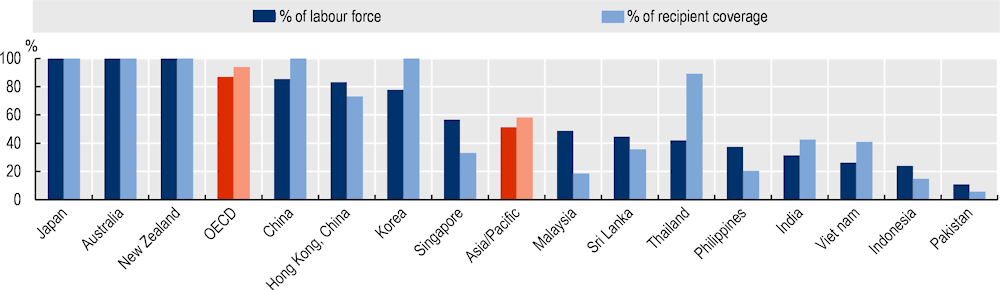

The proportion of people covered by a pension scheme and the extent to which pensions replace previous earnings are two important indicators of the role pension systems play in society. There is massive variation of pension coverage in the Asia/Pacific region (Figure 4.7): in Australia, Japan and New Zealand, the pension system covers the labour force, while coverage is meagre in Indonesia, Pakistan and Viet Nam. One in two persons in the labour force and one in three persons of retirement age are covered by mandatory pension schemes in the Asia/Pacific region, while this is 87% and 97%, respectively in OECD countries. There is a risk that the elderly in the Asia/Pacific region will have to rely more on family support to meet their needs than their peers in OECD countries.

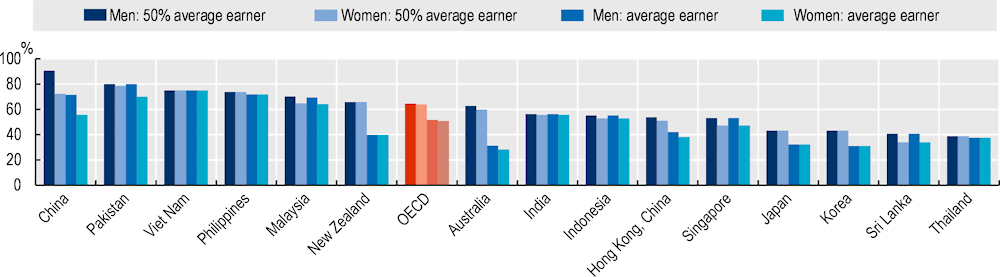

In about half of the selected Asia/Pacific countries, the redistributive nature of pension systems leads to higher replacement rates for lower earners, which is likely to have a reducing effect on income inequality among older people. However, in India, Indonesia, Pakistan, Singapore, Sri Lanka, Thailand and Viet Nam, replacement rates are the same regardless of earning levels, and thus earnings inequality is “translated” into “pension inequality”.

For women, replacement rates are often below, or at best equal to, those for men without exception (Figure 4.8). In most OECD countries pensions systems as such do not lead to gender gaps in replacement rates. However, pension systems frequently generate lower replacement rates for women than for men. This is because in many countries, women have lower earnings than men, and they often retire at an earlier age and have fewer years of contributions. In addition, women have a higher life expectancy and so for countries that have DC schemes – for which sex-specific life expectancy is used, they will receive less year on year. Alongside low pension coverage, the gender pension gap will be another factor to threaten the well-being of the elderly in Asia/Pacific economies in the future.

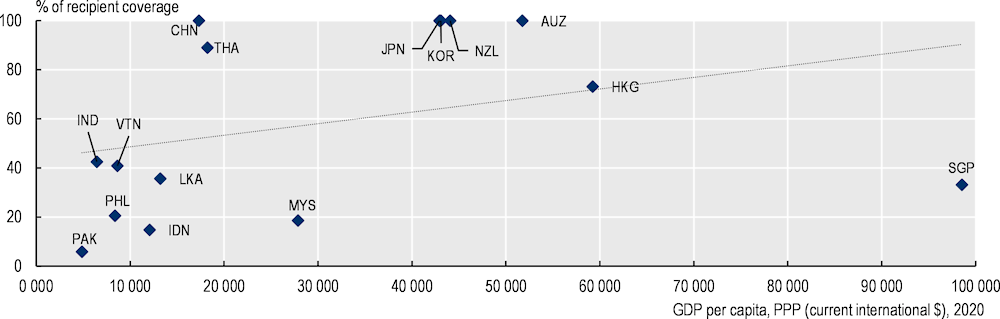

Countries with a lower GDP per capita have lower pension coverage (Figure 4.9). In low-income countries where the informal economy prevails, most people cannot afford or do not want to participate in mandatory pension schemes.