This chapter offers an overview of Bangladesh's developmental journey since its independence in 1971. It delves into the pivotal role of manufacturing, which has not only facilitated the country's sustained growth but has also been a driving force in the transformation of its economy and society. Recognising the need for sustained progress, it advocates for an update of the economic development paradigm currently characterised by a dualistic approach that, over time, has favoured the establishment of the world's second-largest readymade garment industry. In a context of increasing domestic and external fragilities, the chapter provides suggestions that should guide Bangladesh towards a more dynamic and resilient trajectory of development. This entails embracing innovation, fostering regional integration, and optimising the role of foreign direct investment.

Production Transformation Policy Review of Bangladesh

2. Bangladesh: A journey of economic transformation

Abstract

Introduction

Since gaining independence in 1971, Bangladesh has achieved impressive progress. From a country known for its extreme poverty and fragility with a predominantly agrarian landscape, the country embarked on a transformative journey that ultimately culminated in the establishment of a manufacturing-driven economy. After independence, Bangladesh was the world's ninth-poorest country, with a nominal income per capita of USD 95, an infant mortality rate of 210 deaths per 1 000 births, and an average life expectancy of 46.6 years (United Nations Department of Economic and Social Affairs, 2022[1]). At the time of the country's foundation, Bangladesh was facing several challenges. The country was devastated by the consequences of the war for independence, as well as the Bhola cyclone that struck in 1970 and a subsequent flood‑induced food crisis in 1974. These multiple crises took a shattering toll on both lives and infrastructure, making Bangladesh known globally for its extreme poverty (Lewis, 2011[2]; Mookherjee, 2011[3]). Estimates indicate that during the initial years of independence, the country lost over 5 million lives, equivalent to 8% of the population at that time. In addition to the profound social and humanitarian implications, the economy witnessed an 84% decline in agriculture and a 66% contraction in industrial production by the end of 1974 (Bangladesh Bureau of Statistics, 2018[4]). This period also brought about a soaring inflation rate, approaching triple digits. In 1975, the United Nations classified Bangladesh as a Least Developed Country (LDC), making it eligible for international support measures targeted at the world's poorest countries (Van Schendel, 2020[5]).

In the aftermath of independence, international donors mobilised major resources and supported improvements in health, nutrition, and living standards, striving to alleviate extreme deprivation and foster inclusivity. Official development assistance (ODA) to Bangladesh, amounting to 8% of GNI by 1977, reflected international solidarity in aiding the nation's revival. From 1971 to 1981, Bangladesh received USD 8 billion in aid, placing it behind only India, Syria, and Egypt and surpassing neighbouring countries like Pakistan, Indonesia, and Viet Nam (OECD, 2023[6]) Also, local non-government organisations (NGOs), played a pivotal role and complemented the collective effort, notably by curtailing extreme deprivation and exclusion. During this period Bangladesh became a test case of how aid can propel development (Faaland and Parkinson, 1977[7]).

Since then, Bangladesh has advanced across all fronts, thanks to a combination of government policies and international support. The country has undergone a profound transformation of its economy, transitioning from a predominantly agrarian subsistence society into a global manufacturing hub. A total of 20.5 million people lifted themselves above the extreme poverty line between 1991 and 2017, leading to a reduction in the poverty rate from 43.5% to 14.3%. Bangladesh achieved lower-middle-income status in 2015, and in 2018, the United Nations Committee for Development Policy (CDP) recommended the country for LDC graduation based on progress achieved in three criteria: gross national income per capita, human assets, and economic vulnerability. The standard preparatory period towards LDC graduation- three years- expected in 2024 was postponed to 2026 to account for the challenges posed by the COVID-19 pandemic. Presently, Bangladesh stands as the eighth-most populous country in the world and boasts the world's 35th largest economy by GDP size, ranking between Viet Nam and Thailand. Despite these advancements, Bangladesh’s development model faces pressing challenges and the country remains the third-largest global recipient of Official Development Assistance (ODA), trailing behind Syria and Egypt. In 2021, it received a total of USD 5 billion from members of the OECD Development Assistance Committee (DAC), equivalent to 1.2% of Gross National Income (GNI) (OECD, 2023[6]).

This chapter analyses Bangladesh's economic transformation, emphasising the progress achieved, notably in sustaining growth, developing local manufacturing capabilities engaged in global trade, and the more recent strides made in digitalisation. The chapter subsequently discusses the limitations of the current development model in Bangladesh, underscoring the risks associated with overreliance on the Ready-Made Garments (RMG) sector. Furthermore, the chapter addresses challenges related to food and energy dependency, environmental sustainability, and inclusivity. The chapter concludes by identifying three priorities to support diversification and facilitate the transition to a next development phase that is not solely reliant on low-cost labour but, rather, centred around quality and sustainability. These priorities encompass fostering an innovation culture within government and businesses, strengthening regional integration, attracting higher quality Foreign Direct Investment (FDI), and maximising the potential of international partnerships to transform the economy. Chapter 3 of this PTPR delves into the policies that underpinned Bangladesh's economic transformation and identifies areas for reform to ensure continued success. Chapter 4 zooms in on two industries: electronics and pharmaceuticals.

Bangladesh has deeply transformed its economy and society

Since achieving independence, Bangladesh has undergone an impressive transformation from a predominantly rural and agricultural economy to a more urbanised and industrialised one. The contribution of agriculture to GDP decreased from 62% in 1975 to 35% in 1981, while the contribution of industry, including construction, increased from 9% to 14%. This transformation was accompanied by a significant expansion of the capital city, Dhaka, whose population grew from 2 million to 3.3 million during the same time period (World Population Review, 2017[8]; World Bank, 2023[9])

From the 1980s onward, the country has implemented a targeted industrialisation strategy focused on nurturing domestic industries (see Chapter 3). This section provides an overview of Bangladesh's economic transformation, concentrating on three areas where progress has been made over the last forty years. These include sustained growth, the accumulation of industrial capabilities (Bangladesh is now the second-largest global hub for RMG manufacturing), and the more recent developments in embracing digitalisation to revolutionise the economy.

Bangladesh is a South-Asia growing economy

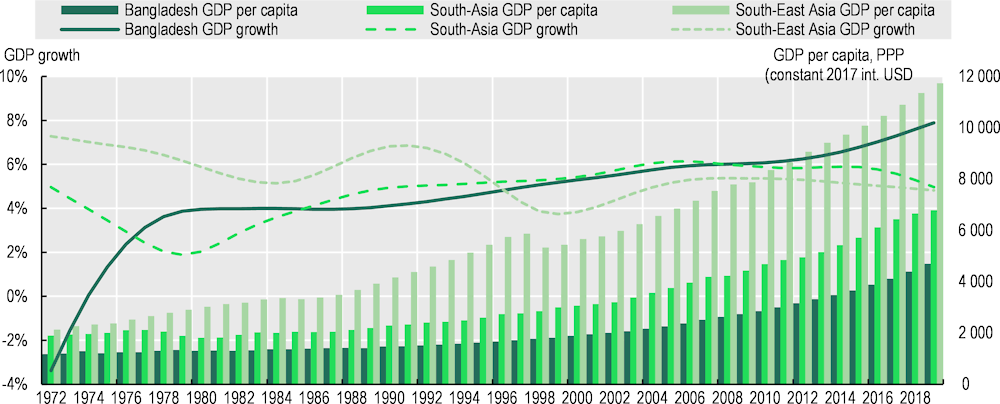

Bangladesh’s GDP growth performance has been remarkable. After stagnant growth rates in the post-independence era, the country recorded annual average GDP growth of 4% in 1976, which remained stable until the 1990s. This growth sustained the country’s progress, albeit at lower rates than other economies in South and South-East Asia. Since the start of the 21st century, Bangladesh's annual GDP growth rate has been, on average, 6%; and since 2010, the country has recorded higher growth rates than the South-Asia average.

Sustained GDP growth since the late 1970s has been accompanied by significant human development gains. Life expectancy has increased to 73 years by 2020, up from 66 in the year 2000, and the infant mortality rate has declined to 24 per 1 000 live births, a substantial decrease from the previous 60 deaths during the same period. As of 2021, GDP per capita was USD 1 684 (in constant 2015 USD). Although Bangladesh has managed to narrow the gap in GDP per capita with other countries in South Asia, similar progress has not been achieved with Southeast Asian economies. In the 1970s, Bangladesh's GDP per capita stood at 55% of the Southeast Asian average and by 2021, it had regressed to 40% (Figure 2.1).

Figure 2.1. Bangladesh average annual GDP growth has outpaced the South-Asia average since 2010

Note: South Asia excludes Bangladesh. Regional aggregates follows UN classification. For GDP growth, HP filter was applied (lambda 54.12), according to OECD guidelines, http://dx.doi.org/10.1787/pdtvy-2016-en

Source: Authors’ elaboration based on data from Penn World Table (PWT) version 10.0. Real GDP at constant 2017 national prices (in mil. 2017 USD)

Now a global garment manufacturing hub

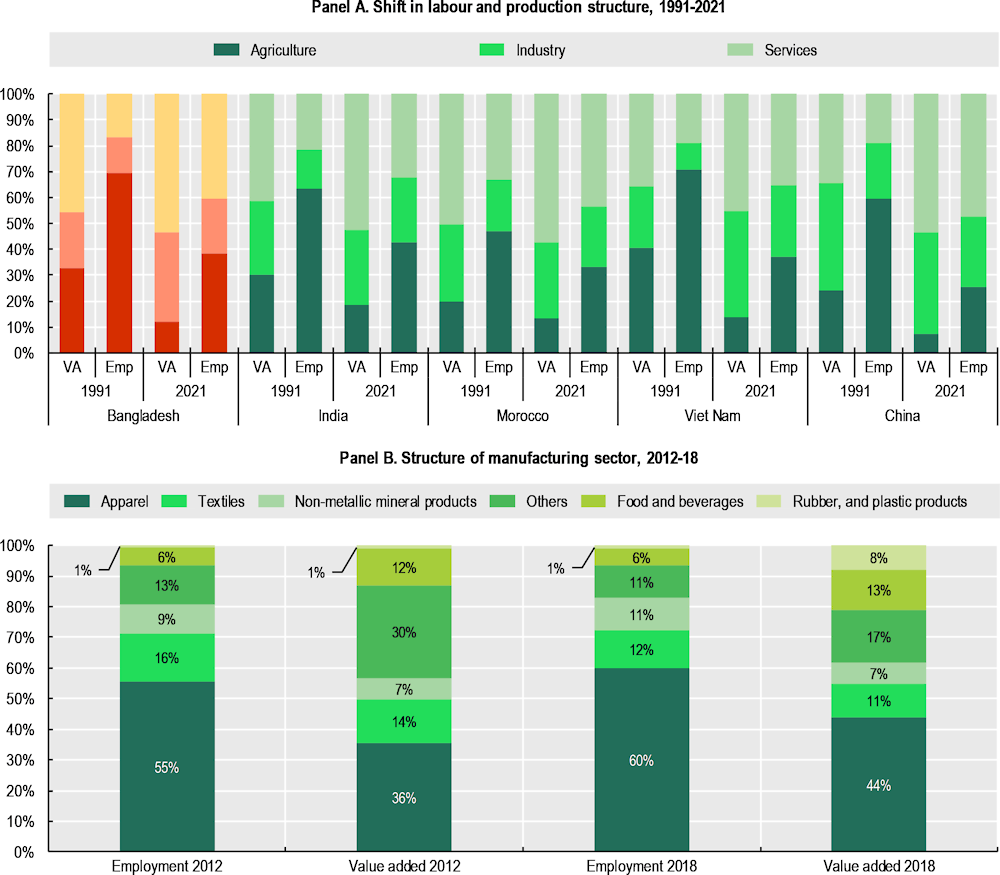

Bangladesh's economic landscape has experienced a profound economic transformation. Like many other Asian countries, since the 1990s the industrial sector's (including construction) contribution to GDP has surged from 18% to over 31%, and the services sector has expanded from 40% to more than 50%, echoing trends observed across Asia (Figure 2.2, Panel A). In these countries, the process of industrialisation has been characterised by a substantive structural shift within their economies. Initially grounded in import substitution policies aimed at fostering local industrial capabilities, these economies have transitioned towards more sophisticated industrial sectors. In tandem, they have fostered innovation and attracted foreign direct investment (FDI), which ultimately culminated in diversifying their production and exports. This diversification journey was accompanied by an elevation of economic structures, with a greater emphasis on higher value-added activities and sectors, including basic metals, electrical and electronics equipment, and chemicals (Lee, 2022[10]).

Bangladesh's economic transformation has exhibited a distinctive characteristic—an industrial system with dual traits. On the one hand, the country has an export-oriented sector primarily driven by Ready-Made Garments (RMG), with many firms acting as sub-contractors for multinational corporations. On the other hand, a more shielded, domestically-oriented sector aims to supply the domestic market. This dualism is upheld and perpetuated by a policy framework that, despite reforms, remains largely anchored to similar principles as it was at the time of independence. Over the past few decades, Bangladesh has grown into a global powerhouse in garment manufacturing. Presently, RMG and textiles account for over 70% of formal manufacturing jobs and contribute to 55% of the total value added in domestic manufacturing (MVA) (Figure 2.2, Panel B). Other sectors include food and beverage, which contributes 13% of MVA, followed by non-metallic mineral products (9%) and rubber and plastic (6%).

Figure 2.2. Manufacturing employment and value added dominated by garments and textiles

Note: Panel A. Employment data refers to 2019.

Source: Authors’ elaboration based on world bank national account, https://data.worldbank.org and UNIDO Indstat (2022), https://stat.unido.org/database.

The history of garment and textile production in Bangladesh spans centuries, with notable developments during the Mughal Empire (16th-19th century) when fine muslins and silks were produced. This growth continued during the British Raj (1858-1947), marked by the establishment of jute mills and expanded cotton production. However, some protectionist measures during this period impacted industrialisation, leading to deindustrialisation in West Bengal due to bans and high tariffs on exports (Fauzia Erfan, 2004[11]).

The modern garment and textile industry in Bangladesh gained momentum after the nation's independence in 1971. In the early 1980s, the sector experienced a revival, aided by the government's creation of free‑trade zones that encouraged foreign investors to build factories. The combination of affordable labour and low production costs further catalysed the industry's growth. A pivotal development occurred in 1977 when the Korean conglomerate Daewoo collaborated with local partner Desh to produce garments in Bangladesh as a cost-effective offshoring strategy, sparking knowledge transfer and inspiring the formation of new companies. By 1984, exports had solidified, and by the early 1990s, the garment and textile sector had replaced jute goods (Balchin and Calabrese, 2019[12]; Van Schendel, 2020[5]).

Bangladesh is now firmly specialised in RMG, producing mass-market finished products such as knit t‑shirts, non-knit men's suits and shirts, and knit sweaters. The upsurge of RMG and related activities has bolstered the industrialisation process. The manufacturing value added as a share of GDP moved from 11% in 2000 to 22% in 2022, in line with other emerging manufacturing hubs such as Türkiye, Viet Nam, and Thailand. This places Bangladesh ahead of other emerging countries like India (16%) and Indonesia (20%) (UNIDO, 2023[13]).

RMG is also the largest employer in Bangladesh, involving around 4.4 million individuals, primarily women. Women comprise a significant 80% of the RMG labour force, making this sector the predominant employer. A stark reality emerges as women bear a higher likelihood of informal employment, a trend exacerbated within the RMG sector where approximately 70% of jobs remain in the informal realm, leading to worker insecurity (ILO, 2020[14]; Bhattacharya, Khan and Khan, 2021[15]).

Domestic and international policies played and continue to play a key role in determining the competitiveness of the RMG in Bangladesh. Since becoming a member of the World Trade Organization (WTO) in 1995, the country progressively liberalised its trade policies and diminished non-tariff barriers, providing a further boost to the sector. The EU's Everything But Arms (EBA) initiative in 2001, offering duty-free, quota-free market access to Least Developed Countries (LDCs), greatly benefitted Bangladesh's competitive garment industry, which capitalised on zero tariff rates and lifted volume restrictions. Although it was feared that the termination of the Multi-fibre Arrangement (MFA) in 2005 would intensify global competition, Bangladesh's existing sector strength and rising demand from Europe and Asia helped mitigate the impact (Lewis, 2011[2]; Whalley, 2006[16]).

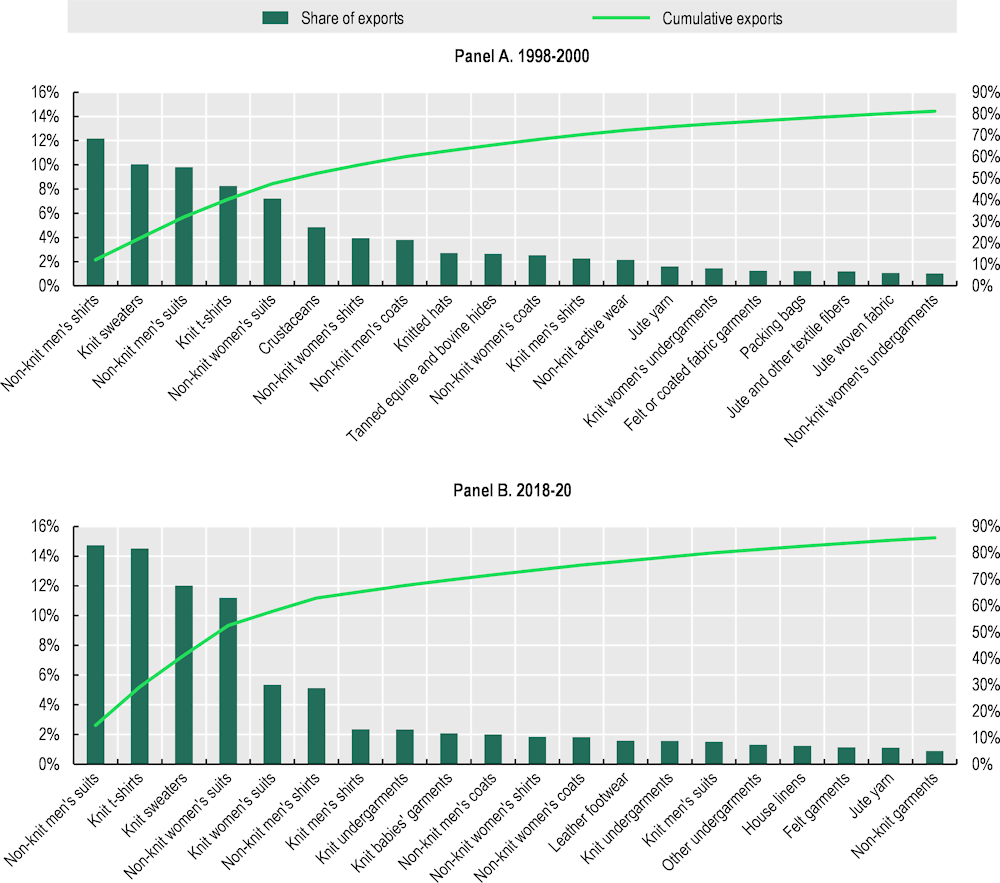

RMG is the pulling sector of Bangladesh exports. From 2000 to 2021, Bangladesh's exports surged eightfold in nominal value, escalating from USD 5.3 billion to USD 43 billion. In 2021, around 84% of the country's exports were RMG-related, solidifying Bangladesh's position as a top-three global RMG exporter, together with the People's Republic of China (hereafter “China”) and Viet Nam. In 2018-20, the first top ten exported products – all related to garment and textiles – accounted for 56% of total exports, up from 45% in 1998 (Figure 2.3). Since the 1990s, Bangladesh has tried to diversify its production and export structure. The country promoted the production of leather and jute which have centred around the state-owned Bangladesh Jute Mills Corporation. The Government also identified other activities that could shift from focusing on the domestic market to exporting, including electrical and electronic equipment (E&E) pharmaceutical and food, but these efforts have yielded very limited results thus far (Kathuria and Malouche, 2015[17]). While leather and frozen food— particularly crustaceans—are currently part of the export mix (albeit marginally at 2% and 1% of total exports in 2018-20), E&E and Pharmaceutical production are mainly aimed at domestic consumption (see Chapter 4). In over twenty years, the export basket of Bangladesh expanded from 846 products (H Harmonized System (HS) Codes6) in 1998-00 to 1 009 in 2018-20. However, in addition to the limited change, these products, which remain linked to primary and resources-based activities, account for only 0.4% of total exports (CEPII, 2023[18]).

Figure 2.3. RMG account for 84% of Bangladeshi exports

Note: CEPII developed a procedure that reconciles the declarations of the exporter and the importer, that may be different in the original data from COMTRADE.

Source: Authors’ elaboration based on BACI HS 6 digits database, from CEPII (2022), http://www.cepii.fr.

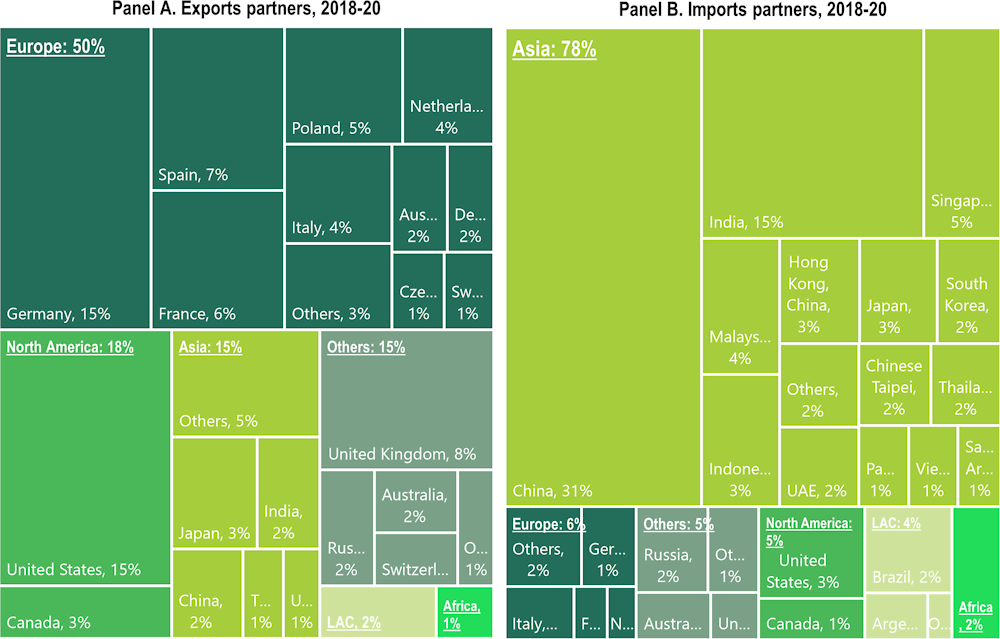

The significance of the RMG sector profoundly influences Bangladesh’s import patterns and trade relationships, with the country primarily sourcing imports from Asia to subsequently export to Europe and North America (Figure 2.4). Since the late 1990s, there has been a notable increase in export concentration within Bangladesh, leading to the emergence of new trade partners as the country solidified its reputation as a key player in the global RMG industry. Between 1998 and 2000, two countries accounted for nearly 50% of Bangladesh’s exports: the United States held the lion’s share with 36%, while Germany contributed 10%. During this time, Europe, including Germany, constituted 48% of total merchandise exports, whereas Asia’s share stood at 11%. In stark contrast, Africa, South America, and Oceania each represented less than 1% of the total.

The United States and Germany remain the foremost destinations for Bangladesh’s exports, each contributing 15% to the overall total. The European Union as a collective entity emerged as the primary trade partner, substantially increasing its share to 50% of Bangladesh’s total exports, up from the previous period’s 40%. The remarkable expansion of Bangladesh’s market share was favored by the 2011 reform of the European Union rules of origin, which allowed LDC apparel exports to qualify for EBA treatment under a single transformation criterion (UNCTAD, 2022[19]). Furthermore, Asia’s overall share reached 15%, on par with the combined percentages of the US and Germany. Other regions continued to hold marginal positions, although Oceania exhibited a slight uptick to 2% (data refers to the period 2018-2020). The escalating demand for RMG products from Europe has served as a major impetus behind export growth, with three key items—non-knit men’s suits, knit t-shirts, and knit sweaters—leading the way. Notably, West European countries, which are home to some of the most prominent apparel brands by market value, have spearheaded this expansion. Among them, Germany, Spain, France, and the United Kingdom have played pivotal roles in propelling the surge in demand (Brand Finance, 2022[20]).1

Figure 2.4. Importing from Asia to export to Europe and North America

Source: Authors’ elaboration based on BACI HS 6 digits database, from CEPII (2022), http://www.cepii.fr.

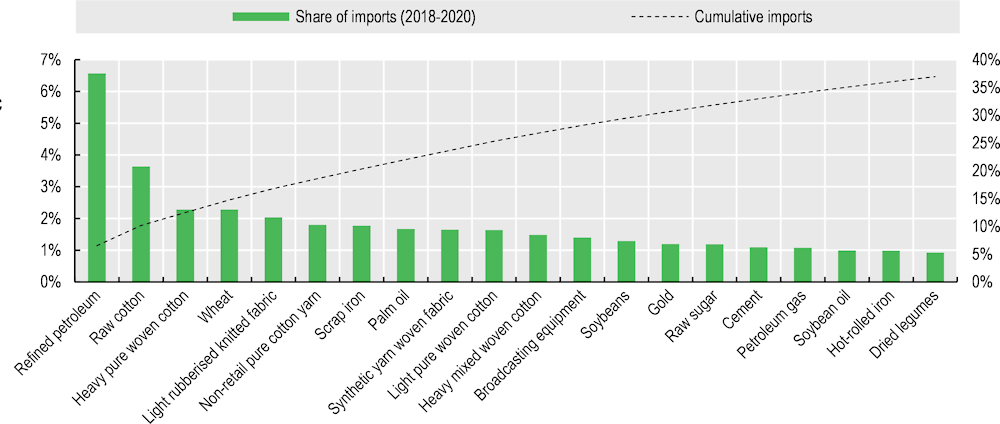

Bangladesh's import sources are concentrated in Asia, with almost 80% of imports coming from China, India, and Singapore. Notably, China is the source of non-raw textiles and machinery, India provides raw cotton and textiles, and Singapore is the source of sewing machines and synthetic colouring matter. The composition of Bangladesh’s imports is more diversified. While imports have not changed significantly during the last 20 years, from 1998-00 to 2018-20, they increased by a factor of eight, but neither the relative shares of technological intensity nor product composition underwent any relevant transformation (Figure 2.5). A large proportion of Bangladesh imports include staple food and other relatively income inelastic commodities such as fuel and petroleum. The import basket also exhibits a high dependence of inputs for the RMG exporting industry, with the single major import being raw cotton (3.71% of total merchandise in 2020). Bangladesh is the third largest importer of raw cotton after China and Viet Nam (12.6% of the world’s total cotton imports), the fourth largest importer of light rubberised knitted fabric and the first importer of heavy pure woven cotton. It is also a significant importer of textile processing machines, sewing machines, synthetic colouring matter, and dyeing finishing agents.

Figure 2.5. Imports are key to sustaining Bangladesh RMG exports, and are determinant for food and energy security

Note: CEPII developed a procedure that reconciles the declarations of the exporter and the importer, that may be different in the original data from COMTRADE.

Source: Authors’ elaboration based BACI HS 6 digits database, from CEPII (2022), http://www.cepii.fr.

Bangladesh has further deepened its specialisation in RMG, establishing it as the economic backbone and a prominent voice in both domestic and international government-business discussions. Bangladesh needs to diversify its exports and RMG can play an important role in it. The RMG sector has demonstrated the ability to enhance worker safety and standards compliance; promote innovation, original design, improved working conditions; and adopt advanced technology for modernising production, enhancing productivity, and bolstering environmental sustainability. These areas must be prioritised as the RMG sector charts its course ahead, with domestic policies and international partnerships converging to support progress in these crucial domains.

Bangladesh has advanced in digitalisation

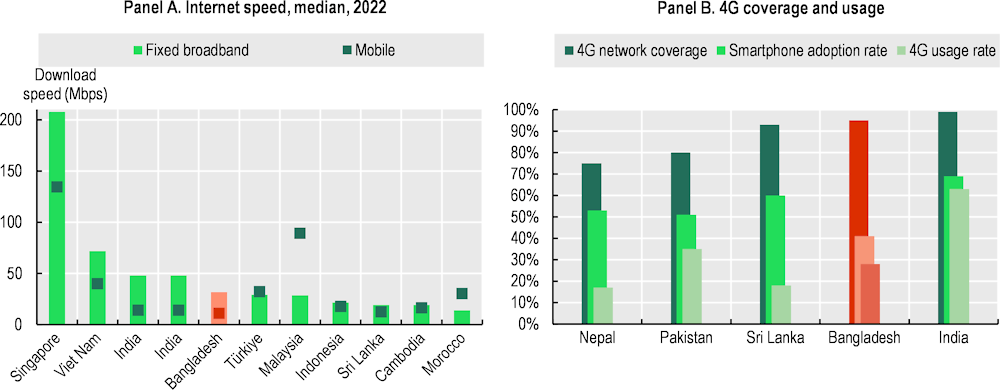

The government of Bangladesh has recognised the importance of digitalisation for development. It has launched two subsequent initiatives to support bridging infrastructure gaps and to promote access to digital technologies: Digital Bangladesh Vision 2021 and Smart Bangladesh Vision 2041 (see Chapter 3 of this PTPR). Presently, 4G coverage extends to 94% of the territory, and individual internet usage has surged from 3% to 25% between 2010 and 2021. Concurrently, fixed broadband subscriptions per 100 inhabitants have doubled from 3 to 6.1 over the same period (Figure 2.6). Bangladesh’s businesses are also increasingly adopting digital technologies for their operations. Local firms engaged in global supply chains display a higher proportion of website adoption (66.5%) compared to firms that are not engaged with foreign partners, for which only 2.5% have an online presence (World Bank, 2023[21]). However, despite the fact that significant strides have been made, several substantial gaps persist when compared to other countries. For instance, Viet Nam has an internet usage rate of 70% of its population, a notable contrast to Bangladesh’s 25%. The slow mobile download speeds in Bangladesh, averaging 11 Mbps in 2022—only 1/3 of the global average and 8 times slower than the fastest country Singapore—underscore the urgency of addressing digital infrastructure challenges to further accelerate the country’s progress.

Figure 2.6. Digitalisation has advanced, but international gaps remain significant

Note: Panel A. April 2022 median values (download speed in Mbps).

Source: Authors’ elaboration based on Speedtest Global Index (Ookla), https://www.speedtest.net/it and GSMA (2021), “Achieving mobile-enabled digital inclusion in Bangladesh'', https://www.gsma.com/mobilefordevelopment/resources/achieving-mobile-enabled-digital-inclusion-in-bangladesh/.

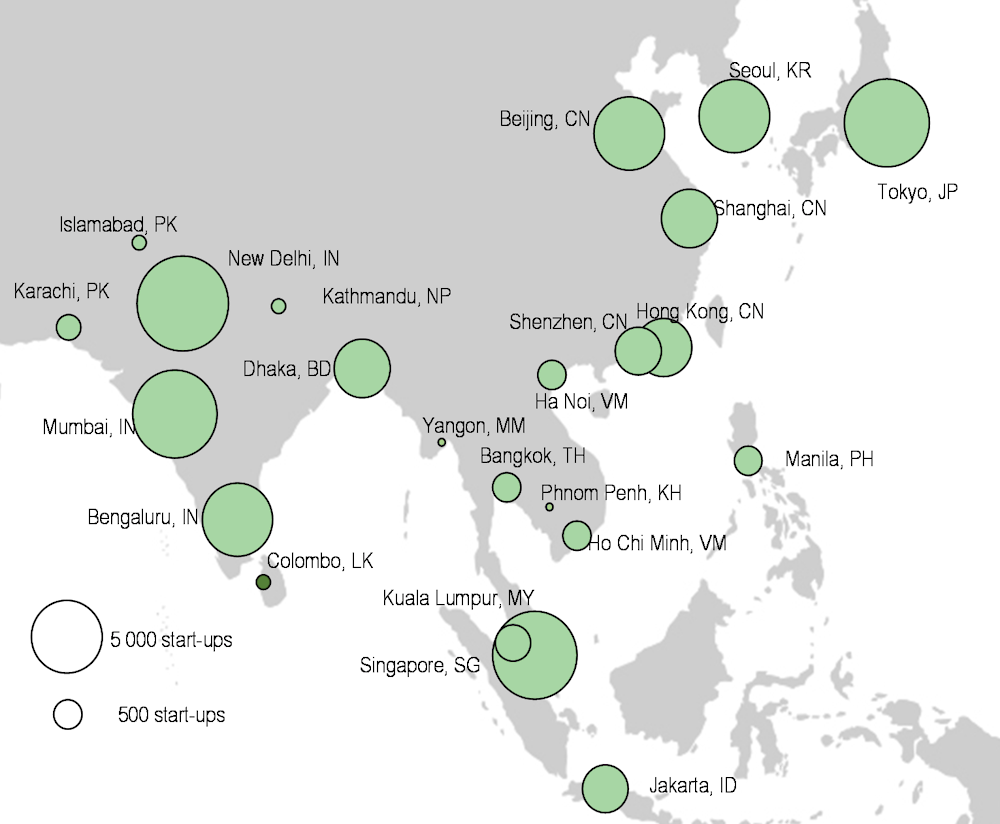

Digitalisation is contributing to enhance entrepreneurship and start-up creation. In 2022, Bangladesh was home to 2% of Asia’s start-ups,2 up from almost zero around a decade ago (OECD, forthcoming[22]). This 2%, even though small for a country the size of Bangladesh (India with a population 8 times larger is home to 23 times the number of start-ups, accounting for 40% of the region’s total), puts the country on par with Viet Nam and Malaysia. In Bangladesh, like most countries where the start-up ecosystem is incipient, start‑ups tend to be concentrated in Dhaka. Indeed, 88% of all start-ups in Bangladesh are located in the capital. The city has become the 10th largest in Asia in terms of start-up hubs, with a population of start‑uppers that is much higher than other LDCs (Figure 2.7). Dhaka is also relatively start-up dense compared to other emerging city in the region, with about 12 start-ups per 100 000 people, similar to, for example, Ho Chi Minh in Viet Nam (9). It has room to grow compared to for example Singapore, which is the densest hub in the region (109 start-ups per 100 000 people), and Bengaluru in India, which comes in second (39).

Figure 2.7. Dhaka has emerged as an important hub in Asia

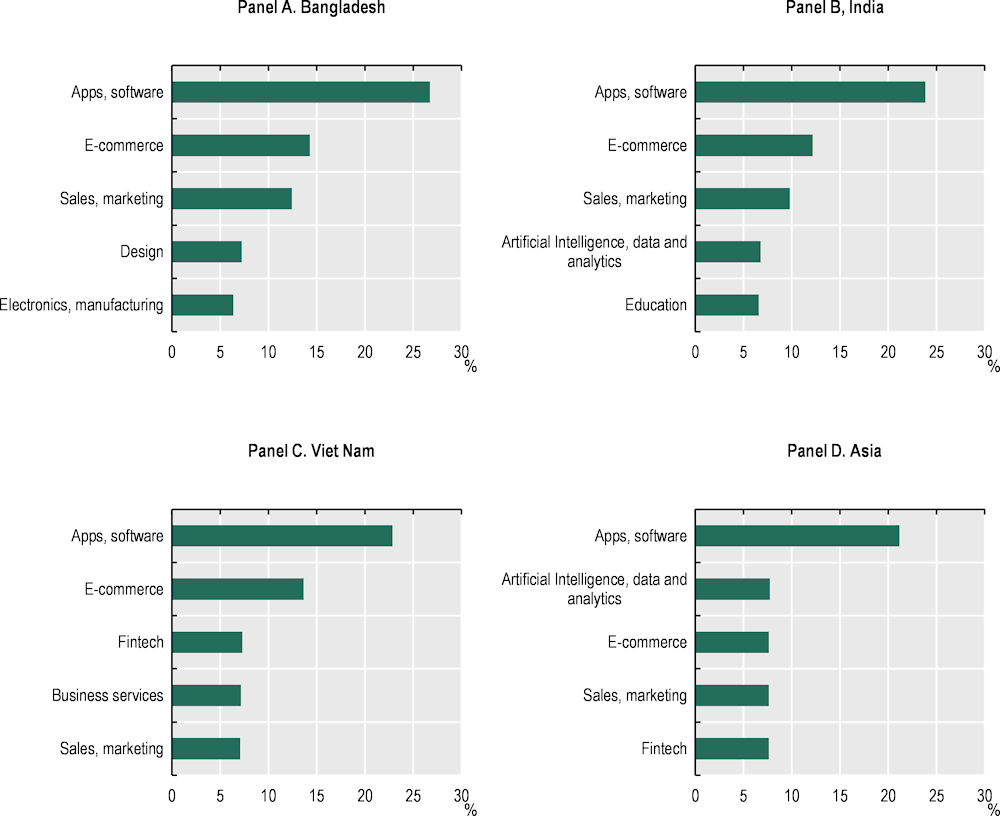

Bangladesh’s start-ups are tapping into the country’s large market. The top sector for Bangladesh’s start‑ups includes apps, software and related activities (27%), similar to other hubs in the region, reflecting also a global rising trend in app-based businesses. Significant proportions of start-ups also gravitate towards e-commerce (14%), closely followed by sales and marketing (12%), in line with a boom in e‑commerce in large developing countries, which are implementing solutions adapted to local needs. Bangladesh also has a small share of start-ups (6%) in electronics and manufacturing. In contrast, other hubs in the region have a higher share of start-ups in relatively more high-tech activities, such as artificial intelligence, data and analytics and fintech (Figure 2.8).

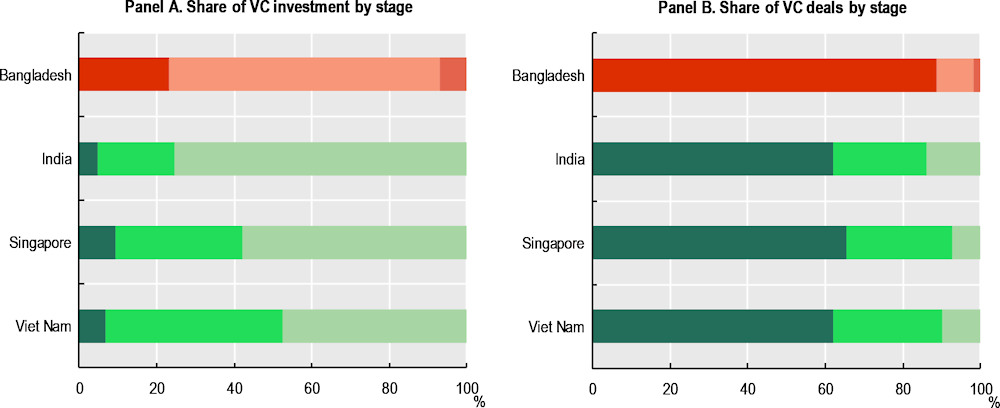

Despite progress, Bangladesh is still a small player when it comes to venture capital (VC). The country’s VC investments have increased from below USD 1 million annually before 2014 to an annual average of around USD 150 million in 2019-21. However, the overall size of investments is still small, making up only about 5% the size of the Viet Nam’s average over the same period, for instance. Scaled to GDP, Bangladesh attracted the 12th highest volume of venture capital in Asia at 0.04% of GDP, on par with Myanmar and slightly lower than Pakistan. This lags significantly behind the 2019-21 Asian and OECD averages at 0.71% and 1.28% respectively. Singapore by contrast is the region’s most mature ecosystem, with VC accounting for nearly 1.6% of its GDP.

Figure 2.8. Design and electronics are among the top start-up sectors in Bangladesh

Note: Start-ups are considered those active in 2022 and founded in the period 2013-2022.

Source: Authors’ elaboration based on Crunchbase (2023), database, https://www.crunchbase.com/.

VC concentrates in fintech and e-commerce and is less diversified than in more established start-up ecosystems in Asia. In fact, while only 3% of start-ups in Bangladesh focus on fintech, the sector attracted 44% of the country’s venture funding thanks to BKash, Bangladesh’s only unicorn. Similarly, the lion’s share of funding that went to e-commerce (a sector that overall represents 40% of all VC in Bangladesh), owes to ShopUp, another successful start-up in the country. When looking at the Asian average, for example, that includes more mature hubs in the region, no sector amounted to more than 14% of the total. Moreover, seed investments account for the majority of investment deals in the country, accounting for 87% of the total, higher than the 62% on average in India, Viet Nam and Singapore (Figure 2.9). On one hand, this means that start-ups that have a promising idea can find investment, but on the other hand, this also indicates a relative lack of scale-up capital that can flow into large deals. As a result, the share of late stage deals is small in the country, accounting for 7% of the total, which is much lower than India, for instance where it stands at 76%.

Looking ahead, alongside government initiatives like Start-up Bangladesh, the new Smart Bangladesh policy framework requires modernising the capital market and banking system. Private credit provision lags behind peers, with low domestic credit for the private sector leading to a "missing middle" scenario. This means just a handful of large companies receive most of the financing, leaving startups and SMEs struggling for capital. Around 35% of firms and half of SMEs cite difficulties in accessing finance as their main obstacle (Gu, Nayyar and Sharma, 2021[23]). A concerning financial issue is the rising non-performing loan (NPL) rate, which increased from 1.9% in 2011 to about 8% in 2020, or possibly higher. By contrast, Viet Nam and Indonesia reported 1.9% and 2.6% NPL ratios in 2020. India's rates (2.7% in 2011, 7.9% in 2020) and Pakistan's now align with Bangladesh's. High NPLs not only suggest future instability but it also hinders financial sector development, which is vital for diversification and structural transformation (IMF, 2022[24]).

Figure 2.9. Bangladesh’s venture capital investments focus on seed and early-stage deals

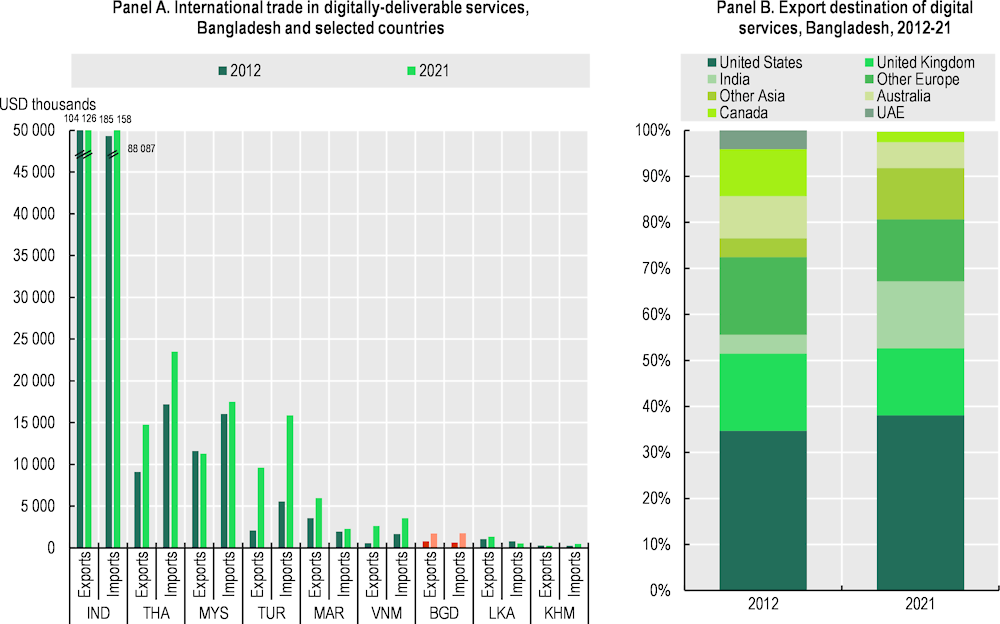

Digitalisation is also contributing to diversifying Bangladesh’s exports. The country's total exports of digital deliverable services grew from USD 780 million in 2012 to USD 1.73 billion in 2021, even though this is still far from its regional and global counterparts. Bangladesh has increased digital service exports to Asian markets, rising from 8% to 27% between 2012 and 2021 (Figure 2.10). As Bangladesh's gig-worker sector burgeons—ranking as the second-largest globally after India—a landscape of opportunities and challenges unfolds. While this sector promises economic potential, it also necessitates measures to address informality and ensure equitable working conditions.

Figure 2.10. Bangladesh has started to export digital services

Note: Digitally-deliverable services are an aggregation of insurance and pension services, financial services, charges for the use of intellectual property, telecommunications, computer and information services, other business services and audio-visual and related services. The digitally-deliverable services series is based on the concept of potentially ICT-enabled services as developed by UNCTAD in a technical note in 2015 as well as in a report of the 47th United Nations Statistical Commission in 2016.

Source: Authors’ elaboration based on UNCTADstat, https://unctadstat.unctad.org and Bangladesh Association of Software and Information (BASIS) annual report 2022, https://basis.org.bd/annual-report.

Despite progress, Bangladesh has much ground to cover in effectively utilising digital technologies and boosting complementary digital skills across the entrepreneurial landscape, thereby intensifying inter-sectoral productive linkages (UNCTAD, 2020[25]). Bangladesh's digital governance progress is commendable, issuing over 100 million digital IDs and digitising 66% of government services. However, challenges remain due to complex procedures and usability concerns. Streamlining processes and user-friendly interfaces are essential for unleashing digital technologies' transformative potential. Progress in regulating the sector is crucial. The announcements of an imminent reform of the 2018 Digital Security Act and the Data Protection of 2023 Act are a positive step, although the key will be to see the details of the implemented reforms. It seems they have relaxed data localization requirements, and they have provided greater recognition of the importance of international co-operation and safeguarding measures for facilitating data flows. All of which are positive step forwards (Randolph, 2023[26]). Moving ahead digitalisation challenges also encompass upskilling the government and private sector workforce, enhancing digital infrastructure resilience, and securing deployment.

Advances in digitalisation can also support stronger and more resilient industrial development. Digitalisation can amplify manufacturing productivity by up to 10% in developing economies, and integrating digital technology increases export intensity and Total Factor Productivity (TFP) (Asian Development Bank, 2023[27]). Likewise, embracing digital technologies can foster innovation sustainable industrial development by signalling quality and standards (Box 2.1). Digitalisation can also serve as a tool to make other sectors more sophisticated and modern while enhancing efficiency in broader areas such as weather forecasting (to improve disaster response, for example), streamlining institutional arrangements and customs procedures, and bolstering tax revenue collection.

Box 2.1. ACIMIT's Digital Ready certification: Pioneering standardisation in textile machinery

Digitalisation stands as a pivotal force in catalysing the evolution of the textile industry while preserving creativity and craftsmanship. The Association of Italian Textile Machinery Manufacturers (ACIMIT), representing 300 companies engaged in textile machinery production and related accessories, launched the “Digital Ready” certification in 2022, tailored to the textile machinery sector. This innovative certification seeks to streamline production processes by establishing a universal language and data reading system, thereby facilitating seamless interaction between machinery and production systems. ACIMIT's collaboration with Polytechnic of Milan ensures a simplified and standardised approach to managing machine data and production processes.

Facilitated by the international certification body RINA, this certification acts as a bridge connecting textile machinery manufacturers and their customers. To achieve the 'Digital Ready' certification, member companies adhere to a structured framework involving machine identification, data collection, document analysis, and on-site audits conducted by RINA. Once earned, the certification remains valid for five years, encompassing all machinery of the same production type and eliminating repetitive procedures. In the pursuit of digital excellence, this initiative is poised to enhance customer relationships, operational efficiency, and promote standardisation.

In 2022, Italian textile machinery production reached EUR 2.7 billion, with a significant 86% being exported to 130 countries. Leading export regions include Asia (44%), non-EU Europe (18%), European Union (17%), North America (9%), South America (8%), and Africa (4%).

ACIMIT, in partnership with the Italian Trade Agency (ITA), is also extending initiatives to Bangladesh, the fifth-largest market for Italian textile machinery. These initiatives aim to bolster skills development and advanced technology adoption in the garment textile sector. Key components include establishing Technological Training Centers in collaboration with the Bangladesh University of Textiles (BUTEX), offering specialised courses in areas such as Sustainable Technologies, Techniques for Reducing Denim Finishing Impact, Water and Energy Saving in Dyeing and Finishing, and Innovative Weaving Technology and Techniques.

Source: Alessandro Zucchi, President Association of Italian Textile Machinery Manufacturers (ACIMIT), Peer Learning Group (PLG) Meeting of the PTPR of Bangladesh, 8 September 2022.

Deep fragilities risk to hampering future progress

Despite the remarkable progress achieved on multiple fronts, such as poverty reduction, sustained growth, and digital business development, certain longstanding vulnerabilities persist that must be addressed to ensure continued progress in the future.

Bangladesh's success should not lead to complacency. The world is experiencing turbulent times, with escalating geopolitical tensions and profound transformations brought about by digital technologies. These changes are rapidly reshaping businesses and jobs, altering power dynamics, and affecting the generation, distribution, and the way in which profits are captured. Emerging technologies like the Internet of Things (IoT) and artificial intelligence (AI), coupled with evolving trade and investment trends, are gradually diminishing the advantage of low labour costs (Primi and Toselli, 2020[28]). Bangladesh faces the risk of becoming stuck in a cycle of relatively low-wage and low-productivity growth, which could limit its potential for expanding production and trade opportunities. Moreover, the acceleration of climate change is adding pressure to redefine work modes, production processes, consumption patterns, trade practices, and even overall societal and territorial structures to ensure economic practices align with the well-being of people and the planet.

Addressing these global challenges alone underscores the need for a reassessment of Bangladesh's economic development model. This necessity becomes even more compelling when considering the country's unique circumstances. Bangladesh’s youthful nation is grappling with increasingly intricate and diverse issues, from mitigating the impacts of climate change to preparing for LDC graduation. Additionally, the country must address the growing calls from both domestic and international stakeholders for more transparency and accountability in the public and private spheres.

The current economic model has reached its limits

To continue succeeding, Bangladesh needs to update its economic model. A business sector operating in a dual economy with enterprises focusing on providing the domestic market and operating in a highly protected market and RMG export-oriented firms engaged in low-hand segments of the fashion industry cannot sustain Bangladesh’s development progress towards development. Public policies will need to be reorganised to avoid perpetuating this duality and to support a shift towards new drivers of growth and development.

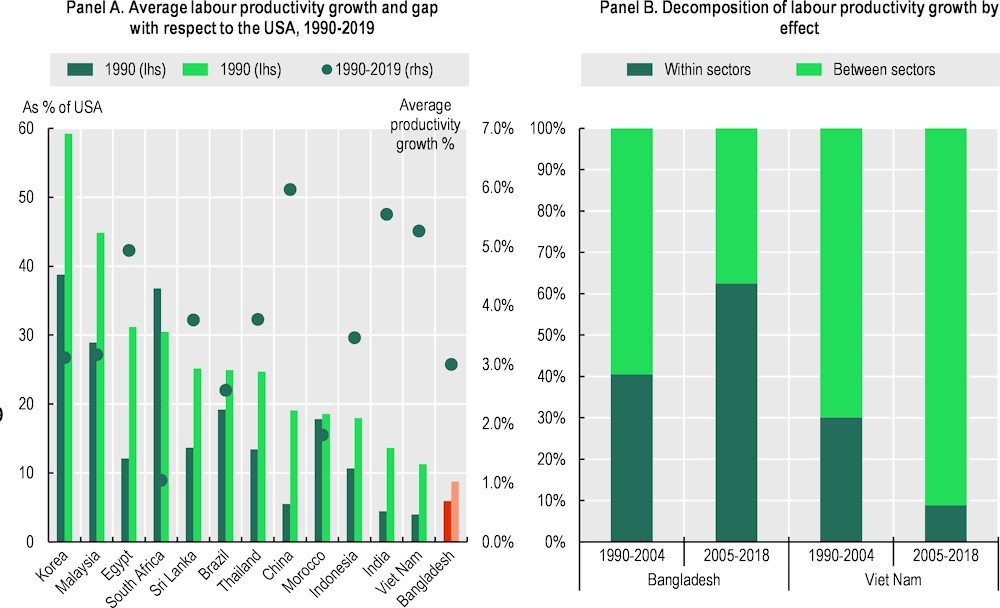

The present arrangement of production, encompassing both export-oriented and domestically-focused enterprises, does not effectively foster the generation of quality employment opportunities with fair compensation or contribute significantly to enhancing productivity. Labour productivity in Bangladesh remains excessively low. Labour productivity growth averaged 3% between 1990 and 2019, which is not enough to close the gap with more advanced countries. In Asia, most countries achieved substantially faster productivity growth rates. By 2019, Bangladesh's labour productivity was 9% of that of the United States, trailing behind India and Viet Nam, which albeit still far from the frontier, at least stand at 12% and 14%, respectively (Figure 2.11, Panel A). The country is trapped in a spiral of relative low wages and low productivity driven by sectors that seem to have limited employment capacity in the future and that do not translate into effective formal job creation. The relative less importance of labour shift to more dynamic sectors – activities in which productivity grows faster than the average- contributes to explain the persistency of the productivity gap with respect to the frontier (Figure 2.11, Panel A). In contrast countries like Viet Nam have seen productivity increase determined by a change in specialisation towards more dynamic activities (Diao, McMillan and Rodrik, 2017[29]). Hence, transforming industries to make them drivers of job creation, secure, safe and decent places to work for all individuals—and ensuring women are not discriminated against—is a key step forward in Bangladesh’s next development phase.

Figure 2.11. Labour productivity gap with the frontier persists

Note: Panel B. The within effect measures the productivity growth in each sector of the economy due to capital, human and technological accumulation. The between effect (or reallocation) measures the productivity growth due to labour reallocation from less to more productive sectors.

Source: Authors’ elaboration based on data from Penn World Table (PWT) version 10.0, https://www.rug.nl/ggdc/productivity/pwt/?lang=en.

The export-led growth model, which is heavily reliant on RMG, has run its course in terms of its capacity to sustain development. Partly also due to its reliance on LDC-specific International Support Measures which will be phase out upon graduation from the LDC category (UNCTAD, 2022[19]). This approach has driven growth and generated employment, yet in the future its adequacy for driving continued success is an open question. Challenges include sustainability, inclusiveness, excessive dependency on external factors, changes in the global fashion industry and calls for a deep transformation of the RMG sector.

The COVID-19 pandemic revealed the fragility of the RMG sector and also the need for increasing responsibilities of foreign lead firms along the whole value chain. In Bangladesh, several production facilities stood by as large orders were cancelled leading to substantial revenue contractions. Indeed, the average decline in the sector was nearly 17.4% in 2020, compared to the preceding year according to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA). Additionally, the pandemic affected capital investment plans, with factories delaying or reducing planned investments, including those directed to automation (Hossain and Alam, 2022[30]).

Sustainability is also paramount for the future of RMG. Environmental concerns including groundwater pollution, airborne waste, soil degradation, and noise pollution require substantial attention and urgent actions. The garment industry's global carbon footprint is significant, accounting for between 4% to 6% of carbon emissions and almost 20% of wastewater generation (OECD, 2018[31]). Collaborative efforts and shared and transparent responsibility across the value chain, standardised practices and due diligence will be key moving forward. Emerging trends in the circular economy should also be taken into account in Bangladesh. RMG generates substantial waste, notably pure cotton waste amounting to 250 000 tones out of the 577 000 tones produced in 2019. Recycling this waste could yield substantial financial benefits, while contributing to reduced imports of textile fibre. Initiatives such as the Circular Fashion Partnership hold promise in upcycling post-production fashion waste, which would steer the sector towards a more sustainable future. (Global Fashion Agenda, 2022[32]). Bangladesh has made clear steps towards increasing sustainability, including fostering the adoption of sustainable business practices, including the LEED certification. Bangladesh currently has the highest number of LEED-certified green factories globally, standing at 192.

The current production model and the relatively weak input-output linkages within the domestic-oriented sectors also exacerbates Bangladesh's persistent trade deficit. Despite the increase in exports over the past two years, the rise in imports of intermediary goods to support established export industries and address growing energy demands has been even more significant. This trade imbalance amplifies the balance-of-payments (BoP) deficit. In FY22, Bangladesh faced a substantial BoP deficit driven by the current account, which deepened in FY23, exerting significant pressure on foreign exchange reserves. The balance-of-payments deficit reached USD 7.2 billion in the first half of FY23, up from USD 5.3 billion in FY22, creating considerable pressure on foreign exchange reserves (World Bank, 2023[33]).

The combination of increased imports, reduced remittances, and external pressures converged to fuel these deficits. Inflation escalated from an average of 6.1% in FY22 to 8.7% during the first eight months of FY23, propelled by global commodity price increases and the progressive depreciation of the Taka. In 2019, the exchange rate was approximately 84.5 BDT to 1 USD and as of 2023, the exchange rate stands at approximately 100 BDT to 1 USD. Global uncertainties, including geopolitical tensions and economic disruptions like the Russian invasion of Ukraine, have exacerbated the situation, casting a pall over foreign exchange reserves and the broader economic landscape (World Bank, 2023[33]).

Bangladesh energy dependency is also a major source of concern. A complex energy crisis, exacerbated by various factors, is hampering the country's progress. Bangladesh has increased the electrification rate ranging from 85% to 95% in 2021 from a mere 20% in 2000 and has increased its total power generation capacity to 25 700 megawatts (MW) in 2021 according to different domestic and international statistics (IEA, 2023[34]). However, during the first five months of 2023 several energy shortages increased due to costly and inadequate natural gas imports. This comes amid a global hike in energy prices, including LNG. In Bangladesh, 70% of electricity production come from LNG, of which 20% is imported. The dependence on imported energy compounds this challenge, underscoring why it is important to diversify imports and energy supplies including renewables. On top of this, gas reserves are expected to be exhausted by 2030 (Bangladesh Power Development Board, 2023[35]).

Bangladesh’s economy is highly and increasingly vulnerable to natural disasters

Sustainability is key for industrial development in Bangladesh and globally. In addition, Bangladesh is highly exposed to natural disasters and needs to rethink its industrial strategy both to minimise the country’s contribution to climate change and to mitigate its impacts in the future.

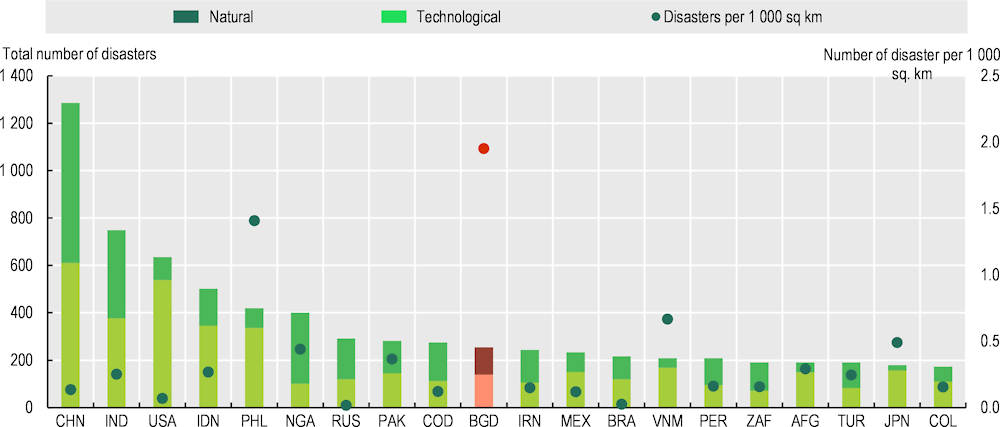

Natural disasters pose a growing threat to global economies and development, with escalating damages and impacts. The Centre for Research on the Epidemiology of Disasters (CRED) reported staggering estimated damages of USD 3.5 trillion from 2000 to 2021. This sum is equivalent to France's 2021 GDP, underlining the severity of these events. Climate change is causing more storms, floods, droughts, fires, and heatwaves, and the effect of such disaster are particularly felt in LDCs and small island developing states (SIDS). These disasters also trigger secondary technological and industrial accidents, compounding their toll on populations and sectors.

Bangladesh is among the countries most exposed to climate and weather-related hazards. The country faces acute weaknesses. Over 50% of its land is less than six meters above sea level, and approximately 80% of its population is exposed to extreme weather risks. The country grapples with a history of multiple threats, from droughts and cyclones to floods and landslides and the increase in frequency and impact of natural disasters induced by climate change is increasing Bangladesh’s precarious situation. In 2000-21, Bangladesh ranked 10th in the world in terms of number of natural and technological disasters, a score which is magnified when the incidence in terms of population is considered (Figure 2.12). These challenges are exacerbated by rapid urbanisation, high population density, and gaps in infrastructure development (UNCTAD, 2020[25]).

Figure 2.12. Bangladesh is among the most exposed countries to natural disasters in the world

Source: Authors’ elaboration based on EM-DAT - The international disaster database, https://www.emdat.be/.

In addition to major human development impacts, natural disasters also hamper Bangladesh’s industrial competitiveness. The vulnerability to natural disasters compounds with industrial and technological hazards, leading to substantial economic losses in sectors like agriculture, logistics, and manufacturing. This results in business uncertainty and trade unpredictability. Floods, driven by storms and heavy rainfall frequently disrupt energy supplies, even with flood protection structures in place at thermal power plants, and impact domestic agricultural production while proving a challenge to transport and logistics. Recently, more than five gas-fired power stations in Sylhet were pre-emptively shut down due to flooding in June 2022. To minimise the impact of natural disasters on industrial development, Bangladesh needs to increase prevention, reaction and restoring and re-building capacities (OECD, forthcoming[36]). Bangladesh and its international partners are aware of the need to increase the country’s resilience to natural disasters (Table 2.1). Bangladesh has initiated programmes with the International Monetary Fund (IMF) under the Resilience and Sustainability Facility, Extended Fund Facility, and Extended Credit Facility. These programmes address both immediate challenges, such as current account imbalances and reserve losses, and long-term structural concerns like actions to tackle climate vulnerability.

Bangladesh's exposure to environmental fragilities, exacerbated by natural and technological disasters, necessitates a comprehensive strategy adaptation and resilience-building. By integrating environmental considerations into development frameworks, enhancing climate adaptation measures, and fostering economic stability, the country can forge a path towards sustainable growth. Bangladesh has already issued a National Adaptation Plan and has estimated that a budget of USD 230 million will be needed to implement it. Increasing access to finance for resilience to natural disasters and partnerships with international stakeholders including the EU, the World Bank and the IMF will be key to implementing the necessary actions and support.

Table 2.1. Building resilience to natural and industrial hazards

|

|

Natural and environmental |

Industrial and technological |

Social |

|---|---|---|---|

|

Priority action to prevent, react and re‑build |

|

|

|

Source: Consensus building event - Working group: cushioning fragilities to develop a sustainable transformation. PTPR of Bangladesh, 18 October 2022, Dhaka.

Bangladesh needs to update its economic model to further its successes

To secure a prosperous future for Bangladesh, a fundamental shift in its development model is essential. Bangladesh must overhaul its economic model and identify new drivers for sustainable and inclusive growth. The subsequent paragraphs delve into three critical issues that, if effectively addressed, could catalyse the transition to the next developmental phase. There needs to be a shift in the business mindset from merely seeking market access to prioritising innovation. This entails updating trade policies and aligning them with a comprehensive industrial development strategy. Second, strategic management of international trade and investment relationships is crucial. Developing a clear approach to maximise benefits from regional integration and attract more and better FDI is essential. This approach should strategically bridge the persistent duality in Bangladesh's business landscape – enterprises serving the domestic market with substantial protection and those focused on exporting to provide multinational corporations with cost-effective, yet high-quality RMG.

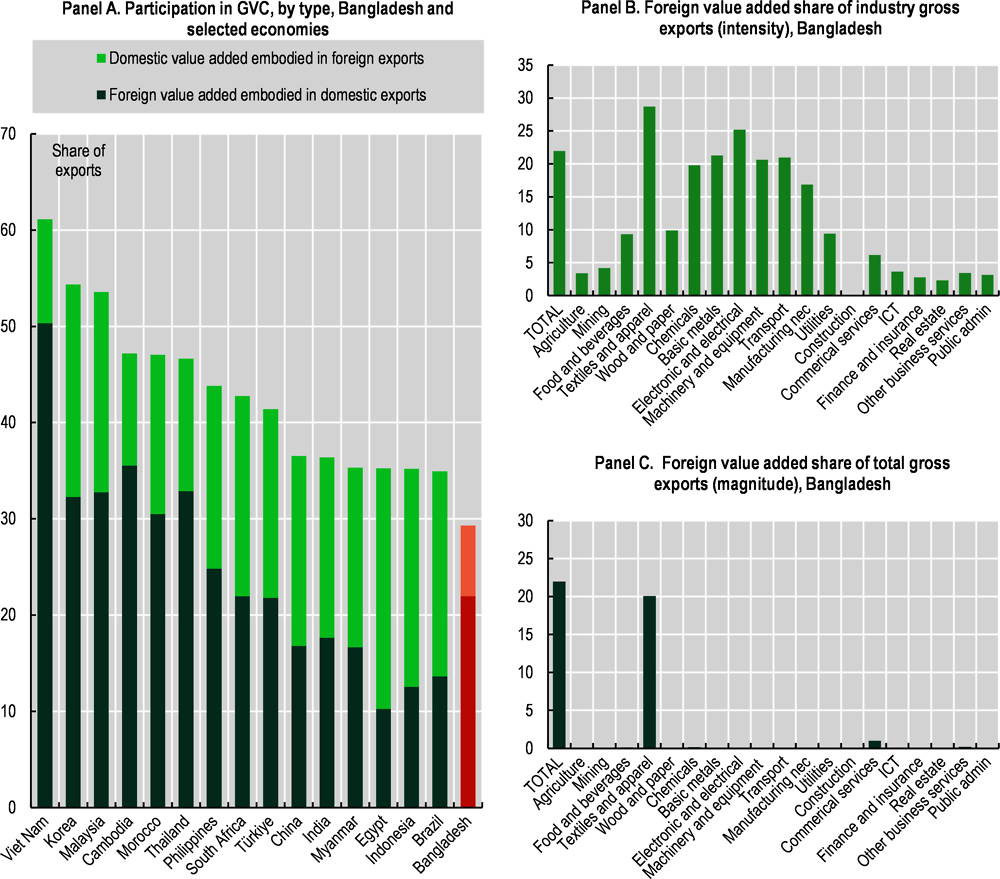

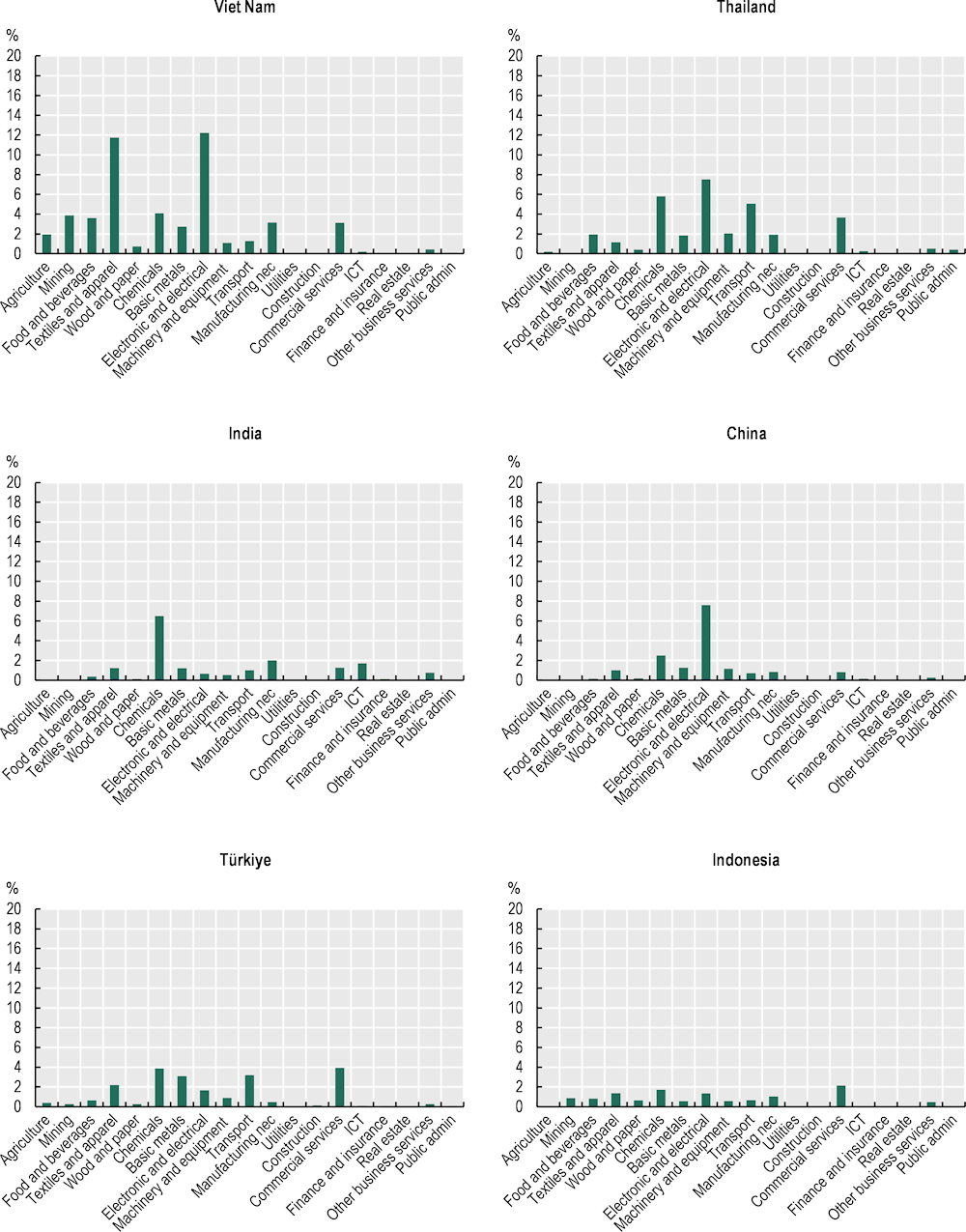

The way forward is the diversification and sophistication of the industrial base. It is not surprising that a granular analysis of the type and intensity of Bangladesh's participation in global value chains (GVCs) is limited. While practically all sectors in the economy rely on imported intermediaries that are further processed and transformed—particularly the manufacturing sector—the magnitude of the participation in GVCs is overwhelmingly explained by a 93% contribution from the garment and textile industry. The specialisation in exporting finished RMG products limits the possibilities for the local industrial sector to provide and increase value-added in other economic activities and countries (Figure 2.13). To some extent, Bangladesh resembles the type of engagement espoused by large developing economies such as, India, Indonesia, and China, which focus on developing domestic industrial capabilities and relying on domestic markets. However, these countries show a more diversified industrial and trade base that allows them to develop domestic and foreign linkages along the entire value chain (Annex 2.A).

Figure 2.13. Bangladesh participation in global value chains, 2020

Shifting the mindset and embracing innovation

Bangladesh has an untapped innovation potential. Despite the progress made in becoming a trusted powerhouse in garment manufacturing in South Asia and the ongoing diversification efforts (e.g., a growing domestic electronic industry and a pharmaceutical industry capable of meeting domestic demand for essential drugs), Bangladesh is not yet an innovation driven economy. The country has home-grown firms and a domestic entrepreneurial class that is very influential; however, businesses continue to be run in two prevailing modes: 1) selling basic and essential products on the protected domestic market or 2) exporting cost-effective but labour-intensive products that leverage on the relative low labour cost. These two prevailing business strategies are nurtured by a targeted policy approach that facilitates domestic production through regulations and controls. These interventions facilitate access to imports that sustain RMG exports and which limits entry of foreign producers to serve the domestic market. They also discourage the creation of a domestic innovation-driven business climate that could serve both domestic and foreign markets (see Chapters 3 and 4).

In Bangladesh, only 1.2% of firms invest in R&D—less than half the rate observed in Indian firms (Table 2.2) and only 2.6% of Bangladeshi firms employ technologies licensed from foreign counterparts, in stark contrast to Viet Nam's 10.8% and Türkiye's 14.4%. This is the result not only of the current incentive schemes, which actually lack targeted conditionalities to support innovation and learning, but also the prevailing approach of international partners, who still see in Bangladesh a business-deal and not an innovation partner. Bangladesh also suffers from overall gaps in technical and managerial skills for innovation. The scarcity of engineering or applied science graduates, coupled with limited R&D workforce engagement, underscores the need for a skilled workforce. While some firms benefit from managers with expertise developed in multinationals, most firms lack an adequately skilled workforce (Asian Development Bank, 2023[27]).

As Bangladesh moves forward, it's crucial for the private sector to assume responsibility for innovation and technological advancement. Businesses are focusing on acquiring technology through strategic partnerships and mergers and acquisitions (M&A) in critical sectors. This approach transcends traditional foreign direct investment (FDI) and showcases proactive engagement by domestic firms. Walton High-Tech Industries PLC, a prominent conglomerate spanning consumer electronics, home appliances, mobile phones, real estate, and automobiles, exemplifies this trend by acquiring foreign technologies abroad. Walton's expansion includes acquiring three European brands: ACC, Zanussi Elettromeccanica (ZEM) and Verdichter (VOE). By doing so, Walton has made significant gains in terms of machinery, trademarks, and patents. The objective of such a strategy involves integration and collaboration with other European brands, as well as establishing research and innovation centres (ORBIS, 2023[37]).

Table 2.2. The private sector in Bangladesh invests little in innovation

Percentage of manufacturing firms that used foreign technology, introduced new products or processes, or that spent on R&D

|

Economy |

% of firms using technology licensed from foreign companies |

% of firms that introduced a new product/service |

% of firms that introduced a process innovation |

% of firms that invested on R&D |

|---|---|---|---|---|

|

Bangladesh (2022) |

2.6 |

n/a |

1 |

1.2 |

|

India (2022) |

5.4 |

2.9 |

3 |

3.7 |

|

Morocco (2019) |

26 |

4.3 |

3.7 |

7.7 |

|

Türkiye (2019) |

14.4 |

11.7 |

1.9 |

22.3 |

|

Viet Nam (2015) |

10.8 |

35.5 |

45.8 |

30.4 |

Source: Authors’ elaboration based on World Bank Enterprise Surveys, https://www.enterprisesurveys.org/en/enterprisesurveys.

Bangladesh has accomplished lots in its first development phase, it now needs to embrace innovation as its next collective bet. Both the government and the private sector need to shift mindsets and approaches to enable innovation. Innovation will be needed at all levels and in all businesses. Not only will it be necessary to make current activities sustainable and inclusive, it will also be essential to support export diversification and to generate new sources of growth. Increasing technology adoption in firms and modernising production would contribute to diversifying the export profile and support local development. Estimates from the Asian Development Bank show for the specific case of Bangladesh a positive correlation between advanced technologies and export success. The increase in overall technology levels is linked to a 3-percentage-point surge in the likelihood of exporting. Moreover, the adoption of industrial technologies increases the probability of being an exporter by 10%. Additionally, technology adoption yields higher social returns, with a 1.0-standard-deviation rise in the technology adoptions leading to an 8% increase in wages (Asian Development Bank, 2023[27]).

Bangladesh possesses the potential to transform into an innovation-driven nation. With its expanding market size and population, established universities and research institutions, and global imperatives to align consumption, production, and trade practices with environmental sustainability, the need to shift from price-driven competition to innovation and quality is evident. This transition necessitates a shift in business perspectives and policy frameworks. Notably, global research and development (R&D) expenditures doubled to USD 2 trillion (USD 2005 PPPs) from 2000 to 2020, with significant contributions from Asian countries (OECD, 2023[38]). As the 8th most populous nation worldwide, it has the capacity and responsibility to emerge as a significant player in global knowledge and innovation dynamics. Achieving this status demands an expansion of the country's science and knowledge base.

To realise this transformation, public authorities must bolster the education system. Bangladesh's current lag in scientific output and human capital poses a challenge, highlighting the urgency for investment in STEM education and research capabilities. In 2021, the country published only 73 scientific articles per million inhabitants, contrasting with the higher figures seen in Indonesia, for instance. Additionally, the share of STEM graduates in 2021 stood at 11%, trailing behind figures for Viet Nam and India, indicating room for improvement (Elsevier, 2023[39]).

Leveraging regional integration

Bangladesh’s size and geostrategic location makes it an attractive partner in South Asia. The country serves as a pivotal point between East Asia, Southeast Asia, and South Asia, with close proximity to China and India, the world's largest and third-largest economies by PPP GDP, respectively. The country's access to the sea is another vital asset, particularly with the ongoing upgrades of the Chittagong and Mongla ports. The ongoing infrastructure developments are expected to strengthen Bangladesh's connectivity with Europe and other regions, providing opportunities to expand established trade links, create new ones and attract foreign investors, while also nurturing local suppliers.

Bangladesh has a distinctive regional trade integration model, mostly focused on importing intermediaries from Asia that are used as inputs for final products that are exported to North America and Europe. Bangladesh is among the least regionally integrated countries in Asia, which is a region known for its high level of regional integration. The country participates in the Asia Pacific Trade Agreement (APTA); the Global System of Trade Preferences among Developing Countries (GSTP); the Protocol on Trade Negotiations (PTN); the South Asian Free Trade Agreement (SAFTA); the South Asian Preferential Trade Arrangement (SAPTA); as well as the Bay of Bengal Initiative on Multi-Sectoral Technical and Economic Cooperation (BIMSTEC). It also enjoys preferential access to various regional markets due to its LDC status. It lacks, however, a strategically crafted network of international and bilateral agreements, which stands in contrast to the well-developed networks from which other countries in the region benefit.

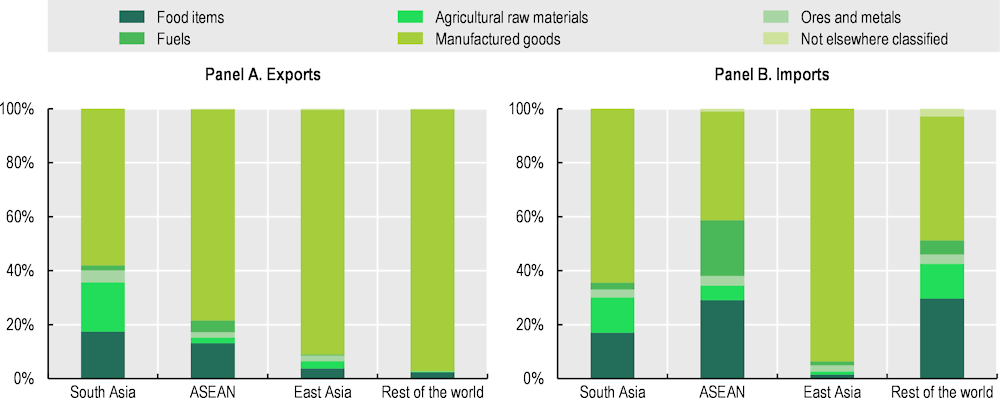

Despite these arrangements, Bangladesh's regional integration presents a lopsided picture: 75% of its merchandise imports come from Asia, while only 16% of its exports are sold within the region. A closer look at Bangladesh's trade patterns reveals a skewed distribution. Between 2019-21, the country exported USD 1.3 billion to South Asia, USD 0.7 billion to ASEAN, and USD 2.5 billion to East Asia, with most of its exports (88%) going to the European and US markets. In contrast, Asian sub-regions played a significant role in supplying imports. Bangladesh relies heavily on regional markets for a wide range of imported inputs, particularly manufactured products and intermediate goods from Asian countries, predominantly China, India, and Singapore, which account for 52% of total merchandise imports between 2019 and 2021. China primarily sources Bangladesh with non-raw textiles and machinery, while India mainly supplies raw cotton and other textiles. Additionally, Singapore is a key source of machinery, such as sewing machines, and chemical products like synthetic colouring matter. Conversely, 58% of Bangladesh's non-RMG exports are destined for Asia (mainly India, China, and Japan), while 29.4% go to Europe. However, sectoral differences exist. For non-RMG manufactured goods, Asia's share as an export destination increases to 66%, while Europe's decreases to 21%. Exports of non-RMG natural resources and resource-based manufactured goods primarily go to Asia (56%), but European countries increased their share as importers of Bangladesh’s less complex non-RMG exports, accounting for 31% of the total (Figure 2.14).

Figure 2.14. Bangladesh trade with Asia is relatively more diversified than its global trade

Note: All food items (SITC 0 + 1 + 22 + 4); Agricultural raw materials (SITC 2 less 22, 27 and 28); Ores and metals (SITC 27 + 28 + 68);

Fuels (SITC 3); Manufactured goods (SITC 5 to 8 less 667 and 68).

Source: Authors’ elaboration based on UNCTADstat, https://unctadstat.unctad.org.

This trend is more pronounced for more sophisticated products, such as chemicals and machinery (which include pharmaceuticals and electronics). Asia accounts for 81% of these exports as destination market for Bangladesh, with emerging markets like Sri Lanka, Myanmar, Philippines, and Nepal gaining importance. Africa’s share also increases capturing 6.5% of the total, mostly due to Kenya, although from a small total average annual value of USD 390 million (2019-2021).

Bangladesh is also a net importer of services across all regions; nonetheless, the regional market also plays a prominent role as a service export destination for the country, accounting for a sizeable 39% of Bangladesh’s services exports. In the same vein, half of Bangladesh's service imports come from Asia, making it Bangladesh’s main trade partner in services.

Table 2.3. Tapping into regional markets to foster economic transformation

|

STRENGTHS Large and dynamic market Young labour force Entrepreneurship Movement of professionals |

WEAKNESSES Non-Tariff Barriers, redtape Logistics & infrastructure Lack of skilled labour force Limited R&D Access to capital |

|

OPPORTUNITIES Some strong sectors with proven track record Growing market in the region Integration with big players in GVCs Improved quality of products and services |

THREATS Small companies might find more difficulties to operate Geopolitics & instability Energy and inflation crises Loss of preferential status & incentives => LDC graduation |

|

PRIORITY ACTIONS Connectivity ASEAN-SAFTA in terms of land and use of ports Addressing non-Tariff Barriers => mutual recognition agreements Harmonised HS codes Visa-free movement of professionals in the region Increased investment in R&D Supporting adherence to Environmental Social Governance standards |

|

Source: Consensus building event - Working group: cushioning fragilities to develop a sustainable transformation. PTPR of Bangladesh, 18 October 2022, Dhaka.

While regional integration presents several opportunities and challenges to diversify and sophisticate the economy, several Asian partners have been more effective at supplying the Bangladeshi economy, than Bangladeshi exporters at penetrating regional markets. This imbalance stems from the interplay of several structural and trade policy constraints that should be addressed to make the most of regional integration (Table 2.3). In particular:

Supply-side constraints limiting product diversification in Bangladesh. Supply-side constraints, ranging from inadequate infrastructure to costly access to advanced technologies and lack of specialised skills (especially in STEM and digital sectors), undermine competitiveness beyond the low-tech labour-intensive industries, thereby limiting trade complementarities within the region. With more than 85% of merchandise exports accounted for by textiles and clothing, mostly RMG, Bangladesh tends to lack the productive capacities to competitively meet varied regional demand. Moreover, despite some engagement in high-tech and more knowledge-intensive sectors (electronics, ICT, pharmaceutical, business services, etc.), to date this process is only incipient and happening mainly with a domestic focus. Meanwhile, the weak development of productive capacities creates a vicious circle slowing down the pace of digital transformation and the establishment of a broader competitiveness basis (UNIDO, 2020[40]; UNCTAD, 2020[25]).

Inefficient transport, logistics and distribution networks. Costly and inefficient logistics and distribution has long weighed on Bangladesh’s competitiveness, creating congestion and delays even in established industries (UNCTAD, 2022[19]). It has also hampered export-oriented trade links and business-to-business contacts regionally and worldwide, particularly outside the established RMG value chains. Transport and logistics bottlenecks affect all modes of transport, but they tend to have a disproportionate bearing on trade taking place by road over land borders, which slows intra-regional trade. For example, about 90% of bilateral trade between Bangladesh and India takes place through land customs stations (including the Benapole-Petrapole that accounts for about 70% of bilateral trade). India is also a transit country to other regional markets such as Bhutan and Nepal. While the government has put in place ambitious infrastructural projects to improve both physical and digital connectivity – think for instance of the Padma Multipurpose Bridge or the National ICT Road Map – tackling these bottlenecks will take time and calls for a concerted approach to develop economic corridors that spatially decentralise productive transformation opportunities (UNCTAD, 2020[25]; Hong, 2018[41]).

Relatively high tariffs prevail, where no LDC-specific preferential market access is available. Bangladeshi producers tend to face relatively high levels of protection when exporting towards the regional market products for which preferential treatment is not available, or in those cases where preference utilisation is hampered by high compliance costs and other barriers. The potentially high rate of protection faced by Bangladeshi exporters outside (LDC-specific) preferential schemes is compounded, as confirmed by focus-group interviews, by the lack of a harmonised understanding of HS product classification, which creates scope for uncertainty on the applicable tariff and adds further transaction costs (Box 2.2).

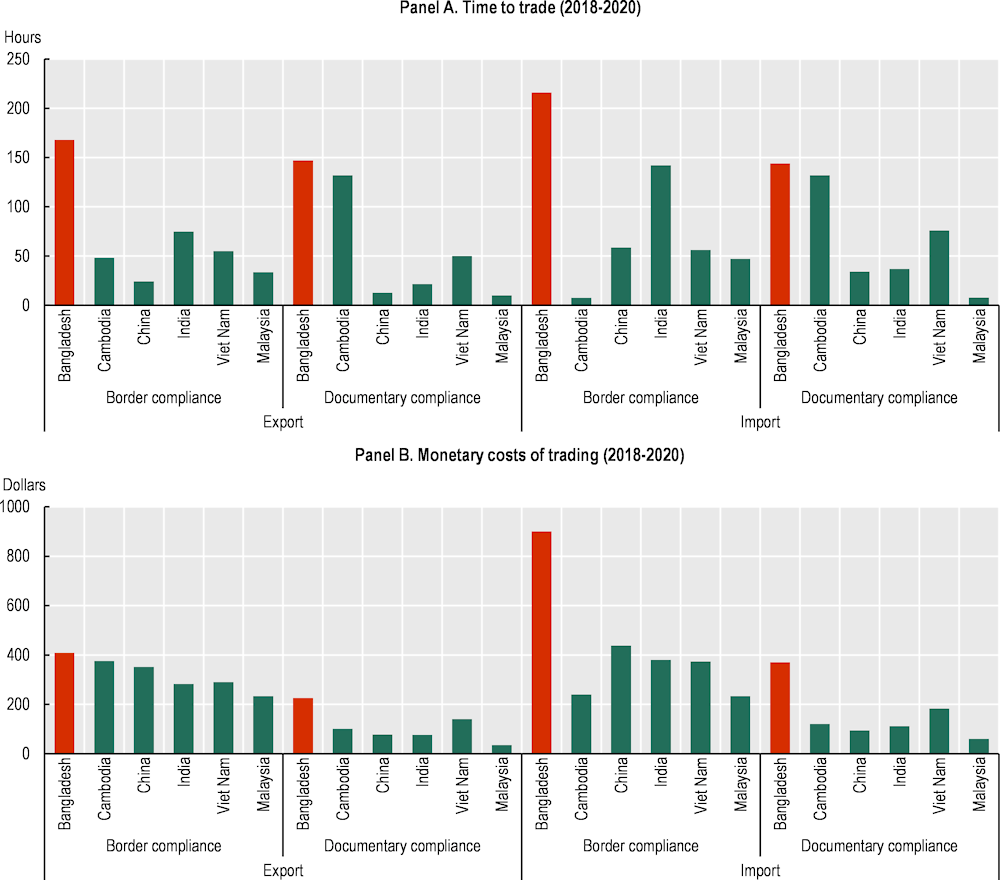

Pervasive non-tariff barriers. Widespread non-tariff barriers, complex trade facilitation, and transit procedures hinder Bangladesh's trade capacities, especially regionally (Rahman, Naimul and Saif, 2015[42]). An analysis of trade costs highlights Bangladesh's lag compared to neighbours, particularly in border compliance. High transaction costs hamper competitiveness, limiting trade with key regional partners (Figure 2.15) however some improvements have been recorded more recently (World Bank, 2021[43]). Digital tech like ASYCUDA and the national single window rollout could lead to efficiency gains, but progress lags behind regional peers. Traders face challenges: a lack of mutual recognition agreements (MRAs) for effective market access, deficient testing facilities at land customs, and transit bottlenecks with India, Bhutan, and Nepal under the BBIN-MVA (UNCTAD, 2023[44]).

Figure 2.15. Non-tariff barriers also hamper regional integration opportunities for Bangladesh

Source: Authors’ elaboration based on World Bank Doing Business 2020 database, https://databank.worldbank.org/source/doing-business.

Box 2.2. Regional integration and LDC graduation: Navigating Bangladesh's transition

As Bangladesh nears LDC graduation, effective regional integration becomes crucial for two reasons. Firstly, as LDC-specific preferential access changes, maintaining competitiveness requires anticipating impacts on trade. Secondly, bolstering regional trade can counterbalance the loss of LDC preference in third-party markets.

Scenario analysis provides insights:

LDC-specific preference withdrawal: This explores the impact of transitioning from LDC-specific access to Most Favoured Nation (MFN) Treatment in partners like India or Japan.

Gaining preferential market access: This examines the effects of Duty-Free Quota-Free (DFQF) access through bilateral or regional agreements, like ASEAN.

Table 2.4 outlines trade impacts for each partner. Key takeaways include:

Losing LDC preferences affects export earnings, even regionally.

Retaining or gaining preferential access boosts exports, diversification, and partner expansion.

Table 2.4. Impact on LDC graduation in selected regional markets under alternative trade arrangements

|

Area |

Region |

Export potential of 5 major items (USD million) |

Total export potential, extrapolated by considering the proportion of 5 items in total exports |

|---|---|---|---|

|

South Asia (if MFN) |

India |

-182.4 |

-641.2 |

|

Pakistan |

-2.8 |

-3.5 |

|

|

Total |

-185.2 |

-644.7 |

|

|

East Asia (if MFN) |

China |

-233.6 |

-615.6 |

|

Japan |

-226.8 |

-529.4 |

|

|

South Korea |

-184.9 |

-396.8 |

|

|

Total |

-645.2 |

-1 541.8 |

|

|

ASEAN (if Duty-free) |

Indonesia |

176.4 |

374.5 |

|

Singapore* |

95.3 |

232.0 |

|

|

Viet Nam |

37.8 |

82.1 |

|

|

Thailand |

20.0 |

41.8 |

|

|

Malaysia* |

95.7 |

231.3 |

|

|

Total |

425.2 |

961.7 |

Note: *Actual export (2019) has been considered as potential export since MFN tariffs facing Bangladesh are zero in both countries.

Bangladesh’s untapped export potential across ASEAN, South Asia, and East Asia presents growth opportunities. A strategy integrating LDC graduation and regional integration is crucial. A proactive regional integration agenda, including bilateral agreements and blocs like ASEAN and RCEP, mirrors Viet Nam's success. This requires gradual implementation, considering Bangladesh's unique situation and potential adjustment costs. Evolving from preferential to reciprocal trade necessitates a revamped policy framework, affecting sectors and politics. Nurturing the growth coalition for sustainable development prevents "middle-income traps" and aligns with a shift from labour-cost to knowledge-driven competitiveness, ensuring a prosperous future.

Source: (UNCTAD, 2023[44]), Regional integration as a strategic avenue for Bangladesh: LDC graduation with momentum, https://unctad.org/publication/regional-integration-strategic-avenue-bangladesh-ldc-graduation-momentum.

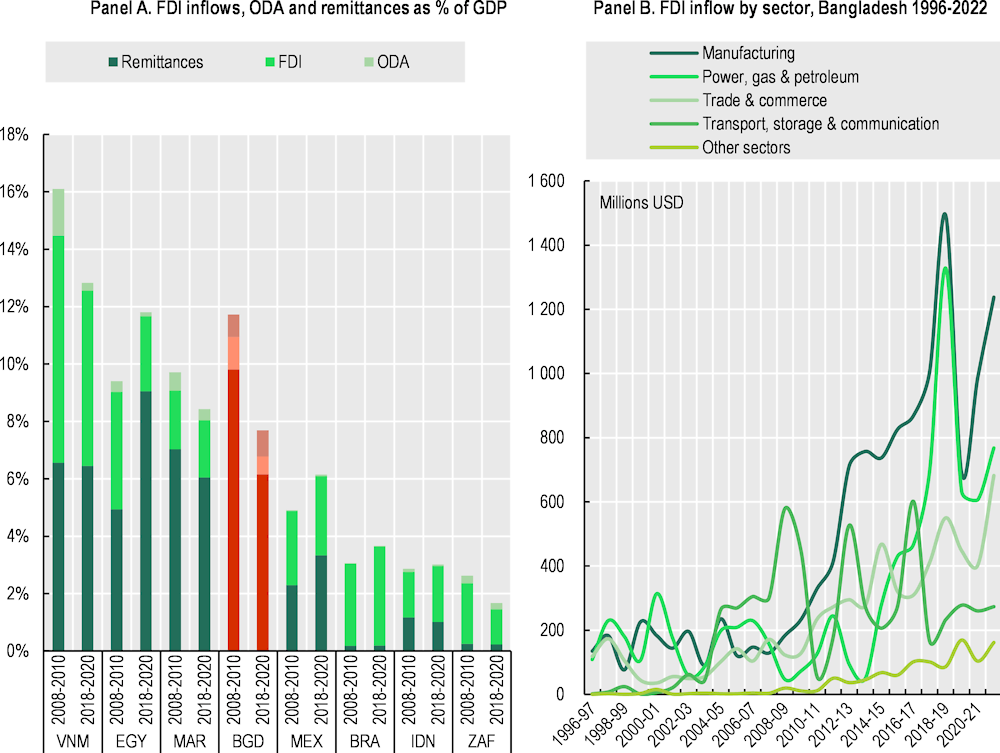

FDI and international partnerships could be further steered to transform the economy

Bangladesh has emphasised that attracting Foreign Direct Investment (FDI) is a key aspect of its industrialisation strategy since the 1980s, primarily through the establishment of Special Economic Zones (SEZs). However, the inflow of FDI into Bangladesh remains modest in comparison to other emerging economies, as well as alternative financial sources such as remittances and Official Development Assistance (ODA). Notably, during 2018-2022, remittances exceeded FDI by a substantial margin, reaching up to seven times the value of total FDI (Figure 2.16, Panel A).

Despite an increase in nominal FDI—rising from an average of USD 400 million in the late 1990s to USD 2 900 million during 2018-22—FDI inflows as a percentage of GDP slipped from 1.1% in 2008-10 to 0.7% in 2018-20. Bangladesh's FDI-to-GDP ratio is mediocre in comparison to other emerging industrial economies. For instance, Viet Nam registers a much higher ratio of 6.10%, and countries like Indonesia and Morocco surpass Bangladesh with figures of 2%. The limited incidence of FDI is balanced by a relatively higher amount of domestic investment, which indicates the significant role played by the local private and public sectors. The Gross Fixed Capital Formation (GFCF) as a percentage of GDP in 2022, is comparable to that of Viet Nam, standing at 32%. This is above of other countries in the region, including India and Indonesia at 29%, as well as Thailand and Malaysia at 23% and 20% respectively.

However, there is a drawback to consider. The low proportion of FDI on GFCF in Bangladesh could lead to potential investment limitations in the medium and long run. In 2022, the FDI as a percentage of GFCF was only 2.8% in Bangladesh. This figure is notably smaller than the 6.2% in India and Indonesia, and significantly lower than Viet Nam's 21%. If larger volumes of foreign investment flow into the country, it could help counterbalance the current fiscal constraints that are delaying or postponing domestic investment. This approach would also assist in increasing the country's foreign currency reserves.

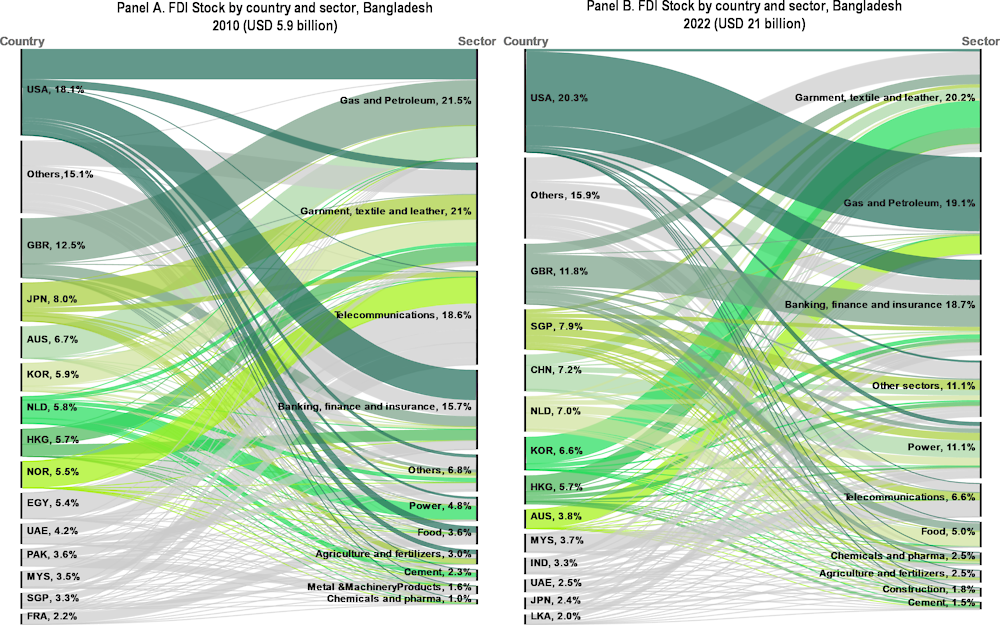

In addition to playing a marginal role in the economy, FDI in Bangladesh tends to concentrate in traditional sectors, limiting FDI’s potential to foster economic diversification and fast track Bangladesh to catch up in more sophisticated industries. Between 2017 and 2022, FDI in Bangladesh focused on manufacturing, which accounted for almost 40% of total FDI inflows to the country. Garments and textiles represented one-third of FDI inflows, followed by food products. In garments and textiles, most FDI continues to be driven by the price competitiveness of domestic production due to persistent low labour and environmental costs. Other factors include the established contract manufacturing and outsourcing arrangements with leading global brands, mostly from the US, Canada and Europe. Within manufacturing, the sectoral composition of FDI hasn’t changed much, with the exception of pharmaceuticals which rose from USD 50 to 500 million of total stock. Two emerging areas for FDI are power and energy, which currently account for 27% of total FDI inflows to Bangladesh and ICT and commercial services, which account today for 25% of total FDI. These new investments are linked to national plans to increase energy and electricity capacity of the country to match population expansion and increase in industrial activities (Figure 2.16, Panel B).

Figure 2.16. Remittances and ODA matter more than FDI for Bangladesh

Source: Authors’ elaboration based on World Bank, https://data.worldbank.org, UCTAD stat, https://unctad.org/statistics and Bangladesh Bank, https://www.bb.org.bd/.

While the total stock of FDI to Bangladesh trebled between 2010 and 2022, the Unites States remained the main investor, accounting for around 20% of the total. The United States invests mainly in energy and banking activities. The second key partner is the United Kingdom, which accounts for 13% of total FDI and which also invests mostly in energy and banking. Asian economies have been increasingly investing in Bangladesh in the last decade. Traditional partners such as Japan reduced its incidence on the total and Korea remained the leading investor in garments and textiles. Overall, South, South-East and East Asia together accounted for 44% of total FDI stock in 2022, up from 30% in 2010. China, Singapore and India emerged as new investors. China and India are mostly investing in power generation whereas Singapore has a more diversified portfolio that encompasses power generation, chemicals and telecommunication. The EU countries overall account for 9.4%, and within them the main investors are the Netherlands followed by Denmark and Germany, all with a relatively diversified portfolio that include investments in consumers goods in addition to energy (Figure 2.17).

Figure 2.17. The US remains the leading investor in Bangladesh, while new players are coming along

Foreign Direct Investment (FDI) holds significant potential as a catalyst for development. It contributes by bolstering foreign currency reserves and promoting exchange rate stability. Furthermore, FDI can facilitate imports of capital goods and services and favours technology transfer and innovation. If effectively managed, it serves as a valuable avenue for industrialisation and cultivating business acumen. FDI plays a role in encouraging economic diversification, fostering the emergence of fresh sectors within the host economy. Realising these benefits requires a focused approach that nurtures local industries and ensures that FDI's positive impacts reverberate throughout the domestic economy.

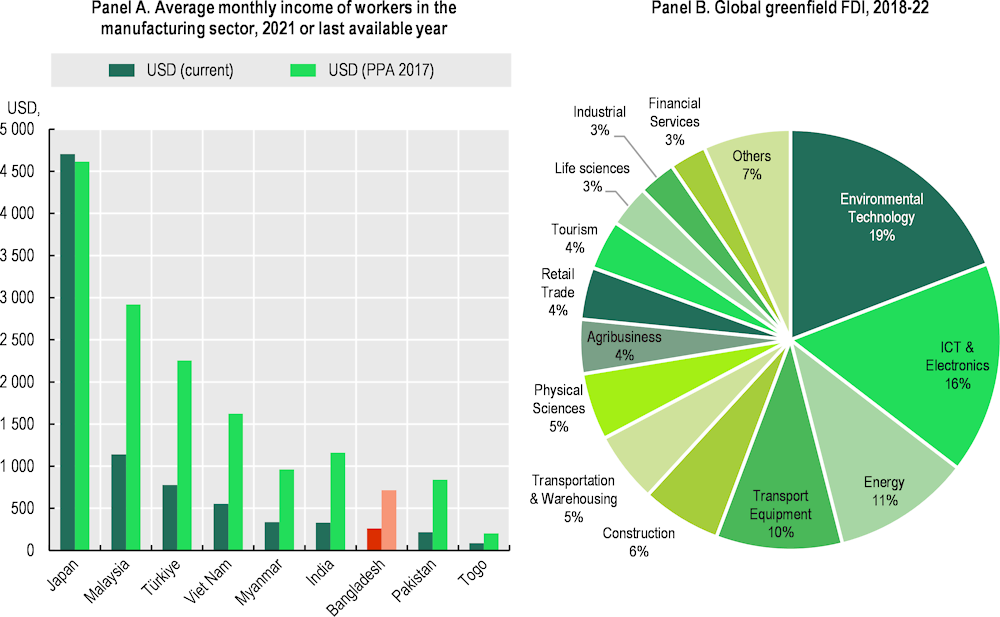

However, the current landscape of FDI in Bangladesh primarily hinges on price competitiveness and aligns with conventional industries, neglecting the transformative potential that FDI can bring to the country. Contrary to the global trend where FDI drives development in cutting-edge sectors, Bangladesh's FDI largely reinforces its existing specialisation pattern. Globally, FDI acts as a major catalyst in pioneering industries. Environmental technologies commanded approximately 25% of investments during 2018-2022, followed by ICT and electronics, representing 16% of global FDI (Figure 2.18).