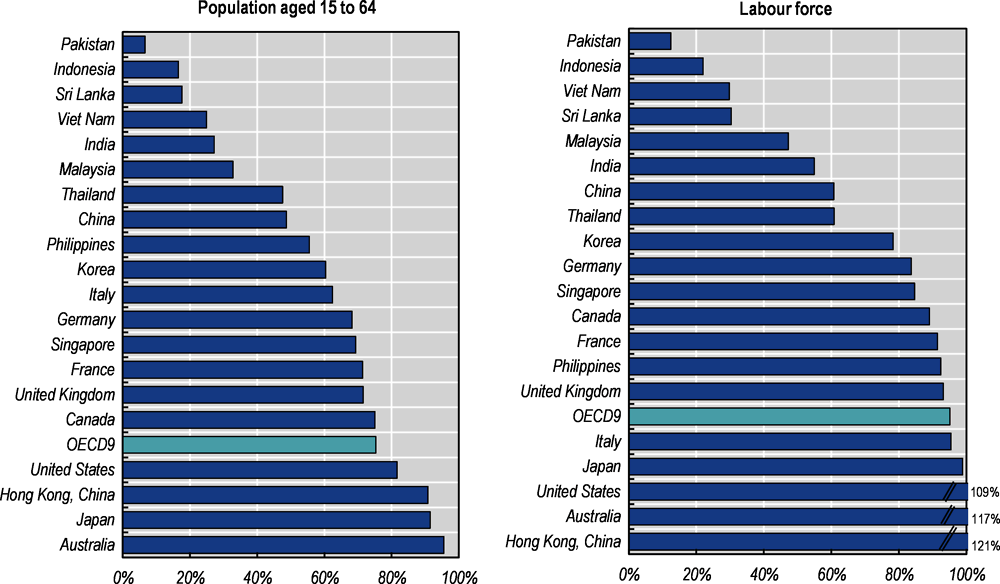

The level of coverage, the proportion covered by mandatory pension schemes, in non-OECD economies ranges from 90.8% in Hong Kong (China) to only 6.6% in Pakistan, for the population aged 15 to 64. In contrast the OECD average is 75.8% and is as high as 95.6% in Australia. For the labour force the non-OECD economies range from 120.6% to 12.4%, whilst the OECD average increases to 95.1%, with Australia again highest at 117.2%.

Pensions at a Glance Asia/Pacific 2022

Coverage

Key results

Coverage is defined as the proportion of people that are covered by mandatory pension schemes. For the purposes of this report the measures used are: i) the population aged 15 to 64; and ii) the active labour force. The coverage percentage is a measure of how effectively a pension system is being utilised by the pre‑retirement population and can act as an indicator of future trends. The coverage value is expressed as the percentage of the population or labour force that is classified as active members of a mandatory pension system during the indicated year. For this purpose, active members include those that have either contributed or accrued pension rights in any of the major mandatory pension schemes during the indicated year.

For OECD countries as a whole there is very little variation between countries using either the population or labour force measurement. The average coverage percentage within the OECD countries listed is 76% for the population measure and 95% using the labour force methodology (Table 1.6). The lowest levels are found in Germany, Italy and Korea at under 70% of the population aged 15 to 64. However, when looking at the labour force percentage Italy increases to 96%, well above Germany (87%) and Korea (80%). All of these levels are still well beyond all of the Asian economies, with the exception of Hong Kong (China) and Singapore for the population percentage and also the Philippines is added when considering the labour force.

The remaining Asian, non-OECD, economies vary considerably in the levels of coverage using either measurement. Pakistan is the lowest on either measure with coverage less than half of that of any other economy. Only the Philippines and Singapore along with the aforementioned Hong Kong (China) have coverage above 50% for the population measure and over 80% for the labour force. India, Malaysia and Viet Nam are around 25‑30% for the population measure with Indonesia and Sri Lanka both under 20%. When considering the size of the populations in this region of the world it becomes apparent that the lack of coverage is a global rather than regional issue.

In a number of countries and economies the percentage of coverage for the labour force is well above 100%. This results from it being possible for individuals to have multiple accounts and also for those currently outside the labour force to have previously being a paid member of an account. In general, for these reasons the numbers for the labour force are particularly inflated, but the multiple account scenario also inflates the population statistic. Conversely, as the retirement age is below 65 in many of the economies listed the population base of 15‑64 is not the most appropriate for all the economies and will underestimate the relevant coverage figure. For example, the retirement age in Thailand is 55 years, so if the population base of 15 to 54 was used instead of 15 to 64 then the coverage figure would increase from 47.6% to 59.6%.

Coverage statistics are better analysed in conjunction with life expectancy and population projections, in order to estimate the numbers of people actually involved rather than percentage (see Chapter 3). Analysis of these characteristics will highlight the problems that may arise if nothing is done to combat the poor levels of coverage that exist within a number of economies across Asia.

Table 1.6. Membership of mandatory pension schemes by population and labour force

|

Country |

Year |

Members |

Percentage of population aged 15 to 65 |

Percentage of labour force |

Country |

Year |

Members |

Percentage of population aged 15 to 65 |

Percentage of labour force |

|---|---|---|---|---|---|---|---|---|---|

|

East Asia/Pacific |

OECD Asia-Pacific |

||||||||

|

China |

2021 |

480 700 000 |

48.7% |

60.7% |

Australia |

2020 |

16 000 000 |

95.6% |

117.2% |

|

Hong Kong (China) |

2022 |

4 590 000 |

90.8% |

120.6% |

Canada |

2019 |

18 723 000 |

75.1% |

89.1% |

|

Indonesia |

2021 |

30 660 901 |

16.5% |

22.0% |

Japan |

2019 |

67 460 000 |

91.4% |

98.9% |

|

Malaysia |

2021 |

7 690 000 |

32.8% |

47.2% |

Korea |

2021 |

22 350 000 |

60.3% |

78.3% |

|

Philippines |

2021 |

40 490 000 |

55.5% |

92.4% |

New Zealand |

||||

|

Singapore |

2021 |

2 770 600 |

69.3% |

84.6% |

United States |

2022 |

179 256 000 |

81.6% |

108.8% |

|

Thailand |

2021 |

23 740 954 |

47.6% |

60.8% |

|||||

|

Viet Nam |

2021 |

16 700 000 |

24.9% |

29.7% |

Other OECD |

||||

|

France |

2019 |

28 322 400 |

71.4% |

91.4% |

|||||

|

South Asia |

Germany |

2019 |

36 694 000 |

68.3% |

83.7% |

||||

|

India |

2021 |

258 786 358 |

27.2% |

54.9% |

Italy |

2019 |

23 823 000 |

62.4% |

95.5% |

|

Pakistan |

2022 |

9 176 081 |

6.6% |

12.4% |

United Kingdom |

2005 |

28 402 200 |

71.5% |

93.2% |

|

Sri Lanka |

2019 |

2 500 000 |

17.6% |

30.3% |

OECD9 |

75.8% |

95.1% |

Source: National reports.