The Netherlands is the world’s second-largest exporter of agricultural products, and agricultural products represent 17% of Dutch exports. Horticulture, grazing livestock and granivores (pig and poultry) contribute the most to agriculture gross value added. This chapter examines trends in agro-food production, consumption, and trade, as well as the policies that most affect this sector. The main drivers and outcomes are presented, with a focus on the evolutions in productivity, input use, and emissions. Sustainability is higher on the agricultural policy agenda, driven by concerns about ammonia and nutrient emissions, issues with water quality and lack of progress in climate change mitigation. The national CAP Strategic plan (CSP) increases emphasis on innovation and environmental sustainability by transferring funds from Pillar 1 to Pillar 2 and emphasising eco-schemes.

Policies for the Future of Farming and Food in the Netherlands

2. Context, drivers and outcomes

Abstract

Key messages

The Netherlands is a major agri-food exporter and re-exporter mostly towards the European Union. Horticultural food and non-food (flowers and plants) products have the largest share of exports.

Dutch agricultural Total Factor Productivity (TFP) growth has slowed since 2000 after impressive growth in previous decades. Reductions in input use and improvements in labour productivity have been the main contributors to recent TFP gains.

The proportion of agricultural land under different farming systems have remained relatively stable since 2010. However, the number of farms has almost halved over the last 20 years, with a corresponding increase in average farm and herd sizes.

Sustainability is higher on the agricultural policy agenda, driven by ammonia and nutrient emissions, issues with water quality and lack of progress in climate change mitigation.

A 2019 court ruling on nitrogen deposition on sensitive landscapes has focussed attention on the need to reduce ammonia emissions from farms.

After significant progress in reducing agricultural emissions since 1990, progress has stagnated over the last decade. Improved performance early on was mainly due to a decrease in emission intensity of production factors.

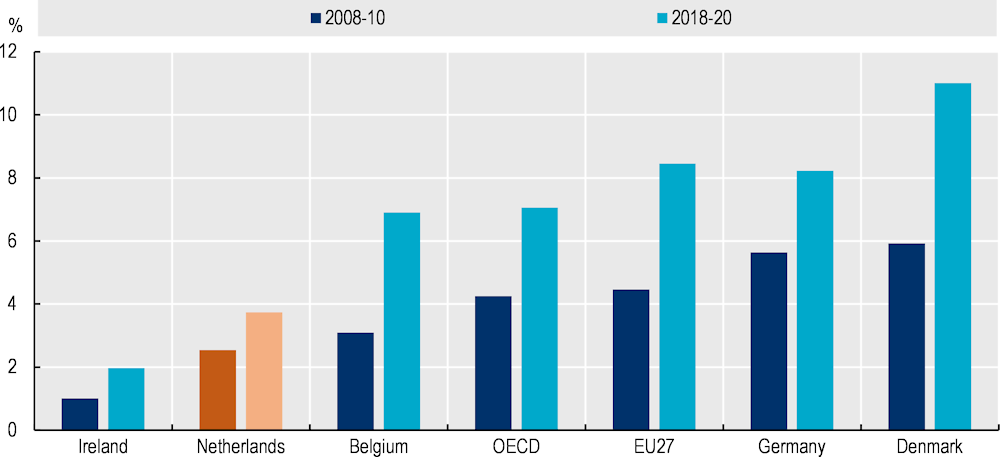

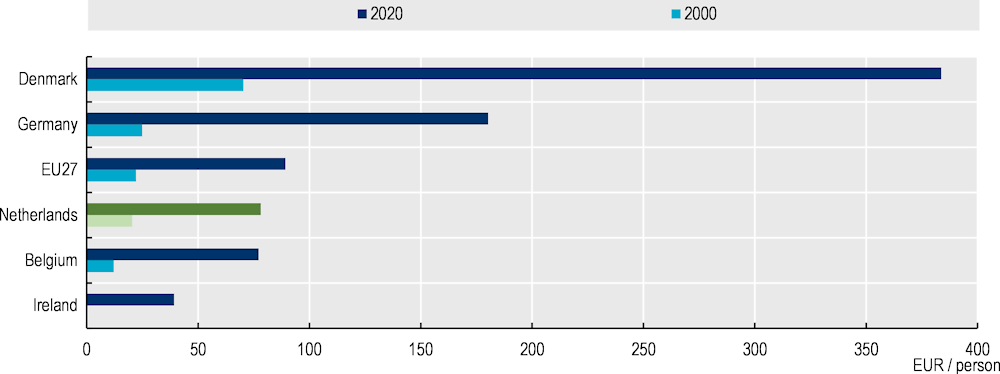

The share of organic farmland at 4% is low compared to the EU average. Per capita organic food purchases are half of German and a quarter of that of Danish consumers.

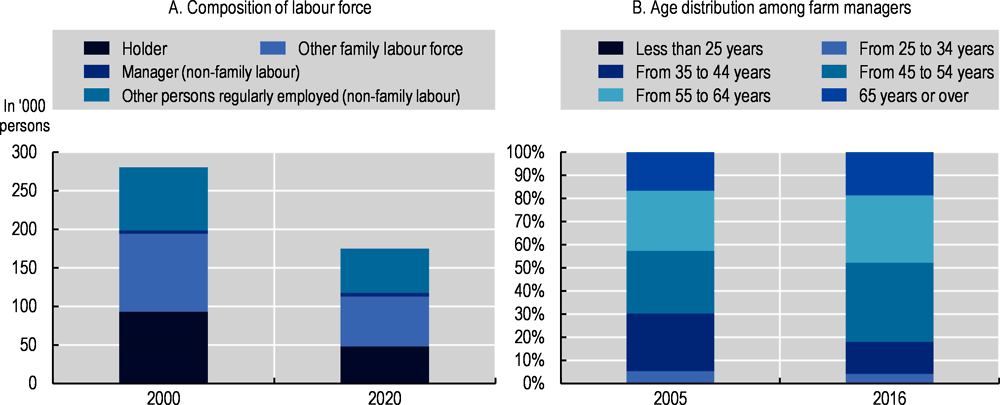

There are about 175 000 regular full-time workers in the primary agricultural sector, about two-thirds of which is farm household labour. Eighty-eight per cent of labour on dairy farms is carried out by the farm household, but only 11% in glasshouse horticulture (which relies more on hired workers).

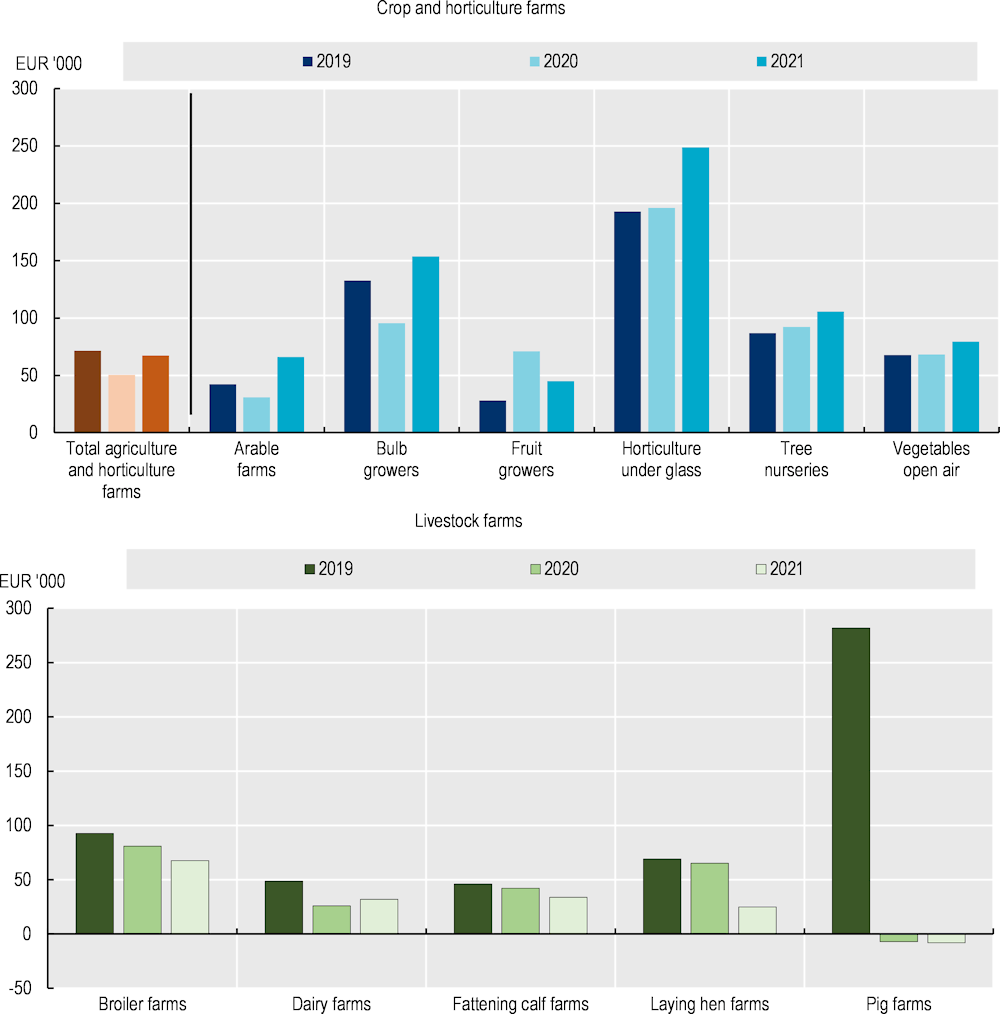

Intensive glasshouse systems have become the most profitable farm enterprises. Recent high EU gas prices are expected to negatively impact glasshouse horticulture, which is dependent on gas for heating and energy co-generation.

The national CAP Strategic plan (CSP) increases emphasis on innovation and environmental sustainability by transferring funds from Pillar 1 to Pillar 2 and emphasising eco-schemes in Pillar 1.

2.1. General context for food and agriculture

The Netherlands is a highly developed and knowledge-intensive economy whose fundamental strengths are a stable political climate, a highly developed financial sector, strategic location, a well-educated and productive labour force and high-quality physical and communications infrastructure. The Netherlands is urbanised and densely populated. Eighty-five per cent of the Dutch population lives in urban areas, the highest share in the OECD. It is the second most densely populated country in the OECD (OECD, 2008[1]).

The Dutch economy has benefited greatly from globalisation, through international trade and investment, access to overseas markets, immigration, and the free exchange of knowledge. The achievements of the “golden age” of the Dutch republic of the 17th century created a strong science, technology and engineering base which has continued to this day (OECD, 2014[2]). At the end of the 19th century, in reaction to the threat of grain imports from the United States, the Netherlands decided to become more competitive by investing in education, research and information services. Since then, a market-oriented philosophy has been an integral part of Dutch agriculture.

Despite its relatively small size and high population density, the Netherlands is an important agricultural producer and exporter. Its mild maritime climate, flat fertile terrain, geographical position and sea, river, road and aviation infrastructure are advantageous for both agricultural production and trade and a few hundred million potential consumers reside within a 500 km radius. Dutch primary agriculture mainly produces plants, flowers, milk, pigs, and vegetables (Eurostat, 2019[3]).

Dutch agricultural policy has focussed on increasing production at lower cost while generating a liveable income for the farmer (Baptist et al., 2019[4]). Over the past decades, Dutch agriculture has experienced remarkable growth and the sector is increasingly high tech and capital intensive. This is reflected in the Netherlands having the highest arable land prices in Europe, estimated at EUR 70 000 per hectare in 2019 (Eurostat, 2021[5]). The transformation of farming into a knowledge-based and capital-intensive activity was part of a broader drive for value enhancement across the food chain.

2.1.1. Share of the agricultural complex in the economy

The agricultural sector plays an important role in the economy. On average, Dutch agriculture occupies relatively more land, generates relatively more value in the economy and is more trade-oriented than in most OECD countries (Table 2.1). Within the primary agricultural sector, horticulture (open and glasshouse), crop and animal production are the most important activities. The contribution of the food and beverage industry to value added is lower than the primary agricultural activities. About 3.2% of the Dutch workforce worked in the agri-food sector (including primary and manufacturing activities) in 2020, almost half the EU average but similar in proportion to its nearby European peers (Belgium, Denmark, and Germany). The sector also represented 17% of exports and 13% of imports.

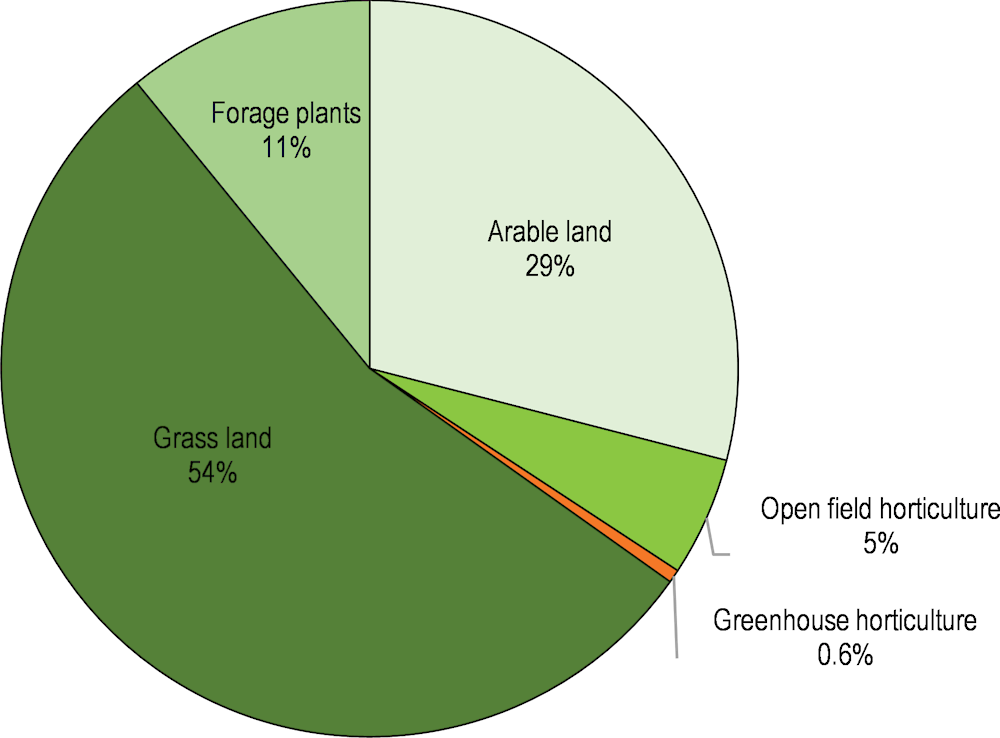

Extensive agriculture systems (grazing livestock and arable farming), have declined as a percentage of GVA since 1995 (Table 2.2), while intensive systems (glasshouse, open field horticulture, pig and poultry) increased their share. Extensive systems still employ close to half of the agriculture workforce. Glasshouse horticulture represented 79% of the energy use of the agricultural sector, despite covering only 0.6% of the total utilised agricultural area (UAA). The horticultural sector also produces a significant amount of electricity via natural gas-fuelled combined heat and power (CHP) plants. Greenhouse operations use CHP to generate and sell electricity while making use of the residual heat and CO2 produced.

Table 2.1. Agriculture is more important to the Dutch economy than in other OECD countries

Share of the agricultural sector in the economy in the Netherlands and selected countries(%) by land use, share of gross value added, employment and agri-food trade, 20201

|

Agricultural land area2 |

Gross value added3 |

Employment4 |

Agri-food exports 5 |

Agri-food imports 5 |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Total: Agriculture, forestry and fishing |

Crop and animal production and hunting |

Forestry and logging |

Fishing and aquaculture |

Total: Manufacture of food and beverages |

Total: Agriculture, forestry and fishing |

Crop and animal production and hunting |

Forestry and logging |

Total: Manufacture of food and beverages |

||||

|

Netherlands |

53.89 |

1.77 |

1.71 |

0.02 |

0.04 |

2.40 |

1.75 |

1.71 |

0.00 |

1.51 |

16.80 |

12.60 |

|

Belgium |

45.07 |

0.75 |

0.72 |

0.02 |

0.01 |

2.08 |

0.83 |

0.81 |

1.79 |

2.45 |

12.43 |

10.75 |

|

Denmark |

65.5 |

1.00 |

0.86 |

0.07 |

0.06 |

1.29 |

1.93 |

1.75 |

0.12 |

2.12 |

16.52 |

12.50 |

|

Germany |

47.5 |

0.86 |

0.78 |

0.08 |

0.00 |

1.52 |

1.14 |

1.02 |

0.11 |

1.72 |

6.12 |

8.50 |

|

Ireland |

65.5 |

0.99 |

0.94 |

0.01 |

0.05 |

2.17 |

3.57 |

3.31 |

0.00 |

2.45 |

8.20 |

11.13 |

|

EU276 |

41.03 |

1.78 |

1.54 |

0.20 |

0.05 |

2.00 |

4.03 |

3.70 |

0.26 |

2.31 |

9.39 |

7.08 |

|

OECD7 |

33.52 |

1.50 |

… |

…. |

|

|

4.77 |

…. |

…. |

…. |

13.34 |

10.34 |

Notes: “…” means not available.

1. or the latest available year.

2. Share of total land area.

3. Share of total gross value added.

4. Share of employed persons, aged 15 years and over, in total NACE activities.

5. Share of total exports (or imports). The agri-food definition does not include fish and fish products. Agri-food codes in H0: 01, 02, 04 to 24 (excluding 1504, 1603, 1604 and 1605), 3301, 3501 to 3505, 4101 to 4103, 4301, 5001 to 5003, 5101 to 5103, 5201 to 5203, 5301, 5302, 290543/44, 380910, 382360

6. For EU27, imports, and exports include only extra-EU trade.

7. For OECD, imports and exports include both intra- and extra-OECD trade.

Source: Authors’ calculations based on OECD (2022), System of National Accounts and Annual Labour Force Statistics (databases), http://stats.oecd.org/; UN (2022), UN Comtrade database, https://comtrade.un.org/; Eurostat (2022), [nama10_a10], [lfsa_egan2], http://ec.europa.eu/eurostat/data; FAO (2022), FAOSTAT, Land use (database), http://www.fao.org/faostat/en/.

Table 2.2. Intensive agricultural systems have become more important

Share of the agricultural sub-sector in the total agricultural sector by share of gross value added, employment and energy use, 1995-2020

|

Sub-complexes |

Gross value added |

Employment |

Energy use |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

1995 |

2005 |

2010 |

2015 |

2020 |

1995 |

2005 |

2010 |

2015 |

2020 |

1995 |

2005 |

2010 |

2015 |

2019 |

|

|

Arable farming |

18.0 |

17.1 |

19.6 |

16.6 |

15.5 |

18.0 |

17.1 |

18.2 |

16.0 |

15.5 |

9.3 |

11.3 |

2.3 |

3.6 |

3.1 |

|

Outdoor horticulture |

8.6 |

8.0 |

10.0 |

9.7 |

10.4 |

8.6 |

8.0 |

9.9 |

9.6 |

9.8 |

2.9 |

3.4 |

3.8 |

3.7 |

3.9 |

|

Greenhouse horticulture |

18.4 |

22.0 |

24.4 |

24.7 |

23.3 |

18.4 |

22.0 |

19.8 |

18.2 |

20.1 |

52.9 |

51.7 |

81.8 |

77.1 |

79.1 |

|

Grazing livestock |

33.6 |

30.2 |

24.6 |

28.5 |

25.9 |

33.6 |

30.2 |

30.5 |

35.0 |

32.4 |

17.1 |

17.3 |

5.4 |

7.5 |

7.5 |

|

Granivore farming* |

18.2 |

21.3 |

19.3 |

18.7 |

23.4 |

18.2 |

21.3 |

19.5 |

19.5 |

20.8 |

13.9 |

12.8 |

4.6 |

5.8 |

4.3 |

|

Fisheries |

3.3 |

1.3 |

2.2 |

1.7 |

1.5 |

3.3 |

1.3 |

2.0 |

1.7 |

1.3 |

4.0 |

3.5 |

2.0 |

2.3 |

2.1 |

|

Agricultural complex |

100.1 |

99.9 |

100.0 |

100.0 |

100.0 |

100.1 |

99.9 |

100.0 |

100.0 |

100.0 |

100.1 |

100.0 |

100.0 |

100.0 |

100.0 |

Note: *Intensive pig and poultry farming systems.

Source: Agrofood portal, WAGENINGEN (University & Research). Accessed August 2022.

2.2. Agricultural trade

The Netherlands is the largest importing country within the European Union and is the second largest exporter of agricultural products in the world (by value), after the United States (USDA, 2021[6]). Exports of agricultural goods (primary unprocessed goods and secondary processed goods) totalled EUR 122.3 billion in 2022 (Jukema, Ramaekers and Berkhout, 2023[7]). Of this, EUR 79.8 billion was domestically produced goods and EUR 45.2 billion in re-exported agricultural goods which originated from other countries. In 2022, an estimated 16.7% of Dutch goods exports were agricultural goods.

The combined horticultural categories (Ornamental and food) generated the biggest share of agricultural export value, totalling USD 31 billion in 2021 (Table 2.3). Food preparations was the second largest category grouping, with exports worth almost USD 25 billion in 2021. The third most exported product is meat, with meat exports in 2021 worth USD 11 billion.

Table 2.3. Horticulture and food preparations make up the biggest share of agricultural export value

Summary: Categories of Dutch Agri-food imports and exports in USD million, 2021

|

HS code |

Product description |

Exports (USD millions) |

Share in agri-food exports |

Imports (USD millions) |

Share in agri-food imports |

Trade balance |

Total trade (X+M) |

|---|---|---|---|---|---|---|---|

|

|

Total horticulture |

31 147 |

26.7% |

14 862 |

18.9% |

16 285 |

46 009 |

|

|

Horticulture non-food |

14 040 |

12.0% |

3 122 |

4.0% |

10 919 |

17 162 |

|

06 |

Live trees and other plants; bulbs, roots, etc.; cut flowers and ornamental foliage |

14 040 |

12% |

3 122 |

4% |

10 919 |

17 162 |

|

|

Horticulture food |

17 107 |

14.6% |

11 740 |

14.9% |

5 366 |

28 847 |

|

07 |

Edible vegetables and certain roots and tubers |

8 528 |

7.3% |

3 263 |

4.1% |

5 265 |

11 791 |

|

08 |

Edible fruit and nuts; peel of citrus fruit or melons |

8 578 |

7.3% |

8 477 |

10.8% |

101 |

17 056 |

|

|

Food preparations |

24 718 |

21.2% |

10 068 |

12.8% |

14 650 |

34 787 |

|

18 |

Cocoa and cocoa preparations |

5 736 |

4.9% |

4 665 |

5.9% |

1 071 |

10 401 |

|

19 |

Preparations of cereals, flour, starch or milk |

6 123 |

5.2% |

3 081 |

3.9% |

3 042 |

9 205 |

|

20 |

Preparations of vegetables, fruit, nuts or other parts of plants |

6 376 |

5.5% |

3 315 |

4.2% |

3 060 |

9 691 |

|

21 |

Miscellaneous edible preparations |

6 484 |

5.5% |

3 671 |

4.7% |

2 813 |

10 155 |

|

02 |

Meat and edible meat offal |

11 051 |

9.5% |

4 642 |

5.9% |

6 409 |

15 693 |

|

04 |

Dairy produce, eggs |

9 840 |

8% |

4 486 |

5.7% |

5 354 |

14 325 |

|

|

Dairy products |

8579 |

7% |

4024 |

5% |

4555 |

12604 |

|

0402 |

Milk and cream products |

1 673 |

1.4% |

833 |

1.1% |

840 |

2 506 |

|

0406 |

Cheese and curd |

4 582 |

3.9% |

1 525 |

1.9% |

3 057 |

6 107 |

|

|

Other dairy products2 |

2 325 |

2.0% |

1 666 |

2.1% |

659 |

3 991 |

|

|

Eggs3 |

1 260 |

1.1% |

462 |

0.6% |

799 |

1 722 |

|

15 |

Animal or vegetable fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes |

8 341 |

7.1% |

10 033 |

12.8% |

-1 692 |

18 375 |

|

10 |

Cereals |

575 |

0.5% |

4 060 |

5.2% |

-3 486 |

4 635 |

|

Total agri-food trade1 |

116 864 |

78 665 |

38 199 |

195 529 |

1. Agri-food trade (Not including fish and fish products) codes in H0: 01 to 24, 3301, 3501 to 3505, 4101 to 4103, 4301, 5001 to 5003, 5101 to 5103, 5201 to 5203, 5301, 5302, 290543/44, 380910, 382360.

2. Other dairy products include products in H04: 0403,0404 and 0405..

3. Birds’ eggs include products in H04:0407 and 0408.

Source: Authors’ calculations based on UN (2022), UN Comtrade (database), http://comtrade.un.org/ (accessed July 2022).

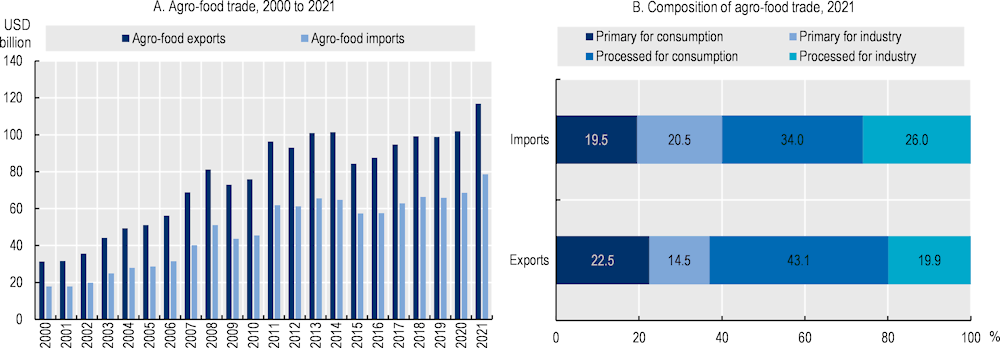

Trends show an almost linear rise in agri-food imports (and associated exports since 2000), with some elevated levels between the 2011-14 period reflecting a global food price spike (Figure 2.1, Panel A). Imports as a proportion of agri-food exports have remained relatively stable over the last decade. A significant share is related to foreign raw materials as the port of Rotterdam is a major European entry point for many products. This includes tropical products like coffee, tea, and cocoa, but also flowers, plants, animal feed and other raw materials. This can be seen in the higher proportion of exports (43.1%) processed for consumption than imports (34%) (Figure 2.1, Panel B).

Figure 2.1. Dutch agri-food exports have increased by almost 400% since 2000

Note: The definition of agri-food trade does not include fish and fish products. Agri-food codes in H0: 01, 02, 04 to 24 (excluding 1504, 1603, 1604 and 1605), 3301, 3501 to 3505, 4101 to 4103, 4301, 5001 to 5003, 5101 to 5103, 5201 to 5203, 5301, 5302, 290543/44, 380910, 382360.

Source: UN (2022), UN Comtrade (database), http://comtrade.un.org/ (accessed August 2022).

2.2.1. Main trading partners

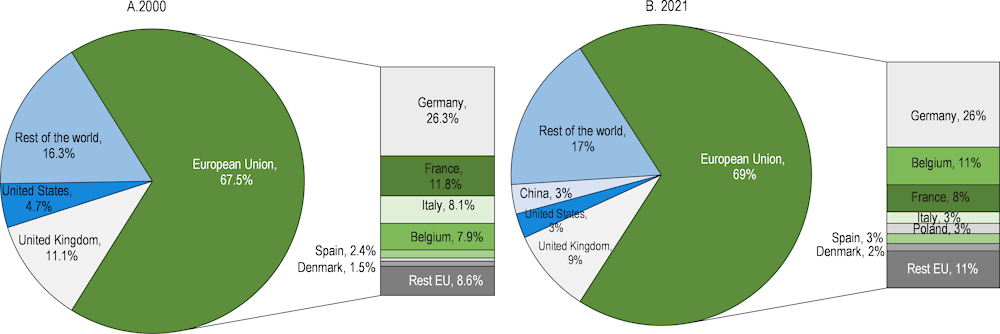

In 2021, most agri-food exports were within the European Union. The top four destinations are Germany (26%), Belgium (11%), the United Kingdom (9%) and France (8%). These shares have been stable since at least 2000 (Figure 2.2).

Even though total agricultural output as expressed in farmgate prices has increased by 11% since 2016 to EUR 30.3 billion in 2021, the Dutch share of total EU agricultural production decreased slightly from 7.2% to 6.8%. France is the European Union’s largest agricultural producer with EUR 81.2 billion (18.4%), along with Germany at EUR 59.4 billion (13.4%). Local peers like Denmark or Belgium contribute around EUR 11.5 billion (2.6%) and EUR 9.8 billion (2.2%) respectively (Eurostat).

Natural capacity limits and high labour costs may limit future growth rates relative to other EU producers. Spain and Denmark have strengthened their positions in the vegetable and pig meat markets, respectively while Germany and France are also taking some dairy market share from the Netherlands (Berkhout et al., 2021[8]).

Figure 2.2. Over 65% of Dutch agri-food exports go to the European Union

Source: Authors’ calculations based on UN (2022), UN Comtrade (database), http://comtrade.un.org/ [accessed July 2022].

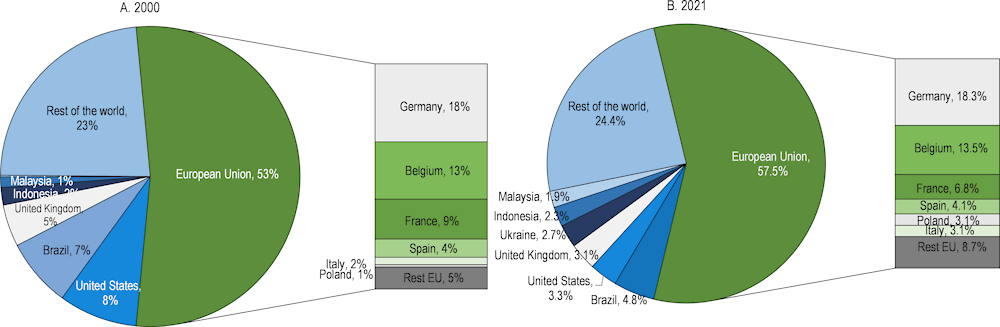

The European Union was the source of 58% of agri-food imports in 2021 (Figure 2.3). As was the case for exports, neighbouring countries Germany (18%), Belgium (14%), and France (7%) are the top trading partners. Imports from Brazil have dropped from 7% to 5% since 2000 and imports from the United States have dropped from 8% in 2000 to 3% in 2021, indicating a more regional market orientation.

Figure 2.3. Over 50% of Dutch agri-food imports come from the European Union

Source: Authors’ calculations based on UN (2022), UN Comtrade (database), http://comtrade.un.org/ [accessed July 2022].

2.3. Trends in agricultural productivity

2.3.1. Total Factor Productivity growth has slowed down over the long term

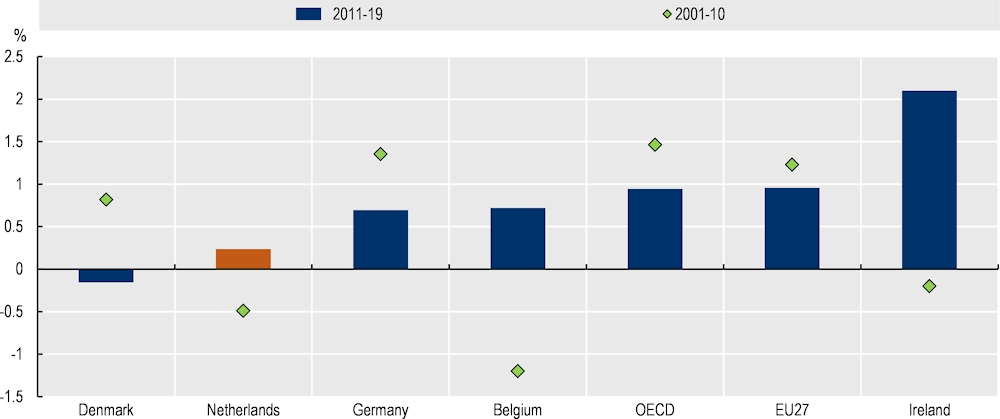

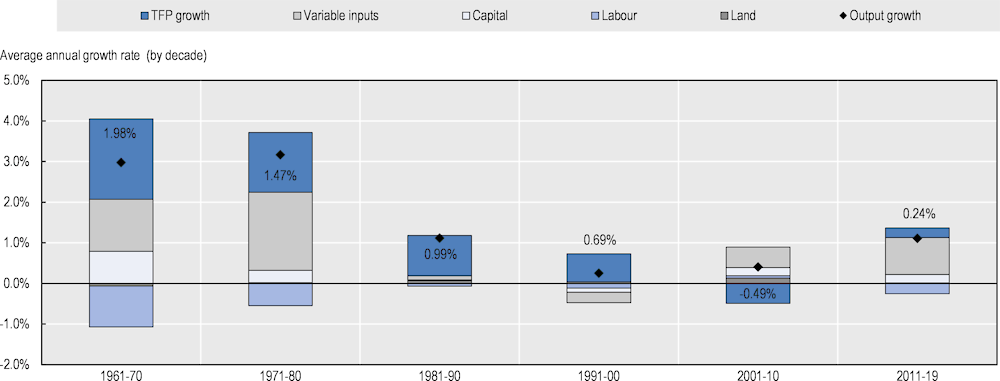

Total Factor Productivity (TFP)1 growth in agriculture from 2011-19 was 0.24%, below the EU and OECD averages (Figure 2.4). However, between 1960 and 2000 TFP grew at significantly higher rates than the EU27 and its level of productivity is high by OECD standards.

Figure 2.4. Since 2001 the Netherlands had low growth in agricultural total factor productivity compared with its regional peers

Output growth in the 1960s and 1970s was driven by a combination of strong TFP growth and industry expansion (as seen by high rates of input growth). In the 1980s and 1990s TFP became the main growth engine as input use stabilised, likely due to environmental constraints. In the last two decades TFP growth has been weak and growth in inputs has once again become the main driver. The growth in inputs in the last decade is likely due in part to the elimination of dairy quotas and a larger dairy herd (Figure 2.5). Larger average farm size and intensification are likely to have contributed to the rise in TFP as well as higher input use (Kimura and Sauer, 2015[9]).

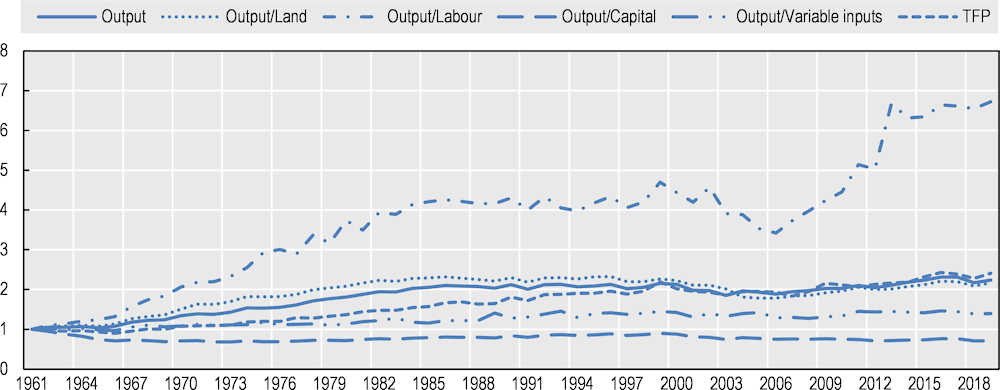

Exit of labour from agricultural has been a major contributor to TFP growth up to the 1980s and since 2011. Labour productivity in agriculture has increased more than any other partial factor productivity in the last six decades (Figure 2.6).

Figure 2.5. The output growth rate is slowing, with a smaller role for TFP growth recently

Source: Authors calculations based on USDA ERS (2021), International Agricultural Productivity database.

Figure 2.6. Increased labour productivity is driving overall productivity growth

Note: All values are normalised with 1961 being the base year.

Source: Authors calculations based on USDA ERS (2021), International Agricultural Productivity database.

2.3.2. High milk and cereal yields

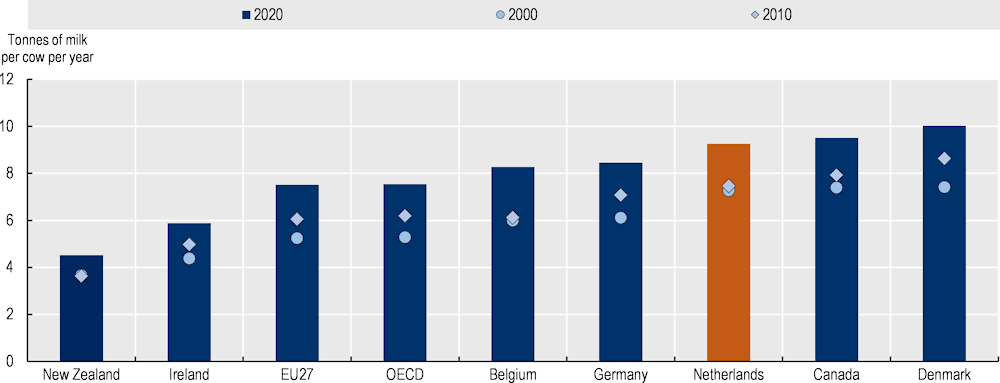

Highly intensive dairy production is the dominant agricultural land use in the Netherlands. The country has more than four times the average European livestock density and is the European Union's fourth-largest milk producer by volume (EC, 2020[10]). Milk yields are higher than both the EU and OECD averages and amongst the highest in the world (Figure 2.7).

Figure 2.7. Milk yields in the Netherlands are above EU and OECD average

Note: The removal of EU milk quota restrictions has had a possible impact on EU Member States milk yield increases since 2015.

Source: FAO (2022), FAOSTAT, Livestock primary(database) [Yield: Milk, whole fresh cow].

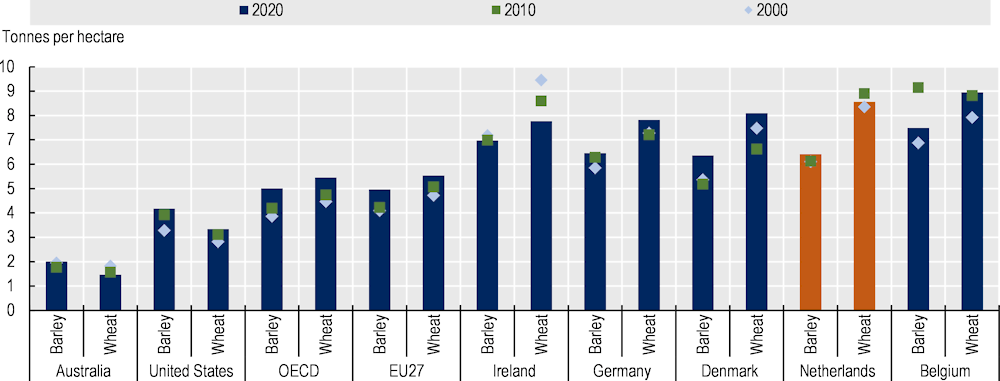

Cereal yields (wheat and barley) are higher than both the OECD and EU averages and among the highest in the world (Figure 2.8), reflecting the high level of intensity of their cereal systems. However arable farms have declined in importance as a share of total agricultural GVA since 1995.

Figure 2.8. Dutch cereal yields are among the highest in the world

Note: Countries are ranked according to 2020 wheat levels.

Source: FAO (2022), Crops [Yields] database, Accessed August 2022.

2.4. Evolution of agricultural production

In 2020 total area of utilisable agricultural land (UAA) was 1.81 million hectares, down from 1.98 million hectares in 2000 as urbanisation, recreation and nature cover more land (WUR, 2022[11]). Over the past 20 years, the average decrease is around 0.4% per year (WUR, 2022[12]). Of the total UAA 54% is permanent, temporary or natural grassland, 11% is used for green fodder crops, 29% for other arable production, 5% for open-field horticulture and 0.6% for greenhouse horticulture (Figure 2.9).

Figure 2.9. Grassland accounts for over 50% of agricultural land use

Source: CBS Statistics Netherlands. Accessed August 2022.

The dairy sector is the largest sub-sector in terms of added value and employment (based on domestic raw materials). In 1970 there were more than 110 000 dairy farms with about 25 dairy cows on each. In 2019 this number had decreased to about 16 300 while the average herd size had increased to 96 cows (USDA, 2021[6]). Milk production until 2015 had been limited by the EU milk quota regime, yet manure quotas continue to restrain dairy expansion. Co-operatives collect and process most raw milk, more than half of which is processed into cheese.

Friesland-Campina is the fifth largest dairy company in the world, employed 22 000 workers and had a turnover of EUR 11.5 billion in 2021 (FrieslandCampina, 2022[13]). In 2019, the gross production value of the dairy sector was EUR 5.5 billion, which was over 19% of the total agricultural production value of the Netherlands. Two-thirds of milk production is exported, mainly to other EU countries. The Netherlands is the fifth largest exporter of dairy products in the world (ZuivelNL, 2020[14]) with an export value of EUR 7.9 billion (Kok et al., 2020[15]).

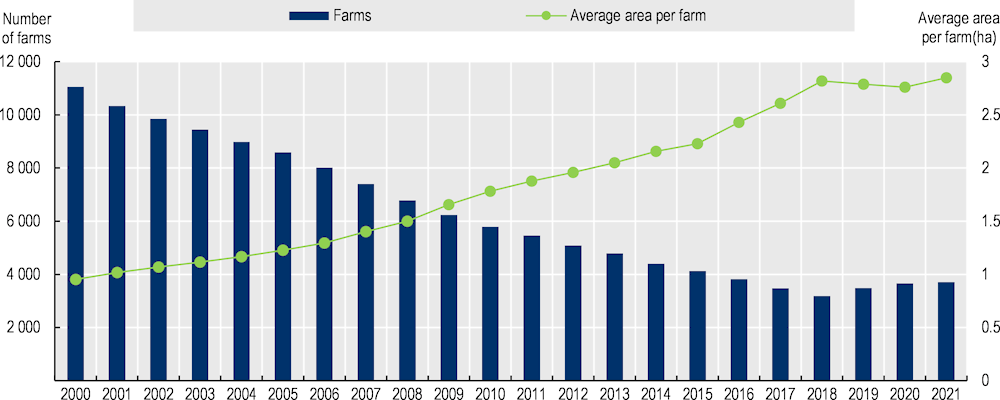

Due to its economic importance and unique characteristics, horticulture has its own Top Sector status under the national Topsectorenbeleid (policy on leading sectors), while the rest of agriculture and food is under a separate top sector (see Chapter 4 for more on the Top Sector system). Open field horticulture has grown to cover 95 000 hectares in 2021. Between 1980 and 2021 glasshouse horticulture area increased from 8 800 hectares to 10 600 hectares. Like the dairy sector, glasshouse horticulture farms have undergone significant structural change over the last two decades, with a significant reduction in the number of farms and a steady increase in farm size (Figure 2.10).

Figure 2.10. Fewer, larger greenhouse horticulture farms

Source: CBS-Landbouwtelling, bewerking Wageningen Economic Research.

In 2022, the export value for floriculture (flower bulbs, nursery products, cut flowers and indoor plants) was estimated to be EUR 11.5 billion or 9.4% of all agri-food exports (Jukema, Ramaekers and Berkhout, 2023[7]). There are 1 000 companies that produce cut flowers, 590 companies that grow house plants and 250 companies that grow garden plants (CBS, 2021[16]). There were an estimated 110 companies involved in the propagation material for cut flowers under glass. In addition, there are also companies that are engaged in growing crops from seed. Despite their small size (in hectares), these companies are very active internationally.

In 2021, about 5 550 companies grew fruit or vegetables using open ground production systems, down from about 8 640 in 2000, and 1 250 companies that grow vegetables under glass compared to around 3 430 in 2000. The number of companies growing fruit under glass has declined from 140 to 115 companies (CBS, 2021[16]).

Brussels sprouts, white and red cabbage, broccoli, and asparagus are important crops (measured in hectares) in open field vegetable cultivation. Apples and pears are the most important fruit crops. In greenhouses, the three most important crops are tomatoes, peppers, and cucumbers. Some varieties of fruit are also grown under glass, including blackberries, and raspberries. Strawberries have become the fourth largest greenhouse product, where these were traditionally cultivated on open ground. Organic greenhouse cultivation of vegetables is less than 1% of the total area. For open-ground vegetables, the percentage of organic area is much higher at 12%.

The share of land in organic agriculture has increased over the last decade but is still less than half of the EU average and less than neighboring countries (Figure 2.11). Current plans are for a doubling of organic area by 2030, a substantial improvement but below the Farm to Fork objective of 25%.

Figure 2.11. The share of organic agriculture in the Netherlands is much lower than in its regional peers

Source: FAO (2022) [Land Indicators], Accessed August 2022.

2.5. Farm consolidation and increased average farm size

The number of farms in the Netherlands has been on a downward trend in recent decades. There were 53 000 farms in 2020, 27% less than in 2010 and 46% less than 2000 (Table 2.4). Glasshouse horticulture and mushrooms saw the most significant consolidation since 2000, down by 68%. Grass-based livestock (sheep and cattle) farm numbers reduced by 47%, while arable farms reduced by a relatively modest 24%.

Table 2.4. Since 2000 the number of farms decreased by almost 50%

Changes in structural characteristics of farm holdings (‘000) and farm type, 2000, 2010 and 2020

|

Indicator |

2000 |

2010 |

2020 |

% change 2000-2020 |

% change 2010-2020 |

|---|---|---|---|---|---|

|

Area farmland (1 000 ha) |

1975 |

1872 |

1814 |

-8% |

-3% |

|

Total number of holdings3 |

97 |

72 |

53 |

-46% |

-27% |

|

Arable farms |

15 |

12 |

11 |

-24% |

-7% |

|

Glasshouse horticulture and mushroom holdings |

9 |

5 |

3 |

-68% |

-39% |

|

Dairy farms |

23 |

17 |

15 |

-38% |

-17% |

|

Other grassland based livestock farms |

20 |

19 |

10 |

-50% |

-47% |

|

Intensive livestock farms |

12 |

8 |

5 |

-55% |

-31% |

|

Mixed farms |

8 |

4 |

3 |

-61% |

-22% |

Note: numbers rounded up to the nearest full number.

The reduction in farm numbers was more pronounced among smaller farms. A total of 52% of the farms under 5 hectares disappeared between 2005 and 2016, while farms between 5 hectares and 29.9 hectares declined by 34%. The number of larger farms (50 hectares or over) increased by 12% over the same period, which highlights the increasing concentration of the Dutch farming sector. In 2016, small farms (less than 5 hectares) made up only 20% of farms, a smaller share than in many other EU countries. The decrease in farm numbers has been matched with higher average farm sizes, up by 35% between 2005 and 2016, from 24 hectares to 32 hectares.

Overall numbers of livestock between 2000 and 2020 have been relatively stable. However, overall pig numbers have declined slightly in 2020 versus 2000 (Table 2.5). The decrease in the number of pigs is partly due to the Ammonia Livestock Farming Action Plan (Actieplan Ammoniak Veehouderij) and the Pig Farming Remediation Subsidy Scheme (Subsidieregeling sanering varkenshouderijen-SRV) (Chapter 3). The number of dairy goats has increased almost fourfold in the last two decades to 633 000 in 2021, while sheep numbers have dropped by almost a third since 2000. Dairy cow numbers have risen 6% since 2000, which is partially linked to the removal of EU milk quotas in 2015. Veal calf and broiler chicken numbers have increased significantly over the last decade.2

Table 2.5. Livestock numbers have been relatively stable since 2000

Number of farm animals in thousands, 2000-2020

|

Number of animals, 1 000 head |

2000 |

2010 |

2020 |

2010-20 difference (%) |

2000-20 difference (%) |

|

Cattle, total |

4 069 |

3 975 |

3 838 |

-3.5% |

-5.7% |

|

Dairy and calf cows (> = 2 years) |

1 504 |

1 479 |

1 593 |

7.7% |

5.9% |

|

Young cattle for dairy farming |

1 325 |

1 239 |

935 |

-24.5% |

-29.4% |

|

Young cattle for meat production |

275 |

197 |

166 |

-15.7% |

-39.6% |

|

Veal calves |

783 |

928 |

1 071 |

15.5% |

36.9% |

|

Other cows and bulls |

182 |

133 |

72 |

-45.7% |

-60.5% |

|

Other grazing animals |

1 601 |

1 625 |

1 613 |

-0.7% |

0.8% |

|

Sheep |

1 305 |

1 130 |

890 |

-21.2% |

-31.7% |

|

Goats |

179 |

353 |

633 |

79.3% |

254.3% |

|

Horses and ponies |

117 |

143 |

90 |

-36.6% |

-23.1% |

|

Pigs, total |

13 118 |

12 255 |

11 950 |

-2.5% |

-8.9% |

|

Piglets |

5 102 |

5 124 |

5 414 |

5.7% |

6.1% |

|

Fattening pigs |

6 505 |

5 904 |

5 446 |

-7.8% |

-16.3% |

|

Chickens, total |

104 015 |

101 248 |

101 863 |

0.6% |

-2.1% |

|

Laying hens |

32 573 |

35 310 |

31 999 |

-9.4% |

-1.8% |

|

Broiler chickens |

50 937 |

44 748 |

49 229 |

10.0% |

-3.4% |

Source: CBS Agricultural CensusKey subsectors of primary production.

2.6. Employment

During peak periods in 2019, the Dutch agricultural workforce reached 329 000, of which 176 000 were full time workers and 153 000 were temporary or seasonal workers (van Hulle and Grotenhuis, 2020[17]). Almost half of the employment is related to greenhouse horticulture and dairy farms. During peak periods, large numbers of people may be working, but only for short periods (Box 2.1).

Box 2.1. Migrant workers in Dutch agriculture

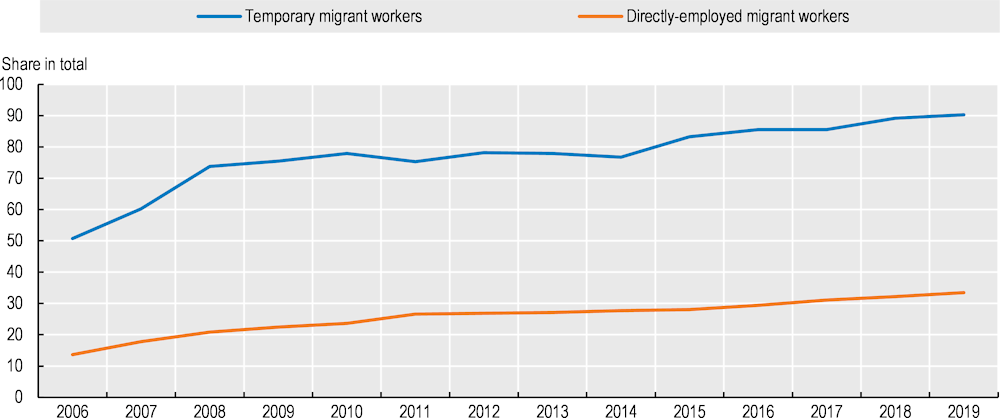

The Dutch agricultural and horticultural sectors have increasingly become dependent on migrant labourers, the large majority of which come from Central and Eastern EU countries (particularly Poland, Bulgaria, and Romania). In recent years, the share of migrant workers in the total number of directly employed and temporary agricultural workers increased significantly (Figure 2.12). Between 2006 and 2019, the number of directly employed migrants in agriculture more than doubled to 58 000 people, a share of 33.5%. The importance of foreign labour is even more pronounced among temporary agricultural workers. Their number more than doubled between 2006 and 2019, reaching 107 000 foreign workers a share of 90% of all temporarily employed agricultural workers (compared to 51% in 2006). The majority of those temporary migrant workers are involved in the labour-intensive horticultural sector, particularly during the planting and harvesting seasons.

Figure 2.12. Migrant workers have become increasingly important for the agricultural sector

Note: Numbers on migrant workers are estimated, based on CBS microdata. The share of agency-employed migrants workers refers to migrants’ share among all agency-employed workers in Dutch agriculture. Similar, the share of directly employed migrants refers to migrants’ share among all directly-employed workers in Dutch agriculture.

Source: Heyma et al. (2020[18]), De economische waarde van arbeidsmigranten uit Midden- en Oost-Europa voor Nederland, (CBS, 2020[19]).

The Netherlands Labour Authority (NLA) listed agriculture as one of the sectors at highest risk for unfair work. Migrant workers face a high risk of exploitation, low incomes, and excessively long workdays. The COVID-19 crisis has highlighted those shortcomings, as migrants could not respect social distancing, had to stay in overcrowded accommodations or lost work, together with housing and health insurance. In addition, their access to training possibilities is low.

Source: Siegmann, Quaedvlieg and Williams (2020[20]).

The agricultural workforce has declined significantly since 2000 and the average working age is higher than that of the general workforce (Figure 2.13) (Eurostat, 2017[21]). In 2016, only 4.1% of farm holders were under the age of 35, compared to 5.3% in 2005. The proportion of farmers older than 65 years increased from 16.6% to 18.7% in that time.

Figure 2.13. Since 2000 the agricultural workforce has shrunk and aged

Source: Eurostat (2021), https://ec.europa.eu/eurostat/databrowser/view/EF_M_FARMLEG__custom_3271728/default/table?lang=en.

2.6.1. Farm incomes

Between 2001 and 2020 accounting profits per unpaid Annual Working Unit (AWU) increased by more than 60%.3 The average profit per AWU was EUR 50 300 in 2020, one of the highest within the European Union (WUR, 2021[22]). However, there are wide differences in profits per AWU depending on the type of farming system.

The profits per AWU on livestock farms have been stable to declining in recent years (Figure 2.14). The exception is for pig farms which originally benefited greatly in 2019 from high world pig meat prices due to the impact of African Swine Fever (ASF).4 Since 2019 international pig prices have slumped leading to negative profitability in 2020 and 2021. Intensive horticultural producers have highest profits per AWU (Figure 2.14).

Figure 2.14. In recent years, accounting profit per AWU has been stable to declining

Source: WUR (2022[23]), Estimation 2021 update: large differences between vegetable and animal farm types, https://www.agrofoodportal.com/SectorResultaat.aspx?themaID=2272&indicatorID=2046&subpubID=2232§orID=2243.

2.7. The Dutch domestic food market and dietary trends

In 2020, consumers spent about EUR 44 billion on food and non-alcoholic beverages, about 13% of all expenditure. This is slightly less than the EU average of 15%.5 The share of food and non-alcoholic beverages in expenditure has stayed consistent over the last decade. This includes consumer spending in retail trade (including supermarkets, specialty stores, markets and internet shops and non-food shops) and direct sales. Online grocery deliveries, at 4% of the total, is modest relative to all retail spending (FSIN, 2021[24]). Between 2013 and 2020, the share of expenditure on sustainable food that is produced with stricter environmental, animal or social welfare regulations than legally required, increased from 3% in 2009 to 19% in 2021 (Berkhout, Van Der Meulen and Ramaekers, 2022[25]).

Overall meat consumption dropped from 79.1 kg per capita in 2009 to 75.9 kg in 2020, still above the EU average of 69.8 kg per capita (Dagevos et al., 2022[26]; European Commission, 2021[27]).In 2020 2.6% of Dutch adults reported eating fish but no meat, 1.7% reported being vegetarian and 0.4% reported eating a fully plant-based diet. Over 35% ate less meat than in previous years or stopped eating meat completely.6 Milk consumption has also declined in recent years: between 2010 and 2021 national per person consumption dropped from 87 kg to 76 kg.7

The Dutch Government introduced a national protein strategy (nationale eiwitstrategie) to increase the share of protein consumed from plant sources. In 2017, the private sector through the Food Valley, launched the Protein Community in co-operation with the provinces of Gelderland, Overijssel and Oost NL, as a public-private partnership to develop and market plant-based protein sources.

The main channels of distribution of food to Dutch consumers are retail and food service. Retail includes traditional supermarkets and small retail outlets. Supermarkets are the most important sales channel for food, although this share is slowly declining in favor of the food service. The market share of the main supermarket chains has been relatively constant since 2013 (Table 2.6).

Table 2.6. Supermarkets remain the most important distribution channel for food

Key figures of main retailers, 2013 and 2021

|

Company |

Store |

2013 Market share (%) |

2021 Market share (%) |

|---|---|---|---|

|

Ahold |

Albert Heijn (AH) |

34.0 |

35 |

|

Jumbo Supermarkten |

Jumbo Groep |

20.1 |

21 |

|

Lidl Nederland |

Lidl |

9.0 |

11 |

|

Aldi Nederland |

Aldi |

7.4 |

5 |

|

Sperwer Groep |

PLUS |

5.8 |

7 |

2.7.1. Organic market (production and consumption)

Dutch organic production is largely driven by demand in Germany and the Nordic countries, which absorb 80% of exports of organic products. The value of exports of organic products is estimated to be USD 1.6 billion. This includes organic products produced in the Netherlands such as potatoes, vegetables, eggs, cheese, and meat and imported organic products that are re-exported. Within the European Union, the Netherlands is the largest importer of organic products from third countries, though domestic demand is relatively low. In 2019 Dutch consumers spent EUR 71 per capita on organic food while Danish and Austrian consumers spent respectively EUR 344 and EUR 215 (FIBL, 2021[28]) (Figure 2.15). In practice most Dutch consumers are not prepared to pay a price premium for sustainable or organic products (Van Galen et al, 2021[29]). In 2021, Dutch overall food prices were below the EU average and those of neighbouring countries (Denmark, Belgium, and Germany).

Organic farmers expect to offset the revenue loss from lower yields with higher prices achieved for their products. While Dutch demand for organic products has grown in recent years, overall demand is still low. First experiences in other European market have indicated that inflation takes a toll on organic sales in particular as consumers try to save money on everyday expenditures. Increasing supply for instance through higher subsidies without addressing the demand lag leads to a disbalanced, unsustainable market structure. The Netherlands released an Organic Action Plan at the end of 2022 with an objective to increase market demand and production as well as strengthen knowledge and innovation (Chapter 3).

Figure 2.15. Organic food consumption in the Netherlands is below EU average

Note: EU27 simple average.

Source: FiBL survey based on national data sources, data from certifiers, Eurostat. Accessed August 2022.

2.8. Policy context

The Netherlands is a decentralised unitary state. The Netherlands has twelve provinces that form the link between the municipalities and the national government. Provinces carry out national as well as regional policies. The provinces are responsible for construction of infrastructure, supervision of municipalities, regional water management boards and environmental compliance, the regional economy, fostering well-being and culture, and play a strong role in nature preservation (more on this in Chapter 3).

Provinces fund their own projects related to sustainable agriculture outside of the CAP. While small provinces such as Drenthe, Flevoland, and Zeeland have limited budgets, larger provinces like Gelderland and Noord-Brabant are able to establish relatively large-scale programmes.

There are a number of soil types, climatic conditions and farming systems in the various provinces. As part of the Dutch national CAP strategic planning process, a study was conducted to examine the relevance of creating regional or local policy within the CAP framework (Smit, 2020[30]). The study assesses whether regional differences in the Netherlands are relevant for an effective CSP and if so, to which extent, and how the CSP should include regional differences. It found that the CSP should allow for tailor-made regulations on a regional level to tackle specific problems by containing contain options that reflect regional differences.

2.8.1. EU policy framework

As an EU Member, Dutch agricultural producers operate in a policy setting shaped by European regulations, of which the Common Agricultural Policy (CAP) is the most important. Successive CAP reforms have reduced border protection and the importance of domestic market interventions.

For the 2014-20 period, the Netherlands received around EUR 6 billion from the CAP budget. The budget available for direct payments amounted to around EUR 5.2 billion and for rural development around EUR 0.8 billion. The Dutch share of CAP funding is relatively small compared to other countries with similar value added in the agricultural sector (European Parliament, 2022[31]). This is a consequence of the relative size of the horticulture sector, which is not eligible for CAP subsidies but represents a large share of the Dutch agricultural system.

The current CAP has been extended for the years 2021 and 2022. Starting in 2023 new rural development measures be established under the CAP 2023-27.8 The CAP Strategic Plan (CSP) was approved in December 2022 and will be phased in during 2023 as final agreement was reached too late for it to be fully implemented as of 1 January 2023.

The Netherlands’ total CAP budget for 2023-27 is EUR 4.8 billion. Of this, EUR 2.8 million is allocated to direct income support and market organisation under Pillar 1, while EUR 2 billion is directed at Rural Development Programs under Pillar 2. Pillar 2 financing is made up of an EU contribution of EUR 365 million, EUR 809 million in transfers from Pillar 1 funding and EUR 789 million cost-sharing from provinces, central government and water management bodies. EU funding is mainly provided through the European agricultural guarantee fund (EAGF) and the European agricultural fund for rural development (EAFRD) (Table 2.7)

Table 2.7. Direct support is the largest part of total CAP funding: Eco-schemes and ANLb are important environmental measures

Structure and budget of the Netherland's CAP Strategic Plan 2023-27

|

Component |

Measures |

Description |

Budget (EUR million) |

|---|---|---|---|

|

Direct payments |

Basic income support |

Direct support to active farmers, subject to enhanced conditionality |

1 693 |

|

Redistributive payment |

Complementary direct payment based on farm size (hectares) subject to thresholds with a higher basic premium for the first 60 hectares; aims to benefit small and middle-sized farms |

298 |

|

|

Young farmers and horticulturists |

Supports young farmers receive with start-up subsidies; Young farmers can receive additional funding for investments |

23 |

|

|

Eco-schemes |

Compensates farmers for applying their choice of 26 eco-activities; applies entry criteria and a point system with regional weighing factors |

964 |

|

|

Coupled support |

Payments for the production of a specific crop or for the maintenance of a specific type of livestock. The Netherlands does not apply coupled income support |

0 |

|

|

Sectoral programmes |

Continuation of sectoral interventions already in place for fruits and vegetables (payments to producers' organisations) and apiculture |

433 |

|

|

Total Pillar 1 |

3 411 |

||

|

Pillar 2: Rural development programmes |

|||

|

Area based co-operation |

ANLb |

Supports the management of nature reserves and habitats through agricultural collectives |

560 |

|

LEADER |

Supports local actions groups (LAG) to draw up local development strategies (LOS) for rural development; increased focus on sustainability |

68 |

|

|

Nitrogen, peatland and Natura 2000 co‑operation |

Supports farmers to establish management programs for transitional buffer zones around nitrogen sensitive Natura 2000 areas or peatland restoration |

397 |

|

|

Set-up aid for young farmers |

Supports young farmers receive start-up support to acquire land or a business |

75 |

|

|

Productive investments young farmers |

Supports young farmers to invest in farm modernisations which drive productivity and business revenue |

34 |

|

|

Productive Investments |

Supports investments aimed at farm modernisations that increase productivity and profitability, provided the investments also drives transformation towards circular agriculture |

85 |

|

|

Non-productive investments |

Farmers can receive subsidies for investments into non-productive farm improvements that target an increase in biodiversity, improved water quality or climate mitigation |

244 |

|

|

Knowledge and innovation |

Knowledge dissemination and innovation |

Farmers can receive advice on their current business situation and draw up a business plan or attend trainings tailored to sustainability and management needs |

43 |

|

Cooperation for chains, sectors, more sustainable food, CAP pilots and innovation EIP |

Supports entrepreneurial partnerships of operational groups within the EIP network |

101 |

|

|

Weather insurance |

Compensates farmers for a share of their insurance premium paid against damages through extreme weather |

88 |

|

|

Total Pillar 2 |

1 796 |

||

|

Total Pillar 1 and 2 |

5 207 |

||

Note: The amount for rural development programmes includes EUR 365 million from the European Agricultural Fund for Rural Development (EAFRD), EUR 809 million of Pillar 1 transfers and EUR 789 million of co-financing from Dutch provinces, central government and water boards.

Source: LNV (2022), “NL - Nederlands Nationaal Strategisch Plan GLB 2023-2027”.

Dutch CAP implementation has previously focused on supporting innovation, increasing productivity, and cutting costs. The CAP 2023-27 arrives in the context of a Dutch agricultural sector facing a large-scale transformation to address challenges of nature restoration, water and climate, and many farmers have to adapt new farming practices while preserving their competitiveness. The CSP has to strike a balance between ensuring that environmental objectives are met with ensuring a long-term perspective for the sector and must complement significant national spending to support the agriculture transition.

The CSP is managed by the Ministry of Agriculture, Nature and Food Quality (Ministerie van Landbouw, Natuur en Voedselkwaliteit – LNV). Provinces and regional water management boards, along with the Ministry for Infrastructure and Water management (Minister van Infrastructuur en Waterstaat – I&W) have been involved in developing the CSP. A midterm review is planned for 2025 to evaluate the efficacy of the CSP and make adjustments if necessary.

Under EU terminology, the CAP green architecture refers to the policy mix of enhanced conditionalities and voluntary eco-schemes under Pillar 1 and the Environment and Climate measures under Pillar 2 that are the main tools to ensure environmental sustainability in the new CAP. The Netherlands describes this framework as the green-blue architecture (groenblauwe architectuur- GBA). This terminology, along with the involvement of the I&W signals the importance the government places on water issues for the Dutch agricultural sector.

Member States tailor their CAP plans to their specific circumstances and needs. The CSP details their priorities, challenges and intended interventions and support programmes. This is done based on an analysis of their specific strengths, weaknesses, opportunities, and threats (SWOT analysis). The Dutch SWOT analysis finds biodiversity, climate and water quality to be the main challenges. Specific needs are to tackle nitrogen deposition on sensitive nature, restore of waterways, improve landscape diversity, mitigate GHG emissions and promote climate resilience. On top of this, generational renewal is a longstanding challenge for all countries in Europe.

Members States can transfer money from Pillar 1 to Rural Development interventions under Pillar 2 to adjust the CAP budget to better fit their individual needs. Under the 2014-20 CAP, around 8% of Pillar 1 funds were transferred to Pillar 2. The 2023-27 CAP increases that transfer to 15% and to 30% by 2027. This is the maximum amount within CAP rules to eco-schemes and environmental and sustainability interventions. Transfers to Pillar 2 do not affect eco-scheme funding, which will be held constant at EUR 152 million. The transfer of funds to Pillar 2 results in a smaller share of support provided as direct payments. While still around one-third of the budget, the share of direct payments is less than many other Member States and below that of past CAPs.

Additional funding for Rural Development projects under Pillar 2 is primarily directed at sustainability interventions, most notably EUR 397 million for the Nitrogen and Natura 2000 programme and EUR 560 million for the ANLb programme. These interventions are implemented by farm collectives, whereby farmer organisations, sometimes in co-operation with civil society organisation, work on the issues within their area. The Netherlands has been a leader in the European Union in exploring collective action approaches (Chapter 3 has more on ANLb and the collective approach). EUR 360 million is dedicated for sustainable productive and non-productive investments in modernisation or environmental improvements.

Pillar 1

Under the basic income support scheme, farmers can receive subsidies based on hectares of eligible land, provided they meet certain conditions. Basic income support for farmers will be reduced from EUR 387 million in 2023 to EUR 290 million by 2028. To support the development of small and medium sized farms, the first 40 eligible hectares on a farm receive additional funding.

All farmers in the European Union must meet certain Statutory Management Requirements (SMR) which are legal obligations as well as additional Good Agricultural and Environmental Conditions (GAEC). Compliance with SMRs and GAECs apply to the basic income support, eco-schemes and the Agricultural Nature and Landscape Management Program (Agrarisch Natuur- en Landschapsbeheer ‒ ANLb). The requirements for buffer strips, crop rotation, and unproductive land (GAEC 4,7 and 8) have been tightened, and there is a new requirement for buffer strips around dry ditches (GAEC 10). The Netherlands is making use of the option to postpone the implementation of stricter conditions on crop rotation and unproductive land until 2024 to mitigate the disruptions in global food supply caused by the Russian invasion of Ukraine.

The Netherlands is one of only five EU Member States introducing a multidimensional eco-scheme. Instead of giving farmers flat rate payments through multiple singular eco-schemes, all interventions are bundled into a single program. Farmers can earn points by participating in their choice of 24 eco-activities. These include measures such as introducing nitrogen-fixing crops, wet cultivation, or introducing buffer strips along arable land. Depending on the number of points, they earn a sustainability ranking and receive the corresponding payout between EUR 60 and EUR 200.

The SWOT analysis found that the biggest obstacles to young farmers are the high entry barriers caused by high land prices. To address this, the basic income support for young farmers under Pillar 1 will be replaced by multiple programmes under Pillar 2 that are designed to support farmers in the early phase of their business. Young farmers receive start-up support to acquire land or a business and additional support for investments to modernise the business and increase sustainability.

Pillar 2: Rural development programme

The Netherlands has introduced multiple area-based interventions that aim to move from farm-level interventions such as conditionalities and eco-schemes to community level action. Most importantly, the new CAP will expand the 2016 Agricultural Nature and Landscape Management Program (Agrarisch Natuur- en Landschapsbeheer ‒ ANLb). Funding will increase from EUR 80 million in 2020 to EUR 120 million over the next CAP period. Farmers are encouraged to design collective action plans that tackle the unique challenges of their agricultural area regarding nitrogen depositions, soil, air, and biodiversity. More emphasis is placed on climate adaptation and building resilience to weather extremes.

A second collective approach is the EU LEADER programme. Municipalities, local businesses, organisation or individuals from the region organise in local actions groups (LAG) to draw up local development strategies (LOS) that are then supported through CAP funds. The LEADER is a long-running programme. In the past, the programme focused on rural development whereas in the new CSP it will increasingly emphasise sustainability projects around climate, biodiversity and the environment. To this end, funding will be expanded: while the Netherlands will continue to dedicate the minimum required 5% of Pillar 2 funding to LEADER, the increased transfers to Pillar 2 translates to a greater budget of around EUR 67 million for the entire CAP period.

A new development of the 2023-27 CAP is the prioritisation of peatland restoration and Natura 2000 protection. EUR 397 million are dedicated for schemes that allow farmers to introduce management plans that either raise water levels in peatlands or establish transition zones around nitrogen sensitive Natura 2000 areas which reduce nitrogen deposition in these critical zones. Farmers can be compensated for investments in drainage systems necessary to raise the water levels as well as the loss of yields through raised water levels and more extensive production.

Support is available to productive or non-productive investments. Productive investments aim at farm modernisation to increase productivity and profitability of the business while non-productive investments target increased biodiversity, improved water quality or climate mitigation. EUR 85 million is available for productive investments, with support available to reimburse farmers for up to 65% of investment costs, provided that these also help the transition towards circular agriculture. Funding for non-productive investments is around EUR 244 million.

Two schemes specifically target innovation and knowledge. The knowledge dissemination and information programme will allow farmers to receive advice on their current business situation and draw up a business plan or attend trainings on management methods. The programme is backed with EUR 43 million and will be deployed through the existing SABE voucher system.

EUR 101 million is dedicated to strengthening innovation in agriculture through co-operation for chains, sectors, more sustainable food, CAP pilots and the European Innovation Partnership (EIP). The programme provides subsidies to entrepreneurial partnerships which aim to develop and implement innovations in various key areas such as organic farming, animal welfare, green-blue architecture, or digitisation. Partnerships can be structured around an area, production chain, sector or other forms of cooperation that include at least one farmer and relate to CAP objectives. These operational groups (OG) are connected to the EIP network which further facilitates knowledges amongst farmers. Currently, around 40 operational groups with 15 000 farmers operate in the Netherlands.

Weather insurance is intended to contribute to climate change adaptation. Farmers can be reimbursed for a maximum of 64% of the insurance premium. An objective is to increase farmers’ participation by 10% per year, from around 2 600 currently to 4 400 participants by 2027.

The Netherlands is currently far from the EU ambitions for organic production as expressed in the Farm to Fork strategy. The CAP 2023-27 aims to increase organic area from the current 3.8% to 6% by 2027, based on a separate SWOT analysis of the organic sector (Koopmans et al., 2021[32]). The new CSP provides greater incentive for organic production, primarily through higher premiums paid in the eco-schemes. Farmers transitioning to organic agricultural or other nature-inclusive practices will automatically receive the highest tier payment of EUR 200 per hectare. (de Wit and Koopmans, 2021[33]). Under the new CAP organic farms will no longer be exempted from applying GAECs (excluding GAEC 7, crop rotation). Despite this new requirement, the new CAP will likely have positive income effects for organic farmers,

2.9. Conclusions

The general picture of the agriculture and food sector is one of ongoing consolidation that reduces the number of farms while average farm size increases. The sector is shaped by its trade orientation to emphasise cost efficiency and has become one of the most productive agriculture sectors in Europe and the world. Trade has expanded fourfold in the past 20 years and the Netherlands is the second largest agricultural exporter in the world, in part due to its role as a major trading hub for Europe. The importance of the greenhouse and horticulture sector as a share of agricultural production value is unique in Europe. The horticulture sector operates on a different model than does the rest of Dutch agriculture; it uses relatively little land, receives a small amount of support from agricultural policy and is exposed to different risks than other forms of production.

Productivity growth has been a main driver of long term output growth. Trends in productivity are driven by the exit of labour from the sector (a common phenomenon in the OECD area), environmental limits and production quotas that influence capital spending, and structural changes in the sector such as economies of scale. Recent low productivity growth is concerning as it coincides with lower output growth. Environmental limits will make TFP growth an important factor for the future prospects of the sector.

Farm income as defined by accounting profits per unpaid Annual Working Unit (AWU) has grown strongly and is among the highest in the European Union, but it has increased only slightly in recent years. This is in part due to external factors such as the COVID-19 pandemic and the cyclical nature of pig markets.

Domestic consumption trends have shown a modest reduction in livestock-based products, though consumption of these is still above the EU average. Organic production is relatively small and dominated by exports. Domestic consumption of organic products is low compared with regional peers and the domestic market has not been able to support a large price premium for organic products.

Agricultural support policies are important, and the CAP is a major feature of the policy landscape, but the current structure of the sector is not dependant on support and the emphasis has been to use public funds for broader objectives and to support the agricultural knowledge and innovation system. The CSP emphasises sustainability objectives and provide good incentives for farmers to take action to improve the environmental performance of their farms. Over time, the importance of direct payments to farmers will continue to decline, though these will still be the largest CAP expenditure for the foreseeable future.

References

[4] Baptist, M. et al. (2019), A nature-based future for the Netherlands in 2120, https://doi.org/10.18174/512277.

[8] Berkhout, P. et al. (2021), A picture of agriculture and rural areas in the netherlands - A SWOT analysis., Wageningen Economic Research, Wageningen, https://doi.org/10.18174/498882.

[25] Berkhout, P., H. Van Der Meulen and P. Ramaekers (2022), Staat van Landbouw en Voedsel Editie 2021, https://doi.org/10.18174/560517.

[34] Bureau, J. and J. Antón (2022), “Agricultural Total Factor Productivity and the environment: A guide to emerging best practices in measurement”, OECD Food, Agriculture and Fisheries Papers, No. 177, OECD Publishing, Paris, https://doi.org/10.1787/6fe2f9e0-en.

[16] CBS (2021), “Agricultural census. CBS, The Hague / Heerlen”.

[19] CBS (2020), Nearly 30 thousand contract workers in agriculture, https://www.cbs.nl/en-gb/news/2020/15/nearly-30-thousand-contract-workers-in-agriculture (accessed on 20 August 2022).

[26] Dagevos, H. et al. (2022), “Vleesconsumptie per hoofd van de bevolking in Nederland, 2005-2021”, https://doi.org/10.18174/577742.

[33] de Wit, J. and C. Koopmans (2021), Inkomensverandering biologische landbouw en het GLB-NSP, https://www.louisbolk.nl/actueel/rapport-inkomensverandering-biologische-landbouw-en-het-glb-nsp.

[10] EC (2020), “Agriculture in the European Union and the Member States - Statistical Factsheet”, https://ec.europa.eu/info/sites/info/files/food-farming-fisheries/farming/documents/agri-statistical-factsheet-eu_en.pdf (accessed on 24 August 2022).

[27] European Commission (2021), EU agricultural outlook for markets, income and environment.

[31] European Parliament (2022), The Common Agricultural Policy in figures | Fact Sheets on the European Union, European Parliament, Brussels, https://www.europarl.europa.eu/factsheets/en/sheet/104/the-common-agricultural-policy-in-figures.

[5] Eurostat (2021), Agricultural land prices: huge variation across the EU., https://ec.europa.eu/eurostat/fr/web/products-eurostat-news/-/ddn-20211130-2 (accessed on 20 September 2022).

[3] Eurostat (2019), Agriculture, Forestry and Fishery Statistics, European Commission, https://data.europa.eu/doi/10.2785/798761.

[21] Eurostat (2017), Farmers in the EU - statistics., https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Archive:Farmers_in_the_EU_-_statistics (accessed on 20 September 2022).

[28] FIBL (2021), Data on Organic Agriculture in Europe, https://statistics.fibl.org/europe.html (accessed on 24 August 2022).

[13] FrieslandCampina (2022), 150 years: a nourishing company, Royal FrieslandCampina NV, Amersfoort, https://www.frieslandcampina.com/about-frieslandcampina/financials/financial-and-sustainability-reports/ (accessed on 9 January 2023).

[24] FSIN (2021), “Extreme growth food delivery in the Netherlands. Food Service Instituut”, https://fsin.nl/media/upload/files/Persbericht FSIN Dossier Delivery 2021.pdf (accessed on 21 September 2022).

[18] Heyma, A. et al. (2020), “The consequences of the corona crisis for migrant workers in agriculture and horticulture. Note 2020-82. SEO Economic Research and Wageningen Economic Research”.

[7] Jukema, G., P. Ramaekers and P. Berkhout (2023), De Nederlandse agrarische sector in internationaal verband : Editie 2023 [The Dutch agricultural sector in an international context - 2023 edition], Wageningen Economic Research and Central Bureau of Statistics, The Hague, https://doi.org/10.18174/584222.

[9] Kimura, S. and J. Sauer (2015), “Dynamics of dairy farm productivity growth: Cross-country comparison”, OECD Food, Agriculture and Fisheries Papers, No. 87, OECD Publishing, Paris, https://doi.org/10.1787/5jrw8ffbzf7l-en.

[15] Kok, A. et al. (2020), “Balancing biodiversity and agriculture: Conservation scenarios for the Dutch dairy sector”, Agriculture, Ecosystems & Environment, Vol. 302, p. 107103, https://doi.org/10.1016/j.agee.2020.107103.

[32] Koopmans, C. et al. (2021), SWOT-analyse van de biologische landbouw met kansen voor stimulering.

[2] OECD (2014), “Innovation performance in the Netherlands”, in OECD Reviews of Innovation Policy: Netherlands 2014, OECD Publishing, Paris, https://doi.org/10.1787/9789264213159-6-en.

[1] OECD (2008), OECD Rural Policy Reviews: Netherlands 2008, OECD Rural Policy Reviews, OECD Publishing, Paris, https://doi.org/10.1787/9789264041974-en.

[20] Siegmann, K., J. Quaedvlieg and T. Williams (2020), Migrant workers in the Netherlands still find themselves in positions of precarity | Erasmus University Rotterdam, https://www.eur.nl/en/news/migrant-workers-netherlands-still-find-themselves-positions-precarity (accessed on 20 August 2022).

[30] Smit, A. (2020), Regionale differentiatie in het nieuwe GLB, Wageningen Economic Research.

[6] USDA (2021), Exporters Guide: The Netherlands, USDA, The Hague, https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Exporter%20Guide_The%20Hague_Netherlands_12-31-2021.pdf (accessed on 29 July 2022).

[29] Van Galen et al (2021), Agro-Nutri Monitor 2021 - Achtergrondrapport : Monitor prijsvorming voedingsmiddelen en analyse belemmeringen voor verduurzaming, Wageningen Economic Research, Wageningen, https://doi.org/10.18174/549562.

[17] van Hulle, R. and M. Grotenhuis (2020), Arbeidsmarkt Colland 2020 : arbeidsmarktstructuur sector agrarisch en groen in beeld.

[12] WUR (2022), Agricultural export in 2021 in excess of 100 billion euros for the first time, https://www.wur.nl/en/research-results/research-institutes/economic-research/show-wecr/agricultural-export-in-2021-in-excess-of-100-billion-euros-for-the-first-time.htm (accessed on 23 August 2022).

[23] WUR (2022), Income estimation 2021 update: large differences between vegetable and animal farm types, https://www.agrofoodportal.com/SectorResultaat.aspx?themaID=2272&indicatorID=2046&subpubID=2232§orID=2243 (accessed on 24 August 2022).

[11] WUR (2022), Staat van Landbouw en Voedsel, Wageningen Economic Research, Wageningen, https://doi.org/10.18174/560517.

[22] WUR (2021), “Economic performance. Agro-food portal.”.

[14] ZuivelNL (2020), “Dutch Dairy in Figures 2020”, https://www.zuivelnl.org/uploads/images/Publicaties/Dutch-Dairy-in-Figures-2020-spread.pdf (accessed on 24 August 2022).

Notes

← 1. TFP is the ratio of an aggregate of the quantities of goods and services produced (outputs) to an aggregate of all the factors used to produce them (inputs) (Bureau and Antón, 2022[34]).

← 2. The Netherlands imports a significant amount of veal calves from other EU Member States.

← 3. Unpaid work is carried out at agricultural businesses by entrepreneurs and the members of their families. An Annual Working Unit is equivalent to a worker working 2 000 hours or more. Accounting profits per AWU can be used as a proxy for farm income for participating family members, which is difficult to observe directly.

← 4. See https://food.ec.europa.eu/animals/animal-diseases/diseases-and-control-measures/african-swine-fever_en.

← 5. See https://ec.europa.eu/eurostat/databrowser/view/NAMA_10_CO3_P3__custom_107542/bookmark/table?lang=en&bookmarkId=0a42eb21-a6f0-4f23-9556-58656ac77be3.