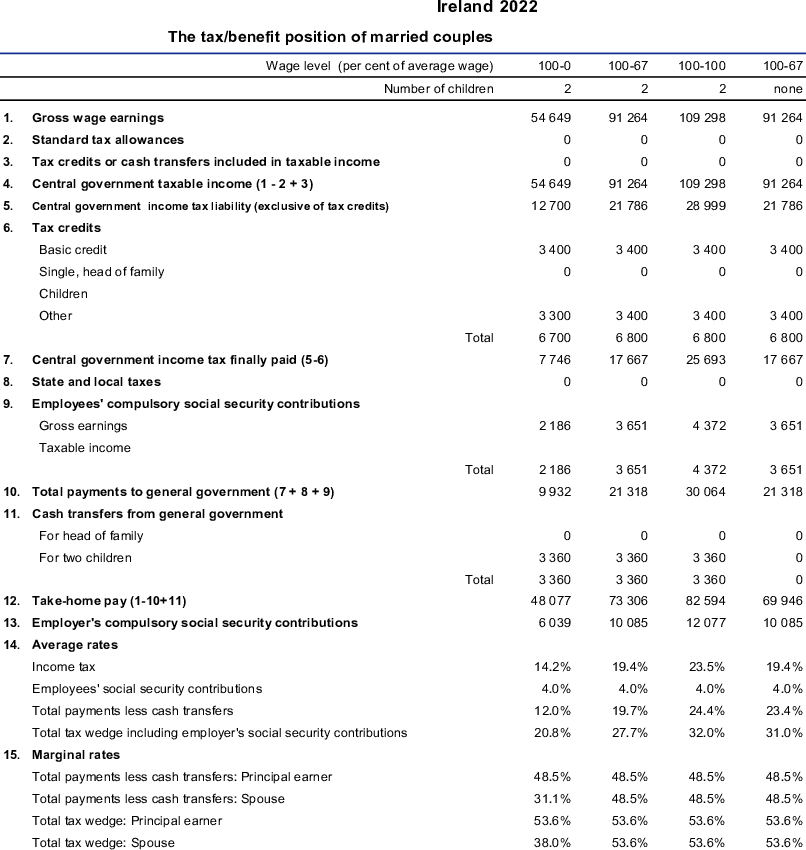

A non-taxable family income supplement is payable to low income families where either the principal earner and/or the spouse are in full-time employment. Full-time employment is defined as working nineteen hours per week or more. The hours worked by the principal and the spouse can be aggregated for the purposes of this definition. When calculating income for the purposes of the relief superannuation payments, social welfare payments, tax payments, health and employment and training levies are all subtracted to arrive at disposable income.

The level of payment is dependent on the amount of family income and the number of children. The supplement payable is 60% of the difference between the family income and the income limit applicable to the family. A minimum of EUR 20 per week is payable to eligible families. No supplement is payable to families with income in excess of the relevant income limit.

The income limit for a family with two children in 2022 is EUR 652 per week.

One Parent Family Payment: This payment is available for men and women who for a variety of reasons are bringing up a child or children without the support of a partner. The payment which is means tested is payable in full where the person’s earnings does not exceed EUR 165 per week). Where earnings are between EUR 165 per week and EUR 425.00 per week a reduced payment is received. From April 2021 working lone parents will no longer lose their One-Parent Family Payment (OFP) when their employment income exceeds the current EUR 425 weekly limit. The amount of the full payment for 2022 is EUR 208 per week (plus EUR 40 per week for each child).