The chapter summarises the most commonly used sustainability reporting standards and presents their use by listed companies globally. It also covers use and preferences of reporting standards by public companies in Brazil. The chapter then summarises the main concepts of materiality for corporate disclosure and discusses the main challenges related to the adoption of each concept. It also analyses the market value of companies in industries where sustainability issues is considered to be financially material in Brazil and in selected countries. The chapter concludes with an overview of the current regulatory framework for sustainability disclosure in Brazil.

Sustainability Policies and Practices for Corporate Governance in Brazil

4. Company sustainability standards and frameworks

Abstract

Nowadays, companies use a great number of frameworks and standards to disclose information on their climate‑related and other ESG performance, risks and strategy. Table 4.1 summarises the most often used frameworks and standards1 with respect to how detailed they are, their targeted audience, issues they cover and the threshold they recommend for information to be disclosed (i.e. which issues would be material for the framework). Possible definitions of “materiality” are discussed in more detail further below, but, concisely, corporate disclosure is “financially material” if it could reasonably be expected to influence an investor or a lender’s analysis of a company’s future cash flows. A “double materiality” concept incorporates what is financially material, but it also includes within its scope information that would be relevant to multiple stakeholders’ understanding of a company’s effect on the environment, on people or on society (e.g. for consumers and employees).

Table 4.1. Climate‑related and other ESG reporting frameworks and standards

|

Institution |

System |

Level of detail |

Materiality |

Audience |

Issues |

|---|---|---|---|---|---|

|

TCFD recommendations |

Financially material |

Investors, lenders and insurance underwriters |

Climate‑related issues |

||

|

IFRS Foundation – International Sustainability Standards Board (ISSB) |

Detailed information |

Financially material |

Investors |

Initial focus on climate‑related issues, but with a plan to cover a great number of ESG issues |

|

|

Value Reporting Foundation – SASB Standards Board |

SASB Standards |

Detailed information |

Financially material |

Investors |

A great number of ESG issues, with subset of standards in each of 77 industries |

|

Value Reporting Foundation – Integrated Reporting Framework Board |

Framework |

Principles-based |

Financially material |

Investors |

A great number of ESG issues |

|

GRI Standards |

Detailed information |

Double materiality |

Multiple stakeholders |

A great number of ESG issues, with a plan to have a subset of standards in each of 40 sectors |

|

|

GHG Protocol Corporate Standards |

Detailed information |

GHG emissions4 |

|||

|

CDP (previously “Carbon Disclosure Project”) |

Detailed information |

Investors and customers |

|||

|

CDSB Framework |

Principles-based |

Investors |

Climate and other environmental information |

Notes:

1: While TCFD’s recommendations (TCFD, 2017[1]) are indeed principles-based, the Task Force has published a number of documents providing detailed guidance on how to better comply with its recommendations, such as the report “Guidance on Scenario Analysis for Non-Financial Companies” (TCFD, 2020[2]). To some extent, therefore, this set of recommendations and guidance documents on how companies may disclose financially material information, preferably in mainstream financial filings, would together demand “detailed information” according to the classification in the third column of this table.

2: IFRS Foundation announced in November 2021 the formation of the International Sustainability Standards Board (“ISSB”), which will sit alongside the International Accounting Standards Board (“IASB”), to set IFRS Sustainability Disclosure Standards. In the same opportunity, IFRS Foundation committed to consolidate with the Value Reporting Foundation Board and CDSB by June 2022. IFRS Foundation’s recently amended constitution provides that IFRS Sustainability Disclosure Standards “are intended to result in the provision of high-quality, transparent and comparable information […] in sustainability disclosures that is useful to investors and other participants in the world’s capital markets in making economic decisions” (item 2.a).

3: SASB Standards Board and Integrated Reporting Framework Board (“ Framework Board”) merged in June 2021. Currently, both standard-setting boards are supervised by a newly created organisation called Value Reporting Foundation Board (“VRF”). In November 2021, the VRF committed to consolidate into the IFRS Foundation by June 2022.

4: GHG Protocol’s corporate accounting and reporting standard provides requirements and guidance for companies preparing a corporate‑level GHG emissions inventory. It does not adopt a materiality concept, and other ESG reporting frameworks and standards will typically either require or allow GHG emissions to be disclosed according to GHG Protocol’s standard. In this standard, GHG emissions are classified under three categories: Scope 1 (direct emissions from a company’s own operations); Scope 2 (emissions from purchased or acquired electricity, steam, heat and cooling); Scope 3 (the entire chain emissions impact from the goods the company purchases to the products it sells).

5: CDP’s questionnaires would not be considered a reporting framework or standard in the traditional sense, but the institution offers a widely used system for companies to answer to any of the following questionnaires: Climate Change; Forests; Water Security. The questionnaires are meant to be disclosed to (i) investors or to (ii) customers interested in assessing the environmental impact of their supply chain. Corporate management is not supposed to make a materiality assessment of the information to disclose, because CDP offers a set of questions by economic sector and companies have strong incentives to answer all of them in order to receive better scorings calculated by CDP’s system. Questionnaires are shortened only for companies with an annual revenue of less than EUR/USD 250 million and corporates answering the questionnaire for the first time.

6: In January 2022, the CDSB consolidated into the IFRS Foundation.

7: According to the CDSB Framework, environmental information should be disclosed if financially material or relevant. “Relevant” in this context would be information that might be financially material at some point, while the link between the information and future cash flows is not evident. In either case, GHG emissions shall be reported in all cases regardless of management’s assessment of their materiality or relevance (CDSB, 2019[3]).

Source: Standards, frameworks and websites of the institutions visited in July and November 2021 and January 2022; OECD elaboration.

For a company that is choosing which reporting framework to use or for a regulator that is considering whether to recommend or require a particular framework, a first question could be which broad issues are the most relevant to the company and to the market (last column in Table 4.1). For instance, TCFD recommendations cover climate‑related risks only, while the SASB Board and GSSB offer reporting standards on a full breadth of ESG issues. Therefore, for example, if climate‑related risks are the most material risks in a specific context, compliance with the TCFD recommendations might be more relevant to advance on as an initial focus, before considering whether to report on other environmental and social dimensions, using SASB or GRI reporting standards for instance.

Another question for companies and regulators assessing existing ESG reporting frameworks is who would be the primary users of the information to be disclosed (the fifth column in Table 4.1). A large majority of existing ESG reporting frameworks cite investors in equity and debt as their main audience with the notable exceptions of the GRI Standards, which aim at being used by shareholders and multiple stakeholders, and CDP’s questionnaires, which have both investors and supply chain customers as their audience. A focus on the information needs of existing and potential investors and lenders has been traditionally adopted by financial reporting standards (IASB, 2018[4]). However, as important as the definition of the main audience of the disclosure may be, the disclosed information might still be relevant to users that are not considered primary. For instance, CO2 emissions will likely be relevant to shareholders of an oil and gas company as primary users due to the potential cash flow impact of carbon pricing policies in the future, but it may also be of interest to consumers or environmentally conscious employees who would prefer to work in a low-carbon company.

The definition of materiality in an ESG disclosure framework or standard goes largely hand in hand with the portrait of its primary users (fourth column in Table 4.1). If the primary users are investors, it is often assumed that they make investment and voting decisions mostly based on a company’s expected future cash flows and their timing. Only the CDSB Framework – which focuses only on environmental and climate change information and considers investors the primary users – somewhat diverges from this general rule in two ways: (i) requiring disclosure of information even if its impact on a company’s cash flows is not evident but could become relevant; (ii) mandating transparency of GHG emissions in all cases regardless of management’s assessment of its materiality.

ESG reporting frameworks and standards summarised in Table 4.1 also vary with respect to the level of detail of their guidance and requirements (see third column). Some of them are principles-based, which allows for flexibility when implemented by companies with different characteristics and operating in different countries. Flexibility, however, makes consistency across time and comparability between companies more difficult, and that is why some ESG reporting standards provide greater detail on how companies should account and report on sustainability information.

In either case, two additional features of ESG reporting should be highlighted. First, companies may choose to report sustainability information based on two different standards with similar issues’ coverage, as long as they clearly segment the disclosed information (for instance, according to SASB for investors and GRI standards for a wider public). Second, a principles-based framework may serve as the overall guidance to management when reporting sustainability information according to a more detailed standard (for instance, using the Framework when developing a sustainability report with information required by SASB Standards).

TCFD recommendations receive particular attention in this report because, in September 2021, the Central Bank of Brazil (BCB) announced mandatory disclosure aligned with the TCFD’s recommendation for financial institutions (BCB, 2021[5]). In a first phase, the rule will require the disclosure of qualitative aspects related to governance, strategy and risk management, and, in a second phase, quantitative information will also be required. The Task Force’s recommendations suggest the disclosure of financially material information, preferably in mainstream financial filings, around four thematic areas (TCFD, 2017[1]):

a. Governance – the organisation’s governance around climate‑related risks and opportunities

b. Strategy – the impacts of climate‑related matters on the organisation’s strategy.

c. Risk management – the processes used by the organisation to identify, assess and manage climate‑related risks

d. Metrics and targets – the metrics and targets used to assess and manage relevant climate‑related risks and opportunities, including greenhouse gas emissions.

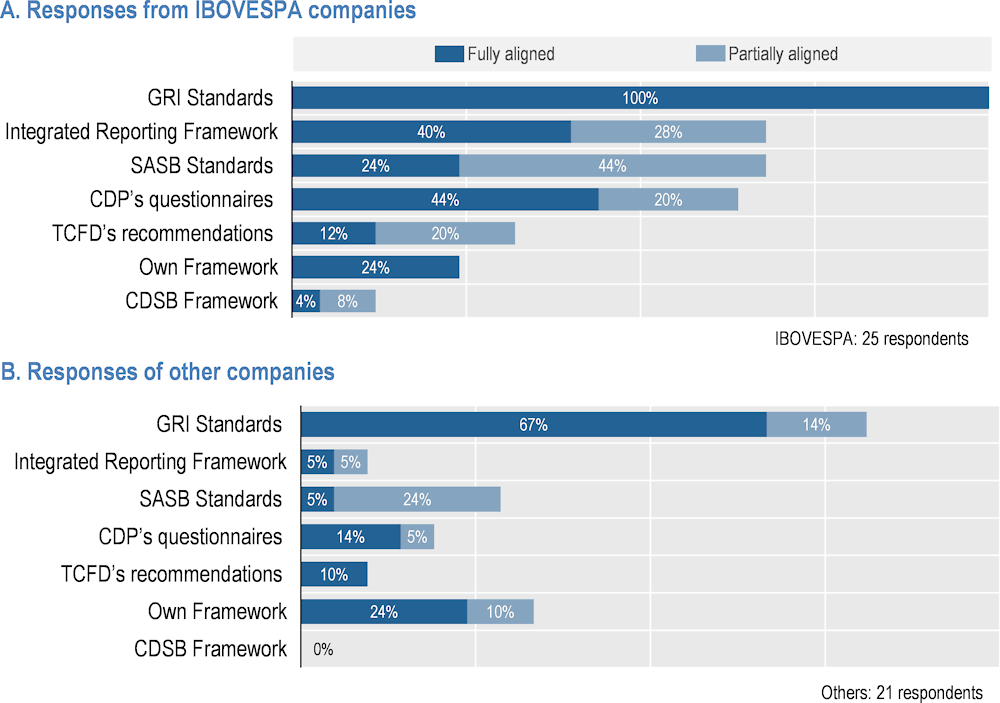

This plenitude of existing standards and frameworks (seven in Table 4.1) raises the question of whether climate‑related information is comparable between companies that effectively disclose them. Figure 4.1 presents the use of the abovementioned ESG standards and frameworks by Brazilian companies in 2021.

Figure 4.1. Use of ESG reporting standards by Brazilian public companies in 2021

Note: Some sustainability reports followed more than one ESG reporting standard, and this is the reason why the percentages in each graph do not add up to 100%.

Source: OECD Survey on Sustainability Practices of Public Companies in Brazil.

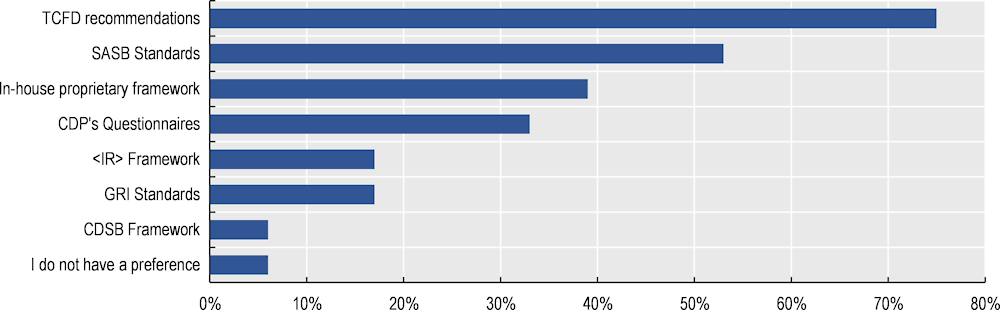

While overlaps and conflicting requirements between ESG reporting standards and frameworks are not assessed in this report, Figure 4.2 shows that global investors do have clear preferences for some ESG standards, which may suggest that existing standards are indeed significantly different.

Figure 4.2. Global institutional investors ESG reporting preferences in 2020

Notes:

1: For information on respondents to the survey, see notes to Figure 3.4.

2: Respondents to the survey could choose more than one preferred ESG framework, what explains why the numbers in this figure add to more than 100%. Specifically, the survey found that a number of institutional investors, including BlackRock, State Street Global Advisors and Vanguard, have called out TCFD recommendations and SASB Standards as the two ESG frameworks that listed companies should follow.

Source: Morrow Sodali (2021, p. 17[6]), Institutional Investor Survey 2021, hhttps://morrowsodali.com/insights/institutional-investor-survey-2021.

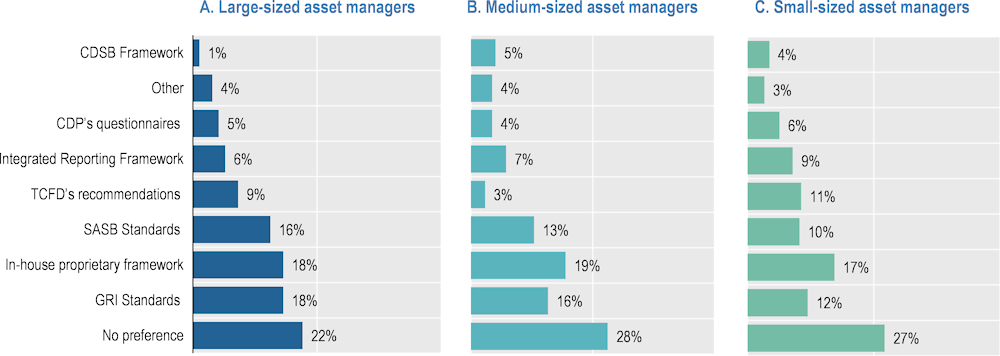

For asset managers investing in Brazil, preferences are less clear with a relatively higher priority for GRI Standards and a smaller one for TCFD’s recommendations (see Figure 4.3).

Figure 4.3. Preference of ESG reporting standards by asset managers investing in Brazil in 2021

Note: In the survey questionnaire, asset managers selected their preferred ESG reporting standard. The shares in this table consider only the universe of asset managers that provided their preferences. Importantly, it was possible for any asset manager to indicate more than a standard as their preferred one.

Source: OECD Survey on Sustainability Practices of Asset Managers Investing in Brazil.

Materiality

An essential part of any reporting system is the criteria to choose which pieces of information must be communicated to end-users. In the case of companies, the term often used to refer to this assessment is “materiality”: whether a piece of information is material enough for its primary users to justify the costs of collecting the information and disclosing it. Clearly, a case‑by-case costs and benefits analysis of the materiality of every piece of information would not be feasible, so the implementation of the materiality concept depends to a large extent on reporting standards, securities regulators’ guidance and practices widely accepted in the capital markets.

Information has traditionally been considered material if it could reasonably be expected to influence an investor’s or a creditor’s analysis of a company’s future cash flows. For instance, the International Accounting Standards Board (IASB) provides that “information is material if omitting, misstating or obscuring it could reasonably be expected to influence the decisions that the primary users of general purpose financial reports make on the basis of those reports, which provide financial information about a specific reporting entity” (2018, p. A22[4]). In an often‑cited precedent, the US Supreme Court clarified that “an omitted fact is material if there is a substantial likelihood that a reasonable shareholder would consider it important in deciding how to vote. […] Put another way, there must be a substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available” (TSC Industries, Inc. v. Northway, Inc.). The aforementioned materiality concept can be labelled “financial materiality”, and, as detailed in Table 4.1, not only financial reporting standards but also a number of ESG reporting frameworks and standards adopt a “financial materiality” approach.

More recently, a “double materiality” concept has been adopted in some sustainability reporting frameworks, defining as material information that – in addition to being financially relevant to investors – would be pertinent to multiple stakeholders’ understanding of a company’s effect on the environment and on people (e.g. for consumers, employees and communities). For example, the 2014 EU Non-Financial Reporting Directive provides that a company subject to the directive is required to disclose information “to the extent necessary for an understanding of the undertaking’s development, performance, position and impact of its activity, relating to, as a minimum, environmental, social and employee matters, respect for human rights, anti-corruption and bribery matters” (Article 19a, item 1).

While in theory clearly distinct, the frontiers between financial and double materiality may be rather fluid in practice. For instance, in what constitutes one aspect of “dynamic materiality” (WEF, 2020, p. 8[7]), a risk that does not seem to be financially material in a moment in time (e.g. GHG emissions in a country with a poor environmental track-record) may gradually or quickly become financially relevant if the social context changes (in the same example, if a climate‑conscious political leadership comes to power). In some contexts, economically irrelevant ESG risks that are material for a society may be expected at some point to become financially material for a company, either through society’s pressure for a switch in public policy (e.g. regulation that makes companies internalise externalities) or consumers’ and employees’ change of preferences (making companies voluntarily change their businesses). To some extent, therefore, the time‑horizon used in the materiality analysis seems to be also key: the longer the time‑horizon, the larger the potential for overlap between financial and double materiality (IOSCO, 2021, pp. 28-30[8]).

Regardless of the time horizon, it should also be noted that even in the shorter term there might also be a significant overlap between information items that are material both to a company’s cash flows and to society as a whole. To take the example of a company in the mining sector, Vale disclosed in 2021 its Scope 1 GHG emissions as required both by SASB and GRI standards (respectively, as seen in Table 4.1, they follow a financial and double materiality concepts). The same company also disclosed, among climate‑related items, Scopes 2 and 3 GHG emissions and the energy intensity of its operations, but, in those cases, only to align itself with the GRI Standards (Vale, 2021, pp. 108-111; 174[9]).

By definition, “double materiality” requires wider disclosure than “financial materiality” because the former includes the latter (the example in the paragraph above concretely shows it). Since collecting information and disclosing it present a relatively fixed cost for a company (somewhat independent from its size), a mandatory requirement to disclose ESG information according to a double materiality standard would represent a greater relative cost for SMEs when compared to larger companies (OECD, 2022, p. 34[10]). Moreover, if disclosure is only mandatory for listed companies, it might represent a disincentive for companies to go public.

Another challenge for policy makers considering to mandate an ESG disclosure regime based on “double materiality” rather than “financial materiality” would be the transition and longer-term costs it would create for some key capital markets actors other than companies, namely for securities regulators and auditors. First, there would be a short-term cost for changing systems and rules that were typically based on the assumption that corporate information to be disclosed should be material for investors. For instance, securities regulators that have a legal mandate only to protect investors and to maintain fair, efficient and transparent markets might need to have their powers enlarged to also include addressing systemic risks or non‑financially material ESG risks more broadly. In the case of Brazil, CMV has a broad mandate, including, for instance, the goals of promoting the efficiency of capital markets and of ensuring public access to listed companies’ information (art. 4 of Law 6 385 from 1976). This mandate would arguably allow Brazil’s securities regulator to require sustainability disclosure based on “double materiality”, but there would still be a risk of litigation involving the regulator’s legal mandate since this regulatory option has not yet been examined by the courts.

Second, if key capital market actors become responsible for analysing information beyond their core expertise in corporate finance, they might become less efficient as a result. For example, securities regulators would need to supervise risks that have been (and will probably continue to be) overseen by environmental agencies, potentially duplicating work and offering conflicting guidance on non-financial materiality in some circumstances. Likewise, the assessment of what is material for the society as a whole requires the use of techniques, reference points and data from the public policy discipline, which are not often mastered by corporate finance experts and may be expensive (e.g. surveys to assess the preferences of a great number of individuals).

Much of the relevance of the discussion above would dissipate if investors were as concerned with their investees’ impact on society as they are with their long-term financial results. If this were the case, a company’s impact on society and the environment would necessarily become financially material because investors would be willing to accept smaller returns in exchange for positive contributions for society (i.e. a company’s cost of capital would be smaller).

The evidence so far is that global investors continue to be by and large more concerned with the financial performance of their assets (as seen in Table 3.2, strategies that often accept a tangible trade‑off between wealth creation and better ESG results do not currently represent a significant share of assets under management) and major global investors are especially interested in sustainability information that is financially material (as shown in Figure 4.2, TCFD recommendations and SASB Standards – which follow a financial materiality criterion – are by far the preferred ESG framework by institutional investors).

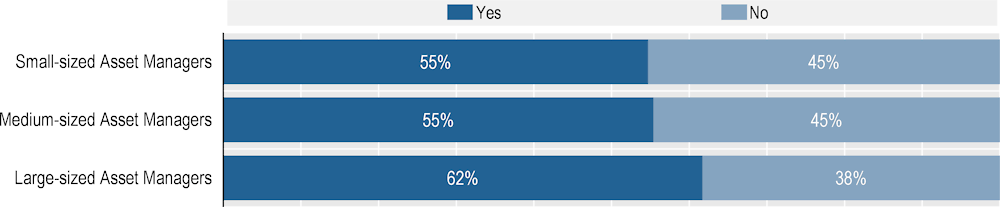

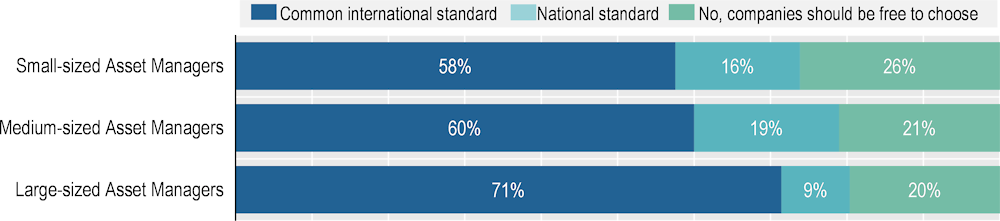

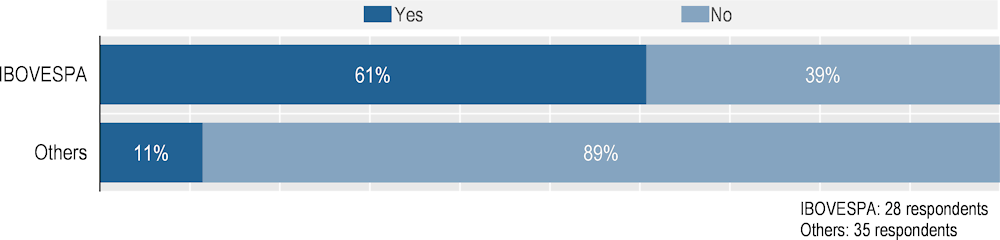

The evidence for asset managers investing in Brazil, however, is less clear-cut. As presented in Figure 4.3, they have a slightly higher preference for the GRI Standards, which follow a double materiality criterion. Likewise, as shown in Figure 4.4 below, a majority of asset managers investing in Brazil said they would be willing to accept a lower rate of return in exchange for societal or environmental benefits (it should be noted, nonetheless, that the question did not estipulate by how much lower).

Figure 4.4. Asset managers investing in Brazil: willingness to trade‑off financial returns

Note: In the survey questionnaire, asset managers could answer “yes”, “no” or leave this question unanswered. The shares in this table consider only the universe of asset managers that answered either “yes” or “no”. On average 76% of the asset managers responded within each size category.

Source: OECD Survey on Sustainability Practices of Asset Managers Investing in Brazil.

ESG accounting and reporting frameworks

Brazil and many other jurisdictions do not currently mandate the use of a specific ESG reporting framework or standard (in the case of Brazil, with the exception of financial institutions as mentioned in Chapter 3). This freedom has led corporations to adopt a number of different standards or, in some cases, disclose only some information items foreseen in a specific standard (see often used standards by Brazilian public companies in (Figure 4.1).

The lack of comparability between companies’ sustainability information harms investors’ capacity to adequately value each company and, therefore, to decide how to allocate their capital and engage with companies. In other words, capital markets are less efficient if companies do not disclose sustainability information that is financially material or if their disclosures are difficult to compare. Likewise, disclosure of material risks is essential for investors to effectively manage the aggregate risks of their portfolios, and for financial stability supervisors to anticipate systemic risks.

The importance of comparability was underlined in a survey recently conducted by International Organization of Securities Commissions (“IOSCO”) of 60 asset managers across 19 jurisdictions on sustainability information for investment decisions. The survey identified the creation and adoption of a mandatory common international standard reporting as the most important area for improvement with respect to sustainability (IOSCO, 2021, p. 18[8]). Similarly, a 2019 survey with investors representing 27 asset managers and 30 asset owners from Asia, Europe and the United States found that 75% of them agreed with the statement that “there should be one sustainability-reporting standard” and 82% concurred that “companies should be required by law to issue sustainability reports” (McKinsey & Co., 2019, p. 3[11]).

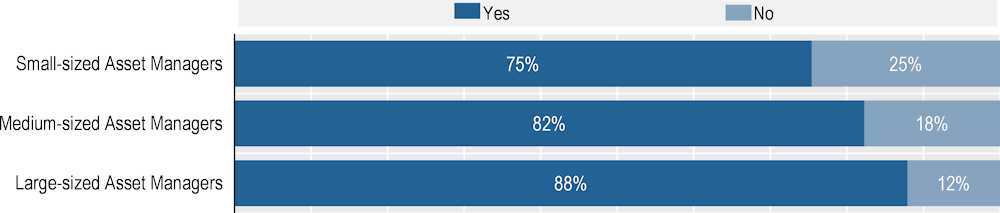

As presented in the figure below, a similar strong support to require Brazilian public companies to issue sustainability reports is also found among asset managers investing in the country.

Figure 4.5. Asset managers’ support for mandatory corporate sustainability disclosure in Brazil

Note: In the survey questionnaire, asset managers could answer “yes”, “no” or leave this question unanswered. The shares in this table consider only the universe of asset managers that answered either “yes” or “no”. On average 93% of the asset managers responded within each size category.

Source: OECD Survey on Sustainability Practices of Asset Managers Investing in Brazil.

In a very concrete way, the adoption of multiple ESG reporting standards also creates costs for corporations, which may have to either comply with different reporting standards or respond to ad hoc information requests by institutional investors interested in comparing results and business prospects of their investees. Moreover, directors and key executives may be interested in benchmarking their non-financial performance against their peers in order to better identify where improvement is needed or claim their success if their results are above‑average. This may explain why, in the same aforementioned 2019 survey, 58% of executives representing 50 companies from Asia, Europe and the United States agreed with the statement that “there should be one sustainability-reporting standard” and 66% concurred that “companies should be required by law to issue sustainability reports” (McKinsey & Co., 2019, p. 3[11]). In Brazil, the support among public companies for mandatory sustainability disclosure is even higher (see figure below).

Figure 4.6. Public companies’ support for mandatory corporate sustainability disclosure in Brazil

Source: OECD Survey on Sustainability Practices of Public Companies in Brazil.

Some jurisdictions have already established regulations or initiated public consultations or legislative proposals to mandate companies to disclose sustainability information according to a specific reporting standard. There are two main challenges in such processes: (i) the definition of the group of companies that will be subject to the new disclosure obligation; (ii) the co‑ordination across jurisdictions to adopt – if not the same reporting standard – at least to develop some core guidance and metrics that could be identical in all markets.

As discussed above, disclosure requirements often represent a greater relative cost for SMEs when compared to larger companies and, if disclosure is only mandatory for listed companies, sustainability disclosure requirements might represent a disincentive for some companies to go public. With respect to disclosure costs, it should be noted that there are not only direct costs such as developing internal control systems and hiring an external auditor, but there are also indirect costs such as revealing information that may be useful for competitors. Having those challenges in mind, policy makers have devised financial information rules that are flexible according to the size of the company or its stage of development, for instance providing a waiver from some non-essential disclosure requirements for emerging growth companies (OECD, 2018, pp. 17-18[12]).

In considering a path towards greater comparability, the experience of adopting IFRS Standards across most jurisdictions on a global basis can serve as a reference. In total, 144 jurisdictions required the use of IFRS Standards for all or most domestic listed companies as of 2018 (IFRS Foundation, 2018[13]). This successful experience is probably the reason why the IFRS Foundation November 2021 announcement that it would amend its constitution to accommodate an International Sustainability Standards Board (“ISSB”) within its structure has been met with enthusiasm by a number of jurisdictions and the IOSCO (see more below).

The ISSB will build on the work of existing investor-focused sustainability reporting initiatives to set IFRS Sustainability Disclosure Standards. The IFRS Foundation’s recently amended constitution provides that IFRS Sustainability Disclosure Standards “are intended to result in the provision of high-quality, transparent and comparable information […] in sustainability disclosures that is useful to investors and other participants in the world’s capital markets in making economic decisions” (item 2.a). Likewise, by June 2022 this new board will merge with the CDSB, SASB Standards Board and Framework Board to consolidate their technical expertise, content, staff and other resources (for more information on those boards, see Table 4.1). In this context, the Technical Readiness Working Group (TRWG) – a group formed by the IFRS Foundation Trustees to undertake preparatory work for the ISSB2 – has already published a prototype climate standard building on the TCFD’s recommendations and another prototype document on general disclosure requirements for consideration by the ISSB in its initial work plan (IFRS Foundation, 2021[14]).

Of special interest is the IFRS Foundation’s views of a “building blocks” approach and an initial priority for climate‑related matters in the work of the planned ISSB (IFRS Foundation, 2021, p. 5[15]). This would mean that ISSB would co‑operate with standard-setters from key jurisdictions in order to have a globally consistent set of core standards that would allow the comparability of sustainability reports in those jurisdictions, and expect that standard-setters from smaller markets would eventually adhere to this global reporting baseline. The “building blocks” strategy may also allow, for instance, globally accepted standards based on a financial materiality criterion but with the flexibility for complementary regional or national standards requiring disclosure on matters deemed material only from a “double materiality” perspective.

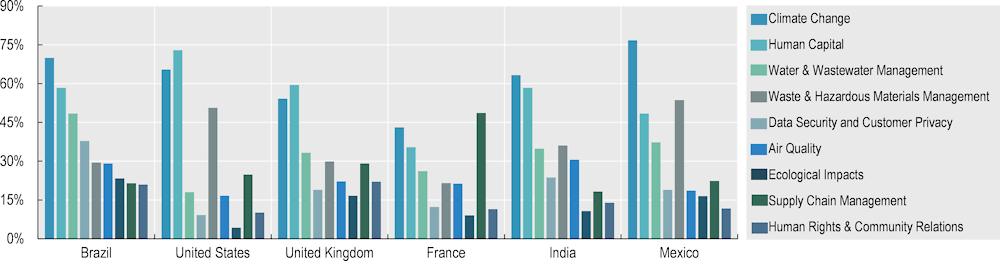

The IFRS Foundation’s decision to initially focus on climate‑related matters before working towards other ESG issues is also interesting from a practical point of view. Local standard-setters may be willing to wait for the establishment of global sustainability standards by the ISSB – instead of creating their own – if they foresee in the short term a standard on one of the most pressing ESG issues. Indeed, as shown in Figure 4.10, despite some regional variations, climate‑related risks are financially material for an important share of companies by market value globally (more than other environmental risks), representing 65% of the total market capitalisation.

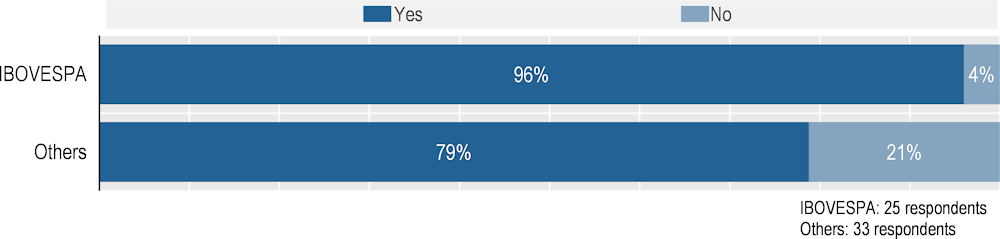

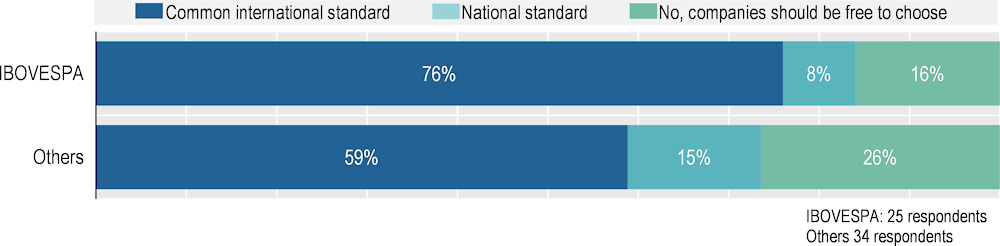

As presented in Figure 4.7 and Figure 4.8, a majority of both Brazilian public companies and asset managers investing in the country support the adoption of an international standard for companies listed in Brazil that either voluntarily or compulsorily disclose an annual sustainability report.

Figure 4.7. Asset managers’ support for the adoption of an ESG reporting standard in Brazil

Note: In the survey questionnaire, asset managers could leave this question unanswered. The shares in this table consider only the universe of asset managers that chose one of the available alternatives. On average 90% of the asset managers responded within each size category.

Source: OECD Survey on Sustainability Practices of Asset Managers Investing in Brazil.

Figure 4.8. Public companies’ support for the adoption of an ESG reporting standard in Brazil

Source: OECD Survey on Sustainability Practices of Public Companies in Brazil.

Most relevant sustainability risks in Brazil

There are many sustainability issues a company can cover in its sustainability report. For instance, the SASB Sustainable Industry Classification System® Taxonomy (“SASB mapping”),3 which is set by the SASB Board,4 presents 26 sustainability issues categorised into five dimensions (see them all in Table 4.4 below). While challenging to decide which issues are financially material for an individual company, it may often be a feasible task. SASB mapping itself offers a classification of which issues would be financially material in each of 77 industries in total. Directors and shareholders may also engage and eventually agree on the most relevant sustainability issues for their company.

A securities regulator that is considering to require sustainability disclosure from public companies, however, may be in a more difficult position. Mandating the disclosure of information related to only some sustainability issues in an initial phase may be the best option because the regulator and market participants may then focus their scarce resources in understanding a manageable number of issues. Ideally, the issues prioritised by the regulator would be those that are overall more relevant to investors and companies in the specific market. There are at least the following four ways to make this assessment:

a. to ask investors which sustainability issues they have recently incorporated into an investment decision or prompted them to engage with a company.

b. to observe which sustainability issues have been included in shareholder resolutions, which is one of the forms of engagement between shareholders and companies.

c. to survey companies on which sustainability issues have been considered by their boards.

d. to use the market capitalisation in each industry in order to calculate the relative importance of all sustainability issues in SASB mapping.

As seen in Table 3.3, water and wastewater management, biodiversity, human capital and data security have recently been some of asset managers investing in Brazil sustainability priorities. While climate change and associated risks are not a top priority for surveyed asset managers investing in Brazil, this issue was still considered by a majority of managers when making investment decisions or engaging with companies in 2021.

As shown in Table 4.2 below, human capital, climate change, biodiversity and data security have been the most frequent sustainability issues in shareholder resolutions from 2019 to 2021 in Brazil. This is broadly in line with asset managers overall preferences when making investment decision and engaging.

Table 4.2. ESG-related shareholder resolution voted in a shareholders` meeting in the last 36 months, by sustainability issue

|

IBOVESPA |

Others |

All |

|

|---|---|---|---|

|

Human Capital |

2 |

4 |

6 |

|

Climate Change |

2 |

3 |

5 |

|

Biodiversity and Ecological Impacts |

- |

5 |

5 |

|

Data Security and Customer Privacy |

- |

4 |

4 |

|

Water & Wastewater Management |

- |

3 |

3 |

|

Supply Chain Management |

- |

3 |

3 |

|

Waste & Hazardous Materials Management |

- |

2 |

2 |

|

Human Rights & Community Relations |

- |

2 |

2 |

|

Air Quality |

- |

1 |

1 |

|

Other ESG issue |

4 |

- |

4 |

|

No ESG-related Resolution |

15 |

18 |

33 |

Notes:

1: In the survey questionnaire, companies could answer “yes”, “no” or leave this question unanswered. If a company had more than one shareholder resolution on the same ESG issue during the 36‑month period, it counts only as one in this table. Nevertheless, there are companies with more than one ESG-related shareholder resolution on different sustainability issues during the last 36 months and, in these cases, each different shareholder resolution is counted in the relevant line.

2: The survey questionnaire only presented the nine sustainability issues listed in this table, which often have the exact same names as these issues are presented in the SASB mapping (respondents could also add “other ESG issues”). In order to facilitate answers and to make the results more easily comparable with other similar surveys, the OECD questionnaire merged some sustainability issues in the SASB mapping: “Climate Change” (SASB mapping has three climate‑related issues); “Human Capital” (three SASB mapping issues); “Data Security and Customer Privacy” (two SASB mapping issues).

Source: OECD Survey on Sustainability Practices of Public Companies in Brazil.

From the perspective of directors in Brazilian public companies, there is a clear priority for considerations and information involving human capital and data security. In 2021, about 90% of surveyed companies’ boards considered these two sustainability issues in their decision-making process (Table 4.3). Among other issues, climate change and biodiversity have also received attention from a majority of public companies’ boards in 2021.

Table 4.3. Share of companies whose board of directors considered sustainability issues during the last 12 months

|

IBOVESPA |

Others |

|

|---|---|---|

|

Human Capital |

92% |

90% |

|

Data Security and Customer Privacy |

92% |

88% |

|

Human Rights & Community Relations |

71% |

67% |

|

Climate Change |

70% |

55% |

|

Supply Chain Management |

61% |

66% |

|

Biodiversity and Ecological Impacts |

52% |

58% |

|

Water & Wastewater Management |

43% |

59% |

|

Waste & Hazardous Materials Management |

43% |

58% |

|

Air Quality |

19% |

26% |

|

Other ESG issue |

77% |

52% |

Notes:

1: In the survey questionnaire, companies could answer “yes”, “no” or leave this question unanswered. The shares in this table consider only the universe of companies that answered either “yes” or “no”, which is slightly different for each one of the sustainability issues. For instance, 60 companies provided an answer related to “Climate Change”, while only 52 answered with respect to the topic “Air Quality”.

2: The survey questionnaire only presented the nine sustainability issues listed in this table, which often have the exact same names as these issues are presented in the SASB mapping (respondents could also add “other ESG issues”). In order to facilitate answers and to make the results more easily comparable with other similar surveys, the OECD questionnaire merged some sustainability issues in the SASB mapping: “Climate Change” (SASB mapping has three climate‑related issues); “Human Capital” (three SASB mapping issues); “Data Security and Customer Privacy” (two SASB mapping issues).

Source: OECD Survey on Sustainability Practices of Public Companies in Brazil.

Specifically with respect to climate change, a majority of large Brazilian companies (those included in IBOVESPA) have publicly disclosed GHG emissions reduction targets, which suggest this sustainability issue is relevant for their business (see figure below). However, only a minority of smaller public companies (those not included in IBOVESPA) have done the same.

Figure 4.9. Disclosure of GHG emissions targets by Brazilian public companies in 2021

Source: OECD Survey on Sustainability Practices of Public Companies in Brazil.

An analysis of the market capitalisation of Brazilian companies according to their industries and SASB mapping classification of which ones face individual sustainability risks provides results broadly aligned with asset managers’ and companies’ preferences above.

As shown in Table 4.4 and Figure 4.10,5 climate‑related risks are financially material to public companies representing 70% of Brazil’s market capitalisation (more than the 65% global figure), human capital is material for companies representing 58% of market capitalisation, water and wastewater management-related risks for 48%, and waste and hazardous materials management for 38%.

While ecological impacts (SASB mapping terminology for biodiversity-related risks) are financially material only for companies representing 23% of market capitalisation in Brazil, it is worth noting that this risk is relatively more important in the country than globally (9% worldwide). Perhaps the most surprising information in the table below is the relevance of companies facing “air quality” as a material risk in Brazil (38% of market capitalisation), whereas this has been a low-priority issue in companies and asset managers in the country as shown above.

Table 4.4. Selected indicators for sustainability issues where risks are likely to be financially material

|

Dimension |

Sustainability Issues |

Share of market capitalisation of industries where the risk is material (in total global market cap.) |

Number of industries where the risk is material (out of a total of 77) |

|

|---|---|---|---|---|

|

Global |

Brazil |

|||

|

Environment |

Water & Wastewater Management |

26% |

48% |

25 |

|

Energy Management |

47% |

45% |

33 |

|

|

GHG Emissions |

27% |

43% |

25 |

|

|

Air Quality |

15% |

38% |

17 |

|

|

Waste & Hazardous Materials Management |

21% |

29% |

19 |

|

|

Ecological Impacts |

9% |

23% |

14 |

|

|

Social Capital |

Data Security |

38% |

29% |

15 |

|

Access & Affordability |

19% |

29% |

8 |

|

|

Human Rights & Community Relations |

14% |

21% |

6 |

|

|

Product Quality & Safety |

26% |

19% |

26 |

|

|

Selling Practices & Product Labelling |

19% |

16% |

15 |

|

|

Customer Welfare |

12% |

11% |

14 |

|

|

Customer Privacy |

19% |

5% |

6 |

|

|

Human Capital |

Employee Health & Safety |

25% |

47% |

12 |

|

Employee Engagement, Diversity & Inclusion |

38% |

14% |

27 |

|

|

Labour Practices |

15% |

13% |

12 |

|

|

Business Model & Innovation |

Product Design & Lifecycle Management |

53% |

48% |

37 |

|

Supply Chain Management |

24% |

21% |

19 |

|

|

Materials Sourcing & Efficiency |

27% |

21% |

19 |

|

|

Business Model Resilience |

7% |

20% |

7 |

|

|

Physical Impacts of Climate Change |

6% |

9% |

8 |

|

|

Leadership & Governance |

Business Ethics |

27% |

35% |

18 |

|

Systemic Risk Management |

17% |

34% |

8 |

|

|

Critical Incident Risk Management |

10% |

22% |

14 |

|

|

Management of the Legal & Regulatory Environment |

7% |

12% |

5 |

|

|

Competitive Behaviour |

8% |

5% |

11 |

|

Note: Sector classification is according to SASB mapping.

Source: OECD Capital Market Series Dataset, Factset, Refinitiv, Bloomberg, SASB mapping and OECD calculations.

Evidently, Table 4.4 cannot be read as the market value at risk, which would depend on an individual assessment of each company’s financial exposure to these risks. For instance, a company with a sound strategy to navigate the transition to a low-carbon economy may face low risks despite the fact it is in a high climate‑related financial risk industry such as metals and mining. However, in the absence of disclosure of comparable value‑at-risk information by a representative sample of companies, the share of market capitalisation in Table 4.4 and in Figure 4.10 can serve as a reference to Brazilian policy makers on how differences in economic sectors’ distribution among local listed companies may justify distinct priorities when supervising and regulating their capital markets.

Companies in sectors where climate‑related risks are considered to be financially material have a high share of market capitalisation across many different jurisdictions (Figure 4.10) – 65% globally, ranging from 43% in France and 77% in Mexico among countries in the figure below (70% in Brazil). Among the issues shown in the figure below, human capital is also relevant across jurisdictions, ranging from 35% in France to 73% in the United States (58% in Brazil). In the comparison below, a sustainability risk that calls attention in Brazil is water and wastewater management: it is financially material for Brazilian companies representing 48% of market capitalisation, while they only represent 18% of market capitalisation in the United States and 35% in India.

Figure 4.10. The share of market capitalisation by selected risks, 2021

Note: In order to facilitate the comparison of this figure with the OECD surveys presented in this report, this figure merges some sustainability issues in the SASB mapping: “Climate Change” is a merger of “energy management”, “GHG emissions” and “physical impacts of climate change” in the SASB mapping; “Human Capital” merges all three sustainability issues within this dimension in the SASB mapping; “Data Security and Customer Privacy” are two different issues in the SASB mapping.

Source: OECD Capital Market Series Dataset, Factset, Refinitiv, Bloomberg, SASB mapping, and OECD calculations.

Existing sustainability disclosure regulation in Brazil

In December 2021, Securities and Exchange Commission of Brazil (CVM) amended its main rule governing listed companies disclosure, including the addition of new requirements to increase transparency on sustainability-related matters. The new rule follows mostly a “comply or explain” approach with emphasis on climate‑related requirements, but it also introduces disclosure requirements related to other sustainability issues, such as workforce and board diversity. Disclosure according to the new rule will become mandatory from January 2023 onwards and apply to 2022 annual filings.

In their annual forms, listed companies will need to either comply or explain why they do not adhere to the following practices (item 1.9 of the annual form):

to annually disclose a sustainability report (if it does so, the company also needs to identify which sustainability reporting standard it uses and in which webpage the report can be found);

to provide assurance for the sustainability report by an independent third-party (if this is the case, identify the service provider);

to indicate which sustainability key performance indicators (KPIs) are material for the company;

to consider in its sustainability report the United Nations Sustainable Development Goals;

to consider TCFD’s recommendations or an equivalent framework focused on climate‑related financially material information;

to disclose its GHG emissions (a company may comply if it discloses its emissions only with respect to one or two scopes, and not necessarily all three).

The following disclosure, however, would be compulsory to all listed companies (with some exceptions for those that do not list their equity in public markets):

the material effects of the legal and regulatory framework with respect to environmental and social matters (item 1.6.b of the annual form);

sustainability opportunities in the company’s business plan (item 2.10.d) and sustainability risks, including climate‑related risks, faced by the company (item 4.1);

if there are any, sustainability-related KPIs in the remuneration plan of senior executives and directors (item 8.1.c.1);

the roles of the board of directors and senior executives in assessing, managing and supervising climate‑related matters (item 7.1.f);

composition of the board of directors and senior executive roles according to gender and race (self-declared in both cases), and in conformity with other diversity criteria considered relevant by the company (item 7.1.d);

if the company has adopted any, diversity goals for the board of directors and senior executive roles (item 7.1.e);

composition of the workforce – segmented by activity, location and seniority – according to gender and race (self-declared in both cases), as well as age and other diversity criteria considered relevant by the company (item 10.1.a).

References

[5] BCB (2021), New regulation on social, environmental, and climate‑related risk disclosures, https://www.bcb.gov.br/content/about/legislation_norms_docs/BCB_Disclosur.

[3] CDSB (2019), CDSB Framework for reporting environmental & climate change information, https://www.cdsb.net/what-we-do/reporting-frameworks/environmental-information-natural-capital.

[4] IASB (2018), Conceptual Framework for Financial Reporting, https://www.ifrs.org/issued-standards/list-of-standards/conceptual-framework.html.

[14] IFRS Foundation (2021), IFRS Foundation announces International Sustainability Standards Board, consolidation with CDSB and VRF, and publication of prototype disclosure requirements, https://www.ifrs.org/news-and-events/news/2021/11/ifrs-foundation-announces-issb-consolidation-with-cdsb-vrf-publication-of-prototypes/ (accessed on 23 December 2021).

[15] IFRS Foundation (2021), Proposed Targeted Amendments to the IFRS Foundation Constitution to Accommodate an International Sustainability Standards Board to Set IFRS Sustainability Standards, https://www.ifrs.org/content/dam/ifrs/project/sustainability-reporting/ed-2021-5-proposed-constitution-amendments-to-accommodate-sustainability-board.pdf.

[13] IFRS Foundation (2018), Who uses IFRS Standards?, https://www.ifrs.org/use-around-the-world/use-of-ifrs-standards-by-jurisdiction/#analysis-introduction.

[8] IOSCO (2021), Report on Sustainability-related Issuer Disclosures, https://www.iosco.org/library/pubdocs/pdf/IOSCOPD678.pdf.

[11] McKinsey & Co. (2019), More than values: The value‑based sustainability reporting that investors want, https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Sustainability/Our%20Insights/More%20than%20values%20The%20value%20based%20sustainability%20reporting%20that%20investors%20want/More%20than%20values-VF.pdf.

[6] Morrow Sodali (2021), Institutional Investor Survey 2021, https://morrowsodali.com/insights/institutional-investor-survey‑2021.

[10] OECD (2022), Climate Change and Corporate Governance, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/272d85c3-en.

[12] OECD (2018), Flexibility and Proportionality in Corporate Governance, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/9789264307490-en.

[16] SASB (2017), SASB Conceptual Framework, https://www.sasb.org/wp-content/uploads/2020/02/SASB_Conceptual-Framework_WATERMARK.pdf.

[17] SASB (2017), SASB Rules of Procedure.

[2] TCFD (2020), Guidance on Scenario Analysis for Non-Financial Companies, https://assets.bbhub.io/company/sites/60/2020/09/2020-TCFD_Guidance-Scenario-Analysis-Guidance.pdf.

[1] TCFD (2017), Recommendations of the Task Force on Cl imate related Financial Disclosures, https://www.fsb-tcfd.org/recommendations/.

[9] Vale (2021), Integrated Report 2020, http://www.vale.com/EN/sustainability/integrated-reporting-2020/Pages/default.aspx.

[7] WEF (2020), Embracing the New Age of Materiality: Harnessing the Pace of Change in ESG, https://www.weforum.org/whitepapers/embracing-the-new-age-of-materiality-harnessing-the-pace-of-change-in-esg.

Notes

← 1. Companies sometimes make reference to the UN Sustainable Development Goals (the 2030 development agenda adopted by all UN members in 2015) and to the UN Global Compact (an engagement initiative with companies on human rights, labour, environment and anti-corruption) in their sustainability and mainstream filings. While relevant, they would not normally be considered as ESG accounting and reporting frameworks or standards per se.

← 2. TRWG is composed of representatives from the CDSB, the IASB, the Financial Stability Board’s TCFD, the VRF and the World Economic Forum, and it is supported by IOSCO.

← 3. © 2021 Value Reporting Foundation. All Rights Reserved. OECD licenses the SASB SICS Taxonomy.

← 4. SASB mapping serves as the organising structure for the SASB Standards. Each one of the 77 industries in the mapping has its own unique set of standards, and the accounting metrics in each standard are directly linked to the sustainability themes that were considered to be financially material to an industry in the mapping (SASB, 2017, pp. 16-17[16]). The changes in the SASB mapping and the SASB Standards are, therefore, intertwined in a structured standard-setting process. This process is based on evidence of both financial impact and investor interest, using both research by Value Reporting Foundation staff and consultation with companies and investors (SASB, 2017, pp. 13-16[17]). Any change in SASB standards and its accompanying mapping should be approved by a majority vote of the SASB board, which is composed of five to nine members with diverse backgrounds (e.g. experience and expertise in investing, corporate reporting, standard-setting and sustainability issues) (SASB, 2017, pp. 9-10[17]).

← 5. Classification in the table is made from a universe of listed companies consisting of 39 260 companies with a total market capitalisation accounting for almost 96% of all publicly listed companies worldwide. The universe covers all non-financial and financial companies and exclude all types of funds and investment vehicles including Real Estate Investment Trusts (REITs). The primary listing venue is taken into account when identifying the market where the company is listed. Secondary listings are not taken into account. The list of listed companies for each market contains only firms that trade ordinary shares and depositary receipts as their main security. Companies trading over-the‑counter and on non-regulated segments are excluded.