(

Taxing Wages 2023

New Zealand (2022-2023 Income tax year)

Abstract

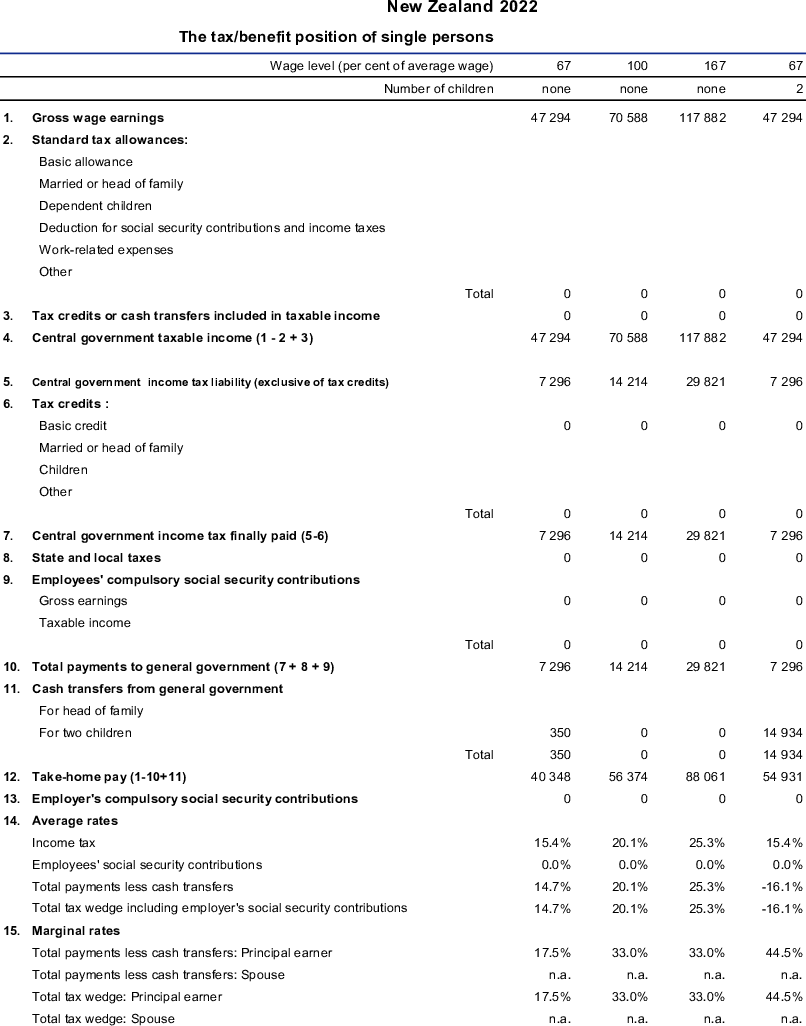

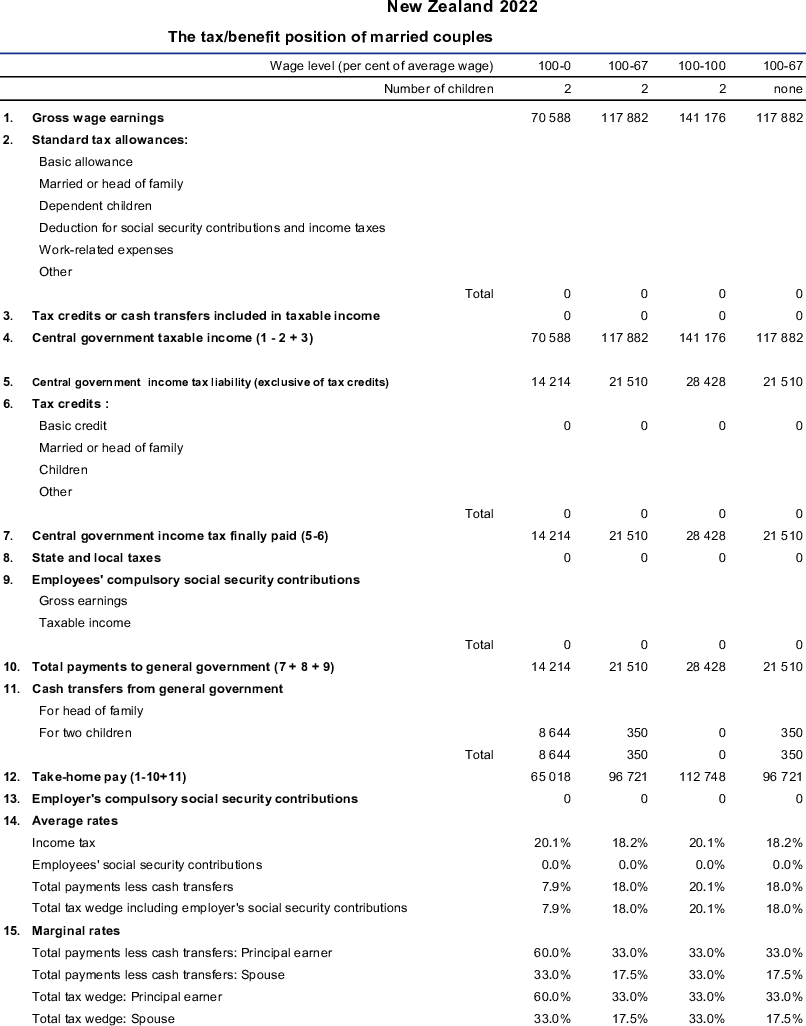

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the New Zealand dollar (NZD). In the year to March 2022, NZD 1.47 was equal to USD 1 on average. The average worker earned NZD 70 588 (Country estimate1).

1. Personal Income Tax System

In New Zealand, the tax year starts April 1st and ends March 31st.

1.1. Central/federal government income taxes

1.1.1. Tax unit

Members of the family are taxed separately.

1.1.2. Tax allowances and tax credits

1.1.2.1. Standard reliefs

Refer to section 1.3.

1.1.2.2. Main non-standard tax reliefs applicable to an average wage

Refer to section 1.3.

1.1.3. Schedule

Rates of income tax for individuals:

On so much of the income as does not exceed NZD 14 000: 10.5%;

On so much of the income as exceeds NZD 14 000 but does not exceed NZD 48 000: 17.5%;

On so much of the income as exceeds NZD 48 000 but does not exceed NZD 70 000: 30%;

On so much of the income as exceeds NZD 70 000 but does not exceed NZD 180 000: 33%;

On so much of the income as exceeds NZD 180 000:

39%.

1.2. State and local income taxes

New Zealand has no state or local income tax.

2. Compulsory Social Security Contributions to Schemes Operated Within the Government Sector

New Zealand has no compulsory social security contributions to schemes operated within the Government sector.

It should be noted that there is an accident compensation scheme administered by the Accident Compensation Corporation for residents and temporary visitors to New Zealand. This scheme is funded in part by premiums paid by employees and employers. For employees, the premium will increase for 2022/23 to represent 1.27% of their gross earnings from 1.21% for gross earnings for 2021/22. For employers and the self-employed, the premiums are based on a percentage of the total payroll and the applicable rate varies depending upon the associated accident risk (the average rate is 0.63% for 2022/23). This scheme is not considered as a compulsory social security contribution for the purposes of the Report.

3. Universal Cash Transfers

The main entitlements in New Zealand are targeted at families under the blanket title ‘Working for Families’ (‘WFF’). There are four main payments that constitute WFF, which are described in 1.3.2 – 1.3.5 below. The Independent Earner Tax Credit (IETC) is another form of support that is separate from WFF and is described in 1.3.6 below.

3.1. Amount for marriage

None.

3.2. Best Start Tax Credit

The Best Start Tax Credit (“BSTC”) is a payment made to families with a new-born baby. From 1 April 2022, the BSTC payment increased to NZD 65 per week (3 388 per year) for the first year of the child’s life. There is no income limit for receiving the BSTC payment in the first year of the child’s life. The BSTC continues to provide NZD 3 388 per year for the second and third year of a child’s life, but this abates at 21.00 cents in the dollar for every dollar by which a family’s income exceeds the abatement threshold of NZD 79 000. For families receiving paid parental leave, the BSTC payment begins after paid parental leave ends.

3.3. Family Tax Credit

The Family Tax Credit (FTC) is available to families with dependent children regardless of whether they receive a main benefit. FTC pays an amount for a family’s eldest child, and a lesser amount for each subsequent child. From 1 April 2022, the eldest child rate increased to NZD 6 642 per year and the subsequent child rate increased to NZD 5 412. The total credit is abated by 27.00 cents (increasing from 25 cents from 1 April 2022) on each dollar earned over NZD 42 700. The abatement is based on the combined family income.

3.4. In Work Tax Credit

The In Work Tax Credit (IWTC) is available to families with dependent children who have some income from paid employment each week, and who are not receiving an income-tested benefit or student allowance. IWTC provides NZD 3 770 per family per year (or NZD 72.50 a week) for up to three children, plus an additional NZD 780 per year (or NZD 15 a week) for fourth and subsequent children. It uses the same abatement regime used with the FTC, although it does not begin to abate until the FTC entitlement has been abated to zero.

From 1 April 2021, the IWTC is available for up to two weeks when taking an unpaid break from work. This is intended to provide support for those transitioning between jobs or who are unpaid for a period.

3.5. Minimum Family Tax Credit

The Minimum Family Tax Credit (“MFTC”) effectively guarantees a minimum after-tax income for all full-time working families with dependent children, and is intended to ensure that working families are better off in work than they would be if they were on a benefit. For the purposes of MFTC, “full-time” employment is defined as 20 hours or more per week for a sole parent, and 30 hours or more per week combined for a two-parent family.

The MFTC threshold (the level to which after-tax income is topped up to) rose from NZD 30 576 per year to NZD 31 096 on 1 July 2021. It increased further to NZD 32 864 on 1 April 2022.

3.6. Independent Earner Tax Credit

The Independent Earner Tax Credit (IETC) of up to NZD 520 per year is available to individuals who do not receive other forms of support such as WFF tax credits or benefits, and who have an annual net income between NZD 24 000 and NZD 48 000. The IETC abates at a rate of 13 cents on each dollar earned over NZD 44 000. Unlike WFF tax credits, the IETC is calculated on the recipient’s individual income rather than family income, and does not require the recipient to have dependent children.

4. Main Changes in Personal Tax/Benefit Systems since 2020/21

4.1. General changes to the tax/benefit system in 2022

4.1.1. The Government announced a Cost of Living Payment as part of Budget 2022.

The payment will total up to $350, split into 3 monthly payments of around NZD 116. The first payment was made on 1 August 2022. The payment will be available to eligible individuals who earned NZD 70 000 or less during the period from 1 April 2021 to 31 March 2022, and who are not eligible to receive the Winter Energy Payment. Eligible individuals will receive the payment directly into their bank account from Inland Revenue.

5. Memorandum Items

5.1. Method used to identify AW and to calculate the AW’s gross earnings

The Annual Earnings figure is derived from the Quarterly Employment Survey (QES) for those employees in the B-N industry groups based on the ISIC Rev.4 definition. The annual earnings figure for the average worker is the sum of the four quarterly earnings figures, with each quarterly figure calculated by taking the average total weekly earnings and multiplying it by 13 weeks per quarter. In 2021 the QES has been redesigned, which means that the average wage data for 2021 may not be directly comparable to previous years.2 In 2022 the ISIC version 4 replaced the version 3 concordance, which has changed average annual earnings estimates for previous years and limits comparability.

5.2. Employer’s contributions to private pension, health schemes, etc.

No information available.

2022 Parameter values

|

|

Ave_earn |

70 588 |

Country estimate |

|---|---|---|---|

|

Income tax schedule |

Tax_sch |

0.105 |

14 000 |

|

0.175 |

48 000 |

||

|

0.3 |

70 000 |

||

|

0.33 |

180 000 |

||

|

0.39 |

|||

|

Family tax credit |

Fam_sup_eld |

6 642 |

|

|

Fam_sup_oth |

5 412 |

||

|

Fam_sup_thrsh |

42 700 |

||

|

Fam_sup_rate |

0.27 |

||

|

In-work tax credit |

In_work_children123 |

3 770 |

|

|

In_work_children4plus |

780 |

||

|

Minimum Family Tax Credit |

Min_inc |

32 864 |

|

|

Independent Earner Tax Credit |

IETC |

520 |

|

|

IETC_thrsh1 |

24 000 |

||

|

IETC_thrsh2 |

44 000 |

||

|

IETC_rate |

0.13 |

||

|

Cost of Living Payment |

COL |

350 |

|

|

COL_thrsh |

70 000 |

Note: Those with children under 3 years of age receive the Best Start Tax Credit and will therefore have a lower effective tax rate than implied by the model.

2022 Tax equations

The equations for the New Zealand system in 2021 are mostly repeated for each individual of a couple. But the cash transfer is calculated only once. This is shown by the Range indicator in the table below. The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.

|

|

Line in country table and intermediate steps |

Variable name |

Range |

Equation |

|---|---|---|---|---|

|

1. |

Earnings |

earn |

||

|

2. |

Allowances |

tax_al |

B |

0 |

|

3. |

Credits in taxable income |

taxbl_cr |

B |

0 |

|

4. |

CG taxable income |

tax_inc |

B |

earn |

|

5. |

CG tax before credits |

CG_tax_excl |

B |

Tax(tax_inc, Tax_sch) |

|

6. |

Tax credits : |

|||

|

Guaranteed minimum income |

GMI |

J |

(Children>0)*Min_inc |

|

|

Independent Earner Tax Credit |

IETC_rebate |

B |

=AND(cash_trans=0,earn>IETC_thrsh1)*Taper(IETC,earn,IETC_thrsh2,IETC_rate) |

|

|

6. |

Tax credits: |

tax_cr |

B |

IETC_rebate |

|

7. |

CG tax |

CG_tax |

B |

CG_tax_excl-tax_cr |

|

8. |

Local tax |

local_tax |

B |

0 |

|

9. |

Employees' soc security |

SSC |

B |

0 |

|

11. |

Cash transfers: |

|||

|

Family tax credit (unabated) |

fam_tax_cr |

J |

Fam_sup_eld*(Children>0)+ Fam_sup_oth*Positive(Children-1) |

|

|

In-work tax credit (unabated) |

in_work_tax_cr |

J |

(Children>0)*(In_work_children123+Positive(Children-3)*In_work_children4plus) |

|

|

Tax credits abated |

tax_cr_ab |

J |

Taper(fam_tax_cr+in_work_tax_cr, earn_total, Fam_sup_thrsh1, Fam_sup_rate1) |

|

|

Minimum Family tax credit |

min_fam_tax_cr |

J |

Positive(GMI-(earn_total-CG_tax_excl_totall)) |

|

|

Cost of Living Payment |

COL_pay |

B |

(earn<=COL_thrsh)*COL |

|

|

Cash transfers |

cash_trans |

J |

tax_cr_ab + min_fam_tax_cr+COL_pay |

|

|

13. |

Employer's soc security |

SSC_empr |

B |

0 |

Key to range of equation B calculated separately for both principal earner and spouse P calculated for principal only (value taken as 0 for spouse calculation) J calculated once only on a joint basis.

Notes

← 1. In the year to March 2022.