[8] Banco Central de Reserva del Perú (2023), BCRPData (database), Central Management of Economic Studies, https://estadisticas.bcrp.gob.pe/estadisticas/series/cuadros/memoria/ca_001.

[24] Banco Mundial (2023), International tourism, receipts (% of total exports), https://data.worldbank.org/indicator/ST.INT.RCPT.XP.ZS.

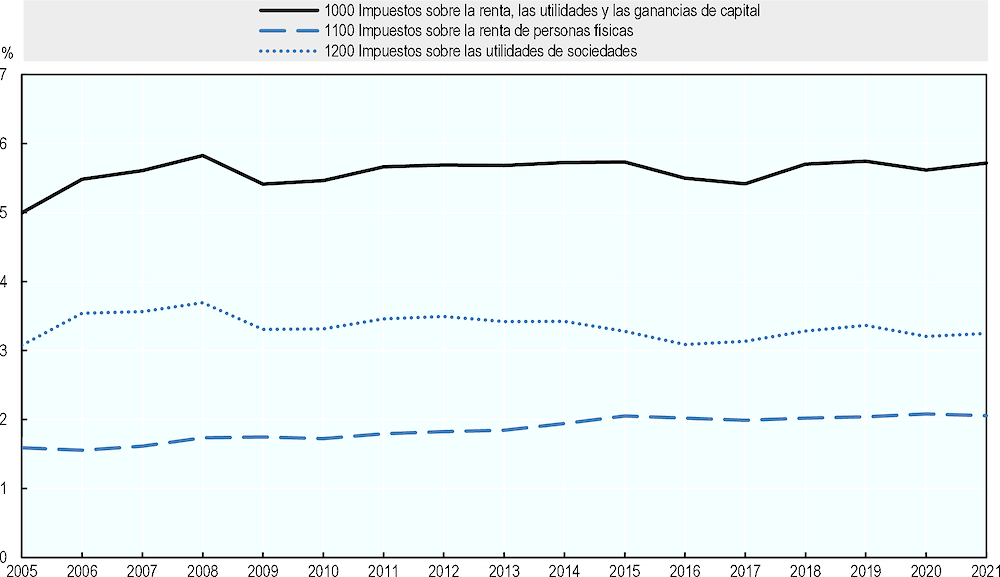

[21] Barreix, A. (2017), “Revisiting personal income tax in Latin America: Evolution and impact”, OECD Development Centre Working Papers, No. 338, OECD Publishing, Paris, https://doi.org/10.1787/16d42b4a-en.

[37] Benton, M. et al. (2021), COVID-19 and the State of, International Organization for Migration, https://publications.iom.int/books/covid-19-and-state-global-mobility-2020.

[41] BID (2022), The Role of Subnational Governments in the Covid 19 Pandemic Response: Are There Opportunities for Intergovernmental Fiscal Reform in the Post Pandemic World, Banque Interaméricaine de Développement.

[19] BID (2013), More than revenues, Taxation as a development tool, Banque Interaméricaine de Développement, https://publications.iadb.org/en/publication/more-revenue-taxation-development-tool-executive-summary.

[44] Canavire-Bacarreza, G. (2012), Sub-national Revenue Mobilization in Peru, IDB Working Paper Series No. 299, IDB, https://publications.iadb.org/en/sub-national-revenue-mobilization-peru.

[4] CEPAL (2022), Fiscal Panorama of Latin America and the Caribbean 2022, Comisión Económica para América Latina y el Caribe, https://www.cepal.org/en/publications/48015-fiscal-panorama-latin-america-and-caribbean-2022-fiscal-policy-challenges.

[17] CEPAL (2020), Fiscal Panorama of Latin America and the Caribbean 2020: Fiscal policy amid the crisis arising from the coronavirus disease (COVID-19) pandemic, Comisión Económica para América Latina y el Caribe, https://repositorio.cepal.org/handle/11362/45731.

[18] CEPAL (2018), The Fiscal Panorama of Latin America and the Caribbean, Comisión Económica para América Latina y el Caribe, https://www.cepal.org/en/publications/43406-fiscal-panorama-latin-america-and-caribbean-2018-public-policy-challenges.

[15] CEPAL (2014), Tax policy in Latin America: Assessment and guidelines for a second generation of reforms, Comisión Económica para América Latina y el Caribe, https://repositorio.cepal.org/handle/11362/36806.

[20] CEPAL (2013), Fiscal Panorama of Latin America and the Caribbean: Tax reform and renewal of the fiscal covenant, Comisión Económica para América Latina y el Caribe, https://www.cepal.org/en/publications/3101-fiscal-panorama-latin-america-and-caribbean-2013-tax-reform-and-renewal-fiscal.

[6] Consejo de Turismo de Belice (2022), Travel & Tourism Statistics Digest 2021, https://www.belizetourismboard.org/belize-tourism/statistics/.

[34] El Economista (2023), Pemex-fue-el-gran-beneficiario-por-los-estimulos-fiscales-a-las-gasolinas, https://www.eleconomista.com.mx/economia/Pemex-fue-el-gran-beneficiario-por-los-estimulos-fiscales-a-las-gasolinas-20230222-0059.html.

[3] FMI (2022), World Economic Outlook Database, October 2022, Fonds monétaire international, https://www.imf.org/en/Publications/WEO/weo-database/2022/October.

[5] Instituto Estadístico de Belice (2023), Annual GDP by Activity: 1990-2021, https://sib.org.bz/statistics/economic-statistics/gross-domestic-product/.

[23] Keen, M. (2013), The anatomy of VAT, WP/13/111, IMF, https://www.imf.org/en/Publications/WP/Issues/2016/12/31/The-Anatomy-of-the-VAT-40543.

[26] KPMG (2019), Mexico: Tax reform 2020, VAT on services provided from digital platforms, https://home.kpmg/us/en/home/insights/2019/11/tnf-mexico-tax-reform-2020-vat-services-digital-platforms.html.

[30] Lorenzo, F. (2016), Inventario de instrumentos fiscales verdes en América Latina, CEPAL, https://agua.org.mx/biblioteca/inventario-instrumentos-fiscales-verdes-en-america-latina-experiencias-efectos-alcances/.

[38] McLeod, S. (2021), Bahamas Government Welcomes Royal Caribbean Cruise Line, https://www.caribbeannationalweekly.com/news/bahamas-government-welcomes-royal-caribbean-cruise-line/.

[10] Melguizo, A. et al. (2017), “No sympathy for the devil! Policy priorities to overcome the middle-income trap in Latin America”, OECD Development Centre Working Papers, No. 340, OECD, https://doi.org/10.1787/26b78724-en.

[40] Ministerio de Turismo de Bahamas (2022), Stopover Visitors by Month Islands of the Bahamas Preliminary 2022, https://www.tourismtoday.com/sites/default/files/stopover_by_month_and_country_comparision_2015-2022a_2.pdf.

[43] Nieto-Parra, S. (2020), Potencializar los impuestos subnacionales en América Latina y el Caribe en tiempos del Covid-19, Los desafíos de las finanzas intergubernamentales ante el Covid-19, AIFIL - Asociación Iberoamericana de Financiación, https://www.aifil-jifl.org/wp-content/uploads/2020/11/AIFIL-2.11.pdf.

[7] OCDE (2023), National Accounts, OECD.Stat (database), OECD Publishing, Paris, http://dotstat.oecd.org/Index.aspx?DataSetCode=SNA_TABLE1.

[22] OCDE (2022), Consumption Tax Trends 2022: VAT/GST and Excise Rates, Trends and Policy Issues, OECD Publishing, Paris, https://doi.org/10.1787/6525a942-en.

[28] OCDE (2022), Multi-dimensional Review of the Dominican Republic: Towards Greater Well-being for All, OECD Development Pathways, OECD Publishing, Paris, https://doi.org/10.1787/560c12bf-en.

[32] OCDE (2022), PINE database, OECD Publishing, Paris, http://www.oecd.org/environment/tools-evaluation/environmentaltaxation.htm.

[46] OCDE (2021), Environmental policy: Environmentally related tax revenue accounts, OECD Environment Statistics (database), https://stats.oecd.org/Index.aspx?DataSetCode=ERTR_ACC.

[31] OCDE (2021), Taxing Energy Use for Sustainable Development, OECD Publishing, Paris, https://www.oecd.org/tax/tax-policy/taxing-energy-use-for-sustainable-development.htm.

[16] OCDE (2020), “COVID-19 in Latin America and the Caribbean: Regional socio-economic implications and policy priorities”, OECD Policy Responses to Coronavirus (COVID-19), http://www.oecd.org/coronavirus/policy-responses/covid-19-in-latinamerica-and-the-caribbean-regional-socio-economic-implications-and-policy-priorities-93a64fde/.

[45] OCDE (2019), Revenue Statistics in Latin America and the Caribbean, OECD Publishing, Paris, https://doi.org/10.1787/25666b8d-en-es.

[12] OCDE (2019), Tax Morale: What Drives People and Businesses to Pay Tax?, OECD Publishing, Paris, https://doi.org/10.1787/f3d8ea10-en.

[25] OCDE (2018), Consumption Tax Trends 2018: VAT/GST and Excise Rates, Trends and Policy Issues, OECD Publishing, Paris, https://doi.org/10.1787/ctt-2018-en.

[11] OCDE (2014), Development Co-operation Report 2014: Mobilising Resources for Sustainable Development, OECD Publishing, Paris, https://doi.org/10.1787/dcr-2014-en.

[29] OCDE (2005), Glossary of statistical terms, https://stats.oecd.org/glossary/detail.asp?ID=6437.

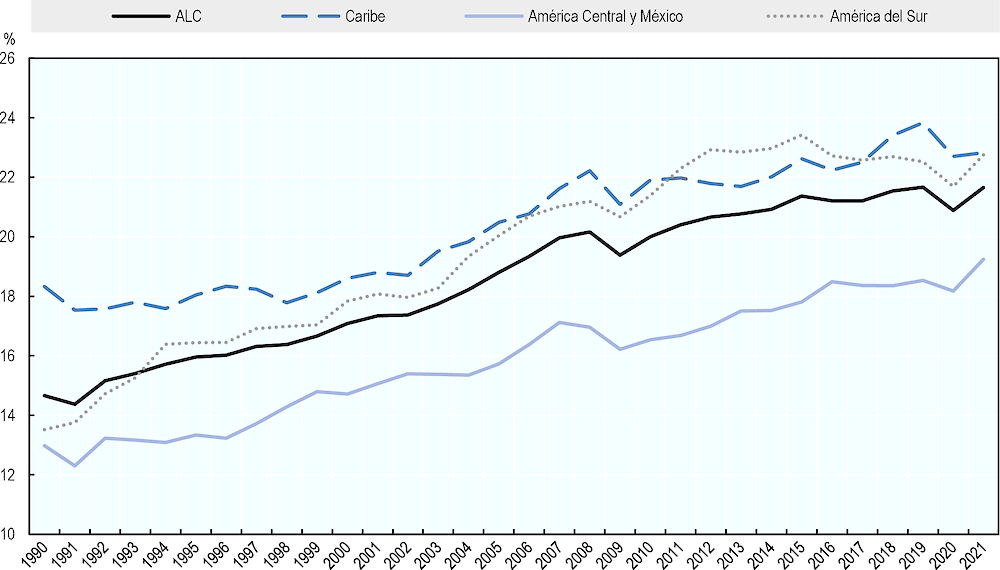

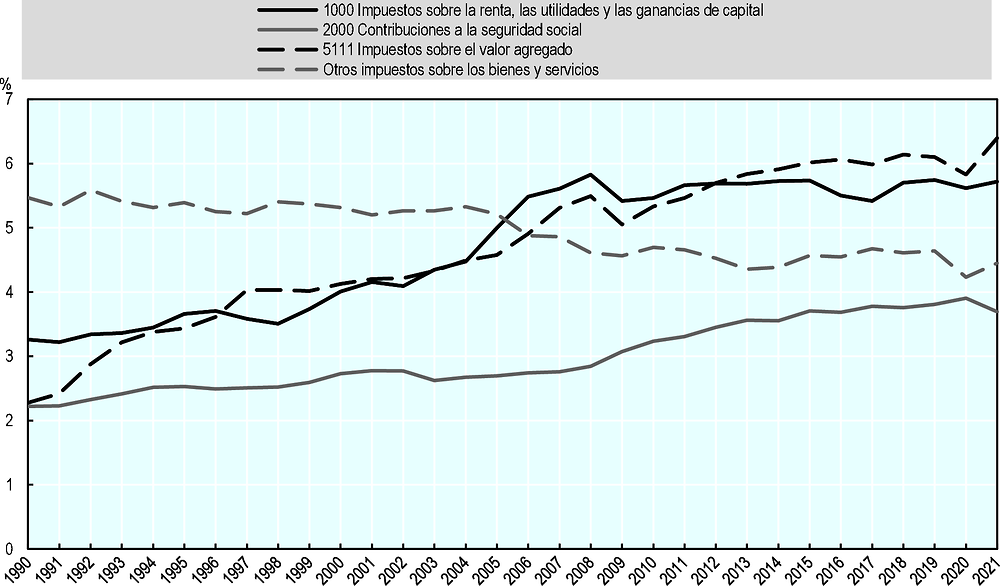

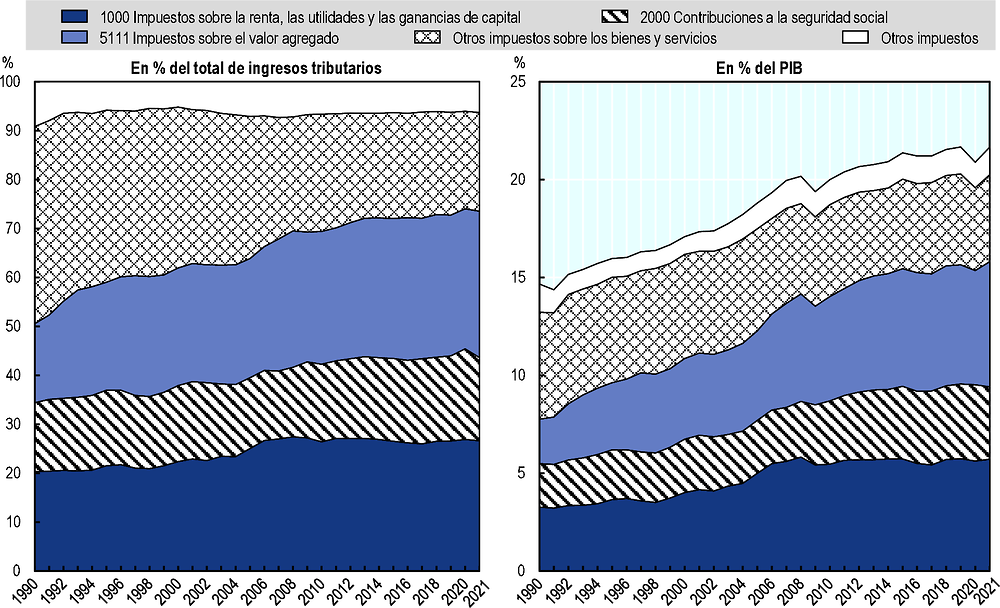

[2] OCDE et al. (2023), Revenue Statistics in Latin America and the Caribbean 2023, OECD Publishing, Paris, https://doi.org/10.1787/5a7667d6-es.

[1] OCDE et al. (2022), Latin American Economic Outlook 2022: Towards a Green and Just Transition, OECD Publishing, Paris, https://doi.org/10.1787/3d5554fc-en.

[9] OCDE et al. (2022), Revenue Statistics in Latin America and the Caribbean 2022, OECD Publishing, Paris, https://doi.org/10.1787/58a2dc35-en-es.

[14] OCDE/BID/Banco Mundial (2014), Pensions at a Glance: Latin America and the Caribbean, OECD Publishing, Paris, https://doi.org/10.1787/pension_glance-2014-en.

[13] OCDE et al. (2015), Revenue Statistics in Latin America and the Caribbean 2015, OECD Publishing, Paris, https://doi.org/10.1787/rev_lat-2015-en-fr.

[36] Oficina del Primer Ministro, Commonwealth de Bahamas (2020), Press Release, Office of the Prime Minister, https://opm.gov.bs/statement-on-upcoming-weekend-lockdowns/.

[27] Schlotterbeck, S. (2017), Tax Administration Reforms in the Caribbean, “Challenges, Achievements, and Next Steps”.

[42] Smoke, P. et al. (2022), The Role of Subnational Governments in the Covid-19 Pandemic Response: Are There Opportunities for Intergovernmental Fiscal Reform in the Post-Pandemic World?, Banco Interamericano de Desarrollo, Washington, D.C., https://doi.org/10.18235/0004391.

[35] Stabroek News (2022), Excise Tax on fuel cut from 10% to 0%, https://www.stabroeknews.com/2022/03/24/news/guyana/excise-tax-on-fuel-cut-from-10-to-0/.

[33] Van Dender et. al., K. (2022), Why governments should target support amidst high energy prices, https://doi.org/10.1787/40f44f78-en.

[39] Wood, D. (2021), The Bahamas Welcomes Back Cruise Industry, https://www.travelpulse.com/news/cruise/the-bahamas-welcomes-back-cruise-industry.html.