This chapter presents a discussion on how shareholders may exercise their rights on sustainability-related matters and it reviews how shareholders and stakeholders have been influencing management to incorporate these matters into their decision‑making processes. It also provides evidence from the OECD survey of asset managers investing in Brazil on their engagement methods with companies in relation to ESG risks and opportunities, and on their willingness to file an ESG-related shareholder resolution in Brazil.

Sustainability Policies and Practices for Corporate Governance in Brazil

7. Shareholders

Abstract

Shareholders’ engagement

With respect to a corporation’s objective and its responsiveness to environmental and social trends, shareholders and other stakeholders commonly have three fora where they may influence or compel managers to incorporate climate change risks into their business decision-making processes: in direct dialogue with directors and key executives, in a shareholders’ meeting and in courts (OECD, 2022, pp. 26-29[1]).

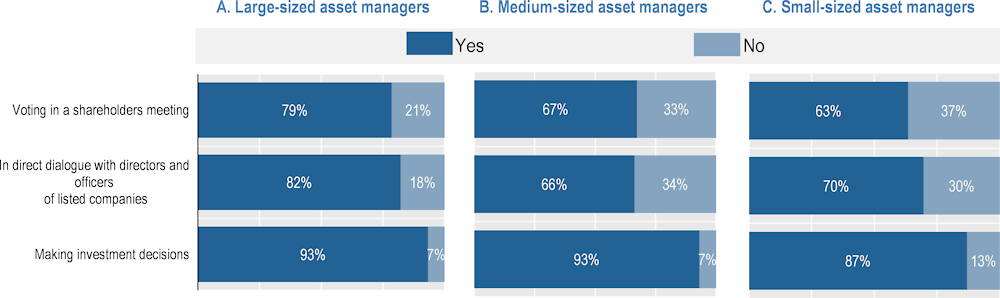

Direct dialogue between shareholders and management can take many forms. The initial engagement would typically take place in private meetings and correspondence, but it could escalate to public letters, proxy contests, complaints to a securities regulator and lawsuits. An individual shareholder may engage independently with a company’s management or a shareholder may choose to co‑ordinate efforts with others (e.g. Climate Action 100+ mentioned in Chapter 3 has regionally focused working groups). Despite some differences in their engagement methods, ESG risks and opportunities are currently a great concern to asset managers investing in Brazil (Figure 7.1).

Figure 7.1. ESG risks and opportunities affect your decisions when…

Note: In the survey questionnaire, asset managers could answer “yes”, “no” or leave each interaction type unanswered. The shares in this table consider only the universe of companies that answered either “yes” or “no”, which is slightly different for each one of the interaction type. For instance, 60 large‑sized asset managers provided an answer related to “Voting in a shareholders meeting”, while only 56 of them answered with respect to the topic “Making investment decisions”. Overall, on average 97% of the asset managers responded with respected to all of the interaction types.

Source: OECD Survey on Sustainability Practices of Asset Managers Investing in Brazil.

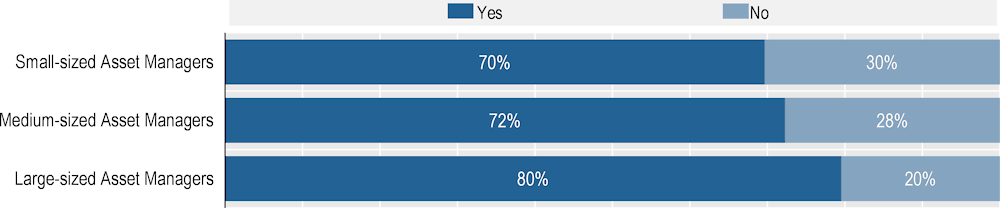

In shareholder meetings, shareholders may typically propose a resolution requiring a change in corporate policy, change the composition of the board or even alter a company’s articles of association. As presented in Table 4.2, there were 35 ESG-related shareholder resolutions (five of them involving climate change) among 46 Brazilian public companies in the period from 2019 to 2021. Likewise, a large majority of asset managers investing in Brazil mentioned they would consider filing or co-filing an ESG-related shareholder resolution in the country (see figure below).

Figure 7.2. Asset managers’ willingness to file an ESG-related shareholder resolution in Brazil

Note: In the survey questionnaire, asset managers could answer “yes”, “no” or leave this question unanswered. The shares in this table consider only the universe of asset managers that answered either “yes” or “no”. On average 75% of the asset managers responded within each size category.

Source: OECD Survey on Sustainability Practices of Asset Managers Investing in Brazil.

Shareholders’ proposals are often focused on specific issues and they demand relatively short-term action from management such as developing a report or a strategy, however shareholders may also propose amendments to a company’s articles of association with broader and longer-term consequences. Applicable company law will evidently affect shareholders’ alternatives and needs, but, for instance, articles of association may require a long-term view from management or even explicitly allow executives’ consideration of non-shareholder interests irrespective of their effect on shareholders’ wealth. For example, Brazilian consumer good Grupo SOMA’s articles of association provide the company “shall consider: the short and long-term interests of the company and its shareholders; the economic, social, environmental and legal short and long-term effect of the company’s operations on its active employees, suppliers, consumers and other creditors of the company and its subsidiaries, as well as the company’s relationship with the community where it operates locally and globally” (article three, single paragraph).

Meaningfully diverting a company from a profit-making goal would, however, create a number of challenges, some of which are further covered in this report. That is why some jurisdictions have amended their legislation with the aim to offer a legal structure fit for for-profit corporations willing to adopt objectives other than simply maximising long-term profits, while allowing shareholders to retain the same degree of control of corporate decision-making, such as electing directors and amending the articles of association. This is the case of the public benefit corporations (“PBC”) in Delaware and sociétés à mission in France (OECD, 2022, pp. 27-28[1]).

In some cases, stakeholders may decide a lawsuit is the best or only solution to a disagreement with a company’s management. It may be either because a company’s management was irresponsive to a legitimate request or due to the fact compensation for an irreversible damage is warranted. As a general rule, only shareholders have standing to sue with respect to the violation of directors’ fiduciary duties, but stakeholders may have a number of other grounds to bring a suit against a corporation or its managers (some examples below).

Corporations are defendants in 18 climate change‑related court cases filed globally between May 2020 and May 2021 (14 in the United States and four in other countries).1 Climate‑related corporate litigation has been traditionally focused on major carbon-emitters (there are still 33 ongoing cases worldwide against the largest fossil fuel companies), and applicants have most commonly argued defendants were liable for past contributions to climate change (for instance, municipalities in the United States requesting damages to pay for climate change adaptation). An increasing number of claims, however, have also covered the current fulfilment of fiduciary duties and due diligence obligations by companies and their managers in industries other than oil and gas, and cement (notably pension funds, banks and asset managers as defendants), including claims of insufficient disclosure of climate‑related information, inconsistencies between discourse and action on climate change, and inadequate management of climate risks (Setzer J and Higham C, 2021[2]).

As examples of recent litigation strategies focused on the fulfilment of fiduciary and care duties, a member of an Australian pension fund claimed the fund was not disclosing and managing climate change risks as it would have been required according to broadly defined duties of care and transparency under company and superannuation industry laws. In a settlement in 2020, the fund agreed to report on climate in line with TCFD recommendations and to adopt a net-zero 2050 goal (McVeigh v. REST). In 2021, answering to a suit brought by seven environmental NGOs and more than 17 000 citizens, the District Court of the Hague ordered an oil and gas company based in the Netherlands to reduce its own emissions and its customers’ emissions in accordance with the goals of the Paris Agreement as an obligation derived from the standard of care laid down in the Dutch Civil Code (Milieudefensie et al. v. Royal Dutch Shell) (LSE, 2020[3]).

In Brazil, an event that has given rise to a number of legal proceedings was the rupture of a Vale’s tailings dam in the city of Brumadinho in 2019, which resulted in 270 fatalities and caused extensive property and environmental damage in the region. In addition to some criminal proceedings and public civil actions with claims for damages (settlements so far have an estimated value of USD 7.5 billion), Vale and some of its current and former executives are defendants in a securities class action brought before federal courts in New York that alleges the company made false and misleading statements or omitted to make disclosures concerning the risks of the operations of the Brumadinho dam and the adequacy of the related programs and procedures. Based on similar claims, six arbitrations have been filled before the arbitration chamber of B3 by (i) 385 minority shareholders, (ii) a class association of minority shareholders and (iii) foreign investment funds (alleged estimated losses in these arbitrations vary between USD 360 million and USD 775 million) (Vale, 2022, pp. 21; 173-176[4]). CVM has also initiated an administrative proceeding to assess Vale’s key executives fulfilment of their duty of care in events related to the rupture of the dam in Brumadinho, and the indictment has yet to be evaluated by the Commissioners (CVM, 2019[5]).

Shareholder rights

Corporate and securities laws usually provide – in a language similar to the one adopted by G20/OECD Principle II – that shareholders have the right to “obtain relevant and material information on the corporation on a timely and regular basis”, “elect and remove members of the board”, and “approve or participate in decisions concerning fundamental corporate changes”. As seen in Table 4.2 shareholders have been exercising some of those rights on ESG-related issues, such as requesting a company to substantially reduce Scope 3 GHG emissions. Likewise, global investors managing more than USD 10 trillion and a large majority of asset managers investing in Brazil have reported to be willing to engage with companies on sustainability issues (see, respectively, Table 3.2 and Figure 7.1).

What may not be clear in some jurisdictions and in the G20/OECD Principles are the limits for a majority of shareholders to impose non-financial goals and reporting obligations to companies (especially public ones). Arguably the two rights are closely linked: if the central objective of the corporation is to maximise long-term shareholder value, the relevant information to be disclosed would be focused on what is financially material. However, when the corporation has societal or environmental goals together with the purpose of maximising shareholders’ wealth, both what is financially material and relevant to those chosen non‑financial goals may need to be reported to shareholders.

This section will refer to the discussion on materiality in Chapter 4, and focus on the questions related to the imposition by shareholders of non-financial objectives that would divert a company from the sole purpose of making profits. In any circumstance, the following should be clear: if the fulfilment of a non-shareholder stakeholder’s interest is expected to increase a company’s long-term value, it is beyond doubt that management should be allowed to fulfil such an interest. The hard question – which is the focus of the following paragraphs – is whether a trade‑off between long-term value and stakeholders’ interests may be possible.

Something to consider is that some individuals who are – directly or through investment vehicles2 – shareholders of listed companies are also philanthropists and may have concerns other than their wealth. Even mainstream economic models that assume rational behaviour often recognise that individuals maximise their utility, which may include avoiding an environmental catastrophe, and not strictly their wealth. This begs the question of whether corporations should fulfil their shareholders’ willingness to advance the common good instead of distributing dividends that may be eventually donated by the shareholders to philanthropic institutions (OECD, 2022, pp. 39-41[1])

It is difficult to assess the extent to which individuals would accept a trade‑off between their wealth and public goods. A proxy may be the value of assets under management by philanthropic foundations, which are sometimes linked to controlling shareholders or founders of public companies, in 24 major jurisdictions in all continents: USD 1.5 trillion in assets as of mid‑2010s with an annual average expenditure rate of 10% (Johnson, 2018, pp. 17-20[6]). These assets under management represent only around 1% of the global equity markets, which may signal that individuals’ willingness to accept an exchange of their wealth for public goods is low.

Despite its conceivable small practical relevance as suggested in the paragraph above, it may be argued that corporations could provide some public goods (or reduce a public bad) more cost-effectively than philanthropic institutions. For instance, permits for European companies to emit one ton of CO2 (a proxy of the cost for a company to emit one less ton) reached a record price of USD 71 in August 2021 (Financial Times, 2021[7]) while the cost of capturing CO2 directly in the air (what an independent institution may do) – without even considering the costs of transporting and storing it – was over USD 134 a tonne in 2019 (Baylin-Stern and Berghout, 2021[8]). In many other contexts, however, corporations may not have any clear advantage in advancing the common good when compared to philanthropic institutions, such as if a fossil fuel company were to develop a reforestation project.

In pondering upon the challenges above, a majority of shareholders have the right in some jurisdictions to eventually decide to change a company’s articles of association in order to establish goals other than maximising long-term value. That is exactly what – as detailed above – shareholders may do in Delaware with the PBCs and in France with the sociétés à mission. In those cases, however, some consideration may also be due to the rights of shareholders that opposed the transformation in the purpose of the corporation. After all, in many jurisdictions, shareholders have traditionally had at least a de facto expectation that the main goal of a company is to maximise long-term value. For instance, jurisdictions could consider the advantages and drawbacks of requiring a supermajority to add non-financial goals, or the right for dissenting shareholders to sell their shares back to the corporation at a fair price.

Finally, companies that voluntarily adopt environmental and social goals will face the challenge of making directors and key executives accountable both for their financial and non-financial performance. As previously mentioned in the “directors’ fiduciary duties” subsection in Chapter 6, since the comparison between goals of different natures can be difficult, companies may consider adopting new controls, such as hiring an independent third-party to regularly verify whether management fulfilled its non-financial goals. Governments may even decide to regulate which controls must be adopted in case a company voluntarily assumes non-financial goals in order to protect the interests of retail investors and unsophisticated stakeholders who value the company higher due to its commitment to the environment and society.

References

[8] Baylin-Stern, A. and N. Berghout (2021), Is carbon capture too expensive?, https://www.iea.org/commentaries/is-carbon-capture-too-expensive (accessed on 17 September 2021).

[5] CVM (2019), Informações relativas à Vale S.A. e o rompimento de barragem em Brumadinho, https://www.gov.br/cvm/pt-br/assuntos/noticias/informacoes-relativas-a-vale-sa-e-o-rompimento-de-barragem-em-brumadinho-e4bd47cf845c4b63928e84ae58627453.

[7] Financial Times (2021), Carbon price rises above €60 to set new record, https://www.ft.com/content/c1a78427-f3d5-4b4f-9878-c3e1dffee2ba.

[9] Freshfields (2021), A Legal Framework for Impact.

[6] Johnson, P. (2018), Global Philanthropy Report: perspectives on the global foundation sector, https://cpl.hks.harvard.edu/files/cpl/files/global_philanthropy_report_final_april_2018.pdf.

[3] LSE, G. (ed.) (2020), , https://climate-laws.org/ (accessed on 20 August 2021).

[1] OECD (2022), Climate Change and Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/272d85c3-en.

[2] Setzer J and Higham C (2021), Global trends in climate change litigation: 2021 snapshot, https://www.lse.ac.uk/granthaminstitute/wp-content/uploads/2021/07/Global-trends-in-climate-change-litigation_2021-snapshot.pdf.

[4] Vale (2022), Form 20-F 2021, http://www.vale.com/brasil/EN/investors/information-market/annual-reports/20f/Pages/default.aspx.

Notes

← 1. 40 countries are included in the database (among others, Argentina, Australia, Brazil, Canada, most European countries, India, Indonesia, Japan, Mexico, Pakistan, South Africa and the US) and 13 regional or international jurisdictions. However, due to limitations in data collection (for instance, cases filed in US state courts are not covered), referred numbers may not include every climate case filed in all aforementioned jurisdictions.

← 2. Another layer in this discussion would be whether institutional investors (e.g. pension and mutual funds) would be able to consider non-financial goals of their final beneficiaries. In many developed jurisdictions, institutional investors are permitted (or may even be required in some cases) to integrate ESG issues into their investment decisions and ownership practices with the goal of maximising financial return (Freshfields, 2021[9]). However, pursuing an investment for non-value‑related sustainability reasons would not likely be possible in the absence of a clear mandate from final beneficiaries. For instance, the US Department of Labor holds the view that employee benefit plans’ fiduciaries are not permitted to sacrifice investment return or take on additional investment risk as a means of using plan investments to promote collateral social policy goals (Interpretive Bulletin 2015‑01).