This chapter is based on the OECD Global Revenue Statistics Database and its accompanying publications. It describes the latest tax revenue trends, analysing both total tax-to-GDP ratios and tax structures over time, across OECD countries and a selection of inclusive framework jurisdictions for whom data are available. A preliminary analysis of the initial impact of the COVID-19 crisis on tax revenues is also included.

Tax Policy Reforms 2022

2. Tax Revenue Trends

Abstract

This chapter describes the latest tax revenue trends, analysing both total tax-to-GDP ratios and tax structures over time, across OECD countries and a selection of Inclusive Framework jurisdictions for whom data is available.1 Where possible, the analysis covers tax revenue trends until 2020 – the last year for which comparable tax revenue data from the OECD Global Revenue Statistics Database are available (see Box 2.1). This overview provides useful background to the subsequent discussion on the latest tax reforms introduced by countries (Chapter 3) and may in part reflect the impact of past reforms discussed in earlier editions of this annual publication.

Overall, this chapter shows that the average OECD and partner countries’ tax-to-GDP ratio rose marginally against the background of the COVID-19 pandemic. Although nominal tax revenues fell in the majority of OECD and partner countries in 2020, the falls in GDP levels across countries were often greater, resulting in a 0.1 percentage point (p.p) increase in the average tax-to-GDP ratio to 32.4% in 2020.

This chapter also identifies trends in tax structures and shows the notable impact that the pandemic had on the composition of overall tax revenues. Previous editions of this report have highlighted how the average tax structure has remained relatively stable over time, but the COVID-19 crisis altered this, at least temporarily, having a much stronger impact on direct taxes on income than indirect or property taxes. In 2020, an increase is observed in tax revenues from personal income taxes (PIT) and social security contributions (SSCs) as a share of GDP, on average across the OECD; whereas corporate income taxes (CIT) experienced the largest relative decrease, albeit smaller than that observed during the global financial crisis. No change was seen in property taxes or Value Added Taxes (VAT) as a share of GDP, on average, and a small but widespread decrease in revenues from excise duties was experienced, particularly because of mobility restrictions and reduced fuel use.

The preliminary data for 2020 discussed in this chapter suggests that tax policy measures implemented in OECD countries, as a whole, did not lead to significant declines in tax-to-GDP ratios. In many cases, the fall in GDP was larger than the fall in tax revenues, and a as result, tax-to-GDP levels remained stable or increased slightly. Tax policy changes via deferrals or reductions in tax liabilities, enhanced tax credits and allowances and temporary or permanent reductions in tax rates often directly reduced revenues, and the sharp reduction in economic activity due to lockdowns and other restrictions reduced labour force participation, household consumption and business profits, further affecting tax revenues. However, government support measures may have indirectly supported tax revenues insofar as they were successful in reducing job losses and business closures. These support measures may therefore have contributed to the weaker nominal falls in tax revenues than were seen during the global financial crisis of 2008-2009.

2.1. Trends in tax revenue levels

2.1.1. Variance in tax revenues remains large despite continued narrowing

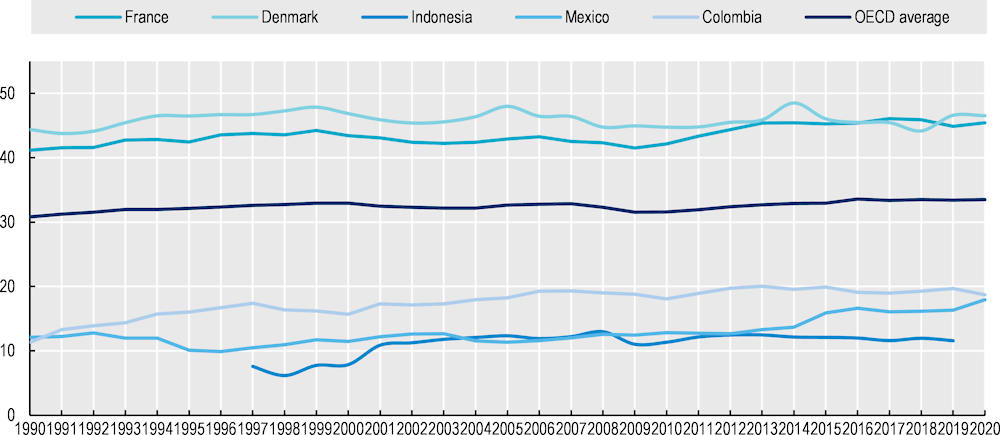

Tax revenues in 2020 varied significantly across the countries for whom data are available, ranging from just above 10% to more than 46% of GDP. Denmark had the highest tax-to-GDP ratio in 2020 (46.5%), and with the exceptions of 2017 and 2018, in which France was higher, has had the highest tax-to-GDP ratio of all OECD countries since 2002. France had the second-highest tax-to-GDP ratio in 2020 (45.4%). On the other end of the scale, and consistent with data over the last decade, Indonesia (11.6%), Mexico (17.9%) and Colombia (18.7%) had the lowest tax-to-GDP ratios (see Figure 2.1).

Figure 2.1. Trends in tax-to-GDP ratios from 1990 to 2020

Note: The OECD average in 2020 is calculated by applying the unweighted average percentage change for 2020 in the 36 countries providing data for that year to the overall average tax to GDP ratio in 2019. The additional countries selected are those that represent the lower and upper bounds of tax-to-GDP ratios.

Source: OECD Global Revenue Statistics Database.

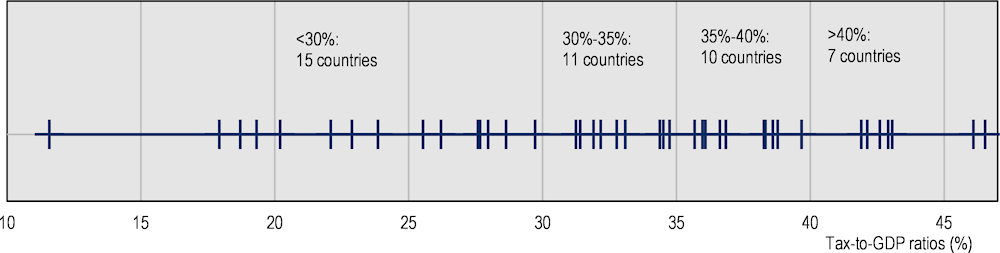

Despite the wide range of tax-to-GDP ratios, there is a relatively high concentration of countries with tax-to-GDP ratios around the OECD average. On average across OECD countries, tax revenues amounted to 33.5% of GDP in 2020 (Figure 2.1), with the average falling slightly to 32.4% when the five additional IF jurisdictions are included (see Note 1). Figure 2.2 shows a high concentration of countries that have tax revenues close to that level with 11 countries recording tax revenues between 30% and 35% of GDP and another 10 countries with tax revenues ranging from 35% to 40% of GDP. Canada (34.4%), the Czech Republic (34.4%) and the United Kingdom (32.8%) were the countries closest to the OECD average. A marginally larger number of countries recorded tax-to-GDP ratios further away from the OECD average: 15 had tax-to-GDP ratios below 30%, including all but one of the five partner countries, Brazil (33.1%), and seven countries recorded tax revenues above 40% of GDP.

Figure 2.2. Distribution of tax-to-GDP ratios in 2020

Note: Each + represents the tax-to-GDP ratio of an OECD or partner country in 2020. Partner countries included are Argentina, Brazil, China (People's Republic of), Indonesia and South Africa. 2019 data were used for Argentina, Australia, Brazil, China, Japan, Indonesia, and South Africa.

Source: OECD Global Revenue Statistics Database.

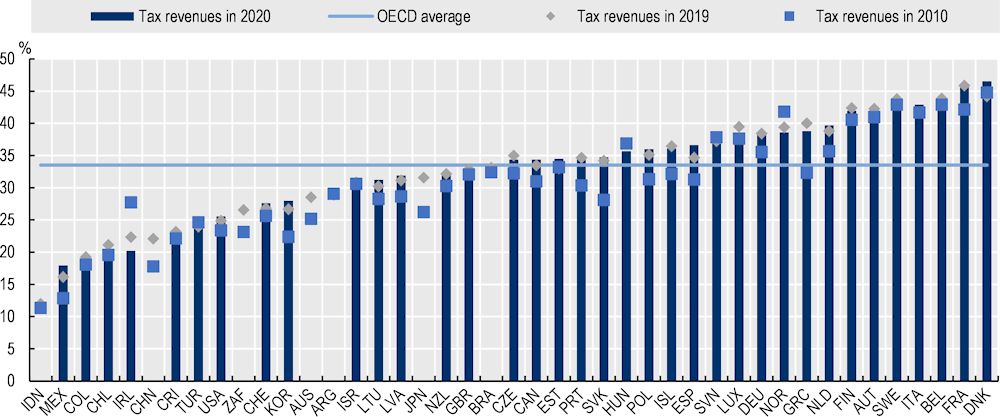

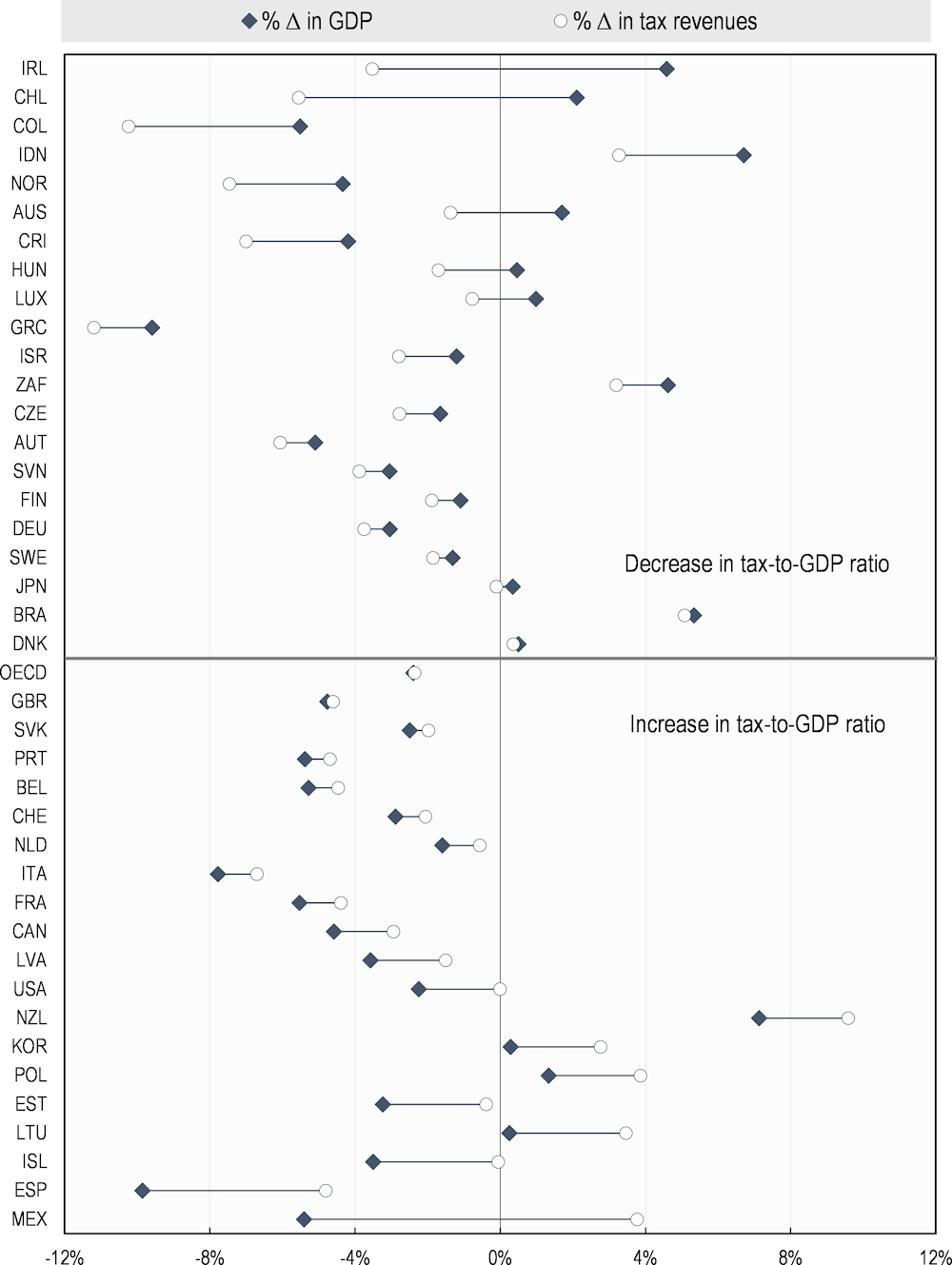

Of the 36 countries for which data for 2020 are available, the ratio of tax revenues to GDP compared to 2019 rose in 20 and fell in 16 (Figure 2.3). Between 2019 and 2020, the largest tax ratio increase was in Spain, at 1.9 (p.p.) of GDP. This was largely due to an increase in revenues from SSCs as a share of GDP (1.5 p.p.), following a smaller fall in SSC revenues than in GDP (see Section 2.2 for more information). The second largest increase was in Mexico (1.6 p.p.), with increases in all major tax types both in nominal terms and as a share of GDP. Iceland was the only other country with an increase of over 1 p.p. Ireland experienced the largest fall in the tax-to-GDP ratio between 2019 and 2020, at 1.7 p.p. The decrease in Ireland was in large part due to a fall in VAT revenues following the temporary reduction in VAT rates in 2020 and the impact of the COVID-19 pandemic in decreasing economic activity. Smaller falls in PIT, SSCs, property taxes and excises also contributed. Decreases in the tax-to-GDP ratio of more than one percentage point were observed in Chile (1.6 p.p.) and Norway (1.3 p.p.). In Norway, the fall was due to a sharp decrease in CIT revenues (3.5 p.p.), due to temporary changes in the Petroleum Tax Act to help oil and gas companies introduce planned investments as well as the opportunity to offset losses in 2020 against taxed surpluses from the previous two years. This fall was counterbalanced by increases in all other major tax types. See Figure 2.9 for a more detailed examination of the change in tax revenues as a share of GDP by tax category between 2019 and 2020.

Figure 2.3. Tax revenues as a share of GDP by country in 2019 and 2020

Note: 2020 data are unavailable for Argentina, Australia, Brazil, China, Japan, Indonesia, and South Africa.

Source: OECD Global Revenue Statistics Database.

Over the last decade, the average tax-to-GDP ratio was higher in 2020 (32.4%) than in 2010 (30.5%) for the countries for whom data were available. Across countries, the tax-to-GDP ratio was higher in 2020 than in 2010 in 34 countries. The largest increase was seen in the Slovak Republic (6.7 p.p.) and in Greece (6.5 p.p.); increases of over 5 p.p. were also seen in Korea, Spain, Japan (2019 data) and Mexico. Decreases since 2010 were seen in the remaining nine countries. The largest fall has been in Ireland, from 27.7% in 2010 to 20.2% of GDP in 2020, largely due to the exceptional increase in GDP in 2015, although the tax-to-GDP ratio has declined more slowly since 2015.

2.1.2. The COVID-19 pandemic had a notable impact on tax-to-GDP ratios

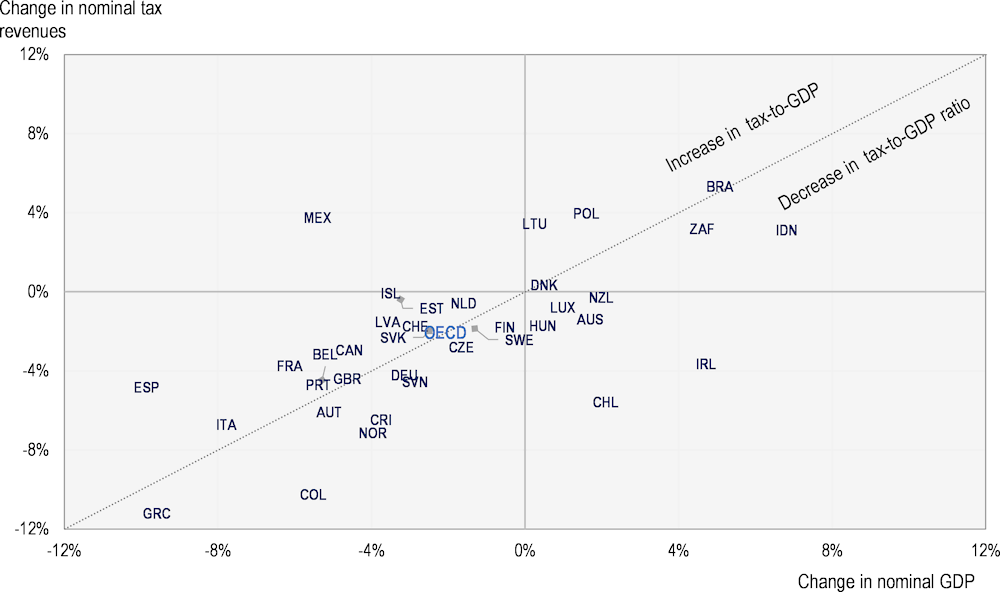

Changes in tax-to-GDP ratios are driven by relative changes in nominal tax revenues and nominal GDP. If tax revenues rise more than GDP or fall less than GDP from one year to the next, the tax-to-GDP ratio will increase. Conversely, if tax revenues rise less than GDP, or fall more than GDP, there will be a decrease in the tax-to-GDP ratio. Therefore, an increase in the tax-to-GDP ratio should not be immediately interpreted as an increase in tax revenues in nominal, or even real, terms.2

In 2020, 20 OECD and partner countries experienced an increase in their tax-to-GDP ratio relative to 2019. However, as shown in Figure 2.4 this was due to an increase in nominal tax revenues in only six of these countries. The slightly higher average tax-to-GDP ratio recorded in 2020 relative to 2019 was therefore the result of marginally larger falls in GDP than tax revenues during the COVID-19 crisis. In the remaining 14 countries in which tax-to-GDP ratios increased in 2020, both tax revenues and GDP fell – with even larger falls in GDP. As shown in Figure 2.5, tax-to-GDP ratios declined in 16 OECD countries, falling by 2.4% on average. Of these 16 countries, only Denmark had higher levels of tax revenues in nominal terms than the preceding year, but this increase was slightly less than the growth in nominal GDP. Eleven of these countries saw declines in both nominal tax revenues and in nominal GDP, with tax revenues decreasing further; and the remaining four countries (Ireland, Chile, Hungary, and Luxembourg) saw decreases in nominal tax revenues concurrent with increases in nominal GDP. The changes for Australia, Brazil, Indonesia, Japan, and South Africa are from 2018 to 2019, as revenue statistics were not available for 2020 at the time of writing.3 All five countries experienced falls in their tax-to-GDP ratios: in Australia and Japan because nominal tax revenues decreased while GDP increased, and in Brazil, Indonesia, and South Africa because tax revenue growth did not keep pace with GDP growth.

Figure 2.4. Changes in nominal tax and nominal GDP from 2019 to 2020

Note: Data for 2020 are preliminary and should be interpreted with caution; please see Box 2.1 for more details. Data for Australia and New Zealand show the change between the fiscal years 2018 and 2019 (as both countries report tax revenues on a fiscal year basis that includes Q2 of 2020 in the 2019 fiscal year); data for Japan are not included as data on SSC revenues is not available. See Box 2.2 for more information. The diagonal line across the graph represents the point at which the change in tax revenues and in GDP were of the same magnitude and therefore the point at which the tax-to-GDP ratio remained unchanged. Countries above the diagonal line had increases in their tax to GDP ratios; countries below it, had falls.

Source: Revenue Statistics (2021[1]).

Figure 2.5. Relative changes in nominal tax revenues and nominal GDP in 2019 and 2020

Note: The figure is split into two sections, the first part for those countries that experienced a decrease in their tax-to-GDP ratio, the second for those who experienced an increase. Within these groups, countries are then ordered by those that experienced the largest change in their nominal GDP between 2019 and 2020 relative to their change in nominal tax revenues between 2019 and 2020. For example, Ireland experienced a -3.5% fall in its tax revenues between 2019 and 2020, and a 4.6% increase in its GDP over the same period. Mexico, meanwhile, recorded a 3.8% increase in its tax revenues between 2019 and 2020, and a -5.4% decrease in its GDP. Data for Australia, Brazil, Indonesia, Japan, and South Africa show the change between 2018 and 2019, as preliminary data for 2020 were not available.

Source: OECD Revenue Statistics (2021[1]).

Box 2.1. The OECD Global Revenue Statistics Database

The Global Revenue Statistics Database provides the world’s largest public source of harmonised tax revenue data, verified by countries and regional partners. Spanning more than 110 countries in all corners of the world, the database provides a rich and accessible resource for policymakers and researchers, based on the internationally recognised OECD standard. It allows comparisons of the tax burden in these countries, measured by the tax-to-GDP ratio, as well as of the tax structure or tax mix, i.e., the distribution of total tax revenues by the main types of taxes. The database presents tax revenue data in national currency and USD and provides information on the share of tax revenues attributed to different levels of government.

Domestic revenues are critical to efforts to fund sustainable development and to implement the Sustainable Development Goals. The database supports these efforts by measuring progress on domestic resource mobilisation, building statistical capability, and providing country-specific indicators as called for in SDG 17, in the Addis Ababa Action Agenda and by more than 55 countries and international organisations in the Addis Tax Initiative.

The database shows that countries have made strong progress towards mobilising domestic financing for development in the 21st century. Tax revenues are now higher as a percentage of GDP and their levels are more evenly distributed across countries than they were at the turn of the century. With few exceptions, the countries that recorded the lowest level of tax revenues in 2000 have increased their revenues the most.

The Global Revenue Statistics Database is updated several times a year with the latest available data from the regional Revenue Statistics publications, which cover Africa, Asia and the Pacific, Latin America and the Caribbean, and OECD countries.

Data are available for most OECD countries up to the year 2020, while other countries included in the analysis have provided data up to 2019. Notably, the 2020 tax revenue data presented in this Chapter remain provisional until possible revisions following the publication of 2021 data.

The database can be accessed at the following web address:

2.2. Trends in the composition of tax revenues

2.2.1. The composition of tax revenues has remained relatively stable

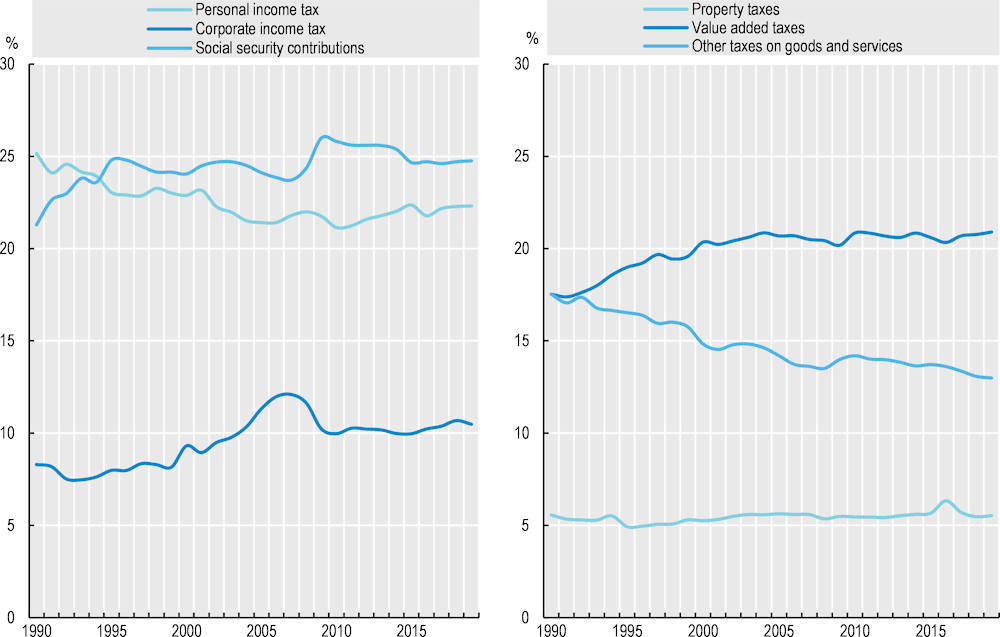

While on average tax levels have generally been rising, the tax structure or tax ‘mix’ has remained relatively stable over time. Nevertheless, several trends have emerged up to 2019 – the latest year for which data is available for the 38 OECD countries and five partner countries.

Revenues from personal income taxes were 22.3% of total taxes on average in 2019 compared with around 24.2% at the beginning of the 1990s. Corporate income tax revenues rose from around 8.2% of total tax revenues in 1990, on average, to a high of 12.1% in 2007. Following the aftermath of the global financial crisis, they have remained at between 9-10% of total tax revenues over the last decade.

Figure 2.6. Trends in tax structures from 1990 to 2019

Note: The OECD average tax revenue in 2016 from main categories includes the one-off revenues from stability contributions in Iceland. This predominately affects the average revenues from property taxes, as a percentage of total tax revenues, in that year only.

Source: OECD Global Revenue Statistics Database.

The average share of SSCs in total tax revenues has increased more than any other tax type over the last 30 years. SSCs represented 24.7% of the overall tax composition in 2019, having risen from 20.3% in 1990. Notable increases in the proportion of SSCs in total tax revenues were seen following the global financial crisis as rates were increased in a significant number of countries, reflecting governments’ desire to raise revenues quickly (OECD, 2016[2]).These trends also highlight the rapid revenue-raising effects of increases in SSCs and consumption tax rates compared to other taxes.

Consumption taxes consistently contributed the largest share to total tax revenues of all major tax category types between 1990 (33.1%) and 2019 (33.9%). However, their composition – between VAT/GST, excise tax and customs duties – has changed considerably. VAT/GST revenues have risen considerably, from 17% of total tax revenues in 1990 to 20.9% in 2019. Similar to SSCs, a particularly large increase in VAT/GST was registered shortly after the global financial crisis given the relatively immediate revenue-raising effects of these taxes. The share of other excise taxes on specific goods and services in total tax revenues fell considerably in OECD and partner countries, from 16.7% to 12.3%, over this period. Customs duties and other trade-related taxes were reduced considerably across countries from 1990 onwards but remain elevated in the five emerging economies for which data are available as compared to OECD countries. These revenue changes reflected a global trend to remove trade barriers, as well as the general shift from specific consumption taxes to general consumption taxes – the VAT in most cases.

Between 1990 and 2019, the share of taxes on property has remained relatively constant within the overall tax composition. Taxes on property as a proportion of total tax revenues have remained between 5.2% and 5.4% for all but one year over this period on average across OECD and partner countries. As noted under Figure 2.6, the average tax revenue from property in 2016 was notably affected by one-off revenues from stability contributions in Iceland.

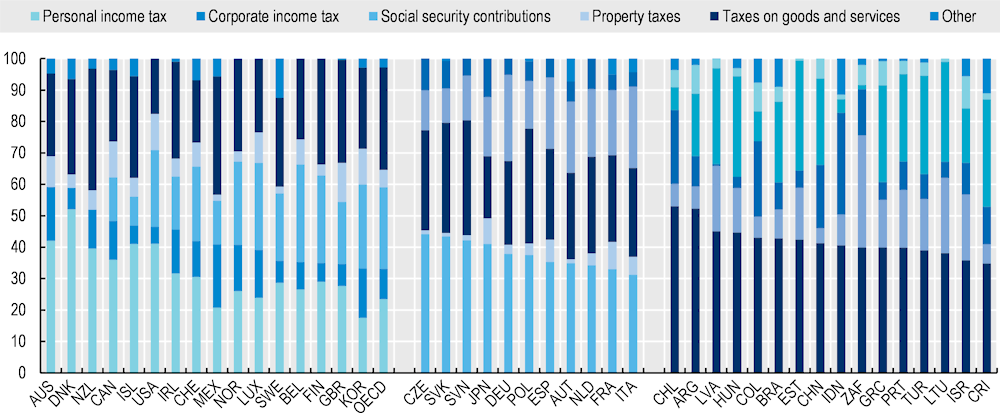

2.2.2. There is notable variation in the composition of countries’ tax revenues

There are significant differences between countries’ tax structures across OECD members and emerging economies. Seventeen countries raised the largest proportion of their total tax revenues from income taxes (both corporate and personal), while ten relied most heavily on SSCs, and 16 countries recorded consumption taxes (including VAT) as the largest contributor – the last group containing all five non-OECD partner countries. Taxes on property and payroll taxes played a smaller role in the revenue systems of most countries in 2019, both in most countries and, on average, across those countries for which data is available.

Figure 2.7. Tax structures by country in 2019

Note: Countries are grouped and ranked by those where income tax revenues (personal and corporate) form the highest share of total tax revenues, followed by those where social security contributions, and, subsequently, taxes on goods and services, form the highest share.

Source: OECD Global Revenue Statistics Database.

As shown in Figure 2.7, OECD and partner countries collected 32.8% of their tax revenues through taxes on income and profits – of both individuals and companies – on average in 2019. There are ten countries in which taxes on personal and corporate incomes represent 40% of total tax revenues – Australia, Canada, Denmark, Iceland, Ireland, Mexico, New Zealand, Norway, Switzerland, and the United States. Of these countries, Australia, Denmark, and New Zealand received over 50% of their total tax revenues in taxes on income, as only a very small proportion (Denmark) or no SSCs are collected these countries.

The variation in the share of income taxes (i.e., PIT and CIT) between countries is considerable. In 2019, it ranged from lows of 4.8% in China, 6.1% in Costa Rica and 6.8% in Colombia to 41% in the United States, 42% in Australia and 52.1% in Denmark. The share of the CIT in total tax revenues varied considerably across countries in 2019, from less than 5% (France, Hungary, Italy, and Latvia) to over 20% in Chile (23.4%), Colombia (24%) and Indonesia (32.3%). In addition to differences in statutory corporate income tax rates, these differences are at least partly explained by institutional and country specific factors, including variations in incorporation rates, the breadth of the corporate income tax base, and the degree of cyclicality of the corporate tax system (given its implications for loss-offset provisions).

In 2019, SSCs accounted for 24.8% of total tax revenues on average across OECD countries and the emerging economies covered. In 11 countries, including Central European countries and large Western European countries, SSCs are the primary source of tax revenues. In the Slovak Republic, the Czech Republic, Lithuania, and Slovenia, SSCs account for over 40% of total tax revenues.

Tax revenues from consumption taxes represented 33.9% of the average OECD and partner countries’ tax composition and were the primary source of revenues in 16 countries in 2019. Argentina and Chile collected over 45% of their tax revenues from consumption taxes in 2019 while personal income taxes accounted for 7.1% and 7.2%4 respectively – the lowest shares among the 43 countries analysed (see footnote 1 at the beginning of this chapter). Property tax revenues also vary widely across countries: Canada, Israel, Korea, the United Kingdom, and the United States had property tax revenues that amounted to more than 10% of total tax revenues, but in Estonia and Lithuania property taxes accounted for less than 1% of total revenues.

2.2.3. Tax structures appear to have changed in the face of the economic impact of the COVID-19 pandemic

The economic impact of the COVID-19 pandemic appears to have driven changes to the tax structure in several countries. These changes were visible in both changes to nominal tax revenues by each tax type and their share as a proportion of GDP. Boxes 1.2 and 2.1 in the OECD’s Revenue Statistics publication (OECD, 2021[1]) provide more detail on the methodology used for calculating the tax-to-GDP ratio and how nominal tax revenues and tax-to-GDP ratios should be interpreted.

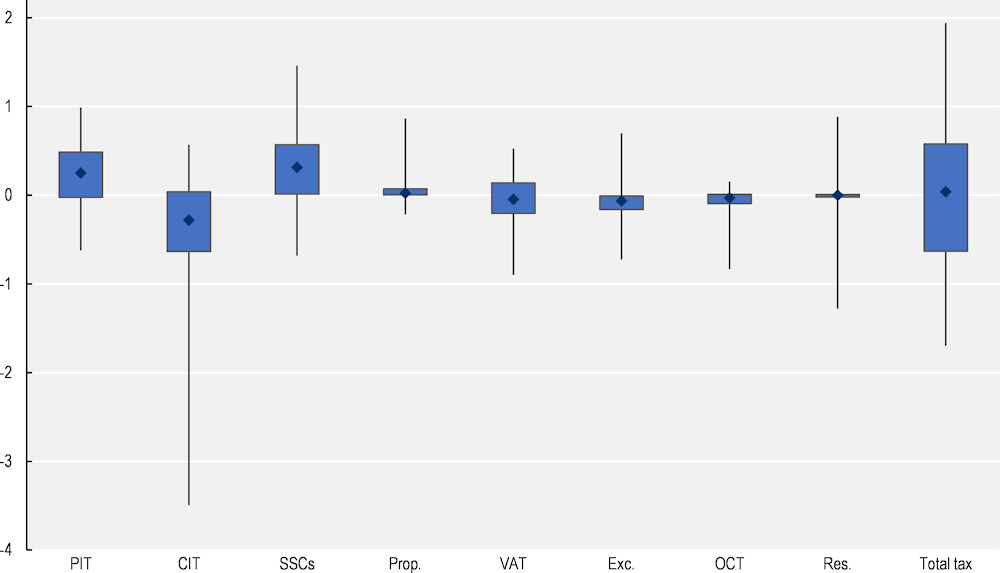

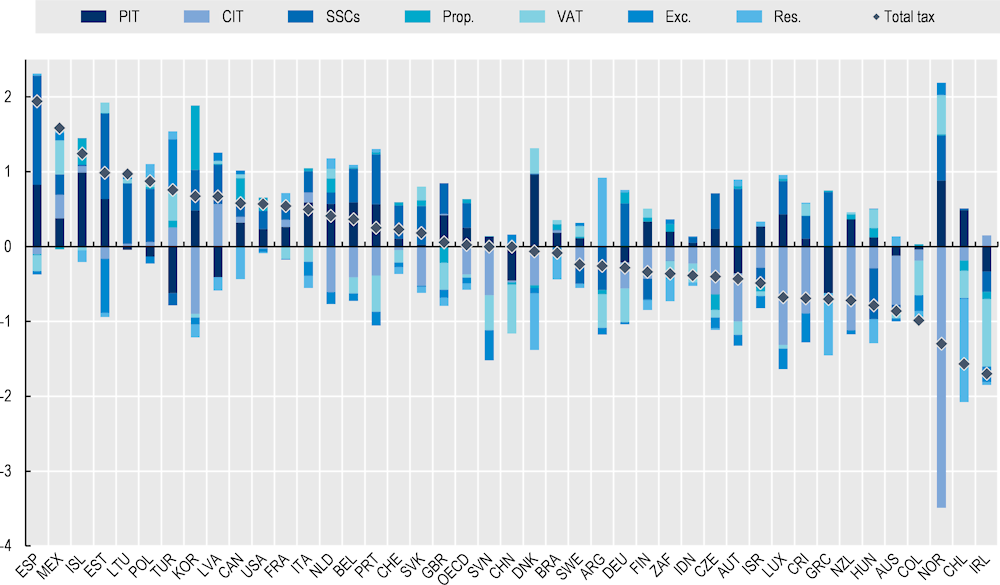

Between 2019 and 2020, taxes on income were more strongly affected than indirect or property taxes. In 2020, the largest increases in revenues as a share of GDP were seen in PIT and SSCs, which both increased on average by 0.3 percentage points. The largest fall was seen in CIT, which decreased by 0.4 p.p., on average (Figure 2.8). No change was seen in property taxes or VAT as a share of GDP, on average, and a smaller decrease (of 0.1 p.p.) was seen for excise revenues.

In nominal terms, PIT and SSC revenues increased on average between 2019 and 2020. In its Revenue Statistics publication (2021[1]), the OECD shows that country-level changes in PIT and SSCs were only weakly correlated with changes in nominal GDP. This suggests that the respective tax bases remained relatively stable considering broader GDP fluctuations, or that policy changes limited the impact of economic changes on revenues from these tax bases, for example, by stabilising the base, or increasing the effective tax rate. Seventeen OECD countries recorded increases in nominal PIT revenues and twenty saw increases in SSCs in nominal terms. In those countries that experienced a nominal fall in PIT and SSCs, many recorded a smaller decrease than that of nominal GDP.

Approximately a quarter of countries (9) experienced decreases in PIT revenues as a share of GDP from 2019 to 2020, while half (18) saw increases of between zero and 0.5 p.p. The remaining quarter (10 countries) recorded increases of more than 0.5 p.p. year-on-year. The country that saw the largest fall in PIT revenues as a share of GDP was Türkiye (-0.6 p.p.), followed by Austria and Latvia (both by -0.4 p.p.). At the other end of the scale, Denmark registered the largest increase in PIT revenues as a share of GDP (1.0 p.p.). Seven OECD countries experienced decreases in SSC revenues as a share of GDP, while 29 countries saw increases, 13 of which were greater than 0.5 p.p. Hungary recorded the largest decrease in SSCs at -0.7 p.p., while the largest increase was seen in Spain (1.5 p.p.); the latter was a consequence of a much sharper fall in nominal GDP (-9.9%, the largest contraction across the OECD) than in SSC revenues (4.8%).

Figure 2.8. Changes in tax revenues by category as a share of GDP from 2019 to 2020

Note: In the figure, the lowest point represents the minimum country change for the tax type between 2019-2020; the box represents the changes for countries between the lower and upper quartiles (i.e., 50% of countries had changes within the range shown by each box); and the upper point for each tax type represents the maximum country change. The line in each box represents the median country change (i.e., half of countries were both above and below this line). The tax category “Prop.” refers to property taxes, “Exc.” to excise taxes, “OCT” to other consumption taxes, and “Res.” to Residual. Note that the figure contains only data for OECD countries who had preliminary data available for 2020 – it therefore does not cover partner countries Argentina, Brazil, China, Indonesia, and South Africa.

Source: OECD Revenue Statistics (2021[1]).

Corporate income taxes, as a share of GDP, fell widely across OECD countries in 2020. The average fall in CIT revenues as a proportion of GDP was -0.37 p.p., with 26 countries recording falls. The largest decrease was seen in Norway (-3.5 p.p.), while the Czech Republic also experienced a decrease of over -1 p.p. Thirteen countries saw increases in CIT revenues as a percentage of GDP in 2020 relative to 2019, the largest of which was experienced in Latvia.

Revenues from excise taxes decreased slightly as a share of GDP on average in 2020 and this tax category saw the most widespread reductions in revenues of all tax types, with falls in 28 countries. Most decreases were caused by reduced sales of transport fuels leading to falls in fuel excises due to COVID-19-related mobility restrictions and lockdowns. The largest fall was seen in Estonia (-0.7 p.p.) and the largest increase was seen in Türkiye (0.7 p.p.). Other than Estonia and Türkiye, the range of changes across countries was comparatively small, reflecting in part the smaller size of excises as a share of total tax revenues. No other changes in excise revenues exceeded 0.5 p.p. of GDP in 2020.

Revenues from the CIT and excise taxes were the most heavily impacted by the crisis, both on average and in terms of the number of countries affected. Nominal CIT revenues fell by 12.1%, with 30 countries experiencing falls, whereas excise tax revenues fell by 5.4% on average, with 31 countries experiencing falls. The sharp fall in CIT revenues can be attributed to the impact of COVID-19 on general economic activity, while changes in nominal excise tax revenues across OECD countries were primarily due to COVID-19-related restrictions on mobility, which in turn limited fuel excise revenues (OECD, 2021[1]).

Figure 2.9. Decomposition of change in tax-to-GDP ratio by tax category, 2019-2020

Note: This graph includes the change between years 2018 and 2019 for Argentina, Australia, Brazil, China, Indonesia, New Zealand, and South Africa, as tax revenues for the full 2020 fiscal year were not available at the time of writing. Due to data availability, the average excludes Japan for SSCs (category 2000) and for total tax revenues; it excludes Greece for PIT (category 1100), CIT (category 1200), VAT (category 5111) and excises (5111) due to disaggregated data for these categories not being available.

Source: OECD Global Revenue Statistics Database.

Only a small change was observed in the average share of property tax revenues to GDP in 2020 relative to 2019 – an increase of 0.05 p.p. of GDP. Twenty-nine OECD countries saw increases in the share of property tax revenues, with 18 of these between 0 and 0.7 p.p. The largest increase was seen in Korea (0.9 p.p.). Of the nine OECD countries where property tax revenues fell as a share of GDP, the largest falls (0.2 p.p.) were seen in the Czech Republic and the United Kingdom.

Similarly, no significant change was observed in the average share of VAT to GDP in 2020 – a very small decrease of 0.04 p.p. was recorded by countries overall. VAT revenues decreased as a share of GDP in 19 countries and increased in the other 17 countries that apply a VAT, half of these changes being between -0.2 and +0.1 p.p. of GDP. The largest fall was seen in Ireland (0.9 p.p.) due to the temporary VAT rate cut during the COVID-19 pandemic as well as a decrease in economic activity. The largest increase was seen in Norway, at 0.5 p.p.

Revenues from VAT decreased slightly on average across OECD countries between 2019 and 2020. However, as described above, as a share of GDP, VAT/GST revenues remained relatively stable as this fall was more muted than the average fall in nominal GDP. Twenty-four OECD countries saw decreases in nominal VAT revenues in 2020. Country changes in VAT revenues were more closely correlated to changes in GDP, contributing to their relative stability as a share of GDP on average.

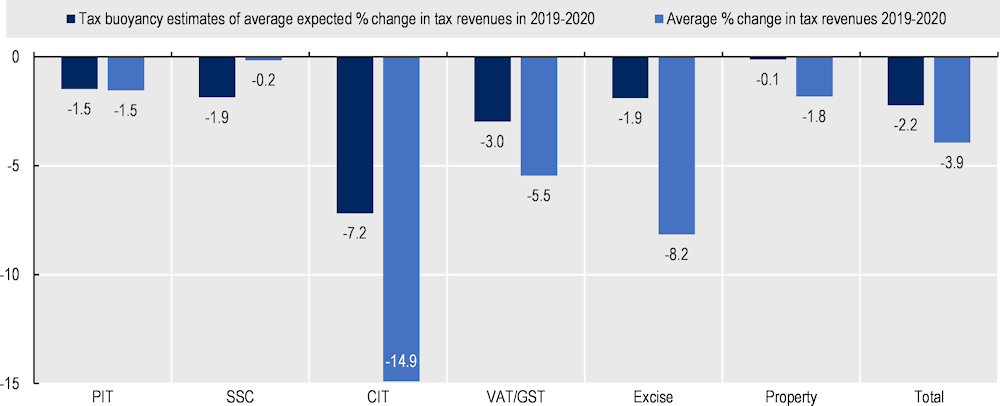

Box 2.2. Using tax buoyancy estimates to assess whether changes in tax revenues in 2020 were smaller or larger than expected

Alongside tax revenue elasticity, tax revenue buoyancy is one of the key measures that captures the sensitivity of government revenue to economic activity. For instance, an overall tax revenue buoyancy of 1.2 suggests that when GDP grows by 1%, total tax revenues would be expected to grow by 1.2%. Buoyancy estimates thus capture the total response of tax revenues to changes in GDP, including the impact of tax policy changes. In contrast, revenue elasticities control for tax policy reforms to isolate the impact of economic growth on tax revenue, i.e., in the absence of policy changes.

As tax buoyancy incorporates the impact of policy changes on tax revenues, it can be used to evaluate how the overall response of tax revenues to changes in economic growth in 2020 may have differed from previous years. Furthermore, decomposing the tax revenue impact into its individual components can suggest whether tax policy changes have been able to limit (or have exacerbated) the impact of macroeconomic conditions on particular tax categories, relative to earlier periods. Comparing real changes in tax revenues following an economic contraction with the estimates of tax revenue changes predicted by tax buoyancy calculations can thus shed light on the role of economic stabilizers and the nature of discretionary policy choices, such as increasing expenditure on furlough schemes and reducing revenue through tax cuts during the pandemic.

This box provides estimates of the short-term revenue buoyancy of different tax types between two consecutive years for OECD countries over the 2010-2019 period. The calculations are based on data from the OECD Global Revenue Statistics database and the methodology employed by Belinga et al. (2014[3]) who estimate short-run and long-run revenue buoyancy for OECD countries in their widely cited paper. As depicted below, the results suggest an average short-run revenue buoyancy over the 2010-2019 period of below 1 for total tax revenues and for all individual taxes components other than the CIT. Short-run buoyancy estimates are the lowest for property taxes, followed by PIT, SSCs, excise taxes, and VAT/GST.

Figure 2.10 compares OECD estimates of the expected tax revenue response (according to tax buoyancy estimates) against the actual experience recorded by countries in 2020. The expected response is calculated by multiplying the average short-run buoyancy estimate with average GDP growth in 2019-2020. Hence, it refers to the expected change in tax revenues had the response to the recession in 2020 been governed by the average short-run buoyancy over the 2010-2019 period. It is important to note that the results in Figure 2.10 may appear different to those described earlier in the Chapter, such as in Figure 2.8 and Figure 2.9. However, these differences reflect in large part the different values and calculations that are referred to, i.e., the difference between percentage changes (as in Figure 2.10) and percentage point changes (as in Figure 2.8 and Figure 2.9), as well as some small variances in the country data coverage.

Figure 2.10. Average inflation-adjusted change in tax revenue in 2019-2020 vs. expected change

Note: Based on 32 OECD countries with available data. Excludes countries without tax revenue data for 2020 and outliers (Iceland, Latvia, and Mexico) that record very large relative revenue changes for some taxes and years that significantly distort the results. Tax-specific short-run buoyancy indicators are estimated for the 2010-2019 period through a log-log single error correction panel regression, following the methodology in Belinga et al. (2014[3]). Property tax short-run buoyancy estimates have been included but the average is not statistically significant. All variables are adjusted for inflation.

Source: OECD Global Revenue Statistics Database and OECD calculations.

As illustrated in Figure 2.10, the decline in total tax revenues (-3.9%) in 2019-2020 was stronger than would have been expected - based on tax buoyancy estimates - given the size of the economic contraction (-4% real GDP). The decline in revenues also exceeded the expected reduction for most individual tax components, namely for CIT, VAT/GST, excise taxes and property taxes. On the contrary, the PIT and SSCs stand out because revenues in 2020 declined by less than or in line with the estimated short-run buoyancy.

The larger than expected decline in total tax revenues suggests that the specific nature of the pandemic shock and/or additional discretionary tax policies played a role. This was in addition to the functioning of automatic stabilizers and the potential replication of past policy choices, which are already represented by the expected reduction in tax revenues. Notably, the reduction of total revenues points to an implicit tax buoyancy of just less than 1 in 2020 (-3.9% average fall in tax revenues divided by a -4% fall in GDP).

The corporate income tax is known to be the most buoyant tax that fluctuates strongly with GDP growth (Dudine and Tovar Jalles, 2017[4]). However, in 2020, the implicit short-run buoyancy (3.7) surpassed the already large estimate for the 2010-2019 period (1.8) – the actual fall in CIT revenues (-14.9%) was therefore almost double its expected size (-7.2%). This large decline in CIT revenues is likely the result of a combination of lower profits due to the pandemic shock and the introduction of generous tax measures sought to provide relief to businesses, such as tax payment deferrals and the reduction of tax prepayments. Furthermore, the pandemic shock resulted in a large decline in excise tax revenues, even though the tax buoyancy estimates suggest that excise tax revenue usually does not respond strongly to changes in GDP. This anomalously large reduction was likely the result of the unprecedented policy response to the health crisis (lockdowns, mobility restrictions), resulting, for example, in reduced revenue from fuel excise taxes.

Though stronger than expected the reduction in VAT and property tax revenues remained closer to the expected contraction. The implicit short-run buoyancy for property taxes in 2020 is smaller than 0.5 (-1.8% fall in average property tax revenues divided by -4% fall in GDP), which compares against a short-run buoyancy that is, in statistical terms, not significantly different from zero over the 2010-2019 period. The somewhat larger buoyancy of property taxes in 2020 could be the result of policies that deferred or waived business and residential property tax payments or reduced property transaction taxes during the pandemic (OECD, 2021[5]). Similarly, the previous edition of the Tax Policy Reforms Report found that more than 80% of OECD countries introduced VAT payment deferrals. In addition, temporary VAT rate reductions, such as for medical supplies, were widespread. These discretionary choices together with changes in the tax bases driven by the pandemic shock elevated the implicit VAT short-run buoyancy in 2020 to a value above one (1.4).

The subdued decline in PIT and SSC revenues demonstrates the importance of automatic stabilizers as well as further unprecedented tax policy choices made in 2019-2020. In particular, the very small decline in PIT and SSC revenues relative to the contraction in GDP appears to reflect the success of large-scale and generous discretionary expenditure programmes such as furlough schemes and job subsidy programmes that were able to prevent widespread layoffs.

References

[3] Belinga, V. et al. (2014), “Tax Buoyancy in OECD Countries”, IMF Working Papers, Vol. 14/110, p. 1, https://doi.org/10.5089/9781498305075.001.

[4] Dudine, P. and J. Tovar Jalles (2017), “How Buoyant is the Tax System? New Evidence from a Large Heterogeneous Panel”, IMF Working Papers, Vol. 17/4, p. 1, https://doi.org/10.5089/9781475569797.001.

[1] OECD (2021), Revenue Statistics 2021: The Initial Impact of COVID-19 on OECD Tax Revenues, OECD Publishing, Paris, https://doi.org/10.1787/6e87f932-en.

[5] OECD (2021), Tax Policy Reforms 2021: Special Edition on Tax Policy during the COVID-19 Pandemic, OECD Publishing, Paris, https://doi.org/10.1787/427d2616-en.

[2] OECD (2016), Tax Policy Reforms in the OECD 2016, OECD Publishing, Paris, https://doi.org/10.1787/9789264260399-en.

Notes

← 1. Country coverage varies across and within Chapters due to the different data sources used. As in previous editions of the Tax Policy Reforms Report, the Tax Revenues Chapter uses data for all OECD countries as well as Argentina, Brazil, China, Indonesia and South Africa. The Chapter largely draws on data from the OECD Revenue Statistics publication. Notably, 2020 revenue data were not available for individual tax categories for certain OECD countries at the time of writing – Australia, Greece, Japan, and New Zealand. The latest data for the Inclusive Framework jurisdictions of Argentina, Brazil, China (People’s Republic of), Indonesia and South Africa were from 2019.

Where the text references an average across OECD and selected Inclusive Framework jurisdictions, this represents the unweighted average for all OECD countries, as well as Argentina, Brazil, China, Indonesia, and South Africa, unless otherwise specified.

← 2. See Box 1.2 in OECD (2021[1]) for details on the methodology used to calculate the tax-to-GDP ratio.

← 3. Argentina, China and Türkiye have also not been included in Figure 2.5 and Figure 2.4, as the data used in the figures are in nominal amounts, high levels of inflation can have a significant impact on the change in nominal tax revenues and nominal GDP. Türkiye, for example, recorded 12.3% inflation in 2020 as compared to 1.4% in the OECD on average, pushing both the change in nominal GDP and tax revenues by a notably larger amount than other OECD and partner countries. Similarly, Argentina recorded 54.4% annual inflation in 2019. China began providing social security contributions data to the OECD from 2019 and thus there is an anomalous increase in the country’s tax-to-GDP ratio for the years covered by Figures 2.4 and 2.5.

← 4. Chile has a dividend imputation system (either total or partial), therefore part of its revenues from personal income taxes are computed as corporate income tax revenues.