This chapter examines how tax administrations’ compliance goals are met by providing effective and efficient services to taxpayers, increasingly through technology.

Tax Administration 2023

5. Services

Abstract

Introduction

A core part of supporting taxpayer compliance is the provision of a wide range effective and easy to use services to taxpayers such as specific guidance, appropriate prompts or calculation tools. Tax administrations report that their investment in services is growing, with a focus on providing services that are more relevant to the taxpayer’s individual circumstances.

This increased range of services is helping facilitate the drive towards self-service, on a real-time and 24/7 basis. In addition, tax administrations are reporting a rapid growth in the use of technology to transform their operational models. The use of advanced techniques in artificial intelligence, machine learning and machine to machine links are opening up new service options for tax administrations that allow more ‘compliance-by-design’ style approaches to be made possible. This is a growing trend that is expected to accelerate as tax administrations continue to unlock the power of digital transformation. Box 5.1. provides an example of digital transformation allowing the introduction of new services and access channels.

Box 5.1. Italy – Enhancing taxpayer assistance

Within the innovation framework of the Italian Public Administration, the topic of improving the digital services delivered to citizens plays a central role. The possibility of offering customised, reliable, and easy-to-use services represents a strategic objective of primary importance in the modernisation and digitalisation of the national administration.

All this was achieved thanks to the migration process to Customer Relationship Management, where the Italian Revenue Agency embarked on a digital transformation journey. This aimed at updating the technological tools used to manage requests for assistance and to ensure a greater effectiveness in supporting taxpayers who require assistance or information. Several online services and access channels have been implemented to:

Manage assistance to taxpayers through different channels (telephone, web mail, SMS);

Carry out surveys to measure user satisfaction at the end of the service subject of monitoring; and

Manage surveys, synthetic or analytical, to find out citizen satisfaction in the specific service.

See Annex 5.A. for supporting material.

Source: Italy (2023).

Taxpayer insights

This growth in the use of technology and more personalised services has seen tax administrations focus more on the experience of taxpayers in using these services. This has also led to taxpayer centred service improvements which help improve outcomes for administrations and taxpayers alike. Box 5.2. below contains examples of taxpayer feedback being used to drive service improvements.

Service improvements have often been supported by the use of behavioural insights. Behavioural insights is an interdisciplinary field of research using principles from the behavioural sciences such as psychology, neuroscience, and behavioural economics to understand how individuals absorb, process, and react to information. These principles can be used to design practical policies and interventions based on human behaviour. This can be particularly powerful when combined with insights gathered from the analysis of the increasingly large volumes of data available to tax administration, both internally and externally generated.

Previous editions of this series have seen and increasing number of tax administrations report employing behavioural researchers and using behavioural insights in specific areas to influence voluntary compliance. This trend has continued with three-quarters of administrations reporting the use of behavioural insight methodologies or techniques in 2021 (see Chapter 6, Figure 6.1.). The 2021 report from the OECD’s Forum on Tax Administration Behavioural Insight Community of Interest also contains many examples of this in practice (OECD, 2021[1]).

Box 5.2. Examples – Taxpayer insights

Australia – Deliberate choice behavioural insights letters

In 2022, the Australian Taxation Office (ATO) undertook research to better understand why taxpayers did not resolve their outstanding obligations after receiving reminder letters from the ATO. The ATO conducted two randomised controlled trials (RCT) to test the impact on compliance rates of:

combining outstanding lodgement and debt reminder letters – a first for the ATO which usually sends separate lodgement and debt letters, and

using behavioural levers that put responsibility for acting on the client, such as: the surveillance effect, social norms, salient consequences, and enablement messaging.

The ATO found that:

combining lodgement and debt reminders did not conclusively impact on client’s total debt positions but did significantly increase payment plan outcome rates, and

using behavioural levers improved lodgement compliance rates compared with a softer control letter, and provided similar rates compared with a firmer legal warning control letter.

These results enable the ATO to quantify the value proposition of updating their letter suite to include behavioural levers, payment reminders and promotion of payment self-service channels.

The ATO were also able to leverage the underlying robust RCT datasets to understand the characteristics and traits of sub-populations which respond more, or less favourably to treatment, such as: Does having a tax agent influence the outcome? This enhanced understanding is then fed in as actionable insights into the development of future tailored strategies to re-engage clients with the tax and super systems.

Brazil – Improving fiscal citizenship

The Receita Federal do Brasil (RFB) identified that they needed to invest in programmes that make taxpayers aware of the economic importance of taxes and how taxes provide the resources needed to support public services.

To measure the success of this, the RFB defined an indicator to measure how the Fiscal Citizenship activities affect people’s perceptions of taxation. This is done through the analysis of comments made by citizens on the RFB's social networks, where each activity is classified according to whether there was a positive, neutral, or negative comment. This allows the RFB's team of Fiscal Citizenship representatives to identify whether the programme addresses issues that are important to citizens.

Georgia – Feedback mechanism

The Georgia Revenue Service’s 2021-2024 strategy document and 2022 action plan commits it to providing taxpayers with an easy access to electronic services accompanied by a feedback system, through which users will be able to share their opinions and experience of using such services.

Therefore, from 2021, users had an opportunity to evaluate the services/information received through the website, contact centre, electronic chat, emails, web portals and so on. As a result, in 2022, the average monthly pieces of feedback received from taxpayers was 1 644, which suggests that taxpayers are active in the feedback system.

This feedback has been used to deliver changes, with for example, English-speaking employees being added to the chat function and call centre, as well as changing the topics available for discussion on the chat function. This has led to increased satisfaction rates amongst users of these functions, rising to 95% by the end of 2022 (from 45% in March 2022). Thanks to this success further departments will be included within the feedback function.

Italy – Improving the delivery of services to taxpayers

Customer Satisfaction (CS) surveys are a fundamental component of the Italian Revenue Agency’s “Citizen Voice System” used to determine how well the services, initiatives and tools provided fulfil users’ needs.

Qualitative research in the field of CS (focus groups, interviews) can measure not only citizen satisfaction but also test the requirements of a new service. This can identify usability issues in the testing phase and help create a "tailor-made" design in the development of new services.

In particular, the Revenue Agency conducts both in-depth surveys tracing the user experience for the most critical services and a lighter form of survey (CS light) to survey the customer satisfaction on a larger number of services. The latter enables the process owner to identify areas of taxpayer dissatisfaction, intervening promptly with improvement actions and undertaking more detailed analyses to retrace the user 'journey' through the service.

CS light, with few but essential questions, is accessible to the user via a link available at the end of the service. This employs a five-point scale and the possibility for the user to insert comments/ considerations against the selection of the extreme values of the scale. In addition to the overall satisfaction level, two of the reference indicators for comparing the usability of services are used: the Customer Effort Score and the Net Promoter Score. In addition, a survey dashboard allows a greater autonomy in the management of CS survey campaigns on the services identified. In this way, a continuous CS Feedback Survey is achieved, where the return data complement the other elements of the Citizen Voice System (Complaints monitoring and the Service Charter).

See Annex 5.A. for supporting material.

New Zealand – IR Connection Panel

During Inland Revenue’s (IR) business transformation to deliver a modern, digital revenue system that makes tax and payments easier for customers, the business question moved from “Should the customer voice be embedded into decision-making?” to, “How can it be done faster and better?”. In October 2021, IR’s first in-house customer research panel – ‘IR Connection’ was launched. It enables flexible and timely engagement with customers, giving IR deeper insights into customer experiences, motivations, and emotions. Customer feedback is available in real-time and supports informed and agile decision-making.

A 7 000 strong community has taken the opportunity to contribute to the development of IR’s strategies, policies, products and services. ‘IR Connection’ provides representation across IR’s core customer segments and products, and also allows IR to identify and connect with traditionally hard-to-reach customers, such as new migrants and those living with disability. The community is designed to be inclusive and diverse, with branding in multiple languages to acknowledge the majority of New Zealand’s unique communities.

Since its launch, ‘IR Connection’ has contributed to various initiatives in the organisation, including communication testing for annual tax assessments, concept testing of products and services and gathering insights for a policy review.

‘IR Connection’ is a genuine way to bring the customer voice into decision-making at IR and it exemplifies the organisation's commitment to being intelligence-led and customer-centric. As it continues to provide insights, IR will be better-positioned to deliver seamless, customer-focused services and solutions that enhance voluntary compliance.

Spain – Assistance portal improvements

The Portal for Integral Assistance to Taxpayers, PACO, (Portal de Asistencia al Contribuyente) is a new programme that brings together guidance and support materials across all functional areas and puts them at the disposal of the officials delivering assistance to taxpayers. The programme allows an easy search of contents to help tax officials give an answer to a specific taxpayer’s need, either digital, by phone or onsite, and it is designed to enable continuous updating.

An important part of PACO is the feedback and support mechanism which is at the bottom of every page. Three icons guide this:

A question mark opens a window for tax officials to send suggestions on improvements or inform on mistakes.

A “plus or minus show” button allows access to all the information for a functionality or a restricted version with only the most relevant information.

A ‘PACO’ button leads to a new window with a summary of useful data for the assistance to a specific taxpayer and informative contents on taxes and other subjects such as PIT, VAT, registration, phone assistance, notifications, legal framework and rulings, frequently asked questions and taxpayer areas. Each section centralises the main information and assistance tools on the subject to facilitate the delivery of the service by tax officials.

See Annex 5.A. for further information.

Türkiye – Applying behavioural insight

The Turkish Revenue Administration has reviewed and evaluated all practices and services to taxpayers across the administration to consider how a behavioural public policy approach can be applied to increase tax awareness and voluntary compliance of taxpayers. This has led to a programme of medium and long-term behavioural public policies, supported by experimental studies. This has required the establishment of a Behavioural Public Policy Development and Implementation section, which is a team of 141 people, established from 17 departments at the headquarters and 30 tax office directorates in the provinces. Studies include:

Raising awareness of the Pre-Filled Return Filing System; and

Increasing payment of Motor Vehicle Tax Debt.

For details of the methodologies used, and the results of these studies, see Annex 5.A.

Sources: Australia (2023), Brazil (2023), Georgia (2023), Italy (2023), New Zealand (2023), Spain (2023) and Türkiye (2023).

Managing service demand

An important aspect of meeting taxpayer preferences is getting the mix of channels right. Such strategies of course need to be based on good measurement and understanding of demands and constraints. Table 5.1. highlights the shift to digital that occurred since the pandemic, with use of online channels continuing to grow significantly. The rapid decline of in-person visits to the tax office persisted during 2021, while the use of paper correspondence went back to pre-pandemic volumes. Digital assistance, for example through chatbots, has become an important channel in many jurisdictions. The data hints at a structural shift away from costly and time-consuming in-person visits to online interactions.

Table 5.1. Evolution of service demand by channel between 2018 and 2021

|

Channel type |

No. of jurisdictions providing data |

2018 |

2019 |

2020 |

2021 |

|

|---|---|---|---|---|---|---|

|

Online via taxpayer account |

Number |

31 |

1 130 253 409 |

1 310 985 136 |

1 731 456 863 |

2 292 638 417 |

|

Previous year change in % |

+16.0 |

+32.1 |

+32.4 |

|||

|

Telephone call |

Number |

52 |

328 816 038 |

314 207 157 |

333 302 424 |

366 456 409 |

|

Previous year change in % |

-4.4 |

+6.1 |

+9.9 |

|||

|

In-person |

Number |

35 |

109 620 990 |

109 052 857 |

48 699 279 |

41 594 555 |

|

Previous year change in % |

-0.5 |

-55.3 |

-14.6 |

|||

|

Mail / post |

Number |

19 |

35 045 875 |

35 167 199 |

31 998 546 |

35 602 576 |

|

Previous year change in % |

+0.3 |

-9.0 |

+11.3 |

|||

|

|

Number |

29 |

11 996 438 |

13 396 755 |

18 533 129 |

20 297 619 |

|

Previous year change in % |

+11.7 |

+38.3 |

+9.5 |

|||

|

Digital assistance |

Number |

28 |

11 071 830 |

21 405 307 |

30 933 041 |

53 271 347 |

|

Previous year change in % |

+93.3 |

+44.5 |

+72.2 |

|||

Note: The table only includes jurisdictions for which data was available for 2018 to 2021.

Sources: Tables A.76. to A.78.

Supporting self-service

The self-service offering from tax administrations continues to grow, with an expanding range of self-services being provided. Common examples of this include the ability to register, file and pay on-line, along with a range of interactive tools. This is leading to efficiency gains in tax administrations, as well as being able to provide a more 24/7-style service to taxpayers. A number of tax administrations are also applying artificial intelligence techniques to the large amounts of data that is collected through these services to help develop them further to better meet taxpayers’ needs.

Box 5.3. Examples – Enhancing self-service

Canada – The ‘Progress Tracker’

The ‘Progress Tracker’ is a new digital service, available within secure portals (My Account and My Business Account), that provides clients with a convenient self-service option to track the status of files submitted to the Canada Revenue Agency (CRA) for processing. It also provides users with a target completion date of their requests, as well as e-notifications when the status of their file changes.

The ‘Progress Tracker’ service was successfully implemented in February 2022 into My Account with the first group of on-boarders:

The disability tax credit,

Appeals covering (digital) individuals’ notices of objections and requests for taxpayer relief on penalties and interest, and

The taxpayer services agent desktop for individuals service for contact centre agents.

The May 2022 release made the ‘Progress Tracker’ service available to users in the My Business Account portal with the second group of on-boarders:

Charities’ services: application and return, and

Appeals services submitted by paper for formal disputes and taxpayer relief.

Subsequent releases have expanded this further to cover additional business’ appeals services, and corporation tax initial assessment and adjustments. The CRA will continue to add additional options for individuals, businesses and representatives in subsequent systems releases.

Japan – Enhanced payments service

The Japanese National Tax Agency (NTA) is striving to make things easier for taxpayers by introducing various measures for national tax payments, and is promoting cashless payments and co-operating with financial institutions and other related entities to deliver new services. These include for cashless payments:

Transfer tax payment: A tax payment procedure whereby tax amounts are automatically debited from a bank account or savings account.

Direct type online payment of national tax: A tax payment procedure whereby tax amounts are debited from a designated bank account via a simple operation after using the “filing through online (e-Tax)” portal.

Online tax payment using internet banking, or ATMs.

Payment with credit card: A tax payment procedure whereby the required information from a taxpayer’s credit card is entered on a dedicated website.

Payment with smartphone application: A tax payment procedure involving the use of a smartphone application payment service on a dedicated website.

For those who want to pay by cash, tax payments can be made at the counters of financial institutions and tax offices via tax payment slips, or via convenience stores with tax payment slips or 2D barcodes.

See Annex 5.A. for further details.

Netherlands – Prefilled digital payment service

The Netherlands Tax Administration (NTA) experience is that taxpayers make all kinds of accidental mistakes in tax payments. The amount due, the bank account number and the payment reference easily lead to unintended errors in the Netherlands. Furthermore, the process of the payment itself is labour intensive for SME’s and results in many cases in late payment with default penalties. The NTA has to put effort into correcting these unintended errors as well. Addressing this issue will lead to substantial reduction of burden in administrative processes for both parties.

In 2018, the NTA started a pilot that enables prefilled digital online payments for SME’s. In the pilot phase the service was offered to 4 software developers. The service prefills the amount due; the bank account number and payment reference. Due to the use of this service the error rate made in payments has been reduced from 4% to 0%. The percentage of late payments has been reduced from 8% to 5%.

A survey of users has shown that 99% found paying with the service much easier, giving the service a grade of 9.2 (scale 1-10). This service has proven to enhance compliance due to its easy-of-use. The ambition for the near future is to provide the prefilled digital payment service for all tax types. Also, the NTA is promoting the use of the payment service to a wider number of software developers.

United Kingdom – Open banking technology

In March 2021, His Majesty’s Revenue and Customs (HMRC) became a leader in implementing a bank transfer payment journey using open banking technology via a Payment Initiation Services Provider (PISP).

PISP provides customers with a way of paying most taxes directly from their bank account to HMRC in a few clicks, using prepopulated payment information meaning payments are not misallocated.

Since its launch, 4.4 million payments (GBP 12 billion) have been submitted via PISP with volumes increasing exponentially (50%) in the 12 months to January 2023. This has led to a significant drop in customer errors and subsequent follow-up contact. In February 2022, the service was extended to users of HMRC’s mobile phone app, which has taken GBP 200 million in payments, including the largest single payment into HMRC of GBP 9 million in January 2023, via the HMRC app.

Enabling customers to use preferred, and familiar, biometric authentication methods such as fingerprint and face recognition is proving popular, with QR codes scanned 600 000 times in 12 months. The QR code option has been developed for customers logged into their online accounts, allowing people to begin payment on a personal computer and complete it securely and seamlessly on a mobile phone.

During 2023, HMRC will introduce functionality enabling customers logged into their online accounts to set a payment to be made on a future date, helping them to manage their tax responsibilities more efficiently.

Sources: Canada (2023), Japan (2023), Netherlands (2023) and United Kingdom (2023).

Virtual assistants

The previous editions of this series highlighted how a growing number of administrations are using virtual or digital assistants to help respond to taxpayer enquiries and support self-service. As Table 5.2. shows the growth has been significant and these services are now commonly used by many administrations.

Table 5.2. Evolution of use of virtual assistants, artificial intelligence and application programming interfaces between 2018 and 2021

Percent of administrations that use this technology

|

Status of implementation and use |

Virtual assistants (e.g. chatbots) |

Artificial intelligence (AI), including machine learning |

Application programming interfaces (APIs) |

||||||

|---|---|---|---|---|---|---|---|---|---|

|

2018 |

2021 |

Difference in percentage points (p.p.) |

2018 |

2021 |

Difference in p.p. |

2018 |

2021 |

Difference in p.p. |

|

|

Technology is implemented and used |

34.5 |

63.8 |

+29.3 |

31.6 |

54.4 |

+22.8 |

79.0 |

93.0 |

+14.0 |

|

Technology is in the implementation phase for future use |

13.8 |

12.1 |

-1.7 |

15.8 |

28.1 |

+12.3 |

7.0 |

5.3 |

-1.7 |

|

Technology is not used, incl. situations where the implementation has not started |

51.7 |

24.1 |

-27.6 |

52.6 |

17.5 |

-35.1 |

14.0 |

1.7 |

-12.3 |

Sources: Tables A.91. to A.93.

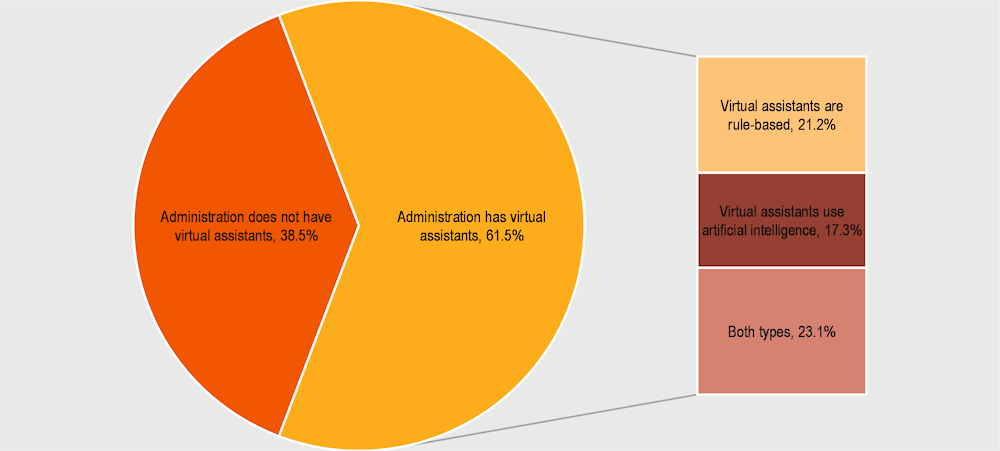

The success of these services are now being developed further with jurisdictions investigating how they use advances in artificial intelligence (AI) to deliver more sophisticated levels of support. Figure 5.1 shows that 40% of administrations who have a virtual assistant are using AI in some form to improve the service. This can allow the system to cope with more complex questions being asked by taxpayers and/or more personalised answers being given. This is part of the wider trend of the use of AI in tax administration which can be seen throughout this report.

Figure 5.1. Type of virtual assistants, 2022

Note: The figure is based on ITTI data from 52 jurisdictions that are covered in this report and that have completed the global survey on digitalisation.

Source: OECD et al. (2023), Inventory of Tax Technology Initiatives, https://www.oecd.org/tax/forum-on-tax-administration/tax-technology-tools-and-digital-solutions/, Table TT5 (accessed on 22 May 2023).

Box 5.4. Examples – Virtual assistants

Portugal – Enhanced virtual assistant

The Portuguese Tax and Customs Authority’s (AT’s) virtual assistant ‘cATia’, available 24/7 on the AT website and social media channels, provides individual taxpayers with answers to the most frequently asked questions, using simple and clear language. On working days, from 9am to 7pm, it is supported by live agents.

One of the advantages of ‘cATia’ is that, while maintaining users’ data privacy and security, it enables AT to channel contacts from face to face and phone services to an automated response service, allowing the standardisation of responses between the different social media platforms. It also allows interactions between the chatbot and social media.

The planned development of the virtual assistant will add speech recognition to the chatbot, enabling voice-bot conversation, and making it available on other social media platforms.

United States – Chatbot

Chatbots, which have handled 2 million chats for collection in the past 6 years, are currently available in both English and Spanish on the Internal Revenue Service (IRS) web page. The chatbots provide taxpayers with self-service options to resolve their Collection notice without calling the IRS. Services offered include information about making a payment, notice clarification and responses to frequently asked questions, with the option to escalate to a live assistor.

The IRS also offers Collection voice bots, which have handled 8.2 million calls in the past 12 months, in both English and Spanish, for taxpayers calling into the Automated Collection System (ACS) and Accounts Management toll-free lines that allow them to use natural language to speak with a bot in a simplified simulation rather than using menu prompts. Voice bots were an important factor in the IRS being able to answer 30% more calls in ACS last fiscal year. Eligible taxpayers can authenticate their identity in a few short steps to receive options to resolve their accounts, such as setting up a payment plan, obtaining a payoff amount, and receiving account transaction information. Additionally, taxpayers can receive unauthenticated services that provide taxpayers with information about making a payment, notice clarification and responses to frequently asked questions.

Taxpayers authenticate their identity by providing their Social Security Number, date of birth, and the caller ID number contained on their collection notice. The taxpayer is then prompted to create a Personal Identification Number that is used to navigate the process.

Sources: Portugal (2023) and United States (2023).

Mobile applications

The recent trend for the increasing use of mobile applications by tax administrations seen in other editions of this series has continued. Mobile applications allow taxpayers to access services on the go and thus provide additional flexibility and support self-service.

While the main use often remains the provision of information and guidance, mobile applications are becoming increasingly transactional, and are becoming a primary way for taxpayers to access relevant records and personal tax accounts, communicate with the tax administration, supply information and tax returns and make payments. Box 5.5. provides latest developments in this area.

Box 5.5. Examples – Mobile applications

Argentina – Biometric authentication

Facial biometric authentication has been incorporated in the Argentinian tax administration’s (AFIP) mobile app “Mi AFIP” which can allow taxpayers to validate their identity without the need to be physically present in an AFIP office.

Before facial biometric authentication was in place, citizens needed to go to an AFIP office and show proof of their identity to obtain their tax login code, which in turn would allow them to digitally interact with AFIP.

Nowadays, citizens can certify their identity from their mobile phones, get their tax login code and, using that same mobile device, they can report their economic activity and register themselves in all relevant taxes so they can be authorised to issue electronic invoices and conduct business.

This development streamlines citizen services, reduces time spent on formalities and procedures, and simplifies compliance with tax obligations. It also provides considerable savings for taxpayers living far from an AFIP office.

Germany – Online tax portal app

The German tax administration is offering a mobile application that can be used to scan individual documents and upload them to the taxpayer’s user account in ELSTER, the online tax portal.

Using this app, taxpayers will be able to photograph documents with their smartphone camera immediately after receiving them. The photographed documents will then be scanned (using OCR or possibly a QR code) and appropriate values will be extracted from them. The user can also assign these documents to different categories. When the income tax return is prepared, the app will automatically insert the metadata into the appropriate input fields of the tax return.

This will make it significantly easier for taxpayers to prepare their income tax returns. They can efficiently scan individual documents that are relevant for the tax return and manage them in their personal online ELSTER account.

As the app will record the metadata (amounts, date, category), time-consuming searches for documents will no longer be necessary when preparing income tax returns. Furthermore, any problems and errors resulting from transfers between different media formats will be avoided, as all tax-related information will be available electronically and can be accessed online at any time through the user account. This will save users a significant amount of time and extend the range of citizen-friendly online services provided by the tax administration.

The app will also reduce the workload for the tax administration. When the scanned documents are filed in the taxpayer’s user account, they can easily be made available to the case worker at the tax office if needed and no longer have to be requested in a laborious written process. This will avoid interruptions in processing tax returns.

Hungary – Vehicle tax via a mobile app

The National Tax and Customs Administration (NTCA) of Hungary took over the assessment of motor vehicle tax from local governments in 2021. In order to support tax assessment and to make the payment smoother for taxpayers, it was necessary develop new IT solutions. During the design process, the NTCA aimed at providing simple and cost-free payment options making it easier for taxpayers to fulfil their obligations thus ensuring the collections of state revenues. Two new payment services were created so that every taxpayer can find the most suitable solution:

Payment link where electronic letters were sent containing a personalised link, which redirects to an online bank card payment interface. This payment service uses customer authentication and also requires credit / debit card data.

NTCA-Mobile application where taxpayers were sent a push notification. In the application, a separate menu item supports the viewing and settling of the motor vehicle tax.

The advantage of these new payment methods is that the vehicle tax can be settled with a few clicks and through an electronic payment. As a result, the number of postal check payments are down by more than 50%.

See Annex 5.A. for supporting material.

Poland – E-receipts

The Ministry of Finance in Poland is working on providing a publicly available service that allows every citizen to download an electronic receipt from a cash register to a smartphone, from a mobile application open to any software supplier, and the service will be fully anonymous via a unique identifier. At the point of purchase the customer will present the barcode identifier to the cashier, the cashier scans it and the cash register sends the receipt to the distribution system. Within a few seconds, the customer can download their receipt from the system to their smartphone. No customer identification data is required to receive the barcode identifier. This service will bring many benefits such as access to the e‑receipt at any time, will help to reduce paper use and reduce the shadow economy.

Portugal – Supporting self-employed taxpayers

ATGO is a newly developed mobile application launched by AT that allows individual taxpayers, who are self-employed and without paid accounting support, to easily comply with their tax obligations and manage their professional activities in a single point of access.

By accessing ATGO, taxpayers can view professional activity data, namely consult VAT and PIT schemes, and they can also issue and view their receipts and send them, on the spot, to their clients electronically. Taxpayers are also able to save templates for easier filling, and analyse previous income and expenses to compare them with the same period of the previous year. A "Top 5 clients” feature is also available, either by the amount of income earned or by the number of receipts issued.

Tutorials and help by tax officials are provided to guide taxpayers into all the features. In the near future, the application will have new developments, such as a digital fiscal agenda, alerts on tax compliance, electronic payments through the app, speech recognition in search and invoice issuance, and it will also be available in English.

The development of solutions such as the ATGO application reinforces the technological innovation plans for AT. The goal is to strength the communication and relationship with taxpayers and minimise the costs associated with tax compliance, through an improved and helpful service.

See Annex 5.A. for supporting material.

Spain – Tax debts app

Following a piece of complex analysis work to present taxpayers with redesigned interfaces so that they can proceed to pay their tax debts, request deferral or pay in instalments, the Spanish Tax Agency (AEAT) has implemented a project to make it easier for taxpayers to pay their tax debts via an application. This system allows the payment of several debts through a single payment to be made online by debiting an account or paying by card at any of the financial institutions that collaborate with AEAT.

Additionally, through the "Consult debts" option, which can be accessed either by a taxpayer or their authorised representative, taxpayers can view their total or partial outstanding debts, accessing all the detailed information about them. In addition, an automated system for processing requests for deferment or instalments of debts has been developed, so that in a high percentage of cases the file is resolved almost instantaneously. In this way, and in a matter of minutes, the taxpayer receives an SMS communication from the AEAT of the result of their application.

The application also includes an "Interest and deferral calculator", a personalised tool that AEAT makes available to all citizens so that they can find out the legal or late payment interest applicable to both tax and non-tax debts, as well as deferrals and payment by instalments. At the end of the payment process, taxpayers are offered the possibility of requesting the issuance of a tax certificate of being of up to date with their tax obligations.

See Annex 5.A. for supporting material.

Sources: Argentina (2023), Germany (2023), Hungary (2023), Poland (2023), Portugal (2023) and Spain (2023).

Digital inclusion

Digital services have been critical to tax administrations delivering enhanced services to customers, as well as opening up new service options. While there is an increasing shift to the use of electronic services for both convenience and cost-efficiency purposes, a proportion of taxpayers will not have access to, or be comfortable with such services. This calls for considered strategies as to how to influence channel shift for those for whom it would offer better outcomes without adversely affecting the service offering to other taxpayers.

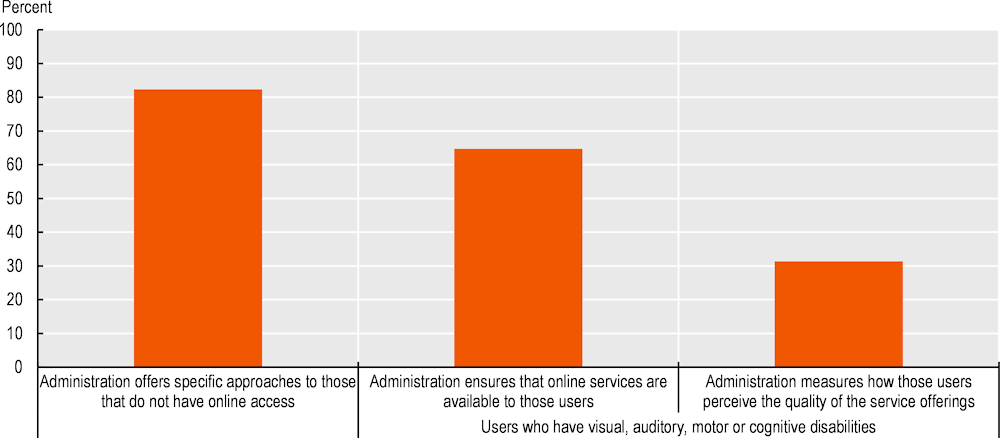

Figure 5.2 highlights that 80% of administrations offer specific services to support those who are not online, and over 60% make sure their services are available to those with a disability. Whilst more progress clearly needs to be made in this space, these programmes are starting to ensure that all taxpayers are served effectively by the tax administration. Tax administrations are therefore continuing to invest in detailed research to understanding the needs and drivers of these taxpayer groups and to develop considered strategies as to how to serve these taxpayers in the most appropriate way.

Figure 5.2. Non-digital services and services for users with visual, auditory, motor or cognitive disabilities, 2022

Note: The figure is based on ITTI data from 52 jurisdictions that are covered in this report and that have completed the global survey on digitalisation.

Source: OECD et al. (2023), Inventory of Tax Technology Initiatives, https://www.oecd.org/tax/forum-on-tax-administration/tax-technology-tools-and-digital-solutions/, Table TT4 (accessed on 22 May 2023).

Box 5.6. Examples – Digital inclusion

Canada – Individual Tax Filing Assistance

Through the Individual Tax Filling Assistance (ITFA), dedicated CRA employees can reach out to eligible individuals to direct them towards various options to meet their tax obligations and help them access their benefits and tax credits. Agents begin by promoting Community Volunteer Income Tax Program (CVITP) clinics, including virtual tax clinics; followed by other filing methods, such as certified tax software; or agents may complete the individual’s tax return over the phone. ITFA does not replace the services offered by CVITP clinics but is presented as a viable alternative to individuals who may have trouble accessing a clinic or filing on their own.

During the pandemic, the CRA recognised that vulnerable individuals may experience barriers to accessing the CVITP and established a new business model whereby qualified individuals are sent a letter offering the CRA’s assistance in helping them access an alternate means to file their individual tax and benefit return. To be eligible for ITFA, individuals must have a modest income, a simple tax situation, and have previously accessed tax preparation services through a CVITP free tax clinic or are currently eligible to use one. Clients must pass confidentiality screening prior to an ITFA agent preparing the return over the phone.

The CRA developed enhanced security measures, including passwords for agents to verify with callers, a specific Canada.ca webpage, and personalised letters to individuals, anticipating the needs and concerns of clients with regards to scams and fraud. The CRA’s efforts contributed to strengthening confidence in the integrity of the Agency.

Latvia – New services to support taxpayers not online

The Electronic Declaration System (EDS) was deployed in 2019 as a secure and easy way to submit all tax returns, declarations and other documents to the State Revenue Service (SRS). EDS is open to all taxpayers, and the main advantages are saving time and increased accuracy, as well as improved data security.

‘Authorization to complete EDS e-services’ was created so that individuals who are not online can still work with the tax administration and submit the information electronically. Two types of services are currently provided: annual tax return submissions and changes to electronic payroll registration.

Private individuals can visit an SRS client service centre with paper documents and have an authorised SRS employee input the information electronically. Data entry is performed in the "employee workplace" solution created in EDS.

Spain – Supporting the elderly

In 2022, AEAT and the Platform for the Elderly and Pensioners (PMP), which is a representative body for this group, signed a protocol setting the basic guidelines of the assistance that AEAT offers to the elderly and a general framework of collaboration for future actions.

PMP brings together the most important organisations, federations, confederations of senior citizens and pensioners in the country, representing 15 079 associations, with more than 5 746 000 affiliated individuals.

The protocol underlines the commitment of AEAT to deliver a customised assistance to the elderly through the promotion of actions that assure them complete and updated tax information. The protocol provides for:

The creation of a joint committee, composed of members of AEAT and the platform, responsible for the identification and analysis of the specific problems of the elderly;

An annual plan of assistance to the elderly;

The development of specific assistance protocols for the elderly; and

Simplification of forms.

Sources: Canada (2023), Latvia (2023) and Spain (2023).

Collaborative services

As the digital services developed by tax administrations grow, more and more administrations recognise that these services bring opportunities to connect into the systems of taxpayers, often through Application Programming Interfaces (APIs). APIs are allowing connectivity between systems, people and things without providing direct access, and are the critical enablers of many of the innovative services highlighted in this report. It is against this background that 80% of tax administrations are now creating APIs and that three-quarters of them are making the APIs available to third party developers. See Box 5.7. for examples of latest developments in administration regarding APIs and Chapter 10 which contains more detail on the role of APIs in digital transformation.

The OECD report Unlocking the digital economy – a guide to unlocking application programming interfaces in government (OECD, 2019[2]) provides an overview of the practices, techniques and standards used to deliver contemporary and effective digital services for taxpayers through APIs. As the services delivered become more sophisticated, and play a greater role in delivering a quality service to taxpayers, tax administrations are having to invest more in the management and oversight of their APIs.

Box 5.7. Examples – Using APIs to provide better services

Latvia – Electronic declaration system API

Using the EDS, which was developed to submit information to the SRS, manual input is reduced to a minimum as information from a company's accounting system is transferred to SRS using a fully automated intersystem interface, the "System to System" principle, and placed in the EDS database. The solution uses recognised standards and protocols to preserve the data structure and content of existing EDS documents. Documents received through EDS are subjected to logic and maths checks, with the results highlighted to the taxpayer, indicating possible errors that can be fixed.

An additional functionality "Taximeters" has been created for the EDS service. Taximeters allows the sending of passenger transportation information to SRS using an authentication and authorisation system for users that can register taxi trips in the EDS.

Mexico – Managing APIs

The Mexican Tax Administration Service (SAT) is in the process of implementing a platform for the management of APIs, which will facilitate the exchange of information between SAT and external entities. This platform aims to streamline APIs administration for users by categorising and classifying the available services. It will also provide the institution with improved oversight of API development and publication. As part of this ongoing initiative, every deployed API will be registered within the platform. The portal will also publish explanatory documentation and serve as the primary access point for obtaining APIs, offering sample code for adaptation. The platform will allow for comprehensive control by SAT throughout the lifecycle of APIs, including design, implementation, and retirement. Additionally, it will enable the management of API versions and generate detailed usage reports, identifying which users or applications are utilising each API, frequency of usage, and quantifying successful or failed calls.

As part of the evolving project, SAT aims to provide API services that will enhance access to taxpayer information. These services will allow users to verify taxpayer registration status and determine if they are up to date with their tax obligations. The work on implementing these services is currently underway, reflecting the institution's commitment to improving information exchange and streamlining processes.

United Kingdom – API development

In the UK’s Making Tax Digital (MTD) programme, taxpayers are required to digitally capture information on a business’s transactions, and then submit updates or returns drawn from that data to His Majesty’s Revenue and Customs (HMRC), using MTD compatible software.

Businesses send tax information directly to HMRC from their records securely with only a click of a button because of the sophisticated APIs HMRC has developed with the software industry. HMRC sets out technical standards for software providers to follow on cyber-security and the security, storage, management and processing of customers’ personal data as a condition of recognising software products as authorised to operate with HMRC’s systems.

These APIs allow taxpayers to send summary-level data to HMRC (derived from the underlying transaction-level data) and for HMRC to send through relevant prompts and nudges to the taxpayer. HMRC already receive financial information securely through this channel for over 2.4 million VAT-registered businesses across the UK, and HMRC is expanding this obligation to other taxes and taxpayers in stages.

For income tax, which is on an annual basis in the UK, in-year updates gathered through APIs will allow HMRC to give the taxpayer a notional estimate of the tax they are on course to owe at the end of the year. These estimations have huge potential benefits for taxpayers, allowing businesses to better plan for future tax liabilities and manage cash flow.

See Annex 5.A for supporting material.

Sources: Latvia (2023), Mexico (2023) and United Kingdom (2023).

The new possibilities for service development opened up by APIs means that tax administrations are also deepening their collaboration with an increasing number of organisations outside of government, including in the development of new joined-up services. It is expected that this trend will accelerate and grow as tax administrations digitally transform their operating models and the natural systems of taxpayers and tax administrations become more connected. Box 5.8. illustrates this.

Box 5.8. Examples – Developing collaborative services

Finland – Digital platform for real estate transactions

This project digitised real estate transactions through the “Digital Housing Trade Platform” (DIAS) and was developed in Finland in co-operation with the entire property ecosystem, including real estate agents and banks. The Finnish Tax Administration was also involved in the platform, which makes it possible to carry out real estate transactions electronically.

The initiative to digitise the transactions with residential real estate came from key market players who identified a place for efficiency in their mutual processes. In particular, this project started from the inefficiency of paperwork recognised by commercial operators and the opportunities that today's technology can offer. In parallel, government authorities had already identified opportunities for co‑operation as part of the real-time economy project, but there were no natural drivers for co‑operation.

As a result of this co-operation, the process became more efficient and faster between banks and brokers. It improved the buyer's experience and automated the reporting and payment of the transfer tax. The definition of common information and process has also made it possible to take a step towards the digitisation of the national, paper-based share capital, of which the implementation period started on 1 January 2023.

See Annex 5.A for supporting material.

Singapore – Redesigning the agent appointment system for banks

As part of the wider drive for digitalisation, the Inland Revenue Authority of Singapore (IRAS) partnered with banks to adopt the use of an encrypted digital listing to improve operational efficiency and eliminate many manual handling processes. Previously, most agent appointment notices were transmitted automatically via secure file transfer to the major banks while hardcopy appointment notices were sent to the remaining banks. The new approach offered a low-cost yet secure and simple digital solution to the banks which can now receive the notice of appointment in an encrypted digital listing format transmitted via email. This approach was well accepted by the banks due to its ease of implementation and cost effectiveness and was fully implemented within 6 months.

The digitalisation of hardcopy appointment notices brought about productivity gains to the banks with the elimination of sorting and distribution processes. Taxpayers also experienced greater convenience as their bank accounts can now be released promptly. IRAS also made subsequent enhancements by using Robotic Process Automation (RPA) to generate the listings and update appointment statuses after responses are received from the banks, which led to further efficiency gains.

The move to digital listings has also allowed for easier identification of digital payments made by banks vs. other agents. The distinctive classification of payments has provided IRAS with insights and allowed IRAS to appoint the most effective agent going forward. About 97% of all bank appointments are now digitalised.

Slovak Republic – E-seizure of bank accounts

In the Slovak Republic, the debt recovery strategy focusses on starting the recovery processes as soon as possible, without giving debtors chance to become insolvent. This depends on swift interactions and the IT tool – IPEX (informative support for tax recovery official) can collate information from banks, the Social Security Agency, as well as the Real Estate Register, and Motor Vehicle Register in just a few clicks. This means that data from organisations like banks can be provided very quickly, often in just a few hours. When these searches indicate there are assets that can be recovered, recovery procedures can begin.

These proceedings are completed electronically, allowing the whole procedure to be carried out quickly, and which prevents debtors from possible fraudulent behaviour. The swift resolution for debtors also helps them get clarity on their position without the need for a long-term freezing of their assets.

See Annex 5.A for supporting material.

United Kingdom – Collaborative services through APIs

The UK’s MTD programme was one of the first of HMRC’s major programmes to embrace APIs.

HMRC’s random audit programme has shown that errors in small business tax returns are more likely to lead to too little tax being paid than too much being paid. Requiring taxpayers to keep digital records and file digitally through API-enabled software reduces transposition and calculation errors and other mistakes, which HMRC expects to lead to better compliance.

A research study found that MTD had reduced errors, leading to additional tax revenue of approximately GBP 115 million in its first year, in line with forecasts from the Office of Budget Responsibility, the UK’s independent fiscal institution.

HMRC’s API strategy provides the commercial software industry with the ability to build standard functionality into products, which ensure ease of compliance with MTD legislation, while still providing the flexibility to personalise design to best meet the target audience’s diverse needs and budgets. Software developers have responded by producing over 500 MTD compatible software options from simple free and low-cost products to fully integrated cloud accounting software.

Many MTD users report that MTD makes it faster to prepare and submit tax returns. Studies have also found that MTD has increased business confidence in using technology. Businesses who respond to new MTD obligations by digitalising their tax compliance operations further can experience considerable productivity gains.

See Annex 5.A for supporting material.

Sources: Finland (2023), Singapore (2023), Slovak Republic (2023) and United Kingdom (2023).

References

[1] OECD (2021), Behavioural Insights for Better Tax Administration: A Brief Guide, https://www.oecd.org/tax/forum-on-tax-administration/publications-and-products/behavioural-insights-for-better-tax-administration-a-brief-guide.htm.

[2] OECD (2019), Unlocking the Digital Economy - A guide to implementing application programming interfaces in Government, OECD, Paris, http://www.oecd.org/tax/forum-on-tax-administration/publications-and-products/unlocking-the-digital-economy-guide-to-implementing-application-programming-interfaces-in-government.htm (accessed on 22 May 2023).

[3] OECD et al. (2023), Inventory of Tax Technology Initiatives, https://www.oecd.org/tax/forum-on-tax-administration/tax-technology-tools-and-digital-solutions/ (accessed on 22 May 2023).

Annex 5.A. Links to supporting material (accessed on 26 May 2023)

Box 5.1. – Italy: Link to more information on the Customer Relationship Management system: https://www.oecd.org/tax/forum-on-tax-administration/database/b.5.1-italy-crm-system.pdf

Box 5.2. – Italy: Link to more information on the Customer Experience Survey: https://www.oecd.org/tax/forum-on-tax-administration/database/b.5.2-italy-customer-experience-survey.pdf

Box 5.2. – Spain: Links to presentations with more information regarding the Portal for Integral Assistance to Taxpayers:

Box 5.2. – Türkiye: Link to more details of the methodologies used and the results of the behavioural insights studies: https://www.oecd.org/tax/forum-on-tax-administration/database/b.5.2-turkiye-behavioral-insight-studies.pdf

Box 5.3. – Japan: For more information on cashless payment options, see pages 21 and 22 of the NTA’s Annual Report 2022: https://www.nta.go.jp/english/Report_pdf/2022.htm

Box 5.5. – Hungary: Link to a video with more detail on the mobile app for vehicle tax: https://youtu.be/dtbxc5sT31M

Box 5.5. – Portugal: Link to a presentation on the ATGO mobile application: https://www.oecd.org/tax/forum-on-tax-administration/database/b.5.5-portugal-atgo-mobile-app.pdf

Box 5.5. – Spain: Links to videos, a presentation and a flyer on the tax debt application:

Box 5.7. – United Kingdom: Links to further material on the use of APIs:

Box 5.8. – Finland: Link to more information on the “Digital Housing Trade Platform”: https://dias.fi/tiedote-29-11-2018.html

Box 5.8. – Slovak Republic: Link to more information on the debt recovery approaches: https://www.oecd.org/tax/forum-on-tax-administration/database/b.5.8-slovak-republic-debt-recovery.pdf

Box 5.8 – United Kingdom: Links to more information on the UK’s Making Tax Digital programme and its impact: