This chapter focuses on factors that underpin the governance framework for foreign direct investment (FDI) promotion and small and medium-sized enterprises (SMEs) development in the Slovak Republic. It provides an overview of the institutions that are currently in place to design and implement FDI, SME, innovation and regional development policies, and explores the policy coordination mechanisms to ensure coherence across policy domains, institutions and tiers of government. This chapter also gives special attention to the monitoring and evaluation framework of the Slovak policy delivery system, and efforts to enhance stakeholder engagement.

Strengthening FDI and SME Linkages in the Slovak Republic

4. The institutional and governance framework for FDI-SME diffusion

Abstract

4.1. Summary of findings

Strengthening FDI spillovers on Slovak SMEs requires public action in different policy domains related to investment promotion, SME internationalisation, innovation and regional development. The institutional framework that governs these policy areas differs from country to country. Different governance structures are feasible as long as appropriate coordination mechanisms are in place to ensure policy alignment across Ministries, implementing agencies and advisory bodies. This chapter aims to assess the quality of the Slovak institutional setting and identify potential governance challenges (Table 4.1). It provides an overview of the main institutions operating at the intersection of FDI, SME, innovation and regional development policy and explores their organisational structures, mandates and scope of activities. It also sheds light on their internal capacities for policy coordination, evaluation and stakeholder engagement, which are all important elements of a conducive institutional environment.

Table 4.1. Findings and recommendations on the Slovak governance framework

|

Findings |

Recommendations |

|---|---|

|

Creating a conducive institutional environment |

|

|

A large number of line ministries and implementing agencies is involved in the implementation of policies that enable FDI spillovers on domestic SMEs, resulting in higher levels of bureaucracy, policy complexity and administrative inefficiencies. |

Consider how coordination mechanisms could be improved or the current governance framework restructured, e.g. by merging business support agencies –in particular those dealing with innovation policy– and through the implementation of joint programming procedures in areas that require complementary expertise. |

|

Government agencies have recently expanded their business advisory services to the subnational level through the establishment of regional branches, one-stop-shops and business consultation centres. However, their regional footprint is still nascent and largely depends on decisions made in a centralised manner in Bratislava. |

Subnational branches should be given the necessary autonomy and resources to tailor their services to local needs, build their own contacts and brands, and lead partnerships with regional and local authorities that may lack the capacity to support local entrepreneurial ecosystems. |

|

Regional and municipal authorities have been given substantial responsibilities in several policy areas affecting business enterprises. However, the increased fragmentation of subnational governments and their lack of organisational capacities often limit their ability to support local FDI-SME ecosystems. |

Consider strengthening the financial and organisational capacities of subnational authorities to enable them to support FDI-SME partnerships. |

|

Encourage cooperation and coordination among municipalities on investment promotion, innovation and SME support issues, for example through the establishment of a forum to share best practices. |

|

|

Ensuring coordination across different institutions, policy areas and tiers of government |

|

|

The Slovak Republic has a well-developed network of high-level government councils to ensure cross-ministerial coordination. However, the lack of human resources and ambiguity on their role and responsibilities often lead to coordination crises. |

Consider broadening the membership of existing Councils to ensure that implementing agencies from across the FDI-SME diffusion policy areas are involved in strategic policy discussions. Alternatively, a consolidation of the current setting could be envisaged through the merger of certain Councils. |

|

There are currently no comprehensive strategic documents laying out policy priorities, programme actions and institutional roles on innovation and SME policy. The Slovak national strategy on investment and trade promotion expired in 2020 and has not yet been renewed. |

Develop national strategies on innovation and SME policy to ensure that policy action is guided by a set of overarching policy priorities, clear targets and effective governance arrangements. Mainstream the issue of FDI-SME spillovers into these national strategies and ensure that the role of each institution is clearly articulated. |

|

Inter-agency collaboration for the implementation of FDI-SME diffusion policies is limited while coordination takes place either informally or in a centralised manner through line Ministries. |

Encourage collaboration and the exchange of information among implementing agencies by introducing joint programming procedures and establishing official coordination mechanisms (e.g. inter-agency committees). |

|

Promoting impact evaluations and policy dialogue with stakeholders |

|

|

The adoption of the Better Regulation Strategy has led to the development of a comprehensive and solid methodology for assessing economic, social and environmental impacts, including an SME Test and policy impacts on innovation. |

Consider appointing one body close to the centre of government – for instance, the Government Office of the Slovak Republic – responsible for coordinating evaluations of integrated impacts, rather than spreading the responsibility across several ministries. |

|

The use of M&E tools by government institutions remains limited and evaluation processes still lack proper implementation due to the administrative and analytical capacities of key ministries. |

Strengthen the analytical and monitoring capacities of key Ministries and implementing agencies through the provision of specialised training to raise education and awareness of public servants on evaluation methods. |

|

The Slovak Republic has recently made significant progress in stakeholder engagement through the introduction of a standardised public consultation procedure and the organisation of several public consultations for the update of national strategies. |

Provide stakeholders with sufficient time to submit their feedback on new regulations and policies. Strengthen the inclusiveness of public consultations by raising awareness of participatory processes among under-represented segments of the business population (e.g. innovative startups, small firms). |

4.2. Overview of the Slovak governance framework for FDI-SME diffusion

Multiple ministries and government agencies are involved in implementing policies that act upon FDI-SME diffusion channels and enabling conditions

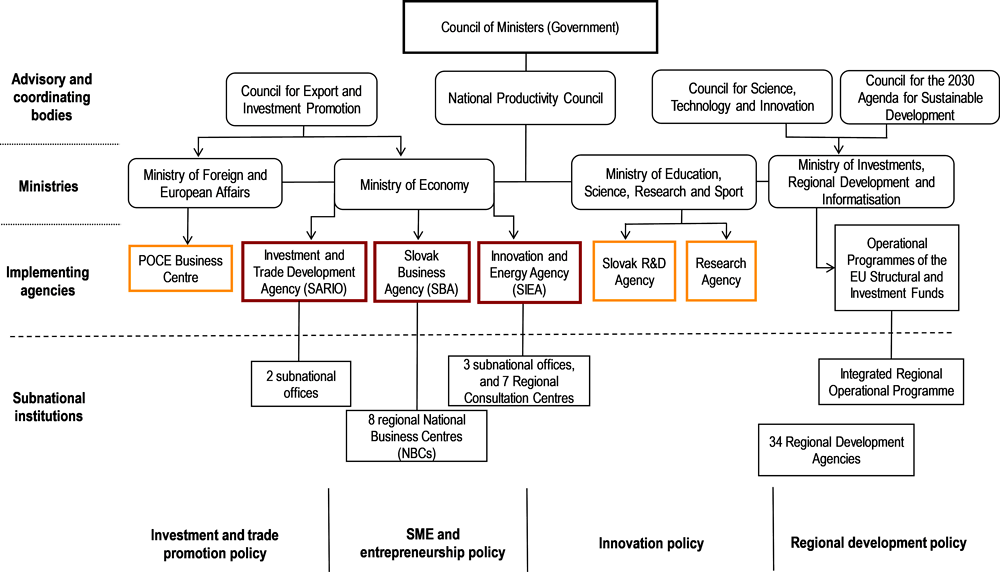

The Slovak policy delivery system is characterised by fragmentation. A large number of line ministries and implementing agencies is involved in the implementation of policies that enable FDI spillovers on domestic SMEs (Figure 4.1), resulting in higher levels of bureaucracy and policy complexity and, in many instances, limiting the uptake of public support programmes among potential beneficiaries (see Chapter 5 for an assessment of the Slovak policy mix).

The primary responsibility for investment, SME and innovation policy lies with the Slovak Ministry of Economy, which is in charge of executing economic growth policies that aim to strengthen industrial production and improve the overall business environment (Government of the Slovak Republic, 2001[1]). The Ministry does not have an SME policy department or unit; SME issues are mainstreamed into the work of the Competitiveness Directorate, which deals with industrial policy, innovation and general business support measures. In contrast, investment policy is coordinated through a dedicated department, which focuses mainly on the provision of state aid and the implementation of Operational Programmes funded by the European Structural and Investment Funds (ESIF).

The majority of Slovak policies that enable FDI spillovers on domestic SMEs are implemented by three government agencies under the supervision of the Ministry of Economy (MHSR) (Table 4.2):

The Slovak Agency for Investment and Trade (SARIO) is the main government body that helps foreign investors set up their business operations in the Slovak Republic, while also supporting domestic firms, in particular SMEs, to develop their export capacities and become internationally competitive. Central to SARIO’s mission is the provision of business consulting, information and facilitation services that promote FDI-driven knowledge and technology transfers and contribute to the diversification of the Slovak economy. In recent years, the agency has placed particular emphasis on promoting knowledge-intensive activities in FDI-intensive sectors, targeting in particular the space and aviation industries, smart and green mobility and medical technologies.

The Slovak Business Agency (SBA) is a public-private agency that was established in 1993 by the Slovak Ministry of Economy, the Association of Slovak Entrepreneurs and the Slovak Trade Association to support the development and growth of domestic SMEs. SBA serves as the main delivery point for a full range of financial and non-financial support services to entrepreneurs and SMEs at the national, regional and local levels. It manages several microloan and risk capital schemes, undertakes analyses of the Slovak business environment and provides training, mentorship, and business consultation services to support individual entrepreneurs, new start-ups and established SMEs in different stages of their life cycles.

The Slovak Innovation and Energy Agency (SIEA) offers technical and financial support to enhance the innovation performance of domestic business enterprises. SIEA serves as an implementing agency for the Operational Programme Integrated Infrastructure (OPII), which finances most programmes supporting innovation in SMEs. Over the past decade, the agency’s role in the delivery of innovation-focused policies has been strengthened and further expanded to also cover the promotion of business clustering initiatives, the support of industrial parks, and the implementation of national projects targeting the services sector and certain creative industries. Since 2015, SIEA also fulfils the role of a Technology Agency for the implementation of the Slovak Research and Innovation Strategy for Smart Specialisation (RIS3), which lays out national priorities for the diversification of the Slovak economy.

Figure 4.1. The institutional environment for FDI-SME diffusion in the Slovak Republic

Source: OECD elaboration based on EC/OECD Survey on Policies enabling FDI spillovers to domestic SMEs (2021).

Note: The main institutions acting upon FDI and SME linkages are designated in red. Institutions that have a complementary contribution to FDI and SME linkages are designated in yellow.

Table 4.2. Key implementing institutions acting upon the FDI-SME diffusion policy areas

|

Innovation policy |

SME policy |

FDI promotion and internationalisation policy |

Regional development policy |

|

|---|---|---|---|---|

|

Implementing agency |

Slovak Innovation and Energy Agency |

Slovak Business Agency |

Slovak Investment and Trade Development Agency |

Regional Development Section |

|

Date of creation |

2007 |

1993 |

2001 |

2020 |

|

Ministry in charge |

Ministry of Economy |

Ministry of Economy |

Ministry of Economy |

Ministry of Investments, Regional Development and Informatisation |

|

Legal form |

Autonomous agency |

Public-private agency |

Autonomous agency |

Ministry department |

|

Mandate |

Encourage domestic entrepreneurs to innovate and promote renewable energy policies |

Support the growth and upgrading of Slovak SMEs |

Attract and facilitate FDI and support the internationalisation of domestic companies, in particular SMEs |

Implement regional development policies and coordinate the EU Funds |

|

Target population |

All firms with emphasis on SMEs, research institutions |

SMEs |

All firms for FDI promotion policies and SMEs for internationalisation policies |

Regional/local authorities and agencies |

|

Priority sectors |

Services sectors, creative industries |

All sectors except tourism and agriculture |

Space and aviation industries, mobility and medical technologies |

None |

Source: EC/OECD Survey on Policies enabling FDI spillovers to domestic SMEs (2021).

Although the investment, SME and innovation policy domains are primarily in the hands of the Ministry of Economy and its implementing agencies, several other public institutions are involved in the execution of programmes that contribute to FDI-SME diffusion (Figure 4.1, Table 4.3).

The Ministry of Education, Science, Research and Sport (MESRS) plays an important role on innovation promotion, focusing on science and technology, higher education and lifelong learning (Government of the Slovak Republic, 2001[2]). Two implementing agencies, the Slovak R&D Agency (SRDA) and the Research Agency (RA), work under the supervision of the MESRS to offer financial support for innovative activities undertaken by research and scientific institutions in collaboration with industry, thereby playing a crucial role in promoting knowledge and technology transfers. Slovak SMEs can benefit from their collaborative funding schemes, which are financed either through the state budget (for SRDA) or through the EU funds (for RA). In recent years, the strategic focus of Slovak economic diplomacy has also shifted towards the internationalisation of the Slovak research and innovation ecosystem and the support of technology transfers to Slovak SMEs through international cooperation. The economic and development cooperation service of the Ministry of Foreign and European Affairs (MZV) operates a Business Centre that helps Slovak SMEs find new business partners and expand their operations abroad through an online portal.

Finally, important prerogatives are in the hands of the Ministry of Investments, Regional Development and Informatisation (MIRRI), which was established in 2020 to monitor and evaluate the socio-economic trends in Slovak regions and coordinate the implementation of regional development policies. Although MIRRI does not target business enterprises directly, it plays a crucial role in addressing regional disparities in the quality of the business environment through financial and capacity-building programmes for subnational authorities and action plans for the development of least developed districts. It also serves as a focal point for coordinating, managing and supervising the use of EU funds for the new programming period 2021-2027. In the past, the use of EU funds by Slovak institutions was stalled by administrative inefficiencies and lack of coordination, which led to their underutilisation. Improving coordination with other parts of government and ensuring that EU funding is channelled to investment, SME and innovation support programmes are key priorities of the new ministry.

Compared to peer EU countries, the Slovak Republic’s governance framework for FDI-SME diffusion is relatively fragmented, due to the number of government agencies involved in the implementation of investment, SME, innovation and regional development policies. The Slovak Ministry of Economy can serve as a central focal point to ensure synergies and prevent overlaps among SARIO, SBA and SIEA. However, this study shows that coordination mechanisms and communication channels among the three agencies and the extent of information exchange are limited (see next section). There is also increased dispersion of innovation and SME policy across many government bodies that fall outside of the supervision of the Ministry of Economy (Table 4.3). The fragmentation of the research and development and innovation (R&D&I) policy landscape (e.g. SIEA, SRDA, RA) and SME support services (e.g. SBA, SARIO, POCE Business Centre) increases the likelihood of duplication of policy efforts and trade-offs across different agencies and Ministries.

The Slovak government is currently finalising a National Strategy on R&D and Innovation, which aims to address the fragmentation of the institutional landscape and adopt a whole-of-government approach to the delivery of knowledge and technology transfer initiatives. Due consideration should be given to how coordination mechanisms could be improved or the current governance framework could be restructured, e.g. through the merger of business support agencies – in particular those dealing with innovation policy (SIEA, SRDA, RA) – and the implementation of joint programming procedures in areas that require complementary expertise (e.g. FDI-SME linkages, SME growth and internationalisation, innovation partnerships). A simpler and more integrated system of public support that targets the entire FDI-SME ecosystem at every step of its growth trajectory could help the Slovak government optimise efficiency. For instance, many EU Member States (e.g. Croatia, Finland, Lithuania, Luxembourg, Slovenia) target the entire FDI-SME ecosystem through a single government entity to facilitate coordination among the different policy domains and make available comprehensive packages of support that are easily accessible to potential beneficiaries (Box 4.1).

Table 4.3. Mandates and strategic policy objectives pursued by key Slovak institutions

|

Ministries |

Implementing agencies |

|||||||

|---|---|---|---|---|---|---|---|---|

|

Ministry of Economy |

Ministry of Investments, Regional Dev. & Informatisation |

POCE Business Centre |

SARIO |

SBA |

SIEA |

SRDA |

RA |

|

|

Policy mandates |

||||||||

|

Innovation promotion |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

||

|

SME development |

✓ |

✓ |

✓ |

|||||

|

FDI promotion |

✓ |

✓ |

✓ |

|||||

|

Regional development |

✓ |

✓ |

✓ |

|||||

|

Trade promotion |

✓ |

✓ |

||||||

|

Applied research |

✓ |

|||||||

|

Industrial parks |

✓ |

|||||||

|

Energy policy |

✓ |

|||||||

|

Strategic policy objectives relevant to FDI-SME diffusion |

||||||||

|

Strengthen SME innovation and technological capabilities |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

||

|

Promote strategic partnerships |

✓ |

✓ |

✓ |

✓ |

✓ |

|||

|

Promote value chain linkages |

✓ |

✓ |

✓ |

✓ |

||||

|

Promote fair competition and knowledge exchange |

✓ |

✓ |

✓ |

✓ |

||||

|

Promote agglomeration and industrial clustering |

✓ |

✓ |

✓ |

|||||

|

Attract FDI that fosters linkages with the local economy |

✓ |

✓ |

||||||

|

Encourage labour mobility |

✓ |

|||||||

Source: EC/OECD Survey on Policies enabling FDI spillovers to domestic SMEs (2021).

Box 4.1. Institutional arrangements for FDI-SME diffusion policy areas in other EU Member States

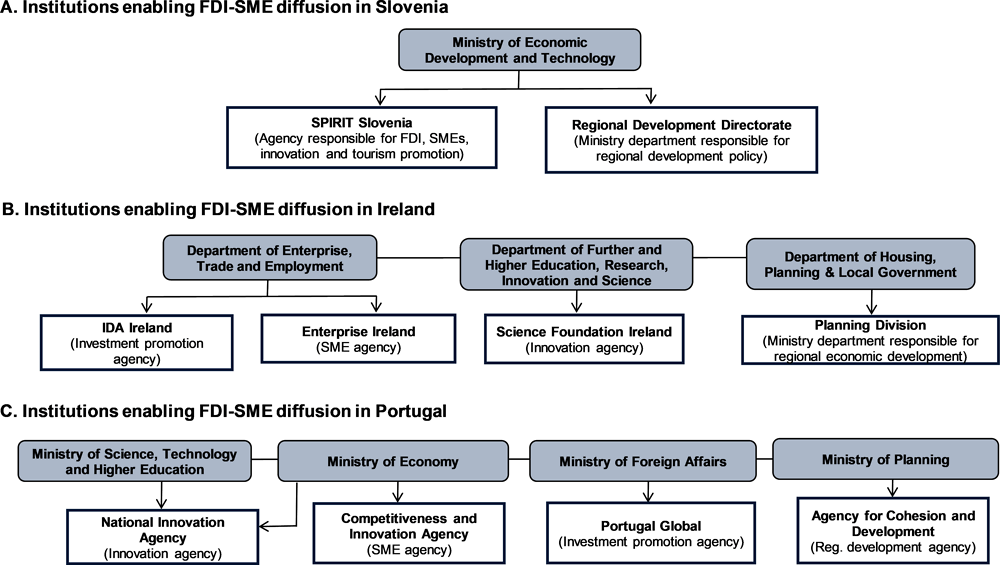

Governance systems within the EU vary, ranging from deeply centralised settings where FDI-SME diffusion policies are the responsibility of a single line Ministry; to balanced institutional set-ups where policy formulation in the areas of FDI, SMEs, innovation and regional development is shared among a small number of institutions; and to fragmented governance systems where several line ministries and implementing agencies are involved in policy formulation and implementation. In Belgium and Portugal, for instance, several implementing agencies operate across the three policy areas under the supervision of different ministries. In Ireland, FDI diffusion policy areas are split across three Ministries, with the Department of Enterprise, Trade and Employment bearing responsibility for FDI and SME policy, while innovation policy sits with the newly established Department of Further and Higher Education, Research, Innovation and Science. Such institutional settings may induce more complex governance systems – i.e. higher risks of information asymmetry, transaction costs and trade-offs – and require strong inter-institutional coordination mechanisms to overcome potential policy silos.

In contrast, other EU governments (e.g. Croatia, Finland, Lithuania, Luxembourg, Slovenia) target the entire FDI-SME-innovation ecosystem through a single government entity to facilitate coordination among the policy domains and make available packages of support that combine various policy instruments and target all the aspects of their entrepreneurial activity (e.g. innovation, internationalisation, business growth, skills, financial capacity, etc.). For instance, Slovenia’s Ministry of Economic Development and Technology is responsible for all FDI-SME diffusion policy areas. Policy implementation is entrusted to one single implementing agency, SPIRIT Slovenia, which is responsible for FDI, SMEs, innovation and tourism promotion, while regional development policy is coordinated through the Ministry’s Regional Development Directorate. By design, the need for inter-institutional coordination in such governance frameworks is limited, as coherence across policy domains needs to be achieved within a single supervising body.

Figure 4.2. Institutions enabling FDI-SME diffusion in Slovenia and Ireland

Source: EC/OECD Survey on Policies enabling FDI spillovers to domestic SMEs (2021).

The regional footprint of government agencies has been strengthened but policy coherence between national and subnational levels could be further improved

The presence or active engagement of government institutions at the regional and local levels are often necessary to ensure that policy is tailored to the socio-economic characteristics and needs of each region. Recent findings from EU countries show that closer proximity to foreign investors’ operations makes investment promotion agencies (IPAs) more effective in pursuing their functions and better addressing investors’ needs, in particular in less developed regions where information asymmetries and institutional failures are more widespread (Crescenzi, Di Cataldo and Giua, 2019[3]). The availability of appropriate business development services is also a local issue because SMEs and entrepreneurs generally access the services within a narrow local area (e.g. approximately 50 kilometres) and are therefore dependent on the quality of local supply (OECD, 2019[4]).

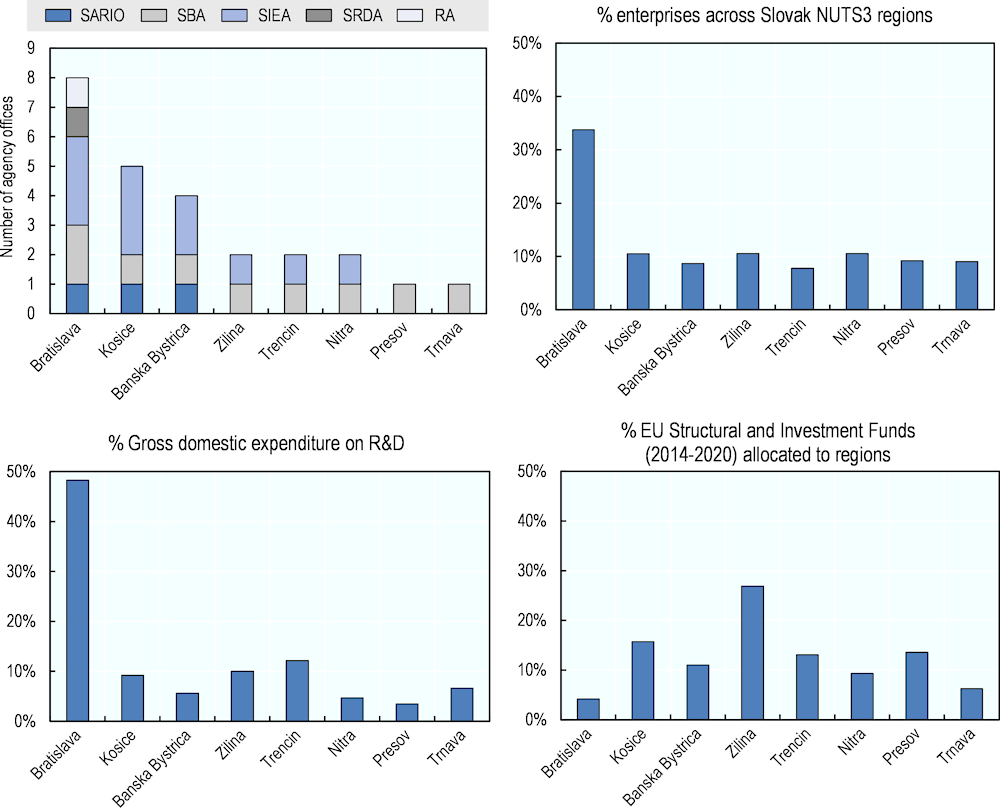

Over the past decade, Slovak implementing agencies have placed particular emphasis on expanding their business advisory services to the subnational level through the establishment of fully‑fledged regional branches, one-stop-shops and business consultation centres (Figure 4.3). Outside of Bratislava, the Košice and Banská Bystrica regions host the largest number of subnational offices, reflecting their population size and their position in the centre of the Central and Western Slovakia regions. This expansion was driven by the lack of effective political engagement and coordination in economically weaker regions and the need to ensure that public support is evenly provided across the country (OECD, 2021[5]).

With support from the European Regional Development Fund (ERDF), the SBA has developed a comprehensive network of National Business Centres (NBCs) to extend the agency’s national programmes to the eight NUTS3 regions. The NBCs serve as one-stop-shops for the delivery of business development services through the organisation of seminars, creative workshops, mentorship and business incubation programmes. Similarly, the SIEA has expanded its local presence across the Slovak regions through two EU-funded national projects aimed at improving the innovation performance of the Slovak economy and supporting creative industries. Seven regional consultation centres have been added to the three subnational SIEA branches since the launch of the projects in 2017. SARIO’s subnational activities are coordinated through two regional offices, which focus primarily on providing FDI facilitation and aftercare services and raising awareness among domestic firms about the availability of national support programmes. In contrast, the SRDA and RA do not have any subnational operations as the scope of their activities is limited to providing financial support rather than technical assistance, which would naturally require closer proximity to beneficiaries.

Efforts to strengthen the local presence of national public institutions is a step in the right direction given regional disparities and the challenges that weaker regions face with regard to mobilising public and private actors in support of local business ecosystems. However, their regional footprint is still nascent and largely depends on decisions made in a centralised manner in Bratislava. Moving forward, policy consideration should be given to the interconnection between national, regional and local delivery of FDI, SME and innovation services, and how to balance national and local priorities. It is recommended that these subnational branches are given the necessary autonomy and resources to tailor their services to the particular needs of their local area, build their own contacts and brands, and lead partnerships with regional and local authorities that may lack the capacity to support local entrepreneurial ecosystems (see next section).

Greater autonomy and tailoring of national policies at the subnational level should however be combined with greater coordination between the SARIO, SBA and SIEA to avoid an inconsistent quality of support or the provision of overlapping services in the regions. As discussed in the previous section, a rationalisation of the Slovak institutional setting at the national level (e.g. through the merger of agencies or joint programming procedures) could help avoid the fragmentation of business development services at the regional and local levels too.

Figure 4.3. Number of agency offices across Slovak regions in relation to their business population, innovation (R&D) intensity and EU funding support

Source: EC/OECD Survey on Policies enabling FDI spillovers to domestic SMEs (2021), and OECD regional statistics database (accessed on 3 November 2021), http://dx.doi.org/10.1787/region-data-en.

Subnational governments have been given substantial responsibilities, but often lack the capacity and own resources to support local FDI-SME ecosystems

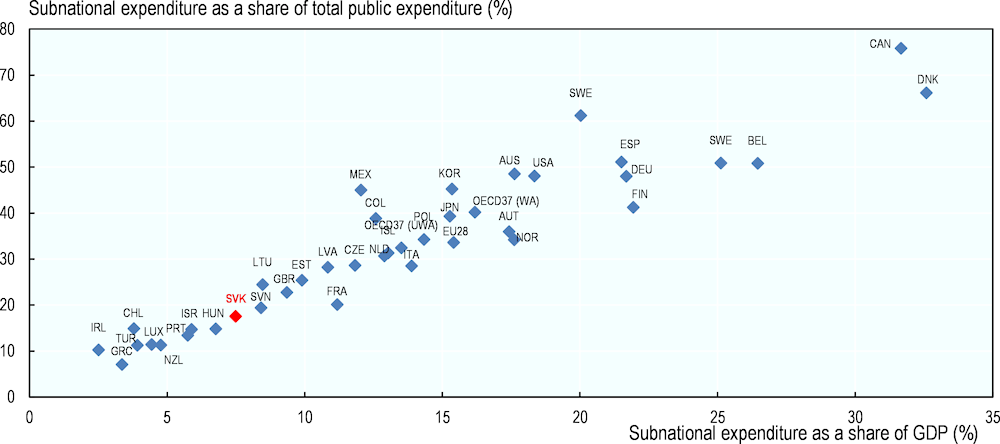

The Slovak Republic has two subnational tiers of government consisting of 8 self-governing regions and 2927 municipalities (OECD/UCLG, 2019[6]). Decentralisation reforms introduced since the early 2000s have given regional and municipal authorities substantial powers and responsibilities in several policy areas affecting business enterprises, such as regulatory procedures for starting a new business, compliance and enforcement of subnational taxes, building permissions, zoning plans and other permit and licensing decisions.

Overall, municipalities have responsibilities for urban planning, social welfare, environment, primary education and healthcare, public order, supervision of economic activities and tourism (including subnational taxes). Municipalities also play an important role in infrastructure development, particularly in the construction and management of industrial parks, which have been used by the Slovak government to attract FDI and improve the quality of local business environments. Regional authorities, on the other hand, focus on trans-regional cooperation, secondary, professional and vocational education, roads and transport, territorial planning and regional economic development. Regions also actively participate in the design and implementation of regional investment strategies in collaboration with the central government and local authorities. Each region is required to produce a regional integrated territorial strategy (RIUs) to access EU funds provided through the Integrated Regional Operational Programme (OECD, 2019[7]). Regions act as the lead authorities for RIUS preparation and implementation while partnership councils consisting of representatives of municipalities, civil society, government actors and businesses play an oversight role.

Although the decentralisation of responsibilities and competences has been rapid and strong, it has not been always matched with the necessary financial resources, resulting in significant financing gaps in the implementation of local development strategies. The Slovak Republic remains one of the most centralised OECD countries in terms of subnational expenditure and tax revenue (OECD, 2020[8]). In 2019, 17.5% of total public investment was carried out by subnational governments compared to an OECD average of 40% (Figure 4.4). Over the past decade, efforts have been made to strengthen the capacities of local governments to raise own-source revenue. The 2005 Act on Local Financing and 2014 ESO Programme aimed to make local governments financially autonomous and more efficient by raising subnational taxes, reducing central government transfers and improving public service delivery to citizens at the local level.

Despite these reforms, nearly 70% of regional and municipal budgets still come from national transfers or grants. EU funds constitute another source of revenue as many operational programmes include activities related to municipal life. However, the absorption rate of EU funds varies with smaller municipalities not having the necessary resources to apply for and benefit from EU funding. In fact, the revenue-raising power, spending efficiency and overall capacity of subnational authorities to effectively design and implement tailored policy approaches are limited by their small size. The Slovak Republic has the second smallest municipalities in the OECD area, with an average of just over 1800 inhabitants per local government area (OECD, 2021[9]).

The high level of decentralisation and the fragmentation of local territorial units in terms of mandates and responsibilities have created different operating environments for businesses across the country (OECD, 2020[8]). The Slovak government has tried to address these issues by promoting the establishment of joint municipal offices (JMOs), which serve as administrative offices for municipalities to ensure transferred competencies. More than 230 JMOs currently operate across the country while several inter-municipal legal entities have been established to take advantage of the economies of scale in delivering public services (Klimovsky and Nemec, 2021[10]). However, such cooperation is voluntary and focuses primarily on administrative matters rather than broader business support services, investment attraction and innovation promotion activities. Moreover, recent evidence on the effectiveness of inter-municipal cooperation on the management of construction and territorial planning issues (including industrial parks) in the Nitra region found that joint municipal offices are less efficient than offices serving a single municipality (Fandel et al., 2019[11]) – pointing towards potential organisational capacity gaps even when resources are pulled together.

In order to improve the implementation of decentralisation reforms, the Slovak Republic could focus on further strengthening the financial and organisational capacities of subnational authorities. As highlighted in the previous section, the regional branches of the main national government agencies could partner with local authorities to help them participate in EU-funded policy initiatives, diversify their sources of revenue (e.g. EU funding), and provide complementary services to local FDI-SME ecosystems that fall under their responsibility. Although such collaboration already exists in large cities and towns, more efficiencies could likely be found through enhanced cooperation and overall coordination mechanisms among municipalities at the local level. The OECD 2020 Regulatory Review of the Slovak Republic suggests the establishment of a forum to share best practices among subnational authorities and promote the involvement of small municipalities in the development of territorially-specific policies on investment promotion, innovation and SME development (OECD, 2020[8]). The recently established Ministry of Investments, Regional Development and Informatisation could play a leading role in the establishment of such a forum and encourage synergies among subnational actors. Funding the responsibilities that are transferred to subnational authorities adequately will be also fundamental to improve multilevel governance.

Incentives for inter-municipal co-operation could be also provided to encourage synergies beyond administrative and licensing procedures. For instance, Slovenia, introduced a set of financial incentives in 2005 to encourage inter-municipal cooperation by reimbursing 50% of staff costs of joint management bodies – leading to a notable rise in the number of such entities (OECD, 2021[12]). In the Autonomous Community of Galicia in Spain, projects that involve several municipalities get priority for regional funds while in Italy the government established financial incentives for municipal mergers and unions of municipalities. Recent decentralisation efforts in Portugal have led to the transfer of new powers to Inter-municipal Communities (CIMs), including on investment attraction (OECD, 2022[13]), while in France an experimental scheme called “city-countryside reciprocity contracts” has led to territorial partnerships for the implementation of joint initiatives for economic development (e.g. joint promotion of the territory, development of territorial strategies, land use policies and support for business) (OECD, 2021[14]). The Slovak Republic could leverage the existing horizontal cooperation means such as the JMOs to provide incentives for inter-municipal cooperation on investment promotion and SME development.

Figure 4.4. The Slovak subnational government expenditure is among the lowest in the OECD

Source: OECD regional statistics database (accessed on 3 November 2021), http://dx.doi.org/10.1787/region-data-en.

4.3. Policy coordination across institutions and tiers of government

Actions to improve the impact of FDI on the productivity and innovation of domestic SMEs need to be aligned with the objectives and priorities set by the government across different policy areas. This often entails cooperating with a number of government institutions dealing with FDI attraction, promotion and facilitation as well as SME development, innovation and internationalisation, and maintaining very strong ties with institutions operating at national and subnational levels (Box 4.2).

Policy coordination has been a major challenge for the Slovak public administration and a root cause of many delayed or postponed policy reforms. According to the 2020 Sustainable Governance Indicators (SGI), the Slovak Republic has a weak performance with regard to inter-ministerial coordination, ranking 38th out of 41 countries behind most OECD and EU economies (Kneuer, Malova and Bonker, 2020[15]). The fragmentation of the policy delivery system, overly bureaucratic governance arrangements, the lack of sufficient financial and human resources, and rigid administrative and programme rules are considered to be the key factors undermining the government’s strategic planning capacity and coordination across levels of government. Overall, informal coordination plays a significant role, but also undermines efforts to establish formal communication channels between ministries and other bodies of the central government, leading to several coordination crises. The role of the centre of government – the Government Office of the Slovak Republic, which is headed by the Prime Minister – has been strengthened in recent years in an effort to improve collaboration among line ministries. However, given the large number of public actors involved in policy design and implementation, collaboration remains challenging.

High-level government councils are generally proactive about bringing together different line Ministries, but fulfilling their coordinating role remains challenging

The Slovak Republic has a well-developed network of high-level government bodies to ensure horizontal policy coordination. Several advisory councils are in place bringing together the Prime Minister’s office, line ministries, implementing agencies, and regional and local governments to identify priority areas where cross-ministerial policy planning and decision-making is necessary. Some of these councils are also responsible for the overall coordination, monitoring and evaluation of national strategies while others have been given broader mandates to foster policy dialogue, convene stakeholders and issue opinions on policy and legislative initiatives (Figure 4.1).

The Council for Science, Technology and Innovation (CSTI) plays an advisory and coordinating role on innovation and smart specialisation policies. Chaired by the Minister of Investments, Regional Development and Informatisation, it brings together the Ministry of Education, Science, Research and Sports, the Ministry of Economy, the Ministry of Foreign and European Affairs, and implementing agencies (i.e. SIEA, SRDA, RA) with representatives from the Slovak Academy of Sciences, business associations, employers’ organisations and academic institutions. Since 2017, the Council oversees the implementation of the National Strategy for Smart Specialisation through a standing committee, which coordinates government decisions on research and innovation alongside monitoring and evaluating policy actions that fall under the smart specialisation domains.

The Council for Export and Investment Promotion (CEIP) advises the Slovak government on international investment and trade and ensures coordination between the Prime Minister’s office, the Council of Ministers and other parts of government that focus on issues affecting the internationalisation of the Slovak economy. The Council is chaired by the Minister of Foreign and European Affairs and the Minister of Economy, and includes representatives from government agencies (i.e. SARIO, SBA), public development banks, the Slovak Chamber of Commerce and Industry, employers’ organisations, trade unions and SME associations.

High-level policy coordination on regional and territorial development issues is ensured primarily through the Council for the 2030 Agenda for Sustainable Development. Alongside monitoring progress in achieving the Sustainable Development Goals (SDGs), the Council is tasked with monitoring and evaluating the National Strategy for Regional and Territorial Development. Since 2019, the Council for Cohesion Policy 2021-2027 has also been established to coordinate the implementation of the Partnership Agreement between the European Commission and the Slovak Republic, which sets the strategic objectives and policy priorities that will guide the allocation of the EU Structural and Investment Funds for the period 2021-2027. The Council gathers representatives from all the Slovak ministries, regional and local governments as well as the private sector. Central to the coordinating role of the Council is its mandate to promote multilevel governance and ensure policy coherence at the national, regional and local levels.

The National Productivity Council (NPC) is responsible for monitoring, analysing and assessing the productivity and competitiveness of the Slovak Republic, covering issues related to innovation, FDI promotion, business environment, education and the effectiveness of the public sector. The council brings together representatives from several Ministry departments (e.g. Ministry of Finance, Ministry of Education, Ministry of Economy, Ministry of Labour) and is chaired by the Director of the Government Office (i.e. the Slovak Republic’s centre-of-government institution). Despite the number of Ministries involved, the council focuses primarily on providing analytical and advisory services – such as conducting independent analyses and preparing an annual report – and less so on coordinating the formulation and implementation of government policies.

The councils meet regularly and have been generally effective in mobilising different parts of the public administration to discuss policy issues deemed as a priority for the Slovak government. The agendas, minutes, conclusions and monitoring reports of their meetings are also made public to ensure transparency. Since its establishment in 2012, the CEIP has met 24 times with members approving 133 documents and adopting more than 150 conclusions on issues affecting the internationalisation of the Slovak economy (Government of the Slovak Republic, 2020[16]). Similarly, more than 20 meetings have taken place among CSTI members, with recent discussions focusing on the update of the national smart specialisation strategy, and proposals on key measures to enhance the innovation performance and competitiveness of the Slovak economy.

The institutional framework appears, however, to lack an overarching body to coordinate cross-ministerial efforts horizontally across the investment, SME, innovation and regional development policy areas. This is illustrated by the membership of the councils, which do not foster horizontal links among implementing agencies. For instance, government agencies responsible for investment promotion and SME development, namely the SBA and SARIO, are not members of the CSTI. Similarly, innovation-focused agencies such as the SIEA, SRDA and RA do not participate in the CEIP meetings. The Slovak government could consider broadening the membership of existing Councils to ensure that implementing agencies from across the FDI-SME diffusion policy areas are involved in strategic policy discussions at the highest level. Alternatively, a consolidation of the current setting could be envisaged through the merger of certain Councils. The Slovak government has recently put forward a legislative proposal for the creation of a Council on Competitiveness and Productivity with a broader remit (i.e. namely covering investment, exports, innovation, business environment, productivity and competitiveness issues), which would merge and replace certain councils, including the CEIP and the NPC. However, no decision has been taken on its establishment yet. If composed of all relevant government institutions and entrusted with sufficient financial and human resources, such a Council could facilitate inter-institutional coordination and strengthen synergies and momentum behind the FDI-SME diffusion policy agenda.

The competences of the councils are also not always aligned with the tasks entrusted to them, leading to bottlenecks in coordination and weak enforcement of collective decisions. Although the CSTI has been the main government body responsible for the management of the R&D&I system in general, and the smart specialisation strategy in particular, it does not have legislatively defined powers to enforce its decisions on individual ministries. The lack of clarity on the role and responsibilities of CSTI members has caused tension and disagreements between line ministries, leading to delays in decision-making and approval processes, and the cancelation of many innovation funding schemes (OECD, 2021[17]). These administrative inefficiencies are reflected in the rather limited use of EU funds to finance research and innovation activities; in fact, the Slovak Republic ranks amongst the EU Member States with the lowest absorption rate (approximately 46%) for the period 2014-2020 (European Commission, 2021[18]).

Box 4.2. Policy coordination: principles, instruments and benchmarking

Coordination occurs when decisions made in one programme or organisation consider those made in others and attempt to avoid conflict (negative coordination) or seek to cooperate on solutions that can benefit all the organisations and their clients (positive coordination) (Scharpf, 1994[19]). Strategic coordination involves the coordination of programmes around broad strategic goals of government, such as the SDGs (Peters, 2018[20]). Co-ordination relies upon a mix of interactions, with both vertical and horizontal aspects, the former referring to co-ordination between a ministry and its delivery agencies, and the latter covering for instance inter-ministry relations (OECD, 2012[21]). Co-ordination can be fostered at different points in the policy cycle, from policy design to implementation to evaluation.

Metcalfe (1994[22]) proposes a policy coordination scale as a method for comparing coordination capacities in governments. The components of policy coordination capacity are cumulative in the sense that higher-level coordination functions depend on the existence and reliability of the lower ones. From almost total independence of programmes (1) to very close policy integration (9): (1) Independent Decision-Making by Ministers; (2) Communication with other Ministers (Information Exchange); (3) Consultation with other Ministers (Feedback); (4) Avoiding Divergences Among Ministers; (5) Search for Agreement Among Ministers; (6) Arbitration of Policy Differences; (7) Setting Limits on Ministerial Action; (8) Establishing Central Priorities; and (9) Government Strategy.

Instruments of co-ordination can be based on regulation, incentives, norms and information sharing. They can be top-down and rely upon the authority of a lead actor or bottom-up and emergent (Peters, 2018[20]). They include (OECD, 2012[21]):

National strategies and action plans typically involve wide consultation and deliberation, provide diagnostic overviews of what the strengths-weaknesses-opportunities-threats of an SME/innovation/local ecosystem could be, and set a shared vision of the goals pursued.

Closely related, policy evaluations and reviews are a source of strategic intelligence, and a means for promoting greater co-ordination.

Dedicated agencies or ministries assume the leadership of the national policy agenda in some policy domains (e.g. FDI/SME/innovation/regional) and often have responsibility of coordination. At the same time, inter-agency joint programming can facilitate co-ordination and other aspects of governance as agencies share agenda and action.

The Centre of government (CoG), e.g. the President's or Prime Minister's Office, can bridge interests and bureaucratic boundaries. High-level policy councils, can also deal with aspects of policy coordination although they often have variable roles and composition across countries.

Finally, informal channels of communication between officials or job circulation (of civil servants, but also experts and stakeholders) can play a role and suggest a relatively well-developed culture of inter-agency trust and communication.

Although coordination is a fundamental and longstanding problem for public administration and policy, there is still no standardised method for approaching related issues, and much of the success or failure of attempts to coordinate appears to depend upon context (Peters, 2018[20]). Coordination approaches and instruments need to be matched to circumstances, so does the need to coordinate across countries and policy areas. Some policy domains may work well with minimal attempts to coordinate with others, but others may require substantial policy integration and coordination. Likewise, some political systems may emphasise coordination and governance more strongly than others (Hayward and Wright, 2002[23]).

The Slovak government could consider clarifying the role and responsibilities of the CSTI and equip it with the necessary human and financial resources to ensure efficient cross-ministerial coordination. The establishment of an executive secretariat could strengthen its capacity to coordinate whole-of-government policy-setting exercises, such as those required for the EU’s smart specialisation framework. Involving the centre of government (CoG), e.g. the Government Office of the Slovak Republic, in the management of the executive secretariat could also help bridge bureaucratic boundaries across ministries and improve the enforcement of policy decisions. In recent years, due to the rise of multi-dimensional issues, many OECD governments have strengthened the role that the CoG plays in aligning cross-ministerial workplans throughout the policy cycle, including across the FDI-SME diffusion policy areas (OECD, 2018[24]). Improving the efficiency of the CSTI is a key objective outlined in the Slovak Republic’s 2020-2030 Recovery and Resilience Plan, which lays out the country’s national priorities for the use of the Next Generation EU fund, the EU’s landmark financial instrument for recovery from the COVID19 pandemic. As the country enters a new policy cycle, the implementation of these reforms will require increased attention on resolving bottlenecks in the implementation of innovation policies across ministries and tiers of government.

Synergies for implementing the FDI-SME diffusion policy agenda could be strengthened through dedicated national strategies on innovation and SME policy

National strategies and action plans can be important instruments for policy coordination as they are crosscutting in nature and often require whole-of-government responses to ensure their effective implementation. In the Slovak Republic, several strategic documents have been adopted in recent years to articulate priorities in FDI-SME diffusion policy areas (Table 4.4). The Strategy of Foreign Economic Relations 2014-2020 has been the main strategic document guiding policy action on investment promotion and the internationalisation of the Slovak economy (Government of the Slovak Republic, 2019[25]). The Ministry of Economy and the Ministry of Foreign Affairs have been jointly coordinating its implementation together with other members of the Council for Export and Investment Promotion, mainly SARIO and the Slovak Export-Import Bank (Eximbanka). However, following its expiration in 2020, the strategy has not yet been renewed, potentially undermining policy continuity and the alignment of resources and strategic priorities with regard to investment promotion.

The Smart Specialisation Strategy (RIS3 SK) has served as the country’s national strategy for innovation policy, under the aegis of the CSTI and with the SIEA and RA serving as managing authorities (Government of the Slovak Republic, 2013[26]). Although the strategy provides a comprehensive needs assessment of the Slovak innovation ecosystem and a list of priorities for public action, its scope focuses primarily on economic specialisation domains, and is therefore rather narrow in terms of serving as a comprehensive innovation strategy. Τhe bureaucratic RIS3 governance framework described in the previous section, coupled with burdensome administrative procedures and public procurement rules, have made the formulation and implementation of innovation policies complex and difficult. Consequently, many strategic reforms envisaged in the strategy such as the merge of R&D&I government agencies and the increase of financial support for applied research, have been cancelled or postponed.

As the Slovak Republic enters a new policy cycle, challenges relating to the governance framework for innovation policy need to be addressed. Beyond the establishment of an executive secretariat within the CSTI to streamline cross-ministerial procedures relating to the smart specialisation framework, the Slovak Republic could benefit from a dedicated national strategy for innovation policy. As part of the reforms outlined in its Recovery and Resilience Plan, the Slovak government is currently developing a national strategy, which is expected to be finalised at the end of 2022. Such a strategic document would allow to create an integrated vision across government that goes beyond the EU’s programming and funding conditionalities, and includes quantifiable targets, policy pillars (e.g. innovation-oriented FDI, SME innovation, access to skills, HEIs reform), related programme actions, and clearly defined roles for all the institutions involved in its implementation. A dedicated national strategy would also allow to pool together additional own resources for SME innovation activities and complement EU funds with contributions from the state budget, which have been historically low compared to other peer countries.

A similar approach could be pursued on SME and entrepreneurship policy, which is currently not guided by a clear, overarching and comprehensive strategic framework. The RIS3 strategy includes a brief SME diagnostic section, outlining policy objectives to improve the innovation performance and absorptive capacities of SMEs, including through linkages with large multinational enterprises in key sectors; but it falls short of setting long-term strategic objectives for the development of the SME&E ecosystem and defining the role and responsibilities of the various policy delivery actors. SME considerations are also mainstreamed in other national strategic frameworks, including the Digital Transformation Strategy and the Regional Development Strategy. Although the mainstreaming of SME issues is a common practice in EU and OECD countries (OECD, 2019[27]), having a dedicated national strategy will help the Slovak Republic pull resources from different parts of the government and facilitate coordination within the currently fragmented system.

Identifying policy priorities, clear-cut targets and effective governance arrangements for the innovation and SME policy areas would be a pre-condition for more targeted action on strengthening FDI-SME linkages and spillovers. The Slovak government should consider mainstreaming the issue of FDI-SME spillovers into these national strategies (e.g. by including a dedicated chapter on this topic, specific objectives, indicators and a short-term action plan) and ensure that the role of each government institution is clearly articulated.

Table 4.4. National strategic frameworks in the Slovak Republic

|

Strategic frameworks |

Timeframe |

Description |

Responsible institutions |

|---|---|---|---|

|

Research and Innovation Strategy for Smart Specialisation |

2014-2020 |

The strategy, which is currently in the process of renewal for 2021-2027, focused on four key areas of economic specialisation: (1) Automotive and mechanical engineering industries; (2) Consumer electronics and electrical equipment; (3) Information and communication technologies and services, and (4) Production and processing of iron and steel. |

CSTI, Ministry of Economy, Ministry of Education, Science, Research & Sport, SIEA, RA |

|

Strategy and action plan for the digital transformation of the Slovak Republic |

2019-2030 |

It defines the policy and particular priorities of the Slovak Republic for the digital transformation of economy and society, focusing on three pillars: 1) human resources (digitally skilled labour); 2) infrastructure (technologies, digital solutions and systems); 3) regulatory framework (legislative rules) |

Ministry of Investments, Reg. Development & Informatisation |

|

Strategy of labour mobility of foreigners |

2018-2030 |

It is the first Slovak strategic document setting out priorities to improve the regulated mobility of foreigners within the Slovak labour market, focusing on new technologies and changes on the labour market, demographic developments, sustainable economic growth, and the integration of foreigners at the local level. |

Ministry of Labour, Social Affairs and Family |

|

Strategy of foreign economic relations of the Slovak Republic |

2014-2020 |

It sets out policy priorities and measures to improve the internationalisation of Slovak firms and the attraction of foreign direct investment, focusing on four main areas: 1) export promotion instruments; 2) investment promotion tools; 3) measures to support cooperation with foreign countries on innovation issues; 4) and measures to improve the Slovak Republic’s brand abroad. |

CEIP, Ministry of Economy, Ministry of Foreign and European Affairs |

|

Vision and Development Strategy of the Slovak Republic |

2020-2030 |

The document directs the Slovak Republic’s regional and territorial development policy to 2030 and enable the co-ordination and implementation of relevant policies at regional and sub-regional levels. |

Ministry of Investments, Reg. Development & Informatisation |

Source: OECD elaboration based on national strategic documents.

Policy coordination among implementing agencies is not frequent and takes place either informally or in a centralised manner through line ministries

Beyond high-level strategic coordination, inter-institutional collaboration for the implementation of policy initiatives is limited and takes place either informally or in a centralised manner through line Ministries. Interaction among the SBA, SARIO and SIEA is not frequent and usually takes place through the Ministry of Economy. The latter has established a Working Group to monitor the implementation of the EU’s Small Business Act for Europe (SBA) Principles, with the participation of SBA and several other ministries. Ad hoc working groups for new legislative initiatives are also often established within ministries bringing together implementing agencies and ministry departments to provide inputs and ensure policy alignment (Table 4.6). However, interviews conducted among agency staff show that coordination through the Ministry of Economy (and the Ministry of Education, Science, Research and Sport in the case of the SRDA and RA) takes place mostly on an ad hoc basis through informal meetings and at the top management level, thereby not involving a regular exchange of information on supported clients and new workstreams.

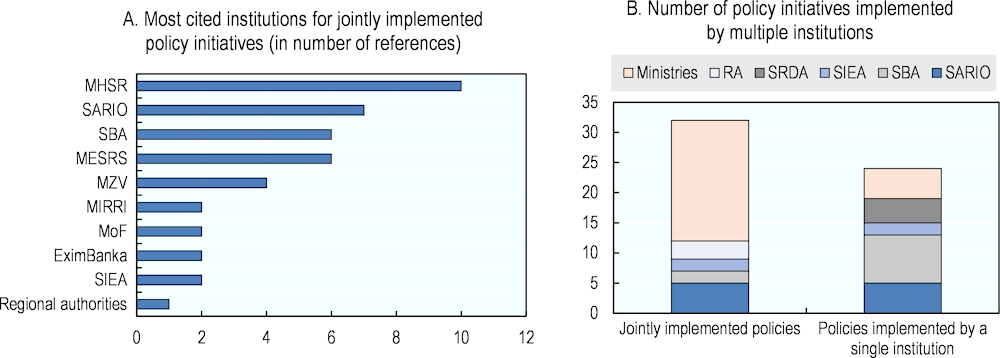

The limited degree of inter-agency interaction is also reflected in the relatively modest number of jointly implemented policy initiatives and the absence of joint programming procedures. Although the majority of Slovak policies involve some type of collaboration with other government entities, this is more common for national strategies and policies administered directly by Ministries rather than implementing agencies (Figure 4.5). In most cases, inter-agency collaboration is limited to the implementation of a few programmes financed by the EU Structural and Investment Funds. For instance, SARIO and SBA have partnered for the implementation of the National Project “Support for the internationalisation of SMEs”. SBA has been also collaborating with the Slovak Centre of Scientific and Technical Information (SCSTI), a public national information centre involved in innovation and R&D support schemes, to establish National Business Centres in Slovak regions with the support of the EU-funded Operational Programme for Integrated Infrastructure.

Figure 4.5. Collaborative policy design and implementation in the Slovak Republic

Note: MHSR: Ministry of Economy; SARIO: Slovak Investment and Trade Agency; SBA: Slovak Business Agency; MESRS: Ministry of Education, Science, Research and Sport; MZV: Ministry of Foreign and European Affairs; MIRRI: Ministry of Investments, Regional Development and Informatisation; MoF: Ministry of Finance; SIEA: Slovak Investment and Energy Agency

Source: EC/OECD Survey on Policies enabling FDI spillovers to domestic SMEs (2021).

Regional and local governments are also involved in the coordination efforts of Slovak implementing agencies given the latter’s extensive subnational presence (Table 4.5). In recent years, contractual partnership agreements and cooperation protocols have been signed between the SBA’s regional centres and some subnational authorities, often focusing on the operationalisation of national strategies at the local level, the targeting of specific sectors that are most prevalent in regions, or the provision of tailored SME support services. Investment promotion and facilitation services also heavily rely on the coordination efforts of SARIO with local municipalities, which are often responsible for the set-up and operation of industrial parks, the approval of construction permits and the development of local infrastructure. Regular meetings between SARIO and local authorities are organised throughout the year to resolve administrative matters for foreign investors and update SARIO’s database of available locations for investment projects.

Table 4.5. Policy coordination in the Slovak Republic by institution and policy domain

|

Implementing agencies coordinate with… |

Other public institutions |

Across the following policy areas |

||||||

|---|---|---|---|---|---|---|---|---|

|

Centre of government |

Ministries |

Regional and local governments |

Investment policy |

SME policy |

Innovation policy |

Regional development |

||

|

SARIO |

✓ |

✓ |

✓ |

✓ |

||||

|

SBA |

✓ |

✓ |

✓ |

|||||

|

SIEA |

✓ |

✓ |

✓ |

✓ |

✓ |

|||

|

SRDA |

✓ |

✓ |

||||||

|

RA |

✓ |

✓ |

||||||

Source: EC/OECD Survey on Policies enabling FDI spillovers to domestic SMEs (2021).

Table 4.6. Most common coordination instruments used by Slovak institutions

|

Coordination instruments used by: |

Ministries |

Implementing agencies |

||||||

|---|---|---|---|---|---|---|---|---|

|

Ministry of Economy |

POCE Business Centre |

SARIO |

SBA |

SIEA |

SRDA |

RA |

||

|

Laws and regulations |

||||||||

|

Contracts and protocols of cooperation |

||||||||

|

Specific programme rules |

||||||||

|

Inter-institutional coordination bodies |

||||||||

|

Informal channels of communication |

||||||||

|

Joint programming procedures |

||||||||

|

Secondment of experts and civil servants across public institutions |

||||||||

Source: EC/OECD Survey on Policies enabling FDI spillovers to domestic SMEs (2021).

4.4. Evaluation of policy impact and engagement with stakeholders

The Slovak Republic has a well-developed framework for undertaking policy evaluations but ministries and implementing agencies should improve their analytical capacities

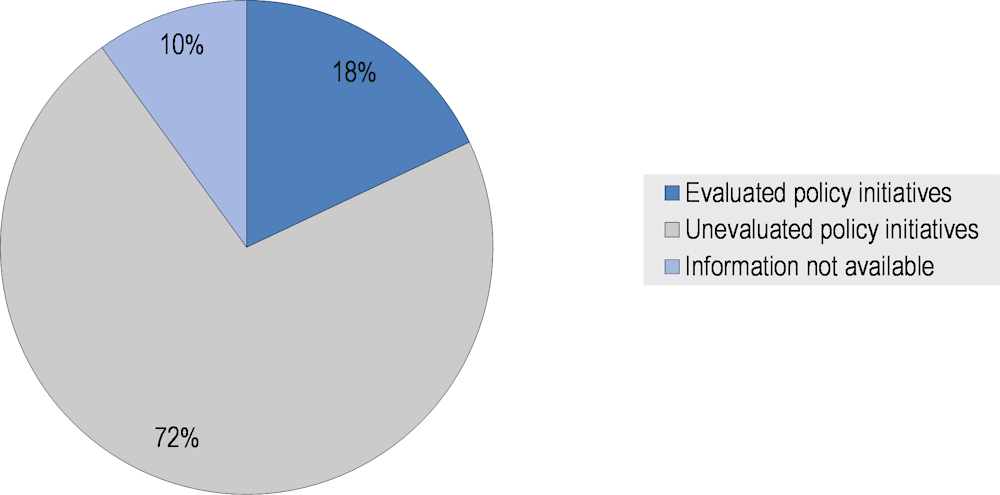

Evaluating the impact of public policy interventions on the domestic economy can help governments identify potential policy gaps and take corrective action to enhance their effectiveness. The adoption and use of monitoring and evaluation (M&E) frameworks by government institutions is particularly important for policy initiatives targeting FDI-SME diffusion, which often requires public action from across different policy areas and therefore enhanced scrutiny to ensure that policy action achieves the expected results. In the Slovak Republic, the use of M&E tools by government institutions is limited. This is reflected in the very small share (18%) of FDI-SME diffusion policy initiatives that have been evaluated (Figure 4.6). Evaluations are undertaken only for policies implemented in the framework of the national smart specialisation strategy (e.g. RA’s financial support scheme for RIS3 projects) and for those funded by the EU Structural and Investment Funds (e.g. SARIO’s National Project for the Internationalisation of SMEs). A notable exception is the Regional Investment Aid Scheme, which is administered by the Ministry of Economy and has been the government’s main state-funded policy instrument to attract FDI in knowledge-intensive and high-tech activities (see Chapter 5 for a discussion on the policy mix).

Figure 4.6. FDI-SME diffusion policies that have been evaluated in the Slovak Republic

Source: EC/OECD Survey on Policies enabling FDI spillovers to domestic SMEs (2021).

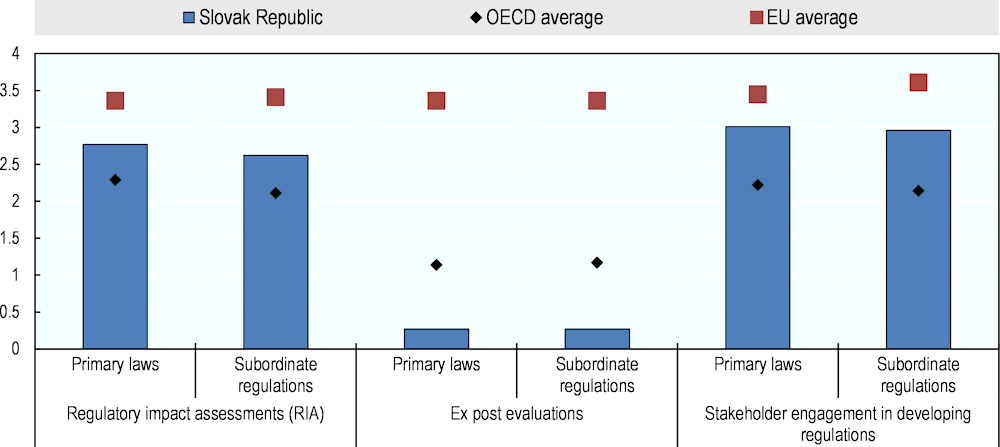

A similar picture emerges when looking at the frequency and quality of ex post evaluations of existing regulations, where the Slovak Republic ranks far below the OECD and EU averages for 2021 according to the OECD Indicators for Regulatory Policy and Governance (Figure 4.7). Proper assessment of outcomes of regulations affecting domestic and foreign firms as well as other economic actors could help policymakers understand their impact over time and ensure that regulations do not stifle their potential to engage in productive and innovative activities. In 2019, the Slovak government pilot-tested a draft methodology introducing a requirement for more comprehensive reviews of existing regulations (OECD, 2021[28]). The publication and operationalisation of the final methodology planned for 2021 could eventually help create a “culture of evaluation” within the Slovak government.

In contrast, regarding regulatory impact assessments (RIA), the country’s performance is significantly better than the OECD average (Figure 4.7). The obligation to conduct RIAs has been in place since 2008 while the recently adopted RIA 2020 Better Regulation Strategy has led to the development of a comprehensive and solid methodology for assessing economic, social and environmental impacts, including a SME Test and impacts on innovation (OECD, 2020[8]). Adopted in 2018, the strategy introduced the obligation to monitor and evaluate progress in the implementation of regulatory reform programmes primarily carried out by the Ministry of Economy, which has been the main national coordinator of better regulation efforts. A RIA Committee has been also established within the ministry to oversee the quality of evaluations and coordinate their implementation across several ministries, the Government Office and the Slovak Business Agency.

Despite these improvements, evaluation processes still lack proper implementation in practice as Slovak ministries struggle with the quantification of wider impacts, focusing mainly on budgetary, procedural and programme implementation issues (OECD, 2021[5]). This is often illustrated in the monitoring frameworks of national strategies and EU funded operational programmes. The indicators included in the Operational Programme Research and Innovation (OP R&I) are primarily output-related (e.g. number of SMEs supported, number of SMEs receiving grants and participating in training programmes), and do not provide for a comprehensive reporting on the impact of the various policy interventions. The systematic use of quantifiable outcome-based indicators and the establishment of robust data tracking tools and feedback processes can ensure that reliable data on impacts are available. In some instances, policymakers may need to develop new indicators or databases to monitor the implementation and impact of a proposed policy or regulation (OECD, 2020[8]). Although the Ministry of Economy and the RIA Committee provide help to ministries to find relevant data and use them for monitoring purposes, ministries often do not have the incentives and resources to undertake data mapping exercises.

Beyond monitoring practices, the implementation of policy evaluations crucially hinges on the administrative and analytical capacities of key ministries and government bodies. Many ministries have established analytical units with responsibility to conduct policy analysis, undertake impact assessments and provide their input for the development of new laws. These specialised units could theoretically play an active role in ex ante and ex post evaluations; in practice, however, their professional make-up and capacities vary across ministries. For instance, although the Ministry of Economy is responsible for FDI, SME and innovation policy, the recent evaluation of the Regional Investment Aid Scheme was conducted by the Ministry of Labour, which is one of the providers of the regional investment aid, while the Ministry of Economy was consulted on the analysis and its outcomes. Similarly, the analytical unit of the Ministry of Finance – the Institute for Financial Policy – has been particularly prominent, acting as an “initiator” of key economic and fiscal topics within the Slovak government.

Given existing disparities in capacity, the Slovak Republic could consider appointing one body close to the centre of government – for instance, the Government Office of the Slovak Republic – responsible for coordinating evaluations of integrated impacts, rather than spreading the responsibility across several ministries (OECD, 2021[28]). Outsourcing evaluations to a body close to the centre of government would also ensure that the evaluation process is impartial and independent from the process concerned with policymaking. Such an approach would also benefit from further strengthening the organisational and human resources of the analytical unit of the Ministry of Economy given its crucial role in the implementation of policies fostering FDI spillovers on domestic SMEs. Capacities for analysis could be supported through the provision of specialised training to raise education and awareness of public servants on the process of monitoring and evaluating policy impacts. Continuous training for policymakers in evaluation methods should be also ensured of within the framework of the Better Regulation Strategy and be coupled with clear guidelines and methodologies for different types of ex ante and ex post evaluations.

Figure 4.7. Policy evaluations and stakeholder engagement in the Slovak Republic

Note: The more regulatory practices as advocated in the OECD Recommendation on Regulatory Policy and Governance a country has implemented, the higher its iREG score. The indicators on stakeholder engagement and RIA for primary laws only cover those initiated by the executive (98% of all primary laws in the Slovak Republic).

Source: OECD Indicators of Regulatory Policy and Governance (iREG) 2021, http://oe.cd/ireg.

Similar capacity building efforts should be made at the agency level to strengthen the monitoring capabilities of implementing agencies. Right now, most agencies have specialised units where some basic monitoring information on programme participation is collected. None of SBA’s business advisory programmes have been evaluated yet, while the collection of information on the impact of services provided on the growth and upgrading of domestic firms (e.g. growth of exports, turnover or jobs in supported firms, number of MNE-SME partnerships) is very limited (OECD, 2021[5]). Similarly, SARIO relies on qualitative tools (e.g. client feedback surveys, stakeholder consultations, and benchmark comparisons) to collect information on the effectiveness of their activities, which does not always allow to gather granular data for more quantitative evaluations such as cost-benefit analyses of assisted investment projects. Qualitative evaluations often provide partial information and incomplete or ambiguous results, and should ideally be complemented by more quantitative and systematic approaches, whenever possible (OECD, 2018[29]). SIEA’s analytical capacities have improved, on the other hand, since the implementation of the Inovujme.sk national project, which includes a foresight component focusing on evaluating the innovation performance of the Slovak economy and collecting data on the impact of project activities. SIEA’s analytical unit and SBA’s Better Regulation Centre also carry out periodic surveys of SMEs for evidence-based input on their operating challenges and the use of government support programmes. Further strengthening internal monitoring competences at the agency level will be crucial for ex ante and ex post evaluations to take place by relevant ministries.

The Slovak Republic has a well-established practice of consulting with business and other stakeholders on legislative proposals and national policy frameworks

Good practice in the design and implementation of policies enabling FDI-SME spillovers includes effective mechanisms for stakeholder consultations, such as with foreign investors, local SMEs and other actors of the national innovation system. Through formal and informal deliberative processes, government bodies can understand the challenges and expectations of foreign and domestic firms, receive feedback on the relevance of their policy programmes and enrich policymaking processes with insights from various stakeholders. The Slovak Republic has recently made significant progress in the use of deliberative processes to receive feedback on prospective laws, regulatory proposals and other national strategic documents. In 2021, it had the fourth best performance out of 34 OECD countries on engaging stakeholders in the development of primary laws and subordinate regulations according to the OECD Indicators for Regulatory Policy and Governance (Figure 4.7).

Rules for stakeholder engagement were first enacted in 2014 as a non-binding recommendation of the government, and their implementation was subsequently strengthened through the introduction of additional provisions and guidance in the framework of the RIA 2020 – Better Regulation Strategy (OECD, 2020[8]). The good performance of the Slovak Republic in the area of stakeholder engagement comes from the introduction of a standardised public consultation procedure, which involves a requirement to undertake early-stage consultations of all legislative proposals and their impact assessments through the governmental portal www.slov-lex.sk. The portal serves as a single access point for comments on legislative and non-legislative drafts, including concept notes, white papers, and other strategic documents. When a new legislative initiative is posted, the general public has four weeks to submit their comments, and ministries are obliged to provide written feedback, including indicating whether comments have been accepted, rejected or partly addressed with the corresponding reasoning for the decision (OECD, 2021[28]). Beyond the portal, the Ministry of Economy also manages a list of business entities who have expressed interest in participating in consultations for policy initiatives that directly affect the business environment. When a proposal touches upon a relevant policy area, the Ministry of Economy forwards the information to the businesses included in the list, who can then engage in the process of drafting the regulation, including through meetings with regulators.

In recent years, several public consultations have also been organised for the update or renewal of national strategies. Several online workshops were organised in 2019-2020 for the update of the National Smart Specialisation Strategy and the formulation of the Recovery and Resilience Strategy, which lays out the country’s national priorities for the use of the Next Generation EU fund, the EU’s landmark financial instrument for recovery from the Covid-19 pandemic. Most of these public dialogue events were organised by high-level government councils (such as the Council for Science, Technology and Innovation, the Council for Export and Investment Promotion and the Council for Cohesion Policy). As mentioned in the previous section, representatives from academia, employer organisations and business associations make up their membership alongside line ministries and other government bodies, allowing for regular input to legislative and policy initiatives. Beyond participation in high-level councils, business stakeholders and other industry experts are often invited to participate in working groups established by ministries responsible for drafting a new law or regulation.

At the agency level, engagement with local SMEs and foreign investors takes place either informally through interactions when businesses participate in government support programmes, or in a more structured way through the organisation of stakeholder events and the launch of online surveys. SBA’s Better Regulation Centre, which was established in 2015 to monitor and explore ways to address the disproportionate regulatory burden on Slovak SMEs, has played a crucial role in organising and undertaking consultations on legislative and non-legislative initiatives involving SMEs. SBA’s role in stakeholder engagement is also facilitated by its dual public-private governance model, with various business associations (i.e. Slovak Entrepreneurs Association, Slovak Craft Industry Federation) participating in the agency’s management board and having an active role in shaping the scope of its activities. Similarly, SIEA’s innovation support programmes increasingly include deliberative processes involving business enterprises and other actors of the national innovation system. For instance, in 2020, a working group consisting of representatives of industrial cluster organisations participated in the preparation of a new financial support scheme together with representatives from SIEA and the Ministry of Economy. SARIO, on the other hand, relies on direct contact with foreign investors to receive feedback on their investment facilitation and aftercare services, including through the organisation of meetings, events and surveys.