This chapter presents global trends in assets under management by institutional investors taking into account sustainability considerations in their portfolio selection, as well as asset managers’ sustainability-related engagement preferences. The chapter also provides an overview of the responses of asset managers investing in Brazil to the OECD survey on sustainability practices.

Sustainability Policies and Practices for Corporate Governance in Brazil

3. The sustainability practices of investors

Abstract

Investors perspectives

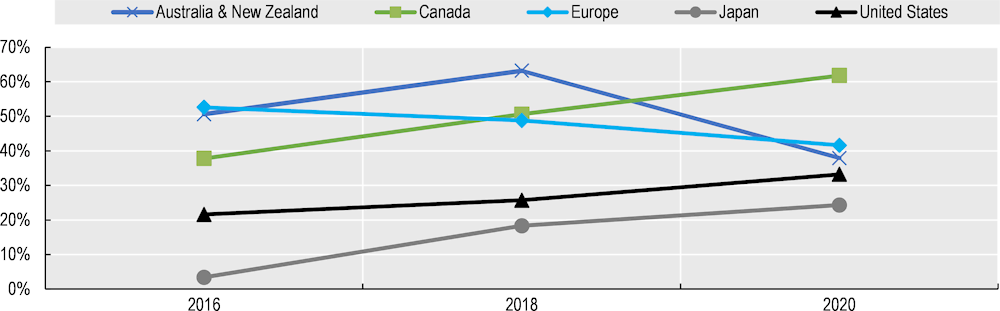

The total assets under management by professional investors that consider environmental, social and governance (ESG) risk factors in portfolio selection and management has grown significantly in the last few years. While the definition of sustainable investment varies between countries and over time, Table 3.1 and Figure 3.1 provide an indicative snapshot of the growing global importance of sustainable investing assets.

Since most of the sustainable investing data rely on survey-based approaches, the large numbers above should be taken with caution because part of the value of sustainable investing assets may be attributed to asset managers who claim to adopt sustainable or ESG-conscious strategies but who do not necessarily contribute to more social and environmental sustainability. This could be either due to misleading investors when labelling a financial product (including the so-called “greenwashing”) or because the mandated goals of an investor are not aligned with what the best scientific evidence would recommend. In any circumstance, one fair conclusion can be extracted from the numbers above: asset owners such as pension funds and families have increasingly allocated their portfolios to investment vehicles that purport to be sustainable in Canada, the United States and Japan. In Europe, Australia and New Zealand, it is difficult to draw any conclusion on trends between 2016 and 2020 because of changes in the definition of sustainable investment during that period, but the proportion of sustainable investing assets reported relative to total managed assets was high (above 37%) in Europe, Australia and New Zealand in 2020 (GSI Alliance, 2021[1]).

Table 3.1. Snapshot of global sustainable investing assets

(USD billions)

|

|

2016 |

2018 |

2020 |

|---|---|---|---|

|

United States |

8 723 |

11 995 |

17 081 |

|

Europe |

12 040 |

14 075 |

12 017 |

|

Japan |

474 |

2 180 |

2 874 |

|

Canada |

1 086 |

1 699 |

2 423 |

|

Australia and New Zealand |

516 |

734 |

906 |

|

Total |

22 839 |

30 683 |

35 301 |

Note: Significant changes in the way sustainable investment is defined have been adopted in Australia, Europe and New Zealand, so direct comparisons across regions and time are not easily made.

Source: GSI Alliance (2021[1]), Global Sustainable Investment Review 2020, http://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf.

Figure 3.1. Proportion of sustainable investing assets relative to total managed assets

Note: Significant changes in the way sustainable investment is defined have been adopted in Australia, Europe and New Zealand, so direct comparisons between regions and years are not easily made.

Source: GSI Alliance (2021[1]), Global Sustainable Investment Review 2020, http://www.gsi‑alliance.org/.

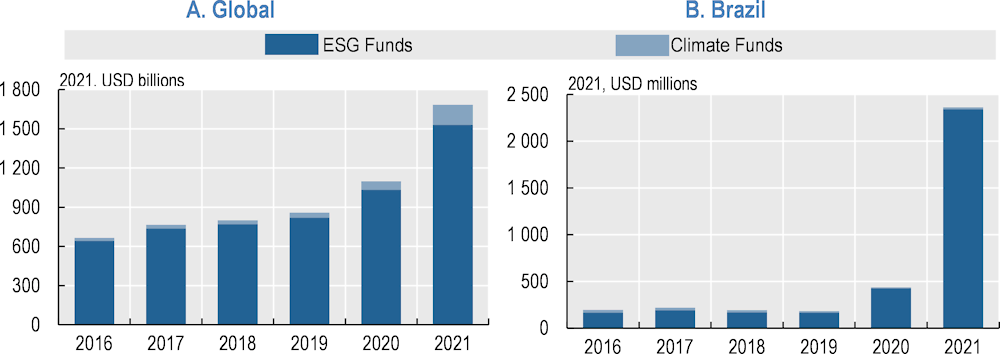

A relatively small subset of the sustainable investing universe is composed of investment funds that label themselves as ESG or sustainable funds – for instance by including “ESG” or “sustainable investing” terms in their names. Focussing only on investment funds and benefiting from a different database than in Table 3.1, it is possible to identify a trend of strong growth in assets under management for these ESG funds1 that reached USD 1.7 trillion in 2021 (Figure 3.2, Panel A). This was mainly the result of the highest net inflow amounts in 2020 and 2021 with USD 241 billion and USD 586 billion, respectively. While the value of assets under management of climate funds was very modest between 2016 and 2019, during 2020 and 2021 climate funds received comparatively larger amounts of inflows than in previous years with net inflows six and 19 times that of the previous three years’ average (2017‑19) inflow, respectively. In Brazil, asset under management of ESG funds saw a significant increase in 2021 when the total amount of funds reached to USD 2.4 billion (Figure 3.2, Panel B). Climate funds, however, represent a very small share of total ESG funds in Brazil.

Figure 3.2. Assets under management of funds labelled as or focusing on ESG and climate

Note: Funds retrieved from Reuters Funds Screen classified as Climate Funds or ESG Funds in the case their names contain, respectively, climate or ESG relevant acronyms and words such as ESG, sustainable, responsible, ethical, green and climate (and their translation in other languages). Funds without any asset value are excluded.

Source: Refinitiv, Datastream, OECD calculations.

Table 3.2. Sustainable investing assets by strategy in 2020

|

Sustainable investment strategy |

Definition |

Assets (USD billions) |

|---|---|---|

|

ESG integration |

The systematic and explicit inclusion by investment managers of ESG factors into financial analysis. |

25 195 |

|

Negative screening |

The exclusion from a portfolio of certain sectors, companies, countries or other issuers based on activities considered not investable (e.g. excluding tobacco companies). |

15 030 |

|

Corporate engagement and shareholder action |

Employing shareholder power to influence corporate behaviour, including through proxy voting that is guided by comprehensive ESG guidelines. |

10 504 |

|

Norm-based screening |

Screening of investments against minimum standards of business practice based on international norms such as those issued by the UN, ILO and OECD. |

4 140 |

|

Sustainability-themed investing |

Investing in themes or assets specifically contributing to sustainable solutions (e.g. sustainable agriculture and gender equity). |

1 948 |

|

Best-in-class screening |

Investment in sectors or companies selected for positive ESG performance relative to industry peers, and that achieve a rating above a defined threshold. |

1 384 |

|

Impact/community investing |

Investing to achieve positive social and environmental impact. |

352 |

Note: Asset managers may apply more than one strategy to a given pool of assets, so there is double‑counting if one adds all strategies above. For information on the total of sustainable investing assets in 2020, see Table 3.1.

Source: GSI Alliance (2021[1]), Global Sustainable Investment Review 2020, http://www.gsi‑alliance.org/.

While the numbers in the table above face the same challenges of categorisation previously mentioned, the following features of the current sustainable investing universe can still be identified:

the most significant strategy (with USD 25 trillion) focuses on the integration by asset managers of ESG factors into their financial analysis

strategies that often accept a tangible trade‑off between wealth creation and better ESG results (“Impact/community investing”) currently add to USD 352 billion2 (only 1.4% when compared to the “ESG integration” strategy)

assets under management by investors who claim to employ shareholder power to influence corporate behaviour on ESG-related issues has reached a meaningful value of USD 10.5 trillion.

With respect to environmental factors related to climate change, the value of assets under management in the last item above might even be an underestimation, because some investors who do not have a clear sustainable investing mandate might be nonetheless concerned with their exposure to climate risk and willing to engage with corporates to reduce their risks. For instance, 615 investors (including from Brazil and other emerging markets) with USD 60 trillion in assets under management have so far joined the Climate Action 100+, which is an initiative to ensure the world’s largest corporate GHG emitters cut emissions to help achieve the goals of the Paris Agreement (2015[2]). Currently, this initiative focuses on 167 companies representing more than 80% of global industrial emissions, including Petrobras, Suzano and Vale from Brazil.

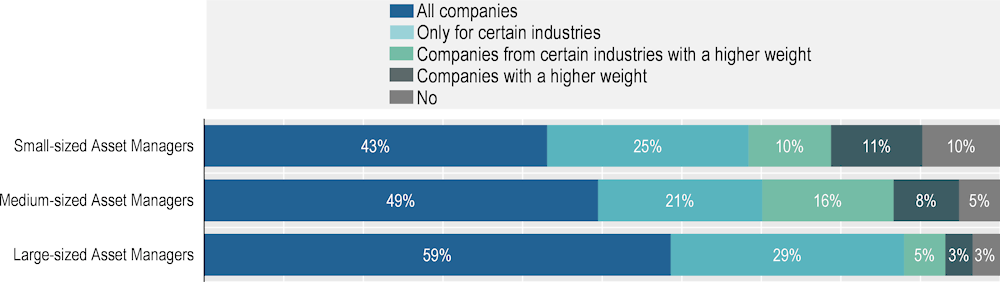

There is no data for “sustainable investing assets” in Brazil, but a majority of asset managers investing in Brazil – and especially the larger ones – review the sustainability or ESG disclosure of their portfolio companies (see figure below).

Figure 3.3. Asset managers’ review of ESG disclosure in Brazil

Note: In the survey questionnaire, asset managers could answer or leave this question unanswered. The shares in this table consider only the universe of asset managers that answered the question. On average 92% of the asset managers responded within each size category.

Source: OECD Survey on Sustainability Practices of Asset Managers Investing in Brazil.

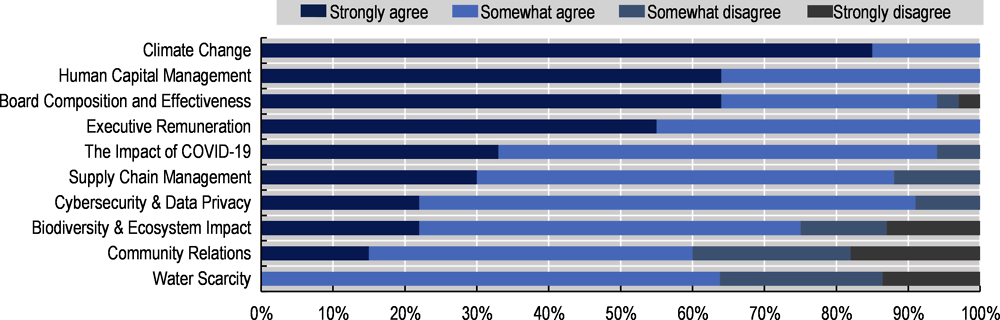

Sustainable investing is a wide category that encompasses ESG issues of very different natures, from climate change to human rights. The relative importance of a number of ESG risks from the company perspective is discussed in this report but still from an investor point of view it is possible to see the current preferences of a sample of major global institutional investors in Figure 3.4 (investors not necessarily self-reported as “sustainable investors” with USD 29 trillion in assets under management). In this sample (with some overrepresentation of UK-based investors), it is clear that climate change and associated risks are the number one priority with respect to engagement with companies, followed by human capital management (a social issue), board composition and executive remuneration (governance issues).

Figure 3.4. Global institutional investor engagement preferences in 2020

Note: 42 global institutional investors (not necessarily self-reported as “sustainable investors”) with USD 29 trillion in assets under management (with nearly two‑thirds of their portfolio in equity) participated in the survey. The geographical distribution of those investors was the following: UK (33%); the United States (17%); Europe ex-UK (12%); rest of the world (38%).

Source: Morrow Sodali (2021[3]), Institutional Investor Survey 2021, hhttps://morrowsodali.com/insights/institutional-investor-survey-2021.

Specifically among asset managers investing in Brazil, water and wastewater management, biodiversity and data security have recently been some of their key sustainability priorities (Table 3.3). While climate change and associated risks are not a top priority for surveyed asset managers investing in Brazil, this issue was still considered by a majority of managers when making investment decisions or engaging with companies in 2021.

Table 3.3. The share of issues that were incorporated into an investment decision or prompted asset managers to engage with a company during the last 12 months in Brazil

|

A. Large‑sized asset managers |

B. Medium-sized asset managers |

C. Small-sized asset managers |

|

|---|---|---|---|

|

Water & Wastewater Management |

85% |

68% |

61% |

|

Biodiversity and Ecological Impacts |

80% |

72% |

67% |

|

Human Capital |

79% |

78% |

75% |

|

Waste & Hazardous Materials Management |

77% |

63% |

63% |

|

Data Security and Customer Privacy |

75% |

81% |

73% |

|

Human Rights & Community Relations |

73% |

70% |

57% |

|

Supply Chain Management |

72% |

68% |

64% |

|

Climate Change |

69% |

58% |

53% |

|

Air Quality |

39% |

39% |

34% |

|

Other ESG issue |

63% |

41% |

23% |

Note: In the survey questionnaire, asset managers could answer “yes”, “no” or leave this question unanswered. The shares in this table consider only the universe of companies that answered either “yes” or “no”, which is slightly different for each one of the sustainability issues. For instance, 335 asset managers provided an answer related to “Climate Change”, while only 319 answered with respect to the topic “Air Quality”. Overall, on average more than 90% of the asset managers responded with respected to all of the sustainability issues.

Source: OECD Survey on Sustainability Practices of Asset Managers Investing in Brazil.

References

[4] GIIN (2020), Annual Impact Investor Survey 2020, https://thegiin.org/research/publication/impinv-survey-2020.

[1] GSI Alliance, G. (2021), Global Sustainable Investment Review 2020, http://www.gsi-alliance.org/.

[3] Morrow Sodali (2021), Institutional Investor Survey 2021, https://morrowsodali.com/insights/institutional-investor-survey-2021.

[2] UNFCCC (2015), The Paris Agreement, https://unfccc.int/sites/default/files/english_paris_agreement.pdf.

Notes

← 1. Funds retrieved from the Reuters Funds Screen were classified as Climate Funds or ESG Funds in the case their names contain, respectively, climate or ESG relevant acronyms and words such as ESG, sustainable, responsible, ethical, green and climate (and their translation in other languages).

← 2. According to another estimate, the impact investing market size worldwide (including Brazil and other emerging markets) would be equal to USD 715 billion as of the end of 2019 (GIIN, 2020[4]).