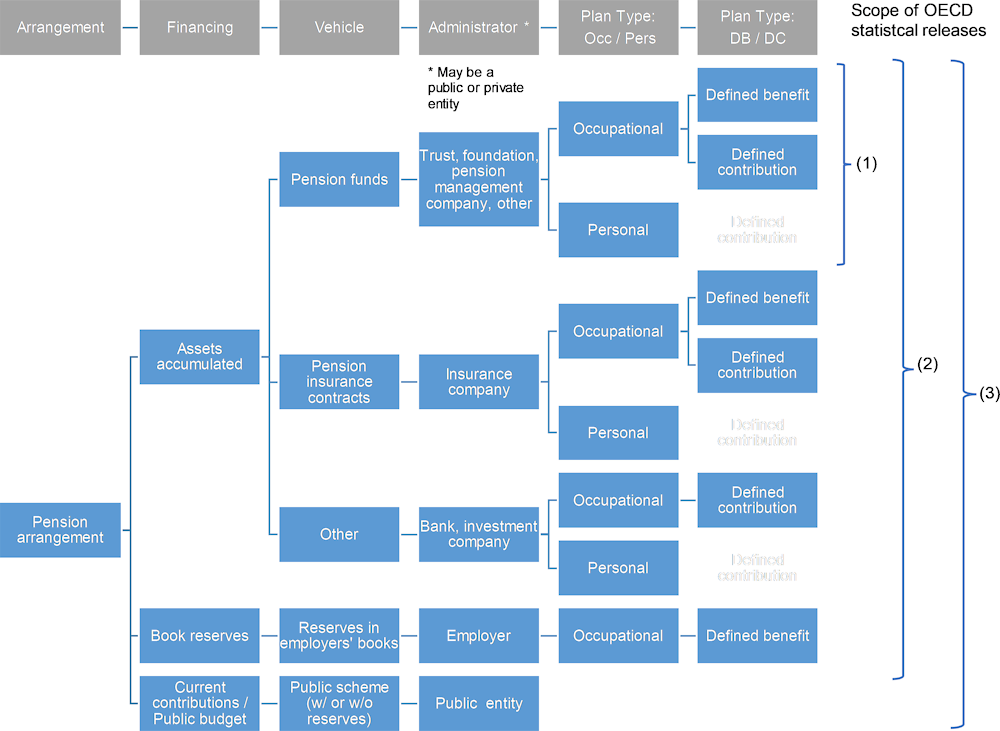

Asset-backed pension systems include various types of arrangements around the world. These arrangements finance the benefits of retirees in different ways, through specific vehicles administered by different entities (Figure A A.1). The way individuals get access to these arrangements and the type of benefits offered also vary across jurisdictions.

Pension Markets in Focus 2023

Annex A. Features of asset-backed pension systems

Copy link to Annex A. Features of asset-backed pension systemsFigure A A.1. Features of asset-backed pension arrangements and evolution of the scope of Pension Markets in Focus

Copy link to Figure A A.1. Features of asset-backed pension arrangements and evolution of the scope of Pension Markets in FocusPension arrangements are designed to provide benefits to individuals at retirement but finance these benefits in various ways. Benefits can be financed through assets accumulated, through provisions in employers’ books, from current contributions or from the public budget.

Members can accrue rights or accumulate assets for their retirement through their contributions or the contributions of their employers during their working lives. These assets are legally separated from the sponsors of the pension plans. Members have a legal or beneficial right or some other contractual claim on these assets.

By contrast, provisions in employers’ books are not legally separated from the employers. The accrued pension rights of employees could potentially be at risk if the employers go bankrupt. Some countries where this financing method exists have set up insolvency guarantee schemes (e.g. Germany). Other countries encourage or require employers to purchase credit insurance or arrange equivalent guarantees (e.g. Sweden) to protect the pension rights of employees in the event of employer insolvency.

In most countries, the current contributions that employees and employers pay into public pension arrangements are used to pay the benefits of current retirees (i.e. unfunded or pay-as-you-go (PAYG) plans), while in some others retirement income may be financed by tax revenues (e.g. some social assistance programmes). These arrangements are usually administered by a public institution and may have reserves to cover expenses and smooth benefit payments over time.

Some pension arrangements rely both on current contributions and assets accumulated to finance benefits, such as the earning-related pension plans regulated by the Employees’ Pension Act (TyEL) and the Seafarer’s Pensions Act (MEL) in Finland. The main part of the pensions in a given year is paid by the contributions received that year. The remaining part is financed by accumulated assets.

Pension plans may be funded through the establishment of pension funds, pension insurance contracts or the purchase of other authorised retirement savings products. Pension funds represent a pool of ring-fenced assets forming an independent legal entity. When pension insurance contracts are used for retirement saving, individuals or their employers pay premiums to insurance companies. Insurance companies manage the assets coming from these premiums (or contributions) together with those coming from their other insurance activities. While the amount of premiums paid for these policies is usually known, it is more difficult to assess the size of assets that insurance companies hold as a result of their pension activities. Individuals or their employers may also open or purchase other retirement savings products offered and administered by banks or investment companies (such as individual retirement accounts (IRAs) in the United States).

Pension funds take different legal forms around the world (Stewart and Yermo, 2008[13]). Pension funds may have a legal personality and capacity in some countries (e.g. Pensionskassen in Austria and Germany, contractual pension funds in Italy, pension funds in the Netherlands and Switzerland). Pension funds in these countries have their own governing board. In some other countries, pension funds are segregated pools of assets without legal personality and capacity. In this case, pension funds are governed and administered by a separate entity. This entity may be a pension fund management company (e.g. in Czechia, Chile, Mexico, the Slovak Republic), a bank or an insurance company for instance. In some other countries (e.g. Ireland, the United Kingdom), the legal form of the pension fund is a trust. The trustees legally own and administer the assets of the trust in the interest of plan members. Irrespective of the legal form of the pension funds, some of the activities, such as those related to the investment of assets or the collection of contributions, may be outsourced to third parties (e.g. asset managers).

Employers (from the public or private sector) may set up a pension plan on behalf of their employees. In such cases, the plan is considered as occupational in the OECD taxonomy.1 Access to the plan is linked to employment. When individuals choose and set up a plan themselves with a dedicated provider, the plan is personal. Access to certain plans may however be limited to individuals with a professional activity but open to both public and private sector workers (e.g. Mexico). These plans are still considered as personal as individuals independently select material aspects of the plan such as the investment strategy, the fund or the administrator of the fund.

Where the employer is responsible for guaranteeing a benefit or return promise to plan members, the OECD considers such occupational plan as a defined benefit (DB) plan. The benefit promise may be a pension calculated on a number of parameters (e.g. salary, length of employment) or an investment rate of return. In the first case, the plan is considered as DB traditional, while the plan is considered as DB hybrid in the second case. When another party offers a guarantee (e.g. an insurance company), the plan is considered as a protected defined contribution (DC) plan. Otherwise, if there is no (fixed) guarantee, the plan is DC unprotected.

The Global Pension Statistics (GPS) exercise that the OECD carries out in co-operation with the IOPS and the World Bank cover employers’ book reserves (which are private pension plans) and all plans accumulating assets, regardless of the financing vehicle and its administrator (public or private institution), the type of plans (occupational, personal, DB or DC) and the type of people covered (public sector workers, private sector workers). Unfunded or pay-as-you-go arrangements with their reserves are out of the scope of this exercise.

This publication mainly relies on all the data collected through this statistical exercise. It endeavours to show data for data for all plans accumulating assets (funded plans) and book reserves, since the 2017 edition of this annual report (scope (2) in Figure A A.1).

Data in the GPS exercise – and therefore in this report – may not always cover book reserves and all plans accumulating assets that exist in each country due to data availability issues. Data are sometimes unavailable (“missing”) for a given type of plan in a country (e.g. book reserves in Austria). In other cases, data may be missing only for some plans in a given type of plan. In Ireland for example, two plans qualify as pension insurance contracts according to the OECD taxonomy: retirement annuity contracts and personal retirement savings accounts (PRSAs). Data in the GPS exercise only cover PRSAs. Table A A.1 shows the types of pension plans and book reserves that exist in all the jurisdictions participating in the OECD, IOPS and World Bank statistical exercise. The table also specifies the coverage of the OECD data. More information is available online on the different pension plans in each jurisdiction.2

Table A A.1. Existing types of funded pension plans and book reserves by jurisdictions and data coverage of the Global Pension Statistics exercise

Copy link to Table A A.1. Existing types of funded pension plans and book reserves by jurisdictions and data coverage of the Global Pension Statistics exercise|

|

Funded |

Book reserves |

|||||||

|---|---|---|---|---|---|---|---|---|---|

|

Pension funds |

Pension insurance contracts |

Other |

|||||||

|

Occupational |

Personal |

Occupational |

Personal |

Occupational |

Personal |

||||

|

DB |

DC |

DB |

DC |

||||||

|

OECD countries |

|||||||||

|

Australia |

✔ |

✔ |

✔ |

Some |

|||||

|

Austria |

Some |

✔ |

✔ |

Some |

Some |

Missing |

|||

|

Belgium |

✔ |

✔ |

Some |

✔ |

✔ |

✔ |

Some |

||

|

Canada |

✔ |

✔ |

Some |

✔ |

✔ |

✔ |

Some |

✔ |

|

|

Chile |

✔ |

✔ |

Missing |

Missing |

Missing |

Missing |

|||

|

Colombia |

✔ |

||||||||

|

Costa Rica |

✔ |

✔ |

✔ |

||||||

|

Czechia |

✔ |

||||||||

|

Denmark |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|||

|

Estonia |

✔ |

✔ |

|||||||

|

Finland |

✔ |

✔ |

✔ |

Missing |

|||||

|

France |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|||

|

Germany |

✔ |

✔ |

Missing |

Missing |

Missing |

Missing |

Missing |

||

|

Greece |

✔ |

Missing |

|||||||

|

Hungary |

Missing |

✔ |

✔ |

✔ |

|||||

|

Iceland |

✔ |

✔ |

✔ |

✔ |

✔ |

||||

|

Ireland |

✔ |

✔ |

Some |

✔ |

|||||

|

Israel |

✔ |

✔ |

Missing |

Some |

|||||

|

Italy |

✔ |

✔ |

✔ |

✔ |

✔ |

||||

|

Japan |

✔ |

✔ |

✔ |

✔ |

✔ |

||||

|

Korea |

✔ |

✔ |

✔ |

✔ |

✔ |

||||

|

Latvia |

✔ |

✔ |

✔ |

||||||

|

Lithuania |

✔ |

||||||||

|

Luxembourg |

✔ |

✔ |

Missing |

Missing |

Missing |

Missing |

|||

|

Mexico |

✔ |

✔ |

✔ |

✔ |

✔ |

Missing |

✔ |

Missing |

|

|

Netherlands |

✔ |

✔ |

Missing |

Missing |

Missing |

||||

|

New Zealand |

✔ |

✔ |

✔ |

✔ |

|||||

|

Norway |

✔ |

✔ |

✔ |

✔ |

|||||

|

Poland |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|||

|

Portugal |

✔ |

✔ |

✔ |

Missing |

Missing |

✔ |

✔ |

||

|

Slovak Republic |

✔ |

||||||||

|

Slovenia |

✔ |

✔ |

✔ |

✔ |

|||||

|

Spain |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

||

|

Sweden |

✔ |

✔ |

✔ |

✔ |

✔ |

Some |

✔ |

Some |

|

|

Switzerland |

✔ |

✔ |

✔ |

||||||

|

Türkiye |

Some |

✔ |

✔ |

✔ |

|||||

|

United Kingdom |

✔ |

✔ |

Missing |

Missing |

Missing |

||||

|

United States |

✔ |

✔ |

✔ |

✔ |

|||||

|

Other jurisdictions |

|||||||||

|

Albania |

✔ |

✔ |

|||||||

|

Armenia |

Some |

||||||||

|

Botswana |

✔ |

✔ |

|||||||

|

Brazil |

✔ |

✔ |

✔ |

||||||

|

Bulgaria |

✔ |

✔ |

|||||||

|

Croatia |

✔ |

✔ |

|||||||

|

Dominican Republic |

✔ |

Some |

✔ |

||||||

|

Egypt |

✔ |

||||||||

|

Georgia |

✔ |

✔ |

|||||||

|

Ghana |

✔ |

✔ |

|||||||

|

Gibraltar |

✔ |

✔ |

Missing |

✔ |

|||||

|

Guyana |

✔ |

✔ |

|||||||

|

Hong Kong (China) |

✔ |

✔ |

✔ |

✔ |

|||||

|

India |

Some |

✔ |

✔ |

||||||

|

Indonesia |

✔ |

✔ |

Some |

||||||

|

Isle of Man |

✔ |

✔ |

✔ |

||||||

|

Jamaica |

✔ |

✔ |

✔ |

||||||

|

Kazakhstan |

✔ |

||||||||

|

Kenya |

✔ |

✔ |

✔ |

||||||

|

Kosovo* |

✔ |

||||||||

|

Lesotho |

✔ |

✔ |

Missing |

||||||

|

Liechtenstein |

✔ |

✔ |

|||||||

|

Macau (China) |

✔ |

✔ |

✔ |

||||||

|

Malawi |

✔ |

✔ |

|||||||

|

Malaysia |

Missing |

✔ |

✔ |

||||||

|

Maldives |

✔ |

||||||||

|

Malta |

✔ |

✔ |

✔ |

||||||

|

Mauritius |

✔ |

✔ |

Missing |

Missing |

|||||

|

Morocco |

✔ |

||||||||

|

Mozambique |

✔ |

✔ |

|||||||

|

Namibia |

✔ |

✔ |

✔ |

✔ |

|||||

|

Nigeria |

✔ |

✔ |

|||||||

|

North Macedonia |

✔ |

✔ |

|||||||

|

Pakistan |

Missing |

Missing |

✔ |

||||||

|

Peru |

✔ |

||||||||

|

Romania |

✔ |

||||||||

|

Russia |

✔ |

✔ |

✔ |

||||||

|

Serbia |

✔ |

✔ |

|||||||

|

South Africa |

✔ |

✔ |

✔ |

✔ |

✔ |

||||

|

Suriname |

✔ |

✔ |

Missing |

Missing |

|||||

|

Tanzania |

Some |

✔ |

|||||||

|

Thailand |

Some |

Missing |

|||||||

|

Uganda |

✔ |

✔ |

✔ |

||||||

|

Ukraine |

✔ |

||||||||

|

Uruguay |

✔ |

||||||||

|

Zambia |

Some |

✔ |

Missing |

Missing |

|||||

|

Zimbabwe |

Some |

✔ |

Missing |

Missing |

|||||

Note: “DB”: defined benefit; “DC”: defined contribution. This Table gives the data coverage of this report, based on the OECD/IOPS/World Bank Global Pension Statistics (GPS) exercise. When a cell is grey with a tick, this means that the GPS exercise covers all the plans of this type for a given country. “Some” means that the GPS exercise only covers some plans of this type. “Missing” means that this type of plan exists but the OECD data do not cover it. Data for Australia cover the whole superannuation sector except retirement savings accounts (RSAs). Data for Germany refer to Pensionskassen and Pensionsfonds only. In Hungary, there is one institution for occupational retirement provision but its market share is negligible compared to other pension providers administering personal pension plans. In Norway, since 2021, members of DC schemes can consolidate their previous DC savings and contributions from their current job into a single account (own pension account). See Annex B for a full and detailed description of all types of funded plans and book reserves in the jurisdictions participating in the OECD/IOPS/World Bank Global Pension Statistics exercise. Any deviation to this data coverage in this report is reported in the specific notes of the related Table or Figure.

This edition of Pension Markers in Focus has a broader coverage of asset-backed pension systems than before, by incorporating reserves of public PAYG pension arrangements in the OECD area (scope (3) in Figure A A.1). Data on these public reserves mainly come from the website of the public pension reserve funds managing these reserves and from desk research.

Notes

Copy link to Notes← 1. The definitions of pension plans by the OECD’s Working Party on Private Pensions are available in the publication Private Pensions: OECD Classification and Glossary, available at https://www.oecd.org/daf/fin/private-pensions/privatepensionsoecdclassificationandglossary.htm.