Bangladesh needs to upgrade its domestic industry and diversify its export basket. Targeted policies since the 1980s have nurtured manufacturing. These measures, backed by favourable trade preferences tied to its LDC status, have spurred industry growth. With LDC graduation slated for 2026, Bangladesh must sustain its industrial evolution, focusing on innovation, sustainability, and inclusivity. This necessitates updating trade policies for business innovation. This chapter examines Bangladesh's electronics and pharmaceuticals sectors, which serve domestic needs and have export potential. Drawing on international dialogue and domestic consultation, this chapter explores the key priorities Bangladesh will have to focus on if it is to unlock its transformative potential.

Production Transformation Policy Review of Bangladesh

4. Transforming industries: Perspectives from electronics and pharmaceuticals in Bangladesh

Abstract

Introduction

The Production Transformation Policy Review (PTPR) process for Bangladesh involved an in-depth look into two industries that have been nurtured by targeted policies to develop local industrial capabilities to meet local demand: electronics and pharmaceuticals. These two industries are deeply different, but both have export-potential, and both can play a key role in sustaining Bangladesh’s shift to its next innovation- and quality-driven development phase.

This fourth chapter of the PTPR of Bangladesh complements the industrial assessment of the Bangladesh manufacturing industry presented in Chapter 2 and Bangladesh’s policy model presented in Chapter 3. It draws on domestic stakeholders’ consultation and international peer learning, including insights from Viet Nam from the United Nations Committee for Development Policy (CDP). The chapter is structured into two sections each providing an overview of the origin and evolution of the sector in the country, an analysis of the main policy approach impacting the sectoral industrial development and a conclusion indicating key steps in going forward. In both cases, reference is made to the key issues at stake in the aftermath of graduation, given the potential termination of intellectual property waivers and the impact they might have on the industry in going forward.

The electronics industry in Bangladesh is still maturing

Electronics and electrical equipment (E&E) is one of the largest industries globally in terms of output, employment and exports. Since the 1960s when the integrated circuit board ushered in a period of continuous miniaturisation and increasing calculating power in electronics, the industry increased in size, going from 9% of global manufacturing value added (MVA) then to 13% today, approximately equal to the GDP of Brazil (authors’ elaboration based on UNIDO, 2022). About 27 million people work in E&E globally, slightly higher than the entire population of Australia, on par with employees in the textile and apparel industry and marginally above the level for food and beverages. The top world producer is the People’s Republic of China (hereafter “China”), accounting for a third of the world’s total (34%), followed by the United States (15%) and Japan (9.7%), while the EU as a whole accounted for 11%. The industry is also known for its highly internationalised value chains, with components and parts crossing borders several times until final assembly and exports. As a result, the industry accounts for a high share of world exports, at 21.7% during 2019-21 (CEPII, 2023[1]). China accounted for 28% of value-added that is exported globally (data for 2018), followed by the United States (19%) and Korea (9%).

In global terms, the size of Bangladesh’s E&E sector is on par with that of Morocco and South Africa, accounting for around 0.07% of world MVA. It remains, however, smaller than the size of this industry in other Asian hubs such as Singapore (2.1%), Viet Nam (1%) and Malaysia (1.5%), where E&E has been established as a major industry (48%, 27% and 24% respectively of their total MVA) (authors’ elaboration based on UNIDO, 2022). Domestically, E&E accounts for a small share of industrial activities, estimated at 2% of its MVA (i.e., approximately 0.3% of its GDP), and 1.2% of its manufacturing employment. By contrast, textiles and apparel, the top industry, generates more than half of MVA (58%) and absorbs three quarters (74%) of manufacturing employment (see Chapter 2 of this PTPR).

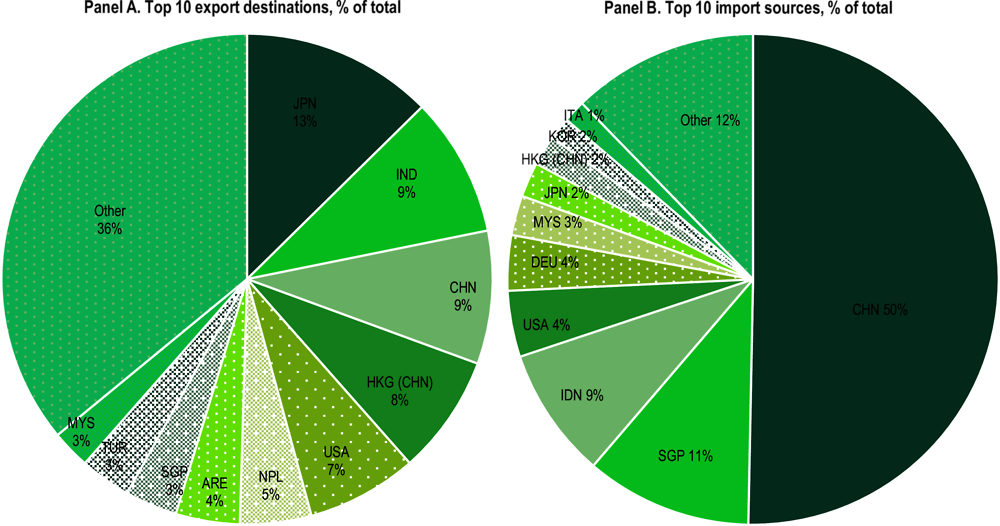

E&E production in Bangladesh is concentrated in lower-tech consumer products that are mostly sold on the domestic market. Home appliances – such as refrigerators and air conditioners – account for just over half (55%) of employment in the sector (Figure 4.1). A further 18% of the E&E workforce is absorbed in the manufacture of communication equipment – particularly mobile phones. By comparison, production in Viet Nam is relatively more diversified and more oriented towards higher technology goods. Communication equipment generated 31.7% of E&E employment in Viet Nam and electronic components an additional 26.4%.

Figure 4.1. Structure of E&E industry by employment, Bangladesh and Viet Nam, 2018

Note: ISIC descriptions have been shortened for visual purposes.

Source: Authors’ elaboration based on UNIDO (2020), INDSTAT 4 2023, ISIC Revision 4 (https://stat.unido.org/database).

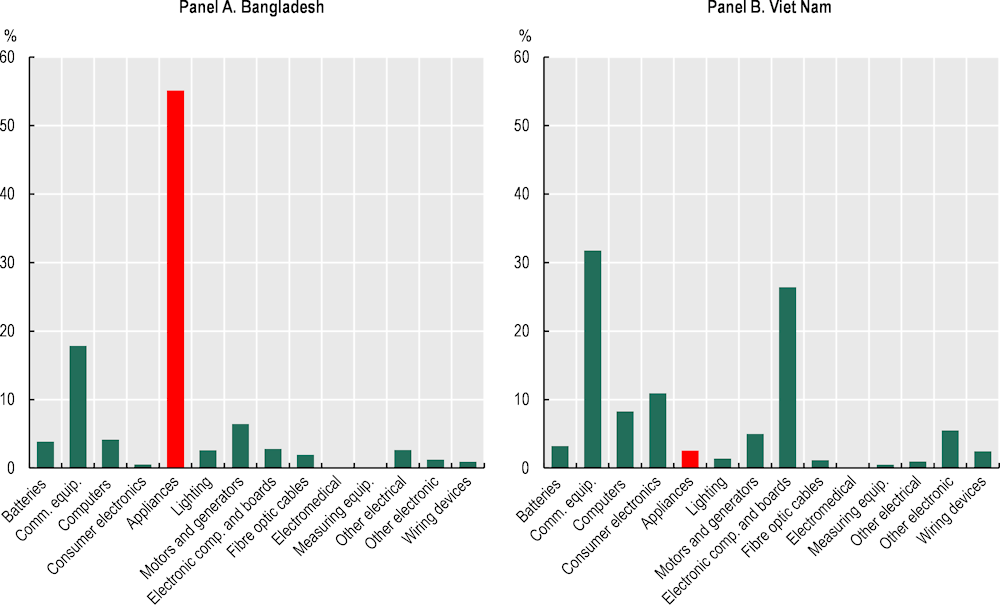

Figure 4.2. Input origins and output destination of the Bangladeshi E&E industry

Note: Nominal values in current USD.

Source: Authors’ elaboration based on ADB-MRIO (Input-Output tables), 2021.

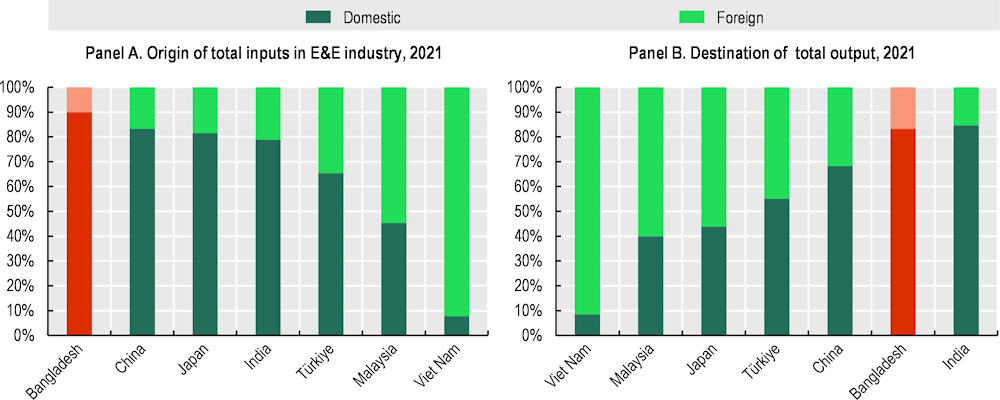

About 83% of Bangladesh’s E&E output is marketed locally (Figure 4.2). This is similar to other large markets in the region, such as India, where 85% of output is absorbed by the domestic market, and China (68%). By contrast, Southeast Asian countries serve mostly as FDI-led export hubs, with most output assembled and then shipped for further processing or for final consumption, including in Viet Nam where 91% of all production goes to export markets, Malaysia (60%) and the Philippines (54%). This difference in production and export models is also reflected in the sourcing of inputs to the industry. Bangladesh sources 89.9% of its total E&E inputs domestically, compared with, for example, 7.7% in Viet Nam and 45.3% in Malaysia. Most of the inputs into the E&E industry include metals (20%), transport and business services (18%), financial intermediation (7.5%) and utilities and construction (12.4%). As a result of the industry’s orientation, the country’s overall exports in E&E are small, amounting to about USD 164 million annually on average during 2019-2021, about 13 times lower than Bangladesh’s imports in this sector. As a share of the country’s total exports, the share of E&E is around 0.35%, a share that has been relatively stable in the last decade (CEPII, 2023[1]). These exports flow to various regional markets, including Japan (13%), India (9%), and China (9%), as well as some LDC markets, such as Nepal (5%) (Figure 4.3). Imported goods come mostly from China (50%), both for final consumption and also components to be assembled, Singapore (11%) and India (9%).

Figure 4.3. Bangladesh top 10 export destinations and import sources for E&E, 2019-2021

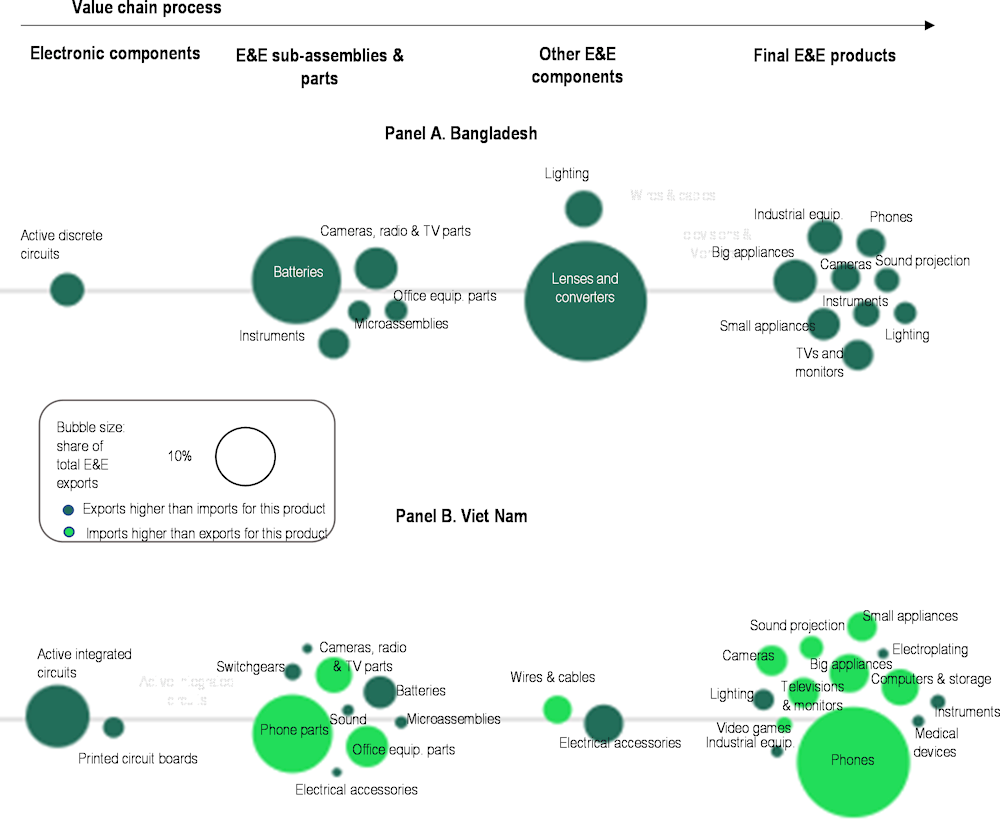

Bangladesh’s engagement with E&E value chains is currently small and fragmented. The country’s exports of E&E are concentrated in low-tech electrical parts and components, which account for about 75% of total E&E exports (Figure 4.4). In particular, the two largest categories of exports in Bangladesh are lenses and static converters (40%) and batteries (21%). Typically, the largest opportunities for value addition lie in the upstream parts of the value chain, in the design and manufacturing of integrated circuits and other sophisticated components that are skill and technology intensive. The export of final goods that reap the benefits of branding can also be sources of value addition, particularly if they embed locally made upstream components. In Bangladesh, the export of electronic components is small, and so are the exports of finished goods where Bangladeshi firms are active in the domestic market. Large domestic appliances (e.g. fridges) and small ones account for 5% and 3% of exports respectively, and phones for 2%. Other countries in Asia have tapped into value chains by exporting final goods based on the assembly of imported parts. For example, about 34% of Viet Nam’s exports are mobile phones, and a further 17% are phone parts. In addition, Viet Nam is a more diversified producer with 26 products accounting for more than 0.1% of its E&E exports, compared to 17 in Bangladesh. This indicates that Viet Nam has a relatively more mature ecosystem with higher expertise in a number of areas that can be attractive for investors.

Figure 4.4. E&E exports from Bangladesh and Viet Nam, by value chain segment, 2019-21

Note: Value segment definition based on a combination and aggregation of categories found in (Gereffi, Frederick and Bamber, 2019[2]), Costa Rica in the Electronics Global Value Chain: Opportunities for Upgrading, https://gvcc.duke.edu/wp-content/uploads/2013-08-20_Ch2_Medical_Devices.pdf and (Frederick and Gereffi, 2016[3]), The Philippines in the Electronics and Electrical Global Value Chain, https://gvcc.duke.edu/wpcontent/uploads/2016_Philippines_Electronics_Electrical_Global_Value_Chain.pdf. Only product categories with more than 0.1% of exports are included for visibility purposes.

Source: Authors’ elaboration based on ITC (2023), trademap, https://www.trademap.org/.

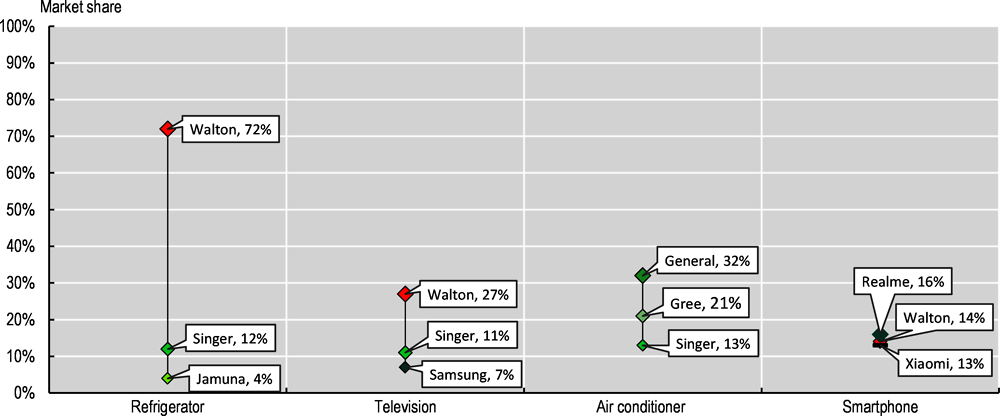

Bangladesh is now home to several homegrown brands. Several of these local firms were established in the 1970s and 1980s and originally started as importers, distributors and retailers of foreign brands, moving towards vertically integrating and manufacturing products in the past decade, such as Walton, Jamuna Electronics and Butterfly Group. Bangladesh’s growing consumer market is an important factor driving industry growth, as well as targeted policy incentives, including the use of tariff barriers for specific activities, such as mobile phones and home appliances. For example, 9% of households in Bangladesh have a computer, 41% have a refrigerator and 62% have a TV according to the \ and the Bangladesh Bureau of Statistics ( (Bangladesh Bureau of Statistics, 2022[4])). Local brands now have large shares in entry level categories, for example, in refrigerators, where Walton accounts for 72% of the local market and Jamuna for 4% (Figure 4.5). Local firms have used diverse strategies to grow their capabilities, relying on a mix of acquisitions and partnering with foreign partners for joint ventures. Nevertheless, firms in E&E in Bangladesh invest little in research and development (Box 4.1). For example, in 2018, Butterfly partnered with LG for making TVs. Joint-ventures are also common for foreign firms to enter and operate in the local market. Samsung, for example, partnered in 2017 with Transcom Group and Fair Electronics for manufacturing consumer electronics and Singer with Arcelik also for consumer electronics and appliances in 2022.

Bangladeshi firms are rapidly growing their capabilities in mobile phone production. In 2017 only 2% of all phones sold in the local market were assembled locally, but by 2022 the figure rose to 78%. As of fiscal year 2021-22, around 15 companies had been licensed to assemble and market mobiles in Bangladesh, including some of the country’s largest E&E conglomerates – such as Walton or Edison Industries, where the former has increased domestic manufacturing capabilities (e.g., including compressor manufacturing through foreign technology acquisition). Several foreign brands have also set up operations, such as Samsung, Nokia and China-based Transsion, Vivo and Oppo (BTRC 2022). Nevertheless, Bangladesh’s production remains small by global standards in this area. Viet Nam, for example, which assembles phones largely for export markets, manufactured about 233 million devices in 2021, compared to Bangladesh’s 35.5 million, with Samsung alone producing the bulk of it in its mega-factories (The Investor, 2013). Moreover, production has been hit recently by inflationary pressures, with monthly production of phones about 50% lower in the first quarter of 2023 compared to the beginning of 2022, a decrease that is sharper than the global decline in smartphone shipments (around 12% reportedly).

Figure 4.5. Domestic market shares of top 3 firms in Bangladesh by E&E product

Note: Market shares should be taken as indicative, as different sources may differ in their approach.

Source: Authors’ elaboration based on UCB Asset Research (2021) and Counterpoint Research Bangladesh Handset Tracker (2021).

Box 4.1. Homegrown electronics brands are developing quickly

Walton Hi-Tech Industries is a consumer electronics and appliances manufacturer that was established in 1977 in Gazipur, Bangladesh (then as Rezvi & Brothers). The company started with the import of appliances and progressed to setting up its own manufacturing facilities, first for consumer appliances in 2007, for televisions in 2013 and for mobile phones and for refrigerator compressors in 2017. Walton is engaging in improving its technological capabilities through its own R&D and other innovation activities (currently investing around 0.01% of revenue in R&D and with 6.4% of its workforce being engineers). It also licenses and acquires brands and technologies from abroad. In 2022, the group acquired the trademarks in selected countries and other intellectual property including patents, design and software patents of ACC, Zanussi Elettromeccanica (ZEM) and Verdichter (VOE). Walton also joined forces with a Korean design house, for instance, in 2022, to improve production. The company has started to export to foreign markets, although these are still small, accounting for about 3% of total sales.

Butterfly Group is an electronics and home appliances firm established in 1987. The firm started with retail-only operations and then moved in 1995 to license and distribute foreign brands. This started with Korea-based LG and later others, including China-based Hisense. Since 2012, the company moved to engage in manufacturing operations with the establishment of manufacturing facilities jointly with LG and Hisense, respectively, to produce and assemble LED TVs, refrigerators and air conditioners.

Source: Firms’ annual reports and webpages (About Walton (waltonbd.com), accessed 21 April 2023.

The country is nurturing local manufacturing capacities in electronics

The E&E industry has been among Bangladesh’s potential growth industries since the 1990s. The electrical and electronics industry, as well as small scale engineering, are among the industries which the country and its development partners have been supporting in the past few decades in Bangladesh. Some of the challenges linked to E&E industrial development identified in the 1980s persist, and include the limited engineering knowledge base in the country, as well as lack of institutional support and infrastructure for research, development and innovation.

This industry is considered critical to the development of the Information and Communication Technologies (ICT) industry and digital and mobile services, as—increasingly—the value added comes from software embedded in electrical and electronics hardware.

The responsibility of fostering E&E development is diffused among the different institutions that undertake industrial development in areas related to investment (e.g., BIDA, BHTPA), export promotion (e.g., Ministry of Commerce, financial incentives (e.g., Ministry of Finance) and quality and standards (e.g., Ministry of Industries). The telecommunications segment is also a key focus of the Bangladesh Telecommunication Regulatory Commission (BTRC), an agency established under the Ministry of Posts, Telecommunication and Information Technology, in 2002 with the goal of developing the telecommunications sector and ensuring reliable and affordable access to services, while increasing competitiveness in this area.

Bangladesh has progressively changed its policy support for this industry by continuing to support domestic manufacturing and at the same time making it gradually easier for foreign businesses to operate in the country and by attempting to bolster exports: Custom duties for E&E imports have been reduced, but total tax incidence (TTI), which considers para-tariffs and taxes, has been modified according to specific product lines on the basis of their domestic manufacturing potential. One example is that of mobile phones. Imported mobile handsets are subject to a 25% customs duty rate (up from 5% in 2016), 15% VAT, 5% advanced income tax (AIT), 3% regulatory duty (RD) and 5% advance tax (AT), bringing the total TTI to 53% in fiscal year 2022-23. By contrast, local factories pay between 1% and 10% duty on parts (which can have up to 10-25% custom duty rates normally) depending on whether they are bringing in parts as “completely knocked down” (CKD) or “semi-knocked down” (SKD). Moreover, no regulatory duty is assessed and their VAT is reduced to 5% (advance tax and advance income tax is still charged on parts imports). The TTI is also high for other priority products, such as air conditioners (212.2%) and refrigerators (104.7%).

Table 4.1. Average custom duty tariffs and total tax incidence (TTI) on E&E products, 2011-2023 (%)

|

|

|

2011-12 |

2015-16 |

2018-19 |

2020-21 |

2022-23 |

|---|---|---|---|---|---|---|

|

Custom duty |

Computers and peripheral equipment |

8.3 |

5.6 |

5.0 |

5.0 |

6.1 |

|

Communication equipment |

17.5 |

10.3 |

11.8 |

13.3 |

18.3 |

|

|

Consumer electronic equipment |

24.6 |

23.0 |

23.0 |

23.0 |

23.8 |

|

|

Electronic components |

11.9 |

9.8 |

10.7 |

10.7 |

11.6 |

|

|

Miscellaneous |

19.5 |

14.5 |

16.7 |

16.7 |

21.7 |

|

|

TTI |

Computers and peripheral equipment |

34.7 |

19.2 |

19.4 |

20.9 |

31.0 |

|

Communication equipment |

59.6 |

45.6 |

46.2 |

41.3 |

56.4 |

|

|

Consumer electronic equipment |

75.4 |

67.5 |

64.9 |

61.2 |

59.1 |

|

|

Electronic components |

92.1 |

40.4 |

42.1 |

39.6 |

79.0 |

|

|

Miscellaneous |

140.9 |

56.2 |

53.5 |

42.5 |

69.8 |

Note: TTI stands for ‘’Total Tax Incidence’’ and accounts for total taxes applied to imports: Custom Duties (CD), Regulatory Duties (RD), Supplementary Duties (SD), Value Added Tax (VAT), Advance Income Tax (AIT), and Advance Trade Tax (ATV). Classification is based on UNCTAD’s revised version of OECD’s ICT goods classification.

Source: Authors’ elaboration based on national tariffs tables from the National Board of Revenues (https://nbr.gov.bd).

Bangladesh regulates the E&E industry through import and production licensing. In line with Bangladesh’s Import Policy Order, which sets out the country’s regulatory environment for imports, while most products that enter Bangladesh do not need a specific license, the importers of radio transmitters and wireless equipment – including for instance mobile phones, tablets and IoT devices – need a no-objection certificate (NOC) called “Radio Equipment Importer and Vendor Enlistment” from BTRC. In addition, for handsets an additional certificate exists, which is issued upon submission of samples and relevant quality reports, as well as upon ensuring the pre-installation of Bangla keyboards. In 2017, BTRC also introduced guidelines for licensing mobile phone manufacturing and assembly facilities that produce for the domestic market. There are two levels of production license, Category A, which refers to those operations that import parts CKD (and have their own testing lab according to BTRC quality and standard specifications) and category B which refers to those that import SKD and have to rely on external testing labs. The license costs between USD 25 000 to USD 50 000 and needs to be renewed every three years. The guidelines also specify the types of testing capacities that must be present in a testing lab, such as for PCB/PCBA, displays and batteries.

Similar to firms operating in other sectors, E&E firms (in particular those that produce electronic components, computer hardware, mobile phones, LED TVs, transformers, consumer appliances, hardware, robotics and AI applications) are eligible for corporate income tax (CIT) incentives. E&E firms are eligible for reduced benefits of 5 to 10 years depending on location, similar to industries such as plastics, chemicals and furniture. For some products, specific CIT rates are set, such as 5% to 10% for air conditioners and freezers (normal rate 20%-30%). Some operations are entirely exempt from CIT, including those that produce parts for light engineering, hardware and robotics or income derived from software development, similar to those that produce Active Pharmaceutical Ingredients (APIs). All manufacturers, including E&E ones, are also eligible for additional incentives, such as reduced rates on import duties for capital machinery and duty exemptions for raw materials. Finally, Bangladesh has also set up various Export Processing Zones (EPZs) and hi-tech parks that offer their own incentives, which are not sector-specific and are more generous than for operations that target the domestic market (see Chapter 3). EPZs offer a 5-10 year tax holiday depending on their year of establishment (duration was reduced for firms established after 2012) and location, duty free imports of construction materials, capital machineries, raw materials and relaxed rules on foreign ownership among others.

The country is actively engaged in supporting E&E exports through grants for exporting firms and tax exemptions for income derived from exports. Similar to other sectors, E&E firms are eligible for cash subsidies, but these vary in size depending on the product. For instance, for accumulators (batteries) there is a subsidy of up to 15% of exported value, and for 10% in the case of photovoltaic modules, consumer electronics and kitchen appliances. By comparison, for APIs and vegetable, fruits and processed agricultural produce and handicrafts the rate is 20%. Additionally, all exporting firms are entitled to a 50% tax exemption of income derived from exports and no VAT imposition on the export goods. LDC graduation is not expected to have any tariff-related impact on E&E exports, because Bangladesh’s E&E exports to the EU will remain duty free under the GSP scheme, which theoretically will replace Everything but Arms (EBA). However, any cash incentives for export (in all industries, not only E&E) will need to be revisited after graduation to ensure that they comply with the Agreement on Subsidies and Countervailing measures. Article 27.2 and Annex VII (a) allows LDCs to use export subsidies, and Bangladesh will no longer have access to this kind of crutch after graduation.

Bangladesh’s policy approach to support the E&E industry is focused on nurturing the domestic industry, leveraging the potential of the domestic market. While the use of Export Processing Zones is similar to other Asian electronics hubs to generate employment and technological upgrade, the overall policy approach differs and retains an emphasis on import controls, as it has since independence. While Bangladesh will benefit from updating its policy approach considering its ambition to diversify production and exports, to attract more FDI and to augment the country’s preparedness to face the post-LDC graduation trading landscape, the country will benefit from updating in a strategic way its policy approach to allow nurturing a competitive industry. To do so, Bangladesh would benefit from strengthening its direct and indirect support to innovation and to define a targeted strategy to better structure its international partnerships (Figure 4.6).

Viet Nam, like other Southeast Asian hubs such as Malaysia and Singapore, has followed a model that has centred on attracting FDI for assembly, gradually developing local capabilities and making its ecosystem more dense and sophisticated (Table 4.2). By contrast, Bangladesh has focused on fostering domestic capabilities first, and is gradually looking to attract foreign investments and export, a trajectory mirroring that of China. Bangladesh and Viet Nam both use widespread financial incentives for industrial investments, but in Viet Nam these are geared towards supporting higher technology industries and applications, and more recently to encourage innovation with various tax exemptions, and rental reductions and non-repayable financial contributions for high-tech enterprises (in all sectors), start-ups, R&D centres and other similar technology-intensive activities. By contrast, Bangladesh supports innovation only through a tax exemption on royalties and technical assistance fees.

Table 4.2. Policy mix, E&E, Bangladesh and Viet Nam, 2023

|

|

Bangladesh |

Viet Nam |

||

|---|---|---|---|---|

|

|

Tools |

Prioritisation and conditionalities |

Tools |

Prioritisation and conditionalities |

|

Fostering industrial development |

||||

|

Financial incentives |

VAT exemptions |

Within E&E: freezers, compressors, air conditioners, motorcycles, spare parts |

VAT declaration facilitations |

Revenue of prioritised SI products for development may choose to declare value-added tax on a monthly, yearly, and quarterly basis. |

|

Reduced CIT 5-10% (normal rate 22.5-30%) |

Within E&E: freezers, compressors, air conditioners, motorcycles, spare parts |

Reduced CIT to 10% -17%, from 10 years to project lifetime |

Greenfield investment in economic zones; Investment projects in disadvantaged areas and certain activities (IT, automation tech, supporting products for high-tech) |

|

|

CIT exemptions for those starting operations 2021-2030 |

Within E&E: Parts of light engineering, agr. machineries, appliances and technical or vocational skills institutes. Hardware, robotics, nanotech. |

CIT exemptions for 2-4 years, and 50% reduction for up to 4-9 more years |

Economic zones; disadvantaged areas and certain activities (IT, automation tech, supporting products for high-tech); large scale; of social importance; high-tech enterprises |

|

|

Import duty exemptions for capital machinery and reduced rates for raw materials and molds |

For all manufacturers |

Import duty exemptions |

For goods imported to create fixed assets; For software products or scientific research and cannot be produced domestically |

|

|

Tariff barriers |

Higher tariffs on imported goods, escalating for final goods |

Differs according to product |

No tariffs on most IT and electronic imported goods |

|

|

Non-tariff trade barriers |

Vendor enlistments / non-objection certificates |

Differs according to product |

||

|

Loans and credits |

Investment credit at reduced rates |

Light engineering sector |

Short-term loans at reduced rates up to 70% - 75% of total investment |

SMEs producing SI products. Up to 75% for SIs using over 85% of raw materials from domestic sources to manufacture SI industrial products |

|

Borrowing at the loan interest rate from the investment credit source of the State |

Supporting industries on the encouraged list. |

|||

|

Land rental exemption for 3 years of construction time, and 15 years to whole life after |

Special sectors or areas; Investment projects in the economic zones; Investment projects to build infrastructure for economic zones. |

|||

|

Boosting exports |

||||

|

Non-repayable financial contr. |

Export cash incentive of 10%-15% |

For all exporters, but rates differ according to sector/product. Rates here for E&E |

Land rental exemption for 7 years |

Export processing enterprises |

|

Fiscal incentives |

50% CIT exemption for income derived from exports CIT exemptions |

For all exporters For those located in EPZs |

CIT exemption for 2 years and discount for 50% in the next 4 years |

Export processing enterprises |

|

Import duty exemptions |

For raw materials, supplies and components imported for production of export goods. For exports from non-tariff zones to foreign countries. |

|||

|

Import duty exemptions |

Construction materials, capital machinery, raw materials in EPZs |

|||

|

0% VAT on exports |

For all exporters |

0% VAT on exports |

All exports with few exceptions (e.g. unprocessed minerals / nat. resources |

|

|

Loans and credits |

Export credit at reduced rates |

Light engineering sector |

||

|

Fostering innovation |

||||

|

Fiscal incentives |

Tax exemption on royalties and technical assistance fees |

Land rental incentives |

For high-tech enterprises, STI firms/ org. TTOs, start-ups etc. |

|

|

Exemptions and reduced CIT rates |

For income from the hi-tech sector, for scientific research and technology development contracts; income from products produced by first-time applied technology in Viet Nam and by technology in pilot period. |

|||

|

Import duty exemptions |

For specialised scientific documents, used for scientific research &, technology development. Equipment needed for R&D, high-tech projects, incubation etc. |

|||

|

Non-repayable financial contr. |

Funding up to 50% of investment cost and land (given or leased) by the state |

For building R&D facilities |

||

Notes: SI = Supporting industries; RDI = Research, development and innovation.

Source: Authors’ elaboration based on official information from Bangladesh and Viet Nam.

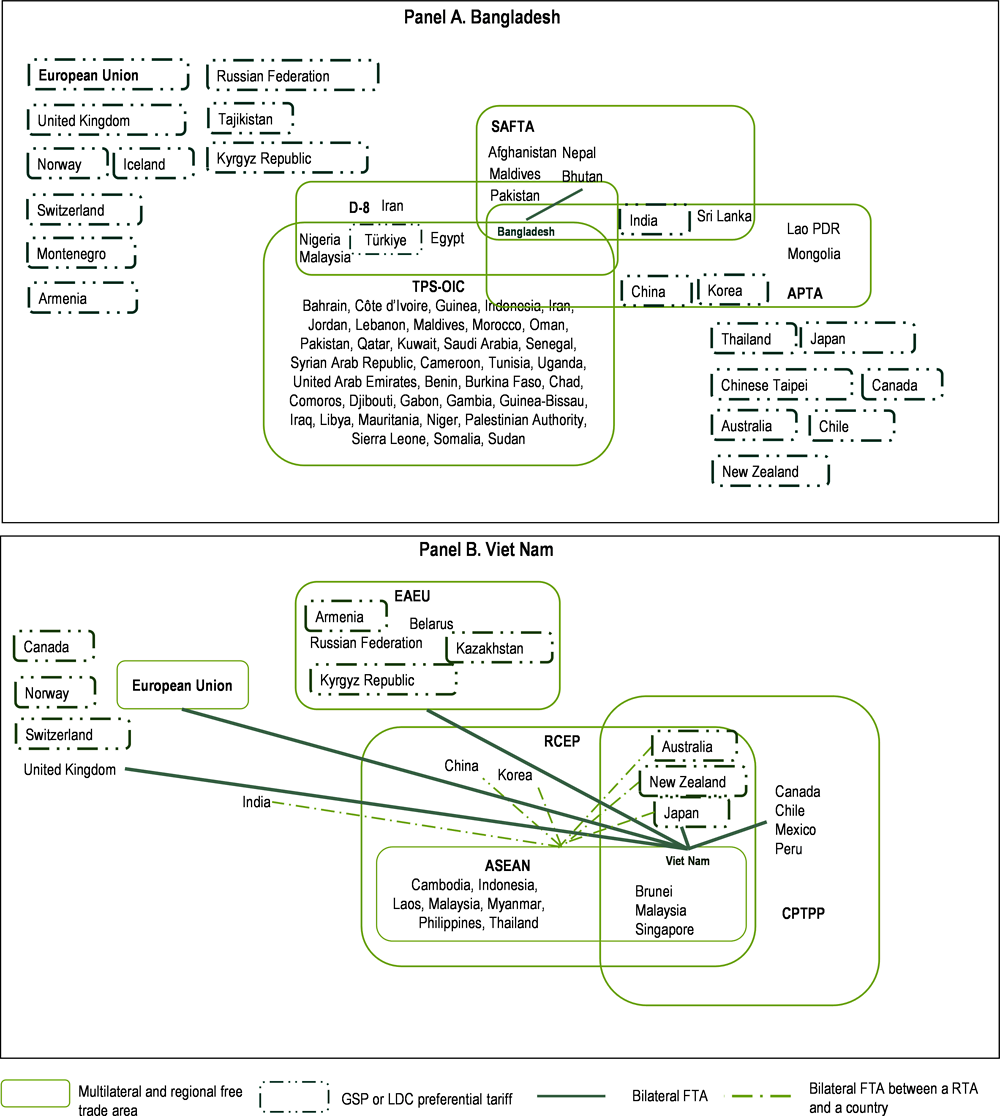

Bangladesh could benefit more from trade (Figure 4.7). Diversifying its export basket and win-win international partnerships are intertwined goals for Bangladesh. The country has not yet tapped into regional trade networks sufficiently, and regional value chains are key in sustaining the competitiveness of the E&E industry in the Asian region. Regional and bilateral free trade agreements (FTAs) have been a driving force for the expansion of the E&E industry in Asia, becoming denser over time as industrial capabilities strengthened in participating countries, and to encourage the relocation of investment and complex trade arrangements that often underpin E&E production. Bangladesh has one bilateral Preferential Trade Agreement (PTA), with Bhutan.

Bangladesh needs to develop a trade and investment network that matches its ambitions of achieving high-income status by 2041 and that habilitates production and trade diversification rooted in innovation, and not purely on competitive labour costs. Viet Nam has a different story and is faced with different challenges and pursuing a similar strategy for Bangladesh might not be the most effective option. For Viet Nam, embeddedness into regional trade areas has been a cornerstone of national development. Viet Nam today enjoys a structured and organised international trade network thanks to deep regional integration. Viet Nam is one of the founding members of ASEAN (the Association for Southeast Asian Nations), and through its membership to ASEAN has benefitted from bilateral FTAs with China, India, Japan, Korea, Australia and New Zealand, all of which – with the exception of India - were consolidated into the recent RCEP (Regional Comprehensive Economic Partnership). It also has bilateral FTAs with key partners such as the EU, the US and Japan. Bangladesh has trade agreements with some 40 countries (WTO, 2019[5]), but only one is an FTA. Bangladesh, with the exception of SAFTA, is not a member of any of the major Asian regional agreements that have emerged in the past few decades. It is a member of the Asia Pacific Trade Agreement (APTA) (since 1975) and the South Asia Free Trade Area (SAFTA) (since 2006). It is also a member of the TPS-OIC (Trade Preferential System among the Member States of the Organization of Islamic Cooperation) and the D8 (Group of Eight Developing Countries). As an LDC, it benefits from several GSP schemes, such as from Canada, the European Union, Australia and Japan among others, and preferential LDC tariffs from China, India, Korea and Thailand. In particular under SAFTA, India provides larger tariff reductions for the four LDC members (Afghanistan, Bangladesh, Bhutan, and Nepal).

What Bangladesh can learn from Viet Nam is learning how to negotiate and focus on pursuing closer linkages with regional partners to attract investments with an interest in regional production and trade networks. It could draw inspiration from its neighbour to better navigate an increasingly geopolitical trade landscape by sharing spaces for common dialogue and co-creation of trade and investment rules. This will necessitate a change in mindset from short-term gains based on market access and cost competitiveness, to foster innovation and strategic use of trade and investment agreements to nurture a competitive, open and transparent local and outward-oriented business environment.

Figure 4.6. Preferential trade agreements with Bangladesh and Viet Nam as parties, 2023

Note: ASEAN: Association of Southeast Asian Nations; APTA: Asia-Pacific Trade Agreement; CPTPP: Comprehensive and Progressive Agreement for Trans-Pacific Partnership; D8: Group of Eight Developing Countries; EAEU: Eurasian Economic Union; RCEP: Regional Comprehensive Economic Partnership; SAFTA: South Asian Free Trade Area; TPS-OIC: Trade Preferential System among the Member States of the Organization of Islamic Cooperation. D8 and TPS-OIC have not been notified to the WTO.

Source: Authors’ elaboration based on WTO (2023), Preferential trade agreements (database), http://ptadb.wto.org/; WTO (2023), Regional trade agreements (database), http://rtais.wto.org; and Asian Development Bank (2023), Free trade agreements (database), https://aric.adb.org/fta/.

International partnerships and innovation will underpin the future of electronics

The global E&E industry is undergoing a significant transformation due to a combination of shifting geopolitical landscapes, new technological imperatives, and new consumer demands. Two main trends stand out.

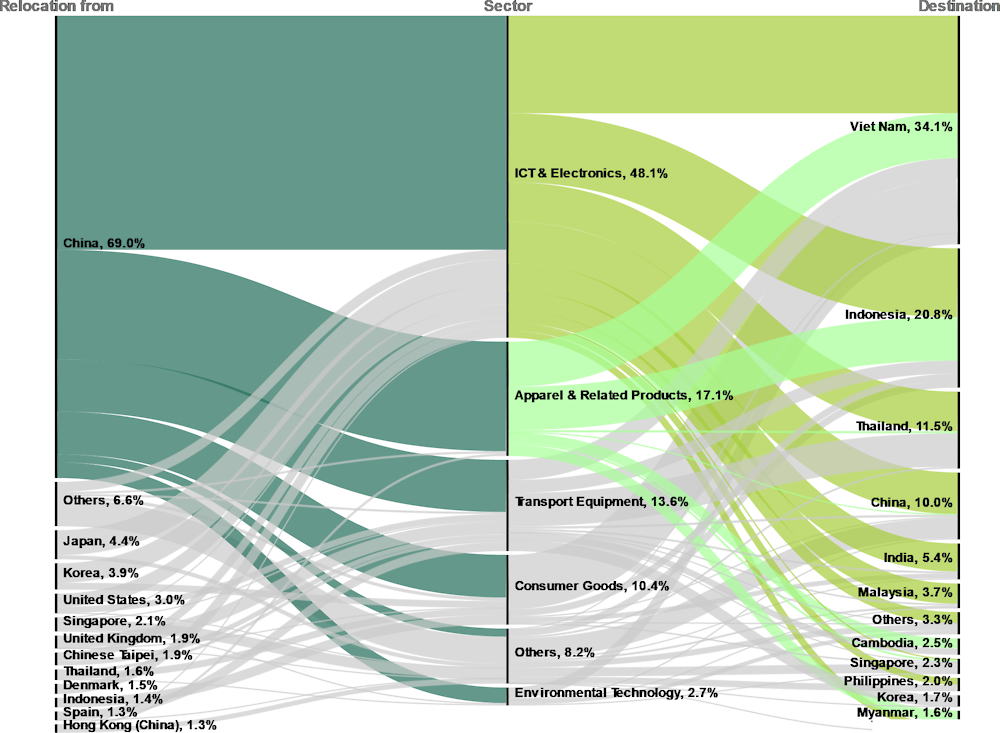

First, the geography centre of the industry has shifted in recent years, in an effort to deal with rising production costs and the need to balance cost-effectiveness with a more diverse, secure and reliable supply chain base, particularly after the supply chain shocks experienced during the COVID-19 pandemic. The shift has also come as a result of mounting trade and geopolitical tensions in the industry and in the Indo-Pacific region. A third of global relocations flow to Asia. Withing the region 69.7% originate from China. The top sector for relocation in Asia is electronics, which accounts for 46%. In turn, the main destinations for relocations in Asia are Viet Nam (36.4% of total) and Indonesia (18.7%). The growing search for new production bases could mean opportunities for newcomers to attract shifting investments (Figure 4.7).

Second, the industry has been witnessing a gradual blurring of the barrier between devices and services, which is increasing demand for new products and components. E&E products are becoming more than just physical goods (e.g. streaming is turning mobile phones into entertainment devices), and with smart components used in other objects (e.g. cars now use a growing amount of digital content). On the one hand, this is increasing demand for new types of components, such as sensors. On the other hand, it is also opening up opportunities for new firms to enter the industry leveraging on their strengths as digital service providers.

Figure 4.7. Global relocations in Asia by source, sector and final destination, 2013-20

Note: The sector classification follows the North American Industry Classification System (NAICS) 2007.

Source: Authors’ elaboration based on Financial Times, FDI Market database, 2021, https://www.fdimarkets.com/.

Bangladesh has a unique window of opportunity to progress from assembler for the local market to leveraging its local E&E players and transforming them into incubators for innovation in the digital economy. The country also has the potential for this journey to leverage more foreign investment and the regional market. Bangladesh can draw on several strengths in this respect: a large and growing consumer market of 160 million consumers, a strategic location in South Asia, linking India, China, and ASEAN countries, and a large ICT industry (see Chapter 2), which could create synergies with its existing manufacturing ecosystem. To achieve this transformation, Bangladesh would benefit from:

Developing a more diversified and updated policy toolkit. Bangladesh’s policy mix for fostering production and upgrading in E&E focuses mostly on protecting domestic firms in selected areas and fostering exports through cash subsidies. However, the structure of instruments implemented has led to a two-track regime, rather than helping firms improve their industrial capabilities and innovate. A more strategic approach to the industry with a ‘whole of value chain’ approach would help to bridge these gaps and amplify opportunities for learning, while addressing the risks producers face in investing in upgrading. First, developing instruments to enable local firms to engage in innovation is crucial, especially in relation to energy efficient appliances and devices. Successful economies usually implement a mix of approaches, combining tax exemptions with grants and services This is the case of Malaysia, for instance, which combines fiscal incentives with R&D and technology investment grants (Box 4.2). Second, export development should also be complemented with instruments that address key challenges firms face in export-readiness, such as obtaining market information, engaging with foreign suppliers and barriers, addressing skills shortages, and improving quality production and branding. Third, the experience of successful exporters has shown that FDI can have a catalytic role in infusing local ecosystems with talent and knowledge, provided that instruments are in place that encourage linkages with local manufacturers.

Investing in the resources and institutions needed for Industry 4.0 and automation. As production becomes smarter, and the E&E industry becomes more digital-intensive, Bangladesh will benefit from investing in bridging gaps for adopting and creating digital technologies. Engineering skills, for instance, are crucial. In Bangladesh, about 11% of tertiary education graduates come from Science, Technology, Engineering and Mathematics (STEM), half to one-third the proportion in countries that are creating digital technologies. In India, the proportion is 34%, in Korea 30% and in Germany 20% (UNESCO data). Targeted institutions are also needed to enable the diffusion of new technologies, particularly by SMEs. For instance, Italy has established Digital Innovation Hubs (DIHs) and Industry 4.0 Competence Centres (I4.0), which aim at increasing awareness of new technologies, providing training and fostering partnerships with the private sector and academia (OECD et al., 2021[6]). The standards for the digital economy are still being shaped. As Industry 4.0 relies on the confluence and integration of a number of different scientific and technical fields, it is important to invest in improving the quality of standardisation, certification and metrology systems while encouraging closer collaboration across fields in this area. Bangladesh should also ensure it has a voice in shaping the standards of tomorrow by participating in relevant international fora and dialogue spaces.

Enhancing collaboration with players across the value chain. Bangladesh could harness synergies between players involved in different parts of the value chain to stimulate innovation, including in ICT. There is also potential to enhance linkages between start-ups and E&E firms. In Bangladesh, electronics is among the top five sectors for start-ups (6% of total), which is unique among hubs in South and Southeast Asia. On the one hand, start-ups could tap into manufacturers to be able to prototype their products fast and cheaply. On the other hand, E&E firms could look to start-ups to strengthen their capacity to use digital technologies in manufacturing and in their product offerings. For example, Bangladesh could think of designing tools that encourage start-ups and manufacturers to work together on solutions, by encouraging open innovation and corporate venture capital, and the location of start-ups near manufacturing zones and hubs. Linking Bangladesh’s players to more advanced hubs in the region could also serve to increase financing for common solutions, and opportunities for talent. Membership of regional agreements such as RCEP could help connect E&E firms with others in the region.

Improving infrastructure and logistics. A robust infrastructure is crucial for the E&E industry, and Bangladesh must prioritise improvements in transportation, energy, and telecommunications to support the growth and expansion of this sector. For instance, ensuring a stable, reliable, and broadly accessible supply of electricity is needed, particularly for more high-tech operations, but this remains a challenge in Bangladesh. Additionally, good transport infrastructure (including air cargo) is essential for reducing delivery times in an industry that is fast-paced, especially in consumer electronics, which has a short design cycle and shelf life. Recent transport infrastructure developments in Bangladesh hold promise to improve the efficiency of logistics, including the Matarbari deep sea port, expected to come into operation in 2026, the first such port to be constructed in Bangladesh. Reducing red tape is also essential in this respect. It takes 216 hours to import and 168 to export (border compliance) in Bangladesh, compared to 56 and 55 respectively in Viet Nam, 33 and 10 in Singapore, to mention just a few examples.

Box 4.2. Updating the policy toolkit to encourage learning: Examples from Southeast Asia in the E&E industry

In Southeast Asia, the E&E industry took root in the 1960s and thereafter accelerated as production was shifted away from advanced economies and more routine, labour-intensive activities were offshored or relocated to low-cost manufacturing hubs. In the last decade, countries have been updating their policy mix to better connect these FDI operations to their local economies and to encourage progression from simple assembly to industrial upgrading and innovation.

Boosting the role of supporting industries in Viet Nam

Viet Nam has been incentivising the creation of industries since the mid-2000s to complement assembly operations and reap higher local value addition. Currently Viet Nam has a dedicated strategy for promoting supporting industries from 2020-30 in electronics, mechanical engineering, hi-tech and automotive industries, with the aim of meeting more than 70% of essential needs for production and consumption domestically. To do so, the government is providing a corporate income tax (CIT) incentive of 10% for 15 years and a 50% reduction in CIT for nine years after, favourable interest rates (up to 5% difference in interest rates can subsidised by the state), investment credit and exemption from rents charged for land. Funding for training activities is also available. The government is also facilitating business connections between firms in Viet Nam and foreign investors and planning to build and operate technical centres to support technology transfer and development.

Fostering linkages across the value chain in Singapore

Singapore introduced the Partnerships for Capability Transformation (PACT) scheme in 2010 to encourage linkages between original equipment manufacturers (OEMs) and their suppliers. The scheme allows OEM suppliers to defray up to 50% of costs incurred in bringing their procedures into compliance with the OEM’s requirements. The scheme also offers wage support for OEMs (up to 70%) to hire and train managers that handle the process of identifying and managing procurement. It also covers productivity improvements and knowledge transfer, as well as co-innovation activities, such as joint product development between OEMs and suppliers, and joint business development. In 2018, PACT was extended to cover start-ups, instead of partnerships between large firms and SMEs only.

Diversifying tools to foster industrial upgrading in Malaysia

Malaysia has over time diversified the tools used to progressively encourage more sophisticated activities and update their conditions. On the one hand, the various fiscal incentives that have been introduced since the late 1950s have become stricter over time, and are now allocated only for designated high-tech activities. For example, before 2012 Pioneer Status was granted to firms operating along the entire E&E value chain. After 2012, this was restricted to semiconductor design and fabrication, advanced displays, equipment for digital convergence and other advanced components and equipment. Moreover, the incentive is higher for high-technology firms, which are defined as those with at least 7% of their workforce being science and technology (S&T) graduates and at least 1% of gross sales devoted to R&D. On the other hand, more tools have been added. The Domestic Investment Strategic Fund, launched in 2012 with a size of RM 1 billion (approx. USD 324 million), provides 1:1 matching grants to firms engaging in R&D, training, modernisation or upgrading of facilities, licencing or purchasing of new/high technologies, and obtaining international standards and certifications.

Source: OECD (2021[6]), Production Transformation Policy Review of Egypt: Embracing Change, Achieving Prosperity, https://doi.org/10.1787/302fec4b-en and official information from Viet Nam and Singapore official sources.

Bangladesh has been nurturing domestic pharmaceutical manufacturing since the 1980s

Domestic policies and international policy space have been pivotal in enabling local manufacturing

The rise of Bangladesh's pharmaceutical industry dates to the early industrialisation efforts of the 1980s. After independence in 1971, Bangladesh confronted substantial health and nutrition challenges. Essential medicines availability and affordability was a pressing issue, as before independence, most essential pharmaceutical needs were met with supplies coming from West Pakistan. A Drug Controller operating in the Central Government of Pakistan oversaw and regulated medicines sales and provision in the territory. At that time, estimates indicate that about eight multinational firms accounted for approximately 75% of the domestic pharmaceutical supply (Islam et al., 2022[7]; Murshid and Haque, 2019[8]).

In 1982, the government approved the first National Drug Policy and issued the Drug Control Ordinance, the National Drug Policy stated the government’s priority of ensuring availability and affordability of essential drugs to the population and outlined a vision for promoting domestic manufacturing capabilities. The Policy and Ordinance responded to a two-pronged objective. On the one hand, it was meant to ensure the provision of affordable drugs to a population which was among the world’s poorest by reducing dependency on an handful of multinationals. Indeed, at the time they were selling or already manufacturing in the country and, on the other hand, they were part of an overall national industrialisation strategy reliant on supporting local manufacturing and nurturing a diversified industrial base.

The Ordinance redefined the drugs market in Bangladesh with immediate effect, leaving to the government the right to define prices for drugs and raw materials for drugs manufacturing and it established a detailed list of which drugs could be manufactured and sold in the country with a detailed phasing out with different timeframes for the stocks that were already available in the country. It restricted and regulated the imports of raw materials for drugs manufacturing and it defined the conditions for manufacturing under licensing agreement in Bangladesh. It stated that any manufacturer in Bangladesh can be allowed to manufacture any drug under any written contract with any manufacturing plant in Bangladesh and that any foreign manufacturer may be allowed to manufacture any drug under licensing agreement with any manufacturer in Bangladesh if it is registered under the same brand name in a given list of countries (Legislative and Parliamentary Affairs Division, 1982[9]).

The 1982 Ordinance established the creation of the Drug Control Committee. This committee continues to operate today, under the Directorate General of Drug Administration (DGDA), together with several other committees, including the Standing Committee for procurement and import of raw materials and finished drugs and the Pricing Committee. The Drug Control Committee decides which medicine, of any type, can be manufactured, sold, imported, distributed, exhibited or stocked in the country. Upon recommendation of the Committee the licensing authority registers the drugs and issues a license which, unless suspended earlier, is valid for a period of five years.

In 1992, regulatory efforts resulted in major achievements. In a decade, the availability of essential medicines increased from 20% to 90%. Through price controls, the government managed to keep the price of essential drugs to 8% while overall consumer prices rose 170% in the same time frame (i.e. between 1982 and 1992) (Srinivasan, 1996[10]). Bangladesh also advanced on safety with the share of substandard drugs falling from 36% in 1970 to a mere 2% in 2002 (Srinivasan, 1996[10]).

Bangladesh has continued to nurture domestic pharmaceuticals manufacturing by updating its policies and institutions. In 1998, the government issued an import restriction, in place still today, on finished drugs that are produced in sufficient quantity by more than two domestic firms. While attaining quite well its healthcare objective, these policies also led to the building on an emergent industrial sector. In fact, the pharmaceuticals industrial sector started to consolidate and increased their role in government-business dialogues. The National Drug Policy of 1982 has been updated twice so far: in 2005 and in 2016. These policies maintain their focus on availability and affordability of essential drugs for the domestic market but also gradually allow more margin of manoeuvre to the private sector, by reducing the number of drugs considered essential and by reducing caps on prices for essential medicines. These changes, albeit pro-market, led to price increases and raised affordability issues (Murshid and Haque, 2019[8]).

In terms of institutional changes, since 2010, the DGDA acts as the national Drug Regulatory Authority and as the Licensing Authority. One of the chief missions of the DGDA is to ensure availability, accessibility and affordability and rational use of essential medicines in the country and to develop a regulatory framework that support international standards compliance, research and innovation. The DGDA implements all drug regulations and regulates all activities linked to import, procurement of raw materials and packaging, production and import of finished drugs, exports and prices for all drugs, including Ayurvedic, Unani, Herbal and Homoeopathic medicines. It also issues licenses to manufacture, store, sell, import and export all drugs and medicines, upon recommendation of the Drug Control Committee. The DGDA operates in all national territory, with 58 district offices, which also acts as inspectors in the territory.

Bangladesh's domestic pharmaceutical production primarily focuses on the manufacture of generic medicines. Among the roughly 5 600 medicine brands produced within the country, about 80% consist of domestically produced branded generics off-patent. Additionally, approximately 15% of the medicines comprise generic versions of patented drugs. Bangladesh, a WTO LDC member benefits from a targeted waiver and specific provisions under the Trade-Related Aspects of Intellectual Property Rights (TRIPS) agreement. These include the possibility to exclude patentability of given drugs and to manufacture generic variants of patented medicines. Bangladesh also benefits from the TRIPS amendments from the 2001 Doha Declaration on Public Health, which permits, for reasons of public health and under precise circumstances, parallel imports, pre-competitive research and compulsory licensing (UNDESA, 2020[11]). Final drug prices are affected by intellectual property rights, as for example the cost of Sofosbuvir in Bangladesh is USD 6.0 (compared to USD 1 000 abroad) and Rosuvastatin is USD 0.25 (contrasting with USD 7.25) (Islam et al., 2022[7]). The country also has also issued licenses to 206 Ayurvedic, 285 Unani, 38 Herbal and 71 Homeopathic manufacturing companies, which are all under the regulatory and licensing power of the DGDA.

Bangladesh pharmaceutical industry albeit growing, remains at incipient stages

Since the establishment of the Drug Control Ordinance in 1982, and thanks to the policy space granted by the WTO to LDCs, including TRIPS, Bangladesh has managed to develop domestic manufacturing capacities in pharmaceuticals and now meets 98% of its essential pharmaceutical needs with domestic production. However, the country remains dependent on imports of more sophisticated medicines, including vaccines, which account for 47% of Bangladesh’s pharmaceutical imports (Authors’ calculations based on ITC 2023).

While Bangladesh's presence in the global pharmaceutical manufacturing arena remains relatively modest, the industry is relevant and growing in the country. The number of firms active in the sector has increased over time. According to data from the DGDA, currently in Bangladesh there are 301 drug manufacturing firms. These firms focus on manufacturing generics, branded generics and on performing contract manufacturing. Local players now dominate the market. The top ten firms, all of Bangladeshi ownership, have 70% of the market share (Islam et al., 2022[7]; Wouters, McKee and Luyten, 2020[12]). Foreign Direct Investment (FDI) plays a minimal role. In Bangladesh, FDI stocks and flows are quite small and this is particularly true in the pharmaceutical sector. As of 2022, the country's FDI stock stood at USD 21 billion and the pharmaceutical sector accounted for a only 1.4% of the country's total FDI stock.

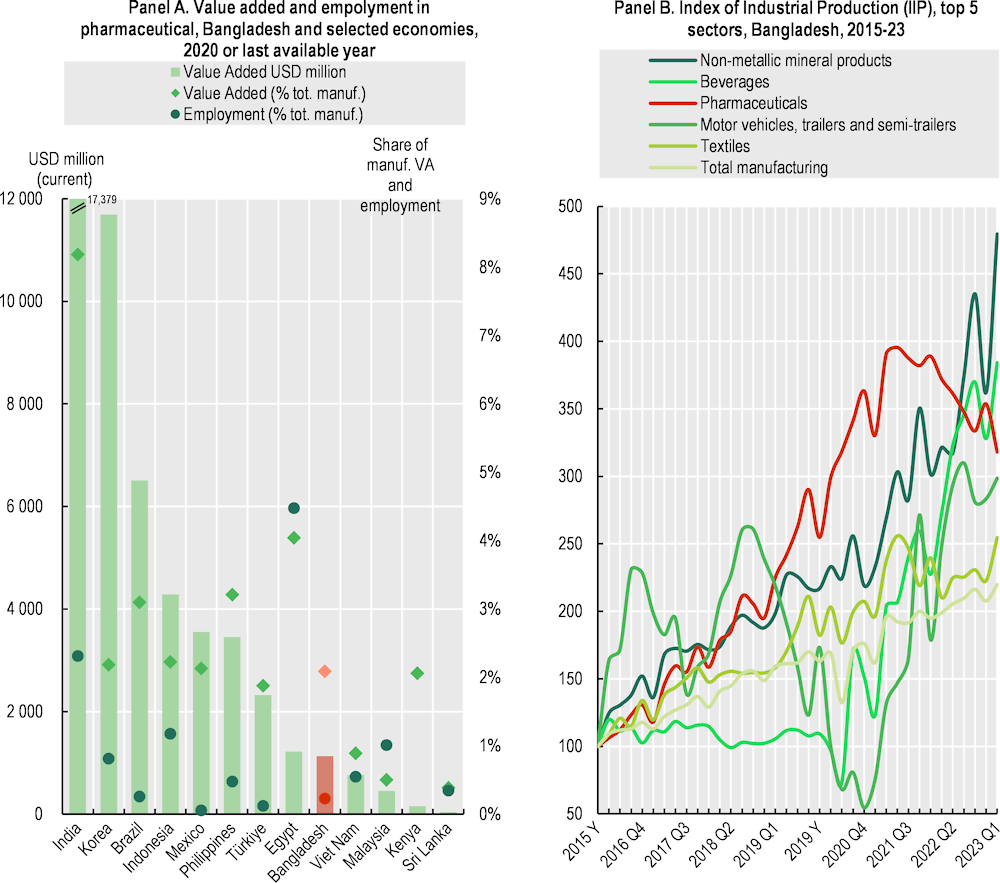

In Bangladesh, total value added for pharmaceuticals is USD 1.5 billion and accounts for 0.2% of the worldwide aggregate, comparable to countries like Egypt, Thailand, and Viet Nam, but trailing behind India (4%). In 2020, the industry accounted for 2% of the country's total manufacturing value added (MVA) and contributing 0.4% to its GDP (Figure 4.8, Panel A). Despite constituting only 0.5% of the manufacturing workforce, pharmaceutical companies offer salaries 2.6 times higher than the average manufacturing job, underscoring the sector's significant economic impact (Bangladesh Bureau of Statistics, 2020[13]). This sector is also one of the fastest-growing industries in the country. From 2015 to 2023, pharmaceuticals have grown, although its growth has been considerably shaped by the COVID-19 pandemic, including the production and manufacturing of coronavirus-related products such as Remdesivir, Favipiravir, Ivermectin, Isopropyl Alcohol, and Hydroxychloroquine. A handful of local companies also engage in contract manufacturing, often targeting foreign markets, including the United States (Rahman et al., 2020[14]).

Figure 4.8. The Bangladesh pharmaceutical industry accounts for 2% of national manufacturing

Note: Panel A. Bangladesh 2018. Panel B. Index of Industrial Production (IIP) measures the growth of the volume of industrial production in real terms, free from price fluctuations. Given the temporal nature of estimates, output growth provides the best approximation of value added growth, assuming that the input-output relationship is relatively stable during the observation period.

Source: Authors’ elaboration based on UNIDO INDSTAT 4, https://stat.unido.org/ and 2019 Bangladesh Survey of Manufacturing Industries, https://www.bbs.gov.bd/site/page/175a795a-df34-4118-9ed6-1ec769fa03de/Industrial-Statistics.

Despite the progresses, Bangladesh has not yet developed a full-fledged pharmaceutical industry:

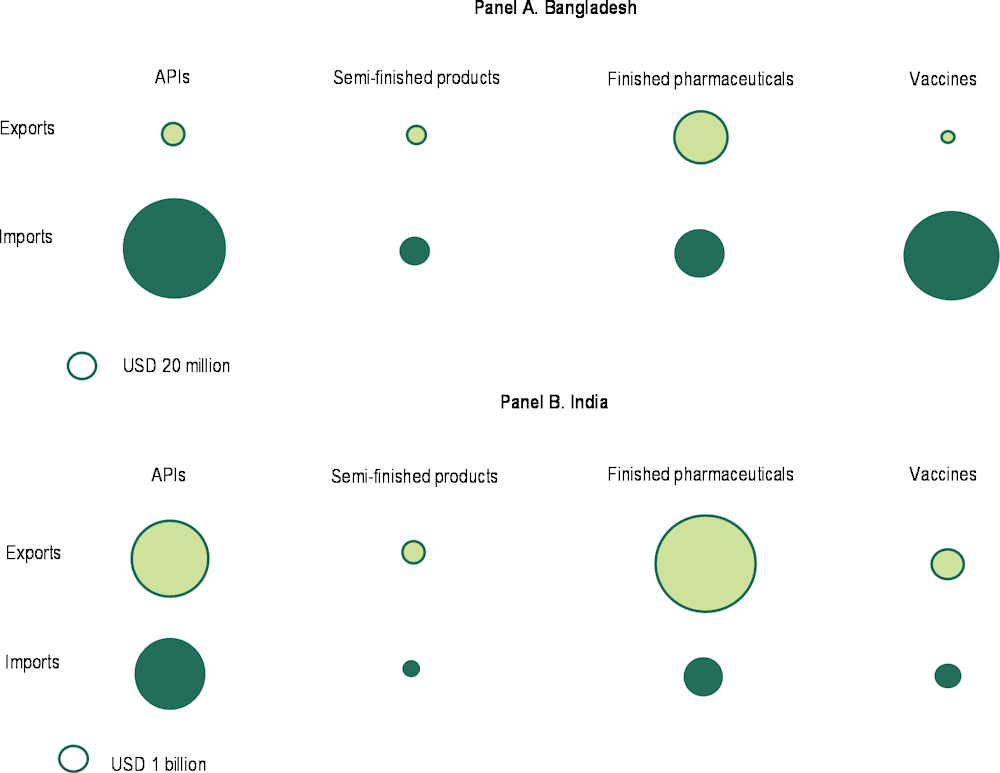

Pharma in Bangladesh remains domestic oriented and import dependent. It almost entirely relies on imports of sophisticated raw materials including active pharmaceutical ingredients (API) which nowadays account for 47% of all pharmaceutical imports. In fact, according to estimates, 90% of Bangladesh API demand is met by imports and about 95% of the raw materials, worth about USD 844.5 million were imported in FY 2018-19 (Rahman et al., 2020[14]). The import-dependency of the sector makes it susceptible to current macro-economic challenges, including inflation and growing import costs.

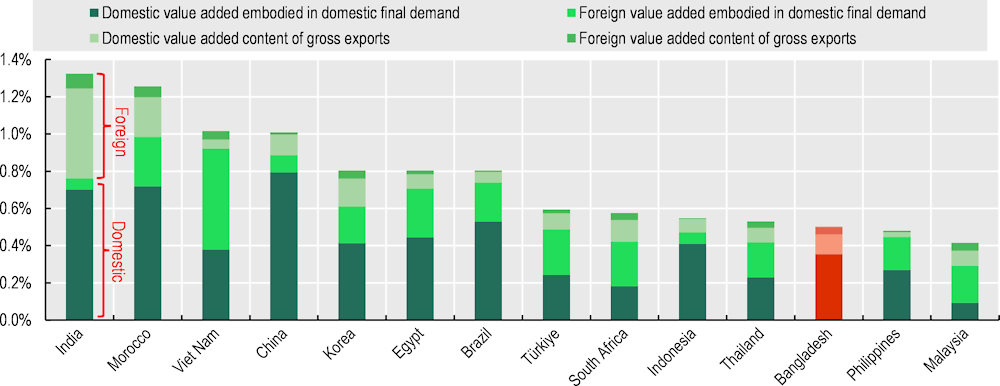

Bangladesh’s trade structure reflects a relatively simple pharmaceuticals industry. When compared with India, Bangladesh displays a simpler organisation. India, albeit also specialised in generics, has a bigger, more diversified, export-oriented and R&D intense pharma industry linked to national industrial and healthcare services. India is also a net pharma exporter, with most exports concentrated in finished pharmaceuticals (62%) and APIs (33%). India is also the largest exporter of APIs to Bangladesh (39% of total during 2019-2021), followed by China (38%) and Singapore (4%) (Figure 4.9, Panel B). Moreover, when we look at Bangladesh’s domestic final consumption of pharmaceutical products 25% of the value added originates from abroad. In India, where upstream industrial capacities are higher, this share is 8% (Figure 4.10).

Figure 4.9. Trade in pharmaceuticals, by category and flow, Bangladesh and India, 2019-2021

Note: Different scales apply to each panel to increase legibility. APIs: Active pharmaceutical ingredients. Data for Bangladesh is mirrored. The categories are based on European Centre for International Political Economy (2020), Key trade data points on the EU-27 pharmaceutical supply chain, https://www.efpia.eu/media/554792/key-trade-data-points-on-the-eu27-pharmaceutical-supply-chain.pdf.

Source: Authors’ elaboration based on ITC (2023), trademap (database), https://www.trademap.org.

Figure 4.10. Foreign value added accounts for 25% of the domestic demand in Bangladesh

Source: Authors’ elaboration based on OECD Trade in Value Added Database (TiVA), 2023, http://oe.cd/tiva.

Bangladesh is at an incipient phase in developing manufacturing capacities in more sophisticated pharmaceutical areas, including vaccines. Despite the progress made during the COVID-19 pandemic, overall vaccines account for 42% of Bangladesh’s pharmaceutical imports (Figure 4.9, Panel A).

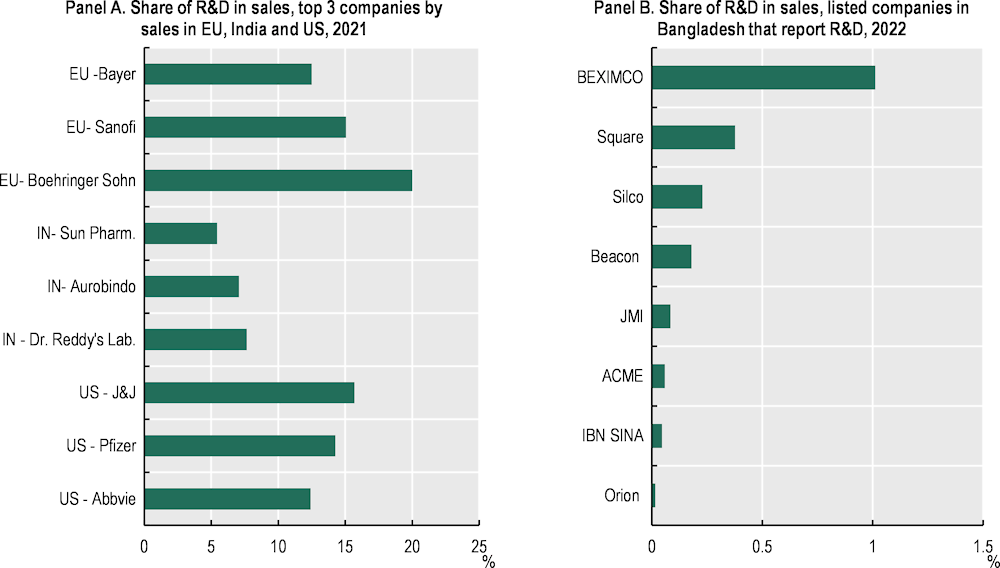

Pharma in Bangladesh invests little in R&D. Among local pharma conglomerates, Beximco and Square Pharmaceuticals stand out as the top two R&D investing firms in pharma. In 2022, they allocated BDT 350 million (USD 3.5 million) and BDT 210 million (USD 2.1 million) to R&D, equivalent to 1% and 0.4% of their business turnover, respectively (Figure 4.11). While these figures are relatively higher than R&D investments made by other manufacturing firms in Bangladesh, they remain considerably lower than the average investment of 15.7% made by leading pharma companies worldwide (European Commission, 2022[15]).

Figure 4.11. Bangladesh’s pharmaceutical firms invest little in R&D

Note: Panel A is calculated based on net sales which is defined as sales excluding sales taxes and shares of sales of joint ventures and associates. Panel B is calculated based on gross revenue/sales.

Source: Source: Authors’ elaboration based on EU (2022), The 2022 EU Industrial R&D Investment Scoreboard, https://iri.jrc.ec.europa.eu/scoreboard/2022-eu-industrial-rd-investment-scoreboard, and Marketwatch (2023), stock financial statistics (database), https://www.marketwatch.com/investing.

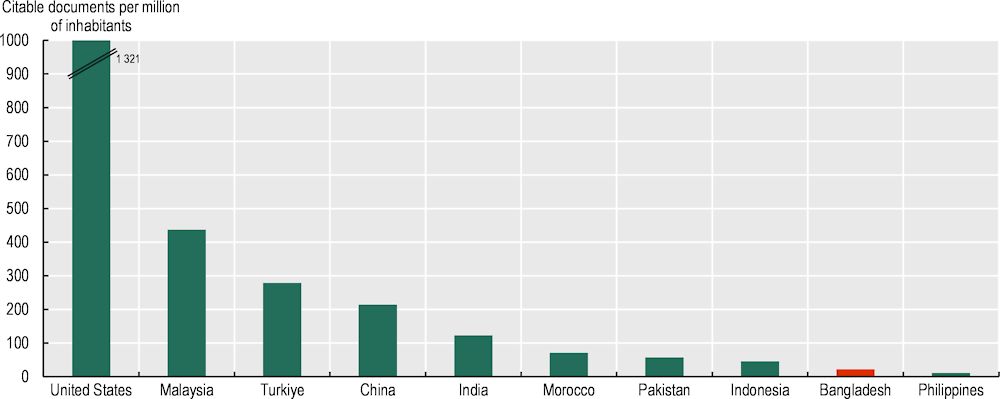

Bangladesh science and research base for healthcare could be denser and more effective. The country counts with 22 academic and research institutions among the world’s top 3 000 in pharmaceuticals. However, all of them are universities, except for two which are government affiliated: the International Centre for Diarrhoeal Disease Research and the Bangladesh Council of Scientific and Industrial Research. In other countries, governments host more public institutes and research centres of excellence linked to healthcare and pharmaceuticals, this is true in India, Brazil as well as in the US. The quality of research can also be improved. In Bangladesh citable documents in pharmacology, toxicology, and pharmaceuticals per million people are 22 versus 1 321 in the US and 124 in India (Figure 4.12).

Figure 4.12. Publications in Pharmacology, Toxicology and Pharmaceutics, Bangladesh and selected countries, 1996-2022

Note: Citable documents are the sum over 1996-2022 period. RCA is computed as (Country’s publication in Pharmacology/Country’s Total publication)/(World’s publication in Pharmacology/World’s Total publication).

Source: Authors’ elaboration based on Scimagojr, https://www.scimagojr.com/.

Table 4.3. Institutions in pharmacology, toxicology and pharmaceutics, Bangladesh

|

Institution name |

Pharmacology, toxicology and pharmaceutics rank |

Overall rank |

Type |

|---|---|---|---|

|

University of Dhaka |

2057 |

4566 |

University |

|

University of Chittagong |

2672 |

4744 |

University |

|

International Centre for Diarrheal Disease Research |

2677 |

2892 |

Health |

|

Southeast University Dhaka |

2809 |

4447 |

University |

|

Bangladeshi Council of Scientific and Industrial Research |

2975 |

5897 |

Government |

Note: Scimago includes 8 433 institutions, 4 136 of which are ranked in pharmacology, toxicology and pharmaceutics.

Source: Authors’ elaboration based on Scimagojr, https://www.scimagojr.com/.

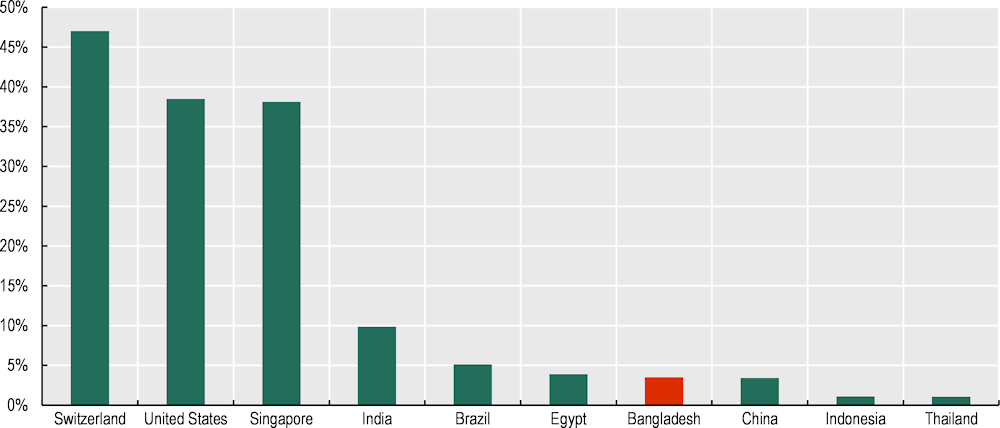

There is room to improve compliance with global standards. Only about 4% of Bangladesh's pharmaceutical establishments adhere to Good Manufacturing Practices (GMP), which sets essential production standards for manufacturers exporting to the EU market. This figure is comparable to Egypt but falls below India's rate of 10% and notably lags behind the two primary EU exporters: Switzerland (47%) and the United States (39%). While the EU may not be the primary target for Bangladesh pharmaceutical exports, adhering to these practices could facilitate access to safe, reliable, and affordable medicines for Least Developed Countries (LDCs) and other developing countries to which Bangladesh could be a provider of safe and affordable drugs (Figure 4.13).

Figure 4.13. GMP certificate, Bangladesh and selected countries, 2023

Note: Certificates for unique organisations and locations have been taken into account.

Source: Authors’ elaboration based on EMA (2023), EudraGMDP (database), http://eudragmdp.ema.europa.eu/, UNIDO, DGDA (2023), Allopathic Drug Manufacturers, https://dgda.portal.gov.bd/, SwissStats (2022), Switzerland by numbers, https://www.swissstats.bfs.admin.ch; National Bureau of Statistics of China (2022), China Statistical Yearbook, http://www.stats.gov.cn/sj/ndsj/2022/indexeh.htm.

The pharmaceutical industry in Bangladesh is evolving

Exports remain limited, but are growing

Despite its international vocation, pharmaceuticals remain one of the least export-oriented manufacturing activities in Bangladesh. Pharma accounts for 1% of Bangladesh’s exports, however pharmaceutical exports have almost doubled over a decade, from USD 56 million in 2008-09 to USD 105 million in 2018-19, but they've grown at 6%, slower than total exports (9%) due to the rapid expansion of the RMG industry. Data for 2021 shows that Bangladesh exports reached USD 169 million (Export Promotion Bureau, 2023[16]).

About 90% of Bangladesh’s exports are finished pharmaceuticals, a category where the country is a slight net exporter. Of the whole value added generated by the pharmaceutical industry in Bangladesh, 7% is exported, setting it apart from countries like Thailand, South Africa, Türkiye, and India, where a larger share of value added comes from export revenues.

Over the last decade, Bangladesh exports have become more concentrated, with the top three export markets accounting for 46% of total exports in 2018-19, up from 27% in 2008-09. Bangladesh pharma is increasingly looking East, with Viet Nam, Myanmar and Philippines being among the top five export destinations together accounting for 44% of total pharma exports. Bangladesh’s exports, although small, are playing and could play an important role in providing LDCs with safe and affordable drugs.

Pharmaceutical firms in Bangladesh are increasingly engaging with foreign firms. They are carrying out joint ventures and are starting to invest abroad. Square Pharmaceuticals, Bangladesh's largest company, invested USD 75 million in a new facility near Nairobi, Kenya, to produce 2 billion tablets and 60 million liquid medicine bottles yearly. Half will serve the local market, and the rest will be exported regionally. Beximco, a major conglomerate, was the first Bangladeshi firm listed on London Stock Exchange in 2005. In 2021, Beximco acquired 54.6% of Sanofi's Bangladeshi subsidiary. In 2017, they partnered with BioCare Manufacturing in Malaysia for a 30-70 joint venture making specialised medical products, like inhalers (Beximco Pharma, 2021[17]; Square Pharmaceuticals, 2022[18]).

Table 4.4. Top five destinations of Bangladeshi pharmaceutical exports

|

|

2008-09 |

|

2018-19 |

||

|---|---|---|---|---|---|

|

Destination |

USD millions |

Share of total |

Destination |

USD millions |

Share of total |

|

Austria |

6 |

11% |

Viet Nam |

21 |

20% |

|

Brazil |

5 |

9% |

Myanmar |

14 |

14% |

|

Germany |

4 |

7% |

USA |

12 |

12% |

|

Myanmar |

4 |

7% |

Philippines |

11 |

10% |

|

Panama |

3 |

6% |

Kenya |

6 |

6% |

|

Total |

23 |

40% |

Total |

65 |

62% |

Source: Authors’ elaboration based on CEPII BACI data.

The government is engaged in supporting API manufacturing capacities

In its continuous effort to ensure availability, access and affordability of essential drugs and to sustain industrial development and export diversification, the government issued in 2018 the Active Pharmaceutical Ingredients (API) and Reagents Production and Export Policy. This policy aims to reduce the excessive dependency on API imports with a view to reducing drugs prices in Bangladesh and fostering API exports. The policy could reduce import dependence to 80%, attracting USD 1 billion in foreign investment, and increasing the number of domestically produced API molecules (from 41 to 370 over 12 years) (Ministry of Commerce, 2018[19]). API holds promise to support export diversification due to the forecast for growing demand, also coming from Africa and Latin America, where countries are looking to strengthen pharmaceuticals industries after the wake up call of the COVID-19 pandemic.

These policies use traditional trade control tools for imports, manufacturing and exports, similar to the ones in use for manufacturing pharmaceuticals and with specific and often higher preferences accorded to API manufacturing plants. The policy includes preferential financing and tax benefits for API and reagent producers, as well as cash incentives that are contingent upon a certain percentage of usage domestic value-added. Firms manufacturing five or more API molecules per year will continue to pay no tax until 2032 and those with at least three are awarded a 75% exemption until 2032. APIs and reagent imports are duty-free until December 2025 and exempted from advance income taxes until 2024. To encourage API development, firms engaged in their manufacturing receive priority in obtaining land in industrial parks and zones. The API policies also explicitly fosters exports by introducing specific tax incentives and grants to API exporting firms.

The government is investing in setting up an API and Reagents Industrial Park offering priority plot allocation and reduced government administrative procedures in a special economic zone at Munshiganj, 37km from Dhaka. The park, whose facilities have been completed in 2022, faces several operational challenges, including stable and affordable energy supply. The API Park seems a well-conceived initiative which, during the pandemic, underwent a difficult gestation period and which needs to be given time to assess its capacity to succeed.

Investing in R&D, innovation and regulatory upgrades will be key after graduation

The pharmaceutical industry could play a key role in Bangladesh’s next development phase. Bangladesh needs to update its economic model to continue succeeding (See Chapters 2 and 3 of this PTPR). To do it, it needs to diversify its export base, develop a strategic network of international partnerships and foster a more innovation and quality based industrial development. It also needs to overcome the duality of its industrial model with an export oriented RMG sector and highly protected industries operating for the domestic market.

The pharmaceutical industry can be a precious ally in the ongoing transformation of Bangladesh’s socio-economic structure. Pharma is an industry with major industrial linkages and spillovers, from agrifood to chemicals. It is an industry that operates in international networks, thus requiring a sound local science and research and development base. It is also an industry with major social implications, from its capacity to ensure availability and affordability of drugs to its well-paid direct and indirect jobs. The COVID-19 pandemic has also shown the need for the world to count on more and increasingly geographically dispersed drugs manufacturing capacities and centres of excellence in pharmaceuticals. Availability and affordability of essential drugs remain an unmet goal for over 2 billion people in the world, according to WHO estimates (WHO, 2018[20]). A sound, trustable, innovative and effective pharmaceutical interest in Bangladesh is in the interest of the country, and of the world.

The pharma industry in Bangladesh has made a remarkable journey so far. Bangladesh has worked to safeguard and bolster its domestic pharmaceutical industry, mostly aiming to address access to essential drugs to its population. The country is poised to further develop this industry and make it a driver of innovation, transformation, and new forms of international partnerships in its next development phase. The pharmaceutical industry is in fact a powerful diver of dense and varied innovation and industrial ecosystems.

So far, the policy toolbox used by Bangladesh mostly focused on enabling domestic manufacturing capacities leveraging trade, industrial and intellectual property policies. The policy toolbox included the suspension of pharmaceutical patents, shorter patent protection terms, and the implementation of broad compulsory licensing and patent revocation provisions, suspending or revoking prior medicine registrations, restricting imports, and offering incentives to encourage local production or export by both domestic and foreign companies. More recently, the government has extended direct subsidies, tax incentives, and specialised financing access to entice companies to venture into the sector for active pharmaceutical ingredients (APIs) and reagents, key components for medicine production.

Going forward, an update of business mindset and of policy approach will be needed. The accomplishments of the industry relied on a combination of targeted domestic policies and a supportive international framework that allowed Bangladesh to substantially diverge from WTO rules on trade and intellectual property. In the context of the WTO, LDCs benefit from temporary pharmaceutical patent protection exemptions until January 1, 2033, as outlined in the TRIPS Council decision of 6 November 2015. LDC are empowered also to enact import restrictions, adjust tariff rates, strategically support exports, and suspend pharmaceutical patents, thereby deploying policies to cultivate and diversify their economies, shielding them from global competition temporarily (UNDESA, 2020[11]).

LDC graduation will affect Bangladesh's flexibility to continue nurturing industrial capacities and poses questions on the compliance of specific policies adopted with the regime applicable to other (i.e. non-LDC) developing countries (Table 4.5). In practice, graduation might entail the withdrawal of these exemptions as of 2026, depending on the outcomes of ongoing negotiations to potentially extend the TRIPS waiver beyond Bangladesh’s graduation date, so to match the deadline set for all LDCs in 2033. The outcomes of these negotiations are quite significant for the industry and for the country. If the extension will not be granted, as of 2026 Bangladesh will have to process and grant 1 190 patent applications from 2006-14 through the mailbox mechanism.1 If the waiver period will be granted until 2033 the patents obtained up to 2013 will no longer have any remaining patent duration, consequently, the country will only need to grant patents for applications filed in 2014, and even then, these patents will only be valid for a single year (Islam and Rizwan Apurbo, 2023[21]). Faced with these prospective challenges, Bangladesh must navigate this transition prudently.

Table 4.5. Compliance of Bangladesh health, industrial and investment policies with the WTO regime for developing countries other than LDCs

|

Bangladesh Health, Industrial and IP Policies |

WTO Compliant |

|---|---|

|

Strategic cancellation or suspension of medicine registration/licensing |

No. |

|

Import bans on strategic products |

No. |

|

Local manufacturing and joint venture requirements (1982) |

Yes. |

|

Administrative rules providing government review of licensing agreements, supervision by local personnel, and strict enforcement of unlicensed imports (1982) |

Possible |

|

Export performance requirements for foreign manufacturers |

No. |

|

Government use licensing carve-out for emergencies (2016) |

Possible |

|

Required donations to local research and development organisations/institutions (or tax benefits contingent on those donations) (2016, 2018) |

Yes |

|

Tax benefits and cash incentives contingent on domestic value added (2018) |

Possible |

|

Access to preferred finance for API and reagent producers |

Yes, but challengeable |

|

Removal of red tape for API and Reagent producers |

Yes, but challengeable |

|

Priority plot allocation in special economic zones for API and reagent producers |

Yes, but challengeable |

|

Suspended pharmaceutical patents |

No |

|

Non-specific exclusionary rights for patent holders |

No |

|

Shortened patent term |

No |

|

Compulsory licensing rules |

Possible |

|

Patent revocation rules; “working” requirement (4 years) |

Possible |

Source: Adapted from (Rahman et al., 2020[14]).

Regardless of the outcomes of the ongoing negotiations, the country needs to prepare and update its policy framework and make it more innovation oriented, and globally compliant. The country is already adapting national regulations and laws to align with international agreements and to strengthen institutional capacities in intellectual property and innovation management. For instance, in 2022, Bangladesh approved a new Patent Act to replace the prior version signed back in 1911 (Box 4.3). Gradual adaptations, including improved scientific and innovation capabilities, and legislative reforms are pivotal for a balanced and sustainable transition. Bangladesh needs to continue advance in improving its national quality infrastructure system (see Chapter 3). This is key to ensure traceability, safety and standards compliance. All essential attributes of competitiveness in an industry that is heavily regulated.

Box 4.3. Enhancing intellectual property regulation in Bangladesh: The Bangladesh Patents Act, 2022

Against the backdrop of Bangladesh's impending transition from a Least Developed Country (LDC) to a Developing Country status by 2026, aligning its patent law with the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) has gained paramount importance. Bangladesh's membership in the TRIPS framework has provided certain concessions, including an extended transition period until 2034 for TRIPS compliance. To ensure a seamless transition amidst challenges posed by the pandemic, the graduation timeline was extended to 2026. In response to these dynamics, the enactment of the Bangladesh Patents Act, 2022 (BPA 2022), has played a pivotal role, acting as a catalyst for comprehensive analysis.

The BPA 2022 introduces significant advancements that address critical aspects, which were absent in the previous 1911 Act. The new legislation bridges gaps to align with TRIPS principles and the Paris Agreement, while concurrently acknowledging the dual significance of fostering innovation and safeguarding public interests. Key innovations encompass:

Definition of Patentable Invention: In alignment with TRIPS, the BPA 2022 embraces patent protection for novel, inventive, and industrially applicable products and processes.