This chapter assesses key enabling conditions for FDI spillovers on SMEs in the Slovak Republic as described in the conceptual framework in Chapter 1. It first examines the Slovak Republic’s economic context, structure and geography and then moves to key factors related to the FDI spillover potential and SME absorptive capacities. The chapter points to the Slovak Republic’s strengths, challenges and opportunities in these enabling conditions.

Strengthening FDI and SME Linkages in the Slovak Republic

2. Enabling conditions for FDI and SME spillovers in the Slovak Republic

Abstract

2.1. Summary of strengths, challenges and opportunities

The assessment of key enabling conditions for FDI spillovers on SMEs in the Slovak Republic reveals a number of strengths in current conditions and points to challenges and opportunities to further improve these fundamental conditions for spillovers to take place (Table 2.1). Chapters 4 to 6 pick up on these challenges and opportunities, identifying policy actions to address them.

Table 2.1. Strengths and challenges/opportunities of enabling conditions for FDI spillovers in the Slovak Republic

|

Strengths |

Challenges and opportunities |

|

|---|---|---|

|

Economic context, structure and geography |

|

|

|

Potential for FDI spillovers |

|

|

|

Absorptive capacities of SMEs |

|

|

Note: See Box 2.3 clarifying sectoral groupings (i.e. lower and higher technology manufacturing and lower and higher technology services) used in this table.

2.2. Economic, structural and geographical characteristics of the Slovak Republic

Before assessing other key enabling conditions of FDI-SME spillovers – namely the spillover potential of FDI and the absorptive capacities of Slovak SMEs – this section provides an overview of the economic, structural and geographical characteristics of the Slovak Republic. It examines (1) recent macroeconomic trends; (2) the structure of the Slovak economy and its main sectoral drivers of growth; (3) its level of integration in the global economy through trade; and (4) the economic geography factors that might affect the FDI-SME spillover potential.

The Slovak Republic’s economy has been performing strongly until the COVID-19 crisis

In the Slovak Republic, the macroeconomic picture was positive as the country entered into the COVID-19 crisis, and so was the short-term economic outlook (OECD, 2019[1]). Over the last two decades before the pandemic, the Slovak Republic had ranked continuously among the fastest growing OECD economies (OECD, 2020[2]) and had been catching up with higher-income countries, while living standards converged towards the OECD average. The convergence process was particularly fast until the 2008-09 global financial crisis – which hardly hit the Slovak economy – and showed signs of moderating since then (OECD, 2022[3]). Nevertheless, GDP has grown steadily since 2008 at an average rate of over 3% per year. On the eve of the COVID-19 crisis, the labour market performance was also strong. Wages had been rising fast, although their level remained below the OECD average (OECD, 2020[2]). Unemployment had reached the historically low level of 7% (OECD, 2019[1]).

The economic impact of COVID-19 has been severe (Box 2.1). Despite the forceful policy measures deployed to contain the spread of the virus, GDP shrunk by over 6% in 2020. The economy rebounded in the second half of 2020, driven by the fast recovery of manufacturing output, but growth has slowed down since then, and GDP remained below the pre-crisis level in the third quarter of 2021 (OECD, 2022[3]). As the duration of the crisis remains uncertain, recovery is likely to be gradual (OECD, 2021[4]). The economy is projected to grow by 5% in 2022 and 4.8% in 2023, spurred by investment growth and the EU recovery and structural funds. However, a slower absorption of EU funds, or the adoption of new confinement measures prompted by a deterioration of the health situation, might slow down the recovery pace (OECD, 2022[3]) (OECD, 2021[4]).

Additionally, the recovery is also dependant on the future developments and the economic impact of the Russian invasion of Ukraine which started in the first quarter of 2022, exacerbating geopolitical tensions and contributing to the tightening of global market conditions (Box 2.2).

Box 2.1. Exposure of the Slovak economy to COVID-19 disruptions

The Slovak Republic was more vulnerable to lockdowns and business disruptions than other OECD countries due to: (1) the composition of its business population, characterised by a high proportion of highly exposed micro firms; (2) its economic structure, with large shares of employment in lower technology services, which were more hard hit by the crisis, and a marked concentration of production and exports in a limited number of industries (namely automotive); and (3) its position in global value chains (GVCs), as a small export-oriented economy highly exposed to shifts in foreign investment and demand, particularly from European trading partners.

The very large share of low-productivity micro-firms (see infra – SME absorptive capacity) accentuated the vulnerability of the Slovak business sector on the eve of the crisis. Smaller businesses were significantly impacted by the COVID-19 pandemic, with both their contribution to value added and employment dropping in 2020 (OECD, 2021[5]). The harsh impact of the COVID‑19 crisis on smaller firms risks to exacerbate the duality of the Slovak economy, characterised by significant productivity differences between domestic micro, small and medium-sized firms, mostly operating in services, and the large, highly productive, often foreign-owned firms which dominate the manufacturing industry (OECD, 2022[3]).

From a regional standpoint, East Slovakia was the most exposed, with about 44% of jobs at risk (OECD, 2021[5]). This is due to the high regional concentration of lower technology services (e.g. wholesale and retail trade, construction, real estate services), which were more severely affected by lockdowns and business disruptions and experienced more pronounced job losses and economic downturn (OECD, 2021[5]). The manufacturing sector was less severely hit. Nonetheless, industrial production lost momentum and the recovery is likely to be gradual (OECD, 2022[3]) (OECD, 2021[4]). In the automotive sector, car production and exports rebounded in the second quarter of 2021 to slow down again in the third quarter, weighed down by supply-side disruptions (e.g. delayed suppliers deliveries, out-of-stock intermediate goods) (OECD, 2021[4]) (Guilloux-Nefussi, 2021[6]). Recovery is expected to resume from mid-2022, with the improvement of the health situation and the gradual easing of supply-side strains (OECD, 2021[4]) (Guilloux-Nefussi, 2021[6]).

The COVID-19 pandemic has raised new concerns about the vulnerability of GVCs and the potential reshoring of production near headquarters in key markets. The Slovak economy risks to be more exposed to such disruptions, due to its strong reliance on a small number of exporting sectors and the high share of domestic employment embodied in foreign demand (over 40% in 2015, i.e. one of the highest rates among OECD countries) (OECD, 2022[3]) (OECD, 2019[1]). If the limited engagement of Slovak SMEs in extra-European international trade reduces their exposure to potential disruptions in GVCs, their significant integration into long value chains as importers (about 37% against an OECD average of 30%) is a potential source of vulnerability (Figure 2.1) (OECD, 2021[5]).

Figure 2.1. International trade and GVC exposure

Note: See (OECD, 2021[5]), SMEs and Entrepreneurship Outlook 2021, OECD Publishing, Paris, for the methodology behind this figure.

Source: (OECD, 2021[5]), SMEs and Entrepreneurship Outlook 2021, Country Profile: Slovak Republic, OECD Publishing, Paris.

Box 2.2. Russia’s war against Ukraine and its possible impact on the Slovak economy

On 24 February 2022, Russia launched a military offensive at Ukraine, triggering a humanitarian crisis and massive economic and trade sanctions in response by Canada, the European Union, the United States and East Asian allies. As a NATO and EU member country, the Slovak Republic has backed the measures undertaken to deter the Russian offensive. As Russian forces advance to the west and fighting intensifies, the world plunges into high insecurity.

The war is likely to have a non-negligible impact on the economic outlook of the Slovak Republic due to the country’s geographic proximity to the conflict and its multiple geopolitical and economic linkages with both Ukraine and Russia.

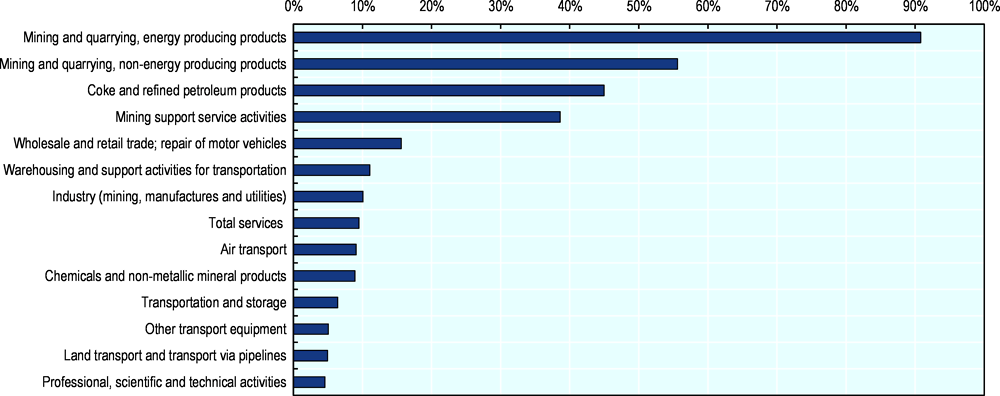

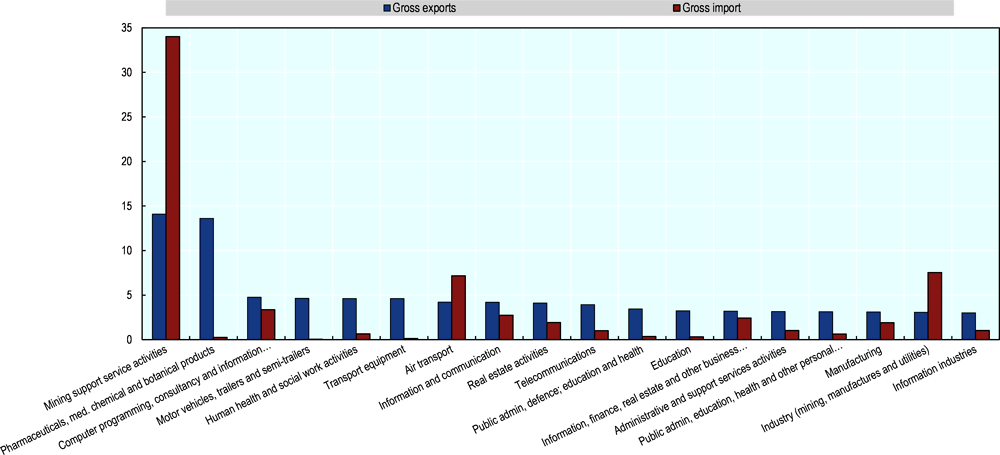

Russia is an important source of intermediate inputs for the Slovak economy, particularly the mining and quarrying industry, energy production and the manufacturing of coke and refined petroleum products (Figure 2.2). Exposure to Russia through international trade is high. Russia accounts for a 7.5% share of Slovak imports in industry (including mining, manufactures and utilities). In mining support services, the Russian share in total imports is about 35% (Figure 2.3). Russia is also an important export market for Slovak manufacturing products, particularly the motor vehicle industry which accounts alone for about half of total exports to Russia (OECD, 2021[7]).

Supply chain and trade disruptions consequent to the Russia-Ukraine crisis are likely to have an asymmetric impact across Slovak regions. Eastern regions (with a traditional industrial specialisation in metallurgy, mining and chemical industries) risk to be more severely hit, overall putting more pressure on regional inequality (Chapter 6) (OECD, 2022[8]).

Figure 2.2. Share of Russian intermediate products in the Slovak Republic’s total gross imports of intermediate products, 2018

Figure 2.3. Russia’s share in total gross exports and imports of the Slovak Republic, 2018

Furthermore, as of April 2022 it is estimated that more than 5.3 million people have fled Ukraine since the invasion started, many crossing into neighbourhood countries, including the Slovak Republic (which borders Ukraine in the East) (UNHCR, 2022[9]). As of 1 May 2022, the Slovak Republic was the sixth destination as per number of arrivals, having welcomed around 6% of total Ukrainian refugees (Table 2.2).

In the first two days of the conflict, approximately 7 500 Ukrainian citizens crossed the Slovak‑Ukrainian border, against an usual average number of 1 400 persons per day (Ministry of Interior of the Slovak Republic, 2022[10]). As an immediate response to the expected massive rise in migration inflows from Ukraine, the Slovak Government declared a state of emergency and established dedicated hotspots in several key locations along the eastern border, to facilitate checks and security operations by the police and military forces (Ministry of the Interior of the Slovak Republic, 2022[11]). The integration of incoming migrants into local communities and labour markets will also require quick policy responses, to prevent and mitigate longer-term economic and social challenges. In the presence of appropriate policy support, substantial inflows of skilled workers from Ukraine into the Slovak less developed regions might become a factor of development of local SMEs and entrepreneurial ecosystems and foster the emergence of new business opportunities in the aftermath of the crisis.

Reversely, the return of male Ukrainian workers to fight is unlikely to have strong impact on the labour market conditions and communities of the Slovak Republic, the population of Ukrainian‑born immigrants living in the country (7 140 persons) being fairly limited compared to neighbouring countries such as Poland (308 274) or Hungary (22 212).

Table 2.2. Refugees fleeing Ukraine since 24 February 2022, by country of destination

Number of persons as of 1 May 2022*

|

Country of destination |

Number of refugees (headcount) |

% of total refugees |

|---|---|---|

|

Poland |

3 056 826 |

51.4% |

|

Romania |

825 874 |

13.9% |

|

Russian Federation |

681 156 |

11.5% |

|

Hungary |

530 157 |

8.9% |

|

Republic of Moldova |

447 604 |

7.5% |

|

Slovak Republic |

379 447 |

6.4% |

|

Belarus |

25 002 |

0.4% |

|

Total |

5 946 066 |

Note: *Figure for Romania and the Russian Federation is of 30 April. Figure for Belarus is of 28 April. Where possible, statistics reflect further movements of refugees, to avoid double counting. The accumulated data in this table is higher than the total number of refugees fleeing Ukraine presented above since it also takes into account people crossing the border between Romania and Moldova

Source: UNHCR (2022), Operational Data Portal, Ukraine Refugee Situation, https://data2.unhcr.org/en/situations/ukraine (accessed 14 March 2022).

The Slovak economy is highly specialised, with a strong industrial base

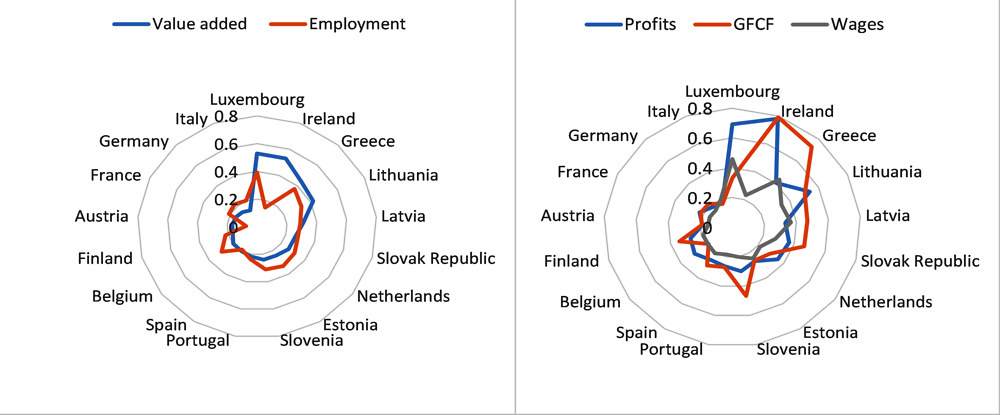

The Slovak Republic shows a high level of economic specialisation (Figure 2.4). Most of the country’s value added and employment, are concentrated in a couple of sectors, mainly in the manufacturing industry (which accounts for over 20% of total value added) and a number of low‑tech sectors, such as wholesale and retail trade, real estate activities and construction. This distribution is consistent with the country’s development stage. Manufacturing pays the largest share of wages (24%) followed by wholesale and retail trade (15%). A large proportion of wages is also paid by the public administration (10%) and a number of labour-intensive sectors, including accommodation and food services, agriculture, or administrative and support services where the productivity gains associated with digitalisation may have not been fully appropriated.

Profits and productive investments are even more strongly concentrated. Investment (as measured by the gross fixed capital formation – GFCF) is particularly more intense in manufacturing, real estate and transport and storage services, which together account for around half of the total. These sectors, together with construction and wholesale and retail trade, also generate in relative terms more profits as measured by gross operating surplus (roughly 10-20% each). This sectoral concentration of productive assets, i.e. profits that remain the first source of finance for most firms (i.e. SMEs) and tangible and intangible investments, signal limitations to the country’s capacity to diversify economic structure and activities in a near term.

Figure 2.4. Specialisation profile of the Slovak Republic

Note: The Krugman specialisation index is a standard index among the specialisation measures. It reveals countries’ relative advantages in relation to a reference group. The higher the index, the more the economic structure of one country deviates from the reference group, i.e. from the average industry structure of the reference group of countries. As compared to absolute measures of specialisation, relative indices take into account that certain industries are naturally larger than others, also a sign of a vital, advanced economy, but this does not necessarily imply specialisation (Palan, 2010[12]). Selected EU countries are euro area countries.

Source: Based on STAN Database for Structural Analysis (ISIC Rev. 4 SNA08) 2020 ed. (accessed 05 January 2022).

The automotive industry drives the performance of Slovak manufacturing

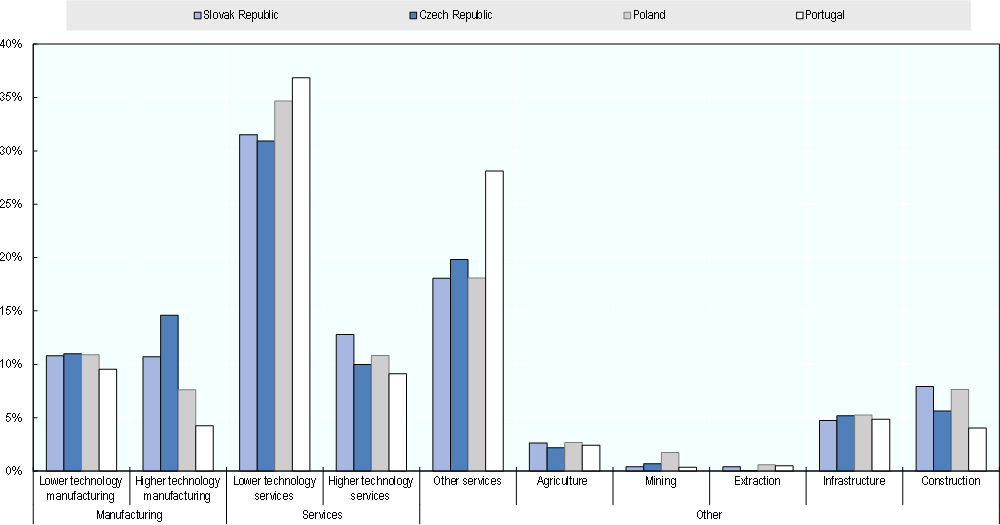

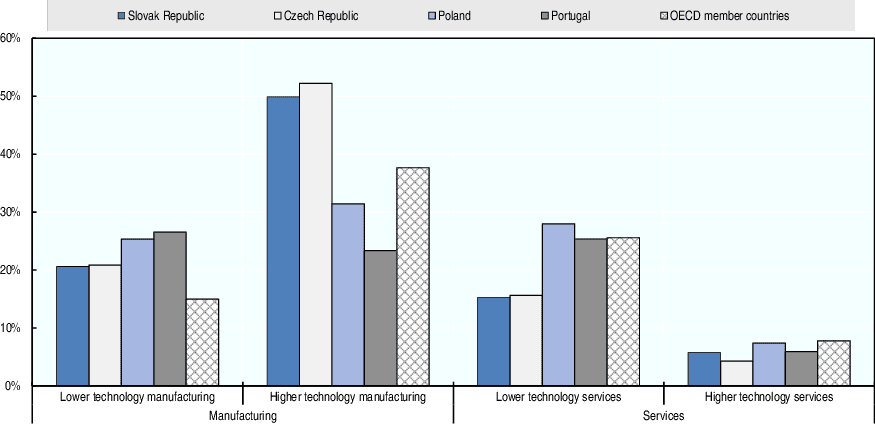

In economies dominated by technology‑intensive sectors, FDI-SME spillovers show greater potential to spur aggregate productivity and innovation. Figure 2.5 compares the structure of the Slovak economy with that of some selected OECD peers. Industries are grouped in four main categories (lower and higher technology manufacturing and lower and higher technology services) based on their technological intensity. Box 2.3 clarifies the sectoral classification that is used here, as well as in the remainder of this report. The purpose of this sectoral classification is to show the technological intensity of the Slovak economy, which is key to understand the potential for FDI-SME knowledge and innovation spillovers.

Box 2.3. Classification of economic activities

The conceptual framework described in Chapter 1 explains that FDI’s local embeddedness and absorptive capacities of SMEs are key determinants for FDI spillovers on SME productivity and innovation to take place. They depend, among other things, on the economic sectors and activities in which investment takes place and SMEs are operating. Given the focus on productivity and innovation spillovers, the sectoral analysis in this and the following chapters is based on technology- or R&D‑intensity. As such, most analysis based on sectors (e.g. regarding economic structure, including of SMEs; GVC integration both through trade and FDI; and FDI-SME diffusion channels) focuses on four main sectoral groupings based on R&D-intensity, which are adapted from Galindo-Rueda and Verger (Galindo-Rueda and Verger, 2016[13]): higher technology manufacturing, lower technology manufacturing, higher technology services and lower technology services. Table 2.3 provides an overview of the industries covered in these groupings. R&D-intensity is measured by the ratio of business R&D expenditure relative to gross value added in each industry covered in a given group. It is important to note that sectoral classifications may vary across data sources covered in this report. Table 2.3 lists industries based on ISIC Rev. 4 two-digit sectors, which is the classification applied for most of the data used (e.g. OECD and Eurostat data). Commercial datasets like Financial Times’ fDi Markets and Refinitiv have their own classification of sectors but for the purpose of this report they were also classified according to the four groupings described above.

The classification has the caveat that R&D-intensity is an imperfect measure of innovation and innovation potential across industries. Not all firms that are successful at developing or implementing innovation are necessarily R&D performers. Many of these firms are successful adopters of technology that they have not developed. Measuring R&D intensity or embedded R&D in their purchases may not effectively characterise the innovative performance of firms or industries. Other OECD indicators measure skill intensity, patenting activities and innovation by industries that facilitate a more refined description of the overall knowledge intensity in different economic activities, although these measures are not always widely available across a majority of OECD countries and partner economies (Westmore and Adamczyk, 2019[14]). Another caveat of this classification is related to the fact that it is not entire sectors that involve either higher or lower technologies but it is specific activities or segments within these sectors that involve different technology intensities. This caveat needs to be considered for any conclusions made in this report.

Table 2.3 Sectoral grouping based on R&D-intensity

|

Economic grouping |

Industries covered based on ISIC Rev. 4 |

|---|---|

|

Lower technology manufacturing |

Food products, beverages and tobacco; Textiles, wearing apparel, leather and related products; Wood and products of wood and cork; Paper products and printing; Rubber and plastic products; Other non‑metallic mineral products; Basic metals; Fabricated metal products |

|

Higher technology manufacturing |

Chemicals and pharmaceutical products; Computer, electronic and optical products; Electrical equipment; Machinery and equipment; Motor vehicles, trailers and semi-trailers; Other transport equipment; Other manufacturing; repair and installation of machinery and equipment |

|

Lower technology services |

Wholesale and retail trade; repair of motor vehicles; Transportation and storage; Publishing, audio-visual and broadcasting activities; Financial and insurance activities; Real estate activities |

|

Higher technology services |

IT and other information services; Professional, scientific and technical activities; Administrative and support service activities. |

Note: A number of industries are not classified into these four groupings as the analysis in this report deliberately avoids focusing on these industries. They include: Mining and extraction (Mining and quarrying; Coke and refined petroleum products); Infrastructure (Electricity, gas, water supply, sewerage, waste and remediation services; Telecommunications); Other services (Accommodation and food services; Public administration and defence; Compulsory social security; Education; Human health and social work; Arts, entertainment, repair of household goods and other service activities). These industries are either highly specialised and would require a more focused analysis, or their role/potential for FDI-SME linkages and spillover is limited

Medium-tech industries make a large contribution to manufacturing value added. The share of manufacturing in the economy’s total value added is 22%, which is higher than in Poland or Portugal (19% and 14% respectively) but lower than in the Czech Republic (26%), mostly because of a more limited contribution of higher-tech industries (see Figure 2.5). The motor vehicles industry alone is responsible for 20% of total manufacturing value added (and half of high-tech manufacturing value added), driving the country performance in this sectoral group. Machinery, electrical equipment and other high-tech manufacturing industries contribute a further 2% of total value added each. Lower technology manufacturing – mainly fabricated metal products; rubber and plastics; and wood and paper products and printing – account for 11% of total value added, a share similar to that reported by comparators.

The Slovak services sector is dominated by, at the two extremes of the tech spectrum, low- tech and knowledge-intensive activities. Wholesale and retail trade, real estate activities, and transport and storage overall account for almost 32% of the economy’s total value added. This is comparable to what can be observed in some benchmarking countries like the Czech Republic, Poland and Portugal, which report a 30-40% share of all value added in lower technology services. The value added of higher technology services (e.g. IT and other information services) is 13% of the total, a larger share than in any of the selected comparators. Other services activities – including public administration and defence, health and social work and education – are responsible for an additional 18% of total value added.

Figure 2.5. Structure of the Slovak economy and selected OECD countries

Note: For a clarification of the sectoral classification based on technology intensity used in this figure, as well as throughout the rest of this report, see Box 2.3. *Data for Portugal are of 2017.

Source: OECD STAN Database for Structural Analysis (ISIC Rev. 4 SNA08) 2020 ed. (accessed 05 January 2022).

Box 2.4. The automotive value chain in the Slovak Republic

The development of the automotive industry played a major role in Slovak recent economic growth. Over the past 10 years, the number of cars produced has increased steadily, making the Slovak Republic the leading per capita car producer in the world (OECD, 2019[1]). In 2018, the automotive sector accounted for about 27% of exports (compared to less than 8% in the EU) and 14% of total output, which is high for international standards and represents an increase of more than 5% since 2010 (EC, 2020[15]). Automotive also accounts for around 3.5% of total employment in the Slovak Republic (OECD, 2022[3]).

In its current configuration, the Slovak automotive sector is characterised by the presence of a few highly-productive and export‑oriented multinationals, focussed on assembly activities (Volkswagen, Kia Motors, PSA Peugeot Citroën and Jaguar Land Rover). These are backed up by a number of local firms that supply car parts to foreign manufacturers and export to Germany and the other countries of the Central and Eastern European (CEE) automotive cluster. The western part of the country, and particularly the Žilina and Trnava regions, has received the most significant investment from the automotive industry and host the majority of car production activity. The European Automobile Manufacturers’ Association (ACEA) estimates 301 automobile assembly and engine production plants operating in Europe in 2022, 194 of which are within the European Union (EU27) (ACEA, 2021[16]) (see note below). The Slovak Republic counts four plants for passenger car production and one for engine production. Neighbours such as Germany has 44, Poland 18, the Czech Republic 8, or Austria 5, placing the Slovak Republic at the heart of the European car industry. In addition, the Slovak Investment and Trade Development Agency (SARIO) estimates that a network of more than 350 automotive suppliers operates across the country, most being established in the Western regions (SARIO, 2022[17]).

Notwithstanding its significant contribution to the Slovak total output, the value added produced by the automotive industry reached only about 5% of the gross total in 2018. Also, this ratio has been slightly falling since 2008, in spite of the simultaneous increase in the number of cars produced. Therefore, the position of the Slovak Republic in the automotive global value chain does not seem to have significantly evolved, even though the size of the sector has been increasing in recent years globally, along with its labour productivity (OECD, 2019[1]). This situation is aligned with that of Hungary and the Czech Republic, but contrasts for instance with the qualitative improvements that could be observed in the German automotive industry, where productivity gains were accompanied by an increased in the ratio of value added to gross output (OECD, 2019[1]). In other words, over the last decade the Slovak automotive industry experienced a more quantitative than qualitative progression (OECD, 2019[1]).

This trend may be related to the prevalence of low value-added activities (fabrication and assembly of imported input) in Slovak automotive. Although foreign affiliates account for the largest share of R&D spending in the automotive sector, their investment tends to generate scarce local technology diffusion, which hampers the sector’s potential to upgrade to more knowledge‑intensive activities. In the long term, further obstacles to the sector’s development and technological upgrade may stem from skilled labour shortages and difficulties to adjust to technological changes in the industry, including the increasing automation and the development of electric or hydrogen-powered cars (OECD, 2019[1]; OECD, 2022[3]).

Note: These numbers do not include automotive suppliers, smaller-sized vehicle and engine manufacturers, as well as custom bodybuilders.

Half of total exports are high-tech manufactured products, especially motor vehicles

Foreign direct investment (FDI) was an important driver of Slovak growth in past decades (see infra – FDI spillover potential). Large FDI inflows contributed to the country’s rapid integration into global value chains (GVCs), which in turn led to an increase of imports and exports. As a result, the country’s openness to trade has increased steadily over the last twenty years. Slovak exports in relation to GDP stood at 92% in 2019, well above the EU average in the same year (49%) and higher than in peer economies like Hungary (81%), Lithuania (77%) or the Czech Republic (73%) (OECD, 2021[18]).

Exports are concentrated in high-tech manufacturing and the automotive industry drives the Slovak Republic’s export performance. High technology manufacturing accounts for half of all exports in the Slovak Republic – a similar share as the Czech Republic, but much larger than in Portugal (23%). The motor vehicles industry alone is responsible for over one-quarter of total exports (OECD, 2021[7]), followed at a distance by machinery and equipment (6%), computer and electronic products (5%), and electrical equipment (4%). Lower technology manufacturing is responsible for over 20% of total exports, once again at par with the Czech Republic, but below the almost 30% share reported by Portugal. In line with the country’s value added structure, exports of services are smaller and dominated by lower technology activities (15%). Services account for 24% of total exports, which is as much as in the Czech Republic but much less than in Portugal (44%) or Poland (37%).

Figure 2.6. Structure of Slovak exports and selected OECD countries

Note: See Box 2.3clarifying sectoral groupings used in this figure.

Source: (OECD, 2021[7]) OECD Trade in Value Added Database (TiVA), 2021 ed. (accessed 05 January 2022).

Slovak SMEs contribute more to the country’s international trade as indirect exporters. Available data from 2014 show that the direct contribution of SMEs to Slovak exports is limited by international standard. SMEs only account for 34% of gross exports in the Slovak Republic, below the average share in OECD countries (40%) and less than in comparator economies like Poland (38%) or Portugal (60%) (OECD, 2019[19]). The picture changes, however, when taking into account SMEs indirect exporting activities (e.g. provision of input to larger direct exporters): SMEs are indeed responsible for 56% of the total value added in Slovak exports – one of the highest shares in the OECD, more than in Poland (50%) or the Czech Republic (47%). In other words, as it is commonly observed in OECD countries, looking only at direct exports by SMEs under‑represents their actual engagement in the country’s gross exports. The Slovak Republic has one of the most significant gaps between SMEs share in gross and value added exports in the OECD – 22%, against a 10% average difference in OECD countries for which data are available (OECD, 2019[19]). This indirect channel of GVC integration allows SMEs to access foreign markets without incurring trade related costs.

Slovak SMEs show a high propensity to export within the European single market, while they seem to face constraints in exporting to extra-EU destinations. In 2019, almost half of Slovak small firms exported within the EU, the highest share among OECD countries (OECD, 2022[20]) (OECD, 2021[21]). The share of medium-sized intra-EU exporters is also comparatively high across the OECD (almost 70% in 2019, compared to 46% in Portugal and 43% in the Czech Republic). However, Slovak SMEs rank lower across OECD countries in terms of extra‑EU exports. In 2019, only 9% of small firms and 30% of medium-sized firms exported outside the EU compared to an OECD average of 15% and 38% respectively (OECD, 2022[20]) (OECD, 2021[21]). Exporting to farther destinations may imply higher costs and risks, but could also be an opportunity to diversify trading partners and increase resilience. Slovak SMEs might build on their pre-existing intra-EU export experience to reach more distant markets and increase profitability (OECD, 2021[5]).

A number of promising regional industry clusters have emerged…

Recent years witnessed the successful rise of diverse regional clusters in the Slovak Republic (OECD, 2021[21]). These often emerged spontaneously from the bottom up, triggered by FDI and the regional entrepreneurial ecosystems. Some industry clusters are certified and supported by formal organisations, as in the case of the IT Valley in Košice; the Automotive Cluster West Slovakia in Trnava; the Electrotechnical Cluster in Galanta; and the Slovak Plastic Cluster in Nitra (see Table 2.4). In other cases, such as the emerging aluminium processing cluster in the Banská Bystrica region, the cluster network is not yet formalised (OECD, 2021[21]). Industry agglomeration and clustering is currently one of the most promising areas for regional entrepreneurship and SMEs development in the Slovak Republic, and may contribute to reinforce tacit knowledge transfer and spillovers from foreign MNEs and local SMEs by facilitating their geographic proximity (OECD, 2021[21]) (OECD, 2022, forthcoming[22]).

Table 2.4. Selected certified cluster initiatives in the Slovak Republic

|

Cluster |

NUTS III Region |

NUTS II Region |

Sector |

|---|---|---|---|

|

Košice IT Valley |

Košice |

Eastern Slovakia |

ICT |

|

Electrotechnical Cluster |

Trnava |

Western Slovakia |

ICT |

|

Cyber Security Cluster |

Žilina |

Central Slovakia |

ICT |

|

Automotive Cluster West Slovakia |

Trnava |

Western Slovakia |

Automotive |

|

Slovak Plastic Cluster |

Nitra |

Western Slovakia |

New materials and chemistry |

|

Bioeconomy Cluster |

Nitra |

Western Slovakia |

Biotechnology |

|

Energy Cluster of Prešov Region |

Prešov |

Eastern Slovakia |

Energy |

|

NEK - National energy cluster |

Bratislava |

Bratislava Region |

Energy |

|

Slovak Association of Photovoltaic Industry (SAPI) |

Bratislava |

Bratislava Region |

Energy |

|

Energy Environmental Cluster from Ipel region |

Banská Bystrica |

Central Slovakia |

Energy |

|

Regional Innovation Industrial Cluster Rimavská Kotlina (REPRIK) |

Banská Bystrica |

Central Slovakia |

Circular economy |

|

House of Events Innovation (HEI) |

Bratislava |

Bratislava Region |

Creative industries |

|

Slovak Smart City Cluster |

Prešov |

Eastern Slovakia |

Smart cities |

|

KRR - Cluster of regional development |

Trnava |

Western Slovakia |

Sports, leisure and tourism |

|

Industry Innovation Cluster |

Žilina |

Central Slovakia |

Production and engineering |

Notes: The table refers to the current EU NUTS classification (Nomenclature of territorial units for statistics) 2021.

Source: Union of Slovak Clusters (http://uksk.sk); European Secretariat for Cluster Analysis (ESCA) (www.cluster-analysis.org/).

… that could help reduce regional economic disparities

As it is discussed in more details in Chapter 6 of this report, economic imbalances between Slovak regions are among the sharpest observed in OECD countries (Figure 2.7). There are particularly important disparities in terms of employment and income between the Bratislava region, and to some extent the whole of the west of the Slovak Republic, and the centre and east of the country. These disparities have deepened in the last two decades, in spite of the favourable national macroeconomic development (OECD, 2021[21]). Factors underlying regional economic disparities include the industrial decline and shift in regional production experienced by some regions (e.g. Košice and Banská Bystrica, both affected by the downturn of production and employment in heavy industries like mining and chemicals – see also Chapter 6 on the industrial profile of these regions). Skill shortages in the eastern regions, jointly with poor labour mobility between regions, also contribute to economic disparities. Furthermore, the uneven quality of transport infrastructure affects regional development, exacerbating the difficulties of the east (OECD, 2021[21]).

Figure 2.7. Gini index of inequality of GDP per capita across regions, 2013

Note: The Gini coefficient is calculated for GDP per capita across regions with equal weight to each region regardless of its size, and it has a range from zero (no disparity) to one. Increasing values of the Gini coefficient thus indicate higher inequality in regions. 2. Unweighted average.

Source: (OECD, 2021[21]) based on OECD (2017), OECD Economic Surveys: Slovak Republic 2017, OECD Publishing, Paris.

Slovak regions also differ in their attractiveness to foreign investors. Traditionally, FDI has been concentrated in the west, and particularly in the Bratislava region (which roughly accounts for 60‑70% of total FDI), reinforcing economic disparities with the centre and east of the country (OECD, 2021[21]). Since 2017, there has been some increase in FDI in Central and Eastern Slovakia, but the performance gap with the west remains significant. The recent development of local clusters in the automotive and electronics sectors further increased the attractiveness of Western Slovakia as an FDI destination relative to the rest of the country. Key factors behind the stronger performance of western regions in terms of FDI attraction are their better entrepreneurial environment, skills endowment and infrastructure, including the proximity of the Vienna airport (OECD, 2021[21]) (OECD, 2022[8]).

SMEs and entrepreneurial activity also varies significantly across Slovak regions and local districts, reflecting local disparities in employment, output and foreign investment levels. There are important gaps in business conditions among Slovak regions, including entrepreneurial attitude, the quality of local regulation, and the availability of R&D and innovation infrastructure (OECD, 2021[21]). Western and northern regions have higher SMEs density compared to eastern and southern-central regions (OECD, 2021[21]). Some regions (e.g. Košice) also have important internal differences across local districts, with areas of high entrepreneurial activity (OECD, 2021[21]). In the stronger economic areas of the country, SMEs and entrepreneurship development face specific constraints, which are mostly related to skill shortages. The Bratislava region, for instance, has a far better entrepreneurial ecosystem than any of the other regions and has developed into a key national technology hub: however, the region struggles to enhance the local skills endowment and to retain the most talented workers from looking for better opportunities abroad (OECD, 2021[21]). The city of Košice is also starting to emerge as a national entrepreneurial hub, and is likely to face some of the same issues as Bratislava (OECD, 2021[21]).

2.3. Potential for FDI productivity spillovers

This section assesses the spillover potential of FDI in the Slovak Republic. First, it evaluates the volume of FDI inflows and the main inward FDI trends. Then it looks at the productivity gap between foreign affiliates and domestic SMEs, which is a key determinant of the FDI-SME spillover potential. Subsequently, this section assesses the level of embeddedness of FDI in the Slovak economy by looking at relevant characteristics such as the FDI prevalent type, motives, country of origin, and regional and sectoral distribution.

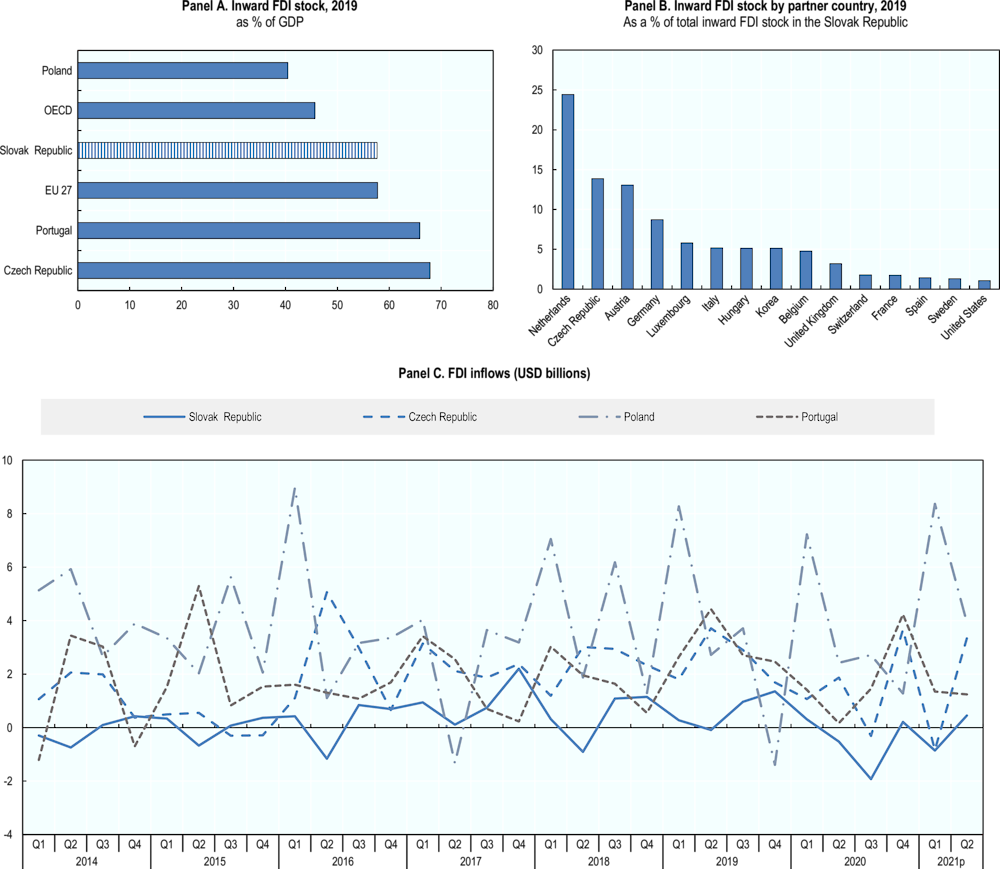

FDI inflows were a key driver of the Slovak Republic’s economic catch-up to higher income countries

Despite some signs of a recent inflection, the Slovak Republic remained successful in attracting FDI. FDI was an important driver of the Slovak growth in past decades. In the 2000s, large FDI inflows contributed to the Slovak Republic’s rapid integration into GVCs and international trade, helping to transform the country into a key European exporting platform, with benefits to the whole economy (OECD, 2019[1]). FDI inflows became more subdued in the years following the 2008 global financial crisis. Nevertheless, the FDI stock represented 58% of GDP in 2019 (Figure 2.8, Panel A) – a share comparable to that of the EU 27 (58%), as well as to other OECD economies like Sweden (59%), Hungary (57%) and Spain (52%) (OECD, 2021[23]; OECD, 2021[24]). Key factors of the Slovak Republic’s success in attracting FDI include its geographic proximity to the most developed European markets and the availability of a relatively skilled but low cost labour force. Euro membership since 2009, and a cautious budgetary, financial and tax policy also contributed to improve the investment climate and boost inward FDI (OECD, 2019[1]).

Figure 2.8. Inward FDI patterns in the Slovak Republic

Notes: p: Preliminary data

Source: Panel A and C: OECD, FDI in Figures, 15 October 2021, www.oecd.org/investment/statistics.htm (accessed 20 January 2022). Panel B: OECD International Direct Investment Statistics (19 May 2021 update) (accessed 17 December 2021).

The COVID-19 crisis severely affected FDI inflows into the Slovak Republic. Year 2020 witnessed massive disinvestment with FDI inflows falling by almost 180% relative to 2019 (Figure 2.8, Panel C). This decline was significantly higher than in other OECD-EU economies, like for instance the Czech Republic, where the year-to-year decline of FDI inflows in 2020 remained below 40%. FDI inflows rebounded in the last quarter of 2020 as the Slovak economy showed signs of recovery (see supra – Economic, structural and geographical characteristics of the Slovak Republic), but slowed down again with the new year. Future trends in foreign investment inflows to the Slovak Republic will also depend on the gradual recovery of European neighbouring economies, including key source markets of Slovak FDI like Germany and the Czech Republic. The Russia-Ukraine crisis started in the first quarter of 2022 is also likely to weigh on inward investment trends, as well as on the broader economic Outlook of the Slovak Republic (Box 2.2).

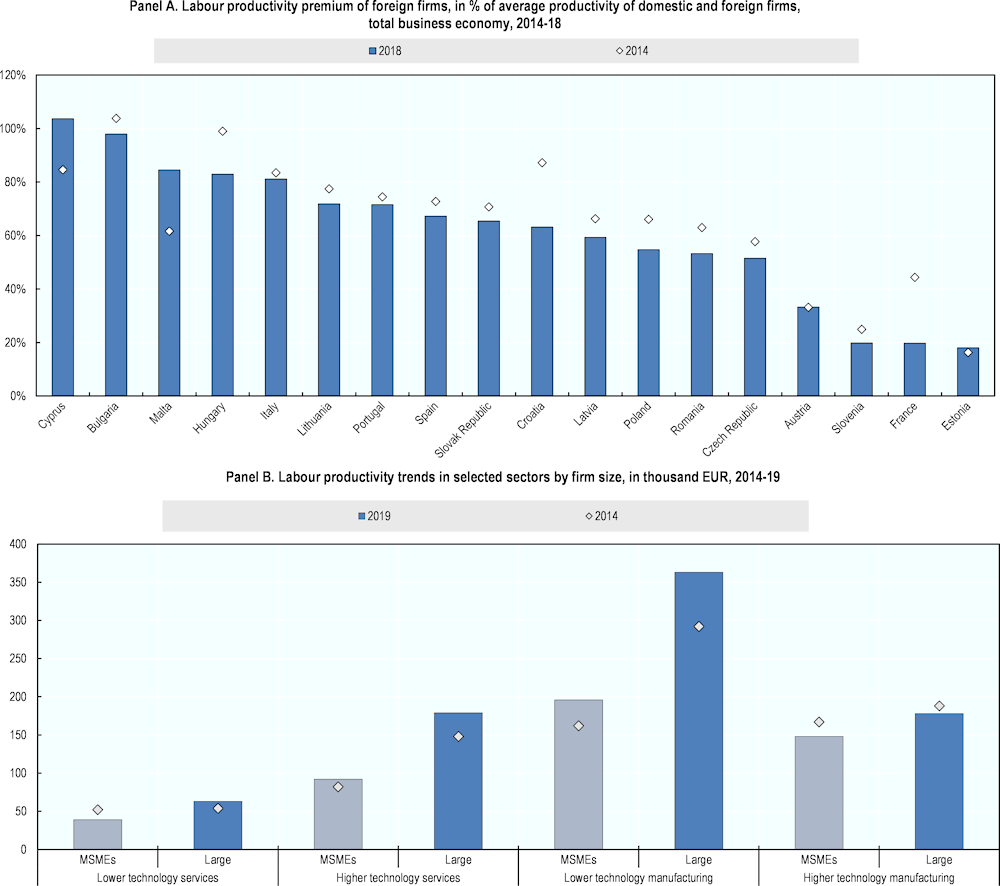

There is an important productivity gap between foreign and domestic firms

Foreign firms are on average more productive than domestic firms, because they tend to be larger, more export-oriented, and better equipped with finance, skills and innovation assets: all features that are associated with higher labour productivity levels (OECD, 2022, forthcoming[22]). FDI-SME spillovers are made possible by the existence of such productivity gap between foreign MNEs and domestic SMEs (OECD, 2019[25]) (OECD, 2022, forthcoming[22]). If the productivity gap is too large, however, this may hamper the capacity of local firms to benefit from spillovers. Assessing the productivity premia of foreign firms over domestic firms is thereby important to estimate the existing FDI-SME spillover potential.

Significant productivity premia of foreign firms over average firms in the economy (including domestic and foreign firms) are a common feature in EU economies, ranging from 98% in Bulgaria to approximately 20% in economies in Estonia, France or Slovenia (Figure 2.9, Panel A). In the Slovak Republic, the gap in the productivity performance of foreign and domestic firms is quite pronounced, with affiliates of foreign multinationals being on average 65% more productive than Slovak firms. The gap has declined only marginally in recent years, if compared with other economies. Since 2014, the productivity premium of foreign firms fell by only 5% in the Slovak Republic, which is fairly limited relative to the approximately 25% decrease observed in France or Croatia. The very high capacity gap between foreign and domestic firms and its relative stability over time points to scarce spillover effects on local firms.

There is also a pronounced divergence in the productivity performance between large companies (which are often foreign owned) and the sector of micro, small and medium-sized firms (MSMEs). The productivity of Slovak smaller firms indeed remains comparatively low across OECD countries and has been stable across all sectors of the economy in recent years (see infra – SMEs absorptive capacity). The disparity in labour productivity levels between MSMEs and large firms has been increasing across almost all industrial sectors since 2014, and especially in high-tech manufacturing and low-tech services (OECD, 2021[21]) (Figure 2.9, Panel B). This widening gap suggests that spillovers from larger foreign companies and domestic SMEs have been limited.

Figure 2.9. Labour productivity performance, by firm ownership and size

Note: See Box 2.3 clarifying sectoral groupings used in this figure. MSMEs: firms with 1 to 249 employees

Source: Panel A: OECD based on Eurostat’s FATS data, 2020. Panel B: OECD Structural and Demographic Business Statistics Database, 2021 (http://dx.doi.org/10.1787/sdbs-data-en) (accessed: 21 January 2022).

Further diversification in FDI’s geographic origin could help foster spillovers

The largest foreign investors in the Slovak Republic are from EU countries (Figure 2.8, Panel B). The Netherlands alone accounts for almost one-quarter of total inward FDI stock in the Slovak Republic (although this share may partly reflect the activity of Special Purpose Entities (SPEs) rather than genuine investment activities of the reporting country itself). The Czech Republic, Austria and Germany are other leading countries of origin of FDI. Extra-European FDI account for a lower share, mostly coming from Korea (5%) and the United States (1%). It should be noted, however, that official FDI statistics based on the ultimate investor ownership could underestimate the actual presence and weight of non‑EU foreign investors (particularly US MNEs) in the Slovak Republic, as they do not capture investment channelled through existing European affiliates.

With almost all the inward FDI stock having its origin within Europe, and more than 50% of it coming from 4 countries (Netherlands, Czech Republic, Austria and Germany), diversification in terms of investment origins is limited and could be improved. Indeed, if there is evidence in literature that the cultural and geographic proximity of foreign investors can help enhance FDI benefits to the local economy (OECD, 2022, forthcoming[22]), research has also shown that heterogeneity in the country of origin of FDI increases their overall positive effect on the productivity of domestic SMEs (Zhang, 2010[26]).

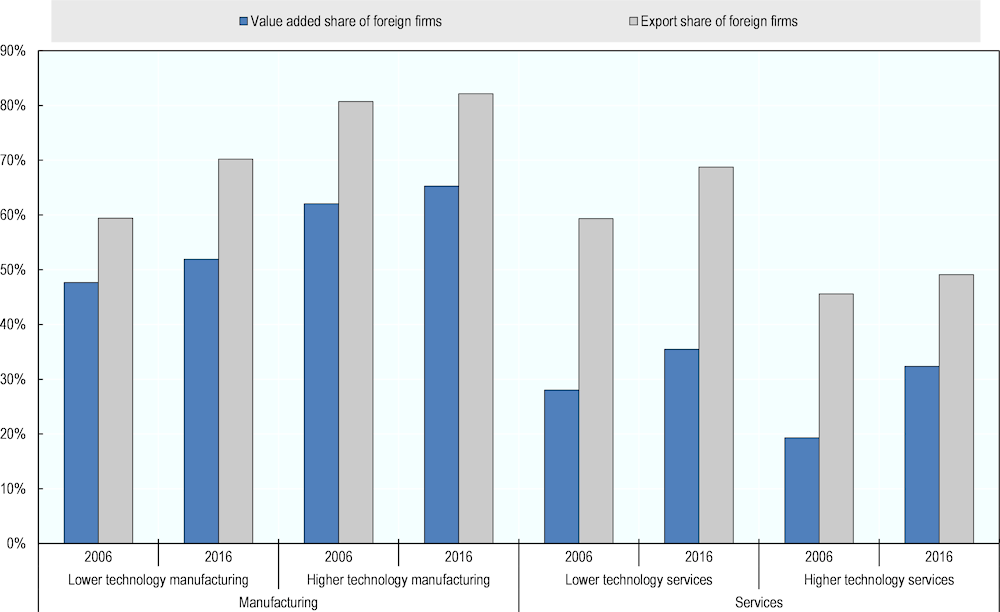

Inward FDI is concentrated in higher technology manufacturing

The significant share of foreign firms in the country’s value added and export corroborates the pivotal role of FDI in the Slovak economy (Figure 2.10). This is true across all sectors. FDI operations, however, are concentrated in manufacturing, where they accounted for almost 60% of value added and 80% of exports in 2016. In higher technology manufacturing (including the key electronic equipment and motor vehicle industries), they were responsible for 65% of value added and 82% of exports in 2016 – and these shares had remained stable over the previous ten years (Figure 2.10).

Foreign firms are less active in the services sector. In 2016, foreign MNEs accounted for 24% of total value added and almost 60% of exports in services. Their contribution in terms of exports and value added is more significant in lower technology services – namely wholesale and retail trade and real estate activities – than in higher-technology services (e.g. IT services) (Figure 2.10).

Since FDI spillovers tend to be stronger in high-tech than low-tech and labour intensive industries (see for instance (Nicolini, 2010[27]) (Keller, 2009[28])), the concentration of Slovak FDI in high-tech manufacturing may be regarded as favourable to their spillover potential. Even in high-tech sectors however, knowledge and technology spillovers ultimately depend on the FDI linkages with the rest of the economy, and remains limited if the latter are not sufficiently developed (OECD, 2022, forthcoming[22]). The scarce representation of SMEs in Slovak high-tech manufacturing (where employment is dominated by large firms – see infra, SMEs absorptive capacity), could be a hampering factor of FDI spillover potential in such sector.

Figure 2.10. Foreign firms’ value added and exports in the Slovak Republic, 2006 and 2016

Note: Total value added and export in this figure refers to the total of the four industrial groupings covered. See Box 2.3 clarifying sectoral groupings used in this figure.

Source: OECD Analytical AMNE database 2021, www.oecd.org/sti/ind/analytical-AMNE-database.htm (accessed 17 December 2021).

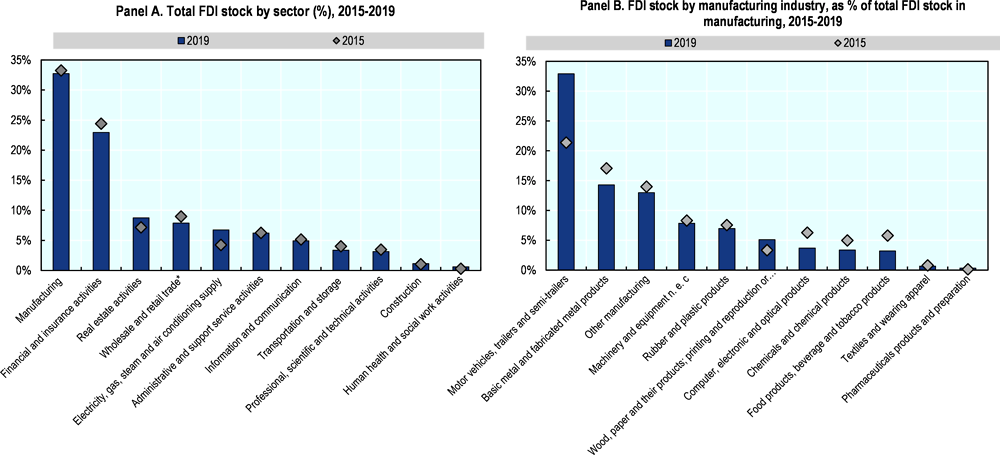

Non-automotive manufacturing industries are responsible for a significant share of the total FDI stock in the Slovak republic. Manufacturing accounts alone for 33% of the total FDI stock in the Slovak Republic (National Bank of Slovakia (NBS), 2022[29]). The motor vehicles industry is responsible for about one third of total manufacturing investment (Figure 2.11, Panel B). Other high-tech manufacturing industries such as machinery and equipment; computer, electronic and optical products; chemicals; and pharmaceuticals overall account for an additional third. The remaining manufacturing FDI stock is distributed across a range of lower technology industries such as basic metals and fabricated metal products (14% of total manufacturing investment), rubber and plastics (7%) or wood and paper products (5%). The overall significant share of FDI attracted by manufacturing industries beyond automotive may be conducive to the development of FDI-SMEs ecosystems in a larger and more diversified range of industrial sectors, with benefits to aggregate growth and productivity.

There are signs of FDI dynamism in low-tech services and non-manufacturing industries. Outside manufacturing, financial and insurance activities account for the second largest share in total FDI stock in the Slovak Republic (23%) (Figure 2.11, Panel A). Other lower technology services such as real estate and wholesale and retail trade and repair of motorvehicles also account for 8-9% of total FDI each. Real estate is also one of the services sectors that registered the largest absolute increase in FDI stock between 2015 and 2019 (56%). Over the same period, important increases in FDI stock were also observed in non‑manufacturing sectors such as electricity, gas, steam and air conditioning supply (+103%) and construction (+40%). The FDI presence and activity in low-tech services and non‑manufacturing activities signals some dynamism and potential of these sectors in terms of FDI attraction, and may be conducive to productivity spillovers, given the larger SMEs employment share in these sectors (see infra – SMEs absorptive capacities).

Figure 2.11. Sectoral distribution of the FDI stock in the Slovak Republic, 2015-2019

Note: The figure does not include sectors accounting for a less than 1% share of FDI stock.

Source: (National Bank of Slovakia (NBS), 2022[29]) (accessed on 5 May 2022).

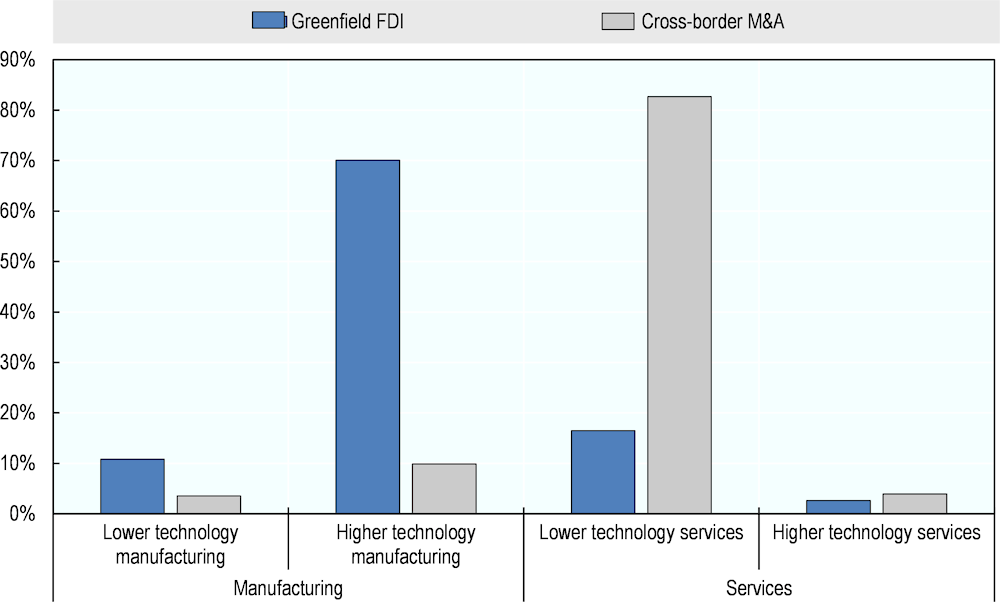

The predominance of greenfield FDI in higher technology manufacturing is likely to facilitate productivity spillovers

Greenfield investment is more likely to generate knowledge and technology transfer to the local economy. Greenfield investment, i.e. establishment of subsidiaries of foreign MNEs, is indeed more likely to involve the implementation of foreign technology in the host country and thereby drive tacit and formal knowledge and technology transfer (OECD, 2022, forthcoming[22]). Mergers and acquisitions, by contrast, tend to be associated with a more gradual implementation of foreign technology in the host economy, making knowledge spillovers less likely in the short-term (although they may still occur in the longer term) (OECD, 2022, forthcoming[22]). Observing the distribution of different types of FDI (e.g. greenfield investment versus mergers and acquisitions) across sectors of the host economy can provide interesting insights on the spillover potential of foreign MNEs to local SMEs.

In the Slovak manufacturing sector, greenfield investment is more common than mergers and acquisitions. This is particularly true in higher technology manufacturing, which attracted 70% of all greenfield investment made between 2003 and 2021, while accounting for only 10% of all acquisitions made over the same period (see Figure 2.12). Mergers and acquisitions, by contrast, are more prevalent in lower technology services, where more than 80% of all deals have occurred since 2003.

Figure 2.12. Sectoral distribution of greenfield FDI and cross-border M&A stocks

Note: See Box 2.3 clarifying sectoral groupings used in this figure. Detailed sector/activity classifications from Financial Times’ fDi Markets and Refinitiv data underlying the analysis in this figure differ marginally from standard classifications based on ISIC Rev. 4 used in other figures in this report.

Source: OECD based on (Financial Times, 2021[30]) Financial Times fDi Markets database and Refinitiv (accessed: 12 July 2021).

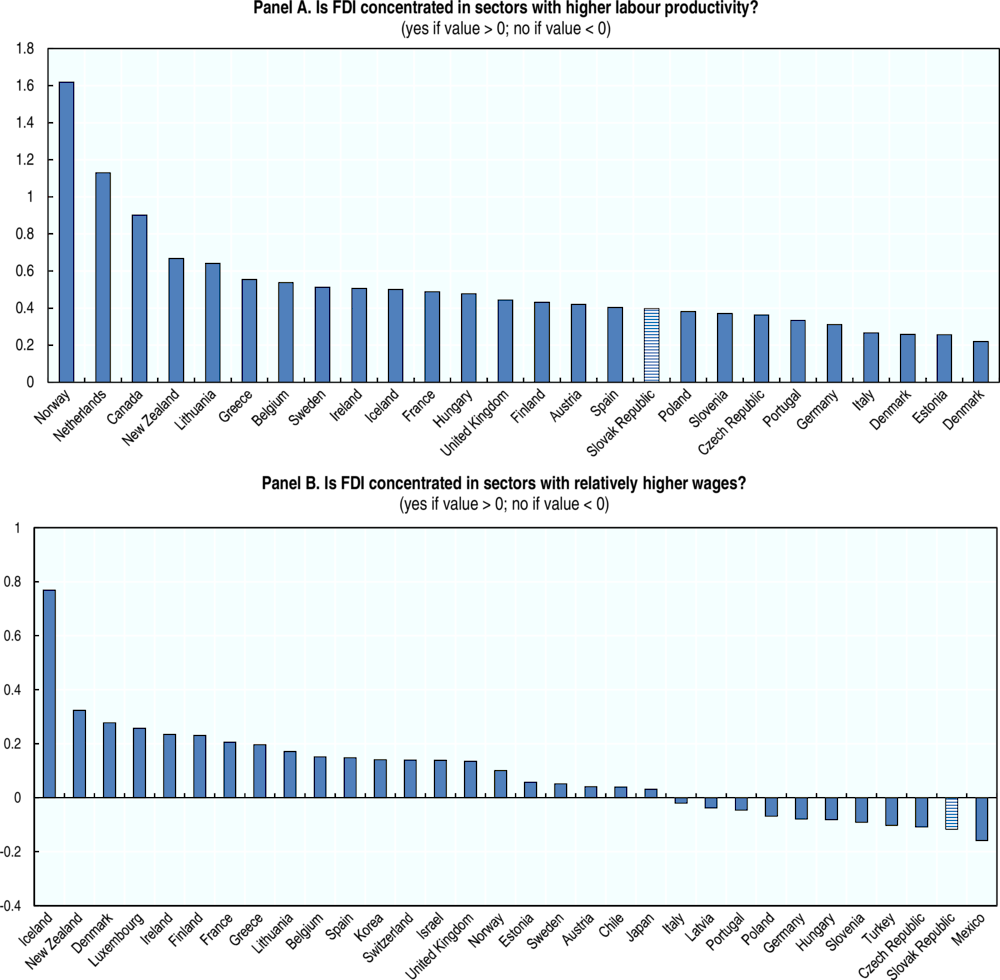

Efficiency-seeking FDI in low value-added GVC activities remains prevalent

The Slovak Republic is an attractive destination for efficiency-seeking FDI. Over the past decades, the availability of relatively skilled and low‑wage labour was a country’s comparative advantage for attracting FDI targeting assembly and fabrication activities within GVCs (Pellény, 2020[31]). Recent evidence on FDI concentration in terms of sectoral productivity and wages seems to confirm the dominance of efficiency-seeking investment attracted by the balance between labour force skills and cost. FDI indeed tend to concentrate in sectors with higher average labour productivity (Figure 2.13, Panel A) and lower wage levels (Figure 2.13, Panel B) relative to the rest of the economy.

Foreign investors in the Slovak Republic tend to target labour‑intensive activities, particularly the assembly of intermediate goods (OECD, 2019[1]). These activities typically require limited interaction with local suppliers and do not necessarily imply the development of strong supply relationships with domestic companies. Therefore, in such a configuration, the potential for knowledge and technology spillovers to local firms appears to be limited. In the automotive sector, for instance, the specialisation of the Slovak economy in low value-added GVC activities has not significantly changed over recent years (OECD, 2019[1]) (Box 2.4).

Figure 2.13. FDI concentration in terms of sectoral labour productivity and wages

Note: See (OECD, 2019[25]) for a description of the methodology and data. Labour productivity = value added per employee; wages = wage per employee.

Source: (OECD, 2019[25]) OECD FDI Qualities Indicators based on Financial Times’ fDi Markets database, 2020, OECD National Accounts and OECD MSTI database, 2020.

2.4. SMEs absorptive capacities

This section assesses the absorptive capacity of Slovak SMEs. Absorptive capacity is defined as the ability of a firm to recognise valuable knowledge and use it productively to innovate (OECD, 2022, forthcoming[22]). The stronger a firm’s absorptive capacity, the higher its chances to benefit from FDI knowledge and technology spillovers. The absorptive capacity of SMEs is related to firm-specific characteristics such as their level of productivity, sector of operation, age, size, and geographic location. It also depends on SMEs’ ability to access the strategic resources that are needed to innovate, namely finance, skills and innovation assets.

This section first provides an overview of the Slovak SMEs sector and its contribution to the Slovak economy, focussing on (1) the structure of the Slovak business population and its productivity performance; (2) relevant business demography trends; and (3) SMEs sectoral distribution across the economy. Subsequently, this section evaluates the endowment of Slovak SMEs in R&D and innovation assets, skills and financial resources, which in turn affect their chances of participating and benefitting from FDI knowledge and technology spillovers (OECD, 2022, forthcoming[22]).

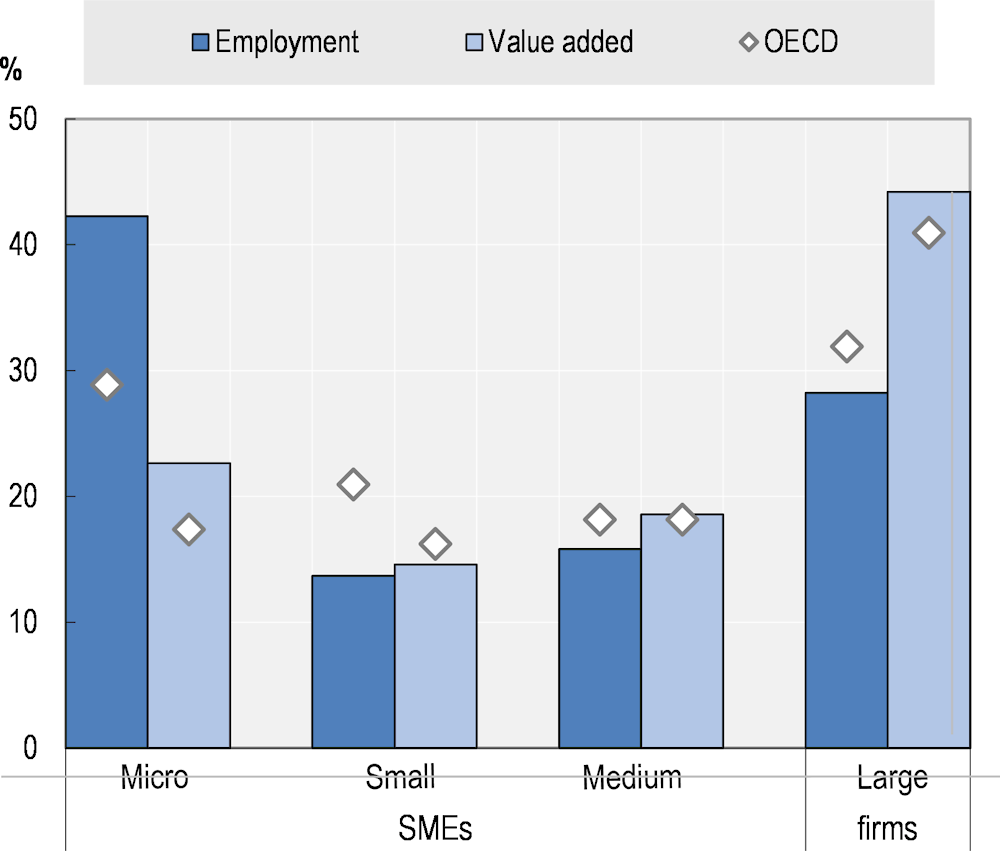

The Slovak business population is dominated by myriad low-productivity micro firms

The Slovak business population is relatively polarised between a large number of micro firms of less than 10 employees, on the one hand, and a few large firms, including affiliates of multinationals, on the other hand (OECD, 2021[5]). The micro, small and medium-sized enterprises (MSMEs) sector accounts for more than 99% of enterprises in the Slovak Republic and is responsible for 72% of employment and 56% of value added (against an OECD average of 68% and 59%) (OECD, 2021[5]). The share of micro firms in the total business population is higher than in any other OECD economies (OECD, 2021[21]). In 2019, 97% of employer firms had fewer than 10 employees (OECD, 2021[21]) (see Table 2.5). Micro firms also account for the largest share of employment and value added within the broader population of micro, small and medium‑sized firms. In turn, employment in larger SMEs is low relative to other OECD countries (Figure 2.14). On the opposite side of the business spectrum, large firms represent only 0.1% of the business population, but contribute around 28% of employment and 44% of value-added (in line with the OECD average of 31% and 40% respectively) (Figure 2.14) (OECD, 2021[5]).

Such evidence suggests the existence of a “missing middle” of SMEs (i.e. firms between 10 and 249 employees) in the Slovak business population (OECD, 2021[21]). This phenomenon is not recent. The relative shares of micro, small and medium‑sized firms remained substantially stable between 2015 and 2019, even slightly increasing for micro firms (see Table 2.5). In terms of employment, the gap has even been widening: employment in micro firms grew by 21% between 2010 and 2017, compared to a growth of only 7% in mid-sized firms (OECD, 2021[21]). The low proportion of SMEs relative to micro firms in the Slovak business population impedes the local embeddedness of foreign MNEs: larger firms are more likely than micro firms to establish linkages with foreign MNEs and eventually capture knowledge and technology from them.

Table 2.5. Number of firms by size

Business economy, except financial and insurance activities

|

2015 |

% |

2016 |

% |

2017 |

% |

2018 |

% |

2019 |

% |

|

|---|---|---|---|---|---|---|---|---|---|---|

|

Micro (1-9 persons employed) |

411,765 |

96.7% |

429,999 |

97.1% |

454,450 |

97.0% |

475,956 |

97.1% |

494,750 |

97.3% |

|

Small (10-49 persons employed) |

11,203 |

2.6% |

10,011 |

2.3% |

11,112 |

2.4% |

11,193 |

2.3% |

10,927 |

2.1% |

|

Medium (50-249 persons employed) |

2,264 |

0.5% |

2,396 |

0.5% |

2,460 |

0.5% |

2,490 |

0.5% |

2,459 |

0.5% |

|

Total MSMEs (1-249 persons employed) |

425,232 |

99.9% |

442,406 |

99.9% |

468,022 |

99.9% |

489,639 |

99.9% |

508,136 |

99.9% |

|

Large (250+ persons employed) |

531 |

0.1% |

555 |

0.1% |

581 |

0.1% |

599 |

0.1% |

594 |

0.1% |

|

Total |

425,763 |

442,961 |

468,603 |

490,238 |

508,730 |

Source: SDBS Structural Business Statistics ISIC Rev 4 (accessed 21 December 2021).

Figure 2.14. Size of the micro, small and medium-sized business sector

Note: See methodology in (OECD, 2021[5]), OECD SME and Entrepreneurship Outlook 2021.

Source: (OECD, 2021[5]), OECD SME and Entrepreneurship Outlook 2021.

The labour productivity of smaller businesses is low compared to most other OECD countries (OECD, 2021[21]). Against an employment share of 42%, micro firms produce only 23% of value added (OECD, 2021[5])(Figure 2.14). Given their high share in the total business fabric, low‑productive micro firms weigh down the aggregate productivity of the economy, pointing to the need of a policy focus on scaling up the innovation potential of smaller businesses (OECD, 2021[21]). The productivity of larger small and medium-sized businesses, albeit higher, still remains comparatively low among OECD countries (OECD, 2021[21]). Additionally, except for some increase in lower technology manufacturing, the productivity of Slovak MSMEs stagnated or declined across all sectors between 2014 and 2018 (OECD, 2022[20]).

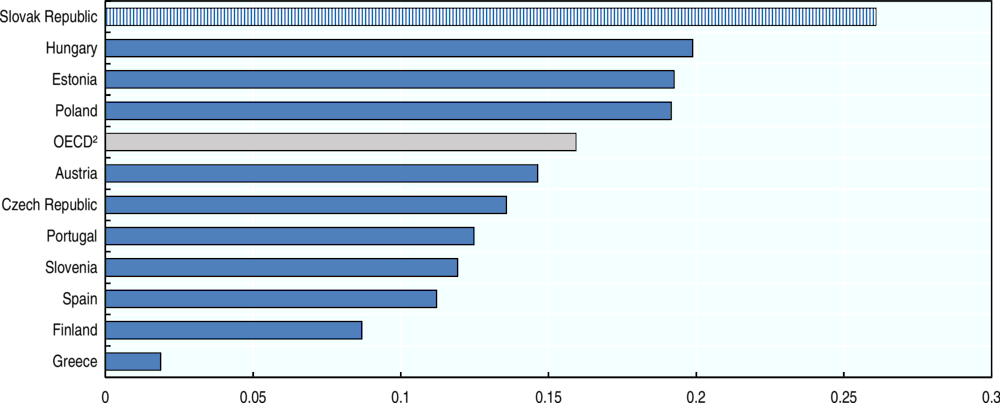

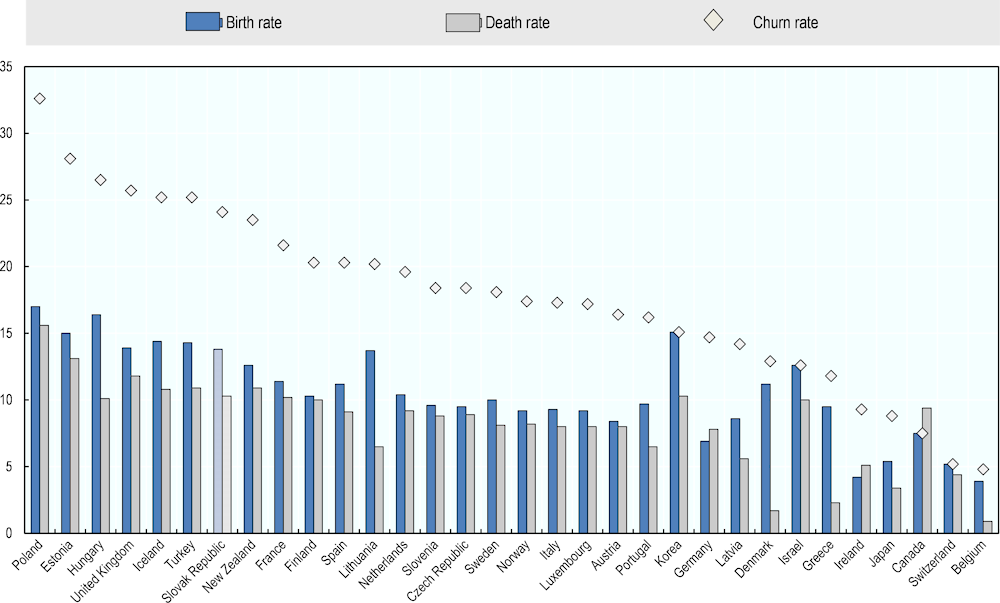

The very high business dynamism may reflect a lack of scale up capacity in smaller firms

Business dynamism is very high in the Slovak Republic, with high business birth and death rates. Business creation is one of the highest in the OECD area (Figure 2.15). By the end of 2017, almost 14% of all firms were created in that year, a rate above the OECD average (10.6%) (OECD, 2021, p. 20[21]). High business creation is combined with a high share of enterprise death. In 2017, 11% of enterprises exited the market, against an OECD average of around 8%. Also, only about 27% of Slovak start-ups were still operating in their fifth year, one of the lowest new enterprises survival rate in OECD countries (OECD, 2022[20]). As a result, the Slovak Republic is among the OECD countries with the highest enterprise churn rate (24% in 2017).

However a high churn rate can also signal the existence of barriers preventing SMEs to scale up their innovation and productivity capacity. Churn rates, calculated as the sum of birth and death rates of all enterprise firms, may be associated with an efficient reallocation of resources from less productive to more productive firms, with positive effects on aggregate productivity. In other cases, however, it can rather reflect firms’ difficulties in innovating and scaling up – for instance, when economies of scale cannot be materialised through firm growth, or a lack of scale limits investment in employee skills development and knowledge that are yet critical to innovate (OECD, 2017[32]) (OECD, 2021[21]) (OECD, 2022, forthcoming[22]). The very high share of low productive micro firms in the Slovak business population suggests limited efficiency of resources reallocation across firms. In a similar scenario, a high churn rate can be a symptom of difficulties in business growth, for instance in hiring the first employee.

Figure 2.15. Churn rate of employer enterprises in selected OECD countries (%), 2017

Notes: Birth and death rates are given for all employers enterprises. The churn rate is calculated as the sum of birth and death rates. Death rate data for Korea and Canada are of 2016. Death rate data for Israel and Switzerland are of 2015.

Sources: OECD Structural and Demographic Business Statistics Database (http://dx.doi.org/10.1787/sdbs-data-en) (accessed 19 September 2021).

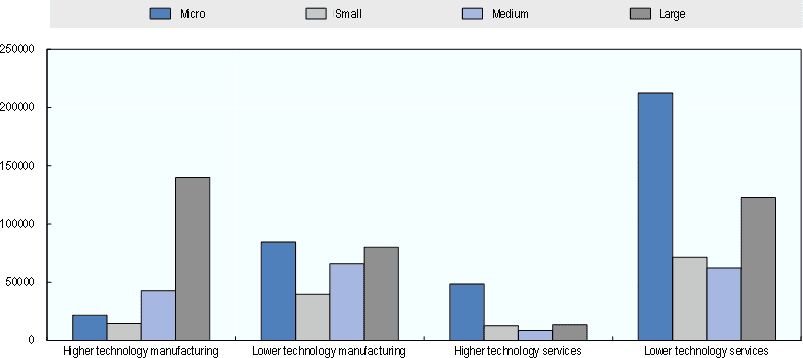

SMEs are more present in the less technology-intensive sectors

In terms of employment, Slovak SMEs tend to be more present in the less technology‑ and knowledge-intensive sectors, characterised by lower productivity and value added and higher labour intensity (Figure 2.16). Lower technology services have the highest number of SME employees – around 134 000, representing 28% of the total sector employment. The services sector also accounts for larger employment shares in micro enterprises, while the manufacturing sector has a higher concentration of larger SMEs (SBA, 2020[33]). In manufacturing, the SME employment share is larger in lower technology industries (where 38% of the persons employed work in SMEs, i.e. 105 000 workers) while employment in higher technology manufacturing is dominated by large firms. Overall, the underrepresentation of SMEs in higher technology industries, characterised by stronger FDI activity (see supra – FDI spillover potential) may hamper their access to foreign firms input and technology, thereby partly explaining their slow productivity growth.

Figure 2.16. Employment by sectoral group and firm size, 2019

Note: See Box 2.3 clarifying sectoral groupings used in this figure. Micro = 1 to 9 employees. Small = 10 to 49 employees. Medium = 50 to 249 employees. Large = 250+ employees.

Source: OECD Structural and Demographic Business Statistics Database (http://dx.doi.org/10.1787/sdbs-data-en) (accessed 23 December 2021).

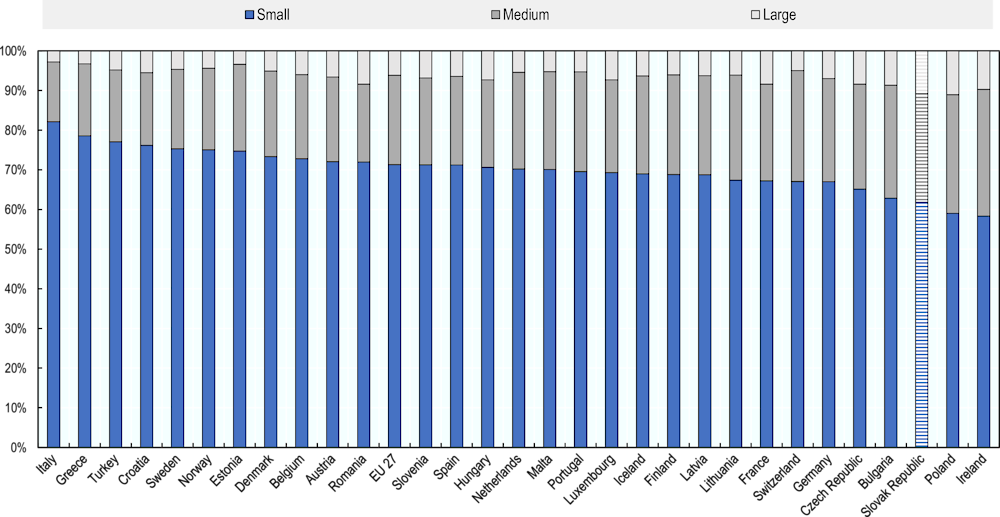

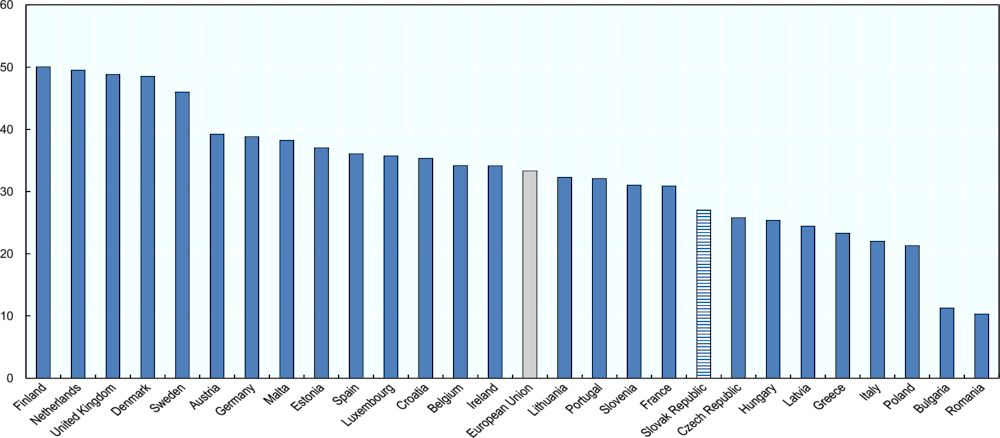

The SME sector still underperforms in R&D and innovation

The Slovak innovation system is not conducive to innovation in SMEs (OECD, 2021[21]).The European Innovation Scoreboard 2021 classifies the Slovak Republic as an “emerging innovator” (i.e. performing well below the EU average) and reports a slight decline in the country’s innovation performance relative to the EU between 2020 and 2021 (-0.6% points) (EC, 2021[34]). The Slovak Republic also ranks low across OECD countries on innovation system measures (OECD, 2021[21]). In terms of innovative entrepreneurship, the share of small businesses (10 to 49 employees) in the total population of innovative enterprises is one of the lowest across EU countries (Figure 2.17).

Figure 2.17. Innovative enterprises

Notes: The enterprise is considered as innovative (INN) if during the reference period it introduced successfully a product or process innovation, had ongoing innovation activities, abandoned innovation activities, completed but yet introduced the innovation or was engaged in in-house R&D or R&D contracted out. Non-innovative (NINN) enterprises had no innovation activity mentioned above whatsoever during the reference period.

Sources: Eurostat, Community innovation survey 2018 (accessed 20 September 2021).

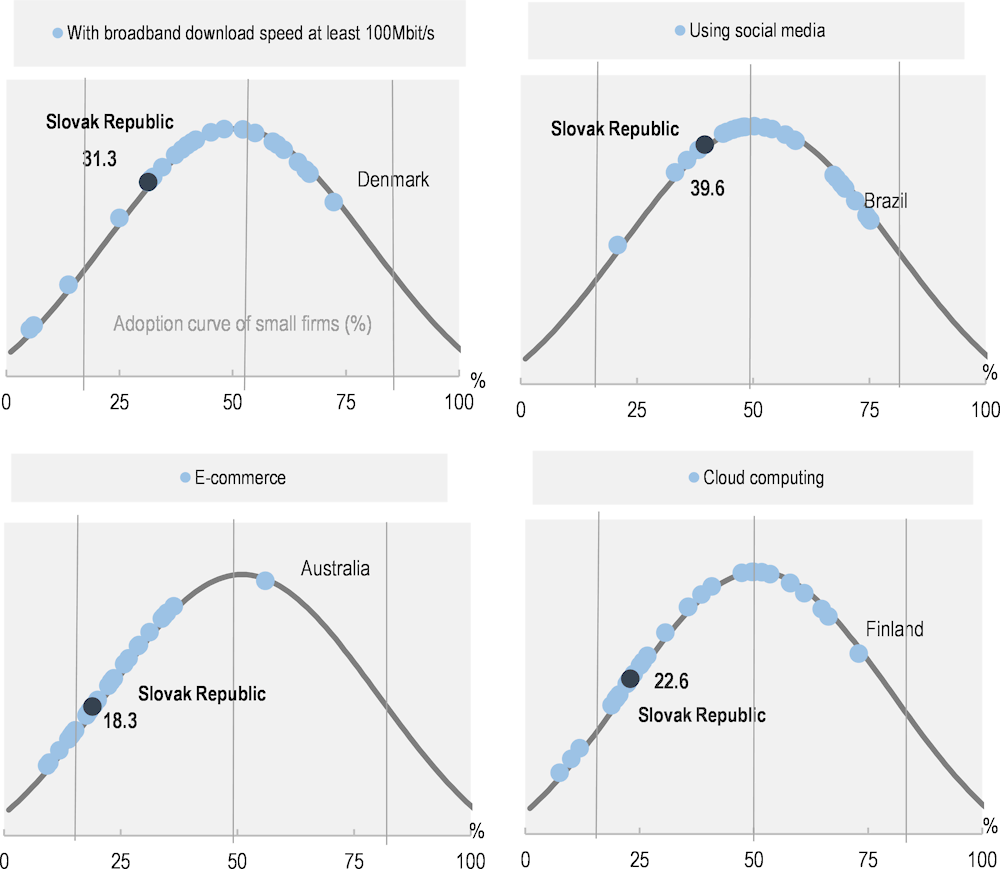

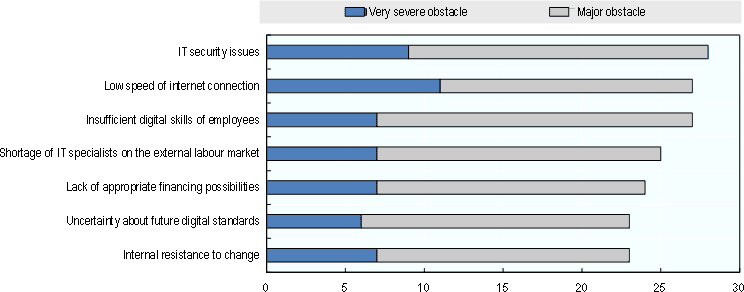

Digitalisation in the Slovak Republic is also relatively low. In 2020, the European Commission’s Digital Economy and Society Index (DESI) (EC, 2020[35]) ranked the country 22nd among the 28 EU member states (OECD, 2021[21]). The digital uptake of Slovak SMEs remains below the OECD average in different areas, including the use of social media and e-commerce, that could nonetheless be entry points to their digital transition (Figure 2.18) (OECD, 2021[5]) (OECD, 2021[36]). Indeed SMEs tend to digitalise general administration or marketing functions first. Business surveys on ICT use show that the digital gap is smaller between SMEs and large firms in their online interactions with the government, in electronic invoicing or in using social media or selling online. SME gaps in adoption increase when technologies become more sophisticated (e.g. data analytics) or scale matters for implementation (e.g. enterprise resource planning for process integration). Likewise, the Slovak SMEs lag behind in using cloud computing solutions, despite the potential of “pay-as-you-go” these services could bring them to raise IT capacity.

Figure 2.18. Digital readiness of small firms in the Slovak Republic

Note: Distribution of country adoption rates along a stylised curve of adoption. Percentage of small businesses [10-49 employees] with a broadband download speed at least 100 Mbit/s (%), using social media (%), receiving orders over computer networks (%), or purchasing cloud computing services (%). All activities in manufacturing and non-financial market services. See (OECD, 2021[36]) for methodology.

Source: (OECD, 2021[5]), SMEs and Entrepreneurship Outlook 2021, OECD Publishing, Paris, based on OECD ICT Use by Businesses data; (OECD, 2021[36]), The Digital Transformation of SMEs, OECD Publishing, Paris.

R&D spending levels of SMEs in the Slovak Republic are low by international standards (OECD, 2021[21]). The gap in R&D investment is a constant feature of Slovak SMEs, across all size classes, especially among the medium-sized ones. At 0.14% of GDP in 2018, SMEs expenditure on R&D is less than half the EU average of 0.3% (EC, 2020[15]). In 2019, Slovak small and medium-sized firms spent respectively EUR 5 and EUR 13.5 per inhabitant in R&D, which is very low compared to more R&D‑intensive economies like Finland (where in 2019 small and medium-sized firms spent in R&D EUR 67 and EUR 100 per inhabitant respectively), but also Portugal (EUR 19 and EUR 33) and the Czech Republic (EUR 11 and EUR 26) (EC, 2021[37]). In the same year, Slovak micro firms only spent EUR 1.5 per inhabitant in R&D, one of the lowest amounts among EU countries for which comparable data is available (EC, 2021[37]). There is also a particular gap in R&D spending among medium-sized enterprises. The Slovak Republic is one of the few EU countries where medium‑sized enterprises invest in R&D less frequently than their smaller counterparts: in 2016, 17% of small businesses reported engaging in R&D spending on a continuous basis (EU average: 20% approximately) against 16% of medium‑sized firms (EU average: 33%) (OECD, 2021[21]).

R&D expenditure by large firms is also comparatively low. In 2019, firms with 500 employees or more spent only 0.24% of GDP in R&D compared to 0.42% in the Czech Republic and 0.49% in Hungary (EC, 2021[37]). The configuration of the Slovak business sector – with few high‑productivity affiliates of foreign MNEs and numerous small domestic low-productivity companies – has favoured technology imports rather than domestic R&D investment (OECD, 2019[19]) (OECD, 2016[38]). Even MNEs operating in the country undertake little R&D compared to other OECD and neighbouring countries, reflecting the role of the Slovak Republic as an assembly hub of intermediate imported inputs (OECD, 2021[21]). In addition to the R&D departments of MNEs, domestic business R&D (BERD) is concentrated in the few large domestically‑owned companies operating in the automotive and ICT sectors, while domestic SMEs continue to compete based on low production costs (OECD, 2021[21]). Also, domestic business R&D is driven by medium- to low-tech manufacturing industries which make a larger contribution to total BERD than firms in high‑tech manufacturing and knowledge intensive services (OECD, 2019[19]).

Recent trends show some improvements: Slovak SMEs have been catching up on R&D spending. R&D expenditure in Slovak SMEs has doubled over the past decade. By 2020, Slovak small firms spent 4 times the 2011 amount, while medium-sized firms increased their spending by more than 2-fold over the same period (EC, 2021[37]) (OECD, 2021[21]).

These results are consistent with the existence of a missing middle of businesses in the country, and the greater difficulties micro firms face to scale up.

Difficult access to strategic resources and inefficient business conditions weigh down on SME innovation capacity

Further diversifying SME sources of finance could help address the financing gap for innovation

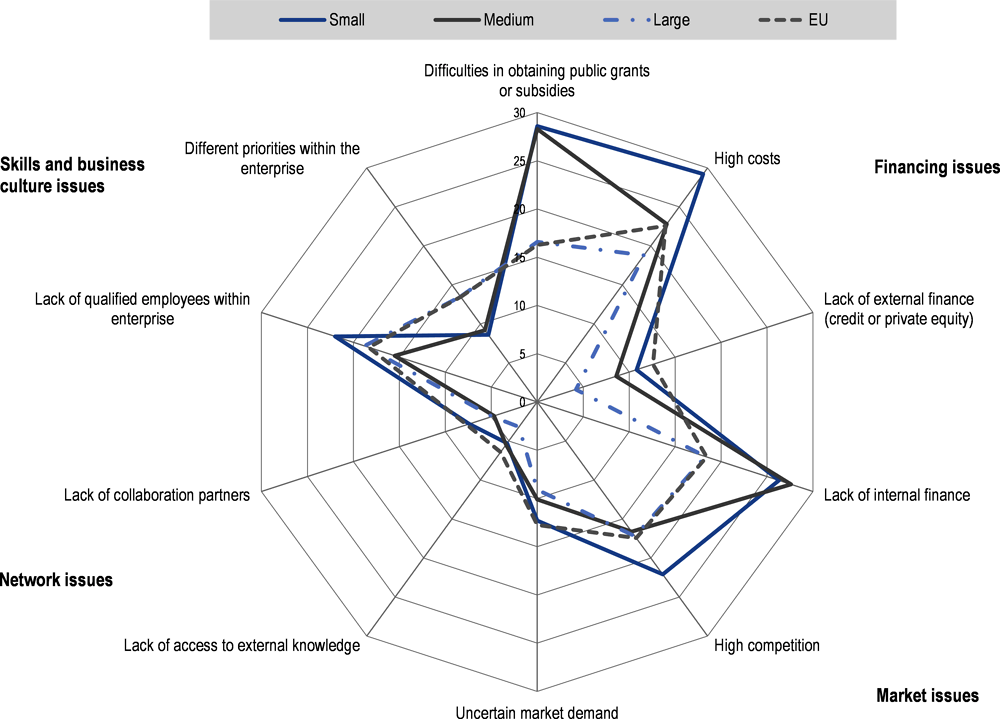

High costs and high risks when associated with difficult access to external sources of finance may typically prevent productive investments. High costs are one of the main barriers to innovation in Slovak small firms, combined with a reported lack of internal finance and difficulties in obtaining public grants and subsidies (Figure 2.19). 29% of innovative small firms in the Slovak Republic report high costs to be a major hampering factor to their innovation activities. Difficulties in obtaining public funding (grants or subsidies) are perceived as an important barrier to innovation by over 28% of small firms. Lack of internal finance is reported to be a challenge by 26% of innovative small firms (Eurostat, 2018[39]). Likewise, factors hampering the adoption of digital technologies by SMEs include scarce availability of financing for digital investment (OECD, 2021[21]) (Figure 2.20).

Figure 2.19. Barriers to innovation among Slovak small, medium-sized and large firms

Note: Large, medium and small: % of innovative firms in innovation core activities (Com.Reg. 995/2012) rating the importance of a barrier as “high”, by size class. Small firms = from 10 to 49 employees. Medium‑sized = from 50 to 249 employees. Large = 250 employees or more. Micro firms with less than 10 employees are not included. EU: average % of innovative firms of all sizes in innovation core activities (Com.Reg. 995/2012) rating the importance of a barrier as “high”. The following EU countries are included: Austria, Bulgaria, Croatia, Cyprus*, Czech Republic, Denmark, Estonia, Finland, France, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Poland, Portugal, Romania, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Republic of Türkiye.

* Note by the Republic of Türkiye: The information in this document with reference to “Cyprus” relates to the southern part of the Island. There is no single authority representing both Turkish and Greek Cypriot people on the Island. Türkiye recognises the Turkish Republic of Northern Cyprus (TRNC). Until a lasting and equitable solution is found within the context of the United Nations, Türkiye shall preserve its position concerning the “Cyprus issue”.

Note by all the European Union Member States of the OECD and the European Union: The Republic of Cyprus is recognised by all members of the United Nations with the exception of Türkiye. The information in this document relates to the area under the effective control of the Government of the Republic of Cyprus.

Source: Eurostat Community Innovation Survey (CIS) 2018 (accessed 8 November 2021).

Figure 2.20. Obstacles to digitalisation by SMEs

Sources: (OECD, 2021, p. 201[21]), SME and Entrepreneurship Policy in the Slovak Republic, OECD Publishing, Paris, from (Abel-Koch et al., 2019[40]), “Going Digital: The Challenges Facing European SMEs”, European SME Survey 2019, www.kfw.de/PDF/Download-Center/Konzernthemen/Research/PDF-Dokumente-Studien-und-Materialien/PDF-Dateien-Paper-and-Proceedings-(EN)/European-SMESurvey-2019.pdf.

The lack of external finance (credit or private equity) seems to be less of an issue, as the share of firms reporting it as an obstacle to undertaking innovative activities is lower (10%) (Figure 2.19). Overall, the Slovak Republic performs in line with the EU average for SMEs access to finance (EC, 2021[41]). Total SME lending has been increasing since 2012 and credit conditions for SMEs have been gradually improving (OECD, 2019[19]). As in other countries, however, Slovak SMEs tend to rely on traditional means of financing, such as bank loans, savings or family funds, while alternative forms of financing are less diffused. This may be an issue as traditional debt is often less appropriate to finance innovative, risk and uncertain endeavours, requiring a broader range of finance solutions to be developed in order to help SMEs scaling up (OECD, 2022, forthcoming[42]).

Slovak SMEs make little use of alternative financing instruments. The equity market is poorly developed (EC/EIB, 2019[43]) and the share of venture capital investment in GDP is among the lowest in the OECD area (0.0046% of GDP in 2018, against an OECD average of 0.06%) (OECD, 2021[21]). After a sharp decline in 2017, following the closure of funding support under the EU and European Investment Bank Group’s initiative “Joint European Resources for Micro to Medium Enterprises” (JEREMIE) for the 2007-13 programming period, the volume of venture and growth capital recovered up to EUR 5.4 million in 2018. The majority of investments targeted established SMEs and focussed on the expansion of production capacities and market potential or product and service development. However, the amount of venture capital invested in 2018 remains negligible if compared to bank financing (OECD, 2020[44]).

In addition to supply-side barriers in the finance market, financial literacy among the Slovak population is generally low and there are signs that it has been declining in recent years (OECD, 2021[21]).

Competition conditions and infrastructure deficiencies raise obstacles to SME innovation

For 22% of innovative small firms in the Slovak Republic, the high level of market competition is a highly important factor hindering their innovation activities – which compounds with a perception of uncertain market demand (Figure 2.19). The situation differs significantly for medium-sized firms which face competition conditions to the same extent as larger firms or average EU firms do. The diffused perception of high market competition as a barrier to (rather than a trigger of) innovation among smaller Slovak firms is probably related to the particular challenges they face in scaling up and coping with evolving product standards and market demand.

SMEs also report challenges in the adoption of digital technologies, i.e. the management of IT security issues, low Internet connection speed and insufficient digital infrastructure development (OECD, 2021[21]) (Figure 2.20). High-speed broadband is key for SMEs digital transformation, as it allows to fully exploit existing Internet services and to foster the diffusion of new ones (OECD, 2017, p. 23[45]) (OECD, 2021[36]). Differences in speed levels are important for customers but also for businesses, for instance for the exchange of data within value chains and for just-in-time production. The Slovak Republic has one of the lowest rate of adoption of high-speed broadband in the OECD area (Figure 2.18). 36% of all firms with at least 10 employees had a download speed connection at least 100 Mbit/s (i.e. fibre) in 2021, 35% of small firms and 38% of medium-sized firms – i.e., about half the share observed in Portugal or Sweden (71-72%). IT security is also a relatively common challenge for Slovak firms. 14% of all firms with at least 10 employees experienced ICT incidents (security breaches) in 2018, which is less than in the Czech Republic (21%) but much more than in Portugal (8%). While Slovak investment in transport infrastructure has been relatively high in recent years, ICT investment has remained low by OECD standards (OECD, 2019[19]).

Emerging skill shortages hamper the innovation performance of Slovak SMEs

The lack of qualified staff is reported as another major barrier to innovation, pointed out by 22% of innovative small firms (Figure 2.19). A lack of workforce skills and IT specialists is also perceived as hampering the digital uptake by SMEs (OECD, 2021[21]) (Figure 2.20).