This chapter provides an assessment of Lithuania’s green finance landscape with a focus on low-carbon infrastructure investments. The chapter focuses on the role of the public sector both as a source of finance and as an enabler for private sector engagement. It discusses the extent to which government can anchor investor expectations by providing strong long-term policy signals and regulatory frameworks that are well aligned with its decarbonisation objectives. It also provides avenues for increasing public sector’s absorptive capacity and spending efficiency of EU funds for investments and underscores the importance of engaging local governments. The chapter identifies barriers to private sector investment that are specific to Lithuania and green infrastructure investments and proposes ways that government action can strengthen incentives for private investments through reaching critical mass for investors and providing risk-sharing schemes between public and private actors.

Reform Options for Lithuanian Climate Neutrality by 2050

5. Mobilising low-carbon infrastructure investment in Lithuania

Abstract

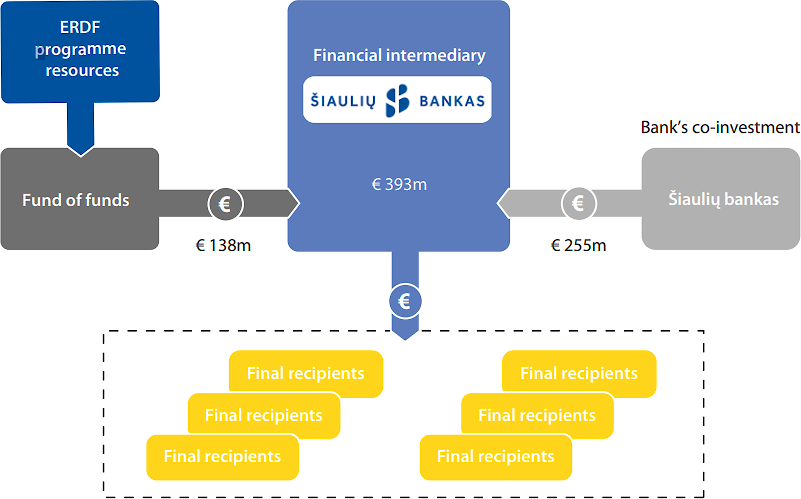

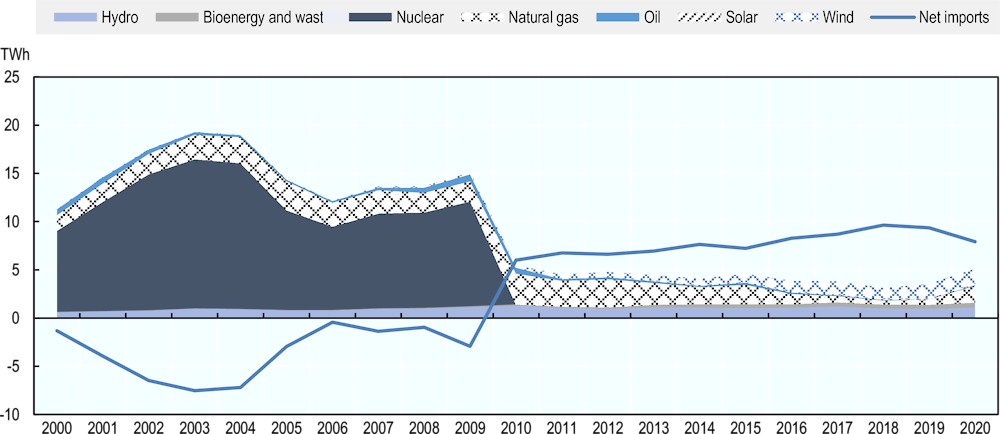

Lithuania’s decarbonisation will require a substantial transformation of energy and production systems, as is the case in other countries. The process is complicated as currently, Lithuania imports three-quarters of its domestic electricity needs given limited domestic generation capacity following the shutdown of the Ignalina nuclear power plant in 2009 (Figure 5.1). With a view of reducing energy imports by half by 2030 and a target to reach 100% renewable energy in its electricity sector and 50% in its transport sector by 2050, the infrastructure needs are considerable (Figure 5.2). These ambitions rest on a two-pronged approach of increasing domestically produced electricity and decarbonising the energy system by raising solar and wind generation capacity. This will require an improvement in electricity system flexibility through larger storage capacity, modern system balancing services and synchronisation of Europe’s power system (IEA, 2021[1]).

The energy mix of Lithuania’s domestic electricity supply has already changed over the past decade in the direction of meeting these goals. The share of natural gas in the energy mix of electricity generation fell from 43% in 2014 to 34% in 2020. On the other hand, the contribution of wind power increased both in absolute and relative terms, from 16% to 30% over the same period; solar power increased by 40% since 2014 contributing 2.5% of total electricity generation (Figure 5.1. ). Investments will continue to add more wind and solar capacity to the grid. An auction for 700 MW of offshore wind capacity (doubling the already installed capacity in 2021) is planned for 2023 (LVEA, 2022[2]). This wind farm would generate up to 3 TWh of electricity (which represents about 26% of the country’s electricity demand in 2019).

Figure 5.1. Electricity imports exceed domestically produced electricity

Total electricity generation by energy carrier in TWh (2000 – 2020)

Source: IEA World Energy Statistics.

Figure 5.2. Renewable energy resources will need to increase substantially to make up for reduction in imports

Composition of electricity supply by energy carrier (2000 -2020)

Source: IEA World Energy Statistics.

Emissions from the transport sector continue to grow while the sector has the lowest renewable energy penetration (Chapter 1). There are several policy options available that can encourage the shift towards less polluting energy sources in the transport sector as discussed in Chapter 2. These include infrastructure investment in recharging stations to facilitate the uptake of electric and other low-emissions vehicles (e.g. hydrogen powered ones) and shifting railway transport and to shift freight transport to shipping.

This chapter provides an assessment of Lithuania’s climate finance landscape with a focus on low-carbon infrastructure investments. It identifies the main challenges and proposes ways for public authorities to scale up investments. The following section discusses modelling results for investment needs in the sector electricity sector to align with net-zero targets. The next section focuses on the role of the public sector both as a source of finance and as an enabler for private sector engagement. It discusses the extent to which government can anchor investor expectations by providing strong long-term policy signals and regulatory frameworks that are well aligned with its decarbonisation objectives. It also provides avenues for increasing public sector’s absorptive capacity and spending efficiency of EU funds for investments, including the development of project pipelines as an important strategy to crowd-in private investors. Finally, the section underscores the importance of engaging local governments to participate in the financing and implementation of infrastructure projects.

The final section identifies barriers to private sector investment that are specific to Lithuania and green infrastructure investments. These include market imperfections, such as the lack of critical size in capital markets, complexity of infrastructure investment and evolving risks over the lifespan of projects. To tackle these challenges, government action can strengthen incentives for private investments in green infrastructure, reaching critical mass for investors and providing risk-sharing schemes between public and private actors.

Quantifying investment needs for decarbonisation

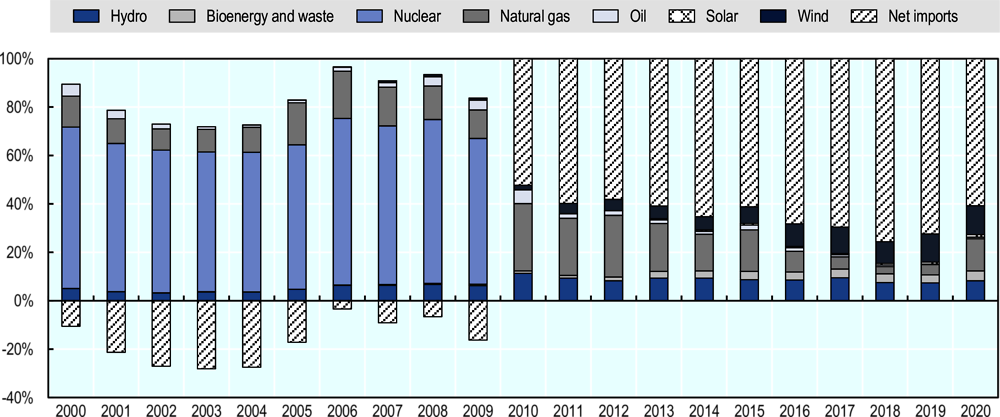

Lithuania’s energy infrastructure will need to undergo a drastic transformation to meet its dual objective of energy independence and decarbonisation. In order to do so, renewable energy capacity needs to be scaled up considerably, in addition to other investments to reduce emissions. Current plans aim to increase renewable installed renewable energy capacity fivefold, from 1.1 GW in 2021 to 5.4 GW in 2030 (Figure 5.3)

Figure 5.3. , driven mostly by onshore wind and solar energy. The estimated cost of additional capacity in renewable energy amounts to a total of EUR 6.5 billion over the period 2021 to 2030. Additional investments are needed, for instance in grid upgrades and storage, as these together with investments in renewables account for 80% of total investments in the power sector (IEA, 2022[3]).

Figure 5.3. Solar and onshore wind power will dominate renewable capacity expansions

Capital expenditure on capacity expansion in renewable electricity generation (2021 – 2030)

Note: Data on capacity expansions and installation costs may not necessarily be consistent with net-zero targets.

Source: Lithuania Energy Agency.

While the public sector will be a key driver of infrastructure investment, the private sector will have to fund additional investments. The Lithuanian government estimates that a total of EUR 14.1 billion of additional investment will be needed to finance decarbonisation objectives by 2030 (EUR 9.8 billion from public sources and EUR 4.3 billion from private funds). Already, about one third of the EUR 6.4 billion EU Structural Investment Funds package for the period covering 2021 to 2027 has been allocated to supporting the green transition (European Commission, 2022[4]). This includes building renovations and providing incentives to reach 50% of electricity and 67% of heating from renewable sources by 2030. In addition, at least 37% of the Recovery and Resilience Facility funds will be focussed on green transition programmes, adding on another EUR 823 million. Nonetheless, private sector involvement is necessary to fill the financing gap, which is large at EUR 3 billion for the renewable energy sector alone. Government efforts to mobilise private finance will be instrumental to this end.

Historically, the public sector has relied heavily on distributing grants or subsidies to fund infrastructure investments, with the risk of crowding it out private investments. Thus far, EU Structural Investment Funds (ESIF) and European Fund for Strategic Investment (EFSI) have dominated climate finance in Lithuania. Over the 2014-2020 period, Lithuania spent EUR 6.3 billion in ESIF (European Commission, 2022[5]), which represented around 60% of its total public investment (EUR 10.4 billion) in the same period (OECD, 2022[6]). National public resources are mobilised as part of the co-financing schemes. EU funding provides financial assistance for a broad selection of sectors and activities, including energy and transport infrastructure and the low-carbon transition. Multilateral banks such as the European Investment Bank and European Bank for Reconstruction and Development have also contributed to funding low-carbon projects. Together, they provided around EUR 2 billion over the 2014-2021 period (EIB, 2022[7]; EBRD, 2022[8]).

Long-run investment needs (to 2050) for decarbonising the energy mix are estimated using the OECD Economics Department Long-term model. This model is used to estimate long-run trends, namely potential output and to assess fiscal sustainability across OECD and eight non-OECD G20 countries (Argentina, Brazil, China, India, Indonesia, Russia, Saudi Arabia and South Africa) and two key partner economies (Bulgaria and Romania). A recent addition to the model is the energy module. It is used to evaluate the impact of decarbonisation on output trajectories under different scenarios. Key assumptions in the model are exogenous energy mixes and effective carbon rates. The model provides projections of CO2 emissions, output, investment in renewable capacity, and government revenue. This setting allows the model to place the energy transition in a context of other evolving key structural changes, such as population aging, though it provides a partial picture of investment needs, focusing on capital expenditure for renewable capacity expansion.

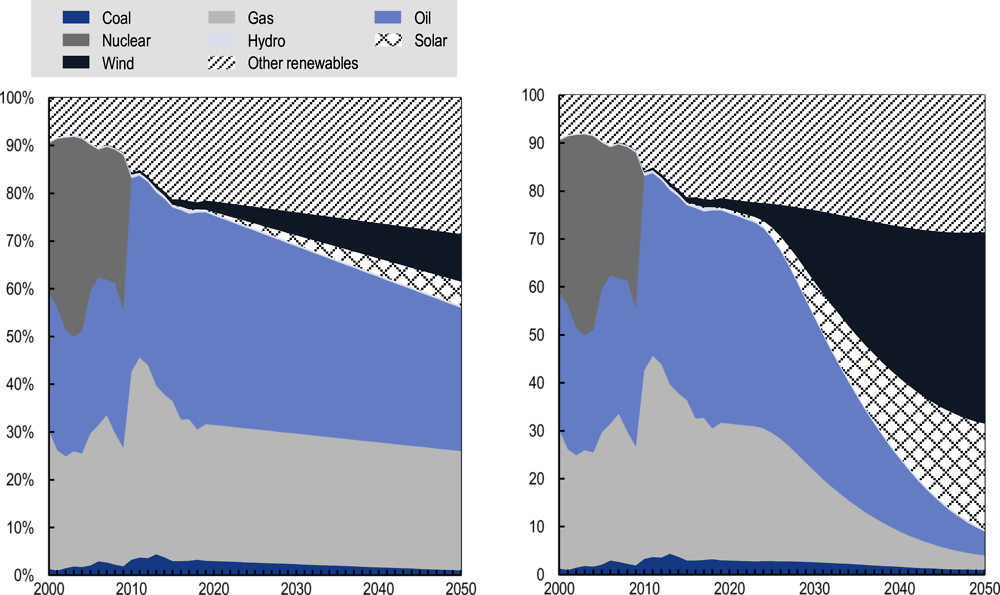

The modelling exercise involved two scenarios: a Baseline Scenario representing current policies, a Net‑Zero Scenario with an energy mix and effective carbon rates path that is consistent with a net-zero emissions goal. The energy mix in the net-zero scenario is set so that targets of reaching 45% renewables in total energy consumption by 2030 and 90% in 2050 are met (Figure 5.4. ).

Figure 5.4. Primary energy use mix in Baseline Scenario (left) and Net-Zero Scenario (right)

Historical and projected share of energy sources in total primary use (2000 – 2050)

Note: The baseline scenario is that decarbonisation continues at the recent pace, but not enough to reach net zero. The Net-zero Scenario is based on stylised assumptions on energy mix and effective carbon rates to reach net-zero emissions.

Source: OECD long-term model.

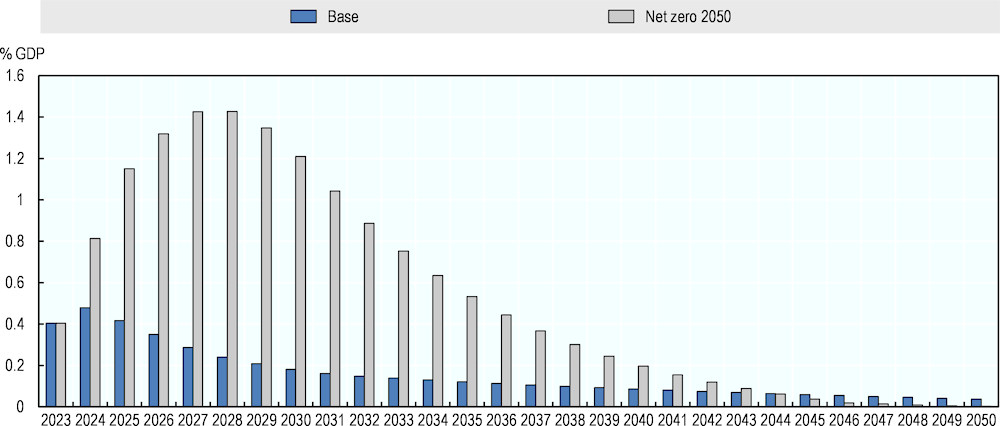

The results for investment show that up to 2035, a net zero consistent path would require annual investments between 0.5% -1.4% of GDP, against the average base case of 0.33% of GDP (Figure 5.5).

Figure 5.5. Annual capital expenditure (% GDP) on new low-carbon electricity generation capacity

Projected capital expenditure under Net-Zero Scenario (2023 – 2050)

Note: The base scenario is that decarbonisation continues at the recent pace, but not enough to reach net zero. The net-zero scenario is based on assumptions on energy mix and effective carbon rates to reach net-zero emissions.

Source: OECD long-term model.

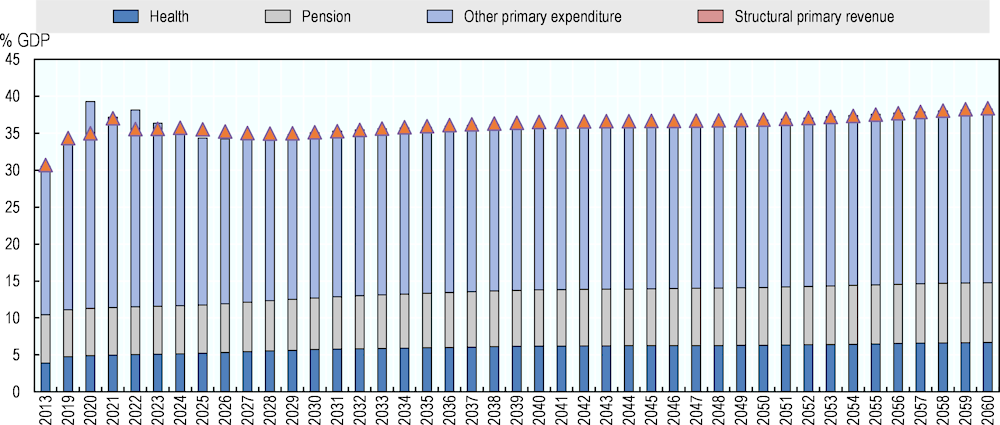

Long-term structural trends are putting pressures on the public finance of Lithuania (Guillemette and Turner, 2021[9]). Simulations of future health and long-term care expenditure show an increase by about 1.7% of GDP by 2060. Pension expenditure by about 1.6% of GDP by 2060. Other primary expenditures are slightly distorted by the COVID-19-related increase in spending but relative to 2019 they also increase slightly by 2060. Altogether ageing is projected to add about 2.75% of GDP in fiscal pressure by 2060 in a scenario where the debt ratio would be stabilised near the current level (Figure 5.6. ).

Figure 5.6. Lithuania public finances in the long term

History and projected government primary expenditure and structure primary revenue (2019 – 2060)

Source: OECD long-term model.

In this context, given that energy transition will require large investments, some of which are quantified as capital expenditure on renewables, there will be additional pressure on public finances. However, an increase in the effective carbon rate to reach net-zero emissions by 2050 – assuming that carbon pricing would be the sole instrument – could generate substantial revenue, seemingly more than the combined increase in fiscal pressure from ageing and required investment for the energy transition. Carbon pricing revenues are estimated in the net-zero scenario to reach up to 6% of GDP between 2033 and 2038 before declining to 1.1% in 2050. Given the model’s focus on carbon pricing as the only mitigation instrument, revenues are substantial. Should there be non-pricing measures in the climate policy package, carbon revenues would be lower. On the other hand, these revenues would be temporary and by 2050 would probably be lower than the projected additional fiscal pressure from ageing. Thus, the revenue from carbon pricing would come at the right time to finance low-carbon investments but would be front-loaded with respect to the fiscal pressure from ageing, which will last longer.

Public sector role in scaling up investment for decarbonisation

The public sector plays a central role in aligning the country’s infrastructure financing ecosystem with its decarbonisation goals. On the one hand the public sector is an important source of financing and in the choices on how to allocate funds to different projects that will contribute to reaching emission reduction targets. On the other hand, the government needs to ensure that the regulatory and policy framework provides strong signals and incentives to the private sector to invest in green projects.

Establishing long-term policy and regulatory frameworks to boost investment

The right regulatory and policy framework can help to anchor investor expectations and provide greater policy certainty, mitigating risk and encouraging the take up of green investment opportunities. Long-term commitments to climate targets and strong policy signals can inform investors of the depth and breadth of the needed transformation. This will lower uncertainty and help to channel private funds towards green investment opportunities.

National development and infrastructure plans offer long-term visibility on investment priority areas and strengthen the business case for low-carbon projects. In Lithuania, such plans include the 2021-2030 National Progress Plan (2021–2030 m. Nacionalinis pažangos planas), which sets out general long-term strategic goals and policy reforms in social, economic, environmental and security areas (Goverment of the Republic of Lithuania, 2021[10]). Documents specific to climate policy include the National Climate and Energy Plan from 2019 and the National Energy Independence Strategy from 2018, both of which identify policy reforms needed for meeting Lithuania’s energy and climate targets (Government of the Republic of Lithuania, 2019[11]; OECD, 2022[6]; Government of the Republic of Lithuania, 2018[12]). The more recent National Climate Change Management Agenda sets and updates the country’s climate policy for short-term (2030), medium-term (2040) and long-term (2050) objectives (Government of the Repulic of Lithuania, 2021[13]). Sector specific infrastructure plans such as Lithuanian transport strategy 2050 (Lietuvos susisiekimo plėtros iki 2050 m. strategija) help complete the long-term vision of the green transition by providing a more granular assessment focusing on specific sectors (Lithuania Ministry of Transport, 2020[14]).1 More broadly, under the EU cohesion policy funds, Lithuania’s recently approved Partnership Agreement lays down the country’s investment strategy, providing avenues to meet their climate goals in line with EU Green Deal (European Commission, 2022[15]).

Lithuania’s climate policy is determined by the domestic policy framework and the EU’s supranational institutions, which work in concert and will become more stringent over time. EU’s Fit for 55 policy package includes several policy and regulatory reforms that ratchet up climate ambition. In addition to the increasing stringency of EU-wide policies such as the increased target for EU Emissions Trading System (EU ETS) and the planned revision of minimum tax rates under the EU’s Energy Tax Directive (ETD) (for more information see Chapters 2 and 4), Lithuania is pursuing its own domestic climate reform agenda. For instance, the proposed amendments to the Excise Tax Law to phase out tax preferences for fossil fuels and the inclusion of a carbon component for non-ETS emissions provide the forward-guidance needed to underpin investment decisions. These reforms go in the right direction by strengthening price signals and setting a long-term trajectory towards higher effective carbon prices.

While Lithuania’s climate agenda sets the right level of ambition, it is now important to implement an effective policy mix and set up a coherent institutional framework to design policies and evaluate progress. The government is pursuing a wide range of policies across different sectors to complement its proposed carbon pricing reforms, including several measures for the decarbonisation of the transport sector and energy system (Chapter 2). However, the implementation of policies has yet to match ambition. For example, a study has found that planned investments in electric vehicles charging stations are insufficient to keep pace with planned electric vehicle use and electrification to 2030 (Ministry of Finance of the Republic of Lithuania, 2022[16]).

Expanding this infrastructure is essential for the success of increasing the penetration of zero-emissions vehicles (D’Arcangelo et al., 2022[17]). The experience of Norway (Box 5.1) suggests that the provision of fast charging infrastructure is a strong driver for electric car uptake as users prefer fast and ultra-fast chargers for both inter- and intra-urban travel (Neaimeh et al., 2017[18]; Transport & Environment, 2018[19]). Strong collaboration between ministries and agencies involved in transport policies and those with responsibilities over land use management, energy and others is key to decarbonising the transport sector. It is also important to note that infrastructure investment in Norway complemented an extensive incentives programme that included exemptions from value-added tax and registration tax and reduced toll and parking feed. While the overall government support did help the market reach critical mass, it proved to be much less cost-effective than carbon pricing policies, costing about EUR 1370 per tonnes of CO2 for battery electric cars. Efforts to scale back incentives and increase their efficiency have been underway since 2021 (D’Arcangelo et al., 2022[17]).

Box 5.1. Norway’s support for EV charging stations

As of 2020, there were some 340 000 electric cars in Norway, the largest number among European countries and representing about 16% of global sales. The share of electric vehicles in the vehicle stock is growing. For instance, the share of battery-only passenger cars increased from 9.3% to 12.1% between 2019 and 2020 (the increase in the battery electric cars traffic volume is roughly similar). The impressive outcomes in electric vehicle take-up have been driven by substantial tax benefits and privileges, including exemptions from value-added tax and vehicle registration tax, along with cheaper access to toll roads and parking.

Government support for charging stations has been in place since 2010 and the current scheme aims for fast charging stations every 50km on around 7 500 km of Norway’s road network. In 2021, according to the NOBIL database of the Electric Car Association, there were around 5 700 charging points, up from 800 in 2015. In recent years, charging operators have been building fast-charging stations without subsidies, especially in larger cities and along major highways. While un-subsidised stations will probably become increasingly viable, government support will likely still be needed to ensure availability in remote areas.

Source: Adapted from (D’Arcangelo et al., 2022[17]). (See also Box 2.3 in Chapter 2).

The liberalisation of electricity prices has also helped further align energy policy with its climate ambitions. Regulated retails prices have been gradually phased out except for some small electricity consumers (households consuming less than 1 000 kWh annually). While the completion of electricity price de-regulation has been halted in the current environment of high energy prices, there are alternative ways to deliver support to vulnerable consumers more efficiently and fairly than price regulation. Eventually, shifting support from regulated electricity pricing to targeted income transfers would strengthen incentives for energy savings and maintain the price signal needed to support the decarbonisation transition (Van Dender et al., 2022[20]). (OECD, 2020[21]).2

Regulatory reforms are also necessary to strengthen the flexibility of the energy system and encourage investment in energy storage. The share of renewables in the energy mix will grow substantially (electricity from renewable sources from 20% to 50% in 2030 and heating from 50% to 67%), requiring a more resilient energy system to deal with intermittent supply. Recent regulatory reforms amending the Law on Renewable Energy Source (Atsinaujinančių išteklių energetikos įstatyme) and the Law on Electricity (Elektros energetikos įstatymas) have simplified administrative procedures for the construction and issuance of permits for power plants, particularly for small-scale installations and off-grid power generation. These reforms are key to attaining the goal of not only higher renewable energy penetration but the envisaged expansion of prosumers; i.e. households and businesses that generate their own electricity.3 In the context of the 2021-2022 energy security crisis, the EU is pushing for further simplification of permitting procedures for the deployment of renewables under its RePowerEU plan, aiming at expanding renewable power in Europe and strengthening energy security.4 These regulatory reforms would contribute to the acceleration of the energy transition for Lithuania.

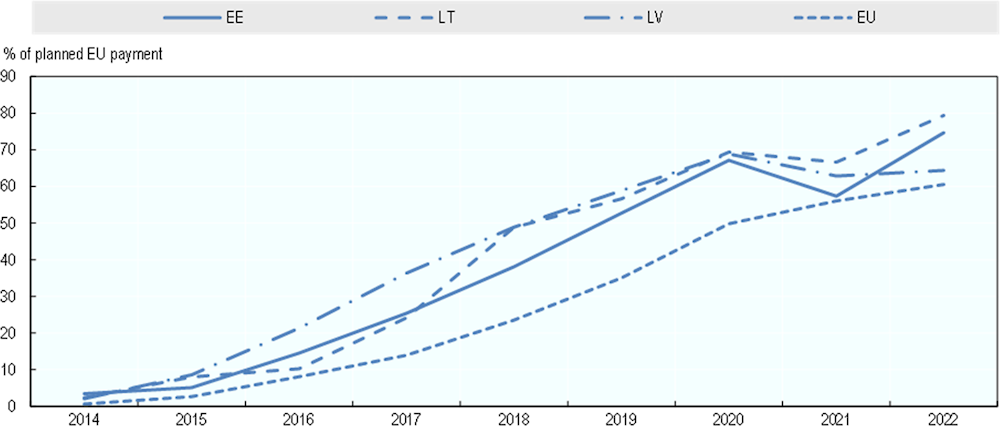

Increasing the absorptive capacity and spending efficiency of public funds

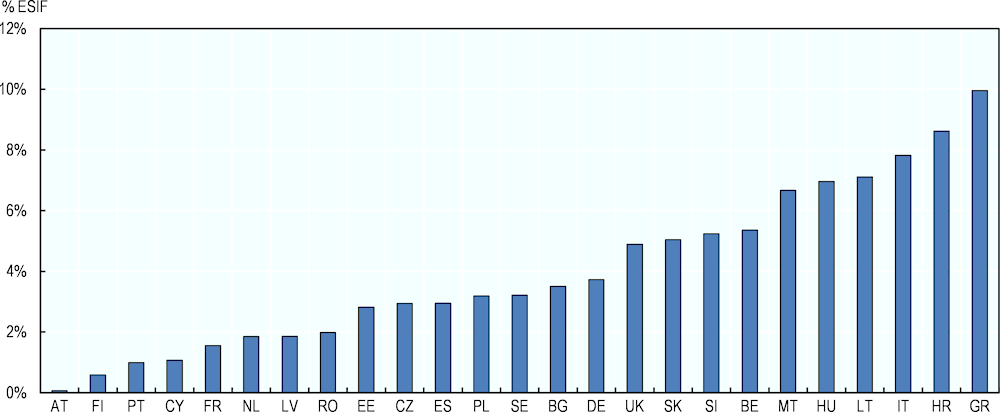

As a key owner of climate-relevant infrastructure assets, particularly in the energy and transport sectors, the government needs to also ensure that its investment decisions are consistent with climate goals. EU structural investment funds make up the bulk of government public expenditure, including on network infrastructure for energy and transport. Between 2014 and 2020, Lithuania’s public investment in energy and transport amounted to EUR 2.5 billion out of which at least EUR 1.3 billion came from EU sources. The key role of EU financing for low-carbon investment underlies the importance of orienting these EU funds toward green projects and to maintain the capacity to absorb and spend them effectively. Thus far, the absorption of ESIFs have been consistent with other Baltic countries, reaching around 70% to the total planned amount and above the EU average of 60% (Figure 5.7).

Figure 5.7. Absorption rate of EU Structural Investment Funds is above EU average in Lithuania

Average payment rate across EU Structural Investment Funds (2014-2020)

Note: ESIF include the European Regional Development Fund (ERDF), European Agricultural Fund for Rural Development (EAFRD), European Social Fund (ESF) and the Youth Employment Initiative (YEI), Cohesion Fund (CF) and European Maritime and Fisheries Fund (EMFF).

Source: EU Cohesion data: https://cohesiondata.ec.europa.eu/.

For the private sector, identifying appropriate projects can be hindered by substantial transaction costs related to the complexity and limited standardisation of investments and of administrative procedures (IPCCC Working Group III, 2022[22]). These create significant opportunity costs of green investments compared with other types of investments. To this end, the Central Project Management Agency (CPMA), the domestic institution responsible for administering the ESIFs, has recently invested in expanding and strengthening its administrative capacity to support the effective and efficiency allocation of funds (European Commission, 2022[23]). By creating specific content units based on project areas, including on environmental sustainability and energy, with qualified personnel, it will be in a stronger position to support investments in line with the decarbonisation agenda.

The EU’s taxonomy for sustainable activities along with its sustainability-related disclosure regulation in the financial services sector - Sustainable Finance Disclosures Regulation (SFDR) –– may also contribute to lowering costs related to identifying green investments. However, translating the new rules to domestic settings is a great challenge as there is a need for further clarification on the new local rules in order for them to comply with EU disclosure rules. Expanding the country’s institutional capacity to provide guidance on these new regulations will go a long way in closing informational gap and reducing related costs and thus lowering barriers to private investors.

A recent report developed jointly by the EU Commission and EBRD identified several recommendations for scaling up sustainable finance in Lithuania. One main priority and cross-cutting recommendation was to establish a Green Finance Institute to co-ordinate climate finance in the country and to develop the know-how on sustainable projects to support the private sector in identifying suitable bankable projects (EBRD, 2021[24]). More concretely, the Green Finance Institute would play a key role in clarifying the new EU taxonomy and implementing the SFDR through consultations with and giving recommendations to private and public stakeholders. The Institute will also act as an advisory body for policy makers and would convene the private and public sector to support sustainable finance initiatives. As such, this institution could also enhance the absorption of EU funds while crowding-in private-sector finance.

Leveraging the existing institutional architecture and expertise within the EU framework and domestically can facilitate and expedite the allocation of funds to projects that help meet the country’s decarbonisation objectives. For instance, the Investment Plan for Europe launched in 2015, not only mobilised private sector funds by providing co-financing opportunities and instruments for risk mitigation in investment funded by the European Investment Bank, but also provided advisory support through the European Investment Advisory Hub. Hence, Lithuania benefitted from the expertise of the EIB and the Advisory hub to launch an energy efficiency investment platform to promote and finance energy efficiency modernisation projects (European Council, 2022[25]). Since the Investment Plan for Europe programme has led to the successful scaling-up of investment, mobilising more than EUR 500 billion in the period 2015-2020, the programme is being extended as the InvestEU programme.

The use of financial instruments, such as loans, guarantees and equity, for part of the ESIF can also contribute to enhancing the efficiency of spending ESIF allocations by targeting projects that could eventually be self-sustainable (European Commission, 2022[26]). The revolving nature of the funds using financial instruments allows the reinvestment of repayments plus interest into other projects, while attracting private sector investment through public-private risk-sharing. At the same time, the repayable nature of financial instruments requires greater accountability from beneficiary compared with grants. Public institutions using financial instruments benefit from the expertise of fund managers (such as EIB) and other administrating financial intermediaries; technical assistance can also be financed since combining loans, grants and technical assistance in the same financial instruments is possible (Interreg Europe, 2022[27]).

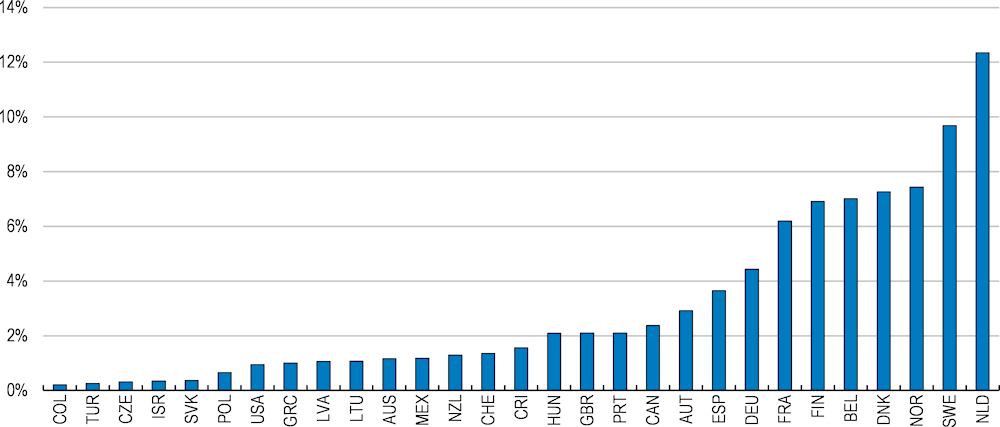

While Lithuania ranks among the countries with the largest share of financial instruments, more could be done. For example, the share of ESIF used for financial instruments, remains a modest 7% ESIF (Figure 5.8.). Financial instruments have been used for energy efficiency programmes in the building sector (see Chapter 2). Several barriers have been identified as preventing a wider uptake of ESIF support financial instruments among EU member states during the previous programming period 2014-2020, particularly in sectors where their use has been limited such as the renewable energy sector. The barriers identified are most notably related to the administrative burden and complexity and regulatory constraints related to the targeted sector (including permitting regulation). There has been emphasis on the limited incentives to invest in a specific sector, such as renewable energy generation, and lack of sectoral knowledge and administrative capacity to plan and procure complex infrastructure projects. There are also difficulties in operationalising policy goals and aligning sectoral strategies with ESIF projects. These challenges are compounded by limited experience and capacity in developing a network of market players which would develop a project pipeline suitable for financial instrument support (fi-compass, 2020[28]). Addressing these barriers could thus encourage greater use of financial instruments for financing decarbonisation-related investments.

Figure 5.8. Financial instruments remain a small part of ESIF allocations

Share of ESIF used for financial instruments (2014-2020)

Source: https://www.fi-compass.eu/fisiyc; Cohesion Policy Open Data Platform:

Building investment-ready and bankable project pipelines

Together with strong policy and regulatory frameworks to underpin investment decisions, building robust project pipelines can contribute to a more effective absorption and spending of funds, in addition to helping to crowd-in private sector funds.5 Project pipelines highlight the scale and scope of investment opportunities and communicate the available tools and policies surrounding them. They also help translate long-term objectives and commitments into tangible projects. For investors, the costs of building capacity in a particular country (e.g. ensuring projects meet regulatory and legal requirements) are difficult to justify for one-off investments. If they have greater certainty that follow-on projects will be available, investors would be better able to gauge risks, invest in capacity building and help foster a market for infrastructure investment. Additionally, increasing the supply of investment-grade projects could help address currently high project valuations. Partnerships between investors and governments can also provide an effective way to share risks, achieve scale and establish a pipeline of investment-grade projects (OECD, 2020[29]).

The government needs to ensure a robust project pipeline linked to the long-term climate mitigation goals. There is no publicly available list of bankable projects aligned with achieving long-term climate targets though the recently issued Partnership Agreement set investment priorities for the current programming period 2021-2027 of ESIF (European Commission, 2022[23]).

The challenge remains to convert project proposals into economically feasible investment opportunities. Project preparation facilities are useful for providing a centralised entity that assists in the development of projects to reach investment ready states. The role of the government is thus to ensure that the design of such facilities, which can be sector and infrastructure-type specific, play to the country’s strength (e.g. offshore wind potential) and reduce the barriers that often prevent projects from reaching investors (Box 5.2). The planned creation of a Green Finance Institute and the existence of a co-ordinating body such as the CPMA offer the opportunities to build synergies to strengthen project-preparation capacity for low-carbon infrastructure.

Box 5.2. The need for a project preparation facility

Improving the bankability of projects in the pipeline is an important step to increase the flow of capital towards low-carbon infrastructure projects. A project preparation facility (PPF) is an entity that supports infrastructure investment by channelling a small amount of finance to overcome technical and financial barriers that prevent the project from being bankable or investable to the investment community.

Since these preparation facilities are to be supported with public funds, governments should properly consider and account for these costs when translating climate objective into granular investment plans. Given their magnitude, the costs would significantly affect the overall returns on investment from designing and developing a pipeline of successful projects and they could also be a significant challenge for smaller government, and risk adding a layer of complexity when implementing low-carbon ambitions.

PPFs provide investors with an entry point into pipeline and project procurement, a means to find answers to queries, and ways to identify investment opportunities suited to their individual requirements and appetites. Approaches to support and finance projects on a project-by-project basis may be administratively burdensome and costly for the institutions involved. Standardisation of contracts and processes, for instance, is one such method to lower these transactions costs.

A more holistic approach to project and pipeline development, including the securitisation and aggregation of smaller assets, would bring advantages if it creates a two-way exchange between investors and policy-makers to identify investment barriers and ensure possible gaps are understood earlier on in the project development cycle. This would include the government’s interface through which it engages and encourage investment from private sector actors.

Source: (OECD, 2018[30])

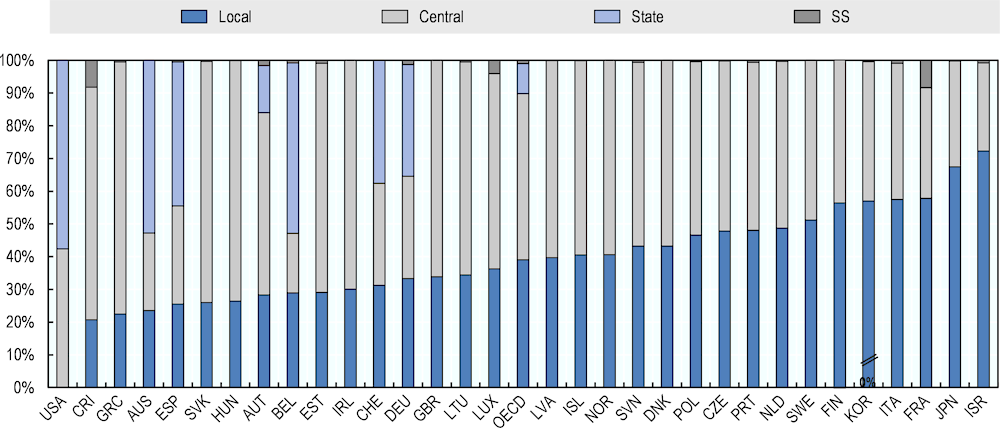

Engaging subnational authorities for funding and implementing infrastructure projects

Subnational governments play a key role implementing strategic investments plans, including those geared towards decarbonisation. As the country strives to reach its climate goals, infrastructure investment by local authorities will need to be aligned with central government goals and policies to tackle the climate challenge. However, subnational governments in Lithuania face a number of challenges that affect their capacity to deliver infrastructure investment (OECD, 2020[21]). Over the period 2014-20, local-government investment as a share of total investment was lower, 35%, than the OECD average of 40% (Figure 5.9).

Figure 5.9. There is scope to increase local government investment (2014-2020)

Distribution of public investment across levels of government over the period 2014 -2020

Note: SS stands for social security fund investment.

Source: OECD National Accounts Statistics (database).

Local governments in Lithuania have limited capacity to fund public investment, because own-source revenue is low and the reliance on earmarked intergovernmental grants provides little spending autonomy. They also have limited capacity to plan public investment, because inter-governmental grants are volatile and there is no medium-term commitment from the central government. This is compounded by low administrative capacity, and weak and purely formal (not linked to budget) strategic planning practices. Additionally, central government public investment funds are fragmented and narrowly defined, that results in incentives for local government to develop projects that suit a particular funding source, rather than responding to a need or a development opportunity (OECD, 2020[31]).

To address its segmented local investment ecosystem, the government has recently passed a reform to consolidate public investment funds, notably the main national promotional institutions, Investment and Business Guarantees Agency (INVEGA), Public Investment Development Agency (VIPA), Valstybės investicijų valdymo agentūra (VIVA) and the Agricultural Credit Guarantee Fund, by the end of the year. This reform aims to ensure a unified investment strategy, to exploit the strengths and competencies of the different institutions and synergies among financial instruments available to municipalities. It will also improve the effective use of EU funds and help scale up private financing, including from institutional investors (Ministry of Finance of the Republic of Lithuania, 2022[16]).

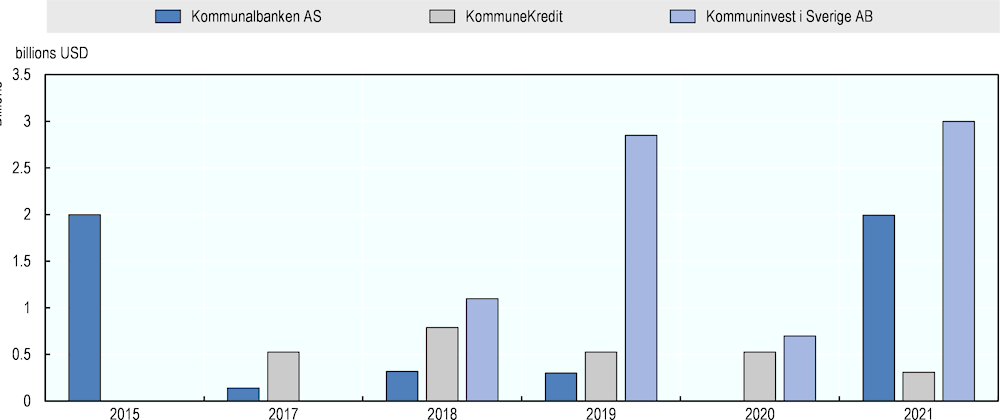

There is scope for deeper co-operation among local governments to pool either expertise (shared service centres) or projects to reach larger scales and to increase bargaining power to reduce costs. This also needs to be bolstered through the development of specialised facilities dedicated to municipal investment financing in cooperation with neighbouring countries (OECD, 2020[31]). One example of such a scheme is the pooled funding model prevalent in Nordic countries like Denmark, Finland, Norway and Sweden for issuing bond to fund infrastructure investments. So-called Local Government Funding Agencies (LGFAs) offer a solution to entities with funding requirements that may not be big enough to justify standalone bond issuance or lack bond expertise or in-house resources (Climate Bonds Initiatives, 2018[32]). They are municipality-owned or guaranteed financial institutions with a specific mandate to finance municipalities, cities and counties. Albeit representing a small share of their bond issuance, the three LGFAs in Denmark (KommuneKredit), Norway (Kommunalbanken) and Sweden (Kommuninvest) have raised USD 15 billion in green bonds over the period of 2015-2021 (Figure 5.10.). Thus far, there have been no bond issuances by local governments in Lithuania.

Figure 5.10. Local government green bond issuance in Denmark, Norway and Sweden

Note: KommuneKredit is from Denmark, Kommunalbanken from Norway and Kommuninvest from Sweden..

Source: Refinitiv.

By pooling funding capacities from several municipalities, LGFAs can raise financing from international bond markets and in return can provide financing to a wide range of small projects that would otherwise be too small or too niche for bond investors. This set up also allows for developing and hiring appropriate expertise to assess project quality for lending, to administer loans and to raise finance in a variety of bond markets to best match demand and their funding requirements. Given the ownership of these financial institutions, bond issues can be raised at sovereign-level credit rating thus giving municipalities access to more favourable borrowing conditions (Climate Bonds Initiatives, 2018[32]). Lithuania’s local governments can thus consider adopting similar financing institutions for their own decarbonisation projects.

Private finance mobilisation

Infrastructure investment by the private sector remains lower than its potential and insufficient to meet Lithuania’ decarbonisation objectives. This is despite infrastructure being an attractive asset class because of inflation-linked cash flows, low correlation with other important assets classes and long-term income. As such infrastructure is suitable for investors with long-term investment horizons (OECD, 2020[29]).

More generally, infrastructure remains a less exploited asset class than bonds and stocks, representing for instance a fraction of institutional investors’ portfolio. OECD work finds that out of a maximum of USD 11.4 trillion of investable assets under management (AUM) that can be allocated to infrastructure, institutional investors hold only USD 1 trillion in infrastructure assets, 30% of which in green infrastructure (OECD, 2020[29]).

Several factors contribute to private sector underinvestment in green infrastructure including its complexity and the potential for risks to materialise over the long lifespan of infrastructure assets as well as the illiquidity of infrastructure assets. Additionally, low-carbon infrastructure entails new infrastructure systems and technologies that are diverse with respect to their economic profiles, their stages of maturity, ownership schemes, delivery and financing models. Together, this heterogeneity heightens uncertainty for investors, compounding the effect of regulatory uncertainly and often weak long-term commitment to climate goals such as low carbon prices. The role of the government is to facilitate the uptake of low-carbon infrastructure investment by offering a wide range financial instruments and of risk-mitigation solutions.

Reaching critical size in capital markets

The private sector still relies heavily on commercial banking sector for its financing needs but has started to look for alternative financing sources in recent years. Regulated utilities and state-owned enterprises will carry out a significant share of green infrastructure investments. This is particularly the case in expanding and upgrading the electricity networks to accommodate for higher renewable energy penetration, more decentralised production with an increase in prosumers, and more effective demand management. Such investments tend to rely on traditional corporate financing models and access to tap into liquid capital markets for both debt and equity (OECD, 2021[33]).

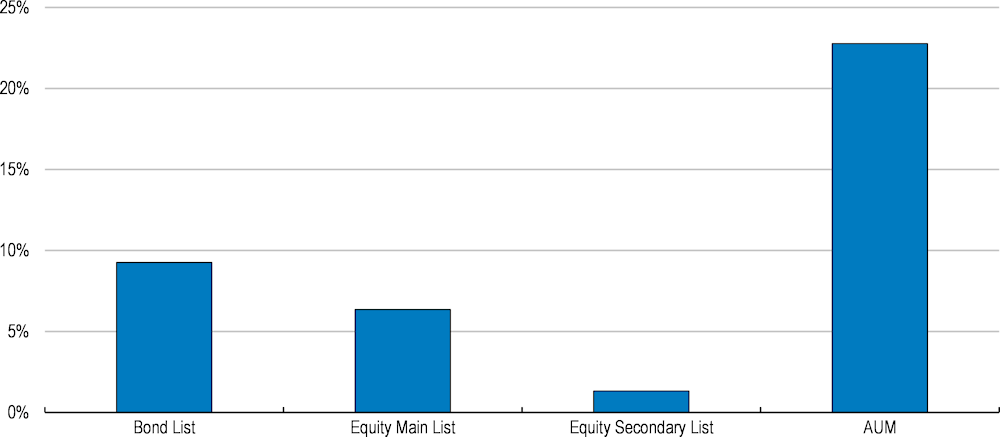

Despite the favourable dynamics in both bond and equity markets, the domestic capital market in Lithuania remains small and with low liquidity. These features tend to be a deterrent to both domestic and foreign investors. While the corporate bond market has expanded, reaching 2.3% of GDP in 2019 (from almost nothing in 2015),), it remains much smaller than that of other European countries (EBRD, 2022[34]). Private equity market growth has also been quite dynamic in large part due to support from national promotional institutions and can be an important alternative source of funding. However, as of 2020, assets under management of institutional investors in the three Baltic states, which tend to be more drawn to longer‑term investments, are estimated to have reached 23% of GDP (or EUR 24 billion) while the bond and equity market 16% GDP (or EUR 18 billion) (Figure 5.11.). The difference between the available capital and the size of capital markets hints to lack of investment options forcing investors to seek opportunities outside of Lithuania’s and the Baltic capital market (EBRD, 2022[34]; EBRD, 2021[24]).

Figure 5.11. Size of capital markets vs institutional investor assets under management

Securities listed on the Baltic exchanges and assets under management as a share of 2020 GDP

Note: Bond list includes both corporate bonds and government bonds listed on Nasdaq Baltic exchange in Estonia, Latvia and Lithuania. AUM denotes assets under management for investment funds, pension and insurance companies in Baltic countries. Data on securities and AUM is for year 2020.

Source: (Eurostat, 2022[35]), (Nasdaq, 2022[36]),

Reaching critical size to attract investors and create a larger pool of liquidity is thus a priority for scaling up climate finance for the transition in a small country. Scaling-up financing for these types of investments will require mechanisms that influence incentives and behaviours in financial markets, particularly with regard to integration of climate-risk considerations.

Policy solutions exist to overcome these problems and attract private capital for projects aligned with climate goals. Ongoing efforts to build a pan-Baltic capital market, with the assistance of EBRD and the European Commission, are a step towards deepening and broadening capital markets. The inclusion of larger SOEs, such as the energy firm Ignitis Group’s initial public offering in 2020 (the largest IPO in the Baltic region), in the domestic exchange (Nasdaq Vilnius), has attracted interest from both domestic and foreign investors, thus contributing to expanding the size and liquidity of the market. In addition, encouraging the utilisation of greener investment mandates by asset owners and clarifying the fiduciary duty with respect to climate-risk that asset managers have towards their beneficiaries can increase the share of funds investors are able to allocate to projects contributing to the climate transition.

Beyond using initiatives to deepen capital markets to increase private sector engagement in green infrastructure finance, the government has issued green bonds (EUR 68 million) to co-finance its energy efficiency programmes for the building sector, being the first to do so in the Baltic region. Furthermore, the state-owned energy company Ignitis conducted two rounds of green bond issuance, in 2017 and 2018, worth a total of EUR 600 million. The proceeds were used to finance green generation and network modernisation projects in Lithuania and abroad (OECD, 2022[37]). These issuances were the largest and longest maturity ever offered by Lithuanian companies and the largest and longest maturity green corporate Eurobond among the issuers from Central and Eastern Europe (CEE) (Ignitis Group, 2020[38]). Despite these efforts, Lithuania’s issuance of green bonds by both public and private entities pales compared with other OECD countries (Figure 5.12.).

Figure 5.12. Cumulative amount of green bond issuance (2014-2021)

Share of 2021 GDP (%)

Note: Both public and private sector bond issuances are included.

Source: Refinitiv and OECD.

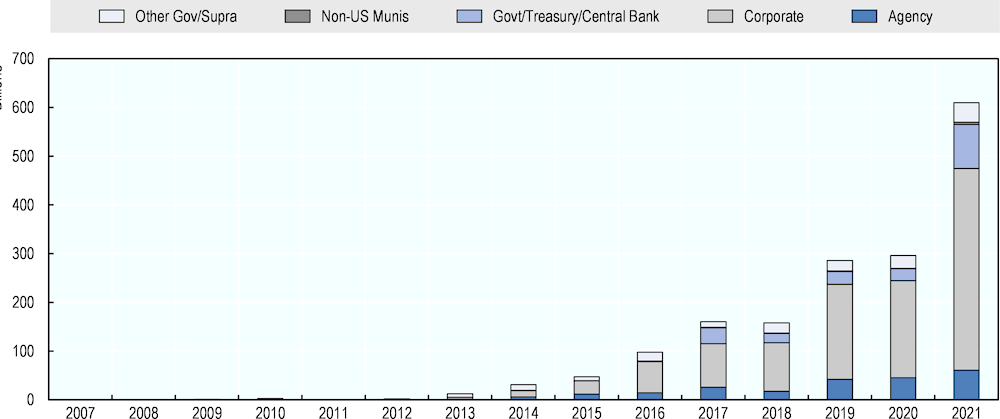

There is thus scope to scale-up the issuance of green instruments to take advantage of the high demand from investors both domestically and abroad. As the decarbonisation transition accelerates around the world, there has been a strong appetite for green instruments to bolster green investment portfolios. Already, the green bond market has expanded considerably (Figure 5.13.). Increasing the institutional capacity to support better disclosure of climate mitigation-related activities and climate-risk can help bolster the uptake and expansion green instruments and the integration of companies into rapidly developing green indices. Local government funding agencies are a further means to scale-up and draw in infrastructure investments.

Figure 5.13. Green bond issuance (2007-2021) by sector

In billion USD

Note: Agency: government agencies such as national development agencies; Corporate, Gov/Treasury/Central Bank, Non-US Munis: non-US local governments; Other gov/supra: government agencies such as regional agencies and multilateral developments banks are included in this category.

Source: Refinitiv.

Public-private risk sharing for low-carbon infrastructure investment

Complementary policies for crowding-in private sector finance can facilitate the implementation of risk‑sharing mechanisms for green infrastructure investment. The choice of infrastructure delivery models shapes financing options. Some long-lived assets operating in stable business environments, such as certain renewable generation projects, can be delivered and financed effectively through project-based vehicles such as public-private partnerships (PPPs) where cash flows are secured by way of long-term contracts. Lithuania needs to improve its capacity to establish and manage such investment vehicles.

Scaling-up financing for such investments will depend on achieving an appropriate allocation of risks between public and private parties, and developing suitable financing channels, vehicles, and risk mitigation instruments. This is key to bridging the cash-flow and risk profile of projects and the preferences of investors (OECD, 2021[33]). Public risk mitigation strengthens the financial liability of projects by transferring extra risk to the public sector. However, caution is needed when undertaking risk-transfer schemes as public authorities should avoid incurring undue costs should the risk materialise. Policy makers should adopt a robust system of assessing value for money that involves classifying, measuring and contractually allocating risks to the partly best able to manage them (OECD, 2012[39]).

Risks evolve over the infrastructure life cycle as different stages of project carry specific financing needs (Table 5.1). These may call for different sources of finance and classes of investors. For instance, green infrastructure investment in the power sector can involve a higher degree of uncertainty during the early phases of a project (i.e. the construction phase), as it may involve high initial capital costs and even continued high operational costs in the case of offshore wind farms. This may deter certain risk-averse investors who prefer predictable and stable cash flows from investing, such as institutional or retail investors, particularly in the early phase of the project, be it equity or debt. Banks and project developers with project finance expertise may have a higher risk tolerance and be prepared to provide debt financing over this early phase based on an assessment of the project and sponsor creditworthiness.

Once the project becomes operational, it may become more acceptable to long-term investors like pension funds and sovereign wealth funds who need low-risk long-term cash flows to match future liabilities. This complementarity implies that institutional investors help take operational assets from banks and project developers, freeing up construction-stage finance for new projects. Here the role for secondary markets is essential for offloading operational assets to more risk-averse investors and recycle capital. The public sector has a role in attracting different types of investors, including institutional investors. Developing secondary markets can help leverage the complementary among different investor types, address liquidity concerns, optimise risk pricing and reduce cost of capital for infrastructure projects (OECD, 2021[40]).

Table 5.1. Risks related to infrastructure assets over the project life cycle

|

Risk categories |

Development phase |

Construction phase |

Operation phase |

Termination phase |

|---|---|---|---|---|

|

Political and regulatory risk |

Environmental review |

Cancellation of permits |

Change in tariff regulation |

Contract duration |

|

Rise in pre-construction costs (longer permitting process) |

Contract renegotiation |

Decommission |

||

|

Asset transfer |

||||

|

Currency convertibility |

||||

|

Change in taxation (carbon taxation) |

||||

|

Social acceptance |

||||

|

Change in regulatory or legal environment |

||||

|

Enforceability of contracts, collateral and security |

||||

|

Macroeconomic and business |

prefunding |

Default of counterparty |

||

|

Financing availability (link to ESG) |

Refinancing risk |

|||

|

Liquidity |

||||

|

Volatility of demand and market risk |

||||

|

Inflation |

||||

|

Real interest rates |

||||

|

Exchange rate fluctuation |

||||

|

Technical |

Governance and management of the project |

Termination value different from expected |

||

|

Environmental |

||||

|

Project feasibility |

Construction delays and cost overruns |

Qualitative deficit of the physical structure and service |

||

|

Archaeological |

||||

|

Technology and obsolescence (electric vs. hydrogen vehicles) |

||||

|

Force majeure |

||||

Note: categories in bolded font may be more specific to green infrastructure projects.

Source: Adapted from (OECD, 2021[33]).

The development and expansion of the offshore wind industry in the United Kingdom provides a good example of how governments can play an integral role in mobilising private sector investments by lowering investment risks. The institutional and policy landscape in the United Kingdom has seen the establishment of an investment-enabling environment via policy incentives, public funds and institutional support to overcome low-carbon infrastructure investment barriers, mitigate project investment risks and develop markets for high potential low-carbon technologies. This was ultimately a result of a series of steps that allowed the UK to rapidly develop its offshore wind industry, including an incentive scheme to ensure predictable cash flow through contracts for difference and a Green Investment Bank (GIB) with a mandate to co-invest in offshore wind projects among other green infrastructure investments (Box 5.3).

Box 5.3. Risk mitigation for offshore wind investments in the United Kingdom

The United Kingdom is frequently cited as an example of a country that managed to create an attractive investment environment for renewable energy worldwide. In 2008, the UK pledged to reduce its greenhouse gas emissions by at least 80% below 1990 levels by 2050. To reach this target, the country chose to capitalise on its renewable energy potential, specifically wind resources on land and in the surrounding seas.

The institutional and policy landscape in the United Kingdom has seen the establishment of an investment-enabling environment via policy incentives, public funds and institutional support to overcome low-carbon infrastructure investment barriers, mitigate project investment risks and develop markets for high potential low-carbon technologies. This was ultimately a result of a series of steps that allowed the UK to rapidly develop its offshore wind industry.

In order to offer predictable cash flow to lower the high investment hurdle rates faced by project developers and investors, the United Kingdom provided financial incentives for 15 years through the “contracts for difference” (CfD). For each unit of energy produced by a project, the CfD establishes a "strike" price that accounts for the expenses associated with acquiring low-carbon technologies. This set energy price is an additional payment made to the project developer above the energy market price. This works as a backstop and prevents payments from ever falling below the strike price; but, if the market price rises above the strike price, the project developer is responsible for making up the difference. Compared to market pricing alone, this mechanism offers investors greater predictability, and the government is less liable to the expenses than it would be with set payments like feed-in tariffs. Additionally, because the CfD offers support for 15 years, it is long enough to conform to conventional economic lifetime assessments like cash-flow studies and is comparable in length to support from feed-in tariffs.

To scale up green investment via institutional support, the UK established the UK Green Investment Bank (GIB) to promote low-carbon infrastructure investment with a key focus on offshore wind and crowd-in investors in 2012. The GIB, a state-owned financial institution with a specialised mandate, offers long-term funding and helps develop and sustain market viability for green infrastructure. The UK GIB invested roughly two-thirds of its capital in offshore wind projects while also being an active investor in onshore wind projects in the UK. Overall, the UK GIB was crucial in helping the market mature to the point where it no longer depends on public co-investment.

Note: The UK Green Investment Bank (GIB) was established by the Government of United Kingdom in 2012 as a non-departmental body of the Department of Business, Energy and Industrial Strategy (UK BEIS). It was acquired by Macquarie Group Limited in August 2017 and is now an independent private organisation.

Source: (OECD, 2018[30]).

Policy makers should thus review and where appropriate reform capital market regulation to ensure the availability of appropriate capital market instruments and vehicles for de-risking infrastructure investment. The availability of a wide variety of capital market instruments and vehicles (i.e. pooling mechanism) can help cater to the preferences of different investors and adapt financing to the evolving risk profile as it moves through the life cycle. A variety of capital market instruments may give institutional investors exposure to infrastructure assets at an acceptable risk-return ratio and help them diversify their exposure across multiple assets. Additionally, institutional innovations, such as adjusting the mandates of existing public financial institutions or forming a new institution like a green investment bank can further leverage complementary tools that help deliver more holistic and effective risk-sharing strategies (OECD, 2020[29]).

Different de-risking instruments have different mobilisation potential and public actors need to determine where their participations can have the most impact (Table 5.2). OECD research shows that fund level co‑investment is frequently used for more established technologies such as wind and solar, and cornerstone stakes are more suitable for crowding in private money for technologies that are relatively less commercially established or underserved, such as energy efficiency-related technologies. Higher risk‑taking by public capital in smaller-scale projects or sectors with new business models and technology creates a demonstration effect, thus proving the viability of the project or technology to incentivise uptake by private investors and foster new markets. To deploy limited public capital to its greatest effect, public actors therefore have to consider the instrument with the greatest possible impact. For example, if a market is established, i.e. sizeable price decreases and leaps in technology development cannot be expected and deployment is beyond a demonstration effect, public actors may consider using funds in other markets (OECD, 2020[29]).

Table 5.2. Risk mitigants to mobilise private finance

|

Name |

Description |

|---|---|

|

Co-investment |

Public actor(s) investment alongside private investor(s) with either debt or equity with an equal or lower stake than a private investor (any larger investment would be classified as cornerstone stake). |

|

Cornerstone stake |

Investment by a public actor in a fund, issue or project amounting to a majority equity stake to achieve a demonstration effect to attract other investors |

|

Loan |

Debt issuance by a public actor |

|

Loan guarantee |

Guarantee by a public actor to pay any amount (either in full or part) due on loan in the event of non-payment by the borrower |

|

Public seed capital |

Concessional fund allocation using public money |

|

Revenue guarantee |

Guarantee by a public actor to pay for the core product to ensure revenue cash flow for a project. |

|

Back-stop guarantee |

Guarantee by a public actor to purchase any unsubscribed portion of an issue (debt or equity) |

Note: Risk mitigants are defined as either a direct use of public finance or backing a project with public funds which puts public funds at risk. In short, the public actor has a contingent liability.

Source: Adapted from (OECD, 2020[29]).

There are many risk transfer mechanisms, including contractual mechanisms, insurance policies, or guarantees. Guarantees provided by the public sector (including government, development banks, specialised agencies, and multilateral banks) can cover a wide range of risks that impact various actors in the infrastructure financing ecosystem. For guarantees to be credible, they typically require the backing of the Ministry of Finance or a Multilateral Development Banks, and strong transparency and accountability mechanism, including reporting and disclosure of project risk and financial performance.

Lithuania has recently deployed a risk-sharing instrument for improving the energy efficiency of its building sector. Historically, the public sector has relied heavily on distributing grants or subsidies to fund infrastructure investments, potentially undermining incentives for private sector involvements and even crowding it out. An initiative that has overcome this shortcoming is the use of financial instruments from European Structural Investment (ESI) Funds in combination with grants for investments in energy efficiency for the building sector in Lithuania.

Risk-sharing programme for the building sector

Lithuania has placed part of its ESIF allocations in financial instruments for both programming periods 2007-2013 and 2014-2020; financial instruments were used for the purposes of improving the energy efficiency of the building sector. For Lithuania, the Joint European Support for Sustainable Investment in City Areas (JESSICA) programme was oriented towards improving the energy efficiency of its multi‑apartment buildings. First it was implemented through a concessional loan programme and then continued as also a concessional loan programme but with a government guarantee to draw in private sector participation through public-private risk sharing (Box 5.4).

Box 5.4. Lessons from Lithuania’s risk-sharing approach in providing energy efficiency loans to modernise old buildings

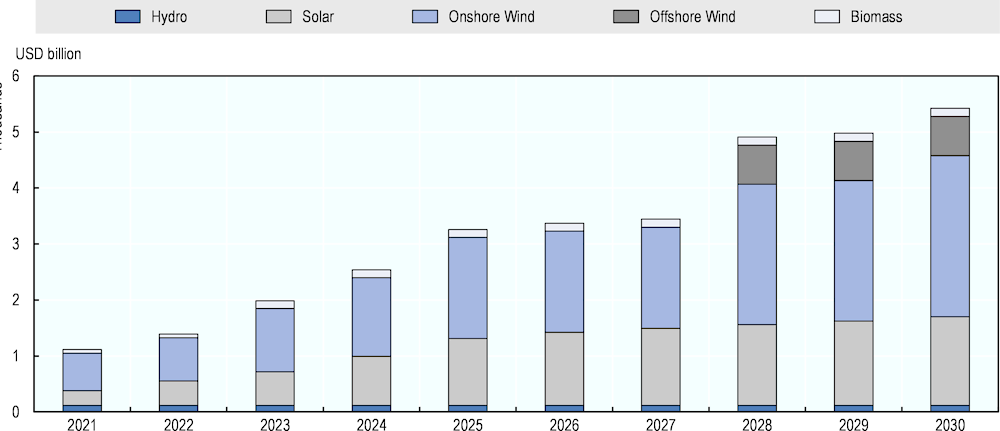

Modernising multi-apartment blocks to a higher standard of energy efficiency has been a key priority for the government, and an important step towards achieving Lithuania’s broader goals of a low-carbon economy. Approximately 90 per cent of all buildings in Lithuania are over 22 years old, while 66 per cent are soviet-era multi-block apartment buildings in energy classes D or lower. These buildings run high maintenance costs and consume around seven times more energy than modern housing types, disproportionately affecting poorer consumers who tend to reside in such housing. To bridge the gap in funding required for the modernisation of old buildings, the Lithuanian government employed a series of European Regional Development Fund (ERDF) operational programme resources to establish loan and guarantee financial instruments for energy efficiency modernisation.

The JESSICA I initiative (2007-2013 programming period) primarily offered preferential loans at a fixed interest rate of 3 per cent, maturing in 20 years. Upon reaching certain energy efficiency goals post- renovation, homeowners were initially eligible for a subsidy of up to 40 per cent. The posterior JESSICA II Fund of Funds (2014¬-2020) was established with EUR 150 million from European Structural and Investment Funds and similarly issued preferential loans to residents. In addition, it set out to maximise the leverage of its assets through private finance in order to lower national public contributions to the scheme. This instrument effectively attracted EUR 180 million of resources from various financial intermediaries, such as commercial banks and public agencies. This was the first time that Lithuanian public sector institutions took on loan-related risks of this kind.

By March 2018, the programmes had reached 47 000 households by improving their energy consumption classification and lowering their energy bills, and reduced greenhouse gas emissions annually by 81 000 tCO2-e. The programmes enjoyed wide public support at national and municipal level and attracted domestic attention and international recognition for successfully employing financial instruments to tackle the problem of energy inefficiency in housing. In addition, the programme had a positive effect on job creation and economic growth.

The implementation of the “Lithuania Leverage Fund” guarantee instrument has secured significant additional leverage of private sector finance (by a multiple of five), closing the financing gap for the project (fi-compass, 2020[41]). The EIB was designated as the fund of funds manager and through a competitive process selected a single intermediary, Šiaulių bankas, the largest domestic commercial bank (Figure 5.14.). While the instrument was designed to attract several domestic financial intermediaries to provide and distribute the Modernisation Loans, EIB determined that other banks lacked the capacity to provide and distribute the funds. Because of the lack of capacity in the local market to support the guarantee instrument, a structured investment platform was also established to allow private sector investors to join commercial banks and financial institutions to contribute low-risk senior debt, with protection of a first loss piece made up of ESIF resources and co-financed by the financial intermediary.

Figure 5.14. Lithuania’s Jessica II Fund of Funds to finance energy efficiency improvements in the building sector

The Fund has allowed the financial intermediary to increase its lending in line with the needs of the building modernisation programme. Rolling out the guarantee has helped to secure significant additional leverage of private sector finance (by a multiple of five) in a period of growing demand for energy efficiency investments in residential housing across the country (fi-compass, 2020[41]). The success that the financial instruments had in lowering risk for investments in energy efficiency projections and mobilising private sector finance is attributable to several factors. First, these instruments were complemented by grants in the form of technical assistance, interest rate subsidies, and capital rebates. Grants are issued to cover the costs related to project preparation, administration, energy audits, and energy certificates. Interest rate subsidies help to reduce the cost of borrowing for households, while capital rebates reduce the overall cost of renovation. An additional capital rebate is also offered to encourage homeowners to save as much energy as possible, with the capital rebate amount increasing as the greater energy efficiency standards are met (fi-compass, 2020[41]). Second, close cooperation between the fund manager (EIB), the provider of the fund and financial intermediaries has been critical in proactively identifying and addressing programme delivery challenges—of particular note were actions taken to monitor compliance at every step of the funding delivery process (Housing Evolutions, 2022[42]).

The JESSICA II programme experienced several challenges highlighting the complexity of implementing such financial instruments (VIPA, 2022[44]). First, it was noted that the timelines of project implementation and preparation for loan agreements did not always align and were cyclical: requests for proposals were published once a year, leading to an uneven distribution of project workload. This proved to be challenging as the agency had to manage huge influxes of loan paperwork at the same time, monitor payments and oversee forecasted disbursements from different funding sources. Moreover, the implementation of the fund of funds faced challenges at different levels—some related to behavioural and motivational peculiarities, some to legal and administrative barriers. Building administrators tended to exhibit a lack of ownership of these projects and were generally slow to reorient themselves from subsidies to loan financing.

Loan maturity timeframe of 20 years also proved too short in some instances: where building condition was extremely poor, higher volumes of investment were warranted, which then exceeded the 20‑year payback period. The complexity of implementing the guaranteed loan model, coupled with the inexperience and unreasonable expectations of all market participants also proved challenging, as did the poor quality of the prepared documents, in particular energy audits, which resulted in high individual project administration costs.

The experience from this specific programme delivers important lessons for subsequent initiatives to support the decarbonisation transition in Lithuania. These point to the importance of developing the technical expertise and administrative capacity to evaluate projects and to process funds for the successful implementation of a risk-sharing scheme. The evolution of the JESSICA programme from programming period 2007-2013 to 2014-2020, shows the progress made in introducing more complex use of financial instruments in the second period, which could be attributed to maturing public administration and greater stakeholder awareness and confidence. A similar leveraged fund could be introduced to fund renewable energy projects, especially those at a smaller scale and in need to critical mass. Given the objective to increase the number of prosumers, a combination of energy efficiency and renewable energy deployment project would benefit from a similar risk-sharing scheme, whereby public funds are used to guarantee and finance the riskier stages of the project (fi-compass, 2020[28]).

The extensive experience of financial intermediary in the renovation sector has also been key to ensuring that cooperation between the fund and intermediaries is productive. Indeed, the financial ecosystem supporting the JESSICA initiative benefited from the expertise of both multilateral development banks like the EIB and domestic financial intermediaries, and in close partnership with public agencies (e.g. Housing and Energy Saving Agency – BETA) and municipalities.6 Thus providing technical assistance throughout the life-cycle of the financial instrument and to the relevant stakeholders facilitates the preparation and implementation of the financial instrument (fi-compass, 2020[28]).

Key findings

There is a substantial financing gap for low-carbon infrastructure that would need to be filled by private sector investment. For the power sector alone, investments to expand renewable generation capacity reach EUR 6.5 billion. EU funds and co-financing from national resources will not be sufficient to meet investment demands for decarbonisation.

Public authorities have the dual role of being both the providers of funds for investments and enablers for private sector investments. The public sector has relied heavily on distributing grants or subsidies to fund infrastructure investments, potentially undermining incentives for private sector involvements and even crowding it out.

Lithuania’s climate agenda sets the right level of ambition, but now it is important to implement an effective policy mix and set up a coherent institutional framework to design policies and evaluate progress.

There is scope to enhance the absorptive capacity and spending efficiency of EU funds. This can be achieved through the building capacity to clarify and help implement new regulation regarding sustainable activities, including EU taxonomy for sustainable activities and the Sustainable Finance Disclosure Regulation (SFDR). Spending efficiency of EU funds can be improved using repayable financial instruments as reflows can be channeled to other projects. Building robust project pipelines can contribute to a more effective absorption and spending of funds, in addition to helping to crowd-in private sector funds.

Subnational governments in Lithuania face a number of challenges that affect their capacity to deliver infrastructure investment. There is scope for deeper co-operation among local governments to pool either expertise (shared service centres) or projects to reach larger scales and to increase bargaining power to reduce costs.

Reaching critical size in capital markets to attract investors and create a larger pool of liquidity is thus a priority for scaling up climate finance for the transition in a small country. Scaling-up financing for these types of investments will require mechanisms that influence incentives and behaviours in financial markets, particularly with regard to integration of climate-risk considerations.

Scaling-up financing for infrastructure investments will depend on achieving an appropriate allocation of risks between public and private parties, and developing suitable financing channels, vehicles, and risk mitigation instruments. This can help cater to the preferences of different investors and adapt financing to the evolving risk profile as it moves through the life cycle.

The experience from the use of a leveraged fund JESSICA II programme as a public-private risk sharing vehicle delivers important lessons for subsequent initiatives to support the decarbonisation transition. These point to the importance of developing the technical expertise and administrative capacity to evaluate projects and to process funds for the successful implementation of a risk‑sharing scheme.

References

[32] Climate Bonds Initiatives (2018), Nordic and Baltic public sector green bonds, https://www.climatebonds.net/files/files/Nordic_Muni_Final-01%281%29.pdf.

[17] D’Arcangelo, F. et al. (2022), “A framework to decarbonise the economy”, OECD Economic Policy Papers, No. 31, OECD Publishing, Paris, https://doi.org/10.1787/4e4d973d-en.

[34] EBRD (2022), Diagnostic of Estonia, Latvia and Lithuania, https://www.ebrd.com/publications/country-diagnostics.

[8] EBRD (2022), “EBRD Investments 1991-2021”, Project Finance, https://www.ebrd.com/work-with-us/project-finance.html.

[24] EBRD (2021), Lithuania strategic action plan on sustainable finance.

[7] EIB (2022), Financed Projects, https://www.eib.org/en/projects/loans/index.htm.

[4] European Commission (2022), “EU cohesion policy: Commission adopts €6.4 billion Partnership Agreement with Lithuania for 2021-2027”, Press Corner, https://ec.europa.eu/commission/presscorner/detail/en/IP_22_2547.

[5] European Commission (2022), “European Structural Investment Funds”, Data, https://cohesiondata.ec.europa.eu/countries/LT.

[26] European Commission (2022), Financial instruments in cohesion policy, https://ec.europa.eu/regional_policy/index.cfm/en/funding/financial-instruments/.

[23] European Commission (2022), “Partnership Agreement with Lithuania - 2021-2027”, Planning and Management Documents.

[15] European Commission (2022), “Planning and Management Documents”, Partnership Agreement with Lithuania 2021-2027, https://ec.europa.eu/info/publications/partnership-agreement-lithuania-2021-2027_en.

[25] European Council (2022), European fund for strategic investments (EFSI), https://www.consilium.europa.eu/en/policies/investment-plan/strategic-investments-fund/#:~:text=The%20European%20fund%20for%20strategic,competitiveness%20in%20the%20European%20Union.

[35] Eurostat (2022), Financial balance sheet - annual data, https://ec.europa.eu/eurostat/databrowser/view/NASA_10_F_BS__custom_3224108/default/table?lang=en.

[41] fi-compass (2020), Residential energy efficiency financial instruments in Lithuania: Case study.

[28] fi-compass (2020), Stocktaking study on financial instruments by sector, https://www.fi-compass.eu/sites/default/files/publications/Stocktaking%20study%20on%20financial%20instruments%20by%20sector%20-%20Final%20report_0.pdf.

[10] Goverment of the Republic of Lithuania (2021), 2021–2030 m. nacionalinis pažangos planas, https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/c1259440f7dd11eab72ddb4a109da1b5/asr.

[45] Government of the Republic of Lithuania (2022), Vyriausybė patvirtino elektros ir dujų kainų kompensavimo tvarką (The government approved the procedure for compensation of electricity and gas prices), https://lrv.lt/lt/naujienos/vyriausybe-patvirtino-elektros-ir-duju-kainu-kompensavimo-tvarka.

[11] Government of the Republic of Lithuania (2019), National Energy and Climate Plan, https://energy.ec.europa.eu/system/files/2020-06/lt_final_necp_main_en_0.pdf.

[12] Government of the Republic of Lithuania (2018), Nacionalinė energetinės nepriklausomybės strategija (National Energy Independence Strategy), https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/TAIS.429490/asr.

[13] Government of the Repulic of Lithuania (2021), National Climate Change Management Agenda (NACIONALINĖ KLIMATO KAITOS VALDYMO DARBOTVARKĖ), https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/7eb37fc0db3311eb866fe2e083228059?positionInSearchResul.

[9] Guillemette, Y. and D. Turner (2021), “The long game: Fiscal outlooks to 2060 underline need for structural reform”, OECD Economic Policy Papers, No. 29, OECD Publishing, Paris, https://doi.org/10.1787/a112307e-en.

[42] Housing Evolutions (2022), Jessica II Fund for Multi-Apartment Building Modernisation, https://www.housingevolutions.eu/project/jessica-ii-fund-for-multi-apartment-building-modernisation/.

[3] IEA (2022), World Energy Investment 2022, OECD Publishing, Paris.

[1] IEA (2021), Lithuania 2021 Energy Policy Review, IEA Energy Policy Reviews, OECD Publishing, Paris, https://doi.org/10.1787/db346bb1-en.

[38] Ignitis Group (2020), Green bond investor letter, https://ignitisgrupe.lt/sites/default/files/inline-files/Green%20Bond%20Investor%20Letter%202020.pdf.

[27] Interreg Europe (2022), What are ESIF Financial Instruments, https://projects2014-2020.interregeurope.eu//innova-fi/news/news-article/7376/what-are-esif-financial-instruments/#:~:text=Financial%20Instruments%20(FIs)%20transform%20EU,which%20promote%20EU%20policy%20objectives.

[22] IPCCC Working Group III (2022), Chapter 15: Investment and Finance, https://www.ipcc.ch/report/ar6/wg3/.

[14] Lithuania Ministry of Transport (2020), Lithuania transport strategy for 2050, https://sumin.lrv.lt/uploads/sumin/documents/files/Strategija%202050%20m_%202020-12-07_Nr_%203-746(1).pdf.

[2] LVEA (2022), Statistics - Wind Energy in Lithuania, https://lvea.lt/en/statistics/.

[16] Ministry of Finance of the Republic of Lithuania (2022), Sutarta jungti Nacionalines plėtros įstaigas: augs investicijų ir tvaraus verslo finansavimo galimybės, https://finmin.lrv.lt/lt/naujienos/sutarta-jungti-nacionalines-pletros-istaigas-augs-investiciju-ir-tvaraus-verslo-finansavimo-galimybes.

[36] Nasdaq (2022), Statistics, https://nasdaqbaltic.com/statistics/en/statistics.

[18] Neaimeh, M. et al. (2017), “Analysing the usage and evidencing the importance of fast chargers for the adoption of battery electric vehicles”, Energy Policy, Vol. 108, pp. 474-486, https://doi.org/10.1016/j.enpol.2017.06.033.

[37] OECD (2022), “Climate change and low-carbon transition policies in state-owned enterprises”, OECD Business and Finance Policy Papers, No. 05, OECD Publishing, Paris, https://doi.org/10.1787/e3f7346c-en.

[6] OECD (2022), “General Government Accounts, SNA 2008 (or SNA 1993): Government expenditure by function”, OECD National Accounts Statistics (database), https://doi.org/10.1787/data-00019-en (accessed on 1 July 2022).