Pension providers levied more fees in 2022 than in 2021 in most reporting jurisdictions. Table 5.1 shows that the amount of fees collected increased the most in several non-OECD jurisdictions (Albania, Liechtenstein, the Maldives and North Macedonia). By contrast, fees declined in some countries, with the largest drop recorded in the Slovak Republic (-55%).

Pension Markets in Focus 2023

5. The recent macro-economic developments indirectly impacted fees levied in 2022

Copy link to 5. The recent macro-economic developments indirectly impacted fees levied in 2022Table 5.1. Evolution of the amount of fees levied in 2022 relative to 2021

Copy link to Table 5.1. Evolution of the amount of fees levied in 2022 relative to 2021In per cent

|

Country |

ISO code |

Change in total fees |

|---|---|---|

|

Slovak Republic |

SVK |

-54.5 |

|

Romania |

ROU |

-45.0 |

|

Mexico |

MEX |

-26.4 |

|

Colombia |

COL |

-24.2 |

|

Kazakhstan |

KAZ |

-20.8 |

|

Hungary |

HUN |

-7.3 |

|

Poland |

POL |

-5.9 |

|

Slovenia |

SVN |

0.3 |

|

Czechia |

CZE |

1.1 |

|

Chile |

CHL |

1.5 |

|

Bulgaria |

BGR |

2.1 |

|

Croatia |

HRV |

2.1 |

|

Pakistan |

PAK |

2.9 |

|

Peru |

PER |

3.3 |

|

Costa Rica |

CRI |

7.4 |

|

Lithuania |

LTU |

8.5 |

|

Albania |

ALB |

11.8 |

|

North Macedonia |

MKD |

13.2 |

|

Maldives |

MDV |

14.9 |

|

Liechtenstein |

LIE |

24.4 |

Source: OECD Global Pension Statistics.

Higher inflation, higher interest rates and improvements in labour markets also affected the fees charged to members of DC plans in 2022. Fees can be charged on contributions or on salaries directly as in some Latin American countries (e.g. Chile, Colombia), on assets (e.g. Estonia, Spain), on performance, or a combination (e.g. Czechia, Bulgaria).1 Fees on assets are the most widespread way pension providers charge members for services (OECD, 2023[4]). On top of regular fees, members in some jurisdictions can be charged fees when they join, switch or leave a pension provider (e.g. Albania, Czechia, Hungary).

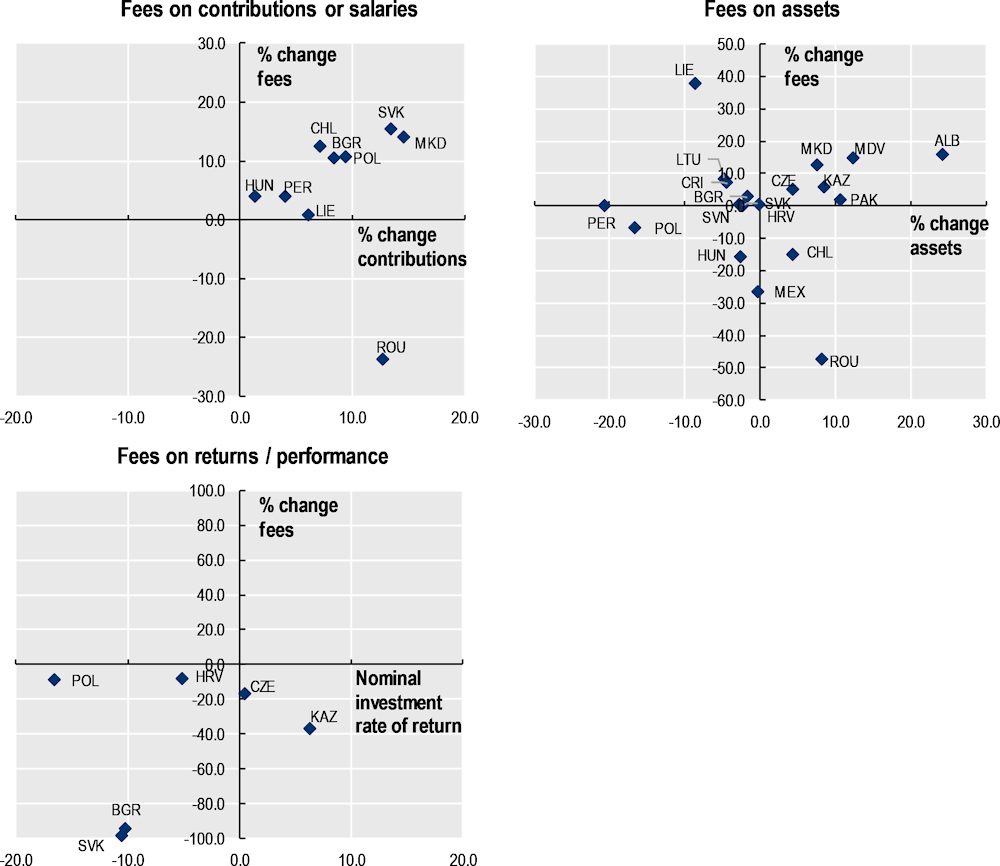

The aggregated amount of fees charged on contributions increased in most jurisdictions where this type of fee exists (Figure 5.1). The rising levels of contributions in 2022 generally led to larger amounts of fees levied on members (top left panel of Figure 5.1). Romania is an exception, as fees on contributions dropped despite the overall increase in contributions.2

Figure 5.1. Evolution of fees charged to members relative to contributions, assets and the investment performance of the plans, 2022

Copy link to Figure 5.1. Evolution of fees charged to members relative to contributions, assets and the investment performance of the plans, 2022In per cent

Note: Jurisdictions are labelled with their ISO codes in the charts.

Source: OECD Global Pension Statistics.

Fees charged on assets also tended to vary with assets. There are some exceptions (top right panel of Figure 5.1). For example, fees on assets decreased in Chile and Romania despite the rise in pension assets. In Chile, this is because the investment expenses that pension funds incurred declined in 2022. In Romania, the fee cap on assets increases with the extent to which the nominal investment rate of return exceeds the inflation rate. Given that Romanian pension funds achieved negative real returns overall in 2022 (Figure 1.2), the fee cap was at its lowest possible level (0.02% monthly). Conversely, fees levied on assets increased in 2022 while the amount of pension assets declined in 2022 in some countries due to the way fees are calculated. For example, in Costa Rica and Lithuania, pension providers charge fees on the amount of assets daily and the average amount of assets was higher in 2022 than in 2021.

Pension providers charging fees on investment performance all collected lower amounts of fees in 2022 than in 2021 (bottom left panel of Figure 5.1). The largest drop occurred in in the Slovak Republic that uses of a high-water mark. The high-water mark mechanism in the Slovak Republic only triggers a fee collection when the unit value of the portfolio exceeds the last highest value over the last three years (for the second pillar) or since the beginning of 2010 (for the third pillar). Given the low investment performance in 2022, almost no performance fee was collected.

Overall, fees were among the highest as a percentage of assets in Albania, Türkiye and Uruguay (Table 5.2) where fees are charged on contributions or assets. However, higher levels of fees, expressed as a percentage of assets, do not necessarily imply that a system is more expensive overall for plan members than another one. Fee structures vary across jurisdictions, and fees charged on contributions (but expressed as a percentage of assets) may seem higher than in countries charging on assets only, especially in the early years of the system where contributions (and therefore fees on contributions) represent a larger share of assets under management (OECD, 2022[8]).

Table 5.2. Annual fees charged to members of defined contribution plans by type of fees, 2022

Copy link to Table 5.2. Annual fees charged to members of defined contribution plans by type of fees, 2022As a percentage of total assets in the plans

|

|

Fees on salaries |

Fees on contributions |

Fees on assets |

Fees on returns / performance |

Other fees |

|---|---|---|---|---|---|

|

Selected OECD countries |

|||||

|

Australia (1) |

0.4 |

||||

|

Chile |

0.6 |

x |

0.3 |

x |

x |

|

Colombia (2) |

0.3 |

x |

x |

x |

0.2 |

|

Costa Rica (3) |

x |

x |

0.4 |

x |

x |

|

Czechia |

x |

x |

0.8 |

0.1 |

0.0 |

|

Estonia |

x |

x |

0.6 |

0.0 |

0.0 |

|

Hungary (4) |

x |

0.4 |

0.4 |

.. |

.. |

|

Lithuania |

x |

.. |

0.5 |

.. |

0.0 |

|

Mexico (5) |

x |

x |

0.5 |

x |

x |

|

Poland (6) |

x |

0.0 |

0.5 |

0.0 |

x |

|

Slovak Republic |

x |

0.1 |

0.4 |

0.0 |

0.0 |

|

Slovenia |

x |

.. |

0.8 |

x |

.. |

|

Spain (5) |

x |

x |

1.1 |

.. |

x |

|

Türkiye |

x |

0.1 |

1.4 |

x |

0.4 |

|

Selected other jurisdictions |

|||||

|

Albania |

x |

x |

1.8 |

x |

0.2 |

|

Bulgaria |

x |

0.4 |

0.7 |

0.0 |

0.0 |

|

Croatia |

x |

0.0 |

0.3 |

0.0 |

0.0 |

|

Kazakhstan |

x |

x |

0.1 |

0.1 |

x |

|

Liechtenstein |

x |

0.2 |

0.4 |

x |

0.0 |

|

Maldives |

x |

x |

0.4 |

x |

x |

|

North Macedonia |

x |

0.2 |

0.4 |

x |

.. |

|

Pakistan |

x |

x |

1.2 |

x |

0.0 |

|

Peru |

0.9 |

x |

0.2 |

x |

x |

|

Romania |

x |

0.0 |

0.3 |

x |

0.0 |

|

Uruguay |

x |

6.5 |

x |

x |

x |

Note: "x" means that the type of fee does not exist or is not allowed in the country. For more details, please see the methodological notes in Annex C.

Source: OECD Global Pension Statistics.

Many jurisdictions have been lowering fee caps to reduce the fees charged to members. This includes Costa Rica, Croatia, the Maldives, and Romania. Only a few countries have provided or considered to provide greater flexibility to the cap, such as the United Kingdom that exempted performance fees from the 0.75% fee cap in 2023 to bolster investments in illiquid assets such as infrastructure.3

Some countries have also introduced structural solutions to reduce the fees charged by the industry or improve value for money. Chile, New Zealand and Peru have auction mechanisms for the selection of default funds, which aim at driving fees down. Pension providers in Chile and Peru bid on fees charged to members. The winning pension provider receives all new eligible entrants for a period of two years. In New Zealand, default providers are selected for a period of seven years based on a range of selection criteria that include fees. In Australia, the pension supervisor publishes heatmaps highlighting underperformance and high fees of superannuation product offerings, so as to urge trustees to reduce fees and review investment performance. In Hong Kong (China), the Mandatory Provident Fund Schemes Authority (i.e. the pension supervisor) is developing a common and integrated electronic platform (the eMPF Platform), which seeks to standardise, streamline and automate the administration processes of MPF schemes, thereby enhancing operational efficiency and reducing the overall costs of the MPF System, which should drive down the fees that members pay.4

Notes

Copy link to Notes← 1. Pension funds in Czechia can charge fees on assets and profits. Supplementary voluntary pension funds in Bulgaria can charge fees on contributions and returns.

← 2. Legal changes removed the possibility for pension fund management companies to charge fees on contributions to cover their administration costs towards the end of 2022. This contributed to the decline in fees that pension fund management companies charged on contributions in 2022.