This chapter presents the main results of the analysis of the taxation of labour income across OECD countries in 2022. Most emphasis is given to the tax wedge, a measure of the difference between labour costs to the employer and the corresponding net take-home pay of the employee. The chapter also examines the net personal average tax rate, which expresses personal income tax and employee social security contributions net of cash benefits as a percentage of gross wage earnings. The analysis focuses on the single worker, with no children, at average earnings, which it compares with a one-earner married couple with two children at the same income level, as well as a two-earner married couple with two children, where one spouse earns the average wage and the other 67% of it. The chapter includes analysis of changes in average wages in OECD countries in 2022.

Taxing Wages 2023

1. Overview

Abstract

This Report provides unique information for the 38 OECD countries on the income taxes paid by workers, their social security contributions, the transfers they receive in the form of cash benefits, as well as the social security contributions (SSCs) and payroll taxes paid by their employers. These data are widely used in the formulation and evaluation of social and economic policies and in academic research. The taxpayer-specific detail in this Report complements the information provided annually in Revenue Statistics, a publication providing internationally comparable data on tax levels and tax structures in OECD countries.

Part I of the Report presents detailed information about the effective tax rates on labour income in OECD countries in 2022 for eight illustrative household types on comparable levels of income as well as the implied total labour costs for employers. It also provides detailed analysis of changes in effective tax rates between 2021 and 2022 as well as historical changes since 2000. Part II provides detailed information on labour taxation systems in all 38 OECD countries. The methodology followed in this Report is described in detail in the Annex.

This chapter begins with an introduction to the Taxing Wages methodology, which is followed by a review of the effective tax rate indicators for 2022. The review analyses the tax wedge and the personal average tax rates for a single worker, without children, earning the average wage, and also the corresponding indicators for a one-earner couple at the average wage level and a two-earner married couple where one spouse earns the average wage and the other 67% of it, and assumes that both couples have two children. The chapter concludes with an analysis of changes in nominal and real average wages by country and the industry classification on which they are based.

Introduction

This section introduces the methodology employed for Taxing Wages, which focuses on full-time employees. It is assumed that their annual income from employment is equal to a given percentage of the average full-time adult gross wage earnings for each OECD economy, referred to as the average wage (AW). This covers both manual and non-manual workers for either industry sectors C-K inclusive with reference to the International Standard Industrial Classification of All Economic Activities, Revision 3 (ISIC Rev.3) or industry sectors B-N inclusive with reference to the International Standard Industrial Classification of All Economic Activities, Revision 4 (ISIC Rev.4).1 Further details are provided in Table 1.8 as well as in the Annex of this Report. Additional assumptions are made about the personal circumstances of these wage earners in order to determine their tax/benefit position.

In Taxing Wages, the term ‘tax’ includes personal income tax, SSCs and payroll taxes (which are aggregated with employer SSCs in the calculation of tax rates) payable on gross wage earnings. Consequently, any income tax that might be due on non-wage income and other kinds of taxes – such as corporate income tax, net wealth tax and consumption taxes – are not taken into account. The transfers included are those paid by general government as cash benefits, usually in respect of dependent children.

For most OECD countries, the tax year is equivalent to the calendar year, the exceptions being Australia, New Zealand and the United Kingdom. In the case of New Zealand and the United Kingdom, where the tax year starts in April, the calculations apply a ‘forward-looking’ approach. This implies that, for example, the tax rates reported for 2022 are those for the tax year 2022-2023. However, in Australia, where the tax year starts in July, a ‘backward-looking’ approach is adopted to present more reliable results; the year 2022 in respect of Australia is the 2021-2022 tax year.

Taxing Wages presents several measures of taxation on labour. Most emphasis is given to the tax wedge, a measure of the difference between labour costs to the employer and the corresponding net take-home pay of the employee. This indicator is calculated by expressing the sum of personal income tax, employee plus employer SSCs together with any payroll tax, minus benefits as a percentage of labour costs. Employer SSCs and – in some countries – payroll taxes are added to gross wage earnings of employees in order to determine a measure of total labour costs.

The average tax wedge measures that part of total labour costs which is taken in tax and SSCs net of cash benefits. In contrast, the marginal tax wedge measures that part of an increase of total labour costs that is paid in taxes and SSCs less cash benefits. It should be noted that the tax wedge only includes payments that are classified as taxes according to the OECD Interpretative Guide. Employees and employers may also have to make non-tax compulsory payments (NTCPs)2 that may increase the indicators that are presented in this Report. An accompanying paper to Taxing Wages is available on the OECD Tax Database that presents “compulsory payment indicators”, which combine taxes and NTCPs: http://www.oecd.org/tax/tax-policy/non-tax-compulsory-payments.pdf.

This section also includes analysis of the personal average tax rate and the net personal average tax rate. The personal average tax rate is the term used when the personal income tax and employee SSCs are expressed as a percentage of gross wage earnings. The net personal average tax rate corresponds to the above measure net of cash benefits. The net personal marginal tax rate shows that part of an increase in gross wage earnings that is paid in personal income tax and employee SSCs net of cash benefits.

Taxation of single workers

Tax wedge

Table 1.1 shows that the tax wedge between the labour costs to the employer and the corresponding net take-home pay for single workers without children, at average earnings levels, varied widely across OECD countries in 2022 (see column 1). While in Austria, Belgium, France, Germany and Italy, the tax wedge as a percentage of labour costs exceeded 45%, it was lower than 20% in Chile and Colombia. The highest tax wedge was observed in Belgium (53.0%) and the lowest in Colombia (0.0%). In Colombia, the single worker at the average wage level did not pay personal income taxes in 2022, while their contributions to pension, health and employment risk insurance are considered to be NTCPs3 and therefore not counted as taxes in the Taxing Wages calculations. Table 1.1 shows that the average tax wedge as a percentage of labour costs in OECD countries was 34.6% in 2022.

The changes in the tax wedge as a percentage of labour costs between 2021 and 2022 for a single worker earning the average wage without children are described in column 2 of Table 1.1. The OECD average tax wedge for this household type increased by 0.04 percentage points (p.p.) in 2022, having decreased by -0.1 p.p. in 2021. Among OECD member countries, the tax wedge increased in 23 countries and fell in eleven. The tax wedge remained at the same level for the average worker in Chile, Colombia, Costa Rica and Finland between 2021 and 2022. Increases in the tax wedge ranged from 0.02 p.p. in Latvia to 2.2 p.p. in the United States. The increase in the tax wedge was larger than 0.5 p.p. in eight countries, while only the United States recorded an increase larger than 1 p.p., which was due to the withdrawal of COVID-19 benefits. Decreases ranged from -0.01 p.p. in Spain to -2.66 p.p. in Türkiye. In Hungary and Poland, the decrease in the average tax wedge also exceeded 1 percentage point (-2.01 p.p. and -1.23 p.p., respectively).

In the majority of countries where the tax wedge increased, the rise was driven by higher personal income tax as a percentage of labour costs (see column 3 of Table 1.1). In some countries, this was driven by increases in the nominal average wage between 2021 and 2022 (discussed below). Higher average wages increase personal income tax through the progressivity of income tax systems if income tax thresholds increase by less than average earnings, as is discussed in greater detail in Chapter 2. In other countries, the higher personal income tax was primarily the result of a higher proportion of earnings becoming subject to tax as the value of tax allowances and tax credits fell relative to earnings.

In Canada, Iceland, Israel, Korea, Mexico, the Netherlands and the United Kingdom, the increase in the tax wedge was due to higher employee and/or employer SSCs as a percentage of labour costs. In Canada, the maximum contributions for pension and unemployment insurance were increased in 2022. In Iceland, the temporary reduction of the employer SSC rate in 2021 expired and the rate went back to 6.35%. In Israel, the progressivity of the SSC schedule contributed to an increase in the tax wedge due to a higher average wage in 2022. In Korea, the contribution rate for national health insurance at the average wage level increased from 3.825136% in 2021 to 3.923836% in 2022. In Mexico, the tax wedge increased due an update of the Unit of Measure and Update (Unidad de Medida y Actualización) as well as due to a higher average wage. In the Netherlands, there was an increase in the employer SSC rate. In the United Kingdom, the employer SSC rate increased from 13.8% to 15.05%. In eight of the eleven OECD countries where the tax wedge decreased as a percentage of labour costs, the decrease was mostly derived from lower personal income tax (Australia, Czech Republic, Hungary, Poland, Slovenia, Sweden, Spain and Türkiye).

Decreases in the tax wedge were smaller than 0.25 p.p. in Australia (-0.22 p.p.), the Czech Republic (-0.17 p.p.), Sweden (-0.11 p.p.) and Spain (-0.01 p.p.). Changes in tax reliefs, tax credits and/or tax schedules contributed to the decreases in these countries. In Slovenia, the basic allowance was increased from EUR 3 500 in 2021 to EUR 4 500 in 2022, leading to a decrease of 0.75 p.p. in the tax wedge. In Poland, the introduction of a non-refundable tax credit without upper limit led to a decrease of the tax wedge of 1.23 p.p. In Türkiye, the introduction of the Minimum Wage tax exemption led to a decrease in the tax wedge of 2.66 p.p.

In the other OECD countries where tax wedges decreased as a percentage of labour costs in 2022, the changes were driven by lower SSCs (Greece and Hungary). In Greece, the social security rate for supplementary insurance of employees was reduced for both employers and employees, leading to a decrease of the average tax wedge of -0.02 p.p. In Hungary, the average tax wedge decreased by -2.01 p.p. due to the lowering of the social contribution tax by 2.5 p.p. and the elimination of the training levy in 2022.

In Austria, the average tax wedge decreased by -0.99 p.p. due to the climate bonus, the anti-inflation bonus and the energy cost credit. In Germany, the tax wedge decreased by -0.29 p.p. because of the Euro 300 lump-sum energy price allowance, which was subject to income tax.

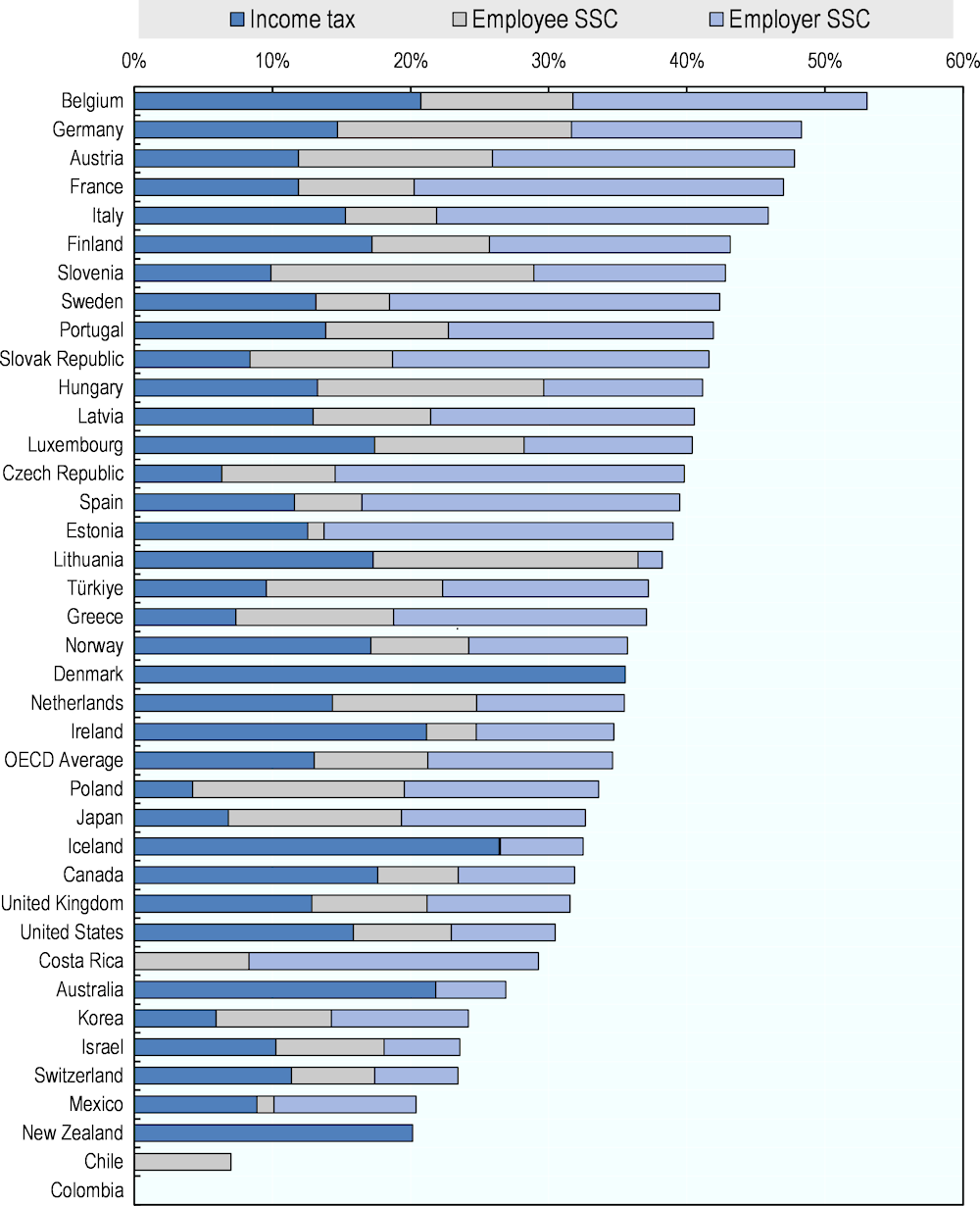

Table 1.2 and Figure 1.1 show the components of the tax wedge in 2022: personal income tax, employee SSCs and employer SSCs (including payroll taxes where applicable), as a percentage of labour costs for the average worker without children. Labour costs in Table 1.2 are expressed in US dollars with equivalent purchasing power.

The percentage of labour costs paid in personal income tax varied considerably across OECD countries in 2022. The lowest figures were in Colombia, Costa Rica and Chile (all zero), with the Czech Republic, Greece, Japan, Korea, Mexico, Poland, the Slovak Republic, Slovenia and Türkiye also below 10%. The highest share was in Denmark (35.5%), with Australia, Belgium, Iceland, Ireland and New Zealand also above 20%. The percentage of labour costs paid in employee SSCs also varied widely, ranging from zero in Australia, Colombia, Denmark and New Zealand to 19.0% in Slovenia and 19.2% in Lithuania. Employers in France paid 26.7% of labour costs in SSCs, the highest amongst OECD countries. Employer SSCs were more than 20% of labour costs in nine other countries: Austria, Belgium, Costa Rica, the Czech Republic, Estonia, Italy, the Slovak Republic, Spain and Sweden.

As a percentage of labour costs, the total of employee and employer SSCs exceeded 20% in 23 OECD countries. It represented at least one-third of labour costs in Austria, Czech Republic, France and Germany.

Table 1.1. Comparison of total tax wedge, 2022

As % of labour costs

|

Country1 |

Total Tax wedge 2022 (1) |

Annual change, 2022/21 (in percentage points)² |

|||

|---|---|---|---|---|---|

|

Tax wedge (2) |

Income tax (3) |

Employee SSC (4) |

Employer SSC3 (5) |

||

|

Belgium |

53.0 |

0.65 |

0.69 |

0.02 |

-0.06 |

|

Germany |

47.8 |

-0.29 |

0.08 |

0.08 |

0.00 |

|

France |

47.0 |

0.14 |

-0.05 |

0.08 |

0.11 |

|

Austria |

46.8 |

-0.99 |

0.02 |

0.01 |

-0.06 |

|

Italy |

45.9 |

0.47 |

1.07 |

-0.61 |

0.00 |

|

Finland |

43.1 |

0.00 |

-0.04 |

-0.19 |

0.23 |

|

Slovenia |

42.8 |

-0.75 |

-0.75 |

0.00 |

0.00 |

|

Sweden |

42.4 |

-0.10 |

-0.11 |

0.00 |

0.00 |

|

Portugal |

41.9 |

0.06 |

0.06 |

0.00 |

0.00 |

|

Slovak Republic |

41.6 |

0.15 |

0.28 |

0.02 |

-0.15 |

|

Hungary |

41.2 |

-2.01 |

0.45 |

0.56 |

-3.03 |

|

Latvia |

40.6 |

0.02 |

0.02 |

0.00 |

0.00 |

|

Luxembourg |

40.4 |

0.63 |

0.62 |

0.01 |

0.00 |

|

Czech Republic |

39.8 |

-0.17 |

-0.17 |

0.00 |

0.00 |

|

Spain |

39.5 |

-0.01 |

-0.01 |

0.00 |

0.00 |

|

Estonia |

39.0 |

0.85 |

0.85 |

0.00 |

0.00 |

|

Lithuania |

38.2 |

0.67 |

0.67 |

0.00 |

0.00 |

|

Türkiye |

37.2 |

-2.66 |

-2.66 |

0.00 |

0.00 |

|

Greece |

37.1 |

-0.02 |

0.18 |

-0.11 |

-0.10 |

|

Norway |

35.7 |

0.06 |

0.23 |

-0.18 |

0.00 |

|

Denmark |

35.5 |

0.16 |

0.07 |

0.00 |

0.00 |

|

Netherlands |

35.5 |

0.56 |

0.14 |

-0.27 |

0.69 |

|

Ireland |

34.7 |

0.19 |

0.19 |

0.00 |

0.00 |

|

Poland |

33.6 |

-1.23 |

-1.24 |

0.00 |

0.01 |

|

Japan |

32.6 |

0.06 |

0.06 |

0.00 |

0.00 |

|

Iceland |

32.5 |

0.14 |

-0.08 |

0.00 |

0.22 |

|

Canada |

31.9 |

0.39 |

0.06 |

0.18 |

0.15 |

|

United Kingdom |

31.5 |

0.76 |

0.22 |

0.00 |

0.54 |

|

United States |

30.5 |

2.20 |

0.13 |

0.00 |

-0.02 |

|

Costa Rica |

29.2 |

0.00 |

0.00 |

0.00 |

0.00 |

|

Australia |

26.9 |

-0.20 |

-0.22 |

0.00 |

0.02 |

|

Korea |

24.2 |

0.34 |

0.14 |

0.13 |

0.08 |

|

Israel |

23.6 |

0.15 |

0.02 |

0.09 |

0.04 |

|

Switzerland |

23.4 |

0.27 |

0.27 |

0.00 |

0.00 |

|

Mexico |

20.4 |

0.19 |

0.01 |

-0.02 |

0.19 |

|

New Zealand |

20.1 |

0.72 |

0.72 |

0.00 |

0.00 |

|

Chile |

7.0 |

0.00 |

0.00 |

0.00 |

0.00 |

|

Colombia |

0.0 |

0.00 |

0.00 |

0.00 |

0.00 |

|

Unweighted average |

|

|

|

|

|

|

OECD Average |

34.6 |

0.04 |

0.05 |

0.00 |

-0.03 |

Note: Single individual without children at the income level of the average worker.

1. Countries ranked by decreasing total tax wedge.

2. Due to rounding, the changes in tax wedge in column (2) may differ by one-hundredth of a percentage point from the sum of columns (3)-(5). For Denmark and the United States, cash benefits contribute to the difference as they are not included in columns (3)-(5).

3. Includes payroll taxes where applicable.

Sources: Country submissions, (OECD[1]) Economic Outlook Volume 2022 Issue 2.

Table 1.2. Income tax plus employee and employer social security contributions, 2022

|

As % of labour costsCountry1 |

Total tax wedge2 (1) |

Income tax (2) |

Social security contributions |

Labour costs4 (5) |

|

|---|---|---|---|---|---|

|

employee (3) |

employer3 (4) |

||||

|

Switzerland |

23.4 |

11.4 |

6.0 |

6.0 |

100 655 |

|

Belgium |

53.0 |

20.7 |

11.0 |

21.3 |

94 362 |

|

Luxembourg |

40.4 |

17.4 |

10.8 |

12.2 |

94 100 |

|

Germany |

47.8 |

14.7 |

16.9 |

16.6 |

90 146 |

|

Austria |

46.8 |

11.9 |

14.0 |

21.8 |

88 550 |

|

Netherlands |

35.5 |

14.3 |

10.4 |

10.7 |

85 828 |

|

France |

47.0 |

11.9 |

8.4 |

26.7 |

81 140 |

|

Norway |

35.7 |

17.1 |

7.1 |

11.5 |

79 921 |

|

Iceland |

32.5 |

26.4 |

0.1 |

6.0 |

78 589 |

|

Ireland |

34.7 |

21.2 |

3.6 |

10.0 |

77 318 |

|

Sweden |

42.4 |

13.1 |

5.3 |

23.9 |

75 477 |

|

Finland |

43.1 |

17.2 |

8.5 |

17.4 |

74 825 |

|

United Kingdom |

31.5 |

12.8 |

8.4 |

10.4 |

71 544 |

|

Canada |

31.9 |

17.6 |

5.8 |

8.4 |

70 907 |

|

Italy |

45.9 |

15.3 |

6.6 |

24.0 |

70 393 |

|

United States |

30.5 |

15.9 |

7.1 |

7.5 |

70 174 |

|

Denmark |

35.5 |

35.5 |

0.0 |

0.0 |

69 941 |

|

Australia |

26.9 |

21.8 |

0.0 |

5.1 |

68 947 |

|

Korea |

24.2 |

5.9 |

8.4 |

9.9 |

66 702 |

|

Japan |

32.6 |

6.8 |

12.5 |

13.3 |

62 028 |

|

Spain |

39.5 |

11.6 |

4.9 |

23.0 |

61 078 |

|

Czech Republic |

39.8 |

6.3 |

8.2 |

25.3 |

48 717 |

|

Israel |

23.6 |

10.3 |

7.8 |

5.5 |

48 697 |

|

Slovenia |

42.8 |

9.9 |

19.0 |

13.9 |

48 179 |

|

Portugal |

41.9 |

13.9 |

8.9 |

19.2 |

47 700 |

|

New Zealand |

20.1 |

20.1 |

0.0 |

0.0 |

47 539 |

|

Estonia |

39.0 |

12.5 |

1.2 |

25.3 |

45 624 |

|

Poland |

33.6 |

4.2 |

15.3 |

14.1 |

44 795 |

|

Hungary |

41.2 |

13.3 |

16.4 |

11.5 |

44 683 |

|

Greece |

37.1 |

7.4 |

11.4 |

18.3 |

43 783 |

|

Lithuania |

38.2 |

17.3 |

19.2 |

1.8 |

42 454 |

|

Latvia |

40.6 |

13.0 |

8.5 |

19.1 |

39 389 |

|

Slovak Republic |

41.6 |

8.4 |

10.3 |

22.9 |

37 239 |

|

Costa Rica |

29.2 |

0.0 |

8.3 |

20.9 |

35 633 |

|

Türkiye |

37.2 |

9.6 |

12.8 |

14.9 |

34 470 |

|

Chile |

7.0 |

0.0 |

7.0 |

0.0 |

26 719 |

|

Mexico |

20.4 |

8.9 |

1.2 |

10.3 |

16 947 |

|

Colombia |

0.0 |

0.0 |

0.0 |

0.0 |

14 644 |

|

Unweighted average |

|

|

|

|

|

|

OECD Average |

34.6 |

13.0 |

8.2 |

13.4 |

60 522 |

Note: Single individual without children at the income level of the average worker.

1. Countries ranked by decreasing labour costs.

2. Due to rounding, the total in column (1) may differ by one tenth of a percentage point from the sum of columns (2)-(4). For Denmark and the United States, cash benefits contribute to the difference as they are not included in columns (2)-(4).

3. Includes payroll taxes where applicable.

4. US dollars with equal purchasing power.

Sources: Country submissions, (OECD[1]) Economic Outlook Volume 2022 Issue 2.

Figure 1.1. Income tax plus employee and employer social security contributions, 2022

Notes: Single individual without children at the income level of the average worker.

Includes payroll taxes where applicable.

Personal average tax rates

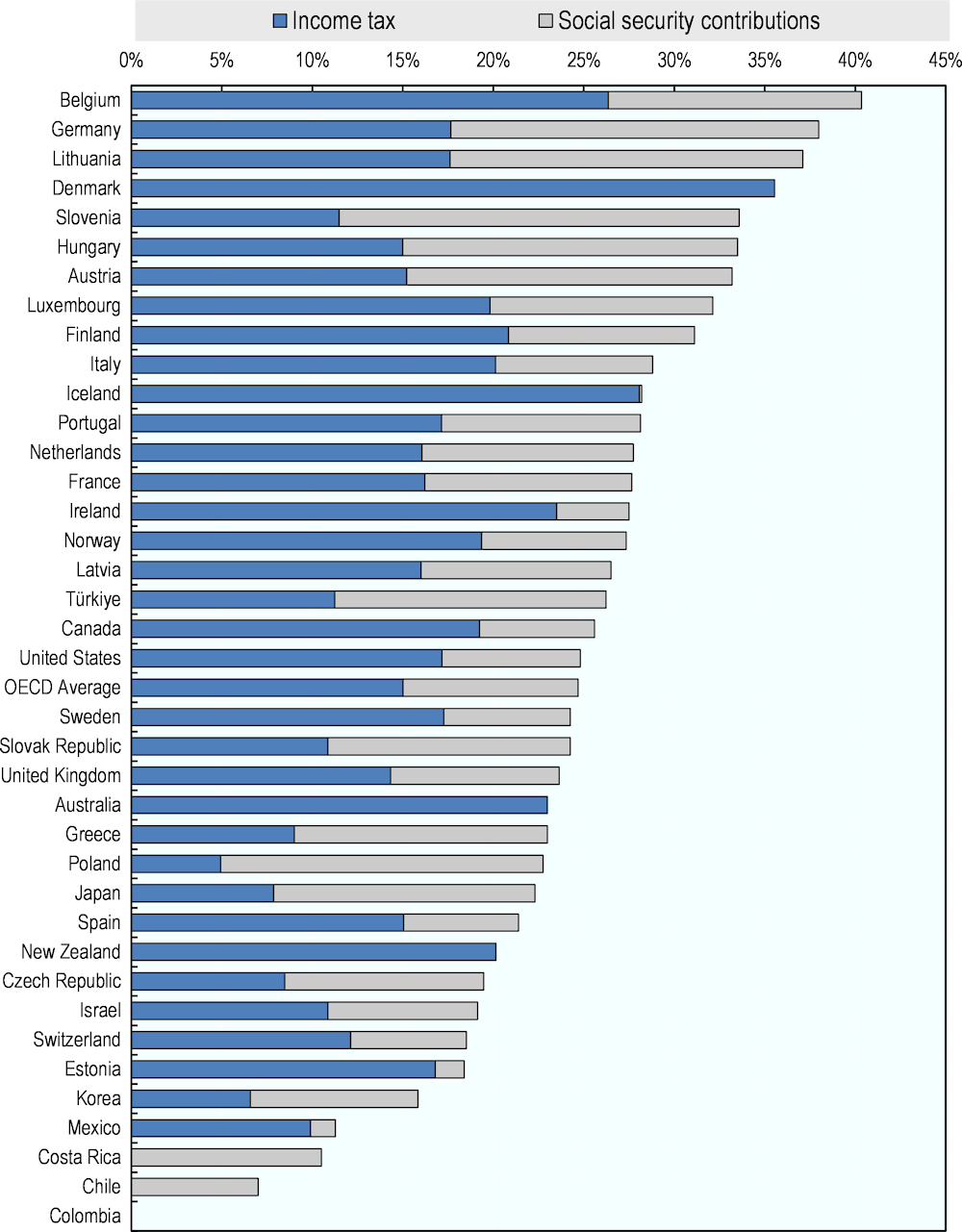

The personal average tax rate is defined as income tax plus employee SSCs as a percentage of gross wage earnings. Table 1.3 shows the personal average tax rates in 2022 for a single worker without children at the average wage level, with the average worker’s gross wage earnings expressed in US dollars with equivalent purchasing power. Figure 1.2 provides a graphical representation of the personal average tax rate decomposed between income tax and employee SSCs.

Table 1.3 and Figure 1.2 show that, on average, the personal average tax rate for a single worker at average earnings in OECD countries was 24.7% in 2022. Belgium had the highest rate, at 40.3% of gross wage earnings; Denmark, Germany and Lithuania were the only other countries with rates above 35%. The lowest personal average tax rates were in Mexico (11.3%), Costa Rica (10.5%), Chile (7.0%) and Colombia (0.0%). The personal average tax rate was zero for Colombia as the single worker did not pay personal income tax at the average wage level in 2022 as discussed above.

The impact of taxes and benefits on a worker’s take-home pay varies greatly among OECD countries. Such wide variations in the size and make-up of the tax wedge in different countries, in part, reflect differences in:

The overall ratio of aggregate tax revenues to Gross Domestic Product; and

The share of personal income tax and SSCs in the national tax mix.

In 2022, the share of income tax within the personal average tax rate was higher than the share of employee SSCs for 23 of the 38 OECD member countries. No employee SSCs were levied in Australia, Colombia, Denmark and New Zealand and their levels were at 4% or less of gross earnings in Estonia, Iceland, Ireland and Mexico. In contrast, the single worker at the average wage level paid substantially more in employee SSCs than in personal income tax (i.e., more than six p.p.) in five countries: Chile, Costa Rica, Japan, Poland and Slovenia. In seven countries – Austria, the Czech Republic, Germany, Israel, Korea, Lithuania and the Slovak Republic – the shares of personal income tax and employee SSCs as a percentage of gross earnings were very close (i.e., differences of less than 3 p.p.).

Table 1.3. Income tax plus employee social security contributions, 2022

As % of gross wage earnings

|

Country1 |

Total payment2 (1) |

Income tax (2) |

Employee social security contributions (3) |

Gross wage earnings3 (4) |

|---|---|---|---|---|

|

Switzerland |

18.5 |

12.1 |

6.4 |

94 601 |

|

Luxembourg |

32.1 |

19.8 |

12.3 |

82 660 |

|

Netherlands |

27.7 |

16.1 |

11.7 |

76 635 |

|

Germany |

38.0 |

17.7 |

20.3 |

75 137 |

|

Belgium |

40.3 |

26.4 |

14.0 |

74 273 |

|

Iceland |

28.2 |

28.1 |

0.1 |

73 897 |

|

Norway |

27.3 |

19.3 |

8.0 |

70 726 |

|

Denmark |

35.5 |

35.5 |

0.0 |

69 941 |

|

Ireland |

27.5 |

23.5 |

4.0 |

69 624 |

|

Austria |

33.2 |

15.2 |

18.0 |

69 202 |

|

Australia |

23.0 |

23.0 |

0.0 |

65 455 |

|

Canada |

25.6 |

19.2 |

6.4 |

64 941 |

|

United States |

24.8 |

17.2 |

7.7 |

64 889 |

|

United Kingdom |

23.6 |

14.3 |

9.3 |

64 134 |

|

Finland |

31.1 |

20.8 |

10.3 |

61 778 |

|

Korea |

15.8 |

6.6 |

9.3 |

60 090 |

|

France |

27.7 |

16.2 |

11.4 |

59 445 |

|

Sweden |

24.3 |

17.3 |

7.0 |

57 432 |

|

Japan |

22.3 |

7.9 |

14.5 |

53 769 |

|

Italy |

28.8 |

20.1 |

8.7 |

53 498 |

|

New Zealand |

20.1 |

20.1 |

0.0 |

47 539 |

|

Spain |

21.4 |

15.0 |

6.4 |

47 019 |

|

Israel |

19.1 |

10.9 |

8.3 |

46 020 |

|

Lithuania |

37.1 |

17.6 |

19.5 |

41 708 |

|

Slovenia |

33.6 |

11.5 |

22.1 |

41 498 |

|

Hungary |

33.5 |

15.0 |

18.5 |

39 542 |

|

Portugal |

28.1 |

17.1 |

11.0 |

38 546 |

|

Poland |

22.8 |

4.9 |

17.8 |

38 493 |

|

Czech Republic |

19.5 |

8.5 |

11.0 |

36 411 |

|

Greece |

23.0 |

9.0 |

14.0 |

35 772 |

|

Estonia |

18.4 |

16.8 |

1.6 |

34 099 |

|

Latvia |

26.5 |

16.0 |

10.5 |

31 864 |

|

Türkiye |

26.2 |

11.2 |

15.0 |

29 336 |

|

Slovak Republic |

24.3 |

10.9 |

13.4 |

28 711 |

|

Costa Rica |

10.5 |

0.0 |

10.5 |

28 169 |

|

Chile |

7.0 |

0.0 |

7.0 |

26 719 |

|

Mexico |

11.3 |

9.9 |

1.4 |

15 204 |

|

Colombia |

0.0 |

0.0 |

0.0 |

14 644 |

|

Unweighted average |

|

|

|

|

|

OECD Average |

24.7 |

15.0 |

9.7 |

52 195 |

Note: Single individual at the income level of the average worker, without children.

1. Countries ranked by decreasing gross wage earnings.

2. Due to rounding, total may differ by one tenth of a percentage point from aggregate of columns for income tax and social security contributions.

3. US dollars with equal purchasing power.

Sources: Country submissions, (OECD[1]) Economic Outlook Volume 2022 Issue 2.

Figure 1.2. Percentage of gross wage earnings paid in income tax and employee social security contributions, 2022

Notes: Countries ranked by decreasing effective tax rates.

Single workers at the income level of the average worker.

Single versus one-earner couple taxpayers

Many OECD countries provide a fiscal benefit to households with children through advantageous tax treatment and/or cash benefits. Table 1.4 compares the tax wedge as a percentage of labour costs for a one-earner married couple with two children with that of a single individual without children, at average wage levels. The tax wedge for the couple with children is generally smaller than that observed for the individual without children: the OECD average tax wedge as a percentage of labour costs for the one-earner married couple with two children was 25.6%, compared with 34.6% for the single average worker. This gap narrowed by 1.02 p.p. between 2021 and 2022 due to an increase in the average tax wedge for one-earner married couple with two children.

The tax savings realised by a one-earner married couple with two children compared with a single worker without children exceeded 20% of labour costs in Luxembourg and Poland, and exceeded 15% of labour costs in Austria, Belgium and the Czech Republic. The tax wedge for one-earner married couples with two children was the same as for single workers on the average wage in Chile, Costa Rica, Mexico and Türkiye.

The tax wedge of an average one-earner married couple with two children increased by 1.05 percentage points and increased in 28 countries between 2021 and 2022 (see column 3). In 23 of the 38 OECD countries, there was only a small change (not exceeding plus or minus one percentage point), and there was no change in Costa Rica. There were increases of more than one percentage point in eight countries: Australia, Belgium, Chile, Estonia, Lithuania, Luxembourg, New Zealand and the United States.

In Australia, the increase of 1.12 p.p. in the tax wedge of an average one-earner married couple with two children was related to the removal of the COVID-19 Economic support payment. In Belgium (1.34 p.p.), the average tax wedge increased because the average wage increased more strongly than tax allowances and the income threshold within the tax schedule, leading to a larger proportion of the income being taxed at a higher rate. In Chile, the tax wedge increased by 25.48 p.p. due the removal of the Emergency Family Income, a COVID-19 support measure introduced in 2021. In Estonia (1.54 p.p.), the increase was due to the progressivity of the tax allowance: households received a lower tax allowance as the average wage rose, resulting in a higher amount being liable for tax. In Lithuania (6.03 p.p.), the tax wedge increased because the one-earner family was no longer eligible for the needs-based family benefit as the average wage was just above the eligibility threshold. In Luxembourg (1.08 p.p.), the average tax wedge increased due to the progressivity of the tax system and higher employee and employer SSCs as a result of an increased average wage, while cash benefits for children remained unchanged. In New Zealand (1.48 p.p.), a higher taper rate for the Family Tax Credit as well as an increase in the average wage caused the increase in the tax wedge. In the United States (10.6 p.p.), the tax wedge increased due to the removal of the child tax credit support measures and cash benefits introduced during the COVID-19 pandemic.

There were decreases of one percentage point or more in the tax wedge of an average one-earner married couple with two children in six countries: Austria, Israel, Latvia, Poland, Slovak Republic and Türkiye. In Austria (-3.93 p.p.), the tax wedge decreased due to the climate bonus, the anti-inflation bonus as well as the energy cost credit, and a higher family tax credit (“Familienbonus Plus”). In Israel (-2.78 p.p.), the average tax wedge decreased as parents became entitled to one extra tax credit point per child, a temporary measure introduced in 2022. In Latvia (-2.41 p.p.), the average tax wedge decreased as a result of an increase in the family state benefit, a cash transfer. In Poland (-2.35 p.p.), the introduction of the non-refundable tax credit without upper limit was the reason for the decrease in the average tax wedge. In the Slovak Republic (-3.18 p.p.), the average tax wedge decreased following the introduction of a tax credit for children. In Türkiye (-1.08 p.p.), the replacement of the minimum living allowance with the Minimum Wage tax exemption led to a decrease in the average tax wedge.

A comparison of the changes in tax wedges between 2021 and 2022 for one-earner married couples with two children and single persons without children, at the average wage level, is shown in column 5 of Table 1.4. The fiscal preference for families increased in six of the 38 OECD countries: Austria, Israel, Italy, Latvia, Poland and the Slovak Republic, in every case by more than one percentage point.

Table 1.4. Comparison of total tax wedge for single and one-earner couple taxpayers, 2022

As % of labour costs

|

Country1 |

Family² Total Tax wedge 2022 (1) |

Single³ Total Tax wedge 2022 (2) |

Fiscal preference for families (1)-(2) (3) |

Annual change, 2022/21 (in percentage points) |

||

|---|---|---|---|---|---|---|

|

Family Tax wedge (3) |

Single Tax wedge (4) |

Difference between single and family (4)-(3) (5) |

||||

|

Poland |

11.9 |

33.6 |

-21.7 |

-2.35 |

-1.23 |

1.12 |

|

Luxembourg |

20.1 |

40.4 |

-20.3 |

1.08 |

0.63 |

-0.45 |

|

Czech Republic |

22.7 |

39.8 |

-17.1 |

0.75 |

-0.17 |

-0.92 |

|

Austria |

30.2 |

46.8 |

-16.6 |

-3.93 |

-0.99 |

2.94 |

|

Belgium |

37.8 |

53.0 |

-15.2 |

1.34 |

0.65 |

-0.69 |

|

Germany |

32.9 |

47.8 |

-15.0 |

0.04 |

-0.29 |

-0.33 |

|

Slovak Republic |

26.8 |

41.6 |

-14.8 |

-3.18 |

0.15 |

3.33 |

|

Ireland |

20.8 |

34.7 |

-13.9 |

0.78 |

0.19 |

-0.59 |

|

Slovenia |

28.9 |

42.8 |

-13.9 |

-0.43 |

-0.75 |

-0.32 |

|

New Zealand |

7.9 |

20.1 |

-12.2 |

1.48 |

0.72 |

-0.76 |

|

Switzerland |

11.6 |

23.4 |

-11.8 |

0.45 |

0.27 |

-0.18 |

|

Latvia |

29.0 |

40.6 |

-11.6 |

-2.41 |

0.02 |

2.43 |

|

Iceland |

21.2 |

32.5 |

-11.3 |

0.49 |

0.14 |

-0.35 |

|

Hungary |

30.0 |

41.2 |

-11.2 |

-0.61 |

-2.01 |

-1.40 |

|

Italy |

34.9 |

45.9 |

-11.0 |

-0.91 |

0.47 |

1.37 |

|

United States |

19.8 |

30.5 |

-10.6 |

11.62 |

2.20 |

-9.42 |

|

Portugal |

31.6 |

41.9 |

-10.3 |

0.67 |

0.06 |

-0.61 |

|

Canada |

21.8 |

31.9 |

-10.1 |

0.62 |

0.39 |

-0.23 |

|

Denmark |

26.0 |

35.5 |

-9.5 |

0.52 |

0.16 |

-0.36 |

|

Lithuania |

29.5 |

38.2 |

-8.8 |

6.03 |

0.67 |

-5.36 |

|

Estonia |

30.6 |

39.0 |

-8.4 |

1.54 |

0.85 |

-0.68 |

|

France |

39.2 |

47.0 |

-7.8 |

0.24 |

0.14 |

-0.10 |

|

Australia |

20.2 |

26.9 |

-6.7 |

1.12 |

-0.20 |

-1.32 |

|

Netherlands |

29.6 |

35.5 |

-5.9 |

0.81 |

0.56 |

-0.26 |

|

Israel |

18.3 |

23.6 |

-5.2 |

-2.78 |

0.15 |

2.93 |

|

Japan |

27.4 |

32.6 |

-5.2 |

0.13 |

0.06 |

-0.07 |

|

Spain |

34.4 |

39.5 |

-5.1 |

0.25 |

-0.01 |

-0.26 |

|

Sweden |

37.5 |

42.4 |

-4.9 |

0.08 |

-0.10 |

-0.19 |

|

Colombia |

-4.8 |

0.0 |

-4.8 |

0.26 |

0.00 |

-0.26 |

|

United Kingdom |

27.2 |

31.5 |

-4.3 |

0.91 |

0.76 |

-0.15 |

|

Finland |

39.2 |

43.1 |

-3.9 |

0.11 |

0.00 |

-0.11 |

|

Korea |

20.4 |

24.2 |

-3.8 |

0.44 |

0.34 |

-0.10 |

|

Norway |

32.3 |

35.7 |

-3.4 |

0.20 |

0.06 |

-0.14 |

|

Greece |

33.7 |

37.1 |

-3.4 |

0.03 |

-0.02 |

-0.05 |

|

Türkiye |

37.2 |

37.2 |

0.0 |

-1.08 |

-2.66 |

-1.58 |

|

Mexico |

20.4 |

20.4 |

0.0 |

0.19 |

0.19 |

0.00 |

|

Costa Rica |

29.2 |

29.2 |

0.0 |

0.00 |

0.00 |

0.00 |

|

Chile |

7.0 |

7.0 |

0.0 |

25.48 |

0.00 |

-25.48 |

|

Unweighted average |

|

|

|

|

|

|

|

OECD Average |

25.6 |

34.6 |

-8.9 |

1.05 |

0.04 |

-1.02 |

1. Countries are ranked by the size of the fiscal preference for families in descending order.

2. One-earner married couple with two children and earnings at the average wage level.

3. Single individual without children and earnings at the average wage level.

Sources: Country submissions, (OECD[1]) Economic Outlook Volume 2022 Issue 2.

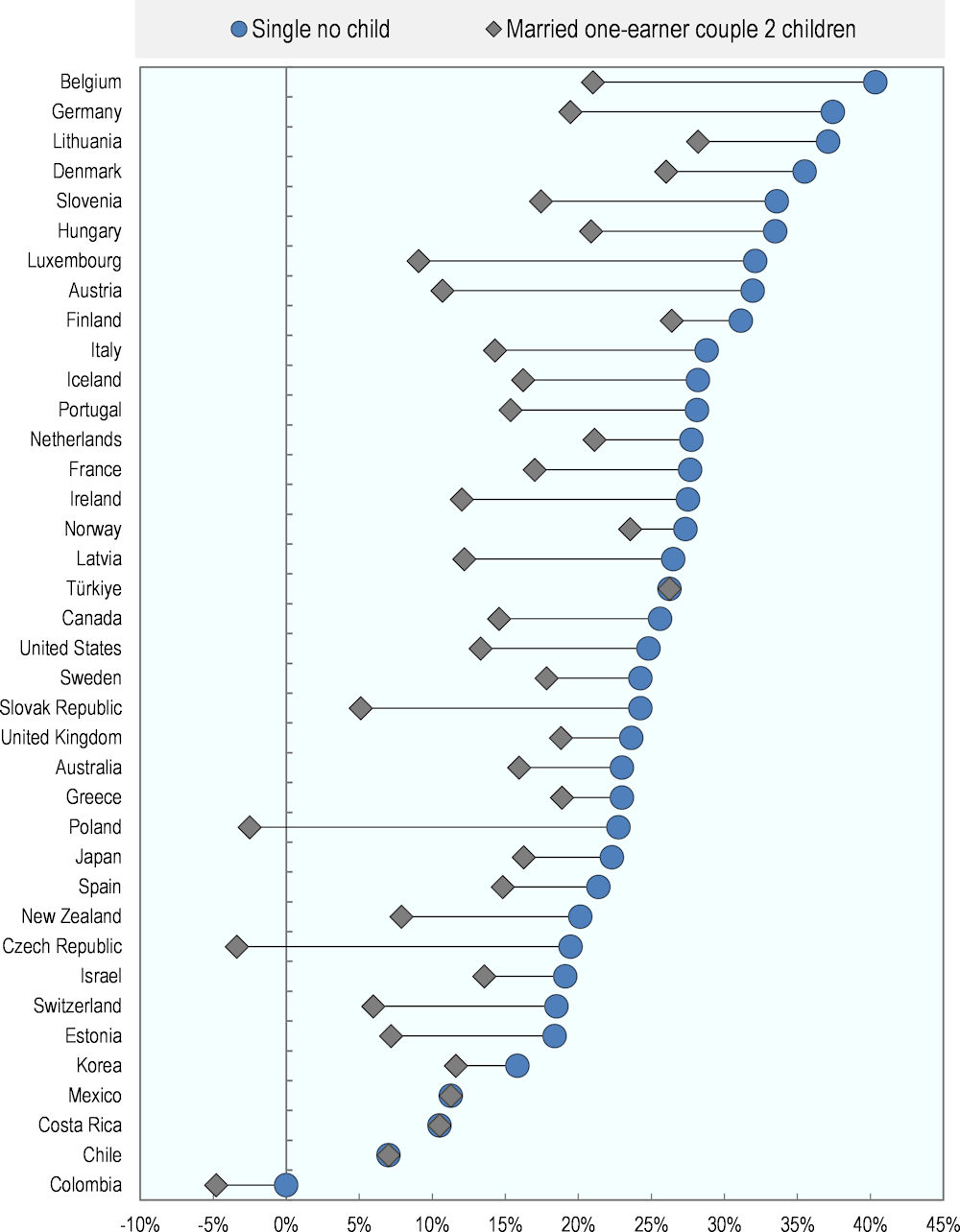

Figure 1.3. Income tax plus employee contributions less cash benefits, 2022

Notes: Countries ranked by decreasing rates for single taxpayer without children.

The household type ‘Single no child’ corresponds to a wage level of 100% of average wage and ‘Married one-earner couple 2 children’ corresponds to a combined wage level of 100%-0% of average wage.

Figure 1.3 compares the net personal average tax rate for a single worker earning the average wage with that of a one-earner married couple with two children at the same income level. Due to tax reliefs and cash benefits for families with children, the one-earner married couple’s disposable income was higher than that of the single worker by more than 20% of earnings in four countries: Austria (21.3%), the Czech Republic (22.9%), Luxembourg (23.1%) and Poland (25.2%). The disposable income of the one-earner married couple exceeded that of the single individual by less than 10% of earnings in 14 countries: Denmark (9.5%), Lithuania (8.9%), Australia (7.0%), the Netherlands and Spain (both 6.6%), Sweden (6.4%), Japan (6.0%), Israel (5.6%), the United Kingdom and Colombia (both 4.8%), Finland (4.7%), Korea (4.2%), Greece (4.1%) and Norway (3.8%). The disposable income was the same for both household types in Chile, Costa Rica, Mexico and Türkiye, as their net personal average tax rates were identical.

Taxation of two-earner married couples

The preceding analysis focused on two households with comparable levels of income: the single worker at 100% of the average wage and the married couple with one earner at 100% of the average wage, with two children. This section extends the discussion to examine the tax wedge and personal average tax rate for a third household type: the two-earner married couple, earning 100% and 67% of the average wage, with two children.

Tax wedge

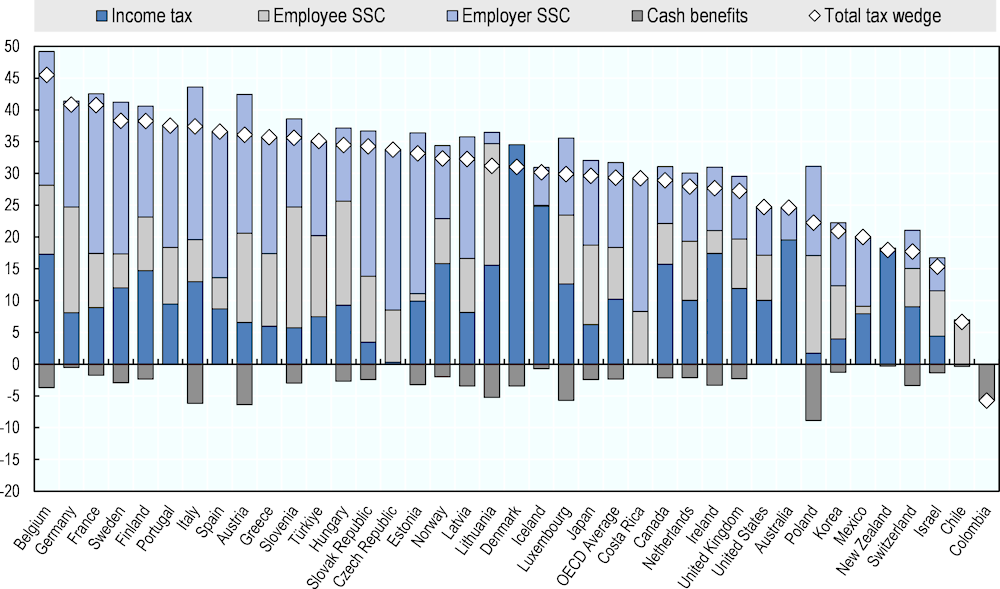

For this household type, the OECD average tax wedge as a percentage of labour costs was 29.4% in 2022 (Figure 1.4 and Table 1.5). Belgium had a tax wedge of 45.5%, which was the highest among OECD countries for this household type. The other countries with a tax wedge exceeding 40% were Germany and France (40.8% and 40.7%, respectively). The lowest tax wedge for this household type was observed in Colombia (-5.7%). In Colombia, the tax wedge was negative because this household type did not pay income taxes at that level of earnings (although it paid contributions that are not considered to be taxes) and received cash benefits that were paid on top of their wages. The other countries where the tax wedge for this household type was below 20% were New Zealand (18.0%), Switzerland (17.7%), Israel (15.3%) and Chile (6.6%).

Figure 1.4 shows the average tax wedge and its components as a percentage of labour costs for the two-earner married couple in 2022. On average across OECD countries, income tax represented 10.2% of labour costs and the sum of the employee and employer SSCs represented 21.5%. The OECD tax wedge is net of cash benefits, which represented 2.4% of labour costs in 2022.

The cash benefits that are considered in the Taxing Wages publication are those universally paid to workers in respect of dependent children between the ages of six to eleven inclusive. In-work benefits that are paid to workers regardless of their family situation are also included in the calculations.

Compared to 2021, the OECD average tax wedge of the two-earner married couple increased by 0.45 p.p. in 2022, as indicated in Table 1.5 (column 2). For this household type, the tax wedge increased in 24 out of 38 OECD countries, decreased in 13 and remained at the same level in Costa Rica. Increases exceeded one percentage point in five countries: Estonia (1.06 p.p.), Luxembourg (1.2 p.p.), Greece (1.52 p.p.), the United States (6.94 p.p.) and Chile (15.25 p.p.). In Estonia, the increase was the result of the progressivity of the tax allowance: due to a higher average wage in 2022, the value of the tax allowance decreased, resulting in a larger tax liability. In Luxembourg, the average tax wedge increased, as previously mentioned, due to the progressivity of the tax system, increases in the employee and employer SSCs as a result of increases in the wage and no changes in cash benefits for children. In Greece, the tax wedge increased as this household type no longer qualified for the child cash benefit due to increases in the average wage. In the United States, the removal of the child support tax credit and cash transfers, both COVID-19 support measures, led to an increase in the average tax wedge. In Chile, the increase was the result of the suspension of the Emergency Family Income, a COVID-19 support measure introduced in 2021.

Among the countries where the tax wedge increased for two-earner married couples with children in 2022, the increase in income tax as a percentage of labour costs accounted for most of the increase in twelve: Belgium, the Czech Republic, Estonia, Ireland, Japan, Lithuania, Luxembourg, New Zealand, Norway, Portugal, Spain and Switzerland. Meanwhile, an increase in SSCs was the main factor responsible for the higher tax wedge for this household type in seven countries in 2022: Canada, Finland, France, Korea, Mexico, the Netherlands, and the United Kingdom. In Chile and the United States, the elimination of cash benefits that were paid in 2021 but not in 2022 was the main driver of increases in the tax wedge.

In most countries where the tax wedge for families with children decreased between 2021 and 2022, this resulted from changes in income tax systems and SSCs, as observed for the single workers, as well as from increased cash benefits or tax provisions for dependent children between the two years. Decreases of more than one percentage point were observed in seven countries: Hungary (-1.17 p.p.), Latvia (-1.74 p.p.), Israel (-1.8 p.p.), the Slovak Republic (-1.93 p.p.), Italy (-2.09 p.p.), Austria (-2.33 p.p.) and Türkiye (-2.76 p.p.). As observed in previous sections, the decreases in the tax wedge resulted from reforms of the employer SSC rate and the scrapping of the training levy in Hungary, reforms of tax credits in Israel, Türkiye and the Slovak Republic, increases in the family state benefit in Latvia, the introduction of a universal allowance in Italy and the introduction of cash benefits and tax credits in Austria.

Figure 1.4. Income tax plus employee and employer social security contributions less cash benefits, 2022

Note: Two-earner married couple, one at 100% and the other at 67% of the average wage, with two children.

Includes payroll taxes where applicable.

Table 1.5. Comparison of total tax wedge for two-earner married couples with children, 2022

As % of labour costs

|

Country1 |

Total Tax wedge 2022 (1) |

Annual change, 2022/21 (in percentage points)² |

||||

|---|---|---|---|---|---|---|

|

Tax wedge (2) |

Income tax (3) |

Employee SSC (4) |

Employer SSC3 (5) |

Cash benefits (6) |

||

|

Belgium |

45.5 |

0.74 |

0.84 |

-0.13 |

0.00 |

-0.03 |

|

Germany |

40.8 |

-0.15 |

0.39 |

0.00 |

0.00 |

0.54 |

|

France |

40.7 |

0.15 |

-0.02 |

0.05 |

0.08 |

-0.04 |

|

Sweden |

38.3 |

-0.04 |

-0.16 |

0.01 |

0.00 |

-0.11 |

|

Finland |

38.2 |

0.05 |

-0.06 |

-0.18 |

0.23 |

-0.07 |

|

Portugal |

37.5 |

0.31 |

0.31 |

0.00 |

0.00 |

0.00 |

|

Italy |

37.4 |

-2.09 |

2.89 |

-0.61 |

0.00 |

4.37 |

|

Spain |

36.6 |

0.09 |

0.09 |

0.00 |

0.00 |

0.00 |

|

Austria |

36.1 |

-2.33 |

-0.70 |

0.01 |

-0.06 |

1.59 |

|

Greece |

35.7 |

1.52 |

0.20 |

-0.11 |

-0.10 |

-1.52 |

|

Slovenia |

35.6 |

-0.63 |

-0.62 |

0.00 |

0.00 |

0.00 |

|

Türkiye |

35.1 |

-2.76 |

-2.76 |

0.00 |

0.00 |

0.00 |

|

Hungary |

34.5 |

-1.17 |

0.96 |

0.56 |

-3.03 |

-0.33 |

|

Slovak Republic |

34.3 |

-1.93 |

-1.32 |

0.02 |

-0.15 |

0.48 |

|

Czech Republic |

33.8 |

0.06 |

0.06 |

0.00 |

0.00 |

0.00 |

|

Estonia |

33.1 |

1.06 |

0.80 |

0.00 |

0.00 |

-0.26 |

|

Norway |

32.4 |

0.02 |

0.11 |

-0.18 |

0.00 |

-0.09 |

|

Latvia |

32.3 |

-1.74 |

0.05 |

0.00 |

0.00 |

1.79 |

|

Lithuania |

31.2 |

0.27 |

0.20 |

0.00 |

0.00 |

-0.07 |

|

Denmark |

31.0 |

0.31 |

0.13 |

0.00 |

0.00 |

-0.18 |

|

Iceland |

30.2 |

-0.13 |

-0.09 |

0.00 |

0.22 |

0.27 |

|

Luxembourg |

29.9 |

1.20 |

0.79 |

0.01 |

0.00 |

-0.41 |

|

Japan |

29.6 |

0.08 |

0.05 |

0.00 |

0.00 |

-0.03 |

|

Costa Rica |

29.2 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

|

Canada |

28.9 |

0.52 |

0.09 |

0.18 |

0.15 |

-0.11 |

|

Netherlands |

28.0 |

0.97 |

0.33 |

-0.03 |

0.69 |

0.03 |

|

Ireland |

27.7 |

0.39 |

0.23 |

0.00 |

0.00 |

-0.16 |

|

United Kingdom |

27.3 |

0.78 |

0.29 |

-0.12 |

0.53 |

-0.07 |

|

United States |

24.7 |

6.94 |

1.98 |

0.00 |

-0.02 |

-4.98 |

|

Australia |

24.6 |

-0.26 |

-0.28 |

0.00 |

0.02 |

0.00 |

|

Poland |

22.2 |

-0.43 |

-1.67 |

0.00 |

0.01 |

-1.23 |

|

Korea |

20.9 |

0.41 |

0.18 |

0.13 |

0.08 |

-0.03 |

|

Mexico |

20.0 |

0.21 |

0.00 |

-0.02 |

0.24 |

0.00 |

|

New Zealand |

18.0 |

0.64 |

0.94 |

0.00 |

0.00 |

0.30 |

|

Switzerland |

17.7 |

0.39 |

0.29 |

0.00 |

0.00 |

-0.10 |

|

Israel |

15.3 |

-1.80 |

-1.95 |

0.11 |

0.05 |

0.00 |

|

Chile |

6.6 |

15.25 |

0.00 |

0.00 |

0.00 |

-15.25 |

|

Colombia |

-5.7 |

0.32 |

0.00 |

0.00 |

0.00 |

-0.32 |

|

Unweighted average |

|

|

|

|

|

|

|

OECD Average |

29.4 |

0.45 |

0.07 |

-0.01 |

-0.03 |

-0.42 |

Note: Two-earner married couple, one at 100% and the other at 67% of the average wage, with two children.

1. Countries ranked by decreasing total tax wedge.

2. Due to rounding, the changes in tax wedge in column (2) may differ by one hundredth of a percentage point from the sum of columns (3)-(6).

3. Includes payroll taxes where applicable.

Sources: Country submissions, (OECD[1]) Economic Outlook Volume 2022 Issue 2.

Table 1.6. Income tax plus employee social security contributions less cash benefits, 2022

For two-earner married couples with two children, as % of gross wage earnings

|

Country1 |

Total payment2 (1) |

Income tax (2) |

Employee social security contributions (3) |

Cash benefits (4) |

Gross wage earnings3 (5) |

|---|---|---|---|---|---|

|

Switzerland |

12.4 |

9.6 |

6.4 |

3.6 |

157 983 |

|

Luxembourg |

20.2 |

14.4 |

12.3 |

6.5 |

138 042 |

|

Netherlands |

19.3 |

11.2 |

10.4 |

2.4 |

127 980 |

|

Germany |

29.0 |

9.7 |

20.0 |

0.7 |

125 479 |

|

Belgium |

30.9 |

21.9 |

13.8 |

4.7 |

124 037 |

|

Iceland |

25.8 |

26.4 |

0.1 |

0.8 |

123 407 |

|

Norway |

23.6 |

17.8 |

8.0 |

2.3 |

118 113 |

|

Denmark |

31.0 |

34.5 |

0.0 |

3.5 |

116 802 |

|

Ireland |

19.7 |

19.4 |

4.0 |

3.7 |

116 272 |

|

Austria |

18.2 |

8.4 |

18.0 |

8.2 |

115 567 |

|

Australia |

20.6 |

20.6 |

0.0 |

0.0 |

109 309 |

|

Canada |

21.9 |

17.3 |

7.0 |

2.4 |

108 452 |

|

United States |

18.5 |

10.9 |

7.7 |

0.0 |

108 365 |

|

United Kingdom |

19.3 |

13.2 |

8.6 |

2.6 |

107 104 |

|

Finland |

25.2 |

17.8 |

10.2 |

2.8 |

103 169 |

|

Korea |

12.2 |

4.4 |

9.3 |

1.4 |

100 350 |

|

France |

20.9 |

11.9 |

11.4 |

2.4 |

99 273 |

|

Sweden |

18.9 |

15.8 |

7.0 |

3.9 |

95 911 |

|

Japan |

18.8 |

7.2 |

14.5 |

2.8 |

89 794 |

|

Italy |

17.6 |

17.1 |

8.7 |

8.1 |

89 342 |

|

New Zealand |

18.0 |

18.2 |

0.0 |

0.3 |

79 390 |

|

Spain |

17.6 |

11.3 |

6.4 |

0.0 |

78 522 |

|

Israel |

10.7 |

4.6 |

7.5 |

1.5 |

76 853 |

|

Lithuania |

30.0 |

15.8 |

19.5 |

5.3 |

69 652 |

|

Slovenia |

25.3 |

6.6 |

22.1 |

3.4 |

69 301 |

|

Hungary |

25.9 |

10.5 |

18.5 |

3.0 |

66 036 |

|

Greece |

21.3 |

7.3 |

14.0 |

0.0 |

65 713 |

|

Portugal |

22.7 |

11.7 |

11.0 |

0.0 |

64 371 |

|

Poland |

9.5 |

2.0 |

17.8 |

10.3 |

64 283 |

|

Czech Republic |

11.4 |

0.4 |

11.0 |

0.0 |

60 806 |

|

Estonia |

10.5 |

13.2 |

1.6 |

4.3 |

56 945 |

|

Latvia |

16.3 |

10.1 |

10.5 |

4.3 |

53 212 |

|

Türkiye |

23.8 |

8.8 |

15.0 |

0.0 |

48 991 |

|

Slovak Republic |

14.7 |

4.5 |

13.4 |

3.2 |

47 948 |

|

Costa Rica |

10.5 |

0.0 |

10.5 |

0.0 |

47 042 |

|

Chile |

6.6 |

0.0 |

7.0 |

0.4 |

44 620 |

|

Mexico |

10.2 |

8.9 |

1.3 |

0.0 |

25 391 |

|

Colombia |

-5.7 |

0.0 |

0.0 |

5.7 |

24 456 |

|

Unweighted average |

|

|

|

|

|

|

OECD Average |

18.5 |

11.7 |

9.6 |

2.7 |

87 323 |

Notes: Two-earner married couple, one at 100% and the other at 67% of the average wage, with two children.

1. Countries ranked by decreasing gross wage earnings.

2. Due to rounding, total may differ by one tenth of a percentage point from aggregate of columns for income tax, social security contributions and cash benefits.

3. US dollars with equal purchasing power.

Sources: Country submissions, (OECD[1]) Economic Outlook Volume 2022 Issue 2.

Personal average tax rates

The net personal average tax rate for the two-earner married couple with two children where one spouse earns the average wage and the other earns 67% thereof was 18.5% of gross wage earnings on average in 2022. Table 1.6 shows the net personal average tax rate for each of the OECD countries and its components as a percentage of gross wage earnings. Household gross wage earnings figures in column 5 are expressed in US dollar terms with equivalent purchasing power. Unlike the results shown in Table 1.3, cash benefits are taken into account in Table 1.6 and reduce the impact of the employees’ income taxes and SSCs (column 2 plus column 3, minus column 4).

The net personal average tax rate of the two-earner married couple varied greatly among OECD countries in 2022, ranging from -5.7% in Colombia to 31.0% in Denmark. In Colombia, the tax wedge was negative because this household type did not pay income taxes at that level of earnings, paid contributions that are not considered to be taxes and received cash benefits that were paid on top of their wages. The disposable income of the household after tax represented 105.7% of the couple’s gross wage earnings in Colombia while it represented 69.0% in Denmark. The net personal average tax rate was lower than 10% in Poland (9.5%) and Chile (6.6%).

The Taxing Wages indicators focus on the structure of income tax systems on disposable income. To assess the overall impact of the government sector on people’s welfare, other factors including indirect taxes (such as value-added tax) should also be taken into account, as should other forms of income (such as capital income). Non-tax compulsory payments that affect households’ disposable incomes are not included in the calculations presented in the publication, but further analysis of those payments is presented in the online report: http://www.oecd.org/tax/tax-policy/non-tax-compuslory-payments.pdf.

Wages

While the average wage increased in nominal terms in all OECD countries between 2021 and 2022, real wages decreased in 35 of the 38 countries, and the real post-tax income for a single worker earning the average wage decreased in 34 countries over the same period. Wage trends over the course of the COVID-19 pandemic are examined in greater detail in Chapter 2.

Table 1.7 shows gross wage earnings in national currency of the average worker in each OECD member country for 2021 and 2022. The figures for 2022 are preliminary and were estimated by the OECD Secretariat by applying the change in the compensation per employee in the total economy as presented in the OECD Economic Outlook Volume 2022 Issue 2 (2022[1]) database to the final average wage values provided by OECD member countries. More information on the value of the average wage and the estimation methodology is included in the Annex of this Report.

The annual change in gross nominal wages in 2022 – shown in column 3 – ranged from 0.7% in Mexico to 57.9% in Türkiye. To a large extent, the changes in wage levels in the 38 OECD countries reflect inflation trends (see column 4 of Table 1.7). The annual change in real wage levels (before personal income tax and employee SSCs) was within the range of -2% to +2% for 11 countries (see column 5 of Table 1.7). Twenty-seven countries recorded declines outside this range. Declines larger than or equal to 5.0% occurred in nine countries: the Czech Republic (-7.0%), Estonia (-10.%), Greece (-7.4%), Latvia (-6.2%), Lithuania (-6.3%), Mexico (-6.8%), the Netherlands (-8.3%), Spain (-5.3%) and Türkiye (-8.8%).

In 34 out of 38 OECD countries, the average single worker without children had lower real post-tax income in 2022 than in 2021, either because the personal average tax rate (column 6) decreased by less than the real wage before tax (column 5), the personal average tax rate increased or remained unchanged while the real wage before tax decreased, or because the personal average tax rate increased by more than the real wage before tax.

In contrast, the average single worker without children had higher real post-tax income in 2022 in Hungary, Iceland, Poland and Türkiye.

The real wage before tax decreased by less than the personal average tax rate in Poland and Türkiye.

The personal average tax rate remained unchanged while the real wage before tax increased in Colombia and Hungary.

When comparing wage levels, it is important to note that the definition of average wage earnings may vary between countries. For instance, some countries do not include the wages earned by supervisory and managerial workers or do not exclude wage earnings from part-time workers (see Table A.4 in the Annex).

Table 1.8 provides more information on whether the average wages for the years 2000 to 2022 are based on industry sectors C-K inclusive with reference to the International Standard Industrial Classification of All Economic Activities, Revision 3 (ISIC Rev.3) or industry sectors B-N inclusive with reference to the International Standard Industrial Classification of All Economic Activities, Revision 4 (ISIC Rev.4).

Most OECD countries have calculated average wage earnings on the basis of sectors B-N in the ISIC Rev. 4 Industry Classification since 2008 or earlier. Some countries have revised the average wage values for prior years as well. Average wage values based on the ISIC Rev. 4 Classification or any variant are available for years back to 2000 for Australia, the Czech Republic, Estonia, Finland, Greece, Hungary, Iceland, Italy, Japan, Latvia, Lithuania, the Slovak Republic, Slovenia, Spain and Switzerland.

Australia (for all years) and New Zealand (from 2004 onwards) have provided values based on the 2006 ANZSIC industry classification, divisions B to N, which substantially overlaps with the ISIC Rev.4, sectors B to N. For New Zealand, the years prior to 2004 continue to be based on sectors C-K in ANZSIC. Türkiye has provided values based on the NACE Rev.2 classification sectors B-N from 2007 onwards. Values for the years prior to 2007 are based on the average production worker wage (ISIC rev.3.1, sector D). The average wage values are not based on the sectors B-N in the ISIC Rev. 4 Industry Classification for Costa Rica (all years), the Netherlands (from 2012 onwards) or Mexico (all years).

Table 1.7. Comparison of wage levels in 2021 and 2022

|

Country |

Gross wage in national currency |

Annual change, 2022/21 (percentage) |

||||

|---|---|---|---|---|---|---|

|

2021 (1) |

2022 (2) |

Gross wage (3) |

Inflation1 (4) |

Real wage before tax (5) |

Change in personal average tax rate2 (6) |

|

|

Australia |

93 254 |

94 685 |

1.5 |

6.5 |

-4.6 |

-1.0 |

|

Austria |

50 447 |

52 666 |

4.4 |

8.5 |

-3.8 |

-3.7 |

|

Belgium |

51 328 |

55 332 |

7.8 |

9.9 |

-1.9 |

2.2 |

|

Canada |

78 018 |

81 704 |

4.7 |

6.8 |

-2.0 |

1.2 |

|

Chile |

10 793 531 |

11 492 895 |

6.5 |

11.6 |

-4.6 |

0.0 |

|

Colombia |

18 908 349 |

21 137 925 |

11.8 |

10.2 |

1.5 |

0.0 |

|

Costa Rica |

8 761 423 |

9 445 151 |

7.8 |

8.8 |

-0.9 |

0.0 |

|

Czech Republic |

441 784 |

472 783 |

7.0 |

15.2 |

-7.1 |

-1.1 |

|

Denmark |

451 800 |

468 195 |

3.6 |

7.8 |

-3.9 |

0.4 |

|

Estonia |

18 489 |

19 996 |

8.2 |

20.2 |

-10.0 |

6.6 |

|

Finland |

49 491 |

50 774 |

2.6 |

7.0 |

-4.1 |

-0.6 |

|

France |

39 429 |

41 540 |

5.4 |

5.9 |

-0.5 |

0.3 |

|

Germany |

52 800 |

55 041 |

4.2 |

8.5 |

-3.9 |

-0.9 |

|

Greece |

19 614 |

19 912 |

1.5 |

9.7 |

-7.4 |

0.3 |

|

Hungary |

5 431 692 |

6 328 111 |

16.5 |

13.5 |

2.6 |

0.0 |

|

Iceland |

10 357 357 |

10 959 626 |

5.8 |

8.3 |

-2.3 |

-0.1 |

|

Ireland |

52 135 |

54 649 |

4.8 |

8.4 |

-3.3 |

0.8 |

|

Israel |

168 240 |

172 609 |

2.6 |

4.3 |

-1.6 |

0.6 |

|

Italy |

32 029 |

33 855 |

5.7 |

8.1 |

-2.2 |

2.2 |

|

Japan |

5 087 487 |

5 154 009 |

1.3 |

2.3 |

-1.0 |

0.3 |

|

Korea |

48 600 252 |

49 775 096 |

2.4 |

5.2 |

-2.7 |

2.0 |

|

Latvia |

15 276 |

16 758 |

9.7 |

17.0 |

-6.2 |

0.1 |

|

Lithuania |

18 560 |

20 667 |

11.3 |

18.8 |

-6.3 |

1.9 |

|

Luxembourg |

65 517 |

70 189 |

7.1 |

8.2 |

-1.0 |

2.3 |

|

Mexico |

153 588 |

154 646 |

0.7 |

8.0 |

-6.8 |

0.1 |

|

Netherlands |

55 904 |

57 513 |

2.9 |

12.2 |

-8.3 |

0.3 |

|

New Zealand |

65 957 |

70 588 |

7.0 |

7.3 |

-0.2 |

3.7 |

|

Norway |

638 564 |

666 115 |

4.3 |

5.7 |

-1.3 |

0.2 |

|

Poland |

64 095 |

72 945 |

13.8 |

14.2 |

-0.3 |

-6.0 |

|

Portugal |

20 680 |

21 606 |

4.5 |

8.3 |

-3.5 |

0.3 |

|

Slovak Republic |

14 438 |

15 538 |

7.6 |

12.0 |

-3.9 |

1.4 |

|

Slovenia |

22 276 |

23 332 |

4.7 |

9.2 |

-4.1 |

-2.5 |

|

Spain |

27 570 |

28 360 |

2.9 |

8.6 |

-5.3 |

-0.1 |

|

Sweden |

476 276 |

494 513 |

3.8 |

8.3 |

-4.1 |

-0.6 |

|

Switzerland |

97 927 |

100 885 |

3.0 |

2.9 |

0.1 |

1.6 |

|

Türkiye |

86 989 |

137 340 |

57.9 |

73.2 |

-8.8 |

-10.6 |

|

United Kingdom |

41 878 |

44 300 |

5.8 |

8.9 |

-2.8 |

1.7 |

|

United States |

62 172 |

64 889 |

4.4 |

8.0 |

-3.3 |

10.7 |

Note: 1. Estimated percentage change in the total consumer price index.

1. Percentage change in the personal average tax rate of the average worker (single without children) between 2021 and 2022.

Sources: Country submissions, (OECD[1]) Economic Outlook Volume 2022 Issue 2.

Table 1.8. Average Wage Industry Classification

|

|

Years for which ISIC Rev. 3.1 or any variant (Sectors C-K) has been used to calculate the AW |

Years for which ISIC Rev. 4 or any variant (Sectors B-N) has been used to calculate the AW |

|---|---|---|

|

Australia1 |

2000-2022 |

|

|

Austria2 |

2004-2007 |

2008-2022 |

|

Belgium |

2000-2007 |

2008-2022 |

|

Canada |

2000-2021 |

|

|

Chile3 |

2000-2008 |

2009-2022 |

|

Colombia4 |

2000-2021 |

|

|

Costa Rica5 |

||

|

Czech Republic |

2000-2022 |

|

|

Denmark6 |

2000-2007 |

2008-2022 |

|

Estonia |

2000-2022 |

|

|

Finland |

2000-2022 |

|

|

France |

2000-2007 |

2008-2022 |

|

Germany |

2000-2005 |

2006-2022 |

|

Greece7 |

2000-2022 |

|

|

Hungary |

2000-2022 |

|

|

Iceland8 |

2000-2022 |

|

|

Ireland9 |

2000-2007 |

2008-2022 |

|

Israel10 |

2000-2012 |

2013-2022 |

|

Italy |

2000-2022 |

|

|

Japan |

2000-2022 |

|

|

Korea11 |

2000-2007 |

2008-2022 |

|

Latvia12 |

2000-2022 |

|

|

Lithuania |

2000-2022 |

|

|

Luxembourg |

2000-2004 |

2005-2022 |

|

Mexico13 |

||

|

Netherlands14 |

2000-2007 |

2008-2011 |

|

New Zealand15 |

2000-2003 |

2004-2022 |

|

Norway |

2000-2008 |

2009-2022 |

|

Poland |

2000-2006 |

2007-2022 |

|

Portugal |

2000-2005 |

2006-2022 |

|

Slovak Republic16 |

2000-2022 |

|

|

Slovenia |

2000-2022 |

|

|

Spain |

2000-2022 |

|

|

Sweden |

2000-2007 |

2008-2022 |

|

Switzerland |

2000-2022 |

|

|

Türkiye17 |

2007-2022 |

|

|

United Kingdom |

2000-2007 |

2008-2022 |

|

United States |

2000-2006 |

2007-2022 |

1. Australia: based on ANZSIC06 such that the categories substantially overlap with ISIC 4, sectors B-N.

2. Austria: 2000-2003 average wage values are not based on the NACE (ISIC) classification.

3. Chile: the values for 2000 to 2008 are estimates deriving from the annual changes in the average wages based on “CIIU Rev.3” (2009=100) between 2000 and 2008, and the average wage for 2009 based on CIIU Rev.4 (2016=100). From 2009, the values are based on ISIC4.CL2012 sectors B to R, excluding O (8422) “Defense Activities” and O (8423) “Public order and safety activities”.

4. Colombia: average wage values based on ISIC rev. 3. The “Agriculture, hunting and forestry”, “Other community, social and personal service activities” and “Activities not adequately defined” sectors are excluded.

5. Costa Rica: the average wages from 2000 onwards refer to the earnings of workers within the formal sector. The average worker’s wage was calculated based on microdata from the national household surveys.

6. Denmark: average wage values are based on sectors B-N and R-S (NACE rev 2).

7. Greece: the average annual earnings refer to full time employees for the sectors B to N of NACE Rev 2, including Division 95 and excluding Divisions 37, 39 and 75 for 2008 onwards.

8. Iceland: using national classification system that corresponds with the NACE rev. 2 classification system.

9. Ireland: values from 2008 onwards are based on CSO table EHA05 for NACE rev.2 B-N. Values for prior years are the Secretariat's estimates, based on the growth rates of the average wages for sectors C to E in reference to NACE.

10. Israel: information on data for Israel: http://oe.cd/israel-disclaimer.

11. Korea: average wage values are based on 6th Korean Standard Industrial Classification (KSIC) C-K for 2000-2001, 8th KISC C-M for 2002 to 2007. Average wage data of 2008 to 2010 is based on the 9th KISC B-N (samples of firms with five or more permanent employees). Average wage data of 2011 to 2019 is based on the 9th KISC B-N (samples of firms with one or more permanent employees). Average wage data of 2020 and the estimate for 2021 are based on the 10th KISC B-N (samples of firms with one or more permanent employees).

12. Latvia: Values are based on NACE rev.2 and cover the private sector that includes commercial companies with central or local government capital participation up to 50%, commercial companies of all types without central or local government capital participation, individual merchants, and peasant and fishermen farms with 50 and more employees.

13. Mexico: 2000-2022 average wage values are based on the Mexican Classification of Economic Activities (Clasificación Mexicana de Actividades Económicas (CMAE)), which is based on one of the first versions of ISIC.

14. Netherlands: the average wages from 2012 onwards include all economic activities (sectors A to U from SBI2008). Values for the private sector only (sectors B to N) are not available.

15. New Zealand: see the note for Australia, which applies from 2004.

16. Slovak Republic: average wage values based on SK NACE Rev. 2 classification (B to N) without the earnings of the self-employed. However, employment data used for the calculation of the weighted mean still include the self-employed.

17. Türkiye: the average wage is based on the average production worker wage ISIC rev. 3.1 sector D for years 2000 to 2006.

References

[1] OECD (2022), OECD Economic Outlook, Volume 2022 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/f6da2159-en.

Notes

← 1. Not all national statistical agencies use ISIC Rev.3 or Rev.4 to classify industries. However, the Statistical Classification of Economic Activities in the European Community (NACE Rev.1 or Rev.2), the North American Industry Classification System (US NAICS 2012). The Australian and New Zealand Standard Industrial Classification (ANZSIC 2006) and the Korean Standard Industrial Classification (6th to 9th KISC) include a classification which broadly conforms either with industries C-K in ISIC Rev. 3 or industries B-N in ISIC Rev.4.

← 2. Non-tax compulsory payments are requited and unrequited compulsory payments to privately-managed funds, welfare agencies or social insurance schemes outside general governments and to public enterprises (http://www.oecd.org/tax/tax-policy/tax-database.htm#NTCP).

← 3. In Colombia, the general social security system for healthcare is financed by public and private funds. The pension system is a hybrid of two different systems: a defined contribution, fully-funded pension system; and a pay-as-you-go system. Each of those contributions are mandatory and more than 50% of total contributions are made to privately managed funds. Therefore, they are considered to be non-tax compulsory payments (NTCPs) (further information is available in the country details in Part II of the report). In addition, in Colombia, all payments for employment risk are made to privately managed funds and are considered to be NTCPs. Other countries also have NTCPs (please see http://www.oecd.org/tax/tax-policy/tax-database.htm#NTCP).