This chapter defines the value-added tax (VAT) benchmark. The chapter then zooms in on the measurement of VAT TEs; first, by providing a high-level description of the method Colombia currently applies to estimate revenue forgone and second, by making a number of technical recommendations on how the methodology can be improved and complemented with further analysis. It pays particular attention to how revenue forgone from the VAT exemption to Free Trade Zones could be measured.

OECD Tax Policy Reviews: Colombia 2022

2. Identifying and Measuring Tax Expenditures in the Value-Added Tax

Abstract

Summary

This chapter starts by defining the value-added tax (VAT) benchmark, which allows for identifying VAT Tax Expenditures (TEs) in a coherent manner. The chapter then zooms in on the measurement of VAT TEs; first, by providing a high-level description of the method DIAN currently applies to estimate revenue forgone and second, by focusing on specific characteristics of the applied methodology. The chapter also makes a number of technical recommendations on how DIAN’s methodology can be improved and complemented with further analysis. These recommendations refine the existing approach by making sure it is aligned with the suggested VAT benchmark and increase the transparency about revenue forgone and complement the top-down model with VAT return data when it comes to specific provisions that cannot be modelled in a macroeconomic framework.

General assessment of the methodology

DIAN’s top-down model (based on national accounts statistics rather than tax return data) to quantify VAT TEs is aligned with international practise and captures correctly the functioning of the VAT system and the channels through which deviations from the benchmark result in VAT revenue forgone.

DIAN’s current (implicitly defined) VAT benchmark is not fully aligned with the OECD’s VAT benchmark proposal. In particular, the DIAN TE benchmark assumes that no sector (except for the hydrocarbon sector) can recover VAT paid on gross fixed capital formation (GFCF). In contrast, under the OECD’s VAT benchmark, businesses are entitled to a credit for the input VAT paid on investment in capital assets. The current DIAN method therefore ignores the tax revenue impact of the non-recoverability of VAT paid on GFCF when estimating item-by-item tax revenue forgone. As a result, DIAN does not measure the negative TE and, thereby, overestimates the VAT revenue forgone as it does not take into account the additional VAT revenue collected by not providing businesses a refund for the VAT paid on capital assets.

The VAT revenue forgone that is calculated using DIAN’s top-down model is adjusted by the compliance gap to ensure that revenue lost due to non-compliance is not wrongly assigned to the revenue forgone from the TEs. However, relying on an economy-wide compliance gap to estimate product-level TEs, is problematic. DIAN’s current approach overestimates the tax revenue forgone for goods and services produced by sectors with a non-compliance rate exceeding the average non-compliance rate; the opposite holds for the tax revenue foregone in sectors that are highly compliant.

The methodology DIAN applies to measure revenue forgone from the Free Trade Zone (FTZ) exemption is incorrect as it compares the input VAT that the FTZ user would have paid in the absence of the exemption to the actual VAT the FTZ user collects when it sells goods and services to the national territory. Furthermore, as explained below, in the OECD’s view revenue forgone from the FTZ exemption only arises as a result of the interaction between the FTZ exemption and VAT exclusions.

A wide range of VAT TEs are neither listed nor measured by DIAN, including the exclusion of food and beverages consumed in restaurants, bars and other shops that are taxed under the National Consumption Tax. These TEs should be measured for transparency purposes but also because revenue forgone from TEs not captured by the DIAN model (and for which potential revenue is not adjusted) leads to an overestimation of the compliance gap and consequently to an underestimation of the TEs the model does measure.

Recommendations regarding VAT revenue forgone measurement

To improve the preciseness of DIAN’s VAT model, the OECD suggests breaking down the compliance gap. To do so, DIAN needs to estimate potential revenue by sector, which cannot be done within the current demand-side framework. DIAN could use a supply-side approach in line with the International Monetary Fund (IMF) VAT GAP methodology (Hutton, 2017[1]). Potential revenue by sector (calculated based on national accounts data) will then be compared to actual revenue from sector-coded tax returns to obtain sector-level compliance gaps. The item-by-item revenue forgone estimates could still be calculated using a demand-side framework but would be adjusted by the corresponding sectoral compliance gaps.

The following recommendations were made regarding the treatment of VAT paid on gross fixed capital formation (GFCF):

The suggested benchmark tax system would allow businesses to recover the VAT paid on total GFCF and, as a result, DIAN would start measuring the negative TE due to the fact that currently VAT paid on investment in fixed assets is not recoverable for businesses.

In order to increase the transparency of the VAT TE figures, the report suggests splitting the overall TE estimate into separate items, namely: 1) the total (net) revenue forgone; 2) the revenue forgone resulting from the positive TE (this measure is currently reported by DIAN); and 3) the negative TE arising from the non-recoverability of VAT paid on GFCF.

To measure the negative TE from non-recoverable VAT paid on GFCF, a proposal was made on how to determine the value of GFCF made by both incorporated and unincorporated businesses.

Revenue forgone from the FTZ VAT exemption arises only in two cases: 1) excluded goods are sold from the national territory to FTZ businesses (the domestic business gets an input VAT refund that it would not get if the FTZ exemption did not exist); 2) FTZ businesses sell excluded goods and services to the domestic economy without paying any input VAT (if the FTZ exemption did not exist, these businesses would have had to pay input VAT without being able to recover it). The chapter suggests two alternative approaches to estimate revenue forgone from the interaction of these exclusions with the FTZ exemption. Which of these approaches DIAN will prefer to measure TEs will depend on the available data and the resources that are available to make the TE estimate as precise as possible. The chapter also discusses how this estimation could be integrated into the VAT model or, otherwise, if the estimation is carried out separately, how the compliance gap should be adjusted.

In addition to defining a VAT benchmark, the chapter recommends listing all VAT TEs within the TE report, including the tax provisions that are currently not measured by DIAN. As a result of exchanges between the MOF, DIAN and the OECD in the context of the elaboration of this review, DIAN included an estimate of the revenue forgone from the VAT exclusion of food and beverages consumed in restaurants and bars in the latest edition of its MFMP for the first time (Minhacienda, 2022[2]). Annex E provides a list of all TEs within the VAT that have been identified in Colombia, based on the VAT benchmark proposal. The list could serve as a template for the list of TEs that DIAN should aim at including in its annual TE report.

If DIAN were to follow the suggestions made by the OECD, it will have to gradually develop its VAT model from a purely top-down approach based on national accounts statistics to a hybrid approach that combines the use of macroeconomic statistics and VAT return data. Actual VAT returns could enhance the estimation of revenue forgone, in particular for TEs that are currently not within the scope of the DIAN top-down model such as the FTZ exemption. In addition, VAT returns could be used to check the robustness of the estimates obtained on the basis of national accounts data. The report identifies those TEs (such as the designation of VAT-free days) that have to be estimated using data sources other than the national accounts. Finally, the report lists VAT TEs that are currently quantified by DIAN whose measurement could be improved using alternative data sources.

2.1 The benchmark tax system for the value-added tax

This section defines the VAT benchmark and provides in italics examples of provisions that would be considered (or not) a tax expenditure (TE) based on the criteria chosen. The structure follows closely the approach followed by the Canadian TE Report (Department of Finance Canada, 2021[3]).

Tax base

The benchmark VAT base comprises domestic final consumption plus gross fixed capital formation (GFCF) by private households, the government and non-profit organizations. While VAT paid on inputs and gross fixed capital formation by businesses is recoverable, the fact that certain entities, such as the general government and non-profit organizations, cannot recover the VAT they paid on their consumption and GFCF is an integral part of the VAT benchmark and, therefore, does not give rise to a TE.1

The non-recoverability of VAT paid by businesses on GFCF in Colombia is a negative TE.

The VAT exclusion of goods and services that are taxed under the “National Consumption Tax” is a VAT TE. For example, the VAT exclusion of food and beverages consumed in restaurants and bars that are taxed at a rate of 8% under the National Consumption Tax is a VAT TE.2

The VAT exclusion applied to financial services is a TE.

If housekeeping services in Colombia are generally provided by salaried workers (who are required to pay SSCs and are subject to PIT on their income earned) rather than self-employed workers (who earn personal business income and work for several households), then the VAT exclusion on these services would not be viewed as a TE.

VAT applied to a different base other than final consumption gives rise to a TE (e.g. the VAT levied within the construction sector3).

The tax applies on a “destination basis”, that is, the tax is levied in the jurisdiction where consumption takes place, following the taxation rules set out in the OECD/G20 International VAT/GST Guidelines (OECD, 2017[4]). Hence, the VAT is applied to goods and services imported into Colombia, but not to goods and services exported from Colombia. As a result, the VAT exemption applied to exports is not considered a TE.

The exemption of services that are provided in the country and are used exclusively abroad by companies or people without business or activities in Colombia is not considered a TE.

Tax exemptions for tourism-related goods and services whose consumption takes place within Colombia, either by tax-resident or non-residents, are a TE. However, goods that are purchased by non-residents in Colombia but that are consumed outside of Colombia are not included in the VAT benchmark; the refundability of the VAT paid at the border in relation to these purchases is therefore not a TE.

The VAT exemption for tourist services provided to individuals who are not resident for tax purposes in Colombia and that are consumed within the Colombian territory, originated in packages sold by operating agencies or hotels registered in the national tourism registry is a TE.

The non-taxation of sales of goods and services by unincorporated businesses which, among other requirements, report turnover below the VAT registration threshold, is viewed as a simplification measure and thereby not as a TE.

Under the proposed VAT benchmark, a sale/ purchase that gives rise to VAT should occur via a market transaction and involve transactions that are legal. That is, the proposed benchmark seeks to identify only actionable TEs.

The non-taxation of imputed rents (i.e. the notional value of home occupancy by homeowners) on owner-occupied housing is not a TE.

The non-taxation of goods and services households produce for their own consumption (e.g. food and agricultural products) is not a TE.

The non-taxation of illegal consumption is not considered a TE as it is consumption beyond the control of national authorities.

The non-taxation of services provided by the government for free such as education and health is not considered a TE.

Exclusions applied to services provided by the private sector that are similar in nature to services provided by the general government for free are considered TEs. Identifying the revenue forgone from VAT exemptions on the private provision of services such as education and health is policy-relevant as these exemptions are well known to be poorly targeted and generally benefit mostly high-income deciles.

The non-taxation of public services provided for free to citizens but bought by the government from private businesses (e.g. outsourcing of sewage services and waste collection) is not considered a TE.4

Unit of taxation

VAT is imposed using a multi-stage system under which tax is collected by businesses on their sales of goods and services at all stages of the production and marketing chain. At each stage of production, businesses can claim tax credits to recover the VAT paid on their business inputs, so that the VAT effectively applies only to the value-added at each stage. The only tax that is not refunded is the tax collected at the last stage of the multi-stage process.

The non-taxation of fuel under the VAT at the last stage of the multi-stage process (when fuel is sold to the final consumer) is a TE.

Tax rate

The benchmark rate is the standard VAT rate in effect at any given time.

Exemptions, exclusions and reduced rates give rise to a TE.

2.2 The DIAN VAT model

Colombia applies a top-down approach to estimate revenue forgone from VAT TEs. A top-down approach aims to measure the difference between estimated potential revenue under full compliance and revenue under the benchmark by means of macroeconomic statistical data. In contrast, a bottom-up approach would start from tax return data at the firm level. Making use of national accounts product-level supply and use tables (see Table 2.1 and Table 2.2), the model allows the tax administration to estimate the potential revenue for any set of real or hypothetical VAT rates.

In the framework deployed by DIAN, it takes three steps to obtain revenue forgone from VAT TEs. First, all exemptions, reduced rates and exclusions are maintained to estimate the tax revenue under the current tax regime, assuming full compliance (i.e. potential revenue). That is, VAT is levied on all final consumption as recorded in national accounts statistics. To obtain the global (i.e. economy-wide) compliance or evasion gap, DIAN then compares the result to the actual VAT revenue that has been collected. Third, DIAN re-estimates tax revenue in the model under the benchmark tax system without exclusions, reduced rates and exemptions (i.e. benchmark revenue). The difference between revenue under the benchmark tax system and potential revenue under the current tax system, corrected for the non-compliance rate, equals revenue forgone. To obtain item-by-item estimates, DIAN only modifies a single tax rate or provision at a time, changing it from the current to the benchmark rate.5

DIAN follows a demand-side approach, which implies that the product-by-industry use table is the key data source for DIAN’s VAT model. Supply and use tables are standard elements of the System of National Accounts (United Nations, 2009[5]). In Colombia, the national statistical agency (DANE) compiles the tables, which are released with a one-year lag. DIAN therefore works with supply and use tables from the previous year, but it adjusts the data to reflect the growth of the economy. In its columns, use tables present intermediate consumption and final uses (Table 2.1 and Table 2.2). Final demand, in turn, consists of the final consumption of households and the government, gross fixed capital formation, and exports. In the rows, the uses are broken down into the products demanded in the economy. In the case of Colombia, 396 products are available in the use table. By using additional data sources, DIAN further breaks down the table into 471 products to reflect the complete list of products subject to preferential VAT rates.

Besides the use table, the second ingredient necessary to estimate potential revenue in DIAN’s model is a vector of VAT rates by product, identifying whether the goods or services are taxed at the standard VAT rate, a reduced rate, a zero rate or are excluded. DIAN then applies the VAT rate vector to all domestic uses in the economy including final consumption, intermediate consumption, and gross fixed capital formation (Table 2.1 and Table 2.2).

The fact that VAT paid on intermediate consumption can be recovered is an integral part of any VAT system, which aims at taxing domestic final consumption. Hence, VAT paid by businesses on inputs as recorded in the intermediate consumption columns of the use table needs to be deducted from potential revenue. The VAT refund matrix breaks down VAT paid on inputs into recoverable and non-recoverable VAT.

Exclusions are fundamentally different from reduced rates or exemptions. They break with the logic of the VAT system because businesses cannot recover input VAT paid on the production of excluded goods and services. To account for the impact of exclusions, DIAN estimates the share of excluded goods and services among the output of each sector in the supply table. These shares are then applied to each sector column in the intermediate demand matrix. For example, if 10% of a sector’s outputs are excluded goods and services, the model assumes that VAT paid on 10% of each of the sector’s inputs cannot be recovered. Implicitly, DIAN assumes that sectors producing excluded and non-excluded products use a uniform fraction of each of their inputs to produce the excluded output.

Table 2.1. Structure of the key macroeconomic data used by DIAN (Supply Table)

|

Industries |

Imports |

Total |

||||

|---|---|---|---|---|---|---|

|

Products |

Agricult., forestry, etc. |

Manufact. of paper |

… |

Services |

||

|

Agriculture, forestry, etc. |

Output by product by industry |

Imports by product |

Total supply by product |

|||

|

Paper and paper products |

||||||

|

… |

||||||

|

Services |

||||||

|

Total |

Total output by Industry |

Total imports |

Total supply |

|||

Note: Stylized table for illustrative purposes.

Table 2.2. Structure of the key macroeconomic data used by DIAN (Use Table)

|

Industries |

Final uses |

Total |

||||||

|---|---|---|---|---|---|---|---|---|

|

Products |

Agricult., forestry, etc. |

Manufact. of paper |

… |

Services |

Final consumption |

Gross capital formation |

Exports |

|

|

Agriculture, forestry, etc. |

Intermediate consumption by product and industry |

Final uses by product and by category |

Total use by product |

|||||

|

Paper and paper products |

||||||||

|

… |

||||||||

|

Services |

||||||||

|

Value added |

Value added by component and industry |

VA |

||||||

|

Total |

Total output by industry |

Total final uses by category |

||||||

Note: Stylized table for illustrative purposes.

Exports are exempt from VAT, both under the current tax system and the benchmark. It implies that, once exported, excluded goods and services become exempt and businesses can recover input VAT. To adjust potential revenue, DIAN estimates the export share for each excluded good or service produced in the domestic economy in the supply table. This allows DIAN to remove the recoverable input VAT paid on the production of these products from potential revenue. In effect, exports reduce the share of excluded output in each sector that DIAN has computed in the previous step.

Subsequently, DIAN removes from potential revenue the recoverable VAT paid on gross fixed capital formation in the hydrocarbon sector. Only businesses in the hydrocarbon sector can currently reclaim VAT paid on gross fixed capital formation in Colombia (article 485-2 of the TC). In the model, DIAN reduces potential revenue to account for that provision, but it subtracts the same amount (taking into account only the hydrocarbon sector) from potential revenue in both the current and benchmark scenario. The value of recoverable VAT paid on investment in the hydrocarbon sector comes from an external data source and is not determined within the model.

Removing the VAT exclusion on non-market services (e.g., public education or public health care provision) is not actionable because no transaction takes place and because the user does not pay for the service. Hence, when computing VAT revenue under the benchmark scenario, the standard rate is not applied to these services that are provided for free. For sectors that are partly market and partly non-market, DIAN deploys non-market shares it obtains from other data sources.

Finally, potential revenue is adjusted to take into account the revenue forgone linked to other TEs or tax provisions that reduce revenue and are not being captured by the model (e.g. the VAT exemption for FTZ users, VAT-free days).

Table 2.3. Illustration of the current DIAN VAT model

|

+ VAT paid on total domestic uses |

- VAT paid on inputs |

+ Non-recoverable input VAT paid on production of excluded goods |

- Recoverable VAT paid on business GFCF |

|

|---|---|---|---|---|

|

Potential revenue: Current tax system |

|

|

|

|

|

Benchmark scenario: Removal of one TE |

|

|

|

|

Note: Excludes adjustments regarding evasion and other adjustments.

2.3 General assessment

DIAN’s approach to quantifying VAT TEs is aligned with international practise. Canada, for instance, draws on national accounts and supply and use tables to estimate revenue forgone from its GST system. (Department of Finance Canada, 2021[3]).An equivalent conceptual approach can also be found in the CASE reports that calculate VAT Gaps for countries in the European Union (Poniatowski et al., 2019[6]). DIAN’s top-down model correctly captures how the VAT functions in practice and through which channels TEs determine VAT revenue forgone. As with any top-down model, the accuracy of the results ultimately depends on the quality of national accounts (i.e. the granular supply and use tables), which are the key data source for the exercise.

It should be noted that the OECD has learnt how the model operates based on technical notes as well as discussions with the DIAN experts. However, without complete access to the model (including the data tables, the tax vector, and the coding), it was not possible to verify DIAN’s actual implementation of the generally sound approach.

The OECD suggests Colombia to evaluate the possibility of applying a supply-side model in line with the IMF VAT Gap methodology (Box 2.1) to break down the compliance gap by sector and thereby improve this adjustment. The alternative supply-side model could then also be applied to compute revenue forgone on an item-by-item basis, but should in theory deliver similar results. The OECD’s suggestion to contemplate switching to the supply-side model therefore does not imply that DIAN’s model is unfit for its current purposes. The main contribution would be to obtain sectoral compliance gap estimates. The following sections explain these and other potential technical improvements of the VAT TE measurement in detail.

DIAN could gradually develop its VAT model from a purely top-down to a hybrid approach that combines the use of national accounts and VAT return data. As DIAN explores and integrates VAT return data into its TE analysis – for instance in order to break down the compliance gap and update its methodology regarding the FTZ exemption – it should be mindful of the large potential this type of data has to improve TE analysis more broadly. For example, in the future, VAT returns could be more broadly used to determine revenue forgone from certain TEs that are not included in the VAT model such as revenue forgone from the FTZ exemption. It could also use VAT returns data to check the robustness of some national accounts estimates. For instance, comparing the export share by sector in supply/use tables to the exports by business in VAT returns to check if the average obtained from macroeconomic data is sufficiently precise and to evaluate how much variation there is within each sector. DIAN might also want to check for inaccuracies in the excluded output shares by sector from the national accounts by comparing these shares to similar data from VAT returns by sector. Using VAT return data is also of paramount importance to assess non-compliance in more depth, for example by comparing individual business’s net VAT collection with the average of businesses of similar size, location and type of sector.

2.4 Potential improvements discussed with DIAN

Several potential improvements have been discussed with DIAN, which would refine the existing approach, make sure it is aligned with the suggested VAT benchmark, increase the transparency regarding revenue forgone or complement the top-down model with VAT return data when it comes to specific provisions that cannot be modelled in a macroeconomic framework.

Treatment of VAT paid on gross fixed capital formation

Under current rules, businesses in Colombia cannot reclaim the VAT paid on investment goods. The only exception is gross fixed capital formation (GFCF) in the hydrocarbon sector. Currently, DIAN estimates item-by-item TEs based on the assumption that no sector (other than the hydrocarbon sector) can recover VAT paid on gross fixed capital formation, both in the benchmark and the current tax system. Such a treatment removes the revenue impact of the non-recoverability of VAT paid on GFCF (negative TE) from the estimation of item-by-item revenue forgone. As a result, revenue forgone is overestimated. In fact, non-standard rates and the non-recoverability of VAT paid on investment are two TEs operating on the same item, but with opposite signs. That is, while revenue is lost due to lower rates (or other types of positive TEs), the non-recoverable investment VAT increases government revenue (negative TE).

The OECD made three suggestions on how to improve item-by-item transparency but also the measurement of revenue forgone linked to the investment provisions in the Colombian VAT system:

1. As already mentioned in the benchmark section, following international practise, the suggested benchmark tax system allows businesses to recover the VAT paid on total gross fixed capital formation in all sectors.

2. It would be advisable to differentiate between the revenue impact of reduced rates, exemptions and exclusions, and the non-recoverable VAT levied on investment when reporting revenue forgone by item. Presenting only the impact of the non-standard rates (as it is done in Colombia currently) overestimates total revenue forgone. On the other hand, only presenting the net (i.e. combined) impact of both the non-standard rate and the non-recoverable VAT levied on investment would not be fully transparent either. In that case, the reader of the TE report might wrongly assume that reduced rates, exemptions and exclusions have a small or even positive (for goods primarily demanded for investment purposes) impact on tax revenue.

DIAN could therefore present for each product, a decomposition of both TEs. The report could include three columns, with one denoting the total (net) revenue forgone. The other two would present revenue forgone resulting from the positive TE (what is currently reported) and from the non-recoverability of VAT paid on gross fixed capital formation (Table 2.4). As long as the VAT paid on GFCF remains non-recoverable, net revenue forgone of VAT TEs applied to a product can be negative, even after taking into account the revenue forgone of exclusions, exemptions, and reduced rates. In particular, revenue forgone might be negative for products that are mainly used as investment goods.

Table 2.4. How to present revenue forgone linked to the VAT paid on GFCF

|

Product |

Revenue forgone |

||

|---|---|---|---|

|

Total |

Exclusion/exemption/ reduced rate* (I) |

Non-recoverability of VAT paid on GFCF (II) |

|

|

Machinery |

-2 360 |

7 140 |

-9 500 |

|

Coffee |

675 |

770 |

-95 |

Note: Values included for illustrative purposes but do not reflect actual estimates.

* Revenue impact of rate variation if rules on investment VAT remain unchanged.

3. Once reported separately, the negative TE from non-recoverable VAT on gross fixed capital formation needs to be measured correctly. Its measurement has to take into account that all businesses can reclaim VAT paid on investment under the suggested benchmark, both corporations and unincorporated businesses (which are included in the GFCF of the household sector in national accounts). On the other hand, private households and the government cannot reclaim VAT paid on investment under the suggested benchmark.

To obtain the correct estimate, the demand for GFCF in the use table needs to be split, for each product row, into the share coming from the government, households, and the corporate sector – and only the VAT paid by the corporate sector should be considered recoverable in the benchmark scenario. On the product level, this type of data is usually not available. However, total GFCF is typically broken down into broad asset categories (e.g., dwellings, machinery and equipment etc.) and by institutional sector in national accounts. Furthermore, unincorporated businesses, are part of the household sector in national accounts but can recover VAT paid on investment under the suggested benchmark (as they are not treated differently than incorporated businesses), representing an additional complication.

In the absence of a split between GFCF by private households and unincorporated businesses, DIAN could assign all housing investment within the household sector to private households. Specifically, when subtracting recoverable VAT under the benchmark scenario, it would first remove the investment in dwellings by the household sector from the total GFCF recorded in the construction row of the use table. Other GFCF within the household sector could be assigned to unincorporated businesses that can recover VAT paid on investment. A similar exercise needs to be performed for government investment. However, GFCF by the government is not concentrated on one asset. Therefore, the asset categories in the national accounts must be matched to the products in the use table for all GFCF assets purchased by the government. Ideally, DIAN can obtain a precise correspondence table between the two classifications (product rows in the use table and asset categories integrated the national accounts) from the statistical office. In the absence of such a table, the OECD proposed a mapping that would use the available information to the best extent possible.

Breaking down the global compliance gap

Currently, DIAN calculates an economy-wide VAT compliance gap, represented by the ratio of actual VAT revenue to the modelled potential revenue under the current tax system. Subsequently, revenue forgone is adjusted by the compliance gap (or evasion rate) to ensure that revenue lost due to non-compliance is not wrongly assigned to the revenue forgone of VAT TEs. Without any correction, absolute revenue forgone would be overestimated for each item because part of the difference between potential VAT revenue and the benchmark revenue is caused by non-compliance.

Relying on a global compliance gap to estimate product-level TEs is problematic, however. The current approach overestimates revenue forgone for goods and services produced in sectors for which non-compliance exceeds the global average while the reverse applies to goods and services from highly compliant sectors.

To break down the compliance gap, DIAN needs to estimate potential revenue by sector, which it cannot do within its current demand-side framework. To obtain sector-level compliance gaps, potential revenue by sector (using the supply-side approach) needs to be compared to actual revenue from sector-coded tax returns that DIAN has access to.

The IMF VAT GAP model offers a framework to decompose total revenue losses into sector-level compliance and policy gaps (Hutton, 2017[1]). DIAN could leverage the IMF approach to break down its economy-wide compliance gap by sector. Then, these more granular compliance gaps can be applied to revenue-forgone estimates for the different products. However, DIAN would need to re-estimate potential revenue by sector using the IMF model because, unlike DIAN, the IMF follows a supply-side approach. The national accounts identities suggest that, in theory, the demand-side approach applied by DIAN and the supply-side approach applied by the IMF should deliver the same result for revenue forgone by product.

An obvious question would be whether it makes sense for Colombia to switch entirely to a supply-side approach – not only to estimate sectoral compliance gaps but also to estimate the revenue forgone by product. Since the IMF model needs to be introduced in any case to obtain potential revenue for the compliance gap, it would be straightforward to apply the benchmark rate instead of the current rate – and also calculate revenue forgone. However, the supply-side approach requires more data tables (e.g., granular data on exports, imports and investment by product and sector). If approximations are necessary, the supply-side approach will likely deliver less precise results.

Two options are available to DIAN:

1. Switch completely to a supply-side approach. DIAN can switch to estimating revenue forgone by product based on the supply table (“supply-side approach”) if reliable data sources are available and then correct revenue forgone by sectoral compliance gaps obtained by the IMF methodology.

2. Use the supply-side approach only to calculate sectoral compliance gaps. DIAN can continue estimating revenue forgone by product based on the use table (“demand-side approach”), but then correct revenue forgone by sectoral compliance gaps obtained by implementing the IMF methodology. It may be worth calculating revenue foregone by item based on both the supply table and the use table and comparing the results to assess the accuracy of the two options.6

If DIAN decides to break down the compliance gap by sector, it could apply the IMF VAT Gap methodology as expounded in Box 2.1. Some adjustments would be necessary, however, to align the framework with how the VAT system works in Colombia.

DIAN can follow the five steps outlined in Box 2.1 to compute potential revenue by sector under the current tax rate regime. When estimating compliance gaps, DIAN should assume VAT on investment is not recoverable (except for the hydrocarbon sector) as it currently does.7

Further adjustments that DIAN currently applies and that aim at aligning the national accounts with the way that the VAT functions in practice (e.g., excluding consumption by residents abroad) should also be maintained. This applies to how DIAN deals with the non-recoverability of input VAT paid on excluded products. In the supply-side approach, it would continue to estimate the share of excluded products among each sector’s output and disallow the sector to recover VAT paid on the same share of its inputs.

The methodology outlined in Box 2.1 also discusses how actual revenue from VAT returns can be calculated to ensure it is consistent with how potential revenue is estimated from the supply and use tables. For example, tax payments need to be reallocated from the year of payment to the year the taxable transaction took place. One additional difficulty concerns the fact that some businesses do not actually transfer money to the government when they are liable to pay VAT but rather reduce the (non-refundable) excess credits they have accumulated over past periods. DIAN could check total net assessments (as defined in Box 2.1) against net collections for earlier years to evaluate the magnitude of the difference and the importance of accumulated excess credits. It is also crucial for DIAN to verify with the statistical agency how businesses operating in multiple industries are assigned to individual sectors, and whether this is broadly in line with how the same is done in VAT returns.

The last step explains how DIAN could apply the compliance gap by sector to the revenue forgone by product if it decides to maintain the demand-side approach to quantify the VAT TEs. For each product, the compliance gap would be equal to the weighted average of compliance gaps found in the industries that produce the product. In detailed supply and use tables, usually only one sector produces a certain good. In that case, no weighted average would be necessary because DIAN would simply make use of that sector’s compliance gap.8

Box 2.1. The IMF VAT Gap methodology

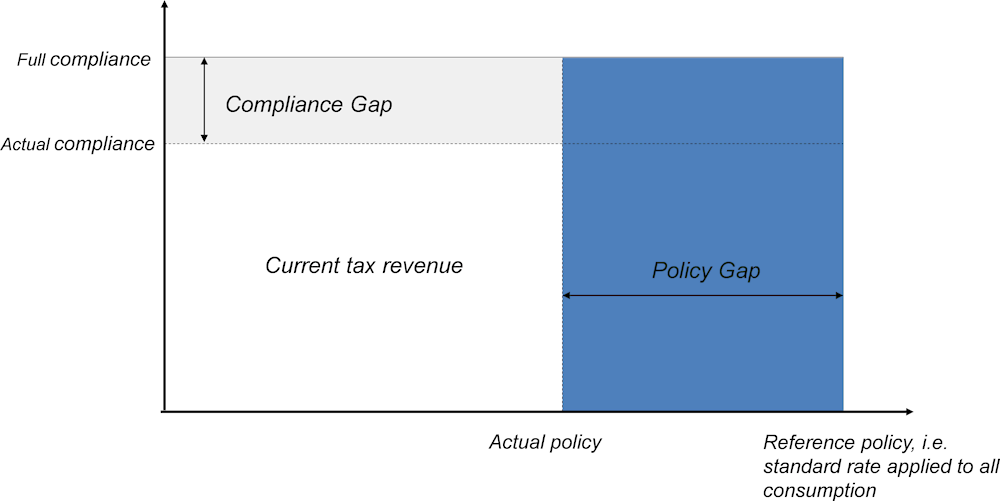

The International Monetary Fund has developed a top-down framework to estimate revenue gaps in the VAT (Hutton, 2017). It allows tax administrations to quantify and decompose revenue losses by industry sector. For each sector, the total gap is broken down into compliance and policy gaps. The compliance gap contrasts actual tax receipts with how much VAT a country could collect under the current rate regime in the absence of tax evasion. The policy gap assesses the revenue loss from non-standard VAT rates and exclusions. The two key data sources are detailed national accounts tables and by-sector information on actual VAT collections.

Even though the policy gap (i.e. VAT rates below the standard rate and exclusions) is similar to revenue forgone in TE analysis, the two concepts are not identical. For example, in the standard configuration, the policy gap assumes full compliance (i.e. does not deduct the rectangle in the upper right corner of Figure 2.1). In contrast, revenue forgone estimates are adjusted for non-compliance by assuming tax compliance would not change when moving to the benchmark tax system (i.e. deducts the rectangle in the upper right corner of Figure 2.1).Furthermore, the IMF reports policy gaps on the industry level whereas revenue forgone is typically presented by product. These discrepancies originate from the different goals of the two undertakings. The IMF VAT GAP framework aims at identifying high and low-compliance sectors, as well as those industries that strongly benefit from the current set of reduced rates and exclusions. In contrast, TE reports quantify the revenue forgone from individual product-level tax provisions that deviate from a benchmark tax system.

Infographic 2.1. Breakdown of policy and compliance gaps

The IMF follows a supply-side approach when estimating potential revenue. In national accounts, the supply table records output from domestic production. It constitutes the starting point of the IMF’s revenue estimate. Broadly speaking, the IMF models VAT as a tax on value-added minus exports plus imports. First, the model applies the respective VAT rates to domestic output. Then, potential revenue is corrected to account for: (i) the recoverability of VAT paid on inputs and investment, (ii) the inclusion of imports in the VAT base and (iii) the VAT exemption of exports.

The following steps and data sources are required to estimate potential VAT revenue () by sector () in the IMF VAT GAP framework:

The model starts from the VAT levied on the output of each sector in the supply table. The vector of actual VAT rates by product () is multiplied by each sector column in the supply table. In each column, the sum of goods and services (in the rows) delivers the sector total.

As part of any VAT system, businesses can recover VAT paid on inputs (). Hence, the potential revenue represented by the intermediate consumption columns in the use table multiplied by the tax vector needs to be subtracted. In each column, the sum of goods and services (in the rows) delivers the sector total. The same applies to VAT paid on capital formation ().

If a product-by-industry investment matrix is unavailable, the second-best option would be to check whether the use table records capital formation as a row at the very bottom. If not, capital formation by sector could be approximated based on the consumption of fixed capital recorded as part of total output at the bottom of the use table. If neither of these sources is available, value-added by sector could proxy the share of total capital formation assigned to each sector.

To account for the non-recoverability of input and investment VAT paid on the production of excluded goods and services, one estimates the share of excluded products among each sector’s output and disallow the sector to recover VAT paid on the same share of its inputs.

Imports () are subject to VAT but not part of the domestic output as recorded in the supply table. Hence, the potential revenue represented by each sector column () in the import use table multiplied by the tax vector by product () needs to be added. In each column, the sum of goods and services (in the rows) delivers the sector total. If the statistical office does not compile an import use table by product and sector, the UN Handbook on Supply and Use Tables and Input-Output Tables (United Nations, 2018[7]), in particular chapter 8, could provide guidance on how DIAN could proceed.

Exports () are not subject to VAT but part of the domestic output as recorded in the supply table. Hence, the potential revenue represented by the sector-by-product export matrix multiplied by the tax vector needs to be subtracted. For each sector column, the sum of goods and services (in the rows) delivers the sector total.

Unfortunately, such a matrix is often not available. In that case, export shares by sector can be applied to total sector output by product in the supply table

Potential revenue by sector is a function of the four components.

To obtain the policy gap by sector, potential revenue is computed twice. First, the tax vector carries the set of current VAT rates (). Then, it consists of the standard VAT rate () for each product, removing reduced rates, exemptions and exclusions. The ratio between the two measures defines the policy gap.

The compliance gap requires information on the actual tax revenue by sector. Choosing the right measure for actual revenue is not straightforward, however. To be aligned with the national accounts, revenue should be assigned to the tax period rather than the period in which the tax is transferred to the government. Otherwise, delays in payment or the time schedule of refund would affect the compliance gap. The natural approach would be to work with the net VAT self-assessed by businesses as recorded in their annual VAT returns. However, not all declared VAT will eventually be collected – and some businesses will be allowed to recover less VAT than initially declared.

The IMF recommends using “accrued collections”, a measure that combines actual tax payments for debits and assessments for VAT credits. As a first step, VAT payments received from each business in a sector are reallocated to the tax period. Thereby, the measure avoids relying on self-assessed tax liabilities. However, businesses regularly use credits from earlier periods to reduce the VAT burden in the current tax period. Merely reallocating actual tax receipts would hence lead to a biased compliance gap. For example, a zero VAT liability in a given tax period does not necessarily mean that no VAT should be assigned to that period. The business could have accumulated excess credits that it used up in the tax period. Reductions in excess credit therefore need to be counted as VAT liabilities, which requires data on the stock of excess tax credits by businesses.

Once potential revenue () and actual revenue () are available at the sector level, the ratio between the two defined the compliance gap.

The supply framework warrants one important adjustment to potential revenue. The output of the wholesale and retail sector is not recorded as a regular column in the supply table, but is only available in the form of trade margins. At the same time, the commercial sector collects net VAT, which will appear in the sector-coded tax returns. Without adjustment, the compliance gap of sectors would be overestimated because the national accounts record VAT levied on trade in the sector producing the product. In tax returns, on the other hand, parts of the value-added would appear in the wholesale and retail sector. To make the national accounts and tax return data consistent, customs data can be used to reallocate imports to the agent of import (e.g., a trading business), rather than the final destination. If a full import use table is available, one can assign the entire final consumption column to the wholesale and trade sector. If available, business surveys allow performing the same adjustment for exports. The statutory rate for the wholesale and retail sector can be computed as a weighted average of the tax rates applicable to all (product-level) trade margins in the supply table.

Source: Based on (Hutton, 2017[1]).

Revenue forgone from Free Trade Zones

Businesses located in Free Trade Zones (FTZs) enjoy a VAT exemption on purchases from abroad and on inputs they buy from the national territory. However, FTZ businesses are obliged to charge VAT if they sell goods and services back to the domestic economy following a special tax base calculation.

Currently, DIAN estimates revenue forgone from FTZs outside the VAT model, focusing only on the TE that arises from the exemption of goods and services sold by domestic businesses to FTZ users (disregarding the import exemption). To calculate revenue under the benchmark, DIAN takes the effective average VAT rate on imports to the entire Colombian economy and applies it to the total value of goods and services sold to businesses in FTZs. The effective rate aims at taking into account that some goods and services are excluded or taxed at reduced rates. Finally, DIAN subtracts the VAT actually collected by FTZ businesses from this “benchmark” revenue to determine the TE.

This procedure is incorrect as it compares the input VAT the FTZ user would have paid in the absence of the exemption to the actual VAT the FTZ user currently collects when it sells goods and services that are not excluded to the national territory. The latter value does not only include the value of the inputs involved in the production but also the value added by FTZ users in the production of these goods and services and hence is not comparable. Furthermore, the latter value corresponds to a tax liability that arises in any case – whether FTZs exist or not. Just like domestic businesses, FTZ businesses are obliged to declare and charge VAT on sales to the national territory. It is hence unclear why such a figure would not also be part of the benchmark revenue collected in the absence of FTZs. As re-sales from FTZs to the national economy are subject to VAT and VAT is levied on final consumption occurring in FTZs, all revenue forgone linked to the FTZ VAT exemption originates from the existence of other TEs, in particular exclusions. In the absence of exclusions, VAT revenue forgone from the FTZ exemption would be zero.

Revenue forgone from the FTZ VAT exemption arises only in two cases:

Excluded goods and services are sold from the national territory to FTZ businesses;

FTZ businesses sell excluded goods and services to the domestic economy.

In the first case, when a domestic business sells a VAT excluded good to a FTZ user, the FTZ turns the VAT exclusion applied to the good into a VAT exemption. The FTZ user does not pay any VAT on its purchase but the domestic business (selling the good to the FTZ user) can now (because of the exemption rather than the exclusion) recover the VAT it had paid on the inputs purchased to produce the VAT excluded good. In the absence of FTZs (or if one domestic business sells the excluded good to another domestic business), the domestic business would not be allowed to receive a refund for the input VAT paid on the production of excluded goods. Hence, because of the FTZ exemption, the government loses revenue (it now has to refund the domestic business the input VAT). Therefore, in the first case, the FTZ exemptions result in a positive TE.9

In the second case, when a FTZ business sells a VAT excluded good or service to a domestic company, the FTZ business did not pay VAT on the inputs it used to produce the excluded good in the first place (because all inputs it purchases from the national territory or from abroad are VAT exempt). However, without the FTZ VAT exemption, the same business would have paid VAT on all the inputs it has purchased and, because it used these inputs to produce excluded goods and services, the business would not have been allowed to receive a refund for the input VAT it paid. Again, because of the FTZ exemption, the government loses revenue (it does not collect the unrecoverable input VAT it normally collects when businesses produce excluded goods). Therefore, in the second case, the FTZ exemption results in another positive TE.10

Whether revenue forgone from these two types of cases is large or not depends on the type of goods FTZ users buy from the national territory and the goods and services FTZ users sell to the domestic territory. If most inputs are excluded goods or if most outputs benefit from a VAT exclusion, the revenue forgone might be significant. However, even in the case in which this revenue forgone was small, this would not imply that economic distortions caused by FTZs would be negligible. A TE can shift the burden between taxpayers, induce behavioural responses, or increase incentives for tax fraud, but these effects are not reflected in revenue forgone estimates.

To estimate VAT revenue forgone from FTZs, DIAN should first define a benchmark, which removes the VAT exemption on FTZs but keeps in place all other TEs (exclusions, reduced rates, exemptions). Such an approach would allow DIAN to isolate VAT revenue forgone linked to FTZs from other VAT TEs.

Quantifying revenue forgone from FTZs requires determining the relative weight of excluded goods and services among the output of businesses involved in sales between FTZs and the domestic territory. The OECD presented two options to DIAN:

1. DIAN can rely primarily on data from tax returns. In light of the type of information available in VAT returns, different strategies need to be used for each of the two scenarios that give rise to revenue forgone.

a) Revenue forgone from the recoverability of input VAT when domestic businesses sell excluded goods to FTZ users: Unfortunately, VAT returns currently only ask domestic businesses to specify total sales to FTZs.11 It hence does not seem possible to determine the share of excluded goods and services among the sales made by domestic businesses to FTZ users (Table 2.5). However, domestic businesses need to declare the sales of excluded goods and services to domestic users in their VAT returns.12 DIAN could therefore assume that sales of excluded goods and services to FTZ users mirror the overall share of excluded goods among domestic businesses’ sales as implicitly available in their tax returns. 13 Once DIAN has found, for each domestic business, a proxy for the share of excluded goods among non-FTZ-related sales, other information available in the VAT return would allow DIAN to estimate the size of the excess recoverable input VAT linked to the fact that sales to FTZs are treated similarly to exports and are thereby VAT exempted. For each domestic business, the VAT returns include a breakdown of exempt, reduced rate, and excluded inputs, which enables DIAN to calculate the total input VAT paid by each domestic business. Finally, DIAN would multiply the excluded-goods-to-FTZ-users output share (e.g. 2% of the business’ output are excluded goods sold to TZs) and the total input VAT paid. The result approximates the amount of input VAT that was recoverable by the domestic business because of the FTZ VAT exemption.

For each domestic business with sales to FTZ users:

is obtained from tax returns.

b) Revenue forgone from the non-payment of input VAT when FTZ businesses sell excluded goods and services to domestic users: For FTZ businesses, the amount of excluded goods sold to the domestic economy can be obtained from the import VAT declarations (Form 500), which ask businesses to specify the imported products.14 However, for FTZ businesses, information on the breakdown of inputs purchased is missing (Table 2.5). This is because FTZ businesses do not submit the standard VAT declaration but only declare as imports their sales to the domestic territory (they do not pay VAT on their inputs). Hence, DIAN would have to find a proxy for the amount and composition of inputs (both purchased from the national territory and abroad) used by FTZ businesses to produce excluded goods sold to the national territory. One option would be to first determine the sector of each FTZ business15 and then draw upon the supply and use tables to estimate the ratio of input VAT to output for the respective sector. Estimating total input VAT per sector would require multiplying the sector column in the use table and the current-rate VAT vector. Subsequently, DIAN would apply that ratio to the total sales of excluded goods by the FTZ business to the national territory. DIAN could then estimate the VAT that FTZ businesses would have paid (and would not have been able to recover) if they had produced the same excluded goods in the domestic territory and sold them to the domestic market.

For each FTZ business in sector with sales to domestic users:

requires multiplying the sector column in the use table and the current-rate VAT vector. The output of the sector is estimated from the supply table.

Table 2.5. Missing data linked to sales involving Free Trade Zone businesses

|

Breakdown of inputs |

|||

|---|---|---|---|

|

Available |

Not available |

||

|

Share of excluded sales |

Available |

FTZ to domestic users |

|

|

Not available |

Domestic to FTZ users |

||

2. If detailed VAT returns cannot be used in the way that was suggested above, DIAN can combine a more limited use of VAT returns with drawing upon information about production structures recorded in the supply and use tables. Such an approach would only require DIAN to determine from VAT returns (i) the sector of businesses and (ii-a) total sales to FTZs (for domestic businesses) or (ii-b) from FTZs to the domestic territory (for FTZ businesses). Based on this information, DIAN could then assume that transactions involving FTZs mirror the average activity of businesses in the respective sector, as recorded in supply and use tables. For example, if the supply table states that 10% of a sector’s output consists of excluded goods and services, the same share would be applied to FTZ-related sales. Furthermore, the approach assumes (as in 1b) that the composition of inputs used for sales involving FTZs is sufficiently similar to the average composition of inputs in the sector. Based on the supply and use tables, DIAN would estimate the average value of inputs necessary to produce one unit of each sector’s output. Finally, combining for each business (i) total sales to or from FTZs, (ii) the sector, (iii) the average share of excluded goods and services among the output of the sector (from the supply table), (iv) the average size and composition of inputs per unit of the sector’s output (from the use table) and (v) the vector of current VAT rates, DIAN could proxy the revenue forgone (i.e., recoverable input VAT) linked to the FTZ VAT exemption. The difference with the first option is that this approach does not require DIAN to estimate the share of excluded goods for each business.

For each domestic business in sector with sales to FTZ users:

For each FTZ business in sector s with sales to domestic users:

requires multiplying the sector column in the use table and the current-rate VAT vector. The output of the sector is estimated from the supply table.

The share of excluded goods among total output of sector s () can be obtained from the supply table as well (and is readily available from the VAT model).

DIAN can choose to integrate the measurement of the FTZ VAT exemption into its existing VAT model. In the model, the impact of the FTZ exemption applied to excluded goods would be similar to the export of excluded goods (exclusions turning into exemptions), which are already reflected in the model. The model would remain unchanged when calculating revenue forgone from other TEs. Both for the benchmark and for potential revenue, the share of output going to or coming from FTZs is set to zero. However, revenue forgone of other TEs would be affected because the compliance gap estimate will be impacted by the FTZ revenue forgone adjustment.

Contrary to common practice, DIAN should modify potential revenue rather than benchmark revenue when quantifying the FTZ exemption.16 To calculate revenue forgone from the FTZ VAT exemption within the model, the share of excluded output of each sector can be used to approximate the share of excluded output sold to FTZ users or sold by FTZ businesses to domestic companies (as in option 2). Alternatively, more precise estimations can be derived from VAT returns covering FTZ-related sales (following the suggestions in option 1). For each sector, excluded output produced in FTZs and sold to domestic users or produced in the domestic economy and sold to FTZ users should be aggregated and divided by total sector output. For example, DIAN may determine that 1% of the output of sector 1 are excluded goods sold between domestic companies and FTZ users. Incorporating these shares into the model would increase recoverable input VAT (as excluded goods become exempt through the FTZ exemption) in each sector, which would reduce government revenue. Consider the following example: Without FTZs, 10% of output in sector 1 would be excluded goods. In such a scenario, the model assumes that 10% of input VAT paid by businesses in sector 1 cannot be recovered (and that 90% of the input VAT paid can be recovered). Let’s assume that that 50% of the output in sector 1 is sold to FTZ businesses. This would imply that 50% of the excluded goods sold by businesses in sector 1 are VAT exempt. As a result, only 5% of the input VAT paid cannot be recovered and 95% of the input VAT paid can be recovered. As a result, the potential revenue is reduced by reducing the shares of excluded output (because FTZs turn exclusions into exemptions) and by increasing the share of recoverable VAT by sector.

To calculate the compliance gap, actual VAT revenue would be compared to potential revenue in the presence of FTZs. The fact that FTZs reduce potential revenue is thereby already taken into account. As a result, the compliance gap is not inflated and there is no need to adjust it further.

If DIAN does not integrate FTZs into the model, it needs to adjust potential revenue (i.e. subtract the revenue forgone from FTZs) when it estimates the compliance gap in the model. Otherwise, when comparing actual revenue to potential revenue, the model would wrongly assign the revenue forgone from FTZs as VAT non-compliance. The result would be an inflated estimate of the compliance gap, which in turn would bias downward all TEs.

To a varying degree, the suggested approaches rely on the assumption that transactions between FTZs and the national territory are comparable to other business transactions in terms of the share of excluded goods and services sold, either on the level of the business or at the sector level. This may not be correct as the VAT exemption can incentivize FTZ businesses to specialize in the production of excluded goods and services – and domestic businesses to route excluded goods and services through FTZ businesses before re-selling them to the domestic market. DIAN should attempt to evaluate the extent to which such behaviour is actually taking place. Domestic businesses and FTZ businesses may be asked to provide more detailed information to DIAN, which would serve different causes, including improving the accuracy of the measurement of VAT TEs.

2.5 Impact of tax expenditures that are currently not reported

Table 2.6 lists tax provisions whose revenue foregone are currently not measured. Any VAT TE that is not measured within the DIAN model (or that is outside the model and for which potential revenue is not adjusted) leads to an overestimation of the compliance gap. In order to avoid this bias, these TEs should be measured – if not by using the DIAN VAT model, then through other means – such that the potential VAT revenue can be adjusted accordingly when computing the VAT compliance gap. Priority should be given to the largest VAT TEs; TEs that are expected to have low revenue foregone or for which the estimation would be time consuming and complicated can be given lower priority. Even if revenue forgone cannot be measured, the TE report should list these TEs in order to increase transparency. If revenue forgone can only be determined with a high degree of uncertainty, an estimate may be included to provide an order of magnitude, but in this case, the report should indicate that the revenue foregone estimate is highly uncertain. Table 2.6 includes preliminary recommendations about the VAT TEs that are currently not reported and that could be measured with priority, based on the size of the expected revenue forgone and based on data availability other than information included in the national accounts.

The information included in Table 2.6 is based on a comparison of the full list of VAT exclusions, exemptions and reduced rates with the information that is included in the Marco Fiscal de Mediano Plazo (MFMP) (Minhacienda, 2021[8]). As the MFMP does not report revenue forgone on a product-by-product basis but rather lists TEs within groups, it is not straightforward to determine whether a TE is currently measured or not by DIAN. The list provided below is therefore tentative. Annex E provides a list of all TEs within the VAT that have been identified in Colombia, based on the VAT benchmark proposal. The list could serve as a template for the list of TEs that DIAN should aim at including in its annual TE report.

The consumption of food and beverages in restaurants and bars is excluded from VAT and, instead, is taxed under the National Consumption Tax at a rate of 8%. The National Consumption Tax itself would be included in the benchmark tax system. As a result of exchanges between the MOF, DIAN and the OECD in the context of the elaboration of this Review, DIAN has included an estimate of the revenue forgone from the VAT exclusion of food and beverages in restaurants and bars in the latest edition of its MFMP for the first time (Minhacienda, 2022[2]). DIAN is advised to continue estimating the revenue forgone from this exclusion and to continue highlighting that the consumption is taxed under the National Consumption Tax.17 In addition, DIAN could provide information in the report on the revenue generated by the National Consumption Tax that is applied to food and beverages consumed in restaurants and bars. In the future, measuring revenue forgone from this exclusion would ideally apply a sector-specific VAT compliance gap for bars, restaurants and other businesses that sell food. While such an estimation might be challenging, it would add significant value and would therefore be worthwhile to be undertaken.

Finally, DIAN could include a separate section on VAT measures introduced during the pandemic. Table 2.7 presents transitory VAT relief and recovery measures introduced during the pandemic. The expected revenue foregone of these measures should be deducted from potential revenue that is determined using the DIAN VAT model and the revenue forgone of these measures could be reported separately.

Table 2.6. Permanent VAT TEs currently not reported in the Marco Fiscal de Mediano Plazo (MFMP)

|

Not listed as a TE nor revenue forgone measured |

Potentially large revenue forgone |

Data for measuring revenue forgone outside the model likely available |

|---|---|---|

|

Exclusions |

||

|

Food and beverages served in restaurants, cafeterias, ice cream shops, fruit shops, bakeries or take away, alcoholic beverages consumed in bars and discotheques taxed under National Consumption Tax |

√1 |

|

|

Import of goods subject to postal traffic under USD 200 |

√ |

√ |

|

Goods and services sold or imported to overseas archipelago department of San Andrés and Providencia |

||

|

Imports of food for human and animal consumption from neighboring countries to Vichada, Guajira, Guainía and Vaupés |

||

|

Sale of goods for human and animal consumption, clothes, medicines for human and veterinary use, hygiene articles and building materials in Guainía, Guaviare, Vaupés and Vichada Departments and Amazonas only if they are used within the corresponding department borders |

||

|

Sales of bicycles, motorcycles, motocross and spare parts in Amazonas, Guainía, Guaviare, Vaupés and Vichada |

||

|

Products that are purchased or introduced to the department of Amazonas within the framework of the Colombian-Peruvian agreement and the agreement with the Federative Republic of Brazil. |

||

|

Supply of airplane fuel for national air transport services (passenger and cargo) from and to Guainía, Amazonas, Vaupés, San Andrés y Providencia, Arauca and Vichada |

||

|

Bicycles, electric bicycles, electric scooters, skates, skateboards, electric skateboards, scooters, and electric scooters, up to 50 UVT (USD 470 approx.)2 |

√ |

√ |

|

Desktop or laptop computers whose value does not exceed 50 UVT (USD 465 approx.)2 |

√ |

√ |

|

Smart mobile devices (tablets and cell phones) whose value does not exceed 22 UVT (USD 210 approx.)2 |

√ |

√ |

|

The sale or import of machinery and equipment for the development of projects or activities that are registered in the National Registry for the Reduction of Greenhouse Gas Emissions |

√ |

√ |

|

Imports of machinery and equipment for recycling, waste disposal and treatment and water treatment |

||

|

Imports for diplomatic missions use |

||

|

Objects with artistic, cultural and historical interest purchased by museums part of the National Museum Network and public entities |

||

|

Exemptions |

||

|

Tourist services provided to residents abroad that are used in Colombian territory, originating from packages sold by operating agencies or hotels registered in the national tourism registry |

√ |

√ |

|

Tourist packages sold by hotels registered in the national tourism registry to operating agencies, provided that the tourist services have to be used in the national territory by residents abroad |

√ |

√ |

|

VAT free days (clothing, appliances, toys, sports items, school supplies, goods and supplies destined to the agricultural sector)2 |

√ |

√ |

|

Solar panels |

||

|

Complete passenger public transport motor vehicles and individually purchased motorized chassis and bodywork to form a new complete public passenger transport motor vehicle. |

||

|

Reduced rates |

||

|

Passenger air tickets, related services and the administrative fee associated with their marketing |

√ |

√ |

Note 1. DIAN has included an estimate for the first time in the MFMP 2022 (Minhacienda, 2022[2]).

Note 2. DIAN already corrects potential revenue from the VAT model considering these TEs. However, the revenue forgone from these TEs is not published separately.

Table 2.7. Transitory VAT relief and recovery measures introduced during the pandemic

|

Not listed as a TE nor revenue forgone measured |

Potentially large revenue forgone |

Data for measuring revenue forgone outside the model likely available |

|---|---|---|

|

Exclusions |

||

|

Artisan crafts (Law 2068 of 2021) |

||

|

Restaurants under franchise agreements (Law 2068 of 2021) |

√ |

√ |

|

Exemptions |

||

|

Hotel and tourism services (Law 2068 of 2021) |

√1 |

√ |

|

Mobile phone plans (voice calls and Internet) up to two UVTs during 4 months (Decree 540 of 2020) |

||

|

Import of cars for the transport of passengers or cargo until 31 December 2021 (Decree 789 of 2020) |

√ |

√ |

|

Import and sale of supplies indispensable for the prevention and the provision of the medical services against COVID-19 (Decree 438 of 2020; Decree 551 of 2021) |

||

|

Reduced rates |

||

|

Flight tickets up to December 20222 |

√ |

√ |

|

National air fuel Jet A1 and/or air fuel 100/130 |

||

|

Refunds |

||

|

VAT paid by some sports organizations during some athletic events in 2021 and 2022 |

Note 1. DIAN has included an estimate for the first time in the MFMP 2022 (Minhacienda, 2022[2]).

Note 2. DIAN already corrects potential revenue from the VAT model considering these TEs. However, the revenue forgone from these TEs is not published separately.

2.6 Suggested steps to estimate VAT revenue forgone

The analysis and recommendations presented in the previous sections leads to the following steps to estimate revenue forgone on an item-by-item basis:

1. Estimate revenue forgone from FTZs and other TEs that are not part of the top-down model (see previous sections).

2. Calculate potential revenue under the current tax system within the top-down model, and correct it for the amount obtained in the previous step (ideally by sector).

3. Access and compile actual by-sector VAT revenue from tax return data. Estimate the compliance gap by contrasting actual revenue with the model-based potential revenue (ideally by sector).

4. Estimate revenue forgone from product-level provisions within the top-down model and correct the amount by the compliance gap.

2.7 Additional potential improvements regarding VAT revenue forgone measurement

Finally, DIAN may also want to evaluate the benefits of using tax return data and other sources of information to check the robustness of the estimates that are derived from the VAT model.

In addition, there are some TEs currently measured in the VAT model that possibly could be measured more precisely using other data sources. For example:

The exemption on internet connection and access services from fixed networks of residential subscribers in socioeconomic levels 1 and 2. It may be worth exploring whether telecom companies can provide DIAN with the value of this consumption.

Revenue forgone from the VAT exclusion on financial services is likely not well captured in the national accounts data. This is an area in which, robustness checks using additional data could improve the measurement significantly. It may also be worth acknowledging in DIAN’s TE report that the current estimates of this TE may not be very reliable.

References

[9] Asociación Nacional de Empresarios de Colombia (2019), Estudio de Impacto Jurídico, Económico Y Fiscal De Las Zonas Francas.

[3] Department of Finance Canada (2021), Report on Federal Tax Expenditures - Concepts, Estimates, Evaluations.

[1] Hutton, E. (2017), “The Revenue Administration–Gap Analysis Program: Model and Methodology for Value-Added Tax Gap Estimation”, IMF Technical Notes and Manuals 4.

[2] Minhacienda (2022), Marco Fiscal de Mediano Plazo 2022.

[8] Minhacienda (2021), Marco Fiscal de Mediano Plazo 2021.

[4] OECD (2017), International VAT/GST Guidelines.

[6] Poniatowski, G. et al. (2019), Study and Reports on the VAT Gap in the EU-28 Member States: 2019 Final Report, CASE-Center for Social and Economic Research.

[7] United Nations (2018), Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications.

[5] United Nations (2009), System of National Accounts 2008.

Notes

← 1. Private households, the government and non-profit organizations cannot recover input VAT under the multi-stage VAT system. Hence, for VAT purposes, their investment activity is similar to final consumption. State-owned companies are treated for benchmark purposes as private companies.

← 2. This report follows the terminology used in Colombia with VAT exclusions referring to VAT exemptions in the OECD terminology and exemptions referring to zero-rated goods or services.

← 3. In this case the tax is levied exclusively over the service fees obtained by the constructor. When fees are not agreed upon, the tax will trigger on the profit of the builder. The only input VAT that can be credited is input VAT directly associated with the provision of the service. VAT paid over costs and expenses necessary for the construction of the building are non-creditable.

← 4. Even if this case may be debatable, charging VAT on these services would be impractical and would not lead to an increase in revenue. For this reason, the report recommends not listing or measuring it as a TE.

← 5. Colombia currently applies an additional 3% downward adjustment to the resulting estimate.

← 6. Note that revenue-forgone estimates require less granular data than the estimation of compliance gaps by sector. For example, a product-by-sector split of investment is necessary to obtain potential revenue by sector but not to obtain potential revenue by product.

← 7. The proposed changes to measuring investment VAT outlined above only refer to the calculation of benchmark revenue within the model.

← 8. Similar to the economy-wide compliance gap, the calculation assumes that the same compliance gap applies regardless of whether the output is used (i) as an intermediate input or (ii) goes to final demand.

← 9. See Scenario 3 in Annex B for a graphical representation.

← 10. See Scenario 4 in Annex B for a graphical representation.

← 11. See box 33 in the Form 300 (Declaración del Impuesto sobre las Ventas – IVA).

← 12. See box 39 in the Form 300 (Declaración del Impuesto sobre las Ventas – IVA).

← 13. If DIAN can reconstruct these data points from alternative sources like the Export Declarations (Form 600) submitted by domestic businesses or the “Formulario de Movimiento de Mercancías”, these breakdowns should be preferred over the approximations presented here.

← 14. Note that it is not necessary to determine whether the FTZ business used inputs from the national territory or from abroad. It is sufficient to know or approximate the total value of excluded goods sold from FTZ businesses to domestic users.

← 15. The sector of each business can be obtained based on its tax identification number. There also exist studies that have already assigned all FTZ businesses to sectors (Asociación Nacional de Empresarios de Colombia, 2019[9]).

← 16. Benchmark revenue could be viewed as equivalent to the potential revenue scenario DIAN has estimated so far.

← 17. The National Consumption Tax was not levied during this year as part of the temporary COVID relief measures.