This chapter presents an overview of the project cycle management procedures developed for each project pipeline identified as part of this green public investment programme. Essentially, the implementation unit should ensure that the programme is executed in accordance with the adopted procedures. A well-designed process – which is a responsibility of the programming entity – should guarantee that only eligible projects compete for public support and that the most cost-effective ones are selected for financing and implementation.

Promoting Clean Urban Public Transportation and Green Investment in Moldova

5. Proposed procedures for project cycle management

Abstract

Project cycle management (PCM) comprises several distinct stages: 1) identifying and assessing projects for eligibility; 2) preparing programmes; 3) project development; 4) financing projects; 5) implementing projects; and 6) controlling and monitoring project impacts. Each of these stages is detailed in the sections below.

5.1. Identifying, assessing, and developing projects

The first step in the PCM process is to identify eligible projects that respond to the strategic and specific objectives of the national environmental/climate and energy policy, as well as the objectives defined in the CPT Programme. Eligible projects would involve the following activities:

Replacing buses used for public urban (Phase 1), suburban (Phase 2, Scenario 1) and also inter-city transport (Phase 2, Scenario 2) with environmentally acceptable models equipped with diesel, CNG or LPG or electricity-powered engines.

Investing in support activities (studies, construction of CNG filling stations, establishment of a maintenance workshop for new buses, and additional investments that improve public transport services) relevant to the bus replacements in the three pipelines (CNG/LPG, diesel, electric).

Only investment projects (i.e. those involving capital outlays) are eligible for financing under this programme. The list of eligible projects will be reviewed on an annual basis by the implementation unit to ensure that the list still meets national environmental/climate and energy policy objectives.

Another crucial step defines the manner in which projects are developed. Under Option 1, the banks will actively promote the CPT Programme by distributing information about it. Under Option 2, promotion will be done by the implementation unit. This will involve publishing leaflets that can be distributed to potential beneficiaries, which define eligible projects and eligible beneficiaries, eligibility criteria, and the type of financing.

5.1.1. Project eligibility criteria

Clearly specifying the eligibility criteria (in terms of project types, beneficiaries and project costs that will be supported by the programme) and setting robust project appraisal criteria will make the implementation of the programme more transparent and efficient. It will also make the programme credible for financiers – be they public or private, local or foreign.

This section lists and describes the minimum eligibility criteria. These are “knock-out criteria”, i.e. failure to meet even one of these criteria at this stage results in rejection of the project (though the option of re-designing the project proposal could be considered). Projects that pass the eligibility assessment but lack sufficient information can be returned to the applicant with a request for clarification. Annex D contains a template of an eligibility evaluation form that could be adapted for project screening.

The criteria include the types of eligible projects, eligible costs and eligible beneficiaries (project owners) for screening individual projects that apply for public support. The purpose of eligibility criteria is to conduct an initial and simple assessment of those projects that appear to address all the objectives related to the CPT Programme and that can potentially qualify for financing.

The following eligibility criteria could be used in screening projects (detailed lists should be prepared by MARDE before the programme launch):

1. Location of the project: limited to urban centres and suburban areas (for Scenario 1) and inter-city connections (for Scenario 2).

2. Criteria related to the types of eligible projects:

a. the project type should be identified in the list of eligible projects

b. all proposed costs of the project should be possible to identify in the list of eligible costs

c. replacement of public transport vehicles that are more than 10 years old and equipped with below Euro V engines.

3. Criteria related to the types of eligible beneficiaries. The following bodies would be eligible to receive support from the Clean Public Transport (CPT) Programme:

private public transport operators that currently provide services in eligible urban centres (Phase 1) and suburban areas of the pilot cities (Phase 2, Scenario 1), or inter-city connections (Phase 2, Scenario 2; see Section 2.2)

municipal public transport operators that currently provide services in eligible urban centres (Phase 1) and suburban areas of the pilot cities (Phase 2, Scenario 1)

administrations of pilot cities (for preparing necessary studies and support investments).

4. Other eligibility criteria: existing city plans for additional (support) investments to improve the city’s urban public transport system.

If a project does not meet the eligibility criteria (i.e. if it receives a “no” response to any of the questions in the eligibility assessment), it is rejected and a written explanation is sent to the applicant. The project may be re-evaluated upon modification and re-submission of the proposal.

Under Option 1, the banks will select employees to review and evaluate projects and the implementation unit will also select/assign employees. The employees must gain a minimum understanding of the programme by participating in training run by MARDE. After the training, bank employees are expected to be able to conduct project evaluation and decide if a project meets the CPT Programme objectives and complies with the eligibility criteria.

A list of eligible vehicle models on the market could be prepared in order to simplify the procedure and eligibility evaluation by banks. The list could be updated in the future when new models become available on the market.

If the type of vehicle that is proposed for purchase is on the list of approved means of transport, the bank continues to work on the project without contacting MARDE. If the vehicle is not on the list, the project documents, especially technical specification (which shall be submitted by the applicant, bus producer or importer on request) of the vehicle is sent to MARDE (i.e. the implementation unit) for evaluation (with assistance, if need be, from the technical support unit).

MARDE evaluates whether the proposed vehicle meets the objectives of the programme. If it is found to comply, it is added to the list. If not, MARDE informs the bank that it has been rejected. In this case the applicant is informed and the project may be re-evaluated upon the applicant’s agreement to consider a different type of vehicle.

For those projects that have passed the eligibility assessment (i.e. those projects that have received a “yes” response to all questions on the eligibility criteria list), a further creditworthiness screening is performed according to the bank’s procedures.

5.1.2. Project appraisal criteria

A project that meets the eligibility criteria then needs to be appraised to assess if it is worth funding. The appraisal is also done on the basis of clearly specified and rigorous criteria. These allow programme managers to compare, rank and select the most cost-effective projects for financing. When these criteria are applied uniformly across all (similar) projects, they can also help reduce management bias in selecting individual projects for financing.

Experience shows that a well-designed appraisal system is fundamental for selecting the most cost-effective investment projects for financing through public resources. However, Option 1 in this programme – involving financing through commercial loans (see Figure 2.9) – assumes that all the projects that meet basic eligibility criteria are accepted (especially if the project selection process is done by banks with no expertise in the public transport sector and which have not received targeted training, e.g. through public authorities).

Under Option 2 – where operators themselves provide the financing, coupled with a public grant (see Figure 2.10) – all projects that pass through the eligibility screening should be appraised and ranked according to the appraisal and ranking criteria listed below, and scored using an evaluation table (see Annex E). Projects with the highest scores would provide the biggest contribution to the CPT Programme objectives and therefore should be the first to be selected for co-financing. They are then contacted by the bank in writing to inform them that their project has been selected for financing. The process of selecting projects for financing and implementation ends when the budget allocated to the type of projects or the CPT Programme as a whole (whichever comes first) is exhausted for the given time period.

The following appraisal criteria are proposed:

1. Project preparation:

a. prepared business plan or strategic plan for implementation of the clean public transport in the city.

2. Project location:

a. buses that will be replaced operate in polluted districts of the cities (list of polluted districts)

b. buses that will be replaced run only in the centre of the eligible city

c. buses that will be replaced run in the city centre and on the outskirts/suburbs of the eligible city

d. buses that will be replaced run in the city and in connecting rural areas outside the eligible city.

3. Project type:

a. buses have higher priority than minibuses

b. compressed natural gas (CNG) buses are assigned higher priority than liquefied petroleum gas (LPG) buses

c. modern diesel buses are assigned the lowest priority.

4. Project size:

a. replacement of more than 20 buses

b. replacement of between 10 and 20 buses

c. replacement of fewer than 10 buses.1

5. Proposed system of improvements of the urban public transport system in the city:

a. length of new bus lanes

b. number of traffic lights with priority for public transport

c. number of bus stops newly equipped with online information for passengers

d. number of new bus stops.

6. Environmental efficiency: cost per reduction of a unit of particulate matter – PM2.5.

For the implementation of the pilot phase in Chisinau and Balti, it is recommended that the selection procedure is based on negotiations between the city administration and potential beneficiaries (public and private operators of the public transport system). The Ministry of Agriculture, Regional Development and Environment (MARDE), in co-operation with the Ministry of Economy and Infrastructure, being responsible for overall oversight of the programme, should give clear directions to local administrations, in particular on:

the amount of funds allocated for the pilot phase for each city

the maximum share of co-financing from public funds

the criteria that pilot projects should meet in order to be eligible for financing (see Section 5.1.1 and Annex D to this report)

5.2. Preparing programmes

The programme preparations under Option 1 (see Figure 2.9) will consist of negotiations with banks, signing agreements and designing procedures and forms that will be used by the banks. Under Option 2 (see Figure 2.10), programme preparations will consist of preparing internal procedures, forms and instructions for successful applicants and beneficiaries (either by MARDE or the IU).

Signing the agreement with banks under Option 1 should be based on negotiations that cover the following criteria. The bank’s selection process could be organised in the form of a tender which meets these criteria:

accessible for beneficiaries (e.g. branch offices in cities where the CPT Programme is implemented)

previous experience working with small and medium-sized enterprises (SMEs)

previous experience financing the transport sector

previous experience working with IFIs

previous experience offering loans in foreign currency

low interest rate margin and bank fees

clear terms of the loans for SMEs, especially loan repayment period

availability of different forms of programme financing, e.g. loans and leasing

flexibility and low costs of loan collateral.

In addition, the loan agreement should oblige the banks to:

market the programme to potential beneficiaries

identify, assess and select eligible projects and beneficiaries, prepare and sign loans according to the programme and conduct project verification

ensure operations comply with the programme, especially applying the procedures and criteria established by MARDE on selecting beneficiaries and their projects

report on financial and physical implementation to MARDE and the Ministry of Finance (MoF) on a regular basis (every three months)

report the forecasted financial involvement in the next reporting period.

5.3. Financing projects

Once the priority projects have been selected for financing, the proposed financing scheme for the project needs to be designed. This involves determining the size of the grant required for the project to be viable.

When the proposed financing schedule has been defined, the bank invites the applicant to negotiations and to sign the loan contract. The contract should detail the rights and responsibilities of each party to the agreement, measures to be taken in the event of the beneficiary’s non-compliance with the terms and conditions of the contract, as well as a disbursement schedule for financial support.

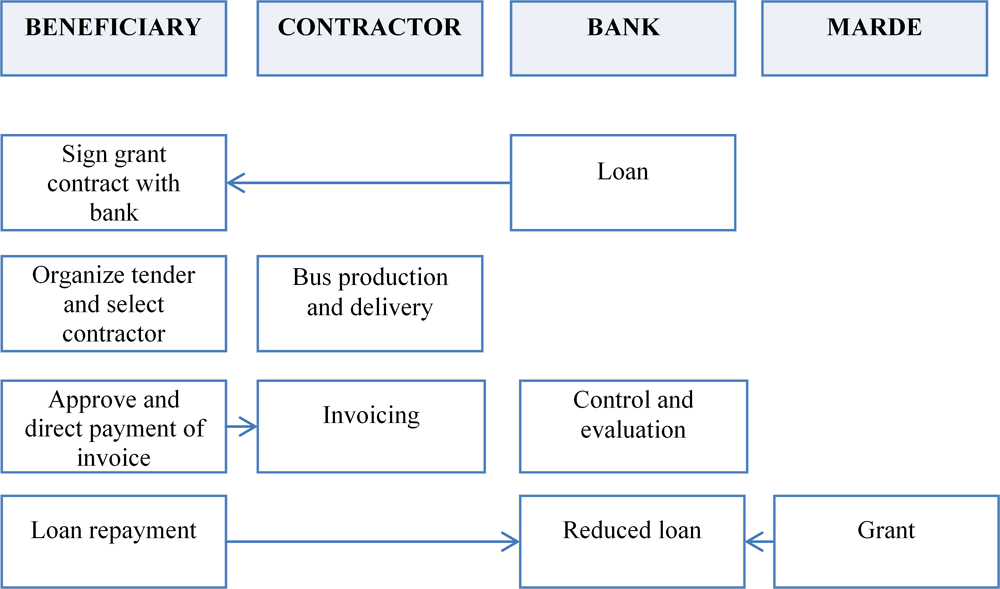

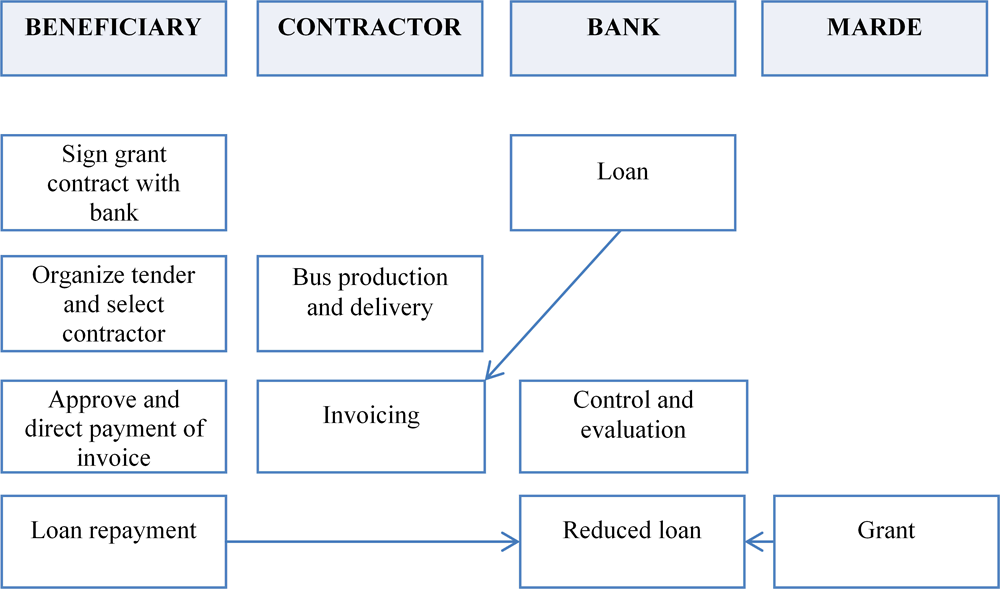

During project implementation, paying contractors is an important practical issue. Two schemes for settling payments with contractors are suggested:

Scheme 1: The bank transfers the funds to the beneficiary (i.e. public transport operator), who pays the contractor/supplier (of public transport vehicles) upon invoicing.

Scheme 2: The bank agrees the amount of financing with the beneficiary, but pays the contractor/supplier directly, upon presentation of a copy of the invoice.

Under Scheme 1, at the end of the agreed time period (for example monthly), MARDE receives from the bank the list of supported beneficiaries, the number and types of purchased motor vehicles, the cost of the purchase and information on the amount of the loan that was provided to beneficiaries. Based on this information, MARDE pays to the bank the grant portion (calculated as a fixed percentage of the purchase cost). In general, Scheme 1 is more widely used than Scheme 2 (which has benefits under special circumstances, such as lack of trust).

After receiving the payment from MARDE, the bank reduces the capital of the respective loan and informs the beneficiary about the grant that was received together with the new loan repayment schedule that takes into account the lower capital to be repaid.

Under Scheme 2, the implementation unit pays the grant individually for each beneficiary.

These two schemes are schematically presented in Figure 5.1 and Figure 5.2 for Option 1 (see Figure 2.9). In case of Option 2 (see Figure 2.10), this schematic is similar but no banks/loans are involved. In both options, if the bus supplier has not already been selected, the beneficiary initiates a tender procedure (in accordance with the public procurement law, if the purchases of this beneficiary fall under this law).

Public support is transferred to the beneficiary, who organises a tender to select a contractor, the contractor is paid upon delivery of service and submission of invoice (Figure 5.1).

Figure 5.1. Payment Scheme 1: Beneficiary receives public funds

Figure 5.2. Payment Scheme 2: Contractor is paid directly

It is important to highlight once again (see Section 2.4) that the rate of financial assistance (subsidy rate) should be set to ensure that it does not replace, but instead leverages, the beneficiary’s spending. Thus, public resources should be seen as a last resort for covering financing gaps in green priority projects (following the principle of additionality). For this reason, the level of the subsidy should be kept at the absolute minimum. This optimal minimum can be defined as the rate of assistance that makes environmentally and economically important projects financially viable.

5.4. Controlling and monitoring project impacts

Once implementation has commenced, the bank (under Option 1) or other IU (under Option 2), as per the contract with the beneficiary, maintains the right to monitor and inspect the implementation of the project. This can include:

comparing actual with planned results in physical terms (e.g. number of buses, type of buses, etc.)

determining whether buses are being used for providing public transport in urban/suburban centres

monitoring the implementation of accompanying investments (e.g. dedicated bus lanes, improved bus stations).

5.4.1. Performance indicators

The following performance indicators could be used by the institution managing the expenditure programme:

number of buses replaced, 15 years or older, including minibuses

number of buses replaced, 10 years or older, including minibuses

number of LPG-fuelled buses replacing outdated buses

number of CNG-fuelled buses replacing outdated buses

number of new trolleybuses

number of model diesel-fuelled (Euro V or better) buses replacing outdated buses

kilometres of dedicated bus lanes

tonnes of carbon dioxide (CO2) reduced per year

tonnes of particulate matter – PM10 – reduced per year

tonnes of particulate matter – PM2.5 – reduced per year.

5.4.2. Impact assessment

In contrast to the control and monitoring procedures during project implementation described above, control and monitoring post-implementation (ex-post evaluation) involve determining whether the project has met its stated objectives. This is the primary responsibility of the bank (under Option 1) or other IU (under Option 2), which reports the results to MARDE (manager of the CPT Programme).

Since direct and immediate measurement of project outcomes in terms of air pollution reduction and fuel consumption is very difficult, it is proposed that only the physical outcomes of the project should be monitored, namely:

the number of buses by engine type and whether buses are used to provide public transport services in urban centres

verification that emission reduction equipment remains installed in diesel engines

implementation of accompanying investments.

If the objectives have not been met, the beneficiary may have to return a part or all of the financial support provided under the programme. The contract must clearly cover such a possibility.

5.4.3. Maintaining a database of project and programme impacts

A final element of PCM is creating and maintaining a database of project and programme impacts. MARDE should determine the best format for the database, such as an Excel-based system or a database software. The following parameters need to be included and maintained in the database:

Programme:

expenditures by year for each type of project

actual expenditures compared to those budgeted

calculated emission reductions by year.

Projects:

number of projects by type, by year

physical outcomes by year: number of buses by engine type

calculated emission reductions by year (estimated based on buses replaced)

project cost-effectiveness: cost per unit of emission reduction.

The database should be used to inform future applicants and beneficiaries in order to adjust eligibility and appraisal criteria as needed and to ensure relevance.

5.5. Conclusions for the CPT Programme

The major purpose of the public support under this programme is to provide incentives to local communities and enterprises to undertake green investments and spend more of their own resources on environmental-friendly products and technologies.

Some additional points emerged from the discussion of programming and project cycle management, as follows:

Programming is a political process, focused on defining priorities and goals and setting out rules for the project cycle (e.g. MARDE). Appraisal – but simplified – is conducted by professional technical staff (e.g. the bank), who are held accountable for their decisions. Responsibilities for programming and project cycle management should be separated.

Transparency is key. Information (on project cycle procedures, eligibility criteria, and achieved results and benefits) should be disseminated widely. All potential applicants should be treated equally; decisions should be explained on time; stakeholders should be invited to participate.

While a two-step appraisal process is preferable, due to the involvement of many small enterprises and banks the appraisal process should be simplified as follows: MARDE approves the list of buses that are eligible for financing, which makes it simple for banks to approve projects for financing. If a type of bus is not on the approved list, it will not be financed and no further assessment is necessary.

The process does not stop once a decision to finance a project has been made: contracting, monitoring project implementation and assessing project outcomes are also essential, as programme managers will learn from this experience.

Attracting and retaining qualified staff is key: the capacity to challenge project owners and to manage the complex process of project appraisal requires experience in the field.

Note

← 1. The appraisal system should award fewer points to projects involving CNG buses when CNG filling stations are commercially unprofitable (less than 100 CNG buses) or do not exist in the city.