This chapter analyses carbon pricing in Lithuania in 2021 and simulates changes to carbon pricing under three policy scenarios. By adopting a sectoral perspective, the analysis highlights areas for improvement in current carbon pricing policies in Lithuania. Depending on the sector, carbon prices in Lithuania are more or less aligned with benchmark rates consistent with attaining carbon neutrality by 2050 or reflecting the externalities caused by CO2 emissions. In particular, emissions in the road and off-road transport, industry and electricity sectors are priced in line with some of these benchmarks, but emissions from energy use in the buildings as well as the agriculture and fisheries sectors face lower prices. All policy scenarios considered in the chapter would help overcome the gaps observed in the current carbon pricing landscape in Lithuania.

Reform Options for Lithuanian Climate Neutrality by 2050

4. Carbon pricing in Lithuania

Abstract

This chapter analyses carbon pricing in Lithuania in 2021 and simulates changes to carbon pricing under three policy scenarios. The policy simulations concern (i) implementation of the Draft Law on fuel excise duties, which proposes changes in fuel excise taxes and the introduction of a carbon tax; (ii) implementation of the proposed revision of the European Union Energy Taxation Directive (EU ETD); and (iii) introduction of a second European Union Emissions Trading System (EU ETS2) on motor and heating fuels. The last section briefly discusses issues related to biofuels.

As highlighted in Chapter 3, carbon pricing is a key policy tool to reduce emissions in a cost-effective way and can raise additional revenue for governments – hence the focus of this chapter on this class of climate mitigation instruments. Other instruments, such as R&D support, technology deployment support or electric vehicle mandates, are discussed in Chapters 2, 5 and 7. Chapter 6 discusses the distributional impacts of carbon pricing in Lithuania.

Carbon pricing in Lithuania in 2021

This section analyses carbon pricing in Lithuania in 2021, drawing on the OECD Effective Carbon Rates (ECR) database (Box 4.1). The ECR database provides detailed information on CO2 emissions from energy use and corresponding effective carbon rates. These rates result from explicit carbon taxes and emissions trading systems, as well as from fuel excise taxes. According to the latest available data, CO2 emissions from energy use excluding biomass combustion represent 68% of the total GHG emissions reported in Lithuania’s greenhouse gas inventory submitted to the UNFCCC.1

Box 4.1. The OECD Effective Carbon Rates database

The OECD Effective Carbon Rates (ECR) database (OECD, 2021[1]; OECD, 2019[2]) provides a breakdown of CO2 emissions from energy use and corresponding effective carbon rates for 44 OECD and G20 countries by sector and fuel. Taken together, these 44 OECD and G20 countries represent 80% of worldwide CO2 emissions from energy use. Effective carbon rates are the sum of explicit carbon taxes, emissions trading systems (ETSs) and fuel excise taxes.

More precisely, the three components of effective carbon rates, depicted in Figure 4.1should be understood as follows:

Carbon taxes generally set a rate on fuel consumption based on its carbon content (e.g. on average, a EUR 30/tCO2 tax on carbon emissions from diesel use would translate into a 7.99 eurocent per litre tax on diesel).

Fuel excise taxes are typically set per physical unit (e.g., litre, kilogram, cubic metre) or per unit of energy (e.g., gigajoule), which can be translated into rates on the carbon content of these fuels.

The price of tradable emission permits issued under ETSs, regardless of the permit allocation method, represent the opportunity cost of emitting an extra unit of CO2.2

Figure 4.1. Components of Effective Carbon Rates

The database covers six sectors that together span all energy uses: agriculture and fisheries, buildings (i.e., residential and commercial heating), electricity, industry, off-road transport and road transport.

Fuels are grouped into ten categories, which in turn can be grouped into two broad classes. Fossil fuels are composed of the categories coal and other solid fossil fuels, diesel, fuel oil, gasoline, kerosene, liquefied petroleum gas (LPG), natural gas and other fossil fuels (a category consisting in those fossil fuels that cannot be classified under the first seven categories in the list). Other combustible fuels are composed of biofuels and non-renewable waste.

The OECD ECR database is available for the years 2012, 2015 and 2018. A 2021 version is available as well, based on emissions data from 2018, to which tax rates from 2021 are applied as well as average permit price values over 2021. The analysis in this chapter of the report is based on this data.

Energy use and carbon pricing in Lithuania

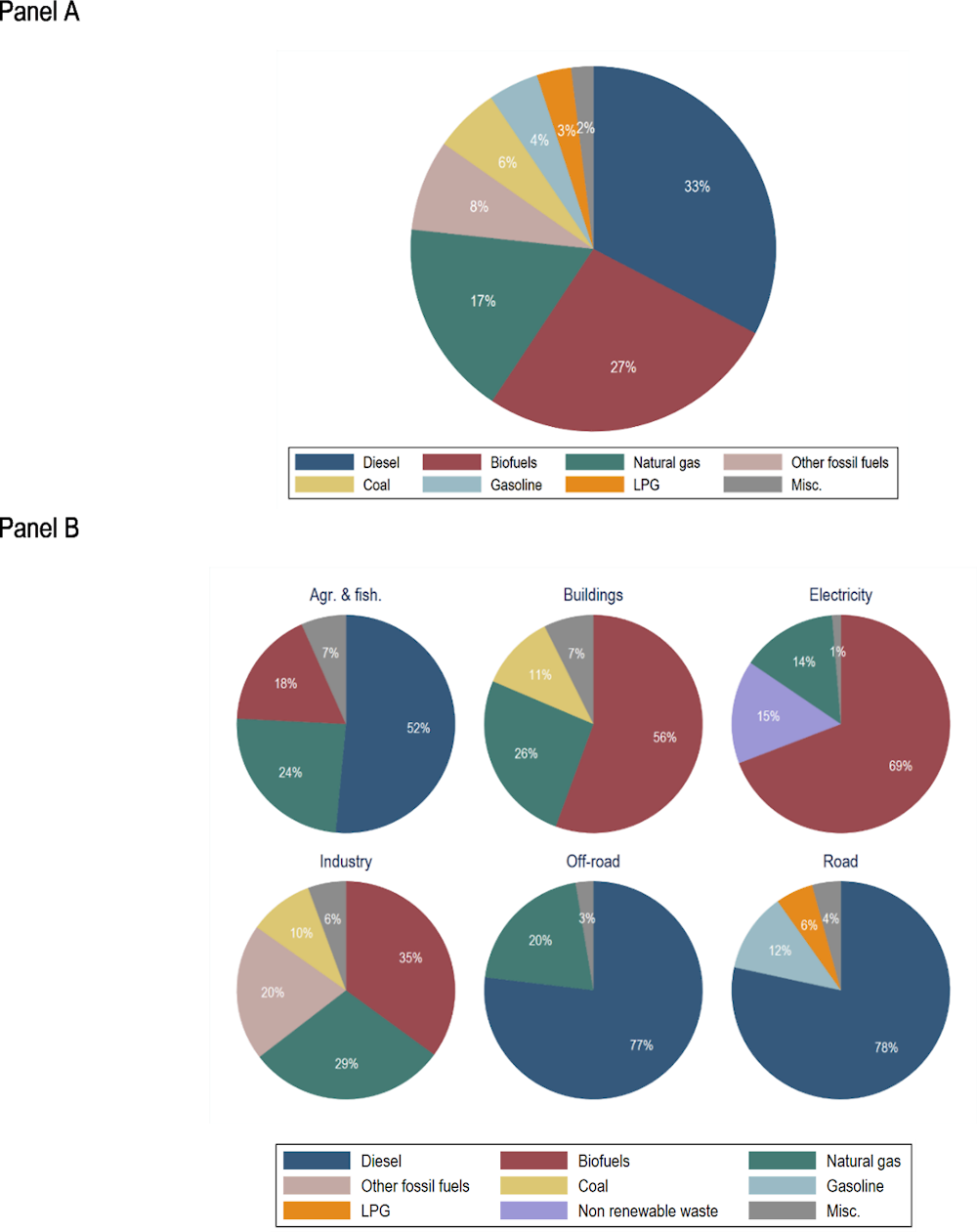

In Lithuania, biofuel, diesel and natural gas use make up more than three quarters of energy use. Diesel accounts for 33% of energy use (mostly in the road sector), biofuels for 27% (mostly in the industry and buildings sectors) and natural gas for 17% (also mainly in the industry and buildings sector) (Figure 4.2., Panel A). As seen in Figure 4.2., Panel B, these shares vary considerably across sectors, for example with the electricity and buildings sector relying predominantly on biofuels, and the transport sectors and agriculture predominantly on diesel. The industry sector exhibits a more balanced use of different fuels.

Figure 4.2. Fuel use in Lithuania principally comprises diesel, biofuels and natural gas use

Based on 2018 energy use, % of GJ

Note: Fuels shares in total energy use are shown as a percentage of total energy use from combustible fuels (219.76 TJ) in Panel A and as a percentage of energy use from combustible fuels for each sector in Panel B. In Panel A, “Misc.” stands for fuels that each represent less than 2% of total energy use from combustible fuels, and which are grouped together. “Misc.” here is composed of fuel oil, non-renewable waste and kerosene. In Panel B, “Misc.” stands for fuels that each represent less than 5% of total sectoral energy use from combustible fuels, and which are grouped together. For the agriculture and fisheries sector, it is composed of coal, LPG, gasoline and fuel oil. For the buildings sector, it is composed of LPG, diesel, kerosene and gasoline. For the electricity sector it is composed of fuel oil. For the industry sector it is composed of fuel oil, diesel, non-renewable waste and gasoline. For the off-road transport sector, it is composed of biofuels, gasoline and kerosene. For the road sector, it is composed of biofuels and natural gas.

Source: OECD.

Box 4.2. CO2 emissions from biofuel use

While not all biomass is carbon neutral, it can be. Taken at the point of combustion, biomass releases CO2. However, as discussed in OECD (2019[2]), sustainably sourced biomass may be carbon-neutral over the life-cycle because before being burnt, feedstocks have previously absorbed a similar amount of CO2 from the atmosphere.

As the combustion of biomass can be carbon neutral, CO2 emissions from biofuel combustion are not explicitly reported in the greenhouse gas inventories submitted under the UN Framework Convention on Climate Change (UNFCCC). The guidelines of the UN Intergovernmental Panel on Climate Change (IPCC) require accounting for emissions and sinks from biofuels as net changes in carbon stocks under the annual reporting of Land Use, Land Use Change and Forestry (LULUCF).

Most governments do not tax biofuels outside the road sector. Instead, they generally use sustainability standards for biofuels (e.g., the EU revised Renewable Energy Directive, RED II3), however this requires gathering reliable sustainability data. This is a challenging task, and such data is often lacking. (Jeswani, Chilvers and Azapagic, 2020[4]; Baudry et al., 2017[5]).

Some governments have attempted to design comprehensive biofuel taxation. For example, the Finnish carbon tax for transport fuels, is based on life-cycle CO2 emissions – a unique feature in the world today (OECD, 2021[6]). Under the Finnish tax, biofuels are classified in three categories: i) biofuels that do not meet sustainability criteria are subject to the same carbon tax as fossil fuels; ii) sustainable first‑generation biofuels are subject to 50% of the rate which applies to equivalent fossil fuels; and iii) sustainable second-generation biofuels are exempt. In 2019, the methodology based on life-cycle carbon emissions was extended to fuels for heating and machinery. While also relying on a comprehensive assessment of biofuel sustainability, this kind of category-dependent tax rate constitutes a novel approach to taxing biofuels that encompasses life-cycle emissions.

Despite its novelty, an approach that only considers the actors responsible for the combustion of biomass does not account for the fact that these are generally not the same actors as those responsible for the CO2-absorption of biomass. Ideally, taxing the CO2 emissions from the combustion of woody biomass would have to go hand-in-hand with subsidising forest owners for the carbon they store. This point, along with the trade-offs between forest harvesting levels and forests’ potential as a carbon sink are extensively discussed in Kooten, Binkley and Delcourt (1995[7]) and OECD (2021[6]).

The proposed revision to the EU ETD currently considers minimum taxation rates for biofuels for additional reasons. This is in line with other issues raised by the increased use of biomass. Harvesting raises issues for biodiversity, soil health and water quality, while biomass combustion may worsen local air pollution (different from greenhouse gas emissions), especially from particulate matter (PM) and nitrogen oxides (NOx) emissions, which is not compensated for from a lifecycle point of view.

In 2021, CO2 emissions from energy use in Lithuania are priced through the EU ETS and through fuel excise taxes; Lithuania does not apply an explicit carbon tax. The EU ETS applies principally to the industry and electricity sectors, while fuel excise taxes apply to all sectors, except the electricity sector. Effective carbon rates are positive for 93% of CO2 emissions from non-biofuel energy use. Biofuels, which make up more than a quarter of energy use in Lithuania (Figure 4.2.), are further discussed in Box 4.2.

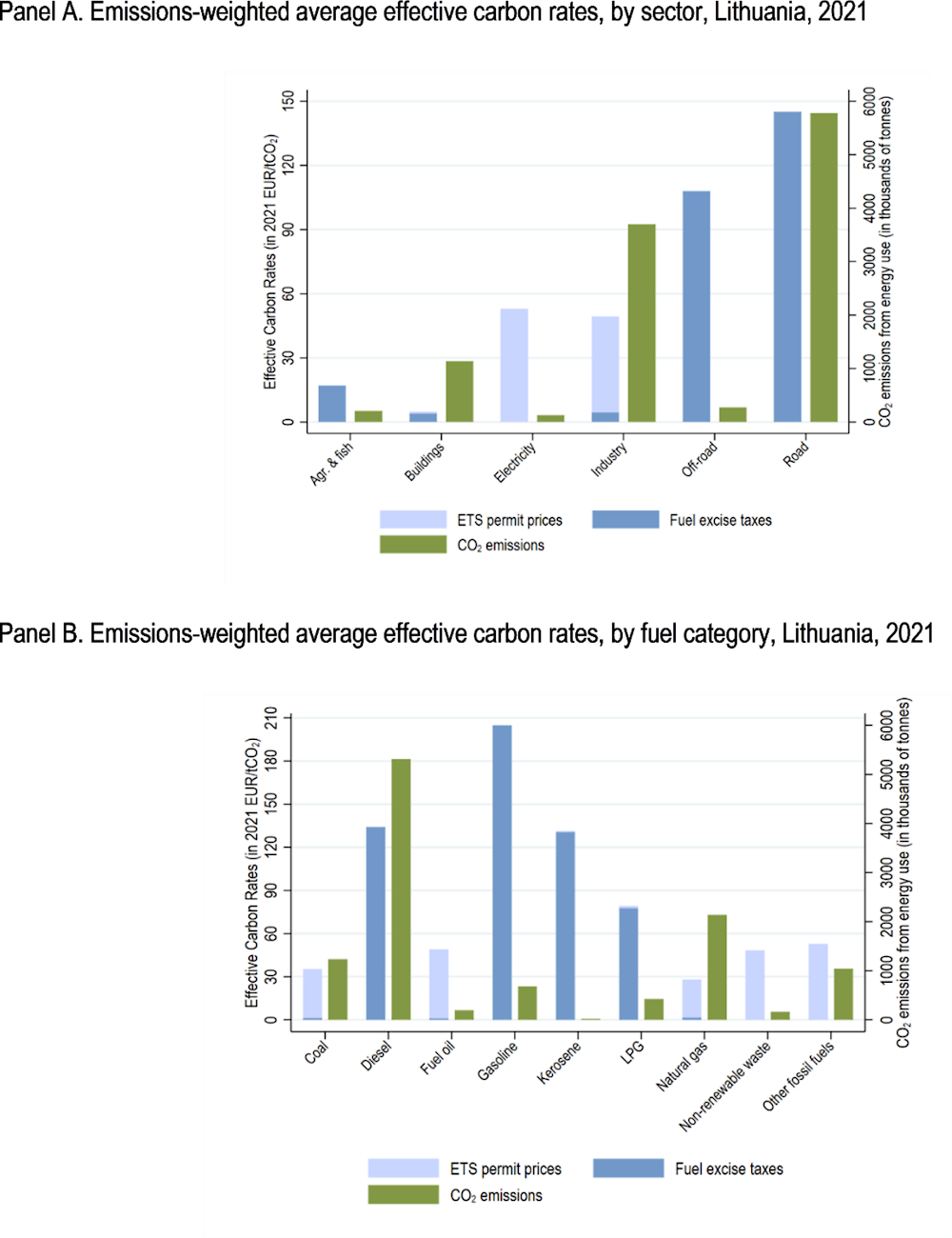

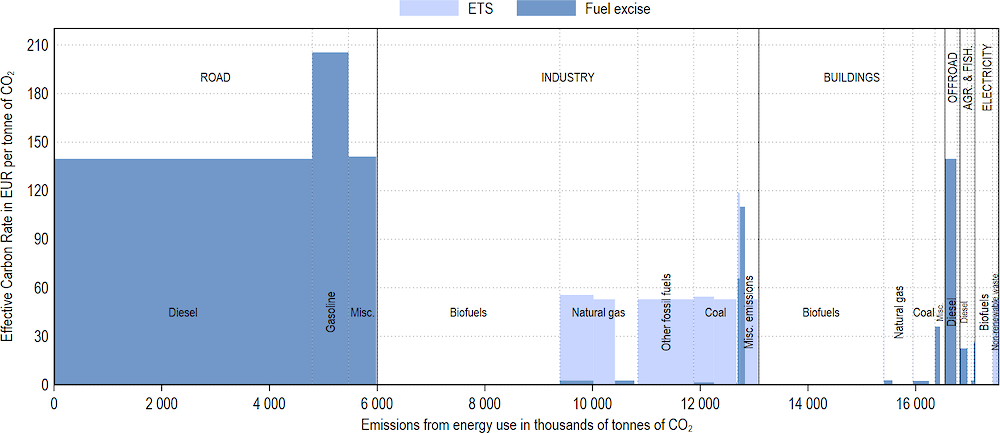

Figure 4.3. presents Effective Carbon Rates and their CO2 emissions base in Lithuania in 2021, by sector (panel A) and fuel category (panel B). The figure distinguishes between the two components comprising Lithuania’s ECRs; tradeable permit prices from the EU ETS. As the figures show, the road and industry sectors are responsible for the largest shares of CO2 emissions from energy use (respectively, 52% and 33%). The buildings sector accounts for 10% of CO2 emissions from energy use, while the electricity, off‑road and agriculture and fisheries sectors each account for less than 3%. Consistent with their shares in energy use, the two main combustible fuels responsible for CO2 emissions are diesel (47%) and natural gas (19%). Coal and other fossil fuels also account respectively for 11% and 9% of CO2 emissions from energy use.

The six sectors (that together span all energy uses, see Box 4.1) face heterogeneous price levels for their emissions. As in the majority of countries covered by the ECR database, in Lithuania the average price signal is highest in the road sector (see, e.g. OECD (2021[1])), at about EUR 145/tCO2 due to the relatively high (albeit different) excise tax rates faced by diesel and gasoline. Emissions in the off-road sector face a slightly lower price on their priced emissions, of about EUR 108/tCO2. Electricity and industry sector emissions are mostly priced through the EU ETS, with slightly different average effective carbon rates (respectively EUR 53 and 49/tCO2), mostly reflecting different shares of emissions not covered by a pricing policy. Emissions in the agriculture and fisheries as well as the buildings sectors face the lowest rates (at EUR 17 and 5/tCO2, respectively).

The differences in price levels between sectors arise mainly from two factors: (i) differences in fuel use across sectors and (ii) price instruments used to cover their emissions. Panel B of Figure 4.3. shows that fuels face heterogeneous tax rates. In particular, the most highly taxed fuels are gasoline, diesel, kerosene and LPG, respectively at EUR 205, 134, 131 and 78/tCO2. Panel A in Figure 4.3. shows the difference in instruments used to cover emissions across sectors. The following subsection takes a closer look at each sector. The more detailed Effective Carbon Rates profiles shown in these subsections highlight unpriced emissions, heterogeneous rates within sectors as well as shares of free permits within the EU ETS.

Figure 4.3. Effective Carbon Rates levels and components are heterogeneous and not necessarily in line with the share of emissions they cover

Note: These figures show fuel excise taxes in Lithuania and the EU ETS average permit price over 2021. These figures show effective marginal carbon rates, i.e. they do not account for free allocations. CO2 emissions are calculated based on energy use data adapted from (IEA, 2020[8]) World Energy Statistics and Balances. In these figures they do not include emissions from the combustion of biomass. The “other fossil fuels” category emissions are composed, in Lithuania, of 91% emissions from refinery gas, 8.8% emissions from crude oil, less than 0.2% from refinery feedstocks and less than 0.05% of additives.

Source: OECD calculations.

Carbon pricing by sector

Road transport

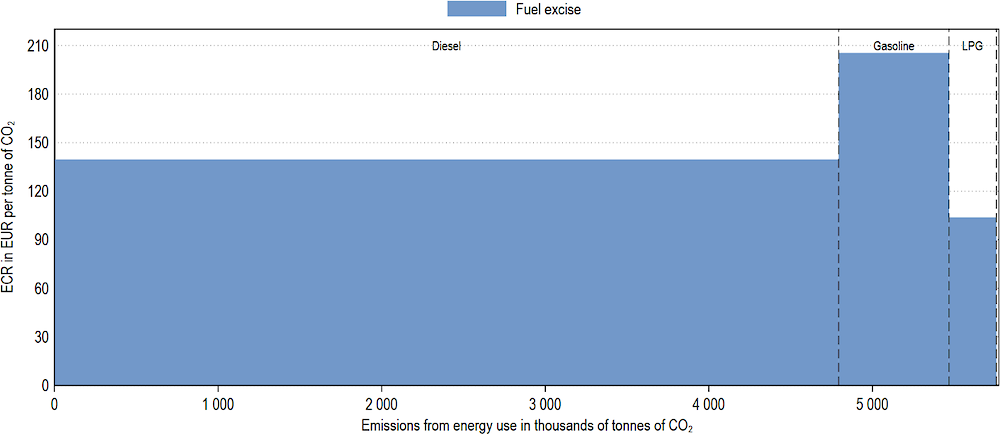

The road transport sector is responsible for 51.5% of CO2 emissions from energy use in Lithuania and fuel excise taxes are the only of the three ECR components covering emissions in this sector (Figure 4.4. ). Apart from natural gas use, which faces no price but represents less than 0.3% of road transport emissions, CO2 emissions in this sector are fully covered by a carbon price. Rates are higher than EUR 100/tCO2 and reach EUR 205/tCO2 for gasoline use.

Diesel use represents 83% of emissions in this sector and faces a lower effective carbon rate than gasoline use, at EUR 139/tCO2 (this gap can be referred to as the “diesel differential”, see Harding (2014[9])). This lower carbon price level results from a lower fuel excise tax in EUR per litre for diesel than for gasoline. Indeed, in 2021 in Lithuania, diesel used as a propellant is taxed at EUR 0.372 per litre whereas gasoline used as a propellant is taxed at EUR 0.466 per litre. Given that CO2 emissions per litre of diesel are about 15% higher than for gasoline, a uniform carbon price would call for taxing diesel at a higher rate per litre than gasoline.4

The levels of carbon prices observed in the Lithuanian road transport sector are higher than in most other sectors, but are among the lowest in the EU. At an average of EUR 145/tCO2, only the ECRS in the Polish and Hungarian road transport sector are lower, respectively at EUR 130/tCO2 and EUR 125/tCO2. By contrast, in 2021, ECRs in the road transport sector reached EUR 264/tCO2 in the Netherlands, EUR 254/tCO2 in Finland and EUR 241/tCO2 in Italy.

Figure 4.4. Effective carbon rates in the road transport sector only consist in fuel excise taxes

Emissions-weighted average ECR, by fuel category and coverage type, Lithuania, 2021

Note: This figure shows CO2 emissions from energy use excluding emissions from the combustion of biomass and the effective carbon rate they are subject to in the road transport sector. For readability purposes, the last category is not named on the graph. These are emissions from natural gas use, which represent 0.3% of emissions in the road sector, and which are not covered by any carbon price.

Source: OECD.

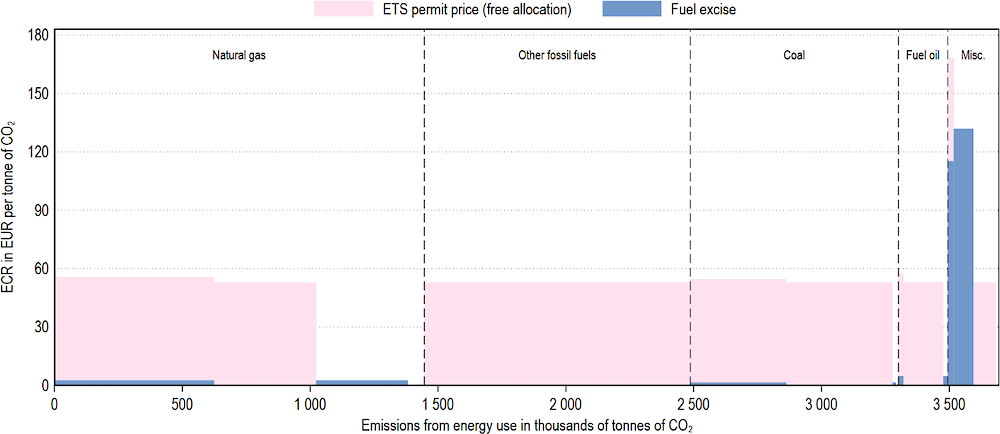

Industry

Industry is the second largest emitting sector in terms of CO2 emissions from energy use, representing 33% of Lithuanian emissions and in this sector firms mainly face a price signal from the EU ETS, with an average permit price of about EUR 53/tCO2 in 2021. Emissions from the use of two of the main fuel categories in this sector, namely natural gas (39% of emissions in the sector) and coal and other solid fossil fuels (22% of emissions in the sector), face excise tax rates for emissions of less than EUR 3/tCO2. Fuels belonging to the category “other fossil fuels” face no fuel excise tax. Fuels contributing to a very low share of emissions in this sector face higher tax rates.5

In the Lithuanian industry sector, the EU ETS and fuel excise taxes complement each other in terms of coverage: they increase emissions coverage by applying to emissions that would otherwise not be covered by the other instrument. For example, natural gas emissions from combined heat and power installations are exempt from fuel excise taxes even though the installation may be covered by the EU ETS. In a similar way, peat and peat products are exempt from fuel excise taxes.6 However, installations emitting emissions from the combustion of these fuels may still be covered by the EU ETS. The opposite is more common: given that the EU ETS does not apply to all firms, certain emissions (from smaller firms or certain exempted subsectors) only face fuel excise taxes. These features are visible in Figure 4.5. , which shows, in particular, that part of the emissions from natural gas and coal are only covered by the EU ETS and not by fuel excise taxes.

The lack of complementary policies to the EU ETS in pricing Lithuanian industry emissions may be an issue given free permit allocation for the industry sector and price volatility of permit prices. These issues are further developed in the following.

In Lithuania’s industry sector 100% of EU ETS emission permits were allocated for free in 2021 (the light pink shading in Figure 4.5. indicates the share of free allocations). Price levels from the EU ETS are about EUR 53/tCO2: effective carbon rates are marginal rates, which means that these are rates faced by fuel users for an extra tonne of CO2 emissions. As such, the ETS price level shown on the Figure is the average EU ETS permit price in 2021, and should be understood as the opportunity cost of emitting an extra unit of CO2 for firms (Box 4.1). However, because all EU ETS permits were allocated for free, there is a wedge between the average carbon price faced by firms and the marginal carbon price. In imperfectly competitive markets, such wedges are important for investment decisions since they can discourage investment of firms in low-carbon technologies (Flues and Van Dender (2017[10])). Other evidence also highlights lower green innovation in firms where a larger share of allocations is distributed for free (Martin et al. (2013[11])). However, as the carbon border adjustment mechanism (CBAM) currently proposed by the European Union is gradually introduced, free permits are planned to be phased out.

Permit prices alone do not provide a stable price signal for investment decisions. Despite the dramatic increase of EU ETS permit prices over 2021 and 2022 (having reached about EUR 88/tCO2 in May 2022 from EUR 34/tCO2 in January 20217), their volatility results in uncertainty for investors. This uncertainty lowers incentives for firms to invest in low-carbon technology and projects (Flues and van Dender, 2020[12]). The difficulty to predict prices for the following years, in turn, also reduces the possibility for firms to plan, adapt and avoid investing in projects that a few years later may cause them to have stranded assets. Carbon price support mechanisms such as those in the United Kingdom (UK) or the Netherlands (Box 4.3) may be useful to address these issues.

A strength of emissions trading systems is that they impose a uniform carbon price on emissions from different fuels and sectors. Contrary to fuel excise taxes, which are generally fuel-specific and are set per physical unit or per unit of energy, emissions trading systems permit prices are expressed per tonne of CO2, so result in all fuels within the covered share of the sector facing the same carbon price.8 This can help avoid switching to fuels that may be less polluting, but remain carbon-intensive all the same, and increases efficiency, by leaving it up to the polluters themselves to decide how to cut emissions in the least costly manner (e.g. which fuels to reduce use of).

Figure 4.5. Effective Carbon Rates in the industry sector mostly consist of EU ETS permit prices

Emissions-weighted average ECR, by fuel category and coverage type, Lithuania, 2021

Note: This figure shows CO2 emissions from energy use excluding emissions from the combustion of biomass and the effective carbon rate they are subject to in the industry sector. “Misc.” groups together fuels that each represent less than 5% of total energy use from combustible fuels in the sector. In this sector, “Misc.” is composed of emissions from diesel, gasoline, LPG and non-renewable waste.

Source: OECD.

Box 4.3. Carbon price support to the EU ETS in the United Kingdom and the Netherlands

The Carbon Price Floor in the United Kingdom

In 2013, the United Kingdom (UK) introduced a carbon price floor (CPF) for the electricity-sector fossil fuel emissions covered by the EU ETS (and now covered by the UK ETS). The CPF consists of two elements: the ETS allowance price and a carbon price support (CPS) mechanism, which is charged on top of permit prices. In 2013, in the electricity sector, the CPS was at GBP 9/tCO2 emissions and rose to GBP 18 in 2015 (Hirst, 2018[13]). In 2018, this allowed the average effective carbon rate in that sector to reach about EUR 26/tCO2 while the average EU ETS permit price over 2018 was at about EUR 16/tCO2.

Leroutier (2022[14]) finds that the UK CPS induced emissions from the UK power sector to drop by 20% to 26% per year on average between 2013 and 2017. (See also Chapter 2, Box 2.1)

The Dutch carbon levy

The Netherlands, as part of its 2020 Climate Agreement, implemented a new carbon levy for industry on 1 January 2021. The new carbon levy complements the permit prices from the EU ETS and implements a domestic price floor for Dutch industrial emissions. The price is intended to increase gradually over time from EUR 30/tCO2 in 2020 to EUR 125/tCO2 in 2030, as shown in Table 4.1. This domestic price floor consists of a floating contribution added on top of the price for emission allowances in the EU ETS – so that if the price of emissions allowances exceeds the floor price, the floating contribution becomes zero.

The carbon price path was designed based on current and planned abatement cost curves in the Dutch industry sector.

This carbon levy was implemented in the industry sector, where abatement costs are relatively low when compared to other sectors of the economy, but where the risk that EU ETS allowance prices drop threatens investment in low-carbon assets. The price path was announced from the start of its implementation (with a foreseen review after five years) to allow firms to plan and invest accordingly (see also Chapter 2, Box 2.5).

Table 4.1. The Dutch carbon price path for industrial emissions

|

Year |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

|---|---|---|---|---|---|---|---|---|---|---|

|

Floor price (in EUR per tonne of CO2) |

30 |

40.56 |

51.12 |

61.68 |

72.24 |

82.80 |

93.36 |

103.92 |

114.48 |

125.04 |

Source: Adapted from Figure 6 in Anderson et al. (2021[15]).

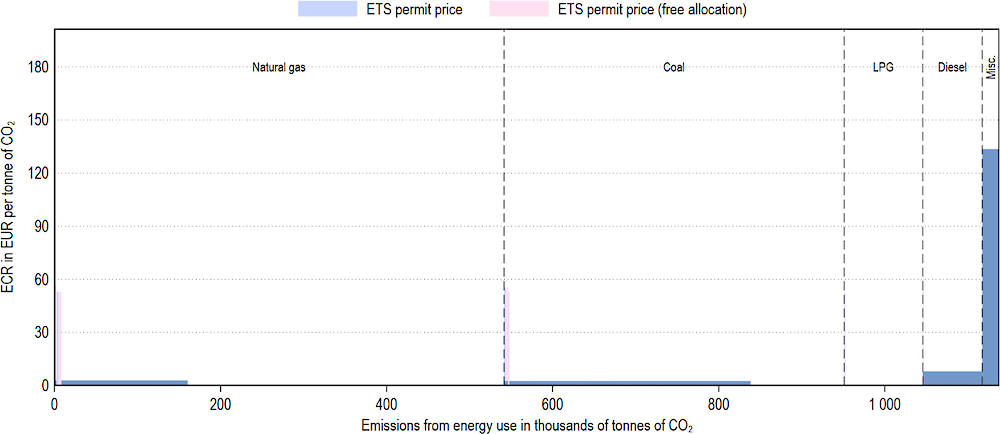

Buildings

The buildings sector (residential and commercial heating) is responsible for about 10% of CO2 emissions from energy use in Lithuania and overall, emissions in this sector are priced at much lower rates than in other sectors. Biomass is the main source of heating in Lithuania, but as discussed in Box 4.2, emissions from biomass combustion are generally not priced. Abstracting from emissions from biomass combustion, natural gas is the largest source of CO2 emissions from energy use in the heating sector, representing 47.6% of emissions in the sector. Among these emissions, about three quarters are for residential use, and hence untaxed (Figure 4.6. ).9 The priced share of emissions from natural gas (stemming from commercial and public services use) face a fuel excise tax rate equivalent to EUR 2.9/tCO2 on average. LPG used for heating is entirely untaxed as well, while the priced share of coal emissions faces a slightly higher tax rate on average than in the industry sector (due to a higher rate on residential users), of EUR 2.5/tCO2. 10 Diesel is the most highly taxed fuel in this sector, at almost EUR 8/tCO2, even though in this sector it faces the lowest fuel excise rate (EUR 0.02114 per litre) when compared to the road (EUR 0.372 per litre) and agriculture and fisheries (EUR 0.06 per litre) sectors.11 The EU ETS is not discussed here, as it covers less than 2% of emissions in this sector (with 60% of permits allocated for free).

Figure 4.6. Effective Carbon Rates in the buildings sector are low and result mostly from fuel excise taxes

Emissions-weighted average ECR, by fuel category and coverage type, Lithuania, 2021

Note: This figure shows CO2 emissions from energy use excluding emissions from the combustion of biomass and the effective carbon rate they are subject to in the buildings sector. “Misc.” groups fuels that each represent less than 5% of total energy use from combustible fuels in the sector. In this sector, it is composed of emissions from gasoline and kerosene.

Source: OECD.

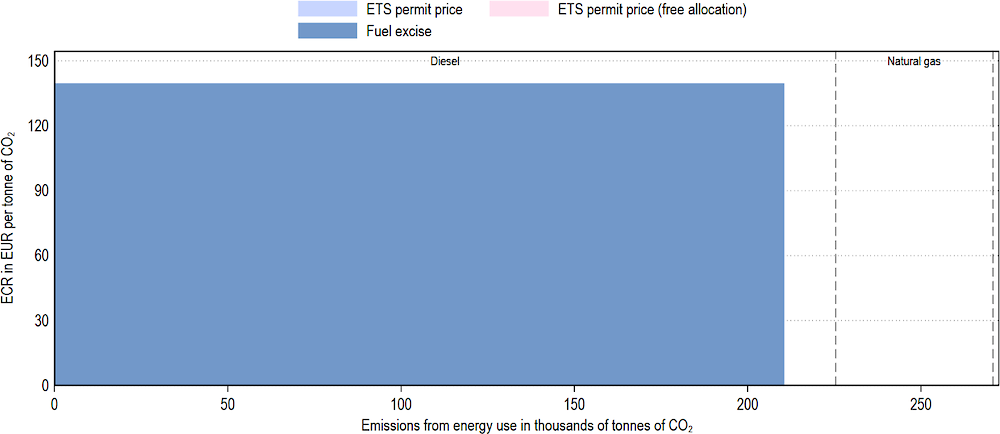

Off-Road Transport

The off-road transport sector is responsible for 2.4%12 of CO2 emissions from energy use in Lithuania and the majority of these either face the same effective carbon rates as in the road transport sector or none. The main fuel responsible for CO2 emissions from energy use in this sector is diesel (accounting for about 83% of emissions), mostly stemming from rail transport (84% of diesel emissions) and to a smaller extent from domestic navigation (6.6%). These emissions are subject to the same fuel excise tax rate as in the road sector, resulting in a rate of about EUR 140/tCO2. Natural gas is used for the support and operation of pipeline transport, and its emissions are subject to no tax.13 Fuels used for the purpose of domestic aviation – gasoline and kerosene – face no tax, although they do when used for other purposes, such as in road transport (Figure 4.4. ). Within the sector, the EU ETS only covers a share of aviation emissions, which themselves represent less than 0.7% of CO2 emissions from energy use in the Lithuanian off-road transport sector.

Figure 4.7. Effective Carbon Rates in the off-road transport sector mostly apply to diesel use

Emissions-weighted average ECR, by fuel category and coverage type, Lithuania, 2021

Note: This figure shows CO2 emissions from energy use excluding emissions from the combustion of biomass and the effective carbon rate they are subject to in the off-road transport sector. Taken together, emissions from gasoline and kerosene represent less than1% of total sectoral emissions, so they were grouped into one category, which is not named for readability reasons. These emissions stem from domestic aviation, and the share of these that is subject to the EU ETS is so low that it is not visible on the graph.

Source: OECD.

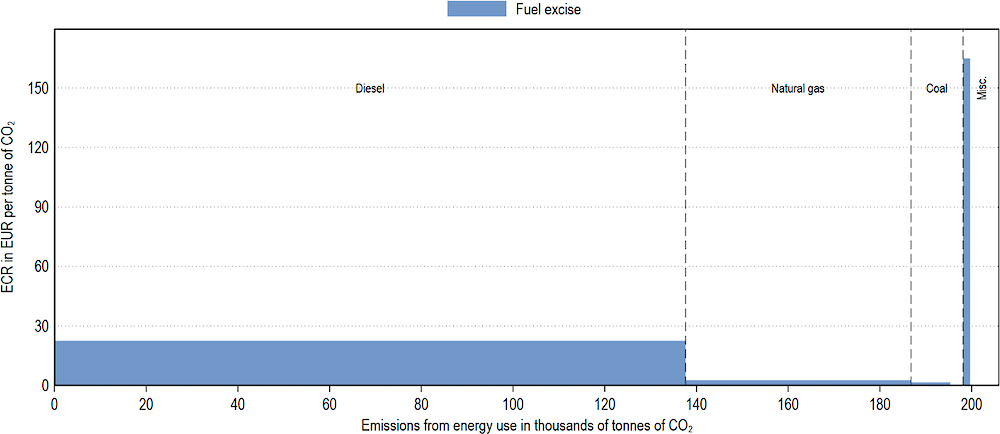

Agriculture and fisheries

The agriculture and fisheries sector represents 1.8% of CO2 emissions from energy use in Lithuania and as for the road sector, emissions are covered by fuel excise taxes only (Figure 4.8. ). The largest share of emissions comes from diesel use (66.8%), which faces the highest fuel excise rate in terms of EUR/tCO2, at EUR 22.5 (a higher rate than in the buildings sector and lower than in the road sector). Natural gas and coal use face much lower rates, both below EUR 3/tCO2. Gasoline use faces the same rate of EUR 205/tCO2 as in the road sector but accounts for less than 1% of emissions.

As in the majority of countries, CO2 emissions from energy use constitute a minor share of emissions in the agriculture and fisheries sector. Methane emissions from livestock and nitrous oxide emissions from agricultural soils are the main GHGs responsible for CO2-equivalent (CO2e) emissions in the sector. Currently, these latter emissions hardly face any carbon price. The New Zealand government, within a long-term process of engagement with farmers and growers is one of the first countries to consider the introduction of carbon pricing (at least on methane emissions) in the agricultural sector.14

Figure 4.8. Effective Carbon Rates in the agriculture and fisheries sector only stem from fuel excise

Emissions-weighted average ECR, by fuel category and coverage type, Lithuania, 2021

Note: This figure shows CO2 emissions from energy use excluding emissions from the combustion of biomass and the effective carbon rate they are subject to in the agriculture and fisheries sector. “Misc.” groups fuels that each represent less than 5% of total energy use from combustible fuels in the sector. In this sector, it is composed of emissions from fuel oil, gasoline and LPG.

Source: OECD.

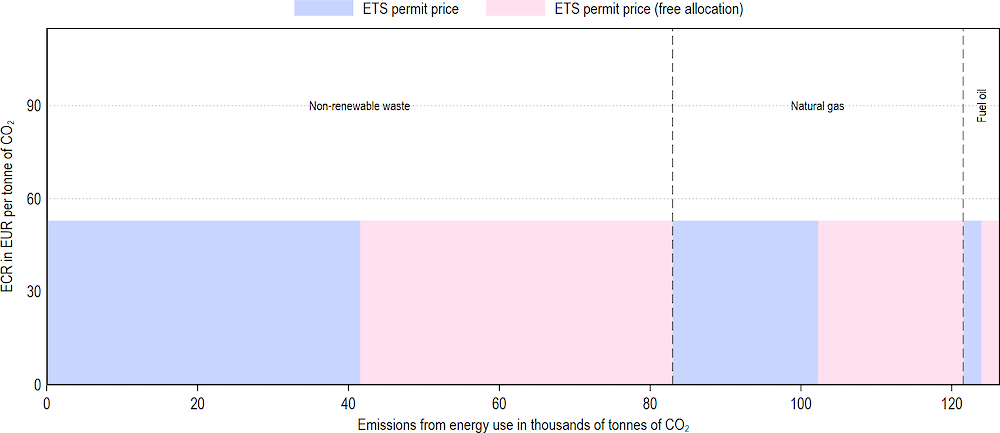

Electricity

The electricity sector (which is made up of plants for which the main activity is to produce electricity) is responsible for 1.1% of CO2 emissions from energy use in Lithuania and its emissions are exclusively covered by the EU ETS. In line with emission use patterns (Figure 4.2.,Panel B), CO2 emissions from energy use excluding biofuel stem mainly from non-renewable waste and natural gas use.15 Emissions from non-renewable waste represent 65.7% of CO2 emissions from energy use excluding biofuels in this sector, while those from natural gas represent 30.5% and fuel oil the remaining 3.9%. However, none of the fuels used in this sector face a fuel excise tax. Thus the EU ETS is the only form of emissions price in the sector (Figure 4.9. ), bringing up the same potential issues as discussed earlier in relation to the industry sector.

Figure 4.9. Effective Carbon Rates in the electricity sector only stem from the EU ETS

Emissions-weighted average ECR, by fuel category and coverage type, Lithuania, 2021

Note: This figure shows CO2 emissions from energy use excluding emissions from the combustion of biomass and the effective carbon rate they are subject to in the electricity sector.

Source: OECD.

Alignment with carbon pricing benchmarks

Depending on the sector, effective carbon rates in Lithuania are more or less aligned with benchmark carbon rates consistent with attaining carbon neutrality by 2050 or reflecting the externalities caused by CO2 emissions. Several studies find that carbon prices of EUR 30/tCO2 in 2021, of at least EUR 60 in 2025 and around EUR 125 in 2030 would be consistent with carbon neutrality goals – under complementary policies and technological development and deployment assumptions (Box 4.4). A recent study by the European Commission (2021[16]) highlights a central estimate for the social cost of carbon (SSC) of EUR 100/tCO2.

Focusing on the low-end EUR 30/tCO2 in 2021 benchmark, the analysis above shows that priced emissions in the road transport, off-road transport, industry and electricity sectors go beyond this benchmark. As in most EU countries, effective carbon rates on priced emissions in road and off-road transport are considerably above the EUR 30/tCO2 benchmark, due to the high rate of fuel taxes in these sectors. However, high taxation rates in the road transport sector also reflect the many other externalities caused by this sector, such as air pollution, accidents, congestion and noise, which have much more immediate impacts. 16 Van Dender (2019[17]) provides a more detailed discussion of the social costs of road usage, and also highlights mechanisms beyond carbon pricing that can help address these issues.

In the off-road sector, 17% of emissions are unpriced and hence fall short of reaching the EUR 30/tCO2 benchmark. The EU ETS covers 85% of emissions in the industry sector, and 100% in the electricity sector. These sectors thus largely meet the benchmark, being marginally priced at EUR 53/tCO2 on average over 2021. The buildings as well as the agriculture and fisheries sectors, which together account for 11.8% of CO2 emissions from energy use (excluding biofuel use), do not meet the EUR 30/tCO2 benchmark. Due to reduced fuel excise rates on households and commercial users, the buildings sector exhibits particularly low rates, at an average of EUR 9.8/tCO2 on priced emissions, with 52% of emissions remaining unpriced. Emissions in the agriculture and fisheries sector face higher prices than in the buildings sector, at an average of EUR 17.8/tCO2 on priced emissions. This low average mainly stems from the preferential fuel excise rate diesel use faces in this sector. However, only 4% of emissions in the agriculture and fisheries sector are unpriced.

Although the majority of emissions in most sectors in Lithuania were priced at least at the 2021 benchmark of EUR 30/tCO2, important disparities remain, which can result in inefficiencies. Disparities are caused by exemptions or lower rates on certain users (e.g. business vs non-business users), different fuel excise rates and different pricing instruments. A uniform carbon price rate at least at the sectoral level would enhance cost-efficiency, encouraging emissions cuts where they are cheapest within each sector.

Box 4.4. Carbon pricing benchmarks

The impact of greenhouse gases on climate

There are seven main greenhouse gases: carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), chlorofluorocarbons (CFCs), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulphur hexafluoride (SF6) and nitrogen trifluoride (NF3). Greenhouse gas emissions are directly responsible for climate change through global warming: by absorbing long-wave infrared radiation reflected by the earth's surface, they prevent part of the infrared radiation from being reflected back to space. This results in the absorbed energy being converted into heat.

Externalities and net-zero targets

As a result, any activity involving greenhouse gas emissions results in a climate externality imposed on others. Moreover, steadily increasing global warming could ultimately result in crossing tipping points beyond which sever and disruptive changes to human society would become irreversible. In line with this, the objective of the Paris Agreement is to minimise the threat of climate change by keeping the increase in the global average temperature to well below 2°C above pre-industrial levels and to preferably limit the increase to 1.5°C above pre-industrial levels.17 In order to implement this objective, countries are seeking to attain carbon neutrality by 2050 with, possibly, mid-term objectives to 2030 such as the European Union’s Fit for 55 proposal.

Carbon pricing benchmarks

Several studies use models to establish carbon prices consistent with these mid-term or longer-term objectives. These models depend on assumptions about energy price pathways, current and future technologies, complementary policies, and carbon capture and storage development and deployment. Kaufman et al. (2020[18]) estimate upper bound carbon prices necessary to reach the United States’ 2030 emissions reduction targets of USD 64/tCO2 in 2025 and USD 124/tCO2 in 2030. These figures are slightly lower than the IEA’s latest carbon price trajectory for the electricity, industry and heat sectors in advanced economies (IEA, 2021[19]), which sets prices at EUR 75/tCO2 in 2025 and EUR 130/tCO2 in 2030.

A recent study by the European Commission (2021[16]) focuses on calculations of the social cost of carbon (SSC)18 and, based on a wide range of studies, highlights a central value of EUR 100/tCO2 through 2030.

Effective carbon rates in Lithuania under prospective policy scenarios

This section simulates three policies reforms that have recently been proposed either at the national or European level, and that if passed, would affect carbon pricing in Lithuania. Each reform would affect the effective carbon rate profile. A detailed examination of the resulting profiles allows an assessment of whether the reforms address certain of the shortcomings of Lithuania’s carbon pricing policies highlighted in Section 4.1. Its effect on carbon pricing revenues for Lithuania are also discussed in the case of the Lithuanian Draft Law on excise duties.

Policy scenario 1 considers the implementation of the national Draft Law on fuel excise duties, which proposes changes in fuel excise taxes and the introduction of a carbon tax. Policy scenario 2 considers the implementation of the proposed revision of the European Union Energy Taxation Directive (EU ETD), which sets higher minimum taxation rates on many fuels. Policy scenario 3 considers the introduction of a second European Union Emissions Trading System (EU ETS) for transport and heating fuels.19

Policy scenario 1: the Draft Law on Excise Duties of the Republic of Lithuania

The Draft Law on Excise Duties aims at increasing fuel excise taxes and expanding their base as well as introducing a carbon tax component in fuel excise duties to pursue Lithuania’s environmental goals while avoiding detrimental effects on economic growth.20 It was prepared by the Lithuanian government in 2021, and initially planned for excise duty rates to increase from 2023, and for the carbon tax component to come into effect from 2025.

The Draft Law seeks to reduce or eliminate excise duty exemptions on fossil fuels and to increase excise duties on diesel, coal, coke and lignite over the period 2023 to 2025. As part of the new law, rates on natural gas use are meant to slightly increase as well in 2025. The law proposes the simultaneous introduction of excise duties on peat used for heating to avoid substitution into this cheaper heating fuel, which is highly carbon-emitting. The excise duty rates on the use of LPG for household heating would also increase (although only once in 2023, as opposed to many other fuel excise rates which would increase incrementally over the 2023-2025 period).21

The Draft Law further proposes the introduction of a CO2 component to fuel excise taxes in 2025, once the excise duty exemptions on fossil fuels have been eliminated or reduced. The CO2 tax component would start at EUR 10/tCO2 in 2025, to reach EUR 60/tCO2 in 2030.22 The carbon tax component would not apply to entities already subject to the EU ETS.

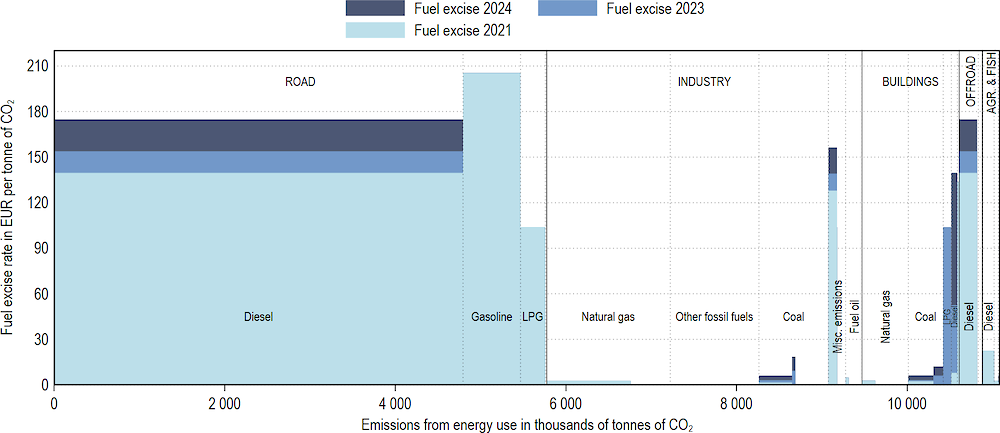

The increases in fuel excise rates and the phasing out of exemptions for 2023 and 2024 would not increase the tax base by much but would considerably increase rates in terms of EUR/tCO2 for emissions from diesel, coal and LPG for used for household heating (Figure 4.10. ). On average, tax rates (i.e. fuel excise taxes) on priced emissions are increased by 7.6% in 2023 and 20.4% in 2024 as compared to 2021 levels.

The most affected sector in terms of base-broadening and rates is the buildings sector, which helps it catch-up with other sectors highlighted in Section 4.1, both in terms of coverage (base) and price-level (rates) gaps. The phasing-out of exemptions ensures that 66% of emissions are priced in 2023 and 2024 (up from 48% in 2021), in particular due to the introduction of a fuel excise rate on LPG used for household heating. The increased rates for emissions from coal (triple) and diesel use (17-fold) ensure that the average effective carbon rate on priced emissions goes from EUR 9.8/tCO2 in 2021 to EUR 36.6/tCO2 in 2024.23

The Draft Law would also partially address the inefficiency of the “diesel differential” highlighted in Section 4.1, by reducing the gap between the ECR for diesel and gasoline. As of 2024, there would still remain a gap of about EUR 30/tCO2 (down from EUR 66/tCO2 in 2021). The proposed increase in diesel excise taxes also significantly increases effective carbon rates in the road and off-road sectors, which, as mentioned in the previous section, may also help address other externalities related to the transport sectors such as air pollution. Additionally, rates for business and non-business users would be evened out for coal as well as for coke and lignite use, and this could help minimise inefficiencies cause by heterogeneous rates as discussed in the previous section. Indeed, aligning carbon rates faced by users within a sector increases the efficiency of carbon pricing by allowing CO2-emission decreases where it is the least costly to do so.

Figure 4.10. In 2023 and 2024 the Draft Law would particularly increase fuel excise rates in the road, off-road and buildings sectors

Emissions weighted average fuel excise rates, in EUR/tCO2, all sectors, Lithuania

Note: This figure shows CO2 emissions from energy use excluding emissions from the combustion of biomass and the fuel excise tax rates they are subject to in EUR/tCO2, in all energy sectors of the Lithuanian economy apart from the electricity sector. Indeed, in this sector fuels are untaxed and would continue to be so under the Draft Law. Fuel excise tax rates are represented for 2021 as a reference, as well as in 2023 and 2024, when only fuel excise taxes are meant to nationally change.

Source: OECD, Draft Law on Excise Duties of the Republic of Lithuania.

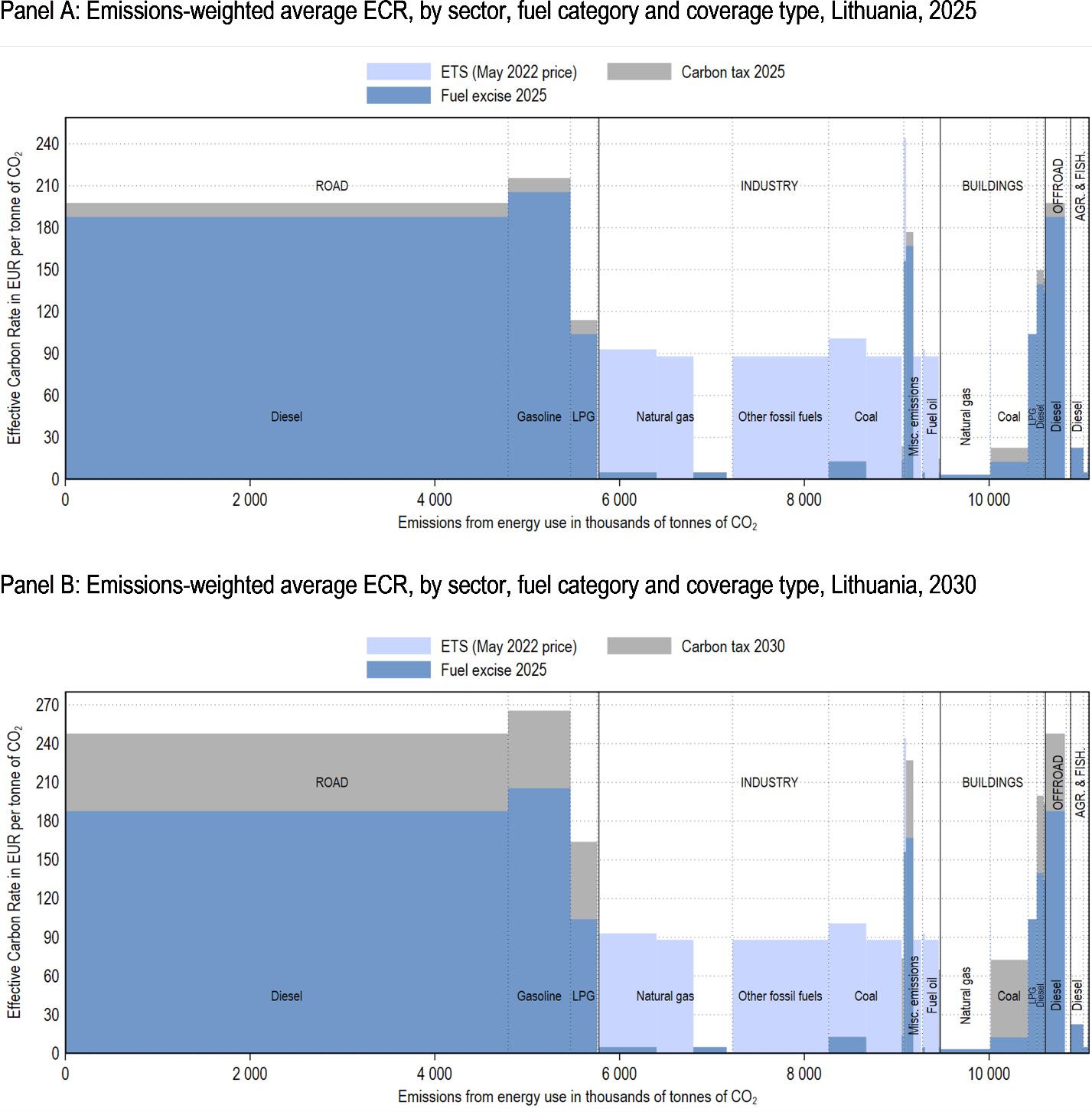

As can be seen in Figure 4.11. , Panel A, the carbon tax component, which is planned to come into effect in 2025 and to steadily increase with a predetermined path at least until 2030, will mainly apply to emissions in harder-to-abate sectors, thus allowing users in these sectors to adapt and plan, but will not apply to emissions covered by the EU ETS. The carbon component is partly meant to complement the EU ETS. However, its price level in 2025 is eight times lower than the current allowance price level, which is at EUR 88/tCO2 in May 2022. Despite this potential caveat, the fuels used in the sectors to which it applies – the road, buildings and off-road sectors – are subject to much higher excise rates than those in EU ETS‑covered sectors (Figure 4.11. ). With current EU ETS allowance prices, this results in higher ECRs in these three sectors, which are also hard-to-abate sectors today (be it for technological, affordability or political economy reasons). The relatively high and stable carbon tax proposed for the next 6 years would allow actors in these sectors to carry out a forward-looking switch to cleaner technologies.

In particular, in the road sector, such price levels (on average EUR 195/tCO2 in 2025 and EUR 245/tCO2 in 2030, see Figure 4.11. , Panel B) can help prepare the transition to electric vehicles (EVs) by making the substitution from internal combustion engine vehicles to EVs more advantageous. This transition would be in line with the EU Fit for 55 proposal of phasing-out the sales of new ICE cars by 2035.24 However, the current design of the carbon tax as a non-overlapping instrument with the EU ETS does not allow it to address certain issues raised by the uncertainty of allowance prices. In certain countries such as the Netherlands or the United Kingdom, carbon taxes have been used with this aim by effectively setting carbon pricing floors in certain sectors (Box 4.3).

The proposed introduction of a fuel excise tax on households’ natural gas use, along with the introduction of a carbon tax on LPG use, both from 2025, would bring coverage of CO2 emissions from energy use in the buildings sector to 100%. This would present important progress from 2024 rates and coverage, and would result in an increase in the coverage of economy-wide emissions from energy use excluding biofuel combustion to 98.5% from 2025 onwards. The residual gap is principally due to emissions from domestic aviation and navigation as well as from pipeline transport remaining unpriced.

In 2025, at current permit prices, the ECR would exceed the benchmark price of EUR 60/tCO2 for the same advanced sectors in terms of carbon pricing as in 2021, i.e., the road, off-road, electricity and industry sectors, and would still fall short of this benchmark price for the buildings and agriculture sectors. This last statement, however, masks a difference in carbon pricing progress between the two sectors, should the law be passed. Despite not meeting the EUR 60/tCO2 benchmark, the Draft Law would induce the most change in the buildings sector, both in terms of base broadening and rates increase, while hardly affecting carbon pricing in the agriculture and fisheries sector. Carbon prices in the electricity and industry sectors would remain largely unaffected by the proposed reform: in both sectors, the EU ETS would remain the main driver of both coverage and price levels.

Under the Draft Law, in 2025, more than 95% of emissions would be priced in the buildings, electricity, road, agriculture and industry sectors, and 77% in the off-road sector. Average effective carbon rates would be at EUR 198/tCO2 on priced emissions in the off-road transport sector, 196 in the road transport sector, 88 in the electricity sector, 84 in the industry sector, 31 in the buildings sector and 19 in the agriculture and fisheries sector. In 2030, abstracting from potential changes to the EU ETS, the proposal would induce progress primarily in the off-road transport, road transport and buildings sectors, with average ECRs on priced emissions of respectively EUR 248/tCO2, EUR 245.5/tCO2 and EUR 53/tCO2.

All in all, the proposed fuel excise rate changes, along with the introduction of the carbon tax would (i) help reduce the diesel differential in the road transport sector, improve coverage in the buildings sector and thus more broadly, and bring ECRs close to levels consistent with net-zero goals, but would (ii) miss the opportunity of providing more stability to investors in the industry sector especially. Indeed, with its current design, the carbon tax component adds on to existing fuel excise taxes and only applies to entities not subject to the EU ETS. However, in the industry sector in particular, where fuels are hardly taxed, its design could be adapted in order to act as a carbon price floor (see Box 4.3 for country-specific examples) – hence applying to emissions covered by the EU ETS and addressing the potential volatility and uncertainty issues discussed in Section 4.1. In practice, carbon taxes applying to emissions covered by the EU ETS could work as a complement to the permit price: for example a carbon tax of EUR 60/tCO2 would kick-in only if the permit price was lower. With such a carbon tax price path, individuals and firms in all sectors would know with certainty which minimum price CO2 emissions would be facing in the years to come, thus improving their adaptation, investment and planning decisions and possibilities.

This planned series of reforms along with the increase of the EU ETS average permit price to EUR 88/tCO225 (from EUR 53/tCO2 in 2021) would result in a 4% reduction in CO2 emissions from energy use by 2030, and a 65% increase in carbon-related revenue. These figures are obtained using recent estimates of CO2 emission responses to carbon pricing (D’Arcangelo et al., Forthcoming[20]), showing that a EUR 10 increase in the effective carbon rate decreases CO2 emissions from fossil fuels by 3.7% on average in the long term.26 Despite their effect on emissions (i.e. on the erosion of the base), it is estimated that the series of increases in effective carbon rates would result in non-negligible revenues of EUR 0.98 billion in 2023, EUR 1.21 billion in 2025 and EUR 1.47 billion in 2030, which would respectively represent 1.96%, 2.43% and 2.96% of the Lithuanian 2020 Gross Domestic Product (GDP).27

The main revenue source, however, would be from the road transport sector,28 and these figures do not account for the electrification of the vehicle fleet, which is bound to substantially decrease revenues from carbon pricing in that sector. In order to tackle this issue as well as the externalities (such as congestion and accidents) that would remain despite electrification of the transport fleet, the use of new price-based instruments could be considered. Distance-based taxes and congestion charges are discussed in Van Dender (2019[17]), and could have the added benefit of being better at tackling this issue than carbon pricing.

Figure 4.11. The carbon tax component would mostly affect the road and off-transport sectors as well as the buildings sector

Note: This figure shows CO2 emissions from energy use excluding emissions from the combustion of biomass and the effective carbon rates they would be subject to in EUR/tCO2, in all energy sectors of the Lithuanian economy apart from the electricity sector, were the Draft Law passed. Indeed, in this sector fuels are untaxed and would continue to be so under the Draft Law. The figure now includes EU ETS coverage, as a point of comparison with the new carbon tax component, which is in part meant as a complement to this mechanism. In 2025, the carbon tax component of the fuel excise tax is at EUR 10/tCO2 on all concerned fuels and in 2030, at EUR 60/tCO2.

Source: OECD, Draft Law on Excise Duties of the Republic of Lithuania.

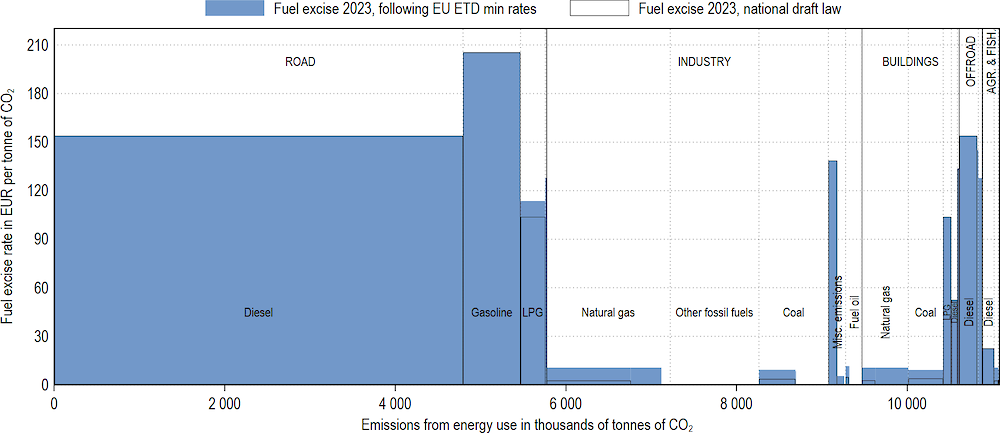

Policy scenario 2: the proposed revision for the European Union Energy Taxation Directive

Fuel excises taxes in Lithuania are subject to the minimum rates set out by the EU ETD. Its revision proposal would hence also impact fuel excises in Lithuania. This section discusses EU ETD revisions and timeline as they were proposed in early January. For now, however, the negotiations are on hold, possibly until March 2023.29

The EU’s Energy Taxation Directive (ETD) was first implemented in 2003 and has since set minimum excise duty rates for the taxation of electricity as well as of energy products used as motor fuels and heating fuels for all EU member states. Individual EU member states may set their own rates as long as they are at least equal to these minimum rates. In practice, most member states tax almost all of their energy products and in some cases, considerably above the ETD minimum rates.30

Revising the ETD to better reflect the EU’s environmental goals is one of the key measures needed to deliver the European Green Deal. On 21 January 2022, the European Economic and Social Committee adopted an opinion on the Energy Taxation Directive; the rates proposed in the 14 July 2021 proposal are for 2023 onwards (European Commission, 2021[21]).31 This update has been proposed for multiple reasons, including:

the fading link between the minimum tax rates of fuels and their energy content as well as environmental impacts;

the development of emerging fuels, to which, for lack of being listed in the current ETD, the tax rate of the fuel that is used for equivalent purposes applies;

the increasing number of exemptions and reductions across Member States, which damages the possibility for a level playing field between all Members.32

To address (i), rates in the proposed revision of the EU ETD are expressed in EUR per GJ, instead of EUR per common commercial unit (e.g. 1000 litres or tonnes). The rates increase with the fuel’s environmental impacts, but also account for the fuel’s us e and hence the distributional consequences of its taxation. For example, motor fuels are taxed at a higher rate than heating fuels.

To address (ii), the European Commission established a more exhaustive list of fuels, from the most polluting to the most sustainable ones. The most polluting fossil fuels as well as non-sustainable biofuels are subject to the highest rates (EUR 10.75 or 0.9 per GJ depending on their use). Fuels which are considered as transitionary fuels are subject to medium rates (EUR 7.17 or 0.6 per GJ depending on their use), while sustainable but not advanced biofuels are subject to even lower rates (EUR 5.38 or 0.45 per GJ depending on their use). The lowest rates apply to advanced sustainable biofuels and biogas, and renewable fuels of non-biological origin (EUR 0.15 per GJ whatever their use). The rates were set according to the environmentally damaging effects of fuels, and as such, are not carbon-specific. Hence, these minimum rates also apply to sectors subject to the EU ETS.

To address (iii), exemptions such as those on aviation or maritime fuels are to be phased out. For intra‑EU flights or navigation, the highest motor fuel rates are applied. International flights and shipments are subject to lower rates, either through reduced rates on motor fuels, or with a slow phase-in to the highest motor fuel rates. Certain reductions remain possible, in particular for the agricultural sector (but not fishery). Moreover, “Member States shall exempt from taxation under fiscal control energy products and electricity used to produce electricity and electricity used to maintain the ability to produce electricity.”

This reform may potentially cause distributional and affordability issues, as the expense share of fuel use in total budgets may be greater for poorer and rural households (see Gore et al. (2022[22]) for a recent analysis), but the goal of the proposal is for the reform to be anchored into a broader package, the Fit for 55 proposal. Under the Energy Efficiency Directive, the public sector will be required to renovate 3% of its buildings each year to drive the renovation wave, create jobs and bring down energy use and costs. Additionally, a Social Climate Fund was proposed, which would provide dedicated funding to EU member states to help households finance investments in energy efficiency, new heating and cooling systems, and cleaner mobility.33 Chapter 6 of this report also study potential ways to recycle revenue that could help address these issues.

Figure 4.12. shows that when comparing the 2023 excise tax rates that would result from Lithuania’s Draft Law to the proposed minimum rates for 2023, it appears that the main additional impact of the EU ETD proposal would be on the taxation of natural gas. This would increase the base coverage of the buildings sector to 98.5% (as compared to around 52% today and 66% in 2023 with the Draft Law only). The increase in coverage as compared to the Draft Law, however, would primarily hold until 2025, after which a tax on natural gas use by households would also be introduced under the Draft Law (the only difference would then be the increased coverage of natural gas in the industry sector due to the EU ETD revision). The extension to navigation and aviation fuels would increase the base in the off-road sector as well. Given that the minimum rates on diesel and gasoline are lower than those which would result from the implementation of the Draft Law in 2023, the flattening out of the gap between the two would not occur, and the inefficiency mentioned previously would persist.

Figure 4.12. In 2023 EU ETD revised rates would mainly affect the ECR for coal and natural gas use

Emissions-weighted average fuel excise rates in EUR/tCO2, by sector, fuel category and coverage type, Lithuania

Note: This figure shows CO2 emissions from energy use excluding emissions from the combustion of biomass and the effective carbon rates they would be subject to in EUR/tCO2, in all energy sectors of the Lithuanian economy apart from the electricity sector, under the Draft Law or the EU ETD revision. In the electricity sector fuels are untaxed and would continue to be so under the Draft Law.

Source: OECD, current proposal for the EU ETD revision.

Policy scenario 3: The proposed extension of the EU ETS

1. The European Commission (EC) has proposed to extend carbon pricing to the buildings and road transport sectors, through a second emissions trading system, the ETS2. This new system would operate in parallel to the existing one and would regulate fuel suppliers upstream (see also Chapter 2). The proposed starting date was initially 2025, with an emissions cap and from 2026, 100% auctioning of emissions allowances (Gore, 2022[22]).34 In Germany, a national ETS was implemented in 2021, with similar features. It is described in Box 4.5.

Box 4.5. The German national Emissions Trading System

In 2021, Germany launched its National Emissions Trading System – Nationales Emissionshandelssystem or ‘nEHS’ – for heating and motor fuels.

The national ETS is to be phased in gradually, with a fixed price per tonne of CO2 from 2021 (EUR 25/tCO2) to 2025 (EUR 55/tCO2). In 2026, auctions with minimum and maximum prices are to be introduced.

The system is to cover fuel oil, LPG, natural gas, gasoline, and diesel in 2021. Other fuels such as coal are to be covered from 2023 onwards.

The cap is to be determined annually based on a separate Cap Regulation (adopted in 2021). The cap was set in line with Germany’s reduction targets for the non-EU ETS sectors as defined by the European Effort Sharing Regulation (ESR) and is to decline each year.

Source: ICAP (2021[23]).See also Box 2.3.

As the ETS 2 and its various design options remain under discussion, the simulation applied here assumes that the German nEHS design is applied to the EU ETS extension. The simulation assumes that the ETS 2 will be introduced from 2025 and that permit prices are fixed at EUR 55/tCO2 that apply to 40% of emissions. It further retains fuel excise rates and carbon tax rates as would apply under the Draft Law and the EU ETD revision in 2025 – i.e. the EU ETS extension would take place along with the EU ETD revision and the implementation of the Draft Law, with no other tax changes.

In the road transport sector in Lithuania, such an EU ETS2 would bring ECRs to an average of EUR 218/tCO2 by 2025, which is in line with currently observed carbon prices in other EU countries such as France, Sweden and Ireland. As such the ETS 2 would provide additional incentive and support to the transition to electric vehicles, while keeping in mind the importance of maintaining an equivalent source of revenue and of finding alternative ways to tackle other externalities caused by circulation.

In the buildings sector, such an EU ETS2 would bring ECRs to an average of EUR 56.5/tCO2 by 2025, which would almost align carbon prices in that sector with the EUR 60/tCO2 benchmark for 2025. An increase of permit prices or ETS2 coverage until 2030 would also ensure an alignment with benchmark prices for 2030.

Pricing CO2 emissions from biofuel use

In Lithuania, only biofuels used in the road sector are taxed – consistent with the discussion in Box 4.2 on the scarcity of taxes on biofuel combustion. In Lithuania, biofuel combustion represents a minor share of emissions from fuel combustion in the sector.

As can be seen in Figure 4.13. , CO2 emissions from biofuel combustion account for a much larger share of emissions in the industry, buildings and electricity sectors (consistent with Figure 4.2.), none of which are priced. When accounting for these emissions, only 61% of total CO2 emissions from fuel combustion are priced in 2021.

The Draft Law proposes to phase-in taxes on first generation biofuels and the proposed revision to the EU ETD includes different rates for biofuels depending on their sustainability (Table A.4). As alluded to in Box 4.2, reliable data on biofuel sustainability may not be readily available and may make taxing biofuels according to sustainability categories challenging. Regardless, the EU ETD revision proposes a minimum rate of EUR 0.15 per GJ even for the most sustainable biofuels. This would increase coverage of emissions taken at the point of combustion (hence including biofuels) from 61% to 96%.

Figure 4.13. A larger share of Effective Carbon Rates is null when including emissions from biofuels

Emissions-weighted average ECR, by sector, fuel category and coverage type, Lithuania, 2021

Note: This figure shows CO2 emissions from energy use including emissions from the combustion of biomass and the effective carbon rates they are subject to in EUR/tCO2 in 2021.

Source: OECD.

References

[15] Anderson, B. (2021), “Policies for a climate-neutral industry: Lessons from the Netherlands”, OECD Science, Technology and Industry Policy Papers 108.

[5] Baudry, G. et al. (2017), “The challenge of measuring biofuel sustainability: A stakeholder-driven approach applied to the French case”, Renewable and Sustainable Energy Reviews, Vol. 69, pp. 933-947, https://doi.org/10.1016/j.rser.2016.11.022.

[20] D’Arcangelo, F. et al. (Forthcoming), “Estimating the CO2 emission and revenue effects of carbon pricing: new evidence from a large cross-country dataset”, OECD Economics Department Working Paper Series.

[25] Dornoff, F. (2019), “Gasoline versus diesel: Comparing CO2 emission levels of a modern medium size car model under laboratory and on-road testing conditions”, The ICCT White Paper, https://www.theicct.org/publications/gasoline-vs-diesel-comparing-co2-emission-levels.

[16] European Commission (2021), Green taxation and other economic instruments - Internalising environmental costs to make the polluter pay.

[21] European Commission (2021), Proposal for a COUNCIL DIRECTIVE restructuring the Union framework for the taxation of energy products and electricity - COM(2021)563.

[12] Flues, F. and K. van Dender (2020), “Carbon pricing design: Effectiveness, efficiency and feasibility: An investment perspective”, OECD Taxation Working Papers, No. 48, OECD Publishing, Paris, https://doi.org/10.1787/91ad6a1e-en.

[10] Flues, F. and K. van Dender (2017), “Permit allocation rules and investment incentives in emissions trading systems”, OECD Taxation Working Papers, No. 33, OECD Publishing, Paris, https://doi.org/10.1787/c3acf05e-en.

[22] Gore, T. (2022), Green and fair taxation in the EU.

[24] Government of Lithuania (2022), Lithuania’s National Inventory Report to the UNFCCC, Government of Lithuania, Vilnius, https://unfccc.int/documents/461952 (accessed on 21 February 2022).

[9] Harding, M. (2014), “The Diesel Differential: Differences in the Tax Treatment of Gasoline and Diesel for Road Use”, OECD Taxation Working Papers, No. 21, OECD Publishing, Paris, https://doi.org/10.1787/5jz14cd7hk6b-en.

[13] Hirst, D. (2018), Carbon Price Floor (CPF) and the price support mechanism, https://researchbriefings.files.parliament.uk/documents/SN05927/SN05927.pdf.

[23] ICAP (2021), German National Emissions Trading System.

[19] IEA (2021), Net Zero by 2050 - A Roadmap for the Global Energy Sector.

[8] IEA (2020), Extended world energy balances (database), http://www.iea.org/statistics/topics/energybalances.

[4] Jeswani, H., A. Chilvers and A. Azapagic (2020), “Environmental sustainability of biofuels: a review”, Proceedings of the Royal Society A: Mathematical, Physical and Engineering Sciences, Vol. 476/2243, p. 20200351, https://doi.org/10.1098/rspa.2020.0351.

[18] Kaufman, N. et al. (2020), “A near-term to net zero alternative to the social cost of carbon for setting carbon prices”, Nature Climate Change, Vol. 10/11, pp. 1010-1014, https://doi.org/10.1038/s41558-020-0880-3.

[7] Kooten, G., C. Binkley and G. Delcourt (1995), “Effect of Carbon Taxes and Subsidies on Optimal Forest Rotation Age and Supply of Carbon Services”, American Journal of Agricultural Economics, Vol. 77/2, pp. 365-374, https://doi.org/10.2307/1243546.

[14] Leroutier, M. (2022), “Carbon pricing and power sector decarbonization: Evidence from the UK”, Journal of Environmental Economics and Management, Vol. 111, p. 102580, https://doi.org/10.1016/j.jeem.2021.102580.

[11] Martin, R. (2013), “Carbon markets, carbon prices and innovation: Evidence from interviews with managers.”, Paper presented at the Annual Meetings of the American Economic Association, San Diego..

[26] Nordhaus, W. (2014), “Estimates of the Social Cost of Carbon: Concepts and Results from the DICE-2013R Model and Alternative Approaches”, Journal of the Association of Environmental and Resource Economists, Vol. 1/1/2, pp. 273-312, https://doi.org/10.1086/676035.

[1] OECD (2021), Effective Carbon Rates 2021: Pricing Carbon Emissions through Taxes and Emissions Trading, OECD Publishing, Paris, https://doi.org/10.1787/0e8e24f5-en.

[6] OECD (2021), OECD Environmental Performance Reviews: Finland 2021, OECD Environmental Performance Reviews, OECD Publishing, Paris, https://doi.org/10.1787/d73547b7-en.

[2] OECD (2019), Taxing Energy Use 2019: Using Taxes for Climate Action, OECD Publishing, Paris, https://doi.org/10.1787/058ca239-en.

[3] OECD (2016), Effective Carbon Rates: Pricing CO2 through Taxes and Emissions Trading Systems, OECD Publishing, Paris, https://doi.org/10.1787/9789264260115-en.

[17] van Dender, K. (2019), “Taxing vehicles, fuels, and road use: Opportunities for improving transport tax practice”, OECD Taxation Working Papers, No. 44, OECD Publishing, Paris, https://doi.org/10.1787/e7f1d771-en.

Notes

← 1. In 2018, Lithuania’s greenhouse gas emissions amounted to 16 400.1 ktCO2eq including Land-Use Change and Forestry (LULUCF) (see (Government of Lithuania, 2022[24])). Lithuania’s CO2 emissions from energy use excluding biomass combustion amounted to 11 214.7 ktCO2 in 2018 (IEA, 2020[8]).

← 2. Thus, effective carbon rates are sometimes also referred to as effective marginal carbon rates.

← 3. https://energy.ec.europa.eu/topics/renewable-energy/bioenergy/biofuels_en, as accessed on 30 May 2022.

← 4. Note that recent research also shows that emissions per kilometre driven are also higher for latest technology diesel cars than gasoline cars (Dornoff, 2019[25]).

← 5. These are diesel, LPG and gasoline not used for heating.

← 6. Peat and peat products belong to the fuel category “Coal and other solid fossil fuels”.

← 7. https://ember-climate.org/data/data-tools/carbon-price-viewer/, as viewed on 16/05/2022. It is also worth noting that the price signal arising from the EU ETS in 2018 was much lower, at an average of EUR 16/tCO2.

← 8. This is not to say that fuel excise taxes cannot result in the same rate per tonne of CO2. If first expressed per tonne per CO2 and transformed per litre or GJ for example, this could be the case. However, this is generally not how fuel excise tax rates are set.

← 9. Law Nr. XI-722 of 2010, art. 58 1. (4).

← 10. In accordance with Law Nr. XI-722 of 2010, art. 43 1. (5-7).

← 11. For emissions representing more than 5% of the base.

← 12. Note however, that this is only domestic transport – even intra-EU flights and shipments are not accounted for in this figure.

← 13. Law Nr. XI-722 of 2010, art. 58 1.

← 14. See https://environment.govt.nz/news/consultaton-on-government-proposals-to-price-agricultural-greenhouse-gas-emissions/, accessed on 08 November 2022.

← 15. While these represent approximately the same share of energy use (about 15%) in the electricity sector, the amount of CO2 emissions they generate differs – non-renewable waste being associated with almost twice as many CO2 emissions per Giga Joule (GJ) as natural gas.

← 16. At least as long as vehicles remain of the internal combustion engine (ICE) type rather than electric vehicles (EVs).

← 17. 2°C has been established as a critical global temperature after which changes may become dramatic and irreversible; 1.5°C would further reduce the risks and impacts of climate change.

← 18. The SCC is defined by Nordhaus (2014[26]) as the economic cost caused by an additional tonne of CO2 emissions or its equivalent; it rests on the concept of internalising externalities and includes considerations on inter- and intra‑generation equity.

← 19. This section does not deal with recent measures by the Lithuanian government to address price increases, in particular the “Mitigation of the Effects of Inflation and Strengthening Energy Independence” package – see e.g., https://finmin.lrv.lt/en/news/the-eur-2-26-billion-package-presented-to-counter-the-effects-of-inflation-and-to-strengthen-energy-independence, as accessed on 8 June 2022.

← 20. Its exact name is the Law on Excise Duties of the Republic of Lithuania No. IX-569 1, 2, 3, 27, 35, 36, 37, 38, 39, 41, 43, 53, 54, 55, 58 1, 59, as well as amendments to Section 5 of Chapter II, the repeal of Article 40 and a supplement to the Law as Annex 4 to the Law. It is hereinafter referred to as the Draft Law. Chapter 3 provides additional details.

← 21. Tables 3 and 4 in Chapter 3 gives a complete picture of the rate changes.

← 22. As in many other countries, this component is expressed in EUR/tCO2 and then converted into a tax in EUR per common commercial metric (e.g. per 1 000 litres for kerosene, per tonne for coal).

← 23. These price levels fix 2024 allowance prices to their May 2022 level, of EUR 88/tCO2.

← 24. https://ec.europa.eu/commission/presscorner/detail/en/IP_21_3541, accessed on 19 May 2022.

← 25. May 2022 EU ETS permit price.

← 26. “Long-term” here and in the referenced paper is taken to be 10 years.

← 27. These figures suppose that free allocation of emission permits remains the same in 2025 and 2030, and that permit prices are fixed at their May 2022 level of EUR 88/tCO2. Both are conservative estimates. It is probable that these figures represent lower bounds, as it could be expected that EU ETS permit prices will increase in the coming years, and that free permits will gradually be phased out.

← 28. Around 90% of revenues would arise from the road sector with the current allocation of free permits and around 75% if free permits were phased out and permit prices remained at 2022 levels.

← 29. https://www.taxnotes.com/tax-notes-international/environmental-taxes/meps-put-energy-taxation-directive-negotiations-hold/2022/10/03/7f63c, as accessed on 08 November 2022.

← 30. https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3662, as accessed on 30 May 2022.

← 31. https://www.europarl.europa.eu/legislative-train/theme-a-european-green-deal/file-revision-of-the-energy-taxation-directive, as accessed on 7 June 2022.

← 32. https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3662, as accessed on 30 May 2022.

← 33. https://ec.europa.eu/commission/presscorner/detail/en/IP_21_3541, as accessed on 7 June 2022.

← 34. The starting date is currently being discussed, however; see https://www.taxnotes.com/tax-notes-today-international/environmental-taxes/ep-groups-agree-less-ambitious-cbam-proposal/2022/06/02/7djnk, as accessed on 2 June 2022.