The subsidy should be sufficient to attract potential investors/beneficiaries to apply for support from the CPT Programme, but without making the projects too profitable. This approach to calculating the subsidy will enable the government to avoid over-investing, while at the same time provide an investment incentive for potential beneficiaries without making it too profitable for them as investors. Essentially, the subsidy level should provide just the necessary leverage for individual potential beneficiaries to invest in clean transport.

In order to evaluate a given project, the net present value (NPV) is calculated by totalling the expected net cash flows (cash inflows, or receipts, minus cash outflows, or expenses) over the project operating period and discounting them using a rate that reflects the costs of a loan of equivalent risk on the capital market. An investment will yield a profit if the NPV is positive. All measures that yield a positive NPV using a discount rate that corresponds to the applied rate of return can be deemed beneficial.

The NPV is calculated as in the following formula:

where:

- NCFi is the net cash flow in the i-th year

- r is the discount rate.

Using discounting considers two factors: the investor’s expectations with respect to the measure and that the NPV can be greater than zero during the operating period.

The calculation of the subsidy level should be based on economic principles. If the project is socially significant rather than profitable for the beneficiary, the subsidy should make a small amount of profit. In simple terms, the financial NPV including the subsidy should be approximately at the level of zero KGS, which means that the project yields an acceptable rate of return for the investor/project promoter (revenues from fares combined with lower operating costs).

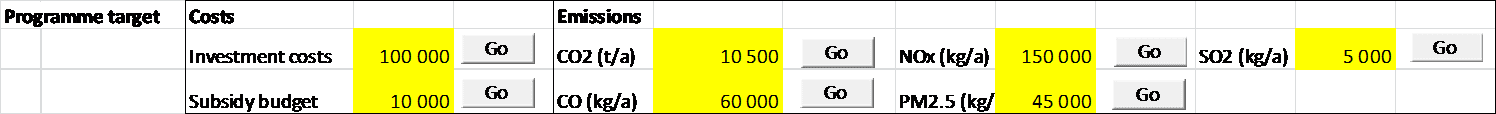

The “determination of the subsidy level” module uses this principle by making a simple financial analysis of the cash inflows and outflows in each year of the analysis. Cash inflows (receipts) generated by the project include fuel savings expressed in terms of the money saved by customers (public transport providers). In terms of cash outflows (expenses), the simple financial analysis totals the difference between the investment costs of a clean and a traditional bus calculated in the other modules. In the subsidy module, the subsidy is included on the cash outflow side as a negative value.

It was assumed that the investments will be made during the first year of the project and the savings averaged over the nine years of operation. The period of analysis is 10 years, a typical lifetime for this type of project. The subsidy is calculated so that the result of the NPV calculation is equal to zero KGS.