Defined contribution

Employees and employers who are covered by the MPF System are each required to make regular mandatory contributions calculated at 5% of the employee’s relevant income to an MPF scheme, subject to the minimum and maximum relevant income levels. For a monthly paid employee, the minimum and maximum relevant income levels are HKD 7 100 and HKD 30 000 respectively.

Accrued benefits in the MPF System are withdrawn in a lump sum when scheme members reach the retirement age of 65.

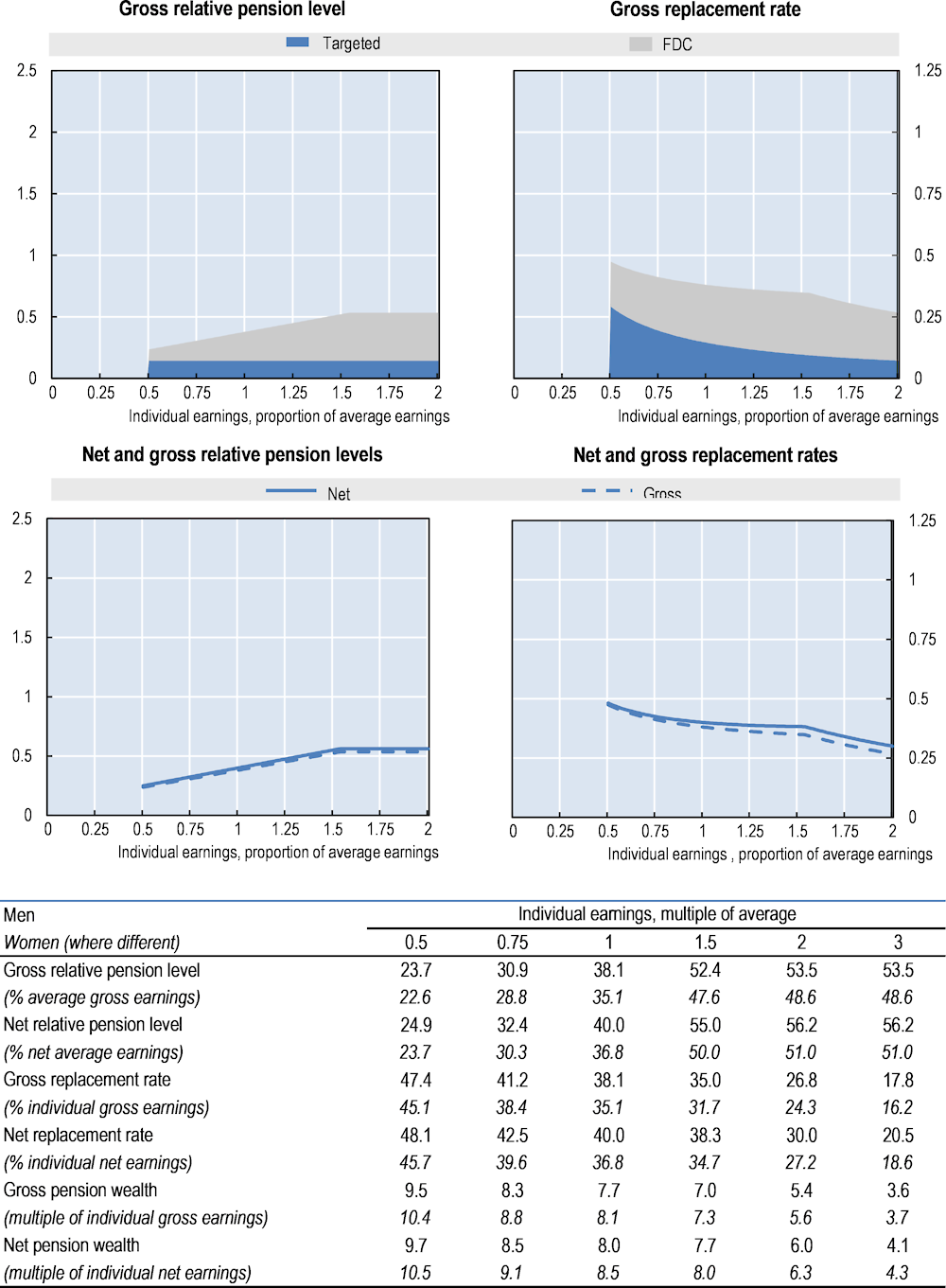

For comparison with other economies, for replacement rate purposes the pension is shown as a price‑indexed annuity based on sex-specific mortality rates.

Targeted/Basic

The old-age allowance has two levels. Normal old age living allowance (Normal OALA) is means-tested and provided to those between 65 and 69. For a single person, the asset limit is HKD 365 000 and monthly income limit is HKD 10 330 (after which benefits are withdrawn). Limits for married couples are higher (HKD 554 000 and HKD 15 620, respectively). The full benefit is HKD 2 845 per month, which is about 14.6% of average earnings.

Higher older age living allowance (Higher OALA) is for those aged 70 and above. For a single person, the asset limit is HKD 159 000 and monthly income limit is HKD 10 330 (after which benefits are withdrawn). Limits for married couples are higher (HKD 241 000 and HKD 15 620, respectively). The full benefit is HKD 3 815 per month, which is about 19.6% of average earnings.

From 1 September 2022 the normal and higher old age allowances will be merged. The merged old age live allowance (OALA) will adopt the more relaxed asset limits of the Normal OALA and the payment rate of the Higher OALA, while the monthly income limits will remain unchanged.