This Chapter provides background information on macroeconomic conditions up until 2021. Tax policy developments are closely connected with economic trends: tax revenues are affected by changes in macroeconomic conditions and economic developments are important factors behind tax reforms. This Chapter covers recent trends in growth, inflation, productivity, investment, the labour market, public finances, and inequality.

Tax Policy Reforms 2022

1. Macroeconomic background

Abstract

1.1. Global growth, labour market and investment trends

This section provides background information on macroeconomic conditions up until 2021 to help better understand the tax policy changes described in Chapter 3. It covers recent trends in growth, inflation, productivity, investment, the labour market, public finances, and inequality. Tax policy developments are closely connected with economic trends: tax revenues are affected by changes in macroeconomic conditions and economic developments are important factors behind tax reforms.

1.1.1. Global growth recovered strongly in 2021 from the COVID-19 crisis

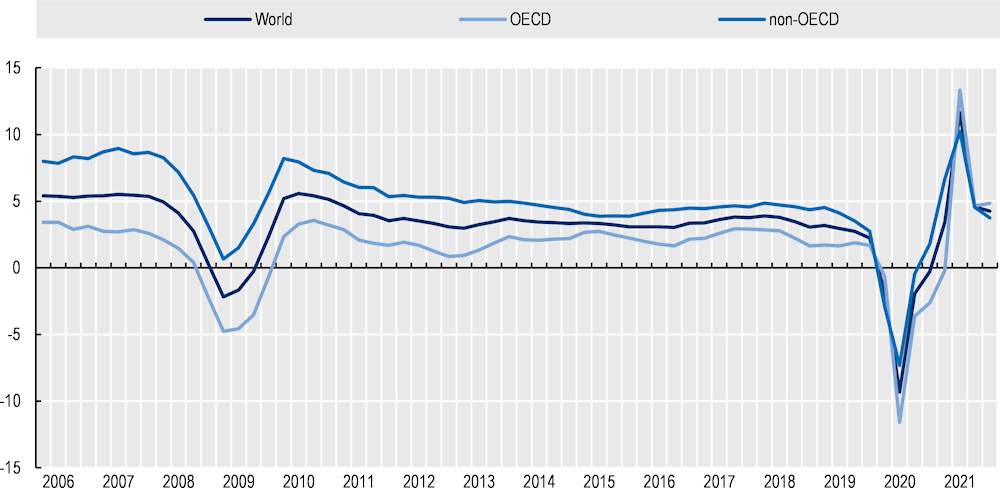

Global GDP growth reached 5.8% in 2021 after a decline of 3.4% in 2020, reflecting a rebound from the deep COVID-19 crisis (Figure 1.1). Most economies experienced output declines in 2020. Unlike the Global Financial Crisis (GFC) of 2008, when many emerging-market economies were less affected by falling output relative to advanced economies, with COVID-19, macroeconomic changes were more similar across the world, and may have lasting costs.1

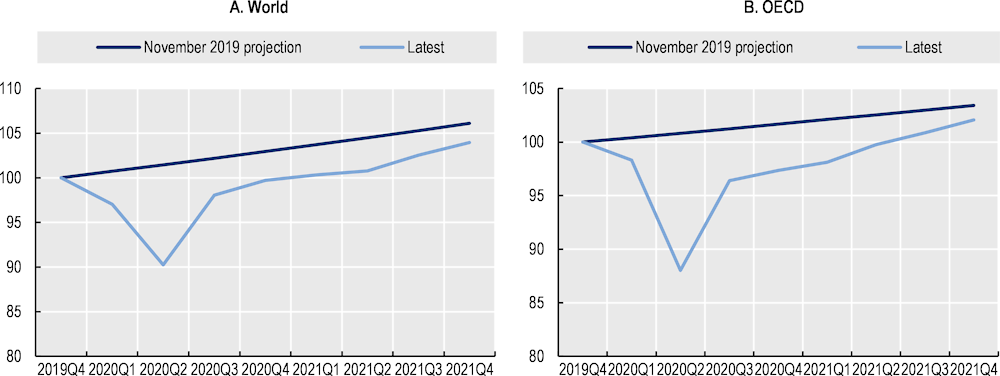

The quarterly profile of global GDP growth since the pandemic began has been volatile. The COVID-19 pandemic hit economies mostly in the second quarter of 2020, before rebounding (Figure 1.1). By the end of 2021 real GDP was back above pre-pandemic levels in most economies. However, despite the swift recovery, the effect of the crisis was still visible at the end of 2021 (Figure 1.2). In Q4 of 2021, the gap between the GDP level recorded and the GDP level projected before the pandemic was still significant at the global level (above 2%) and, to a smaller extent, the OECD as a whole (less than 1.5%).

However, foregone growth to date has not been distributed equally. The loss has been greater for middle-income emerging-market economies than for advanced economies, and greatest of all for low-income developing countries (OECD, 2021[1]). Amongst major emerging-market economies, the gap between the GDP level recorded and pre-pandemic projections is especially large for India and Indonesia, and to a lesser extent for Brazil and South Africa. In those countries that recorded relatively slow recoveries, this has often been due to delays in vaccinations, the greater size and importance of the informal sector and international tourism, poorer quality health systems and more limited fiscal space. There is a risk that scarring results from the crisis, notably due to lasting income losses and to education disruptions affecting the future of many children. In contrast, there was a quick return to the output path projected before the pandemic in China, helped by ample policy space, although the zero-COVID policy has continued to cause occasional disruptions to activity.

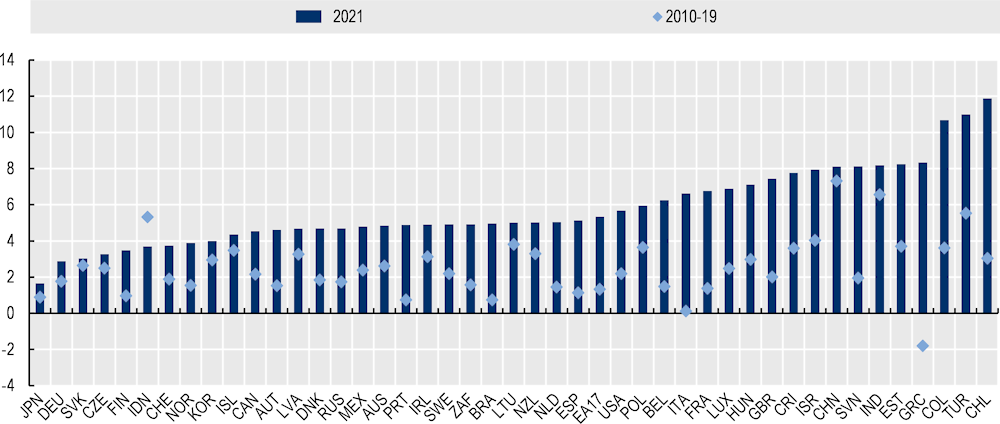

The pace of recovery has also varied across the OECD economies (Figure 1.3). By the end of 2021, output in some OECD countries was in line with a pre-pandemic counterfactual – for Colombia, Costa Rica, Finland, Lithuania, the Netherlands, Poland, Switzerland, and the United States. For the United States, the large pandemic-related fiscal stimulus, including the American Rescue Plan in early 2021, helped to boost GDP growth as well as the global outlook (OECD, 2021[2]). However, many OECD countries lagged behind, especially in Europe. In Q4 of 2021, the GDP of the euro area and the United Kingdom was still more than 2% below pre-pandemic expectations. Policies implemented to mitigate COVID-19 consequences notably diverged between the United States and the euro area, shaping a different recovery (Boone, 2022[3]), where the different size and timing of pandemic waves, as well as the diverse speed of vaccination campaigns during 2021 also partly explain different outcomes across countries. Similar to emerging economies, the pre-existing size of the travel and tourism sector, which suffered from restrictions on international mobility, also played a role (Rusticelli and Turner, 2021[4]). Differences in the measurement of non-market activities contributed to the output differences recorded across countries too (OECD, 2021[5]; Mitchell et al., 2022[6]). Overall, GDP growth in the OECD as a whole was 5.5% in 2021 after a decline of 4.6% in 2020.

Figure 1.1. Real GDP growth

Note: Aggregates using weights in purchasing power parities.

Source: OECD Economic Outlook 111 database.

Figure 1.2. Comparison of GDP with its pre-pandemic expected level

Source: OECD Economic Outlook 111 database; OECD Economic Outlook 106 database; and OECD calculations.

Figure 1.3. Real GDP growth in OECD and selected non-OECD countries

Note: Growth in Ireland was computed using gross value added at constant prices excluding foreign-owned multinational enterprise dominated sectors.

Source: OECD Economic Outlook 111 database; and OECD calculations.

1.1.2. Labour market conditions returned towards the pre-crisis situation

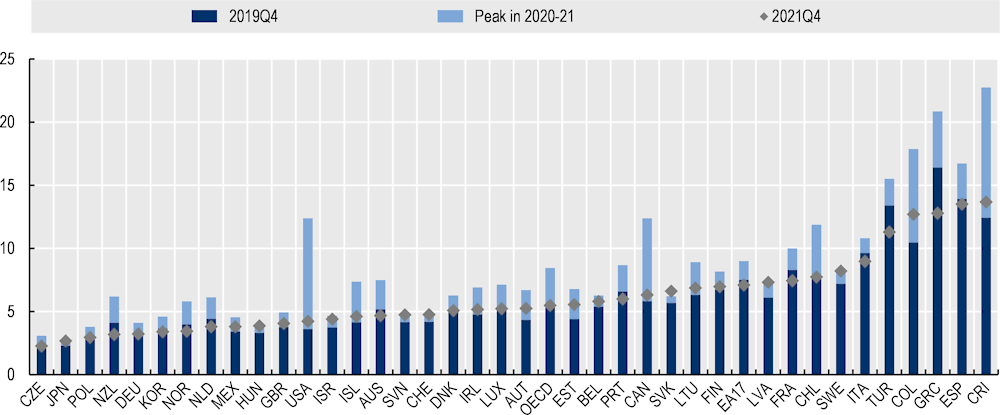

The OECD unemployment rate declined to 5.5% of the labour force by the end of 2021, almost returning to pre-pandemic levels (5.4% in 2019). Compared with previous crises, the impact of COVID-19 on aggregate unemployment proved relatively short-lived, especially given that the recovery of labour markets usually lags output. For many countries, the unemployment rate barely moved during 2020 despite a sizeable fall in output (Figure 1.4), reflecting the successful use of job retention schemes. However, the unemployment rate increased significantly in 2020 in Canada, Chile, Colombia, Costa Rica, Greece, and the United States.

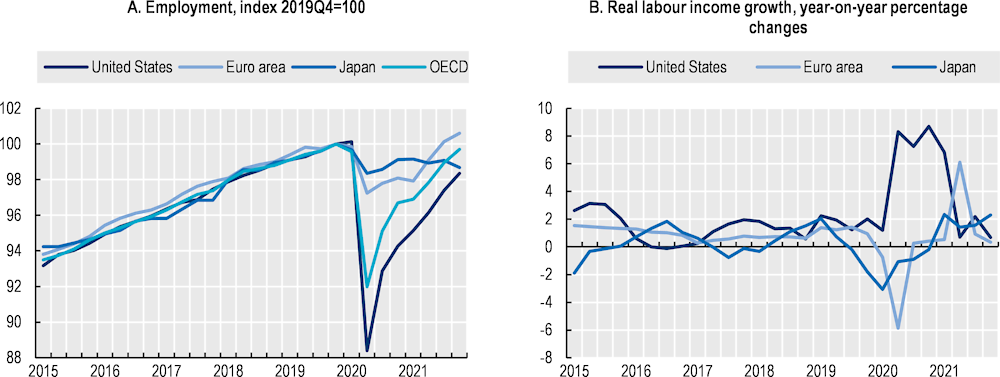

In the United States, the unemployment rate increased by nearly 6.5 percentage points (p.p.) over two quarters to reach approximately 13% by mid-2020. Unemployment quickly returned to levels approaching the pre-pandemic level by the end of 2021, but the employment level remained nearly 2 p.p. below its pre-pandemic rate (Figure 1.5, Panel A), despite rising labour shortages in several sectors – notably in leisure and hospitality, transport and warehousing (OECD, 2021[1]). Part of the decline in labour force participation came from early retirements, as well as exits related to the COVID-19 crisis. Real labour income surged in 2020 for those employed, as inflation was low and the newly unemployed had previously been employed in low-wage occupations (Figure 1.5, Panel B), but by the end of 2021, real labour income growth slowed, reflecting higher inflation and the return of low-wage workers to the labour market.

Changes to the euro area labour market were more limited. While output fell sharply at the peak of the pandemic, the unemployment rate increased by approximately 1 p.p. during 2020 and 2021 and was even below its pre-crisis level at the end of 2021. The fall in employment was temporary in the euro area and by the end of 2021 it had already exceeded its pre-pandemic level (although in many countries total hours worked had not fully recovered) (Figure 1.5, Panel A). The situation was very similar in the United Kingdom, where the expansion in job retention schemes supported workers and firms when health-related restrictions prevented economic activities (OECD, 2021[7]). Inside the euro area, Greece and Spain were more affected than other countries due to the larger contribution of tourism to employment. Labour market policies also resulted in a temporary reduction in labour income at the peak of the pandemic, while data for Q4 of 2021 suggest the real wage rate remained flat over the year (Figure 1.5, Panel B).

Figure 1.4. Unemployment rates in OECD countries

Figure 1.5. Employment and real income growth

Note: In Panel B, labour income per employee deflated by the private consumption deflator.

Source: OECD Economic Outlook 111 database; and OECD calculations.

In Japan, the labour market was less affected by the pandemic than in other economies. The unemployment rate barely moved and changes in employment were marginal in 2020, but 2021 proved more difficult as the country’s economic recovery was more sluggish than elsewhere in the OECD (OECD, 2021[8]). More sanitary restrictions – partly resulting from the slow start to its vaccination campaign – dampened the recovery in employment. Real labour income growth was depressed in 2020 but grew above its long-term average at the end of 2021 helped by limited consumer price inflation.

Recent labour developments appear quite different from those experienced during the global financial crisis. Labour market transitions (mobility between jobs and in and out of employment) were particularly affected in 2008 and it took more than a decade for the transition from study to unemployment to return to pre-recession levels (Causa, Luu and Abendschein, 2021[9]). The impact of COVID-19 is estimated to be smaller in that regard, but with some variation across countries. The increased use of teleworking over the last two years appears likely to persist (Adrjan et al., 2021[10]).

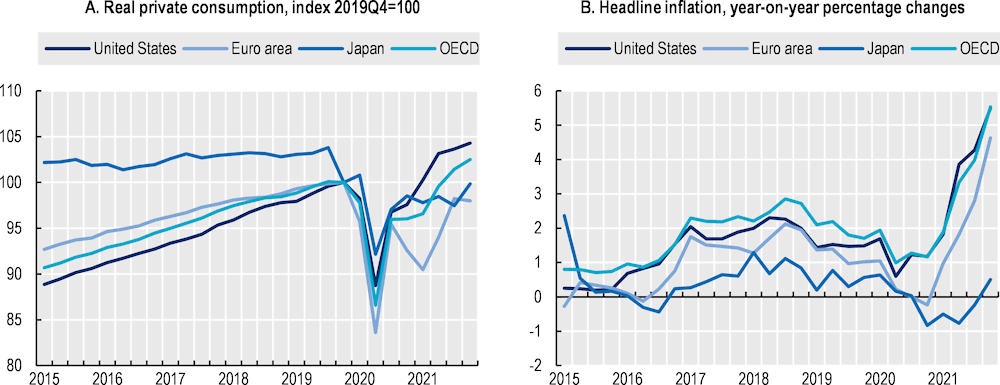

1.1.3. The rebound in private consumption brought a quick recovery but also contributed to higher inflation

Private consumption growth in the OECD returned to a level approaching its pre-crisis trend in 2021 (Figure 1.6, Panel A). The 6.3% growth recorded was despite some service activities remaining constrained due to health-related restrictions and changes in consumer preferences, following a large decline in 2020 (around -5.5%). Policy support for household incomes and the decline in spending led to a marked rise in household saving rates in 2020. The decline in saving rates from these temporarily very high levels, together with accommodative fiscal and monetary policies, helped to push spending growth well above income growth (OECD, 2021[1]).

Despite a sizeable fall in Q2 of 2020, there was a speedy and strong rebound in private consumption in the United States. This rebound was sufficiently large that for the two-year period to the end of 2021, private consumption increased by a similar magnitude to the two previous years (nearly 2.5% for 2017-2019 vs. nearly 2% for 2019-2021). Meanwhile, the composition of spending changed dramatically – spending on goods represented nearly 35% of consumer expenditure by Q4 of 2021, up from just over 30% in 2019. In the euro area and Japan, private consumption at the end of 2021 remained below pre-crisis levels but still increased by approximately 3.5% and 1.25%, respectively. Spending on goods also picked up relative to spending on services, but the composition change was much smaller than in the United States.

The surge in private spending on goods, in addition to persistent supply disruptions, contributed to the acceleration of inflation in the second half of 2021 (OECD, 2021[1]). Sanitary restrictions and COVID-19-related absences caused delivery times to rise, and inventories were substantially depleted in many industries. Production of cars was particularly affected by semiconductor shortages – in Germany, lower car production is estimated to have reduced GDP by more than 1.5% in 2021 (Guilloux-Nefussi and Rusticelli, 2021[11]). The effect of supply disruptions could also be seen in the surge in shipping costs, which also contributed to rising inflation in OECD countries (OECD, 2021[12]).

Figure 1.6. Private consumption and headline inflation

Note: In Panel B, labour income per employee deflated by the private consumption deflator.

Source: OECD Economic Outlook 111 database; and OECD calculations.

Energy prices were another key driver of consumer price inflation during 2021, the result of supply restrictions and resurgent demand (IEA, 2021[13]). In the last quarter of 2021, headline inflation for the OECD reached 5.5% year-on-year, its highest level since the mid-1990s (5.5% in the United States, 4.5% in the euro area 17 and 0.5% in Japan). Even excluding food and energy products, annual consumer price inflation for the OECD as a whole reached 4% in Q4 of 2021. The surge in inflation reduced purchasing power across the population, but the substantial savings accumulated during the pandemic by largely better off households helped partially mitigate their impact on total household demand. Most central banks announced a gradual normalisation of the future monetary stance in 2021 to fight inflation and address the risks of inflation expectations becoming less well anchored, with some central banks in small open advanced economies and emerging-market economies already raising policy rates in the latter part of 2021.

1.1.4. Investment picked up in 2021

With the recovery firming, fixed capital investment rebounded in 2021. For the OECD as a whole, gross fixed capital formation grew 5% in 2021 after a decline of nearly 4.25% in the previous year. Strong output growth, very low interest rates and improvements in business confidence all helped to boost corporate investment. A build-up of corporate raised concerns but did not weigh on investment, notably thanks to strong growth of liquid, short-term investments held by companies (OECD, 2021[1]). While pandemic support measures were partially unwound during 2021, fiscal policy also continued to sustain demand and business investment. Government investment also picked up in some economies.

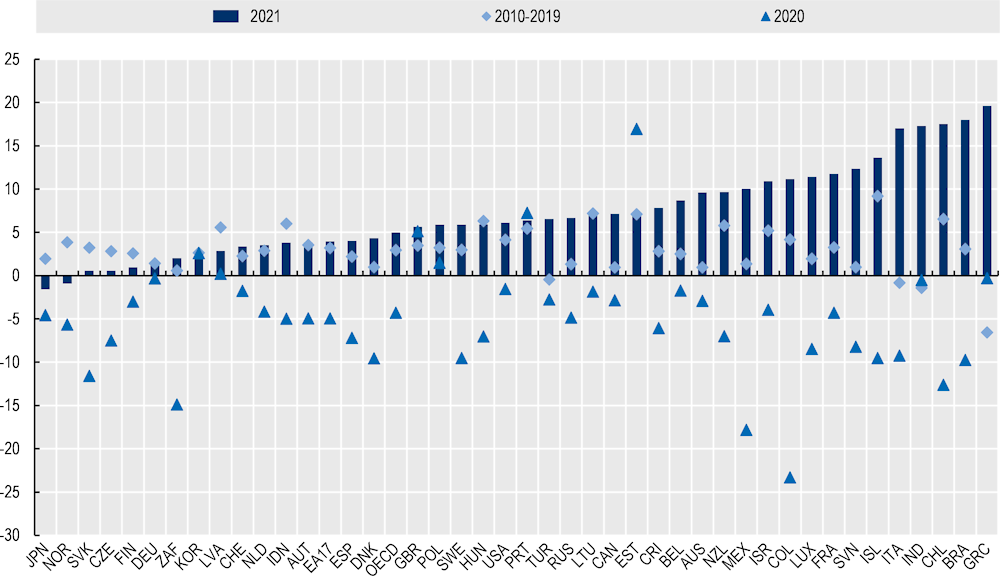

Figure 1.7. Gross fixed capital formation growth in OECD and selected countries

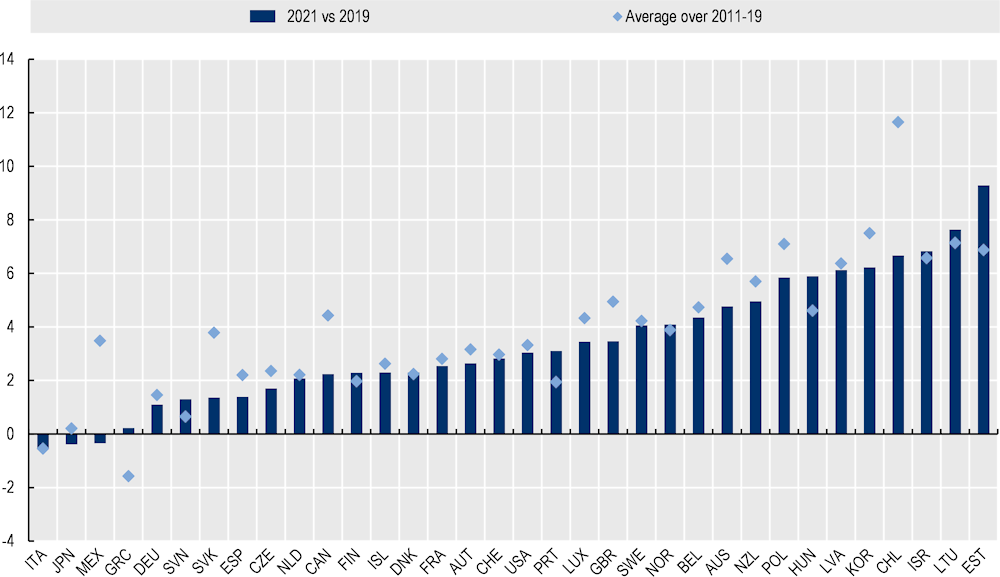

OECD estimates indicate that the two-year growth rate of the productive capital stock in 2021 was comparable with the situation before the COVID-19 crisis (Figure 1.8). Nevertheless, the productive capital stock in 2021 is estimated to have been below that in 2019 in some countries, notably Greece, Italy, Japan, and Mexico.

Figure 1.8. Productive capital stock growth

1.2. Public debt and budget balances

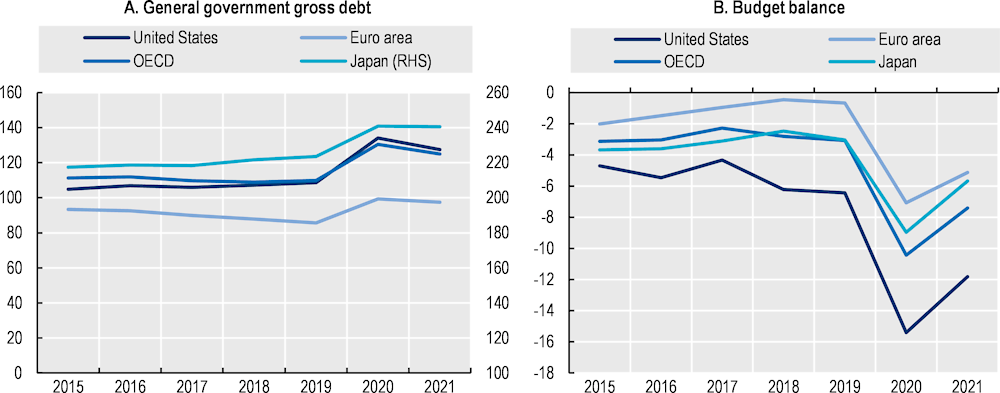

1.2.1. Budget balances started to normalise in 2021 but public debt ratios remained high

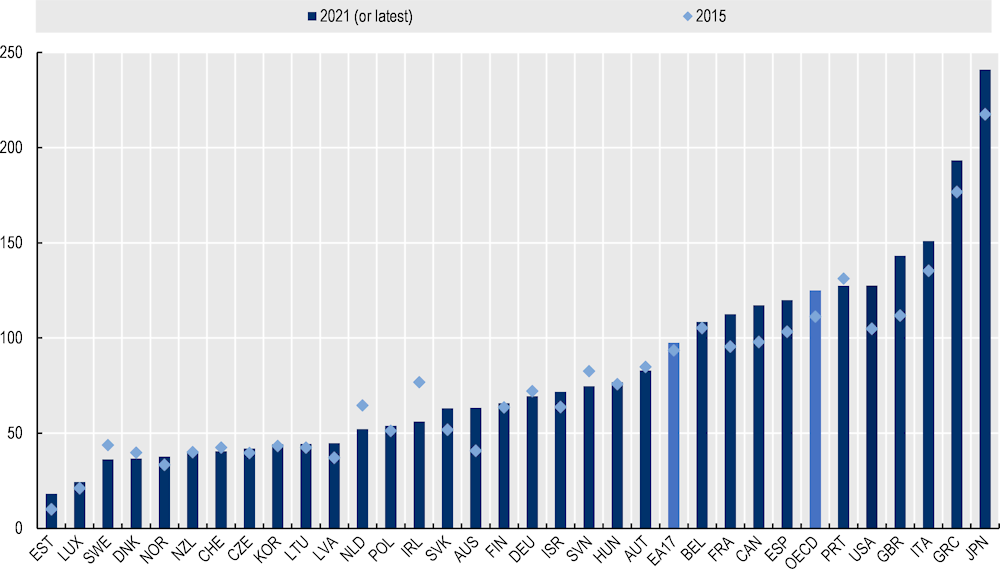

Strong and swift pandemic-related fiscal responses led government expenditures to soar during the pandemic. With revenues declining, borrowing and public debt rose sharply. For the OECD as a whole, general government gross debt increased by more than 20 p.p. in 2020, before declining slightly to an estimated 125% of GDP in 2021 (Figure 1.9, Panel A). In the euro area, the public debt ratio levelled off in 2021 at around 100% of GDP. Across the OECD, there were wide differences with the gross debt ratio ranging from below 30% in Estonia and Luxembourg to above 150% in Italy, Greece, and Japan (Figure 1.10). For all countries, the pandemic-related debt burden has added to existing fiscal pressure from secular trends such as population ageing and the rising relative price of services, implying that most OECD governments will eventually need to undertake fiscal reforms to maintain current public service standards and benefit levels over the longer term (Guillemette and Turner, 2021[14]; OECD, 2021[15]).

Average OECD budget deficits peaked at around -10% of GDP in 2020 and moderated to approximately -7.5% of GDP in 2021 (Figure 1.9, Panel B). The United States recorded a particularly large deterioration in its fiscal balance in 2020, which was maintained in 2021, as the government extended unemployment benefits and sought to support low- and middle-income families and to increase public spending on transport infrastructure, broadband and clean technologies. In the euro area, the fiscal stance remained expansionary in 2021, helped by continued support during successive pandemic waves. Support through the EU-wide recovery plan (“Next Generation EU”) will cover several years (OECD, 2021[7]).

In 2021, many countries started to consolidate their deficit, though to varying degrees. A measure which removes the influence of the economic cycle indicates a moderate pace of consolidation for the OECD as a whole (of about 0.75 percentage points (p.p.) of GDP). Using the same metric, there was discretionary consolidation in the United States (of around 1.25 p.p.) but a further fiscal easing in the euro area (by 0.75 p.p.).

Figure 1.9. General government gross debt and budget balance

Note: Maastricht definition for general government gross debt of the euro area. The 2021 data for Japan are estimates.

Source: OECD Economic Outlook 111 database; and OECD calculations.

Fiscal policies during the pandemic boosted public investment, but not sufficiently to make up for past shortfalls. It is expected that about three-fifths of OECD countries will experience an increase in the share of public investment in total public expenditure over the next two years (Morgavi, Pina and Sunel, 2022[16]), with a notable share of this investment dedicated to addressing long-term challenges such as the transition towards a greener economy. Nonetheless, this is not enough to compensate for insufficient investment in the past and to make up for shortfalls in GDP per capita. In the ten years before COVID-19, annual growth of potential GDP per capita stood at 1.1% in the median OECD country, about 0.9 p.p. lower than in the decade before the GFC.

Figure 1.10. General government gross debt, 2021 or latest

Note: 2020 data was used for Israel, Japan, and Spain; 2019 for Korea; and 2021 data for the rest of the countries.

Source: OECD Economic Outlook 111 database; and OECD calculations.

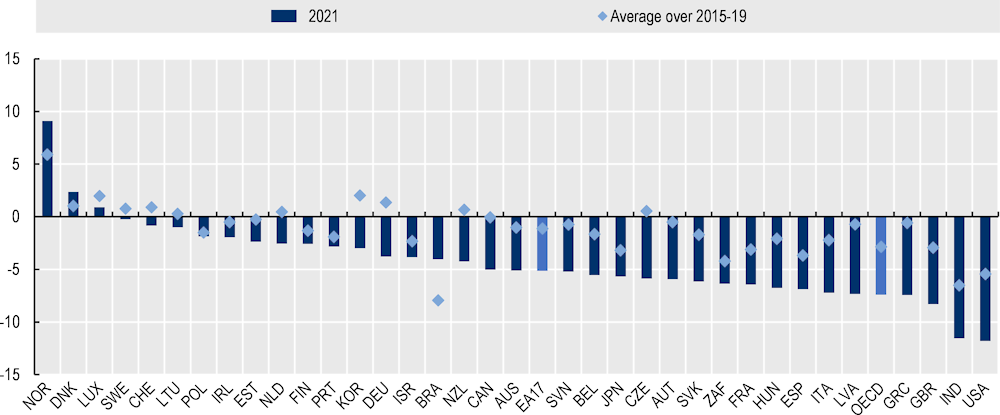

All countries introduced fiscal measures in response to the economic consequences of COVID-19, contributing to higher budget deficits in 2021 (Figure 1.11). In major emerging-market economies, the fiscal response was usually more limited than amongst OECD countries either because they had less fiscal space or because they were less severely affected by the pandemic. The average OECD headline deficit increased by around 7.5 p.p. of GDP in 2020, a significantly larger rise than the 3 p.p. of GDP recorded by China and India in the same year (OECD, 2022[17]; OECD, 2021[1]).

Figure 1.11. General government budget balance, 2021 or latest

Note: 2021 is an OECD projection for Brazil, Japan, Korea, New Zealand, and Switzerland.

Source: OECD Economic Outlook 111 database; and OECD calculations.

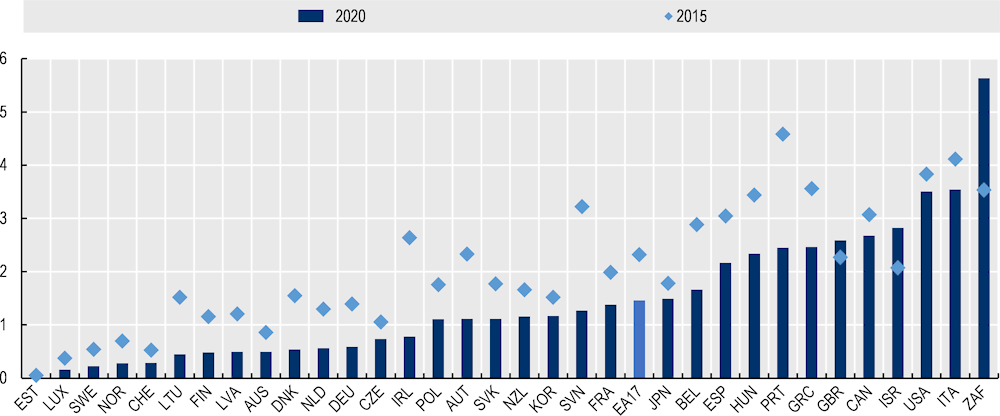

Government bond yields declined substantially over 2020-21 for most countries, supported by accommodative monetary policy by the major central banks (OECD, 2021[1]). The rate on 10-year government bonds was negative on average in both 2020 and 2021 for some countries, including Austria, Belgium, Denmark, Finland, Germany, Luxembourg, the Netherlands, the Slovak Republic, and Switzerland. The increasing share of debt issued at a low interest rate helps to explain a downward trend for overall interest payments on public debt, which were lower in 2021 than in 2015 for all countries, apart from Israel, South Africa, and the United Kingdom, despite higher debt levels. Towards the end of 2021, bond yields started to increase in anticipation of the future normalisation of monetary policy. However, it will take some time for this to be reflected in debt service burdens given the maturity structure of debt.

Figure 1.12. Gross government interest payments in OECD and selected countries, 2020

Note: 2020 data used for Korea, Japan, New Zealand, and Switzerland.

Source: OECD Economic Outlook 111 database; and OECD calculations.

1.3. Trends in income inequality

1.3.1. While income inequality had been decreasing before the crisis, the impact of the pandemic on inequality remains uncertain

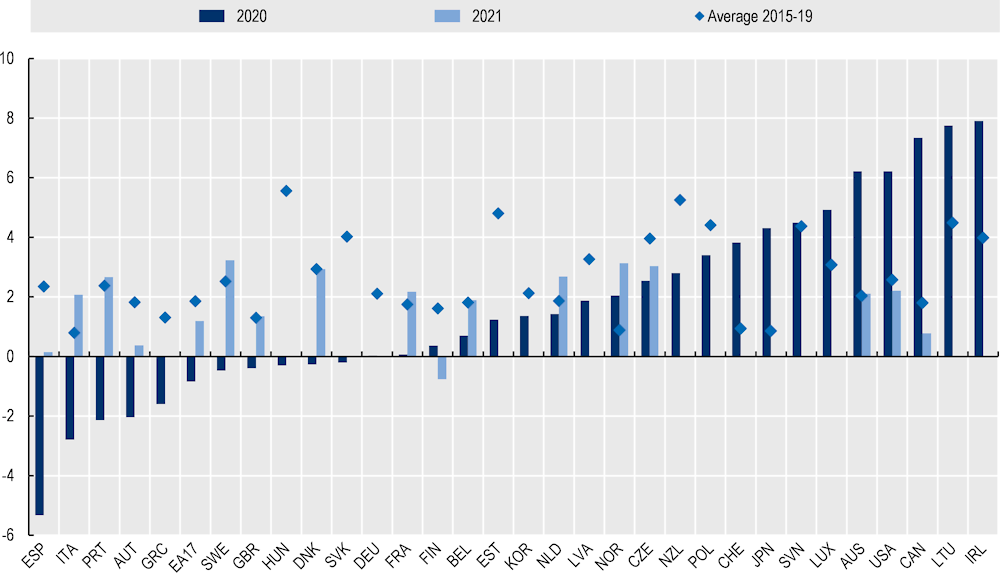

COVID-19 had a diverse impact on household disposable income (Figure 1.13). In some countries, such as Australia, Canada, Ireland, Lithuania and the United States, extraordinary government support, often in the form of cash transfers and other benefits, resulted in an unusually strong increase in real incomes in 2020. However, in most countries, government support associated with restrictions on the consumption of some services also helped to raise household saving rates to record highs (OECD, 2021[5]) largely to the benefit of the wealthy and those households with higher incomes. Household income for 2021, when available, returned to historical averages, except in a few countries such as Austria, Finland, and Spain.

Figure 1.13. Real household disposable income growth, 2020

In some countries, income support during COVID-19 reduced inequalities. In Canada, household disposable income increased substantially more for the lowest two income quintiles in 2020 compared to other quintiles; it was again the case in 2021 except compared to the highest quintile (as reported by Statistics Canada). Disruptions to schooling during the pandemic, which were not uniform in their impact across locations and social groups, also have the potential to exacerbate earnings disparities in the future (OECD, 2021[18]).

References

[10] Adrjan, P. et al. (2021), “Will it stay or will it go? Analysing developments in telework during COVID-19 using online job postings data”, OECD Productivity Working Papers, No. 30, OECD Publishing, Paris, https://doi.org/10.1787/aed3816e-en.

[3] Boone, L. (2022), The EA and the US in the COVID-19 crisis: Implications for the 2022-2023 policy stance, https://oecdecoscope.blog/2022/01/18/the-ea-and-the-us-in-the-covid-19-crisis-implications-for-the-2022-2023-policy-stance/.

[9] Causa, O., N. Luu and M. Abendschein (2021), “Labour market transitions across OECD countries: Stylised facts”, OECD Economics Department Working Papers, No. 1692, OECD Publishing, Paris, https://doi.org/10.1787/62c85872-en.

[14] Guillemette, Y. and D. Turner (2021), “The long game: Fiscal outlooks to 2060 underline need for structural reform”, OECD Economic Policy Papers, No. 29, OECD Publishing, Paris, https://doi.org/10.1787/a112307e-en.

[11] Guilloux-Nefussi, S. and E. Rusticelli (2021), Supply-side disruptions are dragging down the automotive sector, https://oecdecoscope.blog/2021/12/22/supply-side-disruptions-are-dragging-down-the-automotive-sector/.

[13] IEA (2021), What is behind soaring energy prices and what happens next?, https://www.iea.org/commentaries/what-is-behind-soaring-energy-prices-and-what-happens-next.

[6] Mitchell, J. et al. (2022), “International comparisons of the measurement of non-market output during the COVID-19 pandemic”, OECD Statistics Working Papers, No. 2022/03, OECD Publishing, Paris, https://doi.org/10.1787/301f1306-en.

[16] Morgavi, H., A. Pina and E. Sunel (2022), Increasing public investment to strengthen the recovery from the pandemic: A glass only half-full, https://oecdecoscope.blog/2022/03/07/increasing-public-investment-to-strengthen-the-recovery-from-the-pandemic-a-glass-only-half-full/.

[17] OECD (2022), OECD Economic Surveys: China 2022, OECD Publishing, Paris, https://doi.org/10.1787/b0e499cf-en.

[2] OECD (2021), OECD Economic Outlook, Interim Report March 2021, OECD Publishing, Paris, https://doi.org/10.1787/34bfd999-en.

[12] OECD (2021), OECD Economic Outlook, Interim Report September 2021: Keeping the Recovery on Track, OECD Publishing, Paris, https://doi.org/10.1787/490d4832-en.

[5] OECD (2021), OECD Economic Outlook, Volume 2021 Issue 1, OECD Publishing, Paris, https://doi.org/10.1787/edfbca02-en.

[1] OECD (2021), OECD Economic Outlook, Volume 2021 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/66c5ac2c-en.

[7] OECD (2021), OECD Economic Surveys: Euro Area 2021, OECD Publishing, Paris, https://doi.org/10.1787/214e9f0a-en.

[8] OECD (2021), OECD Economic Surveys: Japan 2021, OECD Publishing, Paris, https://doi.org/10.1787/6b749602-en.

[15] OECD (2021), Tax and fiscal policies after the COVID-19 crisis, https://doi.org/10.1787/5a8f24c3-en.

[18] OECD (2021), The State of Global Education: 18 Months into the Pandemic, OECD Publishing, Paris, https://doi.org/10.1787/1a23bb23-en.

[4] Rusticelli, E. and D. Turner (2021), “The economic costs of restricting international mobility”, OECD Economics Department Working Papers, No. 1678, OECD Publishing, Paris, https://doi.org/10.1787/dcad4c73-en.

Note

← 1. Preliminary estimates of medium-term output loss show that annual potential output growth in the median advanced and emerging-market economy could have declined by 0.3 and 0.4 percentage point per year (OECD, 2021[5]).