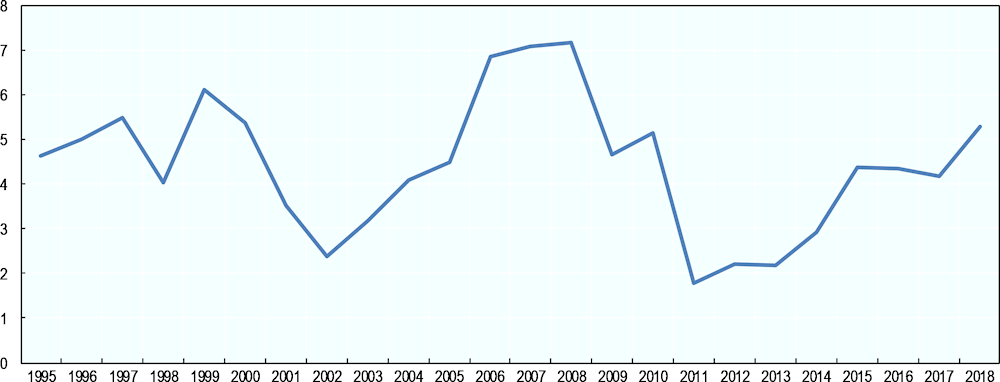

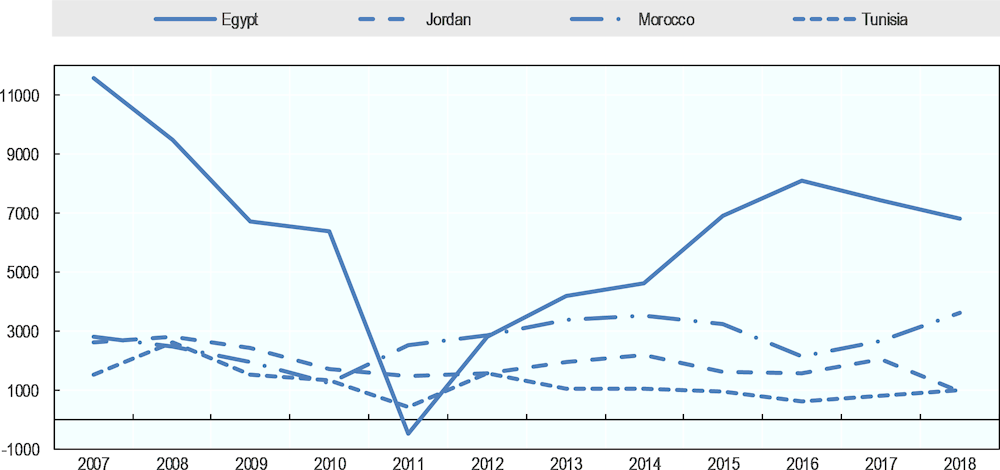

Egypt is implementing ambitious reforms to stabilise its economy, attract investors, and spur durable economic growth. These efforts are having a positive effect. Since 2013, GDP growth has doubled, reaching 5.5% in 2019, its highest level in almost a decade, according to the Central bank of Egypt (CBE). Foreign investment inflows have been steadily increasing since 2011, and despite more modest inflows over the past two years, in 2018 Egypt was the largest recipient of FDI in Africa and the second highest in the MENA region. Both the budget and current account deficit have narrowed, and unemployment is decreasing, from 13% to 7.5% by the second quarter of 2019. These positive gains will be tested in the near- to medium-term. Initial projections on the economic effects of the coronavirus pandemic portend declines in FDI in all economies for the coming year at least, along with disruptions to global value chains. A global recession appears likely. The steps the Egyptian government has taken to address its economic challenges, in recent years and in response to the pandemic, may help it weather some of the negative impacts of the current crisis. The new outlook makes continuing to advance Egypt’s reform agenda all the more imperative.

The Egyptian government has taken substantial measures in the past few years to address its macroeconomic challenges. These form part of an ambitious agenda supported by a USD 12 billion Extended Fund Facility, agreed with the IMF in 2016. This agenda demonstrates the government’s commitment to implementing meaningful, and at times difficult, reforms. Notably, the Egyptian Central Bank allowed the exchange rate to freely float to increase competiveness of the long-overvalued Egyptian pound and stop the depletion of foreign exchange reserves. To address its budget deficit, the government has reduced spending on energy subsidies, introduced a value-added tax (VAT), and curbed its public wage bill. Other fiscal-prudential plans include improving the tax administration and management of state-owned enterprises (IMF, 2018[1]).

The government has also implemented structural reforms to improve the business and investment climate and is moving forward with other reforms. The new Investment Law, adopted in 2017, is an important signal that promoting and facilitating private investment is a government priority and key to Egypt’s economic growth. The legislation introduces an incentives regime to encourage local development in the poorer regions of the country and new one-stop-shops to support business processes. A revised bankruptcy act and companies law, passed in 2018, are positive developments towards fostering entrepreneurship and the growth of small and medium-sized enterprises (SMEs). The government has also established a Micro, Small and Medium Enterprise Development Agency (MSMEDA) to promote MSME growth and coordinate with all relevant stakeholders to this end. It also made progress in improving transparency and accountability of State-owned enterprises while advancing reforms to strengthen the independence of the Egyptian Competition Authority and standardise public procurement. The government has also taken steps to improve access to land for investors.

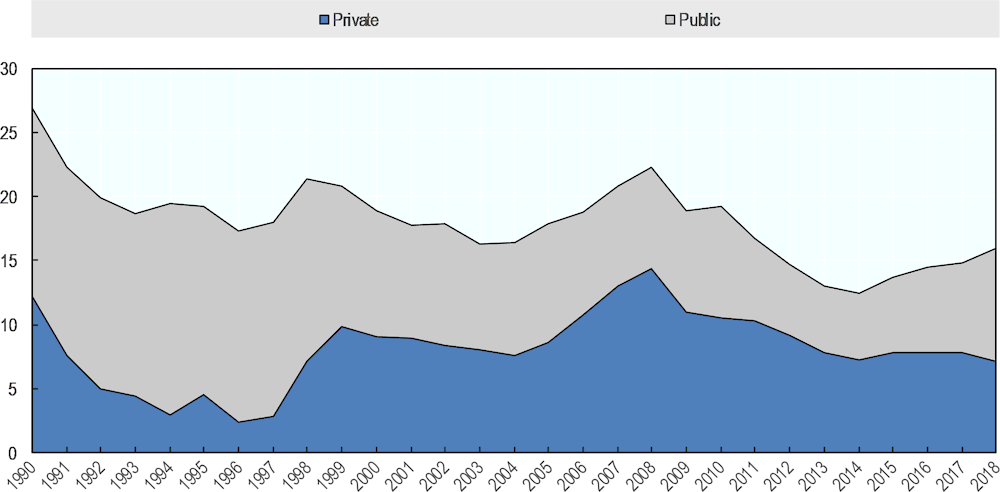

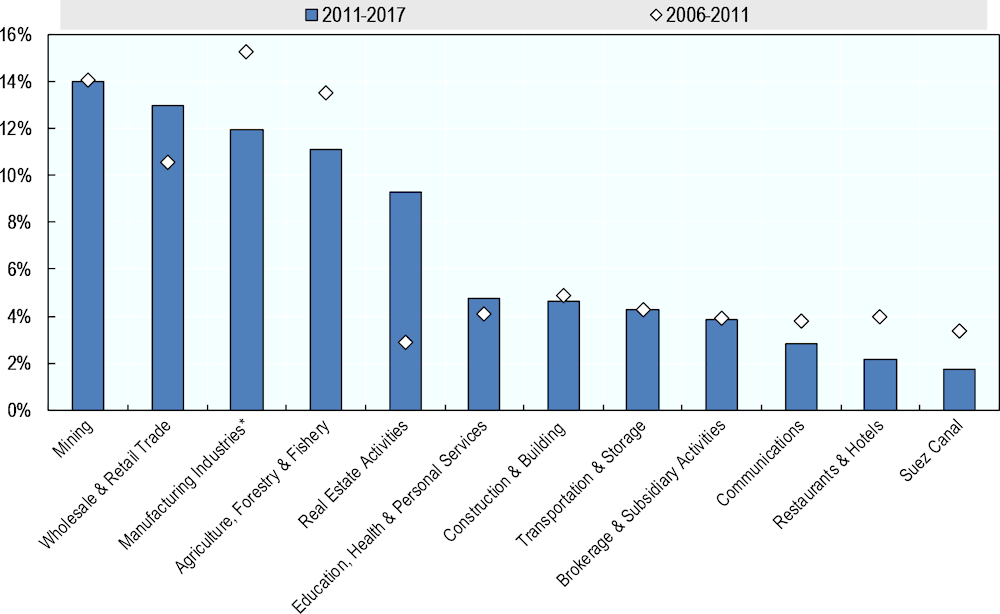

The government has ambitious aims, outlined in its Vision 2030, to nearly triple GDP growth to 12%, reduce unemployment to 5%, and advance within the top 30 countries in terms of doing business. Despite positive reforms, clear challenges remain to these aims. Egypt only briefly reached GDP growth rates of above 9%, between 1976-1982, largely due to petroleum exports and an increase in foreign aid and capital following the country’s shift towards an open market economy (Ikram, 2018[2]). Recent rebounds in investment and exports remain far below peaks reached in 2008, and both will be negatively affected by the coronavirus pandemic. Investment to emerging and developing economies is likely to be particularly affected, as disruptions to trade may prompt firms to reconsider their global supply chains. The Egyptian government has taken a series of measures in an effort to limit the human and economic impact of the pandemic. These include a fiscal stimulus package that will give grants to irregular workers and support to firms that continue to pay employees. Current tax holidays schemes have been extended and industrial sectors are eligible for gas and electricity subsidies. Firms in free zones may temporarily export to the local market at higher rates. The government is also working to further streamline procedures for investors through digitalised one-stop-shops. The rapid implementation of these measures may help the Egyptian economy to weather some of the negative effects of the current crisis. But in the long-term, advancing more durable economic growth will require higher and more sustained levels of investment and savings, as well as substantial improvements in productivity growth and export performance.

The government will also have to contend with ongoing socio-economic challenges, which are likely to be further exacerbated by the coronavirus pandemic and its economic aftermath. Positively, inflation, which spiked at more than 30% after the currency devaluation in 2017, has decreased substantially, reaching 5% in March 2020. The overall unemployment rate prior to the coronavirus pandemic had also been improving, dropping from 13% in 2013 to 10% in 2019, but remained at 20% for women and those with advanced degrees. Youth unemployment is 30%.1 The current health crisis is putting further strain on the workforce. The government recognises that creating more and higher quality jobs is imperative for both economic growth and stability. Reforms could go further to support investment into activities with higher productivity potential, encourage SME growth and promote non-energy exports. Additional short-term and deeper structural reforms would help improve the investment climate and, in turn, advance more sustainable private sector growth.

The Egyptian government has an opportunity to further strengthen its reform efforts, in order to build a more sustainable and transparent investment environment. Based on an updated version of the Policy Framework for Investment (Box 1), this second OECD Investment Policy Review of Egypt identifies several potential areas for reform and provides policy recommendations for the government to consider. Implementing these reforms would help the government advance inclusive growth and reduce political and economic uncertainty. After an overview of trends in foreign investment and their socio-economic benefits (Chapter 1), the Review examines the country’s wider regulatory framework on investors’ entry and expansion (Chapter 2), legal framework for investment (Chapter 3), investment promotion and facilitation (Chapter 4), zone-based policies (Chapter 5), tax policy and investment incentives (Chapter 6), policies to promote responsible business conduct (Chapter 7) and infrastructure connectivity (Chapter 8).