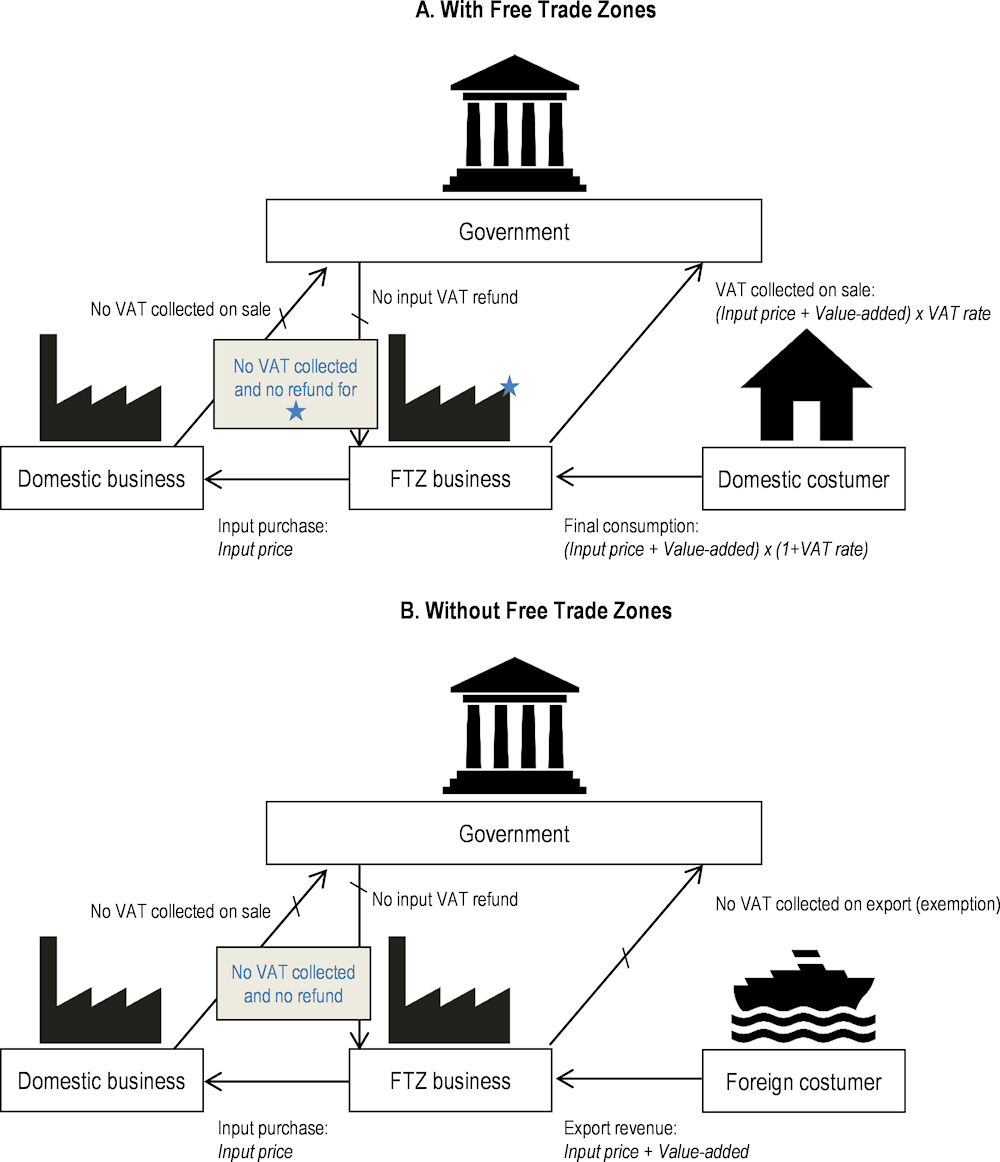

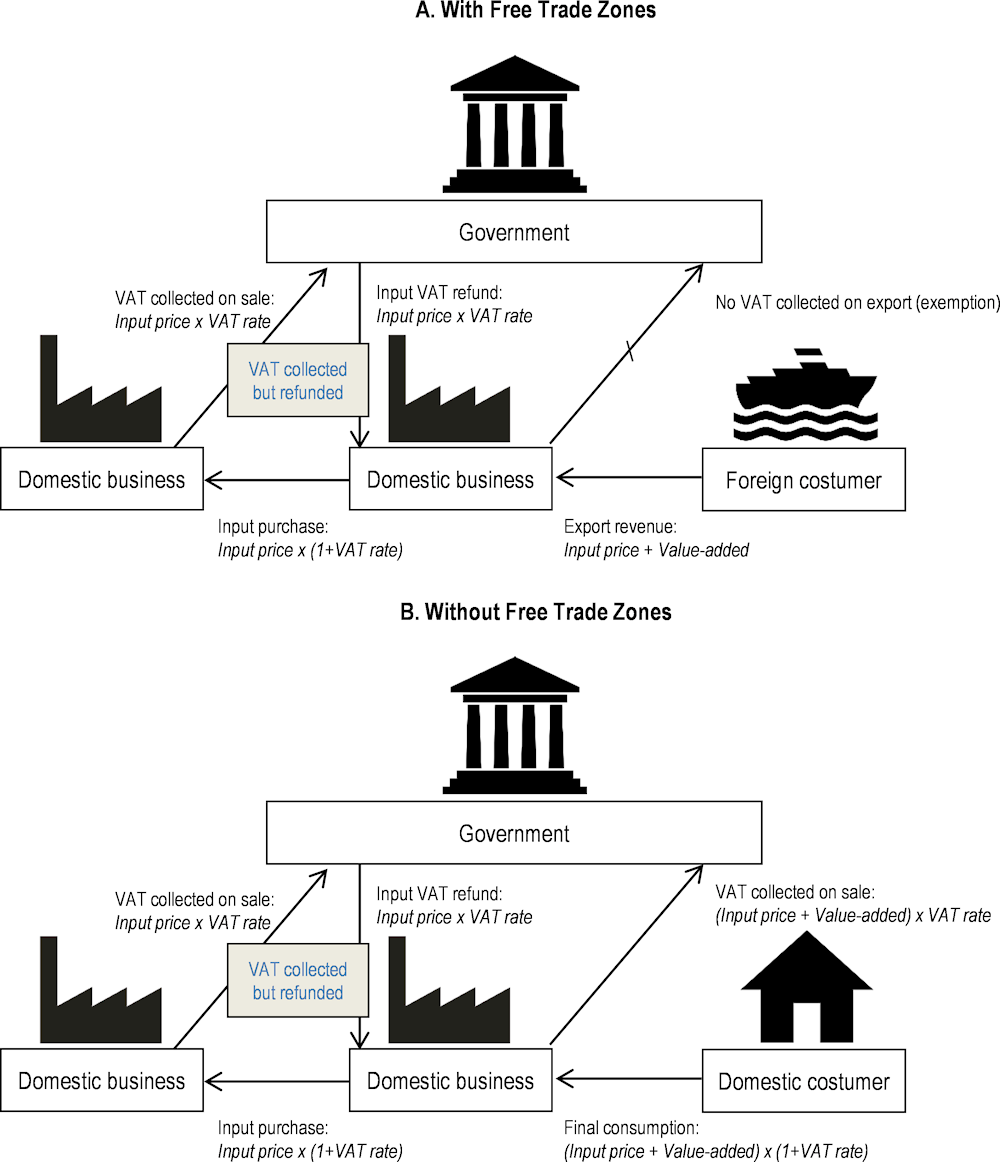

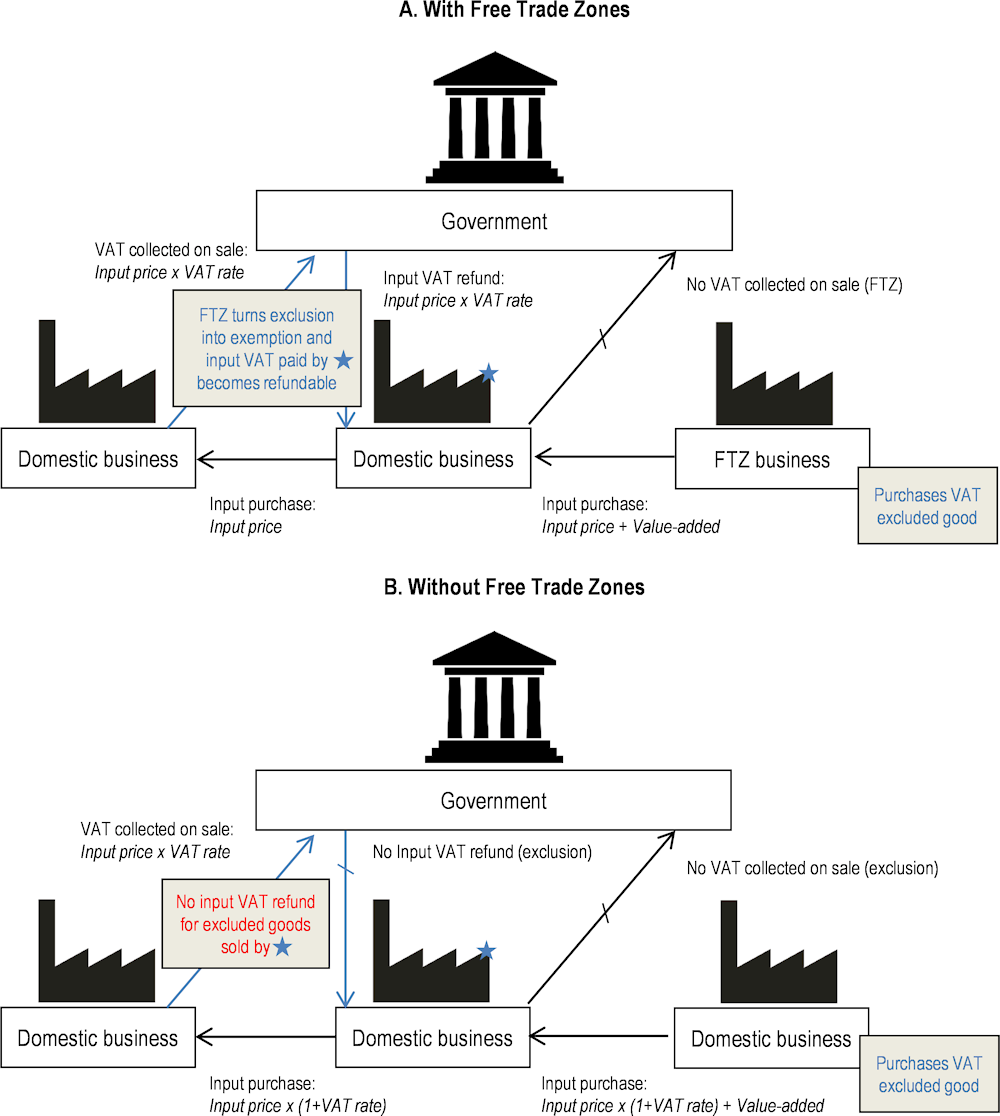

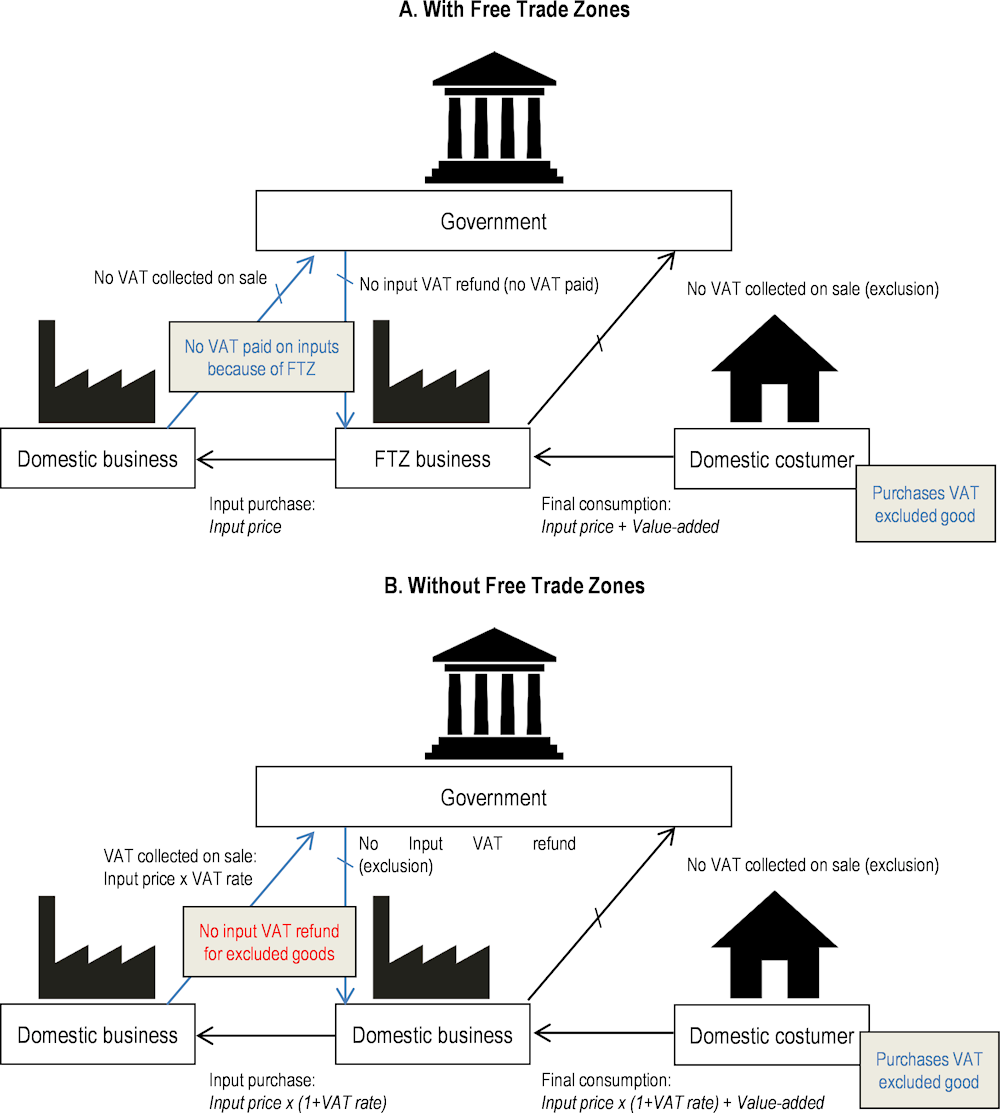

The illustrations on the following pages visualize how the interaction of VAT exclusions and the FTZ exemption give raise to VAT revenue forgone in scenarios 3 and 4. Arrows represent financial flows. For simplicity, the illustrations only focus on FTZ users purchasing inputs from the national territory but the same reasoning holds for inputs purchased from outside Colombia.

OECD Tax Policy Reviews: Colombia 2022

OECD Tax Policy Reviews