure 1.13. Trends in global agricultural production

Note: Estimates are based on historical time series from the FAOSTAT Value of Agricultural Production domain which are extended with the Outlook database. Remaining products are trend-extended. The net value of production uses own estimates for internal seed and feed use. Values are measured at constant USD of the period 2014-2016.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.5.2. Yield improvements support production growth but there is scope for sustainable intensification

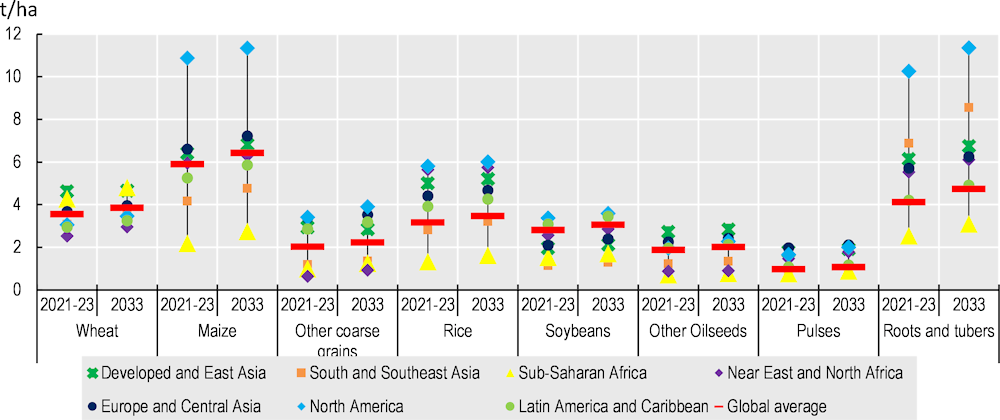

Despite growth in global average yields and notable increases in low and middle-income regions, significant disparities in yield levels between high and low-yielding regions are anticipated to persist across various commodities. Figure 1.14 shows the substantial variations in yields across regions for selected crop commodities. Commodities like maize, roots and tubers exhibit the widest spread in yields, due to greater yield potential for these commodities. The Outlook does not project any significant changes in the distribution of yields over the next decade as reflected in the figure.

Under the caveat that changing composition of commodities may influence yield progress, the largest absolute and relative increases in global average yields are projected for roots and tubers, primarily driven by the South and Southeast Asia region. Soybean yield distribution, on the other hand, is already relatively high across regions indicating that the bulk of the output is produced by advanced producers. Other oilseeds, however, show a shorter spread and the slowest increase in average yield, largely attributed to the challenges associated with ageing palm oil plantations in Indonesia. In Sub-Saharan Africa, significant percentage increases are expected for cereals and roots and tubers, albeit from a very low base. While global yield gaps are expected to narrow for certain cereals such as wheat (-7%), maize (-1%), and rice (-2%), the spread is expected to increase for other coarse grains (7%), soybeans (2%), other oilseeds (7%), pulses (6%), and roots and tubers (7%).

Analysing the application of fertilisers per hectare of planted crop in relation to output per hectare can help to explain the observed variation in yields across regions. However, it is important to note that factors beyond fertilisers – including farm management practices, climatic conditions, and natural endowments – also influence yield development. In the European Union and the United States where yields are already high, future developments in production practices may be limited compared to other countries, although changes in yields are still expected to outpace changes in fertiliser application. Sub-Saharan Africa, despite starting from a low base, is anticipated to see significant increases in both nitrogen fertiliser application and yields.

Meeting future food demand without increasing the land area used for agriculture, and thereby avoiding GHG emissions from land clearance, will require yields to increase on currently cultivated agricultural land through the sustainable intensification of agricultural systems. Box 1.1 highlights current factors limiting farm yields and what actions are required to improve yields in Sub-Saharan Africa.

Figure 1.14. Change in projected yields for selected crops and regions, 2021-23 to 2033

Copy link to Figure 1.14. Change in projected yields for selected crops and regions, 2021-23 to 2033

Note: Yields are defined as tonnes produced per area harvested. Each symbol represents the average yield for a given commodity within a region. The red lines correspond to the global average per commodity.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Box 1.1. Sustainable intensification of agriculture in Sub-Saharan Africa

Copy link to Box 1.1. Sustainable intensification of agriculture in Sub-Saharan AfricaSub-Saharan Africa has become the world’s most food insecure region and is increasingly dependent on imported food to feed its growing population. The risk this brings has become obvious since the start of Russia’s war against Ukraine when fertiliser and food prices spiked. The 2023 Africa Food Summit in Senegal agreed that the continent can and should feed itself. Sub-Saharan Africa is food insecure because of limited agricultural development along with a generally low natural production potential for crops that is increasingly compounded by climate change. The average crop yield is only 1 250 kg/ha of cereal equivalencies compared to the global average of 4 100 kg/ha. However, the potential yields in the region are two to six times higher, depending on the region and crops concerned.

Sustainable intensification: The way forward?

Agricultural policies are required that create an enabling environment for farmers to invest in their existing land instead of clearing forest and rangeland. The potential yield increases from sustainable intensification can have multiple benefits, including increased food security and sovereignty, economic development, reversal of soil depletion, and reduced pressure on land, nature, and the climate. Supporting African countries in an agricultural intensification that triggers socio-economic development can also be a cost-effective way of reducing illegal immigration into Europe by addressing two root causes: poverty and conflict. To intensify agriculture in a sustainable way, several key conditions must be met.

Raise the volume and quality of both food and feed production

African crop production being much more severely limited by poor soils than by low rainfall, increasing fertiliser use is a much more effective and cheaper first step in agricultural intensification than irrigation (Plant Production Systems, 2019[2]). Fertilisers must be used as part of integrated soil fertility management, combined with soil amendments (e.g. organic matter, lime) for improving and maintaining soil health, improved seeds, and crop protection products. Although the region has a higher application rate for manure compared to synthetic fertilisers, the quality of manure is generally low due to poor animal diets and inefficient collection, handling and storage. With respect to synthetic fertilisers, an average 20 kg/ha is currently used in the region, way below the global use of 140 kg/ha. In countries below the 20 kg/ha, the annual production per capita is 250 kg of cereal equivalencies, just enough to cover the energy requirement; in countries above the 20 kg/ha 400 kg/capita is produced. The reasons for the underapplication of fertiliser are not simply high prices and limited farmers experience, but also lack of improved seeds and of crop protection products as well as low farmgate crop prices. Besides quality extension services, well-functioning transparent input and output markets are required to increase availability, affordability and application of fertilisers. In one-fifth of the countries such developments are well underway and can serve as examples.

Promote livestock production

Large areas of the region – mainly desert borders and highlands where rainfall and temperatures limit crop yields – are ideal for ruminant production. In the Sahel, the traditional nomadic system even used to produce up to eight times more protein per square km than ranching under similar conditions in the United States and Australia (Breman and de Wit, 1983[3]). However, nomadic ruminant husbandry is losing more and more of its grazing land to arable farmers as the cropping area expands, driven by population growth. In addition, arable farmers increasingly keep livestock as capital and for manure production and animal traction, instead of maximising the production of animal proteins. Improving food production as described above, goes hand in hand with increasing availability and quality of feed. As the required external inputs usually have better cost/benefit ratios in arable farming than in animal husbandry, one opportunity for increasing livestock productivity can be found in mixed farming systems, where fertiliser use increases the quality of animal feeds produced on-farm. In addition, there is an opportunity for ranching in typical livestock regions such as the Sahel, where deteriorating animal diets due to loss of pastoral mobility can be improved with feed concentrates produced in neighbouring arable regions. In this way, the current competition for land – a root cause of clashes between livestock and arable farmers – can be turned into collaboration.

Invest in infrastructure for growth

The road and rail network as well as storage infrastructure have long remained underdeveloped in Sub-Saharan Africa due to low population densities and lack of public and private sector investment. This has limited agricultural as well wider socio-economic development. A key policy option is therefore to improve transport and infrastructure, invest in storage facilities such as refrigeration to reduce the often-high food losses, and develop input and output markets including value chains. For farmers, this provides strong incentive to raise their production. After all, the best incentive for higher productivity is the market.

Level the playing field

The competitiveness of agriculture in Sub-Saharan Africa being low, countries should be allowed to impose temporary boarder measures (tariffs or quotas) on staples while being supported in their intensification process. Such policies are necessary until the largely infant agri-food industry in the region becomes mature and can compete on the world market. This also levels the playing field in world agriculture, given the subsidies farmers are still receiving in North America, Europe, and many Asian countries.

Note: This box is a summary of a series of articles published by Wouter Van der Weijden and Henk Breman on https://agrifoodnetworks.org.

1.5.3. Only minor changes are projected in land used for agriculture

Agriculture uses 38% of the global land area, with one-third of this land under crop cultivation and the remaining used as livestock pasture. Historically, land conversion from natural ecosystems to agriculture has been the primary source of indirect GHG emissions from the agricultural sector. While the measurement of the effects of land conversion to indirect GHG emissions are not included in the Outlook, projecting changes in land use from both yield and resource perspectives is important to understand future developments in agricultural markets. Over the next decade, the overall area of land used for agriculture is not anticipated to increase, as any increases in cropland will be offset by decreases in pasture (Figure 1.15). The expansion of cropland is expected to contribute 15% of the projected growth in crop production.

Cropland expansion is projected to occur predominantly in Asia and the Pacific (by 15 Mha), Latin America (7 Mha), and Sub-Saharan Africa (18 Mha). In Asia and the Pacific, pasture will likely be converted into cropland, while in Latin America and Sub-Saharan Africa, primarily non-agricultural land will be utilised. However, in the Near East and North Africa, cropland expansion will be restricted by natural conditions, with low rainfall inhibiting rainfed agriculture and the cost of irrigation being prohibitive in most areas. Conversely, in North America and Western Europe, cropland is anticipated to decrease due to strict regulations on environmental sustainability governing any increase in crop production or loss of natural habitats.

Pastureland is projected to diminish by 8 Mha overall in Asia and the Pacific (excluding China and India), with the expected transition from pasture-based livestock production to more intensive systems for pigs and poultry. Ruminant production is also expected to shift towards more feed-intensive systems which require less pastureland. Conversely, pasture is projected to slightly increase in North America due to the anticipated expansion of the cattle herd.

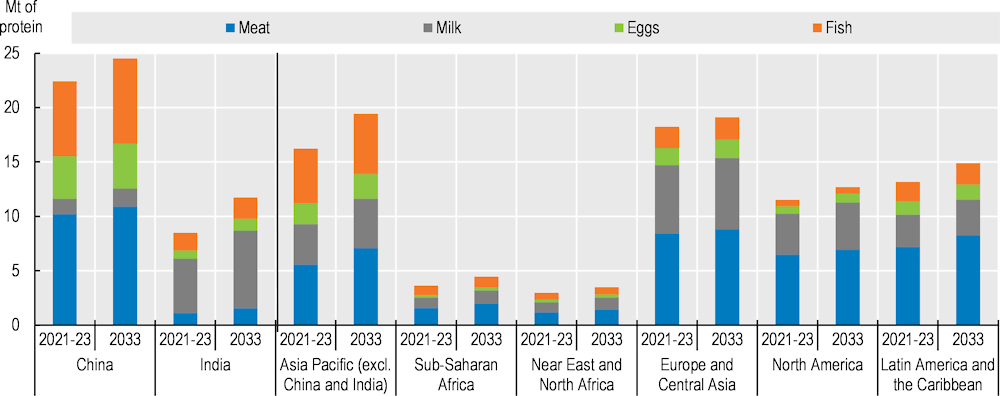

1.5.4. Livestock production, especially dairy, will expand most while growth in fish production will slow

The share of livestock production in agricultural output is projected to decline in high-income countries but to increase in low and middle-income countries (Figure 1.16). The anticipated rise in global meat production will mainly originate in middle and low-income countries across all livestock sectors. Poultry production is projected to account for over half of the total increase in animal protein produced. Shorter production cycles and greater efficiency in feed conversion will contribute to lower prices for poultry meat relative to beef. The greatest volume increase in production will occur in the Asia Pacific region, primarily supported by intensified feed practices and advances in breeding techniques.

Dairy is expected to remain the fastest-growing livestock sector, with India and Pakistan leading in absolute milk production growth. Growth factors will vary by region: high-income countries will focus on intensifying production through yield improvements, while middle and low-income countries, particularly India and Pakistan, will also increase the number of milking animals.

In recent years, global fish production has been evenly split between capture fisheries and aquaculture. Future growth is expected to be based on a continued, though slower expansion in aquaculture, while capture fisheries production will remain relatively constant. This slowdown in aquaculture production growth is attributed to tightened environmental regulations in China. While the negative effects of El Niño on capture fisheries are expected to be temporary, increasing fuel costs will continue to constrain growth in the sector. At the same time, policies promoting sustainable fisheries are driving a transformation of the sector which may entail slower growth as it takes place.

Figure 1.16. Global livestock and fish production on a protein basis

Copy link to Figure 1.16. Global livestock and fish production on a protein basis

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

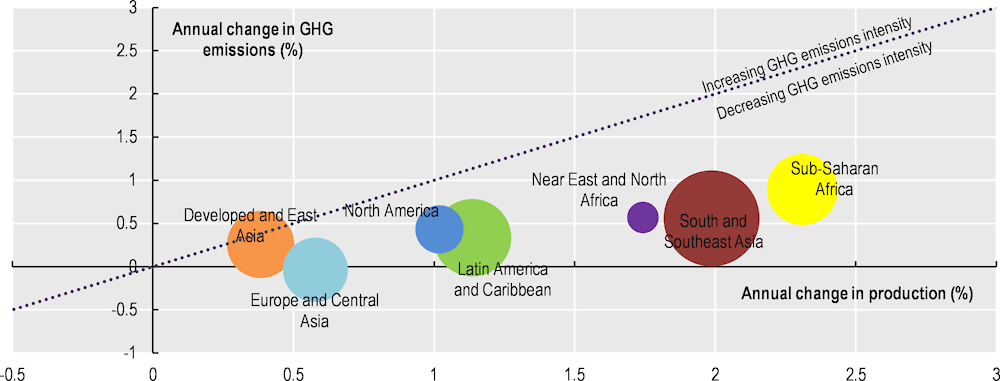

1.5.5. Agriculture’s global GHG emissions intensity will decline despite rising emissions in lower and lower-middle income countries

Overall, agriculture, forestry and other land use (AFOLU) represents around one-fifth (22%) of global anthropogenic GHG emissions. Half of this stems from direct on-farm emissions of methane and nitrous oxide, and the other half from indirect CO2 emissions resulting from land use, land use change and forestry (LULUCF) due to agricultural expansion. The Outlook reports only the direct component linked to on-farm production.

The Outlook estimates IPCC-Agriculture GHG emissions using the historical time series from the FAOSTAT Climate Change: Agrifood systems emissions database and following the IPCC’s Tier 1 approach (i.e. basic method relying on direct emission factors such as herd size, synthetic fertiliser application per hectare, or per hectare emission related to rice cultivation). The projections assume no change in current policies and a continuation of current trends in technological progress. Higher-tier methods (that account for management practices for instance) would provide greater certainty of the estimates but are beyond the scope of the Outlook.

Subject to the above caveat, the projected growth in agricultural production is expected to cause a 5% increase in direct GHG emissions over the coming decade. Ruminants and other livestock production will account for 62% of this increase (Figure 1.17). Furthermore, the use of synthetic fertilisers represents a source of direct GHG emissions, primarily through the release of nitrous oxide during the fertilisation process. Synthetic fertilisers are expected to contribute 34% to the additional direct GHG emissions over the next ten years. The Outlook does not account for GHG emissions associated with fertiliser production. However, if it were to do so, this would effectively increase their reported environmental footprint in the baseline by approximately 70%.

Rice cultivation is another source of direct GHG emissions in agriculture because irrigated paddy fields emit significant quantities of methane. However, the projected increase in rice production will be largely the result of yield improvements with unchanged paddy areas, thereby curbing the increase in GHG emissions.

Most of the increase in GHG emissions is projected to occur in middle and low-income regions, primarily due to the higher growth in ruminant production. Despite significant efforts in these regions to enhance the sustainability of production systems, they tend to be more emission-intensive on average compared to high-income countries. By 2033, Sub-Saharan Africa will have the highest annual growth in direct GHG emissions (0.9%), albeit starting from a low base as this region only accounts for 16% of global direct GHG emissions from agriculture. Conversely, Europe and Central Asia is the only region where GHG emissions are anticipated to decrease due to the declining share of ruminant production. Nevertheless, in per capita terms, GHG emissions in low-income countries will remain below those of high-income countries.

Globally, the carbon intensity of agricultural production is expected to decline over the coming decade as direct GHG emissions are projected to grow more slowly than agricultural production (Figure 1.18). However, this masks important geographical variations. Sub-Saharan Africa is expected to experience the most substantial decrease in GHG emissions intensity. This is because it is generally easier to reduce emissions in production systems that are initially more emissions-intensive than in regions where significant efforts have already been invested in emissions reduction.

Figure 1.18. GHG emissions and emissions intensity from agriculture, 2021-23 to 2033

Copy link to Figure 1.18. GHG emissions and emissions intensity from agriculture, 2021-23 to 2033

Note: This figure shows projected annual growth in direct GHG emissions from agriculture together with annual growth in the estimated net value of production of crop and livestock commodities covered in the Outlook (measured in constant USD 2014-16 prices). The size of the bubbles corresponds to the level of agricultural GHG emissions in the baseline period 2021-2023. Estimates are based on historical time series from the FAOSTAT Climate Change: Agrifood systems emissions databases which are extended with the Outlook database.CO2 equivalents are calculated using the global warming potential of each gas as reported in the IPCC Sixth Assessment Report (AR6). Emission types that are not related to any Outlook variable (organic soil cultivation and burning savannahs) are kept constant at their latest available value. The category ''other'' includes direct GHG emissions from burning crop residues, burning savanna, crop residues, and cultivation of organic soils. The net value of production uses own estimates for internal seed and feed use.

Source: FAOSTAT Emissions-Agriculture and Value of Agricultural Production databases, http://www.fao.org/faostat/en/#data, accessed January 2024; OECD/FAO (2024), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.5.6. The impacts of climate change will pose additional challenges and opportunities to agricultural production

Agricultural production is concurrently shaped by the effects of climate change and by measures taken to adapt to them. While both aspects are factored into the Outlook’s production projections, the strong interlinkages between them makes it impracticable to separate out their individual effects in the medium term. Box 1.2 describes the extent to which the Aglink-Cosimo model incorporates these effects.

Box 1.2. Agricultural production is shaped by climate change impact and adaptation

Copy link to Box 1.2. Agricultural production is shaped by climate change impact and adaptationIn the OECD-FAO Agricultural Outlook the impact of climate change is implicitly incorporated in production projections. Yields are influenced by many interacting and inter-dependent factors, including weather, crop variety, production technique, pests and diseases which lead to wide variations in observed yields. The effects of climate change on yields are being felt increasingly through time, through increased variability of temperatures and rainfall, disruptions to ecosystem services, and increasing frequency and severity of extreme weather events, including droughts, floods, heat waves and storms. While some regions may benefit from longer growing periods, climate change can also render many current growing regions unsuitable for production.

Private actors are taking actions to prepare for, cope with and adapt to the effects of climate change – referred to as “autonomous adaptation”. Typical responses by farmers include on-farm innovation in operations management, such as shifting planting dates, altering crop mix, diversifying farming activities, implementing integrated pest control and other climate-smart agriculture (CSA) practices and technologies. In practice, there are many constraints on farmers’ capacity to adopt these types of practices, including lack of resources and incentives, and these limitations are especially severe where farmers are poor and vulnerable. Governments can promote autonomous adaptation and CSA practices by leveraging on social protection policies, such as social transfers and public work programmes.1 Social protection transfers can ease budget constraints and alter the risk preferences of beneficiaries to increase the likelihood of them implementing CSA practices. Similarly, public work programmes can potentially improve the adaptative capacities of both direct beneficiaries and their communities.

Since the Aglink-Cosimo model is linked to historical developments, its starting point is the world as it is now, where the effects of climate change on potential yields are already visible. However, autonomous adaptation has reduced an important part of its negative effects. All these factors influence the production, especially the yield projections, and are accounted for in the Outlook projections for the next ten years, based on modelling and expert judgement.

Because slow-onset2 events are moderated by autonomous adaptation and extreme events will likely have larger effects over the longer-term, the ten-year projection horizon of the Outlook results in only small yield variations resulting from climate change. Furthermore, due to the close interrelation between the effects of climate change and autonomous adaptation, it is not possible in the current Outlook to separate the individual influences of these drivers.

1. These impacts, however, depend on multiple and very context-specific factors.

2. Slow-onset events evolve gradually from incremental changes occurring over a long period of time or from an increased frequency or intensity of recurring event (UNFCCC, 2011[1]). Classic examples are desertification, sea-level rise and epidemic diseases.

1.6. Food loss and waste: Impact of a 50% reduction

Copy link to 1.6. Food loss and waste: Impact of a 50% reduction1.6.1. Reducing food loss and waste would help foster sustainable food systems

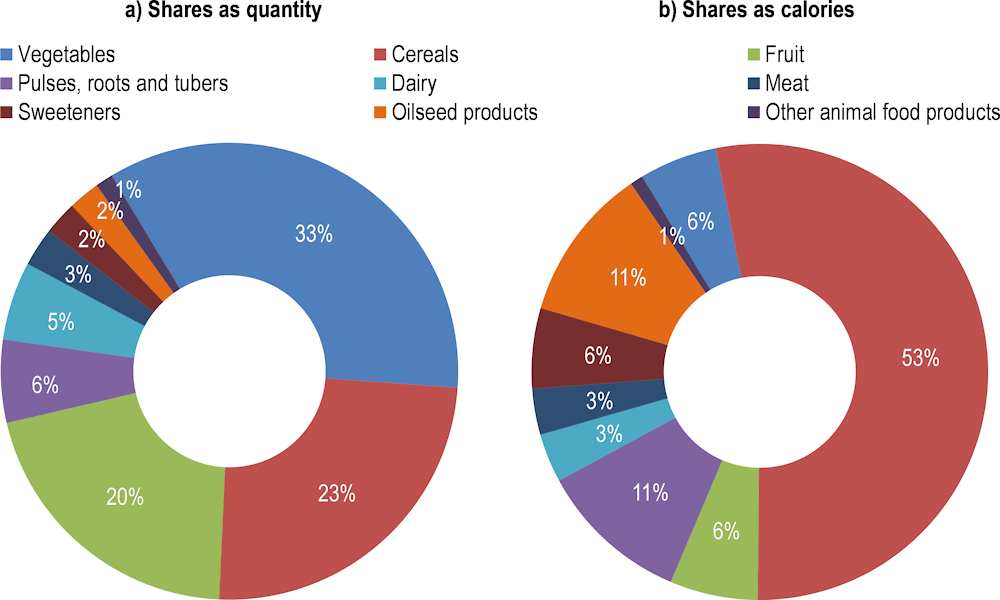

The significant loss and waste of food across global food value chains is widely acknowledged. According to the FAO seminal report on food losses and waste, based on 2007 data (FAO, 2011[9]), “Roughly one-third of the edible parts of food produced for human consumption, gets lost or wasted globally”. This not only strains the natural environment, but also reduces food availability. Tackling food loss and waste is therefore crucial for enhancing the environmental sustainability of global food systems and improving food security and nutrition. Despite the absence of a harmonised framework, food loss is generally defined as all losses within the food value chain from post-harvest, slaughter or catch, right through to the retail stage. Food waste refers to waste in retail and final consumption.

As part of the United Nations 2030 Agenda for Sustainable Development, Sustainable Development Goal (SDG) 12 creates a global commitment to ensure sustainable consumption and production patterns. SDG target 12.3 calls for halving per capita global food waste at the retail and consumer levels by 2030, as well as reducing food losses along production and supply chains, including post-harvest losses, over the same period. Nevertheless, government efforts to tackle this challenge are impeded by the absence of dependable data on the scale and distribution of food loss and waste within value chains, its cross-country variations, and the commodities most affected.

For the purpose of monitoring SDG 12.3, estimates have been made of food loss and food waste. The FAO estimates that globally, around 13% of food produced is lost after harvesting and before reaching retail markets (FAO, 2019[10]), while UNEP finds that 19% of total global food production is wasted in households, the food service and retail (UNEP, 2024[11]). As part of the continued efforts to develop its capacity to track impacts beyond market outcomes and gauge the effects of market developments on food systems, the Outlook has developed enhanced estimates for food intake. It estimates food intake by integrating analytical methods that first remove food loss from the food available after harvest, and then removes food waste from food consumption.

The Outlook projections find that the SDG 12.3 target will be missed without transformation of global agrifood systems. By 2033 under the assumption of constant food loss and waste shares, the Outlook projects that close to 700 Mt of food will be lost between harvest/slaughter/catch and retail, while a further 1 140 Mt will be wasted at retail and household levels. This represents an additional food loss and waste of about 230 Mt compared to the base period (2021-2023).

In the base period, fruit and vegetables account for more than half of the lost and wasted food, given their extremely perishable nature and relatively short shelf life (Figure 1.19, Panel a). As the most produced and consumed commodity, cereals contribute a substantial 23% share of the total. Meat and dairy products represent a low share by weight, which can be explained by the fact that households tend to waste fewer high-value products. However, they predominate, accounting for a third of food loss and waste when measured by monetary value.

In terms of food security and nutrition, food loss and waste shares can be converted to calories or protein to reflect the amount of energy or nutrients of different commodities. Some food commodities have high protein content (animal products), some are rich in calories (staples, fat, and sugar), while others provide essential vitamins and minerals (fruit and vegetables). Panel b of Figure 1.19. Shares of food loss and waste by commodity, 2021-2023illustrates how major food commodities contribute to total food loss and waste on a calorie basis over the base period. It shows that by 2033, an estimated 2.8 million terra calories will be lost and wasted between leaving the farm and reaching retail and households. To put this into perspective, this represents more than double the total number of calories currently consumed in low-income countries in one year. Cereals, pulses, roots and tubers, the primary source of calories in most of the world’s poorest populations, account for almost two-thirds of the lost and wasted calories, with cereals alone contributing 53%.

Reducing food loss and waste therefore represents a potential opportunity to address the existing unequal distribution of calories within and between countries. By minimising losses throughout the food supply chain, more food can be preserved and distributed equitably, ensuring that a greater proportion of available calories reach those in need. This aligns with the SDG objectives of improved food security and nutrition for global population by 2030.

Several factors underpin the occurrence of food loss and waste across income groups. At the lower end of income spectrum, limited access to technology and infrastructure such as cold storage and efficient transport lead to supply chain inefficiencies and household waste. As consumers become more affluent, such technological impediments are overcome gradually and food loss and waste are mostly determined by natural environmental factors, marketing standards, food safety measures (e.g. handling of expiration dates) and consumer behaviour; the latter reflecting an interplay between overconsumption and food waste in high-income economies.

Figure 1.19. Shares of food loss and waste by commodity, 2021-2023

Copy link to Figure 1.19. Shares of food loss and waste by commodity, 2021-2023

Note: Other animal food products include egg and fish.

Source: OECD/FAO (2024), "OECD-FAO Agricultural Outlook", OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.6.2. Scenario analysis shows the implications for food systems of halving food loss and waste

In line with the commitments for sustainable development set in 2015, several intergovernmental initiatives call for the development and implementation of national strategies to meet the SDG 12.3 target. A growing number of countries are setting national targets for reducing food loss and waste, and implementing policies aimed at achieving these targets. A forthcoming OECD report providing a stocktake of food loss and waste policies (OECD, forthcoming[12]) indicates that almost all OECD countries have set national strategies, and all have implemented policies to support these strategies.

In a scenario analysis, this Outlook explores the potential implications for global supply and demand if these strategies successfully halve food loss and waste by 2030. While the SDG 12.3 establishes a clear objective of achieving a 50% reduction in food waste by 2030, it only provides recommendations for reducing food loss without specifying quantitative targets. This stylised scenario uniformly applies a 50% reduction target to both food loss and food waste between the base period and 2030. This target is a highly ambitious upper bound and would require substantial changes by both consumers and producer side. Two assumptions are made:

Assumption 1: Transmission of food waste reduction to food demand

When considering how consumers might respond to a reduction in food waste, it is important to recognise that some households may opt to increase their calorie intake rather than decrease their overall food demand. Therefore the distribution of consumer preferences plays an important role. In this scenario, the first assumption accounts for a lower proportion of food demand reduction in poorer countries, based on the prevalence of undernourishment (PoU). PoU estimates the percentage of the population whose regular food intake fails to meet the energy requirements for maintaining a healthy, active life. In countries where PoU falls below the critical threshold of 2.5%, representing the level required to achieve zero hunger, the scenario assumes that most of the reduction in wasted food will translate directly into a decrease in food demand. However, in countries with higher PoU levels, this transmission will only be partial.

Assumption 2: Transmission of costs to producer and consumer prices

When considering the economic costs associated with reducing food loss and waste, it is crucial to acknowledge that despite their adverse impacts on the overall food systems, food loss and waste originate from individual optimisation decisions that fail to account for their negative externality. In the current production and consumption framework, there is little to no perceived value attached to the food that ends up being lost or wasted. Few policies exist that could achieve a reduction in food loss and waste without incurring costs along the value chain and, among those, hardly any could accomplish a 50% reduction. Therefore a second assumption must be made to account for the cost of implementing measures to push halving food loss and waste below the observed patterns of production and consumption. These costs of reduction inevitably affect both consumers and producers. In the absence of comprehensive information about the cost structure, it is necessary to adopt simplifications and make tractable assumptions to facilitate the analysis. In this stylised scenario, consumer prices are assumed to increase by the same percentage as the reduction in food demand established under assumption 1, while producer prices are adjusted by half of the reduction in losses.

Based on these two assumptions, the scenario projects that global direct GHG emissions from agriculture would fall by 4%, a reduction distributed relatively evenly across countries regardless of income levels. It would also result in increasing the average per capita calorie intake in low-income and lower-middle-income countries (Figure 1.20).

Decreasing food loss and waste is also an important lever for reducing global undernourishment. According to FAO (2023[1]), approximately 600 million people will be facing hunger in 2030. Measures to reduce food loss and waste could significantly increase food intake worldwide as more food becomes available and prices fall, ensuring greater access to food for low-income populations. The scenario analysis shows that cutting food loss and waste in half could result in increased food intake for low- (+10%), lower middle-income (+6%) and upper middle-income (+4%) countries, potentially reducing the number of people facing hunger worldwide in 2030 by 153 million (-26%). This potential decline in global undernourishment parallels the notable improvements seen over the 2004-2014 decade when economic growth, political stability and targeted social protection policies in Asia and Latin America led to a 30% reduction in the number of undernourished globally.

While the scenario illustrates potential benefits for consumers and the environment, it also presents challenges for producers, as decreased production and lower producer prices would significantly impact their livelihoods. It is also important to note that the impact on consumers and producers are sensitive to the underlying assumptions.

Implementing measures to curb food loss and waste would involve significant costs and would need to overcome a number of obstacles. Consumer behavior plays a significant role, with factors such as lack of awareness about food waste impacts, over-purchasing, or discarding food that is still safe to eat because of best-before dates contributing to wastage. Supply chain inefficiencies, including fragmented supply chains, inadequate infrastructure, logistical challenges or lack of circularity in business practices, further hinder food loss and waste reduction efforts. Regulatory and policy constraints, such as regulatory barriers, inconsistent or fragmented policies, and lack of standardised measurement and reporting, pose additional obstacles to effective initiatives. Moreover, technology and innovation gaps, limited adoption of solutions, especially among smaller producers and businesses, and insufficient education and collaboration among stakeholders will also impede progress in addressing food loss and waste. Overcoming these obstacles requires comprehensive strategies encompassing regulatory reform, infrastructure development, technology adoption, education, and collaboration to achieve significant reductions in food loss and waste.

1.7. Trade: Projected evolution for 2024-2033

Copy link to 1.7. Trade: Projected evolution for 2024-20331.7.1. Growth of agricultural trade will slow down and export growth will stabilise

Over the next decade, trade in the agricultural commodities covered in the Outlook is projected to expand by 1% annually. Despite the disruptions caused by the COVID-19 pandemic to global trade, agricultural commodity trade demonstrated greater resilience compared to other sectors of the economy. This resilience is expected to persist, with continued growth anticipated for most of the agricultural commodities covered in the Outlook. Conversely, the share of exported agricultural products has stabilised in recent years, following a significant surge in the 2000s attributed to the implementation of the WTO Agreement on Agriculture and China's accession to the rules-based trading system in December 2001. The Outlook projects that this stabilised share of exported agricultural products will be maintained.

The Outlook also suggests a diminishing impact of past trade liberalisation efforts as progress in reducing multilateral tariffs and addressing trade-distorting producer support has slowed in recent years. The global food and agricultural market have become more resilient, but many countries remain vulnerable to the impact of trade shocks such as supply chain bottlenecks.

Despite this stabilisation, trade remains crucial to provide consumers worldwide with adequate, safe and nutritious food, while also generating income for stakeholders across the agricultural and food industries by efficiently distributing agricultural products globally from surplus to deficit regions. The proportion of production traded for commodities covered in the Outlook has steadily increased over time, rising from an average of 15% in 2000 to 23% in the baseline period of 2021-23, reflecting a trade sector growing at a faster rate than agricultural production.

However, there are significant variations in the importance of trade across commodities. For many agricultural commodities, most of the production is used domestically. For a few commodities trade can represent from one-third to more than half of global production. This is the case for sugar, cotton, vegetable oils, soybean, and milk powders, which are either demanded for further processing or produced in highly concentrated markets.

Over the coming decade, the share of production that is exported will not change significantly for most commodities covered in the Outlook but a few will experience some shifts in trading patterns. The export ratio of vegetable oils, fish and biodiesel are projected to decline, reflecting increasing domestic use.

1.7.2. Shipments between exporting and importing regions will expand

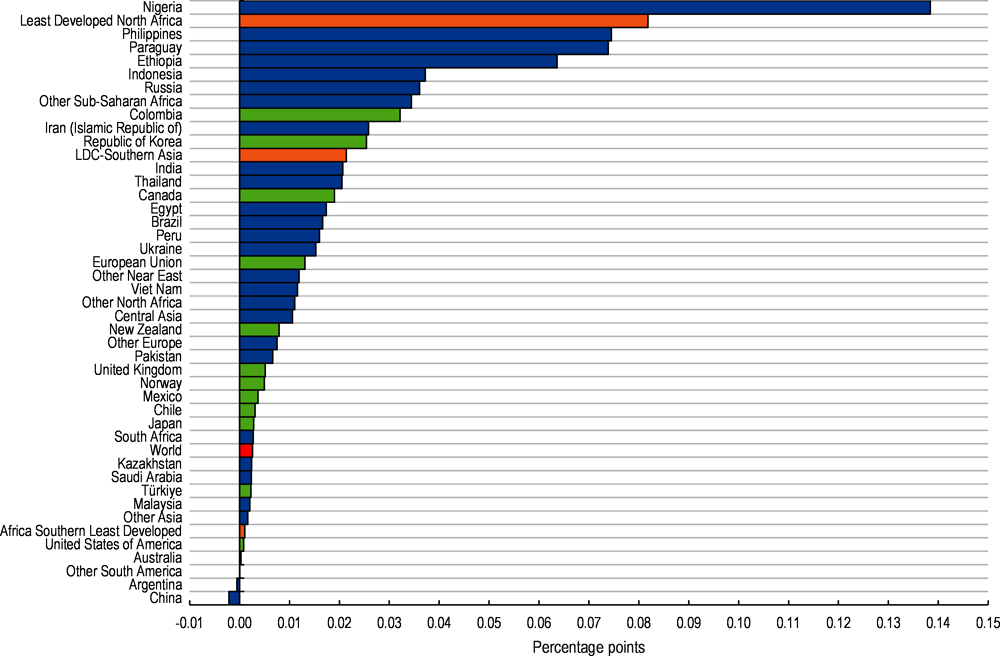

The increasing differentiation between agricultural commodity net exporting and net importing regions is expected to continue in the coming decade (Figure 1.22). Net exporters of agricultural commodities, such as Latin America and North America, are expected to increase their surplus volumes along with their production while regions with significant population growth, such as the Near East and North Africa and Sub-Saharan Africa, are projected to see their net imports grow proportionately to their growing consumption.