Individuals are subject to national income tax.

Individuals who are Greek tax residents are subject to income tax in Greece on their worldwide income earned in a certain tax year, whereas non-residents are subject to tax in Greece only on income sourced in Greece irrespective of their nationality, or place of domicile. Moreover, an individual whose stay in Greece exceeds183 days cumulatively in a twelve month period is considered as a tax resident in Greece and is subject to tax of his/her worldwide income irrespective of the individual’s nationality. This does not apply in the case of individuals who are in Greece exclusively for tourism or medical, therapeutic or similar purposes of private nature and their stay does not exceed 365 days, including short periods of stay abroad. Due consideration is given to bilateral conventions, for the elimination of double taxation, their provisions superseding domestic law.

Individuals who have completed 18 years of age are obliged to file an income tax return regardless whether they have taxable income or not.

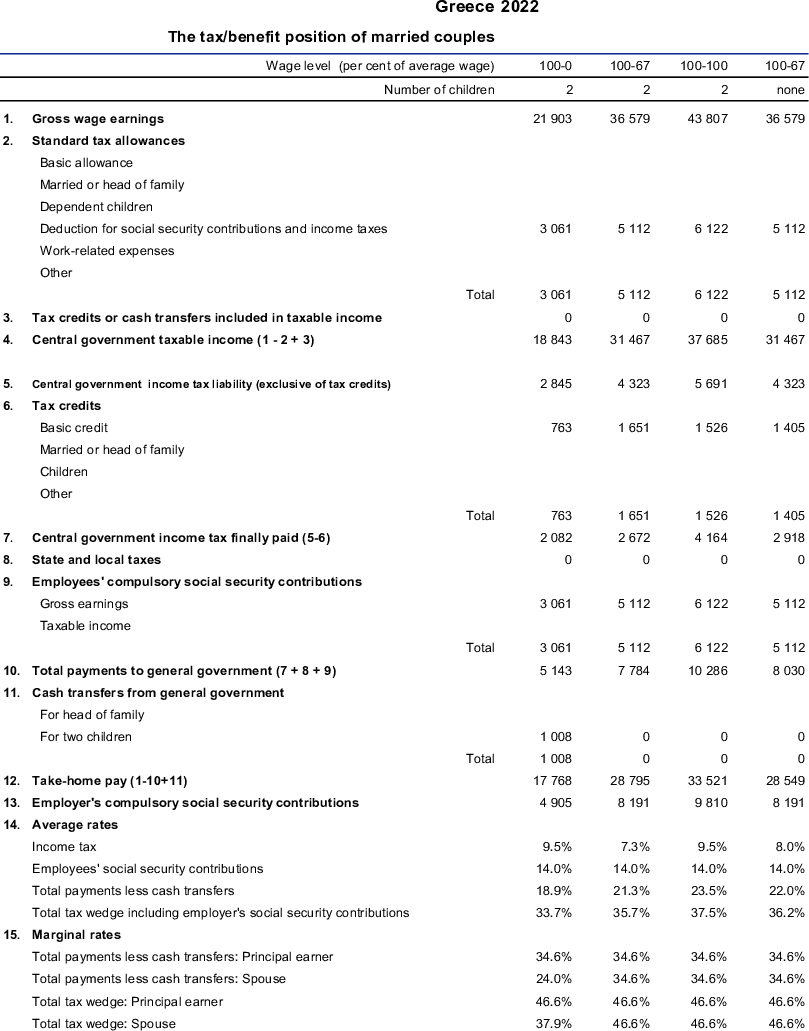

Spouses file a joint income tax return but each spouse is liable for the tax payable on his or her share of the joint income. Persons who have entered into a civil union – partnership can also file a joint income tax return. In this case, civil union partners have the same tax treatment as married couples. The tax return can be filed separately, if at least one of the spouses opts for it, with an irrevocable declaration for each tax year until 28 February of the year of submission of the return. This option is binding for the concerned tax year and also applies to the other spouse. Especially for tax year 2021, the deadline for submitting the irrevocable declaration was set at 2 March 2022.

Regarding income derived by minor children, the parent who has the custody is liable for filing a tax return. The income of minor children is added to the income of the parent who has the custody and is taxed in the name of the parent who is in principle liable for tax filing. This provision does not apply to the following types of income, in respect of which the minor child has a personal tax obligation: a) employment income and b) pensions due to the death of his father or mother.

Losses incurred by a spouse or civil union partner cannot be set off against the income of the other spouse or partner. Spouses or civil union partners file a return separately if (a) they have been divorced or have terminated the civil partnership at the time of the tax filing or (b) one of the spouses or civil union partners is bankrupt or has been subject to guardianship. The taxpayer’s spouse can be considered as a dependent member, provided that he/she does not have any taxable income.

As dependent members, related to the taxpayer, are regarded single children under the age of 18, adult children up to the age of 25 years studying at the university or serving their military service or registered as unemployed to the Manpower Employment Organisation (OAED); taxpayers are deem to be in charge for their ascendants and/or their spouses’ relatives (up to the 3rd degree) who are orphans provided that they live with them and their annual taxable income does not exceed the amount of EUR 3 000 (alimony and disability benefits and similar allowances are not included). The taxpayer children and siblings of both spouses with a disability of at least 67% who are single or divorced or widowed: are also considered as dependent members, unless their annual income exceeds the amount of EUR 6 000 (not including alimony and disability benefits and similar allowances).