This chapter provides an overview of Egypt’s legal framework for the protection of investment. It takes stock of the investment policies in force and examines the level of regulatory protection granted to both domestic and foreign investors since the enactment of the 2017 Investment Law, which constitutes a milestone in Egypt’s recent efforts to reposition itself as an attractive and safe investment destination. The chapter looks into the rules for property protection, access to land and investor-state dispute settlement, and reviews its international investment treaty practice. It also explores Egypt’s efforts to establish a corporate governance framework for state-owned enterprises, which play a major role in the country’s economic landscape.

OECD Investment Policy Reviews: Egypt 2020

Chapter 3. Legal framework for investment

Abstract

Summary and policy recommendations

The government of Egypt is putting strong emphasis on adopting more modern investment legislation and regulations for investment. The new Investment Law, promptly followed by a modernised Companies Law, marked an important milestone in efforts to provide a safer and more consistent regulatory environment for foreign and domestic investments. Yet, further reform endeavours are required to endow Egypt with clear and transparent regulatory and institutional frameworks governing business and investment activities. For clarity and predictability purposes, and to avoid legal loopholes, implementing regulations should also follow more promptly the enactment of new legislation. Likewise, a more uniform and harmonised implementation of these regulations across the country would greatly enhance the enabling environment for investment.

Policy recommendations

The application of administrative procedures should be more consistent across all governorates and relevant public authorities. Strong, regular and transparent institutional cooperation mechanisms, including between central authorities and special economic zones, need to be put in place on a more regular basis to provide for a more efficient administration of investment activities.

One of the main avowed purposes of the new Investment Law was to create a more robust infrastructure for preventing and managing investment disputes. Despite the creation of new dispute settlement bodies, the current institutional setting for the resolution of investor-state disputes appears overly complex and might therefore not serve its purpose in the most efficient way.

Egypt has a vast network of international investment treaties. Bearing in mind the existing scope for treaty shopping, Egypt should consider reviewing and considering possibilities for renegotiation, clarification and exit of investment treaties. Treaties with vague provisions concluded in the past may lead to undesirable interpretations in ISDS disputes. Egypt should consider taking steps to update these treaties to bring them in line with government intent, Egypt’s current priorities and more recent practices in investment treaty policy.

GAFI, the Ministry of Justice and the Ministry of Foreign Affairs should continue to develop Investor-state Dispute Settlement (ISDS) dispute prevention and case management tools. Egypt may also wish to consider efforts to raise awareness about Egypt’s investment treaties and the significance of Egypt’s international obligations under these investment treaties for the day-to-day functions of different government agencies and officials that regularly interact with foreign investors.

The complex landscape of public land ownership, and myriad approvals required to allocate land to investors, means that a substantial gap remains between land demand and supply in Egypt. The centralisation of investor requests for land under GAFI is an important improvement that appears to have enabled faster distribution of state-owned land to firms. But the government could consider taking further steps to centralise the allocation of land to investors, such as empowering one agency to allocate all publicly owned land, regardless of its sectoral use. More immediately, coordination between the many different government landowners should be significantly strengthened. GAFI’s success in directing investors to the appropriate government landowner will depend on close intra-agency cooperation.

Short of a complete inventory and mapping of public land ownership, coordination challenges between agencies allocating public land are likely to persist. A complete registry would assist both GAFI in facilitating investment and firms in their location decisions. The Investment Map is a good step in this direction. Agencies could make public more comprehensive maps of land within their control, rather than only a selection of land available in zones, as is shown on the Investment Map.

The government has taken substantial measures to improve standards of corporate governance for state-owned enterprises. Yet, the current dual regulatory system, under which only a subset of firms adhere to good corporate governance practices, falls short of levelling the playing field between SOEs and their private sector competitors. The government could do more to apply standards to all state-owned enterprises and take steps to minimise the market distortions of publicly-owned firms.

The domestic legal framework for investment protection

The Investment Law is central to business regulation

The degree of openness encountered by investors when establishing in Egypt, and the conditions they face in their on-going operations, is only one part of a broader investment environment. The protection of property, contractual rights and other legal guarantees provided to investors both in domestic legislation and in international agreements, combined with effective enforcement mechanisms and guarantees of access to efficient dispute settlement mechanisms are key building blocks of an enabling investment climate. When procedures for establishing investments and enforcing contracts are perceived as cumbersome and lack predictability, or when disputes cannot be resolved in a timely and cost-effective manner, investors may restrict their activities or refrain from engaging in the country. Providing strong, clear and predictable guarantees of legal protection for investors and offering reliable dispute resolution mechanisms are fundamental to reinforce investors’ confidence. Enforcing regulatory reforms to set the conditions for a healthy and sound investment climate is a key priority in Egypt, where the business climate has considerably suffered from the economic and political turmoil in recent years.

Egypt has a long-standing tradition of economic liberalism and openness to foreign direct investment, which, coupled with a strong legalistic culture, has given rise to a succession of laws regulating investment.

The national programme of economic liberalisation, or Infitah, was introduced with the 1971 Law on Arab Capital Investment and Free Zones, the first ever legislation dedicated to investment in Egypt. The law provided legal guarantees and incentives and marked the establishment of the Investment and Free Zones Authority, which preceded GAFI. It also opened up to foreign investments from non-Arab countries. Partly hindered in its application by a number of inconsistencies in its provisions, it was abrogated in 1973 and replaced by the 1974 Law on Arab and Foreign Capital Investment and Free Zones, which provided a more comprehensive and coherent legal framework for investment.

The 1974 law broadened the scope of sectors opened to private investments and provided more incentives and guarantees to investors, hence signalling the government’s willingness to take a pro-investment stance. Yet, the implementation of the law faced a number of challenges, mainly due to the vagueness of the provisions determining the scope of sectors open to private investment, including foreign investment, as well as of the provisions on applicable exchange rates and on incentives. In recognition of these weaknesses and of the subsequent lack of legal certainty for investors, the government adopted yet another new investment law, enacted in 1977. The amendment clarified the list of sectors open to foreign investment, introduced several dispute settlement options, including arbitration, and repealed procedural obligations for investment projects required by the then Company and Labour laws. Further amendments were introduced with the adoption of the Law No. 230 of 1989, which was subsequently repealed by a new Law on Investment Guarantees and Incentives, issued in 1997.

The 1997 legislation widened the scope of activities open to private investment and further relaxed the incorporation requirements for investing companies. It also reinforced the protection of investments against expropriation, with an explicit protection against “creeping expropriations” that may occur through administrative measures.

Recent regulatory amendments are improving the legal environment

The pace of reforms has accelerated over the past few years towards a modernised regulatory and institutional environment for investment. The aftermath of the 2011 events and of the subsequent political turmoil, during which numerous arbitration cases were brought against the state of Egypt, prompted the authorities to take steps to reposition Egypt as a safe investment destination. To respond to the pressing need to send a positive signal to both prospective and already established investors, the government introduced in 2015 substantial amendments to the 1997 Investment Law. The purpose of the in-depth revision of the law was to attract new investments to Egypt through more generous incentives and stronger guarantees, along with a streamlining of administrative obstacles and procedures.

The amendment brought substantial improvements to the core provisions of the investment legislation. It clarified and strengthened the role of GAFI as a one-stop-shop for investors operating in most sectors and streamlined the system for allocation of state land, pricing and zoning to clarify the institutional infrastructure governing the allocation of land outside of special economic zones. It also reaffirmed the core legal protections granted to investors and brought about a major change in the treatment of foreign investors by relaxing the available options to access dispute resolution mechanisms. In response to Egypt’s increasing exposure to investor-state arbitration, a new dedicated chapter established three out-of-court committees to favour the amicable settlement of disputes between private investors and public institutions.

This first step on the path toward a more enabling regulatory and institutional environment for investment nevertheless gave rise to some criticisms from the business community. The initial delays in adopting the implementing regulations, without which the legislative provisions remained too vague to be effectively enforced, hindered the expected impact of the amendment. Pending the adoption of the implementing decrees, the level of guarantees provided by law remained uncertain and led the business community to adopt a “wait-and-see” position that did not enable the economy to get off the ground as quickly as expected.

Following the lukewarm reception of the 2015 amendment, and in a renewed attempt to signal the pro-investment stance of the government, MIIC and GAFI introduced a new investment law, issued by Law No. 72 of 2017, which formally replaced the Investment Law No. 8/1997 and its subsequent amendments. It was promptly followed by the adoption of the corresponding Executive Regulations in October 2017. With this latest reform, the government marked a major milestone and reaffirmed the strong political will to improve further the business environment and the competitiveness of the country. The substantive content of the new law was hence enriched, while retaining most of the main changes introduced by the 2015 amendment.

The formal adoption of a new law and the repeal of the previous legislation marked an important symbolic step that initiated a wider reform process to spur investment. It also improved the clarity of the overall investment regime by consolidating within a single piece of legislation the investment rules that were scattered under various laws and regulations.

The new law focuses on addressing the obstacles to investment and overcoming major procedural and substantive problems faced by investors. The amendment also introduced both a set of additional incentives and an explicit principle of social responsibility of investors.

One of the main goals of the amendment was to set the foundations for a clearer and more streamlined framework for investments, by prohibiting the application of ad hoc fees and financial and procedural requirements to specific projects unless such requirements are based on the opinion of GAFI’s Board of Directors and of the Supreme Council of Investment. In the same vein, it is by virtue of the law that GAFI was given the mandate prepare an investment map in coordination and cooperation with all concerned state authorities and to be updated every three years. The law also gave authority to the Supreme Investment Council, headed by the President of the Republic, to develop a legislative and administrative reform plan for the investment environment and to approve policies and investment plan setting priorities for targeted investment projects.

Meanwhile, the 2017 amendment also introduced a set of additional advantages and incentives. It grants non-Egyptian investors residence in Egypt (Art. 3.4), and its executive regulations provide for additional guarantees for foreign employees. As further described in Chapter 4, in the same effort to shed light on available opportunities and advantages available to investors, the law provides for the development of an investment map that defines the investment type, regime, geographic areas, and sectors, in addition to the real-estate properties owned by the State or other public legal persons which are prepared for investment, and the arrangements and manner of disposal of such real-estate properties pursuant to the type of the investment regime (Art. 17).

Another prominent aspect of the amendment, as further developed in Chapter 7, is the emphasis given to the principle of investors’ social responsibility. The new law authorises the investor to allocate a percentage of his annual profits to be used for establishing a social development system outside his investment project, through participating in one or more of the following areas: environmental protection, provision of health, social or cultural care services and programmes, supporting technical education or funding research, studies and awareness campaigns aimed at developing and improving production, as well as training and scientific research. The amount spent by the investor in one of these assignments is deductible in the application of the provisions of the Income Tax Law (91/2005).

In the same impetus for reform, the government adopted several key laws governing business activities. The Collateral Registry Law (115/2015) eased the use of movable assets as collateral by businesses and established an electronic collateral registry. In 2018, the revision of the Companies Law (159/1981) substantially enhanced the investment environment by broadening the scope of available corporate structures and providing the possibility of establishing sole person companies in Egypt. The Law on Streamlining Industrial Establishments Licensing (15/2017) was a long-awaited improvement to the existing licensing system, and the Law on Restructuring, Preventive Reconciliation and Bankruptcy in Egypt (the Bankruptcy Law, 11/2018), introduced, for the first time in Egypt, a non-jurisdictional restructuring mechanism for bankrupt businesses. The Law also gave authority to judicial courts to enforce restructuring plans for businesses and created a court-supervised mediation system.

This comprehensive set of reforms, together with the new Investment Law as amended by Law No. 141 of 2019, which streamlines and reinforces the administration of investment projects, forms a more coherent and enabling legislative corpus to reinforce investors’ trust in the stability and certainty in the Egyptian regulatory and institutional ecosystem.

The business and the international community have praised this wave of legislative reforms, but have also called for further efforts to improve Egypt’s image as an investment destination. Despite a now comprehensive set of well-drafted laws, the legal environment still suffers from a perceived lack of predictability.

The implementation of the provisions of the law and of the new mandate of GAFI is sometimes challenged by administrative practices, notably at governorate level. At central level, further coordination across ministries and public agencies, both in the policy-making process and in the operationalisation of reforms would also allow the existing investment regime to achieve its potential. GAFI’s recent affiliation to the Egyptian Council of Ministers, by virtue of the Prime Minister Decree 38/2020, is expected to substantially enhance effective cooperation with all the government bodies in order to facilitate investment services.

Investors are protected by strong de jure guarantees of property rights

Egypt’s domestic legal framework grants de jure property rights protections to investors that are consistent with high, modern standards of protection. The protection of investors’ rights is recognised at constitutional and legislative levels, and, notwithstanding the application of bilateral investment treaty provisions, the same degree of legal protection and available incentives is granted to foreign and domestic investors.

The Investment Law provides the full spectrum of investment guarantees and protection standards that are required to provide a safe de jure regime for investors. It contains a provision granting fair and equitable treatment to both foreign and Egyptian investors, and a guarantee that the invested capital cannot be subject to any coercive or discriminatory measures.

The 2017 Investment Law provides protections against nationalisation and expropriation (Article 4). It also guarantees against sequestration and seizures, as well as the confiscation and freezing of property, except under court order. The state can only expropriate property for “public utility”, with fair compensation and in a prompt manner. The law stipulates this value “shall equal the fair economic value of the expropriated property on the day preceding the expropriation decision date” (Article 4). Meanwhile, Article 6 of the Law 10 of 1990 on expropriation of real estate for public interest, amended in 2018, provides that the compensation is estimated at the rates prevalent at the time of the expropriation decision plus 20% of the estimated price. Seizure of capital is only allowed by virtue of a court judgment, except for tax and social insurance contributions. Likewise, licences granted and state-owned land or property allocated to an investment project cannot be withdrawn without prior notice given by GAFI.

“Public utility” is not defined in the Investment Law or in the Law on expropriation of real estate for public interest. Reports suggest that in practice, different government agencies have adopted different criteria for expropriation (of primarily informal settlements) in the public interest (Wang, 2017[15]). The large amount of informal housing, coupled with low registration, increases the likelihood of cases of expropriation of informal settlements. This is particularly the case in cities, where more than half of residents live in informal housing. Anecdotal evidence suggests that residents in these cases are compensated, but it is not clear who determines their remuneration and how this is calculated (El Rashidi, 2018[22]).

As for ISDS cases, most of the expropriation cases pending before ICSID arbitral tribunals relate to political instability between 2011 and 2014 and were caused by the cancellation of sales of state-owned assets.

The Investment Law also details procedures for the state to recover land in the case of a breach of contract. If an investor commits a material breach of the terms of the contract, and does not rectify this after receiving written notice, GAFI may withdraw real-estate properties allocated for the project. The state can also recover property if: the investor does not receive the property within 90 days; it does not start the project within 90 days (if there are no obstructions and without reasonable excuse); it violates conditions of payment; or it changes the purpose for which the property was allocated (Article 67). In all cases, GAFI must inform the investor of the violations, allow the investor to comment, and give “an adequate grace period to rectify the causes of the breach” (Article 5).

A comprehensive yet complex framework for protecting intellectual property rights

The legal regime for protecting intellectual property (IP) rights comprises several pieces of legislation, including the 2002 Intellectual Property Rights Law, which unified former IP laws to bring Egypt's legal IP regime in line with its obligations under the WTO Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement. The adoption of Law (15/2004) on E-signature and the Establishment of the Information Technology Industry Development Authority (ITIDA) completed the new legal arsenal for a more up-to-date system of IP protection.

ITIDA is a public authority affiliated to Ministry of Communications and Information Technology, which aims to “develop Egypt’s competitive advantages as a one-stop shop for foreign direct investors seeking to enhance their global offering and providing the Egyptian IT industry with the right tools to increase IT/ITES exports.” ITIDA has the authority to deposit, record, and register the original software and databases submitted by entities or individuals, who publish, print, and produce thereof in order to protect copyrights and other rights.

More recently, the 2014 Constitution reinforced IP rights (art. 69), providing that ‘‘the state shall protect all types of intellectual property in all fields”. It established a “specialised body” to uphold the rights of Egyptians and their legal protection, as regulated by law.

Egypt is party to the main international conventions on IP rights, such as the Berne Convention on Copyright, the Paris Convention on Industrial Property and the Madrid Agreement. The government developed an IP Rights Action Plan to bring its IP system in line with the WTO’s Trade-Related aspects of Intellectual Property Rights (TRIPS) commitments. There is a strong awareness, at the highest level of the government, of the immediate benefits of having a robust IP policy (Box 3.1).

Box 3.1. The benefits of IP rights in developing countries: The shifting debate

Traditionally, a limited number of developed countries in which a high proportion of the world’s R&D was concentrated were the main “demandeurs” of strong IP rights internationally. Four recent developments are helping to broaden acceptance of the benefits of intellectual property rights.

More firms in more developing countries are now producing innovative products and thus have a direct stake in the protection of intellectual property rights. In Brazil and the Philippines short-duration patents have helped domestic firms to adapt foreign technology to local conditions, while in Ghana, Kuwait, and Morocco local software firms are expanding into the international market. India’s vibrant music and film industry is in part the result of copyright protection, while in Sri Lanka laws protecting designs from pirates have allowed manufacturers of quality ceramics to increase exports.

A growing number of developing countries are seeking to attract FDI, including in industries where proprietary technologies are important. Foreign firms are reluctant to transfer their most advanced technology, or to invest in production facilities, until they are confident their rights will be protected.

There is growing recognition that consumers in even the poorest countries can suffer from the sale of counterfeit goods, as examples ranging from falsely branded pesticides in Kenya to the sale of poisoned meat in China attest. Consumers usually suffer the most when laws protecting trademarks and brand names are not vigorously enforced.

There is a trend toward addressing intellectual property issues one by one, helping to identify areas of agreement and find common ground on points of difference.

Source: (OECD, 2015a).

Strong legislative and political efforts have been made in the past 20 years to meet the standards required under Egypt’s international commitments, but the domestic IP regime still lags behind and the enforcement of IP legislation continues to be perceived by the private sector as inefficient. IP rights are enforced in Egypt through a wide array of administrative and judicial institutions. Despite the creation, by virtue of the 2014 Constitution, of the high-level IP body, the institutions remain poorly equipped to enforce the protection of IP rights. Further political impetus and greater financial resources are needed to streamline the administration of IP rights and to meet the international standards that Egypt has committed to implement. The body created by the Constitution could hence play a greater coordination role to orchestrate the various responsibilities and powers scattered across public bodies and ministries.

Within the judiciary, the economic courts are specialised in disputes related to intellectual property, and judges are regularly trained on IP law enforcement. Parties have the obligation to seek amicable settlement first, by filing their case with the Economic Courts Preparation Panel. Meanwhile, arbitration remains available as a way to settle an IP dispute, in the event the concerned parties have mutually agreed to recourse to alternative dispute resolution mechanisms. Yet, the management and settlement of IP cases by Economic Courts is reported to remain too lengthy.

Access to dispute settlement and prevention

The national justice system has a fundamental role to play in reinforcing competitiveness and robust economic growth in Egypt. Its efficient functioning is key for setting the conditions for a healthy and competitive business climate. The judiciary is endowed with specialised economic and commercial courts, respectively in charge of economic and commercial disputes relating to the state economic activity, and of commercial disputes which do not involve public authorities.

In parallel to its courts system, Egypt has increasingly made available alternative dispute resolution mechanisms for resolving commercial and investment disputes. When investors perceive a lack of independence and efficiency of the court system, they tend to favour alternative dispute resolution means to settle their business disputes This is especially true in Egypt, where the reputation as a stable jurisdiction has been by the political turmoil of the past years. Along with international investment arbitration, which is provided through international investment treaty provisions (see section below), commercial arbitration has thus become the most common way of resolving business disputes before private arbitration centres, such as the Cairo Regional Centre for International Commercial Arbitration.

Despite the major role played by private institutions in steering and managing business cases, the government has remained very proactive in institutionalising mediation mechanisms to avoid having claims escalate into international arbitration proceedings, both among private parties and against public authorities. The 2015 amendment established three different committees: the Grievances Committee, the Ministerial Committee for Resolving Investment Disputes, and the Ministerial Committee for the Settlement of Investment Contracts Disputes (Box 3.2). Each committee has a different membership and is regulated by a set of specific regulatory provisions.

The 2017 Investment Law brought further clarification and emphasis on the importance of investors’ access to alternative dispute resolution mechanisms. The overall purpose of the new institutional infrastructure is to endow the government with more robust dispute avoidance, prevention and management mechanisms, and the inter-ministerial committees were established as part of a broader effort to optimise the defence of the state in the event of international investment disputes, which represent a growing challenge for the government of Egypt. GAFI is particularly aware of the importance of preventing disputes at an early stage and is recognised by the business community for its very active role in mediating at an early stage emerging disputes. GAFI has made strong efforts to establish a formal dispute prevention and early alerts mechanism to forestall potentially very costly international arbitration proceedings that may stem from investor-state disputes.

The respective roles, functioning and affiliation of each body mentioned above could however be further clarified, and it is not always clear whether the authorities themselves have a clear view on the allocation of responsibilities and of the lines of accountability. For example, it is not clear, under the new 2017 law, whether the MCRID is affiliated to the Cabinet or GAFI, while the previous legislation expressly provided that the MCRID be established under the auspices of the Cabinet. Likewise, the legal community has expressed concerns over the lack of clarity regarding the right to submit an investment contract dispute to the MCSICD. The regulatory provisions are not explicit as to whether such recourse is exclusively afforded to the investor or to the disputing governmental bodies as well. In the event of failure of settlement negotiations, there is no clear provision stating that the investor can then submit the dispute to the MCRID prior to resorting to arbitration or litigation.

Box 3.2. Egypt’s new institutional framework for the prevention of investment disputes

The 2017 Investment Law created new mechanisms dedicated to dispute resolution, giving investors more options when facing a dispute, without prejudice to the inalienable right of the investor to recourse to the judiciary. Dedicated inter-ministerial bodies were created, as follows:

1. Grievance Committee (Article 83 of the Investment Law):

The Grievance Committee’s role is to look into the grievances against administrative resolutions passed by GAFI or other administrative bodies having competence to grant approvals, permits and licences. This committee is chaired by a justice of an authority from among the judiciary. The committee must decide on the grievance within 30 days. In addition, the committee’s resolution is final and binding on all bodies, without prejudice to the investor’s right to appeal against the committee’s resolution before the Judiciary.

2. Ministerial Committee for Investment Disputes Resolution (MCIDR) (Article 85 of the Law):

MCIDR is competent to look into the claims or disputes arising between investors and the state, or any body, authority or company affiliated to the state and relating to a wide range of administrative issues including licensing and land allocation. The Investment Law states that MCIDR resolutions are, upon the approval by the Council of Ministers, enforceable and binding on the appropriate administrative bodies and have the same effect as the writ of execution.

3. Ministerial Committee for Investment Contracts Disputes Settlement (MCICDS) (Article 88 of the Law):

Chaired by the prime minister, the MCICDS is competent to settle any disputes arising out of the investment contracts to which the state, or any body, authority, or company affiliated to the state is a party. It investigates and handles any disagreements arising among the parties to investment contracts. In order to do so and with the consent of such contracting parties, MCICDS may reach any required settlement to redress imbalances in such contracts and to extend the time limits, terms or grace periods stated in the contracts. The Law states that the settlement is, upon the approval by the Council of Ministers, enforceable and binding on all the bodies, and has the same effect as the writ of execution.

4. GAFI Dispute Settlement Centre (Article 90 of the Law):

Along with the ministerial dispute committees, the Investment Law establishes a Mediation Centre, under the auspices of GAFI, to settle investment disputes which might arise among investors. The Mediation Centre is governed by a board of directors, composed of five members appointed by Prime Ministerial Decree. Since its creation, the centre has dealt with more than 200 claims, out of which about 60% were amicably settled. GAFI Dispute Settlement Centre is also competent to deal with investors’ grievances filed against any state entity.

Source: Zulficar and Partners (2018), GAFI

Concerns were also raised about potential overlaps between MCRID and the Grievances Committee. For example, an investor could, by virtue of Art. 83 of the Investment Law, submit to the Grievances Committee a dispute that arises as a result of GAFI’s violation of provisions of the Law. Alternatively, the same investor could also, by virtue of Art. 85 of the same legislation, submit the same dispute arising out of GAFI’s violation of provisions of the new Investment Law to the MCRID. It is essential to quickly address such overlaps and to clarify whether it is an intentional choice to give investors the right to choose between the two recourse options. If so, it is then important, for legal predictability purposes, to clarify if the investor has to opt for one recourse, or whether he can proceed with the two recourses simultaneously or subsequently, and which decision should prevail.

The strong momentum for favouring dispute prevention mechanisms offers a welcome alternative to both the judicial courts, which are less specialised in business matters and suffer from lengthy delays in settling pending cases, and private arbitration centres, which are too costly for small investors. Yet, the newly established institutional infrastructure poses many unanswered questions and has yet to prove itself as an efficient mechanism to prevent disputes and reassure investors about the ability of public authorities to act neutrally when preventing and settling business disputes.

Land access and tenure rights

Land access and security are an investment constraint in many countries. In Egypt, the complexity of the land administration system and shortage of land appropriate for investment present challenges for new investors. The ability to acquire and secure rights to land and property are important prerequisites for prospective investors. Investors need to be confident that their land rights are properly recognised and that they are protected against forced evictions without compensation. Land registers can enhance tenure security. When comprehensive and properly maintained and publicised, registers can limit the time to acquire land tenure rights, reduce corruption, and facilitate tax collection. In order to provide land tenure rights, the land administration should be accessible, reliable and transparent (OECD, 2015[1]).

The Egyptian government has in the past decade significantly improved procedures to access and register land for industrial purposes. Reforms since 2015 have helped enable the state to allocate around 1.8 times more land to investors than it distributed over the previous eight years (IMF, 2017[2]). Management of investor requests for land is now centralised under one agency, GAFI, and a new digital Investment Map helps improve transparency of public land ownership. The Investment Map includes information on projects of all sizes, indicating how close the projects are to key facilities (transport links, schools and hospitals) and provides a platform where investors and government officials can connect. Furthermore, the map indicates the location of ongoing development projects enabling investors to plan ahead for investment projects. Despite land allocation being decentralised, a central land allocation system has been put in place, which allows for the reservation of land electronically through the system (Investment Map Portal1). In addition, a cabinet decree issued in October 2019 states that allocation of industrial land can only be done through the online Investment Map Portal. The Investment Map is considered a very important step towards unifying the processes for land allocation even if the ownership is decentralised (see chapters 4 and 5).

As a result of these various efforts, the number of firms reporting access to land as a major or severe constraint has nearly halved since 2007 to 15% (WB Enterprise Survey, 2016). Very few firms list land access as the biggest obstacle to the business environment in Egypt. But according to government officials, access to land is one of the top hurdles for new investors. Unaddressed, issues related to land availability and tenure affect the stability and developmental impact of FDI.

Land-related challenges in Egypt stem from a number of factors. These include the country’s geography and overly complex legal and institutional frameworks (dozens of laws govern land ownership and registration), which has made land registration difficult (World Bank, 2015[3]). But many of the issues related to land tenure in Egypt involve the management and distribution of public land. The government controls up to 95% of Egyptian territory, much of it desert. Ownership is fragmented: 11 ministries, at least 13 different government agencies and 27 governorates hold territory along a mix of sectoral and geographic lines (World Bank, 2006[4]). Despite progress towards streamlining information on ownership to investors, land administration remains highly complex. The quality of land administration is among the lowest in the region (9 out of 30 compared to 14.2 for MENA), according to the World Bank’s 2019 Doing Business Report (World Bank, 2019[5]).2 This makes it difficult for investors to determine ownership and purchase land at market value and hinders the government’s ability to distribute land efficiently.

There have been a number of improvements with regards to dealing with land registration and access. The 2017 Investment Law clarifies the land acquisition procedures. As with investors competing to acquire real property required to set up investment projects, investors who meet the technical and financial conditions required for investment shall be selected according to a point system and based on preference principles including the value of the bid offered by the investor or other technical or financial specifications. If this proves difficult, then the highest bid is accepted. According to article 54 in the executive regulation, governmental entities shall provide a decision within a week. In addition, GAFI works in coordination with other governmental entities to further facilitate investors’ access to lands.

Main policy recommendations

Improve coordination among government landholders and strengthen centralisation of land requests

The complex landscape of public land ownership, and myriad approvals required to allocate land to investors, means that there remains a substantial gap between land demand and supply in Egypt. The centralisation of investor requests for land under GAFI is an important improvement that appears to have enabled faster distribution of state-owned land to firms. But the government could consider taking even further steps to centralise the allocation of land to investors, such as empowering one agency to allocate all publicly-owned land, regardless of its sectoral use. More immediately, coordination between the many different government landowners should be significantly strengthened. GAFI’s success in directing investors to the appropriate government landowner will depend on close inter-agency cooperation. There are reports that agencies have been slow to share their available land plots with GAFI, despite their legal obligation to do so.

Increase transparency of public land ownership

Short of a complete inventory and mapping of public land ownership, coordination challenges between agencies allocating public land are likely to persist. A complete registry would assist both GAFI in facilitating investment and firms in their location decisions. The Investment Map is a good step in this direction. Agencies could make public more comprehensive maps of land within their control, rather than only a selection of land available in zones, as is shown on the Investment Map.

Adopt more transparent processes for pricing and allocation of public land

There is no overarching authority on land allocation, pricing and development which has allowed different government agencies to pursue their own ad hoc policies. The Investment Law specifies some requirements for the valuation process, but all landholders could be more transparent about how they determine land use, select investors, and determine land pricing. This would help reduce the potential for speculation and corruption in public land sales. The government could consider naming an independent auditor to evaluate pricing set by different agencies.

Improve tenure security by streamlining registration procedures

The government should continue its efforts to ease the number of procedures and cost to register property. This includes addressing challenges of registering informal residents. Notably, reforms could ease requirements of complete records of past ownership. The Egyptian Survey Authority should be strengthened to fulfil its mission to develop and maintain an up-to-date land registry.

Box 3.3. Legal framework for land tenure in Egypt

No one overarching law on public land management or use exists. Laws related to land tenure set out different procedures for registration, requirements for land use, and terms for ownership/lease depending on the location and owner of the land, making for a complex legislative framework.

Property law in Egypt falls under the Civil Code (adopted in 1949) and a series of subsequent laws on land rights, foreign ownership and management of public land. The legal framework allows for private ownership, public ownership, cooperative/collective ownership, lease, waqf land (reserved for religious or charitable purposes), and some forms of encroachment (FAO, 2009[6]). The Civil Code grants ownership after 15 years of unchallenged possession or use of land, but this does not apply to state-owned land. All unregistered land is technically public land. There are restrictions on the sale/lease of public land (discussed below), notably for any land deemed of military or strategic importance, including the Sinai.

Foreigners are restricted from owning certain types of land. These are set out in three laws: No. 15 of 1963, No. 143 of 1981, and No. 230 of 1996. Law 15 (1963) stipulates that foreigners (natural or legal) are prohibited from owning agricultural lands, as well as areas “susceptible of cultivation, fallow lands and desert lands” (United Arab Republic, 1963[7]). Law 143 (1981), also known as the Desert Land Law, places limits on the ownership of desert land, which the Law defines broadly as all territory two kilometres outside city borders (GAFI, 2017[8]). Partnerships and joint stock companies can own desert land up to 42 km2 (10 000 feddans) and 210 km2 (50 000 feddans) respectively, if Egyptian nationals own at least 51% of the capital. A 1998 amendment (Law 55) allows the government to treat Arab nationals as Egyptians for ownership purposes.

Law 230 (1996) sets out further conditions for foreign ownership. With some specific exceptions, non-Egyptians are limited to two real estate properties for accommodation, the area of which cannot exceed 4 000 square metres and must not be a historical site. It is not clear what classifies as a historical site. The Cabinet of Ministers set specific requirements for ownership in tourist areas. Foreign owners are prohibited from selling land for five years from the property registration date, and holders of vacant land must build within five years (GAFI, 2017[8]).

Complex public land administration delays allocation of land to investors

Companies and government officials cite timely access to land as a key barrier to new investment in Egypt. The greatest challenge, according to GAFI, is that the lack of available land suitable to investors’ needs, including with appropriate infrastructure and access to markets and workers. This is partly a geographical challenge: cities are overcrowded and the vast majority of Egyptian territory is desert, often not well connected to hubs and under-developed. But the gap between land supply and demand is largely due to Egypt’s complex and fractured system of public land administration which has caused uncertainty over ownership and delays in allocating land to investors.

Around 90-95% of Egyptian territory is state owned. More than 40 laws and executive orders stipulate which government entities control what land, whether the land can be disposed of, and who has a say in determining land use (Sims, 2015[9]) (World Bank, 2006[4]). A minority of public land is reserved for security or other state purposes. The remaining territory either has a governing authority, which in many cases can allocate land to investors, or does not yet have a designated use and no specific controlling entity.

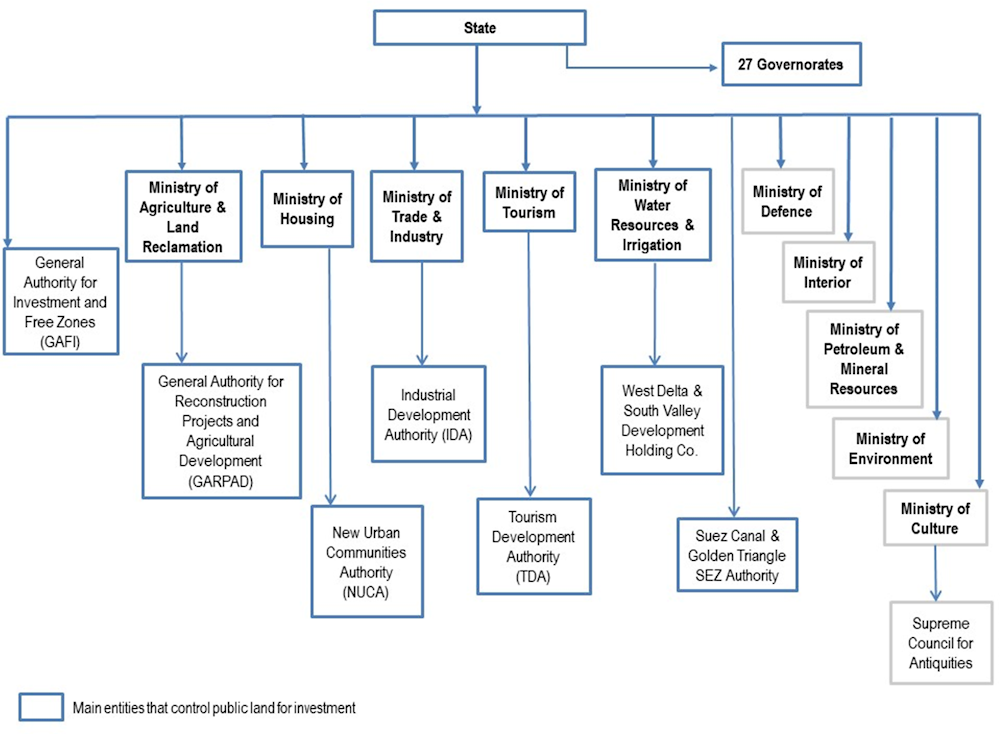

Control of designated public land is complex: 11 ministries, at least 13 government entities and 27 governorates hold land along a mix of sectoral and geographic lines. Figure 3.1 depicts the main agencies involved in state land management. By law (143 of 1981 and 7 of 1991), Governorates manage public land located inside historical urban limits (known as the zimam), and in most cases, within 2km of this boundary. Less than 5% Egyptian territory falls within the zimam; the rest is by law “desert land”. Outside the zimam, control of designated desert public land is divided among ministries and agencies based on sector and land-use.

Figure 3.1. Institutional framework of state land management

Note: Only entities with a major stake in land management presented. Entities in blue are the main holders of public land distributed to investors.

Source: Reproduced and adapted from (World Bank, 2006[4]).

A mix of laws and de facto practice grants certain agencies priority in claiming/requesting control over undesignated desert land and determining its use. Law 143 of 1981 (Desert Land Law) gives the Ministry of Defence first right to claim any territory for military or strategic purposes. The Ministry of Agriculture and Land Reclamation has second rights to name undesignated territory for agricultural development, in coordination with the Ministry of Defence. The Ministry of Housing, Utilities and Urban Development can identify land for new urban areas, subordinate to the claims of the defence and agriculture ministries, while the Tourism Development Authority can demarcate territory for tourism projects (Law 7 of 1991).

In practice, however, other ministries and agencies delimit lands based on their historical value, extractive potential, conservation needs, and potential for industrial use (Sims, 2015[9]) (World Bank, 2006[4]). The hierarchy of these claims is not codified in law, leading to competition between agencies. The National Centre for Planning of State Land Use has the mandate to coordinate between agencies and set coherent plans for land use, but in practice, there is no overarching authority on land allocation and development. In most cases, agencies only gain control over a specific plot of land through an executive decree (of which there are hundreds), and the decision-making process of determining land use is often opaque.

Four government agencies, two SEZ authorities and two holding companies manage most of the desert public land designated for development. Together, they control around 10% of Egypt’s total territory. Table 1 shows the estimated amount of land managed by each entity, though the dearth of publicly available reports on state land ownership means that many of these figures are out of date. The data nonetheless suggest that the vast majority of designated state desert land is earmarked for agriculture, followed by industrial projects and new town development. Other agencies, including GAFI, manage a smaller amount of land through their oversight of free and investment zones. Once allocated state land, investors are prohibited from changing the original designated land use (2017 Investment Law).

Table 3.1. Main agencies controlling public land for development

|

Entity |

Authority/Ministry |

Estimated land controlled, in km2 (year) |

|---|---|---|

|

General Authority for Reconstruction Projects and Agricultural Development (GARPAD) |

Ministry of Agriculture and Land Reclamation |

71 400 (2010) |

|

Suez Canal & Golden Triangle SEZ Authorities |

Prime Minister |

9 761 (2018)* |

|

Industrial Development Authority (IDA) |

Ministry of Trade and Industry |

7 938 (2018)* |

|

New Urban Communities Authority (NUCA) |

Ministry of Housing |

3 574 (2010) |

|

West Delta & South Valley Development Holding Company |

Ministry of Water Resources and Irrigation |

2 730 (2006) |

|

Tourism Development Authority (TDA) |

Ministry of Tourism |

575 (2006) |

* Estimates for 2018 reflect data GAFI made available that year.

Source: GAFI, (Sims, 2015[9]), (World Bank, 2006[4]).

Although there have been efforts to increase transparency of land available to investors (discussed below), there is no cadastre or complete map of which government entities control what territory. There is only one modern map with a rough estimate of agencies’ control, published by the government in 2001, and at the limiting scale of 1:1 000 000. Despite the adoption of decrees detailing land boundaries, some governorates lack knowledge about new settings of lands, and there are reports that agencies have conflicting understandings of the land they manage (Sims, 2015[9]). Notably, some governorates ignore the out-of-date zimam boundary, exerting de facto control over surrounding desert land. Governorates have the legal right to manage public land 2km outside the zimam, but only if no sectoral agency has claimed the area for their use. This means that in many cases neither investors nor the government has a clear picture of which entity owns what plot of land, particularly in areas bordering urban centres.

The entity controlling designated desert land in most cases has the authority to allocate parcels to investors. But this often requires approvals from other government bodies, such as the MoD or local branches of other ministries, a process that can take months (World Bank, 2006[4]). As a result, large portions of designated public land remain unavailable to investors. The government is well aware of these challenges, and as the next section outlines, is taking some measures to centralise land allocation.

Reforms seek to ease land access for investors, primarily in zones

The government has made significant improvements in the past decade, and notably in the past two years, in easing the process of acquiring land for investors. Management of investor requests for land is now centralised under GAFI. The 2017 Investment Law gave the agency and its Investor Service Centres (ISCs) the mandate to direct investors interested in a specific area to the appropriate controlling authority. A new digital Investment Map lists parcels of land available for investment by location and sector, detailing the governing authority of each free plot and their contact information. (The Law stipulates that all agencies must provide GAFI with detailed maps of land in their jurisdiction open to investors). The Investment Map centralises procedures for obtaining lands across the country, which is expected to greatly improve the access to land. It also streamlines the process of identifying available land parcels, which previously required a lengthy coordination with different agencies and governorates. The government has other plans to improve distribution to investors, including allowing governorates to update the Investment Map directly.

Due in part to these reforms, in 2016 and 2017 the government allocated 16.9 million m2 of industrial land, nearly 1.8 times the amount distributed over the previous eight years (IMF, 2017[2]).Fewer firms now report problems with land access: around 15% of firms considered access to land as a major or severe constraint to their operations in 2016, compared to nearly 27% in 2007 (World Bank, 2009[10]). The most recent data show no substantial difference in opinion between foreign and domestic firms (World Bank, 2016[11]).

While GAFI and the ISCs serve as the link between investors and landowners, GAFI does not allocate land used for industrial purposes: this remains the purview of the Industrial Development Authority (IDA). In ensuring transparency of IDA’s land distribution processes and simplifying the institutional framework of public land management, the government is considering establishing a committee to review processes and set standards for industrial land allocation (Government of Egypt, 2018[12]). The government has made a similar proposal to the IMF.

The Investment Map is a positive step towards transparency of public land ownership, but it primarily shows plots of land available in economic, industrial or other types of zones, reflecting the government’s strategy of zone development. Zones have also not solved issues with land access. Surveys suggest that availability of land is actually a greater obstacle for firms located in industrial zones than those outside (22% of firms in IZs reported land access as a major or severe challenge to their operations, compared to 11% of firms outside zones) (World Bank, 2016[11]). This could be due to differences in firm size; most firms in industrial zones are larger and require more land. There is also limited space in zones in areas highly sought out by investors. Incentives to investors, including cheap or free land in zones, has raised competition over land parcels (and the responsibility of zone authorities to allocate land to businesses efficiently). According to GAFI, there is not enough available land for new investments or for the expansion of existing businesses in public free zones, a point which was confirmed in discussions with firms located in the coveted public free zones of Alexandria.

Improvements to land registration but tenure security not widespread

As with land access, the government has made clear progress in easing property registration processes for investors. Compared to a decade ago, the registration process now takes less than half the time and, at 1.1% of the property value, is roughly 1/6th of the cost (Wang, 2017[13]) (OECD, 2007[14]) (World Bank, 2019[5]). Around 95% of agricultural land is now registered, but property registration remains time-consuming and can be arduous in practice. It requires nine procedures (two more than a decade ago), and takes an average of 76 days, more than double the average amount of time in the MENA region. This is despite many previous reform efforts, including in 2006 to establish a one-stop-shop for property registration, which aimed to reduce the time to one week (OECD, 2007[14]). Egypt ranks 130 of 190 economies in terms of ease of registering property in the World Bank’s Doing Business index, lower than most other countries in the region (with the exception of Algeria, Libya and Syria) (World Bank, 2019[5]). Box 3.4 lists the current procedures required to register property for firms under the inland (standard) investment regime in Cairo.

The vast majority of land and private property in Egypt is not registered. The last cadastral survey dates to 1940, and there is no cadastral map with full details on government land ownership (Sims, 2010[15]). The Egyptian Survey Authority, the body responsible for conducting cadastral mapping, lacks technical capacity and has few digital records (Chemonics International, 2005[16]). Only around 10% of urban land is registered (compared to 90% of agricultural land) (Wang, 2017[13]). The disparity is due to a fragmented legal framework for property registration. In agricultural areas, the government has worked to transfer land registered under a deed system (set up in the 1946 Deed Law, No. 114) to a title registration system, notably through a push in 2006 to automate title registration. Urban areas still use the deed system, largely due to a gap in the 1964 Title Law (No. 142), which does not permit the registration of apartment units (Wang, 2017[13]) (World Bank, 2006[4]).

Box 3.4. Property registration procedures in Egypt

Firms under the inland regime, operating in Cairo:

Registering purchased property in most cases involves nine steps. However, these steps are relevant only if the property the buyer is purchasing is already registered and has no title disputes. Only around 10-15% of all private property is registered (Sims, 2015[9]).

Parties procure an official property tax statement from the local Property Tax Authority Office, which proves the property is registered at the Authority, has had a tax assessment, and has no mortgages. This costs EGP 2.25.

Parties get certificate from District Land Registry with details on the property ownership and encumbrances. This costs EGP 30.

Buyer submits a request to register the property with Real Estate Registry, for a maximum fee of EGP 2 000 (for property larger than 300 m2).

Egyptian Surveying Authority (ESA) conducts site inspection and a produces a report, a process that can take a month.*

Both the Measurement Department and the Real Estate Registry must approve the ESA’s report, which may take 21 days. The Registry then accepts the registration request (step 2) and gives the parties a stamped contract form.

Lawyers representing the parties send the completed contract to the Lawyers Syndicate, which verifies the lawyers’ syndicate identification and registration. In 2018 this cost 1% of the property value (up to EGP 25 000), a 0.5% increase from 2017.

Parties submit the contract to the Real Estate Registry for review and approval, which can take 10 days.

Parties stand before Notary Public, which oversees signing of contract and authenticates it.

Buyer gives notarised contract to Real Estate Registry for review, if approved the Registry gives a registration number, confirming the property registration. This may take 10 days.

Note: *The step has no cost if amount not specified.

Source: (World Bank, 2019[5]); 2017 Investment Law, (Egypt.gov website)

Issues with tracing ownership have been a key impediment to registering land. Unlike title registrations, which prove legal ownership of a plot of land, a deed system is a public record of a transaction between two parties. The deed registration process in Egypt is time consuming, costly and reportedly fraught with forgeries and petty corruption, as land ownership and transactions records (required for registration) are incomplete (USAID, 2010[17]) (Sims, 2010[15]). In urban areas, the low percentage of registered land under the deed system is also due to the prevalence of informal settlements; estimates suggest that more than half of Cairo’s residents live in informal housing (Sims, 2015[9]). Many property transactions rely on informal procedures and contracts (Sims, 2010[15]).

The low registration rate negatively affects tenure security, as unregistered land is technically state property. Reliable land titling and property registrars help landholders to seek legal redress in case of violation of property rights. For businesses, better land rights and registries facilitate investment decisions. Transparent, complete and secure land registration is also associated with greater access to credit, as land titles offer a form of collateral. As the majority of property in Egypt is not registered, it is often difficult to prove ownership, complicating and significantly lengthening the process of taking out a mortgage (EBRD, 2012[18]). (The 2001 Real Estate Finance Law sets out details of issuing mortgages). In 2015, the government passed a Movable Securities Law (No.115) allowing the use of other types of assets as collateral, including equipment, crops, current and future receivables and intellectual property rights, which helps facilitate loans to SMEs for example.

Reforms to land registration

The 2017 Investment Law eases some procedures required for property registration. Companies under the law are exempt from taxes and fees involved with land registration (Article 10). New Investor Service Centres (ISCs) have the mandate to receive investor applications and issue approvals, permits and licences (Article 21). For investors, the process of land registration is simplified in industrial zones and other zone types. Investors receive their property licences from zone authorities and/or GAFI. In public free zones and special economic zones, land is licensed to investors under a usufruct system (Article 37). Real-estate property in other zones may be purchased, leased, leased-to-own, or licensed for usufruct (Article 58). The law stipulates that for some sales and lease-to-own transactions, property titles are transferred to the investor after the investor pays in full and begins production, or in some cases, completes the project (Article 62).

The government is also taking steps to improve the land registration procedures. There are reports in the Egyptian press that parliament is considering a new real estate registration law, which will reduce the cost and steps involved in property registration. These efforts are a step towards improving tenure security. But to be successful, the government should evaluate lessons from the many previous efforts to broaden participation in land registers, including schemes to sell titles to informal residents (Sims, 2016[19]). Notably, reforms should address the continued high cost of registration and ease requirements of complete records of past ownership. The Egyptian Survey Authority, responsible for cadastral mapping, should be strengthened to be able to carry out its mission of developing a comprehensive and up-to-date land registry.

Gaps in transparency of state role in land market

The Egyptian state, as the largest landholder in the country, dominates the land market. Its role as both owner and price setter has led to public controversies over corruption and nepotism in land sales (Sims, 2015[9]). A lack of transparency on how land is valued and how buyers are selected has contributed to an uneven playing field for investors and lost revenue for the government, as well as land speculation. One fifth of firms see the price of land as a substantial barrier to investment (World Bank, 2016[11]). Details in the investment law on procedures for valuing land is a step towards standardising the evaluation process. The government could, however, further increase transparency of its land pricing, and in particular, weigh the benefits of selling or renting land to investors at reduced cost.

The Investment Law states that one of five different entities estimates the sale, rent or usufruct price for land based the purpose of the allocated land.3 These are: the General Authority for Government Services, Supreme Committee for Pricing of State-Owned Lands at the Ministry of Agriculture, New Urban Communities Authority, Tourism Development Authority, and the Industrial Development Authority (Article 64). The entity should include “experienced representatives as members in the estimation committees” and finalise estimations within 30 days of requests. The executive regulations of the Law detail that the estimation will involve examining the prices of adjacent property, costs of preparing the property (with infrastructure and utilities), the investment activities, and other relevant technical elements (Article 52). This evaluation is in most cases valid for one year.

A risk is that government agencies involved in evaluating land value are not neutral. The law states that the authority with jurisdiction over the land pays a fee to the entity that estimates the price (Article 64 of the Law and 53 of the Executive Regulations). But several of the entities in charge of estimating prices also control land: IDA, the New Urban Communities Authority and the Tourism Development Authority are among the largest holders of land earmarked for development in Egypt (Table 1). IDA has the authority to allocate land to investors. The Llw does not seem to prevent these authorities from setting their own land prices.

There is further potential for conflicts of interest. The law permits authorities overseeing land to have a stake in investment projects under their jurisdiction, via either in-kind shares or a partnership (Article 58). This requires approval from the Cabinet of Ministers. One of the five aforementioned government agencies estimates share prices. Once again, it appears that in some cases an agency can benefit from setting its own land sale/rent/usufruct prices and share prices. Elsewhere the Law states that in the case of publicly owned land, either GAFI or the administrative authority will “indicate” the price of the land (Article 59). It is not clear if this means that the authority overseeing the land has a final say in the value estimation.

In practice, public land is often dispersed at below-market rates as an investment incentive. The Investment law also permits the free disposal of state-owned property (primarily in zones) to investors, if the investment is for “the sole purposes of development”, and with approval through decree from the Cabinet of Ministers (Article 60). In this case, the investor must provide a cash guarantee of up to 5% of the value of the investment costs – one of the key incentives of the law. Firm-level evidence reveals that “access to land at a reduced or no cost” is the most important reason behind manufacturing firms’ choice to locate in an industrial zone (World Bank, 2016[11]). This incentive is not without distortive risks; cheaper land has created a shortage of land in zones, as discussed earlier.

The pricing of public land also tends not to be transparent. Several highly publicised court cases have involved the sale of land at what was perceived to be below-market value. There have been instances of purchasers of public land re-selling at up to 100 times the original price (Sims, 2015[9]). The government has put in place regulations to discourage land speculation, and the High Price Appeals Committee should act as a regulatory body. But the lack of transparency on land pricing, and on the selection of buyers, means that the potential for speculation and corruption in public land sales persists.

The government has recognised that selling industrial land at nominal, pre-determined prices is “not optimal for the future allocation of land, as it forgoes revenue for the state and creates opportunities for rent seeking” (from the government’s Memorandum of Economic and Financial Policies) (IMF, 2018[20]). In 2018, it proposed to create a working group, under the prime minister, tasked with reforming how industrial land is priced and allocated. The reforms will include reducing restrictions on land use and “market-based land allocation mechanisms that ensure open, transparent and competitive bidding process” (IMF, 2018[20]). The government also intends to digitalise the industrial land tender process, allowing investors to bid and submit documents online. These reforms, if implemented, will be a positive step, but the effect will be limited if the reforms are only applied to industrial land and not to land held by other sectoral agencies.

Investment treaties

Investment treaties (also referred to as international investment agreements or IIAs) are another component of Egypt’s investment policy framework. Investment treaties entered into between two or more states typically protect certain investments made by nationals of a contracting state in the territory of another contracting state. Investment treaties include both bilateral investment treaties (BITs) and investment chapters in trade agreements. This section addresses treaty-based protection for covered investors. Increasingly, investment treaties also address market access for foreign investment (addressed separately below).

Protections afforded under investment treaties generally arise in addition to and independently from domestic law protections. Treaty-based protections generally only cover investors defined as foreign. Treaties also define types of investments and investors that are covered, frequently in broad terms.

The majority of Egypt’s investment treaties grant covered investors two different types of rights:

Substantive rights to standards of treatment for covered investments (such as protections against expropriation or discrimination, or against unfair treatment); and

Procedural rights to enforce government obligations in the treaty, often through investor-state dispute settlement (ISDS) mechanisms. These generally permit covered investors to bring claims against the host state for breach of the treaty before arbitral tribunals.

One of the main reasons motivating certain countries to conclude investment treaties has been to seek to attract foreign investment, and yet the assumption that investment treaties would encourage foreign investment has been difficult to establish as a factual matter despite a multitude of studies.4

Most of Egypt’s investment treaties contain features common to so-called first generation treaties. Concluded in the 1980s and 1990s, these include vague substantive provisions that have been broadly interpreted in ISDS cases and provide little procedural guidance for ISDS. Recent treaties concluded by other states have rejected this approach in favour of more precise definitions of the scope of government obligations and increased regulation of ISDS. These changes often reflect government efforts to improve the balance between covered investor protection and the right to regulate.5

Many governments have been substantially revising their investment treaty policy in recent years.

The European Union’s (EU) rejection of investor-state arbitration has transformed EU policy – and it continues to evolve under increasing public and academic questioning, and growing constraints imposed by EU law.

Long-standing supporters of investment treaties like the United States have recently expressed fundamental doubts about treaty-based investor protection and have exited or sharply narrowed the substantive provisions and scope of ISDS, notably in the United States-Mexico-Canada Agreement (USMCA) signed in November 2018 with Canada and Mexico.

Chinese investment treaty policy is still in flux, with pressures to strengthen covered investor protection in the context of growing outward investment accompanied by concerns about the reputation of Chinese business abroad and the possible exposure to claims which have remained minor to date.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) reflects the expansion of an updated North America Free Trade Agreement (NAFTA)-inspired investment treaty model to a broader range of 11 economies including relations between advanced economies, notwithstanding US rejection of the treaty.

States in Southeast Asia have taken steps towards an ASEAN-driven landscape for regional investment policy, with a strong focus on intra-region liberalisation and protection through both domestic laws and international treaties including the ASEAN Comprehensive Investment Agreement and a host of ASEAN-led investment agreements with third states such Hong Kong (China) (2017), India (2014) and China (2009).

Major G20 capital importers like India, Indonesia and South Africa have all rejected and exited first generation investment treaties with some exiting the system more broadly. Brazil has developed a new model for investment treaties focused on investment facilitation and using state-to-state dispute settlement without ISDS.

Multilateral reform of ISDS is now underway. Following inter-governmental debate, the UNCITRAL Commission entrusted its Working Group III in July 2017 with a broad mandate to work on possible reforms for ISDS. The sixty government members of UNCITRAL as well as many government observers – including Egypt – have found by consensus that reforms should be developed to address concerns raised with eleven different issues relating to ISDS.

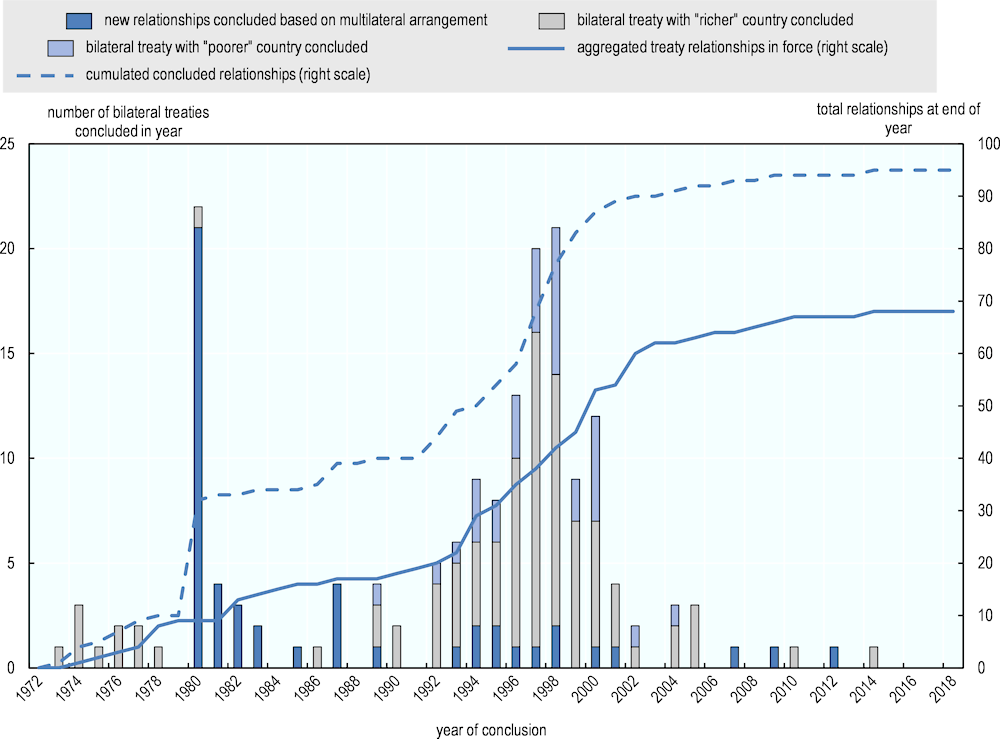

GAFI announced in March 2016 that it was undertaking a new investment treaty reform programme based on two main objectives: updating Egypt’s model BIT and reviewing and amending Egypt’s existing investment treaties.6 GAFI has confirmed that the process of updating Egypt’s model BIT seeks to respond to domestic and international developments regarding investment policy, enhance the role of FDI in achieving sustainable development and establish a new balance between the rights and obligations of investors and the state These reform efforts will undoubtedly be informed by Egypt’s considerable first-hand experience with ISDS cases: it is the fifth most frequent respondent state for known ISDS claims worldwide with at least 34 ISDS claims filed against Egypt.

This section outlines the current status of Egypt’s investment treaties and the historical development of Egypt’s policy towards investment treaties before identifying considerations that may assist Egypt in achieving its desired balance in investment treaty policy in the future.

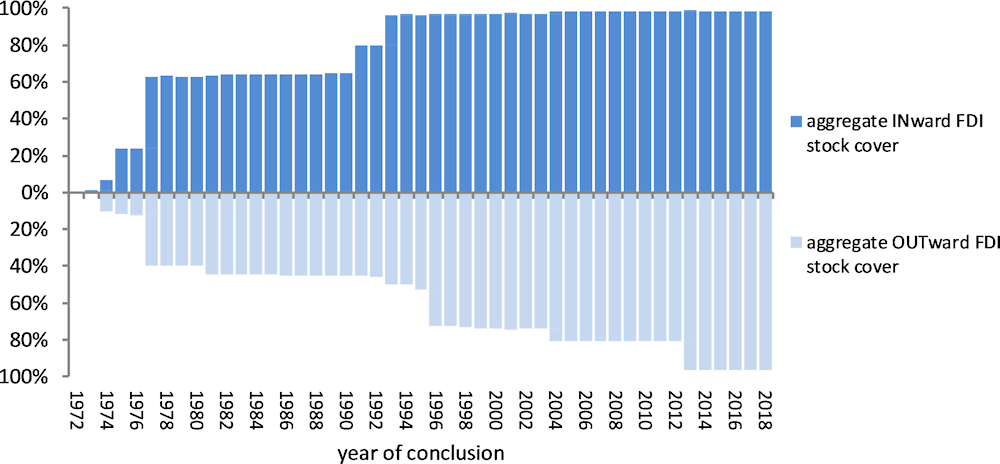

Overview of Egypt’s investment treaties

Egypt has a broad range of investment treaties. GAFI indicates that as of September 2019 Egypt has concluded 111 BITs, 72 of which are currently in force.7 Egypt has BITs in force with all of the G7 states except the EU and all but three of the member states of the EU (Estonia, Ireland and Lithuania) as well as several other major capital-exporting states in the G20 group including Argentina, Australia, China, Korea, the Russian Federation and Turkey.

Egypt has a large number of signed investment treaties that are not in force. According to publicly-available information, Egypt had signed at least 101 BITs and, together with multilateral treaties, has concluded treaty relationships with at least 122 countries as of May 2019.8 The reasons for non-ratification are not clear. GAFI indicates that non-ratification may be linked to assessments of Egypt’s economic interests in respect of these treaties. In any case, many of these treaties are older treaties containing vague provisions now seen as outdated due to broad and varying interpretations in ISDS cases – few if any states are today ratifying treaties dating from this era. The analysis here generally addresses investment treaties in force except where otherwise indicated.

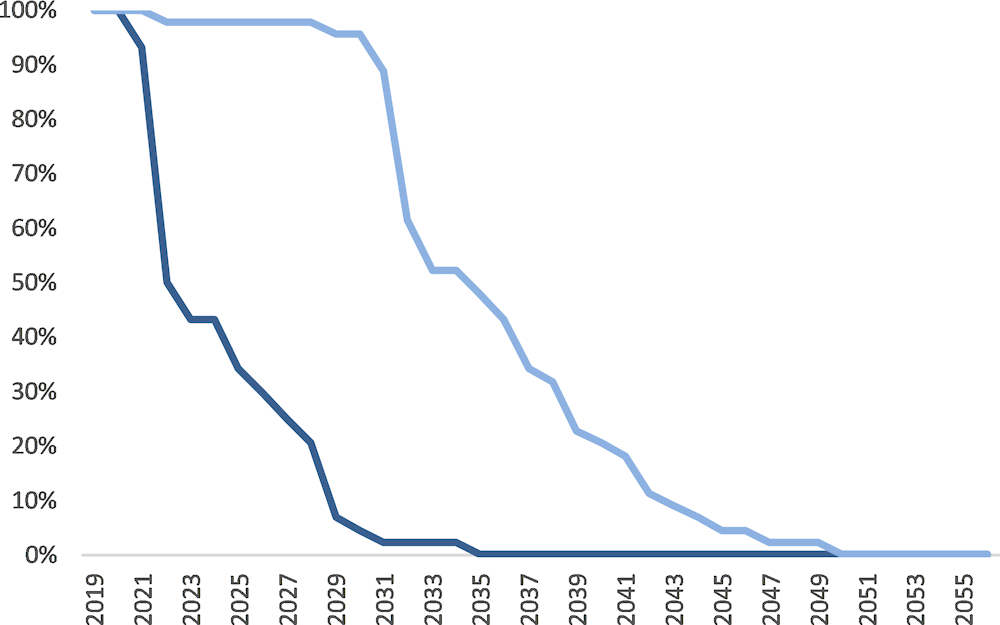

Egypt’s investment treaties are primarily composed of a majority of first generation BITs. The majority of Egypt’s BITs (77) were signed between 1990 and 2005.

In addition to concluding BITs, Egypt has several trade agreements in force that do not contain investment protections, including with Turkey in 2005 and the EFTA states (Iceland, Liechtenstein, Norway and Switzerland) in 2007. Egypt has signed Trade and Investment Framework Agreements (TIFA) with the United States (1998) and the European Union (2001). In June 2013 the EU and Egypt began talks about a Deep and Comprehensive Free Trade Agreement, which is planned to include an investment chapter, but negotiations are currently on hold.9 Egypt has also signed the SADC-EAC-COMESA Tripartite Free Trade Agreement and the African Continental Free Trade Agreement in 2015 and 2018 respectively; negotiations regarding investment issues are yet to start under either of these two frameworks.

At the regional level, Egypt has signed plurilateral agreements with investment protections, most importantly the Unified Agreement for the Investment of Arab Capital in the Arab States (1980) (the Arab Investment Agreement) and the Agreement for Promotion, Protection and Guarantee of Investments among Member States of the Organisation of Islamic Cooperation (1981) (the OIC Agreement).10 The remaining plurilateral agreements contain general investment promotion commitments or investment protection obligations without binding enforcement mechanisms.

The OIC Agreement and the Arab Investment Agreement provide for ISDS. Investor claimants have invoked the OIC Agreement in at least seven ISDS disputes since 201111 (none of which involve Egypt) despite uncertainties in the agreement’s appointing authority mechanism.12 OIC governments are currently discussing proposals to replace investor-state arbitration under that treaty.13

At a global level, Egypt has signed and ratified three important multilateral treaties related to enforcement of arbitral awards, including in ISDS cases under investment treaties – the New York Convention,14 the Washington Convention15 and the Riyadh Agreement.16

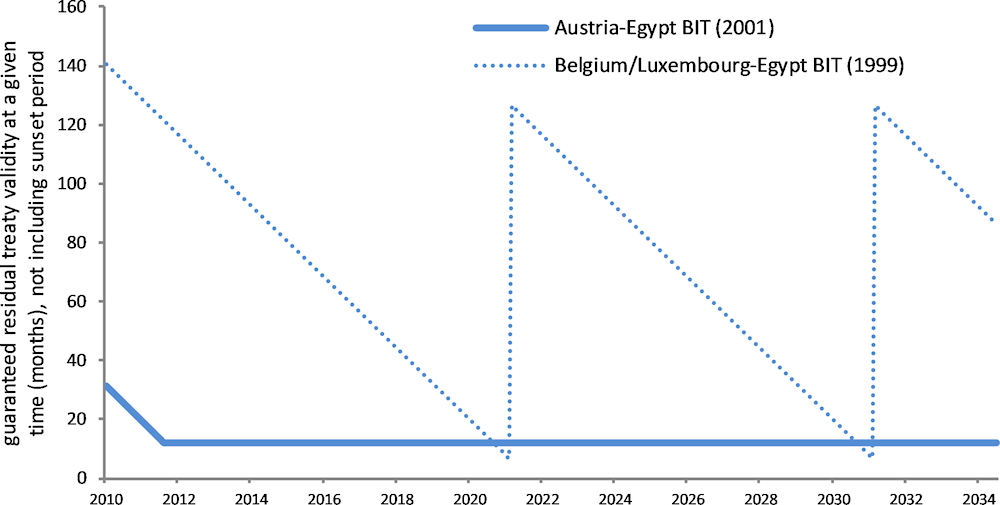

It is difficult to be precise about the status of Egypt’s investment protection treaties due to insufficient and inconsistent publicly-available information. Comprehensive information on the existence of Egypt’s investment treaties, along with any protocols, amendments, earlier versions of renegotiated treaties and in-force status, is not available. Egypt has made some of its investment treaties available on the official website of the Ministry of Foreign Affairs (MFA)17 in multiple languages (e.g. Egypt’s BITs with Uzbekistan and Viet Nam), but many of Egypt’s treaties are not available on this website.18 Some are accessible as part of the United Nations Treaty Collection and other foreign government or third-party websites.19 Some of Egypt’s investment treaties have been made available by the MFA in an Arabic-language version only, even though they are available elsewhere online in other languages.20 Several Egyptian BITs that are not in force are available for download on the MFA website with no indication about their current status.21 This includes the Egypt-Indonesia BIT which is understood to have been terminated recently by a unilateral notification from Indonesia.