Bangladesh is ready to shift to a new development phase. This chapter discusses the government's long-term vision, the policies for economic transformation, and clarifies the priorities in moving forward. To meet its aspirations of achieving high-income status by 2041, Bangladesh needs to future-proof the state and endow it with up to date operational and implementation capacities. It also needs to update its international partnerships to ensure a sustainable and smooth graduation from the LDC status. Moreover, it should update the policy toolbox to foster a diversified, innovative, and green industry. The government has an important reform agenda ahead; the private sector and international partners will be instrumental in enabling Bangladesh to continue to succeed.

Production Transformation Policy Review of Bangladesh

3. Looking forward: Bangladesh’s next development phase

Abstract

Introduction

Bangladesh has impressed the world with its achievements in a rather short span of time. Since its foundation as an independent country in 1971, Bangladesh has achieved remarkable progress. It stands among the fastest-growing economies globally and has demonstrated significant resilience to the global COVID-19 pandemic.

This country, rather small in land size, similar to the Iowa state in the United States and Nepal, and slightly smaller than Cambodia, was once known for extreme poverty and famines. It has transformed into a manufacturing powerhouse in South Asia. Despite facing industrial accidents, including the Rana Plaza accident in 2013, the country has demonstrated the ability to adapt and enhance worker safety as it increasingly commits itself to global sustainability standards.

Bangladesh has gained international recognition as a model for modern poverty reduction and is currently the largest country to graduate from the Least Developed Country (LDC) category. Building on these accomplishments, the country is looking forward to economic diversification and sustainable development in the post-graduation era. With a population of more than 160 million, Bangladesh ranks as the eighth most populous country globally, representing around 2% of the world's population. The country faces high and growing exposure to natural disasters. Over time, Bangladesh has learned to comply with global standards.

Chapter 3 of the PTPR of Bangladesh presents the country's long-term development vision within the context of its current developmental trajectory. It evaluates the country’s governance and policy approach to economic transformation and identifies potential game-changers for future reforms. This chapter concludes by advocating for an acceleration of efforts to fulfil the country's ambition to become a high-income economy by 2041. It calls for implementing reforms to strengthen and upgrade its institutional framework and updating policy approaches to address both domestic and the external challenges and aspirations. Additionally, this chapter urges the private sector and international partners to adapt their mindsets and tools. A revitalised government approach, coupled with innovation-oriented and entrepreneurial business practices, along with collaborative partnerships with all stakeholders, will be pivotal in enabling Bangladesh to sustain and further its accomplishments.

Bangladesh aspires to become a high-income country by 2041

Since its founding as an independent country in 1971, Bangladesh has achieved a remarkable transformation. From a country known for food scarcity, extreme poverty and natural disasters, Bangladesh is today a growing economy and a manufacturing hot-spot in South Asia, home to a globally relevant ready-made garments (RMG) export industry.

In its 50-year anniversary of independence in 2021, Bangladesh has been recommended by the United Nations Committee for Development Policy (CDP) for graduation from the LDC category by fulfilling the three criteria used to grant countries access to LDC-specific international support measures (ISMs). While this underscores a major achievement it also entails some challenges such as the loss of preferential market access, which was specifically crafted to support these poor and vulnerable economies (Box 3.1).

Box 3.1. What does graduation from LDC mean for Bangladesh?

The LDC category is based on three sets of criteria compiled by the UN Committee for Development Policy (CDP): human assets; economic and environmental vulnerability; and income per capita. Each of these criteria is measured by a series of statistical sub-indicators which are monitored annually by the CDP. To be eligible for graduation, a country must meet at least two of the three graduation criteria at two successive Triennial Reviews of the CDP (UN Committee for Development Policy, 2021).

Bangladesh met all three criteria for the first time at the 2018 Triennial Review. For the second time in 2021 it again met the criteria and was recommended for graduation in 2024. The graduation date was subsequently extended until 2026 due to the pandemic. As a result of graduation, Bangladesh will lose access to certain international support measures (ISMs). Three main areas of impact are expected (UN Committee for Development Policy, 2020):

Preferential trading arrangements

The most significant of these impacts is the LDC-specific duty-free quota-free (DFQF) schemes and LDC-specific preferential rules of origin applied in major export destinations. Significant impacts are expected in the EU, Canada, Japan and other markets, affecting especially RMG, which has benefitted particularly from the Everything But Arms (EBA) initiative which provides duty-free, quota-free access to the region. After a three-year transition period extending until 2029, EU exports will be subject either to the regular Generalised System of Preferences (GSP) scheme, GSP+ if granted access, or alternative trading arrangements. No significant impacts are expected in the United States under current rules. In the case of United Kingdom, however, as of 2023 a new GSP scheme has been granted, called the Developing Countries Trading Scheme (DCTS) (Table 3.1).

World Trade Organization Agreements

LDC-specific special and differential treatment under World Trade Organization (WTO) agreements will also be withdrawn. Bangladesh will no longer benefit from the extension given to LDCs under the Agreement on Trade Related aspects of Intellectual Property Rights (TRIPS) and will have to align intellectual property rights and sectoral regulations for the pharmaceutical industry to the agreement. After graduation, Bangladesh will also no longer benefit from the general transition period for LDCs under TRIPs. The country may need to review its subsidies to comply with the Agreements on Agriculture and on Subsidies and Countervailing Measures. It will also lose certain facilities for dispute settlement. In other WTO agreements, several LDC-specific provisions will expire before Bangladesh’s expected date of graduation. Bangladesh will no longer benefit from LDC provisions in regional agreements, unless it negotiates otherwise. Bangladesh will forego benefits accorded to LDCs in future trade negotiations as well as access to or priority in training and capacity-building opportunities at the WTO and other institutions.

Development co-operation

Graduation is expected to have limited impact on development co-operation. It is not expected to affect assistance by the World Bank, the Asian Development Bank, most United Nations entities, GAVI - the Vaccine Alliance, the Global Fund, most ODA from OECD-DAC Members (including Canada, the United Kingdom, the United States and the European Union) or South-South co-operation. Some partners, including Japan, may extend slightly less favourable terms on ODA loans and a gradual shift from grants to loans by partners including Germany. Bangladesh will lose access to mechanisms that are reserved for LDCs, such as the LDC Fund (climate change) in some cases after smooth transition periods.

A final impact of graduation is that Bangladesh will pay higher contributions to the United Nations system (preliminary estimates suggest that this could amount to USD 5 to 5.5 million per year) and no longer benefit from some forms of support for travel to meetings (for reference, the amount disbursed for the travel of Bangladesh delegates to the General Assembly in 2018 was USD 23 500).

Despite the serious impact of the loss of ISMs – principally DFQF and EBA – in its various strategic plans Bangladesh aims to accommodate the impact by upgrading industry, improving linkages, enhancing productivity and diversifying production, as well as accessing new markets. Graduation is viewed not as a hurdle to be overcome but as a stage on which to base the next phase of development.

Table 3.1. Trade implications of LDC graduation

|

LDC status |

Post LDC graduation |

|||

|---|---|---|---|---|

|

Destination |

LDC tariffs |

LDC ROOs |

Graduation tariffs |

Graduation ROOs |

|

EU |

EBA, duty free for all products except arms |

70% value-added can be imported Single transformation for apparel |

Standard GSP or GSP+? |

50% value-added can be imported Double transformation for apparel |

|

United States |

GSP+, no preferences currently apply due to suspension in 2013 |

35% domestic content requirement + other LDCs |

n/a |

35% domestic content requirement only |

|

United Kingdom |

Developing Countries Trading Scheme (DCTS) |

75% non-originating content at the chapter level |

Developing Countries Trading Scheme (DCTS) |

75% non-originating content at the chapter level |

|

Canada |

LDC GSP, duty free for all products except dairy, poultry, and egg products |

60% value-added can be imported |

Standard GSP |

40% value-added can be imported |

|

Japan |

Special preferential treatment for LDCs |

In General on-originating materials of 40% but with donor country content rule de minimis for textile |

Standard GSP |

No specific rules of origin |

|

China |

LDC GSP, duty free for 98% of tariff lines |

Specific criteria for substantial transformation |

APTA or MFN |

n/a |

Source: (UN Committee for Development Policy, 2020[1]; UNCTAD, 2021[2]) and own analysis.

Among the distinctive features of Bangladesh, one notable fact is that the industry, particularly manufacturing, has held a central role in the country's development plans from the outset. Being a densely populated and economically challenged nation, susceptible to natural disasters, and situated in an increasingly significant geostrategic region, the Bangladeshi government has consistently regarded industry, in conjunction with a strategic outlook on outward migration and improvements in agricultural productivity, as pivotal driver for sustaining growth, creating jobs, ensuring food security, and generating foreign exchange.

Industrialisation, anchored in the manufacturing sector has been at the core of the country's development plans since the 1970s and continues to play a key role in the current Perspective Plan 2021-2041: Making Vision 2041 a Reality. This plan builds upon the Perspective Plan 2010-2021, which laid out Bangladesh's aspiration to attain middle-income status and transform the economy through digitalisation. The new plan further elevates the country's ambitions, aiming to achieve high-income status by 2041 through industrialisation.

The Vision 2041 identifies several priorities, including food security, access to education and health, gender equality, and good governance. It emphasises the significance of industrialisation and digitalisation, while stating the government's ambition to enhance domestic export potential, diversify the economy, and attract more private and foreign investment. It also identifies in industry 4.0 and in the modernisation of the energy and transport infrastructure the key enablers to achieving inclusive industrialisation. The Vision aims for industry to generate 40% of GDP by 2031 and then gradually reducing it to 33% by 2041. Industry, and in particular manufacturing, are seen as key sectors to drain surplus labour force from agricultural activities, as well as informal jobs (Government of the People’s Republic of Bangladesh, 2020[3]).

Being one of the countries most profoundly affected by natural disasters on a global scale, Bangladesh is acutely conscious of the imperative to reassess its industrial foundation while proactively addressing the demands of climate change mitigation and adaptation. This commitment is eloquently articulated in another policy document, the Delta Plan 2100, a comprehensive blueprint introduced in 2018. The plan revolves around five overarching goals: i) ensuring resilience to climate change; ii) enhancing water security and efficiency; iii) developing a sustainable and integrated river systems and management; iv) preserving natural ecosystems; and v) developing effective institutions and equitable governance for in-country and transboundary water resource management.

Bangladesh’s modern state is in the making

Bangladesh has a tradition of long-term planning, which have been embedded in its multi-annual development plans since the country’s independence. These plans frame the government’s ambitions and, since 1971, have guided the country’s decision-making processes. To operationalise the Vision 2041, Bangladesh relies on five-year plans, implemented through annual plans and budgets associated with a host of specific policy actions.

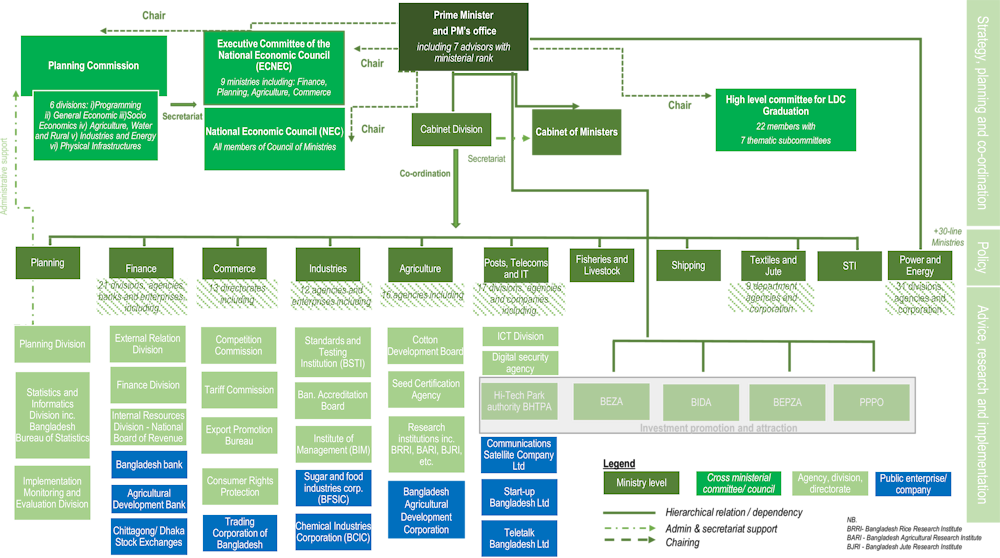

Bangladesh is an institution-rich country. At present, 10 out of the current 42 ministries existing in Bangladesh have direct responsibilities when it comes to industry, trade and investment (Figure 3.1). These ministries are: planning, finance, commerce, industry, agriculture, fisheries and livestock, post, telecommunication and ICT, shipping, textiles and jute, science, technology and innovation and power and energy. In addition to these ministries, several operational agencies and bodies play a crucial role in the economic transformation strategy of the country and oversee the implementation of multiple, often overlapping, policies including the Bangladesh Industrial Policy 2022, the Bangladesh Investment Promotion Scheme (BIPS), and the Bangladesh Economic Recovery and Reform Program (BERRP).

The Prime Minister (PM) and the PM Office play a crucial co-ordinating role in the complex and relatively young institutional architecture of Bangladesh. The PM chairs the Country Economic Council (NEC), which operates as the ministerial council of the country. The NEC’s deliberations are approved by the Executive Committee (ECNEC), which is chaired by the PM and composed of nine-line ministers, including the Finance, Planning, Agriculture and Commerce ministries. The PM also chairs the Planning Commission, which undertakes research and studies to support decision-making by the NEC and the ECNEC. The Planning Commission has six divisions, including Programming, General Economic, Socioeconomic, Agriculture, Water and Rural, Industries and Energy, and Physical Infrastructure. The Ministry of Planning acts as the secretariat for the NEC and the ECNEC, and is mandated to ensure coherence between different policies. The Prime Minister office through the Principal Secretary also chairs the High-level Committee for LDC Graduation, which has 22 members and seven thematic subcommittees, and heads the Cabinet Division, which acts as the Secretariat to the Cabinet of Ministers, the collective decision-making body of the government. This Cabinet Division provides administrative support and facilitates inter-ministerial co-ordination between ministries.

Bangladesh, a relatively young nation, is currently in the process of shaping itself into a modern state. Developing effective and transparent institutions capable of functioning well amidst the political alternation that characterises modern democracies is an enduring process of learning through experience. The intricacy and overlap of institutional structures in Bangladesh, coupled with the pivotal role played by leadership and the multitude of ministries and agencies, reflect a common feature in constructing effective modern nation-states. In the case of Bangladesh, this complexity carries a distinct historical legacy that will take time to resolve if national unity is to be ensured.

A significant portion of the technical and operational institutional framework for industrial development in Bangladesh traces back to the government of Pakistan. The foundation for industrial development institutions was fashioned around the cultural, strategic, and operational norms prevalent in India and Pakistan during that era (Rahim, 1978[4])

Bangladesh had to establish a framework for industrial development, adapt existing institutions, and create new ones that aligned with its national interests. Over time, these institutions underwent significant transformations and persist in their activities to this day. For instance, the Bangladesh Cottage and Small Industries Corporation, originally established during the Pakistani era, was restructured by presidential decree in 1973. Similarly, the Bangladesh Council of Scientific and Industrial Research (BCSIR), originating from the East Pakistani industrial laboratory, was founded in 1973. This entity currently encompasses 13 research institutes and employs slightly over 1 000 personnel. Notably, around 30% of this workforce consists of scientists engaged in diverse fields spanning basic and applied sciences, encompassing disciplines such as chemistry, genomics, medicine, herbal products, biomedical engineering, light engineering, mining, minerals, glass, ceramics, thin-film technology, magnetic materials, and leather products, among others (House, 1990[5]; Van Schendel, 2020[6]).

Over time, Bangladesh has advanced in improving government-business dialogue, with the domestic and the international private sector. Over the last ten years, Bangladesh has also advanced in responsible business conduct (RBS). After the Rana Plaza disaster in 2013, the country implemented a number of policy initiatives to ensure the safety of workers particularly in the garment and textile industry. Several local stakeholders are also members of the Manufacturers Network, hosted by the OECD, including: the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) and Newage Group. Bangladesh signed the Dutch Agreement on Sustainable Garment and Textile, and the Accord on Fire and Building Safety. These agreements between global brands, retailers and trade unions led to the introduction of stricter safety standards, the establishment of independent safety inspection bodies and the development of remediation plans with the support of international partners (OECD, 2018[7]). Other initiatives include the integration of lean manufacturing processes and methodology, which focuses on minimising waste within manufacturing systems while simultaneously maximising productivity. It operates in co-operation with Denmark.

The achievements attained by Bangladesh thus far, alongside the determination to sustain success through a focus on becoming an industrial and trade-oriented nation, exert and will drive further progress in establishing a contemporary, rule-based nation-state. The moment is opportune to transition from an emphasis on nation-building to state development. And this should involve developing modern institutions by streamlining existing ones and injecting efficiency, accountability, and clarity of purpose.

Figure 3.1. Institutional governance for production transformation in Bangladesh, 2023

Source: Authors’ elaboration based on official information.

Public expenditure is expanding but resources remain limited

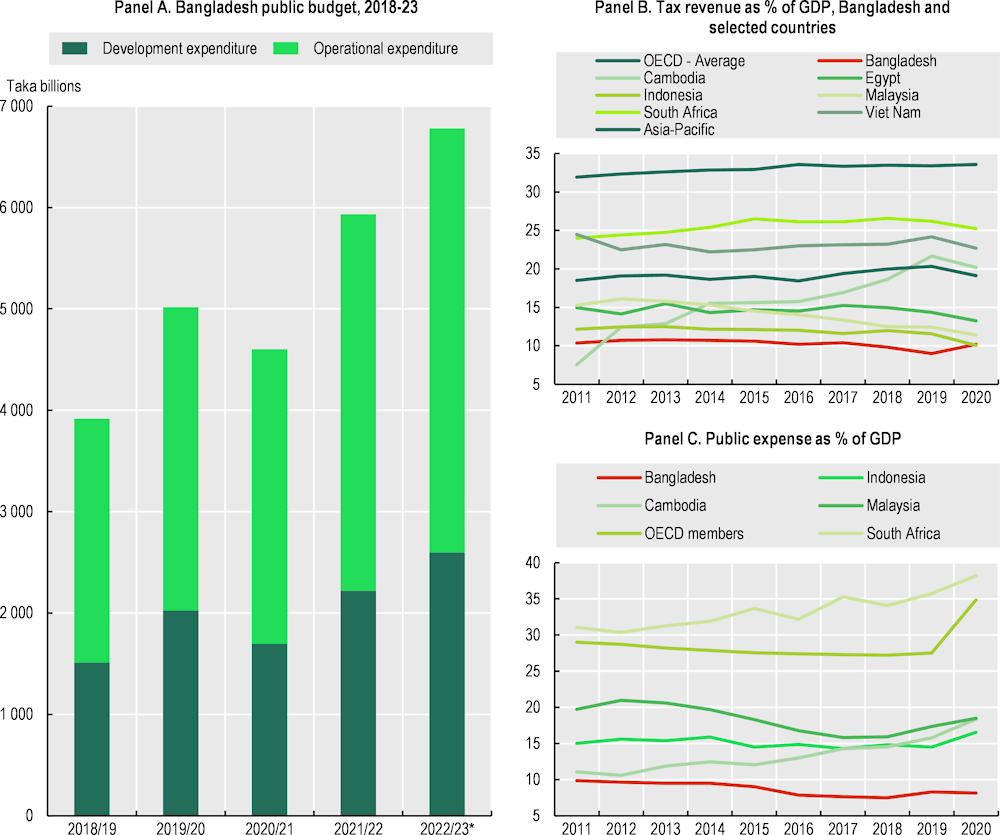

Total public budget has been expanding to limit the effect of external shocks. For the fiscal year 2022-23,1 total country budget is expected to increase by 14% in nominal terms with respect to 2021-22, reaching Taka 6.8 trillion (USD 61 billion) (Figure 3.2, Panel A). While 2020-21 and 2021-22 budgets were structured to mitigate the impacts of Covid-19 with stimulus packages targeting priority sectors including health, agriculture, social inclusion and employment protection, 2022-23 has been designed to boost economic growth while at the same time reducing the impact of other external shocks such as the invasion of Russia of Ukraine (Ministry of Finance, 2022[8]). The latter resulted, like in many other countries, in an inflationary pressure on important commodities such as energy and staple foods products that Bangladesh largely imports. Although global food prices are decreasing after the peak of March 2022, they are still above historical average (e.g., 34% higher than October 2020), with uneven impacts across countries and regions particularly in developing and more fragile contexts. For example, the retail price of one kilogramme of wheat in Dhaka was USD 55 cents at end-2022, 80% more than before the war (FAO, 2023[9]). Exchange rate fluctuations are also creating an uneven impact across countries and regions, undermining the effect of declining international prices for consumers in import-dependent countries (UNCTAD, 2023[10]).

Limited domestic resource mobilisation remains a challenge and is likely to hamper future progress (Figure 3.2, Panels B and C). The 2022-23 budget is composed of tax revenues collected by National Board of Revenue (NBR), domestic loans, foreign loans and grants, and other non-tax revenues. Tax revenues account for 54% of resources, followed by domestic loans with 22% and foreign loans and grants accounting for 15% of the total. Although several actions have been implemented to expand the tax base, including the VAT reform of 2012 and 2019, tax revenues over GDP remains low. In 2020, total tax revenues reached 10.2% of GDP. Although this is higher with respect to the 8.5% of 2007 and in line with Indonesia and Pakistan it remains lower compared to other countries in the region, such as Viet Nam with 22.7%, Philippines with 17.8% or Thailand at 16.5% (OECD, 2022[11]). Expanding tax revenues while preserving equity and redistribution will be fundamental to increasing public investments and effectively realising the ambitious long-term vision of Bangladesh (Ahmed and Heady, 2020[12]). Addressing informality remains crucial, as well. The informal sector, estimated to be around 30% of GDP, and tax avoidance, further shrink the margin of action of the state in designing and implementing long-term effective policies. Of the 213 000 companies registered as a Joint Stock Company in Bangladesh, only 21% filed tax returns leading to an estimated loss of USD 7 billion (Centre for Policy Dialogue, 2023[13]).

Figure 3.2. Public budget and fiscal space, Bangladesh 2018-23

Note: Panel A reports figures in current Taka. * For fiscal year 2022-23 figures are estimated.

Source: Authors’ elaboration based on Bangladesh Finance Division, Ministry of Finance, https://mof.portal.gov.bd, OECD Revenue Statistics in Asia and the Pacific 2022, https://www.oecd.org/dev/revenue-statistics-in-asia-and-the-pacific-5902c320-en.htm and International Monetary Fund finance statistics, https://data.imf.org/.

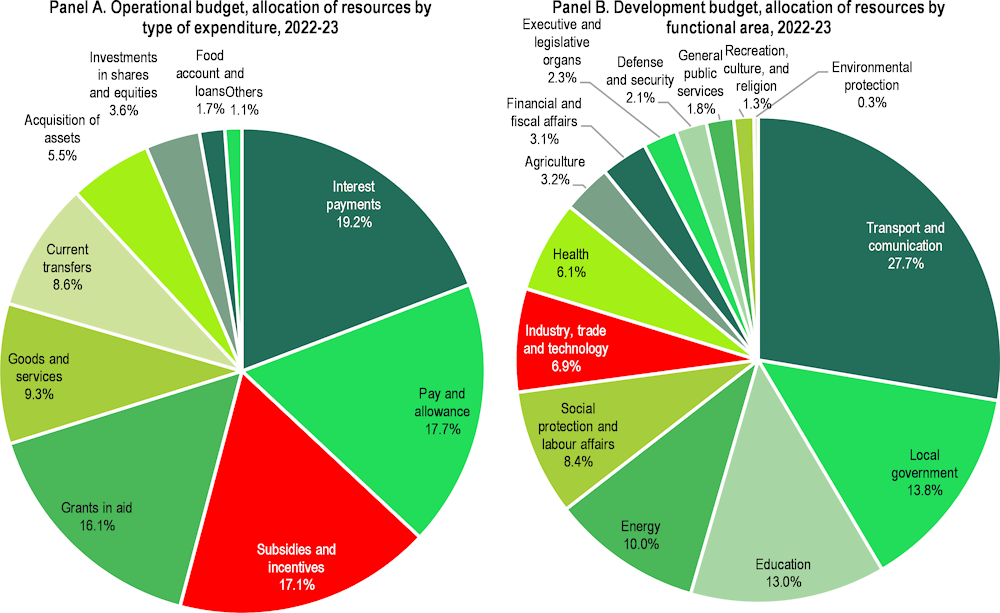

Operational expenditure, which accounts for 60% of the public budget, includes current expenses for the function of the state such as salaries and purchases of goods and services as well as subsidies and transfers to local economic and social actors and for the repayment of foreign loans. Subsidies and incentives are the main instruments in place, accounting for 17% of total operational expenditure (Figure 3.3). These include set of cash incentive packages and subsidies for fuels, fertilisers, micro and small medium enterprises (MSMEs), export-oriented industries and for the formalisation of remittances. Total subsidies and cash incentives are estimated to reach approximately USD 7 billion (Ministry of Finance, 2022[14]).

Development expenditure primarily focuses on transport and energy. The remaining 40% of the budget is allocated to development expenditures including the mobilisation of resources for the implementation of the annual development programme, aligned with the priorities of the eighth five-year plan. Together, transport and energy absorb 42% of total development resources, followed by education with 10%. Industry, trade, and technology absorb 6.9% of development budget, or approximately USD 1.6 billion. Some 85% of latter is mainly driven by capital expenditure related to the construction of the first nuclear power plant in Roopur, which is expected to be operational in 2024.

Figure 3.3. Breakdown of total budget by operational and development expenditure, 2022-23

Note: Development budget refers to Annual Development Program (ADP).

Source: Authors’ elaboration based on Bangladesh Finance Division, Ministry of Finance, https://mof.portal.gov.bd.

Multiple international partners are active in Bangladesh

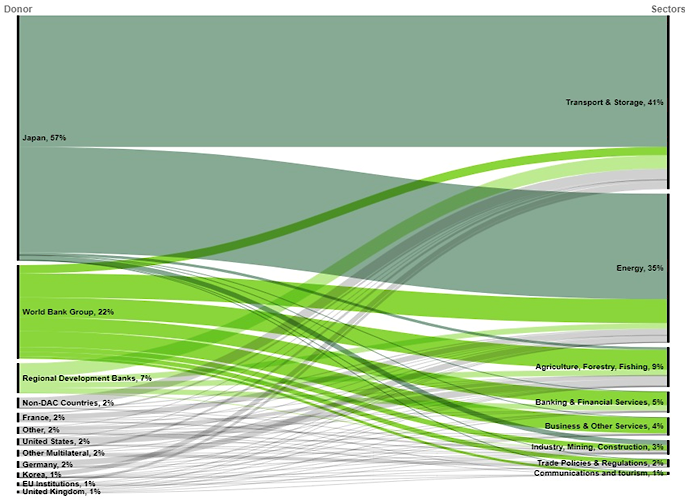

International partners have a long history of co-operation with Bangladesh and have been active since its independence. Bangladesh remains today the third-biggest recipient of official development assistance (ODA), after Syria and Egypt (OECD, 2023[15]). While early development co-operation efforts focused on poverty alleviation, rural development and disaster preparedness, currently international partners are increasingly active in supporting Bangladesh’s economic transformation. Overall, around 32% of total ODA to Bangladesh between 2018 and 2021, which rounds up to USD 8.9 billion, focused on economic transformation programmes, making Bangladesh one of the countries where ODA focuses the most on economic transformation. Within the ODA for economic transformation, infrastructure and energy account for the most, i.e. 75% of the total (Figure 3.4).

Among DAC donors, Japan is by far the leading partner, accounting for 57% of total ODA targeting production transformation in Bangladesh. Japan is active on multiple fronts from transport projects to special economic zones, energy, including the building of a coal power plant and improvements in the electricity grid. The Japan International Cooperation Agency (JICA) is also involved in building one of the country flagship special economic zone and in two major transport projects, including the Dhaka Mass Rapid Transit System and the expansion of the capital International Airport. Other key players include the World Bank (WB), which has been active in Bangladesh since its independence, and which accounts today for 22% of ODA focused on economic transformation, followed by the Asia Development Bank (ADB), active in the country with 7% of the overall support for economic transformation.

Figure 3.4. More than 75% of ODA for economic transformation targets infrastructure and energy

Note: Official development assistance (ODA) is defined as government aid designed to promote the economic development and welfare of developing countries. Loans and credits for military purposes are excluded. Aid may be provided bilaterally, from donor to recipient, or channelled through a multilateral development agency such as the United Nations or the World Bank. Aid includes grants, "soft" loans and the provision of technical assistance. The OECD maintains a list of developing countries and territories; only aid to these countries counts as ODA. The list is periodically updated and currently contains over 150 countries or territories (see DAC List of ODA Recipients: https://oe.cd/dac-list).

Source: Authors’ elaboration based on OECD Creditor Reporting System (CRS), https://stats.oecd.org/Index.aspx?DataSetCode=crs1#.

The European Union member states and institutions account, in total, for 5% of total ODA targeting economic transformation and aid related to economic infrastructure and production. After firmly stepping up in the aftermath of the dramatic Rana Plaza accident to promote and enforce responsible business conduct along the whole supply chain and investing in fostering respect of workers’ rights and safety, and empowering the female workforce, the EU has recently been updating and crafting a new partnership-based model of collaboration with Bangladesh. The EU is actively involved in cultivating a constructive rapport with the government, fostering domestic and cross-border business dialogue, all in support of pro-business and pro-innovation policy reforms rooted in mutual commitments and shared objectives. In 2016, a collaborative initiative was launched between the Government of Bangladesh and the EU, establishing the EU-Bangladesh Government Business Climate Dialogue. This dialogue, led by Bangladesh's Ministry of Commerce and inclusive of key government and business stakeholders, convenes regularly to pinpoint both enduring transformations and quick wins for enhancing business growth, streamlining trade processes, and championing innovation. Since its inception, the dialogue has proven to be an effective platform for the exchange of knowledge and the nurturing of trust (Box 3.2).

One concrete outcome of this dialogue is the establishment of the EU Chamber of Commerce. This chamber unites representatives from EU business entities operating within Bangladesh. The formation of this association is anticipated to amplify the articulation of business requirements, hasten policy reforms, foster business-to-business partnerships, and bolster business accountability concerning responsible practices. This encompasses contributions to local development across social and environmental dimensions. Institutions of this nature play a pivotal role in information generation, enhancing transparency, and thus encouraging foreign direct investment. In addition, it promotes both cross-border and domestic pro-business reforms. As the journey progresses, it is important for Bangladesh to adopt an increasingly proactive role, thereby identifying institutional mechanisms to follow up on the diverse matters addressed in the dialogue and propel related domestic reforms.

Bangladesh geostrategic location makes it an important partner for the whole international community. India, the People’s Republic of China (hereafter “China”) and Russia are also active in Bangladesh, especially in the transport and energy sectors, most specifically in power plants. Bangladesh has recently embarked on ambitious projects to improve its infrastructure and local and regional connectivity. The country inaugurated in 2022 the Padma Multipurpose Bridge that connects the southwest part of the country with Dhaka. The bridge is expected to boost GDP between 1.3-2% and lead to a 10% decrease in travel time to and from Dhaka, which will increase district economic output (JICA, 2005[16]; Ahmad, 2011[17]) by 5.5%. Other ongoing mega projects include the Dhaka-Chittagong Highway Improvement Project, and the Dhaka-Chittagong Port Project, which will connect the two main urban and industrial conglomerates of the country. Of the planned 100 special economic zones (SEZs), most are still at the planning stage, with some already built and linked, individually, to a key partner, including Japan, China and India.

Box 3.2. EU-Bangladesh Business Climate Dialogue: Strengthening trade and investment partnerships

The EU-Bangladesh Business Climate Dialogue (BCD) was launched in May 2016 to facilitate trade and investment from the EU, Bangladesh’s largest trading partner and second-largest source of foreign direct investment (FDI). In 2022, Bangladesh's exports to the EU amounted to approximately EUR 23.8 billion, while EU exports to Bangladesh were around EUR 3 billion.

The purpose of the Dialogue is to facilitate economic co-operation between the two parts, including the exchange of information and experience on trade and investment, as well as the promotion of responsible business practices.

The seventh BCD plenary meeting was held in June 2022 and has identified three priority fields of discussion: Tax and Customs, Shipping and logistics, and green business practices. Numerous government authorities, including the Ministry of Commerce, the Bangladesh Investment Development Authority (BIDA), Ministry of Shipping, the Country Board of Revenue (NBR) and Bangladesh Bank, participated in the dialogue, alongside representatives from the EU private sector. Key agreements and next steps include:

Tax and Customs: a joint committee may be constituted to examine the challenges and opportunities to simplify the customs clearance process for both express and non-express air cargo; policy recommendation from EU companies to introduce a proper risk management system at Customs, using transaction value for determining customs duty, and providing a clear duty structure for importing spare parts.

Shipping and logistics: accelerate the removal of idle containers from the Chittagong Port premises to increase cargo-handling capacities and improve health and safety; Bangladesh has also agreed to launch a survey to assess the costs and benefits of increasing to 100% the allowed FDI in the logistics sector.

Green Business Practices: the EU will inform Bangladesh about the upcoming supply chain due diligence requirements in Europe end encourage adaptive actions.

The parties have also agreed on the establishment of a European Union Chamber of Commerce in Bangladesh, which aims to build bridges between the Bangladeshi private and public sector with the EU private sector and investors and help to navigate Bangladesh’s transition to post-EBA trade regime in the EU.

Source: Final Joint Statement for BCD (June 2022), https://www.eeas.europa.eu/delegations/bangladesh/7th-eu-bangladesh-business-climate-dialogue_en.

The country is committed to diversifying its economy

To achieve its objective of becoming a high-income country by 2041, Bangladesh is well aware of the need to diversify its economy. RMG accounts for 85% of exports, which is a risk factor to sustainable and inclusive growth in Bangladesh. The export-led growth model based on cheap labour has exhausted its capacity to deliver Bangladesh the inclusive and sustainable growth the world economy and the country needs (see Chapter 2).

To embark on a new trajectory characterised by inclusivity and sustainability, as envisioned in Vision 2041, Bangladesh is strategically harnessing digital technologies to revolutionise its economy. This involves attracting more FDI, increasing export capacities, and enhancing industrial competitiveness. In particular, the ongoing implementation of the eighth Five-year Plan for 2020-2025, titled Promoting Prosperity and Fostering Inclusiveness, places considerable emphasis on enhancing resilience, expediting post-COVID-19 recovery, and addressing the intricacies associated with LDC graduation. The primary objectives seek to maintain a robust average annual GDP growth target of 8%, a pivotal factor in ensuring economic vitality. This aspiration is interconnected with generating employment opportunities, elevating firms' productivity, diminishing poverty rates, and fortifying institutional development and governance structures. Figure 3.5 provides an overview of the main priorities and tools Bangladesh has in place to implement the Vision 2041 under the eighth Five-Year Plan 2020-2025.

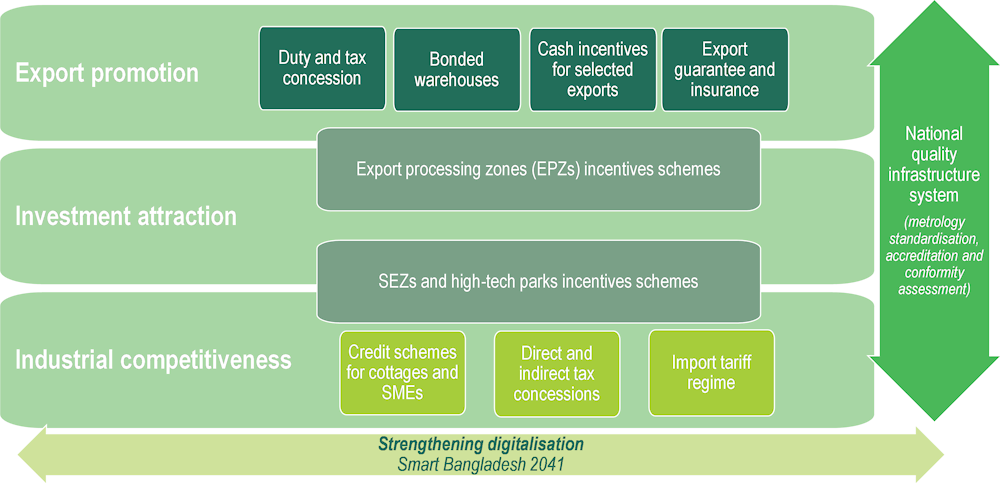

Figure 3.5. Overview of Bangladesh’s approach to transforming the economy, 2022-23

Note: The figure is not meant to be exhaustive. It provides a snapshot of the main public instruments that the country has in place.

Source: Authors ‘elaboration based on official information from Bangladesh Finance Division, Ministry of Finance, Country Budget Speech 2022-2023. Return to the Path of Development Leaving the COVID-19 Behind and Budget speech 2022-23, https://mof.portal.gov.bd and Bank of Bangladesh, Foreign Exchange Policy Department, https://www.bb.org.bd.

A key flagship initiative of the government today is Smart Bangladesh 2041. This initiative builds on the achievements of Digital Bangladesh, which was launched in 2008, and focused on developing digital infrastructure across the country and on fostering access to internet for all citizens. The progress achieved under Digital Bangladesh has been remarkable (see Chapter 2 of this PTPR).

In 2018, Bangladesh launched its first geostationary communication satellite developed in a partnership between Bangladesh Telecommunication Regulatory Commission (BTRC) and the Franco-Italian Thales Alenia Space. The share of individuals using the internet grew from 3% in 2010 to 25% in 2020 and the average broadband speed increased up to 14 Mbps, in 2022. Since 2016, Bangladesh has integrated the Automated System for Customs Data (ASYCUDA) in order to improve the efficiency of customs clearance processes by improving manifest and declaration processing and tax payment mechanisms. In 2021, 73% declarations’ duties and taxes were paid within three days (UNCTAD, 2022[18]).

Smart Bangladesh 2041 leverages progresses achieved so far, including the swift and effective use of digital technologies during the COVID-19 pandemic. Smart Bangladesh frames the current government ambition to deeply transform the government, society, citizens’ life and the economy through digitalisation. The strategy supports the development of Information and Communication technologies (ICTs) and points to embed digital technologies in business activities. In particular, Smart Bangladesh 2041 prioritises speeding-up digitalisation and the application of ICTs through 14 action plans targeting specific activities such as agriculture, healthcare, energy and in enabling industry 4.0 in traditional activities, including RMG. Budget allocation is not publicly available, limiting the capacity to track progress. The strategy also aims to nurture a local start-up ecosystem. Bangladesh is now the 12th start-up hub in Asia and through Startup Bangladesh, a government-owned venture capital fund linked to the Ministry of ITC, the government has channelled seed-funding for local startups for 15 million in 2023 (Crunchbase, 2023[19]).

Increasing FDI is among the government’s top priorities

One of the main priorities of the Vision 2041 and of the ongoing eighth Five-Year Plan is to increase Foreign Direct Investment (FDI) to the country. This is not a new priority for Bangladesh and the country has been trying to attract FDI though targeted policies since the 1980s. However despite the efforts, FDI to Bangladesh remains limited and concentrated in traditional sectors.

In Bangladesh FDI attraction and operation is governed by the Foreign Private Investment Promotion and Protection Act introduced in 1980. The act has been updated several times but has not undergone any major reform since its introduction. It remains the reference for indicating the conditions for entry and operation of FDI in the country. Overall, despite progress, Bangladesh remains a difficult country for foreign investors to operate in, mostly because of red-tape, the persistence of personalisation in dealing with government-business relations and the high level of complexity in the institutionality.

At present four institutions, created in different moments, co-exist and deal with FDI with slightly different responsibilities. The four agencies provide similar support mechanism and services to investors, including fiscal incentives, import duty and tax exemptions, advantages linked to allowances for full repatriation of capital and dividends (Table 3.2).

The Bangladesh Export Processing Zones Authority (BEPZA) was set up in 1980 as the main government body in charge of approving investments in the EPZs and is in charge of managing the services provided by the EPZs. In the 1980s, FDI attraction was instrumental to export promotion and was mostly linked to investors in the Export Processing Zones (EPZs). Bangladesh Export Processing Zones Authority (BEPZA). BEPZA today approves all Export Processing Zones (EPZ) projects and is responsible for providing infrastructure facilities, administering tax incentives, issuing work permits for foreign countries in the EPZ. Three types of investment are permitted in the EPZs: 100% foreign-owned; foreign–local joint ventures; and 100% locally owned and industrial units located in EPZs must export at least 90% of their production while 10% to the domestic market subject to payment of customs duties and other local taxes. There are currently nine operative EPZs across the country. Despite the generous incentives that EPZs provides over time, they have struggled to attract foreign investors or generate linkages with local providers. Between 1996 and 2000, EPZs absorbed between 20% and 40% of FDI in the country, while in 2018-2022 they accounted for less than 10% (Bangladesh Bank, 2022[20]). BEPZA is active but new ones have been created to respond to the changing policy approach and objectives of the subsequent governments.

In 2010, in line with the overall efforts of liberalisation and increasing the role of the private sector in the economy two new agencies were created: the Bangladesh Economic Zones Authority (BEZA), which were set up to manage the privately-owned Special Economic Zones (SEZs) and the Bangladesh Hi-Tech Park Authority (BHPTA), which focuses on fostering industrial and services development in the ICT industry. The Bangladesh Economic Zones Authority (BEZA). Since 2010, BEZA is in charge of establishing and managing the Special Economic Zones (SEZs). Unlike EPZs that are publicly owned, SEZs mainly rely on private capital and expertise. SEZs attempt to attract domestic and international investment in industrial activities, targeting both the domestic and the international markets. In 2018, the government announced the commitment to create up to 100 zones by 2025. Achieving this target seems ambitious as at present only a few are under construction and a couple are ready to operate. One SEZ is under construction in Araihajar, 30km east of Dhaka, through a join partnership between the private Japanese Developer Sumitomo Corp (70%), and BEZA (30%) with the financial support of the Japan International Cooperation Agency (JICA) (15%). The zone plans to attract 100 companies with expected investment worth USD 1 billion. Discussion for the establishment of additional zones with other international partners are underway. One near Chittagong with the support of a Chinese private developer, which will focus on chemical, automotive garment, and pharmaceutical industries, and another with an Indian developer at the border with West Bengal, focusing specifically on agro-food, light engineering and chemicals.

The Bangladesh Hi-Tech Park Authority (BHPTA) is in charge of establishing and managing Information, Communication and Technology (ICT) parks in the country. While BEPZA and BEZA have a prominent manufacturing vocation, BHPTA is largely focused on the attraction of ICT‑related services. The Authority has a plan for building 28 parks in the country. At present only the Bangabandhu Hi-Tech City (BHTC), located in the north of Dhaka is operational and includes a software technology park and IT training & start-up incubation centre.

In 2016, the most recent governance effort to attract FDI attraction involved the creation of the Bangladesh Investment Development Authority (BIDA) tasked in serving as a one-stop-shop for international investors. BIDA operates as primus inter pares and provides services for both domestic and foreign investors at any location outside the jurisdiction of other investment authorities. In 2021, BIDA launched a one-stop-shop online platform that should ultimately serve as a single window for investors to access the more than 20 public services and procedures affecting FDI in Bangladesh, including company registration, tax certificates, work permit insurance and foreign borrowing approval among others.

Despite the considerable market potential of its economy and numerous initiatives to attract FDI, the progress has remained limited. The institutional arrangements and the policy toolbox for attracting FDI in Bangladesh requires streamlining and further modernisation. Entities such as BEPZA, BEZA, and BIDA operate under the direct purview of the Prime Minister, who chairs each board, while BHPTA falls within the administrative jurisdiction of the Ministry of Post, Telecommunication, and Information Technology. In addition, these agencies have similar or overlapping responsibilities.

This intricate landscape complicates both foreign and domestic investors’ access to pertinent information and identifying optimal entry points within the country. Such difficulties are particularly pronounced for new investors lacking prior business history with Bangladesh. Overall, the FDI attraction and operational process exhibits complex and lengthy mechanisms, impeding the country's investment potential. These problems persist despite Bangladesh's advantageous geostrategic location, substantial market size, and established reputation as a reliable business partner. In order for Bangladesh to successfully realise its Vision 2041, it is imperative to streamline and continue modernising the governance and policy framework pertaining to FDI (OECD and ADB, forthcoming[21]).

Table 3.2. Overview of main FDI related incentives by agency in Bangladesh as of May 2023

|

|

Agency |

||||

|---|---|---|---|---|---|

|

|

BEPZA |

BEZA |

BHTPA |

BIDA |

|

|

Instruments |

Fiscal |

||||

|

100% Import duty exemption (on some machinery, raw and construction materials) |

Yes (also finished goods and others) |

Yes |

Yes |

||

|

Stamp duty exemption on loans, land transfer and lease |

Yes |

Yes |

Yes |

No |

|

|

Export cash incentive/subsidies for export-oriented industries |

Yes |

Yes |

Yes |

Yes |

|

|

Tax exemption from VAT and corporate income (for developers, investors, and employees) |

Yes |

Yes (100% for developers and investors, 50% for expatriates) |

Yes (50% for employees) |

Yes (50% for export-oriented firms; 100% for PPP projects) |

|

|

Bonded warehouse and duty drawback facilities |

Yes |

Yes |

Yes |

Yes |

|

|

Full repatriation of capital, dividends, and sales proceeds |

Yes |

Yes |

Yes |

No |

|

|

Repatriation of royalty and technical assistance fees |

No |

Yes (not exceeding 6% of imported machinery cost) |

Yes (not exceeding 6% of imported machinery cost) |

No |

|

|

Remitting income |

Yes (limited amount for residents) |

Yes (up to 75% for foreigners; limited amount for residents) |

Yes (up to 75% of income and 100% for pensions and actual savings for foreigners; limited amount for residents) |

Yes (limited amount for residents) |

|

|

Allowance of foreign currency accounts |

Yes |

Yes |

Yes |

Yes (foreign investors) |

|

|

Non-fiscal |

|||||

|

One-Stop-Shop (clearance, licenses, import/export permits, foreign banking, etc.) |

Yes |

Yes |

Yes |

Yes |

|

|

Conditionalities |

Exporting firm’s criteria and Domestic Tariff Area (DTA) |

100% Export-oriented firms (can sell up to 10% to DTA) |

Export-oriented firms (can sell up to 20% to DTA) |

|

Firms exporting >80% |

|

FDI ceiling |

No FDI ceiling (also foreign ownership fully permissible) |

No FDI ceiling (FDI restricted in few sectors and up to 5% of foreign workers) |

No FDI ceiling |

No FDI ceiling |

|

|

Sectoral investment restrictions (22 controlled industries; 4 reserved industries) |

Yes |

Yes |

Yes |

Yes |

|

|

Focus |

30 sectors/products |

100 planned economic zones |

IT/High-tech industries |

7 high priority sectors/products and 24 priority sectors/products |

|

Note: The table is not exhaustive and includes only main tools. It has been updated as of May 2023.

Source: Authors’ elaboration based on information from BEPZA, BEZA, BHTPA, BIDA, Country Board of Revenue, and Bank of Bangladesh.

Export-promotion continues to benefit mostly garments and textiles

Export promotion has played a pivotal role in Bangladesh's development since the country independency. During that initial phase, the nation directed its efforts towards bolstering traditional exports as a means to sustain growth, foster job creation, and secure foreign exchange reserves. In the 1980s, the government recognised Bangladesh's potential to leverage the evolving global production landscape and the rise of global value chains. It aimed to capitalise on the country's significant population and remarkably low labour costs. With this insight, a proactive stance was taken towards the promotion of labour-intensive industries, particularly the Ready-Made Garment (RMG) sector and the establishment of the SEZs to provide industrial infrastructure. Export promotion became intrinsically linked with the attraction of Foreign Direct Investment (FDI). Fiscal incentives were chiefly employed to facilitate access to essential machinery and materials for export-oriented industries, complemented by tax breaks and streamlined export procedures, primarily benefitting the RMG sector (World Bank, 1978[22]).

After gaining independence in 1972, Bangladesh established the Export Promotion Bureau under the purview of the Ministry of Commerce, aimed at bolstering exports. Concurrently, efforts were made to catalyse industrialisation through the establishment of Export Processing Zones (EPZs). The first Special Economic Zone (SEZ) was initiated in 1983 within the Chittagong region. Chittagong, the country's second-largest city following the capital, Dhaka, is renowned for housing Bangladesh's principal port, further enhancing its strategic significance (House, 1990[5]).

In the 1990s and 2000s, Bangladesh introduced reforms to facilitate trade and started to set up international trade agreements; however, unlike other countries in the region, Bangladesh does not heavily rely on regional supply chains or regional integration, and mostly focuses on nurturing the domestic industry. Bangladesh, as an LDC, benefits from international support measures and special preferential treatment, which have contributed to increasing the competitiveness of its local production. In the process, it has become, in a rather short span of time, a key manufacturing hub for the global textile industry. The generalised system of preference (GSP) and Everything But Arms (EBA) initiative increased the already high-cost competitiveness of the domestic industry, which benefits from duty free and quota free access to international markets.

However, despite progress, the policy approach and the policy toolbox for export promotion remains anchored to the traditional trade policy instruments used in the early stages, including duty and tax concessions, bonded warehouses, export incentives, cash incentives for exporters and additional financial support mechanisms including export finance, insurance and guarantees. The main policy tools include:

Duty drawbacks and tax concessions, which are implemented to ease production costs for exporters. These include a 50% rebate on taxable income generated from any export business and accelerated depreciation on machinery or plant for industrial units set up between 1977 and 2012. Moreover, to maintain price competitiveness for export products, VAT rebates are granted on a number of export-related services.

Bonded warehouses allow exporters to import and store raw materials without payment of customs duties for a certain period of time until the manufacturing process is completed. There are currently two types of bonded warehouses: Special Bonded Warehouses for export-oriented RMG industries and General Bonded Warehouse for other industries that both apply 100% duty-free rate. A bond licence is required to make use of bonded warehousing facilities. After obtaining the licence, the licensee may take possession of the imported material under a back-to-back letter of credit without paying any duties or taxes. In case of failure to export, importers are required to pay duty charges and taxes on the goods imported. Companies have reported tax savings of 25-30% as a result of using bonded warehouses.

Cash incentives are provided to exporters that do not rely on duty drawback or the bonded warehouse facilities. The rate of the incentive is decided by the government, and is updated annually through circulars issued by Bangladesh Bank, which administers the incentive scheme on behalf of the Finance Division of the Ministry of Finance (see Annex Table 3.A.1 for the most recent list of cash incentives). The fiscal weight as a share government budget for these cash incentives has trebled in nominal terms over the last decade. For 2022-23 the total estimated cost of cash incentives of exports is Taka 75.5 million (approximately USD 700 000 million) equivalent to 10% of total subsidy incentives in the operational budget (Finance Division, 2022[23]). These incentives mostly benefit the RMG sector, as, according to most recent available official data from the Government of Bangladesh, 65% of these cash incentives benefitted the garments and textiles industry. The upcoming graduation from the LDC status poses challenges in terms of updating these tools: as they are currently crafted, they could be considered non-compliant with the WTO Agreement on Subsidies and Countervailing Measures (SCM), which explicitly bans or imposes restrictions on the use of all kinds of subsidies for export promotion (Sadiq, 2020[24]).

Bangladesh also provides other instruments to priority sectors. For 2022-23 the government provides a reduction in corporate tax to 12% to export-oriented industries and the textile industry has been granted the extension of a reduced corporate tax of 15% until 2026. Bangladesh provides loans at reduced interest rates, export credits and air transportation facilities on a priority basis for two types of sectors. High priority sectors include RMG, software and IT-enabling services, information communication technology (ICT) products, pharmaceutical products, plastic products, agro-food products and fishing trawlers. Priority sectors, that have export potential but whose production, supply and export bases are not strong enough to compete globally are jute products, electric and electronic products, ceramic products, light engineering products as well as paper and rubber products. Within these policy instruments, the most relevant one is the Export Development Fund (EDF). The EDF is operated by the Bank of Bangladesh to refinance commercial banks for the repayments for the procurement of intermediary inputs. For the fiscal year 2022‑23 the EDF has been expanded to Taka 552 billion (USD 4.8 billion) from 276 billion the previous year. Moreover.

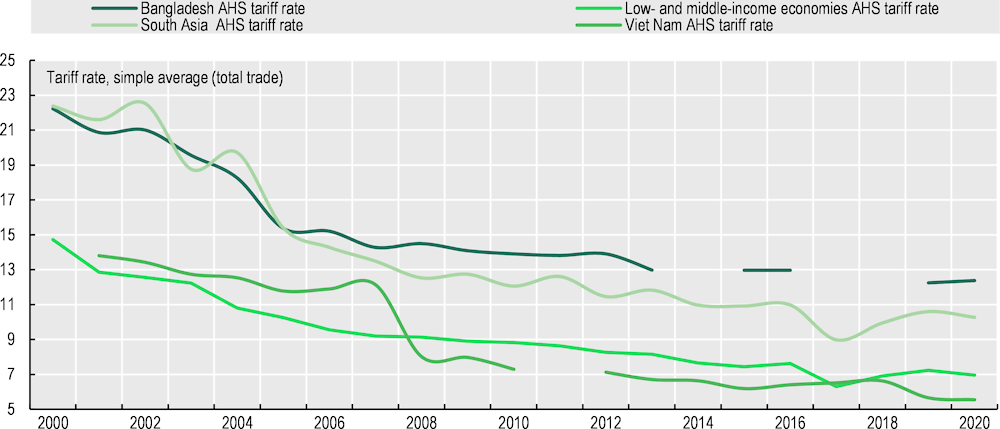

Bangladesh is committed to continue supporting local industrial development. Although over time Bangladesh has reduced the average nominal import tariff (Figure 3.6), the Government has imposed a targeted tariff on specific final goods to promote the development of local fledgling industries by means of import substitution, following the past experiences of other countries such as Brazil and India. While the effectively applied tariff (AHS) is currently 12.4%, which is lower if compared to 22.3% in 2000, other para-tariffs are applied, including supplementary Duties (SD), and Regulatory Duties (RD) and that together with custom duties (CD) contribute to make up a Total Tariff Incidence (TTI) 51.7% in 2020. More concretely, while the custom duty for sport footwear is 25%, the total incidence tax was 73% in 2022 (National Board of Revenue, 2022[25]). The country’s strong focus to develop domestic industrial capabilities (through high important tariffs - with the exception of RMG) has created an anti-export bias that discourages local producers from exporting their goods.

Tariffs on certain final or intermediary goods have been increased with the goal of not only protecting local industries but to prevent the depletion of foreign hard currency, which is essential in financing the imports of crucial goods such as energy and foodstuffs. Higher tariffs provide additional tax revenues but are a challenge for a country that is looking to increase resource mobilisation while preserving equity and progress. Total duties on goods and services (imports and supplementary duties) account for 23% of total tax revenues in the country, markedly higher than the 16% in Viet Nam (OECD, 2022[11]).

The government is currently working to reduce anti-export bias as it prepares for further openness. Several institutions including the Bangladesh Trade and Tariff Commission, the Ministry of Commerce and the National Boards of Revenues are working to reform tariffs with a view to supporting further openness of the economy. The measures include among others the abolition of separate tariff systems for different importers, no imposition of regulatory duty except in emergency situations and the abolition of the existing system of minimum value determination by the National Board of Revenue for imported goods within a predefined time horizon. Together these measures are included in the first national tariff policy and will come into effect by 2023. This should also facilitate the upcoming negotiation of regional and bilateral free trade agreements (FTAs).

Figure 3.6. Effectively applied tariff rates are coming down

Note: AHS tariff rates are simple averages based on total trade.

Source: Authors’ elaboration based on World Integrated Trade Solution, World Bank (2022), https://wits.worldbank.org/.

Incentives for industrial competitiveness target agriculture, small firms and energy

Strengthening the competitiveness of local businesses is also among the priorities of the Bangladesh economic transformation strategy. The policy tools that the country leverages to that effect remains linked to traditional fiscal and financial incentives. These include among others:

Financial support and price controls targeted to agriculture. The Bangladesh Bank provides concessional credits at 4 and 5% interest rate to produce local corps, including oil seeds, spices and maize and subsidises the acquisition of fertiliser and machines. Agricultural subsidies in 2022‑23 are budgeted for Taka 160 billion (USD 1.4 billion) the equivalent of 16% of total subsides (Ministry of Finance, 2022[8]). At the same time, the government, in an attempt to stabilise prices, centralises the procurement of specific commodities, including sugar, soybean oil and lentils through the Trading Corporation of Bangladesh, which operates under the Ministry of Commerce.

Tackling informality in cottage, micro, small and medium-sized enterprises. In addition to what is internationally known as MSMEs, in Bangladesh so-called “cottage firms” operate. These firms are micro-scale enterprises run by the members of the same family either on a full- or part-time basis. These are small and informally operated businesses that many households rely on to generate supplementary income for the household. In this respect, they play a key role in generating the additional income required for poverty reduction. The Bangladesh Bank has encouraged commercial banks and financial institutions to provide loans to these types of firms at a preferential rate and three-month grace period for a one-year term loan, and a three- to six-month grace period for medium- to long-term loans, based on the banker–customer relationship. Refinancing schemes and grants are also provided by Bangladesh Bank and the Ministry of Industry with the support of international donors including the Asian Development Bank and the World Bank (Sadiq, 2020[24]). Of the total USD 145 million development budget of the ministry of Industry, 50% is allocated to refinancing projects to MSMES.

Direct subsidies for access to energy and electricity. While the country has achieved 96% of access to electricity in 2020, up from 55% in 2010 the supply and electricity and energy at an affordable price remains a challenge. Current installed electricity capacity is 22 GW and total demand is 13.7 GW (BPDB, 2022[26]). The government finances the use of the idle or excess capacity through specific subsidies for power. For 2022-23 electricity and LNG subsidises are expected to reach Taka 340 billion (USD 3 billion) while also providing a 20% rebate on electricity bills for some sectors including agriculture (Ministry of Finance, 2022[8]). Total energy subsidies increased over 2022-23 due to the soaring prices of imported LNG due to the invasion of Russia of Ukraine, thus posing an additional burden on both public finances and end-consumers.

Bangladesh also supports industrial competitiveness through modernisation of the country’s quality infrastructure system (NQI) (Box 3.3). Several agencies are responsible for the NQI system in Bangladesh including the Ministry of Industries, which has the overall co-ordination and the Bangladesh Standards and Testing Institute (BSTI) and the Bangladesh Accreditation Board (BAB).

BSTI is responsible for developing and issuing standards, and for providing technical advice and oversees other important areas such as metrology to ensure traceability and legal metrology, testing activities and conformity assessment. BSTI has been active in developing standards in several areas, including food safety, chemicals and textiles. The organisation is also a member of several international bodies including International Organization for Standardization (ISO) since 1985, the International Electrotechnical Commission (IEC) since 2018, and the South Asian Association for Regional Cooperation (SAARC) since 2014.

BAB is responsible for accreditation and for assessing the competence of certification bodies. Since 2015 it is the signatory member of the ILAC laboratories that aim to develop cross-country co-operation for facilitating trade by promoting the acceptance of accredited test and calibration results. BAB is also a member of the World Trade Organisation (WTO) Technical Barriers to Trade (TBT) Agreement Committee. BNMI is a research institute responsible for setting up and managing the country’s metrology system.

In terms of accreditation, product testing and certification, the majority of the services provided are linked to the garments and textiles, leather and toys sectors, and to some extent to agro-food, including in packaging. There are few laboratories for construction materials (cement, bricks, bitumen, gypsum) and metals and for petroleum products, as well as for pharmaceutical products, paint and surface coatings, and personal protective equipment, even though a positive step is the adoption of ISO/IEC 15189 which is important for assuring correct appliance of analytical methods for probes and disease testing. Electrical testing is only covered by a few laboratories. ISO/IEC 17065 (product certification) and ISO/IEC 17063 (CASCO product certification schemes) are currently not available in Bangladesh, and BSTI is working on their introduction. The certification of management systems is centralised and directly carried out by BSTI, though several international certification bodies are active in the country. ISO/IEC 9001 is currently the dominant certification, followed by ISO/IEC 14001. Introducing ISO/IEC 50001 (energy efficiency), ISO/IEC 18000 (safety working place) and ISO/IEC 27000 (information safety) are important for the country's future development. To go forward, Bangladesh needs to continue its journey of updating its NQI (Table 3.3). A key role can be played by international collaboration in this field, including with key regional partners such as India and Thailand, building on initiatives that are currently underway.

Table 3.3. Bangladesh is working to enhance its quality infrastructure system for industrial competitiveness

|

Areas |

Identified reforms and actions to be implemented |

|---|---|

|

Metrology |

|

|

Standardisation |

|

|

Accreditation |

|

|

Digitalisation |

|

|

International and regional co-operation |

|

|

Governance |

|

|

Outreach and SMEs involvment |

|

Source: Authors’ elaborations based on international peer dialogue, domestic stakeholder consultations and official information.

Box 3.3. The role of the national quality infrastructure system as a driver of competitiveness

The National Quality Infrastructure (NQI) system is a comprehensive framework of laws, standards, and regulations designed to ensure the fulfilment of quality standards for products and services. This system not only establishes a foundation for international trade and domestic industrial advancement but also acts as a catalyst for Foreign Direct Investment (FDI) attraction. The significance of an efficient NQI system cannot be understated in fostering industrial competitiveness (OECD/UN/UNIDO, 2019[27]; OECD et al., 2021[28]). This intricate system encompasses four key components: metrology, standardisation, accreditation, and conformity assessment. It caters to a diverse range of stakeholders, including enterprises, universities, and foreign investors, all while prioritising the safeguarding of end consumers.

The crucial role of a well-functioning National Quality Infrastructure (NQI) system in bolstering industrial competitiveness cannot be overstated. NQI encompasses an array of elements such as laws, standards, measurements, testing, and regulations. Its purpose is to guarantee that products and services align with stipulated quality prerequisites. An effectively operating quality infrastructure system holds the potential to elevate competitiveness by refining the caliber of domestic products and services. It simultaneously ensures adherence to international benchmarks, signalling the compliance and caliber of local products and services (Figure 3.7).

Figure 3.7. Elements of NQI for economic diversification and upgrading

Source: Karl-Christian Göthner Senior Expert, German Metrology Insititute (PTB), Peer Learning Group (PLG) Meeting of the PTPR of Bangladesh, 8 September 2022.

Meeting Bangladesh’s ambitions requires shifting gears and sharing responsibilities

Bangladesh is ready to shift to a new phase in its development. The upcoming LDC graduation is acting as an important catalyst to modernise country policymaking and to update the international partnerships the country relies on and participates in. The following sections briefly discuss three key issues emerged during the PTPR process that are important to enable Bangladesh to achieve its ambitions and continue succeeding.

Future-ready the state to achieve its vision

The process of building a modern nation state is still in the making. Bangladesh is an institution-rich country. Currently the public sector consists of 42 ministries and a multiplicity of public institutions, agencies and committees often with overlapping responsibilities and reporting lines. The experience of countries with modern and efficient institutional arrangements shows that what matters most for creating an effective state is not the number of institutions per se but the quality and clarity of purpose of the institutions and the accountability mechanisms in place to measure impact and track progress. While Bangladesh has created numerous institutions and has made some progress in modernising the machinery of the state, the institutional structure remains unwieldy and top heavy, and in practice flagship initiatives continue to be driven from the highest level in government, making co-ordination at lower layers of the structure difficult. In the future, Bangladesh should devote more attention to these elements in order to diversify its economy and realise the 2041 vision.

Linked with the establishment of a robust, well-functioning institutional framework in Bangladesh is the task of enhancing domestic resource mobilisation capabilities and furnishing the state with effective implementation capacities. Although significant improvement has been achieved in the ADP execution rate over the last two decades particularly, the execution rate remains a challenge. In the fiscal year 2021, the government agencies executed 18% of the ADP while 19% in 2020 and 20% in 2019. Moreover, Implementation Monitoring and Evaluation Division (IMED) of the government showed that ministries and agencies had spent 19% of the ADP allocations during the five months of the fiscal year 2022 (Finance Division, 2022[23]).

Likewise, because of a lack of costing of plans, strategies or specific instruments it is difficult to determine what is the total annual or medium-term budget or resource allocation for several policies. This is the case for example of the National Industrial Policy 2022 launched in September 2022. Strengthening Bangladesh's capacity for effective policy implementation will also require better co-ordination between strategic bodies such as the planning commission ENEC, NEC and other line ministries that are in charge of designing and implementing policies.

An empowered state, operating through effective institutions is also a transparent and open state. A pivotal objective for Bangladesh in sustaining its trajectory of success is to harness digital technologies and to foster enhanced efficiency and transparency in interactions between citizens, businesses, and the government. This entails facilitating government accountability across policies, investments, and expenditures by ensuring accessible information and responsiveness to the needs of citizens and businesses. The recent decision to amend the Digital Security Act, issued in 2018, with the Data Protection Act 2023 and the upcoming Cyber Security Act (CSA) are positive signs that will require further. While the relevance of these amendments is still under discussion, this announcement underscores the government's commitment to adapt and implement reforms aimed at promoting openness, transparency, and accountability. Several countries and regions globally are adopting regulation and laws to support digitalisation while at the same time safeguarding individual privacy and transparency (Box 3.4).

Box 3.4. The European Union General Data Protection Regulation (GDPR)

The General Data Protection Regulation (GDPR), officially known as Regulation (EU) 2016/679, is a comprehensive and far-reaching legislation adopted by the European Union (EU) to safeguard individuals' privacy and harmonise data protection regulations across its member states. Enforced since May 25, 2018, the GDPR has redefined the way personal data is collected, processed, and managed, setting new standards for data privacy and security in the digital age. The primary aim of the GDPR is to empower individuals with greater control over their personal data while enhancing the responsibilities of organisations handling such data. It applies to any entity that processes personal data of EU citizens, regardless of the entity's location. The regulation incorporates several key principles and provisions to achieve its objectives.

Transparency and Lawfulness: The GDPR mandates that organisations collect and process personal data lawfully, transparently, and for legitimate purposes. They must provide clear information to data subjects about how their data will be used and obtain their consent when necessary.

Data Subject Rights: The regulation grants individuals a range of rights, including the right to access their data, rectify inaccuracies, erase data (the "right to be forgotten"), restrict processing, and object to processing for certain purposes such as direct marketing. Organisations are obligated to facilitate these rights.

Accountability and Data Protection Officers: GDPR emphasises accountability, requiring organisations to maintain records of their data processing activities. Certain organisations must appoint Data Protection Officers (DPOs) to ensure compliance, especially for public authorities or those engaging in large-scale systematic monitoring or processing of sensitive data.

Data Breach Notification: GDPR mandates prompt notification of data breaches to both the relevant supervisory authority and affected individuals when the breach poses a risk to their rights and freedoms. This enables swift action to mitigate harm and encourages organisations to bolster their cybersecurity measures.

Cross-Border Data Transfer: Data transfers to countries outside the EU are only permitted if those countries ensure an adequate level of data protection. The GDPR offers various mechanisms, such as Standard Contractual Clauses and Binding Corporate Rules, to facilitate such transfers.

Privacy by Design and Default: Organisations must integrate data protection into their systems, processes, and products from the outset. Privacy by Design promotes proactive measures to mitigate privacy risks, while Privacy by Default ensures that only necessary personal data is processed.

Sanctions and Fines: Non-compliance with the GDPR can result in significant penalties. Depending on the violation, organisations can face fines of up to 4% of their annual global turnover or €20 million, whichever is higher. The severity of fines reflects the importance of data protection in the digital age.

Global Impact and Implementation Challenges: While the GDPR is an EU regulation, its effects are felt globally due to its extraterritorial applicability. Organisations worldwide that handle EU citizens' data must adhere to its provisions. Many jurisdictions have revised or introduced their data protection laws to align with GDPR principles.

Impact on Business Practices: GDPR has prompted organisations to revaluate their data handling practices, invest in robust cybersecurity measures, and prioritise privacy in product and service development. This shift has led to increased transparency, improved data subject rights, and better management of personal data.

Source: General Data Protection (GDPR) regulation (EU) 2016/679 of the European parliament and of the council of 27 April 2016.

Manage international partnerships for sustainable and smooth graduation

Bangladesh is on the brink of graduating from its Least Developed Country (LDC) category, which will have significant implications for its access to certain International Support Measures (ISMs). This milestone will push the country to continue the harmonisation of its trade policies and adopt a more strategic and proactive approach also including a modernised tax base structure to favour industrialisation and competitiveness.

While the vast majority of revenues originates from VAT, excise and import duties, revenue productivity for income tax - the amount of revenue generated by an incremental increase in the tax rate- is low, reflecting challenges related to policy design and enforcement, which means that taxes could generate more revenue and become more progressive. Enlarging the tax base and employing efficient and a harmonised set of tax rebates for firms should also be a priority. Also, Bangladesh stands out as the only developing country in Asia that does not collect an environmental tax2 whereas countries such as Viet Nam, Malaysia, or Bhutan cash out around 0.7 to 1% of GDP from environmental taxes (OECD, 2022[11]).

While Bangladesh has taken tangible steps in readiness for graduation, establishing a special committee chaired by the Principal Secretary to the Prime Minister, operating across various domains to identify challenges and opportunities posed by the transition, there remains a need for a more profound shift in conceiving the role of trade in the nation's development. A more proactive and strategic stance towards trade is imperative. It is closely linked with how it can catalyse transformative changes within the domestic economy and the country's role on the international stage alongside FDI and innovation.

While Bangladesh is recognised as a cost-effective, reliable, and quality-driven participant in global supply chains, it should not solely centre its trade policies around this objective. The country’s focus should shift towards revitalising the domestic industry, enhancing trade performance by transitioning from price-driven competitiveness to value-based competitiveness encompassing quality, inclusivity, and sustainability.

The government has already embarked on a journey towards adopting a more proactive trade approach. Presently, the country counts two bilateral agreements: the United Kingdom-Bangladesh Trade and Investment Partnership and the Bangladesh-Bhutan Trade Agreement. Bangladesh is also actively engaged in negotiations and considering accession to several other agreements, including discussions with the European Union (EU), where a transition towards a potential GSP+ scheme—granting preferential access to up to 66% of tariff lines within the EU market—is under negotiation and is contingent upon upgrading domestic standards and policies on multiple fronts.

An updated and targeted vision concerning the role that Asia can play in Bangladesh's international partnerships is also necessary. Notably, although within diverse global circumstances, regional agreements have provided Viet Nam for example greater market access compared to bilateral agreements (Box 3.5 and Chapter 4 of this report). To achieve this, alongside effectively managing the openness process and negotiating strategic trade agreements, there's a requirement for defining a clear strategy for greater engagement with the South Asia region and ASEAN.

Finally, a change in approach from international partners of Bangladesh is also essential, extending beyond responsible business conduct and transparent supply chains. This shift entails establishing comprehensive partnerships to ensure transparent, inclusive, and sustainable business development, including support for greening Bangladesh's energy landscape.

Box 3.5. From regional to global markets. The case of Viet Nam FTAs