This chapter assesses the availability, quality and responsiveness of the public services for small and medium-sized enterprises (SMEs) in the Western Balkans and Turkey. It begins with an overview of the assessment framework, then focuses on the four sub-dimensions of Dimension 4: 1) digital government services for enterprises, which measures the extent to which SMEs can interact with public institutions through the use of digital technologies; 2) company registration, which focuses on the procedures necessary to register a company; 3) business licensing, which considers the complexities of the process of obtaining a licence; and 4) tax compliance procedures for SMEs, which examines whether tax systems are adapted to SMEs’ unique needs. Each sub-dimension concludes with key recommendations for increasing the capacity and efficiency of the operational environment for SMEs in the region.

SME Policy Index: Western Balkans and Turkey 2022

4. Operational environment for SMEs (Dimension 4) in the Western Balkans and Turkey

Abstract

Key findings

The Western Balkans and Turkey economies have made progress in rolling out digital government services for businesses. However, progress is uneven across the seven economies and businesses still cannot complete all the key processes on line.

Monitoring and evaluation of digital government services remains a key challenge in the region, and is very limited in nearly all Western Balkans and Turkey (WBT) economies.

One-stop shops for company registration have been established across the region and online registration has been further optimised. Reforms to simplify company registration processes and increase interoperability in this regard have been undertaken in the majority of WBT economies to reduce the number of days and procedures required to start a business.

Business licencing has been centralised in all economies in the Western Balkans and Turkey and deregulation reforms are ongoing to reduce administrative barriers for businesses. The digitalisation of licensing application processes has begun in some economies.

Labour income taxes across the region are high and discourage entrepreneurship and tax compliance but are, to some extent, offset through the use of simplified tax regimes targeted at SMEs, which tend to decrease tax burdens and tax compliance costs.

Simplified bookkeeping rules for SMEs are common throughout the region and digital services are widely used for business taxation.

Comparison with the 2019 assessment scores

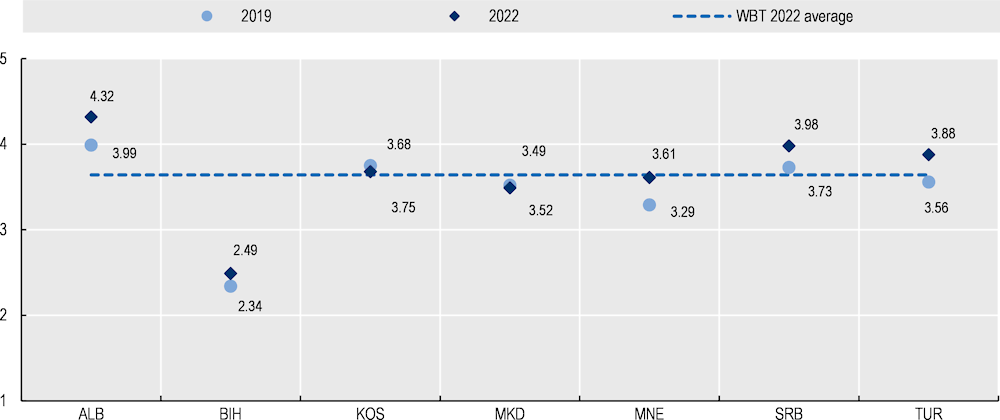

Most WBT economies have progressed in Dimension 4 since the last assessment, with a regional average of 3.63 in 2022, slightly above its performance of 3.44 in 2019. Albania continues to be the best performer of the seven assessed economies, followed by Serbia and Turkey, which have made the most progress since the previous assessment cycle (Figure 4.1).

As in the previous assessment, WBT economies performed the best and have all increased their scores in company registration and business licensing. Most WBT economies have made improvements in digital government services, with some seeing a slight decrease.

Figure 4.1. Overall scores for Dimension 4 (2019 and 2022)

Note: Despite the introduction of questions and expanded questions to better gauge the actual state of play and monitor new trends in respective policy areas, scores for 2022 remain largely comparable to 2019. To have a detailed overview of policy changes and compare performance over time, the reader should focus on the narrative parts of the report. See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology

Implementation of the SME Policy Index’s 2019 recommendations

The speed of implementing the recommendations made in the 2019 SME Policy Index varies across the region. Table 4.1 summarises the progress on implementing the key recommendations made for Dimension 4 in the previous assessment.

Table 4.1. Implementation of the SME Policy Index’s 2019 recommendations for Dimension 4 in the Western Balkans and Turkey

|

Regional 2019 recommendation |

SME Policy Index 2022 |

|

|---|---|---|

|

Main developments during the assessment period |

Regional progress status |

|

|

Allow SMEs to complete all processes on line |

All of the economies in the Western Balkans and Turkey (WBT) have established online portals to serve as digital one-stop shops, allowing for easy access to key government services for businesses. However, the rollout of digital government services for businesses was uneven across the region, and these portals have varying levels of sophistication. Businesses in Albania, Serbia and Turkey can complete the most key procedures fully on line through these online portals. |

Moderate |

|

Improve and promote the use of open government data |

With the exception of Bosnia and Herzegovina and Turkey, all WBT economies have developed open data portals and have gradually increased the amount of open data available and relevant for SMEs. However, the WBT economies lack a strong data-driven culture in the public administration, which would allow for more effective publishing of open data and increased transparency. Only Montenegro and Serbia have outlined concrete goals to promote the use of open government data by small and medium-sized enterprises (SMEs). |

Moderate |

|

Expand the interoperability system to improve connections between various public administration databases |

With the exception of Bosnia and Herzegovina, all WBT economies have made gradual progress in increasing the interoperability of government data through the interconnection of government registers and establishment of interoperability platforms. However, progress is uneven across the region and there is still room for improvement in most economies to implement the once-only principle. |

Moderate |

|

Increase the monitoring and evaluation of digital services targeting SMEs |

Monitoring and evaluation of digital government services remains a persistent challenge for the WBT economies. Kosovo, Montenegro, North Macedonia and Serbia have started to collect data on the use of digital services, thanks to the establishment and development of their online portals, but these data are limited to usage in absolute terms and binary satisfaction rates, which do not paint an accurate picture of a service’s performance. Albania and Turkey collect a broader range of data and conduct user surveys, but no economy in the region monitors service use by type or sub-type of users (for instance citizens vs. businesses and more importantly SMEs vs. larger companies). |

Limited |

|

Adopt the rule of one identification number for each company |

No changes were reported in the assessment cycle. A single identification number for dealing with the public administration has been established in Albania, Kosovo and Montenegro. |

Limited |

|

Fully implement the “silence-is-consent” principle |

The “silence-is-consent” principle is legislated in all WBT economies except Bosnia and Herzegovina, North Macedonia, and Turkey. According to data provided by the governments, the principle is fully implemented by registration agencies. The Law on Crafts and Related Activities adopted in the Federation of Bosnia and Herzegovina in 2021 prescribes the silent-is-consent principle for business registration, and should be implemented when its one-stop shop becomes operational. |

Moderate |

|

Create a central co-ordination body responsible for business licences to have a systematic overview of licensing |

Except for Albania and Kosovo, all economies lack a co-ordination body that oversees the granting of permits and licences by competent authorities. While substantial progress has been achieved in centralising business licensing processes and enhancing interoperability across the region, co-ordination bodies have not been established. |

Limited |

|

Introduce electronic distribution and nomination of licensing officers |

As in the previous assessment, Albania is the only WBT economy that has introduced electronic distribution and nomination of licensing officers. |

No progress |

|

Regularly monitor and evaluate tax simplification measures |

Overall, economies in the region tend to have ample scope to improve both the design and the evaluation of their simplified tax regimes and, in particular, to analyse whether the design of the simplified tax regime takes the profitability of business sectors properly into account, and whether this creates hurdles to grow in the standard tax regime or incentives to work in the informal sector. |

Limited |

|

Strengthen the way the administration provides tax-related information to SMEs |

Efforts have been made to increase tax literacy in the region. In most economies, businesses can find information on the general website of the tax administration, although this information is not necessarily targeted at SMEs. Nevertheless, there is scope to provide more detailed tax information to SMEs. SMEs might find it challenging to obtain detailed information about their tax rights and obligations; they must be made aware of their options to reduce compliance costs and make paying tax as simple as possible. |

Moderate |

Introduction

From registering a company and obtaining a business licence to filing and paying taxes, SMEs interact with public institutions, physically or digitally, at all stages of their development. The operational environment in which SMEs must navigate is determined by the ease of using digital services, the number of procedures and the costs associated with their interactions with the government.

Poor delivery of government services, poorly designed regulations and complex regulatory requirements imposed on businesses can result in potential businesses not being created, and put unnecessary strains on those that do exist. SMEs are particularly affected, as they often operate on thin profit margins and the resulting increased costs may force some to cease operating. One frequent complaint from businesses is the difficulty of accessing relevant information on administrative procedures. Separate government agencies need to work together to ensure that administrative procedures are established in a way that best serves users, which may not necessarily be how governments operate internally (OECD, 2020[1]).

When the COVID-19 pandemic broke out, much of the world moved on line, accelerating a digital transformation that has been underway for decades. While the pandemic has demonstrated the tremendous potential of the digital transformation, including for administrative services, it has also accentuated the gaps that remain (OECD, 2020[2]). For WBT economies heavily impacted by the COVID‑19 pandemic, increasing the availability of digital services for SMEs, including business registration and licensing, as well as improving the efficiency of administrative procedures, including tax compliance procedures, will be key to improving the operational environment by saving time and resources.

Assessment framework

Structure

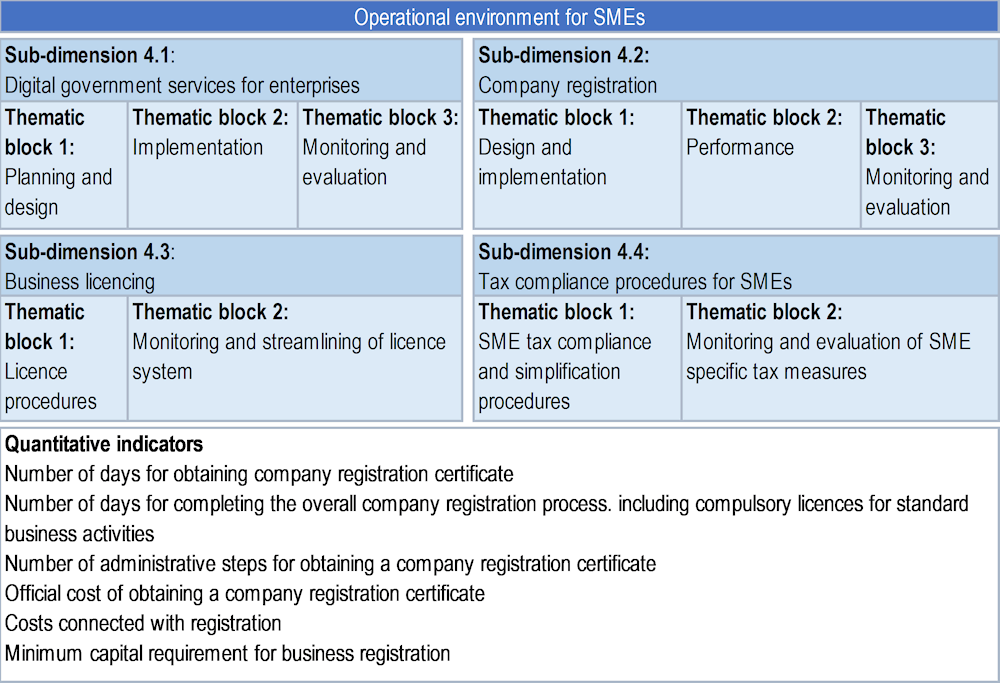

The assessment framework for this dimension is divided into four sub-dimensions (Figure 4.2):

Sub-dimension 4.1: Digital government services for enterprises captures the extent to which interactions between entrepreneurs and public institutions are carried out through electronic or digital means, e.g. electronic filing for taxes, electronic reporting of enterprise statistics or adopting the “once-only” principle for information provided by enterprises.

Sub-dimension 4.2: Company registration focuses on the procedures necessary to register a company.

Sub-dimension 4.3: Business licensing evaluates the process of obtaining a licence or permit.

Sub-dimensions 4.2 and 4.3 both analyse the complexity and length of the procedures involved, and assess whether systems have been simplified through various policy tools and instruments, such as one-stop shops, information portals, digital platforms, written guides or centralised co-ordination bodies.

Sub-dimension 4.4: Tax compliance procedures for SMEs assesses whether governments have introduced policies to make it easy for SMEs to comply with taxes, and gauges whether tax systems are adapted to SMEs’ vulnerabilities and capacities.

Slight adjustments have been made to the framework since the last assessment to enhance the assessment of the range and nature of digital government services provided to SMEs (such as applying for government support programmes). The assessment also takes into consideration COVID-19 response measures, although no evaluation has been made in this regard.

Figure 4.2. Assessment framework for Dimension 4: Operational environment for small and medium-sized enterprises in the Western Balkans and Turkey

Analysis

Digital government services for SMEs (Sub-dimension 4.1)

The development of digital government services can significantly improve the operational environment for SMEs by allowing them to complete an increasing number of administrative procedures and public services fully on line. This allows them to save time and resources, therefore improving the competitiveness of the overall economy. While enabling SMEs to complete key administrative procedures on line is a key step to improving their operational environment, it cannot be properly implemented without a clear, consistent and comprehensive approach on how to integrate digital technologies into the government’s modernisation policies (OECD, 2014[3]).

This section assesses the extent to which SMEs can interact with public institutions through the use of digital tools and channels. It does so by: 1) analysing whether or not governments have adopted a policy framework to advance the availability and development of digital services; 2) exploring the extent to which digital government services, open government measures and data exchange platforms have been introduced; 3) assessing the extent to which monitoring and evaluation of digital services allows the performance of these services to be measured to inform policy making.

Nearly all WBT economies have improved their overall performance in delivering digital government services for SMEs since the last assessment (Table 4.2). With the exception of Kosovo, all WBT economies have seen progress in planning and designing policies and institutional frameworks for the provision of digital services. However, Bosnia and Herzegovina, Kosovo, Montenegro, and North Macedonia have encountered difficulties in implementing these frameworks, and monitoring and evaluation remains a persistent challenge for most economies in the region, despite improvements in all economies since the last assessment.

Table 4.2. Scores for Sub-Dimension 1: Digital government services for small and medium-sized enterprises in the Western Balkans and Turkey

|

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|---|---|---|---|---|---|---|---|---|

|

Planning and design |

4.70 |

2.80 |

3.78 |

4.40 |

4.80 |

4.70 |

4.75 |

4.28 |

|

Implementation |

3.91 |

1.73 |

3.27 |

3.27 |

3.27 |

3.64 |

4.20 |

3.33 |

|

Monitoring and evaluation |

3.80 |

1.48 |

2.60 |

1.73 |

1.73 |

3.00 |

3.00 |

2.48 |

|

Weighted average |

4.12 |

1.99 |

3.26 |

3.22 |

3.34 |

3.80 |

4.07 |

3.40 |

Note: WBT: Western Balkans and Turkey. For more information on the methodology see the Policy Framework and Assessment Process chapter and Annex A

WBT economies have continued to develop their policy frameworks for delivering digital government services, using different approaches

Having a policy for the development of digital government services is the basis for ensuring the rollout of digital government services. However, such policies benefit greatly from being aligned with broader policy and institutional frameworks seeking to develop digital government as a whole.

WBT economies have continued to develop their respective policy frameworks for delivering digital government services, under differing approaches. Most have been implementing frameworks for the development of digital government that focus on providing digital services as part of a larger strategy (such as overall development programmes in the case of Turkey, or public administration reform strategies in the case of Kosovo and North Macedonia) or dedicated documents related to digitalising practices in the public administration (in the case of Serbia). Albania and Montenegro are the only two WBT economies that have developed frameworks that tackle the provision of digital services as part of a larger framework aiming to drive the digital transformation of society at large, through a governance approach, involving a variety of stakeholders, rather than an approach centred on public administration and government.1 These frameworks, Albania’s Digital Agenda (2015‑2020) and Montenegro’s Digital Transformation Strategy (2022‑2026), have objectives related to strengthening the population’s digital skills, and developing the ICT industry and ICT infrastructure in synergy with developing digital government. As digital government reforms often require more horizontal co-ordination and the involvement of a varied array of stakeholders, this is an advantage, as it allows governments to focus on the delivery of digital services against a broader backdrop.

Inter-institutional co-ordination frameworks for digital government reforms have been strengthened in most WBT economies

Digital government reforms are multifaceted processes involving a range of public actors and institutions with many different institutional cultures, priorities and responsibilities. As such, having a framework that allows for effective co-ordination of these diverse actors at a high-level and co-operation at a technical and operational level towards achieving a coherent, holistic vision is key to ensuring the effective development of digital government, including the rollout of digital government services for businesses (OECD, 2021[4]).

Some of the WBT economies have taken steps to reinforce the institutional co-ordination of their digital government reforms. Albania and Turkey stand out in this regard, as they have appointed bodies that serve as leaders of the digital transformation and have a comprehensive approach to institutional co-ordination and co-operation. In Albania, since 2017, the National Agency for Information Society serves as both the policy leader for digital transformation and supports and manages the ICT staff of line ministries to ensure a common approach to managing decentralised ICT infrastructure. Turkey has adopted a more vertical approach, with the Digital Transformation Office of the Presidency taking the leading role in determining priorities related to digitalisation for various institutions since 2019. Montenegro, North Macedonia and Serbia have established councils or working groups to ensure high-level inter-institutional co-ordination of digital service delivery and digital government reforms more broadly. While these bodies do not have the same overall effectiveness as having a specifically mandated leading institution for the digital government agenda, they nevertheless provide a basis for ensuring inter-institutional co-ordination. Kosovo has charged the Agency for Information Society within the Ministry of the Interior with co-ordinating the delivery of digital government services and Bosnia and Herzegovina’s Public Administration Reform Co‑ordinator’s Office oversaw the development of a common Strategic Framework for Public Administration Reform (2018-2022) developed jointly by the state level and the entities. However, for different reasons, both institutions lack the legitimacy and ability to effectively steer the digital transformation of their economies.

The establishment of co-ordination through dedicated bodies has helped some economies (Albania, and to a lesser extent Turkey) establish standards for the delivery of digital services to ensure a consistent level of quality of services among different institutions. This is not, however, the case for the rest of the WBT economies, leading to a divergence in the quality of services in those economies that have not yet established common standards.

The rollout of digital government services has progressed unevenly across the region

The creation and development of one-stop shops allow economies to provide public services more efficiently, ideally reducing the administrative burden on both businesses and the public sector through the provision of more efficient and easily accessible services (OECD, 2020[1]). One-stop shops usually provide a selection of services grouped around a specific set of needs, building on the original organisational delivery channel (OECD, 2020[2]). Ensuring that digital services are easily accessible by businesses through online portals which serve as digital one-stop shops and that they can be completed digitally from end to end is key for facilitating the operational environment for SMEs.

All WBT economies have established online portals which aim to serve as one-stop shops, although the development of these portals, and the degree to which key business services are accessible and can be completed fully on line, varies greatly between the economies. Albania, Serbia and Turkey have the most developed portals, with the greatest number of services that can be accessed and completed fully on line by businesses. Kosovo’s, Montenegro’s and North Macedonia’s portals are at earlier stages of development, with services for businesses being gradually integrated. Bosnia and Herzegovina presents a unique case, as there is no central portal for digital services at the level of the economy, instead, portals for digital services are present at the level of the entities. A major requirement for having fully transactional digital services is having a system which allows for the online payment of administrative taxes and fees. So far, Albania, Serbia and Turkey have developed such systems.

The rollout of digital government services through digital one-stop shop portals has slowed down in some WBT economies since the previous assessment, despite the inclination of governments to realise the benefits and importance of digitalisation, underlined by the COVID-19 pandemic. Specifically, Kosovo and Montenegro reported that the rollout of digital government services was slowed due to the reallocation of resources and shifting of priorities towards more immediate support to businesses in the wake of the pandemic.

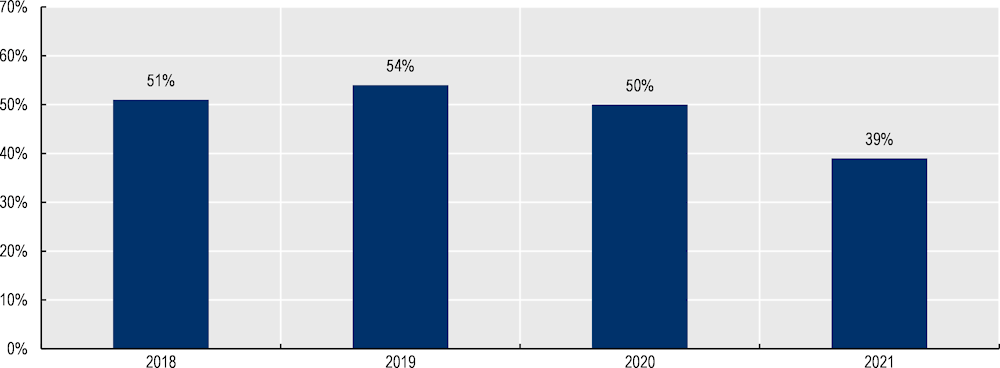

Businesses’ satisfaction in most Western Balkan economies with available digital government services has declined since 2019 (from a regional average satisfaction rate of 54% to 39%2 in 2021) (Figure 4.3), with this decline possibly being exacerbated by the increased need for digital services brought on by the COVID‑19 pandemic. The only exception to this trend is Serbia, where the rollout of digital services saw more progress during the assessment period, and was accelerated by the pandemic.

Figure 4.3. Business satisfaction with digital government services in the Western Balkans (Western Balkans Six average)

Note: The WB6 includes Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia, and Serbia. Data for Turkey are not available, since Turkey is not included in the Balkan Business Barometer Survey.

Source: Regional Cooperation Council (2021[5]), Balkan Barometer: Business Opinion, Database, https://www.rcc.int/balkanbarometer/results/1/business

This declining satisfaction possibly shows that while governments in the region are making progress on digitalising services, there is room for improvement in ensuring service design which is consistent with and designed around the needs of users. The tendency of most WBT governments to plan and implement digital government reforms primarily from a public administration perspective risks alienating businesses and other key stakeholders. Moreover, by adopting a “digital by default” approach, instead of ensuring an omni-channel approach3 which combines digital services with existing channels, governments risk alienating users that rely on traditional services and therefore increasing the digital divide (OECD, 2014[3]).

Progress has been made in strengthening the key enablers for digital services, namely government data interoperability, e-signature and open data

Several key enablers can support and accelerate the delivery of digital services for SMEs, one of which is ensuring the interoperability of data collected by the government. Data interoperability is essential to support the exchange of information among different government bodies in an economy, thus avoiding the need for SMEs to share information more than once as they access different services, in line with the once-only principle.4

With the exception of Bosnia and Herzegovina, all WBT economies have advanced the interconnection of their various government registries, and have thus moved closer to the implementation of the once-only principle and full interoperability of government data. Albania is the regional leader in this regard, with over two-thirds of all data provided to the public administration shared across different bodies, thus saving considerable time for businesses. The other WBT economies have been gradually increasing the number of interconnected public registers since the last assessment and have made efforts to promote the exchange of data between different administrations as a common practice, to varying levels of success. In October 2021, the Western Balkan Six economies signed a Memorandum of Understanding on Interoperable Western Balkans and Free Flow of Data in the Western Balkans region, aiming to intensify co-operation to ensure interoperable cross-border services (such as toll systems and digital identity).

The possibility to use electronic signatures, with equivalent legal value as traditional signatures, is another key enabler for completing more services on line, particularly those requiring a more secure connection. The European framework for e-signature, centred on the eIDAS Regulation,5 ensures the security of e-signatures and the cross‑border reusability within the European Single Market.

Nearly all WBT economies have aligned their legislative frameworks with the eIDAS Regulation, with Kosovo being the most recent economy to have done so, with the adoption of its Law on Electronic Identification and Trust Services in Electronic Transactions in December 2021. During the assessment period, North Macedonia also aligned its framework with the eIDAS Regulation. Bosnia and Herzegovina stands out, as it has not yet developed a common approach to aligning its legal framework on e-signature between the state level and the entities, complicating the usability of e-signatures throughout the economy and its integration with the EU framework. With the exception of Turkey,6 all of the WBT economies have opted to implement e-signatures through the use of qualified electronic certificates, which allow for the secure signing of documents electronically, but present a cost barrier and a technical barrier for an important proportion of SMEs in the region.7 To circumvent the cost barrier, many economies have started issuing electronic ID cards, which contain qualified electronic certificates, and Serbia has implemented a cloud‑based e-signature system which is usable through mobile devices, thereby circumventing the technical barrier.

A data-driven public sector ensures that the government cultivates the availability, accessibility and reuse of data to increase transparency, build trust and create public value (OECD, 2020[6]). While not directly linked to the provision of services, the availability of open data and policies to encourage its reuse constitute a key part of the operational environment for SMEs, as reusable open data have the potential to promote innovation and provide SMEs with a valuable resource to create and develop new products and services.

Most of the WBT economies have established open data portals and have increased the number of datasets available through these portals since the previous assessment. Albania, Montenegro, North Macedonia and Serbia have established standards and criteria for the organisation, annotation, formatting and publishing of open data to encourage its reusability. With the exception of Montenegro and Serbia, the WBT economies are lagging behind in elaborating proactive policies to promote the reuse of open data by SMEs to create value through innovative products and services. Montenegro, through objectives included in its Digital Transformation Strategy (2021-2026), and Serbia, through its National Strategy for the Development of Artificial Intelligence (2020-2025), are currently the regional leaders in this regard, and have organised activities such as innovation challenges and hackathons to stimulate and promote the use of open data.

Monitoring and evaluation of digital services remains a challenge for most WBT economies

Monitoring and evaluation of the performance of digital services allows governments to measure the success of digital one-stop shops and the extent to which they achieve their goals of simplifying the operational environment for SMEs. Effective monitoring and evaluation systems allow relevant data on the use of digital services to be collected, to allow governments to identify where improvements are needed. Some examples of performance indicators that can be collected are use of services, user satisfaction, costs per transaction, usage patterns or service completion rates (OECD, 2020[1]).

Setting up comprehensive and meaningful monitoring and evaluation systems for digital government services is a challenge for the WBT economies. Most economies that have some form of performance monitoring, for instance Kosovo, Montenegro, North Macedonia and Serbia, limit the collection of data to data on the use of services or user satisfaction in absolute numbers or binary satisfaction measurement, with a heavy focus on use by citizens in most cases. No economy differentiates data collection by type or sub-type of users (for instance citizens vs. businesses and more importantly SMEs vs. larger companies). Albania and Turkey have shown a more proactive approach to measuring satisfaction and use of digital services, through user surveys. However, the usefulness of such surveys is limited to measuring user satisfaction at a given point in time, something which could be improved upon by creating dynamic and responsive performance monitoring.

The way forward for digital government services for SMEs

Adopt user-driven approaches to service delivery. While ensuring the rollout of digital government services, WBT economies would benefit from ensuring that services are designed around the needs of the user, and specifically SMEs. This contrasts with simply digitalising existing administrative procedures, as this would be a missed opportunity to simplify and improve procedures, which can be carried out in parallel to ensuring their digital availability. Governments could benefit from engaging and interacting with end users, including SMEs, in a way they can indicate and communicate their own needs to drive the design of services (OECD, 2020[2]). Economies that have designated institutions to serve as digital transformation leaders and co‑ordinators have an advantage in this regard, as the promotion and institutional enforcement of this approach are easier to implement in practice. All WBT economies should include this principle in their policy frameworks and overall institutional approaches to providing digital services. Box 4.1 provides guidance on how governments can ensure that services are designed around the needs of users. Identifying users’ needs is the first key step towards providing relevant benchmarks and performance indicators for meaningful monitoring and evaluation.

Promote and facilitate the use of electronic signatures. Those WBT economies which have established legal frameworks for e-signature use should focus on implementation, specifically on reducing the cost and technical barriers that many SMEs face when confronted with adopting e- signatures. Several options exist to achieve this goal, for instance developing mobile solutions as Serbia has, advancing the rollout of electronic identity cards or even building a federated identity model8 as Turkey is doing. When building and developing their digital identity systems, WBT economies should develop strategies to ensure that solutions developed for citizens are also usable for citizens in their capacity as business representatives, so that these solutions benefit businesses as well.

Promote and facilitate the reuse of open data by SMEs. Most WBT economies would benefit from developing more proactive policies in promoting and facilitating the reuse of open data by SMEs for the creation of innovative products and services. A large, easily accessible and reusable (thanks to regulations to ensure proper formatting, annotation and classification) repository of open data, combined with proactive policies9 (such as communication about the potential benefits of data reuse or promoting collaboration within the data ecosystem), can be a driver of SMEs’ innovation and growth. Ireland’s Open Data Engagement Fund can inspire economies in the region in terms of funding schemes to stimulate open data reuse and innovation (Box 4.2). Box 4.3 showcases an example of how governments can promote open data reuse through events such as innovation challenges or hackathons.

Box 4.1. Keys to successful user-oriented service delivery

Successfully designing public services, which are tailored to and responsive to users’ needs is a process which depends on several key factors, based on the OECD’s Conceptual Framework for Analysing the Design and Delivery of Services:

First, governments must consider contextual factors, such as the political and administrative culture of an economy, the technological context (availability of and widespread use of tools such as the Internet and ICT or e-signatures in businesses), and socio-economic and cultural factors. Embracing a digital-by-default approach risks excluding users who may be unable to complete services on line and need in-person support. Therefore, governments should understand how existing service delivery channels (websites, call centres, networks of service provision) can work together to provide inclusive access to services for all. Information shared though different channels (on line, in-person, telephone) should be integrated to allow users to complete services end-to-end even if they change channels in the middle of the process.

Second, public sector service design should be guided by a philosophy that is based on the inclusiveness of stakeholders, agile design and iteration. In the case of digital services for businesses, this means that businesses, including small and medium-sized ones, should be consulted proactively when designing services or adapting them to digital models. User feedback can also be collected ex post through monitoring and evaluation. An agile design philosophy allows governments to iterate on services and integrate user feedback throughout the service design and delivery process, as opposed to collecting feedback as a separate process.

Last, governments should enable the delivery of services based on a user-centric approach by taking a “government as a platform” approach, giving civil servants the resources and tools necessary to drive this transformation. Concretely, this refers to establishing common standards for service delivery; empowering administrations with the ability and resources to explore, test and propose new services; developing reusable technical components (such as payments or identity); and establishing appropriate guidelines for public procurement to ensure the reflection of these principles when outsourcing.

Box 4.2. Ireland’s Open Data Engagement Fund

Consistent and targeted funding can be a key support mechanism for governments that want to encourage the reuse of open data by the private sector and civil society. Competitive project selection processes can help ensure that the government funds the most innovative and relevant projects, in line with its policy objectives.

Since 2016, the Irish government has been awarding annual grants for selected projects focused on open data reuse and promotion, based on a competitive application process. The Open Data Engagement Fund is aligned with Ireland’s major policy documents in the field of open data, such as the Open Data Strategy (2017-2022) and the Public Service Data Strategy (2019-2023). The total grant allowance for the fund in 2021-22 was EUR 30 000, with a maximum of EUR 5 000 per project. The latest grant cycle focused on projects that showed innovative use of open data for creating public value (through hackathons or initiatives by public bodies) or general engagement and promotion of open data (for example, by analysing the economic benefits of the availability and reuse of open data). Some examples of winning projects include hackathons for optimal installation of electric vehicle infrastructure based on available open data related to transport, or the mapping of accessibility of healthcare services based on available health-related open data.

This funding approach has a double positive impact. On the one hand, it encourages the reuse of open data by stakeholders outside the government as a common practice that can help these stakeholders, including businesses, develop innovative projects, products and services. On the other hand, it allows governments to select projects which present interesting solutions to key challenges, related to sustainability, digital inclusion and other areas. Ireland’s example showcases the benefits of a targeted approach to supporting open data reuse and innovative projects based on open data. For economies in the Western Balkans and Turkey, and especially in the Western Balkans where financial resources are often cited as an obstacle, such a scheme could allow governments to target their limited resources based on projects assessed to provide the most value and relevance for a given year, in line with the government’s policy objectives, as well as with the available open data.

Note: For more information, see: https://data.gov.ie/pages/open-data-engagment-fund.

Source: OECD (2020[6]).

Box 4.3. Sweden’s “Hack for Sweden” hackathon

Organising collaborative or competitive events such as hackathons or innovation challenges can be an effective way to stimulate and promote the reuse of open government data among the private sector. Such events allow participants to gain experience in using open government data to provide innovative products or solutions to public issues.

In Sweden, the Agency for Digital Government co-ordinates “Hack for Sweden”, an all year-round platform for engaging citizens, businesses and other stakeholders in reusing open government data. Competitive projects are awarded with grants as well as promotional assistance and notoriety, which allows them to connect with investors, businesses and other potential partners, and to grow beyond the prototypes created as part of the hackathon.

The benefits of this approach come from the fact that rather than being organised as a single event or series of events, “Hack for Sweden” operates as a platform, allowing developers to showcase their projects year-round. This approach still allows the government, in its co-ordinating role, to conserve some flexibility in the orientation of projects. For example, in 2021, the focus was placed on solutions to issues related to COVID-19 and digital inclusion, with public institutions guiding the process by expressing their needs for innovative solutions.

While some economies (Montenegro, Serbia and Turkey for example) have organised hackathons to drive innovation and deepen collaboration between stakeholders in different sectors, a more consistent orientation towards reusing open data would be welcome. Sweden’s approach allows for the creation of a platform for encouraging, promoting and rewarding open data reuse in line with objectives determined by the government (such as responding to the COVID-19 pandemic or addressing climate change for example).

Economies with developed open data portals could further develop these portals into platforms for open data reuse, and reward the most innovative and competitive projects. A special focus could also be given to businesses, to allow them to connect with developers who show promise through the creation of innovative solutions to the needs of customers or society.

Note: For more information, see: https://www.digg.se/utveckling-av-digital-forvaltning/hack-for-sweden.

Source: OECD, (2020[6]).

Improve monitoring and evaluation systems for digital services. WBT economies should focus on developing monitoring and evaluation systems that allow the performance of digital services to be continuously measured according to key performance indicators. Metrics such as user satisfaction, service completion rates or usage patterns should allow governments to measure the success of digital services in meeting businesses’ needs. It would be very important to allow for differentiated monitoring of use by different categories of users, specifically businesses vs. citizens and more specifically SMEs vs. larger companies, to identify where further outreach efforts are needed. Norway’s digital one-stop shop, Altinn, can serve as an example of how an integrated online portal can be used for effective monitoring and evaluation of the performance of digital services (Box 4.4). For more information on data that WBT governments could consider collecting in this area, please see Annex C.

Box 4.4. Norway’s Altinn portal

Altinn (altinn.no) is Norway’s digital one-stop shop for businesses and citizens. Launched in 2003, the portal has undergone several iterations and has developed into a one-stop shop for digital services, providing over 1 000 digital services and forms, as well as a platform for government design and iteration of public services. The Brønnøysund Register Centre, as the institution responsible for managing Norway’s digitalised registers, is in charge of managing and developing the platform, in co‑ordination with line ministries and in consultation with end users.

Altinn is connected to Norway’s National Population Register and Register of Legal Entities, allowing it to monitor the use of the platform, as well as individual services, by both businesses and citizens dynamically. This allows the Norwegian government to identify potential gaps in service use as well as where additional outreach efforts might be necessary (among which business categories, in which geographic area for example).

Altinn’s success has led to it being used by 100% of businesses for filing tax returns and annual accounts, and some 99% of businesses use it for declaring and paying value-added tax.

Altinn is an example of how the interoperability of government data can strengthen monitoring and evaluation. The platform has automatic access to key information about its users, as such information is collected automatically.

While this requires a high level of interoperability and data security, something which the Western Balkans and Turkey are working towards, it provides an example of how a platform for digital services can monitor the use of the services directly. Some economies in the Western Balkans and Turkey already collect data on the use of services through their portals automatically, and would benefit from expanding the range of indicators collected (in the case of businesses: size class, sector of activity, etc.), without necessarily making this data collection automatic (users could enter the information themselves initially).

Source: OECD (OECD, 2020[1])

Company registration (Sub-dimension 4.2)

Company registration is key for a business environment conducive to private sector activity and the poor delivery of services can result in potential businesses not being created. Several practices can facilitate business registration procedures, such as the establishment of one-stop shops, standard registration forms, unique company identification numbers and online services. Straightforward and clear registration procedures are even more important for SMEs, to narrow the administrative information gap they might face.

This sub-dimension analyses and compares registration procedures across the WBT economies to understand what challenges SMEs face when registering their companies (Table 4.3). The average regional score for this sub-dimension (4.18), which has slightly increased since the last assessment (when it was 3.97), shows that WBT economies perform particularly well in designing, implementing, monitoring and evaluating company registration. While all economies have made positive developments to reform their company registration processes, the most progress was achieved in Bosnia and Herzegovina, Montenegro, and Serbia.

Table 4.3. Scores for Sub-dimension 2: Company registration in the Western Balkans and Turkey

|

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|---|---|---|---|---|---|---|---|---|

|

Design and implementation |

4.90 |

3.50 |

4.60 |

4.85 |

4.70 |

4.80 |

3.60 |

4.42 |

|

Performance |

4.50 |

2.80 |

4.80 |

3.80 |

3.73 |

4.30 |

3.60 |

3.93 |

|

Monitoring and evaluation |

4.80 |

2.50 |

5.00 |

4.80 |

2.55 |

4.75 |

4.00 |

4.06 |

|

Weighted average |

4.78 |

2.96 |

4.80 |

4.62 |

3.65 |

4.68 |

3.76 |

4.18 |

Notes: WBT: Western Balkans and Turkey. For more information on the methodology see the Policy Framework and Assessment Process chapter and Annex A.

One-stop shops for company registration are available throughout the region to facilitate the processes required to start a business

The establishment of one-stop shops for company registration allows for enhanced co‑ordination across and within levels of government and enables the delivery of integrated multi-policy and user-orientated services (OECD, 2020[1]). One-stop shops for business start-up not only save time and money, but also can make procedural requirements more transparent and accessible (World Bank, 2020[7]). Some one‑stop shops are virtual – single or a combination and integration of various platforms; others are physical, with one or more windows. More often than not, existing user journeys are fragmented between online and offline interactions, and hard to trace across different parts of government. Investing in the design process, conceptualising user journeys from end-to-end, and providing support for all steps is crucial for good digital services, including company registration one-stop shops (OECD, 2022[8]).

All WBT economies have established one-stop shops and their number has increased throughout the region. While the only functioning one-stop shops in Bosnia and Herzegovina are in Republika Srpska (RS), in 2021 the Federation of Bosnia and Herzegovina (FBiH) adopted the long-awaited adjustments to its administrative laws as legal bases for making its one-stop shop operational, which should ease the number of procedures required to register a company.

One-stop shops operate in different ways across the region. On the one hand, Albania and Kosovo, the top performers in this sub-dimension, have single-window one-stop shops. When registering at the Albanian National Business Centre (NBC) or the Kosovo Business Registration Agency, entrepreneurs receive a single tax identification number and are simultaneously registered with the tax authorities and social insurance. On the other hand, the process is more cumbersome for entrepreneurs in Turkey, which must complete the procedures to start a business at different windows of the Trade Registry Directorates. In addition to registering their company, entrepreneurs have to complete the company’s tax registration at the tax office and register employees with social security at the social security institution, receiving a specific identification number for each procedure.

Reforms to optimise the functioning of one-stop shops and ease the process of starting a business have been undertaken in some WBT economies. Increased interoperability has been achieved in Serbia since the last assessment. In addition to delivering the two required identification numbers to new businesses (tax identification number and company registration code), since 2020, the Serbian Business Registers Agency has also been in charge of submitting the relevant applications for mandatory social insurance on behalf of companies. In Montenegro, the 16 different forms required to register a company in one‑stop shops were replaced in 2020 with a single registration application. Moreover, the RS government started a project for the “Optimisation of Administrative Procedures and Formalities” in 2021, which should further reduce the number of procedures required to register a business.

Along with the establishment and optimisation of their one-stop shops, all WBT economies have removed the minimum paid-in capital requirement to start a business, with the exception of the Federation of Bosnia and Herzegovina, where no progress has been achieved in eliminating the EUR 500 paid-in minimum capital requirement (10.2% of gross national income per capita (World Bank, 2020[9])).

The rollout of electronic registration services has progressed, but at an uneven pace across the region

Electronic registration services are available in more than 90% of high-income economies, in contrast to only about 40% of low-income ones (World Bank, 2020[7]). The primary motivation is to reduce the time and cost of registering a business as well as to improve access for smaller firms operating at a distance from the registrar’s offices. Moreover, information technology has great potential to narrow the information gap and increase transparency for SMEs.

Electronic registration is available in all WBT economies expect for the Federation of Bosnia and Herzegovina, although different levels of functionality are enabled across the region (Table 4.4).

Table 4.4. Status of online company registration in the Western Balkans and Turkey

|

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

|

|---|---|---|---|---|---|---|---|---|

|

FBIH |

RS |

|||||||

|

Electronic storage of registration records |

X |

X |

X |

X |

X |

X |

X |

|

|

Online registration portal available |

X |

|

X |

X |

X |

X |

X |

|

|

Electronic payment available |

X |

|

|

|

X |

X |

X |

|

|

E-signature mechanism in place |

X |

|

|

|

X |

X |

X |

|

|

Qualified electronic signature required |

|

|

|

|

X |

X |

X |

|

|

Registration available to all types of companies |

X |

|

|

X |

X |

|

|

|

Note: WBT: Western Balkans and Turkey.

Source: Information provided by the respective governments in the SME Policy Index 2022 questionnaire.

In the previous assessment, only Albania, Kosovo and North Macedonia had a functioning online company registration portal. Other WBT economies have made great progress in establishing and optimising online registration. In Montenegro, the secondary legislation on the electronic payment of administrative fees has been adopted, allowing the legislative prerequisites to introduce full electronic registration of enterprises in 2020. While the process was meant to be fully available for all types of companies, only limited liability companies could register on line at the moment of writing. Online registration in Serbia was also made fully available to multi-member limited liability companies in June 2019 (in addition to sole proprietors and single-member limited liability companies). In Albania and Serbia, full digitalisation of some services related to company registration is ongoing.10

In 2019, Republika Srpska adopted the amendment Law on Registration of Business Entities, setting the stage for online registration. A single portal was established in 2021, but is not yet fully operational due to delays in the commissioning of the electronic signature mechanism. Similarly, entrepreneurs in Kosovo still need to submit a hard copy of signed documents as the e-signature mechanism is not yet in place, although implementation of the 2021 Law on Electronic Identification and Trust Services in Electronic Transaction, planned for 2023, should make online registration fully operational. As in the previous cycle, company registration has not yet been fully digitalised in Turkey, but registration records are stored electronically on the Central Commercial Registration System, which is a first step towards improving transparency, security and information sharing. Online company registration is not available in the Federation of Bosnia and Herzegovina and is not planned as part of ongoing reforms.

While positive developments are ongoing to digitalise company registration throughout the region, most SMEs face the barrier of costs and technological requirements associated with obtaining the qualified electronic signature which is necessary for online registration. This causes most companies to register in person or to use the services of authorised registration agents to prepare their company application, adding to the length and cost of registration.

Monitoring and evaluation mechanisms for company registration are satisfactory throughout the region

The performance of (online) company registration should be monitored and evaluated to ensure that it continues to meet both users’ and the government’s needs and expectations (OECD, 2020[1]).

Contrary to most digital services, monitoring and evaluation mechanisms are in place for company registration in almost all WBT economies, albeit at different levels, under the responsibility of registration agencies. Reports and statistics are produced regularly in Albania, Bosnia and Herzegovina (in Republika Srpska), Kosovo, North Macedonia, Serbia, and Turkey, mainly on the number of businesses registered in terms of location, company size, sector of activity or foreign ownership. Further analysis of these statistics is also conducted in some economies. Satisfaction with registration procedures and feedback are also taken into account; for instance, through the Presidency’s Communication Centre CIMER in Turkey or via regular online surveys in Albania.

While monitoring and evaluation of company registration processes remains insufficient in Montenegro and in the Federation of Bosnia and Herzegovina, progress is planned as part of ongoing reforms. While the recently established Council for e-Government in Montenegro will not directly be in charge of improving individual services such as business registration, it should enable better monitoring, compliance and co‑ordination between company registration and other digital services. Such mechanisms are also planned in the Federation of Bosnia and Herzegovina along with the establishment of its one-stop shop.

The way forward for company registration

Continue to digitalise company registration processes. Western Balkan economies should continue to further digitalise their registration processes and Turkey should consider enabling fully operational electronic registration, feasibly as part of its e-Turkiye portal. Kosovo and Republika Srpska in Bosnia and Herzegovina should ensure the commissioning of the electronic signature mechanism on their respective portals. Montenegro and Serbia need to enable the online registration process for all types of companies (currently only available to sole proprietors and limited liability companies). Albania, Montenegro and North Macedonia should work on improving accessibility and lowering the costs of obtaining e-signatures.

Business licensing (Sub-dimension 4.3)

Almost all SMEs are required to have some type of business licence, permit or registration to operate legally, in full compliance with government regulations. Procedures for obtaining a business license can be lengthy and costly, adding to the administrative burden of starting a business. Clear and centralised business licence procedures complying with the principles of cost-recovery are important to ensure prompt operationalisation of SMEs in the market.

This section analyses the complexity of licence procedures in the Western Balkans and Turkey and economies’ efforts to review and streamline legislation pertaining to business licensing (Table 4.5). Solid frameworks for business licensing have been introduced in WBT economies, which translates into a high average score of 3.80. Albania remains the regional leader in this regard, with only slight discrepancies in performance across the other economies.

Table 4.5. Scores for Sub-dimension 3: Business licensing in the Western Balkans and Turkey

|

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|---|---|---|---|---|---|---|---|---|

|

Licence procedures |

4.55 |

3.75 |

3.75 |

3.65 |

4.00 |

3.80 |

3.66 |

3.88 |

|

Monitoring and streamlining of licence system |

4.37 |

3.35 |

3.90 |

3.85 |

3.50 |

3.90 |

3.23 |

3.73 |

|

Weighted average |

4.46 |

3.55 |

3.83 |

3.75 |

3.75 |

3.85 |

3.45 |

3.80 |

Notes: WBT: Western Balkans and Turkey. For more information on the methodology see the Policy Framework and Assessment Process chapter and Annex A.

Progress has been made in centralising business licensing across the region, although co‑ordination between competent institutions remains limited

Access to clear and efficient permit and licence regulations is necessary for SMEs to be able to enter markets. Informational one-stop shops regrouping all the available licences and their specific requirements are key to lowering administrative burdens on SMEs.

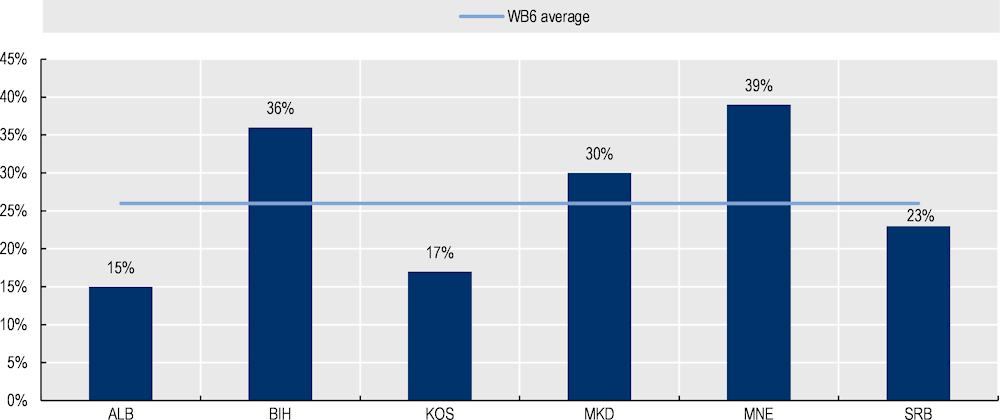

While positive developments are ongoing, the lack of availability and accessibility of relevant licensing information represents a big or very big obstacle for 26% of businesses in the Western Balkans on average, with Bosnia and Herzegovina, Montenegro, and North Macedonia having larger shares of dissatisfied businesses (Figure 4.4) (Regional Cooperation Council, 2021[5]).

Figure 4.4. Business satisfaction with the availability and accessibility of relevant information in the process of obtaining a licence in the Western Balkans and Turkey (2021)

Note: The WB6 includes Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia, and Serbia. Data for Turkey are not available.

Source: Regional Cooperation Council, (2021[5])

Nevertheless, there have been important developments in all WBT economies to enhance the accessibility of licences for businesses. All permits and licences have been centralised on line in the Western Balkans, and to a lesser extent in Turkey.

Both entities in Bosnia and Herzegovina, Kosovo, and Montenegro offer information on the licensing process on a centralised e-licence portal with guidelines that specify the fees to be paid and the necessary procedures to be followed. Albania is the only WBT economy that has streamlined company registration and licensing under its one-stop shop (the NBC), which speeds up the process, increases transparency, and lowers administrative burdens and costs for SMEs.

Since the last assessment, North Macedonia and Serbia have also centralised all business licences on line on their e-government portals. These central registers are a first step towards increasing the efficiency of the licensing process, which should enable more comprehensive data exchange and interoperability in the future. Moreover, Kosovo was in the process of regrouping all licences and permits on its e-government platform with other digital services to increase the accessibility of licensing information. While Turkey lacks a centralised approach when it comes to business licensing, retail licensing has been greatly simplified with the establishment of the perakende bilgi sistemi (PERBIS) platform, which became fully operational in 2019.

Although licensing processes have been centralised, they remain largely fragmented in most economies, with licences being granted by different administrative bodies according to their competences. With the exception of the NBC in Albania and Kosovo’s Central Registry of Permits and Licences, all economies lack a co-ordination body that oversees the granting of permits and licences by competent authorities.

Deregulation of business licensing reforms is ongoing to reduce administrative barriers for SMEs

An important approach to administrative simplification for businesses is to reduce the number of licences or permits required to undertake various activities. Delays in obtaining a licence can be costly to entrepreneurs, as they add uncertainty and additional costs to much-needed business transactions. The number of days required to obtain certain licences varies significantly across the region, but remains particularly high for construction permits in Bosnia and Herzegovina, Montenegro, and North Macedonia (103, 91 and 111 respectively) compared to the WBT average (72 days). The number of days required for import and operating licences is considerably lower (11 and 24 on average in WBT economies) and have been on a downward trend since 2009 (World Bank, 2019[10]).

Several reforms are underway in the majority of WBT economies to optimise licensing processes. Turkey was in the process of establishing an information system at the time of writing as part of the Eleventh Development Plan (2019-2023) to ensure fast, user-friendly and cost-effective processes for business licensing related to investments. In Albania, Kosovo, North Macedonia and in Republika Srpska in Bosnia and Herzegovina, business licences (their number and associated procedures) are being reviewed and streamlined to simplify processes for businesses. At the time of writing, 12 licences had already been removed in Albania.

Digitalisation of applications for business licensing has started in some economies, but at a slow pace

Digitalisation of applications for business licences is a step forward in enabling transactional one-stop shops for businesses. With digitalised application processes, when businesses apply to licences on line, their request is immediately routed to the respective officers for a decision. The lack of a fully digitalised process for applying for and approving licences remains a big or very big obstacle for 23% of businesses in the Western Balkans, a small increase since 2019 (when it was 18%) (Regional Cooperation Council, 2021[5]).

Albania is the frontrunner in this regard: applications for all business licences are available on the NBC’s portal. The NBC receives business licences and submits them to the relevant authorities as needed. Albania is also the only WBT economy that has introduced electronic distribution and nomination of licensing officers (Box 4.5).

Box 4.5. Business licensing granting process in Albania

Categories of licences

There are three categories of permits and licences for businesses in Albania:

The first uses the applicant’s self-declaration alone to evaluate whether the criteria are fulfilled.

In the second category, the decision to grant a licence is based on self-declaration and documentary proof provided by the applicant.

The third category of licences, in addition to the requirements of the second category, evaluates the fulfilment of the criteria using either an inspection, test, contest, interview, hearing or any other evaluation method.

The National Business Centre (NBC) is responsible for granting licences in Categories 1 and 2, and relevant ministries along with the NBC grant licences falling under Category 3.

Electronic distribution and nomination of licensing officers

For all permit and licence requests (in person before 2020 and on line), the electronic system checks the documents and assigns the request randomly to an officer. Using their case number, businesses can trace the status of their application on the NBC’s website.

Overall, a digital system that randomly selects officials responsible for granting licences to businesses enhances the transparency of the business licencing procedure. It helps to monitor and evaluate officials’ compliance with their mandate, as well as distribute the workload equally among licence officers, allowing the administration to respond faster to requests.

Source: AIDA (n.d.[11]).

Digitalisation of business licences has started in other WBT economies, although at a slower pace. While it is planned to fully digitalise applications for all licences on North Macedonia’s digital service web portal, it is already possible to electronically apply to a small number of licences in Montenegro (20) and Serbia (2 for construction permits and electricity licences). Further digitalisation is ongoing, which should reduce the burdensome number of procedures, requirements, paperwork and costs related to obtaining a licence.

The way forward for business licensing

Streamline the process of electronic licensing and strengthen co-ordination between institutions in charge of issuing business licences. While WBT economies have made great progress in centralising business licences on line, digitalising of licensing applications has been undertaken at a slow pace across the region. To enable transactional licensing services, e‑government authorities should be in charge of curating and maintaining standards, systems such as open data, interoperability platforms or trust services, while institutions involved in issuing licences should ensure proper liaison and co-ordination to reduce overly bureaucratic processes for businesses. In line with the OECD recommendation to streamline industrial and manufacturing licences procedures, the WBT governments could establish a specific co-ordinating body to overview and manage the whole licensing journey, on behalf of the public administration, to significantly facilitate the application for business licensing. This body would then serve as the main interface for entrepreneurs and relieve them of having to deal with the various institutions by referring applications to relevant authorities for their review (OECD, 2022[12]).

Tax compliance procedures for SMEs (Sub-dimension 4.4)

Tax compliance costs refer to the costs that businesses incur in terms of the time and resources that need to be spent – in addition to the tax liabilities that need to be paid – to comply with the tax code (OECD, 2021[13]). Compliance costs tend to increase with the number of taxes that a business is subject to, the complexity of the tax rules, the frequency of filing a tax return and the payments that need to be made, and the number of levels of government and government organisations involved in levying and collecting tax (OECD, 2015[14]). Compliance cost considerations may impact business decisions, such as whether to start a business and whether or not to operate in the formal economy.

While tax compliance costs tend to be higher for larger businesses in absolute amounts, they are significantly higher for SMEs in relative terms (OECD, 2015[14]). The tax system might therefore create a tax-induced disadvantage for SMEs. To level the playing field and stimulate entrepreneurship, economies around the world have introduced measures to reduce tax compliance costs for SMEs, by introducing tax preferences and tax simplification measures.

Tax policy and tax administration approaches to reduce compliance costs for SMEs should vary depending on the type of business and should avoid becoming a hurdle to economic growth. SMEs are a diverse group, spanning all business sectors of an economy; they differ in terms of employment, economic activity, level of innovation, growth and profitability (OECD, 2015[14]). As a result, tax simplification measures that are targeted at some types of SMEs might be overly generous for others. While measures that reduce tax compliance costs for SMEs should not become overly complex themselves, they could vary across key dimensions such as SME profitability. Moreover, tax preferences and simplification provisions can create incentives for SMEs to remain small or to split up into different businesses to continue benefiting from the preferential tax treatment. Tax simplification measures should therefore be designed such that these disincentives to growth are avoided as much as possible.

A comprehensive set of tax measures to reduce liquidity constraints for SMEs has been introduced to mitigate the impact of the COVID-19 crisis

The deferral of personal income tax (PIT) and corporate income tax (CIT) payments has been common across the region. The deferral of tax payments was targeted at all businesses, except in Albania where it targeted SMEs and businesses particularly hit by the crisis, and in the Federation of Bosnia and Herzegovina, where the measure applied only to self-employed entrepreneurs. In addition, value-added tax (VAT) payments were deferred in Kosovo, Montenegro, North Macedonia and Turkey; social security contributions (SSCs) were deferred in Kosovo, Montenegro, Serbia and Turkey. The deferral of tax payments supported business cash flow and eased liquidity constraints.

Some crisis-support tax measures were targeted at SMEs. Albania has reduced the tax rate of its simplified CIT regime that applies to SMEs. In the Federation of Bosnia and Herzegovina, self-employed entrepreneurs benefited from a 50% reduction in the flat tax rate (Official Gazette of the Federation of Bosnia and Herzegovina, 2020[15]). The minimum amount of PIT liability for the self-employed was reduced in Republika Srpska.

COVID-related VAT measures varied in scope. Albania increased the mandatory VAT registration threshold. Bosnia and Herzegovina and Serbia introduced VAT exemptions on goods and services related to health. Turkey temporarily reduced the VAT rate on products such as food and beverages, passenger transportation, and maintenance and repair activities.

Labour income taxes across the region are high and discourage entrepreneurship and tax compliance

In the Federation of Bosnia and Herzegovina, Montenegro, Serbia, and Turkey, SSCs are a particularly large tax burden for the self-employed. In these four economies, self-employed SSCs are levied at a rate exceeding 34%. As self-employed entrepreneurs are also required to pay PIT, the total tax burden resulting from taxes on labour income in these economies is particularly high.

There is scope to increase the progressivity of the PIT in most of the economies. Montenegro, North Macedonia and both entities in Bosnia and Herzegovina levy the PIT at a flat rate. In Kosovo and Serbia, the progressivity of the PIT rate schedule remains limited. Such a reform would strengthen equity and reduce the negative growth and compliance impacts of too high taxes on low-income entrepreneurs.

A minimum SSC threshold applies in Albania, Kosovo and North Macedonia, resulting in a very high tax burden for low-income entrepreneurs. In Albania, SSCs for entrepreneurs are levied on the minimum wage or a multiple of it (IBFD, 2021[16]). In North Macedonia, the SSC base for self-employed workers cannot be less than 50% of the average wage. In Kosovo, the minimum SSC base is 30% of the average wage. The use of a minimum SSC threshold results in very high effective tax burdens for entrepreneurs who earn below the threshold, as they will not pay SSCs on their actual earnings but on the minimum threshold instead. This may discourage low-income entrepreneurs from operating in the formal economy.

Restricted SSC bases will reduce future benefit entitlements. In Albania, self-employed SSCs are levied on the minimum wage, or a multiple of it, rather than on the actual earnings. In Republika Srpska, self‑employed SSCs are levied on 60% of income. While these base-narrowing provisions reduce the SSCs that need to be paid, this limitation also significantly reduces the benefits that entrepreneurs will be entitled to in the future.

There is scope to limit the use of stamp duties

In the Federation of Bosnia and Herzegovina, businesses have to pay several transaction costs (stamp duties) when they file official documents, which may result in a significant additional tax burden. Business stamp duties are particularly numerous when businesses participate in public procurements. The Federation of Bosnia and Herzegovina could consider abolishing or reducing some of the stamp duties. Stamp duties might create a relatively higher burden on SMEs than on larger businesses.

Non-standard forms of work might require changes to the design of the tax system

In most of the economies in the region, no special tax rules apply to gig workers (including independent contractors, online platform workers, contract firm workers, and temporary workers). In Albania and North Macedonia, gig workers are taxed under the same rules that apply to employees or to self-employed entrepreneurs, depending on their type of work contract (Official Gazette of the Republic of Albania, 1998[17]). In Kosovo and Montenegro, gig workers are taxed under the same rules that apply to employees (IBFD, 2021[18]). In the Federation of Bosnia and Herzegovina and Republika Srpska, however, gig workers are subject to SSCs that differ from the contributions paid by employees and the self‑employed. No information was available on the tax treatment of gig workers in Serbia or Turkey.

Non-standard forms of work are becoming more frequent all across the world. The digitalisation of the economy has resulted in an increasing share of non-standard forms of work. Tax and benefit systems need to be adjusted to this new reality.

Despite the low statutory corporate income tax rates, economies across the region implement a wide range of CIT incentives

A wide range of CIT incentives applies to businesses that operate in specific sectors or regions, invest in specific areas, or create additional jobs. In Albania, businesses that develop software or operate in the automotive industry benefit from a reduced CIT rate of 5% rather than the standard CIT rate of 15% (IBFD, 2021[19]). In North Macedonia, businesses located in special economic zones benefit from a ten-year CIT exemption. In Kosovo, businesses in specific sectors can deduct 10% of the cost of their newly acquired asset on top of the regular tax depreciation allowances from their CIT base (IBFD, 2021[20]). In Serbia, all businesses are allowed to deduct twice the amount of research and development expenses they have incurred from their CIT base (IBFD, 2021[21]) and in Republika Srpska, businesses can reduce their tax liabilities by the invested amount in manufacturing equipment and plants. Finally, in the Federation of Bosnia and Herzegovina, businesses that employ new staff for at least 12 months can deduct twice the gross salary of these new staff members from the CIT base.

To stimulate tax compliance, businesses in Turkey benefit from a reduction in CIT liabilities when they pay their taxes on time. Moreover, businesses that have paid their CIT on time the previous three years can benefit from a 5% reduction in their CIT liabilities. The reduction cannot exceed TRY 1.5 million (approximately EUR 81 600) annually and businesses that operate in the banking and insurance sector and investment funds do not qualify for the incentive (IBFD, 2021[22]). Until December 2021, businesses in Montenegro that paid their CIT liability on time also benefited from a reduced CIT rate (6% instead of 9%) (Montenegrin Ministry of Finance, 2021[23]). However, the law was amended at the end of 2021 abolishing these reliefs.

The rules regarding carrying forward losses vary across economies. In Albania and North Macedonia, CIT losses can be carried forward up to three years, which is the shortest period in the region. Losses can be carried forward for five years in Bosnia and Herzegovina, Montenegro, Serbia, and Turkey and for four years in Kosovo. As young and innovative SMEs might have low profits and have made high investments, a short period to carry forward losses could create a tax-induced disadvantage for these types of SMEs. Albania and North Macedonia could monitor the tax burden of young and innovative SMEs to assess whether introducing a longer period to carry forward losses could avoid tax-induced hurdles for these types of businesses from growing.

Simplified tax regimes for SMEs are widely used across economies in the region