This chapter presents the approach that Colombia currently follows to measure and report CIT TEs, and identifies areas for improvement including (i) the measurement of CIT revenue forgone, (ii) the presentation of CIT revenue forgone in the TE report, (iii) the extension of the TE report with a distributional analysis of CIT TEs and (iv) the additional data sources that can be used to quantify revenue forgone. The chapter also includes item-by-item CIT revenue forgone estimates for 2020 and distributional analysis of a few TEs estimated by DIAN following the assistance provided by the OECD.

OECD Tax Policy Reviews: Colombia 2022

3. Measuring and Reporting Corporate Income Tax Expenditures

Abstract

Summary

This chapter presents the approach that DIAN currently follows to measure and report CIT TEs, and identifies areas for improvement. The chapter presents recommendations in a number of areas, including (i) the measurement of CIT revenue forgone, (ii) the presentation of CIT revenue forgone in the TE report, (iii) the extension of the TE report with a distributional analysis of CIT TEs and (iv) the additional data sources that can be used to quantify revenue forgone. The chapter also includes item-by-item CIT revenue forgone estimates for 2020 carried out by DIAN based on exogenous information merged to business tax returns for all corporations that are required to submit this information.

General assessment of the DIAN TE methodology

The two most recent editions of the Marco Fiscal de Mediano Plazo (MFMP) – the annual report published by the Ministry of Finance, which includes an annex with TE results (Minhacienda, 2022[1]; Minhacienda, 2021[2]) – have introduced a number of improvements in the measurement of CIT TEs, following the guidance provided by the Tax Incentives Commission (OECD, DIAN and Minhacienda, 2021[3]). For example, while tax revenue forgone from reduced rates was previously only estimated for Free Trade Zones, it is now estimated also for other special regimes (ZOMAC, ZESE, hotels, publishers, state owned companies, non-profit organisations, co-operatives, and perennial crops). Furthermore, in line with the recommendation of the Tax Incentives Commission, the report includes the number of firms that are subject to each special regime.

In order to measure CIT TEs, DIAN currently uses information from corporate tax returns. As only aggregated information needs to be provided in the tax return, DIAN can only quantify and report a number of aggregate CIT TEs in the TE appendix of the MFMP. Furthermore, the aggregated information that needs to be filed combines both items that are considered TEs and items that are not TEs, following the CIT TE benchmark that has been presented in this report. For example, the cell with information on exempt income in the tax return combines exempt income that qualifies as a TE but also income that is not a TE (under the TE benchmark that is proposed), such as income that is exempt under CAN treaty rules. The same applies to tax credits that constitute a TE in general with the exception of tax credits from taxes paid abroad; all of these tax credits are aggregated in the tax return that is filed by each business. This aggregation makes it difficult to even produce accurate aggregate TE estimates. In order for DIAN to calculate and report tax revenue forgone on an item-by-item basis, more disaggregated tax return data is required. This data could possibly be complemented with data from other sources.

In light of these limitations, DIAN made available to the OECD some additional information that businesses need to provide. This information, which DIAN refers to as “exogenous information”, can be merged with tax returns to estimate item-by-item tax revenue forgone. While these forms allow for the estimation of a selection of CIT TEs, the use of this additional source of information remains limited as it does not cover the entire business population because only companies with turnover above COP 100 million are required to submit these forms. Furthermore, our analysis shows that only about half of all identified CIT TEs can be quantified based on the exogenous information that is currently available.

To quantify revenue forgone, DIAN currently multiplies the standard CIT rate with the amount of exempt income that is recorded in the tax return. Such an approach, even if standard practice, biases the item-by-item revenue forgone estimates because it is very common for companies to simultaneously benefit from base narrowing TEs (non-taxable income, exempt income, non-standard deductions) and a reduced CIT rate. In practice, if a base-narrowing TE is abolished, the reduction in revenue forgone will be much lower than that estimated applying the standard rate as many companies benefit from reduced rates.

OECD recommendations to improve the measurement and reporting of CIT revenue forgone

Going forward, the methodology that is applied could be further refined, and the presentation of the revenue foregone could be further developed. DIAN should also start collecting more disaggregated information, both within the tax returns that businesses need to file as well as within the exogenous information that businesses need to provide. This will allow increasing the accuracy of the CIT revenue foregone estimates and increase transparency. This analysis, and the corresponding recommendations, are developed in detail in the following sections.

Section 3.2 presents the tax equations that can be applied to measure revenue forgone from different TEs on an item-by-item basis. The analysis also recommends DIAN to switch from applying the standard CIT rate to applying the company-specific CIT rate (which might be lower or higher, depending on other TEs in place) to calculate tax revenue forgone.

Section 3.3 includes the item-by-item revenue forgone estimates carried out by DIAN based on data from all taxpayers that submit exogenous information forms, following OECD recommendations. The section also makes recommendation with respect to the types of tables with information on CIT revenue forgone that could be included in the TE report. In order to increase transparency, we recommend to report the interaction between reduced rates and tax base narrowing provisions that constitute a TE as part of the table that summarizes revenue forgone from CIT TEs. In addition, DIAN could include in its TE report a table that presents the total revenue forgone of each special tax regime (i.e. the impact of the reduced CIT rate and all other TEs that businesses within that special tax regime benefit from). Finally, the section refers to Annex C which seeks to provide a comprehensive list of all 123 CIT TEs that have been identified.

Section 3.4 provides examples of how DIAN could leverage the tax microdata by including a distributional analysis of the TEs that businesses benefit from.

Section 3.5 presents recommendations on how to improve the amount and quality of data that is needed to measure TEs. The tax forms that corporations need to file will have to be revised in order for DIAN to be able to calculate aggregate TE estimates. The section also argues that more and better data will have to be collected. Finally, the section includes a list of CIT TEs for which the data collection should be prioritized based on the expected magnitude of the revenue forgone.

3.1 Current CIT TE measurement, reporting and data availability

The publication of a report that provides information on the revenue foregone of TEs has been required by law in Colombia since 2002. Revenue forgone estimates are presented in the Appendix of the Marco Fiscal de Mediano Plazo (MFMP), an annual report published by the Ministry of Finance (Minhacienda, 2022[1]). The current MFMP includes the revenue forgone of CIT TEs by sector of activity and covers all entities that (i) submit a tax return and (ii) are considered taxpayers.1 The MFMP only reports revenue forgone from a selection of CIT TEs, namely aggregate estimates of: exempt income, tax credits, some reduced rates and the special deduction for investment in fixed assets. Revenue forgone arising from non-taxable income and from special deductions (other than the deduction for investment in fixed assets) is not reported.

The two most recent editions of the MFMP have introduced a number of improvements in the measurement of CIT TEs, following the guidance provided by the Tax Incentives Commission (OECD, DIAN and Minhacienda, 2021[3]). For example, while tax revenue forgone from reduced rates was previously only estimated for Free Trade Zones (FTZs), DIAN now estimates it also for other special regimes (ZOMAC, ZESE, hotels, publishers, state-owned companies, non-profit organisations, co-operatives and perennial crops). Furthermore, the MFMP report now provides an estimate of the revenue forgone from a selection of other TEs that FTZs businesses benefit from; i.e. apart from the reduced rate, revenue forgone from tax credits and exempt income is also reported separately for FTZs.2

The information that businesses file within the CIT returns is the unique information source that is used by DIAN to estimate tax revenue foregone of CIT TEs. However, the information recorded in CIT returns is aggregated and can therefore only be used to estimate revenue forgone from certain aggregate TE categories. Revenue forgone from exempt income and tax credits is currently reported in an aggregate way covering all tax provisions that fall within that category. Currently, DIAN cannot provide item-by-item CIT TE estimates because different TEs are grouped together and recorded in a very limited number of cells within the tax return.

The estimation of tax revenue forgone using current CIT returns will remain complex under the proposed TE benchmark. The cells in the CIT return that need to be filled in typically include items that are TEs and items that are not considered TEs under the proposed CIT TE benchmark. For example, the cell with information on exempt income in the tax return combines information on exempt income that qualifies as a TE but also income that is not a TE, such as income that is exempt under CAN treaty rules. The same applies to tax credits, that constitute a TE in general, but tax credits from taxes paid abroad are not viewed as a TE; these different tax credits are however aggregated in the tax return that is filed by each business. This aggregation will bias the calculation of aggregate TE estimates. In order for DIAN to calculate and report tax revenue forgone on an item-by-item basis, more disaggregated tax return data is required.

Under the current rules in Colombia, businesses with annual turnover exceeding COP 100 million are required to file supplementary tax forms. These data sources are called exogenous information and could enable DIAN to quantify revenue forgone on an item-by-item basis from several TEs once they are merged with CIT tax returns. However, the information available from these data sources remains incomplete. For example, companies with turnover above COP 100 million only represent around 44% of the legal entities that submit a CIT return. Hence, estimating revenue forgone by means of exogenous information leads to an underestimation or, put differently, provides a lower bound of the actual revenue forgone. According to DIAN’s estimates, 70% of total exempt income and 85% of total tax credits are claimed by firms whose turnover exceeds the threshold. Hence, in the case of CIT TEs, relying on exogenous information to measure revenue forgone on an item-by-item basis constitutes a reasonable strategy, given the data limitations, as TEs are mostly claimed by large corporations. Nevertheless, this approach does lead to an underestimation of total revenue forgone and does not substitute the need for more detailed CIT tax returns that would allow for the estimation of foregone tax revenues on an item-by-item basis based on the full taxpayer population.

To quantify revenue forgone from exempt income, DIAN currently multiplies the standard CIT rate with the size of the amount of exempt income recorded in the tax return DIAN.3 Such an approach biases the revenue forgone estimates because it is very common for companies to simultaneously benefit from base narrowing TEs and a reduced CIT rate. Revenue forgone from reduced rates is calculated by multiplying the company’s current taxable income (which can be lower than the benchmark income due to other TEs) with the difference in CIT rates. For example, the taxable income of a FTZ business would be multiplied by 15% (30% standard rate minus 20% rate in FTZs) to obtain the revenue forgone linked to the reduced CIT rate.

3.2. Measuring revenue forgone

Tax revenue forgone of a TE refers to the direct ex-post revenue loss associated with a tax provision that is not included within the benchmark tax system, holding other factors constant. Put differently, the tax revenue foregone from a TE is calculated by determining the sum of the tax liability the taxpayers would face in the absence of the particular TE, net of the sum of the tax liability the taxpayers actually face in the presence of the TE.

This section provides recommendations on how to measure revenue forgone from different types of CIT TEs. It describes how revenue forgone can be measured and provides a set of equations to implement the item-by-item measurement of the different types of CIT TEs, such as non-standard deductions, exempt income, non-taxable income, reduced rates, deferrals, and tax credits.

Non-standard deductions, exempt and non-taxable income

The OECD recommends that revenue forgone from base narrowing TEs (i.e. non-standard deductions, exempt and non-taxable income) is measured using the CIT rate that each company is subject to. That is, (i) the standard CIT rate, (ii) the reduced rate if the company benefits from a special regime or (iii) a higher rate for companies in the financial sector. Such an approach is preferred over DIAN’s current approach, which multiplies the tax base narrowing amount that is claimed with the standard CIT rate regardless of whether the company pays the standard rate or not. Even though the standard CIT rate is the benchmark rate, multiplying the base narrowing amount with the standard rate biases the revenue foregone estimate upwards (in the case of reduced rates) and provides a wrong indication of the actual revenue foregone that can be attributed to the base narrowing provision. In fact, the DIAN approach combines the effect of two TEs: the base narrowing provision and the impact of the reduced CIT rate.4

Revenue forgone across the total number of firms from a provision that grants exempt income is equal to:

Where stands for the CIT rate business is subject to. The same formula applies to non-standard deductions or special deductions and non-taxable income.5

The revenue forgone from enhanced deductions is equal to the additional deduction exceeding the standard deduction that is included in the benchmark, multiplied by the company’s CIT rate. If the benchmark stipulates full deductibility of the costs incurred (e.g. for the cost linked to salary payments), the additional deduction would be calculated by multiplying the deductible item (e.g. the salary payment to first-job employees under the age of 28) with the difference between the allowed deduction under the enhanced deduction (e.g. 120%) and the standard benchmark deduction (e.g. 100%). Revenue forgone from a provision that grants an enhanced deduction for amount then equals:

Where stands for the currently allowed deduction (in percentage) and for the permitted deduction under the benchmark (in percentage).6

Reduced rates

Revenue forgone from reduced rates can be split into two separate components:

1. The first component multiplies the difference between the standard rate and the reduced rate with taxable income, in line with the approach that DIAN currently follows. In this calculation, taxable income corresponds to the actual taxable income of each business that has been reduced by all other base narrowing TEs that the business can claim (e.g. deductions, exemptions, or non-taxable income). The first category therefore attempts to isolate the revenue forgone from the reduced rate by abstracting from the interaction between the reduced rate and other TEs.

The following formula illustrates the proposal in the case of FTZ businesses; the same formula applies to other special regimes (mega-investments, stability contracts, hotels, etc.). The revenue forgone from the reduced rate of 20% applicable to FTZ businesses with current would be equal to:

2. The second component reflects the interaction between reduced rates and the TEs that narrow the tax base (i.e., non-standard deductions, exempt income, and non-taxable income). This amount is equal to the revenue forgone that could (potentially) be recovered if Colombia would decide to abolish both types of TEs (i.e. the reduced rate as well as the base narrowing TEs). The revenue forgone from the interaction is obtained by multiplying the total value of the special deductions, exempt income and non-taxable income for each firm with the difference between the standard CIT rate and the reduced rate, and then summing the result for all companies subject to the reduced rate.7

The revenue forgone from the interaction for FTZ businesses subject to a reduced rate of 20% would be equal to:

The presentation of the TEs into these 2 components would allow DIAN to (i) isolate the revenue forgone from different type of base-narrowing TEs and the reduced CIT rate; and (ii) demonstrate how the different types of TEs reinforce each other and thereby result in additional revenue forgone. Nonetheless, it should be noted that breaking down the revenue forgone in such a way is merely a matter of displaying total revenue forgone in a more transparent manner.

Overall, this break down of total revenue foregone into three separate components (i.e., the TE corresponding to tax base narrowing discussed in the previous subsection, the reduced tax rate and their interaction discussed in this subsection) would increase transparency; the sum of these three components would be equal to the difference between (benchmark tax base x benchmark tax rate) and (current tax base x current tax rate).

Deferrals

While accelerated tax depreciation allowances do not alter the total amount of the depreciation allowances that can be deducted over the life of an economic asset, they do change the moment in time, and therefore the tax value, when these depreciation allowances can be claimed. Measured on a cash-flow basis, the revenue foregone of accelerated tax depreciation in a given year equals the revenue forgone due to the additional depreciation allowances that can be deducted in the year, relative to the amount that would be deductible under the tax benchmark, which are tax depreciation allowances that match the economic depreciation of the asset.8

Revenue forgone calculated on a cash flow basis is defined by the cost of a TE to the government in a given year.9 Accelerated tax depreciation results in positive tax revenue forgone initially, followed by periods during which revenue receipts are higher than they would have been under tax depreciation that equals the economic deprecation of the asset (because a higher percentage of the asset’s value has already been deducted). Ultimately, the total depreciated value is equal to the cost of the asset. Under the proposed TE benchmark, tax depreciation allowances match the economic depreciation of the asset over the asset’s useful economic life. Because of the impact on tax revenue in different time periods, the cash flow-based estimate of accelerated tax depreciation is not only the result of the accelerated depreciation of investments made in the current year, but the revenue forgone in any given year is also impacted by the accelerated deductions claimed with respect to investments dating from previous time periods (Department of Finance Canada, 2012[4]). For that reason, the net cash-flow fiscal cost in a given year could be positive or negative depending on past, current and projected investments (Department of Finance Canada, 2021[5]; Villela, Lemgruber and Jorratt, 2010[6]). Due to this period-specific impact of tax deferrals, detailed information about investment patterns over time would be required to correctly determine the size of the TE.

The cash flow revenue forgone estimated in the current period could be defined as follows:

Where stands for the allowed amount of depreciation for all assets that fall under the accelerated depreciation provision that were depreciated by business in year . Some of these assets may have been purchased in while other may have been purchased in previous years. The economic depreciation term refers to the value that would have been depreciated for asset in firm if the depreciation schedule had followed the economic depreciation rates (i.e. the benchmark).

The Canadian TE report (Department of Finance Canada, 2012[4]) identifies five key methodological steps to measure revenue forgone from accelerated tax depreciation:

1. Determine the useful life10 for each type of investment subject to accelerated depreciation. If the asset cannot be matched to a particular asset type, use a weighted average of the most similar asset types. For example, clean energy generation equipment may include a broad variety of assets with potentially different benchmark depreciation rates.

2. Create, for every taxpayer, a separate time series on an asset-by-asset basis including all assets that benefit from accelerated tax depreciation as reported in the CIT return.

3. Recalculate claims and balances under the useful life (i.e. economic) depreciation rates (counterfactual).

4. Estimate the total current-year revenue forgone by comparing actual tax depreciation in the year to the depreciation allowances under the TE benchmark (i.e. the counterfactual).

5. Break down the total revenue forgone by separating the impact of current and prior year’s investments.

Tax credits

The revenue forgone from tax credits is equal to the total amount claimed by companies that either (i) reduces the final tax liability or (ii) is refunded. Not all tax credits are viewed as a TE – for example, the foreign tax credit for taxes paid abroad by resident taxpayers earning foreign source income is not viewed as a TE under the proposed benchmark. DIAN is therefore advised to list revenue forgone from tax credits on an item-by-item basis in addition to providing an estimate of total revenue forgone.

3.3. Revenue forgone estimates and reporting recommendations

Revenue forgone estimates

This section provides item-by-item revenue forgone estimates for Colombia in 2020. The OECD produced preliminary estimates based on a representative sample of CIT tax returns that was merged with exogenous information. The coding has been shared with DIAN so that the proposed methodology could be applied to all taxpayers. This report includes the results of the calculations made by DIAN, following the OECD’s recommendations, and based on the methodology described in the previous section.

The figures included in Table A and Table B were calculated by DIAN based on exogenous information that was merged to tax returns. As only 44% of corporations in Colombia are required to file these supplementary forms, the estimates represent a lower bound of the revenue forgone associated with a specific TE.

The totals in the tables also represent a lower bound estimate because a large fraction of TEs cannot be measured on an item-by-item basis due to a lack of data. For this reason, the revenue forgone linked to the “other” category is likely large. For example, revenue forgone from other exempt income (including some non-TE components such as exempt income from Andean Community tax treaties) was equal to COP thousand million 3 961 in 2020. If Colombia were to follow the recommendations made in section 3.5, the design of future tax returns would ensure that TEs and tax provisions that are part of the TE benchmark are not included together in a single box. Consequently, the table is not comparable to figures reported in the MFMP (2022). A tentative full list of CIT TEs is included in Annex C.

Table 3.1. Item-by-item CIT revenue forgone in 2020 for provisions with available data (Table A)

|

Tax expenditure |

Revenue forgone (2020) |

|

|---|---|---|

|

COP thousand million |

% of GDP |

|

|

Exempt income |

1 332 |

0.13% |

|

Income derived from the sale of renewable electricity (15 years, Art 91, Law 2010 of 2019) |

0 |

|

|

Income from certain waterway transport services (art 91, Law 2010 of 2019) |

5 |

|

|

Income from investment in higher agricultural productivity (10 years, art 91, Law 2010 of 2019) |

2 |

|

|

Income from investment in sawmills and related invest. in the lumber industry (art 91, Law 2010 of 2019) |

3 |

|

|

Income from the sale of property for public interest projects (art 91, Law 2010 of 2019) |

204 |

|

|

Income generated in creative industries (orange economy, 7 years, art 91, Law 2010 of 2019) |

11 |

|

|

Income received by authors, translators and copyright holders of certain books (art 28, Law 98 of 1993) |

3 |

|

|

Income received by hotels constructed between 2002-2017 (30 years, art 18, Law 788 of 2002) |

10 |

|

|

Income received by hotels renovated between 2002-2017 (30 years, art 18, Law 788 of 2002) |

1 |

|

|

Income received by non-profit organisations (art 146, Law 1819 of 2019) |

478 |

|

|

Profit on the first sale of low income housing (VIS) and financial returns generated in the first 5 years from VIS loans (art. 235-2, TC) |

616 |

|

|

Other |

n/a |

|

|

Non-taxable income |

1 301 |

0.13% |

|

Compensation for eradication or renewal of crops, or control of pests (Art 70, Law 223 of 1995) |

1 |

|

|

Contributions by National Television Commission to regional stations (Art 40, Law 488 of 1998) |

69 |

|

|

Distribution of gains from shares from companies listed in the Colombian Stock Exchange (Art 37, Law 1819 of 2016) |

272 |

|

|

Donations to projects approved by the Multilateral Fund of the Montreal Protocol (Art. 32, Law 488 of 1998) |

0 |

|

|

Funds for scientific, technological, or innovative projects (Art 37, Law 1450 of 2011) |

544 |

|

|

Incentives for rural capitalization (Art 20, Law 788 of 2002) |

1 |

|

|

Income distributed to employee shareholders (up to 10% of profits, Art 44., Law 789 of 2002) |

0 |

|

|

Income from derivatives with Colombian stock exchange-listed company as underlying (Art. 37, Law 1430 of 2000) |

16 |

|

|

Income from Forest Incentive Certificates (Lit c Art 8, Law 139 of 1994) |

7 |

|

|

Income from the expropriation of property for public use (Art 67, Law 388 of 1997) |

11 |

|

|

Income provided from resources managed by Fogafín and Fogacoop (Art 11, Law 788 of 2002) |

0 |

|

|

Inflationary component if capitalized (Art 10, Decree 2686 of 1999) |

1 |

|

|

Profits from sale of shares registered in a Colombian Stock Exchange (Art 9, Law 633 of 2000) |

125 |

|

|

Profits from the liquidation of a limited liability company (Art 43, Decree 2053 of 1974) |

0 |

|

|

Public funding for urban mass transport network (Art 29, Law 488 of 1998) |

240 |

|

|

Seed capital provided by the State (Art 16, Ley 1429 de 2014) |

7 |

|

|

State contributions to cover obligations of public entities in liquidation (Art 77, Law 633 of 2000) |

0 |

|

|

Subsidies paid by the government in the Agro Ingreso Seguro program (Art. 58, Law 1111 of 2006) |

7 |

|

|

Other |

n/a |

|

|

Non-standard deductions |

6 105 |

0.61% |

|

30% deduction for investment in fixed assets (Art 68, Law 863 of 2003) |

831 |

|

|

50% of the financial transaction tax (Art. 86, Law 2010 of 2019) |

1 031 |

|

|

130% of the salaries paid to workers hired as apprentices or in training (Art. 189, Law 115 of 1994) |

56 |

|

|

200 % of the salaries paid to female workers who are victims of proven violence (Art. 23, Law 1257 of 2008) |

1 |

|

|

200 % of the salaries paid to widows and orphans of members of the Armed Forces killed in combat, kidnapped, or missing (Art. 127, Law 6 of 1992) |

24 |

|

|

200% of salaries paid to workers with a proven disability of no less than 25% (Art. 31, Law 361 of 1997) |

19 |

|

|

Carbon tax (Par 2, Art. 222, Law 1819 of 2016) |

91 |

|

|

Contributions made by corporations to education institutions (Art. 87, Law 2010 of 2019) |

57 |

|

|

Donations for educational programs (Art 87, Law 2010 of 2019) |

38 |

|

|

Donations to libraries (Art. 75, Law 1819 of 2016) |

1 |

|

|

Gifts to customers, suppliers, and employees (Art. 63, Law 1819 of 2016) |

341 |

|

|

Investments in detention centers (Art. 98, Law 633 of 2000) |

0 |

|

|

Maintenance of assets declared as in cultural interest (Art. 14, Law 1185 of 2008) |

4 |

|

|

Mutual investment fund contributions (Art. 7, Law 75 of 1986) |

15 |

|

|

Scholarships for employees (Art. 87, Law 2010 of 2019) |

3 |

|

|

Taxes, fees, and contributions (art 86, Law 2010 of 2019) |

3 593 |

|

|

Other |

n/a |

|

|

Tax credits |

4 075 |

0.41% |

|

25% of donations to certain non-profits (art 105, Law 1819 of 2016) |

177 |

|

|

25% of donations to higher education and science (art 174, Law 1955 of 2019) |

1 |

|

|

25% of environmental investment (art 103, Law 1819 of 2016) |

41 |

|

|

25% of research & development investment (art 171, Law 1955 of 2019) |

223 |

|

|

40% of investments by public service companies providing aqueduct and sewerage services (Art. 104, Law 788 of 2002) |

4 |

|

|

50% of local turnover tax ICA (art 86 Law 2010 of 2019) |

2 298 |

|

|

Donations to foundations defending and protecting human rights (Art. 37, Law 488 of 1988) |

2 |

|

|

Donations to sports and recreational or cultural organizations (Art. 37, Law 488 of 1998) |

1 |

|

|

Input VAT paid on fixed capital assets (art 95, Law 2010 of 2019) |

1 328 |

|

|

Other |

n/a |

|

|

Reduced rates* |

1 332 |

0.13% |

|

Reduced rate on taxable income |

1 032 |

0.10% |

|

Free Trade Zones [20%] (art 101, Law 1819 of 2016) |

340 |

|

|

Stability contracts [**] (Law 963 of 2005) |

174 |

|

|

Hotels, theme parks, ecotourism parks, agro-tourism, nautical docks, old age tourism [9%] (art 41, Law 2068 of 2020) |

5 |

|

|

ZESE first 5 years [0%] (art 268, Law 1995 of 2019) |

206 |

|

|

Micro and small ZOMAC [0%] (art 237, Law 1819 of 2016) |

178 |

|

|

Medium and large ZOMAC [50% of the standard rate] (art 237, Law 1819 of 2016) |

||

|

Non-profit organisations [20%]*** (art 146, Law 1819 of 2019) |

16 |

|

|

Publication industry (9%) (art 100, Law 1819 of 2016) |

18 |

|

|

State-owned alcohol production and gambling [9%] (art 100, Law 1819 of 2016) |

16 |

|

|

Perennial crops [9%] (art 100, Law 1819 of 2016) |

6 |

|

|

Cooperatives [20%] (art. 19-4, Colombian tax code, art. 142 Law 1819 of 2016) |

71 |

|

|

Mega-investments [27% or 9%] (art 75, Law 2010 of 2019)**** |

n/a |

|

|

Other |

n/a |

|

|

Interaction between reduced rates and other TEs |

300 |

0.03% |

|

Free Trade Zones [20%] (art 101, Law 1819 of 2016) |

34 |

|

|

Stability contracts [**] |

20 |

|

|

Hotels, theme parks, ecotourism parks, agro-tourism, nautical docks, old age tourism [9%] (art 41, Law 2068 of 2020) |

3 |

|

|

ZESE first 5 years [0%] (art 268, Law 1995 of 2019) |

9 |

|

|

Micro and small ZOMAC [0%] (art 237, Law 1819 of 2016)***** |

2 |

|

|

Medium and large ZOMAC [50% of the standard rate] (art 237, Law 1819 of 2016)***** |

||

|

Non-profit organisations [20%]*** (art 146, Law 1819 of 2019) |

194 |

|

|

Publication industry [9%] (art 100, Law 1819 of 2016) |

1 |

|

|

State-owned alcohol production and gambling [9%] (art 100, Law 1819 of 2016) |

5 |

|

|

Perennial crops [9%] (art 100, Law 1819 of 2016) |

1 |

|

|

Cooperatives [20%] (art. 19-4, Colombian tax code, art. 142 Law 1819 of 2016) |

30 |

|

|

Mega-investments [27% or 9%] (art 75, Law 2010 of 2019)**** |

n/a |

|

|

Other |

n/a |

|

|

Increased rates |

-475 |

0.05% |

|

Increased rate on taxable income |

-346 |

0.03% |

|

Financial institutions [32%+4%] (Law 2155 of 2021) |

-346 |

|

|

Interaction between increased rates and other TEs |

-129 |

0.01% |

|

Financial institutions [32%+4%] (Law 2155 of 2021) |

-129 |

|

Note: Estimates based on 2020 tax records from the population of taxpayers and supplementary taxpayer data. Values in thousand million Colombian pesos. Item-by-item TEs are estimated based on supplementary taxpayer data from exogenous information forms and thereby do not cover all taxpayers that benefit from these TEs (with the exception of reduced rates). It is suggested that the new TE report includes an “Other” row where TEs which are currently measured using tax return data but not disaggregated on an item-by-item basis can be reported. The estimates reported in this table were calculated by DIAN. OECD provided an initial coding proposal based on a sample of 815 business tax returns merged to exogenous information forms but was not involved in the final calculations.

* The reduced rates row includes estimates from revenue forgone arising from the two components mentioned in section 3.2, namely the revenue forgone resulting from applying a reduced rate to actual taxable income and the revenue forgone resulting from the interaction between reduced rates and base narrowing TEs.

** Each stability contract can grant a different CIT rate.

*** Surpluses not invested or allocated in the development of the non-profit organisation’s “worthy purpose” are subject to a 20% CIT rate.

**** No company qualified to benefit from the mega-investment regime in 2020. The same applied to the Free Trade Zone regime in Cucutá taxed at a rate of 15%.

***** The applicable rates have changed since 2022. See Annex C for more details.

Source: DIAN.

Table 3.2. Revenue forgone in 2020 from tax expenditures granted to companies that benefit from a reduced rate (Table B)

|

Revenue forgone by type of special regime and type of tax expenditure |

Revenue forgone (2020) |

|---|---|

|

COP thousand million |

|

|

Free Trade Zones [20%] (art 101, Law 1819 of 2016) |

486 |

|

Exempt income |

0 |

|

Non-taxable income |

1 |

|

Non-standard deductions |

60 |

|

Tax credits |

50 |

|

Reduced rate [on taxable income and interaction between reduced rates and other TEs] |

375 |

|

Stability contracts* (Law 963 of 2005) |

1,822 |

|

Exempt income |

0 |

|

Non-taxable income |

140 |

|

Non-standard deductions |

945 |

|

Tax credits |

542 |

|

Reduced rate [on taxable income and interaction between reduced rates and other TEs] |

195 |

|

Hotels, theme parks, ecotourism parks, agro-tourism, nautical docks, old age tourism [9%] (art 41, Law 2068 of 2020) |

9 |

|

Exempt income |

0 |

|

Non-taxable income |

0 |

|

Non-standard deductions |

1 |

|

Tax credits |

0 |

|

Reduced rate [on taxable income and interaction between reduced rates and other TEs] |

7 |

|

ZESE first 5 years [0%] (art 268, Law 1995 of 2019) |

221 |

|

Exempt income |

1 |

|

Non-taxable income |

0 |

|

Non-standard deductions |

0 |

|

Tax credits |

5 |

|

Reduced rate [on taxable income and interaction between reduced rates and other TEs] |

215 |

|

Micro and small ZOMAC [0%] & Medium and large ZOMAC [50% of the standard rate] (art 237, Law 1819 of 2016)**** |

187 |

|

Exempt income |

0 |

|

Non-taxable income |

0 |

|

Non-standard deductions |

0 |

|

Tax credits |

5 |

|

Reduced rate [on taxable income and interaction between reduced rates and other TEs] |

181 |

|

Non-profit organisations [20%]** (art 146, Law 1819 of 2019) |

539 |

|

Exempt income |

280 |

|

Non-taxable income |

1 |

|

Non-standard deductions |

43 |

|

Tax credits |

4 |

|

Reduced rate [on taxable income and interaction between reduced rates and other TEs] |

211 |

|

Publication industry [9%] (art 100, Law 1819 of 2016) |

20 |

|

Exempt income |

0 |

|

Non-taxable income |

0 |

|

Non-standard deductions |

0 |

|

Tax credits |

1 |

|

Reduced rate [on taxable income and interaction between reduced rates and other TEs] |

19 |

|

State-owned alcohol production and gambling [9%] (art 100, Law 1819 of 2016) |

26 |

|

Exempt income |

0 |

|

Non-taxable income |

0 |

|

Non-standard deductions |

2 |

|

Tax credits |

2 |

|

Reduced rate [on taxable income and interaction between reduced rates and other TEs] |

22 |

|

Perennial crops [9%] (art 100, Law 1819 of 2016) |

8 |

|

Exempt income |

0 |

|

Non-taxable income |

0 |

|

Non-standard deductions |

0 |

|

Tax credits |

1 |

|

Reduced rate [on taxable income and interaction between reduced rates and other TEs] |

7 |

|

Cooperatives [20%] (art. 19-4, Colombian tax code, art. 142 Law 1819 of 2016) |

164 |

|

Exempt income |

10 |

|

Non-taxable income |

0 |

|

Non-standard deductions |

41 |

|

Tax credits |

12 |

|

Reduced rate [on taxable income and interaction between reduced rates and other TEs] |

101 |

|

Mega-investments [27% or 9%] (art 75, Law 2010 of 2019)*** |

n/a |

|

Financial institutions [32%+4%] (Law 2155 of 2021) |

1,231 |

|

Exempt income |

329 |

|

Non-taxable income |

119 |

|

Non-standard deductions |

716 |

|

Tax credits |

542 |

|

Increased rate [on taxable income and interaction between reduced rates and other TEs] |

-475 |

Note: Estimates based on 2020 tax records from the population of taxpayers merged with supplementary taxpayer data. Values in thousand million Colombian pesos. Item-by-item TEs are estimated based on supplementary taxpayer data from exogenous information forms and thereby do not cover all taxpayers that benefit from these TEs. The estimates reported in this table were calculated by DIAN. OECD provided an initial coding proposal based on a depersonalised sample of 815 business tax returns merged to exogenous information forms but was not involved in the final calculations.

The reduced/increased rate row includes the two components described previously, that is (i) the revenue forgone resulting of applying the difference in tax rates to taxable income and (ii) the interaction between reduced rates and base narrowing TEs

* Each stability contract can grant a different CIT rate.

** Surpluses not invested or allocated in the development of the non-profit organisation’s “worthy purpose” are subject to a 20% CIT rate.

*** No company qualified to benefit from the mega-investment regime in 2020. The same applied to the Free Trade Zone regime in Cucutá taxed at a 15% rate.

**** The applicable rates have changed since 2020. See Annex C for more details.

Source: DIAN.

Reporting recommendations

This section also provides recommendations on how to report CIT revenue forgone in the TE report:

Whenever possible, DIAN should report revenue forgone instead of the aggregate value of tax exemptions, non-taxable income, deductions, or tax credits. Because businesses can pay a CIT rate that is higher or lower than the standard rate (due to surtaxes or special regimes), revenue forgone cannot be easily inferred from the aggregate size of TEs.

The main CIT revenue forgone table (Table A) lists subtotals by type of TE (tax credits, deductions, etc.) and, where data is available, includes rows with item-by-item estimates.

For each type of TE, the table also contains a row that records the revenue forgone that cannot be measured on an item-by-item basis (“Other”). Currently, no estimate can be provided in these rows because the aggregate boxes in the tax return (for example, total exempt income) include both TE and non-TE components.

Over time, DIAN could add more information in the table by adding the revenue forgone in previous years. This will indicate how the revenue foregone has changed over time.

In the TE report, values would be expressed both in thousand million pesos and as a percentage of GDP.

A total of all measured CIT TEs could be included; this total should however be interpreted with caution given the difficulties of summing different TEs. If the total is provided, the report should explicitly mention that the revenue forgone concept does not take into account the interaction between the CIT TEs, and that some TEs are not included in the total because of lack of data. In line with the recommendations made in the preceding section, rows that report revenue forgone from the TEs that cannot be disaggregated within a category (Other), would have to be calculated using the company-specific CIT rate rather than the standard CIT rate.

In addition, DIAN could include an additional table (Table B) that reports total revenue forgone from TEs for firms that are subject to special regimes. Even if all revenue forgone linked to companies under special regimes was included in Table A, Table B would summarize all the revenue forgone that is measured only considering companies that benefit from special regimes. Hence, it would be possible to identify revenue forgone from base narrowing TEs aside from the interaction component. Table B would therefore complement the data in Table A.

The 2022 edition of the MFMP includes a column that records the number of firms that benefit from a reduced rate and are subject to each special regime (FTZ, stability contracts, etc.), in line with the recommendation of the Tax Incentives Commission (OECD, DIAN and Minhacienda, 2021[3]). In the future, the number of firms subject to each special regime could be included in Table B.

Item-by-item discussion

In addition to the tables that provide an overview of revenue forgone from individual CIT TEs (Table A) and revenue forgone linked to companies subject to special regimes (Table B), the TE report could include item-specific tables for each TE measured on an item-by-item basis. These tables would explain why a specific provision is considered a TE, provide a brief description of the data source and estimation method used to calculate the revenue forgone from that particular TE as well as include information about the reliability of the revenue forgone estimate. The table would indicate if the estimate is based on tax return data or exogenous information.

The item-by-item discussion would also provide additional context to guide the interpretation of the revenue forgone figure. For example, when discussing the revenue forgone of a particular TE, it should be mentioned whether the TE corrects for a distortion that is created by another TE. For example, the discussion of revenue forgone from the CIT credit granted for investment in fixed assets should refer to the fact that, in contrast to the proposed benchmark, businesses in Colombia cannot recover the VAT paid on investment (negative VAT TE). Table 3.3 provides an illustrative example.

More specifically, the item-by-item table should include the following elements:11

(i) TE identifier; (ii) Name of the TE; (iii) Revenue forgone in the current year and in the five preceding years; (iv) Tax type; (v) TE type; (vi) Year of implementation; (vii) Year of expiration; (viii) Legal reference; (ix) Reliability of the estimate; (x) Data source used to estimate revenue forgone; (xi) Estimation method; (xii) Paragraph that states why the provision deviates from the benchmark and provides more detail about the TE.

Table 3.3. Suggested presentation of item-by-item CIT revenue forgone

NT17 Profits from the sale of shares registered in a Colombian stock exchange

|

Year |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

||

|---|---|---|---|---|---|---|---|---|

|

Revenue forgone (COP thousand million) |

. |

. |

. |

. |

. |

125 |

||

|

Tax: |

Corporate income tax |

Legal reference: |

Art 9, Law 633 of 2000 |

|||||

|

Tax expenditure type: |

Non-taxable income |

Estimate reliability: |

Medium-High |

|||||

|

Implementation: |

2000 |

Data source: |

Exogenous data (Companies with turnover > 100 m.) |

|||||

|

Expiration: |

n/a |

Estimation method: |

Microsimulation applying the respective corporate tax rate paid by business |

|||||

Note. Reason why this measure is not part of benchmark tax system: Income from the sale of shares registered in a Colombian stock exchange is exempt from taxation under the corporate income tax if the sale does not exceed 10% of the outstanding shares and if the shares are owned by the same real beneficiary. Under the benchmark, the corporate income tax base comprises all sources of income, including profits from carrying out business activity and investment income, rental income, interest income, royalties, dividends, and capital gains, as well as other sources of income such as government cash transfers and donations.

Full list of TEs in appendix tables

Finally, a comprehensive list of TEs such as the one included in the appendix of this report (Annex C) could be included in the appendix to the TE report.12 Ideally, this list should provide information about the legal reference and a brief explanation of the extent to which the tax provision deviates from the benchmark. This list would include all TEs, and not just those that were measured on an item-by-item basis.

3.4. Distributional analysis

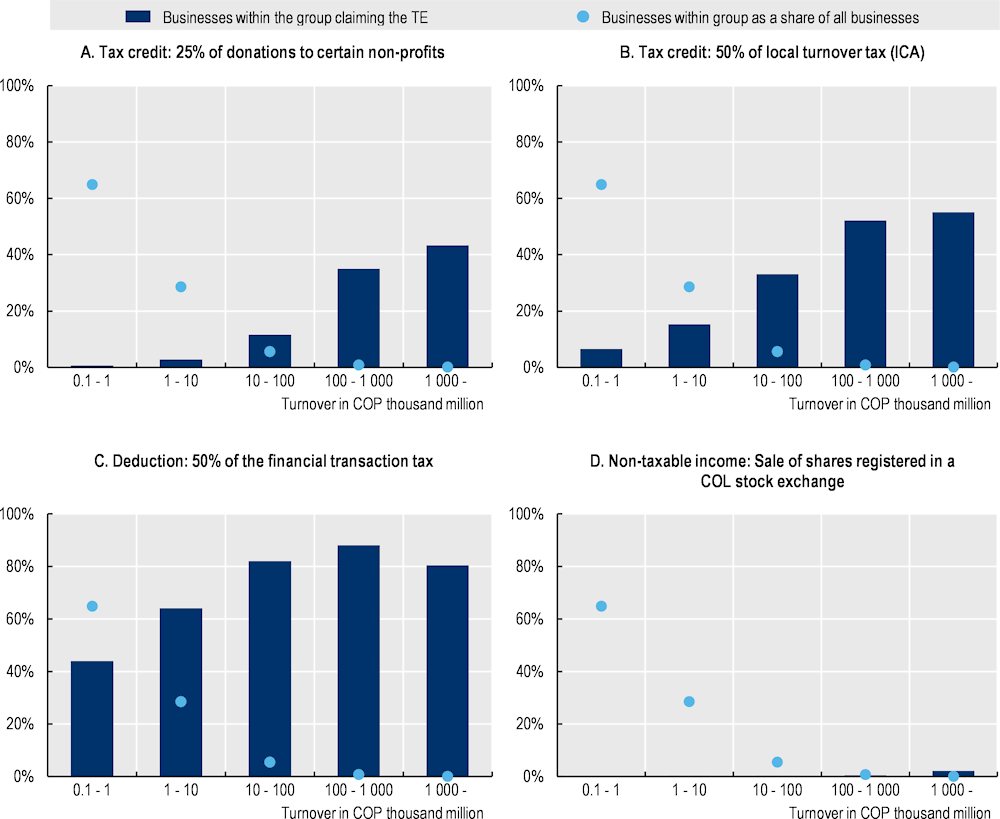

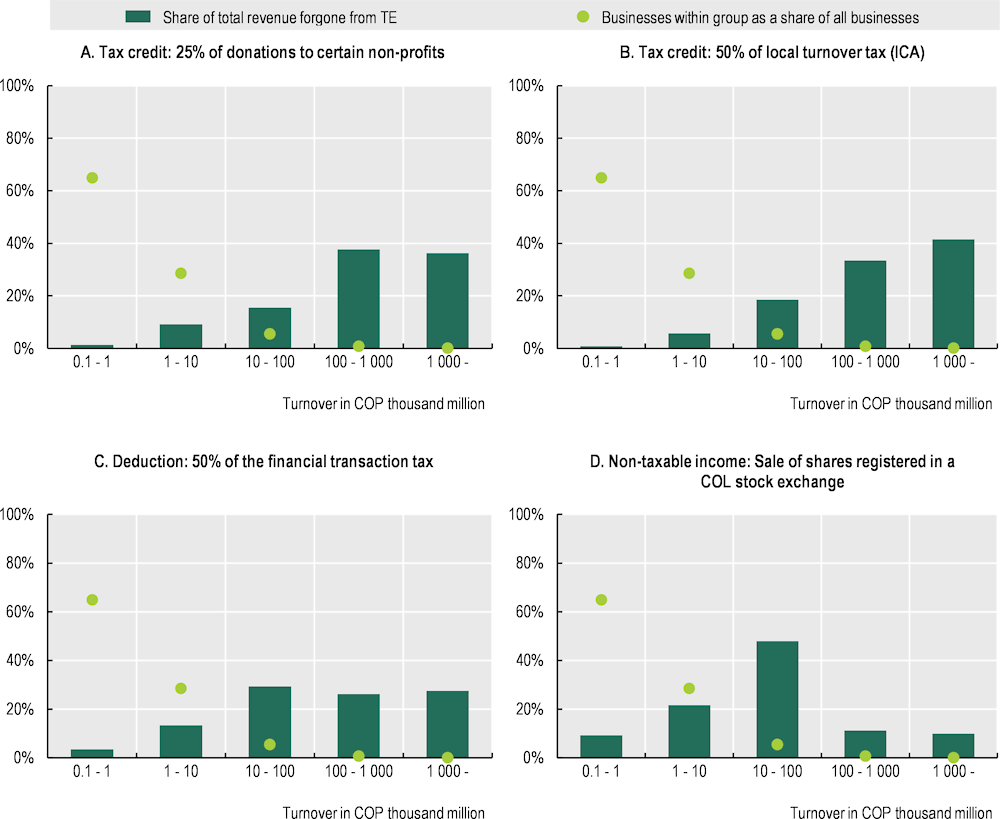

For certain tax provisions, the detailed tax microdata will allow DIAN to move beyond aggregate revenue forgone estimates and also provide information on the types of firms (e.g. by size or profitability) that benefit the most from specific TEs. The section includes a set of graphs estimated by DIAN upon OECD recommendations and is included for illustrative purposes only.

Figure 3.1 shows the percentage of companies claiming four selected TEs within five broad annual turnover groups. Figure 3.2 presents the distribution of total revenue forgone across the same groups. Both figures also include the share of corporations in each turnover group. Note that this type of analysis is currently only possible for businesses with annual turnover above COP 100 million because no exogenous information is available for smaller firms. This restriction implies that the bottom deciles of firms (in terms of turnover) cannot be represented in the graphs. Total revenue forgone therefore corresponds to total revenue forgone among firms with turnover above COP 100 million. As an alternative to Figure 3.1 and Figure 3.2 DIAN could present the firms across turnover deciles but keep the first deciles blank to signal that no exogenous information is available for these firms. Once exogenous information is collected for more firms, DIAN could present the share of companies claiming TEs by turnover decile across the entire distribution.13

These figures need to be interpreted with caution. TEs seem to be regressive but some (e.g. the ICA tax credit and the VAT tax credit) were introduced to neutralize distortive structural design flaws in Colombia’s tax system. Indeed, some of the current preferential tax treatments are necessary design features that seek to correct, albeit indirectly, for the tax distortions generated by the tax system’s structural design flaws. As the Tax Incentives Commission pointed out, reforming TEs will need to be part of a broader fundamental and progressive reform of the tax system that not only abolishes these TEs but at the same time addresses the structural design weaknesses within the Colombian tax system (OECD, DIAN and Minhacienda, 2021[3]) .

Figure 3.1. Share of businesses claiming the TE within selected annual turnover groups (2020)

Note: Based on the full taxpayer population that submitted exogenous information forms in 2020. Only includes businesses with annual turnover above COP 100 million (0.1 COP thousand million).

Source: DIAN.

Figure 3.2. Distribution of revenue forgone across selected annual turnover groups (2020)

Note: Based on the full taxpayer population that submitted exogenous information forms in 2020.Only includes businesses with annual turnover above COP 100 million (0.1 COP thousand million).

Source: DIAN.

3.5. Strengthening the TE measurement through more and better data

The use of the exogenous data constitutes a significant step forward because it allows DIAN to estimate the revenue forgone of a selection of TEs on an item-by-item basis compared to the analysis that is currently included in the MFMP. However, the available information remains incomplete; not all companies are required to submit the information, which results in an underestimation of revenue forgone, and only about half of the identified CIT TEs can be measured based on the data that is currently available (Table 3.4). Furthermore, the information reported in the exogenous information forms can occasionally be not aligned with what is reported in tax returns. For this reason, the use of exogenous data should always be complemented with tax returns data and should not be seen as a substitute for improving the granularity of CIT tax returns.

Table 3.4. Data availability to measure CIT revenue forgone on an item-by-item basis

|

Category |

CIT TEs currently measurable on an item-by-item basis / All identified CIT TEs |

|---|---|

|

Exempt income |

11/16 |

|

Non-taxable income |

18/24 |

|

Non-standard deductions |

16/26 |

|

Deferrals |

0/9 |

|

Tax credits |

9/16 |

|

Reduced rates * |

11/21 |

|

Increased rates |

1/1 |

|

Other |

0/10 |

|

Total |

66/123 |

Note: Based on comparing Table A with the list of identified TEs in Annex C.TEs classified as measurable on an item-by-item basis refer to TEs available in exogenous information forms.

* No company qualified to benefit from the mega-investment regime in 2020. The same applied to the Free Trade Zone regime in Cucutá taxed at a 15% rate. Two other reduced rate regimes were introduced in 2020 and 2021, respectively: First sale of land, real estate or real estate units that are new constructions (9%) [Law 2068 of 2020] and International maritime transportation services provided by vessels or naval artefacts registered in the Colombian registry (2%) [Law 2133 of 2021].

In addition to the changes that have been suggested in previous sections – revise the methodology that is applied to measure TEs (section 3.2) and use the available exogenous information – and that DIAN has already started to implement, DIAN should start collecting more data in order to (i) estimate a larger share of TEs on an item-by-item basis and (ii) improve the quality of the current estimates. DIAN could take the following measures (in decreasing order of priority):

1. Ensure that aggregate revenue forgone estimates can be obtained from CIT tax returns. Ensuring that TEs are reported separately from non-TEs in the tax return would allow DIAN to obtain aggregate revenue forgone estimates by type of TE (e.g. exempt income, non-taxable income, non-standard deductions, etc.). This should be the first priority.14

2. Increase the number of taxpayers that are required to submit exogenous information. Lower the annual turnover threshold that requires companies to submit exogenous information (COP 100 million).

3. Redesign the CIT return and the exogenous information forms. Improve the available information by revising the tax return and exogenous information forms. The revision could include:

Disaggregate tax credits by type of credit, following the example of other countries such as Chile, the United Kingdom, and the United States.

Report the use of the individual enhanced deductions in separate cells in form F-2516. Currently, cells L355, L356 and L358 of this form include more than one type of enhanced deduction which hinders DIAN from calculating revenue forgone on an item-by-item basis. For example, the 120% deduction of the total salary payments made to first-job employees under 28 years old is reported in the same cell together with four other enhanced deductions.15

Explore whether accelerated depreciation and amortization related to natural resources could be measured based on the stock of remaining asset values over time, which might be available from form F -2516 (boxes AE40, AD40).

Some provisions in the Colombian tax system combine enhanced deductions with special deductions or immediate expensing. For example, a 165% deduction is allowed for investments in or donations to Colombian film projects. If the company made a donation, the total amount should be considered a TE (165%) as donations are not deductible under the proposed benchmark. If the company instead carried out an investment, then the provision combines an enhanced deduction with immediate expensing. In the second case, to measure the deferral associated with immediate expensing, DIAN would need to use the respective economic depreciation rate as the benchmark. If one tax provision is linked to several different benchmarks depending on how it is used, revenue forgone could only be calculated if the tax returns ask taxpayers to specify, which benefit they claim; i.e. companies would have to report separately whether the deduction is a donation or an investment.

4. Explore additional sources of information. Review sources of exogenous information that might be available in other government agencies and entities and that could possibly be merged with tax returns data; identify sources of information that third parties, such as the financial sector, could be asked to report to DIAN.

Priority should be given to TEs that are highly distortive, at risk of being abused or for which the expected revenue forgone is large. The following TEs could be given priority:

Sale of shares in a non-resident entity by a CHC. Income derived from the sale or transfer of a Colombian Holding Company (CHC)'s stake in entities that are not resident in Colombia are exempt from income tax (Law 2010 of 2019).

Sale of shares in a CHC. The income derived from the sale or transfer of the shares or participations in a Colombian Holding Company (CHC) are exempt except for the value corresponding to the profits obtained from activities carried out in Colombia (Law 2010 of 2019).

Investments in the exploration of mining and hydrocarbon. Certificates of investment given by the ministry of finance to new investments in the exploration of mining and hydrocarbon (Law 1819 of 2016).

Mutual investment fund contributions: Deduction of the contributions to mutual investment funds (Law 75 of 1986).

Real estate valuation (Law 74 of 1994).

Salaries paid to first-job employees who are under twenty-eight years of age (120%). Deduction of 120% of the employer’s salary payments for employees who are under twenty-eight (28) years of age as part their first job (Law 2010 of 2019).

Deduction of royalties paid for the exploitation of non-renewable natural resources (Art. 107 of the Tax Code).

References

[7] Australian Government the Treasury (2021), Tax Benchmarks and Variations Statement 2020.

[5] Department of Finance Canada (2021), Report on Federal Tax Expenditures - Concepts, Estimates, Evaluations.

[4] Department of Finance Canada (2012), Tax Expenditures and Evaluations 2012.

[8] IMF-OECD (2020), “Chile : Technical Assistance Report—Assessment of Tax Expenditures and Corrective Taxe”, Country Report No. 2020/305.

[1] Minhacienda (2022), Marco Fiscal de Mediano Plazo 2022.

[2] Minhacienda (2021), Marco Fiscal de Mediano Plazo 2021.

[3] OECD, DIAN and Minhacienda (2021), Tax Expenditures Report by the Tax Experts Commission.

[6] Villela, L., A. Lemgruber and M. Jorratt (2010), “Tax Expenditure Budgets - Concepts and Challenges for Implementation”, IDB Working Paper Series IDB-WP-131.

Notes

← 1. Non-profit entities whose income is exempt are not considered taxpayers as long as they use their income in the subsequent period to continue developing their main activity. Following OECD guidance, the revenue forgone linked to the special regime (20%) that applies to taxable income of non-profit organisations has been included in the most recent edition of the MFMP (Minhacienda, 2022[1]).

← 2. Since previous editions of the MFMP, DIAN reports the revenue forgone from a special deduction on the investment in fixed assets and revenue forgone from the reduced rate applicable to companies that have signed a stability contract.

← 3. Section 3.2 recommends to apply the company-specific CIT rate instead while reporting the remainder revenue forgone as a second component of reduced rates.

← 4. Note, however, that even though the suggested method attempts to isolate the revenue forgone of each provision, it remains a static calculation and not an estimate of the revenue gain, which would take into account behavioural responses.

← 5. The additional revenue forgone from the interaction between reduced rates and these TEs (i.e. revenue forgone that could only potentially be recovered if both reduced rates and the other TEs were to be repealed) would be isolated and reported for each reduced rate regime as separate item (see Table 3.1 and second component in the reduced rates section for a detailed discussion of the interaction).

← 6. Note that some provisions in the Colombian tax system combine enhanced deductions with special deductions or immediate expensing. For example, a 165% deduction is allowed for investments in or donations to Colombian film projects. If the company made a donation, the total amount should be considered a TE (165%) as donations are not deductible under the proposed benchmark. If the company instead carried out an investment, then the provision combines an enhanced deduction with immediate expensing. In the second case, to measure the deferral associated with immediate expensing, DIAN would need to use the respective economic depreciation rate as the benchmark. If one tax provision is linked to several different benchmarks depending on how it is used, revenue forgone could only be calculated if the tax returns ask taxpayers to specify, which benefit they claim; i.e. companies would have to report separately whether the deduction is a donation or an investment.

← 7. Currently DIAN applies the standard CIT rate to calculate revenue forgone from exempt income. Hence, the interaction between this type of TE and the reduced rate is included in the revenue forgone of exempt income.

← 8. Under the proposed benchmark tax depreciation allowances reflect estimates of economic depreciation.

← 9. Alternatively, the net present value method takes into account the impact of transactions that take place in the current fiscal period on the current as well as on future fiscal periods (IMF-OECD, 2020[8]). As it accounts for the time value of money, it is a more complex method that requires making assumptions about future cash flows and the discount rate.

← 10. The useful life of an asset implicitly defines its economic depreciation rate, which would be equal to the benchmark depreciation rate as per the proposed benchmark in the first chapter.

← 11. The structure and content of these table follow the reporting practices of the Australian TE report (Australian Government the Treasury, 2021[7]).

← 12. This list was the result of a detailed analysis carried out jointly by DIAN, the MOF and the OECD.

← 13. The OECD provided DIAN with the necessary coding to carry out the distributional analysis, which DIAN applied to the universe of taxpayers that submit exogenous information forms.

← 14. If some item-by-item estimates are available, DIAN could then calculate the residual between the aggregate category (e.g. total revenue forgone from non-taxable income) and the sum of individual TEs, and include a value in the row “other” in Table A.

← 15. Other enhanced deductions reported in the same cell include: Salaries, social benefits and other labour payments, paid to widows and orphans of members of the Armed Forces killed in combat, kidnapped or missing (200%); salaries and social contributions paid to handicapped workers (200%); salaries paid to old age workers who do not receive an old-age pension (120%) and salaries and social contributions of workers hired as apprentices in addition to those foreseen legally (130%).